- SC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Santander Consumer USA (SC) DEF 14ADefinitive proxy

Filed: 28 Apr 17, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to Section 240.14a-12 | |

Santander Consumer USA Holdings Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

CONSUMER USA

| 1601 Elm St. Suite 800 Dallas, Texas 75201 | 214.634.1110

| |

April 28, 2017

Dear Stockholders,

Thank you for your interest in Santander Consumer USA (“SC” and the “Company”). We are proud to lead this dynamic, disciplined and maturing company, which has been a leader in automotive finance for nearly two decades. You are invited to attend the Annual Meeting of Stockholders on Monday, June 12, 2017. The Annual Meeting will begin promptly at 3 p.m., local time, at 1601 Elm Street, Suite 800, Dallas, Texas 75201.

Throughout its evolution, SC has remained a sustainable and profitable business. At the heart of the Company philosophy is our disciplined approach to the market, and ensuring that we have a Simple, Personal and Fair framework for our customers, employees and constituents.

Santander Consumer USA continues to deliver strong, stable performance through cycles, which is largely attributable to seven differentiators:

| » | Compliance, consumer and employee focused culture |

| » | Data-driven underwriting discipline |

| » | Strong and growing capital base |

| » | Deep, sustained and diverse access to funding |

| » | Banco Santander S.A. ownership and support |

| » | Largest provider for Fiat Chrysler (FCA) |

| » | Efficient, scalable, technology-driven platform |

Santander Consumer USA remains focused on our four business pillars – vehicle finance, servicing loans for others, funding and liquidity, and instilling a culture of compliance. In the past year, SC balanced efficiency and disciplined underwriting while working to maximize volume and profitability. We continued to leverage scale and technology for our loan platforms and portfolios. We maintained leadership in the ABS markets while optimizing diverse sources of liquidity. And we made significant progress in strengthening the Company’s compliance and risk management processes.

We are optimistic about SC’s prospects for 2017 as our fundamentals continue to strengthen, and we remain committed to better serving our customers and creating value for all our stakeholders.

The Notice of Annual Meeting and Proxy Statement on the following pages contain information about the official business of the Annual Meeting. Whether or not you expect to attend, please vote your shares now. Of course, if you attend the Annual Meeting in person you will have the opportunity to revoke your proxy and vote your shares in person. This proxy statement is also available athttp://www.proxypush.com/SC.

We gratefully acknowledge your continuing interest in Santander Consumer USA, and we hope you will attend the Annual Meeting.

| Sincerely, | ||||||

|

William Rainer Chairman of the Board |  |

Jason Kulas | |||

| President and Chief Executive Officer | ||||||

CONSUMER USA

| 1601 Elm St. Suite 800 Dallas, Texas 75201 | 214.634.1110

| |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 12, 2017

NOTICE IS HEREBY GIVENthat the Annual Meeting of Stockholders of Santander Consumer USA Holdings Inc. will be held at 1601 Elm Street, Suite 800, Dallas, Texas 75201, at 3 p.m., local time, on June 12, 2017 for the following purposes:

| 1. | To elect 12 directors to the Board of Directors; |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the current fiscal year; and |

| 3. | To transact any business as may properly come before the Annual Meeting in accordance with the terms of our Third Amended and Restated Bylaws. |

The Board of Directors has fixed the close of business on April 13, 2017 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting.

By Order of the Board of Directors,

Christopher Pfirrman

Chief Legal Officer, General Counsel and Corporate Secretary

April 28, 2017

TABLE OF CONTENTS

| 1 | ||||

| 6 | ||||

| 6 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 18 | ||||

| 20 | ||||

| 21 | ||||

| 23 | ||||

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm | 23 | |||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 40 | ||||

| 41 | ||||

| 48 | ||||

| 48 | ||||

| 51 | ||||

| 53 | ||||

| 54 | ||||

SC 2017 Proxy Statement |

1 |

PROXY SUMMARY

THIS SUMMARY HIGHLIGHTS INFORMATION CONTAINED ELSEWHERE IN THIS PROXY STATEMENT. IT DOES NOT CONTAIN ALL OF THE INFORMATION THAT YOU SHOULD CONSIDER. PLEASE READ THE ENTIRE PROXY STATEMENT CAREFULLY BEFORE VOTING.

Important Terms

| » | “Board” – the Board of Directors of SC |

| » | “Common Stock” – shares of SC common stock, par value $.01 per share |

| » | “Company”, “us”, “we”, “our” and “SC” – Santander Consumer USA Holdings Inc. and, where appropriate, Santander Consumer USA Holdings Inc. and its subsidiaries |

| » | “PwC” – PricewaterhouseCoopers LLP |

| » | “Santander” and “SAN” – Banco Santander, S.A. |

| » | “SBNA” – Santander Bank, N.A., a subsidiary of SHUSA and an affiliate of SC |

| » | “SHUSA” – Santander Holdings USA, Inc., SC’s majority stockholder and a subsidiary of Santander |

Your Vote

Your vote is very important. The Board is requesting you to allow your Common Stock to be represented at our 2017 annual meeting by proxies named on the proxy card.

This Proxy Statement is being sent to you in connection with this request and has been prepared for the Board by our management. This Proxy Statement is being sent to our stockholders on or about April 28, 2017.

How to Vote

You may vote your shares prior to the Annual Meeting via the Internet, by telephone or by mail.

INTERNET

|

TELEPHONE

|

| ||

|

|

| ||

| Go to www.proxypush.com/sc | Dial toll-free 855-782-8499 | Mark, sign and date your | ||

You will need the control number included in your Proxy Card/Voting Instruction Form.

| You will need the control number included in your Proxy Card/Voting Instruction Form. | Proxy Card/Voting Instruction Form and return it in the postage-paid envelope provided. | ||

| SC 2017 Proxy Statement |

1 |

PROXY SUMMARY

Summary of Voting Items and Voting Recommendations

PROPOSALS

|

BOARD RECOMMENDATION

| |

ITEM 1. Election of Directors (Page 6)

We are asking stockholders to vote on each director nominee to the Board named in the Proxy Statement. The Board and the Executive Committee believe that each director nominee has the qualifications, experience and skills necessary to represent stockholders through service on the Board.

| FOR ALL | |

ITEM 2. Ratification of Appointment of Independent Registered Public Accounting Firm (Page 23)

The Audit Committee has appointed PwC to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2017. The Audit Committee and the Board believe that the continued retention of PwC to serve as the independent auditor is in the best interests of the Company and its stockholders. As a matter of good corporate governance, stockholders are being asked to ratify the Audit Committee’s appointment of PwC.

| FOR |

Nominees for Election as Directors

The Board recommends a vote FOR the election of each of the following nominees for director:

NAME

|

AGE

|

DIRECTOR SINCE

|

INDEPENDENT

|

COMMITTEE MEMBERSHIP

| ||||

William Rainer

| 70 | 2015 | ● | Board Chair, EC (Chair) | ||||

Stephen A. Ferriss

| 71 | 2013 | ● | Board Vice Chair, CC (Chair), AC, EC | ||||

José Doncel

| 56 | 2015 | --- | |||||

Brian Gunn

| 44 | 2015 | RC | |||||

Victor Hill

| 53 | 2015 | RCOC, RC | |||||

Edith E. Holiday

| 65 | 2016 | ● | CC, RCOC | ||||

Mark P. Hurley

| 58 | 2016 | ● | RC (Chair), AC, RCOC | ||||

Jason A. Kulas

| 46 | 2015 | EC | |||||

Javier Maldonado

| 54 | 2015 | CC, EC, RCOC | |||||

Robert J. McCarthy

| 63 | 2015 | ● | RCOC (Chair), AC, CC | ||||

William F. Muir

| 62 | 2016 | ● | AC (Chair), RC | ||||

Scott Powell

| 55 | 2016 | --- |

AC: Audit Committee, CC: Compensation Committee, EC: Executive Committee, RC: Risk Committee, RCOC: Regulatory and Compliance Oversight Committee

