UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantþ

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

PHILLIPS EDISON GROCERY CENTER REIT II, INC.

(Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

PHILLIPS EDISON GROCERY CENTER REIT II, INC.

11501 Northlake Drive

Cincinnati, Ohio 45249

NOTICE OF 2015 ANNUAL MEETING OF STOCKHOLDERS

AND INTERNET AVAILABILITY OF PROXY MATERIALS

Dear Stockholder:

On Wednesday, July 8, 2015, we will hold our 2015 annual meeting of stockholders at 222 S. Main Street, Suite 1730, Salt Lake City, Utah 84101. The meeting will begin at 9:00 a.m. mountain daylight time.

We are holding this meeting to:

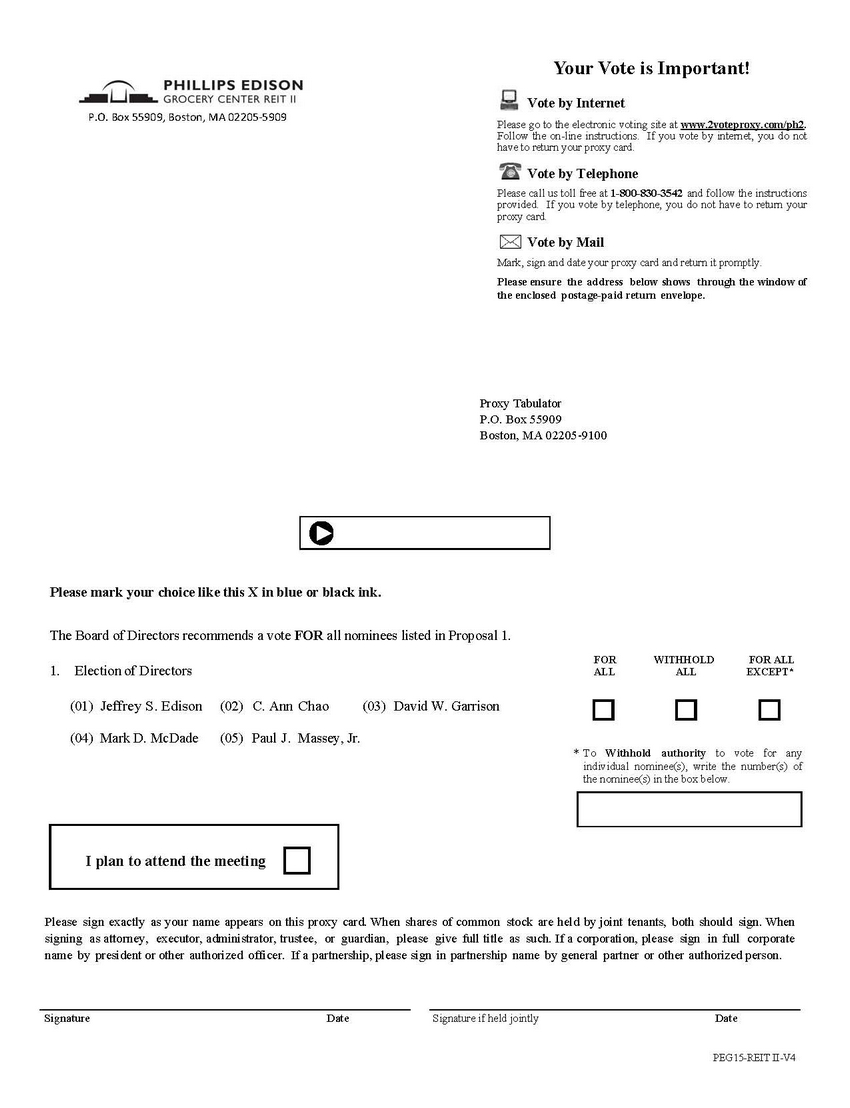

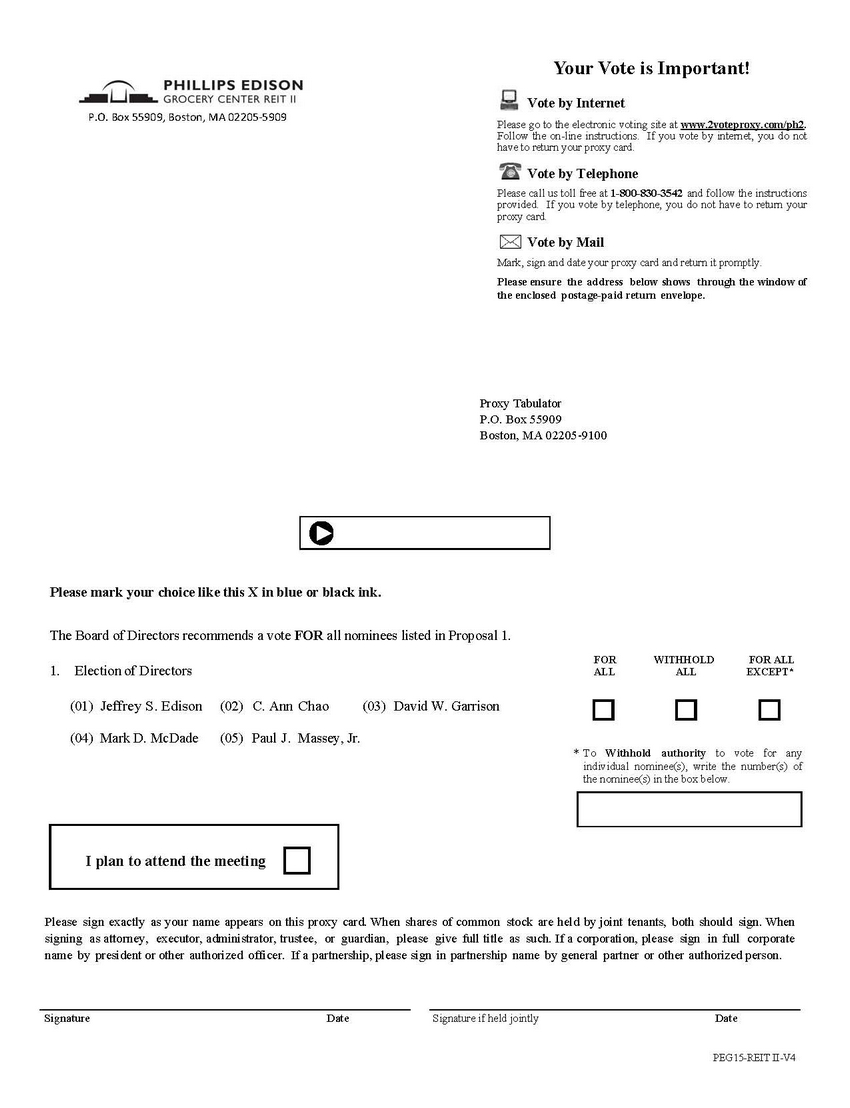

| 1. | Elect five directors to hold office for one-year terms expiring in 2016. |

The Board of Directors recommends a vote FOR each nominee.

| 2. | Attend to such other business as may properly come before the meeting and any adjournment or postponement thereof. |

The board of directors has selected April 9, 2015 as the record date for determining stockholders entitled to vote at the meeting.

This proxy statement and proxy card are being mailed to you on or about April 30, 2015, along with a copy of our 2014 annual report.

Whether you plan to attend the meeting and vote in person or not, we urge you to have your vote recorded as early as possible. Stockholders have the following three options for submitting their votes by proxy: (1) via the Internet; (2) by telephone; or (3) by mail, using the enclosed proxy card.

