Life360, Inc. | ARBN 629 412 942 | 1900 South Norfolk St, Suite 310 San Mateo, CA 94403 | investors.life360.com Page 1 Note: all references to $ are to US$ 17 May 2023 Correction to certain historical information in Q1 2023 Results Announcement San Francisco area-based Life360, Inc. (“Life360” or the “Company”) (ASX: 360) yesterday released its Q1 2023 results. Due to a technical issue, there were errors in certain historical information on pages 12 and 16. Corrected versions of the tables are attached to this release. In addition, supplementary disclosure has been added to pages 13 and 17 which are also attached to this release. There is no impact on reported Q1’23 results. Authorization Chris Hulls, Director, Co-Founder and Chief Executive Officer of Life360 authorized this announcement being given to ASX. About Life360 Life360 operates a platform for today's busy families, bringing them closer together by helping them better know, communicate with, and protect the pets, people and things they care about most. The Company's core offering, the Life360 mobile app, is a market leading app for families, with features that range from communications to driving safety and location sharing. Life360 is based in the San Francisco area and had approximately 50.8 million monthly active users (MAU) as of March 31, 2023, located in more than 150 countries. For more information, please visit life360.com. Tile, a Life360 company, locates millions of unique items every day by giving everything the power of smart location. Leveraging its superior nearby finding features and vast community that spans over 150 countries, Tile’s cloud-based finding platform helps people find the things that matter to them most. In addition to trackers in multiple form factors for a variety of use cases, Tile’s finding technology is embedded in over 55 partner products across audio, travel, wearables, smart home, and PC categories. For more information, please visit Tile.com. Contacts For Australian investor enquiries: For Australian media enquiries: Jolanta Masojada, +61 417 261 367 Giles Rafferty, +61 481 467 903 jmasojada@life360.com grafferty@firstadvisers.com.au For U.S. investors: For U.S. media inquiries: Investors@life360.com press@life360.com

Life360, Inc. | ARBN 629 412 942 | 1900 South Norfolk St, Suite 310 San Mateo, CA 94403 | investors.life360.com Page 2 Life360’s CDIs are issued in reliance on the exemption from registration contained in Regulation S of the US Securities Act of 1933 (Securities Act) for offers of securities which are made outside the US. Accordingly, the CDIs have not been, and will not be, registered under the Securities Act or the laws of any state or other jurisdiction in the US. As a result of relying on the Regulation S exemption, the CDIs are ‘restricted securities’ under Rule 144 of the Securities Act. This means that you are unable to sell the CDIs into the US or to a US person who is not a QIB for