UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| x | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement | | |

| ¨ | Definitive Additional Materials | | |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 | | |

ROI ACQUISITION CORP. II

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No. |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

ROI ACQUISITION CORP. II

601 Lexington Avenue

51st Floor

New York, New York 10022

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD SEPTEMBER 18, 2015

TO THE STOCKHOLDERS OF ROI ACQUISITION CORP. II:

You are cordially invited to attend the special meeting (the “special meeting”) of stockholders of ROI Acquisition Corp. II (“ROI,” “Company,” “we,” “us” or “our”) to be held at 11:00 a.m. Eastern Time on September 18, 2015 at the offices of McDermott Will & Emery LLP, 340 Madison Avenue, New York, New York, for the sole purpose of considering and voting upon the following proposals:

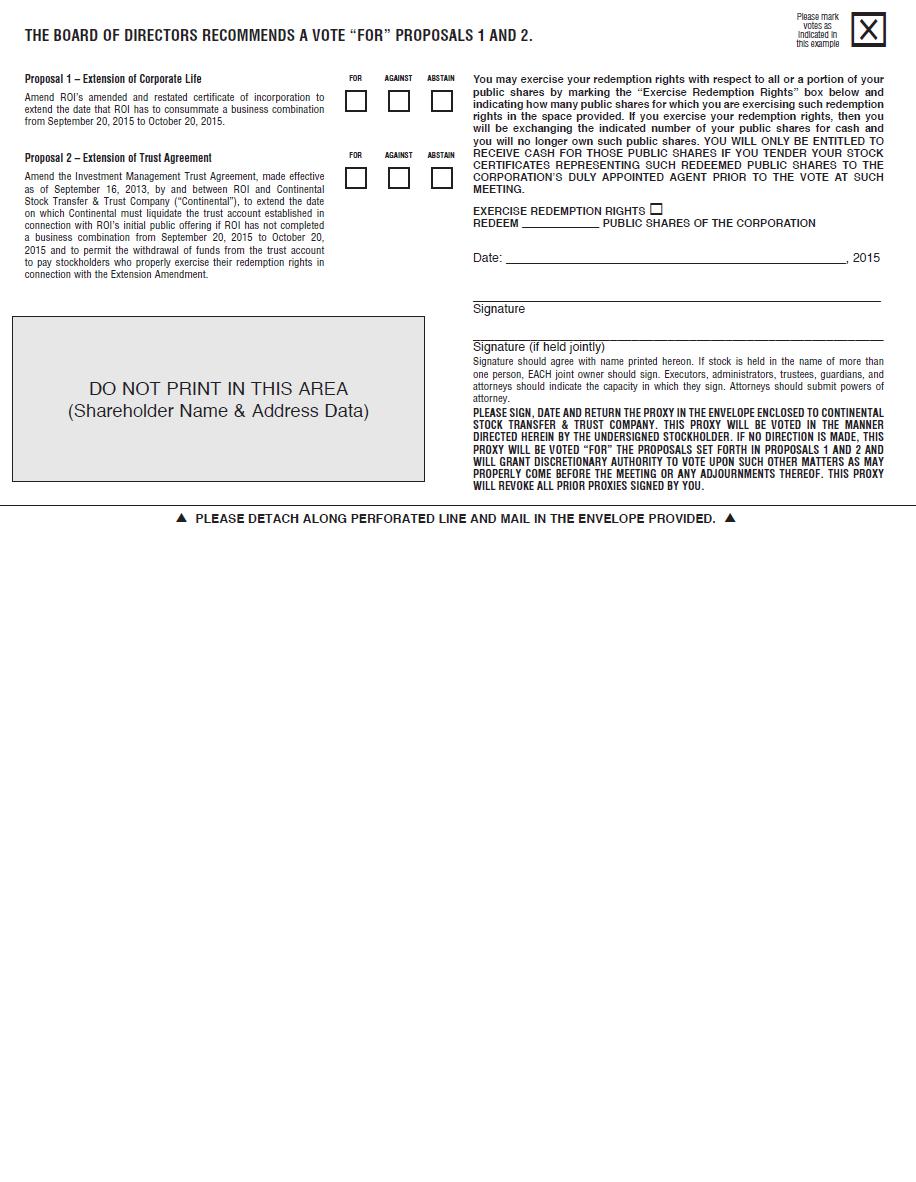

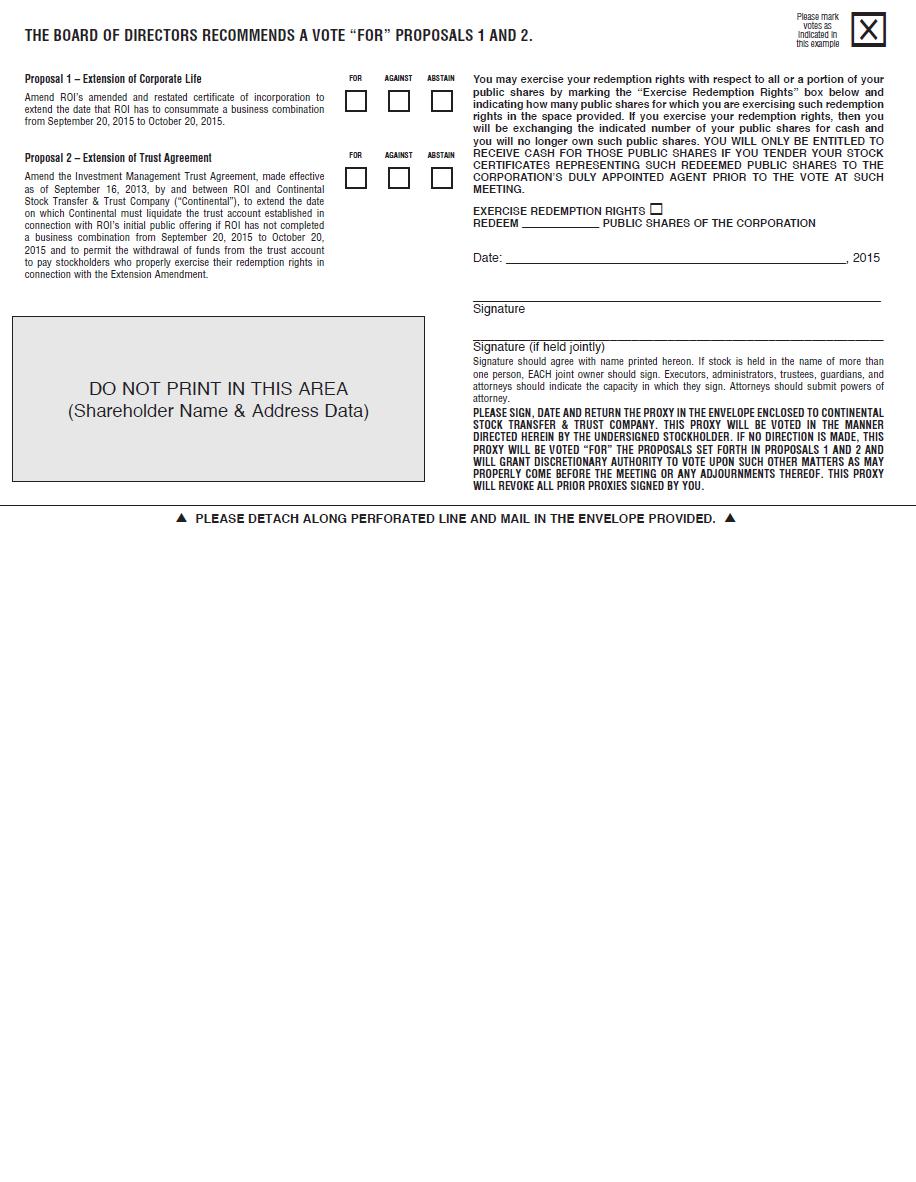

| | · | a proposal to amend (the “Extension Amendment”) ROI’s amended and restated certificate of incorporation (the “charter”) to extend the date by which ROI has to consummate a business combination (the “Extension”) from September 20, 2015 to October 20, 2015 (the “Extended Date”); and |

| | · | a proposal to amend (the “Trust Amendment”) the Investment Management Trust Agreement (the “trust agreement”), made effective as of September 16, 2013, by and between ROI and Continental Stock Transfer & Trust Company (“Continental”), to extend the date on which Continental must liquidate the trust account (the “trust account”) established in connection with ROI’s initial public offering (the “IPO”) if ROI has not completed a business combination from September 20, 2015 to October 20, 2015 and to permit the withdrawal of funds from the trust account to pay stockholders who properly exercise their redemption rights in connection with the Extension Amendment. |

Each of the Extension Amendment and the Trust Amendment is more fully described in the accompanying proxy statement.