Your vote is very important! Your immediate response will help avoid potential delays and may save us significant additional expenses associated with soliciting stockholder votes.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUALMEETING OF STOCKHOLDERS TO BE HELD ON JULY 8, 2015:

Our proxy statement, form of proxy card and 2014 annual report to stockholders are also available at

http://www.grocerycenterreit2.com/Investor-Relations/Proxy-Materials.aspx |

By Order of the Board of Directors

Jeffrey S. Edison

Chairman

Cincinnati, Ohio

April 30, 2015

QUESTIONS AND ANSWERS

We are providing you with this proxy statement, which contains information about the items to be voted on at our annual stockholders meeting. To make this information easier to understand, we have presented some of the information in a question-and-answer format.

| Q: | Why did you send me this proxy statement? |

| A: | We sent you this proxy statement and the enclosed proxy card because our board of directors is soliciting your proxy to vote your shares at the 2015 annual stockholders meeting. This proxy statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission (“SEC”) and is designed to assist you in voting. |

| A: | A proxy is a person who votes the shares of stock of another person who could not attend a meeting. The term “proxy” also refers to the proxy card or other method of appointing a proxy. When you submit your proxy, you are appointing John B. Bessey, R. Mark Addy and Devin I. Murphy, each of whom is an officer, as your proxies, and you are giving them permission to vote your shares of common stock at the annual meeting. The appointed proxies will vote your shares of common stock as you instruct unless you submit your proxy without instructions. If you submit your proxy without instructions, the appointed proxies will vote FOR all of the director nominees. With respect to any other proposals to be voted upon, they will vote in accordance with the recommendation of the board of directors or, in the absence of such a recommendation, in their discretion. If you do not submit your proxy, they will not vote your shares of common stock. |

| Q: | When is the annual meeting and where will it be held? |

| A: | The annual meeting will be held on Wednesday, July 8, 2015, at 9:00 a.m. mountain daylight time at 222 S. Main Street, Suite 1730, Salt Lake City, Utah 84101. If you need directions to the location of the annual meeting, please contact us at (801) 521-6970. |

| Q: | Who is entitled to vote? |

| A: | Anyone who is a stockholder of record at the close of business on April 9, 2015, the record date, or holds a valid proxy for the annual meeting, is entitled to vote at the annual meeting. Every stockholder is entitled to one vote for each share of common stock held, including fractional shares. |

| Q: | How many shares of common stock are outstanding? |

| A: | As of April 9, 2015, there were 30,051,611 shares of our common stock issued and outstanding. |

| A: | A quorum consists of the presence in person or by proxy of stockholders entitled to cast at least 50% of all the votes entitled to be cast at the annual meeting. There must be a quorum present in order for the annual meeting to be a duly held meeting at which business can be conducted. Generally, if you submit your proxy, then you will at least be considered part of the quorum. |

| A: | You may vote on the election of nominees to serve on the board of directors and on any other proposal to be voted on. |

| Q: | How does the board of directors recommend I vote on the proposal? |

| A: | The board of directors recommends that you vote FOR each of the nominees for election as a director who is named as such in this proxy statement. |

| A: | Stockholders can vote in person at the meeting or by proxy. Stockholders have the following three options for submitting their votes by proxy: |

| · | via the Internet at www.2voteproxy.com/ph2; |

| · | by telephone, by calling 1-800-830-3542; or |

| · | by mail, by completing, signing, dating and returning the enclosed proxy card. |

For those stockholders with Internet access, we encourage you to vote via the Internet, since it is quick, convenient and provides a cost savings to us. When you vote via the Internet or by telephone prior to the meeting date, your vote is recorded immediately and there is no risk that postal delays will cause your vote to arrive late and, therefore, not be counted. For further instructions on voting, see the enclosed proxy card.

If you elect to attend the meeting, you can submit your vote in person, and any previous votes that you submitted, whether by Internet, telephone or mail, will be superseded. If you return your signed proxy, your shares will be voted as you instruct, unless you give no instructions with respect to one or more of the proposals. In this case, unless you later instruct otherwise, your shares of common stock will be voted “FOR” the nominees for director. With respect to any other proposals to be voted on, your shares of common stock will be voted in accordance with the recommendation of the board of directors or, in the absence of such a recommendation, in the discretion of Messrs. Bessey, Addy and Murphy.

| Q: | What if I submit my proxy and then change my mind? |

| A: | You have the right to revoke your proxy at any time before the meeting by: |

| (1) | notifying Mr. Devin I. Murphy, our Secretary; |

| (2) | attending the meeting and voting in person; |

| (3) | returning another proxy card dated after your first proxy card, if we receive it before the annual meeting date; or |

| (4) | recasting your proxy vote via the Internet or by telephone. |

Only the most recent proxy vote will be counted and all others will be discarded regardless of the method of voting.

| Q: | Will my vote make a difference? |

| A: | Yes. Your vote could affect the composition of our board of directors. Moreover, your vote is needed to ensure that the proposal can be acted upon. Because we are a widely held company,YOUR VOTE IS VERY IMPORTANT! Your immediate response will help avoid potential delays and may save us significant additional expenses associated with soliciting stockholder votes. |

| Q: | What are the voting requirements to elect the board of directors? |

| A: | With regard to the election of directors, you may vote “FOR ALL” of the nominees, you may withhold your vote for all of the nominees by voting “WITHHOLD ALL”, or you may vote for all of the nominees except for certain nominees by voting “FOR ALL EXCEPT” and listing the corresponding number of the nominee(s) for whom you want your vote withheld in the space provided on the proxy card. Under our charter a majority of the shares present in person or by proxy at an annual meeting at which a quorum is present is required for the election of the directors. This means that, of the shares present in person or by proxy at an annual meeting, a director nominee needs to receive affirmative votes from a majority of such shares in order to be elected to the board of directors. Because of this majority vote requirement,“withhold” votes and broker non-votes (discussed below) will have the effect of a vote against each nominee for director. If an incumbent director nominee fails to receive the required number of votes for re-election, then under Maryland law, he or she will continue to serve as a “holdover” director until his or her successor is duly elected and qualified. If you submit a proxy card with no further instructions, your shares will be voted in accordance with the recommendation of the board of directors at the annual meeting. |

| Q: | What is a “broker non-vote”? |

| A: | A “broker non-vote” occurs when a broker holding stock on behalf of a beneficial owner submits a proxy but does not vote on a non-routine proposal because the broker does not have discretionary power with respect to that item and has not received instructions from the beneficial owner. Brokers may not exercise discretionary voting in uncontested director elections at stockholder meetings and are prohibited from giving a proxy to vote with respect to an election of directors without receiving voting instructions from a beneficial owner. Beneficial owners of shares held in broker accounts are advised that, if they do not timely provide instructions to their broker, their shares will not be voted in connection with the election of directors at the annual meeting. |

| Q: | How will voting on any other business be conducted? |

| A: | Although we do not know of any business to be considered at the annual meeting other than the election of directors, if any other business is properly presented at the annual meeting, a submitted proxy gives authority to Messrs. Bessey, Addy and Murphy, and each of them, to vote on such matters in accordance with the recommendation of the board of directors or, in the absence of such a recommendation, in their discretion. |

| Q: | When are the stockholder proposals for the next annual meeting of stockholders due? |

| A: | Stockholders interested in nominating a person as a director or presenting any other business for consideration at our annual meeting of stockholders in 2016 may do so by following the procedures prescribed in Section 11 of our Bylaws and in Rule 14a-8 under the Securities Exchange Act of 1934 (the “Exchange Act”). To be eligible for presentation to and action by the stockholders at the 2016 annual meeting and to also be eligible for inclusion in our proxy statement for the 2016 annual meeting, director nominations and other stockholder proposals must be received by our secretary no earlier than December 2, 2015 and no later than January 1, 2016. |

| Q: | Who pays the cost of this proxy solicitation? |

| A: | We will pay all of the costs of soliciting these proxies. Employees of our sub-advisor or its affiliates may solicit proxies in person, via the Internet, by telephone or by any other electronic means of communication we deem appropriate, but will be paid no additional compensation for these services. Although we have not retained a proxy solicitor to assist in the solicitation of proxies, we may do so in the future, and do not believe that the cost of any such proxy solicitor will be material. We will also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to our stockholders. |

| Q: | Is this proxy statement the only way that proxies are being solicited? |

| A: | No. In addition to mailing proxy solicitation material, employees of our sub-advisor or its affiliates may also solicit proxies in person, via the Internet, by telephone or by any other electronic means of communication we deem appropriate. Although we have not retained a proxy solicitor to assist in the solicitation of proxies, we may do so in the future. |

| Q: | If I plan to attend the annual meeting in person, should I notify anyone? |

| A: | While you are not required to notify anyone in order to attend the annual meeting, if you do plan to attend the meeting, we would appreciate it if you would mark the appropriate box on the enclosed proxy card to let us know how many stockholders will be attending the meeting so that we will be able to prepare a suitable meeting room for the attendees. |

| Q: | Where can I find more information? |

| A: | You may access, read and print copies of the proxy materials for this year’s annual meeting, including our proxy statement, form of proxy card, and annual report to stockholders, at the following web address: http://www.grocerycenterreit2.com/Investor-Relations/Proxy-Materials.aspx |

We also file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any reports, statements or other information we file with the SEC on the web site maintained by the SEC at www.sec.gov. Our SEC filings also are available to the public at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, DC 20549. You also may obtain copies of the documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, N.E., Washington, DC 20549. Please call the SEC at 1-800-SEC-0330 for further information regarding the public reference facilities.

