Exhibit 99.1

SCUSA Capital Markets

ABS Investor Day – Originations and Servicing

May 13, 2015

IMPORTANT INFORMATION

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions, or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipates,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends,” and similar words or phrases. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements are not guarantees of future performance and involve risks and uncertainties which are subject to change based on various important factors, some of which are beyond our control. For additional discussion of these risks, refer to the section entitled “Risk Factors” and elsewhere in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q filed by us with the SEC. Among the factors that could cause our financial performance to differ materially from that suggested by the forward-looking statements are: (a) we operate in a highly regulated industry and continually changing federal, state, and local laws and regulations could materially adversely affect our business; (b) adverse economic conditions in the United States and worldwide may negatively impact our results; (c) our business could suffer if our access to funding is reduced; (d) we face significant risks implementing our growth strategy, some of which are outside our control; (e) our agreement with Chrysler may not result in currently anticipated levels of growth and is subject to certain performance conditions that could result in termination of the agreement; (f) our business could suffer if we are unsuccessful in developing and maintaining relationships with automobile dealerships; (g) our financial condition, liquidity, and results of operations depend on the credit performance of our loans; (h) loss of our key management or other personnel, or an inability to attract such management and personnel, could negatively impact our business; (i) we are subject to certain bank regulations, including oversight by the Office of the Comptroller of the Currency, the CFPB, the Bank of Spain, and the Federal Reserve, which oversight and regulation may limit certain of our activities, including the timing and amount of dividends and other limitations on our business; and (j) future changes in our relationship with Santander could adversely affect our operations. If one or more of the factors affecting our forward-looking information and statements proves incorrect, its actual results, performance or achievements could differ materially from those expressed in, or implied by, forward-looking information and statements. Therefore, we caution not to place undue reliance on any forward-looking information or statements. The effect of these factors is difficult to predict. Factors other than these also could adversely affect our results, and the reader should not consider these factors to be a complete set of all potential risks or uncertainties. New factors emerge from time to time, and management cannot assess the impact of any such factor on our business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements only speak as of the date of this document, and we undertake no obligation to update any forward- looking information or statements, whether written or oral, to reflect any change, except as required by law. All forward- looking statements attributable to us are expressly qualified by these cautionary statements.

|

|

AGENDA

I. Corporate Overview

II. Originations and Underwriting

III. Servicing

TABLE OF CONTENTS – CORPORATE OVERVIEW

SCUSA OVERVIEW

Auto Loan ABS Platforms Summary SCUSA

HIGHLIGHTS

1Q15: Highlights Origination Trends

Income and Operating Expenses Funding and Liquidity Key Compliance Program Elements

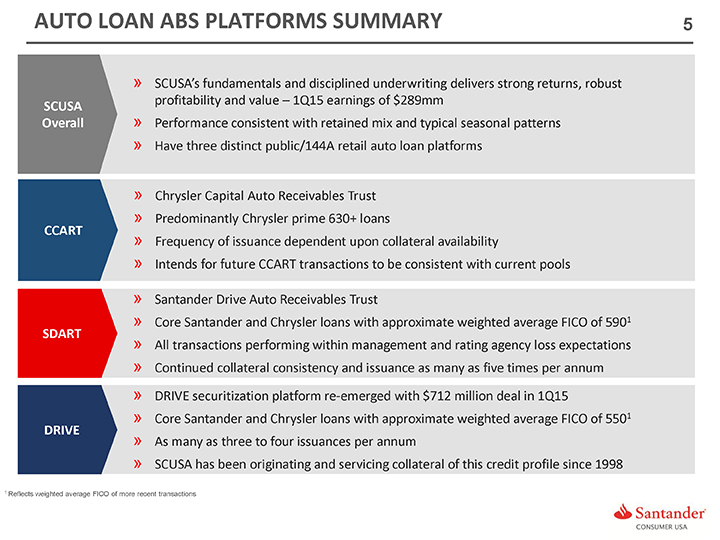

AUTO LOAN ABS PLATFORMS SUMMARY

» SCUSA’s fundamentals and disciplined underwriting delivers strong returns, robust profitability and value – 1Q15 earnings of $289mm

SCUSA Overall

» Performance consistent with retained mix and typical seasonal patterns

» Have three distinct public/144A retail auto loan platforms

» Chrysler Capital Auto Receivables Trust

» Predominantly Chrysler prime 630+ loans

CCART

» Frequency of issuance dependent upon collateral availability

» Intends for future CCART transactions to be consistent with current pools

» Santander Drive Auto Receivables Trust

» Core Santander and Chrysler loans with approximate weighted average FICO of 5901

SDART

» All transactions performing within management and rating agency loss expectations

» Continued collateral consistency and issuance as many as five times per annum

» DRIVE securitization platform re-emerged with $712 million deal in 1Q15

» Core Santander and Chrysler loans with approximate weighted average FICO of 5501

DRIVE

» As many as three to four issuances per annum

» SCUSA has been originating and servicing collateral of this credit profile since 1998

1 | | Reflects weighted average FICO of more recent transactions |

SCUSA

Overview

• | | Santander Consumer USA Holdings Inc. (NYSE:SC) (“SCUSA”) is approximately 60.3% owned by Santander Holdings USA, Inc., a wholly-owned subsidiary of Banco Santander, S.A. (NYSE:SAN)1 |

• | | SCUSA is a full-service, technology-driven consumer finance company focused on vehicle and personal lending, and third-party servicing |

• | | Historically focused on nonprime markets; established and continued presence in prime and lease |

• | | Approximately 4,600 employees and approximately 800 vendor-based employees across multiple locations in the U.S. and the Caribbean |

Strategy

• | | Our strategy is to continue leveraging our efficient, scalable infrastructure and data to underwrite, originate and service consumer assets |

• | | Focus on optimizing the mix of retained assets vs. assets sold and serviced for others |

• | | Continued presence in personal lending as well as prime markets through Chrysler Capital2 |

• | | Efficient funding through third parties and Santander |

• | | Continued focus on compliance excellence |

SCUSA’s fundamentals are strong, and the Company is focused on maintaining disciplined underwriting standards to deliver strong returns, robust profitability and value to its shareholders

1As of March 31, 2015

2Chrysler Capital is a dbaof SCUSA

1Q15: HIGHLIGHTS

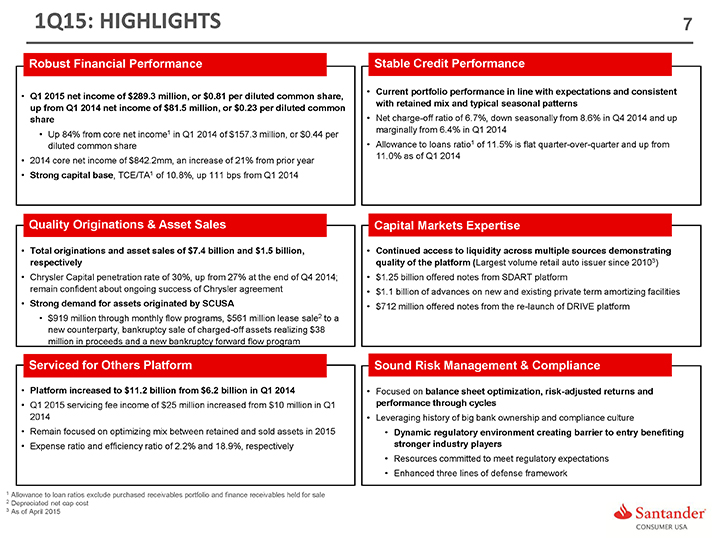

Robust Financial Performance

• | | Q1 2015 net income of $289.3 million, or $0.81 per diluted common share, up from Q1 2014 net income of $81.5 million, or $0.23 per diluted common share |

• | | Up 84% from core net income1 in Q1 2014 of $157.3 million, or $0.44 per diluted common share |

• | | 2014 core net income of $842.2mm, an increase of 21% from prior year |

• | | Strong capital base, TCE/TA1 of 10.8%, up 111 bps from Q1 2014 |

Quality Originations & Asset Sales

• | | Total originations and asset sales of $7.4 billion and $1.5 billion, respectively |

• | | Chrysler Capital penetration rate of 30%, up from 27% at the end of Q4 2014; remain confident about ongoing success of Chrysler agreement |

• | | Strong demand for assets originated by SCUSA |

• | | $919 million through monthly flow programs, $561 million lease sale2 to a new counterparty, bankruptcy sale of charged-off assets realizing $38 million in proceeds and a new bankruptcy forward flow program |

Serviced for Others Platform

• | | Platform increased to $11.2 billion from $6.2 billion in Q1 2014 |

• | | Q1 2015 servicing fee income of $25 million increased from $10 million in Q1 2014 |

• | | Remain focused on optimizing mix between retained and sold assets in 2015 |

• | | Expense ratio and efficiency ratio of 2.2% and 18.9%, respectively |

Stable Credit Performance

Current portfolio performance in line with expectations and consistent with retained mix and typical seasonal patterns

Net charge-off ratio of 6.7%, down seasonally from 8.6% in Q4 2014 and up marginally from 6.4% in Q1 2014 Allowance to loans ratio1 of 11.5% is flat quarter-over-quarter and up from

11.0% as of Q1 2014

Capital Markets Expertise

• | | Continued access to liquidity across multiple sources demonstrating quality of the platform (Largest volume retail auto issuer since 20103) |

• | | $1.25 billion offered notes from SDART platform |

• | | $1.1 billion of advances on new and existing private term amortizing facilities |

• | | $712 million offered notes from the re-launch of DRIVE platform |

Sound Risk Management & Compliance

• | | Focused on balance sheet optimization, risk-adjusted returns and performance through cycles |

• | | Leveraging history of big bank ownership and compliance culture |

• | | Dynamic regulatory environment creating barrier to entry benefiting stronger industry players |

