Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS1

Table of Contents

As confidentially submitted to the Securities and Exchange Commission on October 3, 2014.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TiGenix

(Exact name of Registrant as specified in its charter)

| | | | |

Kingdom of Belgium

(State or other jurisdiction of

incorporation or organization) | | 2834

(Primary Standard Industrial

Classification Code Number) | | Not Applicable

(I.R.S. Employer

Identification Number) |

Romeinse straat 12, box 2

3001 Leuven

Belgium

+32 (16) 39 6060

(Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices)

CT Corporation System

111 Eighth Avenue

New York, NY 10011

+1 (212) 894-8800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| | |

| Copies to: |

Peter Castellon, Esq.

Proskauer Rose LLP

Ten Bishops Square

London E1 6EG

United Kingdom

+44 (20) 7539-0600 |

|

Thomas S. Levato, Esq.

Goodwin Procter LLP

The New York Times Building

620 Eighth Avenue

New York, NY 10018

United States

+1 (212) 813-8800 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

| | | | |

| | | | |

| |

Title of Each Class of Securities

to be Registered(1)

| | Proposed Maximum

Aggregate Offering

Price(2)(3)

| | Amount of

Registration Fee

|

|---|

| |

Ordinary Shares, no nominal value per share | | $ | | $ |

|

- (1)

- American depositary shares, or ADSs, issuable upon deposit of the ordinary shares registered hereby will be registered under a separate registration statement on Form F-6. Each ADS will represent ordinary shares.

- (2)

- Includes ordinary shares that are issuable upon the exercise of the underwriters' option to purchase additional ordinary shares to cover over-allotments, if any.

- (3)

- Estimated solely for the purposes of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a) may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated ,

Preliminary Prospectus

American Depositary Shares

Representing Ordinary Shares

$ per American Depositary Share

TiGenix, a Belgian public limited liability company, is offering American Depositary Shares, or ADSs. Each ADS will represent ordinary shares with no nominal value per share.

This is our initial public offering in the United States. We intend to apply to list our ADSs on the NASDAQ Global Market under the symbol "TIG." Prior to this offering our ordinary shares have traded, and subsequent to this offering will continue to trade, on Euronext Brussels under the symbol "TIG." The latest reported closing sale price of our ordinary shares on Euronext Brussels on October 1, 2014 was 0.57 euros per share, or $0.72 per share based on the rate of exchange on that day.

We anticipate that the initial public offering price of our ADSs will be between $ and $ per ADS.

This investment involves a high degree of risk. See "Risk Factors" beginning on page 11.

| | | | |

| | | | |

| |

| | Per ADS

| | Total

|

|---|

| |

Public offering price | | $ | | $ |

| |

Underwriting discounts and commissions(1) | | $ | | $ |

| |

Proceeds, before expenses, to TiGenix | | $ | | $ |

|

- (1)

- The underwriters will also be reimbursed for certain expenses incurred in this offering. See "Underwriting" for details.

The underwriters have a thirty-day option to purchase up to additional ADSs to cover over-allotments, if any.

We are an "emerging growth company" as that term is defined in the Jumpstart Our Business Startups Act of 2012 and, as such, will be subject to reduced public company reporting requirements for future filings. See "Prospectus Summary—Implications of Being an Emerging Growth Company."

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the ADSs will be made against payment in New York, New York on or about , .

Joint Book-Running Managers

Co-Managers

| | |

| Maxim Group LLC | | Chardan Capital Markets |

The date of this prospectus is , .

Table of Contents

TABLE OF CONTENTS

| | | | |

| | Page | |

|---|

PROSPECTUS SUMMARY | | | 1 | |

RISK FACTORS | | |

11 | |

HISTORY AND ORGANIZATIONAL STRUCTURE | | |

36 | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | | |

38 | |

EXCHANGE RATES | | |

40 | |

USE OF PROCEEDS | | |

41 | |

DIVIDEND POLICY | | |

42 | |

CAPITALIZATION | | |

43 | |

DILUTION | | |

44 | |

MARKET FOR OUR SHARES | | |

46 | |

SELECTED FINANCIAL INFORMATION | | |

47 | |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | |

50 | |

BUSINESS | | |

68 | |

DESCRIPTION OF SHARE CAPITAL | | |

109 | |

MANAGEMENT | | |

120 | |

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | | |

136 | |

PRINCIPAL SHAREHOLDERS | | |

137 | |

DESCRIPTION OF AMERICAN DEPOSITARY SHARES | | |

139 | |

SHARES ELIGIBLE FOR FUTURE SALES | | |

150 | |

TAXATION | | |

151 | |

UNDERWRITING | | |

162 | |

EXPENSES RELATED TO THIS OFFERING | | |

168 | |

LEGAL MATTERS | | |

169 | |

EXPERTS | | |

170 | |

SERVICE OF PROCESS AND ENFORCEMENT OF CIVIL LIABILITIES | | |

171 | |

WHERE YOU CAN FIND MORE INFORMATION | | |

173 | |

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | | |

F-1 | |

i

Table of Contents

You should rely only on the information contained in this prospectus and any related free-writing prospectus that we authorize to be distributed to you. We have not, and the underwriters have not, authorized any person to provide you with information different from that contained in this prospectus or any related free-writing prospectus that we authorize to be distributed to you. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted. The information in this prospectus speaks only as of the date of this prospectus unless the information specifically indicates that another date applies, regardless of the time of delivery of this prospectus or of any sale of the securities offered hereby.

No action is being taken in any jurisdiction outside the United States to permit a public offering of the ADSs or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of the prospectus applicable to that jurisdiction.

Until , (twenty-five days after the commencement of this offering), all dealers that buy, sell or trade our ADSs, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and estimates of our and our industry's future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in "Risk Factors." These and other factors could cause our future performance to differ materially from our assumptions and estimates. See "Special Note Regarding Forward-Looking Statements."

Our registered trademarks, TiGenix and ChondroCelect, the TiGenix logo and other trademarks or service marks of TiGenix appearing in this prospectus are our property. This prospectus contains additional trade names, trademarks and service marks of other companies that are the property of their respective owners.

ii

Table of Contents

PROSPECTUS SUMMARY

This summary highlights selected information about us contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider in making your investment decision. Before investing in the ADSs, you should read this entire prospectus carefully, including the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes, for a more complete understanding of our business and this offering.

Except as otherwise required by the context, references to "TiGenix," "Company," "we," "us" and "our" are to TiGenix and its subsidiaries.