The purpose of the Extension Amendment is to allow ROI more time to complete its previously announced proposed business combination with Ascend Telecom Infrastructure Private Limited (“Ascend”) pursuant to the Agreement and Plan of Merger, dated as of July 23, 2015, as amended on August 19, 2015 and as may be further amended from time to time (the “merger agreement”), by and among ROI, Ascend, Ascend Telecom Holdings Limited (“Ascend Holdings”), and NSR-PE Mauritius LLC. ROI’s IPO prospectus and charter provided that ROI had until June 20, 2015 to complete a business combination, unless it had executed a letter of intent by such date, in which case it had until September 20, 2015 to consummate such a business combination. ROI executed a letter of intent with Ascend on May 21, 2015 and subsequently executed the merger agreement on July 23, 2015. On July 27, 2015, Ascend Holdings filed a registration statement on Form F-4, including a proxy statement/prospectus, relating to the business combination transaction (the “registration statement”). Since that time, ROI and Ascend Holdings have been working together to address comments from the staff of the Securities and Exchange Commission (“SEC”) on the registration statement and to satisfy the various closing conditions under the merger agreement. Our board currently believes that there may not be sufficient time before September 20, 2015 to complete the proposed business combination with Ascend. The purpose of the Extension Amendment and Trust Amendment is to allow ROI more time to complete the business combination, which our board believes is in the best interest of our stockholders. If the Extension Amendment and Trust Amendment are approved, we will hold another stockholder meeting prior to the extended deadline in order to seek stockholder approval of the proposed business combination with Ascend Holdings.

Public stockholders may elect to redeem their shares for a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of franchise and income taxes payable), divided by the number of then outstanding public shares in connection with the Extension Amendment (the “Election”), regardless of how such public stockholders vote on the Extension Amendment and Trust Amendment. If the Extension Amendment and the Trust Amendment are approved by the requisite vote of stockholders, the remaining holders of public shares will retain their right to redeem their public shares upon consummation of the proposed business combination with Ascend when it is submitted to the stockholders, subject to any limitations set forth in the proposed amended and restated certificate and the limitations contained in the merger agreement. In addition, public stockholders who vote for the Extension Amendment and the Trust Amendment and do not make the Election would be entitled to redemption if the Company has not completed a business combination by the Extended Date.

ROI estimates that the per-share price at which public shares will be redeemed from cash held in the trust account will be approximately $10.00 at the time of the special meeting. The closing price of ROI’s common stock on [ ], 2015 was $[ ]. ROI cannot assure stockholders that they will be able to sell their shares of ROI common stock in the open market, even if the market price per share is higher than the redemption price stated above, as there may not be sufficient liquidity in its securities when such stockholders wish to sell their shares.

The purpose of the Trust Amendment is to amend ROI’s Trust Agreement to extend the date on which Continental must liquidate the trust account if ROI has not completed a business combination from September 20, 2015 to October 20, 2015 and to permit the withdrawal of funds from the trust account to pay stockholders who properly exercise their redemption rights in connection with the Extension Amendment.

If the Extension Amendment and Trust Amendment proposals are not approved and we do not consummate a business combination by September 20, 2015, as contemplated by our IPO prospectus and in accordance with our charter, we will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter, redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of franchise and income taxes payable and less up to $50,000 of interest to pay dissolution expenses), divided by the number of then outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders (including the right to receive further liquidation distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining stockholders and our board of directors, dissolve and liquidate, subject in each case to our obligations under Delaware law to provide for claims of creditors and the requirements of other applicable law.

Subject to the foregoing, the affirmative vote of 65% of ROI’s outstanding common stock will be required to approve the Extension Amendment and the Trust Amendment.

Our board has fixed the close of business on August 21, 2015 as the date for determining ROI stockholders entitled to receive notice of and vote at the special meeting and any adjournment thereof. Only holders of record of ROI common stock on that date are entitled to have their votes counted at the special meeting or any adjournment thereof.

You are not being asked to vote on the proposed business combination with Ascend Holdings at this time. If you are a public stockholder, you will have the right to vote on the proposed business combination with Ascend Holdings when it is submitted to stockholders.

After careful consideration of all relevant factors, ROI’s board of directors has determined that the Extension Amendment and Trust Amendment proposals are advisable and recommends that you vote or give instruction to vote “FOR” them.

Under Delaware law and ROI’s bylaws, no other business may be transacted at the special meeting.

Enclosed is the proxy statement containing detailed information concerning the Extension Amendment, the Trust Amendment and the special meeting. Whether or not you plan to attend the special meeting, we urge you to read this material carefully and vote your shares.

I look forward to seeing you at the meeting.

| September [ ], 2015 | By Order of the Board of Directors |

| | |

| | |

| | Chairman and Chief Executive Officer |

Your vote is important. Please sign, date and return your proxy card as soon as possible to make sure that your shares are represented at the special meeting. If you are a stockholder of record, you may also cast your vote in person at the special meeting. If your shares are held in an account at a brokerage firm or bank, you must instruct your broker or bank how to vote your shares, or you may cast your vote in person at the special meeting by obtaining a proxy from your brokerage firm or bank. Your failure to vote or instruct your broker or bank how to vote will have the same effect as voting against each of the proposals.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Stockholders to be held on September 18, 2015: This notice of meeting and the accompany proxy statement are available at www.Okapivote.com/ROIACQUISITION.

ROI ACQUISITION CORP. II

601 Lexington Avenue

51st Floor

New York, New York 10022

SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD SEPTEMBER 18, 2015

PROXY STATEMENT

The special meeting (the “special meeting”) of stockholders of ROI Acquisition Corp. II (“ROI,” “Company,” “we,” “us” or “our”), a Delaware corporation, will be held at 11:00 a.m. Eastern Time on September 18, 2015 at the offices of McDermott Will & Emery LLP, 340 Madison Avenue, New York, New York, for the sole purpose of considering and voting upon the following proposals:

| | · | a proposal to amend (the “Extension Amendment”) ROI’s amended and restated certificate of incorporation (the “charter”) to extend the date by which ROI has to consummate a business combination (the “Extension”) from September 20, 2015 to October 20, 2015 (the “Extended Date”); and |

| | · | a proposal to amend (the “Trust Amendment”) the Investment Management Trust Agreement (the “trust agreement”), made effective as of September 16, 2013, by and between ROI and Continental Stock Transfer & Trust Company (“Continental”), to extend the date on which Continental must liquidate the trust account (the “trust account”) established in connection with ROI’s initial public offering (the “IPO”) if ROI has not completed a business combination from September 20, 2015 to October 20, 2015 and to permit the withdrawal of funds from the trust account to pay stockholders who properly exercise their redemption rights in connection with the Extension Amendment. |

The Extension Amendment and the Trust Amendment proposals are essential to the overall implementation of the board of directors’ plan to extend the date that ROI has to complete a business combination. The purpose of the Extension Amendment and the Trust Amendment is to allow ROI more time to complete its previously announced proposed business combination with Ascend Telecom Holdings Limited (“Ascend Holdings”) pursuant to the Agreement and Plan of Merger, dated as of July 23, 2015, as amended on August 19, 2015 and as may be further amended from time to time (the “Merger Agreement”), by and among ROI, Ascend, Ascend Telecom Holdings Limited (“Ascend Holdings”), and NSR-PE Mauritius LLC.

