- RMAX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

RE/MAX (RMAX) DEF 14ADefinitive proxy

Filed: 21 Apr 22, 4:10pm

f

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ⌧ Filed by a Party other than the Registrant ◻

Check the appropriate box:

◻ | Preliminary Proxy Statement |

◻ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

⌧ | Definitive Proxy Statement |

◻ | Definitive Additional Materials |

◻ | Soliciting Material Pursuant to § 240.14a-12 |

RE/MAX HOLDINGS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| | |||

⌧ |

| No fee required. | ||

| | |||

◻ |

| Fee paid previously with preliminary materials. | ||

| | |||

◻ |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | ||

| | | ||

Dear Fellow Stockholder:

RE/MAX Holdings, Inc. is holding its 2022 annual meeting of stockholders at noon mountain time on Wednesday, June 1, 2022. The meeting will be held as a virtual meeting, which stockholders can attend by visiting www.virtualshareholdermeeting.com/RMAX2022. This will be the sixth year that our annual meeting of stockholders is virtual. We have found that the virtual format makes it easier for stockholders to attend the meeting, improves communication, and reduces costs both for the Company and for stockholders who attend the meeting. We plan to give stockholders the opportunity to ask questions about the items of business for the meeting and our business generally.

We encourage stockholders to vote their shares by proxy in advance of the annual meeting.

The attached notice of the 2022 annual meeting of stockholders and proxy statement provide important information about the meeting and will serve as your guide to the business to be conducted at the meeting. Your vote is very important to us. We urge you to read the accompanying materials regarding the matters to be voted on at the meeting and to submit your voting instructions by proxy. The enclosed proxy statement and proxy card are first being sent to our stockholders on approximately April 21, 2022.

The Board of Directors recommends that you vote “FOR” each of the director nominees named in the proxy statement and “FOR” the ratification of KPMG LLP as our independent registered public accounting firm.

You may submit your proxy either over the telephone or the internet or you may vote through the online portal during the meeting. In addition, if you received a paper copy of the proxy materials, you can vote by marking, signing, dating, and returning the proxy card sent to you in the envelope accompanying the proxy materials.

Thank you for your continued support.

Sincerely,

David Liniger

Chairman and RE/MAX Co-Founder

April 21, 2022

| |

| NOTICE OF 2022 |

Meeting Information | | Items of Business | Our Board’s | More information | ||

| WHEN | | 1 | Elect four directors to our Board of Directors from the nominees named in the proxy statement | FOR each | p. 7 |

| ADMISSION | | 2 | Ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022. | FOR | p. 49 |

| WEBCAST The virtual meeting will be held online at: www.virtualshareholdermeeting.com | | The above actions are described in more detail in this proxy statement. We may also transact any other business as may properly come before the Annual Meeting or before any adjournment or postponement thereof. | |||

| ||||||

Your vote is important. We encourage you to vote by proxy in advance of the meeting, whether or not you plan to attend the meeting. Please vote using one of the following advance voting methods:

| | | |

|

|

| |

BY INTERNET | BY TELEPHONE | BY MAIL | |

You may vote via the internet by visiting http://www.proxyvote.com and entering the unique control number for your shares located on the Notice of Internet Availability of Proxy Materials. | You may vote by phone by calling | Beneficial Owners of Shares Held in Street Name: | Stockholders of Record: |

| | | |

Please feel free to contact our investor relations department at (303) 224-5458 or investorrelations@remax.com if you have any questions about voting or attending the meeting.

| |

| By Order of the Board of Directors |

|

|

| Adam Lindquist Scoville, Secretary |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON JUNE 1, 2022. The Company’s Proxy Statement and Annual Report on Form 10-K for the fiscal year ended December 31, 2021 are also available at http://materials.proxyvote.com/75524W. |

| Page |

1 | |

1 | |

2 | |

3 | |

3 | |

4 | |

6 | |

7 | |

8 | |

8 | |

8 | |

9 | |

18 | |

Board of Directors Leadership Structure; Formal Lead Independent Director Role | 18 |

Enterprise Risk Management and Board of Directors Role in Risk Oversight | 19 |

20 | |

20 | |

20 | |

20 | |

21 | |

23 | |

23 | |

24 | |

24 | |

24 | |

24 | |

24 | |

25 | |

26 | |

28 | |

29 | |

29 | |

30 | |

32 | |

Other Compensation Policies and Compensation Risk Assessment | 33 |

35 | |

36 | |

36 | |

37 | |

38 | |

39 | |

39 | |

39 | |

40 | |

40 | |

42 | |

43 | |

45 | |

45 | |

47 | |

Policies and Procedures Regarding Related Party Transactions | 48 |

PROPOSAL 2: RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 49 |

49 | |

50 | |

52 | |

53 | |

56 |

RE/MAX Holdings, Inc. (“RE/MAX Holdings”) is one of the world’s leading franchisors in the real estate industry. We franchise real estate brokerages globally under the RE/MAX® brand (“RE/MAX”) and mortgage brokerages in the U.S. under the Motto® Mortgage brand (“Motto”). We also sell ancillary products and services, primarily technology, to our franchise networks and, in certain instances, we offer these products and services outside our franchise networks. The RE/MAX network, founded in 1973, has a presence in over 110 countries and territories and more than 140,000 agents in nearly 9,000 offices. Motto is the first and only national franchisor of mortgage brokerages in the United States. Motto is among the fastest growing franchises and has grown to over 175 open offices since it was founded in 2016. RE/MAX and Motto are 100% franchised—we do not own any of the brokerages that operate under these brands. We focus on enabling our networks’ success by providing powerful technology, quality education and training, and valuable marketing to build the strength of the RE/MAX and Motto brands.

|

A Leading Dual-Brand Franchisor with Compelling Growth Opportunities

MAX: #1 Name in Real Estate (US/Canada) and Unmatched Global Footprint. Highly Productive Network of more than 135,000 agents. Agent-centric model is different and better. Motto: Rapidly expanding network of offices with almost $3.5 billion in 2021 annual loan volume. First and only national mortgage brokerage franchise in U.S. Among top fastest growing franchises and a top new franchise brand.

1 Source: MMR Strategy Group Study of unaided brand awareness

2 The RE/MAX network has a presence in more than 110 countries and territories

3 Source: Entrepreneur Magazine based on the net number of franchise units added worldwide between July 2019 to July 2020 as reflected in a its review of unit lists and Franchise Disclosure Documents of 1,116 participating franchises across all industries

4 Source: Entrepreneur Magazine based on its analysis of data, including costs, fees, size, growth and brand and financial strength, from franchise disclosure and related documents dated August 2019 to July 2020 of 262 participating franchise systems that began franchising in the last 5 years (in 2016 or later)

2022 Proxy Statement | RE/MAX Holdings, Inc. | 1 |

Strategic Acquisitions

Acquired the North American operations of RE/MAX INTEGRA, the subfranchisor of the RE/MAX brand in nine U.S. states and five Canadian provinces (shown above). This acquisition brought over 19,000 RE/MAX agents into Company-Owned regions. | | | Our Growing Franchise Brands RE/MAX Agent Count as of December 31

Total Open Motto Mortgage Offices:

|

STRONG FINANCIAL POSITION

| | | | | | |

$329.7M | | | $119.7M | |||

1. Adjusted EBITDA is a non-GAAP measure. Please see the Appendix on page 56 of this Proxy Statement for a definition of this term and reconciliation with the most directly comparable GAAP measure.

|

2 | RE/MAX Holdings, Inc. | 2022 Proxy Statement |

We believe that the compensation of our CEO and other Named Executive Officers should be tied to the long-term interests of our stockholders. We have therefore structured executive compensation to be largely variable, based on Company and individual performance. As the charts to the right show, approximately 80% of our CEO and 75% other Named Executive Officers (“NEO”) target compensation in 2021 was at-risk or performance-based. |

|

|

CEO: base salary 18%, bonus 32%, equity grant 49%, other 1%. Average of other NEOs: base salary 25%, bonus 23%, equity grant 51%, other 1%

Our Mission, Vision, Values, and Beliefs

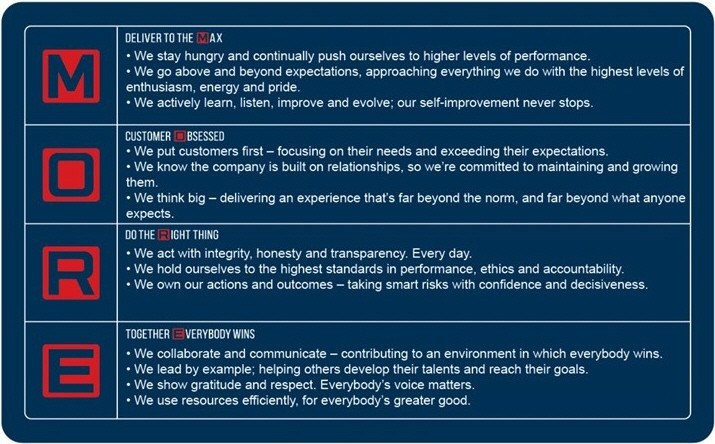

The graphic below shows our mission, vision, values, and beliefs. Our values, summarized by the acronym “MORE,” are reflected in our Code of Conduct, which is discussed in greater detail below.

