- ATEN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

A10 Networks (ATEN) 8-KA10 Networks, Inc. Reports First Quarter

Filed: 1 May 14, 12:00am

Exhibit 99.2

A10 Networks – Q1 2014 Earnings lA10 Networks, A10 Thunder, vThunder, ACOS, aCloud, aFleX, aXAPI, aVCS, Virtual Chassis, AX, SoftAX, and aFlow are trademarks or registered trademarks of A10 Networks, Inc. in the United States and other countrieslA10 customer driven innovation first quarter 2014 financial results & commentary

lA10 Networks – Q1 2014 Earnings lToday’s commentary is provided by Lee Chen, A10’s Founder & CEO and Greg Straughn, A10’s CFO. lShortly after the market closed today, A10 Networks issued a press release announcing its first quarter 2014 financial results. Additionally, A10 has published this presentation that contains management’s prepared comments for its first quarter financial results conference call being held today, May 1, 2014 at 4:30 p.m. ET / 1:30 p.m. PT. Open to the public, investors may access the call by dialing (480) 629-9808 or 1-(877)-941-8416. lOn the conference call management will also discuss the second quarter 2014 outlook and guidance. A question and answer session will follow management’s prepared remarks. Lee Chen, Greg Straughn and A10’s VP of Sales, Ray Smets, will host the question and answer session. lYou may access a live webcast of the conference call, the press release, presentation with prepared comments and trended financial statements on the investor relations section of the company’s website www.a10networks.com. lThe webcast will be archived for a period of one year. A telephonic replay of the conference call will be available two hours after the call and will run for five business days and may be accessed by dialing (303) 590-3030 or 1-(800)-406-7325 and entering the passcode 4678381. Introduction maria riley, investor relations results overview lee chen, ceo, president and founder q1’14 financial results & q2’ 14 bussiness outlook greg straughn,cfo ray smets, vp- global salesl5/1/2014 2 | P a g el

lA10 Networks – Q1 2014 Earnings lIn today’s presentation, management will make forward-looking statements, including statements regarding our projections for our second quarter operating results, our expectations for future revenue growth and the growth of our business generally. These statements are based on current expectations and beliefs as of today, May 1, 2014. A10 disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events, or otherwise. These forward-looking statements involve a number of risks and uncertainties, some of which are beyond our control that could cause actual results to differ materially. lFor a more detailed description of these risks and uncertainties, please refer to our prospectus filed with the SEC on March 21, 2014 and in our future quarterly reports on Form 10-Q, annual reports on 10-K and other filings made with the SEC. ll5/1/2014 3 | P a g el

lA10 Networks – Q1 2014 Earnings lPlease note that with the exception of revenue, financial measures discussed today are on a non-GAAP basis and have been adjusted to exclude certain charges. A reconciliation between GAAP and non-GAAP measures can be found in the press release issued today and on the trended quarterly financial statements posted on the company’s website. lWe will provide our current expectations for the second quarter of 2014 on a non- GAAP basis. However, we will not make available a reconciliation of non-GAAP guidance measures to corresponding GAAP measures on a forward-looking basis due to high variability and low visibility with respect to the charges, which are excluded from these non-GAAP measures. l5/1/2014 4 | P a g el

lA10 Networks – Q1 2014 Earnings l5/1/2014 5 | P a g el lee chen ceo, president and founder

lA10 Networks – Q1 2014 Earnings lLee Chen, Founder & CEO lWe are very pleased with our results and we believe 2014 is off to a great start. A few of our accomplishments so far this year include: l• In January we officially launched our TPS product, which is our first standalone security solution for large scale DDoS protection. ll• Also in January, we introduced our new aCloud Services Architecture, to support next- generation Infrastructure-as-a-Service cloud data center architectures ll• In March, we completed our $193M initial public offering. ll• In April we launched the industry’s first 100 Gigabit Ethernet ADC for layer 4-7 services. ll• Also in April, we expanded our Thunder Series of appliances filling our product portfolio with four new mid-range and high-end models. ll• And last week, we established a new three-tier channel partner program in North America designed to provide our channel with resources and programs to help foster A10 product sales. l5/1/2014 6 | P a g e launched tps stand alone security product introduced acloud services architecture completed $193m initial public offering launched industry first 100 glgabit adc introduced 4 mid range thunder series models established new north American channel program