• | | Resources committed to meet regulatory expectations |

• | | Enhanced three lines of defense framework |

1 Allowance to loan ratios exclude purchased receivables portfolio and finance receivables held for sale

2 | | Depreciated net cap cost |

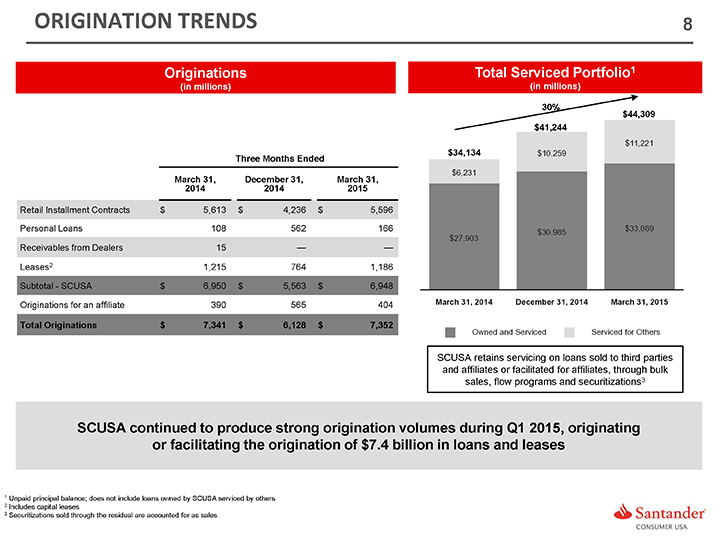

ORIGINATION TRENDS

Originations Total Serviced Portfolio1

(in millions) (in millions)

Three Months Ended

March 31, December 31, March 31,

2014 2014 2015

Retail Installment Contracts $ 5,613 $ 4,236 $ 5,596

Personal Loans 108 562 166

Receivables from Dealers 15 — —

Leases2 1,215 764 1,186

Subtotal—SCUSA $ 6,950 $ 5,563 $ 6,948

Originations for an affiliate 390 565 404

Total Originations $ 7,341 $ 6,128 $ 7,352

30% $44,309 $41,244 $34,134

SCUSA retains servicing on loans sold to third parties and affiliates or facilitated for affiliates, through bulk sales, flow programs and securitizations3

SCUSA continued to produce strong origination volumes during Q1 2015, originating or facilitating the origination of $7.4 billion in loans and leases

1 Unpaid principal balance; does not include loans owned by SCUSA serviced by others

2 | | Includes capital leases |

3 | | Securitizations sold through the residual are accounted for as sales |

9

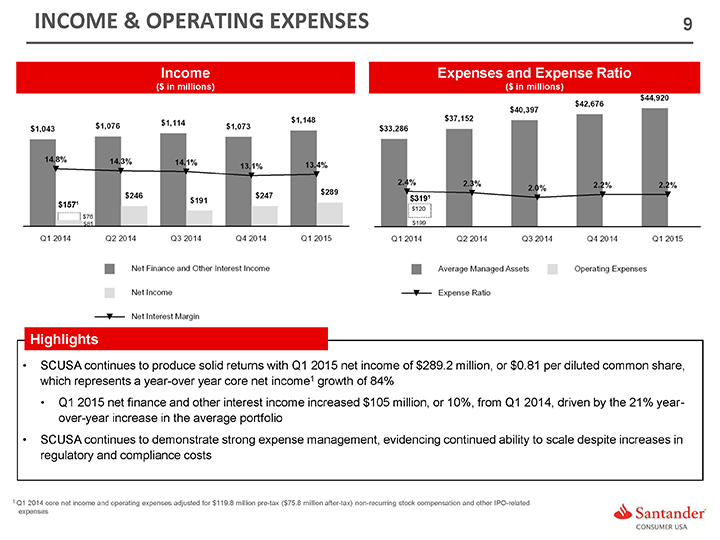

INCOME & OPERATING EXPENSES 9

Income

($ in millions)

Income Expenses and Expense Ratio ($ in millions)

$3191 $1571 $120

$76

$81 $199

Highlights

• | | SCUSA continues to produce solid returns with Q1 2015 net income of $289.2 million, or $0.81 per diluted common share, which represents a year-over year core net income1 growth of 84% |

• | | Q1 2015 net finance and other interest income increased $105 million, or 10%, from Q1 2014, driven by the 21% year-over-year increase in the average portfolio |

• | | SCUSA continues to demonstrate strong expense management, evidencing continued ability to scale despite increases in regulatory and compliance costs |

1 Q1 2014 core net income and operating expenses adjusted for $119.8 million pre-tax ($75.8 million after-tax) non-recurring stock compensation and other IPO-related expenses

10

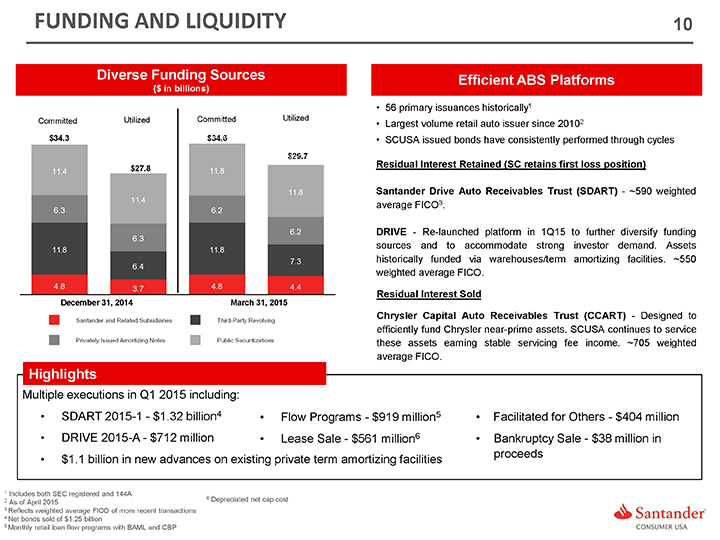

FUNDING AND LIQUIDITY

Diverse Funding Sources

($ in billions)

Efficient ABS Platforms

• | | 56 primary issuances historically1 |

• | | Largest volume retail auto issuer since 20102 |

• | | SCUSA issued bonds have consistently performed through cycles |

Residual Interest Retained (SC retains first loss position)

Santander Drive Auto Receivables Trust (SDART) - ~590 weighted average FICO3.

DRIVE - Re-launched platform in 1Q15 to further diversify funding sources and to accommodate strong investor demand. Assets historically funded via warehouses/term amortizing facilities. ~550 weighted average FICO.

Residual Interest Sold

Chrysler Capital Auto Receivables Trust (CCART)—Designed to efficiently fund Chrysler near-prime assets. SCUSA continues to service these assets earning stable servicing fee income. ~705 weighted average FICO.

Highlights

Multiple executions in Q1 2015 including:

• SDART 2015-1—$1.32 billion(4) • Flow Programs—$919 million(5) • Facilitated for Others— $404 million

• | | DRIVE 2015-A—$712 million Lease Sale—$561 million(6) Bankruptcy Sale—$38 million in |

• | | $1.1 billion in new advances on existing private term amortizing facilities proceeds |

1 | | Includes both SEC registered and 144A |

6 | | Depreciated net cap cost |

3 | | Reflects weighted average FICO of more recent transactions |

4 | | Net bonds sold of $1.25 billion |

5 | | Monthly retail loan flow programs with BAML and CBP |

11

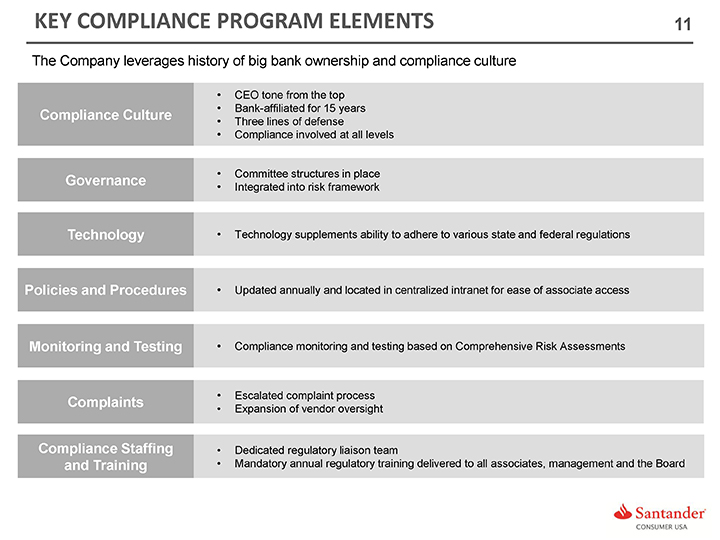

KEY COMPLIANCE PROGRAM ELEMENTS

The Company leverages history of big bank ownership and compliance culture

• | | Bank-affiliated for 15 years |

Compliance Culture

• | | Compliance involved at all levels |

• | | Committee structures in place |

Governance

• | | Integrated into risk framework |

Technology • Technology supplements ability to adhere to various state and federal regulations

Policies and Procedures • Updated annually and located in centralized intranet for ease of associate access

Monitoring and Testing • Compliance monitoring and testing based on Comprehensive Risk Assessments

• | | Escalated complaint process |

Complaints

• | | Expansion of vendor oversight |

Compliance Staffing and Training • Dedicated regulatory liaison team • Mandatory annual regulatory training delivered to all associates, management and the Board

12

AGENDA

I. Corporate Overview

II. Originations and Underwriting

III. Servicing

13

TABLE OF CONTENTS – ORIGINATIONS AND UNDERWRITING

STAFFING / EXPERIENCE

Experience in Originations Staffing

OVERVIEW

Full-Spectrum Lender Chrysler Capital Origination Trends Multiple Product Offerings

Diverse Channels / Consistent Decisioning Life of a Loan – Originations

UNDERWRITING

Mature Model Development and Scorecards Accuracy in Decisioning and Pricing Pricing Example