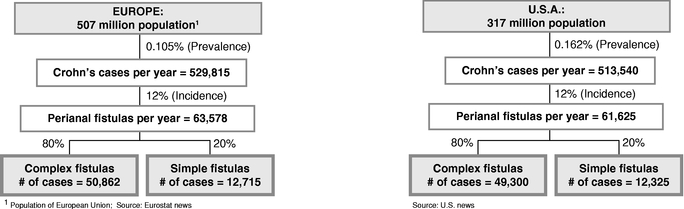

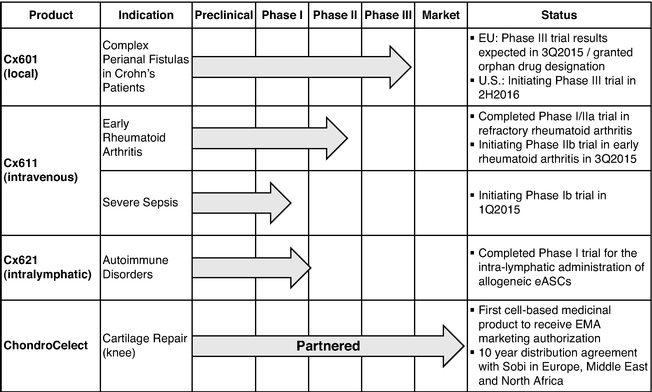

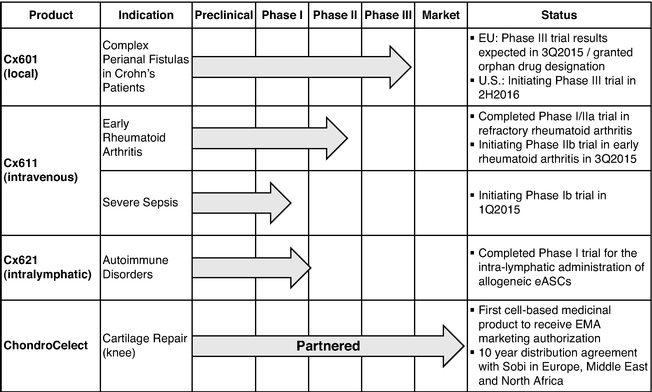

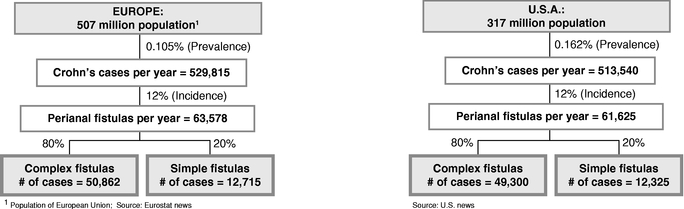

We are an advanced biopharmaceutical company focused on developing and commercializing novel therapeutics from our proprietary technology platform of allogeneic, or donor-derived, expanded adipose-derived stem cells, known as eASCs, in inflammatory and autoimmune diseases. Based on our platform, we have developed a pipeline of product candidates, with our most advanced being Cx601, a first-in-class injectable allogeneic stem cell therapy that has been granted orphan designation by the European Medicines Agency, or EMA. We are conducting a single pivotal Phase III trial for Cx601 for the treatment of complex perianal fistulas in patients suffering from Crohn's disease, a painful and debilitating condition affecting approximately 100,000 patients in the United States and Europe. Data from the single pivotal trial should be available in the third quarter of 2015, based on which we plan to submit a marketing authorization application to the EMA in the first half of 2016. We also intend to initiate a Phase III trial for Cx601 in the United States by the second half of 2016. Based on discussions with the U.S. Food and Drug Administration, or FDA, we believe that the U.S. Phase III trial, if successful, could, together with the European Phase III data, serve as supportive evidence for filing for regulatory approval with the FDA.

Our platform has generated other product candidates, including Cx611, for which we have completed a Phase I/IIa trial in rheumatoid arthritis. We are currently developing two clinical trials for Cx611: a Phase Ib trial in severe sepsis in the first quarter of 2015 and a Phase IIb trial in early rheumatoid arthritis in the third quarter of 2015. Our third product candidate, Cx621, completed a Phase I clinical trial for intra-lymphatic administration of allogeneic eASCs. Its mode of administration has the potential to enable applications in other autoimmune diseases. We also developed and commercialized ChondroCelect, the first cell-based medicinal product to receive marketing authorization from the EMA, which is indicated for cartilage repair in the knee.

Our eASC-based product candidates are manufactured at our facility in Madrid, Spain, that has been approved by the Spanish Medicines and Medical Devices Agency as being compliant with current Good Manufacturing Requirements. Through our expansion process, we can generate up to 2,400 doses of Cx601 from cells extracted from a single healthy donor. Drawing on our experience with ChondroCelect, we already have the capacity to scale up the production of our eASC-based products on a late-stage clinical as well as commercial scale.

We have retained the worldwide rights for all of our product candidates. As of September 30, 2014, we owned or co-owned over twenty patent families and had over ninety granted patents in over twenty jurisdictions, including the United States, with expiration dates from 2020 onwards.

Product and Product Candidates

Our approach to cell therapy is to focus on the use of living cells, rather than conventional drugs, for the treatment of inflammatory and autoimmune diseases. Our advanced clinical stage pipeline of stem cell programs is based on a validated platform of eASCs extracted from human adipose, or fat, tissue. Our eASCs are extracted and cultured from tissue sourced from healthy consenting adult donors that can then be administered in patients for the treatment of autoimmune and inflammatory diseases.

1

Table of Contents

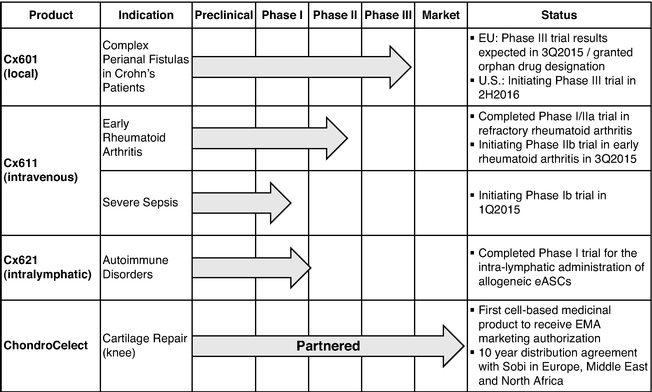

The following chart summarizes our product candidates and our marketed product:

Cx601

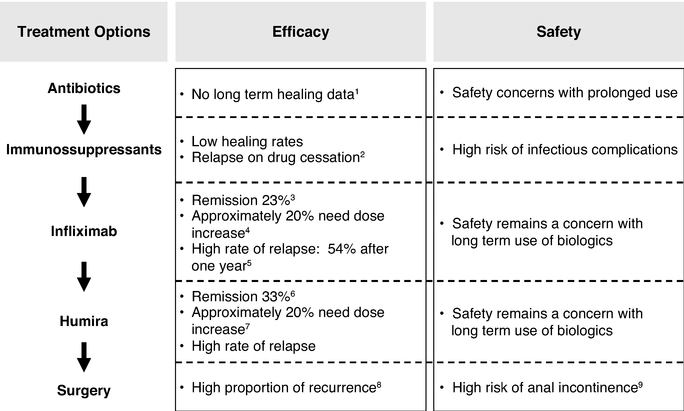

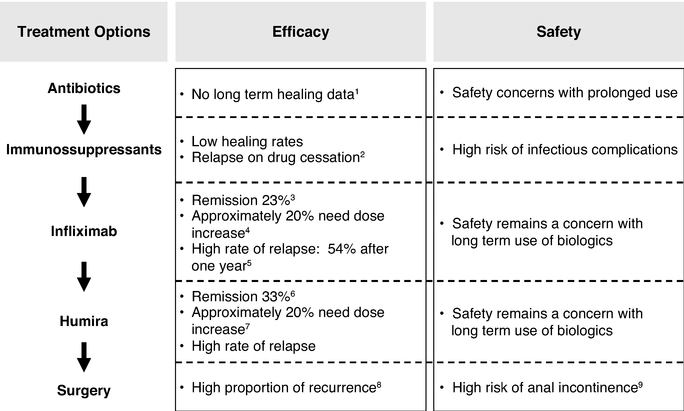

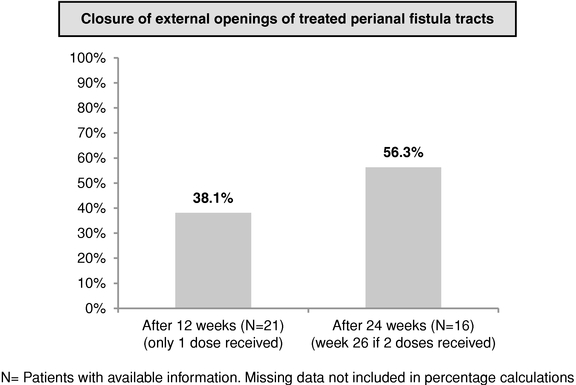

Cx601, our lead product candidate, is a first-in-class injectable allogeneic stem cell therapy that is currently in a pivotal Phase III trial in Europe for the treatment of complex perianal fistulas in patients suffering from Crohn's disease. Crohn's disease is a chronic inflammatory disease of the intestine, which frequently leads to the development of abscesses and fistulas. Current therapies have limited efficacy and there is currently no commercially available cell-based therapy for this indication. We received orphan drug designation for the treatment of anal fistulas from the EMA in 2009.

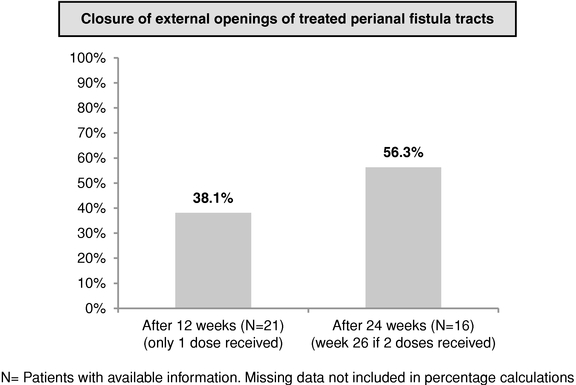

We believe that Cx601, if approved, would fulfill a significant unmet need in the market. We have compelling clinical results that suggest that Cx601 may have clinical utility in treating perianal fistulas in one injectable dose with a more favorable adverse events profile than currently available therapies for this indication. If our pivotal Phase III trial is successful, we expect to file for marketing authorization in Europe by the first half of 2016 and initiate a Phase III trial in the United States by the second half of 2016.