Approval of the Extension Amendment and the Trust Amendment is a condition to the implementation of the Extension. In addition, we will not proceed with the Extension if the number of redemptions of our public shares causes us to have less than $5,000,001 of net tangible assets following approval of the Extension Amendment and Trust Amendment proposals.

Public stockholders may elect to redeem their shares for a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of franchise and income taxes payable), divided by the number of then outstanding public shares in connection with the Extension Amendment (the “Election”), regardless of how such public stockholders vote on the Extension Amendment and Trust Amendment. If the Extension Amendment and the Trust Amendment are approved by the requisite vote of stockholders, the remaining holders of public shares will retain their right to redeem their public shares upon consummation of the proposed business combination with Ascend when it is submitted to the stockholders, subject to any limitations set forth in the proposed amended and restated certificate and the limitations contained in the merger agreement. In addition, public stockholders who vote for the Extension Amendment and the Trust Amendment and do not make the Election would be entitled to redemption if the Company has not completed a business combination by the Extended Date.

The withdrawal of funds from the trust account in connection with the Election will reduce the amount held in the trust account following the Election, and the amount remaining in the trust account may be only a small fraction of the approximately $125 million that was in the trust account as of June 30, 2015. In such event, ROI may need to obtain additional funds to complete the proposed business combination with Ascend, and there can be no assurance that such funds will be available on terms acceptable to the parties or at all.

If the Extension Amendment and Trust Amendment proposals are not approved and we do not consummate a business combination by September 20, 2015, as contemplated by our IPO prospectus and in accordance with our charter, we will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter, redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of franchise and income taxes payable and less up to $50,000 of interest to pay dissolution expenses), divided by the number of then outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders (including the right to receive further liquidation distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining stockholders and our board of directors, dissolve and liquidate, subject in each case to our obligations under Delaware law to provide for claims of creditors and the requirements of other applicable law.

ROI’s initial stockholders prior to the IPO have waived their rights to participate in any liquidation distribution with respect to their initial shares. As a consequence of such waivers, a liquidating distribution will be made only with respect to the public shares. There will be no distribution from the trust account with respect to ROI’s warrants, which will expire worthless in the event we wind up.

If ROI liquidates, each of GEH Capital, Inc. (our “sponsor”), Joseph A. De Perio and George E. Hall has agreed that they will be jointly and severally liable to us if and to the extent any claims by a vendor for services rendered or products sold to us, or a prospective target business with which we have discussed entering into a transaction agreement, reduce the amount of funds in the trust account to below (i) $10.00 per public share or (ii) such lesser amount per public share held in the trust account as of the date of the liquidation of the trust account due to reductions in the value of the trust assets, in each case net of the amount of interest that may be withdrawn to pay franchise and income taxes, except as to any claims by a third party who executed a waiver of any and all rights to seek access to the trust account and except as to any claims under our indemnity of the underwriters of the IPO against certain liabilities, including liabilities under the Securities Act of 1933, as amended. Moreover, in the event that an executed waiver is deemed to be unenforceable against a third party, then our sponsor, Joseph A. De Perio and George E. Hall will not be responsible to the extent of any liability for such third party claims. There is no assurance that our sponsor, Joseph A. De Perio and George E. Hall will be able to satisfy their obligations. The per share liquidation price for the public shares is anticipated to be approximately $10.00. Nevertheless, ROI cannot assure you that the per share distribution from the trust account, if ROI liquidates, will not be less than $10.00, plus interest, due to unforeseen claims of creditors.

Under the Delaware General Corporation Law (the “DGCL”), stockholders may be held liable for claims by third parties against a corporation to the extent of distributions received by them in a dissolution. If the corporation complies with certain procedures set forth in Section 280 of the DGCL intended to ensure that it makes reasonable provision for all claims against it, including a 60-day notice period during which any third-party claims can be brought against the corporation, a 90-day period during which the corporation may reject any claims brought, and an additional 150-day waiting period before any liquidating distributions are made to stockholders, any liability of stockholders with respect to a liquidating distribution is limited to the lesser of such stockholder’s pro rata share of the claim or the amount distributed to the stockholder, and any liability of the stockholder would be barred after the third anniversary of the dissolution.

However, because ROI will not be complying with Section 280 of the DGCL, Section 281(b) of the DGCL requires us to adopt a plan, based on facts known to us at such time that will provide for our payment of all existing and pending claims or claims that may be potentially brought against us within the subsequent ten years. However, because we are a blank check company, rather than an operating company, and our operations have been limited to searching for prospective target businesses to acquire, the only likely claims to arise would be from our vendors (such as lawyers, investment bankers, etc.) or prospective target businesses.

If the Extension Amendment and the Trust Amendment proposals are approved, the approval of the Trust Amendment will constitute consent for ROI to (i) remove from the trust account an amount (the “Withdrawal Amount”) equal to the number of public shares properly redeemed multiplied by the per-share price, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of franchise and income taxes payable), divided by the number of then outstanding public shares and (ii) deliver to the holders of such redeemed public shares their portion of the Withdrawal Amount. The remainder of such funds shall remain in the trust account and be available for use by ROI to complete a business combination on or before the Extended Date. Holders of public shares who do not redeem their public shares now will retain their redemption rights and their ability to vote on a business combination through the Extended Date if the Extension Amendment is approved.

At the time the Extension Amendment and Trust Amendment become effective, ROI will also amend the trust agreement to (i) permit the withdrawal of the Withdrawal Amount from the trust account and (ii) extend the date on which to liquidate the trust account to the Extended Date.

The record date for the special meeting is August 21, 2015. Record holders of ROI common stock at the close of business on the record date are entitled to vote or have their votes cast at the special meeting. On the record date, there were 15,625,000 outstanding shares of ROI common stock including 12,500,000 outstanding public shares. ROI’s warrants do not have voting rights in connection with the Extension Amendment or the Trust Amendment.

This proxy statement contains important information about the special meeting and the proposals. Please read it carefully and vote your shares.

This proxy statement is dated September [ ], 2015 and is first being mailed to stockholders on or about that date.