Mission: Deliver the best experience in everything real estate. Vision: To be the global real estate leader; the ultimate destination for professionals and consumers. Values: Deliver to the max; customer obsessed, do the right thing, together everyone wins. Beliefs: We believe in the value of full-time diverse professionals. We believe in preparation, education, and constant growth. We believe in both experience and innovation. We believe in the power of association—and that individuals thrive in positive, productive, inclusive environments.

2022 Proxy Statement | RE/MAX Holdings, Inc. | 3 |

Our Commitment to our Stakeholders

EVERYBODY WINS: | ||||||

| | |

| | |

|

● LEED Certified headquarters building ● Striving for more efficient resource utilization by reducing our footprint and subleasing portions of our headquarters building. Received a 91 out of 100 on the Energy Star® Energy Performance Scorecard. ● Many initiatives to minimize headquarters building footprint: e.g., single-stream recycling, composting, low-flow appliances, recent LED lighting retrofit, et cetera. | ● Providing aspiring entrepreneurs in over 110 countries and territories the opportunity to become business owners. ● Strong focus on diversity, equity, and inclusion in our networks and at headquarters: two of five Executive Officers and more than half of Board members are women or from diverse populations and nearly 60% of RE/MAX agents in the U.S. are women. ● RE/MAX brokers and agents in the U.S. and Canada have donated over $185 million to Children’s Miracle Network since 1992. ● The Motto Mortgage Mission Against Hunger organizes food drives across the country and headquarter staff volunteers at a local food pantry. | ● Key Board committees are fully independent ● Separate Chair & CEO Roles ● Robust Lead Independent Director Role ● Most Directors attended 100% of Board and committee meetings; no Director attended less than 90% of Board and committee meetings in 2021. ● Four Directors are Leadership Fellows with the National Association of Corporate Directors (“NACD”). ● Annual self-assessments administered by inside counsel or third-party. ● Commitment to Board refreshment—two new members added in 2020 and one new nominee in 2022. | ||||

Diversity, Equity, and Inclusion

As a franchisor, human capital development and opportunity are foundational elements of our business. Diversity, equity, and inclusion permeate our networks as we offer motivated entrepreneurs in over 110 countries and territories the opportunity to elevate their careers as small business owners in real estate. Moreover, we have been a leader in expanding opportunities for women within real estate since our founding almost 50 years ago. In our early days, one of the keys to our initial success was an intentional decision to invite women to join our RE/MAX network as real estate agents, which helped create professional opportunities for women in a persistently male-dominated industry at the time. Through the years, we have consistently prioritized leadership opportunities for women within our organization. For example, in the history of the Company, two of our six CEOs have been women, and today, two of our five Executive Officers and five of our ten board members, as well as this year’s new nominee, are female. Globally, approximately 47% of RE/MAX franchises have at least one female owner and 52% of our agents are women as of December 31, 2021. We remain committed to diversity, equity, and inclusion and continue to expand our efforts around this important topic. To ensure our affiliates as well as our employees are informed, educated, and engaged, we infuse education on diversity, equity, and inclusion at key Company events and routinely promote available educational resources.

We are proud to support multiple industry groups that aim to increase diversity in the real estate profession and homeownership by diverse groups. We financially support organizations such as the National Association of Hispanic Real Estate Professionals, the Asian Real Estate Association of America, the LGBTQ+ Real Estate Alliance, the Women’s Council of REALTORS®, Freddie MAC (Affordable Housing Program) and the National Association of REALTORS®. We

4 | RE/MAX Holdings, Inc. | 2022 Proxy Statement |

seek to have diverse guests and presenters for events such as our annual conventions and on media directed at our networks.

Giving Back

Giving back to our communities is part of our culture. All around the world, RE/MAX affiliates make a difference in their communities. For the past 30 years, RE/MAX affiliates have been making miracles happen through our partnership with Children's Miracle Network Hospitals (CMN Hospitals) in the United States and Canada. During this time, RE/MAX Associates have donated over $185 million to CMN Hospitals. CMN Hospitals raises funds and awareness for 170 member children’s hospitals, which provide 32 million patient visits to 10 million kids each year across the U.S. and Canada. All donations made by RE/MAX Associates through the Miracle Home® program and Miracle Property Program or from local fund-raising events, go to the local member children’s hospital to fund critical treatments and healthcare services, pediatric medical equipment, and charitable care.

In 2018, Motto founded The Motto Mortgage Mission Against Hunger as a way for our nationwide network to give back to the communities we serve every day. The Motto network organizes food drives across the country and Motto Mortgage headquarters staff volunteers regularly at a food pantry in Denver, Colorado.

Environmental Sustainability and Employee Safety

We are committed to sustainability in our operations. Our headquarters building is LEED certified. We have many initiatives at headquarters to minimize our environmental footprint and create a safe and comfortable working environment, including single-stream recycling and composting throughout the building, reusable dishes and utensils in dining areas and break rooms, low-flow plumbing fixtures, a recent LED lighting retrofit with most lights on timers or photocells, a direct digital control HVAC system, and drip irrigation landscaping. We use an environmental consultant to assess design and construction and an industrial hygienist to evaluate usage of chemicals. The COVID-19 pandemic created an opportunity to further improve safety in our building operations and properties. For example, workstations and offices have been either replaced or modified to improve cleaning efficiencies and protocols and touchless door and appliance features have been installed to promote safety for our employees and tenants. We offer most employees the option of working from home and have many employees who are fully remote, which reduces emissions associated with employees commuting to the office. We recently refreshed the space in our headquarters building to strive for more efficient resource utilization both by reducing our own office footprint due to evolving workplace habits, and by increased subleasing of our headquarters building.

2022 Proxy Statement | RE/MAX Holdings, Inc. | 5 |

Code of Conduct and Supplemental Code of Ethics

We have adopted a Code of Conduct applicable to all employees and a Supplemental Code of Ethics applicable to our principal executive, financial, and accounting officers and all persons performing similar functions. Our Code of Conduct emphasizes our core values and that our competitive advantages come by doing MORE – delivering to the max while doing the right thing.

Deliver to the Max: We stay hungry and continually push ourselves to higher levels of performance. We go above and beyond expectations, approaching everything we do with the highest levels of enthusiasm, energy, and pride. We actively learn, listen, improve and evolve; our self-improvement never stops. Customer Obsessed: We put customers first—focusing on their needs and exceeding their expectations. We know the company is built on relationships, so we’re committed to maintaining and growing them. We think big—delivering an experience that’s far beyond the norm, and far beyond what anyone expects. Do the Right Thing: We act with integrity, honesty and transparency. Every day. We hold ourselves to the highest standards in performance, ethics, and accountability. We own our actions and outcomes—taking smart risks with confidence and decisiveness. Together Everybody Wins: We collaborate and communicate—contributing to an environment in which everybody wins. We lead by example; helping others develop their talents and reach their goals. We show gratitude and respect. Everybody’s voice matters. We use resources efficiently, for everybody’s greater good.

The Compensation Committee evaluates how our Executive Officers live our MORE values when evaluating performance and determining annual incentive compensation, as discussed further in the Compensation Discussion and Analysis below.

A copy of each code is available on our investor relations website, accessible through our principal corporate website at www.remaxholdings.com. Any amendments to either code, or any waivers of their requirements, that apply to our Directors or Executive Officers will be disclosed on our investor relations website.

