Third Quarter 2018 Results Presentation Tuesday, November 6, 2018

Agenda Prepared Remarks R. Mark Addy - President and COO • Intro & Portfolio Update Jeff Edison - Chairman and CEO • PECO and REIT II Merger Devin Murphy - CFO • Financial Results R. Mark Addy - President and COO • Share Repurchase Program Question and Answer Session www.grocerycenterREIT2.com/investors 2

Forward-Looking Statement Disclosure This presentation may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements include, but are not limited to, statements related to the anticipated benefits of the business combination transaction involving Phillips Edison & Company, Inc. (“PECO”) and Phillips Edison Grocery Center REIT II, Inc. (“REIT II” or the “Company”), including future financial and operating results, and the combined company’s plans, objectives and expectations, related to the Company’s expectations regarding the performance of its business, its financial results, its liquidity and capital resources, the quality of the Company’s portfolio of grocery-anchored shopping centers and other non-historical statements. You can identify these forward- looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties, such as the risks that retail conditions may adversely affect our base rent and, subsequently, our income, and that our properties consist primarily of retail properties and our performance, therefore, is linked to the market for retail space generally, risk the proposed merger with PECO will not be consummated, as well as other risks that are described under the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017, Quarterly Report on Form 10-Q for the quarter ended June 30, 2018, and the joint proxy statement/prospectus filed with the SEC on August 28, 2018, as such factors may be updated from time to time in the Company’s periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation and in the Company’s filings with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise. Additional Information and Where You Can Find It This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of the federal securities laws. PECO and REIT II have filed a joint proxy statement/registration statement on Form S-4 in connection with the merger. Investors are urged to read carefully the joint proxy statement/prospectus and other relevant materials because they contain important information about the merger. Investors may obtain free copies of these documents and other documents filed by PECO or REIT II with the SEC through the website maintained by the SEC at www.sec.gov. Investors may obtain free copies of the documents filed with the SEC by PECO by going to PECO’s corporate website at www.phillipsedison.com or by directing a written request to: Phillips Edison & Company, Inc., 11501 Northlake Drive, Cincinnati, OH 45249, Attention: Investor Relations. Investors may obtain free copies of documents filed with the SEC by REIT II by going to REIT II’s corporate website at www.grocerycenterREIT2.com or by directing a written request to: Phillips Edison Grocery Center REIT II, Inc., 11501 Northlake Drive, Cincinnati, OH 45249, Attention: Investor Relations. Investors are urged to read the joint proxy statement/prospectus and the other relevant materials before making any voting decision with respect to the merger. PECO and its directors and executive officers and REIT II and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of each of PECO and REIT II in connection with the merger. Information regarding the interests of these directors and executive officers in the merger has been included in the joint proxy statement/prospectus referred to above. Additional information regarding certain of these persons and their beneficial ownership of PECO common stock is also set forth in the Definitive Proxy Statement for PECO’s 2017 Annual Meeting of Stockholders, which has been filed with the SEC. Additional information regarding certain of these persons and their beneficial ownership of REIT II’s common stock is set forth in the Definitive Proxy Statement for REIT II’s 2017 Annualwww.grocerycenterREIT2.com/investors Meeting of Stockholders, which has been filed with the SEC. 3

Q3 2018 Portfolio Highlights • 86 total properties • 23 leading grocery anchors • 24 states • 10.3 million square feet • 94.7% leased occupancy • 76.9% of rents from grocery, national and regional tenants www.grocerycenterREIT2.com/investors 4

Q3 2018 Portfolio Highlights Annualized Base Rent by Tenant Type Annualized Base Rent by Tenant Industry Top 5 Grocers by % of Annualized Base Rent # of Grocer % of ABR Locations Publix Super Markets 6.5% 18 Albertsons-Safeway 5.7% 12 Ahold Delhaize 5.1% 6 Walmart 4.6% 7 Kroger 4.4% 12 We calculate annualized base rent as monthly contractual rent as of September 30, 2018, multiplied by 12 months. www.grocerycenterREIT2.com/investors 5