A10 Networks – Q1 2014 Earnings lLee Chen, Founder & CEO lWe are very pleased with our results and we believe 2014 is off to a great start. A few of our accomplishments so far this year include: l• In January we officially launched our TPS product, which is our first standalone security solution for large scale DDoS protection. ll• Also in January, we introduced our new aCloud Services Architecture, to support next- generation Infrastructure-as-a-Service cloud data center architectures ll• In March, we completed our $193M initial public offering. ll• In April we launched the industry’s first 100 Gigabit Ethernet ADC for layer 4-7 services. ll• Also in April, we expanded our Thunder Series of appliances filling our product portfolio with four new mid-range and high-end models. ll• And last week, we established a new three-tier channel partner program in North America designed to provide our channel with resources and programs to help foster A10 product sales. l5/1/2014 6 | P a g el

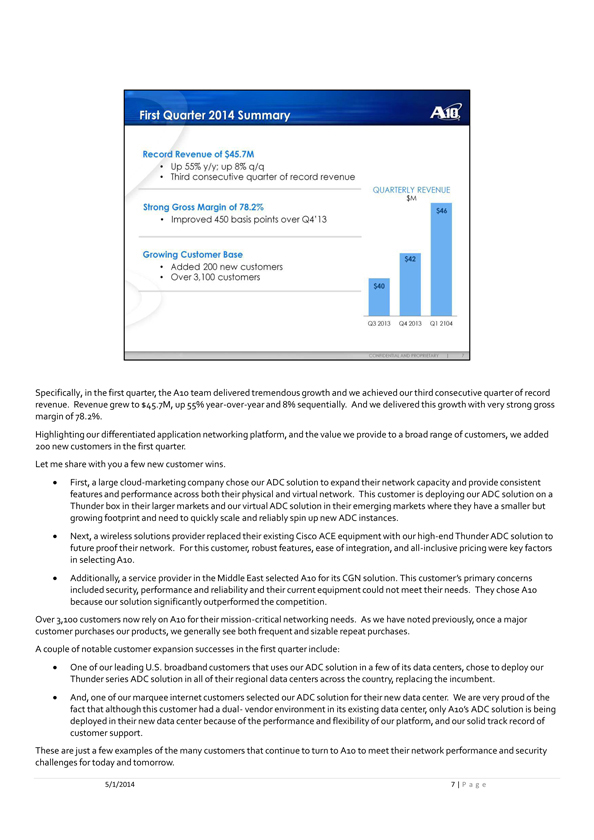

A10 Networks – Q1 2014 Earnings Specifically, in the first quarter, the A10 team delivered tremendous growth and we achieved our third consecutive quarter of record revenue. Revenue grew to $45.7M, up 55% year-over-year and 8% sequentially. And we delivered this growth with very strong gross margin of 78.2%. Highlighting our differentiated application networking platform, and the value we provide to a broad range of customers, we added 200 new customers in the first quarter. Let me share with you a few new customer wins. First, a large cloud-marketing company chose our ADC solution to expand their network capacity and provide consistent features and performance across both their physical and virtual network. This customer is deploying our ADC solution on a Thunder box in their larger markets and our virtual ADC solution in their emerging markets where they have a smaller but growing footprint and need to quickly scale and reliably spin up new ADC instances. • Next, a wireless solutions provider replaced their existing Cisco ACE equipment with our high-end Thunder ADC solution to future proof their network. For this customer, robust features, ease of integration, and all-inclusive pricing were key factors in selecting A10. • Additionally, a service provider in the Middle East selected A10 for its CGN solution. This customer’s primary concerns included security, performance and reliability and their current equipment could not meet their needs. They chose A10 because our solution significantly outperformed the competition. Over 3,100 customers now rely on A10 for their mission-critical networking needs. As we have noted previously, once a major customer purchases our products, we generally see both frequent and sizable repeat purchases. A couple of notable customer expansion successes in the first quarter include: • One of our leading U.S. broadband customers that uses our ADC solution in a few of its data centers, chose to deploy our Thunder series ADC solution in all of their regional data centers across the country, replacing the incumbent. • And, one of our marquee internet customers selected our ADC solution for their new data center. We are very proud of the fact that although this customer had a dual- vendor environment in its existing data center, only A10’s ADC solution is being deployed in their new data center because of the performance and flexibility of our platform, and our solid track record of customer support. These are just a few examples of the many customers that continue to turn to A10 to meet their network performance and security challenges for today and tomorrow. 5/1/2014 7 | P a g e

