Q1 2024 Financial Results & Commentary April 30, 2024

Cautionary Statements & Disclosures This presentation and the accompanying oral presentation contain “forward-looking” statements that are based on our management’s beliefs and assumptions, including statements regarding our future financial performance, strategy, demand, positioning, capital allocation strategy and value creation, and market and technology trends. Forward-looking statements are subject to known and unknown risks and uncertainties and are based on assumptions that may prove to be incorrect, which could cause actual results to differ materially from those expected or implied by the forward-looking statements. Factors that may cause actual results to differ include any unforeseen need for capital which may require us to divert funds we may have otherwise used for the dividend program or stock repurchase program, which may in turn negatively impact our ability to administer the quarterly dividends or the repurchase of our common stock; a significant decline in global macroeconomic or political conditions that have an adverse impact on our business and financial results; business interruptions related to our supply chain; our ability to manage our business and expenses if customers cancel or delay orders; execution risks related to closing key deals and improving our execution; the continued market adoption of our products; our ability to successfully anticipate market needs and opportunities; our timely development of new products and features; our ability to achieve or maintain profitability; any loss or delay of expected purchases by our largest end-customers; our ability to maintain or improve our competitive position; competitive and execution risks related to cloud-based computing trends; our ability to attract and retain new end-customers and our largest end-consumers; our ability to maintain and enhance our brand and reputation; changes demanded by our customers in the deployment and payment model for our products; continued growth in markets relating to network security; the success of any future acquisitions or investments in complementary companies, products, services or technologies; the ability of our sales team to execute well; our ability to shorten our close cycles; the ability of our channel partners to sell our products; variations in product mix or geographic locations of our sales; risks associated with our presence in international markets; weaknesses or deficiencies in our internal control over financial reporting; our ability to timely file periodic reports required to be filed under the Securities Exchange Act of 1934; and other risks that are described in “Risk Factors” in our periodic filings with the Securities and Exchange Commission, including our Form 10-K filed with the Securities and Exchange Commission on February 29, 2024. We do not intend to update or alter our forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law. This presentation and the accompanying oral presentation also include certain non-GAAP financial measures including Non-GAAP gross margin, non-GAAP operating income, non-GAAP net income, non-GAAP operating margin, Adjusted EBITDA and Non-GAAP EPS. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similarly titles measures presented by other companies. A10 Networks considers these non-GAAP financial measures to be important because they provide useful measures of the operating performance of the company, exclusive of unusual events or factors that do not directly affect what we consider to be our core operating performance and are used by the company’s management for that purpose. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. We define non-GAAP net income as our GAAP net income excluding: (i) stock-based compensation and related payroll tax, (ii) restructuring expense, (iii) cyber incident remediation expense and (iv) income tax effect of non-GAAP items (i) to (iii) listed above. We define non-GAAP net income per basic and diluted share as our non-GAAP net income divided by our basic and diluted weighted-average shares outstanding. We define non-GAAP gross profit as our GAAP gross profit excluding (i) stock-based compensation and related payroll tax, (ii) restructuring expense and (iii) cyber incident remediation expense. We define non-GAAP gross margin as our non-GAAP gross profit divided by our GAAP revenue. We define non-GAAP operating income as our GAAP income from operations excluding (i) stock-based compensation and related payroll tax, (ii) restructuring expense and (iii) cyber incident remediation expense. We define non-GAAP operating margin as our non-GAAP operating income divided by our GAAP revenue. We define non-GAAP operating expenses as our GAAP operating expenses excluding (i) stock-based compensation and related payroll tax, (ii) restructuring expense and (iii) cyber incident remediation expense. We define Adjusted EBITDA as our GAAP net income excluding (i) interest and other (income) expense, net, (ii) depreciation and amortization expense, (iii) provision for income taxes, (iv) stock- based compensation and related payroll tax, (v) restructuring expense and (vi) cyber incident remediation expense. We define Adjusted EBITDA margin as our Adjusted EBITDA divided by our GAAP revenue. A reconciliation between GAAP and non-GAAP financial measures can be found in the appendix to this document and in the accompanying financial results press release.