CONSISTENCY

Control Framework

Automated Systems and Processes Robust Quality Controls Systemic Verification Process Dealer Performance and Verifications

RESPONSIVENESS

Flexibility and Innovation

14

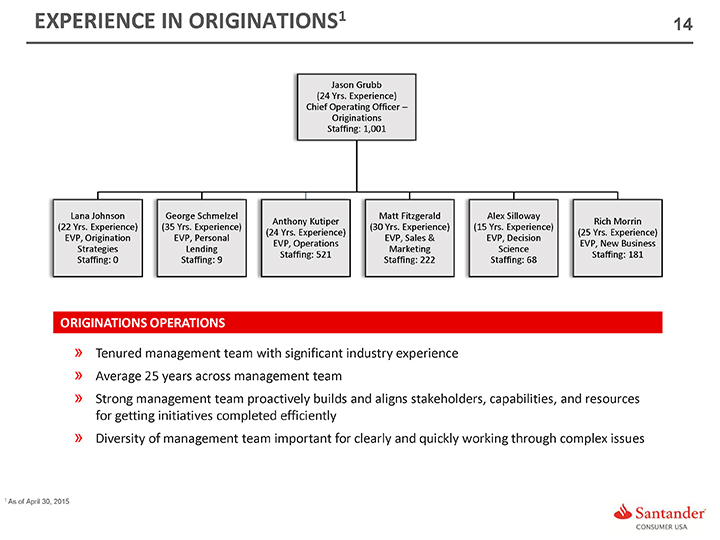

EXPERIENCE IN ORIGINATIONS1

Jason Grubb (24 Yrs. Experience) Chief Operating Officer –Originations Staffing: 1,001

Lana Johnson (22 Yrs. Experience) EVP, Origination Strategies Staffing: 0

George Schmelzel (35 Yrs. Experience) EVP, Personal Lending Staffing: 9

Anthony Kutiper (24 Yrs. Experience) EVP, Operations Staffing: 521

Matt Fitzgerald (30 Yrs. Experience) EVP, Sales & Marketing Staffing: 222

Alex Silloway (15 Yrs. Experience) EVP, Decision Science Staffing: 68

Rich Morrin (25 Yrs. Experience) EVP, New Business Staffing: 181

ORIGINATIONS OPERATIONS

» Tenured management team with significant industry experience

» Average 25 years across management team

» Strong management team proactively builds and aligns stakeholders, capabilities, and resources for getting initiatives completed efficiently

» Diversity of management team important for clearly and quickly working through complex issues

15

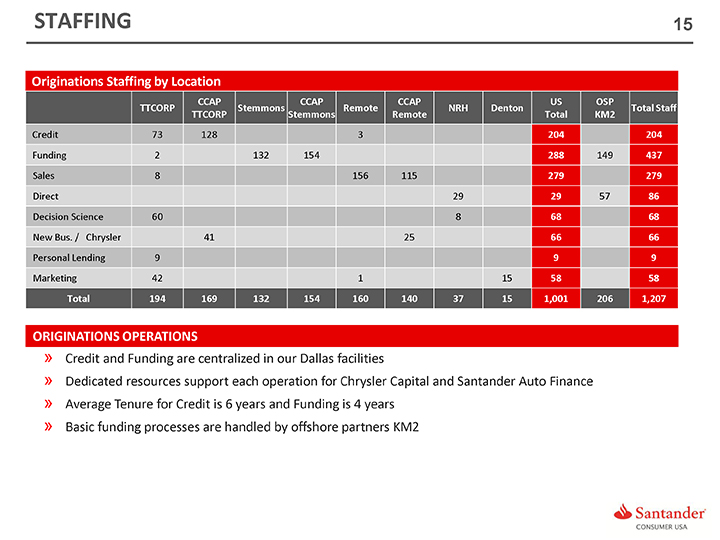

STAFFING

Originations Staffing by Location

CCAP CCAP CCAP US OSP

TTCORP Stemmons Remote NRH Denton Total Staff

TTCORP Stemmons Remote Total KM2

Credit 73 128 3 204 204

Funding 2 132 154 288 149 437

Sales 8 156 115 279 279

Direct 29 29 57 86

Decision Science 60 8 68 68

New Bus. / Chrysler 41 25 66 66

Personal Lending 9 9 9

Marketing 42 1 15 58 58

Total 194 169 132 154 160 140 37 15 1,001 206 1,207

ORIGINATIONS OPERATIONS

» Credit and Funding are centralized in our Dallas facilities

» Dedicated resources support each operation for Chrysler Capital and Santander Auto Finance

» Average Tenure for Credit is 6 years and Funding is 4 years

» Basic funding processes are handled by offshore partners KM2

16

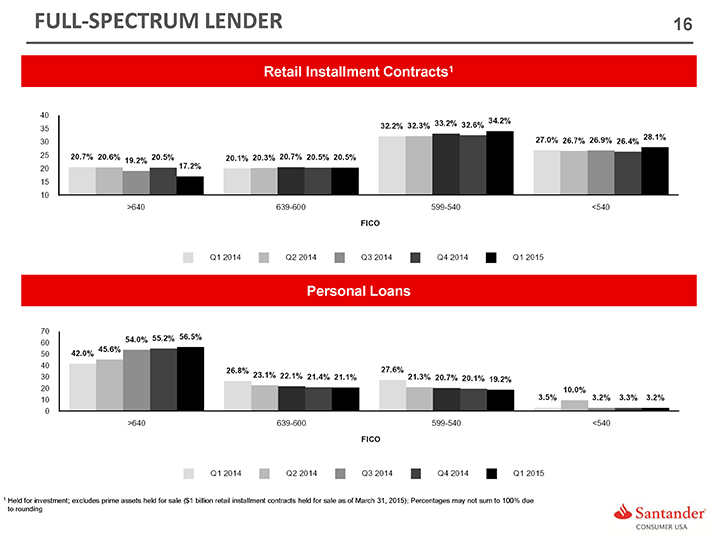

FULL-SPECTRUM LENDER

Retail Installment Contracts1

Personal Loans

1Held for investment; excludes prime assets held for sale ($1 billion retail installment contracts held for sale as of March 31,2015); Percentages may not sum to 100% due to rounding

17

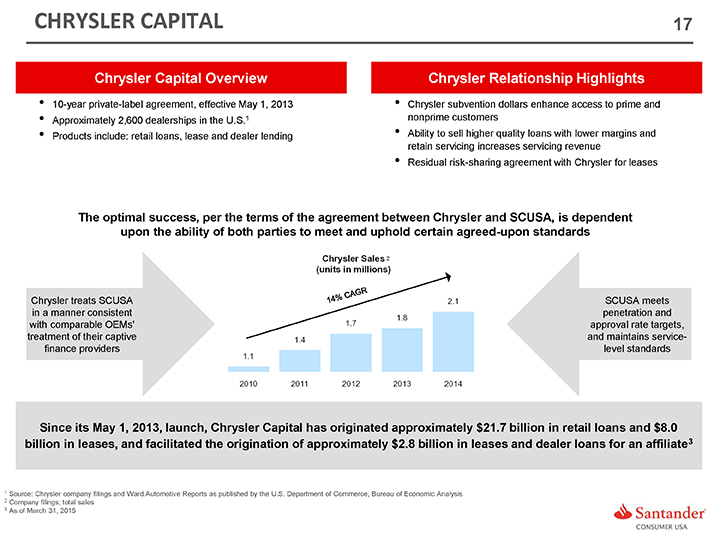

CHRYSLER CAPITAL

Chrysler Capital Overview

10-year private-label agreement, effective May 1, 2013

• | | Approximately 2,600 dealerships in the U.S.1 |

• | | Products include: retail loans, lease and dealer lending |

Chrysler Relationship Highlights

Chrysler subvention dollars enhance access to prime and nonprime customers

• | | Ability to sell higher quality loans with lower margins and retain servicing increases servicing revenue |

• | | Residual risk-sharing agreement with Chrysler for leases |

The optimal success, per the terms of the agreement between Chrysler and SCUSA, is dependent upon the ability of both parties to meet and uphold certain agreed-upon standards

Chrysler treats SCUSA in a manner consistent with comparable OEMs’ treatment of their captive finance providers

SCUSA meets penetration and approval rate targets, and maintains service-level standards

Since its May 1, 2013, launch, Chrysler Capital has originated approximately $21.7 billion in retail loans and $8.0 billion in leases, and facilitated the origination of approximately $2.8 billion in leases and dealer loans for an affiliate3

1Source: Chrysler company filings and Ward Automotive Reports as published by the U.S. Department of Commerce, Bureau of Economic Analysis

2Company filings; total sales

3As of March 31, 2015

18

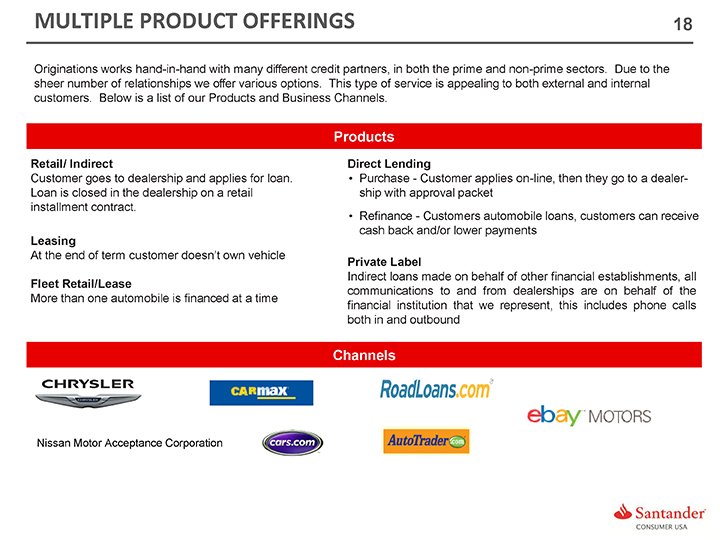

MULTIPLE PRODUCT OFFERINGS

Originations works hand-in-hand with many different credit partners, in both the prime and non-prime sectors. Due to the sheer number of relationships we offer various options. This type of service is appealing to both external and internal customers. Below is a list of our Products and Business Channels.