the foreseeable future except in very limited circumstances until after the end of the restricted period, unless the re-sale of the CDIs is registered under the Securities Act or an exemption is available. To enforce the above transfer restrictions, all CDIs issued bear a FOR Financial Product designation on the ASX. This designation restricts any CDIs from being sold on ASX to US persons excluding QIBs. However, you are still able to freely transfer your CDIs on ASX to any person other than a US person who is not a QIB. In addition, hedging transactions with regard to the CDIs may only be conducted in accordance with the Securities Act. Forward-looking statements This announcement and the accompanying conference call contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Life360 intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements regarding Life360’s intentions, objectives, plans, expectations, assumptions and beliefs about future events, including Life360’s expectations with respect to the financial and operating performance of its business, including subscription revenue, hardware revenue, consolidated revenue, Adjusted EBITDA, and operating cash flow; its capital position; future growth; future price increases and the impact of past price increases on future results of operations and churn; and the impact of past price increases on future results of operations and churn; user engagement, conversion and retention and subscriber churn; the strategic value and opportunities for Tile; operating cost savings, including through reduced commissions as well as Life360’s expectations of any changes to the information disclosed herein. The words “anticipate”, “believe”, “expect”, “project”, “predict”, “will”, “forecast”, “estimate”, “likely”, “intend”, “outlook”, “should”, “could”, “may”, “target”, “plan” and other similar expressions can generally be used to identify forward-looking statements. Indications of, and guidance or outlook on, future earnings or financial position or performance are also forward-looking statements. Investors and prospective investors are cautioned not to place undue reliance on these forward-looking statements as they involve inherent risk and uncertainty (both general and specific) and should note that they are provided as a general guide only and should not be relied on as an indication or guarantee of future performance. There is a risk that such predictions, forecasts, projections and other forward-looking statements will not be achieved. Subject to any continuing obligations under applicable law, Life360 does not undertake any obligation to publicly release the result of any revisions to these forward-looking statements to reflect events or circumstances after the date of this announcement, to reflect any change in expectations in relation to any forward-looking statements or any change in events, conditions or circumstances on which any such statements are based. Although