Agenda ▪ Q1 2024 Overview ▪ Q1 Financial Performance ▪ FY 2024 Outlook

Q1’24: In-line Revenue Growth & EPS Expansion Revenue Overview • Q1 revenue increased 5.2% year-over-year • Improvement from Service Providers represents an encouraging data point amidst an unpredictable economic environment Consistent Profitability • Non-GAAP gross margins of 81.9% • GAAP EPS of $0.13 compared to $0.05 in Q1’23 • Non-GAAP EPS of $0.17 compared to $0.13 in Q1’23 Key Takeaways • Revenue and profitability in-line with consensus • Investing to strengthen our position with enterprise customers, and well-aligned with service provider customer investment plans as demonstrated in Q1 • Security solutions remain in high demand See Appendix for reconciliation to most comparable GAAP financial measures.

Quarterly Revenue & Adjusted EBITDA Operating Income is a Non-GAAP Financial Measure. See Appendix for reconciliation to most comparable GAAP financial measures. $57.7 $65.8 $57.8 $70.4 $60.7 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Revenue, $ Millions $15.5 $17.4 $14.4 $23.9 $13.9 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Adjusted EBITDA, $ Millions $57.7 $60.7 Q1'23 Q1'24 Revenue, $ Millions $15.5 $13.9 Q1'23 Q1'24 Adjusted EBITDA, $ Millions

62% 38% Q1’24 $60.7 million Quarterly Revenue by Customer Vertical 56.4% 67.4% 49.7% 58.4% 62.0% 43.6% 32.6% 50.3% 41.6% 38.0% Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Enterprise Service Provider

Quarterly Revenue by Geography 49% 49% 48% 53% 57% 50% 53% 52% 56% 45% 57% 45% 39% 34% 35% 28% 32% 34% 33% 27% 33% 37% 26% 41% 12% 17% 17% 19% 11% 16% 14% 21% 11% 19% 16% 14% Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 $ Millions Americas APJ EMEA 45% 41% 14% Q1’24 $60.7 million