Products

Retail/ Indirect

Customer goes to dealership and applies for loan. Loan is closed in the dealership on a retail installment contract.

Leasing

At the end of term customer doesn’t own vehicle

Fleet Retail/Lease

More than one automobile is financed at a time

Direct Lending

• | | Purchase -Customer applies on-line, then they go to a dealer-ship with approval packet |

• | | Refinance -Customers automobile loans, customers can receive cash back and/or lower payments |

Private Label

Indirect loans made on behalf of other financial establishments, all communications to and from dealerships are on behalf of the financial institution that were present, this includes phone calls both in and outbound

Channels

Nissan Motor Acceptance Corporation

19

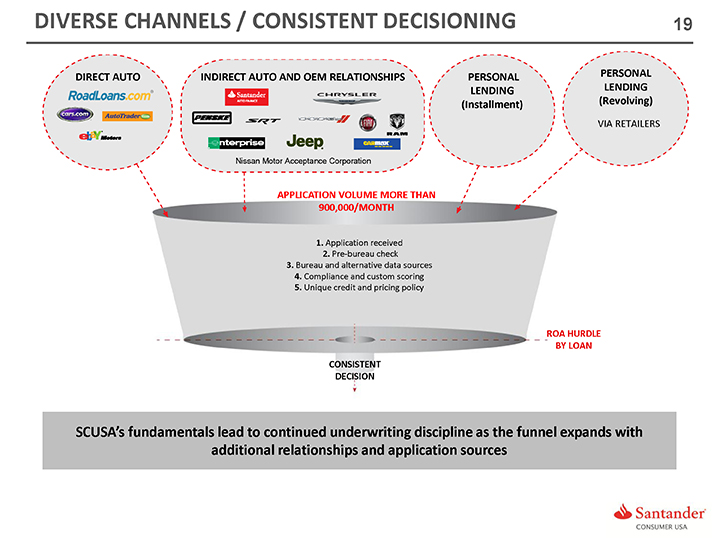

DIVERSE CHANNELS / CONSISTENT DECISIONING

DIRECT AUTO INDIRECT AUTO AND OEM RELATIONSHIPS PERSONAL PERSONAL LENDING LENDING

(Installment) (Revolving)

VIA RETAILERS

Nissan Motor Acceptance Corporation

APPLICATION VOLUME MORE THAN 900,000/MONTH

1. Application received 2. Pre-bureau check 3. Bureau and alternative data sources 4. Compliance and custom scoring 5. Unique credit and pricing policy

ROA HURDLE BY LOAN

CONSISTENT DECISION

SCUSA’s fundamentals lead to continued underwriting discipline as the funnel expands with additional relationships and application sources

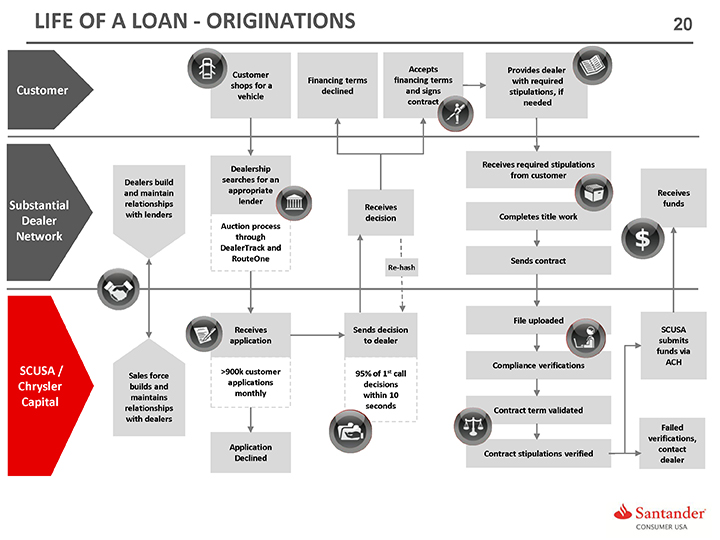

LIFE OF A LOAN—ORIGINATIONS 20

Customer Accepts Provides dealer

shops for a Financing terms financing terms with required

declined and signs stipulations, if

vehicle

contract needed

Dealership Receives required stipulations

from customer

Dealers build searches for an

and maintain appropriate Receives

relationships lender Receives funds

with lenders decision Completes title work

Auction process

through

DealerTrack and

RouteOne Sends contract

Re-hash

File uploaded

Receives Sends decision SCUSA

application to dealer submits

funds via

Compliance verifications ACH

Sales >900k customer 95% of 1st call

force

builds and applications decisions

maintains monthly within 10

relationships seconds Contract term validated

with dealers

Failed

verifications,

Application contact

Contract stipulations verified

Declined dealer

21

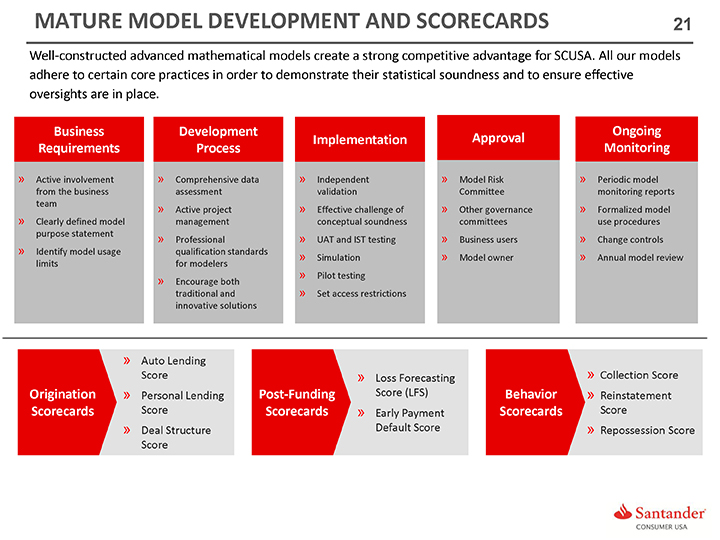

MATURE MODEL DEVELOPMENT AND SCORECARDS

Well-constructed advanced mathematical models create a strong competitive advantage for SCUSA. All our models adhere to certain core practices in order to demonstrate their statistical soundness and to ensure effective oversights are in place.

Business Requirements

» Active involvement from the business team

» Clearly defined model purpose statement

» Identify model usage limits

Development Process

» Comprehensive data assessment

» Active project management

» Professional qualification standards for modelers

» Encourage both traditional and innovative solutions

Implementation

» Independent validation

» Effective challenge of conceptual soundness

» UAT and IST testing

» Simulation

» Pilot testing

» Set access restrictions

Approval

» Model Risk Committee

» Other governance committees

» Business users

» Model owner

Ongoing Monitoring

» Periodic model monitoring reports

» Formalized model use procedures

» Change controls

» Annual model review

» Auto Lending Score

Origination » Personal Lending

Scorecards Score

» Deal Structure Score

» Loss Forecasting

Post-Funding Score (LFS)

Scorecards » Early Payment Default Score

» Collection Score

Behavior » Reinstatement

Scorecards Score

» Repossession Score

22

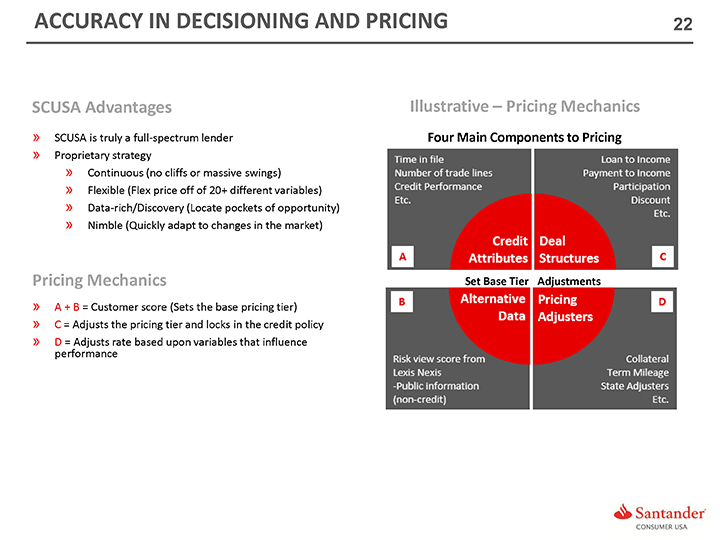

ACCURACY IN DECISIONING AND PRICING

SCUSA Advantages

» SCUSA is truly a full-spectrum lender

» Proprietary strategy

» Continuous (no cliffs or massive swings)

» Flexible (Flex price off of 20+ different variables)

» Data-rich/Discovery (Locate pockets of opportunity)

» Nimble (Quickly adapt to changes in the market)

Pricing Mechanics

» A + B = Customer score (Sets the base pricing tier)

