Kathleen H. Moriarty

Attorney

+1 212 836-8276 Direct

kathleen.moriarty@apks.com

March 24, 2017

VIA EDGAR CORRESPONDENCE

Mr. Edward P. Bartz, Senior Counsel

United States Securities and Exchange Commission

Division of Investment Management

100 F Street, NE

Washington, DC 20549-0102

RE: Syntax ETF Trust – SEC File Nos. 333-215607 and 811-23227 (the “Registrant”)

Dear Mr. Bartz:

On behalf of the Registrant, we are filing this letter to respond in writing to the Staff’s written comments on the registration statement filed under the Securities Act of 1933, as amended, and the Investment Company Act of 1940, as amended, on Form N-1A with the Securities and Exchange Commission (the “Commission”) on January 18, 2017 (the “Registration Statement”), to register the Trust and the shares of the Syntax Stratified Core ETF, Syntax Stratified LargeCap ETF, Syntax Stratified MidCap ETF, Syntax Stratified Financials ETF, Syntax Stratified Energy ETF, Syntax Stratified Industrials ETF, Syntax Stratified Information Tools ETF, Syntax Stratified Information ETF, Syntax Stratified Consumer ETF, Syntax Stratified Food ETF, and Syntax Stratified Healthcare ETF (each a “Fund,” and collectively, the “Funds”), which are the initial series of the Trust (“Funds”). The Staff’s comments on the Registration Statement and the Registrant’s responses thereto are included in this letter.

PROSPECTUS

Fund Summaries

Syntax Stratified Core ETF

Fees and Expenses of the Fund (Page 3)

1. Comment: Footnote (2) to the fee table describes a fee waiver agreement between the adviser and the Fund. Please disclose in this footnote or in response to Item 10 of Form N-1A that the Fund may only make repayments to the adviser if such repayment does not cause the Fund’s expense ratio (after the repayment is taken into account) to exceed both (1) the Fund’s net expense ratio in place at the time such amounts were waived; and (2) the Fund’s current net expense ratio (before recoupment). In addition, please file a copy of the fee waiver agreement as an exhibit to the registration statement. See Item 28(h) of Form N-1A.

Response: The Registrant has added the requested disclosure in response to Item 10 of Form N-1A. A copy of the fee waiver agreement will be included in a pre-effective amendment to the Registration Statement.

2. Comment: In the example following the fee table, please modify the narrative explanation to state that investors may pay brokerage commissions on their purchases and sales of the Fund’s shares, which are not reflected in the example. See Instruction 1(e)(i) to Item 3 of Form N-1A.

Response: The Registrant has added the requested disclosure.

Principal Strategy (Page 4)

3. Comment: The first sentence of the second paragraph of this section states that the Index is the stratified-weight version of the S&P 900 Index, “which combines the S&P 500 Index and the S&P 400 Index.” Please revise “S&P 400 Index” to “S&P MidCap 400 Index” in this sentence. See https://us.spindices.com/indices/equity/sp-900.

Response: The Registrant has added the requested disclosure.

4. Comment: Please confirm to us that the Index is rules-based, and provide us with a copy of the complete Index methodology (i.e., white paper) as soon as possible. Also, please explain “stratified-weight” and “related business risks” in the second paragraph of this section, and summarize how the Index selection methodology is applied to the S&P 900 Index. Please also disclose the Index’s rebalance and reconstitution process, and the approximate number of Index components. Finally, please disclose the market capitalizations of the constituents of the S&P 900 Index (e.g., small-cap, mid-cap, large cap), and provide the market capitalization range of the companies included in this Index as of a recent date.

Response: Each Syntax Index is rules-based. “Stratified-weight” refers to the weighting methodology of each Syntax Index and is the method by which Syntax diversifies its indices by hierarchically grouping and distributing the weight of constituent companies that share “Related Business Risks”. Related Business Risk occurs when two or more companies’ earnings are affected by the same fundamental drivers. The process of identifying, grouping, and diversifying across related business risk is called stratification. Attached hereto as Appendix A is the complete Syntax Index methodology.

Each Syntax Index rebalances quarterly on the third Friday of the month. Each Syntax Index uses the exact constituents, with their respective capitalization, selected by S&P for their capitalization weighted indices. The Registrant applies the S&P constituents, additions and deletions, to its stratification model (please see Appendix A) which assigns stratified weights versus the conventional capitalization weighted indices.

The Registrant has added the requested disclosure regarding the rebalance process, approximate number of index components and market capitalizations.

5. Comment: The third paragraph of this section states that the Index is sponsored by Locus Analytics, LLC, “an affiliate of the investment adviser” which “determines the composition, classification and relative weightings of the securities in the Index.” Please explain to us the affiliation between Locus Analytics and the investment adviser. Also, since Locus Analytics “determines the composition, classification and relative weightings of the securities in the Index,” please explain to us why Locus Analytics should not be considered an investment adviser to the Fund under Section 2(a)(20) of the Investment Company Act of 1940 (the “Investment Company Act”) subject to the requirements of Section 15 of the Investment Company Act.

Response: Locus Analytics, LLC (“Locus”) was an affiliate (as defined under the Investment Company Act) of Syntax Advisors LLC because both entities were under common control with Locus LP. Under a recent restructuring of its subsidiaries, Locus LP reorganized the index division of Locus as division of Syntax, LLC, the parent of Syntax Advisors LLC. Thus, the index sponsor continues to be an affiliate of Syntax Advisors LLC.