6 | RE/MAX Holdings, Inc. | 2022 Proxy Statement |

PROPOSAL 1: ELECTION OF DIRECTORS

What am I voting on? Stockholders will elect 4 directors to serve as Class III directors, each for a three-year term. | | | At the 2022 Annual Meeting of Stockholders (the “Annual Meeting”), stockholders will vote to elect four directors to the Board of Directors as Class III directors. Each of the Class III directors elected at the Annual Meeting will hold office until the 2025 Annual Meeting of Stockholders and until his or her successor has been duly elected and qualified. Based on the recommendation of the Nominating and Corporate Governance Committee, the Board of Directors has nominated Stephen Joyce, David Liniger, Annita Menogan, and Teresa Van De Bogart to serve as Class III directors for terms expiring at the 2025 Annual Meeting of Stockholders. In the event that any nominee for Class III director becomes unavailable or declines to serve as a director at the time of the Annual Meeting, the persons named as proxies will vote the proxies in their discretion for any nominee who is designated by the current Board of Directors to fill the vacancy. Three of the nominees currently serve as Directors and we do not expect that any nominee will be unavailable or will decline to serve. |

What is the required vote? Each director must be elected by a plurality of the votes cast. This means that the four nominees receiving the largest number of “for” votes will be elected as directors. We do not have cumulative voting. |

Recommendation of the Board: The Board recommends you vote FOR each of the nominees in this Proposal 1.

Class III Directors nominated for election or re-election at this year’s annual meeting. | |||

|

|

|

|

Stephen P. Joyce | David L. Liniger | Annita M. Menogan | Teresa S. Van De Bogart |

Stephen brings extensive franchising and public company leadership to his role as Director and as CEO, a position he currently holds on an interim basis. | As RE/MAX co-founder, David brings nearly five decades of leadership experience at the Company and a deep expertise in real estate and franchising. | Annita will bring significant legal and corporate governance expertise and experience leading companies through transitions. | Teresa brings substantial expertise in technology and information security as well as finance and management. |

2022 Proxy Statement | RE/MAX Holdings, Inc. | 7 |

| | ||

Gender Diversity1 | | | RE/MAX Holdings Tenure |

| | |

|

| | | |

| | | |

Racial Diversity1 | | | Independence1 |

| | |

|

Gender Diversity: 55% women. RE/MAX Holdings Tenure: Average tenure 6.7 years. Less than 3 years: 20%, greater than 5 years, 80%. Racial diversity: 18% diverse. Independence: 72% independent.

1 Includes new nominee (Annita Menogan)

✓ 11 Members of the Board of Directors (including nominee) ✓ 8 Independent Directors (including nominee) ✓ Lead Independent Director ✓ Separate Chair and CEO ✓ Corporate Governance Guidelines ✓ Independent Directors Meet Without Management or Other Directors ✓ Board and Committee Self-Evaluations ✓ Annual Review of Director Independence | ✓ Policy for Auditor Independence ✓ Independent Compensation Consultant ✓ Anti-Hedging and Anti-Pledging Policy ✓ Clawback Policy for Executive Compensation ✓ Board Succession Plan ✓ Management Succession Plan ✓ Committee Charters ✓ Board Onboarding Process ✓ Annual Compliance Training for Directors and Employees ✓ Demonstrated Commitment to Director Education |

* All members of the Audit, Compensation, and Nominating and Corporate Governance committees are independent.

8 | RE/MAX Holdings, Inc. | 2022 Proxy Statement |

Our Board of Directors currently consists of ten members and will have eleven members after a new member is elected at the Annual Meeting. The Board is divided into three classes with staggered three-year terms. At each annual meeting of stockholders, the successors to Directors whose terms expire will be elected to serve until the third annual meeting following election. The following table summarizes information about each Director nominee and continuing Directors.

Director and | Age | RMAX Director Since | Independent | COMMITTEES | |||||||||||

Audit | Compensation | Finance and | Nominating and Corporate Governance | ||||||||||||

CLASS III―DIRECTOR NOMINEES (FOR TERMS EXPIRING IN 2025) | |||||||||||||||

Stephen P. Joyce | 62 | 2020 | | | | M | | ||||||||

David L. Liniger Non-Executive Chair and Co-Founder of RE/MAX, former CEO | 76 | 2013 | | | | | | ||||||||

Annita M. Menogan Former General Counsel, Secretary, and Compliance Officer at Atkins Nutritionals / The Simply Good Food Company | 67 | n/a | ✓ | (Committee assignments to be determined) | |||||||||||

Teresa S. Van De Bogart | 66 | 2016 | ✓ | M | | | M | ||||||||

CLASS I―CONTINUING DIRECTORS (WITH TERMS EXPIRING IN 2023) | |||||||||||||||

Joseph A. DeSplinter | 68 | 2016 | ✓ | M | | C | | ||||||||

Roger J. Dow | 75 | 2013 | ✓ | | C | | | ||||||||

Ronald E. Harrison | 86 | 2013 | ✓ | | M | | M | ||||||||

Laura G. Kelly | 65 | 2020 | ✓ | M | M | | | ||||||||

CLASS II―CONTINUING DIRECTORS (WITH TERMS EXPIRING IN 2024) | |||||||||||||||

Kathleen J. Cunningham | 75 | 2013 | ✓ | C | | M | | ||||||||

Gail A. Liniger | 76 | 2013 | | | | | | ||||||||

Christine M. Riordan | 57 | 2015 | ✓ | | M | | C | ||||||||

Number of Meetings in 2021: | 13 | 5 | 3 | 4 | |||||||||||

2022 Proxy Statement | RE/MAX Holdings, Inc. | 9 |

Diversity of Skills, Qualifications, and Experience

Your Board members possess a diverse range of skills and experience including in the areas below. The table shows the number of members with substantial experience in each area.

| | | ||

| | Cyber Security | | 1 |

| | Finance Board members with strong financial backgrounds assist the Board in its oversight of the Company’s accounting and financial reporting. Two members are “audit committee financial experts.” | | 6 |

| | Franchise Expertise | | 7 |

| | Global RE/MAX, with a presence in over 110 countries and territories, continues to grow quickly in international markets. Board members with experience in global businesses can help as the Company seeks to expand global revenue opportunities. | | 9 |

| | In-Depth Company Knowledge | | 2 |

| | Public Company Board Experience (other than RMAX) Experience on other public company boards gives members a broad perspective on the issues that public companies face. | | 3 |

| | Real Estate Expertise | | 5 |

| | Technology Expertise | | 4 |

10 | RE/MAX Holdings, Inc. | 2022 Proxy Statement |

Nominees for Election at the Annual Meeting (For Terms that will Expire in 2025) (Class III)

David L. Liniger Age: 76 RMAX Director Since: 2013 Committee Membership: None |

|

David L. Liniger is the non-executive Chair of our Board of Directors and our Co-Founder. He has been Chair of the Board of Directors of RE/MAX Holdings since July 2013, and, before that, of RE/MAX, LLC or its parent and predecessor companies since the first RE/MAX company was founded in January 1973. Mr. Liniger served in a variety of leadership roles within the RE/MAX organization over the past 45 years, including Co-CEO and Principal Executive Officer from May 2017 through February 2018 and CEO from December 2014 until May 2017. Mr. Liniger is married to Gail Liniger, our Vice Chair and Co-Founder. Mr. and Mrs. Liniger were named to the International Franchise Association’s Hall of Fame in 2005. The Board recommends you vote for Mr. Liniger because of his role in co-founding RE/MAX and launching Motto Mortgage, his intimate knowledge of our Company, and his long history as a visionary in the real estate industry. | Key Skills |

Real Estate Industry Expertise

Franchise Industry Expertise

Global Business Experience

Deep Company Specific Knowledge—RE/MAX Co-Founder |

2022 Proxy Statement | RE/MAX Holdings, Inc. | 11 |

| Stephen P. Joyce Age: 62 RMAX Director Since: 2020 Committee Membership: Finance and Investment |

Key Skills | Stephen P. Joyce was appointed to the Board of Directors of RE/MAX Holdings in April 2020. Mr. Joyce began serving as Chief Executive Officer on March 1, 2022, serving as co-CEO alongside our outgoing CEO, Adam Contos, for the month of March 2022. Mr. Joyce is serving as Chief Executive Officer on an interim basis until the Company appoints a new Chief Executive Officer. Further information about Mr. Joyce can be found under “Executive Officers.” The Board recommends you vote for Mr. Joyce due to his leadership of franchise brands, both as a board member and as an executive. |