» C = Adjusts the pricing tier and locks in the credit policy

» D = Adjusts rate based upon variables that influence performance

Illustrative – Pricing Mechanics

Four Main Components to Pricing

Set Base Tier Adjustments

23

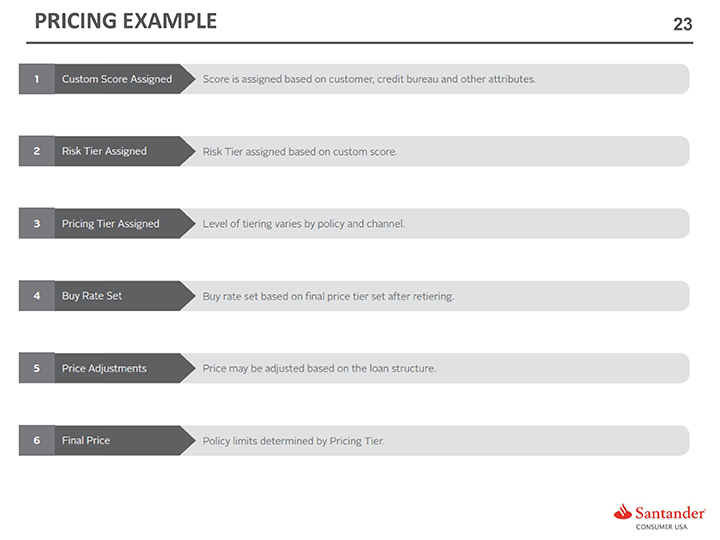

PRICING EXAMPLE

24

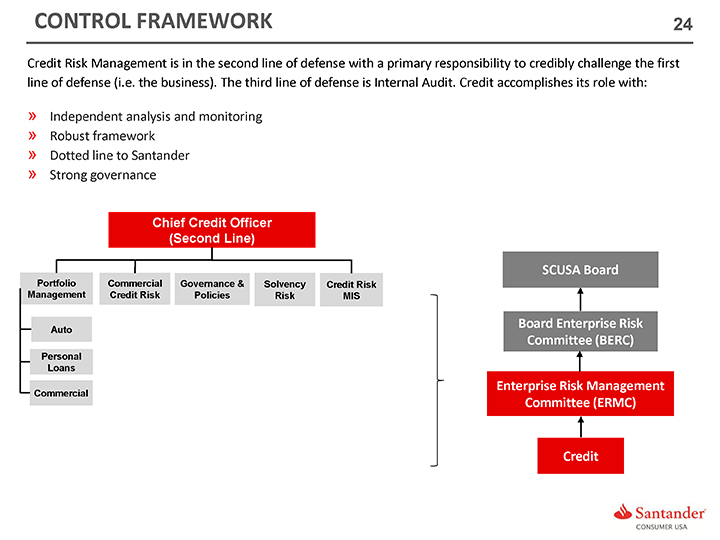

CONTROL FRAMEWORK

Credit Risk Management is in the second line of defense with a primary responsibility to credibly challenge the first line of defense (i.e. the business). The third line of defense is Internal Audit. Credit accomplishes its role with:

» Independent analysis and monitoring

» Robust framework

» Dotted line to Santander

» Strong governance

Chief Credit Officer (Second Line)

Portfolio Commercial Governance & Solvency Credit Risk Management Credit Risk Policies Risk MIS

Auto Personal Loans Commercial

SCUSA Board

Board Enterprise Risk Committee (BERC)

Enterprise Risk Management Committee (ERMC)

Credit

25

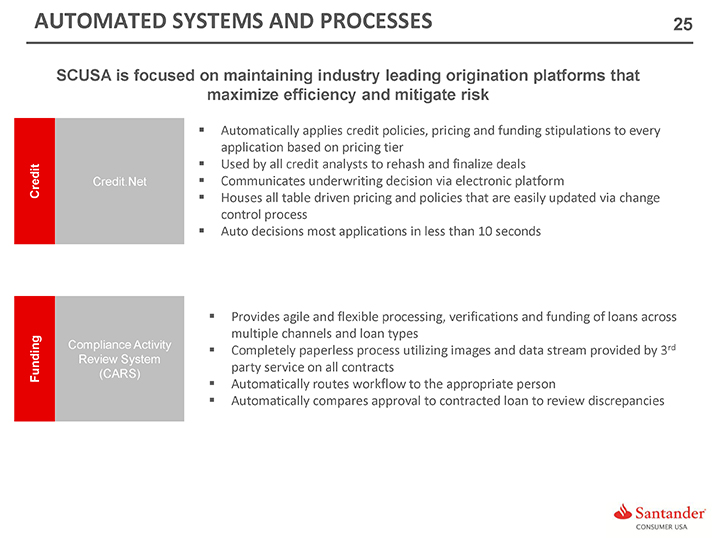

AUTOMATED SYSTEMS AND PROCESSES

SCUSA is focused on maintaining industry leading origination platforms that maximize efficiency and mitigate risk

Credit Credit. Net

Automatically applies credit policies, pricing and funding stipulations to every application based on pricing tier Used by all credit analysts to rehash and finalize deals Communicates underwriting decision via electronic platform Houses all table driven pricing and policies that are easily updated via change control process Auto decisions most applications in less than 10 seconds

Compliance Activity Review System

Funding (CARS)

Provides agile and flexible processing, verifications and funding of loans across multiple channels and loan types Completely paperless process utilizing images and data stream provided by 3rd party service on all contracts Automatically routes workflow to the appropriate person Automatically compares approval to contracted loan to review discrepancies

26

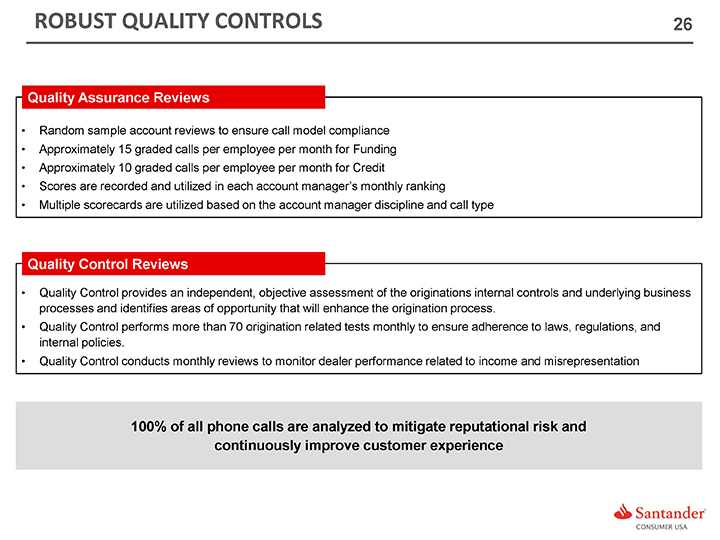

ROBUST QUALITY CONTROLS

Quality Assurance Reviews

• | | Random sample account reviews to ensure call model compliance |

• | | Approximately 15 graded calls per employee per month for Funding |

• | | Approximately 10 graded calls per employee per month for Credit |

• | | Scores are recorded and utilized in each account manager’s monthly ranking |

• | | Multiple scorecards are utilized based on the account manager discipline and call type |

Quality Control Reviews

• | | Quality Control provides an independent, objective assessment of the originations internal controls and underlying business processes and identifies areas of opportunity that will enhance the origination process. |

• | | Quality Control performs more than 70 origination related tests monthly to ensure adherence to laws, regulations, and internal policies. |

• | | Quality Control conducts monthly reviews to monitor dealer performance related to income and misrepresentation |

100% of all phone calls are analyzed to mitigate reputational risk and continuously improve customer experience

27

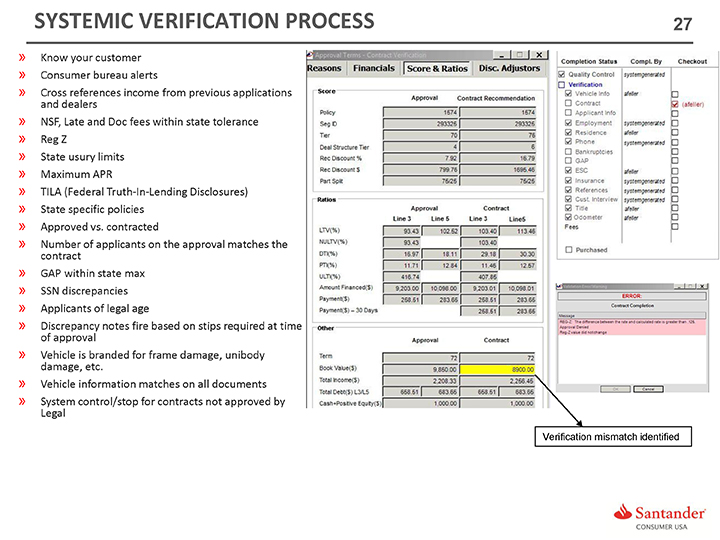

SYSTEMIC VERIFICATION PROCESS

» Know your customer

» Consumer bureau alerts

» Cross references income from previous applications and dealers

» NSF, Late and Doc fees within state tolerance

» Reg Z

» State usury limits

» Maximum APR

» TILA (Federal Truth-In-Lending Disclosures)

» State specific policies

» Approved vs. contracted

» Number of applicants on the approval matches the contract

» GAP within state max

» SSN discrepancies

» Applicants of legal age

» Discrepancy notes fire based on stips required at time of approval

» Vehicle is branded for frame damage, unibody damage, etc.

» Vehicle information matches on all documents

» System control/stop for contracts not approved by Legal

28

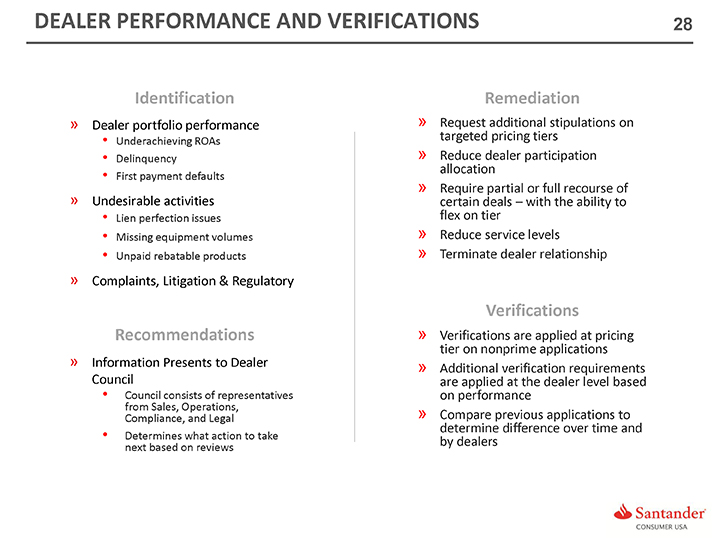

DEALER PERFORMANCE AND VERIFICATIONS

Identification

» Dealer portfolio performance

» Undesirable activities

• | | Missing equipment volumes |

• | | Unpaid rebatable products |

» Complaints, Litigation & Regulatory

Recommendations

» Information Presents to Dealer Council

• | | Council consists of representatives from Sales, Operations, Compliance, and Legal |

• | | Determines what action to take next based on reviews |

Remediation

» Request additional stipulations on targeted pricing tiers

» Reduce dealer participation allocation

» Require partial or full recourse of certain deals – with the ability to flex on tier

» Reduce service levels

» Terminate dealer relationship

Verifications

» Verifications are applied at pricing tier on nonprime applications

» Additional verification requirements are applied at the dealer level based on performance

» Compare previous applications to determine difference over time and by dealers

29

FLEXIBILITY AND INNOVATION

Pricing Flexibility

» Pricing can be flexed by almost any customer credit or deal structure available.