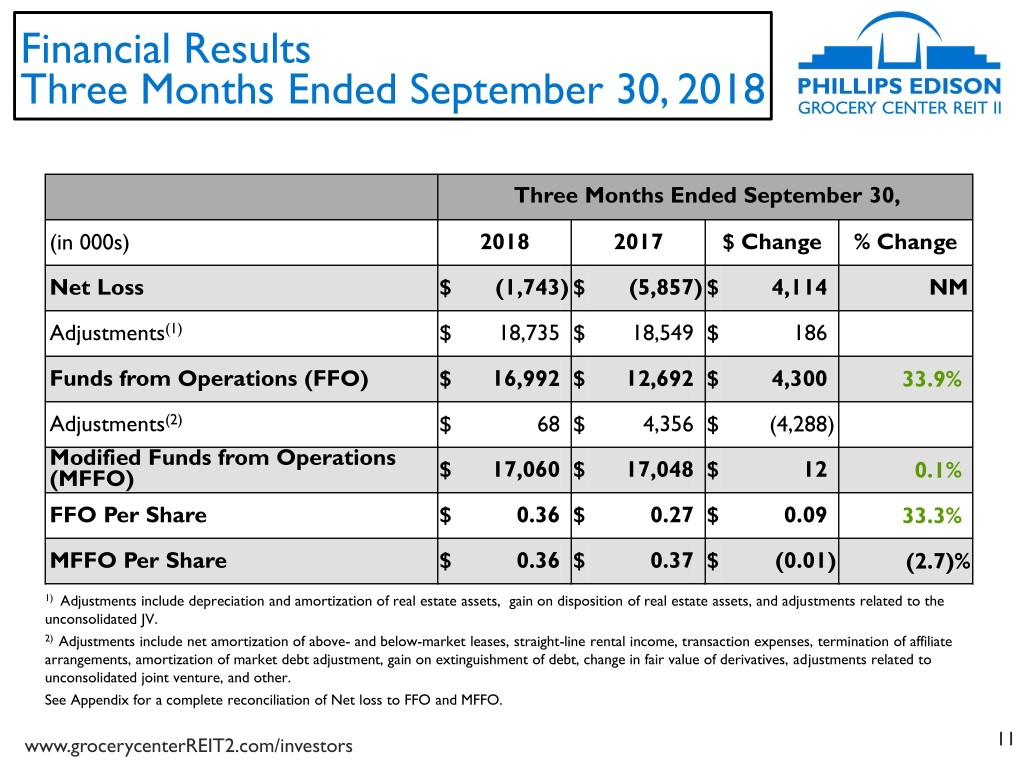

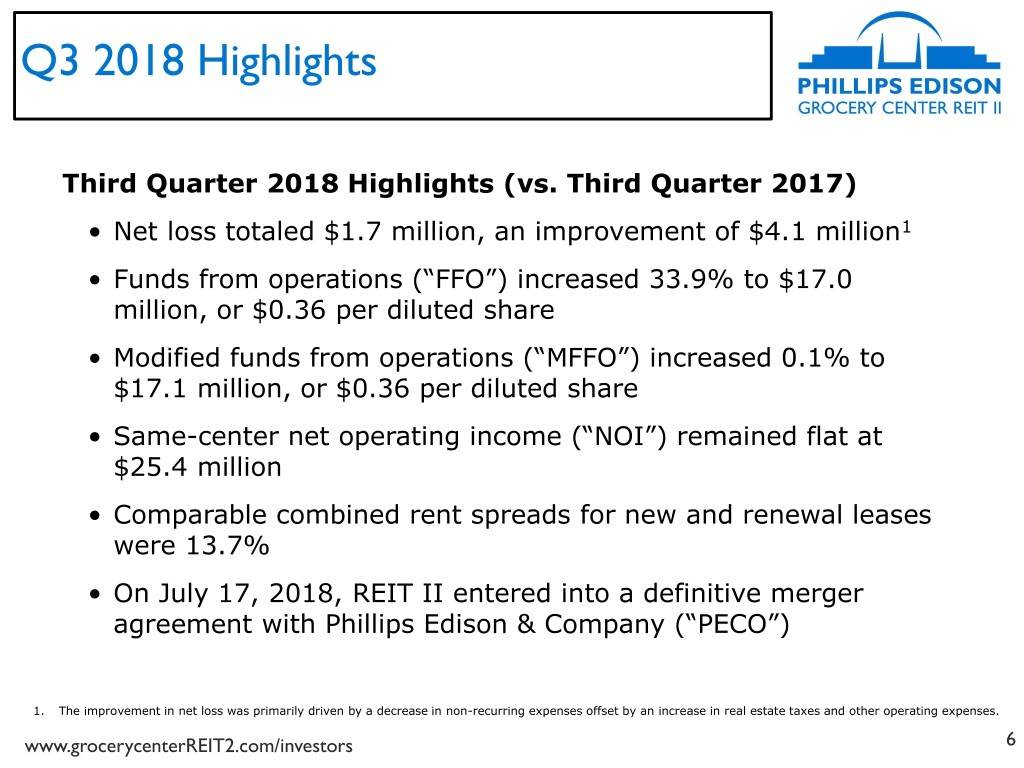

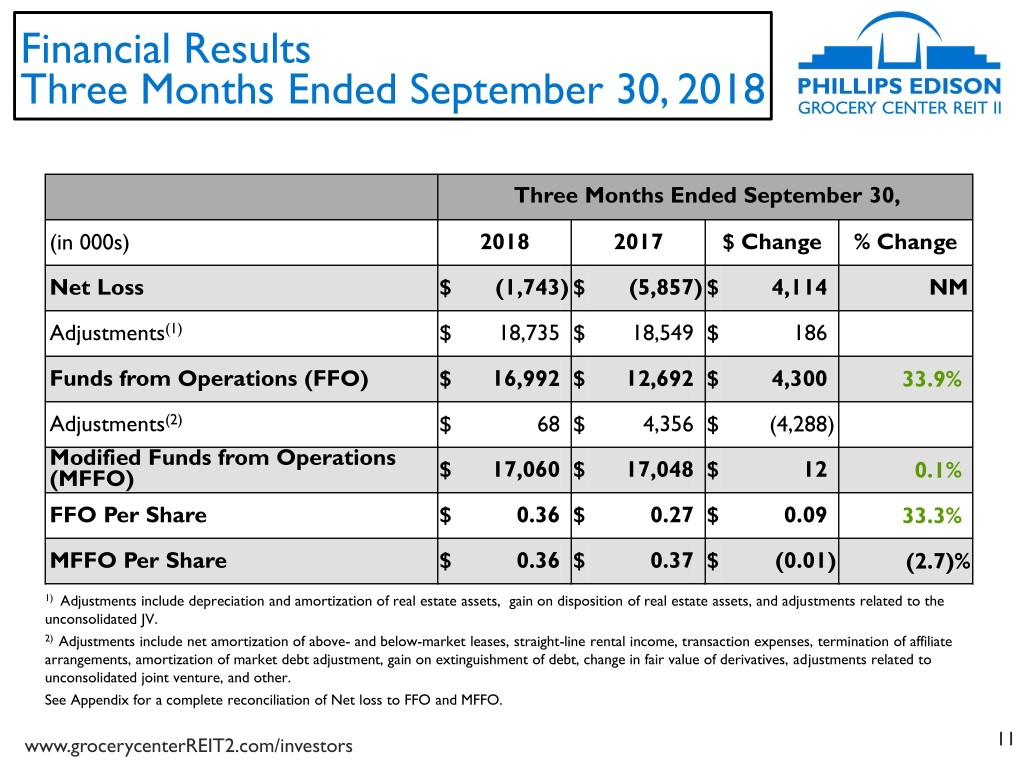

Q3 2018 Highlights Third Quarter 2018 Highlights (vs. Third Quarter 2017) • Net loss totaled $1.7 million, an improvement of $4.1 million1 • Funds from operations (“FFO”) increased 33.9% to $17.0 million, or $0.36 per diluted share • Modified funds from operations (“MFFO”) increased 0.1% to $17.1 million, or $0.36 per diluted share • Same-center net operating income (“NOI”) remained flat at $25.4 million • Comparable combined rent spreads for new and renewal leases were 13.7% • On July 17, 2018, REIT II entered into a definitive merger agreement with Phillips Edison & Company (“PECO”) 1. The improvement in net loss was primarily driven by a decrease in non-recurring expenses offset by an increase in real estate taxes and other operating expenses. www.grocerycenterREIT2.com/investors 6

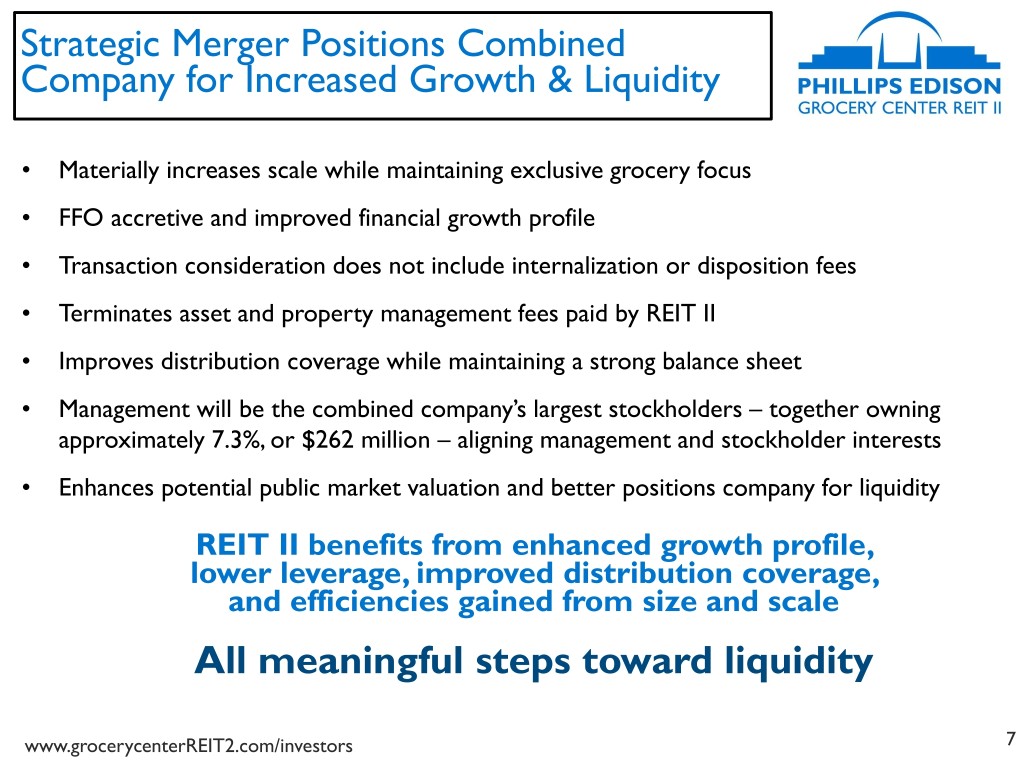

Strategic Merger Positions Combined Company for Increased Growth & Liquidity • Materially increases scale while maintaining exclusive grocery focus • FFO accretive and improved financial growth profile • Transaction consideration does not include internalization or disposition fees • Terminates asset and property management fees paid by REIT II • Improves distribution coverage while maintaining a strong balance sheet • Management will be the combined company’s largest stockholders – together owning approximately 7.3%, or $262 million – aligning management and stockholder interests • Enhances potential public market valuation and better positions company for liquidity REIT II benefits from enhanced growth profile, lower leverage, improved distribution coverage, and efficiencies gained from size and scale All meaningful steps toward liquidity www.grocerycenterREIT2.com/investors 7