Consistent Value Creation Business Model Revenue Growth Capital Allocation

Appendix

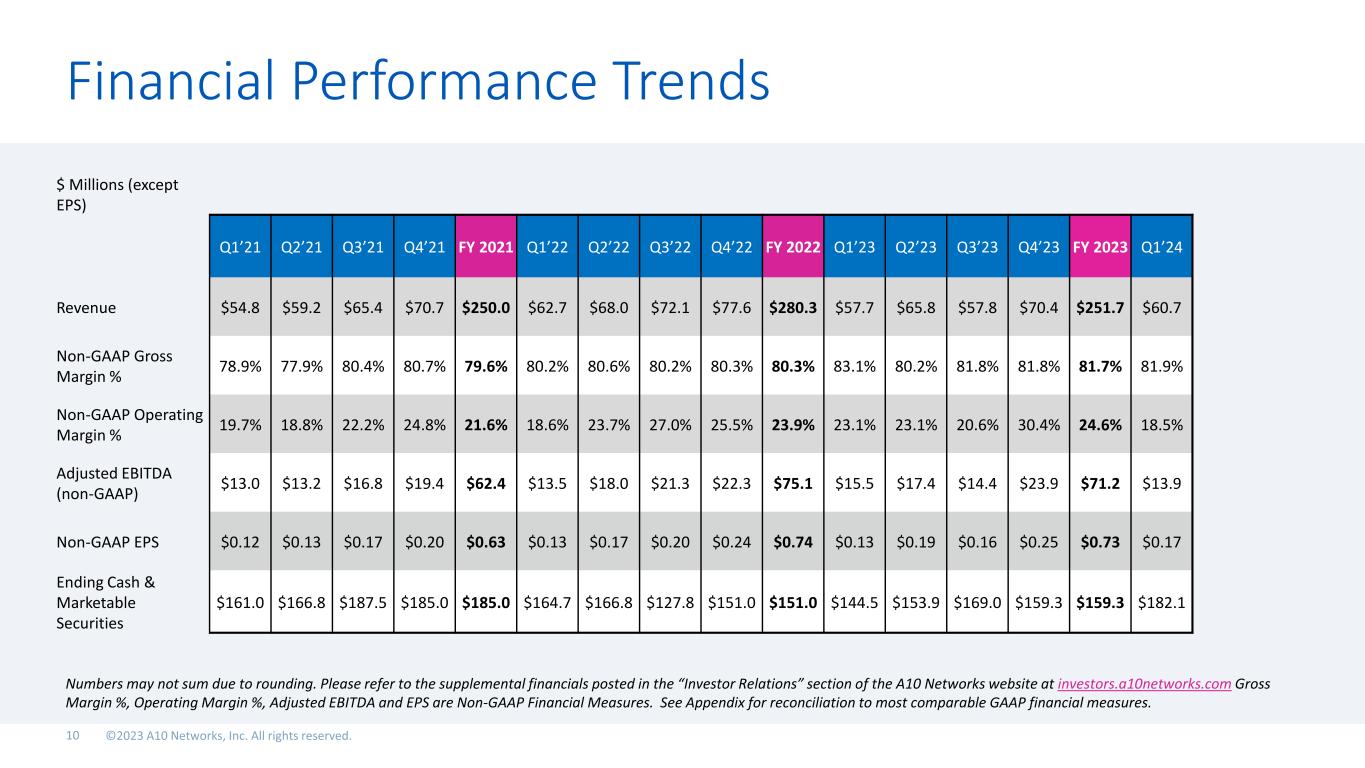

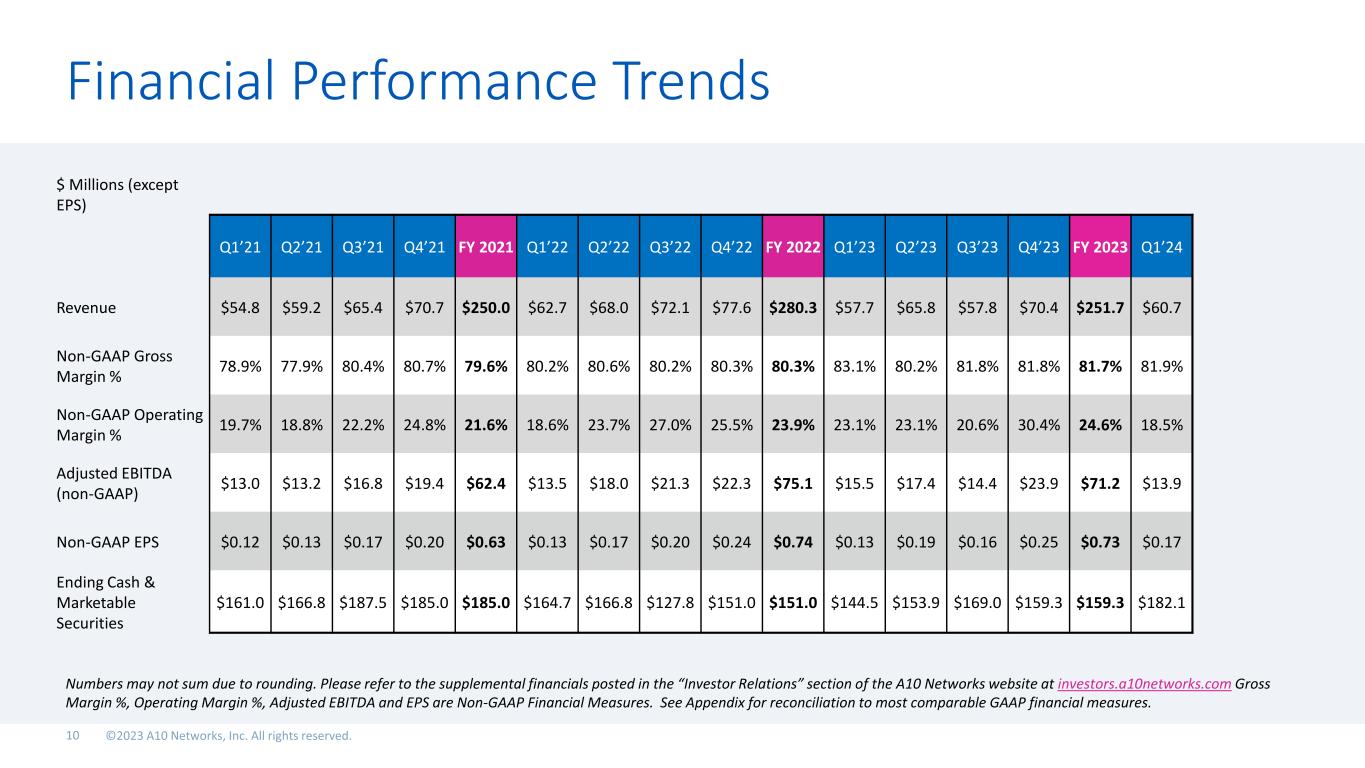

Financial Performance Trends Numbers may not sum due to rounding. Please refer to the supplemental financials posted in the “Investor Relations” section of the A10 Networks website at investors.a10networks.com Gross Margin %, Operating Margin %, Adjusted EBITDA and EPS are Non-GAAP Financial Measures. See Appendix for reconciliation to most comparable GAAP financial measures. $ Millions (except EPS) Q1’21 Q2’21 Q3’21 Q4’21 FY 2021 Q1’22 Q2’22 Q3’22 Q4’22 FY 2022 Q1’23 Q2’23 Q3’23 Q4’23 FY 2023 Q1’24 Revenue $54.8 $59.2 $65.4 $70.7 $250.0 $62.7 $68.0 $72.1 $77.6 $280.3 $57.7 $65.8 $57.8 $70.4 $251.7 $60.7 Non-GAAP Gross Margin % 78.9% 77.9% 80.4% 80.7% 79.6% 80.2% 80.6% 80.2% 80.3% 80.3% 83.1% 80.2% 81.8% 81.8% 81.7% 81.9% Non-GAAP Operating Margin % 19.7% 18.8% 22.2% 24.8% 21.6% 18.6% 23.7% 27.0% 25.5% 23.9% 23.1% 23.1% 20.6% 30.4% 24.6% 18.5% Adjusted EBITDA (non-GAAP) $13.0 $13.2 $16.8 $19.4 $62.4 $13.5 $18.0 $21.3 $22.3 $75.1 $15.5 $17.4 $14.4 $23.9 $71.2 $13.9 Non-GAAP EPS $0.12 $0.13 $0.17 $0.20 $0.63 $0.13 $0.17 $0.20 $0.24 $0.74 $0.13 $0.19 $0.16 $0.25 $0.73 $0.17 Ending Cash & Marketable Securities $161.0 $166.8 $187.5 $185.0 $185.0 $164.7 $166.8 $127.8 $151.0 $151.0 $144.5 $153.9 $169.0 $159.3 $159.3 $182.1

GAAP to Non-GAAP – Gross Margin and EPS Numbers may not sum due to rounding. EPS data is presented on a basic and diluted basis. Please refer to the supplemental financials posted the “Investor Relations” section of the A10 Networks website at investors.a10networks.com. Q1'23 Q2'23 Q3'23 Q4'23 Dec 31 2023 Q1'24 Revenue 57.7$ 65.8$ 57.8$ 70.4$ 251.7$ 60.7$ Gross Margin % - Non-GAAP 83.1% 80.2% 81.8% 81.8% 81.7% 81.9% Income from operations % - Non-GAAP 23.1% 23.1% 20.6% 30.4% 24.6% 18.5% Adjusted EBITDA - Non-GAAP 15.5$ 17.4$ 14.4$ 23.9$ 71.2$ 13.9$ EPS $ - Non-GAAP 0.13$ 0.19$ 0.16$ 0.25$ 0.73$ 0.17$ Ending Cash & Marketable Securities 144.5$ 153.9$ 169.0$ 159.3$ 159.3$ 182.1$ Years Ended

