Nareit’s REITworld 2023 Annual Conference NOVEMBER 14-15, 2023 Exhibit 99.1

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to our expectations for future periods. Forward-looking statements do not discuss historical fact, but instead include statements related to expectations, projections, intentions or other items related to the future. Such forward-looking statements include, without limitation, statements regarding expected operating performance and results, property stabilizations, property acquisition and disposition activity, joint venture activity, development, redevelopment and repositioning activity and other capital expenditures, and capital raising and financing activity, as well as lease pricing, revenue and expense growth, occupancy, supply level, demand, job growth, interest rate and other economic expectations. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “forecasts,” “projects,” “assumes,” “will,” “may,” “could,” “should,” “budget,” “target,” “outlook,” “proforma,” “opportunity,” “guidance” and variations of such words and similar expressions are intended to identify such forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, as described below, which may cause our actual results, performance or achievements to be materially different from the results of operations, financial conditions or plans expressed or implied by such forward-looking statements. Although we believe that the assumptions underlying the forward-looking statements contained herein are reasonable, any of the assumptions could be inaccurate, and therefore such forward-looking statements included in this presentation may not prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be achieved. The following factors, among others, could cause our actual results, performance or achievements to differ materially from those expressed or implied in the forward-looking statements: inability to generate sufficient cash flows due to unfavorable economic and market conditions, changes in supply and/or demand, competition, uninsured losses, changes in tax and housing laws, or other factors; exposure, as a multifamily focused REIT, to risks inherent in investments in a single industry and sector; adverse changes in real estate markets, including, but not limited to, the extent of future demand for multifamily units in our significant markets, barriers of entry into new markets which we may seek to enter in the future, limitations on our ability to increase rental rates, competition, our ability to identify and consummate attractive acquisitions or development projects on favorable terms, our ability to consummate any planned dispositions in a timely manner on acceptable terms, and our ability to reinvest sale proceeds in a manner that generates favorable returns; failure of new acquisitions to achieve anticipated results or be efficiently integrated; failure of development communities to be completed within budget and on a timely basis, if at all, to lease-up as anticipated or to achieve anticipated results; unexpected capital needs; material changes in operating costs, including real estate taxes, utilities and insurance costs, due to inflation and other factors; inability to obtain appropriate insurance coverage at reasonable rates, or at all, or losses from catastrophes in excess of our insurance coverage; ability to obtain financing at favorable rates, if at all, and refinance existing debt as it matures; level and volatility of interest or capitalization rates or capital market conditions; price volatility, dislocations and liquidity disruptions in the financial markets and the resulting impact on financing; the effect of any rating agency actions on the cost and availability of new debt financing; the impact of adverse developments affecting the U.S. or global banking industry, including bank failures and liquidity concerns, which could cause continued or worsening economic and market volatility, and regulatory responses thereto; significant change in the mortgage financing market that would cause single-family housing, either as an owned or rental product, to become a more significant competitive product; our ability to continue to satisfy complex rules in order to maintain our status as a REIT for federal income tax purposes, the ability of MAALP to satisfy the rules to maintain its status as a partnership for federal income tax purposes, the ability of our taxable REIT subsidiaries to maintain their status as such for federal income tax purposes, and our ability and the ability of our subsidiaries to operate effectively within the limitations imposed by these rules; inability to attract and retain qualified personnel; cyber liability or potential liability for breaches of our or our service providers’ information technology systems, or business operations disruptions; potential liability for environmental contamination; changes in the legal requirements we are subject to, or the imposition of new legal requirements, that adversely affect our operations; extreme weather and natural disasters; disease outbreaks and public health events and measures that are taken by federal, state and local governmental authorities in response to such outbreaks and events; impact of climate change on our properties or operations; legal proceedings or class action lawsuits; impact of reputational harm caused by negative press or social media postings of our actions or policies, whether or not warranted; compliance costs associated with numerous federal, state and local laws and regulations; and other risks identified in reports we file with the Securities and Exchange Commission from time to time, including those discussed under the heading “Risk Factors” in our most recently filed Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q. We undertake no duty to update or revise any forward-looking statements appearing in this presentation to reflect events, circumstances or changes in expectations after the date of this presentation. REGULATION G This presentation contains certain non-GAAP financial measures within the meaning of the Securities Exchange Act of 1934, as amended. Our definitions of such non-GAAP financial measures and reconciliations to the most directly comparable GAAP measures can be found in the accompanying Appendix and under the “Filings & Financials – Quarterly Results” navigation tab on the “For Investors” page of our website at www.maac.com.

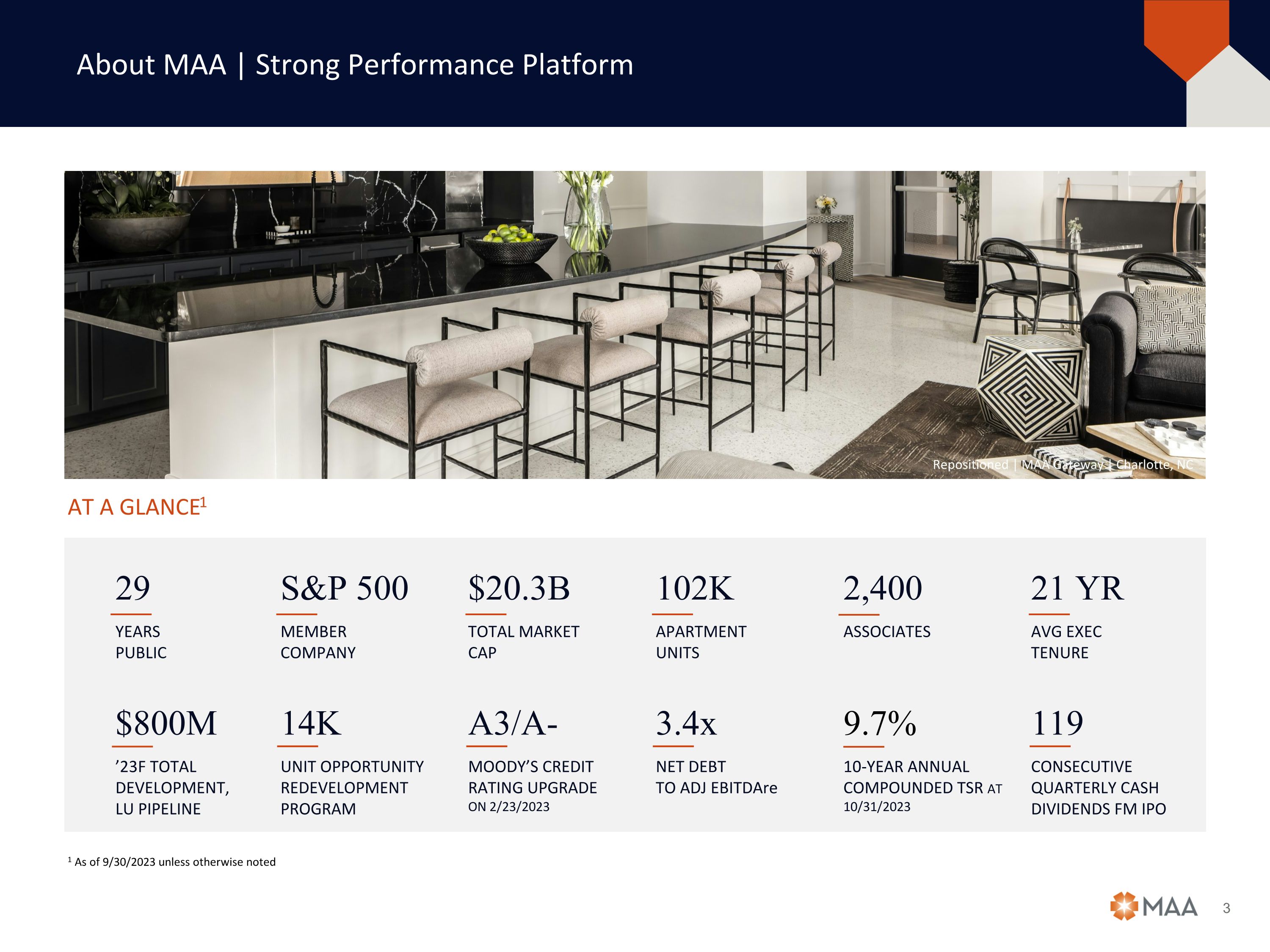

About MAA | Strong Performance Platform 29 S&P 500 $20.3B 102K 2,400 21 YR YEARS PUBLIC MEMBER COMPANY TOTAL MARKET CAP APARTMENT UNITS ASSOCIATES AVG EXEC TENURE $800M 14K A3/A- 3.4x 9.7% 119 ’23F TOTAL DEVELOPMENT, LU PIPELINE UNIT OPPORTUNITY REDEVELOPMENT PROGRAM MOODY’S CREDIT RATING UPGRADE ON 2/23/2023 NET DEBT TO ADJ EBITDAre 10-YEAR ANNUAL COMPOUNDED TSR AT 10/31/2023 CONSECUTIVE QUARTERLY CASH DIVIDENDS FM IPO AT A GLANCE1 Repositioned | MAA Gateway | Charlotte, NC 1 As of 9/30/2023 unless otherwise noted

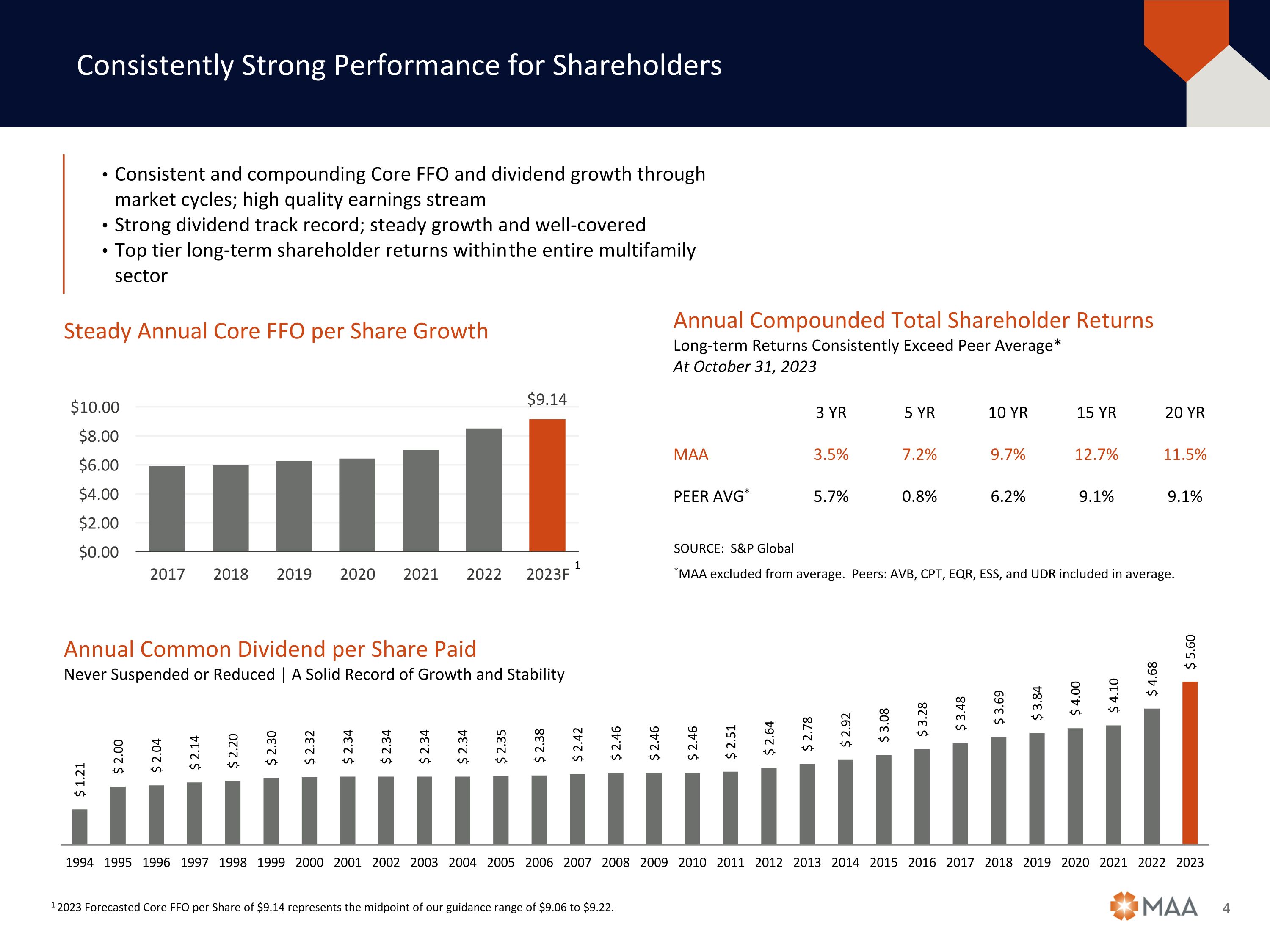

Consistently Strong Performance for Shareholders Steady Annual Core FFO per Share Growth Consistent and compounding Core FFO and dividend growth through market cycles; high quality earnings stream Strong dividend track record; steady growth and well-covered Top tier long-term shareholder returns within the entire multifamily sector Annual Compounded Total Shareholder Returns Long-term Returns Consistently Exceed Peer Average* At October 31, 2023 3 YR 5 YR 10 YR 15 YR 20 YR MAA 3.5% 7.2% 9.7% 12.7% 11.5% PEER AVG* 5.7% 0.8% 6.2% 9.1% 9.1% SOURCE: S&P Global *MAA excluded from average. Peers: AVB, CPT, EQR, ESS, and UDR included in average. 1 2023 Forecasted Core FFO per Share of $9.14 represents the midpoint of our guidance range of $9.06 to $9.22. 1 Annual Common Dividend per Share Paid Never Suspended or Reduced | A Solid Record of Growth and Stability

Differentiated Portfolio Strategy Unique market focus…captures benefits of high growth and demand Submarket and property type/class diversification helps to lessen periodic supply-side pressures… drives superior, long-term and full-cycle performance Diversified renter price point… appeals to largest segment of the rental market… creates stability Outlook & Update Portfolio strategy and market dynamics…support long-term rent growth prospects New development, redevelopment and tech initiatives…expected to drive meaningful future value creation External Growth Opportunities 29 years successful Sunbelt transactions + strong balance sheet…drive robust deal flow In-house new development operation + JV “pre-purchase” development program…expands growth platform Robust Redevelopment Program Proven unit interior redevelopment program...enhances long-term earnings potential Property repositioning program...expected to drive additional property-level rent growth Technology Initiatives & Innovation Smart home installations…expected to continue to enhance revenue in 2023 and into 2024 Tech advances in website lead generation & virtual leasing…expands prospect management effectiveness Balance Sheet Strength Strong, investment-grade balance sheet… positions us well to pursue new growth opportunities 2023 rating upgrade reflects continued strength Sustainability Increasing focus on property efficiency measures…align with climate objectives Long-established focus on driving energy/natural resources efficiency, strong governance and value in people Creating Value Through the Full Market Cycle Repositioned | MAA McKinney | Dallas, TX

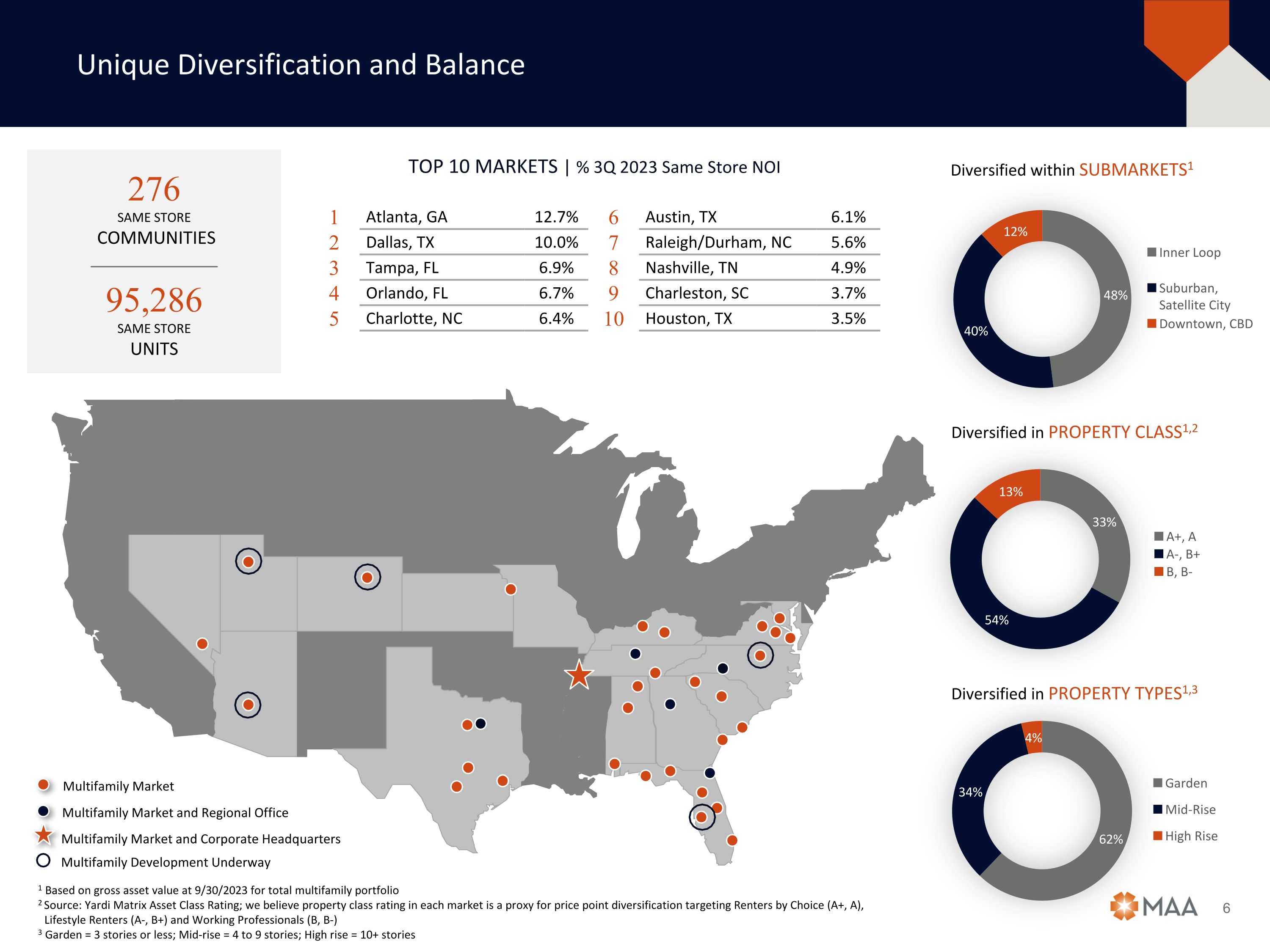

TOP 10 MARKETS | % 3Q 2023 Same Store NOI TOP 10 MARKETS 1 Atlanta, GA 12.7% 6 Austin, TX 6.1% 2 Dallas, TX 10.0% 7 Raleigh/Durham, NC 5.6% 3 Tampa, FL 6.9% 8 Nashville, TN 4.9% 4 Orlando, FL 6.7% 9 Charleston, SC 3.7% 5 Charlotte, NC 6.4% 10 Houston, TX 3.5% Unique Diversification and Balance 1 Based on gross asset value at 9/30/2023 for total multifamily portfolio 2 Source: Yardi Matrix Asset Class Rating; we believe property class rating in each market is a proxy for price point diversification targeting Renters by Choice (A+, A), Lifestyle Renters (A-, B+) and Working Professionals (B, B-) 3 Garden = 3 stories or less; Mid-rise = 4 to 9 stories; High rise = 10+ stories Diversified within SUBMARKETS1 Diversified in PROPERTY CLASS1,2 Diversified in PROPERTY TYPES1,3 276 SAME STORE COMMUNITIES 95,286 SAME STORE UNITS Multifamily Market Multifamily Market and Regional Office Multifamily Market and Corporate Headquarters Multifamily Development Underway

A Proven Portfolio Strategy for Long-Term Growth and Stability Our diverse portfolio of high-quality properties appeals to the largest segment of the rental market Our portfolio strategy drives long-term growth and greater stability through the full market cycle + Repositioned | MAA Worthington | Dallas, TX