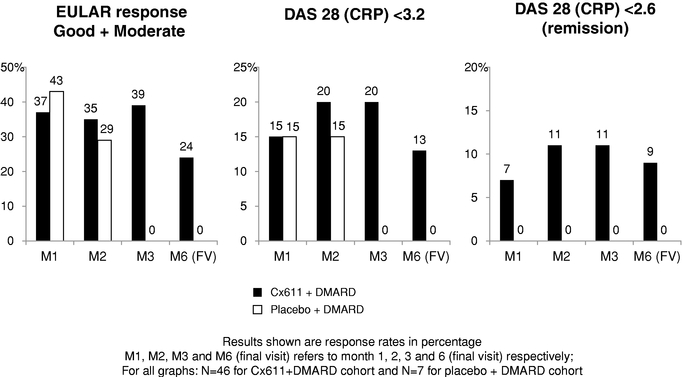

Cx611

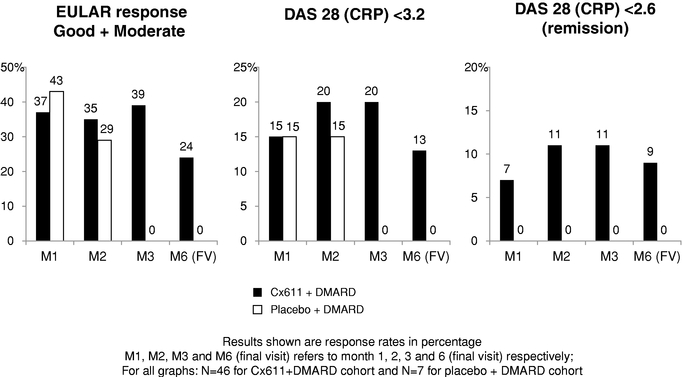

Cx611, our second product candidate, is a first-in-class injectable allogeneic stem cell therapy in development for the treatment of early rheumatoid arthritis and severe sepsis. We believe that Cx611, if approved for early rheumatoid arthritis patients, would have advantages over current treatments such as biologics due to its safety profile and higher induction of remission. We have completed a successful Phase I/IIa trial of Cx611 in refractory rheumatoid arthritis patients that illustrated the safety of the therapy and provided indications of therapeutic activity. If Cx611 is approved for severe sepsis, we believe that it would be an add-on therapy that has the potential to reduce mortality. We are planning to advance Cx611 in severe sepsis in a Phase Ib trial and in early rheumatoid arthritis in a Phase IIb trial in the first and the third quarter of 2015, respectively.

2

Table of Contents

Cx621

Cx621, our third clinical stage product candidate, has generated safety and feasibility information on the intra-lymphatic administration of allogeneic eASCs. This different route of administration has the potential to enable applications in other autoimmune diseases.

ChondroCelect

ChondroCelect, our commercial product, was the first cell-based product approved in Europe, and received centralized marketing authorization in October 2009 as an advanced therapy medicinal product. Effective June 1, 2014, we have entered into a distribution agreement with Swedish Orphan Biovitrium, or Sobi, for the exclusive marketing and distribution rights with respect to ChondroCelect within the European Union (except for Finland), as well as several other countries, including the Middle East and North Africa.

Technology Platform

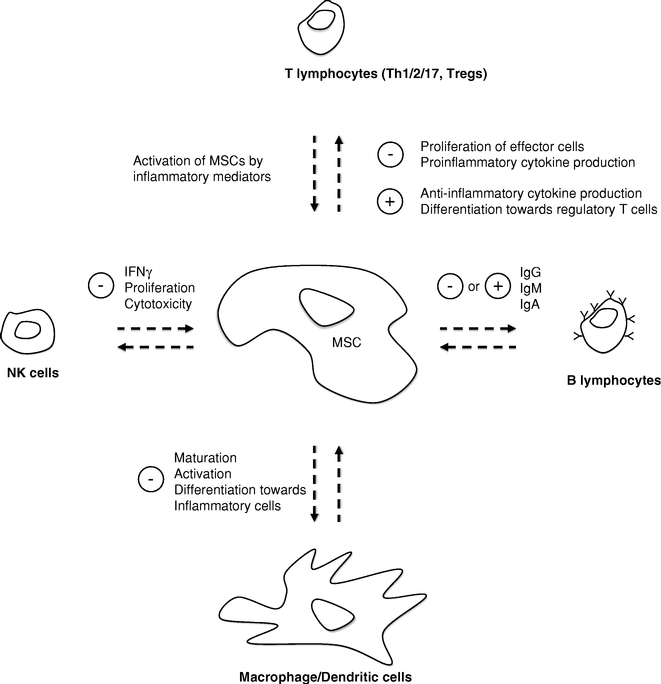

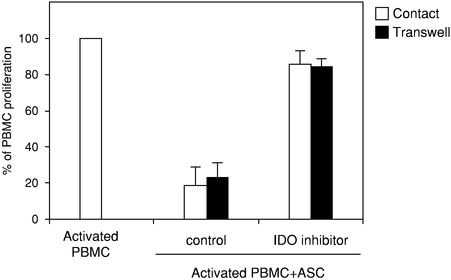

Our development programs are based on a proprietary technology platform of eASCs, exploiting their recognized mechanism of action in immune-mediated inflammatory processes. The eASCs target a different pathway than conventional drugs and may be effective in patients who fail to respond to such drugs, including the biologics that are currently used to treat autoimmune conditions. We believe our platform offers significant market opportunities in inflammatory and autoimmune diseases based on the following distinguishing factors:

- •

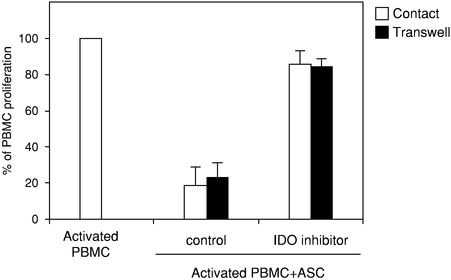

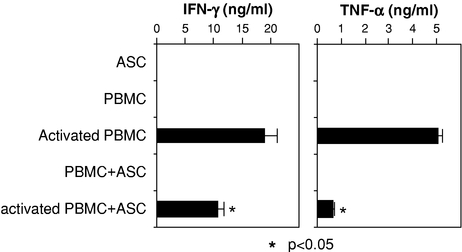

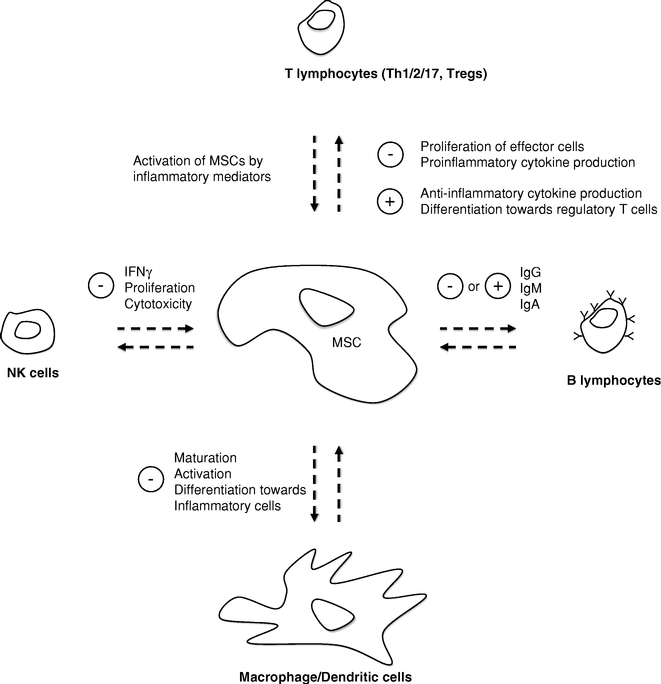

- Our mechanism of action utilizes two main biological pathways that underlie the efficacy of stem cells in disease treatment: (i) their anti-inflammatory properties and (ii) their secretion of repair and growth promoting molecules. Our eASCs exhibit broad immunomodulatory properties, including the regulation of immune cells such as B lymphocytes, T lymphocytes, natural killer cells, monocytes or macrophages and neutrophils.

- •

- Our experience in enabling both local and systemic routes of administration.

- •

- Our use of eASCs extracted from human adipose tissue sourced from healthy volunteers. We believe that this type of cell offers significant advantages over other cell types, such as stem cells sourced from bone marrow.