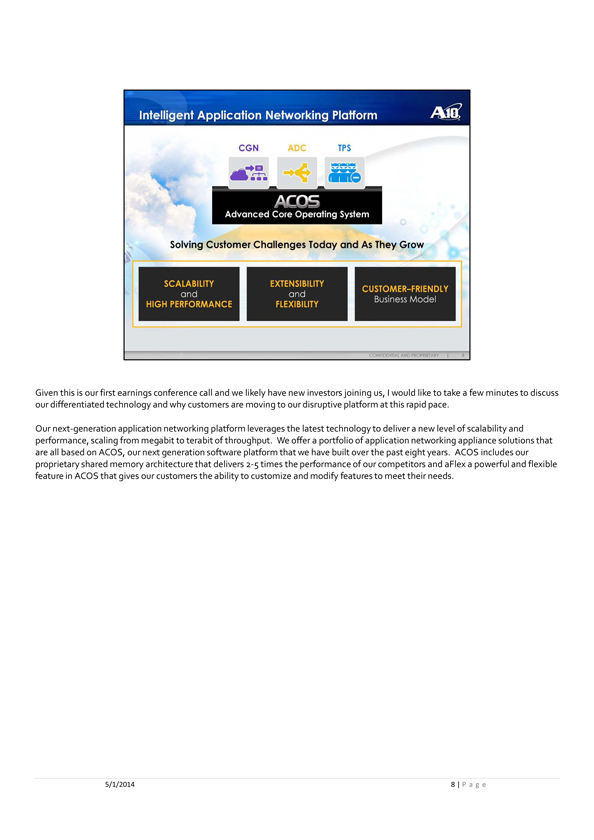

lA10 Networks – Q1 2014 Earnings lGiven this is our first earnings conference call and we likely have new investors joining us, I would like to take a few minutes to discuss our differentiated technology and why customers are moving to our disruptive platform at this rapid pace. lOur next-generation application networking platform leverages the latest technology to deliver a new level of scalability and performance, scaling from megabit to terabit of throughput. We offer a portfolio of application networking appliance solutions that are all based on ACOS, our next generation software platform that we have built over the past eight years. ACOS includes our proprietary shared memory architecture that delivers 2-5 times the performance of our competitors and aFlex a powerful and flexible feature in ACOS that gives our customers the ability to customize and modify features to meet their needs.l5/1/2014 8 | P a g el cgn adc tps acos advanced card operating system

lA10 Networks – Q1 2014 Earnings lWe have leveraged the power of ACOS to launch three standalone solutions that address three different mission-critical application networking needs. We started with our ADC solutions that optimize network and data center performance. lIn response to customer needs in 2010, we leveraged the ACOS platform to develop our standalone carrier-grade CGN solution. This standalone appliance gives our customers the ability to support an increasing number of mobile devices and subscribers as IP address availability is becoming scarce. lMore recently, we extended our ACOS platform again to introduce our standalone threat protection solution (TPS) that is deployed at the perimeter of the network. This standalone security solution provides real-time protection from large-scale DDoS attacks. l5/1/2014 9 | P a g el

