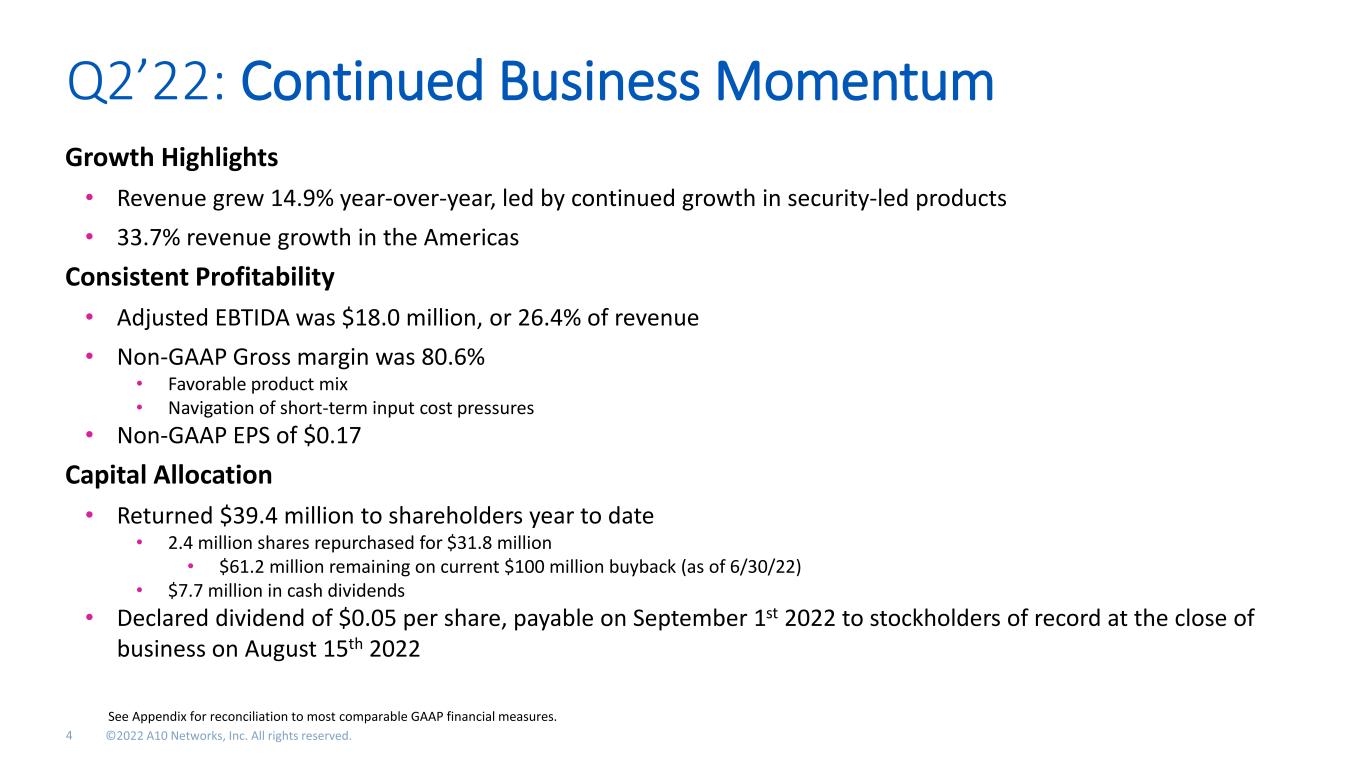

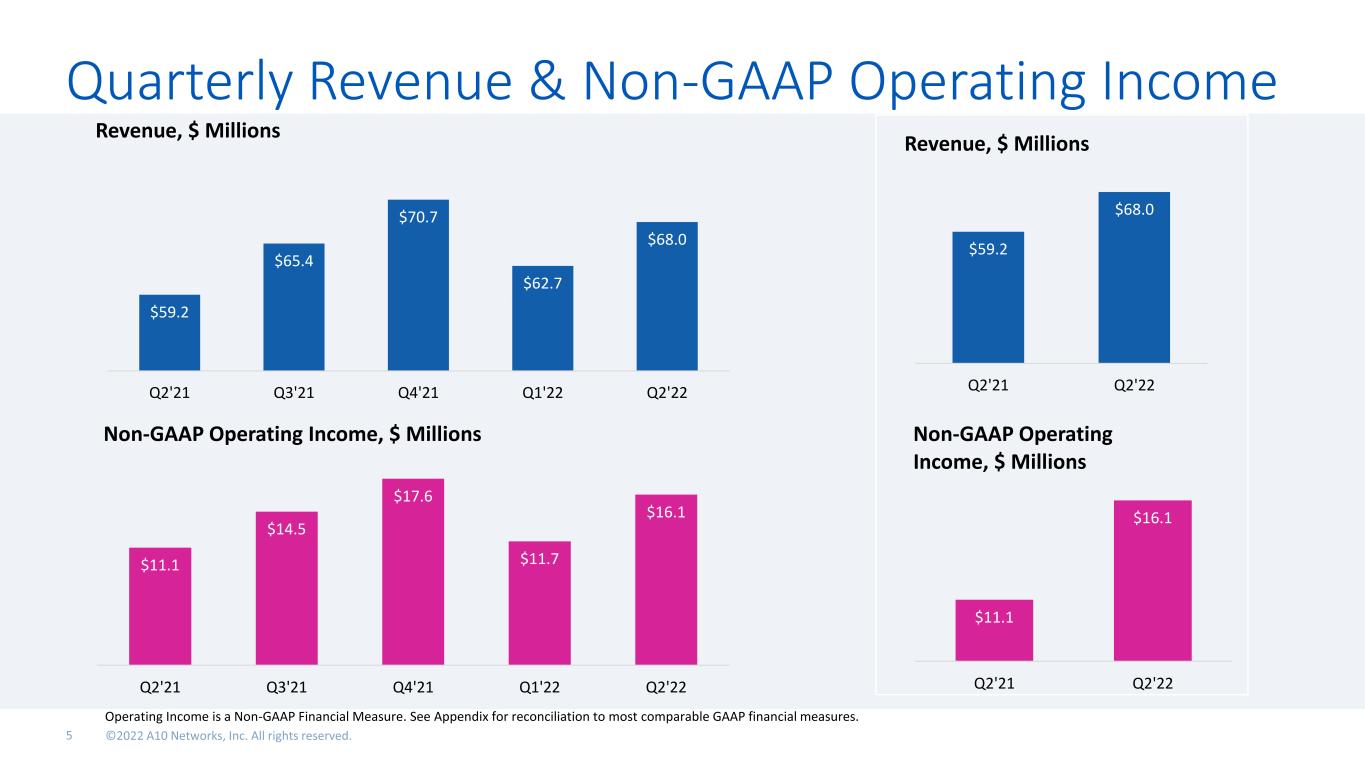

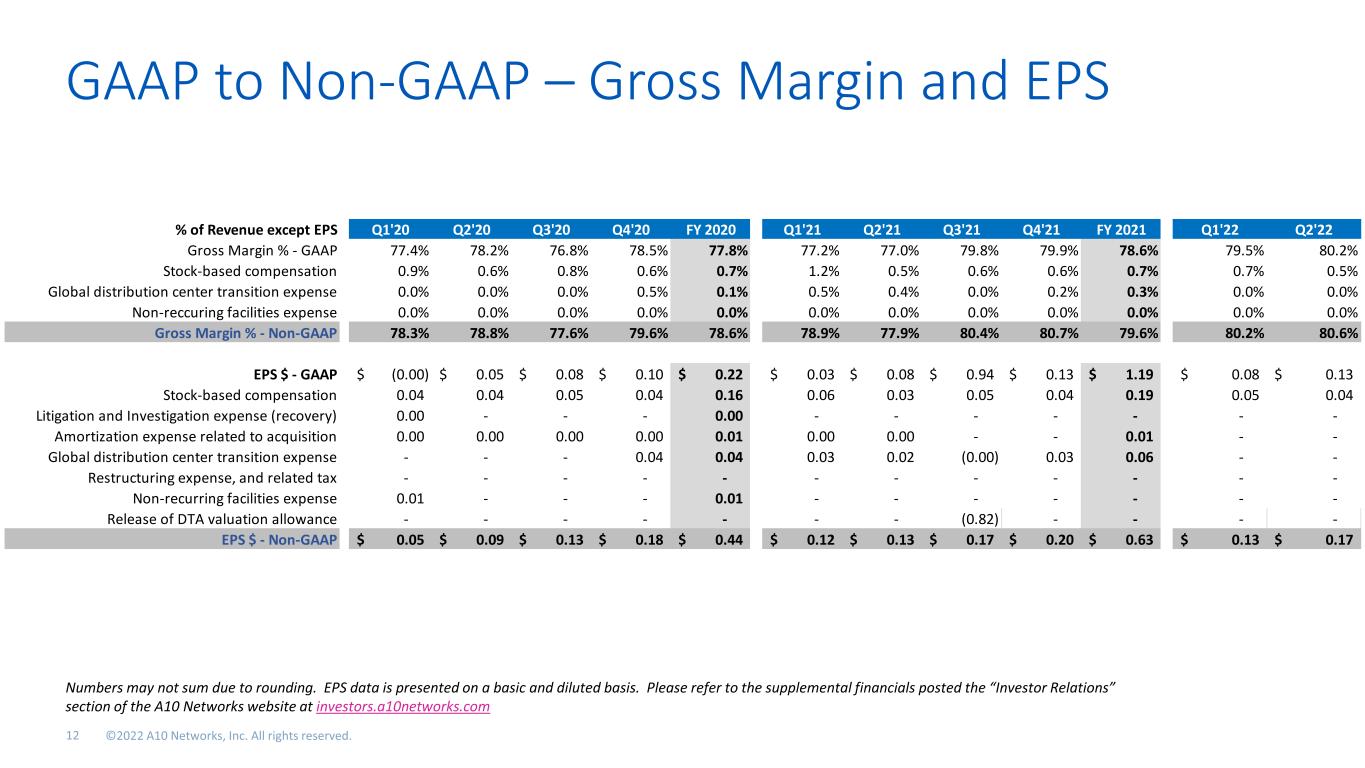

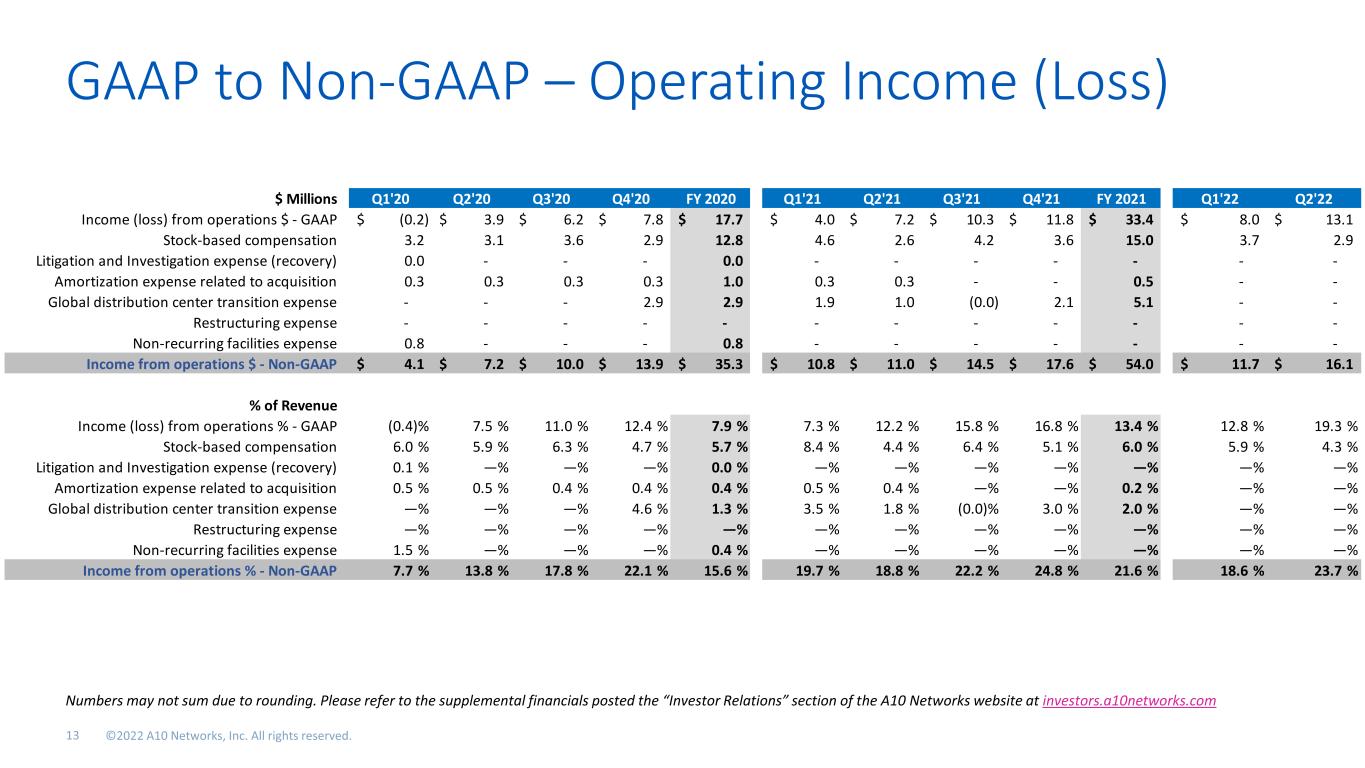

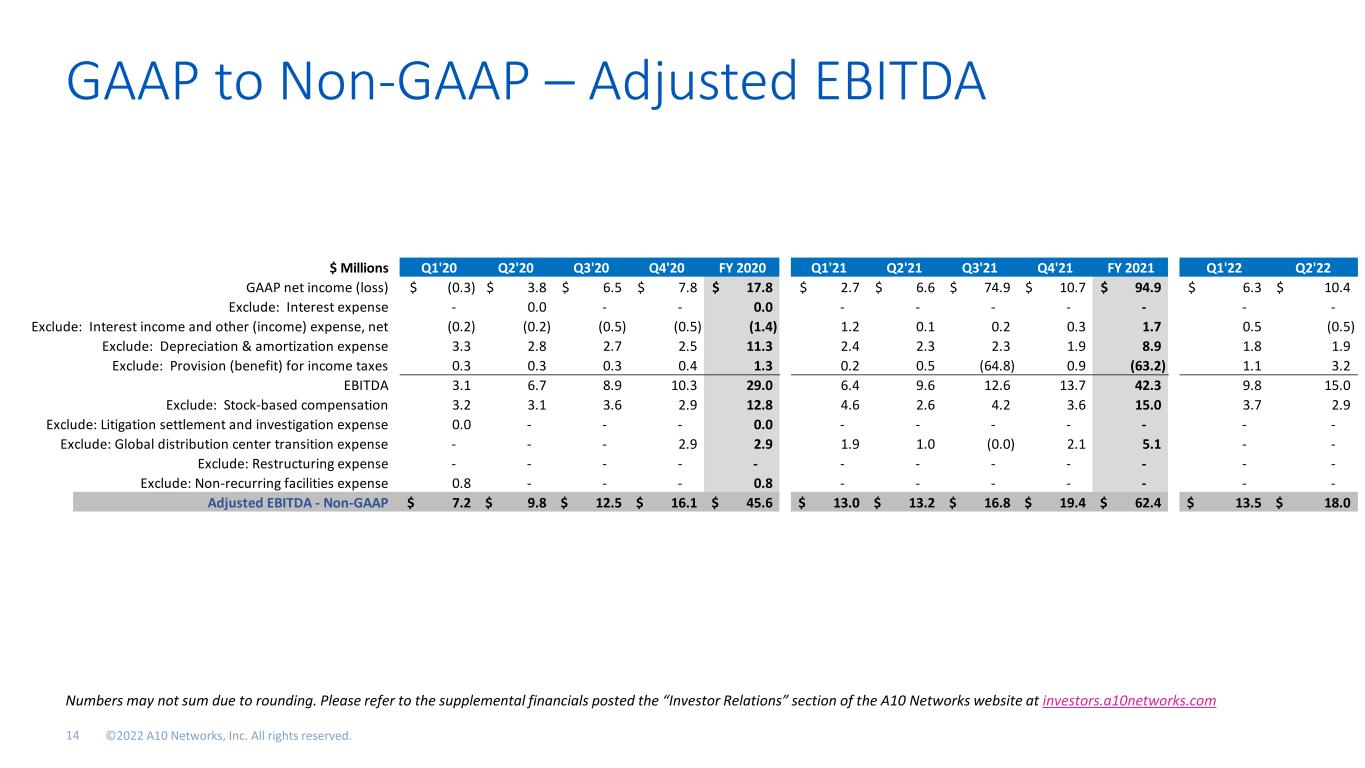

Cautionary Statements & Disclosures This presentation and the accompanying oral presentation contain “forward-looking” statements that are based on our management’s beliefs and assumptions, including statements regarding our future financial performance, strategy, routes to market, technical differentiation, positioning, capital allocation strategy, expansion opportunities, growth, profitability, market growth, as well as market and technology trends. Forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other factors that could cause our actual results to differ materially from those anticipated or implied by our forward-looking statements. These factors include, but are not limited to, the impact of the COVID-19 pandemic on our business, on the business of our customers and suppliers, and on the global