- •

- Our use of allogeneic adult stem cells. This enables efficient production of large batches of cells and does not require any patient biopsy or tissue procurement.

Strategy

Key elements of our strategy to provide innovative and safe treatment options for a broad range of inflammatory and autoimmune diseases are as follows:

- •

- Successfully advance the clinical development of Cx601 for the treatment of complex perianal fistulas in patients with Crohn's disease and secure regulatory approval in Europe and the United States.

- •

- Achieve global commercialization of Cx601, leveraging our experience in bringing ChondroCelect to market.

- •

- Advance our product candidates, Cx611 and Cx621, in the United States and the rest of the world.

- •

- Discover, develop and commercialize first-in-class novel therapeutics for areas of high unmet medical need by leveraging our proprietary technology platform of eASCs.

3

Table of Contents

- •

- Strengthen our competitive position by leveraging our experienced management team and reinforcing key opinion leader support.

Summary Risk Factors

An investment in the ADSs involves a high degree of risk. You should consider carefully the risks discussed below and under the heading "Risk Factors" beginning on page 11 of this prospectus before purchasing the ADSs. If any of these risks actually occurs, our business, financial condition or results of operations would likely be materially adversely affected. In such case, the trading price of our ADSs would likely decline, and you may lose all or part of your investment.

These risks include the following:

- •

- We may experience delays or failure in the preclinical and clinical development of our product candidates.

- •

- Regulatory approval of our product candidates may be delayed, not obtained or not maintained, and we may be affected by future changes to any pharmaceutical legislation or guidelines.

- •

- We may need substantial additional funding, which may not be available on acceptable terms when required, if at all.

- •

- Our net losses and significant cash used in operating activities have raised substantial doubt regarding our ability to continue as a going concern.

- •

- We may not be able to protect our proprietary technology adequately or enforce any rights related thereto.

- •

- We rely or may rely on third parties for certain of our research, clinical trials, technology, supplies, manufacturing and sales and marketing, and a failure of service by such parties could adversely affect our business and reputation.

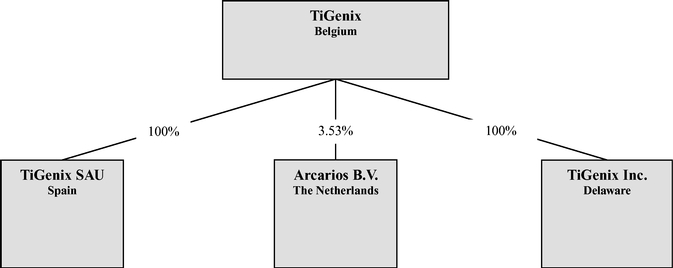

Company Information

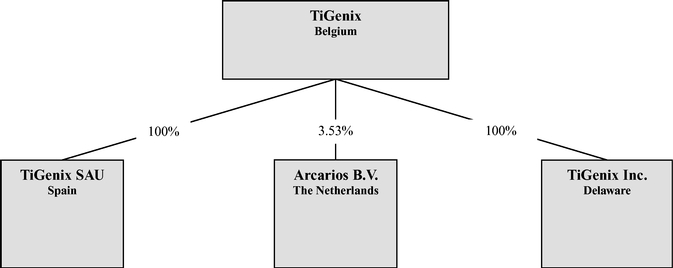

TiGenix was incorporated in Belgium on February 21, 2000 as a company with limited liability under Belgian corporate law. Our principal executive and registered offices are located at Romeinse straat 12, box 2, 3001 Leuven, Belgium. Our telephone number is +32 (16) 39 60 60. We are registered with the Register of Legal Entities (Leuven) under the enterprise number 0471.340.123. Our internet website is www.tigenix.com. The information contained on, or accessible through, our website is not incorporated by reference into this prospectus and should not be considered a part of this prospectus.

Our agent for service of process in the United States is CT Corporation System, whose registered offices are located at 111 Eighth Avenue, 13th Floor, New York, NY 10011. Their telephone number is +1 (212) 894-8800.

For additional information regarding our Company organizational history, see "History and Organizational Structure."

Recent Developments

On December 20, 2013, we entered into a loan facility agreement of up to 10.0 million euros with Kreos Capital IV (UK), under which we borrowed 7.5 million euros during the first half of 2014. On September 30, 2014, we borrowed the final installment of 2.5 million euros available under the facility.

4

Table of Contents

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during its fiscal year, we qualify as an "emerging growth company" as defined in Section 2(a) of the Securities Act of 1933, as amended, as modified by the Jumpstart our Business Startups Act of 2012, or the JOBS Act. As such, we are eligible to take advantage of specified reduced reporting requirements and are relieved of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company:

- •

- We are permitted to present only two years of audited consolidated financial statements and only two years of related Management's Discussion and Analysis of Financial Condition and Results of Operations in the registration statement of which this prospectus forms a part.

- •

- We are exempt from the requirement to obtain an attestation and report from our auditors on the assessment of our internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act of 2002.

- •

- We are permitted to provide less extensive disclosure about our executive compensation arrangements.

We expect to remain an "emerging growth company" for up to five years, or until any one of the following occurs:

- •

- The last day of the first fiscal year in which our annual gross revenue exceeds $1 billion.

- •

- The last day of the fiscal year that we become a "large accelerated filer" as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, which would occur if the market value of our common equity held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter and we have been publicly reporting for at least twelve months.

- •

- The date on which we have issued more than $1.0 billion in non-convertible debt during the preceding three-year period.

We may choose to take advantage of some but not all of these reduced burdens. We have taken advantage of reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different from the information you receive from our competitors that are public companies, or other public companies in which you have made an investment.

5

Table of Contents

The Offering

| | |

Issuer | | TiGenix |

ADSs offered | | ADSs. |

Ordinary shares outstanding immediately after this offering | | ordinary shares. |

Over-allotment option | | ADSs. |

The ADSs | | Each ADS represents ordinary shares. |

| | ADSs may be evidenced by American Depositary Receipts, or ADRs. The depositary will hold the ordinary shares underlying your ADSs. You will have rights of an ADR holder as provided in the deposit agreement. You may cancel your ADSs and withdraw the underlying ordinary shares. The depositary will charge you fees for, among other acts, any cancellation. In certain limited instances described in the deposit agreement, we may amend or terminate the deposit agreement without your consent. If you continue to hold your ADSs, you agree to be bound by the terms of the deposit agreement then in effect. |

| | To better understand the terms of the ADSs, you should carefully read the section in this prospectus entitled "Description of American Depositary Shares." You should also read the deposit agreement, which is an exhibit to the registration statement of which this prospectus forms a part. |

Depositary for the ADSs | | Deutsche Bank Trust Company Americas. |

Custodian for the ADSs | | Deutsche Bank AG, Amsterdam Branch. |

Use of proceeds | | We expect to receive total net proceeds from this offering of approximately $ , after deducting the underwriting discounts and commissions and estimated offering expenses, assuming an initial public offering price of $ per ADS, the midpoint of the price range set forth on the cover page of this prospectus. We intend to use the net proceeds of this offering to: (i) fund new clinical trials of our product candidates, (ii) discover and develop new product candidates from our proprietary technology platform and (iii) fund research and development activities, working capital and other general corporate purposes, including the costs and expenses of being a U.S.-listed public company. Pending our use of the net proceeds as described above, we may invest the net proceeds in short-term bank deposits or interest-bearing, investment-grade securities. See "Use of Proceeds." |

Dividend policy | | We do not currently pay dividends and we do not anticipate declaring or paying any dividends for the foreseeable future. |

6

Table of Contents

| | |

Listing | | We intend to apply to list our ADSs on the NASDAQ Global Market under the symbol "TIG." Prior to this offering, our ordinary shares have traded, and subsequent to this offering will continue to trade, on Euronext Brussels under the symbol "TIG," and we will timely apply for the listing and admission to trading on Euronext Brussels of the new ordinary shares underlying the ADSs. |

Risk factors | | Investing in our ADSs involves a high degree of risk. You should carefully read the information set forth under "Risk Factors" beginning on page 11 of this prospectus and the other information set forth in this prospectus before deciding to invest in the ADSs. |

The number of our ordinary shares that will be issued and outstanding immediately after this offering is based on 160,476,620 ordinary shares outstanding as of September 30, 2014 and excludes the following:

- •

- ordinary shares represented by the ADSs subject to the underwriters' over-allotment option to purchase additional ADSs.