Public Company Board Experience

Franchise Industry Experience

Technology Experience

Global Business Experience |

Annita M. Menogan Age: 67 Nominee for Election Committee Membership: To be determined |

|

Annita M. Menogan has been nominated for election to the Board. Ms. Menogan has nearly four decades of experience as a business and corporate attorney, including 20 years as chief legal and governance executive with publicly held companies. She served as General Counsel, Corporate Secretary, and Compliance Officer of Atkins Nutritionals, Inc. / The Simply Good Foods Company from 2015 through 2018 and, prior to that was Senior Vice President, Chief Legal Officer, and Corporate Secretary for Red Robin Gourmet Burgers, Inc. from 2006 through 2013. Prior to that she was Vice President, Corporate Secretary, and Deputy General Counsel at Adolph Coors Company and Molson Coors Brewing Company. She has worked in private law practice. She has served on the Board of Children’s Hospital Colorado since 2014, and on the Board of the National Association of Corporate Directors, Colorado Chapter since 2018. Previously she has served on the Boards of Denver Kids, Inc. and the University of Denver, Sturm College of Law Institute for the Advancement of the American Legal System. Additionally, she has served on the boards of several other non-profits. The Board recommends you vote for Ms. Menogan due to her deep expertise in legal and governance matters and extensive experience as a public company executive, including at a publicly held franchisor. | Key Skills |

Franchise Industry Experience

Legal Expertise

Public Company Leadership |

12 | RE/MAX Holdings, Inc. | 2022 Proxy Statement |

65 : 2016 : Audit, Nominating and Corporate Governance | |

| Teresa S. Van De Bogart Age: 66 RMAX Director Since: 2016 Committee Membership: Audit, Nominating and Corporate Governance |

Key Skills

Public Company Leadership

Technology Experience

Cybersecurity Knowledge | Teresa S. Van De Bogart was first elected to the Board of Directors in May 2016. Ms. Van De Bogart retired in 2019 as Vice President—Global IT Solution Delivery for Molson Coors Beverage Company, a position she held since 2012. She had been an IT vice president of Molson Coors (and its predecessors) since 2005 establishing a global project management office and leading large-scale global project implementations. She previously served in various other leadership roles at the company including procurement, finance and accounting. Ms. Van De Bogart is a Board Leadership Fellow of NACD and has earned the NACD Directorship Certification®. She additionally serves on the Board of Sunflower Bank where she serves as chair of the risk committee and as a member of the compensation committee as well as Craig Hospital Foundation Board where she serves as chair of the nominating and governance committee. She previously served as the board chair for the Colorado Women’s Chamber of Commerce as well as the Women’s Leadership Foundation. The Board recommends you vote for Ms. Van De Bogart because of her information technology and financial background including security trends and risk assessment, and her experience as a senior leader in a global public company. |

2022 Proxy Statement | RE/MAX Holdings, Inc. | 13 |

Directors Whose Terms Expire in 2024 (Class II Directors):

| Kathleen J. Cunningham Age: 75 RMAX Director Since: 2013 Committee Membership: Audit (Chair), Finance and Investment |

Key Skills | Kathleen J. Cunningham was first appointed to the Board of Directors of RE/MAX Holdings in July 2013 and serves as Chair of the Audit Committee. She was a member the Board of Managers of RMCO, LLC (“RMCO”) from February 2013 until she transitioned to the RE/MAX Holdings Board. Ms. Cunningham has been retired since 2009. From October 2005 to May 2009, she was Chief Financial Officer of Novatix Corporation. She was previously Chief Financial Officer at Webroot Software and US WEST Information Systems. She has been a board member of Q Advisors, LLC since 2003. Previously, she served on the boards of Chileno Bay LLC from December 2011 to October 2013, The Assist Group from June 2011 to March 2013 and Novatix Corporation from 2005 to 2009. Ms. Cunningham has served on a total of four public company boards and their audit committees. Ms. Cunningham is a Board Leadership Fellow of the NACD and is a co-founder and past President of its Colorado Chapter. Ms. Cunningham was selected for our Board because of her particular knowledge of and experience in finance, capital structure, and board governance practices of other major organizations. |

Financial Expertise

Global Business Experience

Technology Expertise

Public Company Board Experience |

Gail A. Liniger Age: 76 RMAX Director Since: 2013 Committee Membership: None |

|

Gail A. Liniger is our Vice Chair and Co-Founder. She has been a Director of RE/MAX Holdings since July 2013 and, before that, of RE/MAX, LLC or its parent companies, since 1974. Mrs. Liniger held many officer positions with the Company since its founding in 1973, including President from 1979-1991, and Chief Executive Officer from 1991 through 2002. Mrs. Liniger is married to David Liniger, our Chair and Co-Founder. Mr. and Mrs. Liniger were to the International Franchise Association’s Hall of Fame in 2005. Ms. Liniger was selected for our Board because of her role in founding RE/MAX, and her intimate knowledge of the Company and the real estate industry. | Key Skills |

Real Estate Experience

Franchise Industry Expertise

Company Specific Knowledge – RE/MAX Co-Founder |

14 | RE/MAX Holdings, Inc. | 2022 Proxy Statement |

| Christine M. Riordan Age: 57 RMAX Director Since: 2015 Committee Memberships: Nominating and Corporate Governance (Chair), Compensation |

Key Skills | Christine M. Riordan, Ph.D. was first appointed to the Board of Directors of RE/MAX Holdings in January 2015. She is Chair of the Nominating and Corporate Governance Committee. Dr. Riordan is President of Adelphi University in New York, a top-150 ranked comprehensive university. Dr. Riordan is an internationally recognized expert in leadership, talent development and career success, strategy, team performance, and diversity and inclusion. For more than twenty-five years, she has designed leadership and diversity and inclusion programs, and served as an executive coach for senior-level executives within various industries. She has experience in the financial services, insurance, real estate, mortgage, franchised businesses, human resources/talent development, consulting, non-profit, and higher education industries. She also currently serves on the board of directors of the Commission for Independent Colleges and Universities and as a Trustee for Adelphi University. Dr. Riordan is a Board Leadership Fellow of the NACD. Dr. Riordan was selected for our Board because of her deep experience as a senior executive and chief executive officer, broad business background, board experienced, and expertise in leadership and strategy. |

Strong Leadership Experience

Broad Business Experience |

Directors Whose Terms Expire in 2023 (Class I Directors):

Joseph A. DeSplinter Age: 68 RMAX Director Since: 2016 Committee Membership: Finance and Investment (Chair), Audit |

|

Joseph A. DeSplinter was first appointed to the Board of Directors of RE/MAX Holdings in February 2016. He serves as Chair of the Finance and Investment Committee. Mr. DeSplinter was a partner with Ernst & Young for nearly 30 years prior to his retirement in 2014. In that role, he served clients in many industries, particularly real estate, financial services, banking, and technology. Mr. DeSplinter served as the office managing partner for the Phoenix and Denver offices for ten years, which included fulfilling a number of regional roles, such as market strategy development. Mr. DeSplinter led the firm’s U.S. private equity professional practice group for five years, which also entailed serving on its U.S. professional practice committee. He also led the firm’s Americas’ Assurance implementation and enablement group for three years, focused on the rollout of the latest technological changes to the assurance group. As a result of these various roles, he has worked in a number of countries and has significant international experience. Mr. DeSplinter previously served on the Board of Directors and member of the audit committee of the Catholic Foundation of Northern Colorado from September 2015 through June 2021 and was a member of the Board of Directors and Chairman of the Audit Committee of Adolfson & Peterson Construction Company from June 2015 through June 2019. Mr. DeSplinter is a Board Leadership Fellow of the NACD. Mr. DeSplinter was selected for our Board because of his strong financial background and vast experience advising public companies. | Key Skills |

Financial Expertise

Global Business Experience

Real Estate Industry Experience

Technology Expertise |

2022 Proxy Statement | RE/MAX Holdings, Inc. | 15 |

| Roger J. Dow Age: 75 RMAX Director Since: 2013 Committee Membership: Compensation (Chair) |