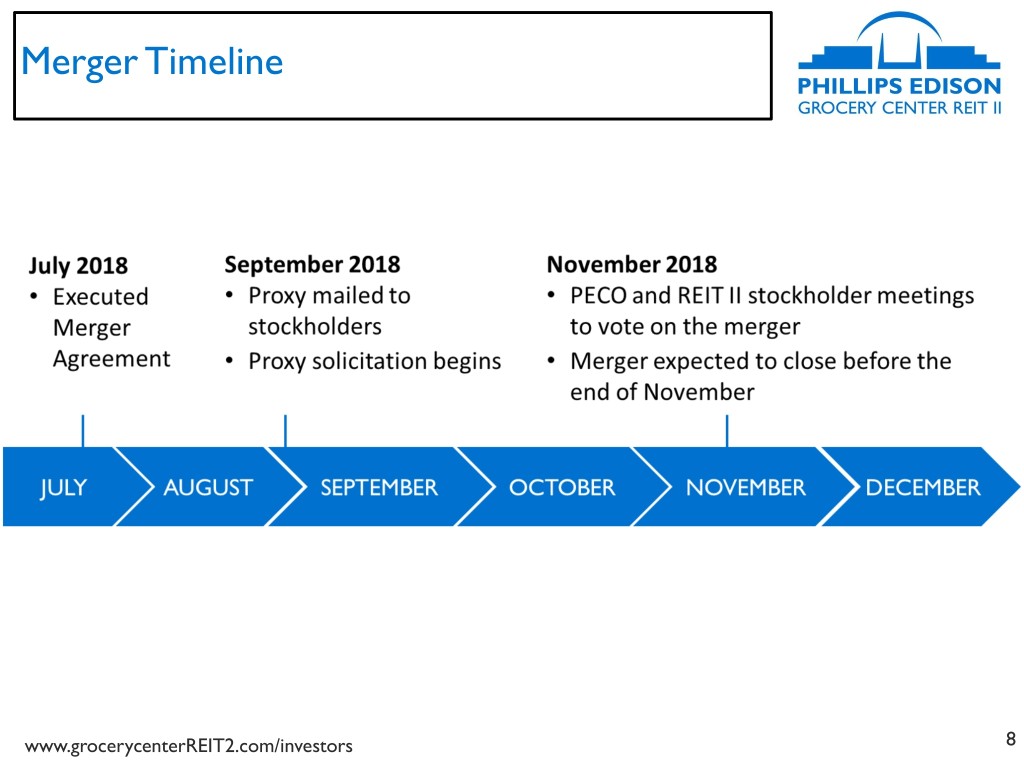

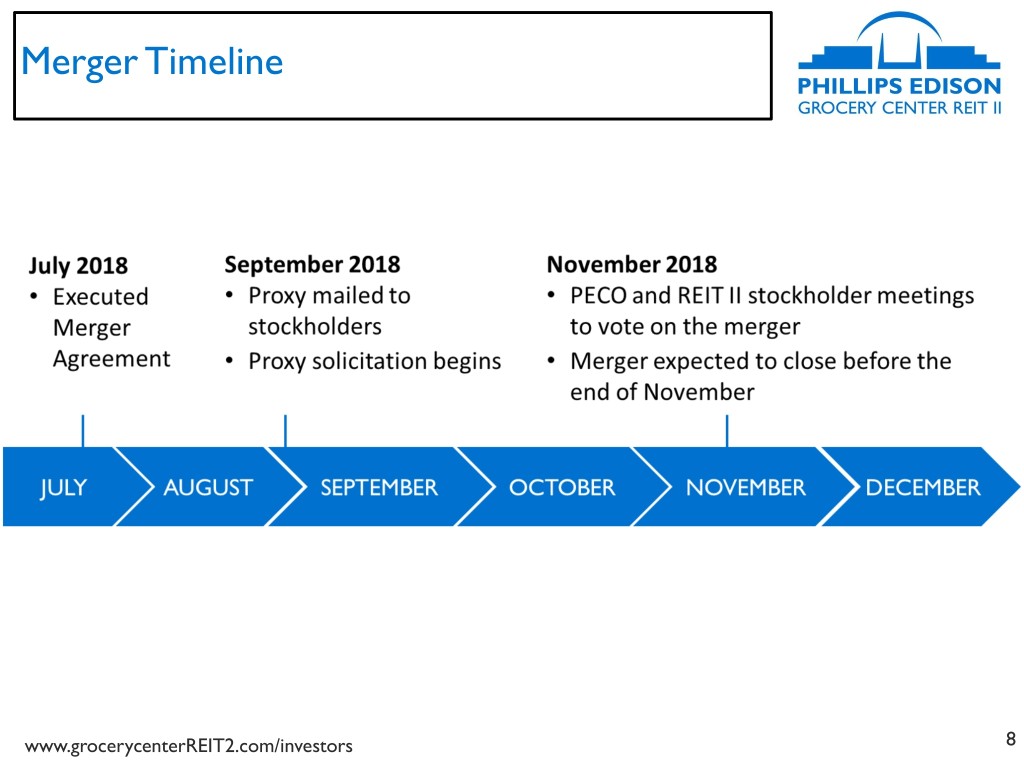

Merger Timeline www.grocerycenterREIT2.com/investors 8

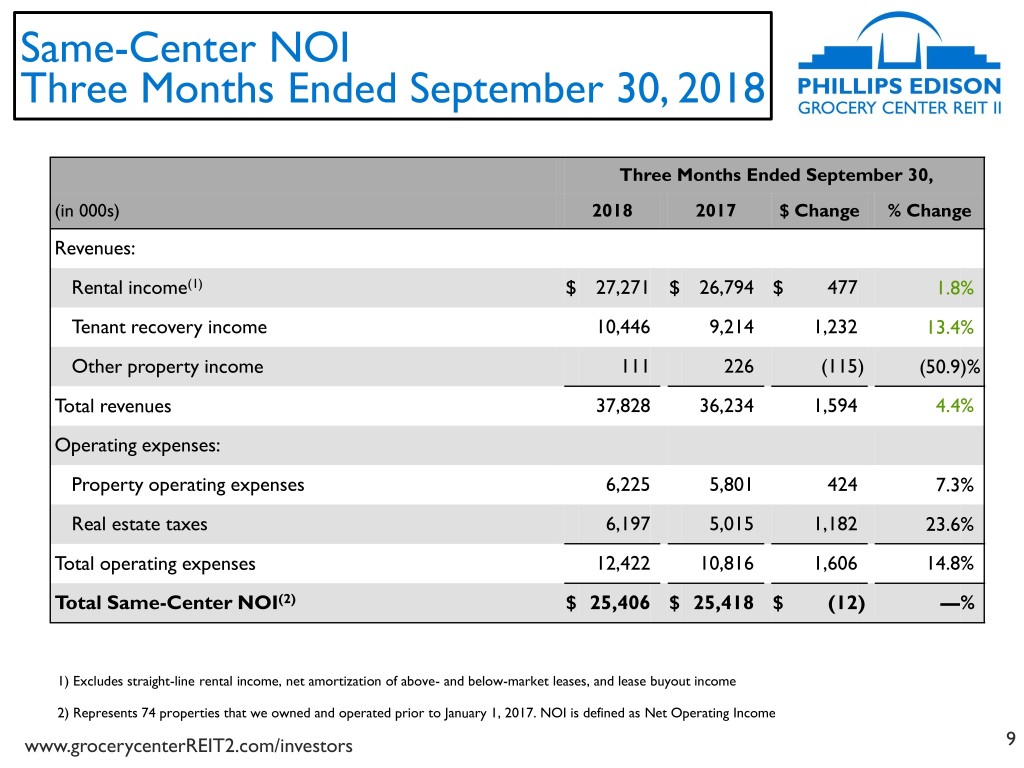

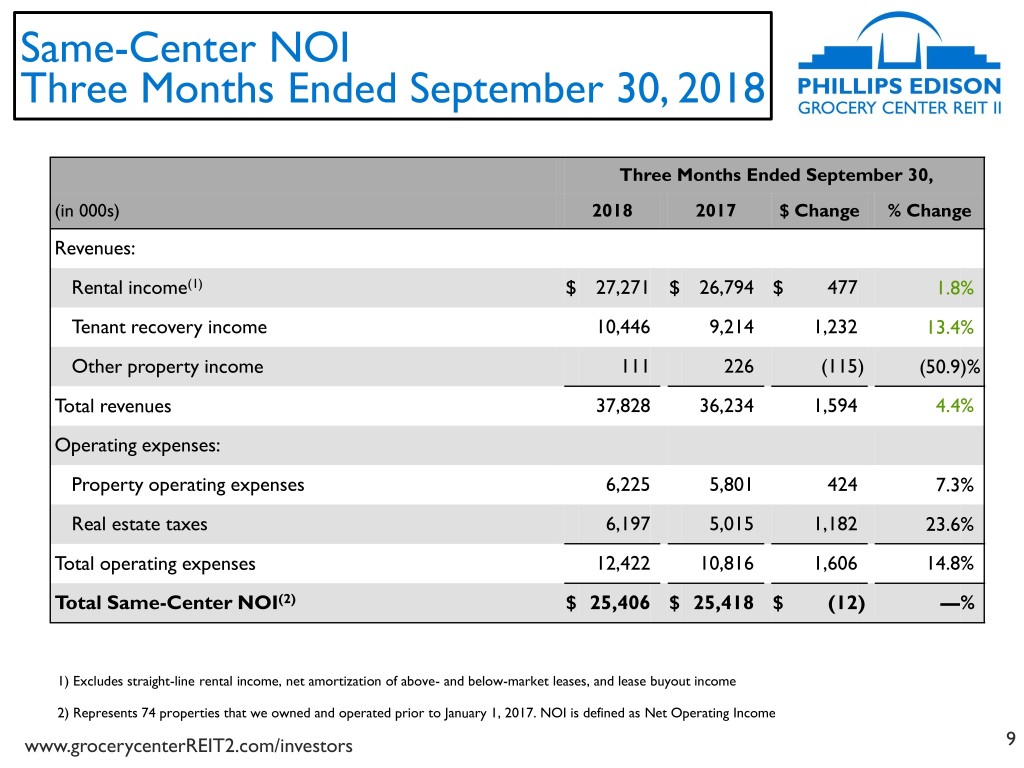

Same-Center NOI Three Months Ended September 30, 2018 Three Months Ended September 30, (in 000s) 2018 2017 $ Change % Change Revenues: Rental income(1) $ 27,271 $ 26,794 $ 477 1.8% Tenant recovery income 10,446 9,214 1,232 13.4% Other property income 111 226 (115) (50.9)% Total revenues 37,828 36,234 1,594 4.4% Operating expenses: Property operating expenses 6,225 5,801 424 7.3% Real estate taxes 6,197 5,015 1,182 23.6% Total operating expenses 12,422 10,816 1,606 14.8% Total Same-Center NOI(2) $ 25,406 $ 25,418 $ (12) —% 1) Excludes straight-line rental income, net amortization of above- and below-market leases, and lease buyout income 2) Represents 74 properties that we owned and operated prior to January 1, 2017. NOI is defined as Net Operating Income www.grocerycenterREIT2.com/investors 9