- •

- 8,696,498 ordinary shares issuable upon exercise of outstanding warrants as of September 30, 2014, at a weighted-average exercise price of 1.36 euros per share.

Unless otherwise indicated, this prospectus assumes no exercise of the underwriters' option to purchase up to an additional ADSs from us.

7

Table of Contents

Summary Historical Consolidated Financial Data

The tables below present our summary historical consolidated financial data. Our summary historical consolidated financial data as of December 31, 2013 and 2012 and for the years ended December 31, 2013 and 2012 has been derived from our audited consolidated financial statements, which are included elsewhere in this prospectus. Our summary historical consolidated financial data as of June 30, 2014 and for the periods ended June 30, 2014 and 2013 have been derived from our unaudited interim consolidated financial statements, which are included elsewhere in this prospectus. The consolidated financial statements have been prepared and presented in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. The interim consolidated financial statements have been prepared and presented in accordance with International Accounting Standard 34 "Interim Financial Reporting." These interim consolidated financial statements do not include all the information required for full annual financial statements in accordance with IFRS as issued by IASB and should be read in conjunction with our consolidated financial statements as at and for the year ended December 31, 2013.

Our consolidated financial statements are prepared and presented in euros, our presentation currency. Solely for the convenience of the reader our consolidated financial statements as at and for the year ended December 31, 2013 and the period ended June 30, 2014, have been translated into U.S. dollars at 1.00 euro=$1.3779 on December 31, 2013 and 1.00 euro=$1.3690 on June 30, 2014, respectively, based on the certified foreign exchange rates published by the Federal Reserve Bank of New York. Such translation should not be construed as a representation that the euro amounts have been or could be converted into U.S. dollars at these or at any other rate of exchange, or at all.

The following summary historical consolidated financial data should be read in conjunction with our historical consolidated financial statements and the related notes thereto and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Selected Financial Information," each of which is included elsewhere in this prospectus. The historical results for any prior period are not necessarily indicative of results to be expected for any future period.

8

Table of Contents

Consolidated Income Statement Data:

| | | | | | | | | | | | | | | | | | | |

| | Six-month periods

ended June 30, | | Years ended

December 31, | |

|---|

| | 2014 | | 2013 | | 2014 | | 2013 | | 2012 | | 2013 | |

|---|

| | In thousands of

euros, except

per share data

(Unaudited)

| | In thousands of

U.S. dollars, except

per share data

(Unaudited)

| | In thousands of

euros, except

per share data

| | In thousands of

U.S. dollars, except

per share data

(Unaudited)

| |

|---|

Continuing Operations | | | | | | | | | | | | | | | | | | | |

Revenues | | | | | | | | | | | | | | | | | | | |

Royalties | | | — | | | — | | | — | | | — | | | — | | | — | |

Grants and other operating income | | | 821 | | | 736 | | | 1,124 | | | 883 | | | 1,389 | | | 1,217 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total revenues | | | 821 | | | 736 | | | 1,124 | | | 883 | | | 1,389 | | | 1,217 | |

Research and development expenses | | | (5,097 | ) | | (5,314 | ) | | (6,978 | ) | | (9,705 | ) | | (12,136 | ) | | (13,373 | ) |

General and administrative expenses | | | (2,859 | ) | | (2,735 | ) | | (3,914 | ) | | (5,829 | ) | | (6,237 | ) | | (8,032 | ) |

Total operating charges | | | (7,956 | ) | | (8,049 | ) | | (10,892 | ) | | (15,534 | ) | | (18,373 | ) | | (21,404 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Operating Loss | | | (7,135 | ) | | (7,313 | ) | | (9,768 | ) | | (14,651 | ) | | (16,984 | ) | | (20,188 | ) |

Financial income | | | 25 | | | 5 | | | 34 | | | 7 | | | 35 | | | 10 | |

Financial expenses | | | (369 | ) | | (28 | ) | | (505 | ) | | (45 | ) | | (58 | ) | | (62 | ) |

Foreign exchange differences | | | 170 | | | (38 | ) | | 233 | | | (352 | ) | | (142 | ) | | (485 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Loss before taxes | | | (7,309 | ) | | (7,374 | ) | | (10,006 | ) | | (15,041 | ) | | (17,149 | ) | | (20,725 | ) |

Income taxes | | | — | | | 42 | | | — | | | 59 | | | (1 | ) | | 81 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Loss for the period from continuing operations | | | (7,309 | ) | | (7,332 | ) | | (10,006 | ) | | (14,982 | ) | | (17,150 | ) | | (20,644 | ) |

Discontinued Operations | | |

| | |

| | |

| | |

| | |

| | |

| |

Loss for the period from discontinued operations | | | (1,842 | ) | | (1,505 | ) | | (2,522 | ) | | (3,408 | ) | | (3,243 | ) | | (4,696 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Loss for the period | | | (9,151 | ) | | (8,837 | ) | | (12,528 | ) | | (18,390 | ) | | (20,393 | ) | | (25,340 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Attributable to equity holders of TiGenix | | |

(9,151 |

) | |

(8,837 |

) | |

(12,528 |

) | |

(18,390 |

) | |

(20,393 |

) | |

(25,340 |

) |

Basic and diluted loss per share | | |

(0.06 |

) | |

(0.09 |

) | |

(0.08 |

) | |

(0.16 |

) | |

(0.22 |

) | |

(0.22 |

) |

Basic and diluted loss per share from continuing operations | | |

(0.05 |

) | |

(0.07 |

) | |

(0.07 |

) | |

(0.13 |

) | |

(0.19 |

) | |

(0.18 |

) |

Basic and diluted loss per share from discontinued operations | | |

(0.01 |

) | |

(0.02 |

) | |

(0.01 |

) | |

(0.03 |

) | |

(0.04 |

) | |

(0.04 |

) |

9

Table of Contents

Consolidated Statement of Financial Position Data:

| | | | | | | | | | | | | |

| | As at June 30, | | As at June 30, | |

|---|

| | 2014

(Actual) | | 2014

(As adjusted)(1) | | 2014

(Actual) | | 2014

(As adjusted)(1) | |

|---|

| | In thousands of euros

(Unaudited)

| | In thousands of

U.S. dollars

(Unaudited)

| |

|---|

Assets | | | | | | | | | | | | | |

Non-current assets | | | 37,732 | | | | | | 51,655 | | | | |

Current assets | | | 22,399 | | | | | | 30,664 | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Total Assets | | | 60,131 | | | | | | 82,319 | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | |

Equity and Liabilities | | |

| | |

| | |

| | |

| |

Equity attributable to equity holders | | | 39,340 | | | | | | 53,856 | | | | |

Total equity | | | 39,340 | | | | | | 53,856 | | | | |

Non-current liabilities | | | 14,353 | | | | | | 19,649 | | | | |

Current liabilities | | | 6,438 | | | | | | 8,814 | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Total Equity and Liabilities | | | 60,131 | | | | | | 82,319 | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | |

- (1)

- Gives effect to the sale of ADSs by us in this offering at an assumed initial public offering price per ADS of $ , the midpoint of the price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

Consolidated Statements of Cash Flow Data—Summary:

| | | | | | | | | | | | | | | | | | | |

| | Six-month periods

ended June 30, | | Years ended

December 31, | |

|---|

| | 2014 | | 2013 | | 2014 | | 2013 | | 2012 | | 2013 | |

|---|

| | In thousands of

euros

(Unaudited)

| | In thousands of

U.S. dollars

(Unaudited)

| | In thousands of

euros

| | In thousands of

U.S. dollars

(Unaudited)

| |

|---|

Net cash used in operating activities | | | (6,093 | ) | | (7,817 | ) | | (8,341 | ) | | (14,427 | ) | | (17,627 | ) | | (19,879 | ) |

Net cash used in investing activities | | | (2,552 | ) | | (225 | ) | | (3,494 | ) | | (1,320 | ) | | (721 | ) | | (1,819 | ) |

Net cash provided by financing activities | | | 6,266 | | | 707 | | | 8,580 | | | 20,237 | | | 9,647 | | | 27,885 | |

Cash and cash equivalents at end of period | | | 13,186 | | | 3,738 | | | 18,052 | | | 15,565 | | | 11,072 | | | 21,447 | |

10

Table of Contents

RISK FACTORS

Investing in the ADSs involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with other information contained in this prospectus, before making an investment decision. Any of the following risks and uncertainties could have a material adverse effect on our business, prospects, results of operations and financial condition. The market price of our ADSs could decline due to any of these risks and uncertainties, and you could lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations.