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

These Questions and Answers are only summaries of the matters they discuss. They do not contain all of the information that may be important to you. You should read carefully the entire document, including the annexes to this proxy statement.

| Q. | Why am I receiving this proxy statement? | | A. ROI is a blank check company formed in 2013 for the purpose of entering into a merger, share exchange, asset acquisition, stock purchase, recapitalization, reorganization or other similar business combination with one or more businesses or entities. In September 2013, ROI consummated its IPO from which it derived gross proceeds of $125,000,000. Like most blank check companies, our charter provides for the return of the IPO proceeds held in trust to the holders of shares of common stock sold in the IPO if there is no qualifying business combination(s) consummated on or before a certain date (in our case, September 20, 2015). The board of directors believes that it is in the best interests of the stockholders to continue ROI’s existence until the Extended Date in order to allow ROI more time to complete its previously announced proposed business combination with Ascend and is submitting these proposals to the stockholders to vote upon. |

| | | | |

| Q. | What is being voted on? | | A. You are being asked to vote on: |

| | | | |

| | | | • a proposal to amend ROI’s charter to extend the date by which ROI has to consummate a business combination to the Extended Date; and |

| | | | |

| | | | • a proposal to amend ROI’s Trust Agreement to extend the date on which Continental must liquidate the trust account if ROI has not completed a business combination from September 20, 2015 to October 20, 2015 and to permit the withdrawal of funds from the trust account to pay stockholders who properly exercise their redemption rights in connection with the Extension Amendment. |

| | | | |

| | | | The Extension Amendment and the Trust Amendment proposals are essential to the overall implementation of the board of directors’ plan to extend the date that ROI has to complete a business combination. Approval of the Extension Amendment and the Trust Amendment is a condition to the implementation of the Extension. |

| | | | |

| | | | If the Extension is implemented, the stockholder’s approval of the Trust Amendment proposal will constitute consent for ROI to remove the Withdrawal Amount from the trust account, deliver to the holders of redeemed public shares their portion of the Withdrawal Amount and retain the remainder of the funds in the trust account for ROI’s use in connection with consummating a business combination on or before the Extended Date. |

| | | | |

| | | | We will not proceed with the Extension if redemptions of our public shares cause us to have less than $5,000,001 of net tangible assets following approval of the Extension Amendment and Trust Amendment proposals. |

| | | | |

| | | | If the Extension Amendment and Trust Amendment proposals are approved and the Extension is implemented, the removal of the Withdrawal Amount from the trust account in connection with the Election will reduce the amount held in the trust account following the Election. ROI cannot predict the amount that will remain in the trust account if the Extension Amendment and Trust Amendment proposals are approved and the amount remaining in the trust account may be only a small fraction of the approximately $125 million that was in the trust account as of June 30, 2015. In such event, ROI may need to obtain additional funds to complete the proposed business combination with Ascend, and there can be no assurance that such funds will be available on terms acceptable to the parties or at all. |

| | | | If the Extension Amendment and Trust Amendment proposals are not approved and we have not consummated a business combination by September 20, 2015, we will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter, redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of franchise and income taxes payable and less up to $50,000 of interest to pay dissolution expenses), divided by the number of then outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders (including the right to receive further liquidation distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining stockholders and our board of directors, dissolve and liquidate, subject in each case to our obligations under Delaware law to provide for claims of creditors and the requirements of other applicable law. |

| | | | |

| | | | ROI’s initial stockholders have waived their rights to participate in any liquidation distribution with respect to their initial shares. There will be no distribution from the trust account with respect to our warrants, which will expire worthless in the event we wind up. ROI will pay the costs of liquidation from its remaining assets outside of the trust account. If such funds are insufficient, the Sponsor, Joseph A. De Perio and George E. Hall have agreed to advance ROI the funds necessary to complete such liquidation (currently anticipated to be no more than approximately $50,000) and have agreed not to seek repayment of such expenses. |

| | | | |

| Q. | Why is the Company proposing the Extension Amendment and the Trust Amendment proposals? | | A. ROI’s charter provides for the return of the IPO proceeds held in trust to the holders of shares of common stock sold in the IPO if there is no qualifying business combination(s) consummated on or before September 20, 2015. As we explain below, ROI may not be able to complete the business combination with Ascend by that date. |

| | | | |

| | | | On July 23, 2015, ROI entered into the Merger Agreement, by and among ROI, Ascend, Ascend Telecom Holdings Limited (“Ascend Holdings”), and NSR-PE Mauritius LLC. Pursuant to the Merger Agreement, ROI will merge with and into a subsidiary of Ascend Holdings, with each outstanding share of common stock of ROI being converted into the right to receive one newly issued ordinary share of Ascend Holdings, par value $1.00 per share. In connection therewith, a subsidiary of Ascend Holdings will use a portion of the proceeds held in the trust account and released to Ascend Holdings to purchase from Infrastructure Leasing & Financial Services Limited, N.K. Tele Systems Limited and N.K. Telecom Products Limited (collectively, the “IL&FS Parties”) 100% of the ordinary shares of Ascend not already owned by it for an aggregate purchase price of INR 2,700,000,000, resulting in Ascend becoming an indirect wholly owned subsidiary of Ascend Holdings. |

| | | | Ascend (formerly known as Aster Infrastructure Private Limited) is a private limited company incorporated in March 2002 under the Indian Companies Act, 1956 in the Republic of India, and its name was changed in 2010. Ascend is an independent owner and provider of passive telecommunications infrastructure on a shared, multi-tenancy basis for all 11 wireless telecommunications service providers in India. As of March 31, 2015, Ascend had 4,843 towers. |

| | | | |

| | | | The foregoing summary of the terms of the Merger Agreement is qualified in all respects by reference to the complete text of the Merger Agreement, which is attached as Exhibit 2.1 to the Form 8-K ROI filed with the SEC on July 23, 2015, and the Amendment No. 1 to the Merger Agreement, which is attached as Exhibit 2.1 to the Form 8-K ROI filed with the SEC on August 21, 2015, as the same may be amended from time to time. |

| | | | |

| | | | The proposed business combination with Ascend qualifies as a “business combination” under ROI’s charter. However, ROI may not be able to consummate the business combination with Ascend by September 20, 2015, given when the Merger Agreement was signed and the actions that must occur prior to closing. |

| | | | |

| | | | ROI believes the proposed business combination with Ascend would be in the best interests of ROI’s stockholders, and because ROI may not be able to conclude a business combination within the permitted time period, ROI has determined to seek stockholder approval to extend the date by which ROI has to complete a business combination. |

| | | | |

| | | | ROI believes that, given ROI’s expenditure of time, effort and money on the proposed business combination with Ascend, circumstances warrant providing public stockholders an opportunity to consider the proposed business combination with Ascend. Accordingly, ROI’s board of directors is proposing the Extension Amendment, to extend ROI’s corporate existence until the Extended Date, and the Trust Amendment. |

| | | | |

| | | | You are not being asked to vote on the proposed business combination with Ascend at this time. If the Extension is implemented and you do not elect to redeem your public shares, you will retain the right to vote on the proposed business combination with Ascend when it is submitted to stockholders and the right to redeem your public shares for cash in the event the proposed business combination is approved and completed or ROI has not consummated a business combination by the Extended Date. |

| | | | |

| Q. | Why should I vote for the Extension Amendment? | | A. ROI’s board of directors believes stockholders will benefit from ROI consummating the business combination with Ascend and is proposing the Extension Amendment to extend the date by which ROI has to complete a business combination until the Extended Date. The Extension would give ROI the opportunity to complete a business combination. |

| | | | ROI’s charter provides that if ROI’s stockholders approve an amendment to ROI’s charter that would affect the substance or timing of ROI’s obligation to redeem 100% of ROI’s public shares if we do not complete our business combination before September 20, 2015, we will provide our public stockholders with the opportunity to redeem all or a portion of their shares of common stock upon such approval at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of franchise and income taxes payable), divided by the number of then outstanding public shares. We believe that this charter provision was included to protect ROI stockholders from having to sustain their investments for an unreasonably long period, if ROI failed to find a suitable business combination in the timeframe contemplated by the charter. We also believe, however, that given ROI’s expenditure of time, effort and money on the potential business combination with Ascend, circumstances warrant providing those who believe they might find the potential business combination to be an attractive investment with an opportunity to consider such a transaction. ROI’s board of directors recommends that you vote in favor of the Extension Amendment, but expresses no opinion as to whether you should redeem your public shares. |

| | | | |

| Q. | Why should I vote for the Trust Amendment? | | A. As discussed above, ROI’s board of directors believes stockholders will benefit from ROI consummating the business combination with Ascend, and approval of the Trust Amendment is a condition to the implementation of the Extension Amendment. |