2 |

SC 2017 Proxy Statement |

PROXY SUMMARY

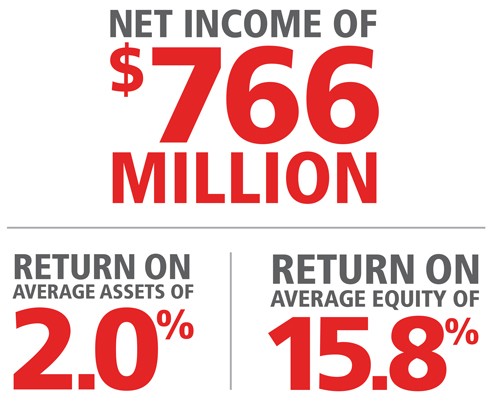

2016 BUSINESS HIGHLIGHTS

|

|

|

| |||||||||

» Total auto originations of $22 billion

» More than 900,000 units originated

» Largest provider for Fiat Chrysler (FCA) | » More than $38 billion in committed liquidity

» Santander support totaling $6.3 billion

» Issued and sold $8.3 billion in bonds across three distinct platforms

» Two new revolving warehouse facilities established, including one new lender | » FormedOffice of Consumer Practices

» Real-time call monitoring rolled out for all inbound/ outbound call center lines

» LaunchedIdeas Into Action campaign to encourage employees to submit ideas to improve process and better serve customers | » Totaled $12 billion

» Servicing fee income of $156 million | |||||||||

SC 2017 Proxy Statement |

3 |

PROXY SUMMARY

Governance Highlights

Annual election of all directors

|

Annual evaluation of CEO by Board

|

Annual Board and Committee self-evaluations and annual individual director evaluations

|

Strong Board providing challenge to management opinions

|

Strong independent Chairman of the Board

|

Orientation program for new directors and continuing education for all directors

|

Robust stock ownership guidelines for independent directors

|

Strong risk oversight by full Board and Board Committees

|

Regular executive sessions of non-management directors

|

Compensation Program

Our executive compensation program is designed to reinforce the link between the long-term interests of our executive officers and our stockholders. A significant portion of our executive officers’ incentive compensation is deferred and payable in SC shares, and therefore, directly aligned with the Company’s performance, including total stockholder return.

ELEMENT

|

KEY CHARACTERISTICS

|

PURPOSE

| ||||||

| Base Salary |

Fixed cash compensation component, reviewed at least annually, that reflects the executive’s position, responsibilities, qualifications, tenure and contributions to the Company

| Offers security for executives and allows the Company to maintain a stable management team | ||||||

Annual Incentive Award Program | Comprised of both short-term and long-term incentives; a significant portion of annual bonuses are deferred and half are payable in cash and half are payable in SC equity awards |

Designed to motivate and reward the achievement of Company and individual performance goals, appropriately balance compensation risk and align management and stockholder interests

| ||||||

Retirement Benefits; Welfare Benefits; Perquisites | Indirect compensation consisting of a retirement plan, health and welfare plans and minimal perquisites |

Provides executives with security during employment and into retirement and promotes employee health, which assists in the retention of our executives

|

4 |

SC 2017 Proxy Statement |

PROXY SUMMARY

Key Features of our Compensation Program

Tie annual incentive compensation to the achievement of meaningful Company and individual performance goals

|

Subject a significant portion of annual incentive compensation to deferral

|

Pay a significant portion of annual incentive compensation in SC stock

|

Subject Omnibus Incentive Plan awards to “double-trigger” change in control vesting

|

Subject incentive compensation to a robust malus and clawback policy

|

Condition a significant portion of compensation on the acceptance of confidentiality, non-compete, non-solicit and other restrictive covenants

|

Use a prominent independent compensation consultant

|

Use a representative and relevant peer group

|

Structure performance-based compensation to be tax-deductible where appropriate

|

Impose annual limits on non-employee director compensation

|

Maintain independent non-employee director stock ownership guidelines

|

Conduct a robust annual compensation risk assessment

|

Do not reprice underwater stock options

|

Do not grant discounted stock options

|

Do not allow hedging or pledging of SC stock by executive officers or directors

|

Awarded 2016 Total Direct Compensation

The amounts reported as Awarded Total Direct Compensation below differ from the amounts determined under SEC rules as reported for 2016 in the Summary Compensation Table set forth on page 41 of this Proxy Statement. The table below is a supplement to–not a substitute for–the Summary Compensation Table.

NAME AND PRINCIPAL POSITION | SALARY ($) |

ANNUAL BONUS(1)

| ||||||||||||||||||||||||||||||

SHORT-TERM

|

LONG-TERM

|

SIGN-ON/RETENTION

| AWARDED TOTAL DIRECT COMPENSATION ($) | |||||||||||||||||||||||||||||

CASH ($)

|

RSUS ($)

| CASH ($)

| RSUS ($)

| CASH ($)

| RSUS ($)

| |||||||||||||||||||||||||||

Jason Kulas

| 1,800,000 | 491,750 | 491,750 | 491,750 | 491,750 | — | — | 3,767,000 | ||||||||||||||||||||||||

Ismail Dawood

| 724,750 | 420,450 | 420,450 | 280,300 | 280,300 | 1,221,555 | — | 3,347,805 | ||||||||||||||||||||||||

Richard Morrin

| 531,923 | 214,500 | 214,500 | 143,000 | 143,000 | — | 480,000 | 1,726,923 | ||||||||||||||||||||||||

Kalyan Seshan

| 665,000 | 193,500 | 193,500 | 129,000 | 129,000 | — | — | 1,310,000 | ||||||||||||||||||||||||

Christopher Pfirrman

| 649,418 | 156,000 | 156,000 | 104,000 | 104,000 | 300,000 | 300,000 | 1,769,418 | ||||||||||||||||||||||||

(1) Amounts include the annual bonus earned in 2016 and awarded in 2017.

(2) Subject to future vesting and forfeiture conditions.

SC 2017 Proxy Statement |

5 |

CORPORATE GOVERNANCE - PROPOSAL 1: ELECTION OF GOVERNANCE

Proposal 1: Election of Directors

WHAT YOU ARE VOTING ON:

At the 2017 Annual Meeting, 12 directors are to be elected to hold office until the 2018 Annual Meeting and until their successors are elected and qualified, or until the directors either resign or are removed from office.

|

Introduction

As of the date of our Annual Meeting, the Board will consist of 12 members. The current members are José Doncel, Stephen A. Ferriss, Brian Gunn, Victor Hill, Edith E. Holiday, Mark P. Hurley, Jason A. Kulas, Javier Maldonado, Robert J. McCarthy, William F. Muir, Scott Powell and William Rainer. Each member of our Board is also a member of the board of directors of Santander Consumer USA Inc., an Illinois corporation, a wholly-owned subsidiary of SC (“SC Illinois”).

SHUSA has the right to nominate eight members of the Board. See “Corporate Governance— Nomination of Directors.” SHUSA has nominated Mr. Doncel, Mr. Ferriss, Mr. Gunn, Mr. Hill, Mr. Kulas, Mr. Maldonado, Mr. Powell and Mr. Rainer for election to the Board. The Board has nominated Ms. Holiday, Mr. Hurley, Mr. McCarthy and Mr. Muir for election to the Board. The Board has determined that Mr. Ferriss, Ms. Holiday, Mr. Hurley, Mr. McCarthy, Mr. Muir and Mr. Rainer are independent directors.

Each of the directors elected at the Annual Meeting will be elected for a one-year term which expires at the next Annual Meeting and will serve until the director’s successor has been elected and qualified, or until the director’s earlier resignation or removal.

