Always Secure. Always Available. Q3 2021 Financial Results & Commentary Dhrupad Trivedi, CEO Brian Becker, CFO October 28, 2021

2 Cautionary Statements & Disclosures This presentation and the accompanying oral presentation contain “forward-looking” statements that are based on our management’s beliefs and assumptions, including statements regarding our strategy, expectations for the fourth quarter of 2021, including as to revenue, revenue growth, recurring revenue expectations, growth of our bottom line vis-à-vis our top line, and our growth rate. vis-à-vis Forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other factors that could cause our actual results to differ materially from those anticipated or implied by our forward-looking statements. These factors include, but are not limited to, the impact of the COVID-19 pandemic on our business, on the business of our customers and suppliers, and on the global economy in general, execution risks related to closing key deals and improving our execution, successfully executing our strategies, market adoption of our products, successfully anticipating market needs and opportunities, timely development of new products and features, achieving or maintaining profitability, loss or delay of expected purchases, our ability to maintain or improve our competitive position; competitive and execution risks related to cloud-based computing trends, attracting and retaining new end-customers, maintaining and enhancing our brand and reputation, changes demanded by our customers in the deployment and payment model for our products, growth in markets relating to network security, the success of any future acquisitions or investments, the success of our partnerships with technology providers, the ability of our sales team to execute well, our ability to shorten our close cycle, the ability of our channel partners to sell our products, variations in product mix or geographic locations of our sales, our presence in international markets, and other factors described in our quarterly reports on Form 10-Q, annual reports on Form 10-K and other filings made with the Securities and Exchange Commission, to which your attention is directed. The forward-looking statements included in this presentation are based on current expectations and beliefs as of October 28, 2021 only. We do not intend to update this information contained in the forward-looking statements, except as required by law. This presentation and the accompanying oral presentation also include certain non-GAAP financial measures including Non-GAAP gross margin, non-GAAP operating income, non-GAAP net income, non-GAAP operating margin, Adjusted EBITDA and Non-GAAP EPS. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similarly titles measures presented by other companies. A10 Networks considers these non-GAAP financial measures to be important because they provide useful measures of the operating performance of the company, exclusive of unusual events or factors that do not directly affect what we consider to be our core operating performance, and are used by the company’s management for that purpose. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. We define non-GAAP net income as our GAAP net income (loss) excluding: (i) stock-based compensation and related payroll tax, (ii) amortization expense related to acquisition, (iii) non-recurring expenses associated with the litigation settlement and internal investigation expense, (iv) global distribution center transition expense, (v) non-recurring facility expense, and (vi) release of deferred tax asset valuation allowance. We define non-GAAP net income per basic and diluted share as our non-GAAP net income (loss) divided by our basic and diluted weighted-average shares outstanding. We define non-GAAP gross profit as our GAAP gross profit excluding (i) stock-based compensation and related payroll tax, and (ii) global distribution center transition expense. We define non-GAAP gross margin as our non-GAAP gross profit divided by our GAAP revenue. We define non-GAAP operating income (loss) as our GAAP income (loss) from operations excluding (i) stock-based compensation and related payroll tax, (ii) amortization expense related to acquisition, (iii) non-recurring expenses associated with the litigation settlement and internal investigation expense, (iv) global portfolio rationalization expense, and (v) non-recurring facilities expense. We define non-GAAP operating margin as our non-GAAP operating income (loss) divided by our GAAP revenue. We define non-GAAP operating expenses as our GAAP operating expenses excluding (i) stock-based compensation and related payroll tax, (ii) amortization expense related to acquisition, (iii) non-recurring expenses associated with the litigation settlement and internal investigation expense, (iv) global distribution center transition expense, and (v) non-recurring facilities expense. We define Adjusted EBITDA as our GAAP net income (loss) excluding (i) interest expense (if any), (ii) interest income and other (income) expense, net, (iii) depreciation and amortization expense, (iv) provision (benefit) for income taxes, (v) stock-based compensation and related payroll tax, (vi) litigation settlement and internal investigation expense, (vii) global distribution center transition expense, and (viii) non-recurring facility expense. A reconciliation between GAAP and non-GAAP financial measures can be found in the appendix to this document and in the accompany financial results press release.