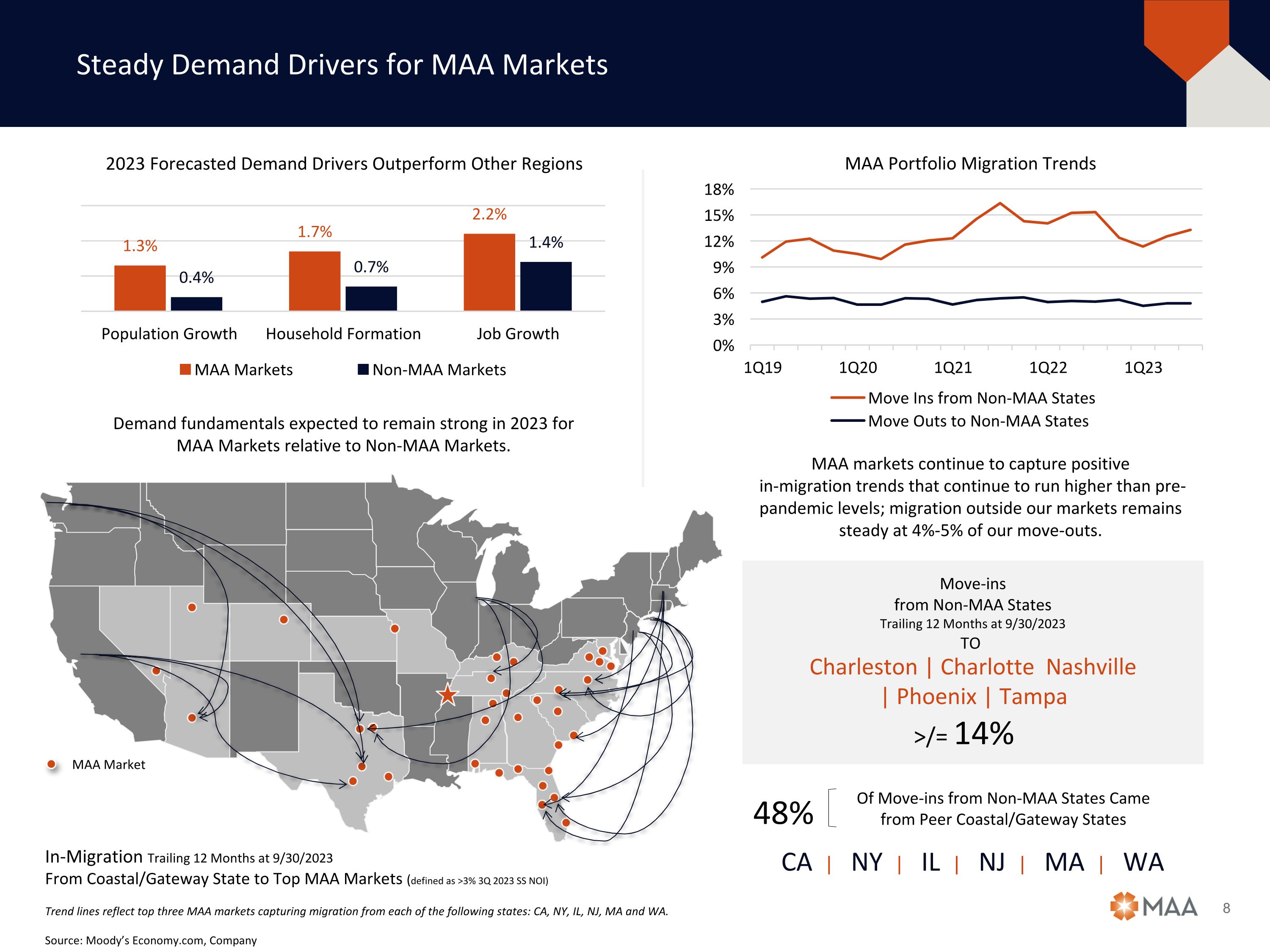

Steady Demand Drivers for MAA Markets Move-ins from Non-MAA States Trailing 12 Months at 9/30/2023 CA | NY | IL | NJ | MA | WA 48% Of Move-ins from Non-MAA States Came from Peer Coastal/Gateway States MAA markets continue to capture positive in-migration trends that continue to run higher than pre-pandemic levels; migration outside our markets remains steady at 4%-5% of our move-outs. In-Migration Trailing 12 Months at 9/30/2023 From Coastal/Gateway State to Top MAA Markets (defined as >3% 3Q 2023 SS NOI) Trend lines reflect top three MAA markets capturing migration from each of the following states: CA, NY, IL, NJ, MA and WA. MAA Market Charleston | Charlotte Nashville | Phoenix | Tampa Source: Moody’s Economy.com, Company 2023 Forecasted Demand Drivers Outperform Other Regions Demand fundamentals expected to remain strong in 2023 for MAA Markets relative to Non-MAA Markets. >/= 14% TO MAA Portfolio Migration Trends

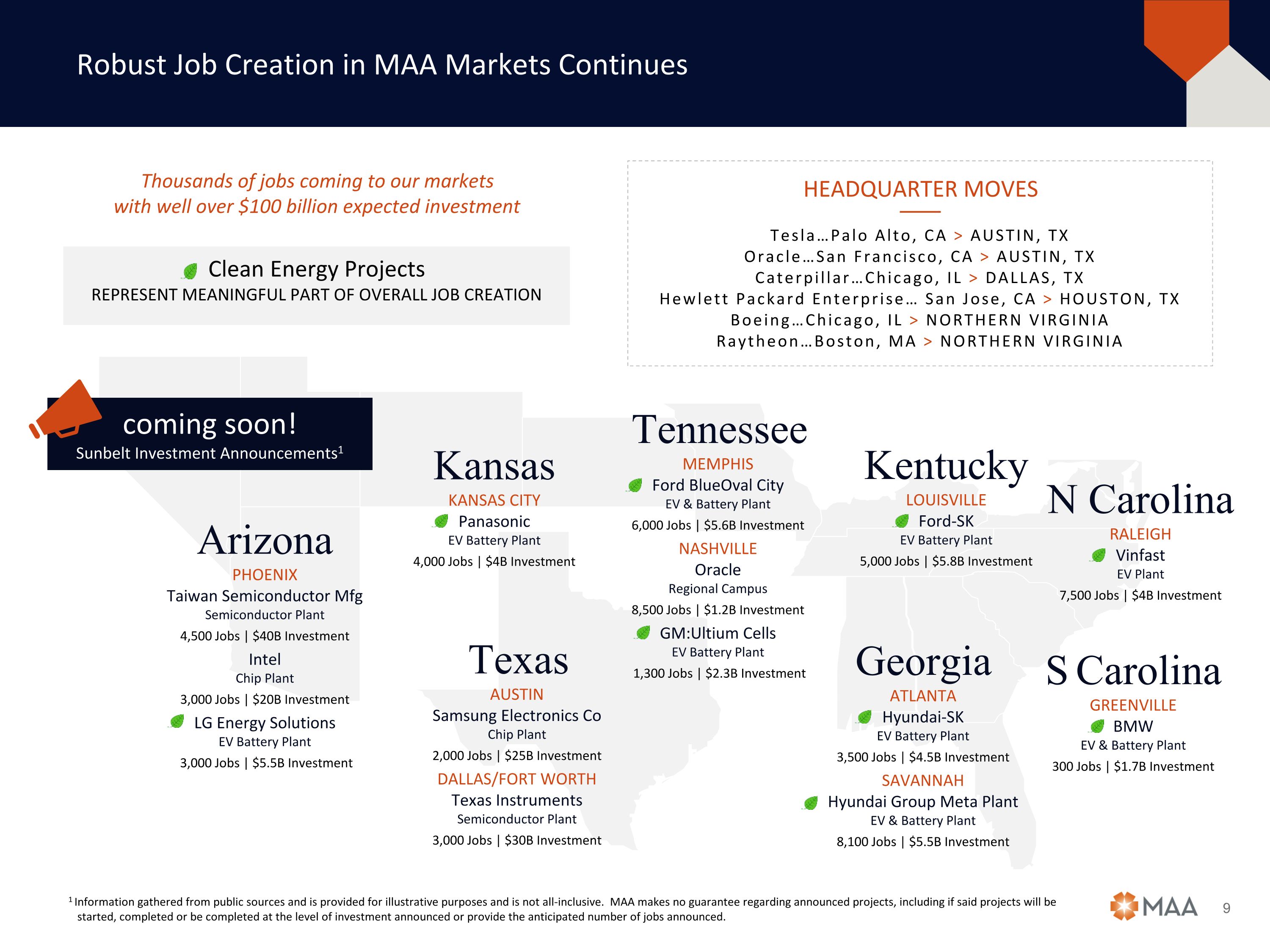

Robust Job Creation in MAA Markets Continues Georgia ATLANTA Hyundai-SK EV Battery Plant 3,500 Jobs | $4.5B Investment SAVANNAH Hyundai Group Meta Plant EV & Battery Plant 8,100 Jobs | $5.5B Investment Texas AUSTIN Samsung Electronics Co Chip Plant 2,000 Jobs | $25B Investment DALLAS/FORT WORTH Texas Instruments Semiconductor Plant 3,000 Jobs | $30B Investment HEADQUARTER MOVES Tesla…Palo Alto, CA > AUSTIN, TX Oracle…San Francisco, CA > AUSTIN, TX Caterpillar…Chicago, IL > DALLAS, TX Hewlett Packard Enterprise… San Jose, CA > HOUSTON, TX Boeing…Chicago, IL > NORTHERN VIRGINIA Raytheon…Boston, MA > NORTHERN VIRGINIA S Carolina GREENVILLE BMW EV & Battery Plant 300 Jobs | $1.7B Investment Arizona PHOENIX Taiwan Semiconductor Mfg Semiconductor Plant 4,500 Jobs | $40B Investment Intel Chip Plant 3,000 Jobs | $20B Investment LG Energy Solutions EV Battery Plant 3,000 Jobs | $5.5B Investment Tennessee MEMPHIS Ford BlueOval City EV & Battery Plant 6,000 Jobs | $5.6B Investment NASHVILLE Oracle Regional Campus 8,500 Jobs | $1.2B Investment GM:Ultium Cells EV Battery Plant 1,300 Jobs | $2.3B Investment Kentucky LOUISVILLE Ford-SK EV Battery Plant 5,000 Jobs | $5.8B Investment Kansas KANSAS CITY Panasonic EV Battery Plant 4,000 Jobs | $4B Investment coming soon! Sunbelt Investment Announcements1 Clean Energy Projects REPRESENT MEANINGFUL PART OF OVERALL JOB CREATION N Carolina RALEIGH Vinfast EV Plant 7,500 Jobs | $4B Investment 1 Information gathered from public sources and is provided for illustrative purposes and is not all-inclusive. MAA makes no guarantee regarding announced projects, including if said projects will be started, completed or be completed at the level of investment announced or provide the anticipated number of jobs announced. Thousands of jobs coming to our markets with well over $100 billion expected investment

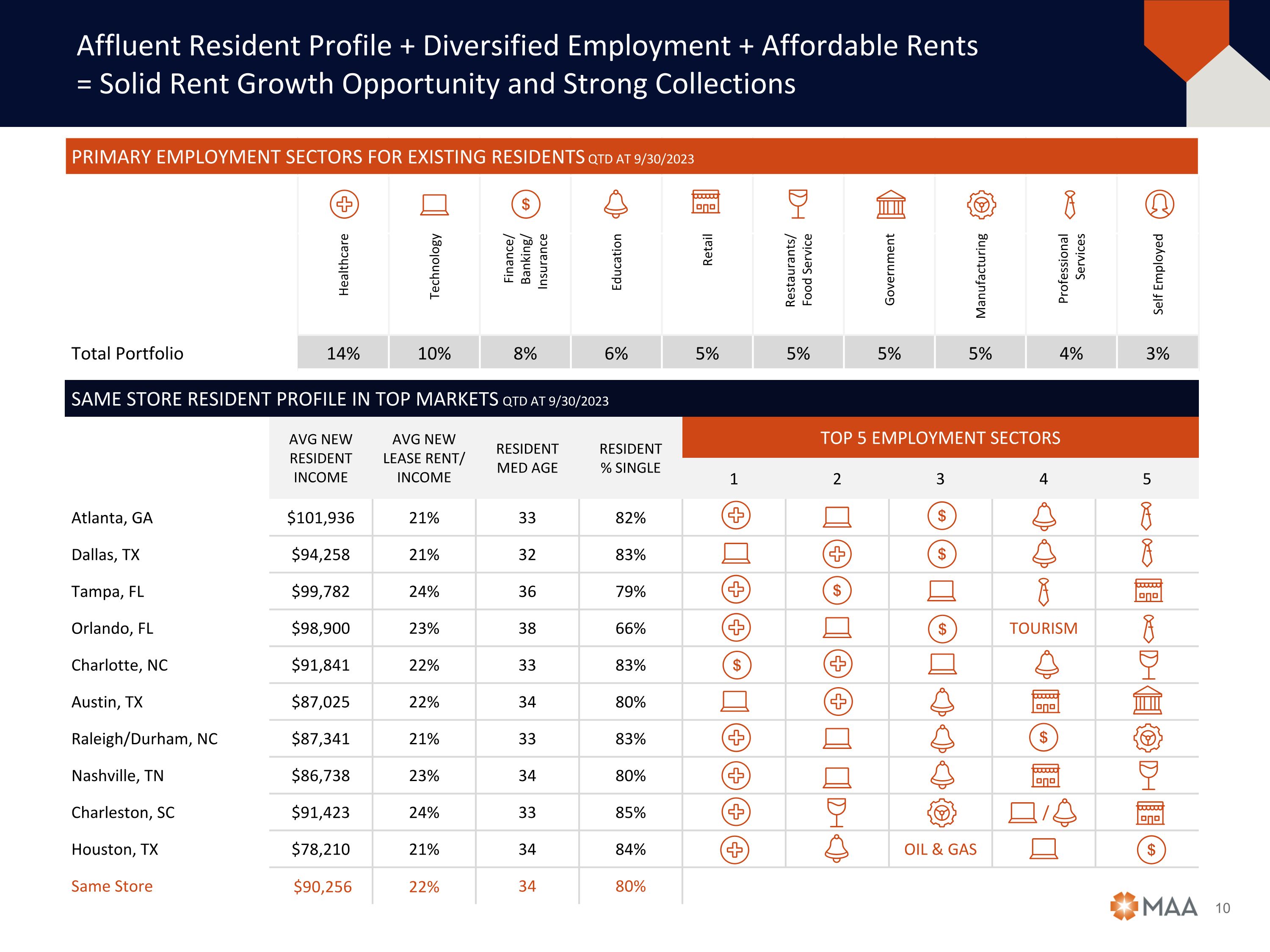

SAME STORE RESIDENT PROFILE IN TOP MARKETS QTD AT 9/30/2023 AVG NEW RESIDENT INCOME AVG NEW LEASE RENT/ INCOME RESIDENT MED AGE RESIDENT % SINGLE TOP 5 EMPLOYMENT SECTORS 1 2 3 4 5 Atlanta, GA $101,936 21% 33 82% Dallas, TX $94,258 21% 32 83% Tampa, FL $99,782 24% 36 79% Orlando, FL $98,900 23% 38 66% TOURISM Charlotte, NC $91,841 22% 33 83% Austin, TX $87,025 22% 34 80% Raleigh/Durham, NC $87,341 21% 33 83% Nashville, TN $86,738 23% 34 80% Charleston, SC $91,423 24% 33 85% / Houston, TX $78,210 21% 34 84% OIL & GAS Same Store $90,256 22% 34 80% PRIMARY EMPLOYMENT SECTORS FOR EXISTING RESIDENTS QTD AT 9/30/2023 Healthcare Technology Finance/ Banking/ Insurance Education Retail Restaurants/ Food Service Government Manufacturing Professional Services Self Employed Total Portfolio 14% 10% 8% 6% 5% 5% 5% 5% 4% 3% Affluent Resident Profile + Diversified Employment + Affordable Rents = Solid Rent Growth Opportunity and Strong Collections

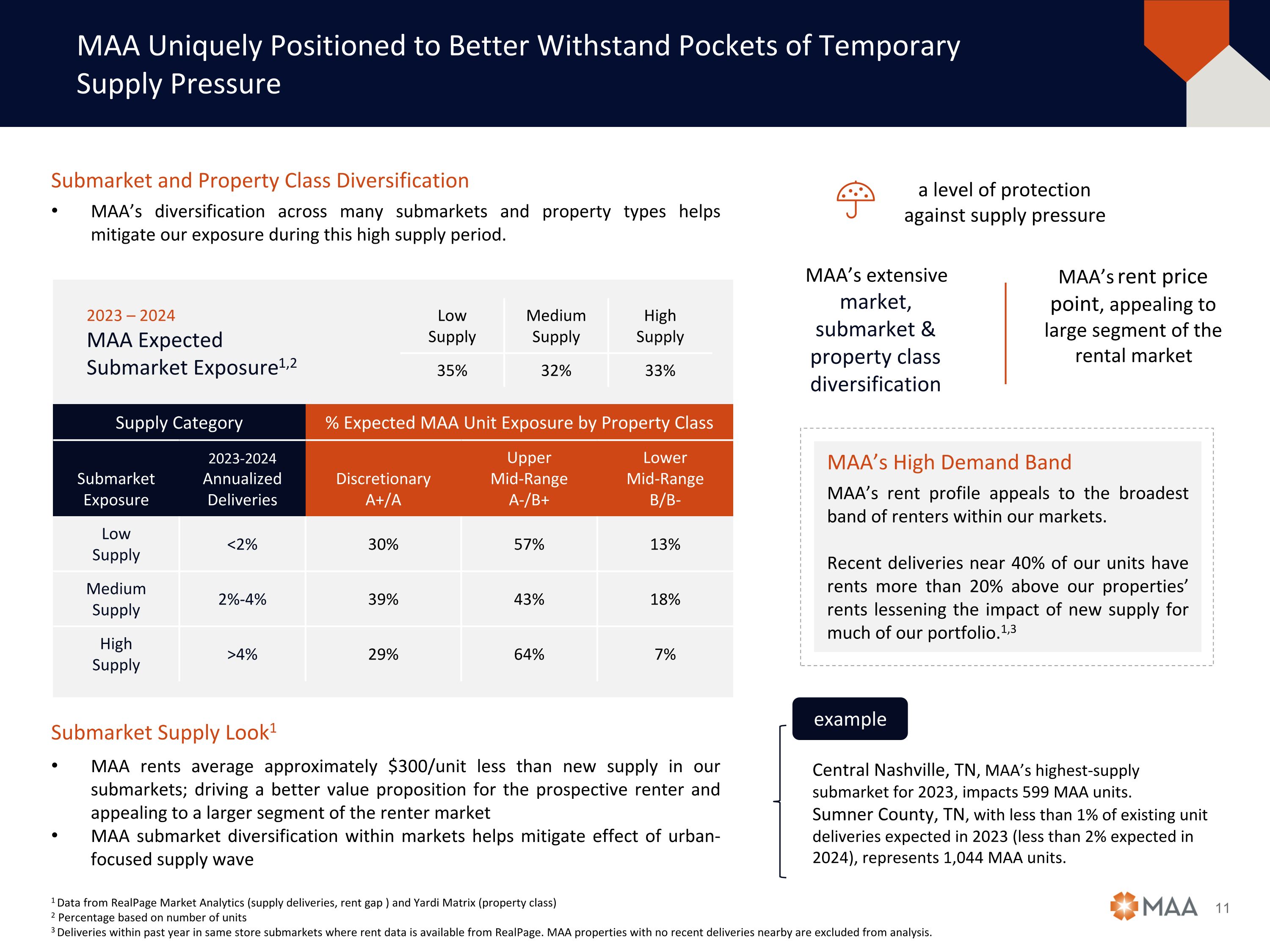

Submarket and Property Class Diversification MAA’s diversification across many submarkets and property types helps mitigate our exposure during this high supply period. Submarket Supply Look1 MAA rents average approximately $300/unit less than new supply in our submarkets; driving a better value proposition for the prospective renter and appealing to a larger segment of the renter market MAA submarket diversification within markets helps mitigate effect of urban-focused supply wave MAA Uniquely Positioned to Better Withstand Pockets of Temporary Supply Pressure 1 Data from RealPage Market Analytics (supply deliveries, rent gap ) and Yardi Matrix (property class) 2 Percentage based on number of units 3 Deliveries within past year in same store submarkets where rent data is available from RealPage. MAA properties with no recent deliveries nearby are excluded from analysis. MAA’s High Demand Band MAA’s rent profile appeals to the broadest band of renters within our markets. Recent deliveries near 40% of our units have rents more than 20% above our properties’ rents lessening the impact of new supply for much of our portfolio.1,3 MAA’s extensive market, submarket & property class diversification MAA’s rent price point, appealing to large segment of the rental market a level of protection against supply pressure Supply Category % Expected MAA Unit Exposure by Property Class Submarket Exposure 2023-2024 Annualized Deliveries Discretionary A+/A Upper Mid-Range A-/B+ Lower Mid-Range B/B- Low Supply <2% 30% 57% 13% Medium Supply 2%-4% 39% 43% 18% High Supply >4% 29% 64% 7% 2023 – 2024 MAA Expected Submarket Exposure1,2 Low Supply Medium Supply High Supply 35% 32% 33% Central Nashville, TN, MAA’s highest-supply submarket for 2023, impacts 599 MAA units. Sumner County, TN, with less than 1% of existing unit deliveries expected in 2023 (less than 2% expected in 2024), represents 1,044 MAA units. example