Locus is an economic think tank founded to explore alternative theories for classifying companies in the economy as a whole, and it developed the patented Functional Information System (“FIS”) of classification and the indices as a result of its research. The Registrant believes that Locus, and subsequent to the reorganization discussed above, Syntax, LLC (together with Locus, the “Index Provider”), does not meet the definition of an “investment adviser” under Section 2(a)(20)(A) of the Investment Company Act because it meets the exclusion contained in Section 2(a)(20)(B)(iii) of the Investment Company Act. The Trust and its Funds will not pay for any of the index information provided by the Index Provider. Given that they are all investment companies registered under the Investment Company Act, they will be receiving services from the Index Provider at no cost, and hence the Index Provider is entitled to rely on the exclusion from the definition of “investment adviser” provided by Section 2(a)(20)(B)(iii) of the Investment Company Act.

6. Comment: The last sentence of this section states that “[a]dditional information on the Indices can be found at syntaxindices.com.” We have accessed the link provided, and noted backtested performance results for the Index. Please explain to us the basis for indirectly including, by means of this link, backtested performance information for the Index in the Fund’s registration statement. We may have further comments after reviewing your response.

Response: The Registrant has deleted the references to “syntaxindices.com”. Once the Funds’ website is established and operational, the reference provided will link to the Funds’ website and not that of the Syntax Indices.

7. Comment: Please provide a cross reference to the section “Additional Strategies Information” that describes the proprietary “FIS” system developed by Locus Analytics on page 66 of the prospectus.

Response: The Registrant has added the requested disclosure.

Principal Risks of Investing in the Fund (Page 4)

8. Comment: Since the S&P 900 includes the common stocks of small-capitalization and mid-capitalization companies, please disclose in this section the risks associated with these types of companies.

Response: The Registrant has added disclosure related to large-capitalization and mid-capitalization companies.

9. Comment: Please provide a risk in this section disclosing that the Fund will concentrate to the same extent as its Index. See Investment Company Act Release No. 31590 at Applicant Representation 8. Is the Index currently concentrated in any industry or group of related industries? If so, please disclose the risks of the industry or group of related industries in which the Index is currently concentrated. Finally, please add a fundamental concentration policy to the “Investment Restrictions” section on page 11 of the Statement of Additional Information stating that the Fund will concentrate to the same extent as its Index. See Item 16(c)(1)(iv) of Form N-1A.

Response: The Syntax Stratified Core Index, Syntax Stratified LargeCap Index and Syntax Stratified MidCap Index are not currently concentrated in any industry or group of related industries. The Syntax stratification methodology prevents concentration risk by rebalancing the portfolio of each of these Indices equally among the eight industry sectors. Therefore, the Registrant has disclosed the risk of concentrating in a particular industry for each of the sector focused Funds, but does not believe that such a risk is appropriate for the broad market Funds. The Registrant has added the requested fundamental policy.

10. Comment: Please disclose the risk that the Fund’s market price may deviate from the value of the its underlying portfolio holdings, particularly in times of market stress, with the result that investors may pay significantly more or receive significantly less than the underlying value of Fund shares bought or sold. For clarity, consider disclosing that this may be reflected as a spread between the “bid” and “ask” prices for the Fund quoted during the day, or a premium or discount in the closing price from the Fund’s net asset value.

Response: The Registrant believes the risk that the Fund’s market price may deviate from the value of its underlying portfolio holdings is addressed under the heading “Shares of the Fund may trade at prices other than NAV” in the Additional Risk Information section of the prospectus.

11. Comment: Please disclose the risk that an active trading market for shares of the Fund may not develop or be maintained. Please also disclose that in times of market stress, market makers or authorized participants may step away from their respective roles in making a market in shares of the Fund and in executing purchase or redemption orders, and that this could lead to variances between the market price of the Fund’s shares and the underlying value of those shares.

Response: The Registrant has added the requested disclosure under the heading “Shares of the Fund may trade at prices other than NAV” in the Additional Risk Information section of the prospectus.

Fund Performance (Page 5)

12. Comment: This section provides the performance of the Syntax 900 I, LP, for the period from inception to January 1, 2015, and the performance of Syntax Index Series LP from January 1, 2015 to the Fund’s commencement of operations. Please explain to us the legal basis for including the performance of multiple predecessor accounts in this section. See MassMutual Institutional Funds no-action letter (pub. avail. Sept. 28, 1995) (“MassMutual”).

Response: The Registrant believes that the inclusion of the past performance of, each sleeve of the Syntax 900 I, LP (a “Sleeve”) and each series of the Syntax Index Series LP (a “Series”), in the performance of its corresponding Syntax ETF is consistent with the guidelines established in MassMutual.

The Registrant acknowledges that the fact pattern in MassMutual involved a fund’s use of the past performance of a single predecessor account. However, the Registrant does not believe that the precedent set by MassMutual precludes a fund from including the performance of two predecessor accounts when each account meets the standards established in that letter.1 The Registrant believes that each Sleeve and each Series comply with the MassMutual standard for including predecessor fund performance.

Each Sleeve and Series had investment policies, objectives, guidelines and restrictions that are in all material respects equivalent to those of its corresponding Fund. Each Sleeve and Series was managed by the same investment adviser, sub-adviser and portfolio manager as its corresponding Fund. Each Fund will be an effective continuation of its corresponding Sleeve and Series, each of which was created for reasons unrelated to the establishment of a performance record (please see Response 19). All assets of each Sleeve were transferred to its corresponding Series, and all assets of each Series will be transferred to its corresponding Fund. Each Fund will hold the same portfolio securities held by its corresponding Series immediately prior to the transfer of assets. Furthermore, not including the past performance of each Fund’s corresponding Sleeve and Series would deprive investors of important information regarding the Funds.