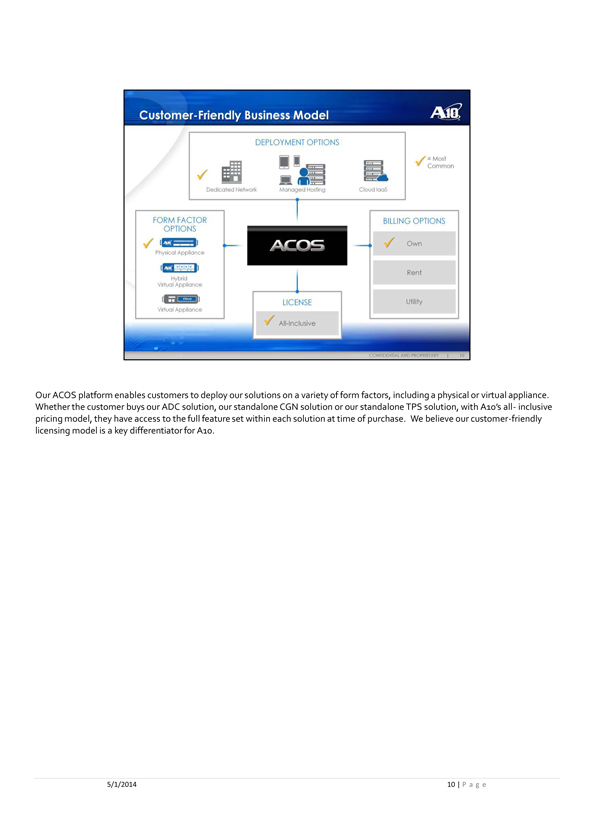

lA10 Networks – Q1 2014 Earnings lOur ACOS platform enables customers to deploy our solutions on a variety of form factors, including a physical or virtual appliance. Whether the customer buys our ADC solution, our standalone CGN solution or our standalone TPS solution, with A10’s all- inclusive pricing model, they have access to the full feature set within each solution at time of purchase. We believe our customer-friendly licensing model is a key differentiator for A10. 5/1/2014 10 | P a g e

lA10 Networks – Q1 2014 Earnings lWe plan on continuing to leverage our ACOS platform to develop new products in new segments of the $12 billion application networking market. This is an essential component to our growth strategy. Additionally, we plan on investing in our go-to- market engine in the U.S. and internationally. We believe these investments will help increase our number of sales opportunities. And given that we have a very high win- rate, we are confident that this will translate to new customers and long-term revenue growth. lIn summary, we delivered a very strong first quarter and achieved our third consecutive quarter of record revenue. The superior price performance and flexibility of our application networking platform, our customer-friendly business model and our outstanding customer support are fueling our success. We believe we are in a very strong position to continue our growth and we’ve never been more excited by the opportunities we see for A10. ll5/1/2014 11 | P a g e

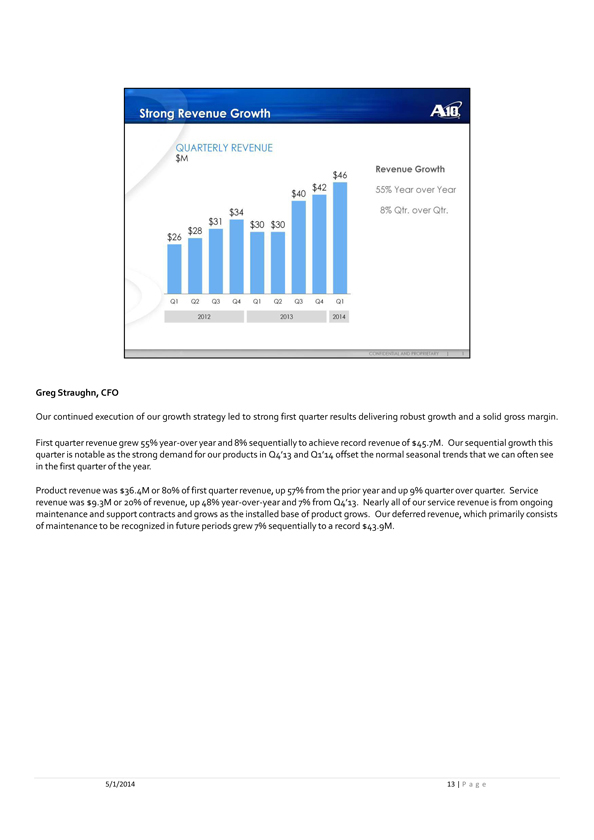

lA10 Networks – Q1 2014 Earnings l5/1/2014 12 | P a g ellA10 Networks – Q1 2014 Earnings lGreg Straughn, CFO lOur continued execution of our growth strategy led to strong first quarter results delivering robust growth and a solid gross margin. lFirst quarter revenue grew 55% year-over year and 8% sequentially to achieve record revenue of $45.7M. Our sequential growth this quarter is notable as the strong demand for our products in Q4’13 and Q1’14 offset the normal seasonal trends that we can often see in the first quarter of the year. lProduct revenue was $36.4M or 80% of first quarter revenue, up 57% from the prior year and up 9% quarter over quarter. Service revenue was $9.3M or 20% of revenue, up 48% year-over-year and 7% from Q4’13. Nearly all of our service revenue is from ongoing maintenance and support contracts and grows as the installed base of product grows. Our deferred revenue, which primarily consists of maintenance to be recognized in future periods grew 7% sequentially to a record $43.9M. 5/1/2014 13 | P a g e $26 $28 $ 31 $34 $30 $30 $40 S42 $42 $46 q1 q2 q3 q4 q1 q2 q3 q4 q1 Stron revenue growth quarterly revenue revenue growth 55% year over year 8% qtr. Over qtr.