Certain Information About Management

The Board of Directors

Our board of directors has oversight responsibility for our operations and makes all major decisions concerning our business. We currently have five directors, all of whom have been nominated for re-election at the annual meeting. We currently have no vacant director positions. Our board of directors held five meetings during 2014. During 2014, each director attended at least 75% of the board meetings either in person or by teleconference. Additionally, during 2014, each director attended at least 75% of the meetings for each committee on which he or she served either in person or by teleconference. For biographical information regarding our executive officers and directors, see “Executive Officers and Directors” on page 18.

Our board of directors has established an Audit Committee and our charter has established a Conflicts Committee consisting of all of our independent directors. Information regarding each of the committees is set forth below.

Director Independence

Although our shares are not listed for trading on any national securities exchange, a majority of our directors, and all of the members of the Audit Committee and Conflicts Committee, are “independent” as defined by the New York Stock Exchange (the “NYSE”). The NYSE standards provide that to qualify as an independent director, in addition to satisfying certain bright-line criteria, the board of directors must affirmatively determine that a director has no material relationship with us (either directly or as a partner, stockholder, or officer of an organization that has a relationship with us). The board of directors has determined that each of C. Ann Chao, David W. Garrison, Mark D. McDade and Paul J. Massey, Jr. is “independent” as defined by the NYSE.

The Audit Committee

General

The Audit Committee’s primary function is to assist our board of directors in fulfilling its responsibilities by overseeing our independent auditors and reviewing the financial information to be provided to our stockholders and others, overseeing the system of internal control over financial reporting that our management has established, and overseeing our audit and financial reporting process. The Audit Committee also is responsible for overseeing our compliance with applicable laws and regulations and for establishing procedures for the ethical conduct of our business. The Audit Committee fulfills these responsibilities primarily by carrying out the activities enumerated in the Audit Committee Charter adopted by our board of directors in 2013. The Audit Committee Charter is available on our web site at www.grocerycenterreit2.com/Investor-Relations/Governance.aspx.

The members of the Audit Committee currently are David W. Garrison (Chairman), Mark D. McDade and C. Ann Chao. The board of directors has determined that Mr. Garrison qualifies as the Audit Committee “financial expert” within the meaning of SEC rules. During 2014, the Audit Committee held four meetings.

Independent Auditors

During the year ended December 31, 2014, Deloitte & Touche LLP served as our independent auditor and provided certain domestic tax and other services. Deloitte & Touche LLP has served as our independent auditor since our formation in 2013. The Audit Committee intends to engage Deloitte & Touche LLP as our independent auditor to audit our consolidated financial statements for the year ending December 31, 2015. The Audit Committee may, however, select new auditors at any time in the future in its discretion if it deems such decision to be in our best interest. Any decision to select new auditors would be disclosed to our stockholders in accordance with applicable securities laws.

Representatives from Deloitte & Touche LLP are expected to be present at the annual meeting, to have the opportunity to make a statement if they desire to do so and to be available to respond to appropriate questions posed by any stockholders.

Preapproval Policies

The Audit Committee Charter imposes a duty on the Audit Committee to preapprove all auditing services performed for us by our independent auditors, as well as all permitted nonaudit services (including the fees and terms thereof) in order to ensure that the provision of such services does not impair the auditors’ independence. Unless a type of service to be provided by the independent auditors has received “general” preapproval, it will require “specific” preapproval by the Audit Committee. Additionally, any proposed services exceeding “general” preapproved cost levels will require specific preapproval by the Audit Committee.

All requests or applications for services to be provided by the independent auditor that do not require specific preapproval by the Audit Committee will be submitted to management and must include a detailed description of the services to be rendered. Management will determine whether such services are included within the list of services that have received the general preapproval of the Audit Committee. The Audit Committee will be informed on a timely basis of any such services rendered by the independent auditors.

Requests or applications to provide services that require specific preapproval by the Audit Committee will be submitted to the Audit Committee by both the independent auditors and the Chief Financial Officer, and must include a joint statement as to whether, in their view, the request or application is consistent with the SEC’s rules on auditor independence. The Chairman of the Audit Committee has been delegated the authority to specifically preapprove all services not covered by the general preapproval guidelines up to an amount not to exceed $75,000 per occurrence. Amounts requiring preapproval in excess of $75,000 per occurrence require specific preapproval by all members of the Audit Committee prior to engagement of our independent auditors. All amounts specifically preapproved by the Chairman of the Audit Committee in accordance with this policy are to be disclosed to the full Audit Committee at the next regularly scheduled meeting.

All services rendered by Deloitte & Touche LLP for the year ended December 31, 2014 were preapproved in accordance with the policies and procedures described above.

Principal Auditor Fees

The Audit Committee reviewed the audit and nonaudit services performed by our principal auditor, as well as the fees charged by the principal auditor for such services. In its review of the nonaudit service fees, the Audit Committee considered whether the provision of such services is compatible with maintaining the independence of the principal auditor. The aggregate fees billed to us for professional accounting services, including the audit of our annual consolidated financial statements by our principal auditor for the year ended December 31, 2014 and for the period from June 5, 2013 (formation) to December 31, 2013, are set forth in the table below.

| | | 2014 | | | 2013 | |

| Audit fees | | $ | 484,200 | | | $ | 145,900 | |

| Audit-related fees | | | 10,000 | | | | - | |

| Tax fees | | | 50,600 | | | | 3,800 | |

| All other fees | | | - | | | | - | |

| Total fees | | $ | 544,800 | | | $ | 149,700 | |

For purposes of the preceding table, the principal auditor’s professional fees are classified as follows:

| · | Audit fees – These are fees for professional services performed for the audit of our annual consolidated financial statements and the required review of quarterly consolidated financial statements and other procedures performed by the principal auditor in order for them to be able to form an opinion on our consolidated financial statements. These fees also cover services that are normally provided by independent auditors in connection with statutory and regulatory filings or engagements, including reviews of our consolidated financial statements included in the registration statements, as amended, related to our public offerings of common stock. Audit fees are presented for the period to which the audit work relates, regardless of whether the fees are actually billed during the period. |

| · | Audit-related fees – These are fees for assurance and related services that traditionally are performed by independent auditors that are reasonably related to the performance of the audit or review of the consolidated financial statements, such as due diligence related to acquisitions and dispositions, attestation services that are not required by statute or regulation, internal control reviews, and consultation concerning financial accounting and reporting standards. |

| · | Tax fees – These are fees for all professional services performed by professional staff in our independent auditor’s tax division, except those services related to the audit of our consolidated financial statements. These include fees for tax compliance, tax planning and tax advice, including federal, state, and local issues. Services also may include assistance with tax audits and appeals before the Internal Revenue Service and similar state and local agencies, as well as federal, state, and local tax issues related to due diligence. Tax fees are presented for the period in which the services were provided. |

| · | All other fees – These are fees for any services not included in the above-described categories. |

Report of the Audit Committee

The Audit Committee reviews the financial reporting process on behalf of the board of directors. Our management has the primary responsibility for the financial statements and the reporting process, including the system of internal control over financial reporting. Membership on the Audit Committee does not call for the professional training and technical skills generally associated with career professionals in the field of accounting and auditing. In addition, the independent auditors devote more time and have access to more information than does the Audit Committee. Accordingly, the Audit Committee’s role does not provide any special assurance with regard to our financial statements, nor does it involve a professional evaluation of the quality of the audits performed by the independent auditors. In this context, the Audit Committee reviewed the 2014 audited consolidated financial statements with management, including a discussion of the quality and acceptability of our financial reporting, the reasonableness of significant judgments, and the clarity of disclosures in the consolidated financial statements.