Information Concerning the Nominees

Biographical information for each nominee for election to the Board appears below. The information is based entirely upon information provided by the respective nominees.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR EACH OF THE NOMINEES. |

6 |

SC 2017 Proxy Statement |

CORPORATE GOVERNANCE - PROPOSAL 1: ELECTION OF GOVERNANCE

JOSÉ DONCEL

| DIRECTOR SINCE: 2015 AGE: 56 | |

|

EXPERIENCE

Mr. Doncel has served as a senior executive of Santander and predecessor companies since 1993, most recently as Senior Executive Vice President and Director of the Accounting and Control Division since October 2014, as Senior Executive Vice President and Director of the Corporate Division of Internal Audit from June 2013 to October 2014, and as Senior Executive Vice President and Director General of the Retail Banking Management Control Area from April 2013 to June 2013. He was previously employed by Arthur Andersen Auditores, S.A., Division of Financial Institutions. Mr. Doncel is currently a member of the boards of directors of SHUSA and SBNA. He is also chairman of the boards of directors of Banco de Albacete, S.A., Administración de Bancos Latinoamericanos Santander, S.L., Grupo Empresarial Santander, S.L., Santander Investment I, S.A., and Ablasa Participaciones, S.L., and a member of the boards of directors of Santander Holding Internacional, S.A., Santusa Holding, S.L, Ingeniería de Software Bancario, S.L., Geoban, S.A. and Produban Servicios Informáticos Generales, S.L. Mr. Doncel holds a degree in economic and business sciences from the Universidad Complutense de Madrid. Mr. Doncel has extensive experience in leadership, finance and risk management, and we believe he is qualified to serve on the Board.

| |

STEPHEN A. FERRISS

| DIRECTOR SINCE: 2013 AGE: 71 | |

Vice-Chairman of the Board

COMMITTEES

» Audit

» Compensation (Chair)

» Executive

|

EXPERIENCE

Mr. Ferriss has served as a director of SHUSA since 2012 and is also the chairman of the boards of Santander BanCorp and Banco Santander Puerto Rico. Mr. Ferriss was a director of SBNA from 2012 to 2015 and was also a director of Iberchem from 2007 until 2013. Previously, he served as President and Chief Executive Officer of Santander Central Hispano Investment Services, Inc. from 1999 to 2002, and held various roles at Bankers Trust, including Managing Director and Partner of the Bankers Trust Global Investment Bank in London and New York. Prior to Bankers Trust, Mr. Ferriss spent 19 years at Bank of America. He also previously served as the senior independent director of Management Consulting Group PLC, London. Mr. Ferriss graduated from Columbia College and received a master’s degree in Latin American International Economics from Columbia University School of International and Public Affairs. Mr. Ferriss has extensive experience in management and international finance, and we believe he is qualified to serve on the Board. |

SC 2017 Proxy Statement |

7 |

CORPORATE GOVERNANCE - PROPOSAL 1: ELECTION OF GOVERNANCE

BRIAN GUNN

| DIRECTOR SINCE: 2015 AGE: 44 | |

COMMITTEES

» Risk

|

EXPERIENCE

Mr. Gunn has served as Chief Risk Officer and Senior Executive Vice President of SHUSA since June 2015, and is a member of SHUSA’s CEO Executive Committee. In February 2016, he was named Chief Risk Officer and Senior Executive Vice President of SBNA and also serves on SBNA’s CEO Executive Committee. Prior to joining SHUSA, Mr. Gunn served as the Chief Risk Officer of Ally Financial Services from 2011 to June 2015. Prior to that role, Mr. Gunn was Chief Risk Officer of Ally’s Global Automotive Services division. Before joining Ally, he spent 10 years in a variety of risk management positions at GE Capital including Chief Risk Officer of GE Money Canada. He holds a bachelor’s degree in finance from Providence College and a master’s degree in business administration from Hofstra University. Mr. Gunn has extensive experience in risk management and finance, and we believe he is qualified to serve on the Board. | |

VICTOR HILL

| DIRECTOR SINCE: 2015 AGE: 53 | |

COMMITTEES

» Regulatory and Compliance Oversight

» Risk

|

EXPERIENCE

Mr. Hill has served as Managing Director and Chief Executive Officer of Santander Consumer (UK) plc (“SCUK”) since 2005. Mr. Hill has over thirty years’ experience in the UK motor finance industry, the last seventeen at the board level. He began his career with First National Motor plc (f/k/a Lombard North Central plc), where he focused on operations, in particular, customer service and collections. In 2005, he was responsible for the launch of SCUK and has led the business over the past twelve years, during which time SCUK undertook a major acquisition and integration of the auto loans portfolio from GE Capital Bank in 2009. Mr. Hill currently serves on the boards of directors of Santander Consumer (UK) Plc, Hyundai Capital UK Ltd (JV), PSA Finance UK Ltd (JV), First National Motor Plc and PSA Finance Plc. He has previously served as a director of GE Capital Bank Limited and of several companies in the Abbey National Group. Mr. Hill qualified as a Chartered Director in 2007, achieved a Fellowship of the Institute of Directors in London in 2012, and became a Qualified Mediator for Civil and Commercial Disputes in 2008. Mr. Hill has extensive experience in management and in the auto finance industry, and we believe he is qualified to serve on the Board. |

8 |

SC 2017 Proxy Statement |

CORPORATE GOVERNANCE - PROPOSAL 1: ELECTION OF GOVERNANCE

EDITH E. HOLIDAY

| DIRECTOR SINCE: 2016 AGE: 65 | |

COMMITTEES

» Compensation

» Regulatory and Compliance Oversight

|

EXPERIENCE

Ms. Holiday is a member of the boards of directors of Hess Corporation, White Mountains Insurance Group Ltd., and Canadian National Railway and is a member of the boards of directors or trustees of various investment companies in the Franklin Templeton Group of Funds, serving as Lead Director of the Templeton Funds. She also served on the boards of directors of RTI International Metals, Inc. from 1999 to 2015, and of the HJ Heinz Company from 1994 to 2013. Ms. Holiday was also the President, Secretary and Treasurer of Comcast TW Holdings, Inc. from 2006 to 2007. From 1990 to 1993, Ms. Holiday was Assistant to the President of the United States and Secretary of the U.S. Cabinet. From 1989 to 1990, she served as General Counsel of the U.S. Treasury Department, and from 1988 to 1989, she served as Counselor to the Secretary and Assistant Secretary for Public Affairs and Public Liaison of the U.S. Treasury Department. Prior to that, Ms. Holiday held various other positions in government and in private practice. Ms. Holiday holds a B.S. and a J.D. from the University of Florida and is a member of the State Bars of Florida and Georgia and the District of Columbia Bar. Ms. Holiday has extensive experience in legal and regulatory matters and in public service, and we believe that she is qualified to serve on the Board.

| |

MARK P. HURLEY

| DIRECTOR SINCE: 2016 AGE: 58 | |

COMMITTEES

» Audit

» Regulatory and Compliance Oversight

» Risk (Chair)

|

EXPERIENCE

Mr. Hurley co-founded Fiduciary Network, a specialty finance business focused on wealth management companies, and has served as its Chairman and Chief Executive Officer since 2006. Mr. Hurley served as Chairman and Chief Executive Officer of Undiscovered Managers, a mutual fund company that he founded, from 1997 until 2004, when it was sold to JPMorgan. He previously was a Managing Director at Merrill Lynch and a Vice President at Goldman Sachs and served as the Director of Resolutions at the Office of Thrift Supervision, U.S. Treasury Department. Mr. Hurley currently serves on the board of directors of the University of North Texas Foundation. He holds a bachelor’s degree in engineering and history from the United States Military Academy and a master’s degree in business administration from the Stanford Graduate School of Business. Mr. Hurley also was a Captain in the U.S. Army Field Artillery, serving for five years. Mr. Hurley has extensive managerial and finance experience, and we believe he is qualified to serve on the Board. | |

SC 2017 Proxy Statement |

9 |

CORPORATE GOVERNANCE - PROPOSAL 1: ELECTION OF GOVERNANCE

JASON A. KULAS

| DIRECTOR SINCE: 2015 AGE: 46 | |

President and Chief Executive Officer

COMMITTEES

» Executive

|

EXPERIENCE

Mr. Kulas has served as our Chief Executive Officer (“CEO”) since July 2015 and as our President since February 2016, having previously served as our President from November 2013 to July 2015 and our Chief Financial Officer from January 2007 to July 2015. Since July 2015, he has also served as a director, having previously served on our Board from 2007 to 2012. He also served as a director of SHUSA from October 2015 to September 2016. Prior to joining us, Mr. Kulas was a Managing Director in investment banking for JPMorgan Securities, Inc., where he was employed from 1995 to 2007. He also worked previously at Dun & Bradstreet and as an adjunct professor at Texas Christian University. Mr. Kulas also currently serves on the board of directors of the nonprofit Santander Consumer USA Inc. Foundation. He holds a bachelor’s degree in chemistry from Southern Methodist University and a master’s degree in business administration from Texas Christian University. Mr. Kulas has extensive knowledge and experience in finance and in the consumer finance industry, and we believe he is qualified to serve on the Board. | |