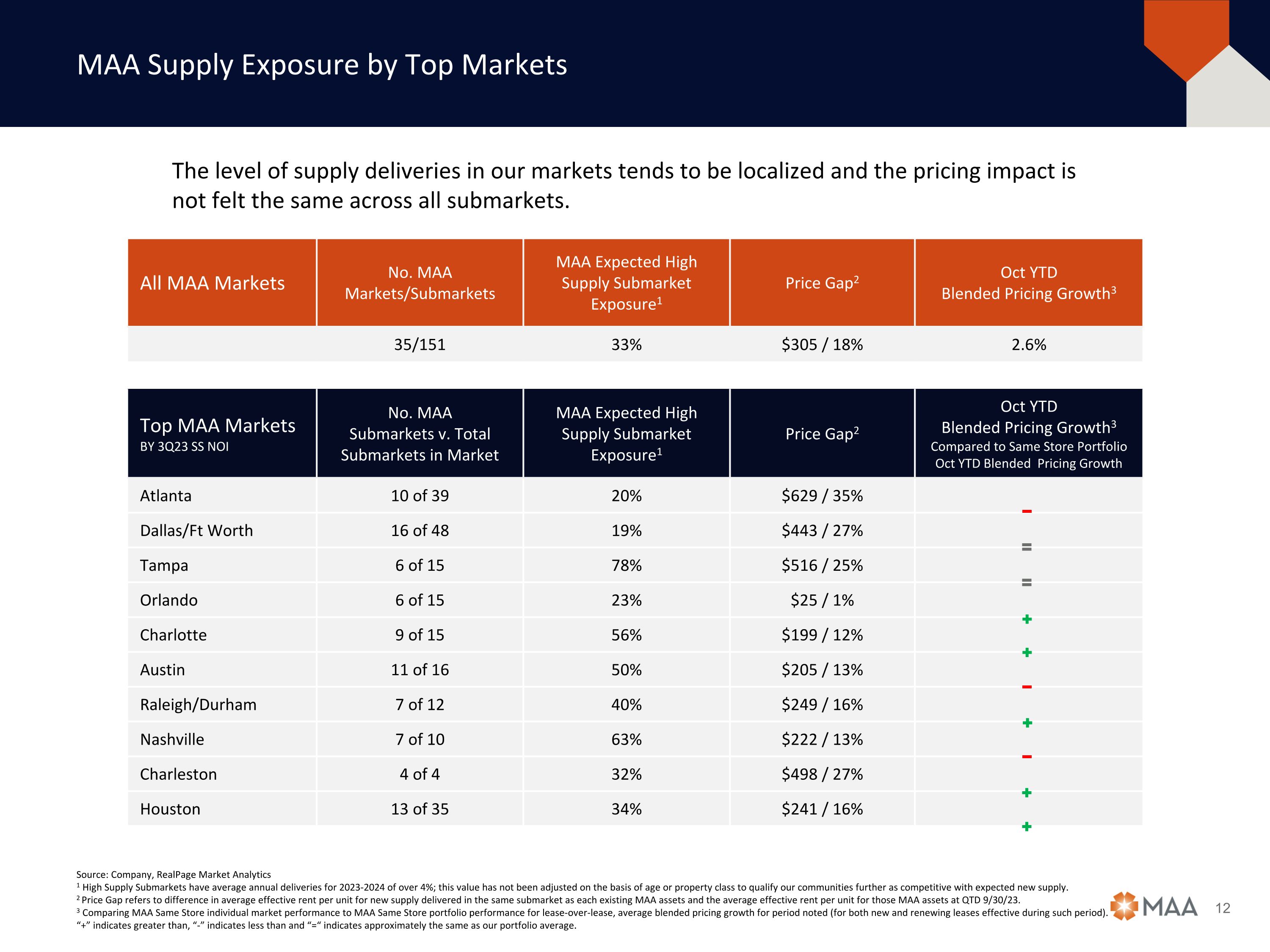

All MAA Markets No. MAA Markets/Submarkets MAA Expected High Supply Submarket Exposure1 Price Gap2 Oct YTD Blended Pricing Growth3 35/151 33% $305 / 18% 2.6% Top MAA Markets BY 3Q23 SS NOI No. MAA Submarkets v. Total Submarkets in Market MAA Expected High Supply Submarket Exposure1 Price Gap2 Oct YTD Blended Pricing Growth3 Compared to Same Store Portfolio Oct YTD Blended Pricing Growth Atlanta 10 of 39 20% $629 / 35% Dallas/Ft Worth 16 of 48 19% $443 / 27% Tampa 6 of 15 78% $516 / 25% Orlando 6 of 15 23% $25 / 1% Charlotte 9 of 15 56% $199 / 12% Austin 11 of 16 50% $205 / 13% Raleigh/Durham 7 of 12 40% $249 / 16% Nashville 7 of 10 63% $222 / 13% Charleston 4 of 4 32% $498 / 27% Houston 13 of 35 34% $241 / 16% MAA Supply Exposure by Top Markets The level of supply deliveries in our markets tends to be localized and the pricing impact is not felt the same across all submarkets. Source: Company, RealPage Market Analytics 1 High Supply Submarkets have average annual deliveries for 2023-2024 of over 4%; this value has not been adjusted on the basis of age or property class to qualify our communities further as competitive with expected new supply. 2 Price Gap refers to difference in average effective rent per unit for new supply delivered in the same submarket as each existing MAA assets and the average effective rent per unit for those MAA assets at QTD 9/30/23. 3 Comparing MAA Same Store individual market performance to MAA Same Store portfolio performance for lease-over-lease, average blended pricing growth for period noted (for both new and renewing leases effective during such period). “+” indicates greater than, “-” indicates less than and “=“ indicates approximately the same as our portfolio average.

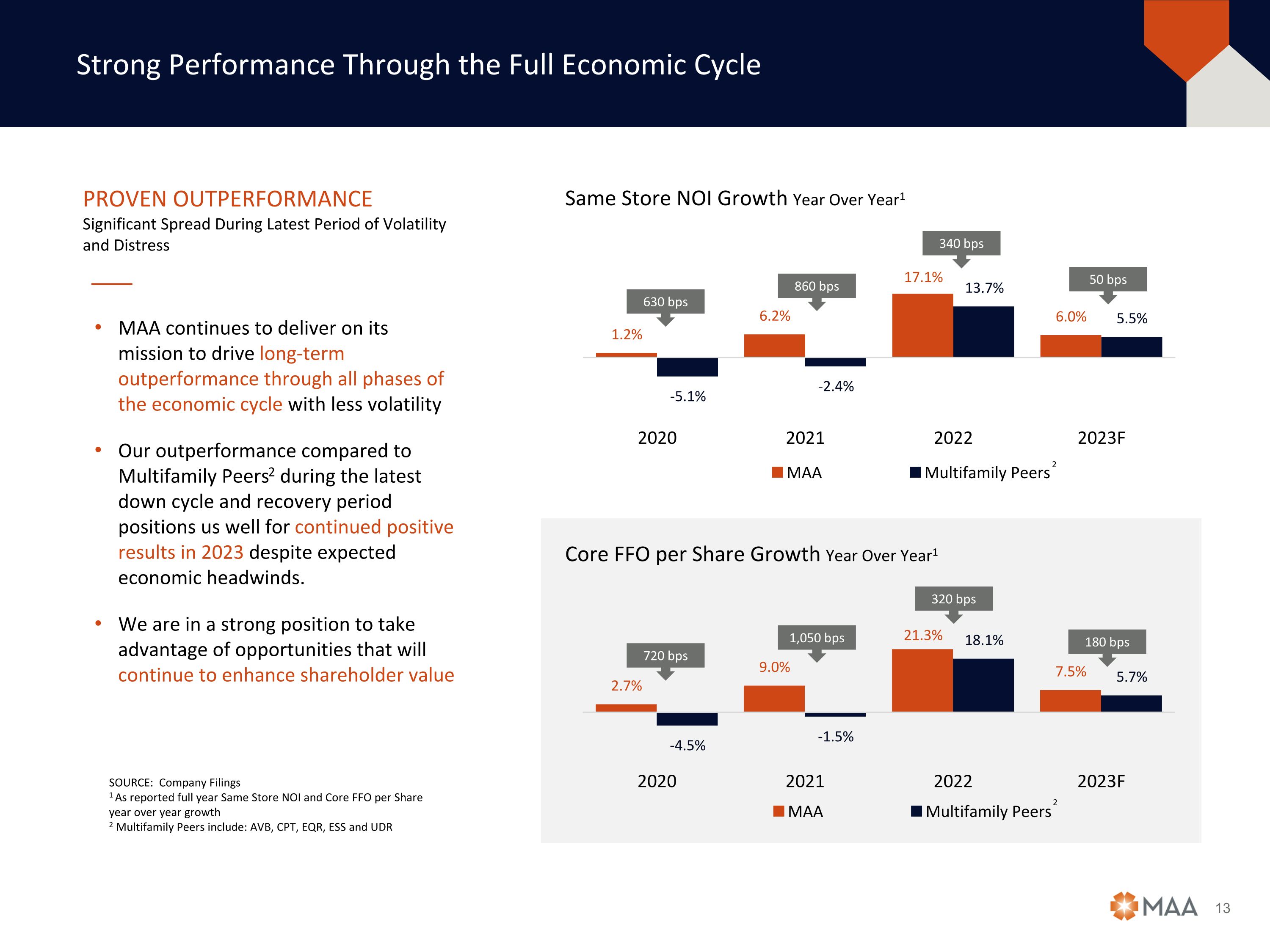

Strong Performance Through the Full Economic Cycle MAA continues to deliver on its mission to drive long-term outperformance through all phases of the economic cycle with less volatility Our outperformance compared to Multifamily Peers2 during the latest down cycle and recovery period positions us well for continued positive results in 2023 despite expected economic headwinds. We are in a strong position to take advantage of opportunities that will continue to enhance shareholder value SOURCE: Company Filings 1 As reported full year Same Store NOI and Core FFO per Share year over year growth 2 Multifamily Peers include: AVB, CPT, EQR, ESS and UDR Core FFO per Share Growth Year Over Year1 2 PROVEN OUTPERFORMANCE Significant Spread During Latest Period of Volatility and Distress Same Store NOI Growth Year Over Year1 2 50 bps 340 bps 860 bps 630 bps 180 bps 320 bps 1,050 bps 720 bps

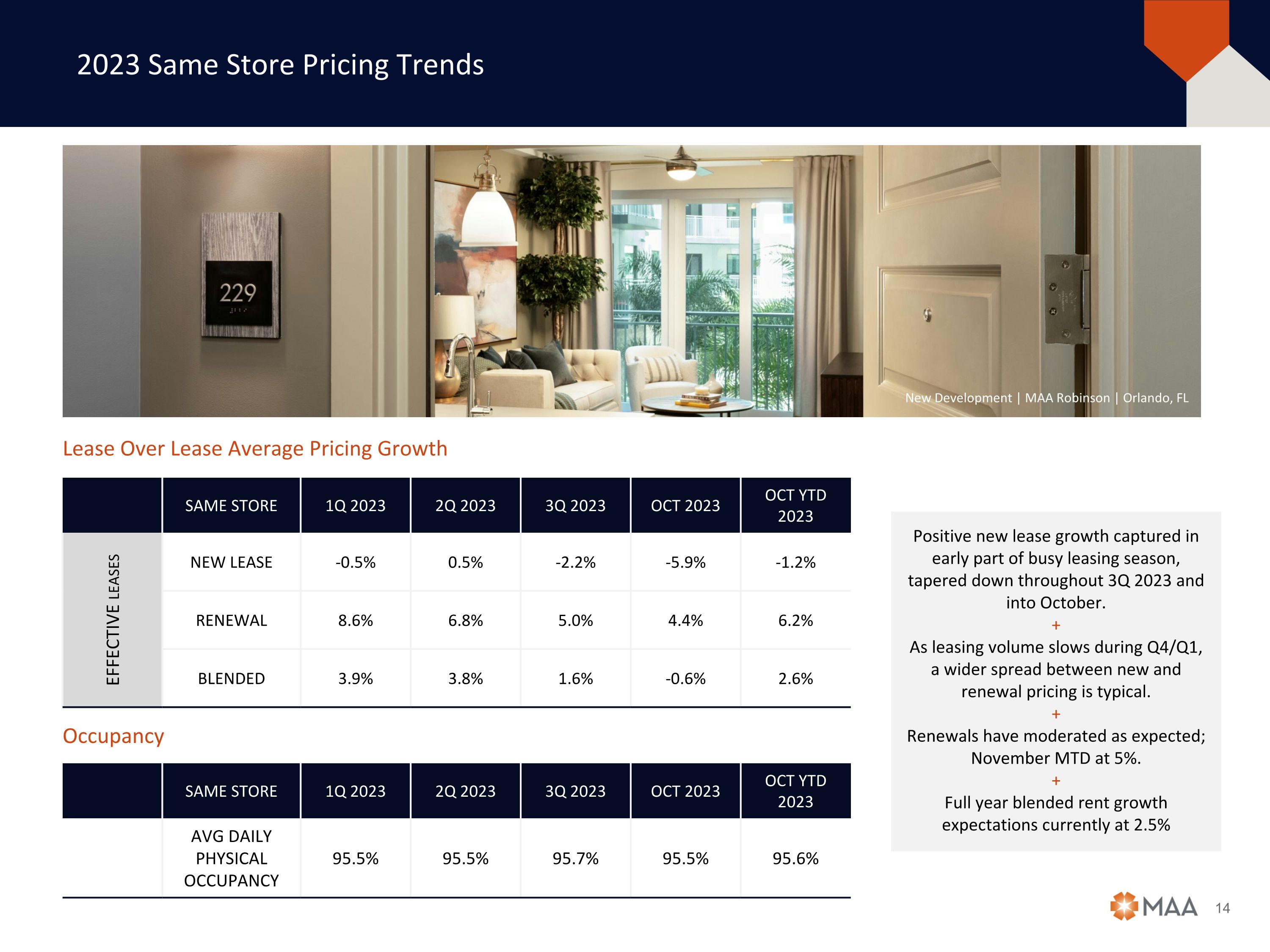

2023 Same Store Pricing Trends Lease Over Lease Average Pricing Growth same store 1Q 2023 2Q 2023 3q 2023 OCT 2023 oct ytd 2023 EFFECTIVE LEASES NEW LEASE -0.5% 0.5% -2.2% -5.9% -1.2% RENEWAL 8.6% 6.8% 5.0% 4.4% 6.2% BLENDED 3.9% 3.8% 1.6% -0.6% 2.6% Occupancy SAME STORE 1Q 2023 2q 2023 3q 2023 OCT 2023 oct YTD 2023 AVG DAILY PHYSICAL OCCUPANCY 95.5% 95.5% 95.7% 95.5% 95.6% Positive new lease growth captured in early part of busy leasing season, tapered down throughout 3Q 2023 and into October. + As leasing volume slows during Q4/Q1, a wider spread between new and renewal pricing is typical. + Renewals have moderated as expected; November MTD at 5%. + Full year blended rent growth expectations currently at 2.5% New Development | MAA Robinson | Orlando, FL

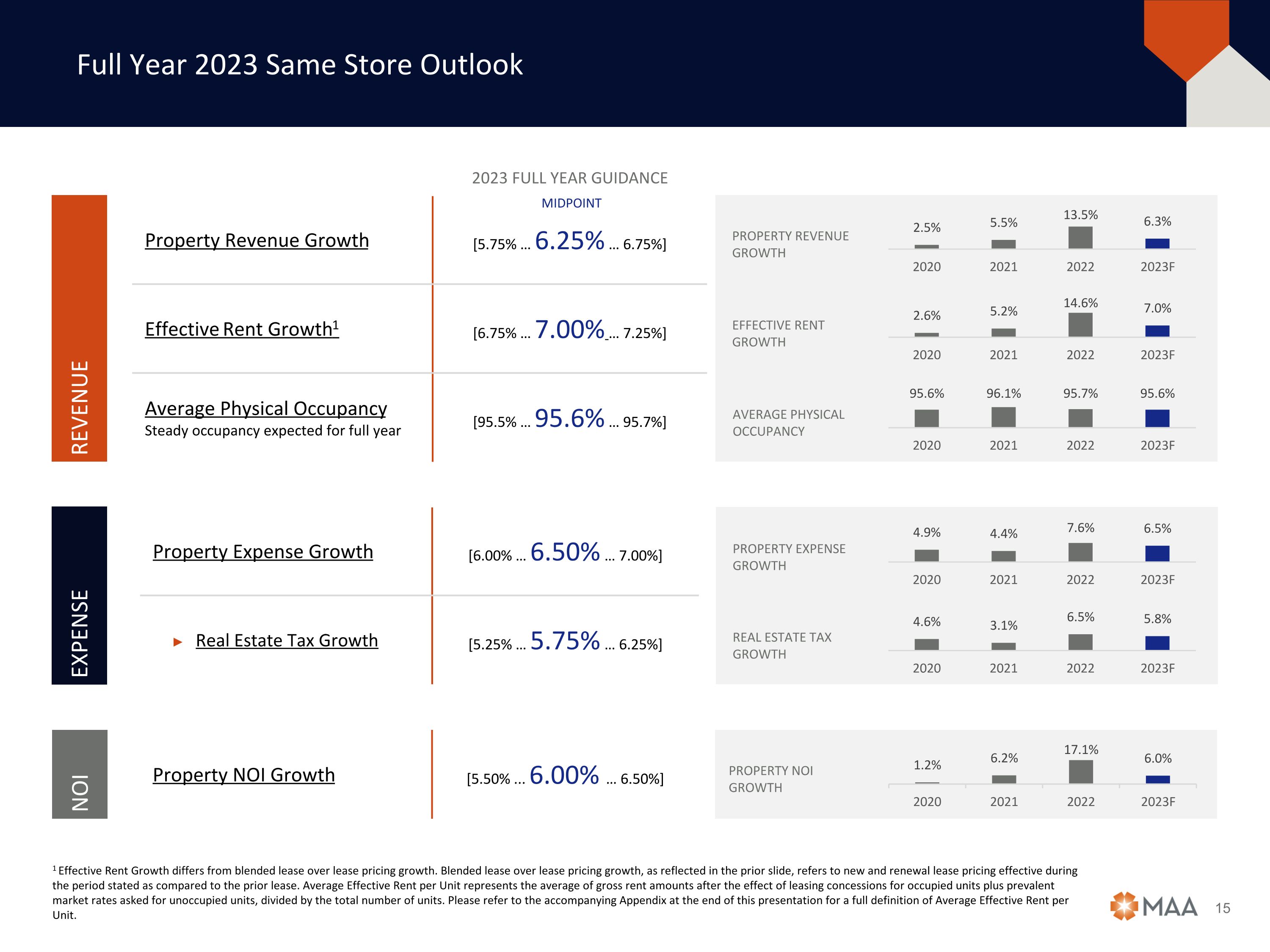

Property Revenue Growth [5.75% … 6.25% … 6.75%] Effective Rent Growth1 [6.75% … 7.00% … 7.25%] Average Physical Occupancy Steady occupancy expected for full year [95.5% … 95.6% … 95.7%] Full Year 2023 Same Store Outlook REVENUE Property Expense Growth [6.00% … 6.50% … 7.00%] Real Estate Tax Growth [5.25% … 5.75% … 6.25%] PROPERTY REVENUE GROWTH EFFECTIVE RENT GROWTH AVERAGE PHYSICAL OCCUPANCY PROPERTY EXPENSE GROWTH EXPENSE REAL ESTATE TAX GROWTH Property NOI Growth [5.50% ... 6.00% … 6.50%] PROPERTY NOI GROWTH NOI 2023 FULL YEAR GUIDANCE MIDPOINT 1 Effective Rent Growth differs from blended lease over lease pricing growth. Blended lease over lease pricing growth, as reflected in the prior slide, refers to new and renewal lease pricing effective during the period stated as compared to the prior lease. Average Effective Rent per Unit represents the average of gross rent amounts after the effect of leasing concessions for occupied units plus prevalent market rates asked for unoccupied units, divided by the total number of units. Please refer to the accompanying Appendix at the end of this presentation for a full definition of Average Effective Rent per Unit.