13. Comment: Since this section provides performance information for predecessor accounts (the “Private Funds”) that were previously not registered as investment companies under the Investment Company Act, please explain to us the specific section of the Investment Company Act that the Private Funds relied on for exclusion from the definition of investment company.

1 The Registrant notes that other funds have included the past performance of multiple predecessor accounts. Please see the Neuberger Berman Intrinsic Value Fund, a series of Neuberger Berman Equity Funds (CIK 0000044402).

Response: The Syntax 900 I, LP was excluded from the definition of investment company pursuant to Section 3(c)1 of the Investment Company Act.

The Syntax Index Series LP was excluded from the definition of investment company pursuant to Section 3(c)1 of the Investment Company Act.

14. Comment: The first paragraph of this section states that the returns of the Private Funds were calculated using the methodology required of registered funds. Please disclose whether this is the standardized SEC method of calculating performance. Please also disclose the specific commencement date for the performance information.

Response: The returns were calculated generally using the methodology required of registered funds. However, since the Private Funds did not calculate their returns on a per share basis, their returns have been calculated on the total net asset value of the Private Funds, which the Registrant believes yields the same results.

The Registrant has added the requested disclosure regarding the commencement date for the performance information.

15. Comment: The third paragraph of this section states that the Private Funds had investment objectives and strategies that were, in all material respects, the same as those of the Fund. Please explain to us the basis for this statement, given the differences between the Syntax Index Series LP, which appears to have emphasized industry sectors, and the Syntax 900 I, LP, which does not appear to have emphasized industry sectors. Also, please explain the role that Locus Analytics played in determining the composition, classification, and relative weightings of securities for the Private Funds, compared to the role Locus Analytics will play for the Fund.

Response: As more fully described in Response 21, the Syntax 900 I, LP was managed as 11 distinct pools or Sleeves. Each of those Sleeves has its own investment objectives and strategies that were, in all material respects, the same as those of its corresponding Series.

Locus was the Index Provider for each Sleeve of the Syntax 900 I, LP and each Series of the Syntax Index Series, LP. As noted in Response 5, the index division of Locus has been reorganized and is now a division of Syntax, LLC. Syntax, LLC will be the Index Provider to each Fund.

16. Comment: Please disclose in this section that the Private Funds had policies that were, in all material respects, the same as those of the Fund, and that the Private Funds were not subject to restrictions applicable to investment companies. See MassMutual.

Response: The Registrant has added the requested disclosure.

17. Comment: The fourth paragraph of this section states that the advisory fees and other charges that are charged to the Fund do not exceed the fees and other charges that were charged to the Private Funds. Please disclose whether the performance data shown for the Private Funds is net of all actual fees/expenses incurred by the Private Funds. We may have additional comments based on your response.

Response: The Registrant has deleted the reference to the Fund’s fees not exceeding the Private Funds’ fees and added the requested disclosure.

18. Comment: Please include in the Statement of Additional Information at least two years of audited financial statements for the Private Funds that comply with Regulation S-X and include a full schedule of investments and financial highlights.

Response: Similar to the applicant in MassMutual, the Registrant is not asking that the Funds be treated as the successors of their corresponding Sleeve and Series for financial accounting purposes. Any performance figures used in the Funds’ financial statements will reflect the actual performance of the Funds from the effective date of their registration statement.

19. Comment: In your response letter, please describe the backgrounds of the Private Funds, including information regarding when and why the Private Funds were created. Please also explain to us whether the investment adviser managed any other private funds that were materially equivalent to the Fund, and whether any of these private funds were converted to registered investment companies and, if not, why not? Please also explain to us why the Syntax Index Series LP was chosen to be registered and whether any other materially equivalent private funds had lower performance compared to the Syntax Index Series LP.

Response: The Syntax 900 I, LP and its Sleeve structure (as more fully described in Response 21) was created in 2010 to provide investors the opportunity to employ the Syntax stratification methodology in a live investment product. The Syntax 900 I, LP was reorganized into the Syntax Index Series LP in 2015 to provide investors the opportunity to invest directly in the individual Sleeves that constituted the Syntax 900 I, LP. The Adviser chose to register the Syntax Index Series LP to provide investors with the assurance and protections that come with investing in a registered product.

The Adviser manages one other private fund which uses a stratification methodology. However, unlike the Syntax Index Series LP which is limited to domestic equities, that private fund provides exposure to international equities.

20. Comment: Please explain to us whether the Syntax Index Series LP transferred substantially all of its assets, or only a portion of its assets, to the newly-registered Fund. Please also explain to us whether the investment adviser believes that the Syntax Index Series LP could have complied with Subchapter M of the Internal Revenue Code. In addition, please represent to us that the Fund has the records necessary to support the calculation of the performance as required by Rule 204-2(a)(16) under the Investment Advisers Act.

Response: Substantially all assets of each series of Syntax Index Series LP will be transferred to its corresponding Fund prior to the launch of that particular Fund. The Registrant believes that the Syntax Index Series LP could have complied with Subchapter M of the Internal Revenue Code. The Registrant also represents that the Funds have the records necessary to support calculation of their performance as required by Rule 204-2(a)(16). However, because Syntax Index Series LP did not calculate a net asset value per share, its return is calculated on its total net asset value, which the Registrant believes yields the same result.