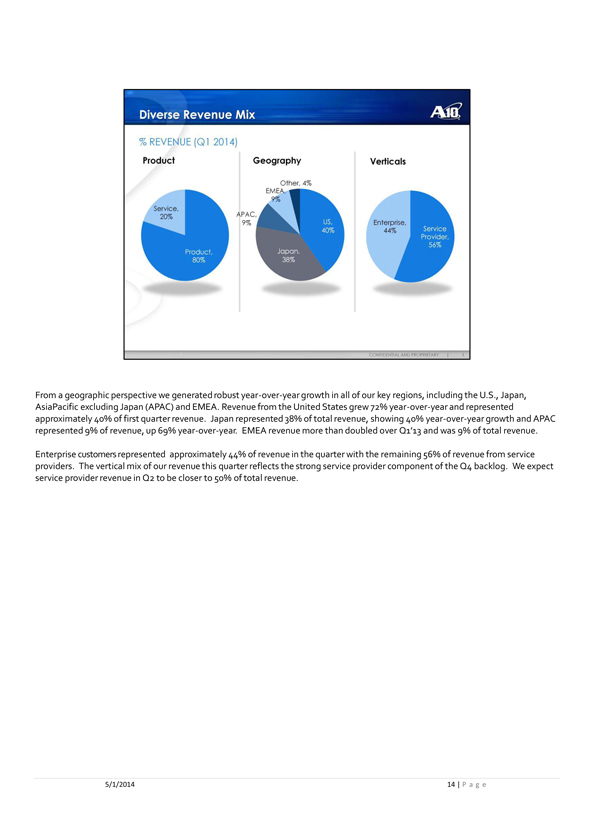

lA10 Networks – Q1 2014 Earnings lFrom a geographic perspective we generated robust year-over-year growth in all of our key regions, including the U.S., Japan, AsiaPacific excluding Japan (APAC) and EMEA. Revenue from the United States grew 72% year-over-year and represented approximately 40% of first quarter revenue. Japan represented 38% of total revenue, showing 40% year-over-year growth and APAC represented 9% of revenue, up 69% year-over-year. EMEA revenue more than doubled over Q1’13 and was 9% of total revenue. lEnterprise customers represented approximately 44% of revenue in the quarter with the remaining 56% of revenue from service providers. The vertical mix of our revenue this quarter reflects the strong service provider component of the Q4 backlog. We expect service provider revenue in Q2 to be closer to 50% of total revenue. ll5/1/2014 14 | P a g el diverse revenue mix % revenue (q1 2014) product geography verticals