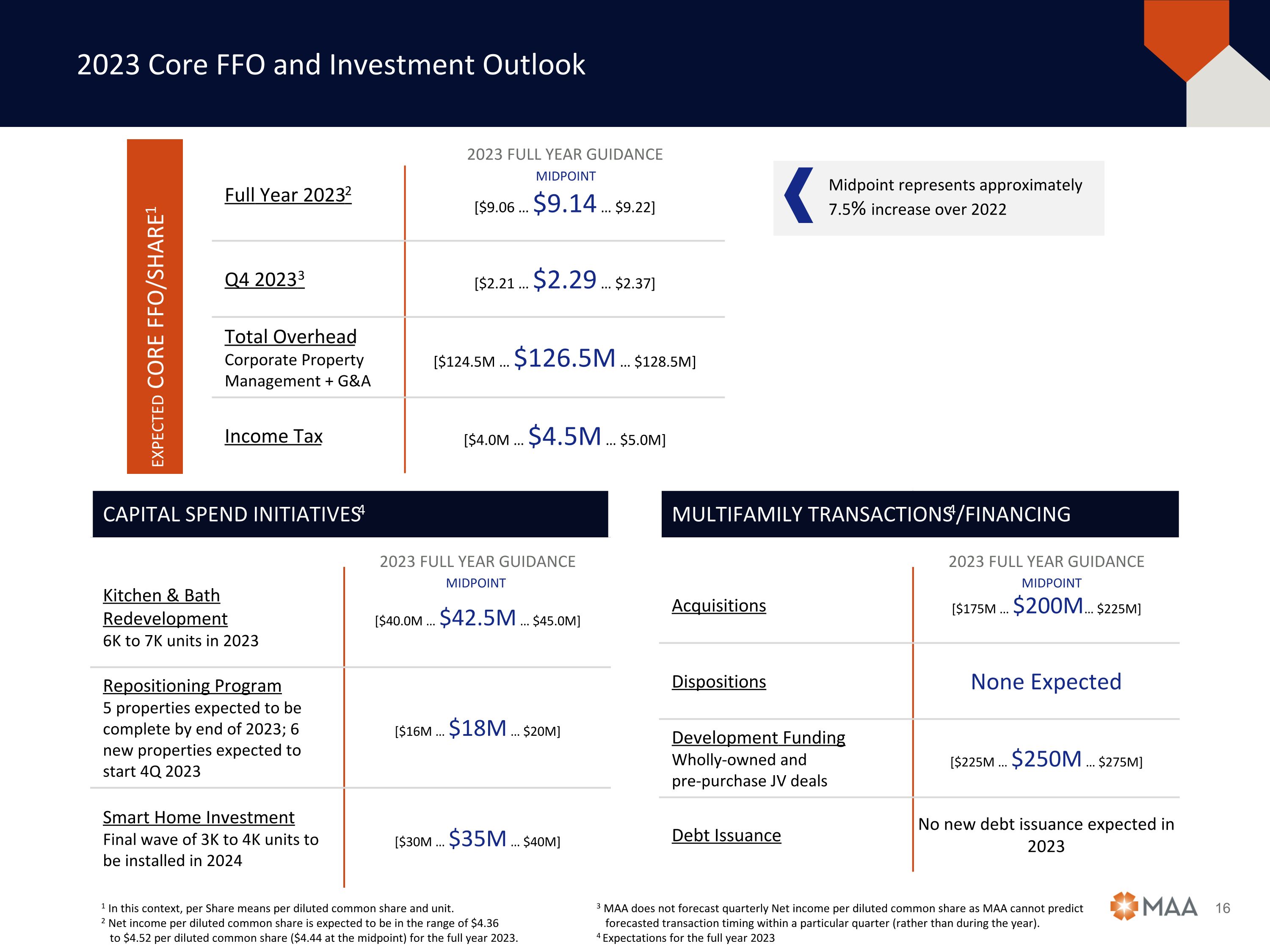

2023 Core FFO and Investment Outlook Full Year 20232 [$9.06 … $9.14 … $9.22] Q4 20233 [$2.21 … $2.29 … $2.37] Total Overhead Corporate Property Management + G&A [$124.5M … $126.5M … $128.5M] Income Tax [$4.0M … $4.5M … $5.0M] EXPECTED CORE FFO/SHARE1 Midpoint represents approximately 7.5% increase over 2022 CAPITAL SPEND INITIATIVES4 Kitchen & Bath Redevelopment 6K to 7K units in 2023 [$40.0M … $42.5M … $45.0M] Repositioning Program 5 properties expected to be complete by end of 2023; 6 new properties expected to start 4Q 2023 [$16M … $18M … $20M] Smart Home Investment Final wave of 3K to 4K units to be installed in 2024 [$30M … $35M … $40M] MULTIFAMILY TRANSACTIONS4/FINANCING Acquisitions [$175M … $200M… $225M] Dispositions None Expected Development Funding Wholly-owned and pre-purchase JV deals [$225M … $250M … $275M] Debt Issuance No new debt issuance expected in 2023 1 In this context, per Share means per diluted common share and unit. 2 Net income per diluted common share is expected to be in the range of $4.36 to $4.52 per diluted common share ($4.44 at the midpoint) for the full year 2023. 3 MAA does not forecast quarterly Net income per diluted common share as MAA cannot predict forecasted transaction timing within a particular quarter (rather than during the year). 4 Expectations for the full year 2023 2023 FULL YEAR GUIDANCE 2023 FULL YEAR GUIDANCE 2023 FULL YEAR GUIDANCE MIDPOINT MIDPOINT MIDPOINT

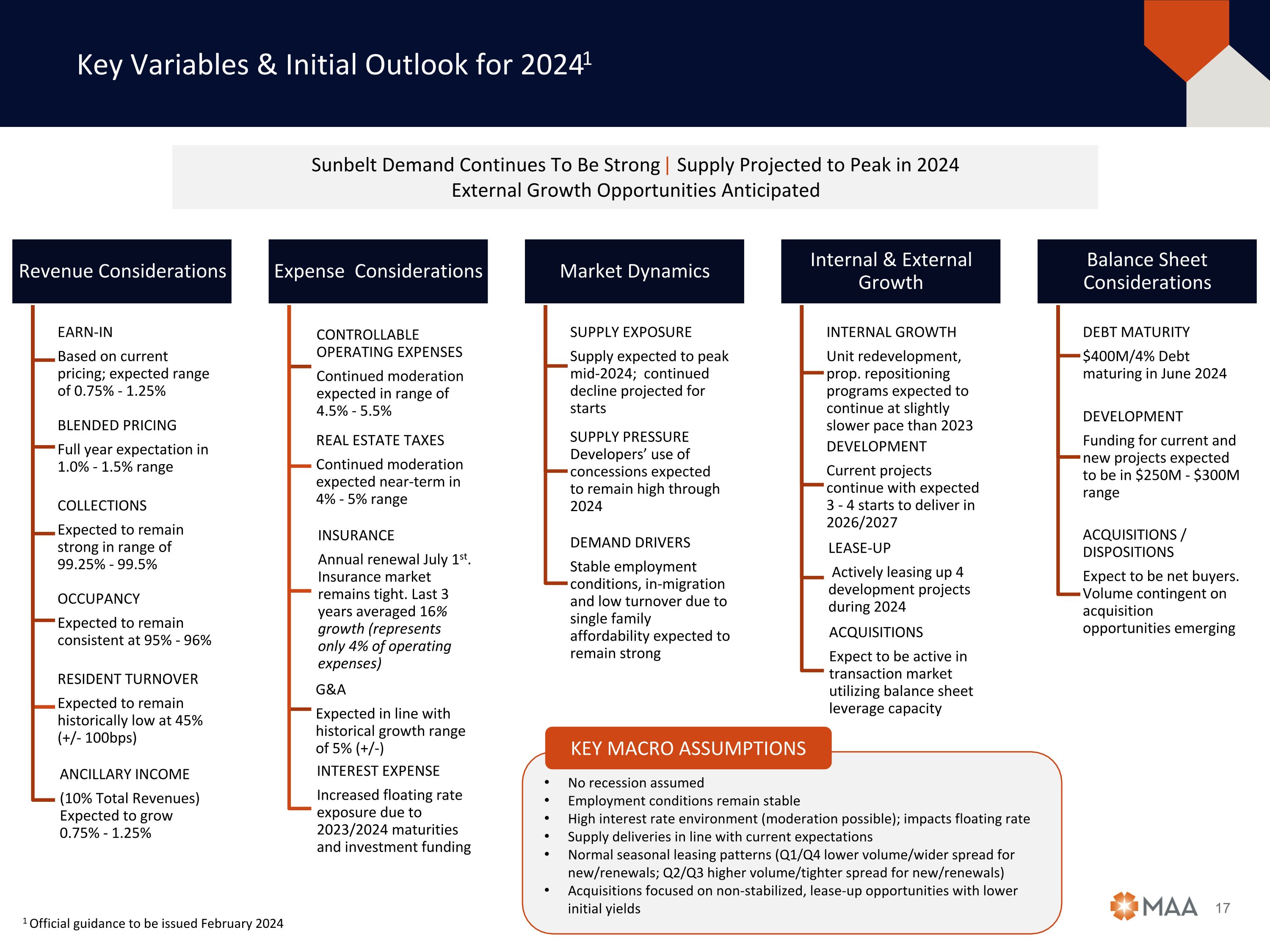

Key Variables & Initial Outlook for 20241 Revenue Considerations EARN-IN Based on current pricing; expected range of 0.75% - 1.25% BLENDED PRICING Full year expectation in 1.0% - 1.5% range COLLECTIONS Expected to remain strong in range of 99.25% - 99.5% OCCUPANCY Expected to remain consistent at 95% - 96% RESIDENT TURNOVER Expected to remain historically low at 45% (+/- 100bps) ANCILLARY INCOME (10% Total Revenues) Expected to grow 0.75% - 1.25% Expense Considerations CONTROLLABLE OPERATING EXPENSES Continued moderation expected in range of 4.5% - 5.5% REAL ESTATE TAXES Continued moderation expected near-term in 4% - 5% range INSURANCE Annual renewal July 1st. Insurance market remains tight. Last 3 years averaged 16% growth (represents only 4% of operating expenses) G&A Expected in line with historical growth range of 5% (+/-) INTEREST EXPENSE Increased floating rate exposure due to 2023/2024 maturities and investment funding Market Dynamics SUPPLY EXPOSURE Supply expected to peak mid-2024; continued decline projected for starts SUPPLY PRESSURE Developers’ use of concessions expected to remain high through 2024 DEMAND DRIVERS Stable employment conditions, in-migration and low turnover due to single family affordability expected to remain strong Internal & External Growth INTERNAL GROWTH Unit redevelopment, prop. repositioning programs expected to continue at slightly slower pace than 2023 DEVELOPMENT Current projects continue with expected 3 - 4 starts to deliver in 2026/2027 LEASE-UP Actively leasing up 4 development projects during 2024 ACQUISITIONS Expect to be active in transaction market utilizing balance sheet leverage capacity Balance Sheet Considerations DEBT MATURITY $400M/4% Debt maturing in June 2024 DEVELOPMENT Funding for current and new projects expected to be in $250M - $300M range ACQUISITIONS / DISPOSITIONS Expect to be net buyers. Volume contingent on acquisition opportunities emerging Sunbelt Demand Continues To Be Strong | Supply Projected to Peak in 2024 External Growth Opportunities Anticipated 1 Official guidance to be issued February 2024 No recession assumed Employment conditions remain stable High interest rate environment (moderation possible); impacts floating rate Supply deliveries in line with current expectations Normal seasonal leasing patterns (Q1/Q4 lower volume/wider spread for new/renewals; Q2/Q3 higher volume/tighter spread for new/renewals) Acquisitions focused on non-stabilized, lease-up opportunities with lower initial yields KEY MACRO ASSUMPTIONS

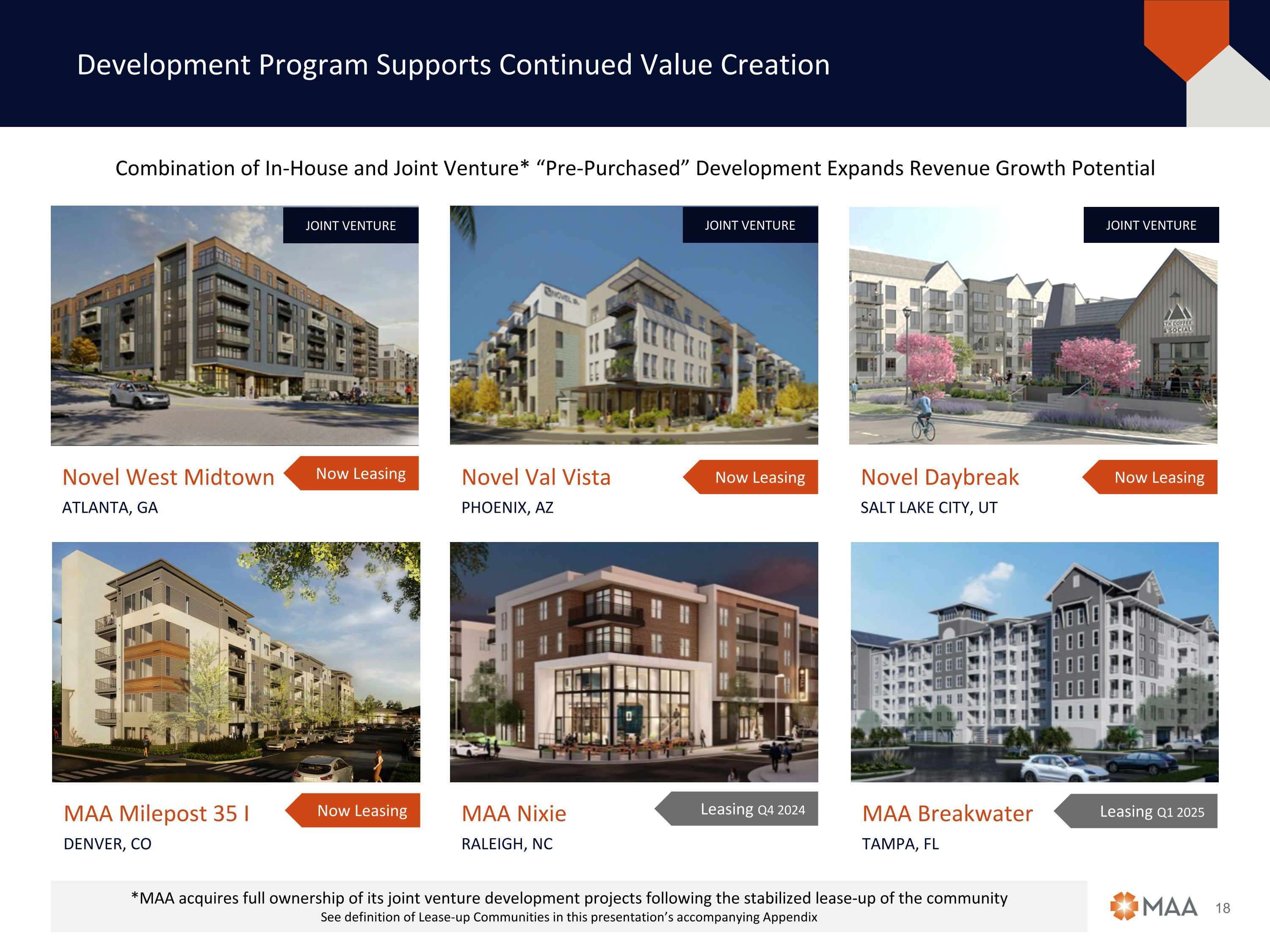

Development Program Supports Continued Value Creation PHOENIX, AZ Novel Val Vista ATLANTA, GA Novel West Midtown SALT LAKE CITY, UT Novel Daybreak DENVER, CO MAA Milepost 35 I RALEIGH, NC MAA Nixie Combination of In-House and Joint Venture* “Pre-Purchased” Development Expands Revenue Growth Potential TAMPA, FL MAA Breakwater JOINT VENTURE JOINT VENTURE JOINT VENTURE *MAA acquires full ownership of its joint venture development projects following the stabilized lease-up of the community See definition of Lease-up Communities in this presentation’s accompanying Appendix Now Leasing Now Leasing Now Leasing Now Leasing Leasing Q4 2024 Leasing Q1 2025

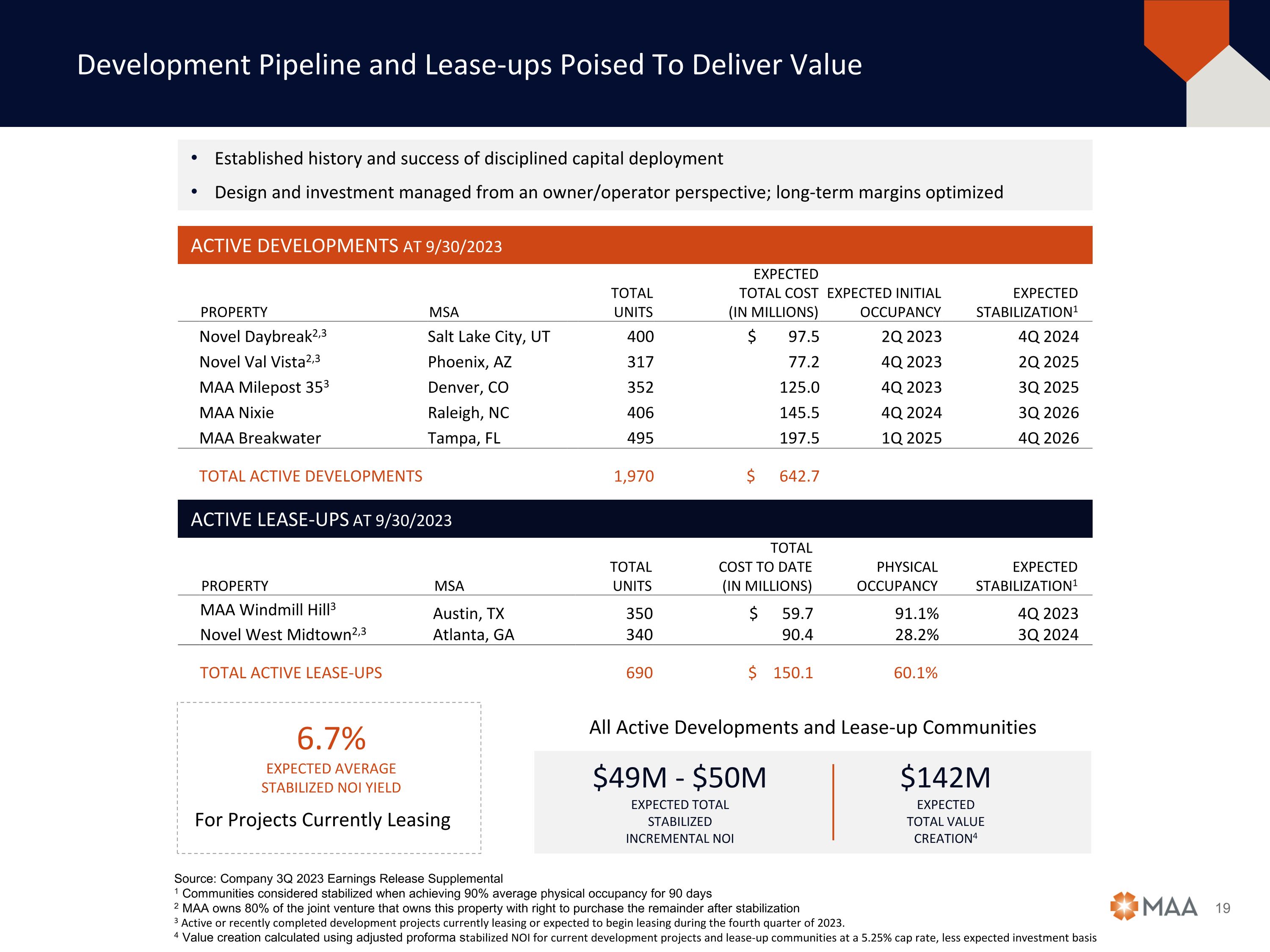

Development Pipeline and Lease-ups Poised To Deliver Value ACTIVE DEVELOPMENTS AT 9/30/2023 PROPERTY MSA TOTAL UNITS EXPECTED TOTAL COST (IN MILLIONS) EXPECTED INITIAL OCCUPANCY EXPECTED STABILIZATION1 Novel Daybreak2,3 Salt Lake City, UT 400 $ 97.5 2Q 2023 4Q 2024 Novel Val Vista2,3 Phoenix, AZ 317 77.2 4Q 2023 2Q 2025 MAA Milepost 353 Denver, CO 352 125.0 4Q 2023 3Q 2025 MAA Nixie Raleigh, NC 406 145.5 4Q 2024 3Q 2026 MAA Breakwater Tampa, FL 495 197.5 1Q 2025 4Q 2026 TOTAL ACTIVE DEVELOPMENTS 1,970 $ 642.7 ACTIVE LEASE-UPS AT 9/30/2023 ACTIVE LEASE-UPS AT 9/30/23 PROPERTY MSA TOTAL UNITS TOTAL COST TO DATE (IN MILLIONS) PHYSICAL OCCUPANCY EXPECTED STABILIZATION1 MAA Windmill Hill3 Austin, TX Atlanta, GA 350 340 $ 59.7 90.4 91.1% 28.2% 4Q 2023 3Q 2024 Novel West Midtown2,3 TOTAL ACTIVE LEASE-UPS 690 $ 150.1 60.1% Established history and success of disciplined capital deployment Design and investment managed from an owner/operator perspective; long-term margins optimized Source: Company 3Q 2023 Earnings Release Supplemental 1 Communities considered stabilized when achieving 90% average physical occupancy for 90 days 2 MAA owns 80% of the joint venture that owns this property with right to purchase the remainder after stabilization 3 Active or recently completed development projects currently leasing or expected to begin leasing during the fourth quarter of 2023. 4 Value creation calculated using adjusted proforma stabilized NOI for current development projects and lease-up communities at a 5.25% cap rate, less expected investment basis All Active Developments and Lease-up Communities $49M - $50M EXPECTED TOTAL STABILIZED INCREMENTAL NOI $142M EXPECTED TOTAL VALUE CREATION4 6.7% EXPECTED AVERAGE STABILIZED NOI YIELD For Projects Currently Leasing

2024 Development Expectations msa Units STATUS Charlotte, NC 302 Owned Denver, CO 259 Owned Phoenix, AZ 345 Controlled Orlando, FL 308 Owned Denver, CO 181 Owned Atlanta, GA 250 Controlled Raleigh, NC 191 Controlled Denver, CO 648 Owned Denver, CO 520 Owned Atlanta, GA 294 Owned Orlando, FL 390 Owned TOTAL 3,688 Future Development Pipeline Expansion (2024 & Beyond) 2024 Development Pipeline Expected to Approach APPROXIMATELY $1 BILLION Additional Opportunities In ATLANTA | CHARLOTTE DENVER | ORLANDO PHOENIX | RALEIGH $19M EXPECTED TOTAL STABILIZED INCREMENTAL NOI $57M EXPECTED TOTAL VALUE CREATION1 2024 EXPECTED 3 - 4 DEVELOPMENT STARTS New Development | Novel Val Vista | Phoenix, AZ 1 Value creation calculated using proforma adjusted stabilized NOI for 2024 expected development projects at a 5.25% cap rate, less expected investment basis