Syntax Stratified LargeCap ETF

Fund Performance (Page 10)

21. Comment: The second paragraph in this section states that the predecessor performance from inception to January 1, 2015, is that of the “500 Sleeve” of the Syntax 900 I, LP. The MassMutual letter permits inclusion of predecessor performance only if it is the performance of the entire predecessor account. Since the 500 Sleeve is a portion of the Syntax 900 I, LP, please delete the performance results of the 500 Sleeve from this performance section. Additionally, please make similar deletions from the performance sections of subsequent series in this prospectus that show the performance of “Sleeves” or portions of accounts.

Response: The Registrant acknowledges that the fact pattern in MassMutual involved a fund’s use of the past performance of an entire predecessor account. However, the Registrant does not believe that the precedent set by MassMutual precludes a fund from including the performance of a distinct and easily identifiable portion or sleeve of a predecessor account. The Registrant believes that each Sleeve complies with the MassMutual standard for including predecessor fund performance (please see Response 12). The Registrant would particularly note that potential investors in the Funds would be deprived of materially important information regarding the Funds if the performance of the Sleeves was omitted from each Fund’s past performance.

The Syntax 900 I, LP was managed as a collection of 11 separate pools or Sleeves. The sole investment strategy of the Syntax 900 I, LP was to equally allocate all of its assets to the 11 Sleeves. Each Sleeve was treated as a distinct portfolio within the Syntax 900 I, LP and the performance of each Sleeve was tracked and recorded separately from the performance of the whole.

Each Sleeve was at all times managed subject to its own unique strategy and constituent rules. The investments of each Sleeve were determined only by the Syntax stratification methodology applicable to that particular Sleeve and without regard to the investments of any other Sleeve. Accordingly, each security in the S&P 900 Index was held in three different Sleeves (the 900 Sleeve; the 500 or 400 Sleeve; and a sector Sleeve) in varying weights as guided by that particular Sleeve’s index’s methodology. The performance of each portfolio security was considered for its contribution to the Sleeve holding it and not to the overall performance of the Syntax 900 I, LP.

Upon the launch of the Syntax Index Series LP, the Syntax 900 I, LP transferred substantially all of its assets on a Sleeve by Sleeve basis to each Sleeve’s corresponding Series. Therefore it is possible to track the continuous performance history of each of the 11 Syntax stratification methodologies.

Syntax Stratified MidCap ETF

Principal Risks of Investing in the Fund (Page 14)

22. Comment: Since the Fund will invest in mid-cap stocks, please provide mid-cap risk disclosure in this section.

Response: The Registrant has added the requested disclosure.

Syntax Stratified Information Tools ETF

Principal Risks of Investing in the Fund (Page 37)

23. Comment: The second risk in this section states that a significant portion of the Fund’s assets will be invested in companies in the information tools sector. Please explain to us whether the Fund will concentrate in the information tools sector and, if so, revise this risk to include this disclosure. Please also make this revision, if appropriate, to the risk section of the Syntax Stratified Information ETF.

Response: The Fund will concentrate its investments in the information tools sector. The Registrant has added the requested disclosure for the Syntax Stratified Information Tools ETF and the Syntax Stratified Information ETF.

GENERAL COMMENTS

24. Comment: Please advise us whether you have submitted or expect to submit any exemptive applications or no-action requests in connection with your registration statement.

Response: The Registrant was granted an order under sections 6(c), 12(d)(1)(j), and 17(b) of the Investment Company Act on May 27, 2015. The Registrant does not anticipate submitting any additional exemptive applications or no-action requests in connection with the Registration Statement at this time.

25. Comment: We note that portions of the filing are incomplete. We may have additional comments on such portions when you complete them in pre-effective amendments, on disclosures made in response to this letter, on information you supply to us, or on exhibits added in any pre-effective amendments.

Response: The Registrant will complete the blanks and provide any other missing information in a pre-effective amendment to the Registration Statement.

26. Comment: Responses to this letter should be in the form of a pre-effective amendment filed pursuant to Rule 472 under the Securities Act of 1933. Where no change will be made in the filing in response to a comment, please indicate this fact in a letter to us and briefly state the basis for your position.

Response: The Registrant will provide its responses in a pre-effective amendment to the Registration Statement and indicate any instance in which no change is being made in response to a comment.

Please do not hesitate to contact me at (212) 836- 8276 or at kathleen.moriarty@apks.com, or in my absence, Deborah Ferraro at 212-836-7425 or at deborah.ferraro@apks.com if you have any questions or comments with respect to the enclosed filing.

| |

| Very truly yours, |

| |

| /s/Kathleen H. Moriarty |

| |

Appendix A

Syntax

Syntax

Syntax® Stratified Indices

U.S. Equity Index Methodology

December 26, 2016

Syntax

Syntax

Table of Contents

| I. | Syntax U.S. Equity Indices | 1 |

| III. | Universe Selection Process | 5 |

| V. | Corporate Action Methodology | 9 |

| VI. | Weight Generation and Rebalance | 12 |

| VIII. | Index Dissemination | 16 |

Syntax

Syntax

I. Syntax U.S. Equity Indices

This methodology covers the following Syntax U.S. equity indices:

| | | Total Return Index (TR) |

| | | or |

| Index Name | Index Ticker | Price Return Index (PR) |

| Syntax Stratified LargeCap Index | SYLC | PR |

| Syntax Stratified LargeCap Index (TR) | SYLCTR | TR |

| Syntax Stratified MidCap Index | SYMID | PR |

| Syntax Stratified MidCap Index (TR) | SYMIDTR | TR |

| Syntax Stratified Core Index | SYCORE | PR |

| Syntax Stratified Core Index (TR) | SYCORETR | TR |

| Syntax Stratified Financials Index | SYFIN | PR |

| Syntax Stratified Financials Index (TR) | SYFINTR | TR |

| Syntax Stratified Energy Index | SYENY | PR |

| Syntax Stratified Energy Index (TR) | SYENYTR | TR |

| Syntax Stratified Industrials Index | SYIND | PR |

| Syntax Stratified Industrials Index (TR) | SYINDTR | TR |

| Syntax Stratified Information Tools Index | SYIT | PR |

| Syntax Stratified Information Tools Index (TR) | SYITTR | TR |

| Syntax Stratified Information Index | SYINFO | PR |

| Syntax Stratified Information Index (TR) | SYINFOTR | TR |

| Syntax Stratified Consumer Index | SYCPS | PR |

| Syntax Stratified Consumer Index (TR) | SYCPSTR | TR |

| Syntax Stratified Food Index | SYFOOD | PR |

| Syntax Stratified Food Index (TR) | SYFOODTR | TR |

| Syntax Stratified Healthcare Index | SYHLTH | PR |

| Syntax Stratified Healthcare Index (TR) | SYHLTHTR | TR |

Syntax

Syntax

II. Index Objectives

Syntax® Stratified Indices™ are a family of U.S. equity indices that weight constituents based on Syntax’s patented methodology to control exposure to related business risks (RBRs). Traditional indices do not control for related business risks and are thus vulnerable to poor performance when economic shocks impact companies that are exposed to the same business risks. Syntax stratification diversifies indices by establishing target weights for RBRs and rebalancing to these targets every quarter. This methodology is designed to mitigate the adverse effects of inadvertent over weightings of related businesses that regularly occur in the market without sacrificing upside potential.

A. Syntax Stratified LargeCap Index

The Syntax Stratified LargeCap Index is the stratified-weight version of the widely-used S&P 500® Index. The index holds the same constituents as the S&P 500, but the weight of each company in the Syntax Stratified LargeCap Index is based on Syntax’s patented methodology to control exposure to related business risks (RBRs).

B. Syntax Stratified MidCap Index

The Syntax Stratified MidCap Index is the stratified-weight version of the widely-used S&P MidCap 400® Index. The index holds the same constituents as the S&P MidCap 400, but the weight of each company in the Syntax Stratified MidCap Index is based on Syntax’s patented methodology to control exposure to related business risks (RBRs).

C. Syntax Stratified Core Index

The Syntax Stratified Core Index is the stratified-weight version of the S&P 900® Index, which combines the S&P 500 Index and S&P MidCap 400 Index. The index holds the same constituents as the S&P 900, but the weight of each company in the Syntax Stratified Core Index is based on Syntax’s patented methodology to control exposure to related business risks (RBRs).

Syntax

Syntax

D. Syntax Stratified Financials Index

The Syntax Stratified Financials Index is a stratified-weight index of S&P 900 companies that operate in the financial sector. It uses Syntax’s patented methodology to control exposure to related business risks (RBRs). The Syntax Sector Indices hold the constituents of the S&P 900, with every constituent in the S&P 900 assigned to exactly one sector index.

E. Syntax Stratified Energy Index

The Syntax Stratified Energy Index is a stratified-weight index of S&P 900 companies that operate in the energy sector. It uses Syntax’s patented methodology to control exposure to related business risks (RBRs). The Syntax Sector Indices hold the constituents of the S&P 900, with every constituent in the S&P 900 assigned to exactly one sector index.

F. Syntax Stratified Industrials Index

The Syntax Stratified Industrials Index is a stratified-weight index of S&P 900 companies that operate in the industrial sector. It uses Syntax’s patented methodology to control exposure to related business risks (RBRs). The Syntax Sector Indices hold the constituents of the S&P 900, with every constituent in the S&P 900 assigned to exactly one sector index.

G. Syntax Stratified Information Tools Index

The Syntax Stratified Information Tools Index is a stratified-weight index of S&P 900 companies that operate in the IT sector. It uses Syntax’s patented methodology to control exposure to related business risks (RBRs). The Syntax Sector Indices hold the constituents of the S&P 900, with every constituent in the S&P 900 assigned to exactly one sector index.

Syntax

Syntax

H. Syntax Stratified Information Index

The Syntax Stratified Information Index is a stratified-weight index of S&P 900 companies that operate in the information sector. It uses Syntax’s patented methodology to control exposure to related business risks (RBRs). The Syntax Sector Indices hold the constituents of the S&P 900, with every constituent in the S&P 900 assigned to exactly one sector index.

I. Syntax Stratified Consumer Index

The Syntax Stratified Consumer Index is a stratified-weight index of S&P 900 companies that operate in the consumer products sector. It uses Syntax’s patented methodology to control exposure to related business risks (RBRs). The Syntax Sector Indices hold the constituents of the S&P 900, with every constituent in the S&P 900 assigned to exactly one sector index.

J. Syntax Stratified Food Index

The Syntax Stratified Food Index is a stratified-weight index of S&P 900 companies that operate in the food sector. It uses Syntax’s patented methodology to control exposure to related business risks (RBRs). The Syntax Sector Indices hold the constituents of the S&P 900, with every constituent in the S&P 900 assigned to exactly one sector index.

K. Syntax Stratified Healthcare Index

The Syntax Stratified Healthcare Index is a stratified-weight index of S&P 900 companies that operate in the healthcare sector. It uses Syntax’s patented methodology to control exposure to related business risks (RBRs). The Syntax Sector Indices hold the constituents of the S&P 900, with every constituent in the S&P 900 assigned to exactly one sector index.