» Pricing can be set at various levels of granularity including channel, state, or vehicle level.

» Pricing can be set to provide the best solution for a program’s needs by adjusting not just the buy rate, but also the fee.

Deployment Flexibility

» IT environment allows policy changes to be updated at any time giving the business the flexibility to adapt quickly to the changing business needs.

Innovation

» New methods of pricing allow us to help grow the business in ways that benefit both the program and SCUSA.

Resources

» SCUSA uses several third party resources available to determine the credit risk of each application, including FICO and alternative data sources, in order to optimize pricing and provide the best solution for our programs.

30

AGENDA

I. Corporate Overview

II. Originations and Underwriting

III. Servicing

TABLE OF CONTENTS—SERVICING

31

LOAN SERVICING STAFFING AND EMPLOYEE STATISTICS

n Organizational Scalability

LOAN TREATMENT

n Loan Servicing Overview

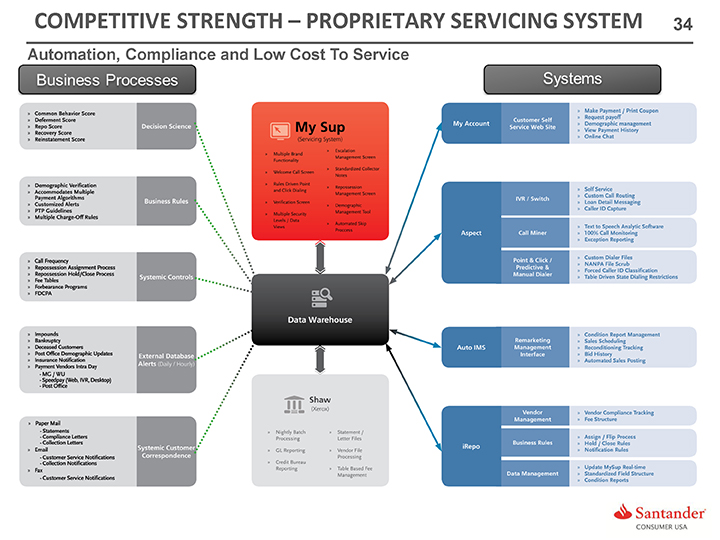

n Competitive Strength – Proprietary Servicing Systemn Risk-Based Collections Approachn Welcome – New Customers

n Systemically Controlled Loan Servicing Platform – Point and Click Dialing

CALL QUALITY AND ANALYTICS

n Multiple Approaches to Speech Analytics

n CallMiner – Real-Time Speech Analytics Softwaren Quality Assurance

REPOSSESSION / LIQUIDATION

n Repossession and Liquidation Strategy

LEASE END OF TERM

n Lease End of Term Timeline – Customer Experiencen Chrysler Capital Allegiance Teamn Lease Return Vehicle Disposition

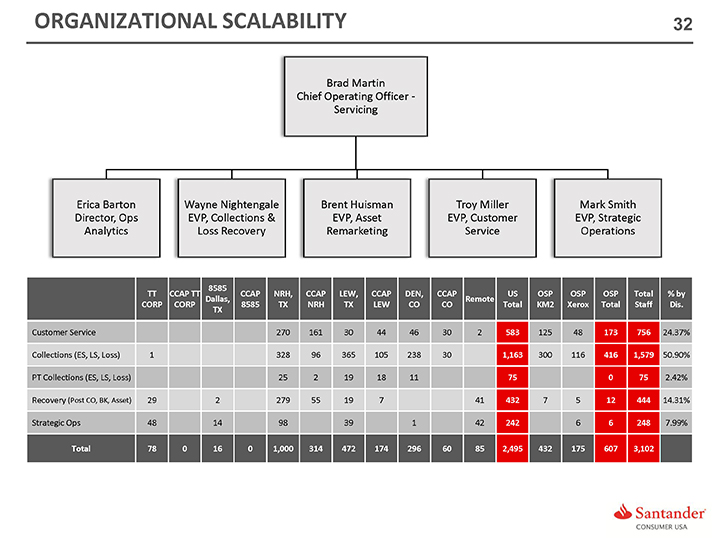

ORGANIZATIONAL SCALABILITY

32

Brad Martin Chief Operating Officer -Servicing

Erica Barton Director, Ops Analytics

Wayne Nightengale EVP, Collections & Loss Recovery

Brent Huisman EVP, Asset Remarketing

Troy Miller EVP, Customer Service

Mark Smith EVP, Strategic Operations

8585

TT CCAP TT CCAP NRH, CCAP LEW, CCAP DEN, CCAP US OSP OSP OSP Total% by

Dallas, Remote

CORP CORP 8585 TX NRH TX LEW CO CO Total KM2 Xerox Total Staff Dis.

TX

Customer Service 270 161 30 44 46 30 2 583 125 48 173 756 24.37%

Collections (ES, LS, Loss) 1 328 96 365 105 238 30 1,163 300 116 416 1,579 50.90%

PT Collections (ES, LS, Loss) 25 2 19 18 11 75 0 75 2.42%

Recovery (Post CO, BK, Asset) 29 2 279 55 19 7 41 432 7 5 12 444 14.31%

Strategic Ops 48 14 98 39 1 42 242 6 6 248 7.99%

Total 78 0 16 0 1,000 314 472 174 296 60 85 2,495 432 175 607 3,102

LOAN SERVICING OVERVIEW

33

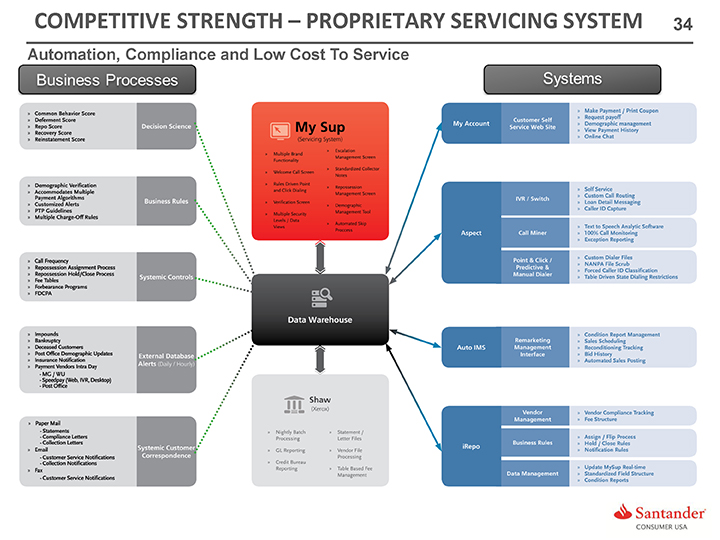

SCUSA is focused on maintaining an industry leading loan-servicing platform that maximizes efficiency and minimizes the need for customer contact.

The platform provides loan-servicing tools, utilizing a best-in-class proprietary account management and collection technology system for a superior customer service experience.

n Model driven account management strategies based on custom scores and predictive modeling.

n Strategies leverage application characteristics, refreshed credit data and customer behavior to apply risk-driven treatment.

n Robust process and cutting-edge technology maximize efficiency, consistent loan treatment and cost control.

The anchor system is the proprietary My Supervisor platform, which integrates a suite of account management tools into one system of record.

n Predictive Dialern Automated Customer Correspondence

n Proprietary Scoring Enginen Interactive Voice Response System

n Customized Account Routingn Agent Call Recording

n Escalation Management Tooln Speech Analytics Software

n Demographic Managementn Repossession Management Tool

n Rules-Driven Point and Click Dialingn Remarketing Management Tool

System

COMPETITIVE STRENGTH – PROPRIETARY SERVICING SYSTEM 34

Automation, Compliance and Low Cost To Service

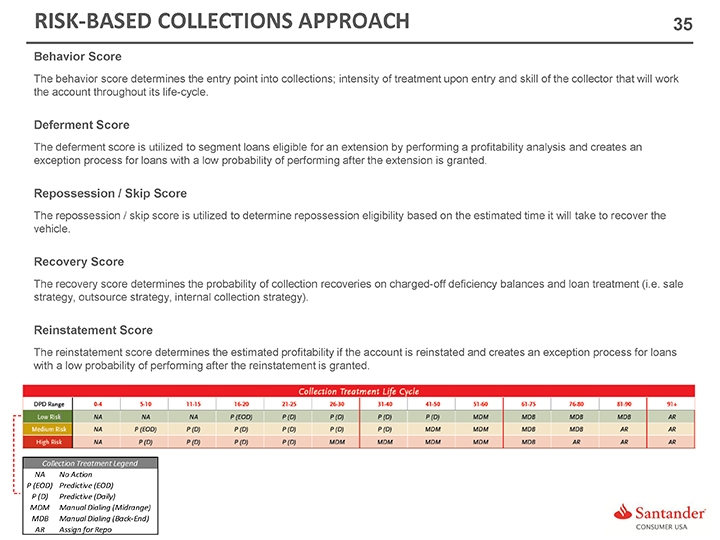

RISK-BASED COLLECTIONS APPROACH 35

Behavior Score

The behavior score determines the entry point into collections; intensity of treatment upon entry and skill of the collector that will work the account throughout its life-cycle.