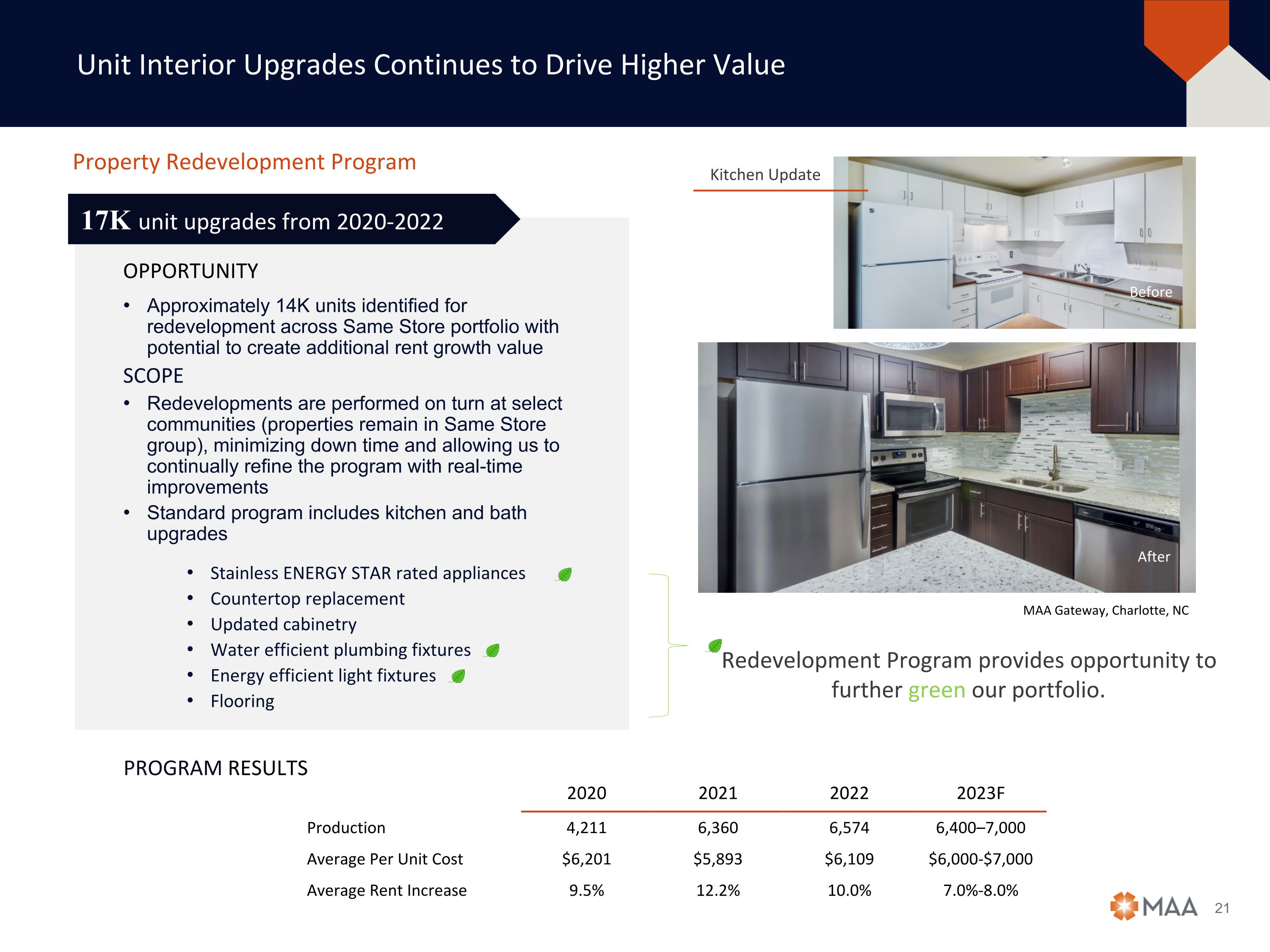

Unit Interior Upgrades Continues to Drive Higher Value Property Redevelopment Program Opportunity Approximately 14K units identified for redevelopment across Same Store portfolio with potential to create additional rent growth value SCOPE Redevelopments are performed on turn at select communities (properties remain in Same Store group), minimizing down time and allowing us to continually refine the program with real-time improvements Standard program includes kitchen and bath upgrades Stainless ENERGY STAR rated appliances Countertop replacement Updated cabinetry Water efficient plumbing fixtures Energy efficient light fixtures Flooring 17K unit upgrades from 2020-2022 2020 2021 2022 2023F Production 4,211 6,360 6,574 6,400–7,000 Average Per Unit Cost $6,201 $5,893 $6,109 $6,000-$7,000 Average Rent Increase 9.5% 12.2% 10.0% 7.0%-8.0% PROGRAM RESULTS Kitchen Update MAA Gateway, Charlotte, NC Before After Redevelopment Program provides opportunity to further green our portfolio.

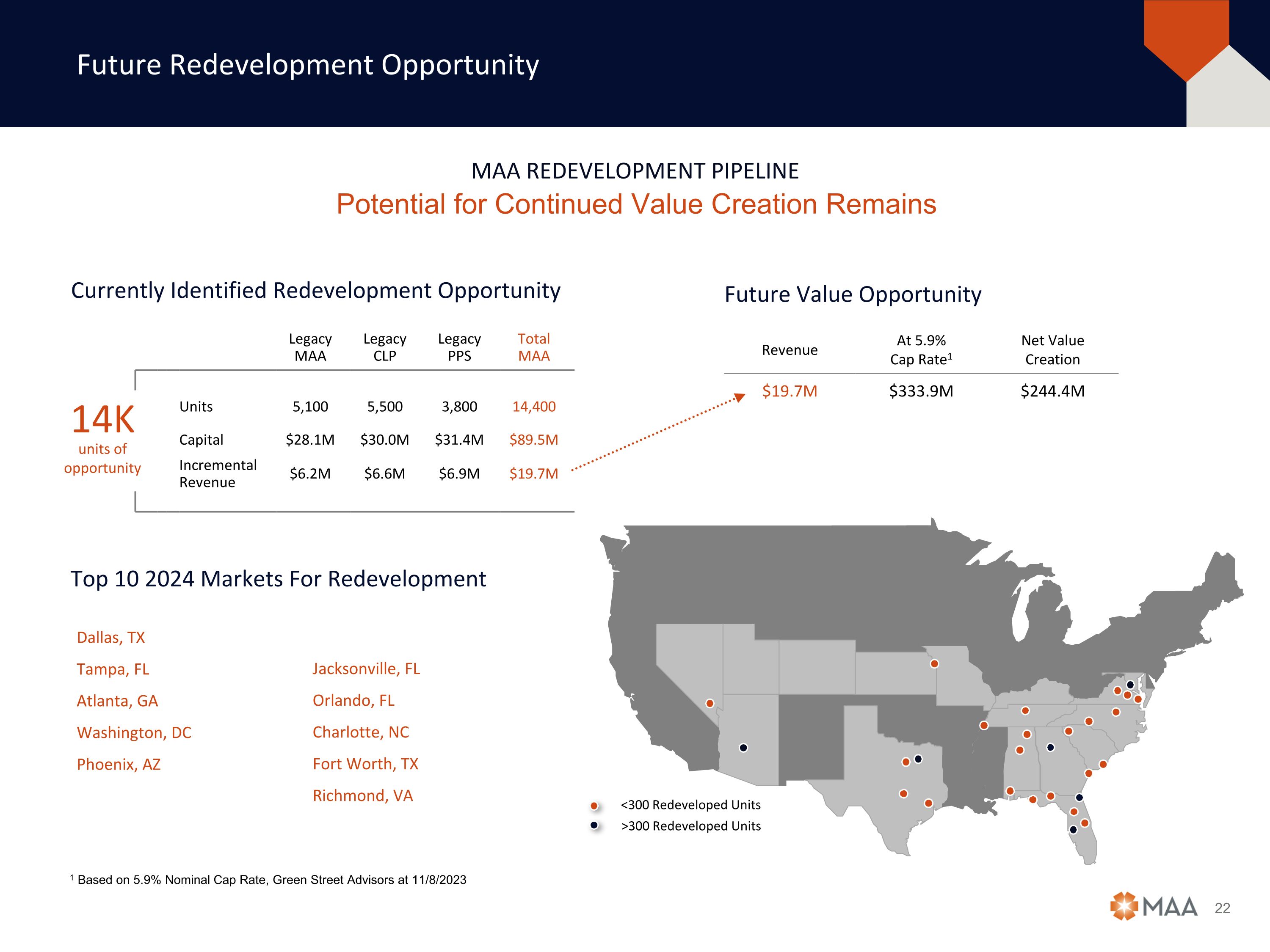

Future Redevelopment Opportunity Potential for Continued Value Creation Remains MAA REDEVELOPMENT PIPELINE Currently Identified Redevelopment Opportunity Future Value Opportunity Revenue At 5.9% Cap Rate1 Net Value Creation $19.7M $333.9M $244.4M Legacy MAA Legacy CLP Legacy PPS Total MAA Units 5,100 5,500 3,800 14,400 Capital $28.1M $30.0M $31.4M $89.5M Incremental Revenue $6.2M $6.6M $6.9M $19.7M Top 10 2024 Markets For Redevelopment Dallas, TX Tampa, FL Atlanta, GA Washington, DC Phoenix, AZ Jacksonville, FL Orlando, FL Charlotte, NC Fort Worth, TX Richmond, VA 14K units of opportunity 1 Based on 5.9% Nominal Cap Rate, Green Street Advisors at 11/8/2023 <300 Redeveloped Units >300 Redeveloped Units

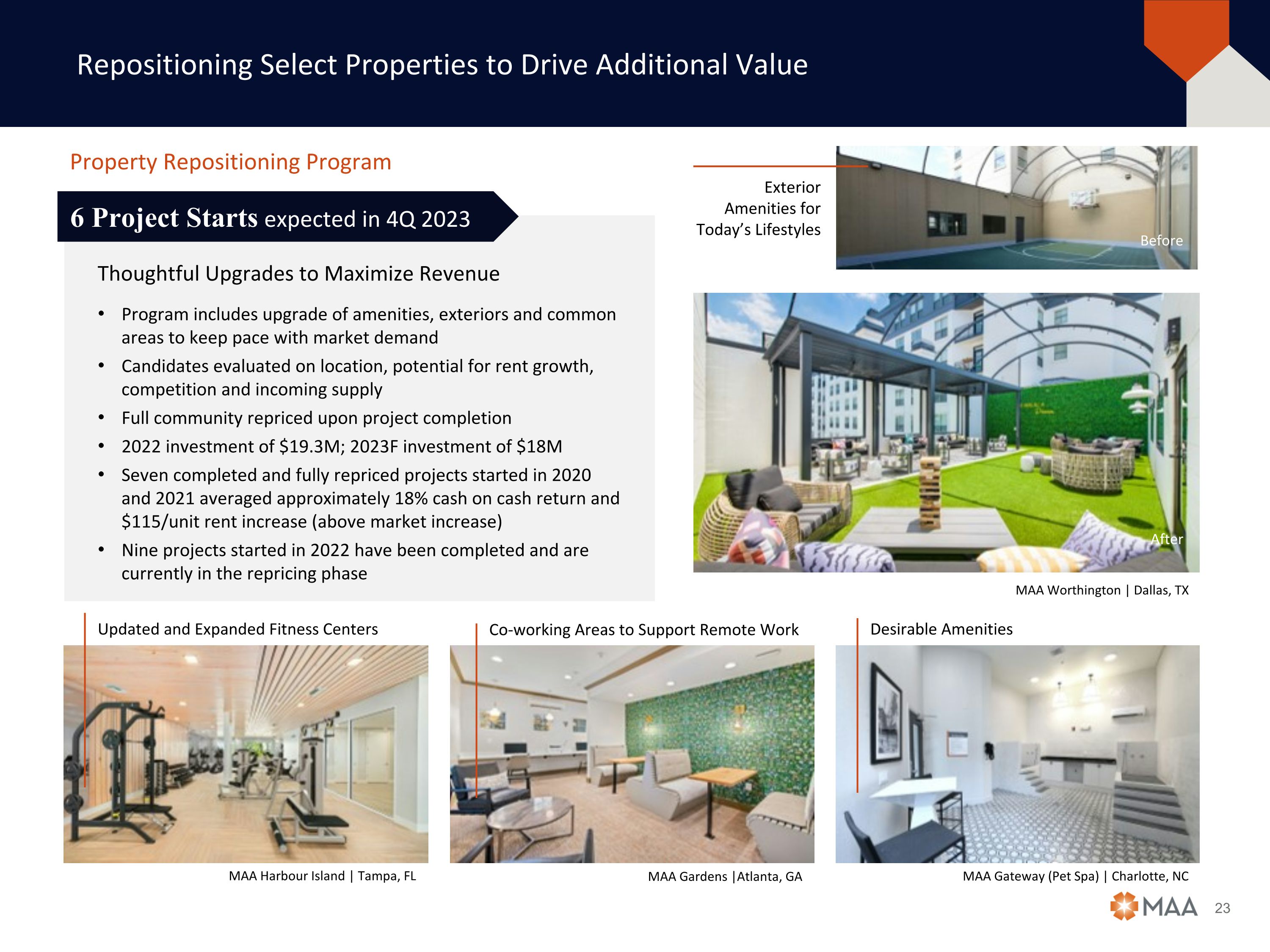

Repositioning Select Properties to Drive Additional Value MAA Harbour Island | Tampa, FL Updated and Expanded Fitness Centers Co-working Areas to Support Remote Work Desirable Amenities MAA Gardens |Atlanta, GA MAA Gateway (Pet Spa) | Charlotte, NC Exterior Amenities for Today’s Lifestyles MAA Worthington | Dallas, TX Property Repositioning Program Thoughtful Upgrades to Maximize Revenue Program includes upgrade of amenities, exteriors and common areas to keep pace with market demand Candidates evaluated on location, potential for rent growth, competition and incoming supply Full community repriced upon project completion 2022 investment of $19.3M; 2023F investment of $18M Seven completed and fully repriced projects started in 2020 and 2021 averaged approximately 18% cash on cash return and $115/unit rent increase (above market increase) Nine projects started in 2022 have been completed and are currently in the repricing phase 6 Project Starts expected in 4Q 2023 Before After

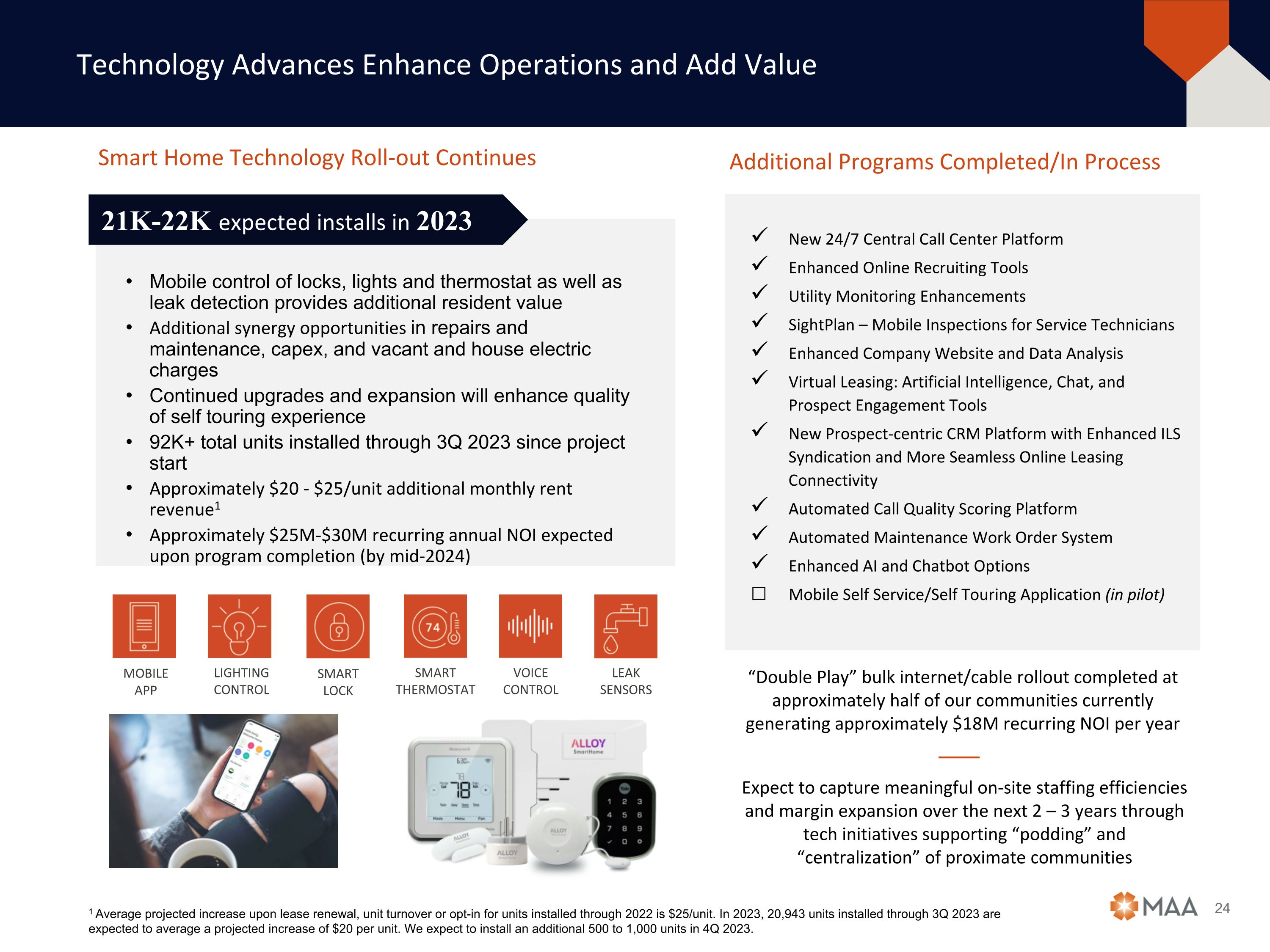

Technology Advances Enhance Operations and Add Value Mobile control of locks, lights and thermostat as well as leak detection provides additional resident value Additional synergy opportunities in repairs and maintenance, capex, and vacant and house electric charges Continued upgrades and expansion will enhance quality of self touring experience 92K+ total units installed through 3Q 2023 since project start Approximately $20 - $25/unit additional monthly rent revenue1 Approximately $25M-$30M recurring annual NOI expected upon program completion (by mid-2024) Smart Home Technology Roll-out Continues Additional Programs Completed/In Process New 24/7 Central Call Center Platform Enhanced Online Recruiting Tools Utility Monitoring Enhancements SightPlan – Mobile Inspections for Service Technicians Enhanced Company Website and Data Analysis Virtual Leasing: Artificial Intelligence, Chat, and Prospect Engagement Tools New Prospect-centric CRM Platform with Enhanced ILS Syndication and More Seamless Online Leasing Connectivity Automated Call Quality Scoring Platform Automated Maintenance Work Order System Enhanced AI and Chatbot Options Mobile Self Service/Self Touring Application (in pilot) 21K-22K expected installs in 2023 Mobile App Lighting Control Smart Lock Leak Sensors Smart Thermostat Voice Control 1 Average projected increase upon lease renewal, unit turnover or opt-in for units installed through 2022 is $25/unit. In 2023, 20,943 units installed through 3Q 2023 are expected to average a projected increase of $20 per unit. We expect to install an additional 500 to 1,000 units in 4Q 2023. Expect to capture meaningful on-site staffing efficiencies and margin expansion over the next 2 – 3 years through tech initiatives supporting “podding” and “centralization” of proximate communities “Double Play” bulk internet/cable rollout completed at approximately half of our communities currently generating approximately $18M recurring NOI per year