| | | | |

| | | | Whether a holder of public shares votes in favor of or against the Extension Amendment or the Trust Amendment, if such amendments are approved, the holder may, but is not required to, redeem all or a portion of its public shares for a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of franchise and income taxes payable), divided by the number of then outstanding public shares. We will not proceed with the Extension if redemptions of public shares cause us to have less than $5,000,001 of net tangible assets following approval of the Extension Amendment and Trust Amendment proposals. |

| | | | |

| | | | Liquidation of the trust account is a fundamental obligation of ROI to the public stockholders and ROI is not proposing and will not propose to change that obligation to the public stockholders. If holders of public shares do not elect to redeem their public shares, such holders shall retain redemption rights in connection with the proposed business combination with Ascend and any future business combination ROI proposes. Assuming the Extension Amendment is approved, ROI will have until the Extended Date to complete a business combination. |

| | | | |

| | | | ROI’s board of directors recommends that you vote in favor of the Trust Amendment proposal, but expresses no opinion as to whether you should redeem your public shares. |

| | | | |

| Q. | How do the ROI insiders intend to vote their shares? | | A. All of ROI’s directors, executive officers and their respective affiliates are expected to vote any common stock over which they have voting control (including any public shares owned by them) in favor of the Extension Amendment and Trust Amendment proposals. |

| | | | ROI’s directors, executive officers and their respective affiliates are not entitled to redeem the shares of ROI common stock acquired by them prior to the IPO (the “founder shares”). With respect to shares purchased on the open market by ROI’s directors, executive officers and their respective affiliates, such public shares may be redeemed. On the record date, ROI’s directors, officers and their affiliates beneficially owned and were entitled to vote 3,125,000 founder shares, representing approximately 20.0% of ROI’s issued and outstanding common stock. ROI’s directors, executive officers and their affiliates beneficially owned approximately 10,000 public shares as of such date. |

| | | | |

| | | | The sponsor, ROI’s directors, executive officers and their affiliates may choose to buy public shares in the open market and/or through negotiated private purchases. In the event that such purchases do occur, the purchasers may seek to purchase shares from stockholders who would otherwise have voted against the Extension Amendment or the Trust Amendment. Any public shares held by or subsequently purchased by affiliates of ROI may be voted in favor of the Extension Amendment and the Trust Amendment proposals. |

| | | | |

| Q. | What vote is required to adopt the Extension Amendment? | | A. Approval of the Extension Amendment will require the affirmative vote of holders of 65% of ROI’s outstanding common stock on the record date. Approval of the Trust Amendment is a condition to the implementation of the Extension Amendment. |

| | | | |

| | | | If the Extension Amendment and Trust Amendment are approved, any holder of public shares may redeem all or a portion of their public shares at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of franchise and income taxes payable), divided by the number of then outstanding public shares. |

| | | | |

| Q. | What vote is required to approve the Trust Amendment? | | A. Approval of the Trust Amendment will require the affirmative vote of holders of 65% of ROI’s outstanding common stock on the record date. If the Extension Amendment and Trust Amendment are approved, any holder of public shares may redeem all or a portion of their public shares at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of franchise and income taxes payable), divided by the number of then outstanding public shares. |

| | | | |

| Q. | What if I don’t want to vote for the Extension Amendment or Trust Amendment proposal? | | A. If you do not want the Extension Amendment or Trust Amendment to be approved, you must abstain, not vote, or vote against the proposals. If the Extension Amendment and the Trust Amendment are approved, and the Extension is implemented, then the Withdrawal Amount will be withdrawn from the trust account and paid to the redeeming holders. |

| Q. | Will you seek any further extensions to liquidate the trust account? | | A. Other than the extension until the Extended Date as described in this proxy statement, we do not anticipate seeking any further extension to consummate a business combination. Our charter provides that if our stockholders approve an amendment to our charter that would affect the substance or timing of our obligation to redeem 100% of ROI’s public shares if we do not complete our business combination before September 20, 2015, we will provide our public stockholders with the opportunity to redeem all or a portion of their shares of common stock upon such approval at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of franchise and income taxes payable), divided by the number of then outstanding public shares. Those holders of public shares who elect not to redeem their shares now will retain redemption rights with respect to any future business combinations we propose, or, if no future business combination is brought to a vote of the stockholders or if a business combination is not completed for any reason, such holders shall be entitled to a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of franchise and income taxes payable and less up to $50,000 of interest to pay dissolution expenses), divided by the number of then outstanding public shares, on the Extended Date. |

| | | | |

| Q. | What happens if the Extension Amendment is not approved? | | A. If the Extension Amendment is not approved and we have not consummated a business combination by September 20, 2015, we will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter, redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of franchise and income taxes payable and less up to $50,000 of interest to pay dissolution expenses), divided by the number of then outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders (including the right to receive further liquidation distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining stockholders and our board of directors, dissolve and liquidate, subject in each case to our obligations under Delaware law to provide for claims of creditors and the requirements of other applicable law. |

| | | | |

| | | | ROI’s initial stockholders waived their rights to participate in any liquidation distribution with respect to their initial shares. There will be no distribution from the trust account with respect to our warrants which will expire worthless in the event we wind up. ROI will pay the costs of liquidation from its remaining assets outside of the trust account, which it believes are sufficient for such purposes. If such funds are insufficient, the Sponsor, Joseph A. De Perio and George E. Hall have agreed to advance ROI the funds necessary to complete such liquidation (currently anticipated to be no more than approximately $50,000) and have agreed not to seek repayment of such expenses. |

| | | | |

| Q. | If the Extension Amendment and Trust Amendment proposals are approved, what happens next? | | A. ROI is continuing its efforts to complete the proposed business combination with Ascend, which will involve: • completing joint proxy statement and prospectus materials; • establishing a meeting date and record date for considering the proposed business combination, and distributing the joint proxy statement and prospectus materials to stockholders; and |

| | | | • holding a special meeting to consider the proposed business combination with Ascend. |

| | | | |

| | | | ROI is seeking approval of the Extension Amendment and the Trust Amendment because ROI may not be able to complete all of the tasks listed above prior to September 20, 2015. If the Extension Amendment and Trust Amendment are approved, ROI expects to seek stockholder approval of the proposed business combination with Ascend. If stockholders approve the proposed business combination with Ascend, ROI expects to consummate the business combination as soon as possible following stockholder approval. |

| | | | |

| | | | Upon approval by 65% of the common stock outstanding as of the record date of the Extension Amendment and Trust Amendment proposals, ROI will file an amendment to the charter with the Secretary of State of the State of Delaware in the form of Annex A hereto. ROI will remain a reporting company under the Securities Exchange Act of 1934, as amended, and its units, common stock and warrants will remain publicly traded. |

| | | | |

| | | | If the Extension Amendment and Trust Amendment proposals are approved, the removal of the Withdrawal Amount from the trust account will reduce the amount remaining in the trust account and increase the percentage interest of ROI’s common stock held by our sponsor and ROI’s directors and officers through the founder shares. |

| | | | |

| Q. | Would I still be able to exercise my redemption rights if I vote against the proposed business combination with Ascend? | | A. Unless you elect to redeem your shares, you will be able to vote on the proposed business combination with Ascend when it is submitted to stockholders. If you disagree with the business combination, you will retain your right to redeem your public shares upon consummation of the business combination in connection with the stockholder vote to approve the business combination, subject to any limitations set forth in the charter. |