Key Skills | Roger J. Dow was first appointed to the Board of Directors of RE/MAX Holdings in July 2013 and serves as Lead Independent Director and as Chair of the Compensation Committee. He has served as a member of the Company’s Board of Directors or Board of Managers since 2005. Since January 1, 2005, he has been the President and Chief Executive Officer of the U.S. Travel Association. He previously served in various roles at Marriott International, including as Senior Vice President, Global Sales. He is currently a director of Forbes Travel Guide. Mr. Dow was selected for our Board because of his particular knowledge of and experience in strategic planning and leadership of complex organizations and his franchising experience. |

Strategic Planning Experience

Strong Leadership Experience

Franchise Industry Experience |

Ronald E. Harrison Age: 86 RMAX Director Since: 2013 Committee Memberships: Compensation, Nominating and Corporate Governance |

|

Ronald E. Harrison was first appointed to the Board of Directors of RE/MAX Holdings in July 2013 and has served on the Company’s Board of Directors or Board of Managers since 2005. Since 2004, Mr. Harrison has been Chief Executive Officer and Managing Director of Harrison & Associates LLC. Prior to that, he served in various roles over his 40 years with PepsiCo, Inc., including as Senior Vice President, External Relations, and Special Assistant to the Chairman until April 2004. Mr. Harrison is the Chair Emeritus of the Diversity Institute of the International Franchise Association’s Education Foundation. He served as the International Franchise Association’s Chairman in 1999. He has also served on the Board of Trustees of the College of New Rochelle and on the Advisory Board of the University of New Hampshire’s Rosenberg Center for International Franchising. Mr. Harrison was selected for our Board because of his vast experience in leadership roles of complex organizations and knowledge in strategic planning. | Key Skills |

Financial Experience

Strong Leadership Experience

Franchise Industry Expertise |

16 | RE/MAX Holdings, Inc. | 2022 Proxy Statement |

| Laura G. Kelly Age: 65 RMAX Director Since: 2020 Committee Memberships: Audit, Compensation |

Key Skills | Laura G. Kelly was elected to the Board of Directors of RE/MAX Holdings in 2020. Ms. Kelly previously served as President of The Columbia Institute for CoreLogic also served as its Managing Director of Valuation Solutions, a hybrid technology and operating subsidiary with revenues of nearly $500 million. Before joining CoreLogic, Ms. Kelly had significant executive and financial responsibilities at Dun & Bradstreet, American Express and MasterCard. Ms. Kelly is also a member of the Board of Directors for Jack Henry (NASDAQ: JKHY), a financial technology company, and USAA’s Saving’s Bank Board. Ms. Kelly’s early career included service to her country as an active duty and reserve officer for the United States Air Force. Ms. Kelly was selected for our Board because of her experience in leading global change and innovation and extensive background in financial services and data solutions. |

Global Business Experience

Public Company Board Experience |

Board Diversity and Refreshment

David and Gail Liniger founded RE/MAX with the view that anyone can be an entrepreneur, regardless of race, gender, or background. The RE/MAX network has grown to nearly 9,000 offices with over 140,000 agents from virtually every walk of life who share a commitment to helping people realize the dream of homeownership. That commitment to diversity, which is shared by its start-up sister brand, Motto, continues today and is reflected in our Board and management team.

The Board aims to have directors with diverse backgrounds, viewpoints, and experiences. To that end, the Board pays special attention to the diversity of its members and potential nominees, and the Board believes its oversight capabilities are bolstered by its diverse composition.

Gender and Racial Diversity | |

(Includes new nominee) | More than half of our Board members are women or from racially diverse populations: our Board currently has five female Directors and one Black Director and this year’s new nominee is a Black woman. Most of the new members since our initial public offering in 2013 (the “IPO”) are women. Women serve as the Chairs of both our Audit and Nominating and Corporate Governance Committees. The Nominating and Corporate Governance Committee does not have a formal policy regarding diversity, but continually looks for opportunities to maintain and increase the diversity of the Board. |

The Board aims to have diverse mix of tenure on the Board, so that the Board has members with substantial experience with the Company as well as newer members who bring fresh perspectives to the Board. Five of the current members of the Board have joined since our IPO in 2013, including two new members in 2020 and we are adding one new member at the Annual Meeting.

2022 Proxy Statement | RE/MAX Holdings, Inc. | 17 |

Our Board periodically assesses the independence of its members. For a Director to be considered independent, our Board must affirmatively determine that the Director does not have any direct or indirect material relationship with us, other than as a Director, that would interfere with their exercise of independent judgment in carrying out their responsibilities as a Director of the Company. When assessing the materiality of a Director’s relationship with us, our Board will consider the question not merely from the standpoint of the Director, but also from the standpoint of persons or organizations with which the Director has an affiliation. Material relationships can include commercial, industrial, banking, consulting, legal, accounting, charitable, social, and familial relationships, among others.

The Board of Directors has determined that Kathleen Cunningham, Joseph DeSplinter, Roger Dow, Ronald Harrison, Laura Kelly, Christine Riordan, and Teresa Van De Bogart are each an “independent Director” under applicable New York Stock Exchange (“NYSE”) standards and the Company’s corporate governance guidelines, and that none of these Directors have any relationships with the Company that would interfere with their exercise of independent judgment in carrying out their responsibilities as a Director of the Company. The Board has also determined that Annita Menogan, who has been nominated for election to the Board, will be independent under these same standards.

Mr. Joyce was previously considered independent; however, he currently serves as our Chief Executive Officer on an interim basis and, due to that role, the Board has determined that he is not independent at this time. Once Mr. Joyce’s interim service ends, the Board will reassess whether he qualifies as an independent Director depending on the length of his service as Chief Executive Officer and other factors.

David and Gail Liniger have not, since our IPO, been considered independent Directors, due to their service as officers of the Company. The Linigers have a close, personal relationship with our former CEO, Adam Contos, and his family, which the Linigers and Mr. Contos describe as like immediate family. As a result, Mr. and Mrs. Liniger represented that they recused themselves from any matters relating to Mr. Contos and his performance, including evaluations of his performance, compensation, and continued employment. In addition, as befitting such relationships, the Linigers and Contoses occasionally give gifts to each other, such as the cost of vacations they spend together, or the Linigers’ contributions to the Contos children’s college funds. These gifts are made from the Linigers’ personal funds and the Board is satisfied that they are intended as gifts in good faith. Because of this, and because there is no incremental cost to the Company, those amounts are not considered income to Mr. Contos or compensation from the Company and are not included in the Compensation Discussion and Analysis, below.

Board of Directors Leadership Structure; Separate Board Chair and Chief Executive Officer; Formal Lead Independent Director Role

The Board annually elects a Chair of the Board. Currently the roles of Chair and CEO are split between Mr. Joyce, our Chief Executive Officer, and Mr. Liniger, the Chair of the Board, who serves in a non-executive capacity. The Board believes it is important to retain the flexibility to determine whether it is in the best interest of the Company and its stockholders to have the same person serve as both CEO and Chair or whether the roles should be separated based on the circumstances at any given time. Mr. Liniger was most recently re-elected as Chair of the Board in February 2022. The independent members of the Board elect a Lead Independent Director annually. The role of the Lead Independent Director is defined in the Company’s Bylaws and Lead Independent Director charter, which are both available on our investor relations website, accessible through our principal corporate website at www.remaxholdings.com.

| Chief Executive Officer | | Lead Independent | | Chair of the Board | |

| Mr. Joyce has been CEO since March 2022. Mr. Joyce is serving in this capacity on an interim basis while the Company searches for a new Chief Executive Officer. Mr. Joyce is the principal management representative of the Company and is responsible for all aspects of oversight of the management team and day-to-day operations. | | Roger Dow was first elected Lead Independent Director in May 2019 and was most recently reelected in February 2022. The role is described below. | | Mr. Liniger’s role as Chair of the Board allows him to provide leadership as a RE/MAX co-founder and real estate industry veteran and to focus on considerations of long-term strategy for the business. | |

| ||||||

| | | | | | |

18 | RE/MAX Holdings, Inc. | 2022 Proxy Statement |

Enterprise Risk Management and Board of Directors Role in Risk Oversight

Risk management is primarily the responsibility of the Company’s management, and the Board of Directors oversees an enterprise-wide approach to risk management designed to support the achievement of corporate objectives, including strategic objectives, to improve long-term Company performance and enhance stockholder value. A fundamental part of risk management is to understand the specific risks the Company faces and what mitigating steps are being taken, while balancing an appropriate level of risk for the Company. The Company’s enterprise risk management (“ERM”) program provides an effective tool for managing risks. As part thereof, annually, management evaluates a comprehensive list of enterprise risks, identifies those that are most significant and ensures that, where possible, adequate risk mitigation strategies are deployed. At least annually, management provides the Audit Committee with a comprehensive review of the Company’s ERM processes, as well as updates on key risks that have been identified and assessed during the year and the accompanying mitigation strategies. Additional risk assessments are performed, as required, for material events such as the integration of acquired businesses, and those results are also shared with the Audit Committee. On an annual basis, the Board discusses enterprise risk activities including risk assessment and risk management.