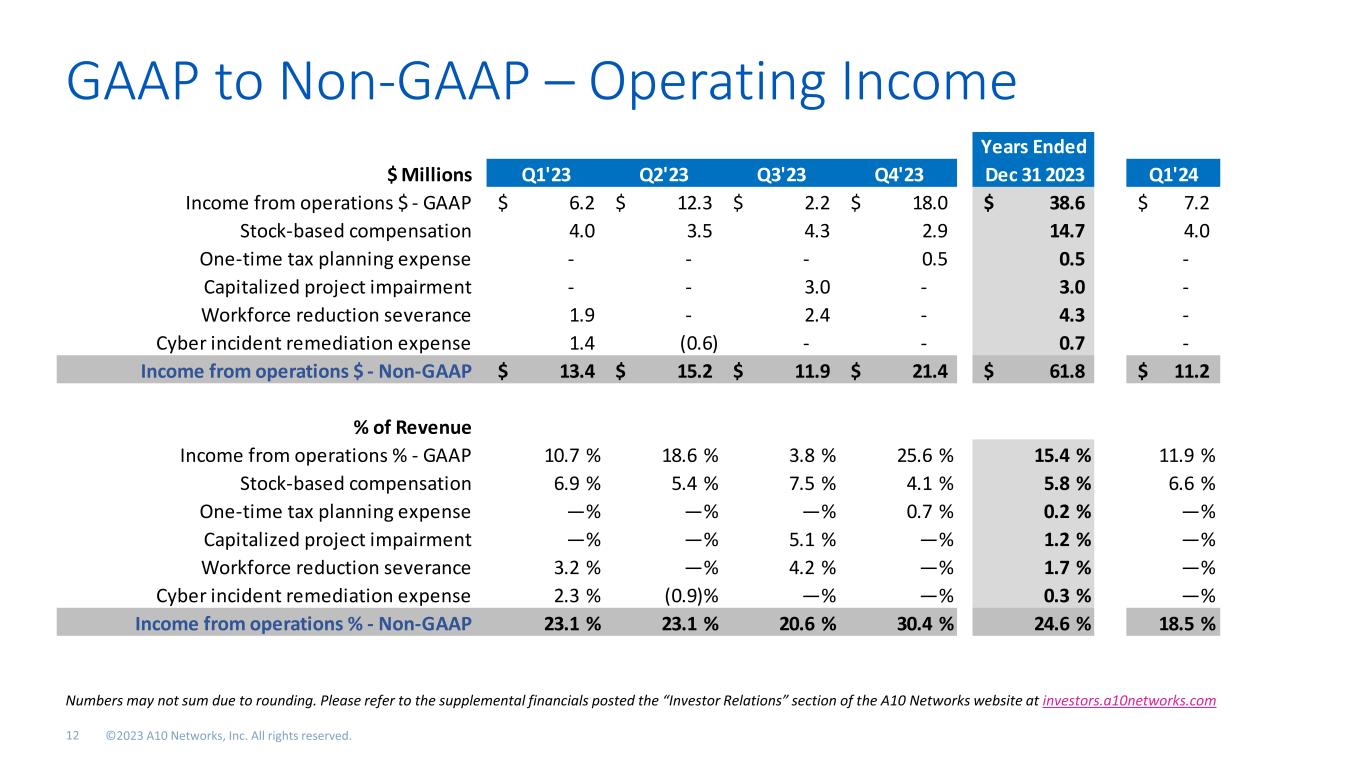

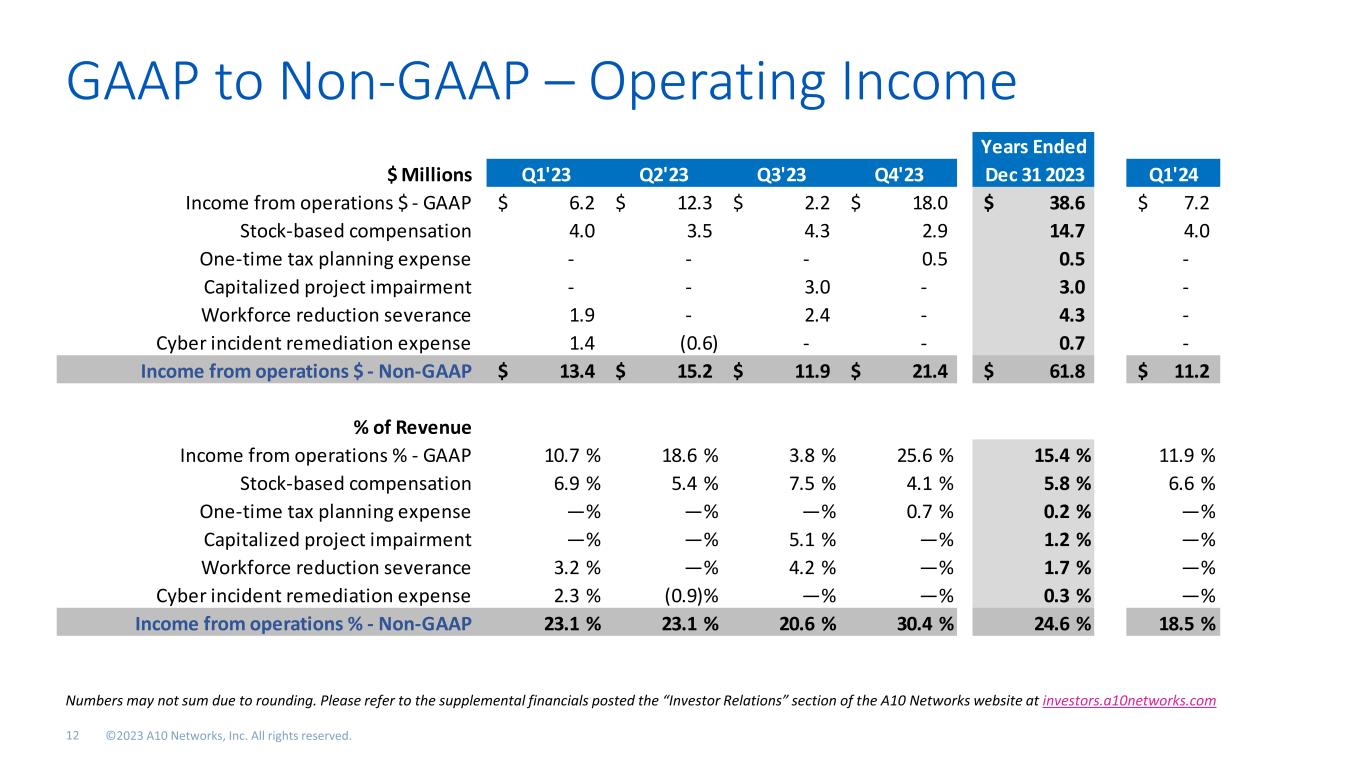

GAAP to Non-GAAP – Operating Income Numbers may not sum due to rounding. Please refer to the supplemental financials posted the “Investor Relations” section of the A10 Networks website at investors.a10networks.com. Q3’23 $ Millions Q1'23 Q2'23 Q3'23 Q4'23 Dec 31 2023 Q1'24 Income from operations $ - GAAP 6.2$ 12.3$ 2.2$ 18.0$ 38.6$ 7.2$ Stock-based compensation 4.0 3.5 4.3 2.9 14.7 4.0 One-time tax planning expense - - - 0.5 0.5 - Capitalized project impairment - - 3.0 - 3.0 - Workforce reduction severance 1.9 - 2.4 - 4.3 - Cyber incident remediation expense 1.4 (0.6) - - 0.7 - Income from operations $ - Non-GAAP 13.4$ 15.2$ 11.9$ 21.4$ 61.8$ 11.2$ % of Revenue Income from operations % - GAAP 10.7 % 18.6 % 3.8 % 25.6 % 15.4 % 11.9 % Stock-based compensation 6.9 % 5.4 % 7.5 % 4.1 % 5.8 % 6.6 % One-time tax planning expense —% —% —% 0.7 % 0.2 % —% Capitalized project impairment —% —% 5.1 % —% 1.2 % —% Workforce reduction severance 3.2 % —% 4.2 % —% 1.7 % —% Cyber incident remediation expense 2.3 % (0.9)% —% —% 0.3 % —% Income from operations % - Non-GAAP 23.1 % 23.1 % 20.6 % 30.4 % 24.6 % 18.5 % Years Ended