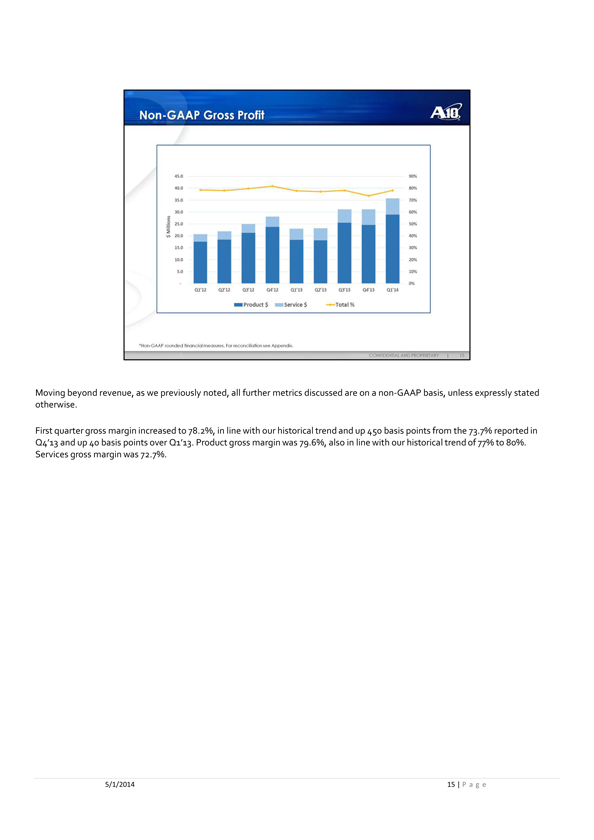

lA10 Networks – Q1 2014 Earnings lMoving beyond revenue, as we previously noted, all further metrics discussed are on a non-GAAP basis, unless expressly stated otherwise. lFirst quarter gross margin increased to 78.2%, in line with our historical trend and up 450 basis points from the 73.7% reported in Q4’13 and up 40 basis points over Q1’13. Product gross margin was 79.6%, also in line with our historical trend of 77% to 80%. Services gross margin was 72.7%. ll5/1/2014 15 | P a g el