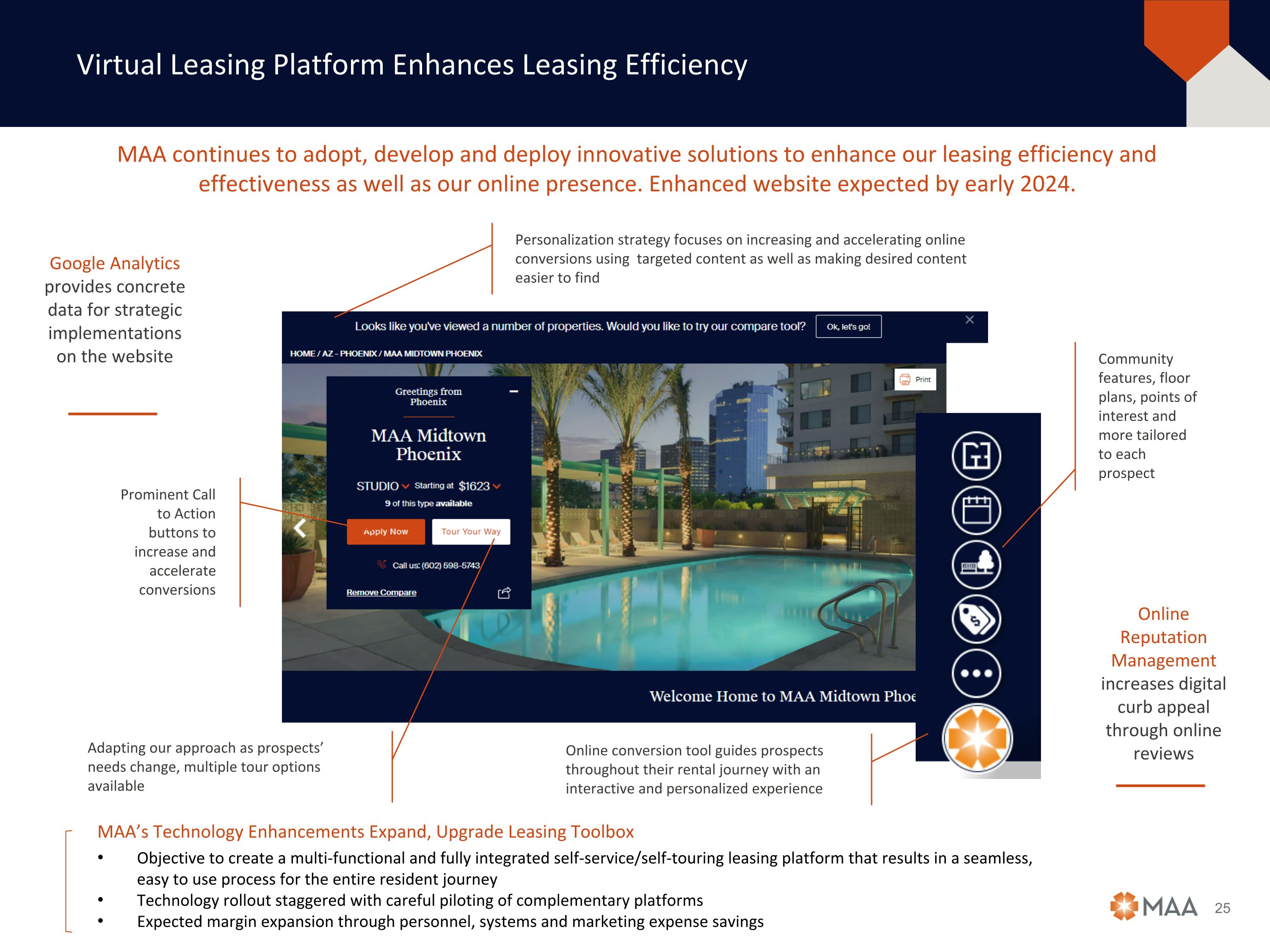

MAA’s Technology Enhancements Expand, Upgrade Leasing Toolbox Objective to create a multi-functional and fully integrated self-service/self-touring leasing platform that results in a seamless, easy to use process for the entire resident journey Technology rollout staggered with careful piloting of complementary platforms Expected margin expansion through personnel, systems and marketing expense savings Virtual Leasing Platform Enhances Leasing Efficiency MAA continues to adopt, develop and deploy innovative solutions to enhance our leasing efficiency and effectiveness as well as our online presence. Enhanced website expected by early 2024. Adapting our approach as prospects’ needs change, multiple tour options available Prominent Call to Action buttons to increase and accelerate conversions Personalization strategy focuses on increasing and accelerating online conversions using targeted content as well as making desired content easier to find Online Reputation Management increases digital curb appeal through online reviews Google Analytics provides concrete data for strategic implementations on the website Community features, floor plans, points of interest and more tailored to each prospect Online conversion tool guides prospects throughout their rental journey with an interactive and personalized experience

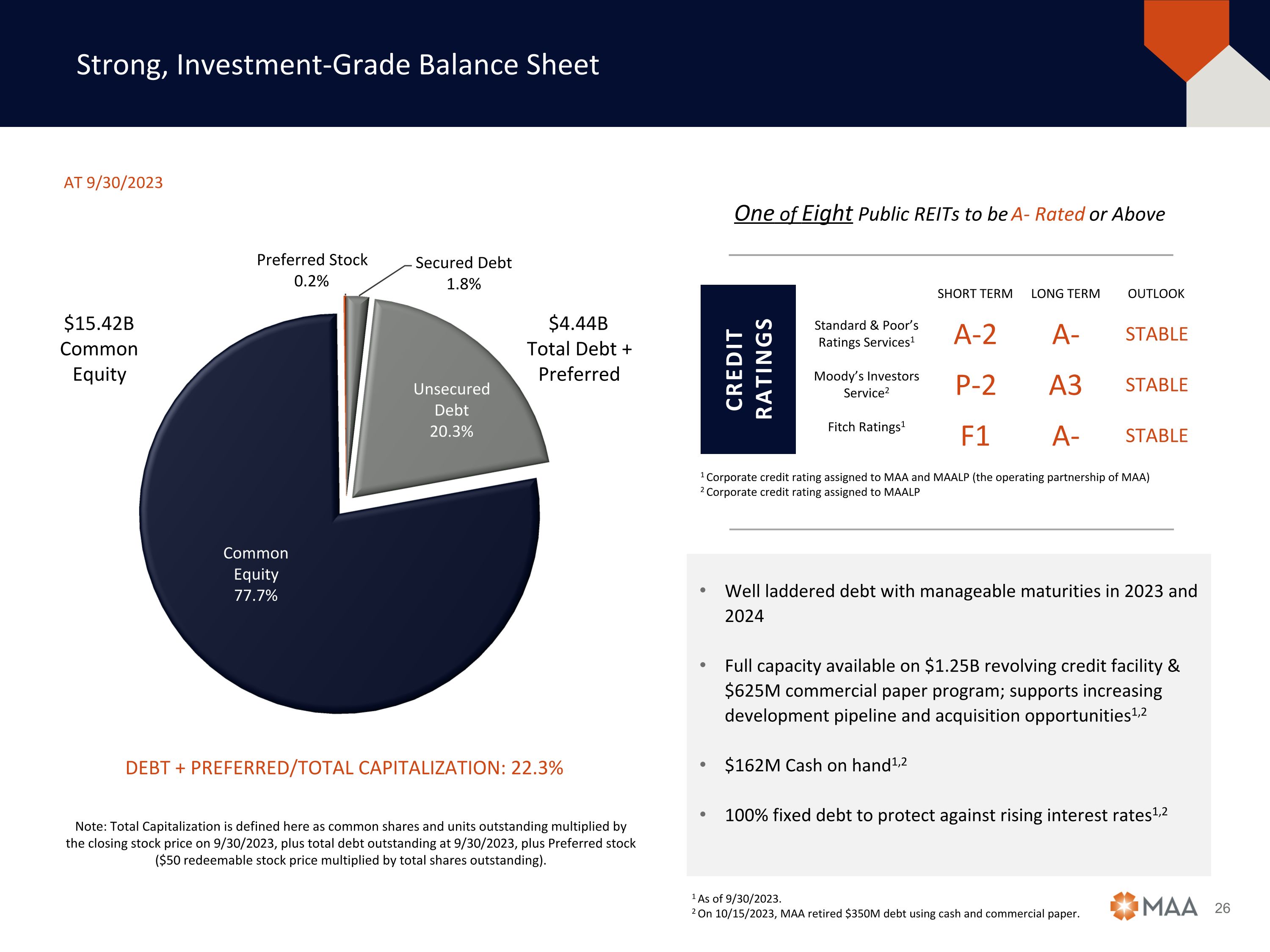

Strong, Investment-Grade Balance Sheet Note: Total Capitalization is defined here as common shares and units outstanding multiplied by the closing stock price on 9/30/2023, plus total debt outstanding at 9/30/2023, plus Preferred stock ($50 redeemable stock price multiplied by total shares outstanding). $15.42B Common Equity $4.44B Total Debt + Preferred Debt + Preferred/Total capitalization: 22.3% credit ratings SHORT TERM LONG TERM OUTLOOK Standard & Poor’s Ratings Services1 A-2 A- STABLE Moody’s Investors Service2 P-2 A3 STABLE Fitch Ratings1 F1 A- STABLE 1 Corporate credit rating assigned to MAA and MAALP (the operating partnership of MAA) 2 Corporate credit rating assigned to MAALP Well laddered debt with manageable maturities in 2023 and 2024 Full capacity available on $1.25B revolving credit facility & $625M commercial paper program; supports increasing development pipeline and acquisition opportunities1,2 $162M Cash on hand1,2 100% fixed debt to protect against rising interest rates1,2 One of Eight Public REITs to be A- Rated or Above AT 9/30/2023 1 As of 9/30/2023. 2 On 10/15/2023, MAA retired $350M debt using cash and commercial paper.

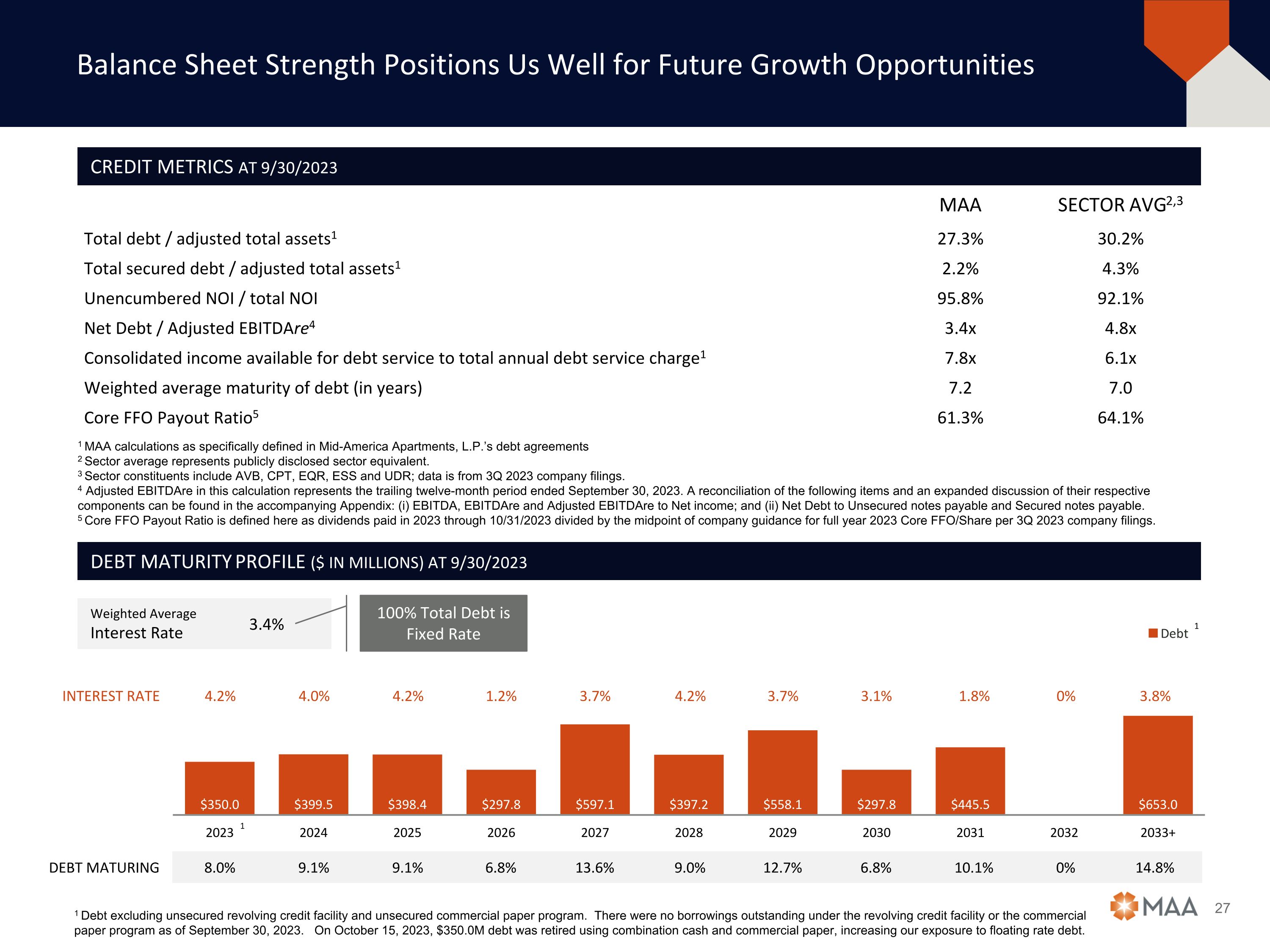

Balance Sheet Strength Positions Us Well for Future Growth Opportunities DEBT MATURING 8.0% 9.1% 9.1% 6.8% 13.6% 9.0% 12.7% 6.8% 10.1% 0% 14.8% Credit metrics At 9/30/2023 MAA SECTOR AVG2,3 Total debt / adjusted total assets1 27.3% 30.2% Total secured debt / adjusted total assets1 2.2% 4.3% Unencumbered NOI / total NOI 95.8% 92.1% Net Debt / Adjusted EBITDAre4 3.4x 4.8x Consolidated income available for debt service to total annual debt service charge1 7.8x 6.1x Weighted average maturity of debt (in years) 7.2 7.0 Core FFO Payout Ratio5 61.3% 64.1% Debt maturity profile ($ in millions) AT 9/30/2023 1 MAA calculations as specifically defined in Mid-America Apartments, L.P.’s debt agreements 2 Sector average represents publicly disclosed sector equivalent. 3 Sector constituents include AVB, CPT, EQR, ESS and UDR; data is from 3Q 2023 company filings. 4 Adjusted EBITDAre in this calculation represents the trailing twelve-month period ended September 30, 2023. A reconciliation of the following items and an expanded discussion of their respective components can be found in the accompanying Appendix: (i) EBITDA, EBITDAre and Adjusted EBITDAre to Net income; and (ii) Net Debt to Unsecured notes payable and Secured notes payable. 5 Core FFO Payout Ratio is defined here as dividends paid in 2023 through 10/31/2023 divided by the midpoint of company guidance for full year 2023 Core FFO/Share per 3Q 2023 company filings. Weighted Average Interest Rate 3.4% 1 Debt excluding unsecured revolving credit facility and unsecured commercial paper program. There were no borrowings outstanding under the revolving credit facility or the commercial paper program as of September 30, 2023. On October 15, 2023, $350.0M debt was retired using combination cash and commercial paper, increasing our exposure to floating rate debt. 100% Total Debt is Fixed Rate 1 1 INTEREST RATE 4.2% 4.0% 4.2% 1.2% 3.7% 4.2% 3.7% 3.1% 1.8% 0% 3.8%

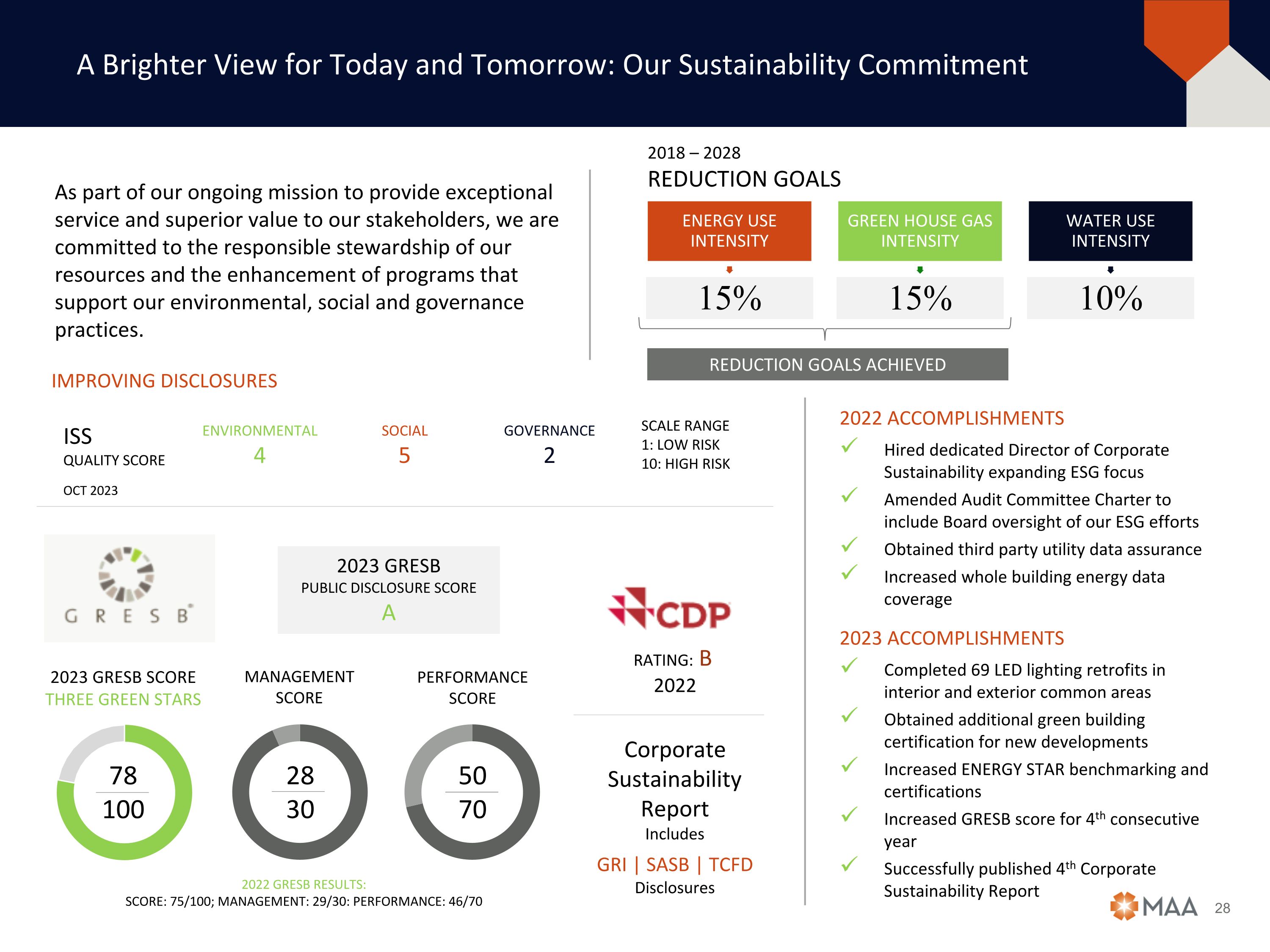

A Brighter View for Today and Tomorrow: Our Sustainability Commitment 2023 GRESB Public Disclosure Score A 78 100 28 30 50 70 2023 GRESB SCORE THREE GREEN STARS MANAGEMENT SCORE PERFORMANCE SCORE ENERGY USE INTENSITY 15% GREEN HOUSE GAS INTENSITY 15% WATER USE INTENSITY 10% 2018 – 2028 REDUCTION GOALS IMPROVING DISCLOSURES 2022 ACCOMPLISHMENTS Hired dedicated Director of Corporate Sustainability expanding ESG focus Amended Audit Committee Charter to include Board oversight of our ESG efforts Obtained third party utility data assurance Increased whole building energy data coverage 2023 ACCOMPLISHMENTS Completed 69 LED lighting retrofits in interior and exterior common areas Obtained additional green building certification for new developments Increased ENERGY STAR benchmarking and certifications Increased GRESB score for 4th consecutive year Successfully published 4th Corporate Sustainability Report As part of our ongoing mission to provide exceptional service and superior value to our stakeholders, we are committed to the responsible stewardship of our resources and the enhancement of programs that support our environmental, social and governance practices. ISS QUALITY SCORE ENVIRONMENTAL 4 SOCIAL 5 GOVERNANCE 2 SCALE RANGE 1: LOW RISK 10: HIGH RISK RATING: B 2022 Corporate Sustainability Report Includes GRI | SASB | TCFD Disclosures 2022 GRESB RESULTS: SCORE: 75/100; MANAGEMENT: 29/30: PERFORMANCE: 46/70 REDUCTION GOALS ACHIEVED OCT 2023