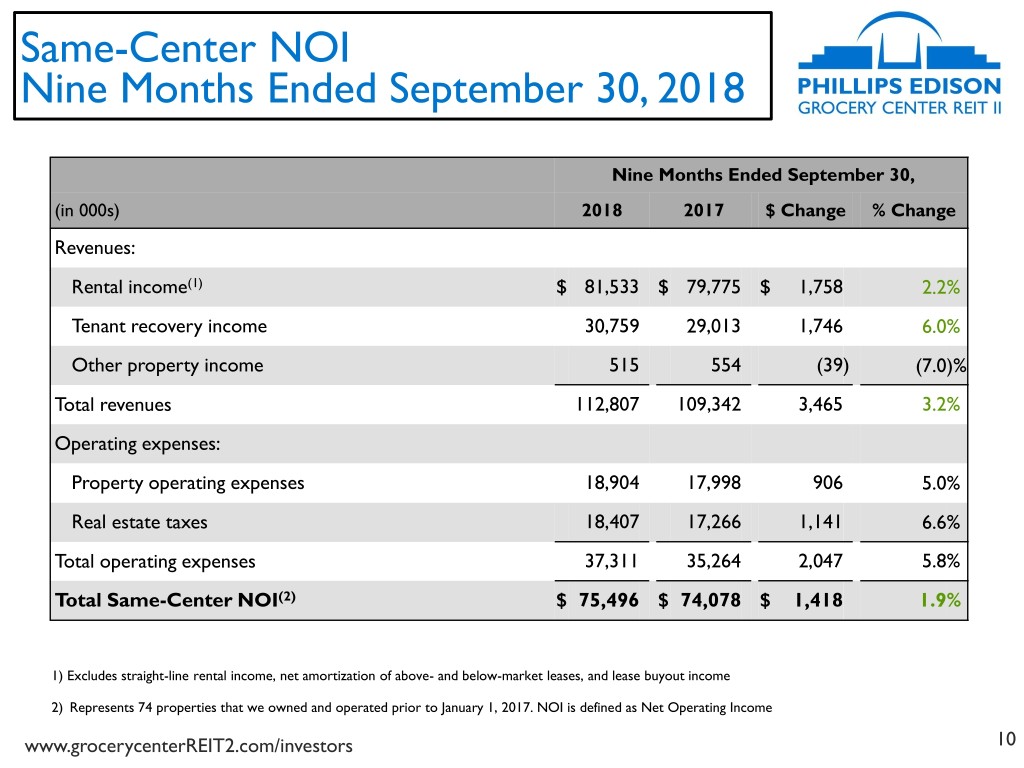

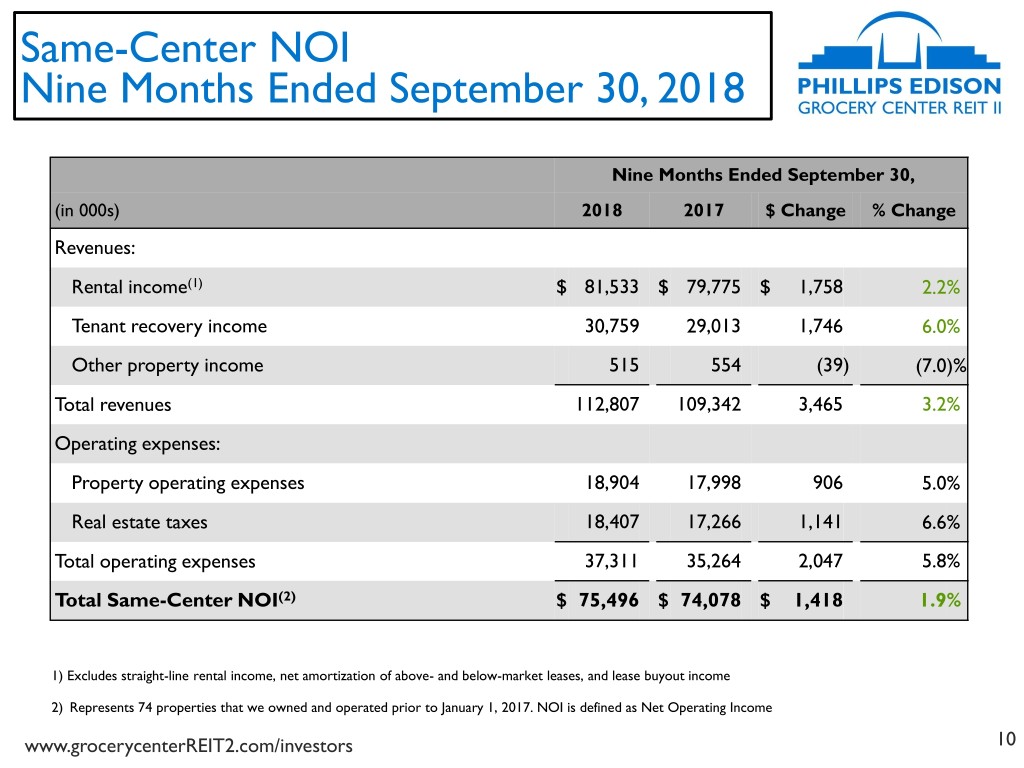

Same-Center NOI Nine Months Ended September 30, 2018 Nine Months Ended September 30, (in 000s) 2018 2017 $ Change % Change Revenues: Rental income(1) $ 81,533 $ 79,775 $ 1,758 2.2% Tenant recovery income 30,759 29,013 1,746 6.0% Other property income 515 554 (39) (7.0)% Total revenues 112,807 109,342 3,465 3.2% Operating expenses: Property operating expenses 18,904 17,998 906 5.0% Real estate taxes 18,407 17,266 1,141 6.6% Total operating expenses 37,311 35,264 2,047 5.8% Total Same-Center NOI(2) $ 75,496 $ 74,078 $ 1,418 1.9% 1) Excludes straight-line rental income, net amortization of above- and below-market leases, and lease buyout income 2) Represents 74 properties that we owned and operated prior to January 1, 2017. NOI is defined as Net Operating Income www.grocerycenterREIT2.com/investors 10

Financial Results Three Months Ended September 30, 2018 Three Months Ended September 30, (in 000s) 2018 2017 $ Change % Change Net Loss $ (1,743) $ (5,857) $ 4,114 NM Adjustments(1) $ 18,735 $ 18,549 $ 186 Funds from Operations (FFO) $ 16,992 $ 12,692 $ 4,300 33.9% Adjustments(2) $ 68 $ 4,356 $ (4,288) Modified Funds from Operations (MFFO) $ 17,060 $ 17,048 $ 12 0.1% FFO Per Share $ 0.36 $ 0.27 $ 0.09 33.3% MFFO Per Share $ 0.36 $ 0.37 $ (0.01) (2.7)% 1) Adjustments include depreciation and amortization of real estate assets, gain on disposition of real estate assets, and adjustments related to the unconsolidated JV. 2) Adjustments include net amortization of