JAVIER MALDONADO

| DIRECTOR SINCE: 2015 AGE: 54 | |

COMMITTEES

» Compensation

» Executive

» Regulatory and Compliance Oversight

|

EXPERIENCE

Mr. Maldonado has served as Senior Executive Vice President, Global Head of Cost Control of Santander since October 2015. He has held numerous management positions at Santander and its affiliates, including Senior Executive Vice President of Santander, Head of the New General Directorate for Coordination and Control of Regulatory Projects of Santander, from September 2014 to October 2015; Executive Committee Director, Head of Internal Control and Corporate Development, for Santander (UK) plc from May 2012 to September 2014; Vice President in Charge of Closed Funds and Complaints for Banco Santander Brazil from October 2011 to April 2012; and General Manager for Santander in the Middle East from January 2011 to September 2011. Previously, Mr. Maldonado was an attorney with Baker & McKenzie and Corporate and International Law Department Head at J.Y. Hernandez-Canut Law Firm. Mr. Maldonado has served as a director of SHUSA since April 2015 and has served as vice-chairman of the board of directors of SHUSA since October 2015. He also currently serves as a director of Banco Santander Puerto Rico, Santander BanCorp and Santander Investment Securities (“SIS”). Mr. Maldonado also serves as a director of Saudi Hollandi Bank Riyadh. He holds law degrees from Northwestern University and UNED University. Mr. Maldonado has extensive knowledge and experience in international finance and legal and regulatory affairs, and we believe he is qualified to serve on the Board. | |

10 |

SC 2017 Proxy Statement |

CORPORATE GOVERNANCE - PROPOSAL 1: ELECTION OF GOVERNANCE

ROBERT J.

| DIRECTOR SINCE: 2015 AGE: 63 | |

COMMITTEES

» Audit

» Compensation

» Regulatory and Compliance Oversight (Chair)

|

EXPERIENCE

In 2014, Mr. McCarthy retired from Marriott International, Inc., where he served as Chief Operations Officer. Mr. McCarthy joined Marriott in 1975, where he served in various leadership positions, including Senior Vice President, Northeast Region from 1995 to 2000; Executive Vice President, Operations from 2000 to 2002; President, North America from 2003 to 2009; Group President from 2009 to 2011; and Chief Operations Officer from December 2011 until February 2014. Mr. McCarthy has served as Chairman of Hotel Development Partners since March 2014. He currently is a member of the Board of Trustees at Villanova University and a member of the Board of Priton, LLC. Previously, Mr. McCarthy served as a director of the ServiceSource Foundation, as a member of the board of the Autism Learning Center, as a member of the Dean’s Advisory Board at Cornell University School of Hotel Administration, as a member of the Dean’s Advisory Board at Villanova University School of Business and as a member of the board of managers at Avendra, LLC. He holds a bachelor’s degree in business administration from Villanova University and is a graduate of the Advanced Management Program at the Wharton School of Business at the University of Pennsylvania. Mr. McCarthy has extensive managerial and finance experience, and we believe he is qualified to serve on the Board. |

WILLIAM F. MUIR

| DIRECTOR SINCE: 2016 AGE: 62 | |

COMMITTEES

» Audit (Chair)

» Risk

|

EXPERIENCE

In 2014, Mr. Muir retired from Ally Financial Inc. (formerly known as General Motors Acceptance Corporation (“GMAC”)), where he served as President and head of its Global Automotive Services business since 2004. In that role, he led Ally’s automotive finance, insurance, vehicle remarketing and servicing operations. Prior to that time, he served as Executive Vice President and Chief Financial Officer of GMAC from 1998 to 2004. From 1996 to 1998, Mr. Muir served as executive-in-charge of operations and then executive director of planning at Delphi Automotive Systems, a former subsidiary of General Motors (“GM”). Prior to serving at Delphi Automotive Systems, he served in various executive capacities since first joining GMAC in 1992 and also served in a number of capacities with GM since joining GM in 1983. Mr. Muir also served as Chairman of the Ally Insurance Group from 1999 to 2014 and a member of the Ally Bank board of directors from 2004 to 2014. Mr. Muir received a bachelor’s degree in industrial engineering and operations research from Cornell University in 1977. He earned a master’s degree in business administration from Harvard University in 1983. Mr. Muir has extensive experience in management, finance and the auto finance industry, and we believe that he is qualified to serve on the Board. |

SC 2017 Proxy Statement |

11 |

CORPORATE GOVERNANCE - PROPOSAL 1: ELECTION OF GOVERNANCE

SCOTT POWELL

| DIRECTOR SINCE: 2016 AGE: 55 | |

|

EXPERIENCE

Mr. Powell has served as the Chief Executive Officer and a director of SHUSA since March 2015, and he is a member of SHUSA’s Board Executive Committee. He has also served as Chief Executive Officer and a director of SBNA since July 2015, and he is a member of SBNA’s Board Executive Committee. Previously, Mr. Powell held numerous management roles at JPMorgan Chase & Co. and its predecessor Bank One Corporation, including Head of Banking and Consumer Lending Operations, Chief Executive Officer of Consumer Banking and Retail Investments, Head of Consumer Lending, and Chief Risk Officer, Consumer. He also spent 14 years at Citigroup and its predecessors in senior risk management positions. Most recently, before joining SHUSA, Mr. Powell was Executive Chairman of National Flood Services Inc. Mr. Powell is a director of the Phipps Houses and The End Fund in New York City. Mr. Powell graduated from the University of Minnesota and received a master’s degree in business administration from the University of Maryland. Mr. Powell has extensive experience in management, finance, risk management and consumer and auto lending, and we believe he is qualified to serve on the Board.

|

WILLIAM RAINER

| DIRECTOR SINCE: 2015 AGE: 70 | |

Chairman of the Board

COMMITTEES

» Executive (Chair)

|

EXPERIENCE

Mr. Rainer has extensive experience and has held numerous leadership roles in the financial services industry. From 2001 to 2004, Mr. Rainer served as the Chairman and Chief Executive Officer of OneChicago, LLC, a regulated futures exchange. He also served as the Chairman of the Commodity Futures Trading Commission from 1999 to 2001, as Chairman of the United States Enrichment Corporation from 1994 to 1998, and as Founder of Greenwich Capital Markets, Inc. from 1981 to 1988. Previously, Mr. Rainer held various leadership positions at Kidder, Peabody & Co., Inc. From July 2015 to March 2016, he served as a director of Banco Santander International (“BSI”), and from December 2015 to March 2016, he served as chairman of the board of SIS. Mr. Rainer served as director of IQ Funds, a family of closed-end mutual funds, from 2004 until 2010. From 1996 to 2000 and from 2004 to 2008, Mr. Rainer served as a trustee for Southern Methodist University. He has served as a member of the Dean’s Council of the Harvard Divinity School since 2003 and as its Chair from 2005 through June 2013. He is currently the Chairman of Shortridge Academy, Ltd. and New Braunfels Communications, Inc. Mr. Rainer received his bachelor’s degree in economics and master’s degree in business administration from Southern Methodist University. Mr. Rainer has extensive knowledge and experience in finance, regulatory affairs, and leadership of financial services firms, and we believe he is qualified to serve on the Board. |

12 |

SC 2017 Proxy Statement |

CORPORATE GOVERNANCE - DIRECTOR INDEPENDENCE

Because we are a controlled company, we are exempt from the requirement in the New York Stock Exchange (“NYSE”) Listed Company Rules that a majority of our directors must be independent. In addition, we are exempt from the requirements (i) that our Executive Committee (which has the responsibilities under its charter of a Nominating and Governance Committee) be composed solely of directors who meet the independence standards under the NYSE Listed Company Rules and (ii) that our Compensation Committee be composed solely of directors who meet additional, heightened independence standards under the NYSE Listed Company Rules and the rules of the Securities and Exchange Commission (“SEC”). The Company is subject to the requirement that all members of our Audit Committee satisfy independence requirements set forth under the NYSE Listed Company Rules and meet the additional criteria for independence of audit committee members set forth in Rule of 10A-3(b)(1) under the Securities Exchange Act of 1934 (the “Exchange Act”).

Under the NYSE Listed Company Rules, to be considered independent, the director must not have a disqualifying relationship, as defined in the NYSE Listed Company Rules; and the Board must affirmatively determine that the director otherwise has no direct or indirect material relationship with the Company. In making independence determinations, the Board complies with all NYSE and SEC criteria and considers all relevant facts and circumstances. The Board has determined that Mr. Ferriss, Ms. Holiday, Mr. Hurley, Mr. McCarthy, Mr. Muir and Mr. Rainer (the “Independent Directors”) are independent as defined by the NYSE Listed Company Rules. The Board also determined that Blythe Masters and Heidi Ueberroth, each of whom resigned from the Board during 2016, and Wolfgang Schoellkopf, who resigned from the Board in 2017, were independent as defined by the NYSE Listed Company Rules.