Life360 believes that the expectations reflected in the forward-looking statements and the assumptions upon which they are based are reasonable, Life360 can give no assurance that such expectations and assumptions will prove to be correct and, actual results may vary in a materially positive or negative manner. Forward-looking statements are subject to known and unknown risks, uncertainty, assumptions and contingencies, many of which are outside Life360’s control, and are based on estimates and assumptions that are subject to change and may cause actual results, performance or achievements to differ materially from those expressed or implied by such statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include risks related to the preliminary nature of financial results, risks related to Life360’s business, market risks, Life360’s need for additional capital, and the risk that Life360’s products and services may not perform as expected, as described in greater detail under the heading “Risk Factors” in Life360’s ASX filings, including its Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 23,2023 and other reports filed with the SEC. To the maximum extent permitted by law, responsibility for the accuracy or completeness of any forward- looking statements whether as a result of new information, future events or results or otherwise is disclaimed. This announcement should not be relied upon as a recommendation or forecast by Life360. Past performance information given in this document is given for illustrative purposes only and is not necessarily a guide to future performance and no representation or warranty is made by any person as to the likelihood of achievement or reasonableness of any forward-looking statements, forecast financial information, future share price performance or any underlying assumptions. Nothing contained in this document nor any information made available to you is, or shall be relied upon as, a promise, representation, warranty or guarantee as to the past, present or the future performance of Life360.

Key Financial Metrics: Three Months Ended March 31, 2023 2022 (in millions) Revenue U.S. subscription revenue $ 45.7 $ 29.2 International subscription revenue 6.0 3.8 Subscription revenue 51.7 33.1 Hardware revenue 10.0 9.6 Other revenue 6.5 8.3 Total revenue 68.1 51.0 Non-GAAP Gross Margin15 51.5 35.5 Non-GAAP Gross Margin % 76 % 70 % Non-GAAP Subscription Gross Margin % 85 % 80 % Research and Development (Non-GAAP) 19.6 22.1 Sales and Marketing (Non-GAAP) User acquisition and TV costs 6.3 6.6 Other Sales and Marketing 5.1 6.5 Commissions 10.3 8.3 General & Administrative (Non-GAAP) 9.7 6.5 Non-GAAP Operating Expenses16 51.0 50.1 Net loss (14.1) (25.2) Adjusted EBITDA19 0.5 (13.7) Adjusted EBITDA Margin % 1 % (27) % Stock-based Compensation (9.0) (6.1) Other Non-GAAP Adjustments (4.2) (5.3) EBITDA $ (12.6) $ (25.0) 15 Non-GAAP Gross Margin is calculated using Cost of revenue, Non-GAAP. For a reconciliation between Total Cost of revenue, GAAP and Total Cost of revenue, Non-GAAP, refer to the Cost of Revenue (GAAP to Non-GAAP reconciliation) section below. 