above- and below-market leases, straight-line rental income, transaction expenses, termination of affiliate arrangements, amortization of market debt adjustment, gain on extinguishment of debt, change in fair value of derivatives, adjustments related to unconsolidated joint venture, and other. See Appendix for a complete reconciliation of Net loss to FFO and MFFO. www.grocerycenterREIT2.com/investors 11

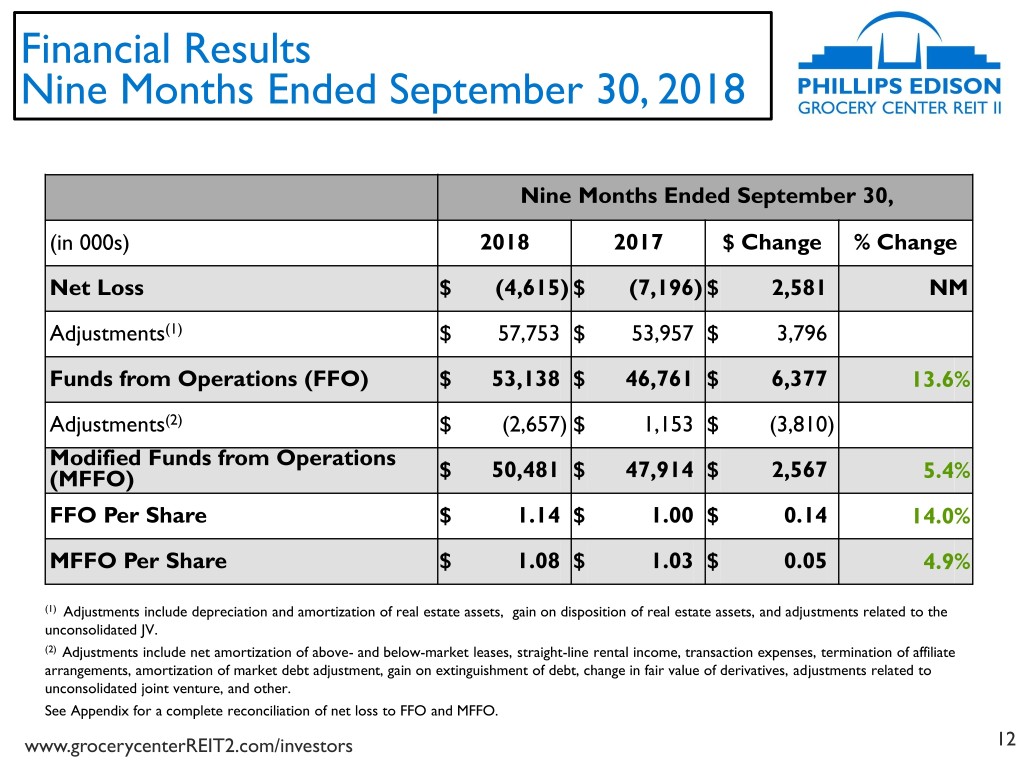

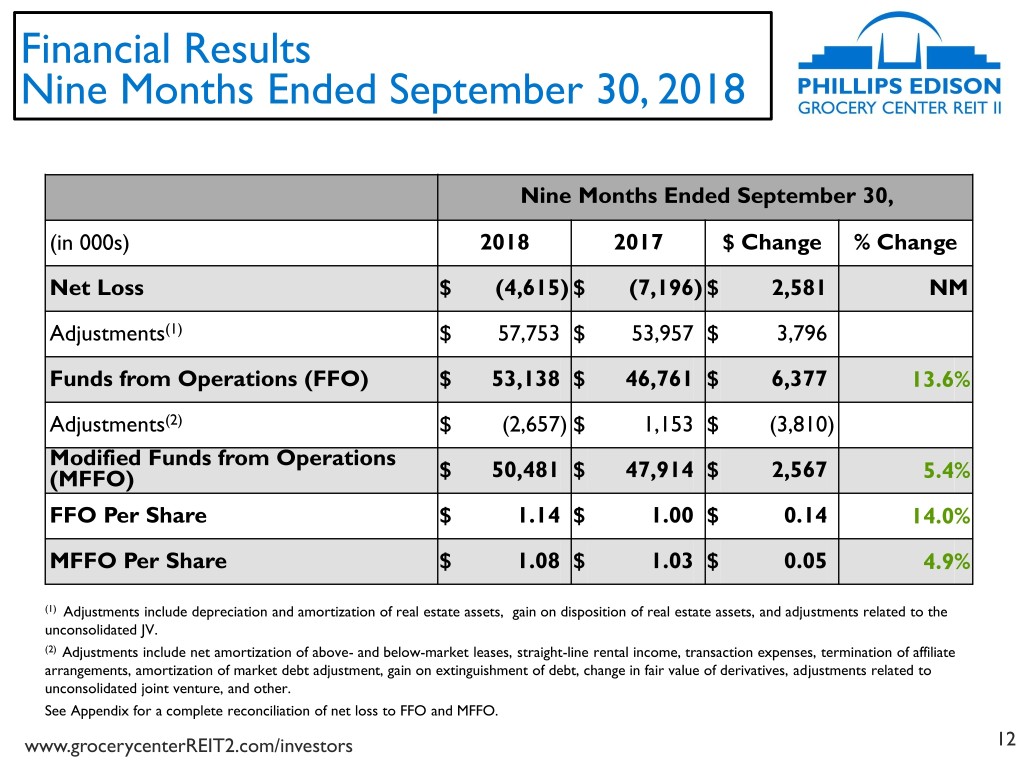

Financial Results Nine Months Ended September 30, 2018 Nine Months Ended September 30, (in 000s) 2018 2017 $ Change % Change Net Loss $ (4,615) $ (7,196) $ 2,581 NM Adjustments(1) $ 57,753 $ 53,957 $ 3,796 Funds from Operations (FFO) $ 53,138 $ 46,761 $ 6,377 13.6% Adjustments(2) $ (2,657) $ 1,153 $ (3,810) Modified Funds from Operations (MFFO) $ 50,481 $ 47,914 $ 2,567 5.4% FFO Per Share $ 1.14 $ 1.00 $ 0.14 14.0% MFFO Per Share $ 1.08 $ 1.03 $ 0.05 4.9% (1) Adjustments include depreciation and amortization of real estate assets, gain on disposition of real estate assets, and adjustments related to the unconsolidated JV. (2) Adjustments include net amortization of above- and below-market leases, straight-line rental income, transaction expenses, termination of affiliate arrangements, amortization of market debt adjustment, gain on extinguishment of debt, change in fair value of derivatives, adjustments related to unconsolidated joint venture, and other. See Appendix for a complete reconciliation of net loss to FFO and MFFO. www.grocerycenterREIT2.com/investors 12