Deferment Score

The deferment score is utilized to segment loans eligible for an extension by performing a profitability analysis and creates an exception process for loans with a low probability of performing after the extension is granted.

Repossession / Skip Score

The repossession / skip score is utilized to determine repossession eligibility based on the estimated time it will take to recover the vehicle.

Recovery Score

The recovery score determines the probability of collection recoveries on charged-off deficiency balances and loan treatment (i.e. sale strategy, outsource strategy, internal collection strategy).

Reinstatement Score

The reinstatement score determines the estimated profitability if the account is reinstated and creates an exception process for loans with a low probability of performing after the reinstatement is granted.

Collection Treatment Life Cycle

Collection Treatment Legend

NA

No Action

P (EOD)

Predictive (EOD)

P (D)

Predictive (Daily)

MDM

Manual Dialing (Midrange)

MDB

Manual Dialing (Back-End)

AR

Assign for Repo

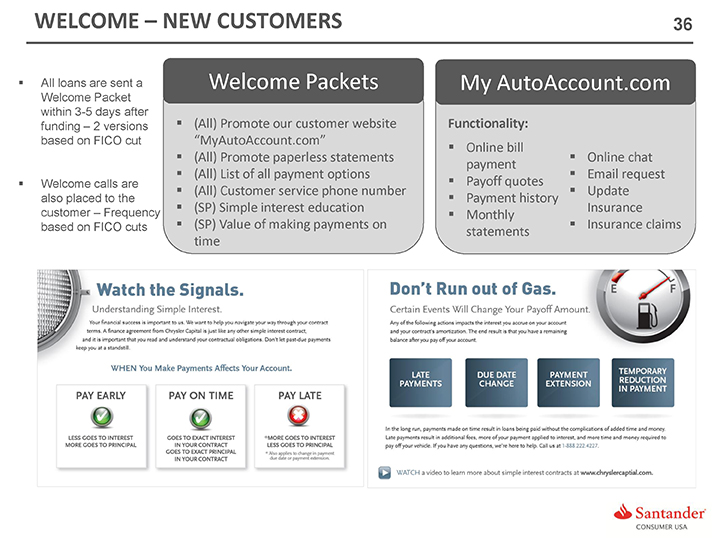

WELCOME – NEW CUSTOMERS 36

All loans are sent a Welcome Packet within 3-5 days after funding – 2 versions based on FICO cut

Welcome calls are also placed to the customer – Frequency based on FICO cuts

Welcome Packets

(All) Promote our customer website

“MyAutoAccount.com”

(All) Promote paperless statements (All) List of all payment options (All) Customer service phone number (SP) Simple interest education (SP) Value of making payments on time

My AutoAccount.com

Functionality:

n Online bill paymentn Payoff quotesn Payment historyn Monthly statements

Online chat Email request Update Insurance Insurance claims

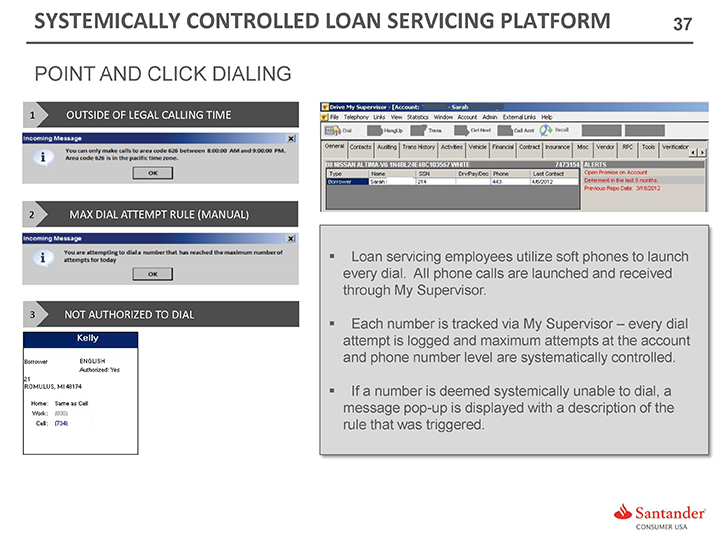

SYSTEMICALLY CONTROLLED LOAN SERVICING PLATFORM 37

POINT AND CLICK DIALING

n Loan servicing employees utilize soft phones to launch

every dial. All phone calls are launched and received

through My Supervisor.

n Each number is tracked via My Supervisor – every dial

attempt is logged and maximum attempts at the account

and phone number level are systematically controlled.

n If a number is deemed systemically unable to dial, a

message pop-up is displayed with a description of the

rule that was triggered.

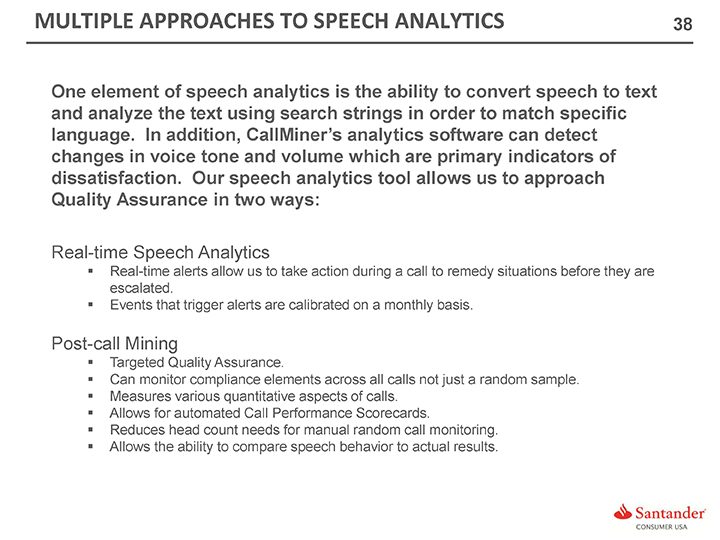

MULTIPLE APPROACHES TO SPEECH ANALYTICS 38

One element of speech analytics is the ability to convert speech to text and analyze the text using search strings in order to match specific language. In addition, CallMiner’s analytics software can detect changes in voice tone and volume which are primary indicators of dissatisfaction. Our speech analytics tool allows us to approach Quality Assurance in two ways:

Real-time Speech Analytics

n Real-time alerts allow us to take action during a call to remedy situations before they are escalated.

n Events that trigger alerts are calibrated on a monthly basis.

Post-call Mining

n Targeted Quality Assurance.

n Can monitor compliance elements across all calls not just a random sample.n Measures various quantitative aspects of calls.

n Allows for automated Call Performance Scorecards.

n Reduces head count needs for manual random call monitoring.n Allows the ability to compare speech behavior to actual results.

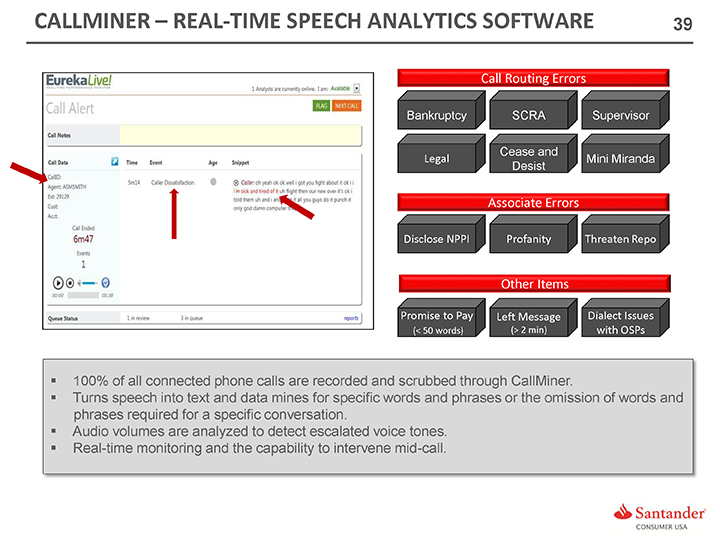

CALLMINER – REAL-TIME SPEECH ANALYTICS SOFTWARE 39

Call Routing Errors

Bankruptcy SCRA Supervisor

Cease and

Legal Mini Miranda Desist

Associate Errors

Disclose NPPI Profanity Threaten Repo

Other Items

Promise to Pay Left Message Dialect Issues

> 50 words) (> 2 min) with OSPs

100% of all connected phone calls are recorded and scrubbed through CallMiner.

Turns speech into text and data mines for specific words and phrases or the omission of words and phrases required for a specific conversation.

Audio volumes are analyzed to detect escalated voice tones. Real-time monitoring and the capability to intervene mid-call.

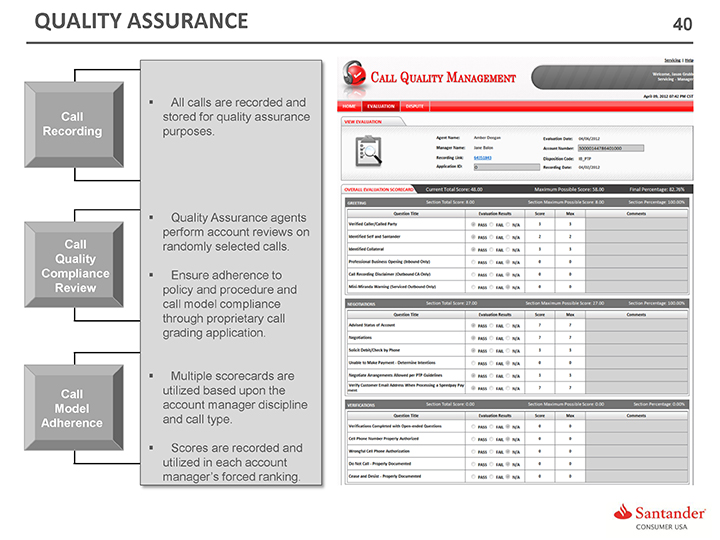

QUALITY ASSURANCE 40

n All calls are recorded and Call stored for quality assurance

Recording purposes.

n Quality Assurance agents perform account reviews on Call randomly selected calls.