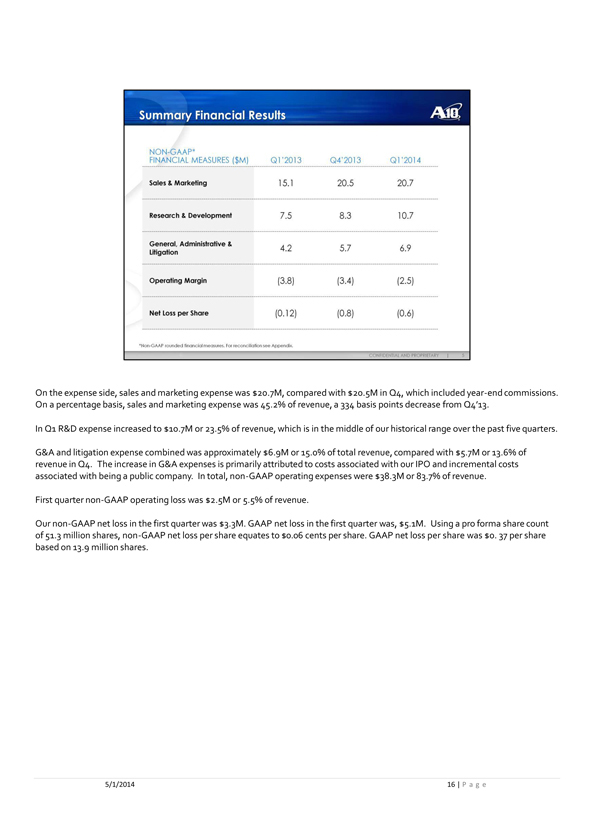

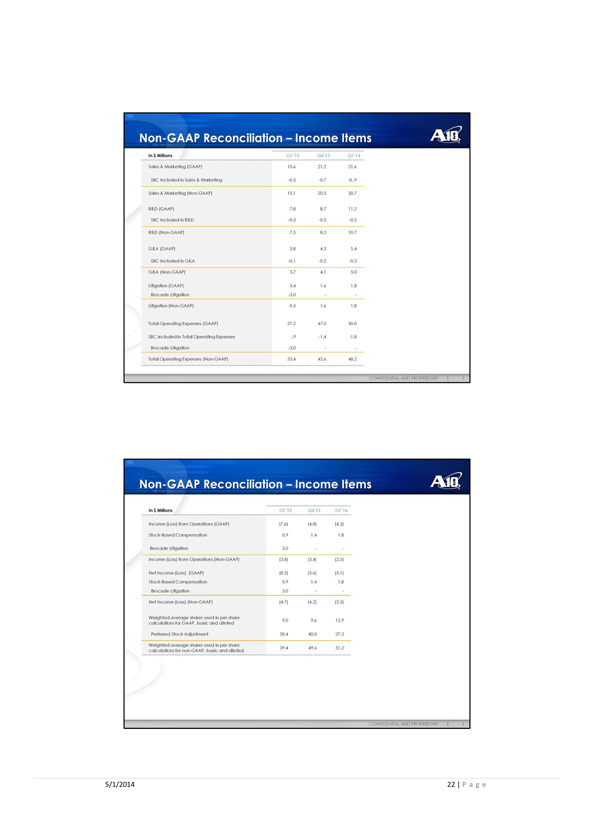

lA10 Networks – Q1 2014 Earnings lOn the expense side, sales and marketing expense was $20.7M, compared with $20.5M in Q4, which included year-end commissions. On a percentage basis, sales and marketing expense was 45.2% of revenue, a 334 basis points decrease from Q4’13. lIn Q1 R&D expense increased to $10.7M or 23.5% of revenue, which is in the middle of our historical range over the past five quarters. lG&A and litigation expense combined was approximately $6.9M or 15.0% of total revenue, compared with $5.7M or 13.6% of revenue in Q4. The increase in G&A expenses is primarily attributed to costs associated with our IPO and incremental costs associated with being a public company. In total, non-GAAP operating expenses were $38.3M or 83.7% of revenue. lFirst quarter non-GAAP operating loss was $2.5M or 5.5% of revenue. lOur non-GAAP net loss in the first quarter was $3.3M. GAAP net loss in the first quarter was, $5.1M. Using a pro forma share count of 51.3 million shares, non-GAAP net loss per share equates to $0.06 cents per share. GAAP net loss per share was $0. 37 per share based on 13.9 million shares. ll5/1/2014 16 | P a g el

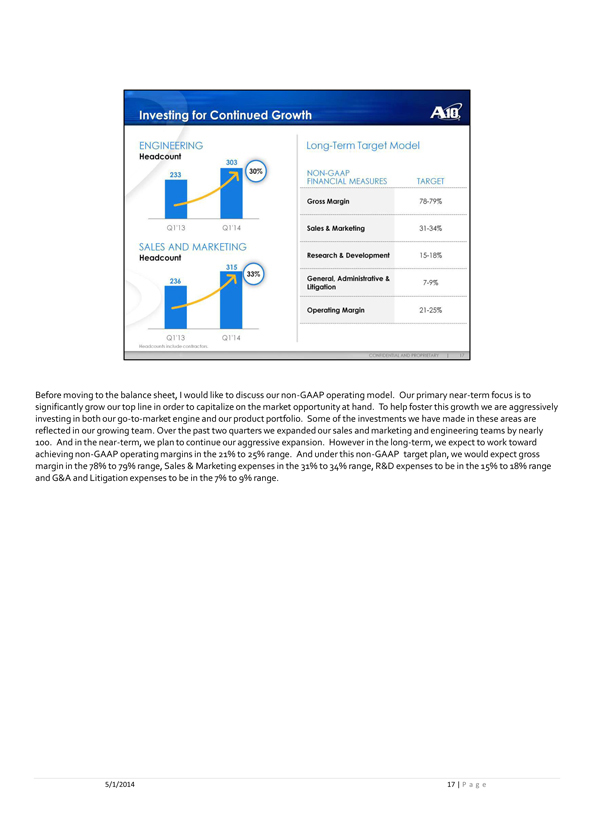

llA10 Networks – Q1 2014 Earnings lBefore moving to the balance sheet, I would like to discuss our non-GAAP operating model. Our primary near-term focus is to significantly grow our top line in order to capitalize on the market opportunity at hand. To help foster this growth we are aggressively investing in both our go-to-market engine and our product portfolio. Some of the investments we have made in these areas are reflected in our growing team. Over the past two quarters we expanded our sales and marketing and engineering teams by nearly 100. And in the near-term, we plan to continue our aggressive expansion. However in the long-term, we expect to work toward achieving non-GAAP operating margins in the 21% to 25% range. And under this non-GAAP target plan, we would expect gross margin in the 78% to 79% range, Sales & Marketing expenses in the 31% to 34% range, R&D expenses to be in the 15% to 18% range and G&A and Litigation expenses to be in the 7% to 9% range. ll5/1/2014 17 | P a g el