| | | | |

| Q. | How do I change my vote? | | A. If you have submitted a proxy to vote your shares and wish to change your vote, you may do so by delivering a later-dated, signed proxy card to ROI’s secretary prior to the date of the special meeting or by voting in person at the special meeting. Attendance at the special meeting alone will not change your vote. You also may revoke your proxy by sending a notice of revocation to ROI at 601 Lexington Avenue, 51st Floor, New York, New York 10022, Attn: Corporate Secretary. |

| | | | |

| Q. | How are votes counted? | | A. Votes will be counted by the inspector of election appointed for the meeting, who will separately count “FOR” and “AGAINST” votes, abstentions and broker non-votes. Each of the Extension Amendment and Trust Amendment proposals must be approved by the affirmative vote of 65% of the outstanding shares as of the record date of ROI’s common stock, voting together as a single class. |

| | | | With respect to the Extension Amendment and Trust Amendment proposals, abstentions and broker non-votes will have the same effect as “AGAINST” votes. If your shares are held by your broker as your nominee (that is, in “street name”), you may need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. We believe the Extension Amendment and the Trust Amendment are “non-discretionary” items, and therefore if you do not give your broker instructions, the shares will be treated as broker non-votes |

| | | | |

| Q. | If my shares are held in “street name,” will my broker automatically vote them for me? | | A. No. Your broker can vote your shares only if you provide instructions on how to vote. You should instruct your broker to vote your shares. Your broker can tell you how to provide these instructions. |

| | | | |

| Q. | What is a quorum requirement? | | A. A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares of common stock on the record date are represented by stockholders present at the meeting or by proxy. |

| | | | |

| | | | Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the special meeting. Abstentions (but not broker non-votes) will be counted towards the quorum requirement. If there is no quorum, a majority of the votes present at the special meeting may adjourn the special meeting to another date. |

| | | | |

| Q. | Who can vote at the special meeting? | | A. Only holders of record of ROI’s common stock at the close of business on August 21, 2015 are entitled to have their vote counted at the special meeting and any adjournments or postponements thereof. On this record date, 15,625,000 shares of common stock were outstanding and entitled to vote. |

| | | | |

| | | | Stockholder of Record: Shares Registered in Your Name. If on the record date your shares were registered directly in your name with ROI’s transfer agent, Continental Stock Transfer & Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person at the special meeting or vote by proxy. Whether or not you plan to attend the special meeting in person, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted. |

| | | | |

| | | | Beneficial Owner: Shares Registered in the Name of a Broker or Bank. If on the record date your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the special meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the special meeting unless you request and obtain a valid proxy from your broker or other agent. |

| Q. | Does the board recommend voting for the approval of the Extension Amendment and the Trust Amendment? | | A. Yes. After careful consideration of the terms and conditions of these proposals, ROI’s board of directors has determined that the Extension Amendment and the Trust Amendment are in the best interests of ROI and its stockholders. The board of directors recommends that ROI’s stockholders vote “FOR” the Extension Amendment and the Trust Amendment. |

| | | | |

| Q. | What interests do the Company’s directors and officers have in the approval of the proposals? | | A. ROI’s directors and officers have interests in the proposals that may be different from, or in addition to, your interests as a stockholder. These interests include ownership of founder shares and warrants that may become exercisable in the future, loans by them that will not be repaid in the event of our winding up and the possibility of future compensatory arrangements. See the section entitled “The Extension Amendment and Trust Amendment Proposals—Interests of ROI’s Directors and Officers.” |

| | | | |

| Q. | What if I object to the Extension Amendment and the Trust Amendment? Do I have appraisal rights? | | A. ROI stockholders do not have appraisal rights in connection with the Extension Amendment or the Trust Amendment under the DGCL. |

| | | | |

| Q. | What happens to the ROI warrants if the Extension Amendment and Trust Amendment are not approved? | | A. If the Extension Amendment is not approved and we have not consummated a business combination by September, 20 2015, we will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter, redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of franchise and income taxes payable and less up to $50,000 of interest to pay dissolution expenses), divided by the number of then outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders (including the right to receive further liquidation distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining stockholders and our board of directors, dissolve and liquidate, subject in each case to our obligations under Delaware law to provide for claims of creditors and the requirements of other applicable law. In such event, your warrants will become worthless. |

| | | | |

| Q. | What happens to the ROI warrants if the Extension Amendment and Trust Amendment proposals are approved? | | A. If the Extension Amendment and Trust Amendment proposals are approved, ROI will continue to attempt to consummate a business combination until the Extended Date, and will retain the blank check company restrictions previously applicable to it. The warrants will remain outstanding in accordance with their terms. In connection with the proposed business combination with Ascend, ROI has proposed to amend the terms of the warrant agreement governing ROI’s outstanding warrants to provide that, upon the consummation of the proposed business combination with Ascend, warrantholders have the option to either (i) have their warrants survive and become exercisable for Ascend Holdings ordinary shares in accordance with the terms of the warrant agreement, as amended, or (ii) have their warrants exchanged at the closing for $1.00, comprised of $0.50 in cash, 0.05 of an ordinary share of Ascend Holdings and cash in lieu of fractional shares. |

| | | | |

| Q. | What do I need to do now? | | A. ROI urges you to read carefully and consider the information contained in this proxy statement, including the annexes, and to consider how the proposals will affect you as a ROI stockholder. You should then vote as soon as possible in accordance with the instructions provided in this proxy statement and on the enclosed proxy card. |

| Q. | How do I vote? | | A. If you are a holder of record of ROI common stock, you may vote in person at the special meeting or by submitting a proxy for the special meeting. Whether or not you plan to attend the special meeting in person, we urge you to vote by proxy to ensure your vote is counted. You may submit your proxy by completing, signing, dating and returning the enclosed proxy card in the accompanying pre-addressed postage paid envelope. You may still attend the special meeting and vote in person if you have already voted by proxy. |

| | | | |

| | | | If your shares of ROI common stock are held in “street name” by a broker or other agent, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the special meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the special meeting unless you request and obtain a valid proxy from your broker or other agent. |

| | | | |

| Q. | How do I redeem my shares of ROI common stock? | | A. If the Extension is implemented, each public stockholder may seek to redeem all or a portion of his public shares at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of franchise and income taxes payable), divided by the number of then outstanding public shares. You will also be able to redeem your public shares in connection with any stockholder vote to approve a proposed business combination, or if ROI has not consummated a business combination by the Extended Date. |

| | | | |

| | | | To demand redemption, you must check the box on the proxy card provided for that purpose and return the proxy card in accordance with the instructions provided, and, at the same time, ensure your bank or broker complies with the requirements identified elsewhere herein. You will only be entitled to receive cash in connection with a redemption of these shares if you continue to hold them until the effective date of the Extension and Election. |

| | | | |

| | | | In connection with tendering your shares for redemption, you must elect either to physically tender your stock certificates to Continental Stock Transfer & Trust Company, ROI’s transfer agent, at Continental Stock Transfer & Trust Company, 17 Battery Place, New York, New York 10004, Attn: Mark Zimkind,mzimkind@continentalstock.com, prior to the vote for the Extension Amendment and Trust Amendment or to deliver your shares to the transfer agent electronically using The Depository Trust Company’s DWAC (Deposit/Withdrawal At Custodian) System, which election would likely be determined based on the manner in which you hold your shares. |

| | | | |

| Q. | What should I do if I receive more than one set of voting materials? | | A. You may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards, if your shares are registered in more than one name or are registered in different accounts. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Please complete, sign, date and return each proxy card and voting instruction card that you receive in order to cast a vote with respect to all of your ROI shares. |

| Q. | Who is paying for this proxy solicitation? | | A. ROI will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors and officers may also solicit proxies in person, by telephone or by other means of communication. These parties will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners. |

| | | | |

| Q. | Who can help answer my questions? | | A. If you have questions about the proposals or if you need additional copies of the proxy statement or the enclosed proxy card you should contact: |

| | | | |

| | | | ROI Acquisition Corp. II |

| | | | 601 Lexington Avenue |

| | | | 51st Floor |

| | | | New York, New York 10022 |

| | | | Attn: Daniel A. Strauss |

| | | | Telephone: (212) 825-0400 |

| | | | |

| | | | You may also obtain additional information about the Company from documents filed with the SEC by following the instructions in the section entitled “Where You Can Find More Information.” |