3 Agenda ▪ Introduction ▪ Q3 Overview ▪ Q3 Financial Performance ▪ Q4 Guidance

4 Key Financials A10 At-a-Glance $226M 2020 ANNUAL REVENUE $92M TRAILING 12-MONTH NET INCOME (GAAP) $187M CASH & MARKETABLE SECURITIES AS OF 9/30/21 $0 DEBT 80.4% Q3’21 NON-GAAP GROSS MARGIN $117M DEFERRED REV AS OF 9/30/21 Large installed base and best-in-class solutions aligned with secular tailwinds • Delivering solutions for managing data growth with integrated security • Geographically diversified with a global presence • Directly aligned with trends in cybersecurity, 5G and cloud supporting investment protection as well as new buildouts Experienced management team driving continued business transformation • Built upon leadership position in technology • Integrated product platform with focus on recurring revenue, security-led solutions • Evolving to support new consumption models and hybrid environments Driving investor returns though improved business model and strategy for sustainable growth • Consistent GAAP profitability and cash flow generation • Rigorous and disciplined approach to potential inorganic options • $100M upsized share repurchase plan • Introduced dividend

5 Q3’21: Strong Execution, Capturing Share • Growth and diversification • Revenue grew 15% YoY • Deferred revenue reaches a record $117.1 million • Record profitability • Quarterly net income increased 33% year-over-year • Adjusted EBITDA improved by $4.3 million, or 35% year-over-year • Continued execution in a challenging economic environment • Significantly improved commercial execution in North America • Security-led solutions sales enabled us to capture market share

6 Quarterly Recurring Revenue $20.3 $20.9 $21.8 $21.7 $21.1 $21.2 $21.7 $22.4 $22.2 $22.5 $23.6 $24.1 $23.4 $24.0 $24.7 $31.0 $1.0 $1.2 $1.3 $2.7 $1.8 $2.2 $1.6 $2.4 $1.6 $3.0 $4.6 $4.3 $2.3 $3.3 $4.3 $21.3 $22.1 $23.1 $24.4 $22.9 $23.4 $23.3 $24.8 $23.8 $25.5 $28.2 $28.4 $25.7 $29.0 Q1'18 Q2'18 Q3'18 Q4'18 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Exiting 2021 Support Subscription $120.0 $ Millions $27.3

7 Quarterly Revenue & Non-GAAP Operating Income Operating Profit is a Non-GAAP Financial Measure. See Appendix for reconciliation to most comparable GAAP financial measures. $56.6 $62.7 $54.8 $59.2 $65.4 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Revenue, $ Millions $10.0 $13.9 $10.8 $11.1 $14.5 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Non-GAAP Operating Income, $ Millions $56.6 $65.4 Q3'20 Q3'21 Revenue, $ Millions $10.0 $14.5 Q3'20 Q3'21 Non-GAAP Operating Income, $ Millions

8 65% 35% Q3’21 $65.4 million Quarterly Revenue by Customer Vertical 59.5% 60.0% 62.0% 60.9% 64.7% 40.5% 40.0% 38.0% 39.1% 35.3% Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Enterprise Service Provider