In addition to the Company’s ERM process, the oversight of additional specific risks is performed by committees of the Board. The Audit Committee is primarily responsible for overseeing the quality and integrity of the Company’s financial reporting process, internal controls over financial reporting, the Company’s compliance programs, and the risks related to each of these areas. Oversight of the Company’s management of cybersecurity risks is also primarily the responsibility of the Audit Committee. To effectively address the cybersecurity threats present in today’s environment, RE/MAX has a dedicated Information Security team responsible for leading enterprise-wide information security strategy, policy, standards, architecture, and processes. Our comprehensive information security program includes, among other aspects, threat management, vulnerability management, incident response management, access management, and monitoring. The Vice President of Information Technology (who serves as the Company’s Information Security Officer), along with the Chief Compliance Officer, lead regular reviews and discussions with the Audit Committee, including results of testing and training, initiatives to continuously improve cybersecurity measures and policies, and implementation of new technologies. The ERM process discussed above includes evaluation of information technology risks. We have an Incident Response Policy and Plan in place which provides a framework for handling security incidents and facilitates coordination across the Company. We collaborate with vendors and other third parties on threat intelligence, vulnerability management, and response. All employees receive annual cybersecurity awareness training, and we provide information to employees throughout the year. We also provide educational resources and information to our franchisees about cybersecurity.

The Compensation Committee oversees compensation-related risks and oversees an annual compensation risk assessment. The Nominating and Corporate Governance Committee oversees the Company’s corporate governance programs, including the Code of Conduct. The Nominating and Corporate Governance Committee also oversees management of social and environmental matters. The Finance and Investment Committee oversees risks such as those relating to capital structure and allocation, investment of cash, interest rates, currency, and other financial arrangements. Management regularly reports to the Board and its committees on the risks that the Company may face and the steps that management is taking to mitigate those risks.

2022 Proxy Statement | RE/MAX Holdings, Inc. | 19 |

Board of Directors Role in Succession Planning

Succession planning is a crucial role of the Board in ensuring the long-term performance of the Company. The Board maintains, and at least annually evaluates and updates, succession plans for Executive Officers, other key management positions as well as for the Chair of the Board and Lead Independent Director roles. These plans cover both planned and emergency succession scenarios. Executive management regularly discusses succession planning with the Board, including reviewing development plans for senior non-executive employees who may be candidates for future executive positions. The Board executed its succession plan in connection with Mr. Contos’s departure, by appointing Mr. Joyce to serve as Chief Executive Officer on an interim basis until the Board completes its search for a permanent replacement.

Our Board’s Commitment to Director Training and Education

Our Board of Directors is committed to continuing director education. As highlighted in their biographical information above, many of our Board of Directors have been named as Fellows by NACD and one has earned a Directorship Certification. For the past several years, the Board has engaged NACD for annual customized training sessions for all members. During 2021, the customized training session focused on environmental, social, and governance (ESG) matters and investor relations. Previous sessions have covered topics such as mergers and acquisitions, building the board as a strategic asset, company culture, stockholder engagement, communication, and transitioning from a controlled company. All then-current members attended each of these sessions.

Board of Directors Evaluation Process

The Board, under the direction of the Nominating and Corporate Governance Committee, conducts an assessment of the Board, its committees, and its members. The timing of the assessment may vary from year to year but occurs approximately once per year. Each Director is asked to evaluate the performance of the Board and the committees on which he or she serves. In order to encourage Directors to speak candidly, responses to evaluation questions are collected by the Company’s counsel or an outside consultant, who provides aggregated responses that protect the anonymity of individual ratings and comments. Each committee discusses its own assessment results, and the Nominating and Corporate Governance Committee reviews all results and reports the results to the Board. The Nominating and Corporate Governance Committee also oversees an evaluation of the skills, background, and experience of each Board member to ensure an appropriate mix of expertise on the Board.

Our Board is divided into three classes, with each member serving a three-year term. Our Board believes that this structure continues to be appropriate. Our Board believes that a classified Board promotes stability, continuity, and a focus on the long-term interests of the Company and its stockholders and that three-year terms enhance Board independence.

20 | RE/MAX Holdings, Inc. | 2022 Proxy Statement |

During 2021, our Board of Directors had the following standing committees: Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee, and Finance and Investment Committee. From time to time, the Board may also establish committees for special limited purposes.

The Board met 11 times in 2021. The tables below show the number of times each committee met in 2021. In 2021, most Directors attended 100% of the meetings of the Board and the committees on which they serve, and no Directors attended less than 90% of the total number of meetings of the Board and committees on which they serve.

The tables below summarize some information about each committee. More information about each committee can be found in the committees’ charters, which have been adopted by the Board and are reviewed annually. The charters are available on our investor relations website, accessible through our principal corporate website at www.remaxholdings.com. The content of our website is not incorporated in this proxy statement.

| AUDIT COMMITTEE | | Our Audit Committee is fully independent under applicable NYSE standards and Rule 10A-3 of the Securities Exchange Act of 1934 (as amended, the “Exchange Act”). Our Board of Directors has determined that Kathleen Cunningham and Joseph DeSplinter each qualifies as an “Audit Committee financial expert,” as such term is defined in Item 407(d)(5) of Regulation S-K. | |

|

| Meetings: 13 | | |

| Chair: Kathleen Cunningham | |||

| Other Members: | | ||

| ● Joseph DeSplinter ● Teresa Van De Bogart ● Laura Kelly | | ||

| ||||

| | |||

| Key Responsibilities: | | | |

| ● appointing, compensating, retaining, evaluating, terminating, and overseeing our independent registered public accounting firm; | |||

| ● discussing with our independent registered public accounting firm its independence from our management; | |||

| ● reviewing with our independent registered public accounting firm the scope and results of their audit; | |||

| ● approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm; | |||

| ● overseeing the financial reporting process and discussing the interim and annual financial statements that we file with the Securities and Exchange Commission (“SEC”) with management and our independent registered public accounting firm; | |||

| ● reviewing and monitoring our accounting principles, accounting policies, financial and accounting controls, and compliance with legal and regulatory requirements; | |||

| ● monitoring the implementation and impact of new accounting policies; | |||

| ● establishing procedures for the confidential and/or anonymous submission and review of concerns regarding questionable accounting, internal controls, auditing matters, or anything else that appears to involve financial or other wrongdoing; | |||

| ● reviewing and approving related party transactions; and | |||

| ● overseeing the Company's efforts to mitigate cybersecurity risks. | |||

| The Audit Committee reviews our annual reports and makes recommendations to the full Board about its approval. The Audit Committee reviews and approves our quarterly reports and earnings releases for the first, second, and third quarters. After approving the first dividend each year and determining the anticipated dividend for the remainder of the year, the Board generally delegates authority to the Audit Committee to approve the subsequent quarterly dividend for that year, within parameters established by the Board. | |||