Syntax

Syntax

III. Universe Selection Process

The Syntax Stratified LargeCap Index licenses its constituents from the S&P 500 Index. As such, the Syntax Stratified LargeCap Index holds the exact constituents of the S&P 500 Index.

The Syntax Stratified MidCap Index licenses its constituents from the S&P 400 MidCap Index. As such, the Syntax Stratified MidCap Index holds the exact constituents of the S&P 400 MidCap Index.

The Syntax Stratified Core Index licenses its constituents from the S&P 900 Index. As such, the Syntax Stratified Core Index holds the exact constituents of the S&P 900 Index.

Combined, the eight Syntax Sector Indices hold the constituents of the S&P 900 Index, with every constituent in the S&P 900 assigned to exactly one Syntax Sector Index, as defined by Syntax’s patented methodology.

Syntax

Syntax

IV. Index Information

| Launch Date: | December 27, 2016 |

| | |

| First Value Date: | December 20, 1991 |

| | |

| Base Date: | December 20, 1991 |

| | |

| Base Value: | 100 |

| | |

| Currency: | USD |

| | |

| Rebalancing: | The Syntax U.S. Indices rebalance quarterly, at the close on the third Friday of the quarter-ending month (March, June, September, December). Index share counts are assigned using closing prices from the second Friday of the quarter-ending month (i.e. one week prior to rebalance). Therefore, the actual weight of each constituent at the rebalance differs from the target weight due to market movements. |

| | |

| Additions, Deletions, and Replacements: | For the Syntax Stratified LargeCap, Syntax Stratified MidCap, and Syntax Stratified Core Indices: |

| | |

| | The Syntax Stratified LargeCap Index follows the addition and deletion schedule of the S&P 500 Index. When a constituent enters the S&P 500 Index, that same constituent enters the Syntax Stratified LargeCap Index. When a constituent is deleted from the S&P 500 Index, that constituent is deleted from the Syntax Stratified LargeCap Index. |

| | |

| | The Syntax Stratified MidCap Index follows the addition and deletion schedule of the S&P 400 MidCap Index. When a constituent enters the S&P 400 MidCap Index, that same constituent enters the Syntax Stratified MidCap Index. When a constituent is deleted from the S&P 400 MidCap Index, that constituent is deleted from the Syntax Stratified MidCap Index. |

Syntax

Syntax

| | The Syntax Stratified Core Index follows the addition and deletion schedule of the S&P 900 Index. When a constituent enters the S&P 900 Index, that same constituent enters the Syntax Stratified Core Index. When a constituent is deleted from the S&P 900 Index, that constituent is deleted from the Syntax Stratified Core Index. |

| | |

| | For the Syntax Stratified LargeCap, MidCap, and Core, Indices, replacement constituents are added at the weight of the deleted constituent they replace. For example, if Company A is removed from the index at a weight of 3% and replaced by Company B, Company B is added to the index at a weight of 3%. |

| | |

| | Because all intra-quarter deletions for the Syntax Stratified LargeCap, MidCap, and Core Indices are replaced using the methodology described above, intra-quarter replacements in these three indices do not trigger index divisor adjustments. |

| | |

| | For the Syntax Sector Indices: |

| | |

| | The Syntax Sector Indices follow the deletion schedule of the S&P 900. Because S&P 900 replacement constituents may be assigned to a different sector than the constituent that has been deleted, the Syntax Sector Indices do not add or replace constituents intra-quarter. However, each Syntax Sector Index rebalances to the constituents of the S&P 900 that correspond to each sector index. |

| | |

| | When a company is deleted from the S&P 900 in the middle of a quarter, that company is also deleted from its Syntax Sector Index. A subsequent divisor adjustment takes place to that Syntax Sector Index where a deletion is occurring. |

Syntax

Syntax

| | If a company is added to the S&P 900 in the middle of the quarter, it will not be added to its respective Syntax Sector Index until the quarterly rebalance. |

Syntax

Syntax

V. Corporate Action Methodology

The Syntax U.S. Indices are calculated by S&P Dow Jones Indices Custom Index Group. Calculations are performed in accordance with the S&P U.S. Indices Methodology and constituents are weighted using Syntax’s proprietary weighting methodology. Please see important disclaimers at the end of this document.

Corporate actions (including stock splits, stock dividends, spin-offs and rights offerings) that impact the Syntax Index constituents are applied after the close of trading on the day prior to the ex-date. Share changes resulting from exchange offers are made on the ex-date.

| Spin-offs: | The spun-off company is added to the index at a zero price at the market close of the day before the ex-date with no divisor adjustment. |

| | | |

| 1. | If the spin-off is replacing a company that will be removed from the S&P Index: on the effective day of the replacement, the weight of the spin-off is redistributed to the parent company. After this redistribution occurs, the weight of the dropped company is redistributed to the spin-off. The spun-off stock (child) will be added at the open of the ex-date with a zero weight (no divisor change). At the open (equivalently, close of the day before) of the effective day of replacement, the weight of the spun-off stock (child) is reinvested into the parent stock, then the weight of the dropped stock is reinvested into the spun-off stock. As a result, there is no divisor change to the Index. |

| | | |

| 2. | If the spin-off is replacing the parent company in the S&P Index: on the effective date of the replacement, the weight of the parent is redistributed to the spin-off. The spun-off stock (child) will be added with the same weight of the parent stock at the open of the ex-date. As a result, there is no divisor change to the Index. |