FORWARD-LOOKING STATEMENTS

We believe that some of the information in this proxy statement constitutes forward-looking statements. You can identify these statements by forward-looking words such as “may,” “expect,” “anticipate,” “contemplate,” “believe,” “estimate,” “intends,” and “continue” or similar words. You should read statements that contain these words carefully because they:

| • | discuss future expectations; |

| • | contain projections of future results of operations or financial condition; or |

| • | state other “forward-looking” information. |

We believe it is important to communicate our expectations to our stockholders. However, there may be events in the future that we are not able to predict accurately or over which we have no control. The cautionary language discussed in this proxy statement provides examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described by us in such forward-looking statements, including, among other things, claims by third parties against the trust account, unanticipated delays in the distribution of the funds from the trust account and ROI’s ability to finance and consummate the proposed business combination with Ascend. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this proxy statement.

All forward-looking statements included herein attributable to ROI or any person acting on ROI’s behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except to the extent required by applicable laws and regulations, ROI undertakes no obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise.

BACKGROUND

ROI

We are a blank check company formed in Delaware on June 28, 2013 for the purpose of acquiring, through a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or other similar business combination, one or more operating businesses or assets.

On September 20, 2013, ROI consummated its initial public offering of 12,500,000 units, with each unit consisting of one share of ROI’s common stock and one warrant to purchase one-half of one share of ROI’s common stock at an exercise price of $5.75 per half share ($11.50 per whole share). The shares of ROI’s common stock sold as part of the units in ROI’s initial public offering are referred to as the “public shares.” The units in ROI’s initial public offering were sold at an offering price of $10.00 per unit, generating total gross proceeds of $125,000,000.

Simultaneously with the consummation of ROI’s initial public offering, ROI consummated the private sale of 8,000,000 private placement warrants, each exercisable to purchase one-half of one share of ROI’s common stock at $5.75 per half share ($11.50 per whole share) to the sponsor at a price of $0.50 per warrant, generating gross proceeds of $4,000,000. Immediately after the closing of the private placement, the sponsor transferred the private placement warrants to Clinton Magnolia Master Fund Ltd., an affiliate of the sponsor (“CMMF”), which paid a purchase price of $4,000,000 for the private placement warrants. After deducting the underwriting discounts and commissions (excluding the deferred portion of $4,375,000 in underwriting discounts and commissions, which amount will be payable upon consummation of ROI’s initial business combination if consummated) and the offering expenses, the total net proceeds from ROI’s initial public offering and the private placement of the private placement warrants was approximately $126,000,000, of which $125,000,000 (or approximately $10.00 per unit sold in ROI’s initial public offering) was placed in a trust account with Continental Stock Transfer & Trust Company acting as trustee. The trust proceeds are invested in permitted United States “government securities” within the meaning of Section 2(a)(16) of the Investment Company Act of 1940, as amended, or the Investment Company Act, having a maturity of 180 days or less or in money market funds meeting certain conditions under Rule 2a-7 promulgated under the Investment Company Act which invest only in direct U.S. government treasury obligations. ROI’s amended and restated certificate of incorporation provides that, other than the withdrawal of interest to pay income taxes and franchise taxes, none of the funds held in trust will be released until the earlier of: (i) the completion of ROI’s business combination; or (ii) the redemption of 100% of the shares of common stock included in the units sold in ROI’s initial public offering if ROI is unable to complete a business combination by September 20, 2015.

After the payment of underwriting discounts and commissions (excluding the deferred portion of $4,375,000 in underwriting discounts and commissions, which amount will be payable upon consummation of ROI’s initial business combination if consummated) and approximately $500,000 in expenses relating to ROI’s initial public offering, approximately $1,000,000 of the net proceeds of ROI’s initial public offering and private placement of the private placement warrants was not deposited into the trust account and was retained by ROI for working capital purposes. The net proceeds deposited into the trust account remain on deposit in the trust account earning interest. As of June 30, 2015, there was $125,090,083 in investments and cash held in the trust account and $179,472 held outside the trust account available for working capital purposes. As of June 30, 2015, no amounts had been withdrawn from the trust account for the payment of taxes. The mailing address of ROI’s principal executive office is 601 Lexington Avenue, 51st Floor, New York, New York 10022.

The Proposed Business Combination with Ascend

Pursuant to the Agreement and Plan of Merger, dated as of July 23, 2015, as amended from time to time (the “merger agreement”), by and among ROI, Ascend, Ascend Holdings, and NSR-PE Mauritius LLC (“NSR”), subject to the terms and conditions set forth therein, ROI will merge with and into a subsidiary to be formed by Ascend Holdings, with each outstanding share of common stock of ROI being converted into the right to receive one newly issued ordinary share of Ascend Holdings, par value $1.00 per share. Upon consummation of the business combination, a subsidiary of Ascend Holdings, will use a portion of the proceeds of the trust account released to Ascend Holdings to purchase from Infrastructure Leasing & Financial Services Limited, N.K. Tele Systems Limited and N.K. Telecom Products Limited (collectively, the “IL&FS Parties”) 100% of the ordinary shares of Ascend not directly owned by it for an aggregate purchase price of INR 2,700,000,000, resulting in Ascend becoming an indirect wholly owned subsidiary of Ascend Holdings. ROI estimates that the ordinary shares to be issued by Ascend Holdings to ROI’s stockholders pursuant to the merger agreement will constitute between 36.0% and 41.9% of the issued share capital of Ascend Holdings, depending on the number of shares redeemed by ROI’s public stockholders and the number of warrantholders exchanging their warrants for cash and ordinary shares of Ascend Holdings. In addition, Ascend Holdings will issue 2,000,000 of its ordinary shares to NSR and 307,652 of its ordinary shares to the sponsor, which, collectively with the 781,250 ROI earnout shares issued to GEH Capital, Inc. at the time of ROI’s initial public offering and which will be exchanged for shares of Ascend Holdings in connection with the business combination, will be subject to forfeiture if certain Ascend Holdings share price targets are not achieved within a specified time period following the closing of the business combination.

In addition, ROI is proposing to amend the agreement governing its outstanding warrants to provide that, upon the consummation of the business combination, warrantholders have the option to either (i) have their warrants survive and become exercisable for Ascend Holdings ordinary shares in accordance with the terms of the warrant agreement, as amended, or (ii) have their warrants exchanged at the closing for $1.00, comprised of $0.50 in cash and 0.05 of an ordinary share of Ascend Holdings and cash in lieu of fractional shares. In addition, CMMF has agreed to forfeit to ROI all of the 8,000,000 private placement warrants held by it. Accordingly, the private placement warrants will neither survive the business combination nor be eligible to be exchanged for cash or shares at closing.

You are not being asked to vote on the proposed business combination with Ascend at this time. If the Extension is implemented and you do not elect to redeem your public shares in connection with the Extension, you will retain the right to vote on the proposed business combination with Ascend when it is submitted to stockholdersand the right to redeem your public shares for cash from the trust account in the event the proposed business combination is approved and completed or ROI has not consummated a business combination by the Extended Date.

THE EXTENSION AMENDMENT AND TRUST AMENDMENT PROPOSALS

The Extension Amendment

ROI is proposing to amend its charter to extend the date by which ROI has to consummate a business combination to the Extended Date.

