Exhibit 99.2

vroom fourth quarter 2024 update february 2025

disclaimer Forward Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this presentation that do not relate to matters of historical fact should be considered forward-looking statements, including without limitation statements regarding our anticipated financial performance for any period of time, including preliminary unaudited cash and excess liquidity, for the fourth quarter ended December 31, 2024, expectation regarding originations since early 2023, and the impacts of credit tightening. These statements are based on management’s current assumptions and are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. For factors that could cause actual results to differ materially from the forward-looking statements in this presentation, please see the risks and uncertainties identified under the heading "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2023, as updated by our Quarterly report on Form 10-Q for the quarter ended September 30, 2024, which is available on our Investor Relations website at ir.vroom.com and on the SEC website at www.sec.gov. All forward-looking statements reflect our beliefs and assumptions only as of the date of this presentation. We undertake no obligation to update forward-looking statements to reflect future events or circumstances. Industry and Market Information To the extent this presentation includes information concerning the industry and the markets in which the Company operates, including general observations, expectations, market position, market opportunity and market size, such information is based on management's knowledge and experience in the markets in which we operate, including publicly available information from independent industry analysts and publications, as well as the Company’s own estimates. Our estimates are based on third-party sources, as well as internal research, which the Company believes to be reasonable, but which are inherently uncertain and imprecise. Accordingly, you are cautioned not to place undue reliance on such market and industry information. Financial Disclosure Advisory This presentation contains certain estimated preliminary financial results for the fourth quarter ended December 31, 2024. These estimates are based on the information available to the Company at this time. The Company's financial closing procedures for the fourth quarter and full year 2024 are not yet complete and, as a result, actual results may vary from the estimated preliminary results presented here due to the completion of the Company's financial closing and audit procedures. The estimated preliminary financial results have not been audited or reviewed by the Company's independent registered public accounting firm. These estimates should not be viewed as a substitute for the Company's full interim or annual financial statements. Accordingly, you should not place undue reliance on this preliminary data.

fourth quarter preliminary unaudited results(1) 4th quarter cash and liquidity $58M total cash and excess liquidity as of December 31, 2024 $29M Cash and Cash Equivalents(2), includes $28M of excess liquidity available to UACC under the warehouse lines (receivables that could be pledged to draw cash from warehouse lines) (1) All amounts are estimated preliminary financial results for or as of the fourth quarter ended December 31, 2024. Actual results may vary from the estimated preliminary results presented here due to the completion of the Company’s financial closing and audit procedures (2) Represents unrestricted cash and cash equivalents. Excludes restricted cash and warehouse availability.3 $29M of cash and cash equivalents (2) at fourth quarter end 2024 V