Risks Related to the Clinical Development and Regulatory Approval of Our Product Candidates

We may experience delays or failure in the preclinical and clinical development of our product candidates.

As part of the regulatory approval process, we conduct preclinical studies and clinical trials for each of our unapproved product candidates to demonstrate safety and efficacy. The number of required preclinical studies and clinical trials varies depending on the product, the indication being evaluated, the trial results and the applicable regulations. Clinical testing is expensive and can take many years to be completed, and its outcome is inherently uncertain. Failure can occur at any time during the clinical trial process. The results of preclinical studies and initial clinical trials do not necessarily predict the results of later-stage clinical trials, and products may fail to show the desired safety, efficacy and quality despite having progressed through initial clinical trials. The data collected from preclinical studies and clinical trials may not be sufficient to support the U.S. Food and Drug Administration, or FDA, the European Medicines Agency, or EMA, or other regulatory approval or approval by ethics committees in various jurisdictions. In addition, the review of a study by an independent data safety monitoring board or review body does not necessarily indicate that the clinical trial will ultimately be successfully completed.

We cannot accurately predict when our current preclinical studies and clinical trials or future clinical trials will be completed, if at all, nor when planned preclinical studies and clinical trials will begin or be completed. Successful and timely completion of clinical trials will require us to recruit a sufficient number of patient candidates, locate or develop manufacturing facilities with regulatory approval sufficient for production of the product to be tested and enter into agreements with third party contract research organizations to conduct the trials. We may need to engage or further engage in preclinical studies and clinical trials with partners, which may reduce any future revenues from any future products.

Our products may cause unexpected side effects or serious adverse events that could interrupt, delay or halt the clinical trials and could result in the FDA, the EMA or other regulatory authorities denying approval of our products for any or all targeted indications. An independent data safety monitoring board, an institutional review board or ethics board, the FDA, the EMA, any other regulatory authorities or we ourselves may suspend or terminate clinical trials at any time, and none of our product candidates may ultimately prove to be safe and effective for human use.

Regulatory approval of our product candidates may be delayed, not obtained or not maintained.

In the United States, all of our cell-based product candidates are subject to a biologics license application, or BLA, issued by the FDA. In Europe, all of our product candidates require regulatory approval through the centralized marketing authorization procedure coordinated by the EMA for advanced therapy medicinal products.

Besides the marketing authorization, we also need to obtain and maintain specific national licenses to perform our commercial operations, including manufacturing and distribution licenses, as well as authorizations to obtain and handle human cells and tissues.

11

Table of Contents

Regulatory approval may be delayed, limited or denied for a number of reasons, most of which are beyond our control, including the following:

- •

- The requirement to perform additional clinical trials.

- •

- The failure of the product to meet the safety or efficacy requirements.

- •

- The failure of the relevant manufacturing processes or facilities to meet the applicable requirements.

Any delay or denial of regulatory approval of our product candidates or any failure to comply with post-approval regulatory policies is likely to have a significant impact on our operations and prospects, in particular on our expected revenues.

Regulatory authorities, including the FDA and the EMA, may disagree with our interpretations of data from preclinical studies and clinical trials, our interpretation of applicable regulations including, without limitations, regulations relating to patent term extensions or restorations. They may also approve a product for narrower spectrum of indications than requested or may grant approval subject to the performance of post-marketing studies for a product. Such post-approval studies, if required, may not corroborate the results of earlier trials. Furthermore, the general use of such products may result in either or both of the safety and efficacy profiles differing from those demonstrated in the trials on which marketing approval was based, which could lead to the withdrawal or suspension of marketing approval for the product. In addition, regulatory authorities may not approve the labelling claims that are necessary or desirable for the successful commercialization of our products.

In addition, a marketed product continues to be subject to strict regulation after approval. Changes in applicable legislation or regulatory policies or discovery of problems with the product, production process, site or manufacturer may result in delays in bringing products to the market, the imposition of restrictions on the product's sale or manufacture, including the possible withdrawal of the product from the market, or may otherwise have an adverse effect on our business.

The failure to comply with applicable regulatory requirements may, among other things, result in criminal and civil proceedings and lead to imprisonment, fines, injunctions, damages, total or partial suspension of regulatory approvals, refusal to approve pending applications, recalls or seizures of products and operating and production restrictions.

We may not receive regulatory clearance for trials at each stage and approval for our products and product candidates still in development without delay or at all. If we fail to obtain or maintain regulatory approval for our products, we will be unable to market and sell such products, and such failure or any delay could prevent us from ever generating meaningful revenues or achieving profitability.

We work in a strict regulatory environment, and future changes in any pharmaceutical legislation or guidelines, or unexpected events or new scientific insights occurring within the field of cell therapy, could affect our business.

Regulatory guidelines may change during the course of a product development and approval process, making the chosen development strategy suboptimal. This may delay development, necessitate additional clinical trials or result in failure of a future product to obtain marketing authorization or the targeted price levels and could ultimately adversely impact commercialization of the authorized product. Market conditions may change, resulting in the emergence of new competitors or new treatment guidelines, which may require alterations in our development strategy. This may result in significant delays, increased trial costs, significant changes in commercial assumptions or the failure of future product candidates to obtain marketing authorization.

12

Table of Contents

Although the basic regulatory frameworks appear to be in place in the United States and in Europe for cell-based products, at present regulators have limited experience with such products and the interpretation of these frameworks is sometimes difficult to predict. Moreover, the regulatory frameworks themselves will continue to evolve as the FDA and the EMA issue new guidelines. The interpretation of existing rules or the issuance of new regulations may impose additional constraints on the research, development, regulatory approval, manufacturing or distribution processes of future product candidates.

Unexpected events may occur in the cell therapy field, in particular unforeseen safety issues in ongoing clinical trials of any cell therapy product. Moreover, scientific progress might yield new insights on the biology of stem cells which might in turn impact the requirements of safety and efficacy demonstration for stem cell or other cell therapies. Such events or new insights might change the regulatory requirements and framework, in particular strengthening the required clinical research package and increasing the amount of data required to be provided. This could result in additional constraints on our product development process and lead to significant delays, which could prevent us from ever generating meaningful revenues or achieving profitability.

Risks Related to Our Financial Condition and Capital Requirements

If we fail to obtain additional financing, we may be unable to complete the development and commercialization of our product candidates.

Our operations have consumed substantial amounts of cash since inception. We expect to continue to spend substantial amounts to continue the clinical development of our product candidates. If our product candidates are approved, we will require significant additional funds in order to launch and commercialize such product candidates in the United States and internationally. We may also need to spend substantial amounts to expand our manufacturing infrastructure.

We believe our currently available cash and cash equivalents, together with our royalties from the sales of ChondroCelect under our distribution agreement with Swedish Orphan Biovitrium, or Sobi, will be sufficient to fund our operations through the third quarter of 2015. However, changing circumstances may cause us to consume capital significantly faster than we currently anticipate, and we may need to spend more money than currently expected because of circumstances beyond our control. As a result, we may require additional capital for the further development and commercialization of our product candidates.

Our future funding requirements, both near and long-term, will depend on many factors, including, but not limited to, the following:

- •

- The initiation, progress, timing, costs and results of clinical trials for our product candidates.

- •

- The clinical development plans we establish for these product candidates.

- •

- The number and characteristics of the product candidates that we develop and for which we seek regulatory approval.

- •

- The outcome, timing and cost of regulatory approvals by the FDA, the EMA and any other comparable foreign regulatory authorities, including the potential for the FDA, the EMA or any other comparable foreign regulatory authorities to require that we perform more studies than those that we currently expect.

- •

- The cost of filing, prosecuting, defending and enforcing any patent claims and other intellectual property rights.

- •

- The effects of competing technological and market developments.

- •

- The cost and timing of completion of commercial-scale manufacturing activities.

13

Table of Contents

- •

- The cost of establishing sales, marketing and distribution capabilities for any product candidates for which we may receive regulatory approval in regions where we choose to commercialize our products on our own.

Additional funding may not be available on a timely basis, on favorable terms, or at all, and such funds, if raised, may not be sufficient to enable us to continue to implement our business strategy. If we are unable to raise additional funds through equity or debt financing, we may need to delay, scale back or eliminate expenditures for some of our research, development and commercialization plans, or grant rights to develop and market products that we would otherwise prefer to develop and market ourselves, thereby reducing their ultimate value to us.

We have a history of operating losses and an accumulated deficit and may never become profitable.