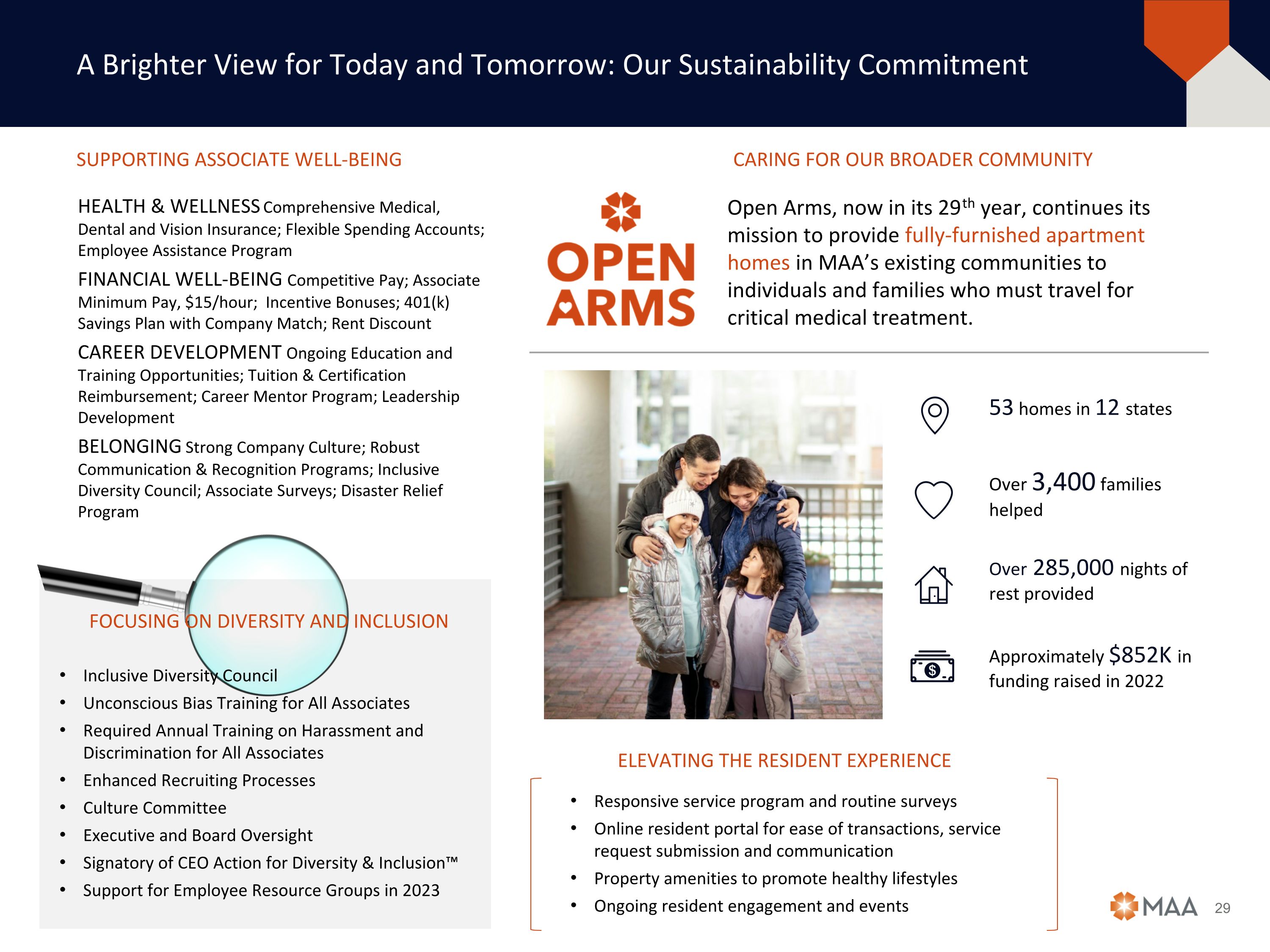

SUPPORTING ASSOCIATE WELL-BEING A Brighter View for Today and Tomorrow: Our Sustainability Commitment Responsive service program and routine surveys Online resident portal for ease of transactions, service request submission and communication Property amenities to promote healthy lifestyles Ongoing resident engagement and events CARING FOR OUR BROADER COMMUNITY 53 homes in 12 states Over 3,400 families helped Over 285,000 nights of rest provided Approximately $852K in funding raised in 2022 Open Arms, now in its 29th year, continues its mission to provide fully-furnished apartment homes in MAA’s existing communities to individuals and families who must travel for critical medical treatment. FOCUSING ON DIVERSITY AND INCLUSION Inclusive Diversity Council Unconscious Bias Training for All Associates Required Annual Training on Harassment and Discrimination for All Associates Enhanced Recruiting Processes Culture Committee Executive and Board Oversight Signatory of CEO Action for Diversity & Inclusion™ Support for Employee Resource Groups in 2023 HEALTH & WELLNESS Comprehensive Medical, Dental and Vision Insurance; Flexible Spending Accounts; Employee Assistance Program FINANCIAL WELL-BEING Competitive Pay; Associate Minimum Pay, $15/hour; Incentive Bonuses; 401(k) Savings Plan with Company Match; Rent Discount CAREER DEVELOPMENT Ongoing Education and Training Opportunities; Tuition & Certification Reimbursement; Career Mentor Program; Leadership Development BELONGING Strong Company Culture; Robust Communication & Recognition Programs; Inclusive Diversity Council; Associate Surveys; Disaster Relief Program ELEVATING THE RESIDENT EXPERIENCE

Appendix At SEPTEMBER 30, 2023 Reconciliation of Non-GAAP Financial Measures Definitions of Non-GAAP Financial Measures and Other Key Terms

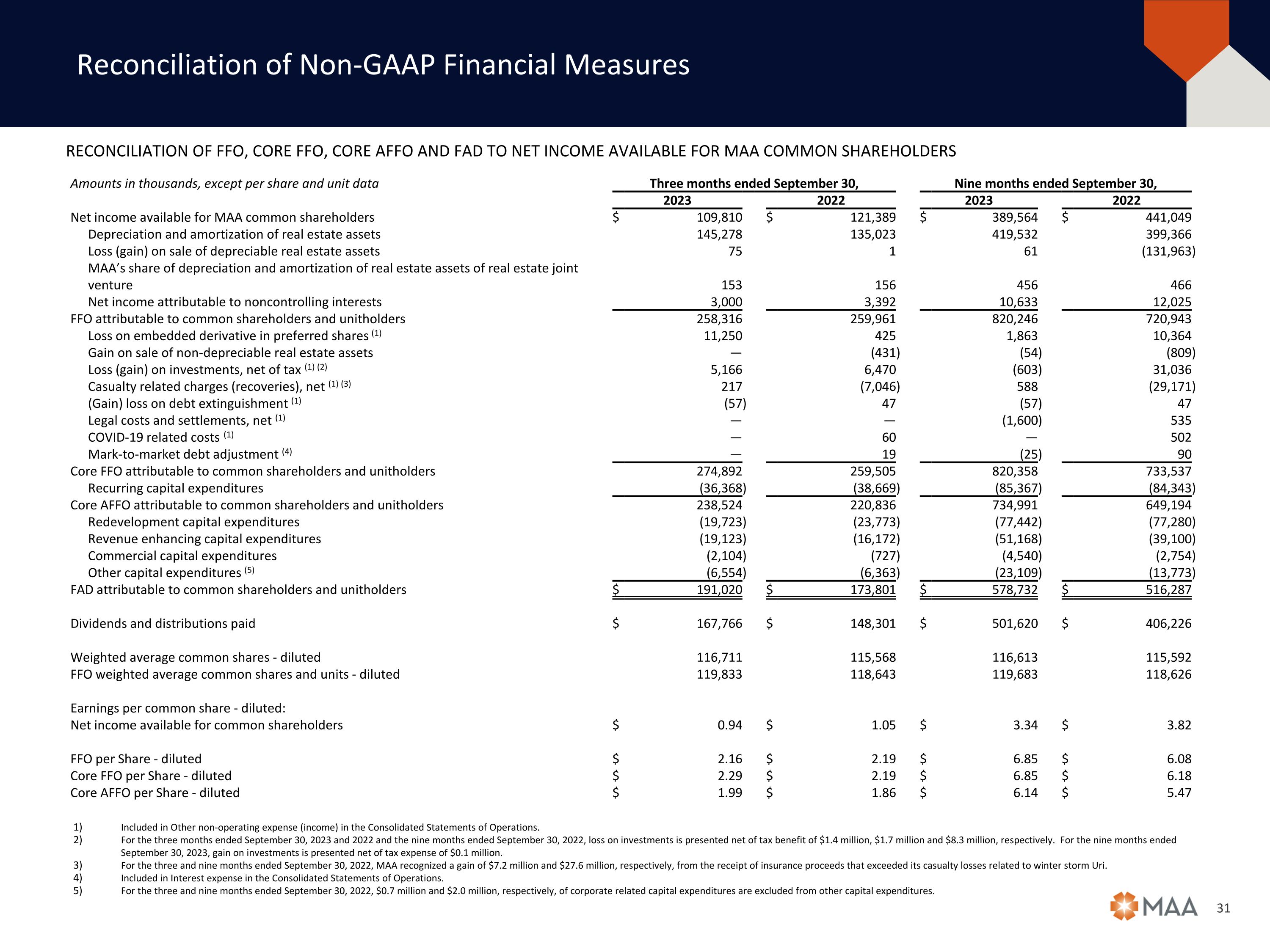

Reconciliation of Non-GAAP Financial Measures RECONCILIATION OF FFO, CORE FFO, CORE AFFO AND FAD TO NET INCOME AVAILABLE FOR MAA COMMON SHAREHOLDERS Included in Other non-operating expense (income) in the Consolidated Statements of Operations. For the three months ended September 30, 2023 and 2022 and the nine months ended September 30, 2022, loss on investments is presented net of tax benefit of $1.4 million, $1.7 million and $8.3 million, respectively. For the nine months ended September 30, 2023, gain on investments is presented net of tax expense of $0.1 million. For the three and nine months ended September 30, 2022, MAA recognized a gain of $7.2 million and $27.6 million, respectively, from the receipt of insurance proceeds that exceeded its casualty losses related to winter storm Uri. Included in Interest expense in the Consolidated Statements of Operations. For the three and nine months ended September 30, 2022, $0.7 million and $2.0 million, respectively, of corporate related capital expenditures are excluded from other capital expenditures. Amounts in thousands, except per share and unit data Three months ended September 30, Nine months ended September 30, 2023 2022 2023 2022 Net income available for MAA common shareholders $ 109,810 $ 121,389 $ 389,564 $ 441,049 Depreciation and amortization of real estate assets 145,278 135,023 419,532 399,366 Loss (gain) on sale of depreciable real estate assets 75 1 61 (131,963 ) MAA’s share of depreciation and amortization of real estate assets of real estate joint venture 153 156 456 466 Net income attributable to noncontrolling interests 3,000 3,392 10,633 12,025 FFO attributable to common shareholders and unitholders 258,316 259,961 820,246 720,943 Loss on embedded derivative in preferred shares (1) 11,250 425 1,863 10,364 Gain on sale of non-depreciable real estate assets — (431 ) (54 ) (809 ) Loss (gain) on investments, net of tax (1) (2) 5,166 6,470 (603 ) 31,036 Casualty related charges (recoveries), net (1) (3) 217 (7,046 ) 588 (29,171 ) (Gain) loss on debt extinguishment (1) (57 ) 47 (57 ) 47 Legal costs and settlements, net (1) — — (1,600 ) 535 COVID-19 related costs (1) — 60 — 502 Mark-to-market debt adjustment (4) — 19 (25 ) 90 Core FFO attributable to common shareholders and unitholders 274,892 259,505 820,358 733,537 Recurring capital expenditures (36,368 ) (38,669 ) (85,367 ) (84,343 ) Core AFFO attributable to common shareholders and unitholders 238,524 220,836 734,991 649,194 Redevelopment capital expenditures (19,723 ) (23,773 ) (77,442 ) (77,280 ) Revenue enhancing capital expenditures (19,123 ) (16,172 ) (51,168 ) (39,100 ) Commercial capital expenditures (2,104 ) (727 ) (4,540 ) (2,754 ) Other capital expenditures (5) (6,554 ) (6,363 ) (23,109 ) (13,773 ) FAD attributable to common shareholders and unitholders $ 191,020 $ 173,801 $ 578,732 $ 516,287 Dividends and distributions paid $ 167,766 $ 148,301 $ 501,620 $ 406,226 Weighted average common shares - diluted 116,711 115,568 116,613 115,592 FFO weighted average common shares and units - diluted 119,833 118,643 119,683 118,626 Earnings per common share - diluted: Net income available for common shareholders $ 0.94 $ 1.05 $ 3.34 $ 3.82 FFO per Share - diluted $ 2.16 $ 2.19 $ 6.85 $ 6.08 Core FFO per Share - diluted $ 2.29 $ 2.19 $ 6.85 $ 6.18 Core AFFO per Share - diluted $ 1.99 $ 1.86 $ 6.14 $ 5.47

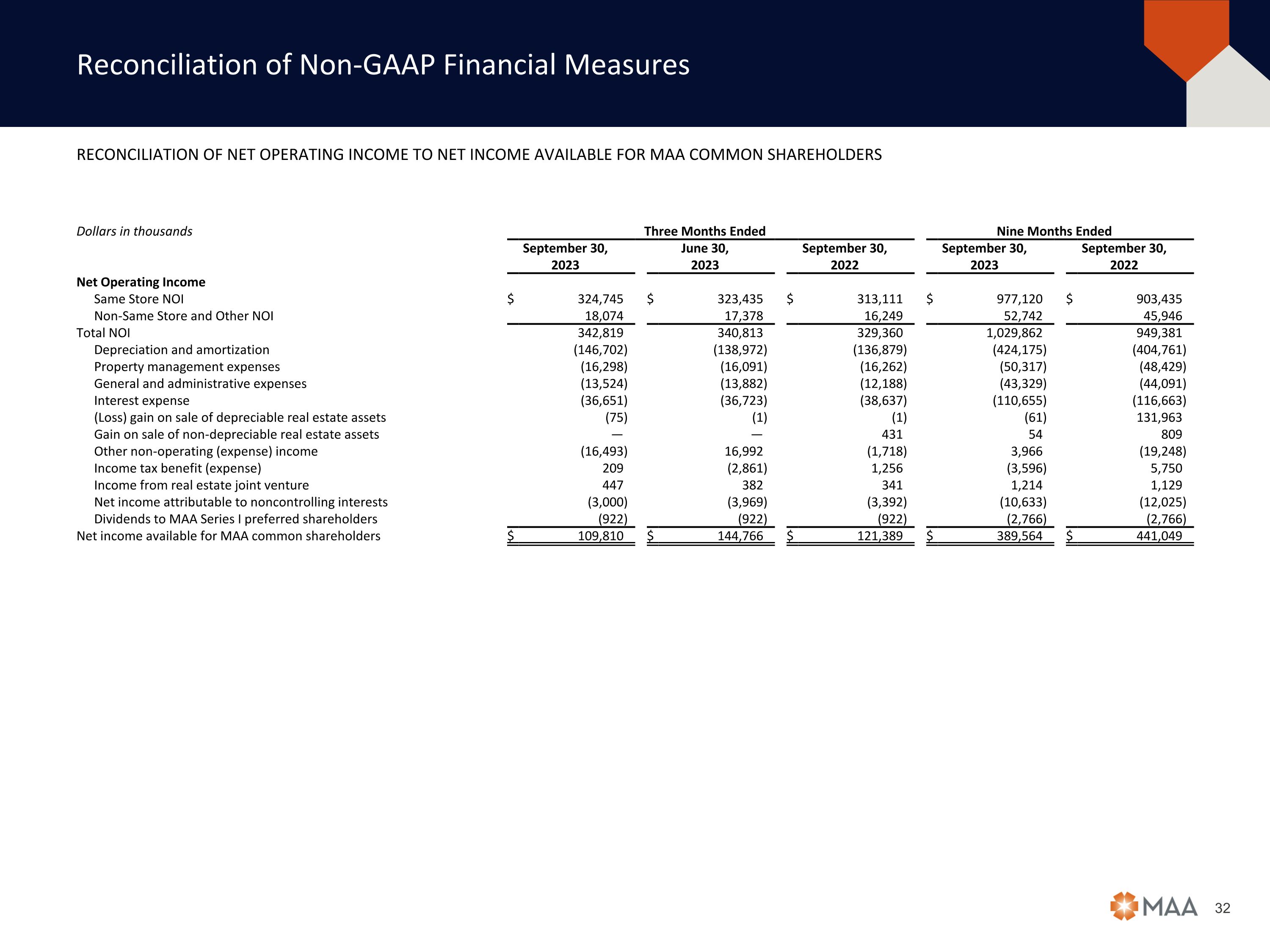

Reconciliation of Non-GAAP Financial Measures RECONCILIATION OF NET OPERATING INCOME TO NET INCOME AVAILABLE FOR MAA COMMON SHAREHOLDERS Dollars in thousands Three Months Ended Nine Months Ended September 30, 2023 June 30, 2023 September 30, 2022 September 30, 2023 September 30, 2022 Net Operating Income Same Store NOI $ 324,745 $ 323,435 $ 313,111 $ 977,120 $ 903,435 Non-Same Store and Other NOI 18,074 17,378 16,249 52,742 45,946 Total NOI 342,819 340,813 329,360 1,029,862 949,381 Depreciation and amortization (146,702 ) (138,972 ) (136,879 ) (424,175 ) (404,761 ) Property management expenses (16,298 ) (16,091 ) (16,262 ) (50,317 ) (48,429 ) General and administrative expenses (13,524 ) (13,882 ) (12,188 ) (43,329 ) (44,091 ) Interest expense (36,651 ) (36,723 ) (38,637 ) (110,655 ) (116,663 ) (Loss) gain on sale of depreciable real estate assets (75 ) (1 ) (1 ) (61 ) 131,963 Gain on sale of non-depreciable real estate assets — — 431 54 809 Other non-operating (expense) income (16,493 ) 16,992 (1,718 ) 3,966 (19,248 ) Income tax benefit (expense) 209 (2,861 ) 1,256 (3,596 ) 5,750 Income from real estate joint venture 447 382 341 1,214 1,129 Net income attributable to noncontrolling interests (3,000 ) (3,969 ) (3,392 ) (10,633 ) (12,025 ) Dividends to MAA Series I preferred shareholders (922 ) (922 ) (922 ) (2,766 ) (2,766 ) Net income available for MAA common shareholders $ 109,810 $ 144,766 $ 121,389 $ 389,564 $ 441,049

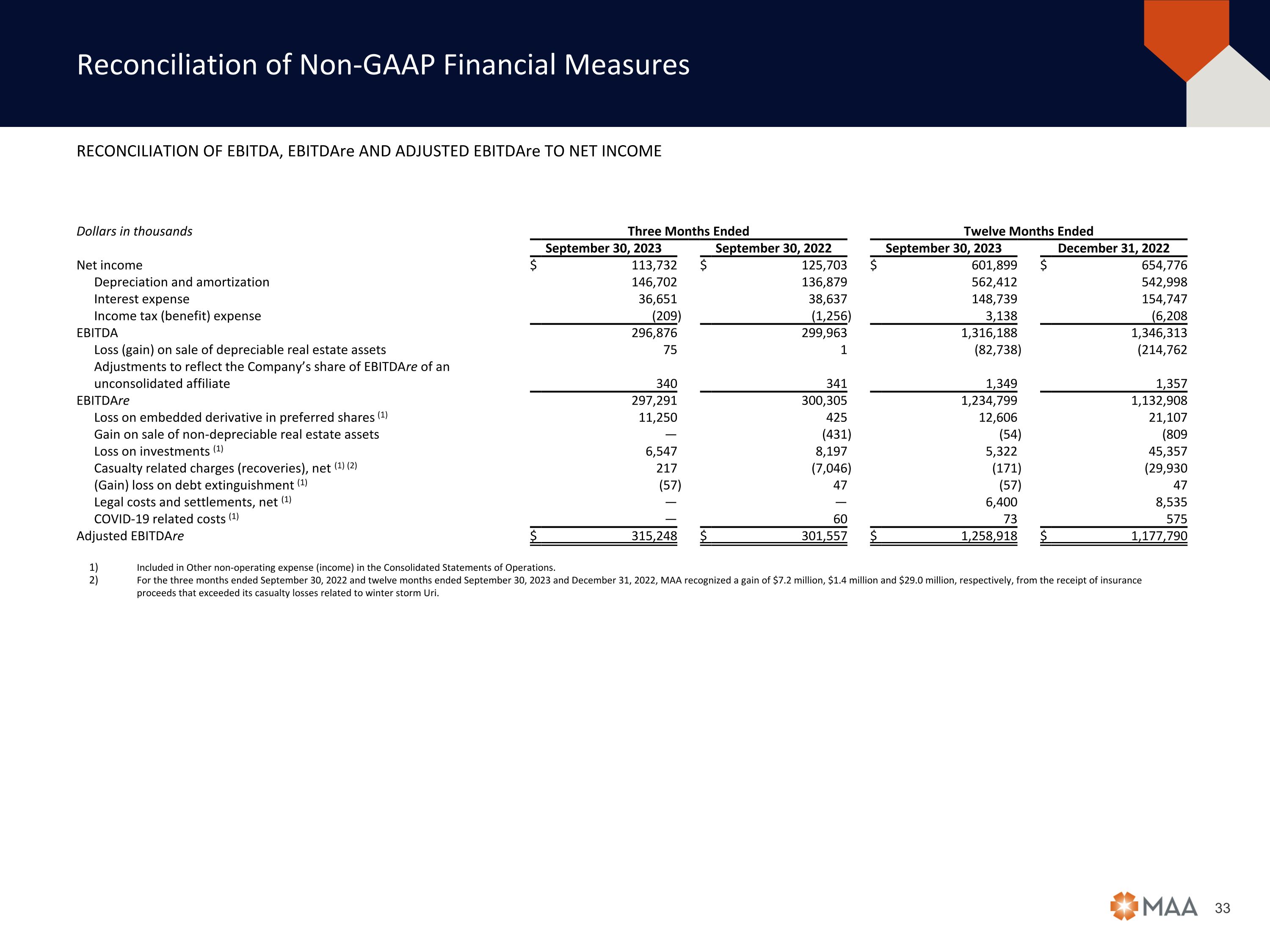

Reconciliation of Non-GAAP Financial Measures RECONCILIATION OF EBITDA, EBITDAre AND ADJUSTED EBITDAre TO NET INCOME Included in Other non-operating expense (income) in the Consolidated Statements of Operations. For the three months ended September 30, 2022 and twelve months ended September 30, 2023 and December 31, 2022, MAA recognized a gain of $7.2 million, $1.4 million and $29.0 million, respectively, from the receipt of insurance proceeds that exceeded its casualty losses related to winter storm Uri. Dollars in thousands Three Months Ended Twelve Months Ended September 30, 2023 September 30, 2022 September 30, 2023 December 31, 2022 Net income $ 113,732 $ 125,703 $ 601,899 $ 654,776 Depreciation and amortization 146,702 136,879 562,412 542,998 Interest expense 36,651 38,637 148,739 154,747 Income tax (benefit) expense (209 ) (1,256 ) 3,138 (6,208 EBITDA 296,876 299,963 1,316,188 1,346,313 Loss (gain) on sale of depreciable real estate assets 75 1 (82,738 ) (214,762 Adjustments to reflect the Company’s share of EBITDAre of an unconsolidated affiliate 340 341 1,349 1,357 EBITDAre 297,291 300,305 1,234,799 1,132,908 Loss on embedded derivative in preferred shares (1) 11,250 425 12,606 21,107 Gain on sale of non-depreciable real estate assets — (431 ) (54 ) (809 Loss on investments (1) 6,547 8,197 5,322 45,357 Casualty related charges (recoveries), net (1) (2) 217 (7,046 ) (171 ) (29,930 (Gain) loss on debt extinguishment (1) (57 ) 47 (57 ) 47 Legal costs and settlements, net (1) — — 6,400 8,535 COVID-19 related costs (1) — 60 73 575 Adjusted EBITDAre $ 315,248 $ 301,557 $ 1,258,918 $ 1,177,790