Q3 2018 Debt Profile & Maturity Ladder September 30, 2018 Net Debt to Total Enterprise Value* 43.2% Weighted-Average Interest Rate 3.4% Weighted-Average Years to Maturity 2.7 Fixed-Rate Debt 84.9% Variable-Rate Debt 15.1% www.grocerycenterREIT2.com/investors *See Appendix for a complete calculation of net debt to enterprise value 13

Share Repurchase Program (“SRP”) • REIT II repurchased 293,000 shares totaling $6.7 million during the third quarter of 2018 • At the closing of the proposed merger, the combined company will be required to reset its share repurchase queue. As a result, all repurchase requests currently on file will be terminated on the date of the merger, which is expected to happen later this month. • Investors that wish to continue their participation in the SRP must submit a new share repurchase request with DST to be included in the next standard repurchase, which is expected to be in July 2019. • New SRP forms must be submitted after the date the merger closes to be considered in good order. If the demand for standard redemptions exceeds the funding available for repurchases at the time of the next standard repurchase, then the combined company is expected to make pro-rata redemptions. • Following the first standard repurchase after the merger closes, requests that are on file and in good order, that have not been fully executed (due to pro-rata redemptions), will remain on file for future redemptions. New paperwork will not be required. www.grocerycenterREIT2.com/investors 14

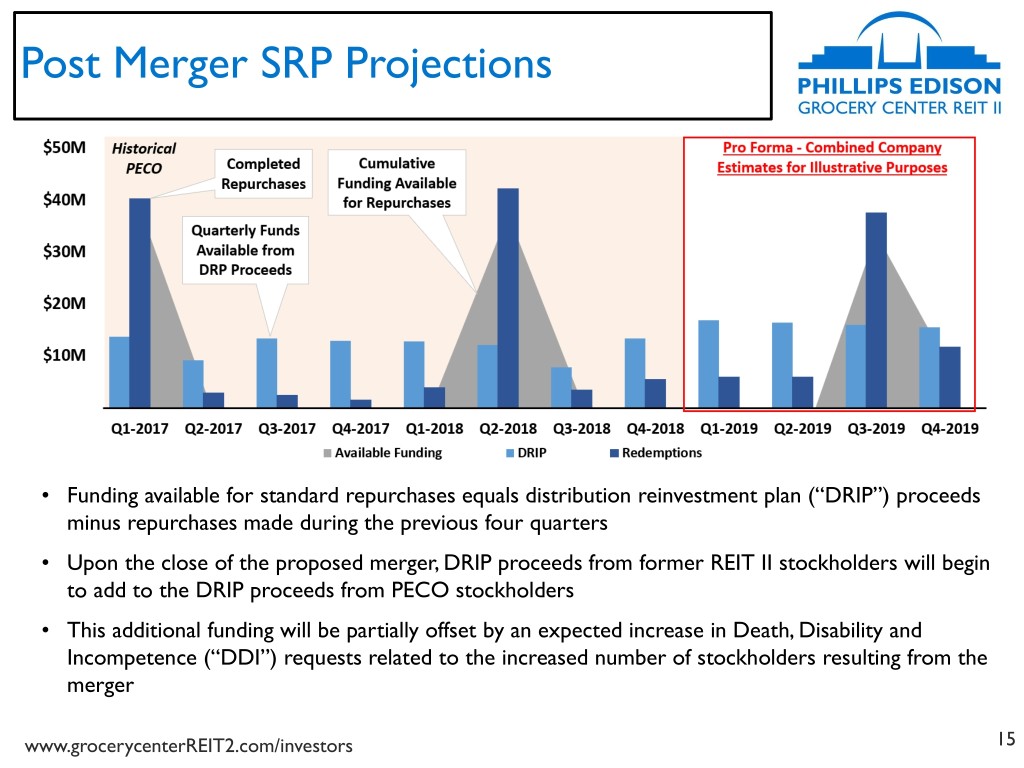

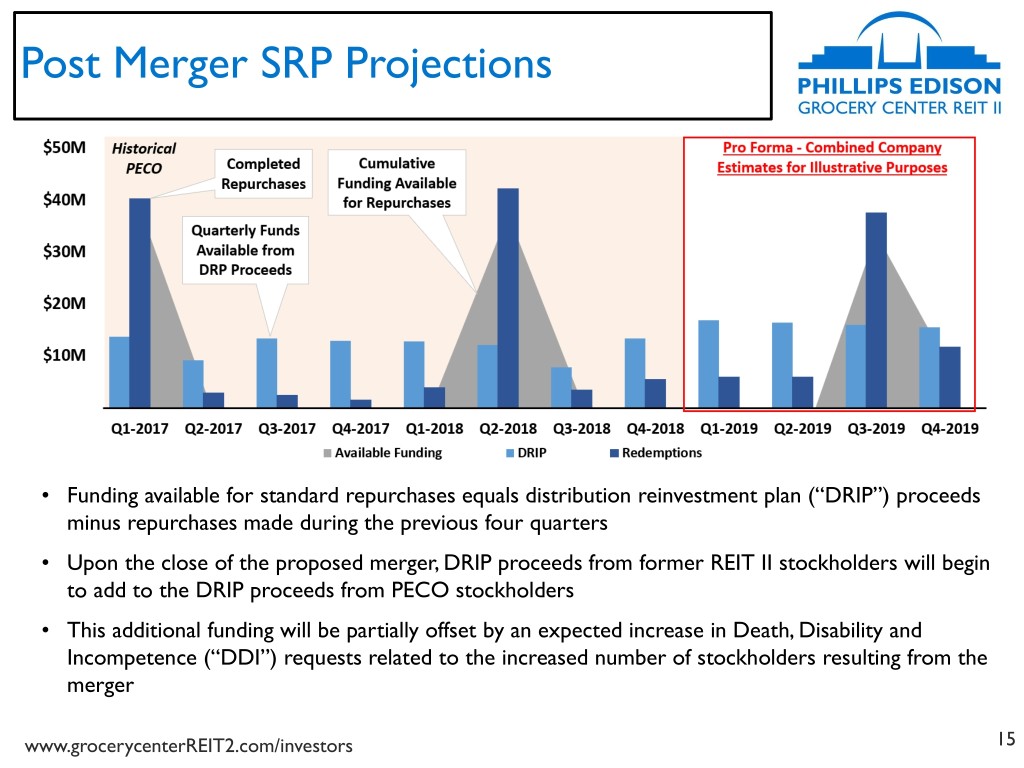

Post Merger SRP Projections • Funding available for standard repurchases equals distribution reinvestment plan (“DRIP”) proceeds minus repurchases made during the previous four quarters • Upon the close of the proposed merger, DRIP proceeds from former REIT II stockholders will begin to add to the DRIP proceeds from PECO stockholders • This additional funding will be partially offset by an expected increase in Death, Disability and Incompetence (“DDI”) requests related to the increased number of stockholders resulting from the merger www.grocerycenterREIT2.com/investors 15