In assessing the independence of the Independent Directors, the Board considered, without limitation, the following transactions, relationships and arrangements:

| DIRECTOR | ORGANIZATION | RELATIONSHIP |

SC TRANSACTION/ RELATIONSHIP

| |||

| Mr. Ferriss | SHUSA | Director |

Majority Stockholder

| |||

SBNA | Former Director |

Affiliate

| ||||

Santander Central Hispano Investment Services, Inc.

| Former CEO | Affiliate | ||||

Santander BanCorp | Chairman of the Board |

Affiliate

| ||||

Banco Santander Puerto Rico | Chairman of the Board |

Affiliate

| ||||

| Ms. Holiday | SC | Independent Advisor |

During 2016, SC paid Ms. Holiday $18,739 for advisory services to the Board prior to her appointment as a director.

| |||

| Mr. Muir | SC | Independent Advisor |

During 2016, SC paid Mr. Muir $18,739 for advisory services to the Board prior to his appointment as a director.

| |||

| Mr. Rainer | BSI | Former Director |

Affiliate

| |||

SIS | Former Chairman |

Affiliate

|

The Board has also determined that each member of the Audit Committee (Mr. Ferriss, Mr. Hurley, Mr. McCarthy and Mr. Muir) is an “audit committee financial expert” in accordance with the

definition established by the SEC. Further, all of the directors, except for Mr. Kulas (the “Outside Directors”), qualify as outside directors as defined by the NYSE Listed Company Rules.

SC 2017 Proxy Statement |

13 |

CORPORATE GOVERNANCE - BOARD LEADERSHIP STRUCTURE AND RISK OVERSIGHT

Board Leadership Structure and Risk Oversight

The Board is responsible for the oversight of management on behalf of our stockholders. The Board and its committees meet periodically throughout the year to (i) review strategy, business and financial performance, risk and control matters, and compensation and management development, and (ii) provide guidance to and oversight of, and otherwise assess and advise, the CEO and other senior executives. The Board’s leadership structure, described below, is designed to ensure that authority and responsibility are effectively allocated between the Board and management.

The Board does not have any formal policy on whether the same person should serve as both the CEO and Chairman of the Board, as the Board believes that it should have the flexibility to make the determination of the appropriate leadership for us at any given point in time. In July 2015, the Board decided to separate the positions of Chairman of the Board and CEO. Currently, Mr. Rainer serves as the independent Chairman of our Board. We believe that having an independent Chairman can create an environment that leads to objective evaluation and oversight of management’s performance, increases management accountability and improves the ability of the Board to monitor whether management’s actions are in the best interests of all stockholders. As a result, at this time, we believe that Mr. Rainer serving as our independent Chairman enhances the effectiveness of the Board as a whole. The Board will continue to review the Board’s leadership periodically and may modify this structure from time to time if it is in the best interests of our Company and our stockholders.

The Chairman of the Board leads the Board, sets the tone for its culture and ensures its effectiveness in overseeing the Company and its management. The Chairman presides at all meetings of the Board, as well as executive sessions of outside directors and, in consultation with the CEO, other directors and management, establishes the agenda for each Board meeting. The Chairman also has the power to call special meetings of the Board. Mr. Ferriss serves as the Board’s Vice-Chairman, who acts as Chairman of the Board if Mr. Rainer is absent.

The Company has established a risk governance structure that assigns responsibility for risk management among front-line business personnel, an independent risk management function, and internal audit. According to this model, business owners maintain responsibility for identifying and mitigating the risks generated through their business activities. The Chief Risk Officer (“CRO”), who reports to the CEO and is independent of any business line, is responsible for developing and maintaining a risk framework that ensures risks are appropriately identified and mitigated, and for reporting on the overall level of risk in the Company. The CRO is also accountable to the Risk Committee and to SHUSA’s Chief Risk Officer. The CRO is charged with the implementation and execution of the enterprise risk management (“ERM”) program under the oversight of the Board and its committees.

Risk management is overseen by the Board through four standing committees: the Risk Committee, the Audit Committee, the Compensation Committee and the Regulatory and Compliance Oversight Committee, each of which is chaired by an independent director. Committee chairs are responsible for calling meetings of their committees, presiding at meetings of their committees,

approving agendas and materials for their committee meetings, serving as a liaison between committee members and the Board, and between committee members and senior management, including the CEO and CRO, and working directly with the senior management responsible for committee matters. Each Board committee provides regular reports to the Board regarding matters reviewed by the Board committee.

In addition to receiving and discussing reports of risks under the purview of a particular committee, the Board monitors our risk culture and reviews specific and aggregate risks the Company faces. Further, at least annually, the Board approves, at the recommendation of the Risk Committee, a Risk Appetite Statement (a “RAS”), which defines the levels and types of risks the Company is willing to assume to achieve its business plans while controlling risk exposures within our risk capacity. In addition, the RAS establishes principles for risk taking in the aggregate and for each risk type, and is supported by a comprehensive system of risk limits, escalation triggers and control programs.

The Risk Committee is charged with responsibility for establishing governance over the ERM process, providing oversight of risk policies and risk management performance. The Risk Committee monitors our aggregate risk position and reviews reports from management on the comprehensive portfolio of risk categories and the potential impact these risks can have on our risk profile. A comprehensive risk report is submitted regularly by the CRO to the Risk Committee and to the Board providing management’s view of our risk position. Further, the Risk Committee reviews and recommends for the Board’s approval the RAS and an ERM Policy along with various sub-policies governing, without limitation, enterprise risk, credit risk, information risk, market and liquidity risk, operational risk, model risk and strategic risk. The Risk Committee also provides oversight of our impact on SHUSA’s compliance with its capital adequacy assessment process, including its Comprehensive Capital and Review (“CCAR”) submissions and resolution planning. The Risk Committee also reviews and concurs in the appointment, replacement, performance and compensation of the CRO.

The Audit Committee is charged with oversight relating to the integrity of our financial statements and financial reporting process, the integrity of our systems of internal accounting and financial controls and internal and external auditing, including the qualifications and independence of our independent registered public accounting firm. The Audit Committee oversees the performance of our internal audit function, reviews and concurs in the appointment, replacement, performance and compensation of our Chief Audit Executive and approves our internal audit function’s annual audit plan, charter, policies and budget. The Audit Committee also receives regular updates on the audit plan’s status and results including significant reports issued by our internal audit function and the status of management’s corrective actions. The Audit Committee also reviews risk management policies and procedures related to financial and accounting matters, including, without limitation, our Supplemental Statement of Ethics and Code of Ethics for the CEO and Senior Financial Officers.

14 |

SC 2017 Proxy Statement |

CORPORATE GOVERNANCE - BOARD COMMITTEES

The Compensation Committee works to ensure that the compensation programs covering our executives, business units and risk-taking employees appropriately balance risk with incentives such that business performance is achieved without taking imprudent or uneconomic risks. At least annually, the Compensation Committee conducts an assessment of the compensation policies and practices for our employees, including our executive officers. The assessment includes whether such compensation policies and practices created risks that were reasonably likely to have a material adverse effect on the Company.

The Regulatory and Compliance Oversight Committee is charged with the oversight of risk relating to the effectiveness of our compliance management system. The Regulatory and Compliance Oversight Committee also oversees our progress in remediating risks identified in risk assessment findings, internal audit findings and outstanding corrective actions identified by regulators in examination reports, enforcement actions and other communications.

In addition to the Board and Board committees, the CEO and CRO delegate risk management responsibility to management committees including the Enterprise Risk Management Committee (“ERMC”), which is co-chaired by our CEO and CRO. The ERMC is responsible for ERM governance and oversight. The ERMC maintains and monitors compliance with the RAS and the limits and escalations defined in it. The ERMC oversees implementation of risk policies across the Company with approval by the Board or the appropriate Board committee. The ERMC also reviews and reports to the Board or appropriate Board committees on key risk exposures, trends, and concentrations and significant compliance matters and provides guidance on the steps to monitor, control and report major risks.

In addition, the Asset Liability Committee (“ALCO”) is responsible for managing market, liquidity and asset and liability risks. ALCO is chaired by the CFO, and the CRO is a member of ALCO.