2022 Proxy Statement | RE/MAX Holdings, Inc. | 21 |

| COMPENSATION COMMITTEE | Our Compensation Committee is fully independent under applicable Exchange Act rules and NYSE standards. | |

|

| Meetings: 5 | |

| Chair: Roger Dow | ||

| Other Members: | ||

| ● Ronald Harrison ● Christine Riordan ● Laura Kelly | ||

| |||

| | | |

| | | |

| | ||

| Key Responsibilities: | ||

| ● reviewing and approving the compensation of our Directors and Executive Officers; | ||

| ● overseeing compensation of other officers; | ||

| ● reviewing key employee compensation goals, policies, plans, and programs; | ||

| ● administering the RE/MAX Holdings, Inc. Omnibus Incentive Plan; | ||

| ● reviewing and approving employment agreements and other similar arrangements between us and our Executive Officers; | ||

| ● reviewing the Compensation Discussion and Analysis and Compensation Committee Report contained in this proxy statement; and | ||

| ● engaging any compensation consultants. | ||

| The Compensation Committee’s role is discussed further below in the Compensation Discussion and Analysis. | ||

| NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | Our Nominating and Corporate Governance Committee is fully independent under applicable Exchange Act rules and NYSE standards. | |

|

| Meetings: 4 | |

| Chair: Christine Riordan | ||

| Other Members: | ||

| ● Ronald Harrison ● Teresa Van De Bogart ● | ||

| |||

| | ||

| Key Responsibilities: | ||

| ● identifying and evaluating potential candidates for the slate of Directors nominated for election by stockholders at annual meetings and vacancies occurring on the Board from time to time and making recommendations to the Board regarding qualified individuals to be members of our Board of Directors; | ||

| ● overseeing the organization of our Board of Directors to discharge the Board’s duties and responsibilities properly and efficiently; | ||

| ● developing and recommending to our Board of Directors a set of corporate governance guidelines and principles and reviewing portions of our code of conduct related to corporate governance; | ||

| ● assisting the Board in developing, evaluating, and updating succession plans for key leadership roles, both in Company management and at the Board level; | ||

| ● overseeing the Company’s management of environmental, social, and governance (ESG) matters and initiatives; and | ||

| ● overseeing the Board’s annual self-evaluation. | ||

22 | RE/MAX Holdings, Inc. | 2022 Proxy Statement |

| FINANCE AND INVESTMENT COMMITTEE | ||

|

| Meetings: 4 | |

| Chair: Joseph DeSplinter | ||

| Other Members: | ||

| ● Kathy Cunningham ● Stephen Joyce | ||

| |||

| | ||

| Key Responsibilities | ||

| ● assisting the Board with oversight, approval, and recommendations regarding capital structure and capital strategy, return of capital to shareholders, investment of cash, management of financial risks such as interest rate and currency risks and | ||

| ● overseeing management of tax issues, including tax receivable agreements. | ||

We encourage all Directors to attend our annual meetings of stockholders. All of our Directors and nominees attended the 2021 annual meeting of stockholders. The Annual Meeting will coincide with a regularly scheduled meeting of the Board and, because the Annual Meeting will be completely virtual, we expect that all members and nominees will attend the meeting virtually. We do not have a formal policy with respect to Director attendance at annual meetings of stockholders.

| |

Nominating and Corporate Governance Committee Responsibilities: The Nominating and Corporate Governance Committee is responsible for evaluating potential candidates and making recommendations to the Board of Directors with respect to candidates to be nominated to serve as Directors. The Nominating and Corporate Governance Committee ensures that candidates meet qualifications necessary under SEC rules or NYSE standards. | Factors Considered by the Committee: Among the qualifications the Nominating and Corporate Governance Committee may consider are: ● personal and professional integrity; ● exceptional ability and judgment; ● broad experience in business, finance, legal, and/or administration; ● familiarity with the real estate, mortgage, and/or franchising industries; ● executive leadership experience; ● service on other boards; ● ability to serve the long-term interest of our stockholders; and ● sufficient time to devote to the Board duties. |

2022 Proxy Statement | RE/MAX Holdings, Inc. | 23 |

Director Recommendations and Nominations by Stockholders

The Nominating and Corporate Governance Committee welcomes the Company’s stockholders to nominate candidates for Board membership. The Committee will consider any such nominee in the same manner in which it evaluates other potential nominees, so long as the recommendation is submitted in accordance with the Company’s Bylaws and the Committee’s charter. A summary of the requirements for nominating candidates is below under “Information Regarding Stockholder Proposals.”

We value the opportunity to engage with our stockholders and gain insight into their perspectives on our business strategy, governance, and compensation practices. Executives and management from the RE/MAX Holdings investor relations team meet regularly with stockholders on a variety of topics. Annually, a cross-functional group from our finance, legal, and investor relations teams conducts an investor outreach to gather feedback on key strategic initiatives, corporate governance matters, executive compensation, and other topics of interest to our stockholders. We also regularly engage with proxy advisory firms. Feedback received during these conversations is communicated to and discussed by the full Board and helps to inform our ongoing decision-making on our governance, compensation, and other practices.

Communication with the Board of Directors

We believe communication between the Board and our stockholders is an important aspect of corporate governance. Any stockholder or other interested party who would like to communicate with the Board of Directors, the Chair, the Lead Independent Director, the independent Directors as a group, or any specific member or members of the Board of Directors should send such communications to the attention of our Corporate Secretary at 5075 S. Syracuse St., Denver, CO 80237 or legal@remax.com. Communications should contain instructions regarding the Directors for whom the communication is intended. In general, such communication will be, depending on the nature of the communication, either forwarded or periodically presented to the intended recipients. However, we may, in the Corporate Secretary’s discretion, decline to forward any communications that are abusive, threatening, or otherwise inappropriate, or may summarize communications as appropriate.

Compensation Committee Interlocks and Insider Participation

None of our Executive Officers currently serves or in the past year has served as a member of the Board of Directors or Compensation Committee of any other entity that has one or more executive officers serving on our Board of Directors.

Corporate Governance Guidelines

We have adopted corporate governance guidelines that provide a framework for corporate governance. The corporate governance guidelines address, among other matters, selection of directors, director independence, director responsibility, director access to management, director compensation, information about the Board and its committees, director orientation and continuing education, management succession, and evaluation of the Board. The corporate governance guidelines are available on our investor relations website, accessible through our principal corporate website at www.remaxholdings.com.

24 | RE/MAX Holdings, Inc. | 2022 Proxy Statement |

COMPENSATION DISCUSSION AND ANALYSIS

Executive Compensation Roadmap

| | | | Page |

1 | | | Our Named Executive Officers | |

| | Our five Named Executive Officers for 2021 | 26 | |

|

| | | |

| | | ||

2 | | | Overview and Philosophy of our Executive Compensation Program | 28 |

Compensation philosophy and an overview of decisions on compensation practices | | |||

|

| | | |

| | | ||

3 | | | Compensation Best Practices | 29 |

Examples of practices we follow and some that we avoid | | |||

|

| | | |

| | | ||

4 | | | Performance Highlights | 29 |

Our key business achievements in 2021 | | |||

|

| | | |

| | | ||

5 | | | Elements of Executive Compensation | 30 |

Explanation of our primary components of executive compensation | | |||

|

| | | |

| | | | |

6 | | | Peer Groups | 32 |

| | | List of Peer companies used in 2021 | |

|

| | | |

| | | | |

7 | | | Other Compensation Policies and Risk Assessment | 33 |

Overview of other compensation policies and practices, including stock ownership guidelines, clawback policy, and compensation risk assessment | | |||

2022 Proxy Statement | RE/MAX Holdings, Inc. | 25 |

In this Compensation Discussion and Analysis, we provide information on how we compensate our Named Executive Officers. During 2021, five individuals were designated by our Board of Directors as Executive Officers and they are referred to as our “Named Executive Officers” for 2021. Stephen Joyce, who is our current Chief Executive Officer, and Principal Executive Officer, started in that role in March 2022 and therefore is not a Named Executive Officer with respect to 2021.