The Audit Committee reviewed with Deloitte & Touche LLP, which is responsible for expressing an opinion on the conformity of those audited consolidated financial statements with U.S. generally accepted accounting principles, their judgments as to the quality and the acceptability of the consolidated financial statements and such other matters as are required to be discussed with the Audit Committee under Statement on Auditing Standards No. 16 (Communication with Audit Committees). The Audit Committee received from and discussed with Deloitte & Touche LLP the written disclosures and the letter required by the applicable requirements of the Public Company Accounting Oversight Board regarding that firm’s independence from us. In addition, the Audit Committee considered whether Deloitte & Touche LLP’s provision of nonaudit services is compatible with maintaining its independence from us.

The Audit Committee discussed with Deloitte & Touche LLP the overall scope and plans for the audit. The Audit Committee meets periodically, and at least quarterly, with Deloitte & Touche LLP, with and without management present, to discuss the results of their examinations, their evaluations of our internal controls, and the overall quality of our financial reporting.

In reliance on these reviews and discussions, the Audit Committee recommended to the board of directors, and the board of directors approved, the inclusion of the 2014 audited consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2014 for filing with the Securities and Exchange Commission.

| April 15, 2015 | The Audit Committee of the Board of Directors: |

| | David W. Garrison (Chairman), C. Ann Chao and |

| | Mark D. McDade |

The Conflicts Committee

General

The members of our Conflicts Committee currently are C. Ann Chao (Chair), David W. Garrison, Mark D. McDade and Paul J. Massey, Jr., all of whom are independent directors. Our charter empowers the Conflicts Committee to act on any matter delegated to a committee under Maryland law. If a matter cannot be delegated to a committee under Maryland law but the Conflicts Committee has determined that the matter at issue is such that the exercise of independent judgment by directors who are affiliates of our advisor or sub-advisor could reasonably be compromised, both the board of directors and the Conflicts Committee must approve the matter. Among the duties of the Conflicts Committee are the following:

| · | reviewing and reporting on our policies (see “ – Report of the Conflicts Committee – Review of Our Policies” below); |

| · | approving transactions with affiliates and reporting on their fairness to us (see “ – Report of the Conflicts Committee –Transactions with Related Persons” below); |

| · | supervising and evaluating the performance and compensation of our advisor and our sub-advisor; |

| · | reviewing our expenses and determining that they are reasonable and within the limits prescribed by our charter; |

| · | approving borrowings in excess of the limit set forth in our charter; and |

| · | discharging the board of directors’ responsibilities relating to compensation. |

The primary responsibilities of the Conflicts Committee are enumerated in our charter. The Conflicts Committee does not have a separate committee charter. The Conflicts Committee held eight meetings during 2014.

Report of the Conflicts Committee

Review of Our Policies

The Conflicts Committee has reviewed our policies and determined that they are in the best interest of our stockholders. Set forth below is a discussion of the basis for that determination.

Offering Policy. We are currently conducting a primary public offering of up to 80 million shares of common stock at $25.00 per share (with discounts available for certain categories of investors). We are also offering up to 20 million shares of common stock under our distribution reinvestment plan. On January 22, 2015, our board of directors made the determination to close the primary portion of our initial public offering upon the earlier of (1) June 30, 2015 or (2) the sale of $1.6 billion in shares of our common stock. We believe these offerings are currently in the best interest of our stockholders because they increase the likelihood that we will be able to acquire a diverse portfolio of income-producing assets, thereby reducing risk in our portfolio. For the year ended December 31, 2014, the costs of raising capital in our primary offering and our distribution reinvestment plan represented 12.3% of the capital raised. However, we are not required to reimburse any of these costs to the extent they exceed 12.0% of the capital raised in our offering, measured at the termination of our offering.

Acquisition and Investment Policies. We intend to acquire and manage a diverse asset base of real estate properties and real estate-related loans and securities. We plan to diversify our real estate portfolio by geographic region, anchor tenants, tenant mix, investment size and investment risk with the goal of attaining an asset base of income-producing real estate properties and real estate-related assets that provide stable returns to our investors and the potential for growth in the value of our assets. We intend to allocate at least 90% of our asset base to investments in grocery-anchored neighborhood and community shopping centers throughout the United States with a focus on well-located shopping centers that are well occupied at the time of purchase and typically purchased for less than $20.0 million per property. We may also allocate up to 10% of our asset base to other real estate properties, real estate-related loans and securities and the equity securities of other real estate investment trusts (“REITs”) and real estate companies, assuming we sell the maximum offering amount. Although these percentages represent our target portfolio, we may make adjustments to our target portfolio based on real estate market conditions and investment opportunities. We will not forego a good investment opportunity because it does not precisely fit our expected portfolio composition. We believe that there are sufficient acquisition opportunities that meet this investment focus. Affiliates of our sub-advisor have extensive expertise with these types of real estate investments.

Borrowing Policies. Our borrowing strategy is to utilize primarily secured and possibly unsecured debt to finance our investment portfolio. We may elect to secure financing subsequent to the acquisition date on future real estate properties and initially acquire investments without debt financing. Once we have fully invested the proceeds of our ongoing public offering, we expect our debt financing to be approximately 45% of the aggregate fair market value of our assets (calculated after the close of the offering). Our charter limits our borrowings to 300% of our net assets; however, we may exceed that limit if the majority of the Conflicts Committee approves each borrowing in excess of our charter limitation and we disclose such borrowings to our stockholders in our next quarterly report with an explanation from the Conflicts Committee of the justification for the excess borrowing. This charter limitation, however, does not apply to individual real estate assets or investments. To the extent financing in excess of this limit is available at attractive terms or is deemed to be temporary in nature, the Conflicts Committee may approve debt in excess of this limit. From time to time, our debt financing may be below 45% of the aggregate fair market value of our assets due to the lack of availability of debt financing or due to our temporarily having excess liquidity or cash on hand. As of December 31, 2014, our borrowings were approximately 5.7% of the fair market value of our assets. We believe the current borrowing policies are in the best interests of our stockholders because they provide us with an appropriate level of flexibility to purchase assets promptly and begin generating returns quickly, while limiting risk to stockholder capital associated with excessive leverage.

Disposition Policies. We intend to hold our properties for an extended period, typically three to six years, which we believe is the optimal period to enable us to capitalize on the potential for increased income and capital appreciation. The period that we will hold our investments in real estate-related assets will vary depending on the type of asset, interest rates and other factors. Our advisor or our sub-advisor will develop a well-defined exit strategy for each investment we make, initially at the time of acquisition as part of the original business plan for the asset, and thereafter by periodically reviewing each asset to determine the optimal time to sell the asset and generate a strong return. The determination of when a particular investment should be sold or otherwise disposed of will be made after considering relevant factors, including prevailing and projected economic conditions, whether the value of the asset is anticipated to decline substantially, whether we could apply the proceeds from the sale of the asset to make other investments consistent with our investment objectives, whether disposition of the asset would allow us to increase cash flow, and whether the sale of the asset would constitute a prohibited transaction under the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), or otherwise impact our status as a REIT. Our disposition policy provides us with the flexibility to time and structure property sales in a manner that optimizes our investment return. For this reason, we believe the current disposition policy is in the best interests of our stockholders.

Policy Regarding Working Capital Reserves. We may from time to time temporarily set aside offering proceeds, rather than pay down debt or acquire properties, in order to provide financial flexibility or in the event that suitable acquisitions are not available. While temporarily setting aside funds will decrease the amount available to invest in real estate in the short term and, hence, may temporarily decrease future net income, we believe that it may be prudent under certain economic conditions to have these funds available, in addition to funds available from operations and borrowings.

Policies Regarding Operating Expenses. Commencing June 30, 2015, operating expenses incurred by our advisor or our sub-advisor will be reimbursable by us, but we will have the responsibility of limiting total operating expenses to no more than the greater of 2.0% of our average invested assets or 25.0% of our net income, as these terms are defined by our charter, unless the Conflicts Committee has determined that such excess expenses were justified based on unusual and non-recurring factors. For the four consecutive quarters ended December 31, 2014, our total operating expenses represented 0.6% of average invested assets. For the four consecutive quarters ended December 31, 2014, we had a net loss of approximately $5.8 million.