16 Non-GAAP operating expenses are calculated using Research and Development, Non-GAAP, Sales and Marketing, Non-GAAP and General & Administrative, Non-GAAP expenses. For a reconciliation between Total operating expenses, GAAP and Total operating expenses, Non-GAAP, refer to the Operating expenses (GAAP to Non-GAAP reconciliation) section below. 19 Includes non-recurring costs reflecting the alignment of accounting policies attributable to the integration with Tile. As these adjustments are not deemed to be non-routine or one time in nature, they have not been added back to EBITDA or Adjusted EBITDA. Note: The financial information in this announcement is unaudited and may not add or recalculate due to rounding. All references to $ are to U.S. $. Life360, Inc. | ARBN 629 412 942 | 1900 South Norfolk St, Suite 310 San Mateo, CA 94403 | investors.life360.com 12

Cost of Revenue (GAAP to Non-GAAP reconciliation): Three Months Ended March 31, 2023 2022 (in millions) Cost of subscription revenue, GAAP $ 8.0 $ 7.1 Less: Depreciation and amortization (0.3) (0.2) Less: Stock-based compensation (0.1) (0.2) Less: Severance and other (0.1) — Total Cost of subscription revenue, Non-GAAP $ 7.6 $ 6.6 Cost of hardware revenue, GAAP $ 9.4 $ 7.8 Less: Depreciation and amortization (0.9) (0.9) Less: Stock-based compensation (0.2) — Less: Severance and other (0.1) — Non-GAAP Cost of hardware revenue included in Adjusted EBITDA $ 8.2 $ 6.9 Less: Alignment of accounting policies19 — 1.0 Total Cost of hardware revenue, Non-GAAP $ 8.2 $ 7.9 Cost of other revenue, GAAP $ 0.8 $ 1.0 Less: Stock-based compensation — (0.1) Total Cost of other revenue, Non-GAAP $ 0.8 $ 0.9 Cost of revenue, GAAP $ 18.3 $ 15.9 Less: Depreciation and amortization (1.2) (1.1) Less: Stock-based compensation (0.3) (0.3) Less: Severance and other (0.2) — Non-GAAP Cost of revenue included in Adjusted EBITDA $ 16.6 $ 14.5 Less: Alignment of accounting policies19 — 1.0 Total Cost of revenue, Non-GAAP $ 16.6 $ 15.5 19 Includes non-recurring costs reflecting the alignment of accounting policies attributable to the integration with Tile. As these adjustments are not deemed to be non-routine or one time in nature, they have not been added back to EBITDA or Adjusted EBITDA. Operating expenses (GAAP to Non-GAAP reconciliation): Three Months Ended March 31, 2023 2022 (in millions) Research and development expense, GAAP $ 27.2 $ 25.7 Less: Stock-based compensation (4.8) (3.6) Less: Severance and other (2.8) — Total Research and development, Non-GAAP $ 19.6 $ 22.1 Sales and marketing expense, GAAP $ 24.3 $ 23.2 Less: Depreciation and amortization (1.1) (1.0) Less: Stock-based compensation (0.9) (0.8) Less: Severance and other (0.7) — Less: User acquisition and TV costs (6.3) (6.6) Less: Commissions (10.3) (8.3) Total Sales and marketing expense, Non-GAAP $ 5.1 $ 6.5 General and administrative expense, GAAP $ 13.2 $ 13.2 Less: Depreciation and amortization — (0.1) Less: Stock-based compensation (2.9) (1.4) Less: Severance and other (0.6) (5.3) Total General and administrative expense, Non-GAAP $ 9.7 $ 6.5 Note: The financial information in this announcement is unaudited and may not add or recalculate due to rounding. All references to $ are to U.S. $. Life360, Inc. | ARBN 629 412 942 | 1900 South Norfolk St, Suite 310 San Mateo, CA 94403 | investors.life360.com 13

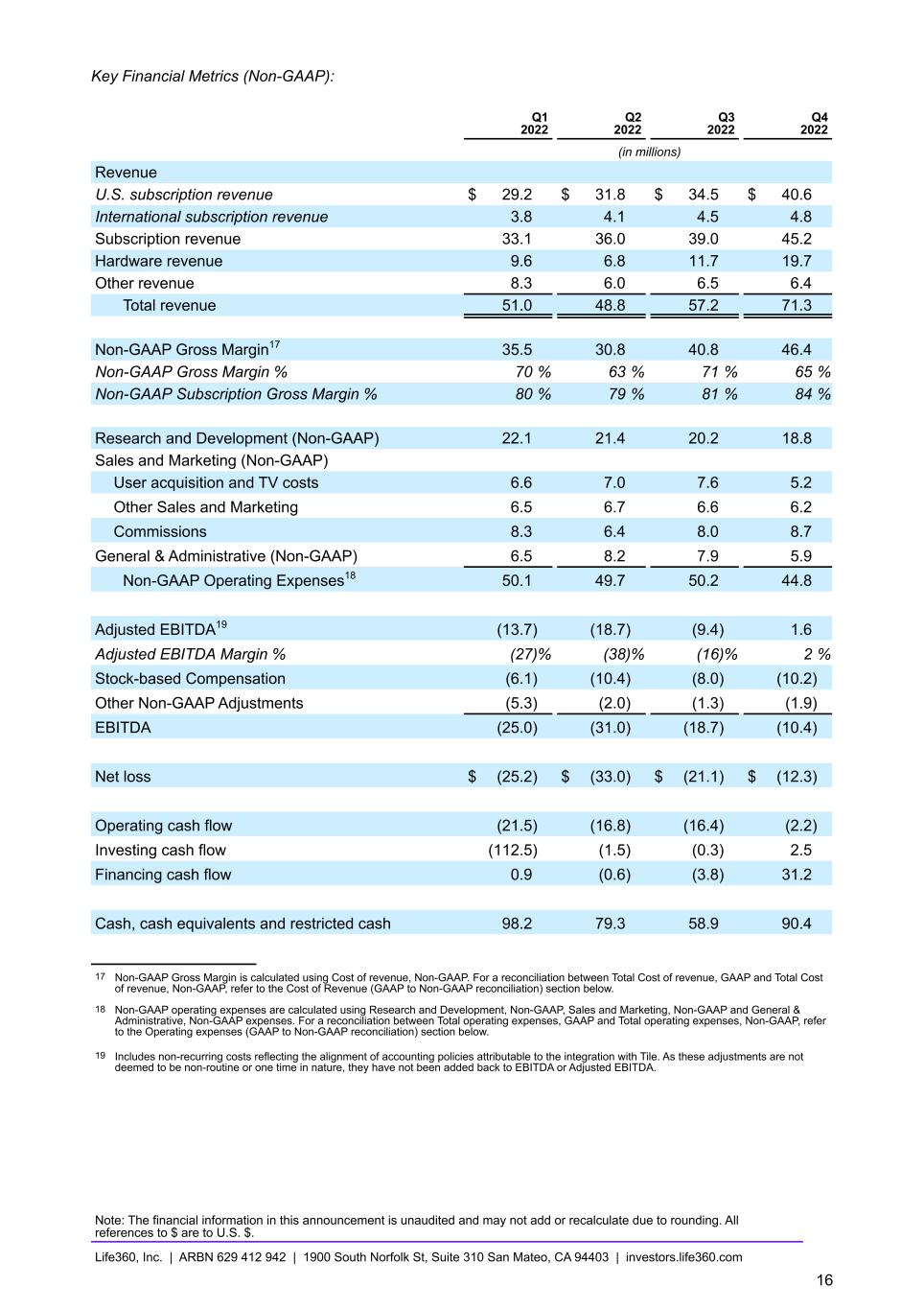

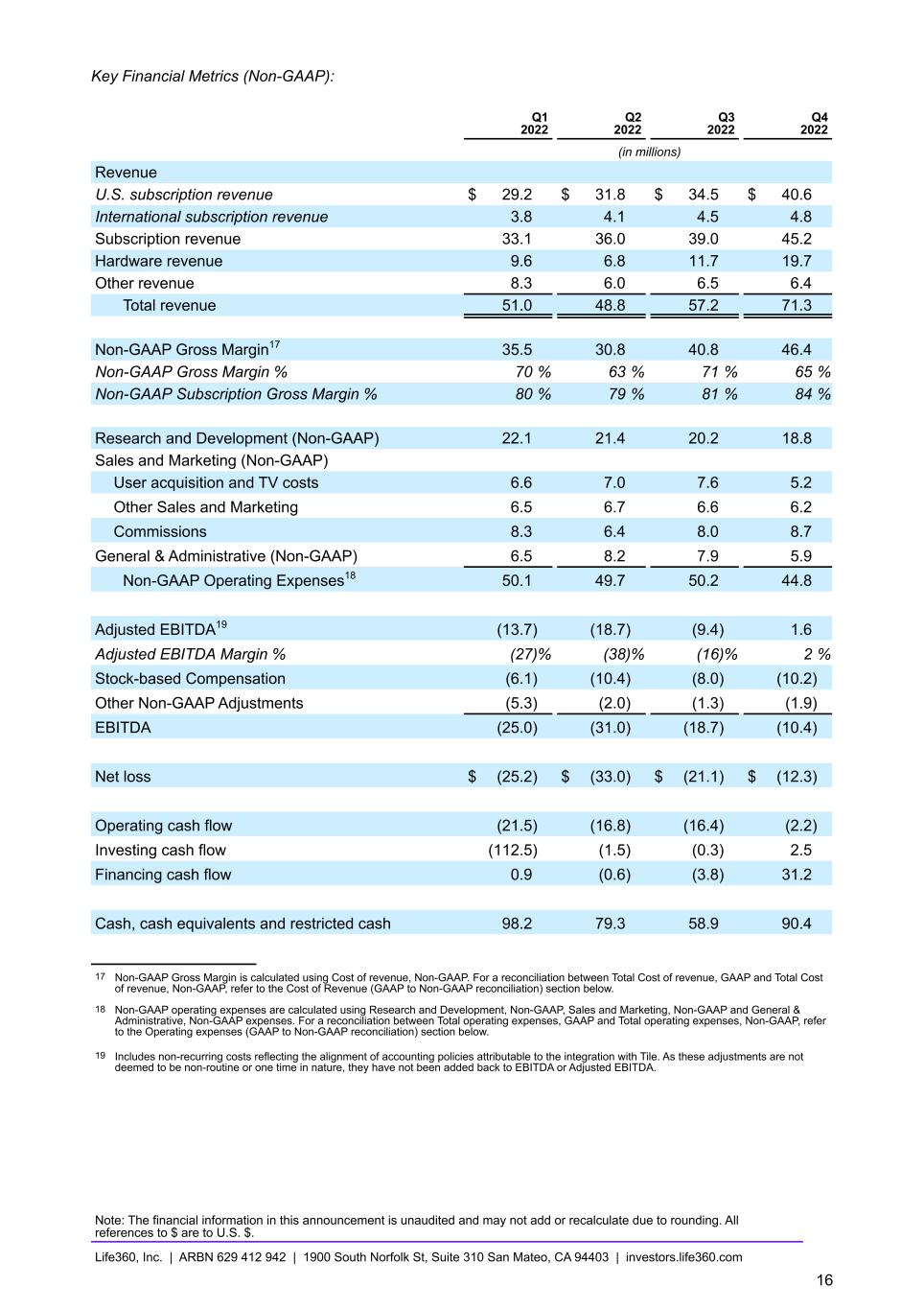

Key Financial Metrics (Non-GAAP): Q1 2022 Q2 2022 Q3 2022 Q4 2022 (in millions) Revenue U.S. subscription revenue $ 29.2 $ 31.8 $ 34.5 $ 40.6 International subscription revenue 3.8 4.1 4.5 4.8 Subscription revenue 33.1 36.0 39.0 45.2 Hardware revenue 9.6 6.8 11.7 19.7 Other revenue 8.3 6.0 6.5 6.4 Total revenue 51.0 48.8 57.2 71.3 Non-GAAP Gross Margin17 35.5 30.8 40.8 46.4 Non-GAAP Gross Margin % 70 % 63 % 71 % 65 % Non-GAAP Subscription Gross Margin % 80 % 79 % 81 % 84 % Research and Development (Non-GAAP) 22.1 21.4 20.2 18.8 Sales and Marketing (Non-GAAP) User acquisition and TV costs 6.6 7.0 7.6 5.2 Other Sales and Marketing 6.5 6.7 6.6 6.2 Commissions 8.3 6.4 8.0 8.7 General & Administrative (Non-GAAP) 6.5 8.2 7.9 5.9 Non-GAAP Operating Expenses18 50.1 49.7 50.2 44.8 Adjusted EBITDA19 (13.7) (18.7) (9.4) 1.6 Adjusted EBITDA Margin % (27) % (38) % (16) % 2 % Stock-based Compensation (6.1) (10.4) (8.0) (10.2) Other Non-GAAP Adjustments (5.3) (2.0) (1.3) (1.9) EBITDA (25.0) (31.0) (18.7) (10.4) Net loss $ (25.2) $ (33.0) $ (21.1) $ (12.3) Operating cash flow (21.5) (16.8) (16.4) (2.2) Investing cash flow (112.5) (1.5) (0.3) 2.5 Financing cash flow 0.9 (0.6) (3.8) 31.2 Cash, cash equivalents and restricted cash 98.2 79.3 58.9 90.4 17 Non-GAAP Gross Margin is calculated using Cost of revenue, Non-GAAP. For a reconciliation between Total Cost of revenue, GAAP and Total Cost of revenue, Non-GAAP, refer to the Cost of Revenue (GAAP to Non-GAAP reconciliation) section below. 18 Non-GAAP operating expenses are calculated using Research and Development, Non-GAAP, Sales and Marketing, Non-GAAP and General & Administrative, Non-GAAP expenses. For a reconciliation between Total operating expenses, GAAP and Total operating expenses, Non-GAAP, refer to the Operating expenses (GAAP to Non-GAAP reconciliation) section below. 19 Includes non-recurring costs reflecting the alignment of accounting policies attributable to the integration with Tile. As these adjustments are not deemed to be non-routine or one time in nature, they have not been added back to EBITDA or Adjusted EBITDA. Note: The financial information in this announcement is unaudited and may not add or recalculate due to rounding. All references to $ are to U.S. $. Life360, Inc. | ARBN 629 412 942 | 1900 South Norfolk St, Suite 310 San Mateo, CA 94403 | investors.life360.com 16

