improve their research and development process. Syngenta has continued to increase the volume and diversity of products they order from us, consistent with our increase in capabilities.

Case studies demonstrating conversion of makers to buyers

Centre for the Commercialization of Antibodies and Biologics

Since August 2016, we have been working with the Centre for the Commercialization of Antibodies and Biologics (CCAB), which is taking promising therapeutic compounds and providing initial validation andscale-up services for these molecules prior to licensing them to biotechnology companies. CCAB was attracted to us because of our low price for their genes of interest and our ability to supply these genes in CCAB’s own vector systems. Importantly, CCAB decided not to hire additional staff for cloning, given their satisfaction with our products, which allowed them to focus staffing resources on other aspects of development within their lab. Given their positive experience, CCAB has continued to expand their business with us and has referred other Toronto academic laboratories to us.

Antibody drug development company

We are working with an antibody drug development company that develops fully human antibody drugs, who uses our synthetic genes for some of its antibody discovery and development. They find that they are able to make better therapeutics using a targeted synthetic approach and have switched to buying synthetic DNA from us. They continue to order larger quantities of our DNA over time.

Competition

Our markets are characterized by significant technological changes, frequent new product introductions and enhancements, and evolving customer demands. We face competition from a broad range of providers of core synthetic biology products such as GenScript Biotech Corporation, GENEWIZ, Inc., Integrated DNA Technologies, Inc., DNA 2.0 Inc. d/b/a ATUM, GeneArt (owned by Thermo Fisher Scientific Inc.), Eurofins Genomics LLC,Sigma-Aldrich Corporation (an indirect wholly owned subsidiary of Merck & Company, Inc.), Promega Corporation, OriGene Technologies, Inc., Blue Heron Biotech, LLC and others. Additionally, we compete with both large and emerging providers in the life sciences tools and diagnostics industries focused on sample preparation for next generation sequencing such as Thermo Fisher Scientific Inc., Illumina, Inc., Integrated DNA Technologies, Inc., Agilent and Roche NimbleGen, Inc. In the antibody discovery market, we compete with clinical research organizations, such as LakePharma, Inc. (mouse hybridoma, llama immune libraries, XOMA phage display library) and Aldevron, LLC (genetic mouse immunization coupled with hybridoma), and antibody discovery biotechnology companies, such as Iontas Ltd (human phage display libraries, human phage display library focused on ion channels), Adimab, LLC (human synthetic yeast display libraries), and Distributed Bio (human synthetic phage display library, lead optimization libraries). In the field of DNA digital data storage, we compete with Catalog Technologies, Inc., ETH Zurich, Helixworks Technologies Limited, Iridia, Inc., North Shore Bio and Roswell Biotechnologies. Many of our competitors have greater financial, technical, research and/or other resources than we do. They may also have larger and more established manufacturing capabilities and marketing, sales, and support functions. The competition is intense within this market and we believe that the principal defining factors driving competition in our market will continue to be quality, cost, throughput and scalability, turnaround time, product offering and complexity, reliability,e-commerce capabilities, customer satisfaction and convenience.

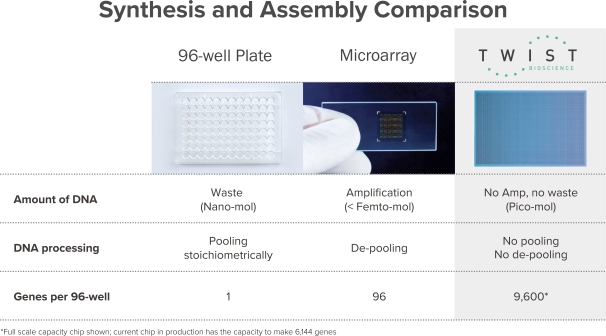

We believe that we compete favorably against our competitors based on our proprietary, integrated DNA synthesis platform, which enables us to achieve high levels of quality, precision, automation, and manufacturing throughput at a significantly lower cost as compared to our competitors.

116