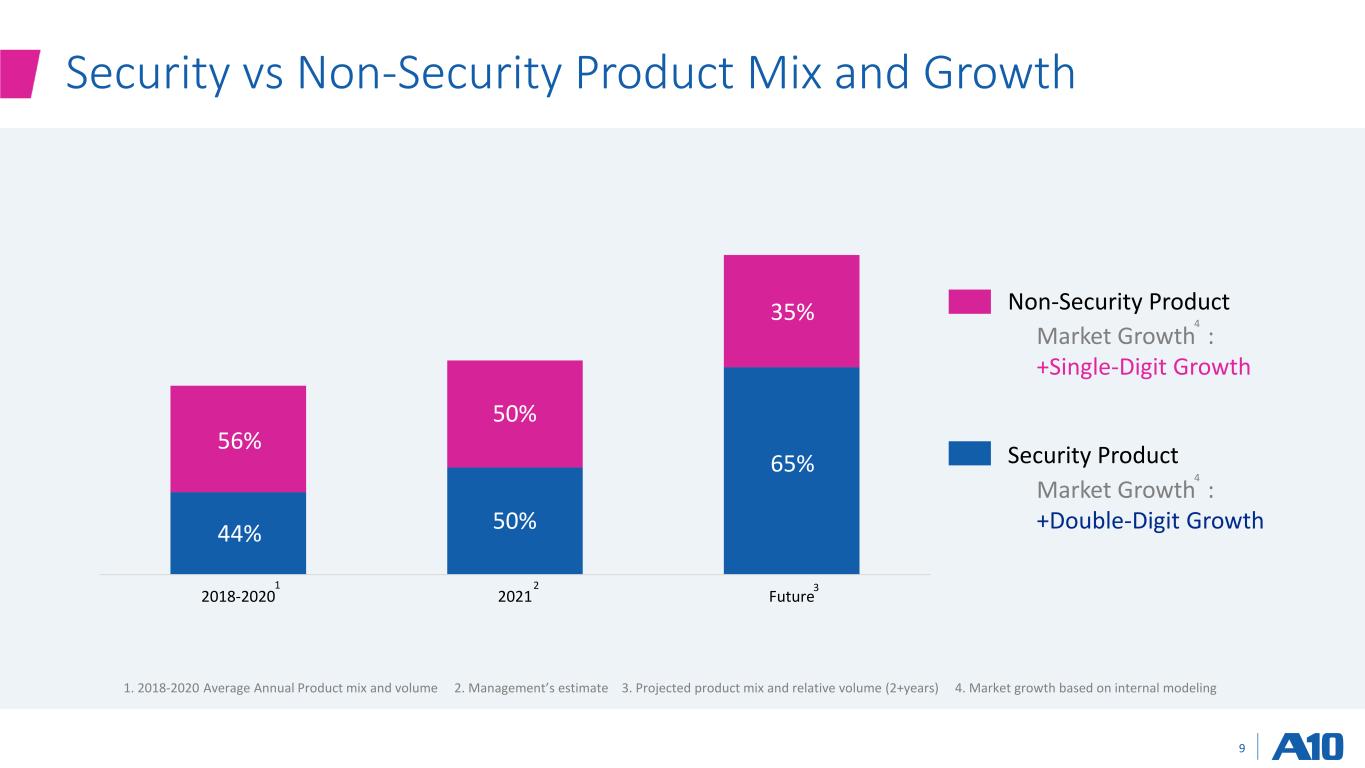

9 Security vs Non-Security Product Mix and Growth 2018-2020 2021 Future Non-Security Product Security Product 56% 44% 50% 50% 35% 65% Market Growth : +Single-Digit Growth Market Growth : +Double-Digit Growth 1. 2018-2020 Average Annual Product mix and volume 2. Management’s estimate 3. Projected product mix and relative volume (2+years) 4. Market growth based on internal modeling 1 2 3 4 4