Liquidation or Listing Policy. We believe it is in the best interest of our stockholders not to list our shares of common stock on a national exchange at this time. First, we are in the fundraising and acquisition stage of our life cycle, and remaining unlisted improves our ability to continue to raise new equity and purchase additional investments so that our portfolio can achieve greater size and diversification. Second, our shares are offered as a long-term investment. We believe that the ability to provide our stockholders with liquidity in the near term is outweighed by the long-term benefits of completing the current offering and allowing the portfolio to mature.

Transactions with Related Persons

Our charter requires our Conflicts Committee to review and approve all transactions involving our affiliates and us. Prior to entering into a transaction with an affiliate that is not covered by the advisory agreement with our advisor, a majority of the Conflicts Committee must conclude that the transaction is fair and reasonable to us and on terms and conditions not less favorable to us than those available from unaffiliated third parties. In addition, our Code of Ethics lists examples of types of transactions with affiliates that would create prohibited conflicts of interest. Under the Code of Ethics, our officers and directors are required to bring potential conflicts of interest to the attention of the Chairman of our Audit Committee promptly. The Conflicts Committee has reviewed the material transactions between our affiliates and us since the beginning of 2014. There are no currently proposed material transactions with related persons other than those covered by the terms of the agreements described below. Set forth below is a description of such transactions and the Conflicts Committee’s report on their fairness.

Our advisor, American Realty Capital PECO II Advisors, LLC, is wholly owned by our American Realty Capital sponsor. Our sub-advisor, Phillips Edison NTR II LLC, is owned by our Phillips Edison sponsor. Additionally, certain of our directors and officers, Jeffrey S. Edison, R. Mark Addy, John B. Bessey and Devin I. Murphy, serve as the executive officers of our sub-advisor. Our property manager, Phillips Edison & Company, Ltd. (our “property manager”), is wholly owned by our Phillips Edison sponsor and Mr. Edison and Mr. Murphy hold key positions at our property manager. Our dealer manager, Realty Capital Securities, LLC (our “dealer manager”), is controlled by an affiliate of our American Realty Capital sponsor.

Our Relationship with Our Advisor and Our Sub-advisor

Pursuant to our advisory agreement, our advisor is entitled to specified fees for certain services, including managing our day-to-day activities and implementing our investment strategy. Our advisor has entered into a sub-advisory agreement with our sub-advisor, which manages our day-to-day affairs and our portfolio of real estate investments, subject to the board of directors’ supervision and certain major decisions requiring the consent of both our advisor and our sub-advisor. The expenses to be reimbursed to our advisor and our sub-advisor will be reimbursed in proportion to the amount of expenses incurred on our behalf by our advisor and our sub-advisor, respectively.

Under the terms of the advisory agreement, we are to reimburse on a monthly basis our advisor, our sub-advisor or their respective affiliates for cumulative organization and offering costs and future organization and offering costs they may incur on our behalf, but only to the extent that the reimbursement would not exceed 2.0% of gross offering proceeds over the life of our initial public offering. As of December 31, 2014, our advisor, our sub-advisor or their affiliates had paid approximately $16.4 million of organization and offering costsfor which they were entitled to reimbursement. We had reimbursed $13.2 million of such costs, while $3.2 million of such costs had yet to be reimbursed as of December 31, 2014. We anticipate that cumulative organization and offering costs will not exceed the 2.0% limitation upon completion of our initial public offering. Of the amount reimbursed, $7.3 million was allocated to reimbursement for personnel costs incurred by our advisor and sub-advisor in connection with our initial public offering during the year ended December 31, 2014. Included in the amount of reimbursements allocated to personnel costs of our sub-advisor was $523,600 for a portion of the compensation of Jeffrey S. Edison, our Chief Executive Officer, and $368,300 for a portion of the compensation of Devin I. Murphy, our Chief Financial Officer.

We pay our advisor and our sub-advisor an acquisition fee related to services provided in connection with the selection and purchase or origination of real estate and real estate-related investments. The acquisition fee is equal to 1.0% of the cost of investments acquired or originated by us, including any debt attributable to such investments. We incurred acquisition fees payable to our advisor, sub-advisor and their affiliates of approximately $3.2 million for the year ended December 31, 2014, respectively, all of which had been paid as of December 31, 2014. We paid no acquisition fees for the period from June 5, 2013 (formation) to December 31, 2013.

In addition to acquisition fees, we reimburse our advisor and our sub-advisor for customary acquisition expenses, whether or not we ultimately acquire an asset. For the year ended December 31, 2014, we incurred acquisition expenses reimbursable to our advisor and sub-advisor of approximately $2.2 million. We reimbursed no acquisition expenses for the period from June 5, 2013 (formation) to December 31, 2013.

Within 60 days after the end of each calendar quarter (subject to the approval of our board of directors), we, as the sole member of the general partner of Phillips Edison Grocery Center Operating Partnership II, L.P. (the “operating partnership”), will cause the operating partnership to pay an asset management subordinated participation by issuing a number of restricted operating partnership units designated as Class B Units of our operating partnership (“Class B Units”) to our advisor and our sub-advisor equal to: (i) 0.25% multiplied by (a) prior to our net asset value (“NAV”) pricing date (i.e., the earlier to occur of (X) our acquisition of $2.0 billion in total portfolio assets and (Y) November 25, 2015), the cost of assets and (b) on and after the NAV pricing date, the lower of the cost of assets and the applicable quarterly NAV divided by (ii) (a) prior to the NAV pricing date, the value of one share of common stock as of the last day of such calendar quarter, which is equal initially to $22.50 (the primary offering price minus selling commissions and dealer manager fees) and, (b) on and after the NAV pricing date, per share NAV.

Class B Units are subject to forfeiture until such time as: (a) the value of the operating partnership's assets plus all distributions made equals or exceeds the total amount of capital contributed by investors plus a 6.0% cumulative, pretax, non-compounded annual return thereon, or the “economic hurdle”; (b) any one of the following events occurs concurrently with or subsequently to the achievement of the economic hurdle described above: (i) a listing of our common stock on a national securities exchange; (ii) a transaction to which we or our operating partnership shall be a party, as a result of which partnership units in our operating partnership or our common stock shall be exchanged for or converted into the right, or the holders of such securities shall otherwise be entitled, to receive cash, securities or other property or any combination thereof; or (iii) the termination of the advisory agreement without cause, provided that we do not engage our sub-advisor or an affiliate of our advisor or sub-advisor as our new external advisor following such termination; and (c) our advisor is providing services to us immediately prior to the occurrence of an event of the type described in clause (b) above, unless the failure to provide such services is attributable to the termination without cause of the advisory agreement by an affirmative vote of a majority of our independent directors after the economic hurdle described above has been met.

Any outstanding Class B Units will be forfeited immediately if the advisory agreement is terminated for any reason other than a termination without cause. Any outstanding Class B Units will be forfeited immediately if the advisory agreement is terminated without cause by an affirmative vote of a majority of our board of directors before the economic hurdle described above has been met. During the year ended December 31, 2014, the operating partnership issued a total of 17,515 Class B Units to our advisor and sub-advisor for the asset management services performed during the period from January 1, 2014 through September 30, 2014. On January 22, 2015, the operating partnership issued 27,946 additional Class B Units to our advisor and sub-advisor for the asset management services performed during the period from October 1, 2014 through December 31, 2014. For the period from June 5, 2013 (formation) to December 31, 2013, the operating partnership issued no Class B Units to our advisor and our sub-advisor. The Class B Units are participating securities that receive distributions at the same rates and dates as the distributions paid to our common stockholders. These distributions are calculated as the product of the number of Class B Units issued to date and the stated distribution rate at the time such distribution is authorized.

We pay our advisor or sub-advisor a financing coordination fee equal to a total of 0.75% of the amount available and/or outstanding under such financing or such assumed debt, subject to certain limitations. Our advisor and sub-advisor may reallow some of or all of this financing coordination fee to reimburse third parties with whom they may subcontract to procure such financing. We incurred financing coordination fees of approximately $1.7 million for the year ended December 31, 2014. We incurred no financing coordination fees for the period from June 5, 2013 (formation) to December 31, 2013.