The Extension Amendment and the Trust Amendment are essential to the overall implementation of the board of directors’ plan to allow ROI more time to complete a business combination. Approval of the Extension Amendment and the Trust Amendment is a condition to the implementation of the Extension.

If the Extension Amendment proposal is not approved and we have not consummated a business combination by September 20, 2015, we will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter, redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of franchise and income taxes payable and less up to $50,000 of interest to pay dissolution expenses), divided by the number of then outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders (including the right to receive further liquidation distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining stockholders and our board of directors, dissolve and liquidate, subject in each case to our obligations under Delaware law to provide for claims of creditors and the requirements of other applicable law.

The board of directors believes that the business combination with Ascend is in the best interest of ROI’s stockholders. Additionally, given ROI’s expenditure of time, effort and money on the proposed business combination with Ascend, our board believes that circumstances warrant providing public stockholders an opportunity to consider the proposed business combination with Ascend.

A copy of the proposed amendment to the charter of ROI is attached to this proxy statement as Annex A.

Trust Amendment Proposal

The purpose of the Trust Amendment is to amend ROI’s Trust Agreement to extend the date on which Continental must liquidate the trust account if ROI has not completed a business combination from September 20, 2015 to October 20, 2015 and to permit the withdrawal of funds from the trust account to pay stockholders who properly exercise their redemption rights in connection with the Extension Amendment. A copy of the proposed amendment to the Trust Agreement is attached to this proxy statement as Annex B.

Reasons for the Proposals

ROI’s IPO prospectus and charter provided that ROI had until June 20, 2015 to complete a business combination, unless it had executed a letter of intent by such date, in which case it had until September 20, 2015 to consummate such a business combination. ROI executed a letter of intent with Ascend Holdings on May 21, 2015 and subsequently executed the merger agreement on July 23, 2015, leaving approximately two months to complete the business combination. ROI’s IPO prospectus and charter stated that if ROI’s stockholders approve an amendment to ROI’s charter that would affect the substance or timing of ROI’s obligation to redeem 100% of ROI’s public shares if we do not complete our business combination before September 20, 2015, we will provide our public stockholders with the opportunity to redeem all or a portion of their shares of common stock upon such approval at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of franchise and income taxes payable), divided by the number of then outstanding public shares. Because ROI believes the proposed business combination with Ascend to be in the best interests of ROI’s stockholders, and because ROI may not be able to complete the proposed business combination by September 20, 2015, ROI has determined to seek stockholder approval to extend the time for closing a business combination beyond September 20, 2015 to the Extended Date. If the Extension Amendment and Trust Amendment are approved, ROI expects to seek stockholder approval of such business combination after the registration statement on Form F-4 filed by Ascend Holdings in connection with the proposed business combination, which includes a proxy statement/prospectus, is declared effective by the SEC.

We believe that the foregoing charter provision was included to protect ROI stockholders from having to sustain their investments for an unreasonably long period if ROI failed to find a suitable business combination in the timeframe contemplated by the charter. We also believe, however, that given ROI’s expenditure of time, effort and money on the potential business combination with Ascend, circumstances warrant providing those who believe they might find the potential business combination to be an attractive investment with an opportunity to consider such a transaction.

If the Extension Amendment and Trust Amendment Proposals Are Not Approved

If the Extension Amendment and Trust Amendment is not approved and we have not consummated a business combination by September 20, 2015, we will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter, redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of franchise and income taxes payable and less up to $50,000 of interest to pay dissolution expenses), divided by the number of then outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders (including the right to receive further liquidation distributions, if any), subject to applicable law, and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining stockholders and our board of directors, dissolve and liquidate, subject in each case to our obligations under Delaware law to provide for claims of creditors and the requirements of other applicable law.

ROI’s initial stockholders have waived their rights to participate in any liquidation distribution with respect to their initial shares. There will be no distribution from the trust account with respect to ROI’s warrants which will expire worthless in the event we wind up. ROI will pay the costs of liquidation from its remaining assets outside of the trust account.

If the Extension Amendment is not approved, the holders of the public shares will not vote on the Trust Amendment, and the trust account will be liquidated as described above. If the Trust Amendment is not approved, the Company will not effect the Extension.

If the Extension Amendment and Trust Amendment Proposals Are Approved

If the Extension Amendment and the Trust Amendment are approved, ROI will file an amendment to the charter with the Secretary of State of the State of Delaware in the form of Annex A hereto to extend the time it has to complete a business combination until the Extended Date. ROI will remain a reporting company under the Securities Exchange Act of 1934, as amended, and its units, common stock and warrants will remain publicly traded. ROI will then continue to work to consummate a business combination by the Extended Date.

You are not being asked to vote on the proposed business combination with Ascend at this time. If the Extension is implemented and you do not elect to redeem your public shares in connection with the Extension, you will retain the right to vote on the proposed business combination with Ascend when it is submitted to stockholdersand the right to redeem your public shares for cash from the trust account in the event the proposed business combination is approved and completed or the Company has not consummated a business combination by the Extended Date.

If the Extension Amendment and Trust Amendment proposals are approved, and the Extension is implemented, the removal of the Withdrawal Amount from the trust account in connection with the Election will reduce the amount held in the trust account. ROI cannot predict the amount that will remain in the trust account if the Extension Amendment and Trust Amendment proposals are approved, and the amount remaining in the trust account may be only a small fraction of the approximately $125 million that was in the trust account as of June 30, 2015. However, we will not proceed with the Extension if the number of redemptions of our public shares cause us to have less than $5,000,001 of net tangible assets following approval of the Extension Amendment and Trust Amendment proposals.

Redemption Rights

If the Extension Amendment and Trust Amendment proposals are approved, and the Extension is implemented, each public stockholder may seek to redeem his public shares at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest (which interest shall be net of franchise and income taxes payable), divided by the number of then outstanding public shares. Holders of public shares who do not elect to redeem their public shares in connection with the Extension will retain the right to redeem their public shares in connection with any stockholder vote to approve a proposed business combination, or if the Company has not consummated a business combination by the Extended Date.

TO DEMAND REDEMPTION, YOU MUST CHECK THE BOX ON THE PROXY CARD PROVIDED FOR THAT PURPOSE AND RETURN THE PROXY CARD IN ACCORDANCE WITH THE INSTRUCTIONS PROVIDED, AND, AT THE SAME TIME, ENSURE YOUR BANK OR BROKER COMPLIES WITH THE REQUIREMENTS IDENTIFIED ELSEWHERE HEREIN, INCLUDING DELIVERING YOUR SHARES TO THE TRANSFER AGENT PRIOR TO THE VOTE ON THE EXTENSION AMENDMENT AND THE TRUST AMENDMENT. You will only be entitled to receive cash in connection with a redemption of these shares if you continue to hold them until the effective date of the Extension Amendment and Election.

In connection with tendering your shares for redemption, you must elect either to physically tender your stock certificates to Continental Stock Transfer & Trust Company, ROI’s transfer agent, at Continental Stock Transfer & Trust Company, 17 Battery Place, New York, New York 10004, Attn: Mark Zimkind, mzimkind@continentalstock.com, prior to the vote on the Extension Amendment and the Trust Amendment or to deliver your shares to the transfer agent electronically using The Depository Trust Company’s DWAC (Deposit/Withdrawal At Custodian) System, which election would likely be determined based on the manner in which you hold your shares. The requirement for physical or electronic delivery prior to the vote at the special meeting ensures that a redeeming holder’s election is irrevocable once the Extension Amendment and the Trust Amendment are approved. In furtherance of such irrevocable election, stockholders making the election will not be able to tender their shares after the vote at the special meeting.