We have experienced operating losses since our founding in February 2000. We experienced net losses of 20.4 million euros for the year ended December 31, 2012, 18.4 million euros for the year ended December 31, 2013 and 9.2 million euros for the six-month period ended June 30, 2014. As of June 30, 2014, we had an accumulated deficit of 83.2 million euros. These losses resulted mainly from the preclinical, clinical, manufacturing and regulatory efforts we undertook to advance the product candidates in our pipeline and to obtain marketing authorization from the EMA with respect to ChondroCelect, from our commercial efforts in launching ChondroCelect and from general and administrative costs associated with our operations. Our costs have always exceeded our revenues, which have been historically generated mainly through grants and income from the sale of ChondroCelect.

Our ability to become profitable depends on our ability to develop and commercialize our product candidates, and we do not know when, or if, we will generate significant revenues from their sale in the future. Our revenues to date from sales of ChondroCelect, our approved and commercialized product, have been limited.

Even if we do generate sales from our product candidates in the future, we may never achieve or sustain profitability. We anticipate that our operating losses will substantially increase over the next several years as we execute our plan to expand our research, development and commercialization activities, including the clinical development and planned commercialization of our product candidates, and incur the additional costs of operating as a U.S.-listed public company. In addition, if we obtain regulatory approval of our product candidates, we may incur significant sales and marketing expenses. Because of the numerous risks and uncertainties associated with developing pharmaceutical products, we are unable to predict the extent of any future losses or when we will become profitable, if ever.

Our net losses and significant cash used in operating activities have raised substantial doubt regarding our ability to continue as a going concern.

We have a limited operating history and have experienced net losses and significant cash used in operating activities in each period since inception. We expect to continue to incur net losses and have significant cash outflows for at least the next year. These conditions, among others, raise substantial doubt about our ability to continue as a going concern. As a result, our independent registered public accounting firm included an explanatory paragraph in its report on our financial statements as of and for the year ended December 31, 2013 with respect to this uncertainty. Our ability to continue as a going concern could materially limit our ability to raise additional funds through the issuance of new debt or equity securities or otherwise. Future reports on our financial statements may include an explanatory paragraph with respect to our ability to continue as a going concern. We have not been profitable since inception, and it is possible we will never achieve profitability. None of our product candidates can be marketed until governmental approvals have been obtained. Accordingly, there is no substantial source of revenues, much less profits, to sustain our present activities, and no substantial

14

Table of Contents

revenues will likely be available until, and unless, our product candidates are approved by the EMA, FDA or comparable regulatory agencies in other countries and successfully marketed, either by us or a partner, an outcome which may not occur. Based upon our currently expected level of operating expenditures, we expect to be able to fund our operations through the third quarter of 2015. This period could be shortened if there are any significant increases in planned spending on development programs or more rapid progress of development programs than anticipated. Other financing may not be available when needed to allow us to continue as a going concern. The perception that we may not be able to continue as a going concern may cause others to choose not to deal with us due to concerns about our ability to meet our contractual obligations.

Our revenues and operating results may fluctuate and may not be sufficient to cover our fixed costs.

Our revenues and operating results have fluctuated in the past and are likely to do so in the future due to a number of factors, many of which are not under our control. Some of the factors that could cause our operating results to fluctuate include, but are not limited to, those listed below and identified throughout this prospectus:

- •

- The (positive or negative) success rate of our development efforts.

- •

- Our ability to manage future clinical trials, given the regulatory environment.

- •

- The timing of approval, if any, of our products by the appropriate regulatory bodies.

- •

- Our ability to commercialize our products (including our ability to obtain reimbursement from public and private insurers for our products).

There is no direct link between the level of our expenses in connection with developing our pipeline of expanded adipose-derived stem cell-based, or eASC-based, product candidates and our revenues, which will primarily consist of royalties from sales of ChondroCelect under our distribution agreement with Sobi until we are able to bring another product to market. Accordingly, if revenues decline or do not grow as we expect, we may not be able to reduce our operating expenses correspondingly and may suffer losses accordingly.

The allocation of available resources could affect our ability to carry out our business plan.

We have significant flexibility and broad discretion to allocate and use our available resources. If such resources are not wisely allocated, our ability to carry out our business plan could be threatened. Our board of directors and management will determine, in their sole discretion and without the need for approval from the holders of our ordinary shares and ADSs, the amounts and timing of our actual expenditures, which will depend upon numerous factors, including the status of our product development and commercialization efforts, if any, and the amount of cash received resulting from partnerships and out-licensing activities. We constantly evaluate opportunities to acquire businesses and technologies that we believe are complementary to our business activities.

Our international operations pose currency risks, which may adversely affect our operating results and net income.

Our operating results may be affected by volatility in currency exchange rates and our ability to manage effectively our currency transaction risks. We use the euro as our currency for financial reporting purposes. In the future, a significant portion of our operating costs may be in U.S. dollars, because we are entering into research and development collaborations, trial collaborations, and professional services contracts in the United States. We also expect a share of our future revenues to be in U.S. dollars. Our exposure to currency risks could increase over time. We do not manage our foreign currency exposure in a manner that would eliminate the effects of changes in foreign exchange rates. For example, we have not engaged in any active hedging techniques, and we have not employed

15

Table of Contents

any derivative instruments to date. Therefore, unfavorable fluctuations in the exchange rate between the euro and U.S. dollars could have a negative impact on our financial results.

Risks Related to Our Business

The manufacturing facilities where our product candidates are made are subject to regulatory requirements, that may affect the development of our product candidates and the successful commercialization of our product candidates.

Our product candidates must be manufactured to high standards in compliance with regulatory requirements. The manufacture of such product candidates is subject to regulatory authorization and to requirements of the current good manufacturing practice, or cGMP requirements, prescribed in the relevant country or territory of manufacture or supply.

The cGMP requirements govern quality control of the manufacturing process and require written documentation of policies and procedures. Compliance with such procedures requires record keeping and quality control to ensure that the product meets applicable specifications and other requirements including audits of vendors, contract laboratories and suppliers. Manufacturing facilities are subject to inspection by regulatory authorities at any time. If an inspection by a regulatory authority indicates that there are deficiencies, we could be required to take remedial actions, stop production or close the relevant facility. If we fail to comply with these requirements, we also may be required to curtail the relevant clinical trials, might not be permitted to sell our product candidates or may be limited as to the countries or territories in which we are permitted to sell them.

Our eASC-based development and clinical stage product candidates are manufactured in our facilities in Madrid, Spain, which have been certified by the Spanish Medicines and Medical Devices Agency under cGMP requirements. However, the certification may be interrupted, suspended or discontinued because of a failure to maintain compliance or for any other reason. In addition, the regulations or policies applied by the relevant authorities may change, and any such change would require us to undertake additional work, which may not be sufficient for us to comply with the revised standards.

Any failure to comply with applicable cGMP requirements and other regulations may result in fines and civil penalties, suspension of production, product seizure or recall, import ban or detention, imposition of a consent decree, or withdrawal of product approval, and may limit the availability of our product candidates. Any manufacturing defect or error discovered after products have been produced and distributed also could result in significant consequences, including adverse health consequences, injury or death to patients, costly recall procedures, damage to our reputation and potential for product liability claims. An inability to continue manufacturing adequate supplies of our product candidates at our facilities in Madrid, Spain, could result in a disruption in the supply of our product candidates.

There may be uncertainty over reimbursement from third parties for newly approved healthcare products or such reimbursement may be refused, which could affect our ability to commercialize our product candidates.

Our ability to commercialize future product candidates will depend, in part, on the availability of reimbursement from government and health administration authorities, private health insurers, managed care programs and other third-party payers. Significant uncertainty exists as to the reimbursement status of newly approved healthcare products. In many countries, medicinal products are subject to a regime of reimbursement by government health authorities, private health insurers or other organizations. Such organizations are under significant pressure to limit healthcare costs by restricting the availability and level of reimbursement. For example, we have not been successful in obtaining certain forms of reimbursement with respect to ChondroCelect, such as the decision of the FrenchHaute Autorité de la Santé that ChondroCelect will not be reimbursed in France. Negative

16

Table of Contents

decisions by certain authorities or third-party payers may have an unfavorable spillover effect on pending or future reimbursement applications.

We may not be able to obtain or maintain prices for products sufficient to realize an appropriate return on investment if adequate public health service or health insurance coverage is not available. In addition, rules and regulations regarding reimbursement may change, in some cases at short notice, especially in light of the global cost pressures on healthcare and pharmaceutical markets. Such changes could affect whether reimbursement is available at adequate levels or at all.