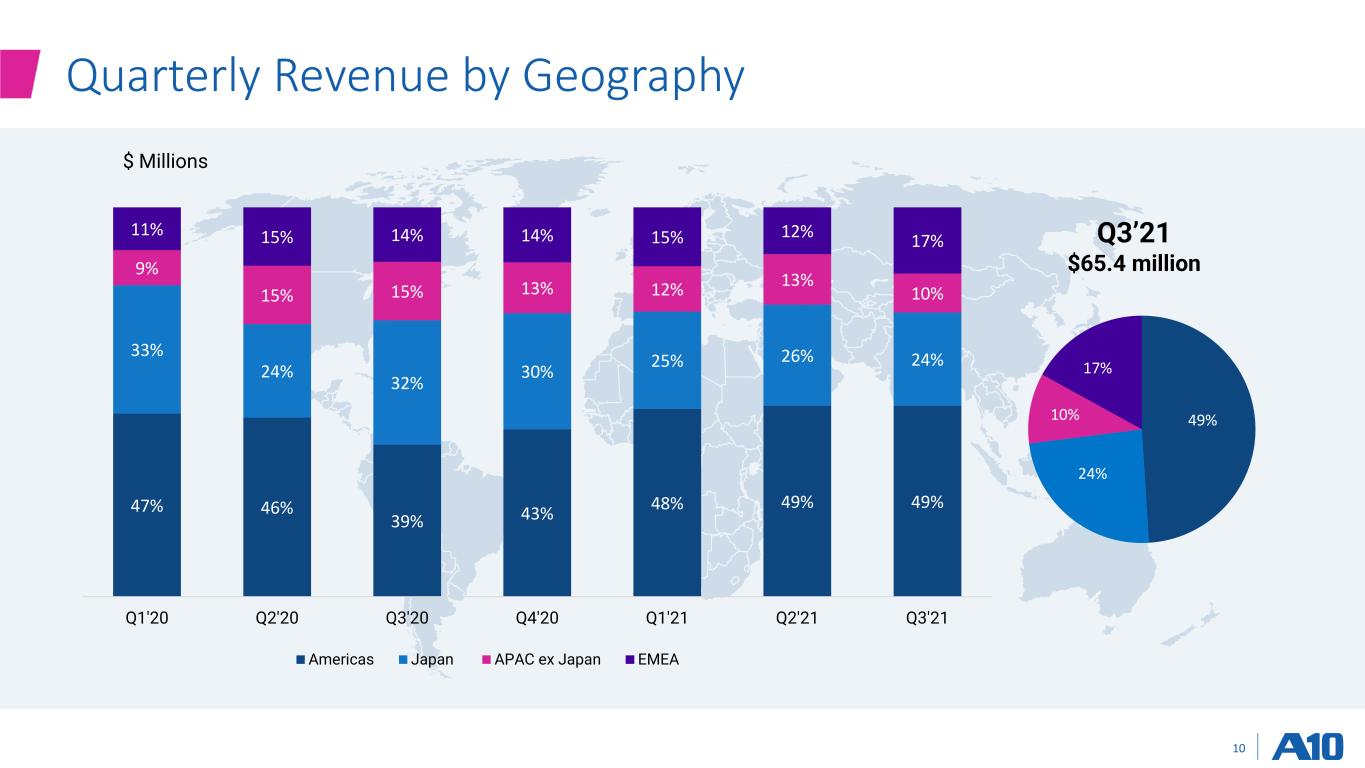

10 Quarterly Revenue by Geography 47% 46% 39% 43% 48% 49% 49% 33% 24% 32% 30% 25% 26% 24% 9% 15% 15% 13% 12% 13% 10% 11% 15% 14% 14% 15% 12% 17% Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 $ Millions Americas Japan APAC ex Japan EMEA 49% 24% 10% 17% Q3’21 $65.4 million

11 Quarterly Revenue & Non-GAAP Operating Income Operating Profit is a Non-GAAP Financial Measure. See Appendix for reconciliation to most comparable GAAP financial measures. $56.6 $65.4 Q3'20 Q3'21 Revenue, $ Millions $10.0 $14.5 Q3'20 Q3'21 Non-GAAP Operating Income, $ Millions

12 Financial Performance Trends Numbers may not sum due to rounding. Please refer to the supplemental financials posted in the “Investor Relations” section of the A10 Networks website at investors.a10networks.com Gross Margin %, Operating Margin %, Adjusted EBITDA and EPS are Non-GAAP Financial Measures. See Appendix for reconciliation to most comparable GAAP financial measures. $ Millions (except EPS) Q1'19 Q2'19 Q3’19 Q4'19 FY 2019 Q1’20 Q2’20 Q3’20 Q4’20 FY 2020 Q1’21 Q2’21 Q3’21 Revenue $50.3 $49.2 $52.8 $60.3 $212.6 $53.8 $52.5 $56.6 $62.7 $225.5 $54.8 $59.2 $65.4 Non-GAAP Gross Margin % 76.3% 78.0% 78.1% 78.5% 77.8% 78.3% 78.8% 77.6% 79.6% 78.6% 78.9% 77.9% 80.4% Non-GAAP Operating Margin % (11.8%) (1.9%) 3.5% 12.7% 1.2% 7.6% 13.8% 17.8% 22.1% 15.6% 19.7% 18.8% 22.2% Adjusted EBITDA (non-GAAP) ($3.7) $1.3 $4.0 $10.0 $11.6 $7.2 $9.8 $12.5 $16.1 $45.6 $13.0 $13.2 $16.8 Non-GAAP EPS ($0.10) $0.00 $0.02 $0.10 $0.03 $0.05 $0.09 $0.13 $0.18 $0.44 $0.12 $0.13 $0.17 Ending Cash & Marketable Securities $122.8 $119.3 $122.6 $129.9 $129.9 $142.9 $143.4 $159.1 $158.1 $158.1 $161.0 $166.8 $187.5

13 • Revenue growth of approximately 10% • We expect to grow our bottom-line faster than our top line Q4'2021 Outlook

14 Appendix

15 GAAP to Non-GAAP — Gross Margin and EPS Numbers may not sum due to rounding. EPS data is presented on a basic and diluted basis. Please refer to the supplemental financials posted the “Investor Relations” section of the A10 Networks website at investors.a10networks.com. % of Revenue except EPS Q1'20 Q2'20 Q3'20 Q4'20 FY 2020 Q1'21 Q2'21 Q3'21 Gross Margin % - GAAP 77.4% 78.2% 76.8% 78.5% 77.8% 77.2% 77.0% 79.8% Stock-based compensation 0.9% 0.6% 0.8% 0.6% 0.7% 1.2% 0.5% 0.6% Global distribution center transition expense 0.0% 0.0% 0.0% 0.5% 0.1% 0.5% 0.4% 0.0% Non-reccuring facilities expense 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% Gross Margin % - Non-GAAP 78.3% 78.8% 77.6% 79.6% 78.6% 78.9% 77.9% 80.4% EPS $ - GAAP (0.00)$ 0.05$ 0.08$ 0.10$ 0.22$ 0.03$ 0.08$ 0.94$ Stock-based compensation 0.04 0.04 0.05 0.04 0.16 0.06 0.03 0.05 Litigation and Investigation expense (recovery) 0.00 - - - 0.00 - - - Amortization expense related to acquisition 0.00 0.00 0.00 0.00 0.01 0.00 0.00 - Global distribution center transition expense - - - 0.04 0.04 0.03 0.02 (0.00) Restructuring expense, and related tax - - - - - - - - Non-recurring facilities expense 0.01 - - - 0.01 - - - Release of DTA valuation allowance - - - - - - - (0.82) EPS $ - Non-GAAP 0.05$ 0.09$ 0.13$ 0.18$ 0.44$ 0.12$ 0.13$ 0.17$