Key Takeaways • REIT II’s merger with PECO will create an internally-managed portfolio of approximately 320 grocery-anchored shopping centers with a total enterprise value of approximately $6.3 billion that is well positioned for long-term growth • Management will be the combined company’s largest shareholder – owning approximately 7.3%, or $262 million – aligning management and stockholder interests • The merger with PECO is a positive step toward successfully completing a full-cycle liquidity event at an attractive price www.grocerycenterREIT2.com/investors 16

Question and Answer Session If you are logged in to the webcast presentation, you can submit a question by typing it into the text box, and clicking submit. www.grocerycenterREIT2.com/investors 17

For More Information: InvestorRelations@PhillipsEdison.com www.grocerycenterREIT2.com/investors DST: (888) 518-8073 Griffin Capital Securities: (866) 788-8614

Appendix

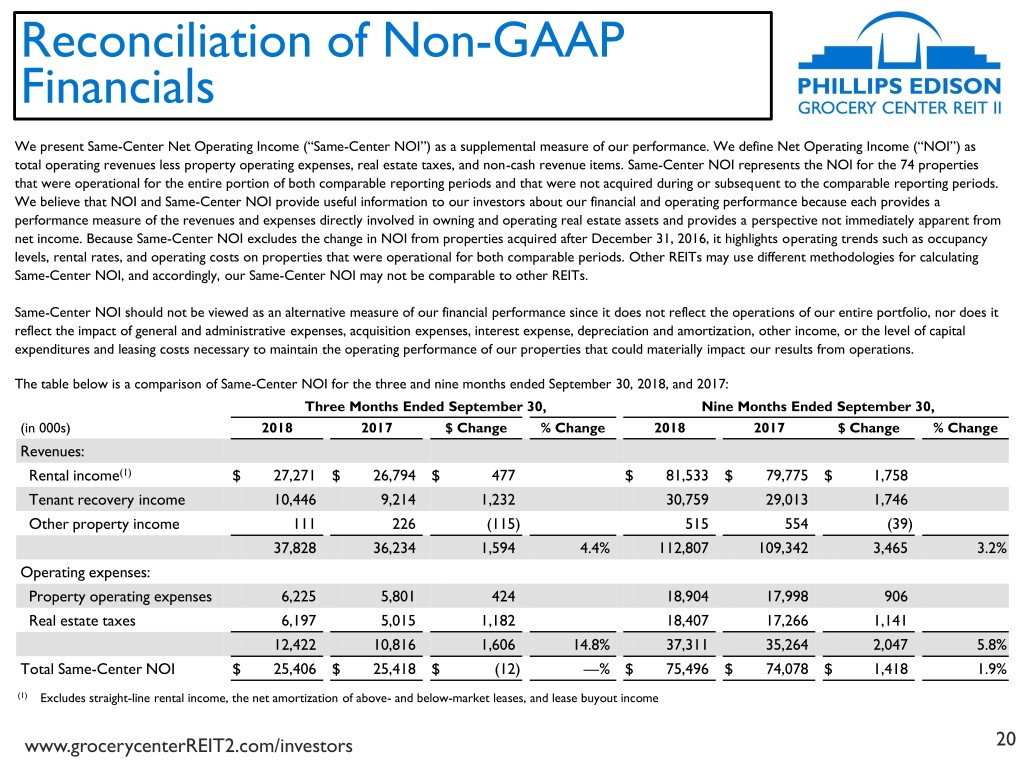

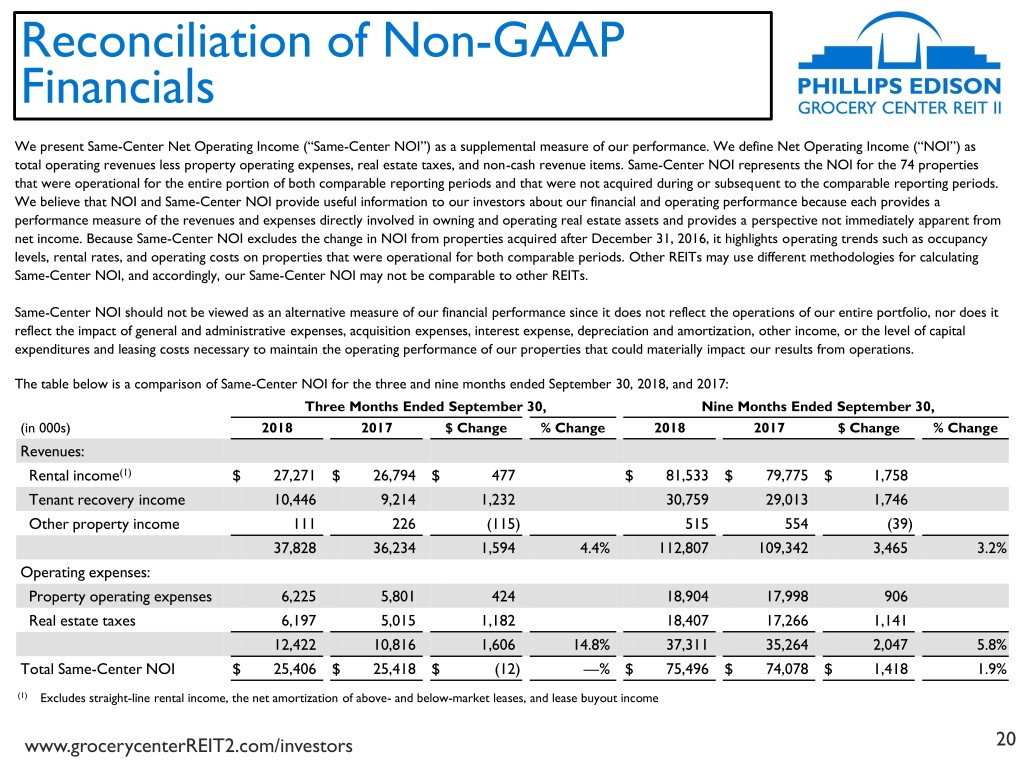

Reconciliation of Non-GAAP Financials We present Same-Center Net Operating Income (“Same-Center NOI”) as a supplemental measure of our performance. We define Net Operating Income (“NOI”) as total operating revenues less property operating expenses, real estate taxes, and non-cash revenue items. Same-Center NOI represents the NOI for the 74 properties that were operational for the entire portion of both comparable reporting periods and that were not acquired during or subsequent to the comparable reporting periods. We believe that NOI and Same-Center NOI provide useful information to our investors about our financial and operating performance because each provides a performance measure of the revenues and expenses directly involved in owning and operating real estate assets and provides a perspective not immediately apparent from net income. Because Same-Center NOI excludes the change in NOI from properties acquired after December 31, 2016, it highlights operating trends such as occupancy levels, rental rates, and operating costs on properties that were operational for both comparable periods. Other REITs may use different methodologies for calculating Same-Center NOI, and accordingly, our Same-Center NOI may not be comparable to other REITs. Same-Center NOI should not be viewed as an alternative measure of our financial performance since it does not reflect the operations of our entire portfolio, nor does it reflect the impact of general and administrative expenses, acquisition expenses, interest expense, depreciation and amortization, other income, or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties that could materially impact our results from operations. The table below is a comparison of Same-Center NOI for the three and nine months ended September 30, 2018, and 2017: Three Months Ended September 30, Nine Months Ended September 30, (in 000s) 2018 2017 $ Change % Change 2018 2017 $ Change % Change Revenues: Rental income(1) $ 27,271 $ 26,794 $ 477 $ 81,533 $ 79,775 $ 1,758 Tenant recovery income 10,446 9,214 1,232 30,759 29,013 1,746 Other property income 111 226 (115) 515 554 (39) 37,828 36,234 1,594 4.4% 112,807 109,342 3,465 3.2% Operating expenses: Property operating expenses 6,225 5,801 424 18,904 17,998 906 Real estate taxes 6,197 5,015 1,182 18,407 17,266 1,141 12,422 10,816 1,606 14.8% 37,311 35,264 2,047 5.8% Total Same-Center NOI $ 25,406 $ 25,418 $ (12) —% $ 75,496 $ 74,078 $ 1,418 1.9% (1) Excludes straight-line rental income, the net amortization of above- and below-market leases, and lease buyout income www.grocerycenterREIT2.com/investors 20