The Board has five standing committees: the Audit Committee; the Compensation Committee; the Executive Committee; the Regulatory and Compliance Oversight Committee; and the Risk

Committee. The charters for each committee may be found on SC’s website athttp://investors.santanderconsumerusa.com.

| NAME | AUDIT | COMPENSATION | EXECUTIVE |

REGULATORY AND COMPLIANCE OVERSIGHT

| RISK | |||||

Stephen A. Ferriss

| ● | Chair | ● | |||||||

Brian Gunn

| ● | |||||||||

Victor Hill

| ● | ● | ||||||||

Edith E. Holiday

| ● | ● | ||||||||

Mark P. Hurley

| ● | ● | Chair | |||||||

Jason A. Kulas

| ● | |||||||||

Javier Maldonado

| ● | ● | ● | |||||||

Robert J. McCarthy

| ● | ● | Chair | |||||||

William F. Muir

| Chair | ● | ||||||||

William Rainer

| Chair |

SC 2017 Proxy Statement |

15 |

CORPORATE GOVERNANCE - BOARD COMMITTEES

The following summarizes the membership of each committee, as well as the primary roles and responsibilities of each committee and the number of times each committee met in 2016.

AUDIT COMMITTEE

| NUMBER OF MEETINGS IN 2016:22 | |||||

MEMBERS

|

AMONG OTHER THINGS, OUR AUDIT COMMITTEE: | |||||

» Mr. Muir (Chair)

» Mr. Ferriss

» Mr. Hurley

» Mr. McCarthy | » | Reviews financial reporting policies, procedures, and internal controls. | ||||

» |

Administers the appointment, compensation, and oversight of our independent registered public accounting firm. | |||||

» |

Pre-approves audit, audit-related, and non-audit services to be performed by our independent registered public accounting firm. | |||||

» |

Reviews and approves or ratifies all related-party transactions. | |||||

» |

Oversees our internal audit function, including approval of the annual internal audit plan and the review of the performance of the Chief Audit Executive. | |||||

» |

Reviews certain risk management policies and procedures, certain policies, processes, and procedures regarding compliance matters, as well as our Supplemental Statement of Ethics and Code of Ethics for the Chief Executive Officer and Senior Financial Officers.

| |||||

The Board has determined that each of the members is “independent” as defined by Section 10A(m)(3) of the Exchange Act, Rule 10A-3 under the Exchange Act, and the NYSE Listed Company Rules. The Board has also determined that each of the members is “financially literate” as required by Section 303A.07 of the NYSE Listed Company Rules and an “audit committee financial expert” as defined in the SEC’s rules.

| ||||||

COMPENSATION COMMITTEE

| NUMBER OF MEETINGS IN 2016:18 | |||||

MEMBERS

|

AMONG OTHER THINGS, OUR COMPENSATION COMMITTEE:

| |||||

» Mr. Ferriss (Chair)

» Ms. Holiday

» Mr. Maldonado

» Mr. McCarthy | » | Reviews and approves the compensation of the CEO and each other executive officer.

| ||||

| » | Reviews and makes recommendations to the Board regarding the compensation of the Independent Directors.

| |||||

| » | Approves and evaluates all compensation plans, policies and programs of the Company as they affect our directors, CEO and other executive officers.

| |||||

| » | Sets performance measures and goals and verifies the attainment of performance goals under performance-based incentive compensation arrangements applicable to our executive officers.

| |||||

| » | Monitors and assesses whether the overall design and performance of our compensation plans, policies and programs do not encourage employees, including our NEOs, to take excessive risk.

| |||||

| » | Oversees the management development, succession planning, and retention practices for our executive officers.

| |||||

The Board has determined that Mr. Ferriss, Ms. Holiday, Mr. Maldonado, and Mr. McCarthy qualify as “outside” directors within the meaning of Internal Revenue Code Section 162(m) (“Section 162(m)”). The Board has determined that Mr. Ferriss, Ms. Holiday and Mr. McCarthy are “independent” as defined by the NYSE Listed Company Rules and qualify as “non-employee” directors within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934, as amended (“Rule 16b-3”). Mr. Ferriss, Ms. Holiday and Mr. McCarthy constitute a subcommittee of the Compensation Committee when considering issues governed by Rule 16b-3.

| ||||||

16 |

SC 2017 Proxy Statement |

CORPORATE GOVERNANCE - BOARD COMMITTEES

EXECUTIVE COMMITTEE

| NUMBER OF MEETINGS IN 2016:10 | |||||

| MEMBERS | AMONG OTHER THINGS, OUR EXECUTIVE COMMITTEE: | |||||

»

»

»

» |

Mr. Rainer (Chair)

Mr. Ferriss

Mr. Kulas

Mr. Maldonado

| » |

Acts on the Board’s behalf between Board meetings on all matters that may be lawfully delegated. | |||

| » |

Considers and recommends candidates for election to the Board. | |||||

| » |

Leads the annual performance evaluations of the Board and Board committees. | |||||

| » |

Reviews and advises the Board on our corporate governance.

| |||||

The Board has determined that Mr. Rainer and Mr. Ferriss are “independent” as defined by the NYSE Listed Company Rules.

| ||||||

REGULATORY AND COMPLIANCE COMMITTEE

| NUMBER OF MEETINGS IN 2016:11 | |||||

MEMBERS |

AMONG OTHER THINGS, OUR REGULATORY AND COMPLIANCE OVERSIGHT COMMITTEE: | |||||

»

»

»

»

» |

Mr. McCarthy (Chair)

Mr. Hill

Ms. Holiday

Mr. Hurley

Mr. Maldonado

|

» |

Provides oversight and assesses the effectiveness of our compliance management system. | |||

» |

Oversees our compliance function including the Chief Compliance Officer. | |||||

» |

Oversees our progress in responding to internal audit findings, risk assessment findings, and outstanding corrective actions identified by regulators in examination reports, enforcement actions and other communications. | |||||

» |

Reviews our regulatory correspondence and reports received from or submitted to regulators to ensure effective communication between the Company and its respective regulators.

| |||||

The Board has determined that Mr. McCarthy, Ms. Holiday and Mr. Hurley are “independent” as defined by the NYSE Listed Company Rules.

| ||||||

RISK COMMITTEE

| NUMBER OF MEETINGS IN 2016:21 | |||||

MEMBERS

|

AMONG OTHER THINGS, OUR RISK COMMITTEE:

| |||||

»

»

»

»

| Mr. Hurley (Chair)

Mr. Gunn

Mr. Hill

Mr. Muir | »

|

Assesses and manages our enterprise risk, credit risk, market risk, operational risk, liquidity risk and other risk matters. | |||

» |

Provides oversight of our risk governance structure in order to evaluate and control our risks, including the approval of our Risk Appetite Statement. | |||||

» |

Oversees our risk management function including the review of the performance of the CRO. | |||||

» |

Oversees and manages our activities related to capital planning and analysis.

| |||||

The Board has determined that Mr. Hurley and Mr. Muir are “independent” as defined by the NYSE Listed Company Rules.

| ||||||

SC 2017 Proxy Statement |

17 |

CORPORATE GOVERNANCE - DIRECTOR COMPENSATION

Effective July 15, 2015, we adopted a director compensation program that provided for the following compensation for independent members of the Board of Directors:

| » | An annual cash retainer of $100,000 (paid quarterly in arrears); plus |

| » | An annual grant of restricted stock or RSUs with a grant date fair market value equal to $50,000, vesting on the earlier of the 1st anniversary of the grant date or the 1st Annual Stockholder Meeting following the grant date (with the grant date occurring at or around the start of the applicable term of service); plus |

| » | $70,000 in cash annually for serving as the chair of any committee of the Board (paid quarterly in arrears); plus |

| » | $20,000 in cash annually for serving as a non-chair member of any committee of the Board (paid quarterly in arrears); plus |

| » | $600,000 in cash annually if the director also serves as the Chairman of the Board (paid quarterly in arrears). |

The Compensation Committee periodically reviews the form and amount of director compensation and recommends changes to the Board, as appropriate. As a result of its review in 2016, the Compensation Committee recommended that the Board revise the independent director compensation program to reduce the additional cash retainer for the Chairman of the Board from $600,000 to $450,000. Effective October 1, 2016, the Board approved the Compensation Committee’s recommendation to reduce the additional cash retainer for the Chairman of the Board from $600,000 to $450,000. There were no other changes to the independent director compensation program in 2016.