16 GAAP to Non-GAAP — Operating Income (Loss) Numbers may not sum due to rounding. Please refer to the supplemental financials posted the “Investor Relations” section of the A10 Networks website at investors.a10networks.com. $ Millions Q1'20 Q2'20 Q3'20 Q4'20 FY 2020 Q1'21 Q2'21 Q3'21 Income (loss) from operations $ - GAAP (0.2)$ 3.9$ 6.2$ 7.8$ 17.7$ 4.0$ 7.2$ 10.3$ Stock-based compensation 3.2 3.1 3.6 2.9 12.8 4.6 2.6 4.2 Litigation and Investigation expense (recovery) 0.0 - - - 0.0 - - - Amortization expense related to acquisition 0.3 0.3 0.3 0.3 1.0 0.3 0.3 - Global distribution center transition expense - - - 2.9 2.9 1.9 1.0 (0.0) Restructuring expense - - - - - - - - Non-recurring facilities expense 0.8 - - - 0.8 - - - Income from operations $ - Non-GAAP 4.1$ 7.2$ 10.0$ 13.9$ 35.3$ 10.8$ 11.0$ 14.5$ % of Revenue Income (loss) from operations % - GAAP (0.4)% 7.5 % 11.0 % 12.4 % 7.9 % 7.3 % 12.2 % 15.8 % Stock-based compensation 6.0 % 5.9 % 6.3 % 4.7 % 5.7 % 8.4 % 4.4 % 6.4 % Litigation and Investigation expense (recovery) 0.1 % —% —% —% 0.0 % —% —% —% Amortization expense related to acquisition 0.5 % 0.5 % 0.4 % 0.4 % 0.4 % 0.5 % 0.4 % —% Global distribution center transition expense —% —% —% 4.6 % 1.3 % 3.5 % 1.8 % (0.0)% Restructuring expense —% —% —% —% —% —% —% —% Non-recurring facilities expense 1.5 % —% —% —% 0.4 % —% —% —% Income from operations % - Non-GAAP 7.7 % 13.8 % 17.8 % 22.1 % 15.6 % 19.7 % 18.8 % 22.2 %

17 GAAP to Non-GAAP — Adjusted EBITDA Numbers may not sum due to rounding. Please refer to the supplemental financials posted the “Investor Relations” section of the A10 Networks website at investors.a10networks.com. $ Millions Q1'20 Q2'20 Q3'20 Q4'20 FY 2020 Q1'21 Q2'21 Q3'21 GAAP net income (loss) (0.3)$ 3.8$ 6.5$ 7.8$ 17.8$ 2.7$ 6.6$ 74.9$ Exclude: Interest expense - 0.0 - - 0.0 - - - Exclude: Interest income and other (income) expense, net (0.2) (0.2) (0.5) (0.5) (1.4) 1.2 0.1 0.2 Exclude: Depreciation & amortization expense 3.3 2.8 2.7 2.5 11.3 2.4 2.3 2.3 Exclude: Provision (benefit) for income taxes 0.3 0.3 0.3 0.4 1.3 0.2 0.5 (64.8) EBITDA 3.1 6.7 8.9 10.3 29.0 6.4 9.6 12.6 Exclude: Stock-based compensation 3.2 3.1 3.6 2.9 12.8 4.6 2.6 4.2 Exclude: Litigation settlement and investigation expense 0.0 - - - 0.0 - - - Exclude: Global distribution center transition expense - - - 2.9 2.9 1.9 1.0 (0.0) Exclude: Restructuring expense - - - - - - - - Exclude: Non-recurring facilities expense 0.8 - - - 0.8 - - - Adjusted EBITDA - Non-GAAP 7.2$ 9.8$ 12.5$ 16.1$ 45.6$ 13.0$ 13.2$ 16.8$

Thank You Always Secure. Always Available. Investors@A10networks.com