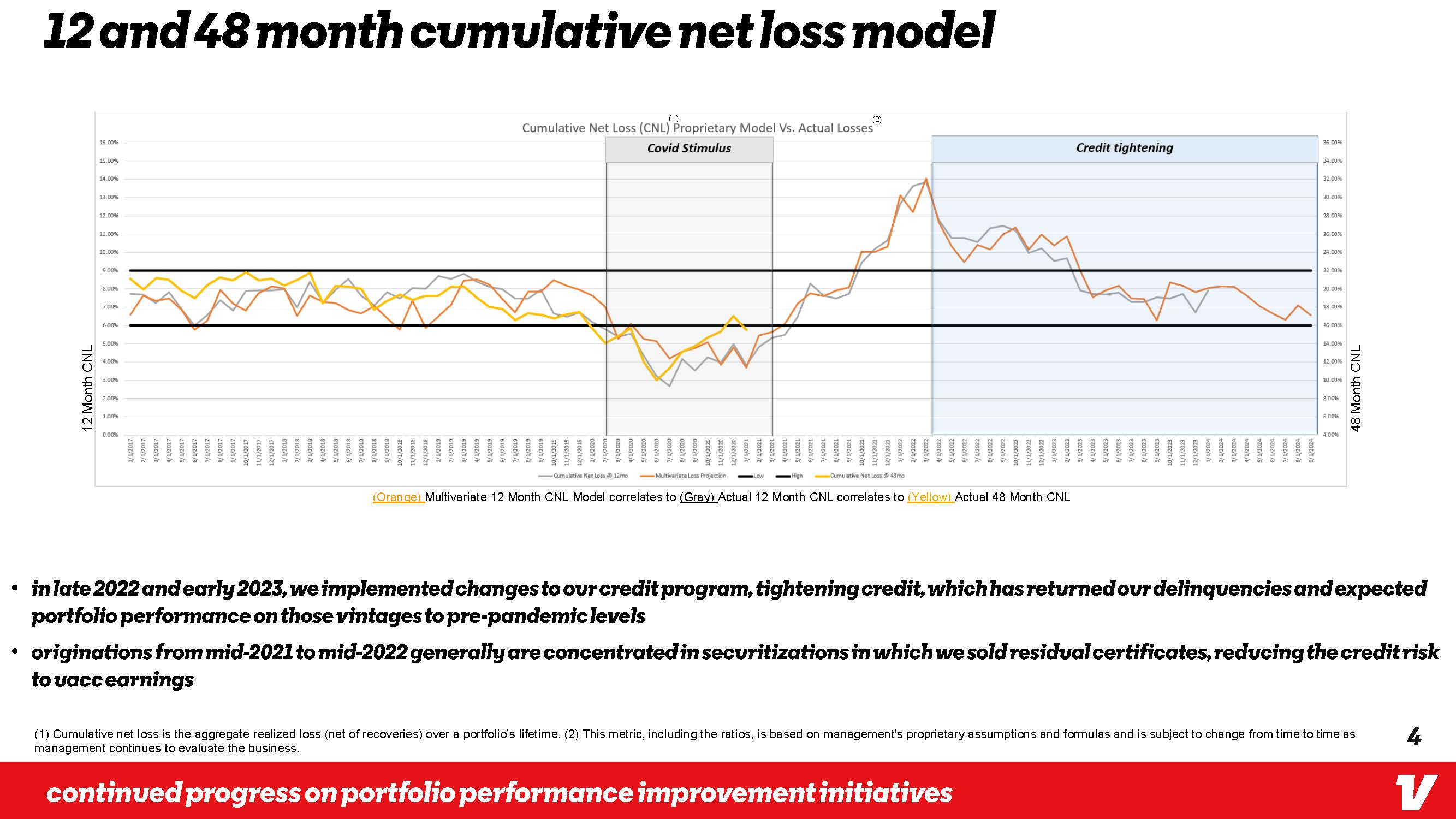

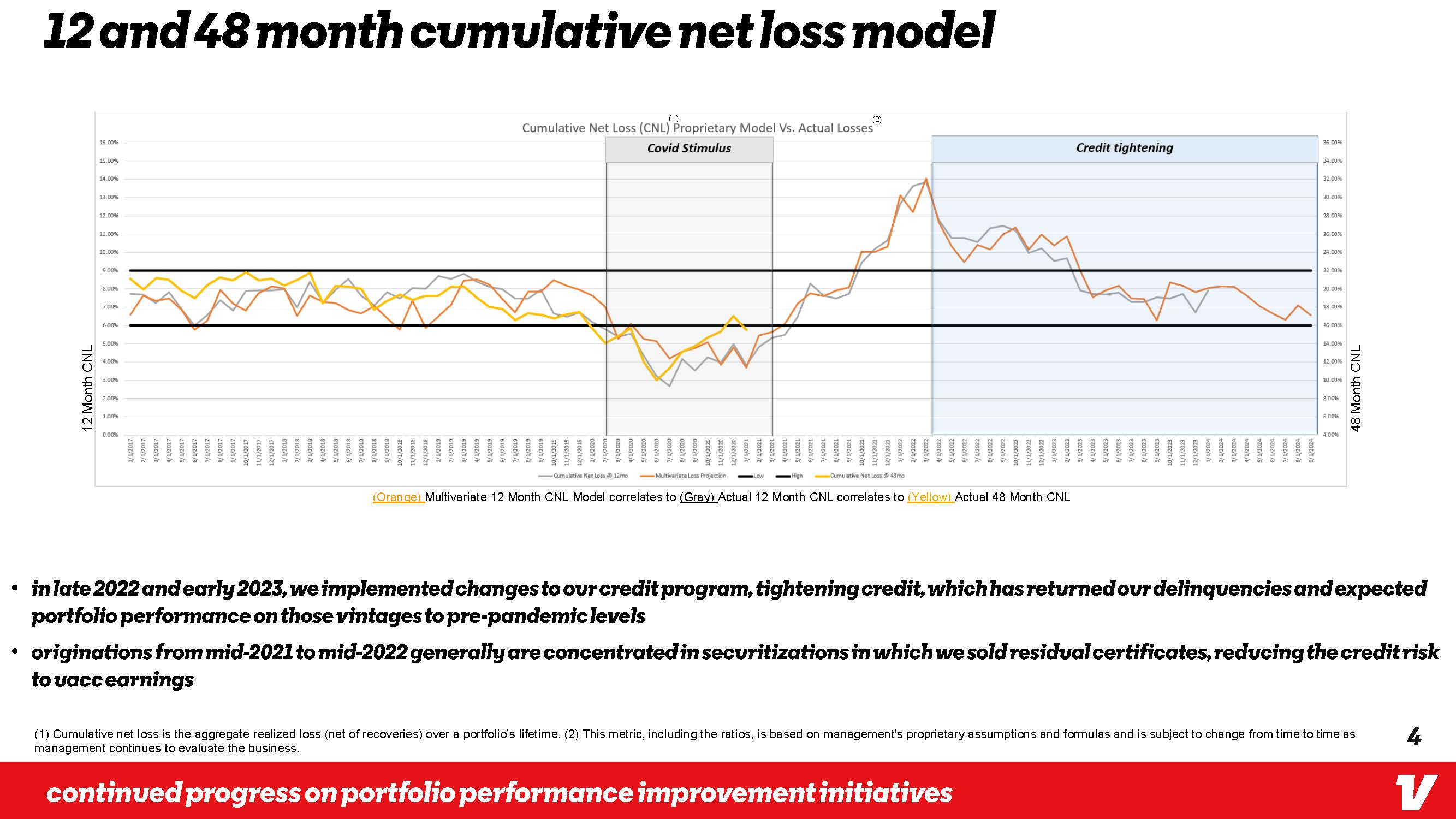

12 and 48 month Cumulative net loss model 12 Month CNL 48 Month CNLOrange) Multivariate 12 Month CNL Model correlates to (Gray) Actual 12 Month CNL correlates to (Yellow) Actual 48 Month CNL In late 2022 and early 2023, we implemented changes to our credit program, tightening credit, which has returned our delinquencies and expected portfolio performance on those vintages to pre-pandemic levels Originations from mid-2021 to mid-2022 generally are concentrated in securitizations in which we sold residual certificates, reducing the credit risk to uacc earnings (1) Cumulative net loss is the aggregate realized loss (net of recoveries) over a portfolio’s lifetime. (2) This metric, including the ratios, is based on management's proprietary assumptions and formulas and is subject to change from time to time as management continues to evaluate the business. 4 Continued progress on portfolio performance improvement initiatives V