The revised independent director compensation program was approved by our non-independent directors, who do not receive compensation for their service on the Board.

Independent Non-Employee Director Stock Ownership Guidelines

In order to align the economic interests of our independent non-management directors with those of our stockholders, the Board has determined that our independent directors should hold a meaningful equity stake in SC. To that end, our Independent Non-Employee Director Stock Ownership Guidelines (adopted by the Board in 2016) requires each of our independent directors to acquire and retain shares or share equivalents of our Common Stock with a target value not less than five times the annual equity retainer.

There is no required time period within which an independent director must attain the applicable stock ownership target. However, until the stock ownership target is achieved, the independent directors will be required to retain 100% of all shares of our Common Stock received under SC’s independent director compensation program, after taking into account any applicable taxes due on the vesting of those shares.

As of the date hereof, all directors are in compliance with the Independent Non-Employee Director Stock Ownership Guidelines.

18 |

SC 2017 Proxy Statement |

CORPORATE GOVERNANCE - DIRECTOR COMPENSATION

Director Compensation Table for Fiscal Year 2016

The following table provides information regarding compensation for each independent member of the Board in 2016. Under our

independent director compensation program, only independent directors are compensated for their service on the Board.

| NAME |

FEES EARNED OR PAID IN CASH ($)

| STOCK AWARDS(1) ($) | ALL OTHER COMPENSATION ($) | TOTAL ($) | ||||

Stephen A. Ferriss

| 153,425 | 50,000(7) | — | 203,425 | ||||

Edith E. Holiday(2)

| 12,274 | 45,068(8) | 18,739(10) | 76,081 | ||||

Mark P. Hurley(3)

| 92,826 | 58,219(9) | — | 151,045 | ||||

Blythe Masters(4)

| 408,016 | — | 3,424(11) | 411,440 | ||||

Robert J. McCarthy

| 160,000 | 50,000(7) | — | 210,000 | ||||

William F. Muir(2)

| 12,274 | 45,068(8) | 18,739(10) | 76,081 | ||||

William Rainer

| 474,674 | 50,000(7) | — | 524,674 | ||||

Wolfgang Schoellkopf(5)

| 210,000 | 50,000(7) | — | 260,000 | ||||

Heidi Ueberroth(6)

| 168,856 | — | 16,986(11) | 185,842 |

| (1) | To align our independent directors’ compensation with stockholder interests, each independent director is granted a RSU award upon election or re-election. In 2016, except for Ms. Holiday and Mr. Muir, each RSU award was granted on November 1, 2016. The awards for Ms. Holiday and Mr. Muir were granted on December 7, 2016. Each award will vest upon the earlier of (i) the first anniversary of the grant date and (ii) the first annual stockholder meeting following the grant date. This column represents the aggregate grant date fair value computed in accordance with FASB ASC Topic 718, based on the closing price of our Common Stock on the applicable grant date, but excluding the effect of potential forfeitures. |

| (2) | Ms. Holiday and Mr. Muir were appointed to the Board on November 29, 2016. |

| (3) | Mr. Hurley was appointed to the Board on April 17, 2016. |

| (4) | Ms. Masters resigned from the Board effective July 12, 2016. |

| (5) | Mr. Schoellkopf resigned from the Board effective April 21, 2017. |

| (6) | Ms. Ueberroth resigned from the Board effective October 18, 2016. |

| (7) | Represents a grant of RSUs on November 1, 2016 for service as an independent director from the director’s election at the 2016 Annual Meeting of the Stockholders through the 2017 Annual Meeting of the Stockholders. The RSUs will vest on the earlier of (i) the first anniversary of the grant date and (ii) the first Annual Meeting of the Stockholders following the grant date. |

| (8) | Represents a grant of RSUs on December 7, 2016 for service as an independent director from the director’s appointment to the Board on November 29, 2016 through the 2017 Annual Meeting of the Stockholders. The RSUs will vest on the earlier of (i) the first anniversary of the grant date and (ii) the first Annual Meeting of the Stockholders following the grant date. |

| (9) | Represents a grant of RSUs on November 1, 2016, with a grant date fair market value of (i) $50,000 for service as an independent director from the director’s election at the 2016 Annual Meeting of the Stockholders through the 2017 Annual Meeting of the Stockholders and (ii) $8,219 for service as an independent director from April 17, 2016 to June 15, 2016 (the day before the 2016 Annual Meeting of the Stockholders). The RSUs will vest on the earlier of (i) the first anniversary of the grant date and (ii) the first Annual Meeting of the Stockholders following the grant date. |

| (10) | Represents cash paid for service as an independent contractor advisor to the board from October 24, 2016 until November 29, 2016. |

| (11) | Represents cash payments to compensate former directors for the pro rata portion of equity retainer earned from June 16, 2016 until their resignations from the Board. |

SC 2017 Proxy Statement |

19 |

CORPORATE GOVERNANCE - NOMINATION OF DIRECTORS

The Shareholders Agreement, by and among SC, SHUSA, Thomas G. Dundon, and certain other holders of our Common Stock, which we refer to as the Shareholders Agreement, provides SHUSA with special rights to nominate directors to the Board of Directors. See “Related Party Transactions—Shareholders Agreement” for further information. Pursuant to the Shareholders Agreement, SHUSA is entitled to nominate eight members of our Board. The Shareholders Agreement provides further that SHUSA may remove any director nominated by SHUSA with or without cause. In addition, SHUSA has the right to designate a replacement to fill a vacancy on the Board created by the departure of a director that was nominated by SHUSA, and we are required to take all action within our power to cause such vacancy to be filled by such designated replacement (including by promptly appointing such designee to the Board).

The Shareholders Agreement provides that Mr. Dundon will serve as a member of the Board (i) so long as Mr. Dundon is the CEO of the Company or (ii) if (a) he owns at least 5% of our then-outstanding shares of Common Stock (excluding shares acquired pursuant to any equity-based compensation plan) and (b) his employment was not terminated by the Company for cause or by him without good reason (subject to certain exceptions) and he has continued to comply with certain provisions of his employment agreement with the Company. Mr. Dundon voluntarily resigned from the Board on April 1, 2016.

With respect to directors not nominated by SHUSA, the Board is responsible for selecting nominees for election to the Board by our stockholders. Generally, the Board begins identifying nominees by first evaluating the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to our business and who are willing to continue in service are considered for re-nomination. If any member of the Board does not wish to continue in service or if the Board decides not to re-nominate a member for re-election, the Board then identifies the desired skills and experience of a new nominee in light of the criteria described below. Generally, the Board identifies candidates for director nominees in consultation with sitting members of the Board and with management, through the use of search firms or other advisers, through recommendations submitted by other directors or stockholders and through such other methods as the Board deems appropriate. In identifying and evaluating a potential director nominee, the Board considers, among other things, the following factors:

| » | Our needs with respect to the particular talents and experience of our directors; |

| » | The nominee’s knowledge, skills and experience, including experience in finance, administration or public service, in light of prevailing business conditions and the knowledge, skills and experience already possessed by other members of the Board; |

| » | Whether the nominee is independent, as that term is defined under the NYSE Listed Company Rules; |

| » | The familiarity of the nominee with our industry; |

| » | The nominee’s experience in legal and regulatory affairs; |

| » | The nominee’s experience with accounting rules and practices; and |

| » | The desire to balance the benefit of continuity with the periodic injection of the fresh perspective provided by new Board members. |

In its identification and evaluation process, the Board collects information about candidates through interviews, detailed questionnaires, background checks and other means that the Board deems helpful in such process.

The Board’s goal is to assemble a Board that brings together a variety of perspectives and skills derived from high quality business and professional experience. In doing so, the Board will also consider candidates with appropriate non-business backgrounds.

The Board is also committed to diversified Board membership. The Board will not discriminate on the basis of race, national origin, gender, sexual orientation, religion, or disability in selecting nominees. Diversity and inclusion are values embedded into our culture and are fundamental to our business. In keeping with those values, when assessing a candidate, the Board considers the different viewpoints and experiences that a candidate could bring to the Board and how those viewpoints and experiences could enhance the Board’s effectiveness in the execution of its responsibilities. The Board is also committed to seeking highly qualified women and individuals from minority groups to include in the pool from which new candidates are selected. In addition, the Board assesses the diversity of the Board and committees as a part of its annual self-evaluation process.