Quality

Compliancen Ensure adherence to Review policy and procedure and call model compliance through proprietary call grading application.

n Multiple scorecards are Call utilized based upon the Model account manager discipline Adherence and call type.

n Scores are recorded and utilized in each account manager’s forced ranking.

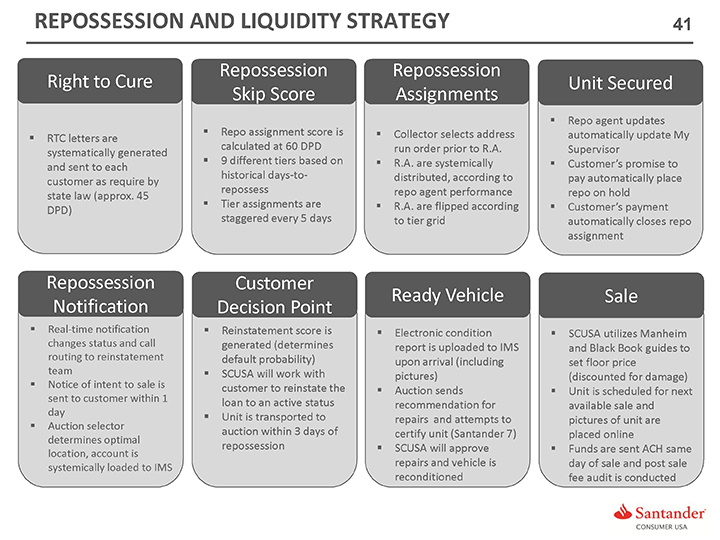

REPOSSESSION AND LIQUIDITY STRATEGY 41

Repossession Repossession

Right to Cure Unit Secured

Skip Score Assignments

Repo agent updates

Repo assignment score is Collector selects address automatically update My RTC letters are calculated at 60 DPD run order prior to R.A. Supervisor systematically generated 9 different tiers based on R.A. are systemically Customer’s promise to and sent to each historical days-to- distributed, according to pay automatically place customer as require by repossess repo agent performance repo on hold state law (approx. 45 Tier assignments are R.A. are flipped according Customer’s payment DPD) staggered every 5 days to tier grid automatically closes repo assignment

Repossession Customer

Ready Vehicle Sale

Notification Decision Point•

Real-time notification Reinstatement score is Electronic condition SCUSA utilizes Manheim changes status and call generated (determines report is uploaded to IMS routing to reinstatement and Black Book guides to default probability) upon arrival (including set floor price team SCUSA will work with Notice intent pictures) (discounted for damage) of to sale is customer to reinstate the Auction sends Unit is scheduled for next sent to customer within 1 loan to an active status recommendation for available sale and day

Unit is transported to repairs and attempts to pictures of unit are

Auction selector determines optimal auction within 3 days of certify unit (Santander 7) placed online repossession SCUSA will approve Funds are sent ACH same location, account is repairs and vehicle is systemically loaded to IMS day of sale and post sale reconditioned fee audit is conducted

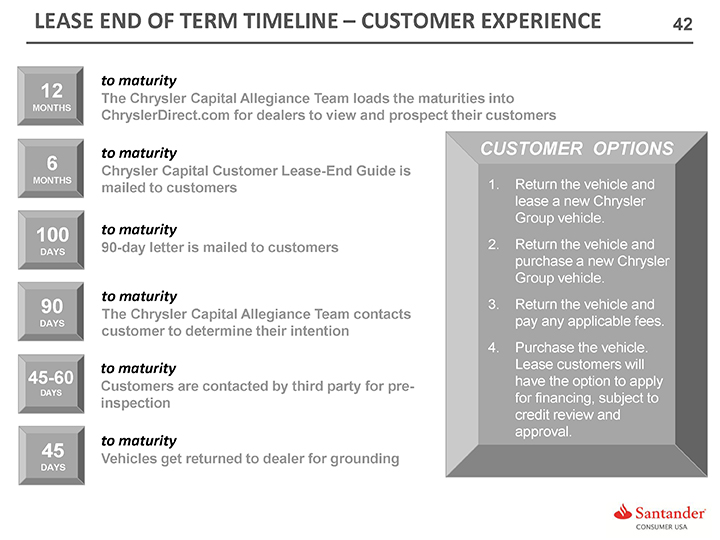

LEASE END OF TERM TIMELINE – CUSTOMER EXPERIENCE 42

to maturity

The Chrysler Capital Allegiance Team loads the maturities into ChryslerDirect.com for dealers to view and prospect their customers

to maturity

Chrysler Capital Customer Lease-End Guide is mailed to customers

to maturity

90-day letter is mailed to customers

to maturity

The Chrysler Capital Allegiance Team contacts customer to determine their intention

to maturity

Customers are contacted by third party for pre-inspection

to maturity

Vehicles get returned to dealer for grounding

12

MONTHS

6

MONTHS

100

DAYS

90

DAYS

45-60

DAYS

45

DAYS

CUSTOMER OPTIONS

1. Return the vehicle and lease a new Chrysler Group vehicle.

2. Return the vehicle and purchase a new Chrysler Group vehicle.

3. Return the vehicle and pay any applicable fees.

4. Purchase the vehicle. Lease customers will have the option to apply for financing, subject to credit review and approval.

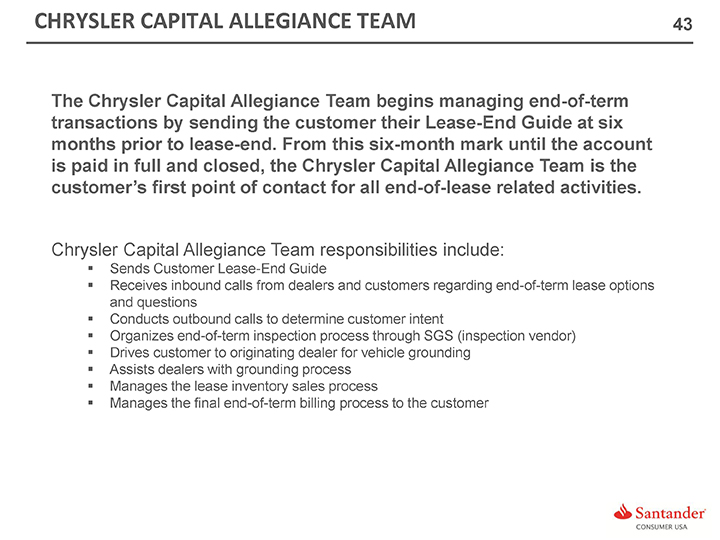

CHRYSLER CAPITAL ALLEGIANCE TEAM 43

The Chrysler Capital Allegiance Team begins managing end-of-term transactions by sending the customer their Lease-End Guide at six months prior to lease-end. From this six-month mark until the account is paid in full and closed, the Chrysler Capital Allegiance Team is the customer’s first point of contact for all end-of-lease related activities.

Chrysler Capital Allegiance Team responsibilities include:

n Sends Customer Lease-End Guide

n Receives inbound calls from dealers and customers regarding end-of-term lease options and questionsn Conducts outbound calls to determine customer intentn Organizes end-of-term inspection process through SGS (inspection vendor)n Drives customer to originating dealer for vehicle groundingn Assists dealers with grounding processn Manages the lease inventory sales processn Manages the final end-of-term billing process to the customer

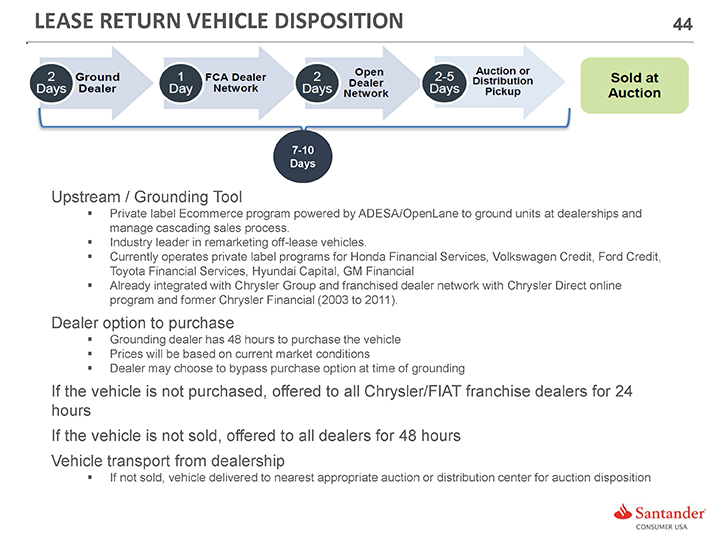

LEASE RETURN VEHICLE DISPOSITION 44

Upstream / Grounding Tool

n Private label Ecommerce program powered by ADESA/OpenLane to ground units at dealerships and manage cascading sales process.

n Industry leader in remarketing off-lease vehicles.

n Currently operates private label programs for Honda Financial Services, Volkswagen Credit, Ford Credit, Toyota Financial Services, Hyundai Capital, GM Financialn Already integrated with Chrysler Group and franchised dealer network with Chrysler Direct online program and former Chrysler Financial (2003 to 2011).

Dealer option to purchase

n Grounding dealer has 48 hours to purchase the vehiclen Prices will be based on current market conditions

n Dealer may choose to bypass purchase option at time of grounding

If the vehicle is not purchased, offered to all Chrysler/FIAT franchise dealers for 24 hours If the vehicle is not sold, offered to all dealers for 48 hours Vehicle transport from dealership

n If not sold, vehicle delivered to nearest appropriate auction or distribution center for auction disposition

Santander

CONSUMER USA