GAAP to Non-GAAP – Adjusted EBITDA Numbers may not sum due to rounding. Please refer to the supplemental financials posted the “Investor Relations” section of the A10 Networks website at investors.a10networks.com. $ Millions Q1'23 Q2'23 Q3'23 Q4'23 Dec 31 2023 Q1'24 GAAP net income 4.0$ 11.6$ 6.5$ 17.9$ 40.0$ 9.7$ Exclude: Interest income and other (income) expense, net 1.2 (2.5) (2.8) (1.1) (5.1) (4.0) Exclude: Depreciation & amortization expense 2.1 2.2 2.5 2.5 9.3 2.7 Exclude: Provision (benefit) for income taxes 1.0 3.2 (1.5) 1.2 3.8 1.5 EBITDA 8.3 14.5 4.7 20.5 48.0 9.9 Exclude: Stock-based compensation 4.0 3.5 4.3 2.9 14.7 4.0 Exclude: Sone-time tax planning expense - - - 0.5 0.5 - Exclude: Capitalized project impairment - - 3.0 - 3.0 - Exclude: Workforce reduction severance 1.9 - 2.4 - 4.3 - Exclude: Cyber incident remediation expense 1.4 (0.6) - - 0.7 - Adjusted EBITDA - Non-GAAP 15.5$ 17.4$ 14.4$ 23.9$ 71.2$ 13.9$ Years Ended