economy in general, a significant decline in global macroeconomic or political conditions, execution risks related to closing key deals and improving our execution, successfully executing our strategies, market adoption of our products, successfully anticipating market needs and opportunities, timely development of new products and features, achieving or maintaining profitability, loss or delay of expected purchases, our ability to maintain or improve our competitive position; competitive and execution risks related to cloud-based computing trends, attracting and retaining new end-customers, maintaining and enhancing our brand and reputation, changes demanded by our customers in the deployment and payment model for our products, growth in markets relating to network security, the success of any future acquisitions or investments, the success of our partnerships with technology providers, the ability of our sales team to execute well, our ability to shorten our close cycle, the ability of our channel partners to sell our products, variations in product mix or geographic locations of our sales, our presence in international markets, and other factors described in our quarterly reports on Form 10-Q, annual reports on Form 10-K and other filings made with the Securities and Exchange Commission, to which your attention is directed. The forward-looking statements included in this presentation are based on current expectations and beliefs as of August 2, 2022, only. We do not intend to update this information contained in the forward-looking statements, except as required by law. This presentation and the accompanying oral presentation also include certain non-GAAP financial measures including Non-GAAP gross margin, non-GAAP operating income, non-GAAP net income, non-GAAP operating margin, Adjusted EBITDA and Non-GAAP EPS. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similarly titles measures presented by other companies. A10 Networks considers these non-GAAP financial measures to be important because they provide useful