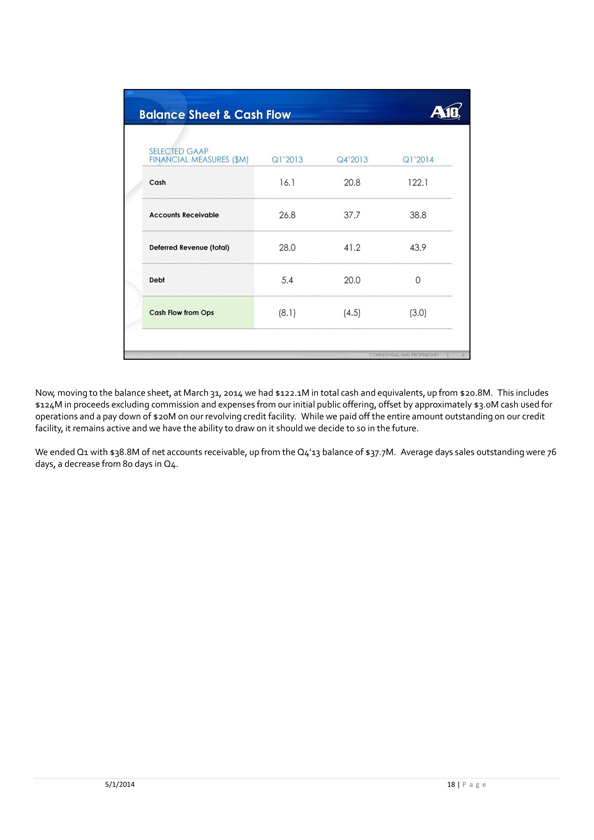

lA10 Networks – Q1 2014 Earnings lNow, moving to the balance sheet, at March 31, 2014 we had $122.1M in total cash and equivalents, up from $20.8M. This includes $124M in proceeds excluding commission and expenses from our initial public offering, offset by approximately $3.0M cash used for operations and a pay down of $20M on our revolving credit facility. While we paid off the entire amount outstanding on our credit facility, it remains active and we have the ability to draw on it should we decide to so in the future. lWe ended Q1 with $38.8M of net accounts receivable, up from the Q4’13 balance of $37.7M. Average days sales outstanding were 76 days, a decrease from 80 days in Q4. ll5/1/2014 18 | P a g el

lA10 Networks – Q1 2014 Earnings l5/1/2014 19 | P a g e management will that a conference call to discuss a10’s financial for its first quarter 2014 and the outlook for the second of 2014 on may 1, 2014 at 4:30 p.m. easter time/1:30 p.m. pacific time. Open to the public , investors may across (480) 629-9808 or 1-(877)-941-8416. A live audio webcast of the conference call will be accessible from the “investors” section of a10 networks website at investors, a10networks.com. the webcast will be archived for a period of one year. A telephonic replay of the conference call will be available two hours after the call and will fun for five business days and may be accessed by dialing (303) 593-3030 of 1-(800)-406-7325 and entering the passcode 4678381. Lee chen ceo, president and founder greg straughn cfo, ray smets vp worldwide sales

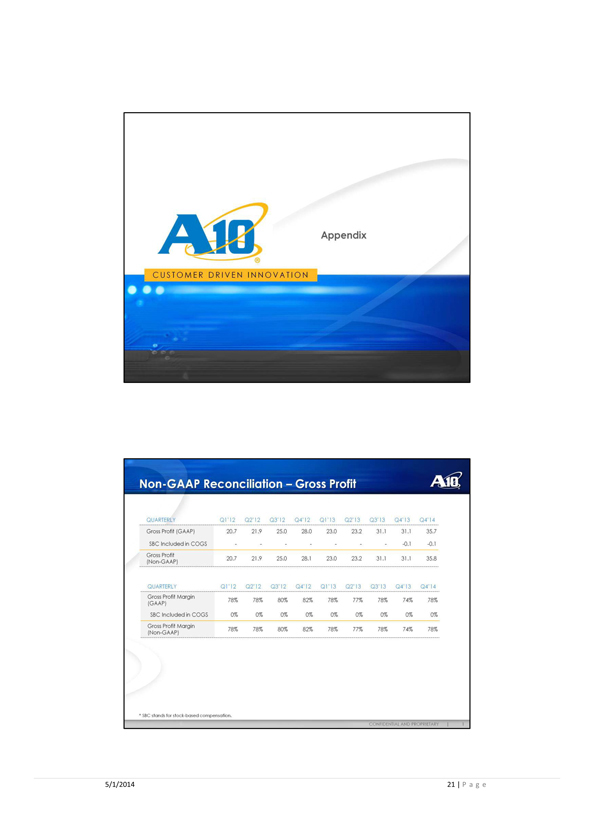

Non-gaap reconciliation – gross profit lA10 Networks – Q1 2014 Earnings l5/1/2014 21 | P a g el

lA10 Networks – Q1 2014 Earnings l5/1/2014 21 | P a g el

lA10 Networks – Q1 2014 Earnings l5/1/2014 23 | P a g el