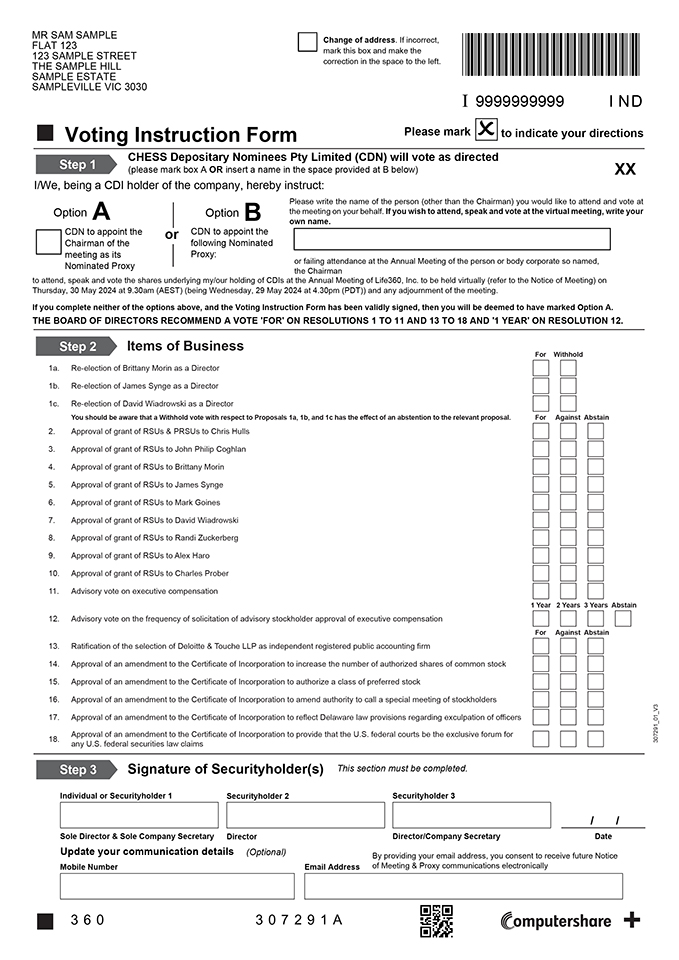

PROPOSAL 15

APPROVAL OF AMENDMENT TO THE CERTIFICATE OF INCORPORATION

TO CREATE A CLASS OF PREFERRED STOCK

On April 1, 2024, our Board of Directors adopted a resolution approving, subject to stockholder approval, an amendment to our Certificate of Incorporation to authorize 50,000,000 shares of “blank check” preferred stock, issuable in one or more series, and to implement ancillary changes related thereto (the “Preferred Stock Amendment”). The term “blank check” preferred stock refers to preferred stock, the creation and issuance of which is authorized in advance by a company’s stockholders and the terms, rights and features of which are determined by the board of directors of a company without seeking further actions or vote of the stockholders. The Preferred Stock Amendment is conditional on each of (i) approval of Proposal 14 and the effectiveness of the Share Increase Amendment, (ii) the consummation of a public offering of the Company’s Common Stock and related listing on a national securities exchange in the United States, if any, and (iii) the Company changing its admission category on the ASX to a “Foreign Exempt Listing,” such change to admission category being subject to the ASX Listing Rules.

If stockholders approve this proposal, then following the satisfaction of each of the foregoing conditions, we expect to file a certificate of amendment to our Certificate of Incorporation reflecting the Preferred Stock Amendment with the Secretary of State of the State of Delaware. Upon the filing of such certificate of amendment with the Secretary of State of the State of Delaware, the following changes would be made to the Certificate of Incorporation (as through the filing of such certificate of amendment):

(1) Paragraph (A) of Article IV is amended as follows:

“Classes of Stock. The Corporation is authorized to issue one class of stock to be designated “Common Stock.” The total number of shares of all classes of stock which the Corporation is authorized to issue is 500,000,000550,000,000 shares, each with a par value of consisting of two classes: 500,000,000 shares of common stock, $0.001 par value per share, all of which shares shall be (“Common Stock”), and 50,000,000 shares of preferred stock, $0.001 par value per share (the “Preferred Stock”).”

(2) Paragraph (B)(1) of Article IV is amended as follows:

“Dividend Rights. Subject to the prior rights, if any, of the holders of all classes of stock at the time outstanding having prior rights as a class or series of stock having a preference senior to or right to participate with the Common Stock with respect to dividends, the holders of the Common Stock shall be entitled to receive, when, as and if declared by the Board of Directors, out of any assets of the Corporation legally available therefor, such dividends as may be declared from time to time by the Board of Directors.”

(3) Paragraph (B)(2) of Article IV is amended as follows:

“Liquidation Rights. Upon the liquidation, dissolution or winding up of the Corporation, or the occurrence of a Liquidation Transaction (as defined below), subject to the rights, if any, of the holders of a class or series of stock having a preference senior to or right to participate with the Common Stock upon a liquidation, dissolution or winding up of the Corporation or the occurrence of a Liquidation Transaction, the assets of the Corporation available for distribution to stockholders (or the consideration received by the Corporation or its stockholders in a Liquidation Transaction) shall be distributed among the holders of the Common Stock pro rata based on the number of shares of Common Stock held by each. For purposes of this Section 2, a “Liquidation Transaction” shall be deemed to occur if the Corporation shall sell, lease or otherwise dispose of all or substantially all of the assets of the Corporation, or sell, exclusively license, convey, exchange or otherwise transfer all or substantially all of the intellectual property of the Corporation, or merge with or into or consolidate with any other corporation, limited liability company or other entity (other than a wholly-owned subsidiary of the Corporation), provided that none of the following shall be considered a Liquidation Transaction: (A) a merger effected exclusively for the purpose of changing the domicile of the Corporation or (B) a bona fide equity financing in which the Corporation is

42