Syntax

Syntax

| 3. | If the spin-off will not stay in the S&P Index: the spin-off will be removed from the Syntax Index on the trading date following the ex-date of the event. Its weight will be redistributed to the parent company. The spun-off stock (child) will be added at the open of the ex-date with a zero weight (no divisor change). At the close of the ex-date, the weight of the spun-off stock (child) is reinvested into the parent stock. As a result, there is no divisor change to the Index. |

| | | |

| Dividends: | Dividends are reinvested in the index after the close on the ex-date. |

| | |

| Special Dividends: | The price of the stock making the special dividend payment is reduced by the per share special dividend amount after the close of trading on the day before the dividend ex-date. |

| | |

| Rights Offering: | Rights issues are only enacted if they are in-the-money. In the event of an enacted rights issue, the price is adjusted for the value of the right before the open on the ex-date, and the shares are increased to maintain the constituent’s existing weighting within the index. |

| | |

| Share Changes | Changes in the number of shares outstanding, typically due to share repurchases, tenders, or offerings, will not be reflected in the index. |

| | |

| Bankruptcy: | Syntax removes bankrupt securities from its indices at the same time the security is removed from S&P Dow Jones Indices. |

| | |

| | S&P gives a minimum of one day notice of a removal of a bankrupt security. Same day removals for bankruptcy do not occur. |

| | |

| | If the security is trading on its usual or primary exchange at the close of the day it is removed, that price is used. If the security is halted on or delisted from its usual exchange, the stock may be deleted from the index with a presumed market value of zero. |

Syntax

Syntax

| | When a security is in FDIC Receivership, they are dropped from all Syntax indices at the earliest reasonable date. |

| | |

| Bonus Issues, Stock Splits, and Reverse Stock Splits: | For bonus issues, stock splits, and reverse stock splits, the number of shares included in the index will be adjusted in accordance with the ratio given in the corporate action. Since such events will not change the value of the company included in the index, the divisor will not be adjusted when such corporate actions occur. |

| | |

| Mergers, and Acquisitions: | Each Syntax Index follows the deletion/addition schedule of its respective S&P Index, and they will follow the same addition/deletion schedule when there are constituent changes as a result of mergers/acquisitions. See the Additions, Deletions, and Replacements sections for more details. |

Syntax

Syntax

VI. Weight Generation and Rebalance

All Syntax Indices diversify constituents across groups of related business risks as defined by the patented FIS classification system. Syntax Indices use stratification, a common technique used in statistics, to control exposure to related business risks.

Each Syntax Index has a Syntax Stratification Architecture that outlines a hierarchy of related business risk groups that form the basis for each constituent’s weight. Related business risk groups at each level of the Stratification Architecture are defined by a sequence of FIS tags, and every constituent is allocated to exactly one related business risk group at each level of the Syntax Stratification Architecture. This allocation takes place by matching the FIS tags applied to the company against the sequence of FIS tags that define the related business risk group.

At least two weeks prior to each quarterly rebalance, Syntax conducts a quality control review of each index’s Stratification Architecture to verify that it continues to be representative of the relevant related business risks present in the set of constituents. Syntax also implements a quarterly review on constituents in the index that underwent a merger, acquisition, or spin-off to determine if these corporate actions necessitate a change to the function of the business and in turn, changed the constituent’s FIS tags. Annually, Syntax conducts a review of the FIS tags.

Syntax

Syntax

VII. Index Calculations

Syntax Indices are calculated by S&P Dow Jones Indices. Below is a summary of the basic math used to calculate Syntax Indices.

Pi= price of shares of stock i in the index

Qi= quantity of shares of stock i in the index

Sharesi= number of shares of stock i in the index

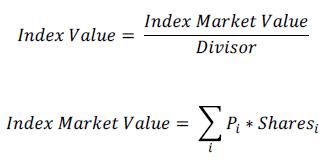

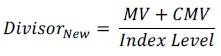

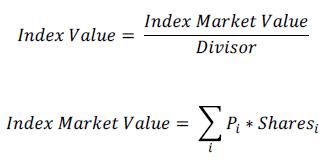

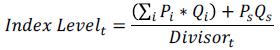

The index value is the index market value divided by the index divisor:

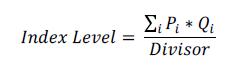

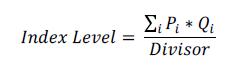

The index level can be written as:

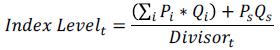

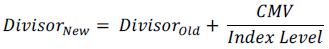

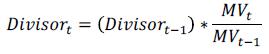

To maintain the continuity of the index, it is also necessary to adjust the divisor at each rebalance:

Which means that:

Syntax

Syntax

Calculating the Divisor Adjustment:

As described Section V, some corporate actions will trigger a divisor adjustment in the index.

A divisor is a factor by which the total market value of an index is divided to a give a scaled, and more easily handled, number.

The divisor allows continuous measurement of market valuation because it ensures that the value of the index does not fluctuate across events that do not stem from the performance of the index.

The following formula expands the original formula for calculating the Index Level to show the stock, r, which is being removed separately.

Similarly, rewriting the Index Level after the addition of stock s to show that stock separately:

Where t-1 is the moment immediately preceding the deletion of stock r and t is the moment immediately after the addition of stock s. By design, IndexLevelt-1 exactly equals IndexLevelt. This allows us to rewrite the above as:

Let the left-most and right-most numerators be the Market Value, MV, of the index at times t-1 and t.