Reconciliation of Non-GAAP Financials Below is a reconciliation of Net Loss to NOI and Same-Center NOI for the three and nine ended September 30, 2018 and 2017 (in thousands): Three Months Ended September Nine Months Ended September 30, 30, 2018 2017 2018 2017 Net loss $ (1,743) $ (5,857) $ (4,615) $ (7,196) Adjusted to exclude: Straight-line rental income (619) (771) (1,938) (2,261) Net amortization of above- and below-market leases (606) (566) (1,808) (1,782) General and administrative expenses 4,811 5,110 13,842 15,190 Transaction expenses 1,742 — 2,237 — Termination of affiliate arrangements — 5,962 — 5,962 Depreciation and amortization 19,195 18,037 57,166 52,573 Interest expense, net 7,261 5,691 22,295 15,617 Other (896) (19) (903) 7 NOI 29,145 27,587 86,276 78,110 Less: NOI from centers excluded from Same-Center (3,739) (2,169) (10,780) (4,032) Total Same-Center NOI $ 25,406 $ 25,418 $ 75,496 $ 74,078 www.grocerycenterREIT2.com/investors 21

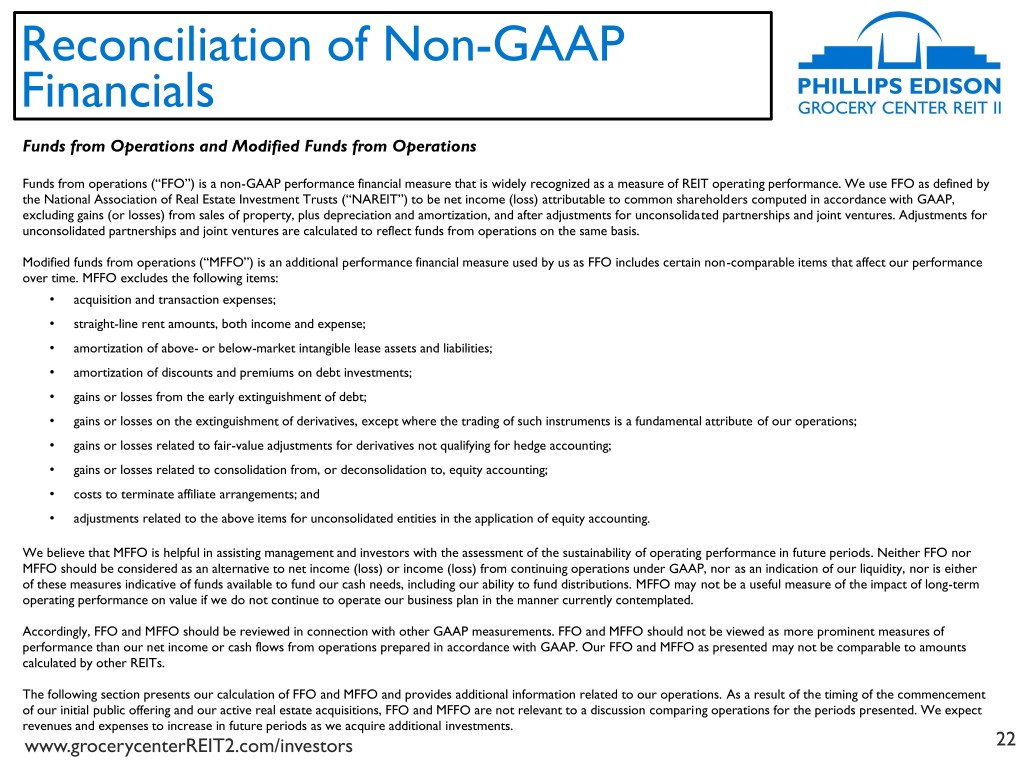

Reconciliation of Non-GAAP Financials Funds from Operations and Modified Funds from Operations Funds from operations (“FFO”) is a non-GAAP performance financial measure that is widely recognized as a measure of REIT operating performance. We use FFO as defined by the National Association of Real Estate Investment Trusts (“NAREIT”) to be net income (loss) attributable to common shareholders computed in accordance with GAAP, excluding gains (or losses) from sales of property, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures are calculated to reflect funds from operations on the same basis. Modified funds from operations (“MFFO”) is an additional performance financial measure used by us as FFO includes certain non-comparable items that affect our performance over time. MFFO excludes the following items: • acquisition and transaction expenses; • straight-line rent amounts, both income and expense; • amortization of above- or below-market intangible lease assets and liabilities; • amortization of discounts and premiums on debt investments; • gains or losses from the early extinguishment of debt; • gains or losses on the extinguishment of derivatives, except where the trading of such instruments is a fundamental attribute of our operations; • gains or losses related to fair-value adjustments for derivatives not qualifying for hedge accounting; • gains or losses related to consolidation from, or deconsolidation to, equity accounting; • costs to terminate affiliate arrangements; and • adjustments related to the above items for unconsolidated entities in the application of equity accounting. We believe that MFFO is helpful in assisting management and investors with the assessment of the sustainability of operating performance in future periods. Neither FFO nor MFFO should be considered as an alternative to net income (loss) or income (loss) from continuing operations under GAAP, nor as an indication of our liquidity, nor is either of these measures indicative of funds available to fund our cash needs, including our ability to fund distributions. MFFO may not be a useful measure of the impact of long-term operating performance on value if we do not continue to operate our business plan in the manner currently contemplated. Accordingly, FFO and MFFO should be reviewed in connection with other GAAP measurements. FFO and MFFO should not be viewed as more prominent measures of performance than our net income or cash flows from operations prepared in accordance with GAAP. Our FFO and MFFO as presented may not be comparable to amounts calculated by other REITs. The following section presents our calculation of FFO and MFFO and provides additional information related to our operations. As a result of the timing of the commencement of our initial public offering and our active real estate acquisitions, FFO and MFFO are not relevant to a discussion comparing operations for the periods presented. We expect revenues and expenses to increase in future periods as we acquire additional investments. www.grocerycenterREIT2.com/investors 22

Reconciliation of Non-GAAP Financials Three Months Ended September 30, Nine Months Ended September 30, (in thousands, except per share amounts) 2018 2017 2018 2017 Calculation of FFO Net loss $ (1,743) $ (5,857) $ (4,615) $ (7,196) Adjustments: Depreciation and amortization of real estate assets 19,195 18,037 57,166 52,573 Depreciation and amortization related to unconsolidated JV (453) 512 594 1,384 Gain on disposition of real estate assets (7) — (7) — FFO $ 16,992 $ 12,692 $ 53,138 $ 46,761 Calculation of MFFO FFO $ 16,992 $ 12,692 $ 53,138 $ 46,761 Adjustments: Net amortization of above- and below-market leases (606) (569) (1,808) (1,782) Straight-line rental income (619) (769) (1,938) (2,261) Transaction expenses 1,742 — 2,237 — Termination of affiliate arrangements — 5,962 — 5,962 Amortization of market debt adjustment (253) (263) (793) (797) Gain on extinguishment of debt (141) — (141) (11) Change in fair value of derivatives (16) (213) (255) (448) Adjustments related to unconsolidated joint venture (41) (32) 36 (9) Other 2 240 5 499 MFFO $ 17,060 $ 17,048 $ 50,481 $ 47,914 Weighted-average common shares outstanding - diluted(1) 46,815 46,548 46,758 46,533 FFO per share - diluted $ 0.36 $ 0.27 $ 1.14 $ 1.00 MFFO per share - diluted $ 0.36 $ 0.37 $ 1.08 $ 1.03 (1) Restricted stock awards were dilutive to FFO/MFFO for the three and nine months ended September 30, 2018 and 2017, and accordingly, were included in the weighted-average common shares used to calculate diluted FFO/MFFO per share. www.grocerycenterREIT2.com/investors 23