The Conflicts Committee considers our relationship with our advisor and our sub-advisor during 2013 and 2014 to be fair. The Conflicts Committee believes that the amounts payable to our advisor and our sub-advisor are similar to those paid by other publicly offered, unlisted, externally advised REITs and that this compensation is necessary in order for our advisor and our sub-advisor to provide the desired level of services to us and our stockholders.

Our Relationship with the Property Manager

All of our real properties are managed and leased by our property manager. Our property manager manages real properties acquired by the Phillips Edison affiliates or other third parties.

Until June 1, 2014, we paid to our property manager monthly property management fees equal to 4.5% of the annualized gross revenues of the properties managed by our property manager. On June 1, 2014, this amount decreased to 4.0% of the annualized gross revenues of such properties. In the event that we contract directly with a non-affiliated third-party property manager in respect of a property, we pay our property manager a monthly oversight fee equal to 1.0% of the annualized gross revenues of the property managed. In addition to the property management fee or oversight fee, if our property manager provides leasing services with respect to a property, we pay our property manager leasing fees in an amount equal to the usual and customary leasing fees charged by unaffiliated persons rendering comparable services based on national market rates. We pay a leasing fee to our property manager in connection with a tenant’s exercise of an option to extend an existing lease, and the leasing fees payable to the property manager may be increased by up to 50% in the event that the property manager engages a co-broker to lease a particular vacancy. We reimburse the costs and expenses incurred by our property manager on our behalf, including legal, travel and other out-of-pocket expenses that are directly related to the management of specific properties, as well as fees and expenses of third-party accountants.

If we engage our property manager to provide construction management services with respect to a particular property, we will pay a construction management fee in an amount that is usual and customary for comparable services rendered to similar projects in the geographic market of the property.

Our property manager hires, directs and establishes policies for employees who have direct responsibility for the operations of each real property it manages, which may include, but is not limited, to on-site managers and building and maintenance personnel. Certain employees of our property manager may be employed on a part-time basis and may also be employed by our sub-advisor or certain of its affiliates. Our property manager also directs the purchase of equipment and supplies and will supervise all maintenance activity.

For the year ended December 31, 2014, we incurred property management fees of approximately $273,000, leasing fees of approximately $245,000, and construction management fees of approximately $26,000 due to our property manager. As of December 31, 2014, approximately $97,000 of property management fees, $43,000 of leasing commissions and $5,000 of construction management fees remained due and payable to our property manager. Additionally, our property manager incurred approximately $251,000 of costs and expenses on our behalf for which our property manager was entitled to reimbursement during the year ended December 31, 2014. For the period from June 5, 2013 (formation) to December 31, 2013, we incurred no fees or reimbursements payable to our property manager.

The Conflicts Committee believes that this arrangement with our property manager is fair and reasonable and on terms and conditions no less favorable to us than those available from unaffiliated third parties.

Our Relationship with the Dealer Manager

The dealer manager provides certain sales, promotional and marketing services in connection with the distribution of the shares of common stock offered in our initial public offering. The dealer manager is generally paid a sales commission equal to 7.0% of the gross proceeds from the sale of shares of the common stock sold in our primary offering and a dealer manager fee equal to 3.0% of the gross proceeds from the sale of shares of the common stock sold in our primary offering. Alternatively, a participating broker-dealer may elect to receive a fee equal to 7.5% of the gross proceeds from the sale of shares by such participating broker-dealer, with 2.5% thereof paid at the time of such sale and 1.0% thereof paid on each anniversary of the closing of such sale up to and including the fifth anniversary of the closing of such sale, in which event, a portion of the dealer manager fee will be reallowed such that the combined selling commission and dealer manager fee do not exceed 10.0% of the gross proceeds from the sale of our common stock.

Dealer manager fees incurred during the year ended December 31, 2014 were approximately $16.6 million, of which $6.4 million was re-allowed to participating broker-dealers. Selling commissions incurred during the year ended December 31, 2014 were approximately $36.2 million, all of which were re-allowed to participating broker-dealers. For the period from June 5, 2013 (formation) to December 31, 2013, because the offering had not broken escrow, we incurred no selling commissions or dealer manager fees.

The Conflicts Committee believes that this arrangement with the dealer manager is fair. The compensation payable to the dealer manager reflects our belief that such selling commissions and dealer manager fees will maximize the likelihood that we will be able to achieve our goal of acquiring a large, diversified portfolio of real estate and real estate-related investments.

Our Relationship with the Transfer Agent

We are a party to a transfer agent agreement with American National Stock Transfer, LLC, or our transfer agent, which is an entity under common ownership with our American Realty Capital sponsor. Pursuant to this agreement, our transfer agent provides customer service to investors and supervises third party vendors, including DST Systems, Inc., in its execution of investor subscription agreements and other administrative forms. Our sub-advisor pays the transfer agent certain fees for the provision of such services. We reimburse our sub-advisor for these fees through the reimbursement of organization and offering costs. Such fees incurred during the year ended December 31, 2014 were approximately $659,000, of which approximately $220,000 was due and payable to our transfer agent as of December 31, 2014. No such fees were incurred during the year ended December 31, 2013.

| April 15, 2015 | The Conflicts Committee of the Board of Directors: |

| | C. Ann Chao (Chairwoman), David W. Garrison, |

| | Mark D. McDade and Paul J. Massey, Jr. |

Nomination of Directors

General

We do not have a standing nominating committee. However, our Conflicts Committee is responsible for identifying and nominating replacements for vacancies among our independent director positions. Our board of directors believes that the primary reason for creating a standing nominating committee is to ensure that candidates for independent director positions can be identified and their qualifications assessed under a process free from conflicts of interest with us. Because nominations for vacancies in independent director positions are handled exclusively by a committee composed only of independent directors, our board of directors has determined that the creation of a standing nominating committee is not necessary. Nominations for replacements for vacancies among non-independent director positions are considered and made by the full board of directors. We do not have a charter that governs the director nomination process.

Board Membership Criteria

The board of directors annually reviews the appropriate experience, skills and characteristics required of directors in the context of the then-current membership of the board of directors. This assessment includes, in the context of the perceived needs of the board of directors at that time, issues of knowledge, experience, judgment and skills such as an understanding of commercial real estate, capital markets, business leadership, accounting and financial management. No one person is likely to possess deep experience in all of these areas. Therefore, the board of directors has sought a diverse board of directors whose members collectively possess these skills and experiences. Other considerations include the candidate’s independence from us and our affiliates and the ability of the candidate to participate in board meetings regularly and to devote an appropriate amount of effort in preparation for those meetings. It also is expected that independent directors nominated by the Conflicts Committee shall be individuals who possess a reputation and hold (or have held) positions or affiliations befitting a director of a large publicly held company and are (or have been) actively engaged in their occupations or professions or are otherwise regularly involved in the business, professional or academic community. Moreover, as required by our charter, at least one of our independent directors must have at least three years of relevant real estate experience and at least one of our independent directors shall be a financial expert with at least three years of relevant financial experience. Each director must have at least three years of relevant experience demonstrating the knowledge and experience required to successfully acquire and manage the type of assets we acquire and manage. As detailed in the director biographies below, the board of directors believes that the slate of directors recommended for election at the annual meeting possesses these diverse skills and experiences.

Selection of Directors

The board of directors is responsible for selecting its own nominees and recommending them for election by the stockholders. Pursuant to our charter, however, the independent directors, through the Conflicts Committee, must nominate replacements for any vacancies among the independent director positions. All director nominees then stand for election by the stockholders annually.

In order to be considered by the board of directors or the Conflicts Committee, recommendations made by stockholders must be submitted within the timeframe required to request a proposal to be included in the proxy materials. See “Stockholder Proposals” on page 28. In evaluating the persons recommended as potential directors, the board of directors and the Conflicts Committee will consider each candidate without regard to the source of the recommendation and take into account those factors that the board of directors and the Conflicts Committee determine are relevant. Stockholders may directly nominate potential directors (without the recommendation of the board of directors or the Conflicts Committee) by satisfying the procedural requirements for such nomination as provided in Section 11 of our Bylaws.