measures of the operating performance of the company, exclusive of unusual events or factors that do not directly affect what we consider to be our core operating performance, and are used by the company’s management for that purpose. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. We define non-GAAP net income as our GAAP net income (loss) excluding: (i) stock- based compensation and related payroll tax, (ii) amortization expense related to acquisition, (iii) global distribution center transition expense. We define non-GAAP net income per basic and diluted share as our non-GAAP net income (loss) divided by our basic and diluted weighted-average shares outstanding. We define non-GAAP gross profit as our GAAP gross profit excluding (i) stock-based compensation and related payroll tax, and (ii) global distribution center transition expense. We define non-GAAP gross margin as our non-GAAP gross profit divided by our GAAP revenue. We define non-GAAP operating income (loss) as our GAAP income (loss) from operations excluding (i) stock-based compensation and related payroll tax, (ii) amortization expense related to acquisition, and (iii) global distribution center transition expense. We define non-GAAP operating margin as our non-GAAP operating income (loss) divided by our GAAP revenue. We define non-GAAP operating expenses as our GAAP operating expenses excluding (i) stock-based compensation and related payroll tax, (ii) amortization expense related to acquisition, and (iii) global distribution center transition expense. We define Adjusted EBITDA as our GAAP net income (loss) excluding (i) interest expense (if any), (ii) interest income and other (income) expense, net, (iii) depreciation and amortization expense, (iv) provision (benefit) for income taxes, (v) stock-based compensation and related payroll tax, and global distribution center transition expense. A reconciliation between GAAP and non-GAAP financial measures can be found in the appendix to this document and in the accompany financial results press release.