Reconciliation of Non-GAAP Financial Measures RECONCILIATION OF NET DEBT TO UNSECURED NOTES PAYABLE AND SECURED NOTES PAYABLE RECONCILIATION OF GROSS ASSETS TO TOTAL ASSETS RECONCILIATION OF GROSS REAL ESTATE ASSETS TO REAL ESTATE ASSETS, NET Included in Restricted cash in the Consolidated Balance Sheets. Included in Restricted cash in the Consolidated Balance Sheets. Dollars in thousands September 30, 2023 December 31, 2022 Unsecured notes payable $ 4,034,153 $ 4,050,910 Secured notes payable 360,110 363,993 Total debt 4,394,263 4,414,903 Cash and cash equivalents (161,897 ) (38,659 ) 1031(b) exchange proceeds included in Restricted cash (1) — (9,186 ) Net Debt $ 4,232,366 $ 4,367,058 Dollars in thousands September 30, 2023 December 31, 2022 Total assets $ 11,382,322 $ 11,241,165 Accumulated depreciation 4,725,099 4,302,747 Gross Assets $ 16,107,421 $ 15,543,912 Dollars in thousands September 30, 2023 December 31, 2022 Real estate assets, net $ 10,991,185 $ 10,986,201 Accumulated depreciation 4,725,099 4,302,747 Cash and cash equivalents 161,897 38,659 1031(b) exchange proceeds included in Restricted cash (1) — 9,186 Gross Real Estate Assets $ 15,878,181 $ 15,336,793

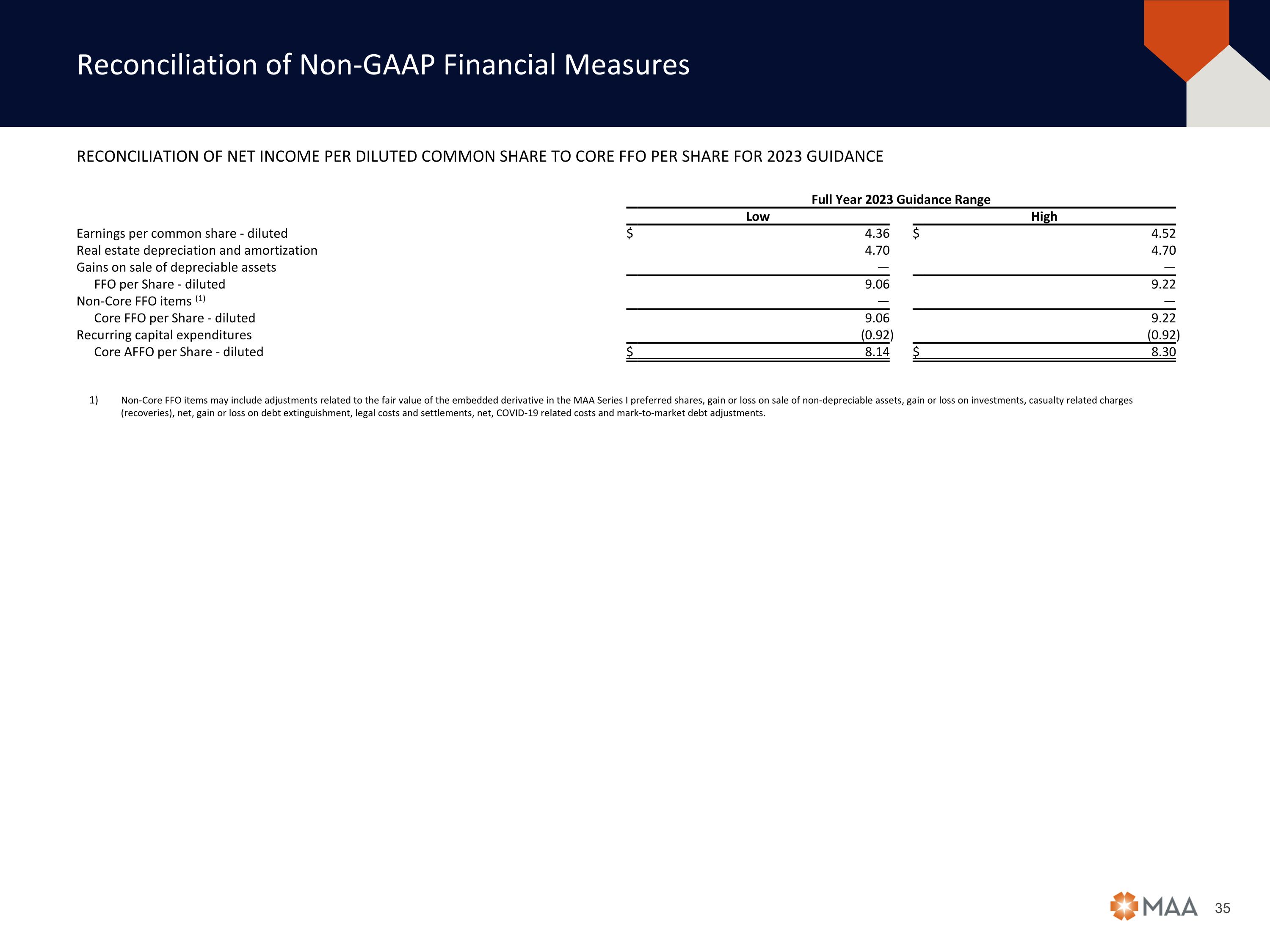

Reconciliation of Non-GAAP Financial Measures RECONCILIATION OF NET INCOME PER DILUTED COMMON SHARE TO CORE FFO PER SHARE FOR 2023 GUIDANCE Non-Core FFO items may include adjustments related to the fair value of the embedded derivative in the MAA Series I preferred shares, gain or loss on sale of non-depreciable assets, gain or loss on investments, casualty related charges (recoveries), net, gain or loss on debt extinguishment, legal costs and settlements, net, COVID-19 related costs and mark-to-market debt adjustments. Full Year 2023 Guidance Range Low High Earnings per common share - diluted $ 4.36 $ 4.52 Real estate depreciation and amortization 4.70 4.70 Gains on sale of depreciable assets — — FFO per Share - diluted 9.06 9.22 Non-Core FFO items (1) — — Core FFO per Share - diluted 9.06 9.22 Recurring capital expenditures (0.92 ) (0.92 ) Core AFFO per Share - diluted $ 8.14 $ 8.30

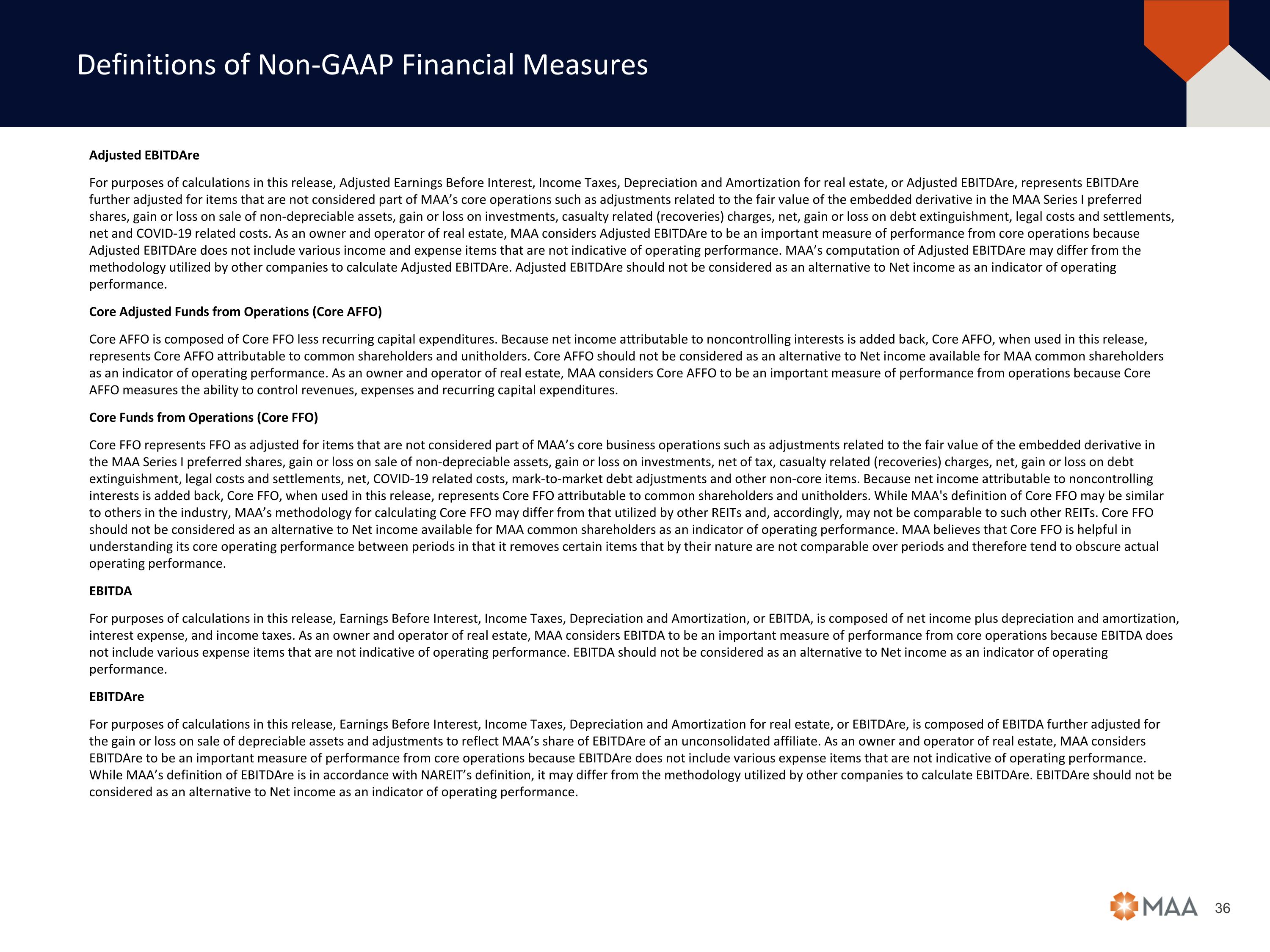

Definitions of Non-GAAP Financial Measures Adjusted EBITDAre For purposes of calculations in this release, Adjusted Earnings Before Interest, Income Taxes, Depreciation and Amortization for real estate, or Adjusted EBITDAre, represents EBITDAre further adjusted for items that are not considered part of MAA’s core operations such as adjustments related to the fair value of the embedded derivative in the MAA Series I preferred shares, gain or loss on sale of non-depreciable assets, gain or loss on investments, casualty related (recoveries) charges, net, gain or loss on debt extinguishment, legal costs and settlements, net and COVID-19 related costs. As an owner and operator of real estate, MAA considers Adjusted EBITDAre to be an important measure of performance from core operations because Adjusted EBITDAre does not include various income and expense items that are not indicative of operating performance. MAA’s computation of Adjusted EBITDAre may differ from the methodology utilized by other companies to calculate Adjusted EBITDAre. Adjusted EBITDAre should not be considered as an alternative to Net income as an indicator of operating performance. Core Adjusted Funds from Operations (Core AFFO) Core AFFO is composed of Core FFO less recurring capital expenditures. Because net income attributable to noncontrolling interests is added back, Core AFFO, when used in this release, represents Core AFFO attributable to common shareholders and unitholders. Core AFFO should not be considered as an alternative to Net income available for MAA common shareholders as an indicator of operating performance. As an owner and operator of real estate, MAA considers Core AFFO to be an important measure of performance from operations because Core AFFO measures the ability to control revenues, expenses and recurring capital expenditures. Core Funds from Operations (Core FFO) Core FFO represents FFO as adjusted for items that are not considered part of MAA’s core business operations such as adjustments related to the fair value of the embedded derivative in the MAA Series I preferred shares, gain or loss on sale of non-depreciable assets, gain or loss on investments, net of tax, casualty related (recoveries) charges, net, gain or loss on debt extinguishment, legal costs and settlements, net, COVID-19 related costs, mark-to-market debt adjustments and other non-core items. Because net income attributable to noncontrolling interests is added back, Core FFO, when used in this release, represents Core FFO attributable to common shareholders and unitholders. While MAA's definition of Core FFO may be similar to others in the industry, MAA’s methodology for calculating Core FFO may differ from that utilized by other REITs and, accordingly, may not be comparable to such other REITs. Core FFO should not be considered as an alternative to Net income available for MAA common shareholders as an indicator of operating performance. MAA believes that Core FFO is helpful in understanding its core operating performance between periods in that it removes certain items that by their nature are not comparable over periods and therefore tend to obscure actual operating performance. EBITDA For purposes of calculations in this release, Earnings Before Interest, Income Taxes, Depreciation and Amortization, or EBITDA, is composed of net income plus depreciation and amortization, interest expense, and income taxes. As an owner and operator of real estate, MAA considers EBITDA to be an important measure of performance from core operations because EBITDA does not include various expense items that are not indicative of operating performance. EBITDA should not be considered as an alternative to Net income as an indicator of operating performance. EBITDAre For purposes of calculations in this release, Earnings Before Interest, Income Taxes, Depreciation and Amortization for real estate, or EBITDAre, is composed of EBITDA further adjusted for the gain or loss on sale of depreciable assets and adjustments to reflect MAA’s share of EBITDAre of an unconsolidated affiliate. As an owner and operator of real estate, MAA considers EBITDAre to be an important measure of performance from core operations because EBITDAre does not include various expense items that are not indicative of operating performance. While MAA’s definition of EBITDAre is in accordance with NAREIT’s definition, it may differ from the methodology utilized by other companies to calculate EBITDAre. EBITDAre should not be considered as an alternative to Net income as an indicator of operating performance.

Definitions of Non-GAAP Financial Measures Funds Available for Distribution (FAD) FAD is composed of Core FFO less total capital expenditures, excluding development spending, property acquisitions, capital expenditures relating to significant casualty losses that management expects to be reimbursed by insurance proceeds and corporate related capital expenditures. Because net income attributable to noncontrolling interests is added back, FAD, when used in this release, represents FAD attributable to common shareholders and unitholders. FAD should not be considered as an alternative to Net income available for MAA common shareholders as an indicator of operating performance. As an owner and operator of real estate, MAA considers FAD to be an important measure of performance from core operations because FAD measures the ability to control revenues, expenses and capital expenditures. Funds From Operations (FFO) FFO represents net income available for MAA common shareholders (calculated in accordance with GAAP) excluding gain or loss on disposition of operating properties and asset impairment, plus depreciation and amortization of real estate assets, net income attributable to noncontrolling interests, and adjustments for joint ventures. Because net income attributable to noncontrolling interests is added back, FFO, when used in this release, represents FFO attributable to common shareholders and unitholders. While MAA’s definition of FFO is in accordance with NAREIT’s definition, it may differ from the methodology for calculating FFO utilized by other companies and, accordingly, may not be comparable to such other companies. FFO should not be considered as an alternative to Net income available for MAA common shareholders as an indicator of operating performance. MAA believes that FFO is helpful in understanding operating performance in that FFO excludes depreciation and amortization of real estate assets. MAA believes that GAAP historical cost depreciation of real estate assets is generally not correlated with changes in the value of those assets, whose value does not diminish predictably over time, as historical cost depreciation implies. Gross Assets Gross Assets represents Total assets plus Accumulated depreciation. MAA believes that Gross Assets can be used as a helpful tool in evaluating its balance sheet positions. MAA believes that GAAP historical cost depreciation of real estate assets is generally not correlated with changes in the value of those assets, whose value does not diminish predictably over time, as historical cost depreciation implies. Gross Real Estate Assets Gross Real Estate Assets represents Real estate assets, net plus Accumulated depreciation, Cash and cash equivalents and 1031(b) exchange proceeds included in Restricted cash. MAA believes that Gross Real Estate Assets can be used as a helpful tool in evaluating its balance sheet positions. MAA believes that GAAP historical cost depreciation of real estate assets is generally not correlated with changes in the value of those assets, whose value does not diminish predictably over time, as historical cost depreciation implies. Net Debt Net Debt represents Unsecured notes payable and Secured notes payable less Cash and cash equivalents and 1031(b) exchange proceeds included in Restricted cash. MAA believes Net Debt is a helpful tool in evaluating its debt position. Net Operating Income (NOI) Net Operating Income represents Rental and other property revenues less Total property operating expenses, excluding depreciation and amortization, for all properties held during the period, regardless of their status as held for sale. NOI should not be considered as an alternative to Net income available for MAA common shareholders. MAA believes NOI is a helpful tool in evaluating operating performance because it measures the core operations of property performance by excluding corporate level expenses and other items not related to property operating performance. Non-Same Store and Other NOI Non-Same Store and Other NOI represents Rental and other property revenues less Total property operating expenses, excluding depreciation and amortization, for all properties classified within the Non-Same Store and Other Portfolio during the period. Non-Same Store and Other NOI includes all storm-related expenses related to hurricanes. Non-Same Store and Other NOI should not be considered as an alternative to Net income available for MAA common shareholders. MAA believes Non-Same Store and Other NOI is a helpful tool in evaluating operating performance because it measures the core operations of property performance by excluding corporate level expenses and other items not related to property operating performance.

Definitions of Non-GAAP Financial Measures and Other Key Terms Same Store NOI Same Store NOI represents Rental and other property revenues less Total property operating expenses, excluding depreciation and amortization, for all properties classified within the Same Store Portfolio during the period. Same Store NOI excludes storm-related expenses related to hurricanes. Same Store NOI should not be considered as an alternative to Net income available for MAA common shareholders. MAA believes Same Store NOI is a helpful tool in evaluating operating performance because it measures the core operations of property performance by excluding corporate level expenses and other items not related to property operating performance. OTHER KEY TERMS Average Effective Rent per Unit Average Effective Rent per Unit represents the average of gross rent amounts after the effect of leasing concessions for occupied units plus prevalent market rates asked for unoccupied units, divided by the total number of units. Leasing concessions represent discounts to the current market rate. MAA believes average effective rent is a helpful measurement in evaluating average pricing. It does not represent actual rental revenue collected per unit. Average Physical Occupancy Average Physical Occupancy represents the average of the daily physical occupancy for an applicable period. Development Communities Communities remain identified as development until certificates of occupancy are obtained for all units under development. Once all units are delivered and available for occupancy, the community moves into the Lease-up Communities portfolio. Lease-up Communities New acquisitions acquired during lease-up and newly developed communities remain in the Lease-up Communities portfolio until stabilized. Communities are considered stabilized when achieving 90% average physical occupancy for 90 days. Non-Same Store and Other Portfolio Non-Same Store and Other Portfolio includes recently acquired communities, communities in development or lease-up, communities that have been disposed of or identified for disposition, communities that have experienced a significant casualty loss, stabilized communities that do not meet the requirements defined by the Same Store Portfolio, retail properties and commercial properties. Resident Turnover Resident turnover represents resident move outs excluding transfers within the Same Store Portfolio as a percentage of expiring leases on a rolling twelve month basis as of the end of the reported quarter. Same Store Portfolio MAA reviews its Same Store Portfolio at the beginning of each calendar year, or as significant transactions or events warrant. Communities are generally added into the Same Store Portfolio if they were owned and stabilized at the beginning of the previous year. Communities are considered stabilized when achieving 90% average physical occupancy for 90 days. Communities that have been approved by MAA’s Board of Directors for disposition are excluded from the Same Store Portfolio. Communities that have experienced a significant casualty loss are also excluded from the Same Store Portfolio.