Cost of Revenue (GAAP to Non-GAAP reconciliation): Q1 2022 Q2 2022 Q3 2022 Q4 2022 (in millions) Cost of subscription revenue, GAAP $ 7.1 $ 7.9 $ 7.8 $ 7.9 Less: Depreciation and amortization (0.2) (0.2) (0.2) (0.3) Less: Stock-based compensation (0.2) (0.2) (0.1) (0.1) Total Cost of subscription revenue, Non-GAAP $ 6.6 $ 7.4 $ 7.4 $ 7.5 Cost of hardware revenue, GAAP $ 7.8 $ 10.8 $ 9.3 $ 17.5 Less: Depreciation and amortization (0.9) (0.9) (0.9) (0.9) Less: Stock-based compensation — (0.2) (0.1) (0.1) Less: Severance and other — — (0.1) — Non-GAAP Cost of hardware revenue included in Adjusted EBITDA $ 6.9 $ 9.7 $ 8.2 $ 16.5 Less: Alignment of accounting policies19 1.0 — — — Total Cost of hardware revenue, Non-GAAP $ 7.9 $ 9.7 $ 8.2 $ 16.5 Cost of other revenue, GAAP $ 1.0 $ 0.9 $ 0.8 $ 0.9 Less: Stock-based compensation (0.1) — (0.1) (0.1) Total Cost of other revenue, Non-GAAP $ 0.9 $ 0.9 $ 0.8 $ 0.9 Cost of revenue, GAAP $ 15.9 $ 19.6 $ 17.9 $ 26.3 Less: Depreciation and amortization (1.1) (1.1) (1.1) (1.2) Less: Stock-based compensation (0.3) (0.4) (0.3) (0.3) Less: Severance and other — — (0.1) — Non-GAAP Cost of revenue included in Adjusted EBITDA $ 14.5 $ 18.1 $ 16.4 $ 24.8 Less: Alignment of accounting policies19 1.0 — — — Total Cost of revenue, Non-GAAP $ 15.5 $ 18.0 $ 16.4 $ 24.9 19 Includes non-recurring costs reflecting the alignment of accounting policies attributable to the integration with Tile. As these adjustments are not deemed to be non-routine or one time in nature, they have not been added back to EBITDA or Adjusted EBITDA. Operating expenses (GAAP to Non-GAAP reconciliation): Q1 2022 Q2 2022 Q3 2022 Q4 2022 (in millions) Research and development expense, GAAP $ 25.7 $ 27.0 $ 24.6 $ 25.1 Less: Stock-based compensation (3.6) (5.3) (4.2) (6.3) Less: Severance and other — (0.3) (0.2) — Total Research and development, Non-GAAP $ 22.1 $ 21.4 $ 20.2 $ 18.8 Sales and marketing expense, GAAP $ 23.2 $ 22.9 $ 24.2 $ 22.1 Less: Depreciation and amortization (1.0) (1.1) (1.1) (1.1) Less: Stock-based compensation (0.8) (1.3) (0.9) (0.7) Less: Severance and other — (0.4) (0.1) (0.1) Less: User acquisition and TV costs (6.6) (7.0) (7.6) (5.2) Less: Commissions (8.3) (6.4) (8.0) (8.7) Total Sales and marketing expense, Non-GAAP $ 6.5 $ 6.7 $ 6.6 $ 6.2 General and administrative expense, GAAP $ 13.2 $ 12.8 $ 11.6 $ 10.5 Less: Depreciation and amortization (0.1) (0.1) (0.1) (0.1) Less: Stock-based compensation (1.4) (3.3) (2.5) (2.9) Less: Severance and other (5.3) (1.2) (1.0) (1.6) Total General and administrative expense, Non-GAAP $ 6.5 $ 8.2 $ 7.9 $ 5.9 Note: The financial information in this announcement is unaudited and may not add or recalculate due to rounding. All references to $ are to U.S. $. Life360, Inc. | ARBN 629 412 942 | 1900 South Norfolk St, Suite 310 San Mateo, CA 94403 | investors.life360.com 17