Oversight of Executive Officer and Director Compensation

We do not have a standing compensation committee as we have no paid employees and our executive officers do not receive compensation directly from us for services rendered to us. Our executive officers are also officers of our sub-advisor and its affiliates and are compensated by these entities, in part, for their services to us. Thus, we do not expect our board of directors to be required to act upon matters of executive compensation. Our Conflicts Committee is, however, expected to act upon the continuation, renewal or enforcement of the advisory agreement with our advisor pursuant to which our advisor and our sub-advisor receive fees and reimbursement of expenses from which our sub-advisor compensates our executive officers. Our Conflicts Committee is also responsible for discharging the board of directors’ responsibilities relating to the compensation of our directors and would be expected to act upon matters of executive compensation as necessary.

Stockholder Communications with the Board of Directors

We have established several means for stockholders to communicate concerns to the board of directors. If the concern relates to our financial statements, accounting practices, or internal controls, stockholders should submit the concern in writing to Mr. David W. Garrison, the Chairman of our Audit Committee, in care of our Secretary at our headquarters address. If the concern relates to our governance practices, business ethics, or corporate conduct, stockholders should submit the concern in writing to Ms. C. Ann Chao, the Chairwoman of our Conflicts Committee, in care of our Secretary at our headquarters address. If uncertain as to which category a concern relates, a stockholder may communicate the concern to any one of the independent directors in care of our Secretary.

Stockholders also may communicate concerns with our directors at our annual meeting. We expect all of our directors to be present at our 2015 annual meeting. All of our directors were present, in person or via telephone, at our 2014 annual meeting.

Board Leadership Structure and Role in Risk Oversight

Chief Executive Officer and Board Chair Positions

Mr. Edison serves as both our chief executive officer and as chairman of our board of directors. As chief executive officer, Mr. Edison manages our business under the direction of the board of directors and implements our policies as determined by the board of directors. As chairman of the board of directors, Mr. Edison presides over board and stockholder meetings, represents our company at public events and oversees the setting of the agenda for those meetings and the dissemination of information about our company to the board of directors. Our board of directors believes that it is appropriate for our company that one person serve in both capacities. Mr. Edison, along with Michael C. Phillips, founded our company and devotes a substantial amount of his time to its management. With his greater knowledge of our company’s day-to-day operations, our board of directors believes that Mr. Edison is in the best position to oversee the setting of the agenda for the meetings of the board of directors and the dissemination of information about our company to the board of directors. Our board of directors believes that Mr. Edison is best suited to preside over stockholder meetings and that his representation of our company at public events is good for our company’s growth.

Some commentators regarding board leadership advocate separating the role of board chair and chief executive officer, maintaining that such separation creates a system of checks and balances to prevent one person from having too much power. Our board of directors believes that this issue is less of a concern for our company than many others. Our board of directors has four independent directors out of a five-member board of directors. Those four directors constitute the Conflicts Committee, which has the maximum power delegable to a board committee under Maryland law. As an externally advised company, many matters raise conflicts of interest. As a result, our Conflicts Committee largely directs the management of our company. Given the power and dominance of the Conflicts Committee, our board of directors has few concerns regarding concentration of power and believes it is in our best interest that Mr. Edison serves as both chief executive officer and chairman of the board.

Risk Oversight

Our executive officers and our sub-advisor are responsible for the day-to-day management of risks faced by our company, while our board of directors has an active role in the oversight of the management of such risks. The entire board is actively involved in overseeing risk management for the company through (1) its approval of all property acquisitions and the incurrence and assumption of debt; (2) its oversight of our executive officers, our advisor and our sub-advisor; (3) its review and approval of all transactions with affiliated parties; (4) its review and discussion of regular periodic reports to the board of directors and its committees, including management reports on property operating data, compliance with debt covenants, actual and projected financial results, compliance with requirements set forth in our charter, and various other matters relating to our business; and (5) regular periodic reports from our independent public accounting firm to the Audit Committee regarding various areas of potential risk, including, among others, those relating to our qualification as a REIT for tax purposes.

Executive Officers and Directors

We have provided below certain information about our executive officers and directors. All of our directors have terms expiring on the date of the 2015 annual meeting, and all of our directors have been nominated to be re-elected to serve until the 2016 annual meeting and until their successors are elected and qualified.

| Name | | Position(s) | | Age* | | Year First Became a Director |

| Jeffrey S. Edison | | Chairman of the Board of Directors and Chief Executive Officer | | 54 | | 2013 |

| John B. Bessey | | Co-President and Chief Investment Officer | | 57 | | N/A |

| R. Mark Addy | | Co-President and Chief Operating Officer | | 53 | | N/A |

| Devin I. Murphy | | Chief Financial Officer, Treasurer and Secretary | | 55 | | N/A |

| Jennifer L. Robison | | Chief Accounting Officer | | 38 | | N/A |

| C. Ann Chao | | Independent Director | | 54 | | 2013 |

| David W. Garrison | | Independent Director | | 59 | | 2013 |

| Mark D. McDade | | Independent Director | | 59 | | 2013 |

| Paul J. Massey, Jr. | | Independent Director | | 55 | | 2014 |

* As of the date of this filing

Jeffrey S. Edison – (Chairman of our board of directors and Chief Executive Officer) Mr. Edison has been chairman of our board of directors and our chief executive officer since August 2013. Mr. Edison has served as chairman or co-chairman of the board of directors and chief executive officer of Phillips Edison Grocery Center REIT I, Inc. (“PEGCR I”) since December 2009. Mr. Edison, together with Michael C. Phillips, founded Phillips Edison in 1991 and has served as a principal of Phillips Edison since 1995. From 1991 to 1995, Mr. Edison was employed by Nations Bank’s South Charles Realty Corporation, serving as a senior vice president from 1993 until 1995 and as a vice president from 1991 until 1993. Mr. Edison was employed by Morgan Stanley Realty Incorporated from 1987 until 1990 and The Taubman Company from 1984 until 1987. Mr. Edison received his bachelor’s degree in mathematics and economics from Colgate University in 1982 and a master’s degree in business administration from Harvard Business School in 1984.

Among the most important factors that led to our board of directors’ recommendation that Mr. Edison serve as our director are Mr. Edison’s leadership skills, integrity, judgment, knowledge of our company and our sub-advisor, his prior experience as a director and chief executive officer of PEGRC I and his commercial real estate expertise.

John B. Bessey – (Co-President and Chief Investment Officer) Mr. Bessey has served as our co-president and chief investment officer since August 2013. Mr. Bessey has served as the co-president and chief investment officer of PEGCR I since April 2013, before which he served as president beginning in December 2009. Mr. Bessey has also served as the president of the PEGCR I advisor from December 2009 to October 2010, as the chief investment officer from October 2010 to April 2013, and as co-president since April 2013. Mr. Bessey served as chief investment officer for Phillips Edison from 2005 to December 2009. During that time he managed the placement of over $1.2 billion in 140 individual shopping centers comprising over 14,000,000 square feet. Prior to that, he served Phillips Edison as vice president of development from May 1999, starting the ground up development program for the company. During that time he completed over 25 projects, which included Walgreens, Target, Kroger, Winn Dixie, Safeway and Wal-Mart. Prior to joining Phillips Edison, Mr. Bessey was employed by Kimco Realty Corporation as a director of leasing from 1995, by Koll Management Services as director of retail leasing and development from 1991 and by Tipton Associates as leasing manager from 1988. Prior to entering retail real estate in 1988, Mr. Bessey worked in the hospitality industry as a convention sales director for the Cincinnati Convention and Visitors Bureau and for Hyatt Hotels in a number of sales management positions in Minneapolis and Cincinnati. Mr. Bessey received his bachelor’s degree in hotel and restaurant management from the University of Wisconsin – Stout in 1981.