| Executive Officers | Biography: |

|

Stephen P. Joyce Age: 62 Position: Chief Executive Officer | Stephen P. Joyce began serving as Chief Executive Officer on March 1, 2022, serving as co-CEO alongside our outgoing CEO, Adam Contos, for the month of March 2022. Mr. Joyce is serving as Chief Executive Officer on an interim basis until the Company completes its search for a new Chief Executive Officer. Mr. Joyce is the former Chief Executive Officer and served on the Board of Directors of Dine Brands Global, Inc. (NYSE: DIN), the franchisor of Applebee’s Grill + Bar and IHOP. Prior to that he served as President, Chief Executive Officer, and Director of Choice Hotels International, Inc. Prior to that he spent over 25 years at Marriott International, Inc., in several roles, including Executive Vice President Global Development, Owner and Franchise Services. Mr. Joyce has served on the Board of the Hospitality Investors Trust, serving on their Compensation and Special Litigation Committees. Mr. Joyce has held many leadership roles with the International Franchise Association, including Chairman. He also serves on the boards of a variety of community organizations. Mr. Joyce was selected for our Board due to his leadership in franchise brands, both as a Board member and executive. Mr. Joyce was not an executive officer of the Company during 2021 and therefore is not covered in this Compensation Discussion and Analysis. Information about compensation Mr. Joyce received in 2021 as a member of our Board of Directors is under “Director Compensation.” |

| ||

|

Adam M. Contos Age: 50 Position: Former Chief Executive Officer | Adam M. Contos was our Chief Executive Officer (“CEO”) and principal executive officer throughout all of 2021, a position he held beginning in February 2018. Mr. Contos’s employment with the Company ended in March 2022. Prior to serving as CEO, Mr. Contos served as Co-Chief Executive Officer alongside David Liniger beginning in May 2017. During his more than 15 years at RE/MAX, Mr. Contos has held a variety of leadership positions. He served as Chief Operating Officer from January 2016 to May 2017, as Senior Vice President, Marketing, from February 2015 through January 2016, as Vice President, Business Development, from February 2014 until February 2015, as Vice President, Region Development, from August 2013 through February 2014, and as Regional Vice President from 2005 through August 2013. Mr. Contos is a Board Leadership Fellow of NACD and serves on the Board of the International Franchise Association. |

|

| Nicholas R. Bailey is the President and Chief Executive Officer of RE/MAX, LLC. He previously served as President of RE/MAX, LLC since June 2021 and as Chief Customer Officer beginning in September 2019. Mr. Bailey has over 24 years of real estate experience. He previously worked for RE/MAX from 2001 to 2012 leading growth and development for several RE/MAX regions. He left RE/MAX for approximately seven years, first becoming Senior Vice President of Strategic Partnerships at Market Leader from 2012 through its acquisition by Trulia in 2013. Following Zillow’s acquisition of Trulia in 2015, he served as a Vice President of Zillow. Then, Mr. Bailey served as President and CEO of Century 21 Real Estate, LLC from August 2017 to March 2019. |

| Nicholas R. Bailey Age: 47 Position: President and Chief Executive Officer, RE/MAX, LLC |

26 | RE/MAX Holdings, Inc. | 2022 Proxy Statement |

|

| Karri R. Callahan is our Chief Financial Officer, a position she has held since March 2016. From January 2016 to March 2016 she served as Co-Chief Financial Officer. Ms. Callahan joined RE/MAX Holdings in April 2013 as Senior Manager of SEC Reporting and was promoted to Vice President, Corporate Controller in June 2014. She served as the Company’s Acting Chief Accounting Officer from November 2014 to January 2015 and as Acting Chief Financial Officer from December 2014 through January 2015. Prior to joining the Company, Ms. Callahan worked at Ernst & Young, LLP. |

| Karri R. Callahan Age: 44 Position: Chief Financial Officer | |

|

| Serene M. Smith has served as Chief of Staff and Chief Operating Officer since January 2019. She served as Chief Operating Officer since May 2017. Prior to becoming Chief Operating Officer, Ms. Smith served as Senior Vice President, Financial Planning and Business Analytics from January 2016 to May 2017. From April 2014 to December 2015, Ms. Smith served as Vice President, Financial Planning and Analysis and was Vice President, Operational Controller, from April 2010 to April 2014. She has served in various other capacities since joining RE/MAX in 2006. |

| Serene M. Smith Age: 43 Position: Chief of Staff and Chief Operating Officer | |

|

| Ward M. Morrison is the President and Chief Executive Officer of Motto Mortgage and wemlo. He previously served as President of Motto since Motto was launched in the fall of 2016. Prior to leading Motto Mortgage, Mr. Morrison served the Company as Vice President, Region Operations from 2013 to 2016, as Region Vice President from 2011 to 2013, and in various other roles since joining the Company in 2005. Due to the continued growth of our mortgage business and its increasing importance to the overall results of the Company, the Board designated Mr. Morrison as an Executive Officer in February 2020. |

| Ward M. Morrison Age: 54 Position: President and Chief Executive Officer of Motto Mortgage and wemlo |

2022 Proxy Statement | RE/MAX Holdings, Inc. | 27 |

28 | RE/MAX Holdings, Inc. | 2022 Proxy Statement |

We have adopted common best practices that are consistent with our compensation philosophy and serve the long-term interests of our stockholders. These include the following:

| ||||

| What we do: | |

| What we don’t do |

● Our short-term incentive award goals are tied to key Company financial and strategic performance metrics. ● Most executive compensation is “at-risk” and performance driven. ● The majority of long-term incentive awards for Executive Officers have performance-based vesting. ● Payout of long-term incentive (“LTI”) awards based on total shareholder return (“TSR”) is capped at the target level if TSR is negative. ● We have multi-year targets for LTI performance. ● We compare executive compensation targets against a relevant Peer Group to ensure market competitiveness. ● We have stock ownership guidelines. ● We have a clawback policy. ● We conduct a compensation risk assessment. ● Our LTI program encourages retention of key personnel through long-term vesting. ● We consider our Company’s “MORE” values when rewarding annual incentives. | | ● No guaranteed bonuses. ● No excessive perquisites. ● We do not have single-trigger change in control provisions in equity awards. ● Our Insider Trading Policy prohibits hedging or pledging Company stock without Board or Chief Compliance Officer approval. ● We do not pay accumulated dividends on restricted stock units until vesting. | ||

Despite a challenging global economic environment, the Company performed well in 2021.

| | | | | | | |

$329.7M Revenue | $119.7M Adjusted EBITDA1 | ||||||

RE/MAX Holdings continues to focus on growing its RE/MAX and Motto Mortgage brands, thereby increasing revenue and ultimately the Company’s profitability and cash flow.

| | ||

Revenue ($ in millions) | Adjusted EBITDA1 ($ in millions) | ||

|

| ||

1 Adjusted EBITDA is a non-GAAP measure Please see the Appendix on page 56 of this Proxy Statement for a definition of this term and reconciliation with the most directly comparable GAAP measure.

2022 Proxy Statement | RE/MAX Holdings, Inc. | 29 |

The compensation of our Named Executive Officers consists primarily of base salary, short-term incentive, and long-term incentive compensation.

Compensation Element | Key Features | Primary Objectives |

Base Salary | Factors considered in determining Base Salary: ● the recommendation of the CEO, ● market data provided by the Company’s compensation consultant on base salary paid to similar officers at other companies, and ● each officer’s experience and performance. | Attract & Retain quality officers who will drive the Company’s success |

Short-Term Incentive | Each Executive Officer’s short-term incentive target level is based on a percentage of base salary and the actual payout is based on Company and individual performance. | Motivate & Reward officers for meeting and exceeding personal and corporate objectives. |

Long-Term Equity Incentive Compensation | Long-term incentive grants for Executive Officers are restricted stock units, 60% of which have performance-based vesting conditions and 40% of which are time-based. | Incentivize long-term value creation by aligning each officer’s interests with those of stockholders. Reward Company performance. Retain key personnel through long-term vesting. |

Perquisites and Other Benefits (Fixed) | The Company offers a comprehensive benefit package to all full-time employees designed to attract and retain talented employees at all levels. | Attract & Retain talented employees at all levels. |

Pay Mix

|

|

Base salary 18%, bonus 32%, equity grant 49%, other 1%. Average of other NEOs: base salary 25%, bonus 23%, equity grant 51%, other 1%

The tables above show the pay mix for the CEO and the Named Executive Officers as a group for 2021 based on the actual bonus paid and grant date fair value of equity grants (as reflected in the Summary Compensation Table below).

Base Salary

Each Named Executive Officer receives a base salary, which is a fixed component of their compensation. Paying a competitive base salary is a crucial aspect of attracting and retaining qualified leaders who will drive the Company’s success. The Company aims to pay experienced, seasoned officers near the midpoint of the established base salary range for that position, based on data from its compensation consultant. Base salary for each of the Executive Officers is determined by the Compensation Committee, taking into account the recommendation of the CEO (for Executive Officers other than the CEO), market data provided by the Company’s compensation consultant on base salary paid to similar

30 | RE/MAX Holdings, Inc. | 2022 Proxy Statement |