Other than the foregoing, there are no stated minimum criteria for director nominees. The Board may also consider such other factors as it may deem in our best interests and the best interests of our stockholders. We also believe it may be appropriate for key members of our management to participate as members of the Board.

Subject to the rights of our majority stockholder and Mr. Dundon, stockholders may nominate candidates for election to the Board. In order to nominate a candidate for election to the Board, stockholders must follow the procedures set forth in our Bylaws, including timely receipt by the Secretary of the Company of notice of the nomination and certain required disclosures with respect both to the nominating stockholder and the recommended director nominee. For complete description of the requirements and procedures for stockholder nominations, please refer to our Bylaws.

Directors may be elected by a plurality of votes cast at any meeting called for the election of directors at which a quorum is present. The presence of a majority of the holders of our Common Stock, whether in person or by proxy, constitutes a quorum. The Board did not receive any recommendations from stockholders (other than SHUSA) requesting that the Board consider a candidate for inclusion among the nominees in our Proxy Statement for this Annual Meeting. However, our policy is that we will consider any such recommendation as long as the stockholder making the recommendation provides to us the information concerning the recommended individual that is required under our Bylaws.

20 |

SC 2017 Proxy Statement |

EXECUTIVE OFFICERS

The names, ages, and current positions of our executive officers as of the date of this Proxy Statement are listed in the table below. Each executive officer, including the CEO, is elected by the Board. Each executive officer holds office until his or

her successor is elected and qualified. There are no family relationships among the executive officers nor is there any agreement or understanding between any officer and any other person pursuant to which the officer was elected.

NAME

| AGE | POSITION | ||

Jason A. Kulas

| 46 | President and Chief Executive Officer | ||

Ismail Dawood

| 45 | Chief Financial Officer | ||

Richard Morrin

| 47 | Chief Operating Officer | ||

Christopher Pfirrman

| 57 | Chief Legal Officer and General Counsel | ||

Kalyan Seshan

| 49 | Chief Risk Officer | ||

Donald Goin

| 46 | Chief Information Officer | ||

Mary Barnes

| 66 | Chief Compliance Officer | ||

Lisa VanRoekel

| 47 | Chief Human Resources Officer |

Jason A. Kulas

President and Chief Executive Officer

Mr. Kulas’s biography is included under “Corporate Governance—Proposal 1: Election of Directors—Information Concerning the Nominees” above.

Ismail Dawood

Chief Financial Officer

Mr. Dawood joined us as our Chief Financial Officer in December 2015. Prior to joining us, Mr. Dawood served as Executive Vice President and Chief Financial Officer of the Investment Services division of The Bank of New York Mellon Corporation (“BNY Mellon”) since April 2013, as Executive Vice President and Director of Investor Relations and Financial Planning and Analysis of BNY Mellon from June 2009 to March 2013 and as Senior Vice President and Global Head of Corporate Development and Strategy of BNY Mellon from November 2006 to May 2009. He also served in various senior roles at Wachovia Corporation, where he was employed from 1994 to 2006, including Managing Director of Structured Treasury Activities and Managing Director of Corporate Development. Mr. Dawood holds a master’s degree in business administration from the Wharton School of Business and a bachelor’s degree in finance from St. John’s University, Jamaica (Queens), New York and is a Chartered Financial Analyst (CFA) charterholder.

Richard Morrin

Chief Operating Officer

Mr. Morrin has served as our Chief Operating Officer since February 2016, having joined us as our Executive Vice President, New Business in August 2011. Prior to joining us, Mr. Morrin held a variety of management positions in 21 years of combined service at Ally Financial and General Motors Acceptance Corp. Most recently, he managed the commercial lending operations for Ally automotive dealers in the United States and Canada. Mr. Morrin is also a member of the board of directors of Santander Consumer International Puerto Rico, LLC, a wholly-owned subsidiary of SC Illinois (“SCI”). He holds a bachelor’s degree in economics from the University of Pennsylvania and a master’s degree in business administration from the University of Virginia.

Christopher Pfirrman

Chief Legal Officer and General Counsel

Mr. Pfirrman has served as our Chief Legal Officer and General Counsel Since September 2015. (His title changed from Senior Chief Legal Officer and General Counsel in December 2016.) He was previously employed by SHUSA, and most recently, served as Senior Executive Vice President and General Counsel of SHUSA and of SBNA from January 2012 to September 2015. He served as SBNA’s Senior Vice President and Deputy General Counsel from 2000 to January 2012, and he was an attorney in the law firm of Edwards & Angell, LLP (now Locke Lord LLP) from 1996 to 2000. He received a bachelor’s degree from Fairfield University in Connecticut and a Juris Doctorate from the College of William and Mary in Virginia. He is a member of the Massachusetts and Connecticut bars.

SC 2017 Proxy Statement |

21 |

EXECUTIVE OFFICERS

Kalyan Seshan

Chief Risk Officer

Mr. Seshan has served as our Chief Risk Officer since September 2015. Prior to joining us, he served as Senior Vice President and Chief Risk Officer of Nationstar Mortgage from November 2013 to September 2015. Mr. Seshan was previously employed by JPMorgan Chase as Senior Vice President and Head of Default Strategies of Mortgage Capital Markets from October 2010 to November 2013; Chief Risk Officer of Mortgage Default from April 2009 to October 2010; and Chief Risk Officer of Chase Auto and Education Finance from October 2007 to April 2009. He received a master’s degree in business administration from the Indian Institute of Management and a bachelor’s degree in mathematics from Loyola College, Madras University.

Donald Goin

Chief Information Officer

Mr. Goin re-joined us as our Chief Information Officer in August 2015 having served as our Chief Information Officer from January 2003 to September 2011. He was employed by Capital One Financial Services as Digital Operations Officer from March 2014 to August 2015, by Capital One Auto Finance as Managing Vice President, Customer Operations from March 2013 to March 2014 and as Chief Information Officer from September 2011 to March 2013. Prior to joining us, he held a variety of consulting and technology management roles at Raytheon E-Systems, Southwest Airlines and IONA Technologies. He currently serves on the St. Jude Charities Technology Advisory Council. Mr. Goin pursued graduate studies at Duke University and received a bachelor’s degree in computer science from the University of Texas at Dallas. Mr. Goin served honorably in the United States Marine Corps.

Mary Barnes

Chief Compliance Officer

Ms. Barnes has served as our Chief Compliance Officer since January 2017, having joined us as our Senior Vice President, Consumer Compliance in April 2016. Previously, Ms. Barnes served as a consultant, providing compliance and risk management consulting services to large financial institutions with a special emphasis on comprehensive compliance governance, controls, assessment, mitigation and remediation, with Treliant Risk Advisors as a Senior Advisor from 2013 to 2016 and with North Highland Company as a Principal from 2011-2013. Prior to that, she served as a compliance and risk management professional with various companies, including KPMG LLP, where she was a Principal in the Risk Advisory practice, and Bank of America, where she was a Senior Vice President. Ms. Barnes earned a bachelor’s degree in industrial engineering from the University of Texas at Arlington.

Lisa VanRoekel

Chief Human Resources Officer

Ms. VanRoekel has served as our Chief Human Resources Officer since March 2016, having previously served as our Head of Human Resources from 2006 to 2009. Previously, she served as the Interim Chief Human Resources Officer of SHUSA from December 2015 to February 2016; as the Chief Human Resources Officer of SBNA from December 2013 to February 2016; and as the Deputy Managing Director, Human Resources of SBNA from July 2012 to December 2013. Ms. VanRoekel is also a member of the board of directors of SCI. She holds a bachelor’s degree and a master’s degree in journalism from East Texas State University.

22 |

SC 2017 Proxy Statement |

AUDIT - PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

| Proposal 2: | Ratification of Appointment of Independent Registered Public Accounting Firm |

WHAT YOU ARE VOTING ON:

We are asking our stockholders to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2017.

|

Our Audit Committee is responsible for the appointment, compensation, retention, and oversight of the independent registered public accounting firm retained to perform the audit of our financial statements and our internal control over financial reporting. The Audit Committee has appointed the accounting firm of PwC to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2017.

Stockholder Ratification of Appointment of Independent Registered Public Accounting Firm

A proposal to ratify the appointment of PwC to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2017 will be presented at the Annual Meeting. Representatives of PwC are expected to be present at the meeting. They will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions from stockholders.