R. Mark Addy – (Co-President and Chief Operating Officer) Mr. Addy has served as our co-president and chief operating officer since August 2013. Mr. Addy has served as the co-president of PEGRC I since April 2013 and as the chief operating officer of PEGCR I since October 2010. Mr. Addy has also served as the president of the PEGCR I advisor from October 2010 to April 2013 and as co-president since April 2013. Mr. Addy served as chief operating officer for Phillips Edison from 2004 to October 2010. He served Phillips Edison as senior vice president from 2002 until 2004, when he became chief operating officer. Mr. Addy was the top executive in the Cincinnati, Ohio headquarters, responsible for implementing the company’s growth strategy. Prior to joining Phillips Edison, Mr. Addy practiced law with Santen & Hughes in the areas of commercial real estate, financing and leasing, mergers and acquisitions, and general corporate law from 1987 until 2002. Mr. Addy was the youngest law partner in the 50 year history of Santen & Hughes, and served as president of Santen & Hughes from 1996 through 2002. While at Santen & Hughes, he represented Phillips Edison from its inception in 1991 to 2002. Mr. Addy received his bachelor’s degree in environmental science and chemistry in 1984 from Bowling Green State University, where he received the President’s Award for academic achievement and was a member of the Order of the Omega leadership honor society. Mr. Addy received his law degree from the University of Toledo, where he was a member of the Order of the Barristers.

Devin I. Murphy– (Chief Financial Officer, Treasurer and Secretary) Mr. Murphy has served as our chief financial officer, treasurer and secretary since August 2013. Mr. Murphy has served as the chief financial officer, treasurer and secretary of PEGCR I since June 2013. He previously served as vice chairman of investment banking at Morgan Stanley from November 2009 to June 2013. He began his real estate career in 1986 when he joined the real estate group at Morgan Stanley as an associate. Prior to rejoining Morgan Stanley in June 2009, Mr. Murphy was a managing partner of Coventry Real Estate Advisors, or Coventry, a real estate private equity firm founded in 1998 which sponsors a series of institutional investment funds that acquire and develop retail properties. Since its inception, Coventry has invested over $2.5 billion in retail assets. Prior to joining Coventry in March 2008, Mr. Murphy served as global head of real estate investment banking for Deutsche Bank Securities, Inc. from February 2004 until November 2007. At Deutsche Bank, Mr. Murphy ran a team of over 100 professionals located in eight offices in the U.S., Europe, and Asia. Mr. Murphy’s Deutsche Bank team was recognized as an industry leader and under his management executed over 500 separate transactions on behalf of clients representing total transaction volume exceeding $400 billion. Prior to joining Deutsche Bank, Mr. Murphy was with Morgan Stanley for 15 years. He held a number of senior positions at Morgan Stanley including co-head of U.S. real estate investment banking and head of the private capital markets group, or PCM. PCM is the team at Morgan Stanley responsible for raising equity capital for Morgan Stanley’s real estate private equity funds as well as private equity capital on behalf of clients. During the time that Mr. Murphy ran PCM, the team raised in excess of $5 billion of equity capital. Mr. Murphy served on the investment committee of the Morgan Stanley Real Estate Funds from 1994 until his departure in 2004. During his tenure on the investment committee, the Morgan Stanley Real Estate Funds invested over $6.5 billion of equity capital globally in transactions with a total transaction value in excess of $35 billion. Mr. Murphy has served as an advisory director for Hawkeye Partners, a real estate private equity firm headquartered in Austin, Texas, since March 2005 and for Trigate Capital, a real estate private equity firm headquartered in Dallas, Texas, since September 2007. Mr. Murphy is a member of the Urban Land Institute, the Pension Real Estate Association and the National Association of Real Estate Investment Trusts (“NAREIT”). He received a bachelor of arts with honors from the College of William and Mary and a master of business administration from the University of Michigan.

Jennifer L. Robison – (Chief Accounting Officer) Ms. Robison has served as our chief accounting officer since March 2015. Ms. Robison has also served as the chief accounting officer of PEGCR I since March 2015. Ms. Robison has served as the senior vice president and chief accounting officer of Phillips Edison & Company since July 2014. She previously served as vice president, financial reporting at Ventas, Inc., an S&P 500 company and one of the 10 largest equity REITs in the country, from February 2005 to July 2014. Prior to her time at Ventas, Ms. Robison served as an audit manager at Mountjoy Chilton Medley LLP from September 2003 to February 2005. Ms. Robison began her career at Ernst & Young LLP, serving most recently as assurance manager, and was an employee there from February 1996 to September 2003. She received a bachelor of arts in accounting from Bellarmine University, where she graduated magna cum laude. Ms. Robison is a certified public accountant and a member of the AICPA, NAREIT and the SEC Professional Group.

C. Ann Chao– (Independent Director) Ms. Chao has served as one of our directors since September 2013. Ms. Chao is a former investment banker and financial analyst. From September 2003 to June 2012, Ms. Chao served in various volunteer and professional capacities at the United Nations International School in New York, including as co-chair of its capital campaign. From 1992 to 1997, she was with Goldman Sachs in New York, most recently as a vice president in its public finance group where she specialized in corporate tax-exempt debt underwriting. From 1986 to 1990, she was an equity research analyst and broker with Jardine Fleming (now part of JPMorgan Chase) and affiliates, based in Hong Kong and New York. Ms. Chao is a former board member of TADA!, a philanthropic musical theater organization for children, and is a current board member of The Diller-Quaile School of Music in New York. She received a bachelor of arts in economics from Colgate University in 1982 and a master’s degree in public policy from Harvard University in 1992.

Among the most important factors that led to the board of directors’ recommendation that Ms. Chao serve as our director are Ms. Chao’s integrity, judgment, leadership skills, accounting and financial management expertise and independence from management, our sponsor and their affiliates.

David W. Garrison– (Independent Director) Mr. Garrison has served as one of our directors since September 2013. Mr. Garrison is currently chief navigator of Garrison Growth, an international consulting services firm. From October 2002 to June 2013, Mr. Garrison served as chief executive officer and director of iBahn Corp. (formerly STSN), a provider of broadband services for hotels. On September 6, 2013, iBahn Corp. filed for bankruptcy protection under the provisions of Chapter 11 of the United States Bankruptcy Code for the District of Delaware. Such action was dismissed by the court on February 3, 2015. From 2000 to 2001, Mr. Garrison was chairman and chief executive officer of Verestar, a satellite services company, where he also served on the board of Verestar's parent company, American Tower. From 1995 to 1998, Mr. Garrison was chairman and chief executive officer of Netcom, a pioneer Internet service provider. From January 2003 to July 2013, Mr. Garrison served as a director of SonicWall, Inc., where at various times he served on the Audit Committee, the Compensation Committee (Chair) and the Corporate Governance and Nominations Committee. From 1997 to 2002, Mr. Garrison served as an independent director of Ameritrade, the first online trading company, and he was also the chair of the compensation committee and lead independent director at different times. Mr. Garrison holds a bachelor of science degree from Syracuse University and a master of business administration degree from Harvard University.

Among the most important factors that led to the board of directors’ recommendation that Mr. Garrison serve as our director are Mr. Garrison’s integrity, judgment, leadership skills, commercial business experience, public company director experience and independence from management, our sponsors and their affiliates.

Mark D. McDade– (Independent Director) Mr. McDade has served as one of our directors since September 2013. Mr. McDade has served as executive vice president of Established Brands, Solutions and Supply for UCB since February 2013. He also currently serves as chief operating officer of UCB, SA, located in Brussels, Belgium. From April 2008 to February 2013, Mr. McDade served as executive vice president of Global Operations for UCB. From 2002 until late 2007, Mr. McDade served as chief executive officer and a director of PDL Biopharma Inc., an antibody-based biopharmaceutical company located in Redwood City, California. Prior to 2002, he served as chief executive officer of Signature Bioscience Inc., located in San Francisco, California. Mr. McDade was founder and a director of Corixa Corporation, where he served as chief operating officer from September 1994 to December 1998 and as president and chief operating officer from January 1999 until his departure in late 2000 to join Signature Bioscience Inc. Before Corixa Corporation, Mr. McDade was chief operating officer of Boehringer Mannheim Therapeutics, the bio-pharmaceutical division of Corange Ltd., and prior to that he held several positions at Sandoz Ltd., including in business development, product management and general management. Mr. McDade received his bachelor of arts degree from Dartmouth College and his master of business administration degree from Harvard Business School.

Among the most important factors that led to the board of directors’ recommendation that Mr. McDade serve as our director are Mr. McDade’s integrity, judgment, leadership skills, commercial business experience, public company director experience, and independence from management and our sponsors and their affiliates.