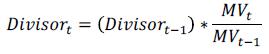

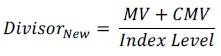

MVt, MVt-1, and Divisort-1 are all known values. Therefore, we can rearrange the formula to calculate the value of the new divisor:

Syntax

Syntax

Equivalently, we can write the new divisor as the old divisor plus the percentage change in index value from the event. Rearranging the formula for the Index Value:

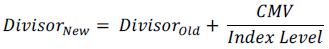

Let CMV be the change in market value from the addition and deletion. Because the Index Level will not change, the new divisor must be:

Because MV/IndexLevel is the divisor, we can rewrite this as:

Syntax

Syntax

VIII. Index Dissemination

Syntax U.S. Indices are calculated by S&P Dow Jones Indies. Daily levels can be found on us.spindices.com/custom-indices, as well as the websites of other major data providers.

Syntax

Syntax

VIII. Disclaimers

The Syntax Stratified Stratified LargeCap Index, Syntax Stratified MidCap Index, Syntax Stratified Core Index, Syntax Stratified Financials Index, Syntax Stratified Energy Index, Syntax Stratified Industrials Index, Syntax Stratified Information Tools Index, Syntax Stratified Information Index, Syntax Stratified Consumer Index, Syntax Stratified Food Index, and Syntax Stratified Healthcare Index (the “Index”) is the property of Syntax, LLC, which has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) to calculate and maintain the Index. The Index is not sponsored by S&P Dow Jones Indices LLC or its affiliates or its third party licensors, including Standard & Poor's Financial Services LLC and Dow Jones Trademark Holdings LLC (collectively, “S&P Dow Jones Indices”). S&P Dow Jones Indices will not be liable for any errors or omissions in calculating the Index. “Calculated by S&P Dow Jones Indices” and the related stylized mark(s) are service marks of S&P Dow Jones Indices and have been licensed for use by [Licensee]. S&P® is a registered trademark of Standard & Poor's Financial Services LLC, and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Syntax®, Stratified®, Stratified Indices®, Stratified-WeightTM, and Locus® are trademarks or registered trademarks of Locus Analytics, LLC.

The Syntax Indices based on S&P Indices are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices. S&P Dow Jones Indices does not make any representation or warranty, express or implied, to the owners of the Syntax Indices or any member of the public regarding the advisability of investing in securities generally or in the Syntax Indices particularly or the ability of the Index to track general market performance. S&P Dow Jones Indices’ only relationship to Syntax LLC with respect to the Index is the licensing of the S&P 500 Index, S&P MidCap 400 Index, and S&P900 Index, certain trademarks, service marks and trade names of S&P Dow Jones Indices, and the provision of the calculation services related to the Index. S&P Dow Jones Indices is not responsible for and has not participated in the determination of the prices and amount of the Syntax Indices or the timing of the issuance or sale of the Syntax Indices, or in the determination or calculation of the equation by which the Syntax Indices may converted into cash or other redemption mechanics. S&P Dow Jones Indices has no obligation or liability in connection with the administration, marketing or trading of the Syntax Indices. S&P Dow Jones Indices LLC is not an investment advisor. Inclusion of a security within the Index is not a recommendation by S&P Dow Jones Indices to buy, sell, or hold such security, nor is it investment advice.

S&P Dow Jones Indices does not guarantee the adequacy, accuracy, timeliness and/or the completeness of the index or any data related thereto or any communication with respect thereto, including, oral, written, or electronic communications. S&P Dow Jones Indices shall not be subject to any damages or liability for any errors, omissions, or delays therein. S&P Dow Jones Indices makes no express or implied warranties, and expressly disclaims all warranties, of merchantability or fitness for a particular purpose or use or as to results to be obtained by Locus Analytics, owners of the Syntax Stratified Indices, or any other person or entity from the use of the index or with respect to any data related thereto. Without limiting any of the foregoing, in no event whatsoever shall S&P Dow Jones Indices be liable for any indirect, special, incidental, punitive, or consequential damages, including but not limited to, loss of profits, trading losses, lost time, or goodwill, even if they have been advised of the possibility of such damages, whether in contract, tort, strict liability, or otherwise.

It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. Syntax LLC is not an investment advisor, and Syntax Indices makes no representation regarding the advisability of investing in any such investment fund or other investment vehicle. A decision to invest in any such investment fund or other investment vehicle should not be made in reliance on any of the statements set forth in this document. Prospective investors are advised to make an investment in any such fund or other vehicle only after carefully considering the risks associated with investing in such funds, as detailed in an offering memorandum or similar document that is prepared by or

Syntax

Syntax

on behalf of the issuer of the investment fund or other investment product or vehicle. Syntax LLC is not a tax advisor. A tax advisor should be consulted to evaluate the impact of any tax-exempt securities on portfolios and the tax consequences of making any particular investment decision. Inclusion of a security within an index is not a recommendation by Syntax LLC or S&P Dow Jones Indices to buy, sell, or hold such security, nor is it considered to be investment advice. Closing prices for Syntax U.S. Stratified Indices are calculated by S&P Dow Jones Indices based on the closing price of the individual constituents of the index as set by their primary exchange. Closing prices are received by S&P Dow Jones Indices from one of its third party vendors and verified by comparing them with prices from an alternative vendor. The vendors receive the closing price from the primary exchanges. Real-time intraday prices are calculated similarly without a second verification.

The complete S&P U.S. Indices Methodology can be found at: https://us.spindices.com/documents/methodologies/methodology-sp-us-indices.pdf

The complete S&P U.S. Index Mathematic Methodology can be found at: http://us.spindices.com/documents/methodologies/methodology-index-math.pdf

Syntax

Syntax Syntax

Syntax