Our cell therapy product candidates may not be accepted by patients or medical practitioners.

Our ability to commercialize future product candidates and the ability of our distributors to further commercialize ChondroCelect will depend, in part, on market acceptance, including the willingness of medical practitioners to invest in training programs to use the products. Cell therapy products are a novel treatment, and such products may not be immediately accepted as complementary or alternative treatments to the current standards of care. We may not be able to obtain or maintain recommendations and endorsements from influential physicians, which are an essential factor for market acceptance of our product candidates, or our product candidates may not gain sufficient market recognition in spite of favorable opinions from key leaders.

The public perception of ethical and social issues surrounding the use of tissue-engineered products or stem cells may limit or discourage the use of our product candidates. The use of human cells, such as differentiated cartilage cells, eASCs and other adult stem cells, as starting material for the development of our product candidates could generate negative public perceptions of our product candidates and public expressions of concern could result in stricter governmental regulation, which may, in turn, increase the cost of manufacturing and marketing our product or impede market acceptance of our product candidates.

We face competition and technological change, which could limit or eliminate the market opportunity for our product candidates.

The pharmaceutical industry is characterized by intense competition and rapid innovation. Our competitors may be able to develop other products that are able to achieve similar or better results than our product candidates. Our potential competitors include established and emerging pharmaceutical and biotechnology companies and universities and other research institutions. Many of our competitors have substantially greater financial, technical and other resources, such as larger research and development staff and experienced marketing and manufacturing organizations and well-established sales forces. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large, established companies. Mergers and acquisitions in the pharmaceutical and biotechnology industries may result in even more resources being concentrated in our competitors. Competition may increase further as a result of advances in the commercial applicability of technologies and greater availability of capital for investment in these industries. Our competitors may succeed in developing, acquiring or licensing on an exclusive basis products that are more effective or less costly than our product candidates. We believe the key competitive factors that will affect the development and commercial success of our product candidates are efficacy, safety and tolerability profile, reliability, price and reimbursement.

Our success depends on certain key people, and we must continue to attract and retain key employees and consultants to be in a position to continue our activities.

Our future success is substantially dependent on a number of key individuals as well as our ability to attract and retain qualified management, scientific, technical, marketing and sales personnel and consultants and upon the continued contributions of such personnel and consultants. Competition for

17

Table of Contents

qualified employees and consultants in scientific research and biotechnology industries is intense and there is a limited number of persons with knowledge appropriate to, and experience within, such industries. We do not maintain "key man" insurance policies on the lives of any of our employees.

Our employees may voluntarily terminate their employment at any time. We may not be successful in attracting and retaining qualified employees and consultants to replace existing employees or consultants or to support our growth strategy further. The process of identifying personnel with the combination of skills required to enable us to carry out our strategy is often lengthy and uncertain as to its outcome.

Our employees may engage in misconduct or other improper activities, including noncompliance with regulatory standards and requirements.

We are exposed to the risk of employee fraud or other misconduct. Misconduct by employees could include intentional failures to comply with FDA regulations, to provide accurate information to the FDA, to comply with manufacturing standards we have established, to comply with federal and state healthcare fraud and abuse laws and regulations, to report financial information or data accurately or to disclose unauthorized activities to us. In particular, sales, marketing and business arrangements in the healthcare industry are subject to extensive laws and regulations intended to prevent off-label promotion, fraud, kickbacks, self-dealing and other abusive practices in the United States and in jurisdictions outside of the United States where we conduct our business. These laws and regulations may restrict or prohibit a wide range of pricing, discounting, marketing and promotion, sales commission, customer incentive programs and other business arrangements. Employee misconduct could also involve the improper use of information obtained in the course of clinical trials, which could result in regulatory sanctions and serious harm to our reputation. If governmental investigations or other actions or lawsuits stemming from a failure to be in compliance with such laws or regulations are instituted against us, and we are not successful in defending ourselves or asserting our rights, those actions could have a significant impact on our business, including the imposition of significant fines or other sanctions, up to and including criminal prosecution, fines and imprisonment.

We could face product liability claims, resulting in damages against which we are uninsured or underinsured.

Our business exposes us to potential product liability and professional indemnity risks, which are inherent in the research, development, manufacturing, marketing and use of medical treatments. It is impossible to predict the potential adverse effects that our product candidates may have on humans. The use of our product candidates in human clinical trials may result in adverse effects, and long-term adverse effects may only be identified following clinical trials and approval for commercial sale. In addition, physicians and patients may not comply with any warnings that identify the known potential adverse effects and the types of patients who should not receive our product candidates. We may not be able to obtain necessary insurance at an acceptable cost or at all. In the event of any claim, the level of insurance we carry now or in the future may not be adequate, and a product liability or other claim may materially and adversely affect our business. If we cannot adequately protect ourselves against potential liability claims, we may find it difficult or impossible to commercialize our product candidates. Moreover, such claims may require significant financial and managerial resources, may harm our reputation if the market perceives our drugs or drug candidates to be unsafe or ineffective due to unforeseen side effects, and may limit or prevent the further development or commercialization of our product candidates and future product candidates.

We use various chemical and biological products to conduct our research and to manufacture our medicines. Despite the existence of strict internal controls, these chemical and biological products could be the object of unauthorized use or could be involved in an accident that could cause personal injury to people or damage to the environment, which could result in a claim against us. Our activities are subject to specific environmental regulations that impose obligations which, if not complied with, could

18

Table of Contents

give rise to third party or administrative claims and could even result in fines being imposed or, in the worst case scenario, to our operations being suspended or shut down.

Risks Related to Our Intellectual Property

We may not be able to protect adequately our proprietary technology or enforce any rights related thereto.

Our ability to compete effectively with other companies depends, among other things, on the exploitation of our technology. In addition, filing, prosecuting and defending patents on all of our product candidates throughout the world would be prohibitively expensive. Our competitors may, therefore, develop equivalent technologies or otherwise gain access to our technology, particularly in jurisdictions in which we have not obtained patent protection or in which enforcement of such protection is not as strong as it is in the United States.

Patents might not be issued with respect to our pending or future applications. The lack of any such patents may have a material adverse effect on our ability to develop and market our proposed product candidates. We may not be able to develop product candidates that are patentable, or our current or future patents may not be sufficiently broad in their scope to provide commercially meaningful protection against competition from third parties. The validity or scope of any of our patents may be insufficient, claims relating to our patents may be asserted by other parties and, if challenged, our patents may be revoked. Even if competitors do not successfully challenge our patents, they might be able to design around such patents or develop unique technologies or products providing effects similar to our product candidates.

If our intellectual property rights, trade secrets and know-how are infringed, litigation may be necessary to protect our intellectual property rights, trade secrets and know-how, which could result in substantial costs and diversion of efforts with no guarantee of success. Our attempts to obtain patent or other protection for certain of our product candidates or technologies may also be subject to opposition. We may need to incur substantial costs to overcome such opposition with no guarantee of success. We may also decide to engage in costly opposition or interference proceedings to prevent third parties from obtaining relevant patent or other protection, again with no guarantee of success.

Developments in U.S. patent law may prevent us from obtaining or enforcing patents directed to our stem cell technologies, which could have a material adverse effect on our business.

U.S. courts have recently issued decisions limiting the patent eligibility of natural products and natural correlations. On June 13, 2013, inAssociation for Molecular Pathology v. Myriad Genetics, the U.S. Supreme Court held that claims to isolated genomic DNA are not patentable subject matter, but claims to complementary DNA molecules are patentable subject matter. On May 8, 2014, the U.S. Court of Appeals for the Federal Circuit held that claims to cloned animals are not patentable subject matter. Furthermore, on March 20, 2012, inMayo Collaborative Services v. Prometheus Laboratories, the U.S. Supreme Court held that several claims drawn to measuring drug metabolite levels from patient samples and correlating them to drug doses are not patentable subject matter.

The Patent and Trademark Office has signaled that a claim reciting any natural phenomenon or natural product will be treated as ineligible for patenting, unless the claim as a whole recites something significantly different from the natural product. The effect of these decisions on patents for inventions relating to other natural phenomena and natural products, such as stem cells, is uncertain. Because our patent portfolio is largely directed to stem cells and their use, as well as to uses of naturally-occurring biomarkers, these developments in U.S. patent law could affect our ability to obtain new U.S. patents or to enforce our existing patents. In some of our pending U.S. patent applications the Patent and Trademark Office has questioned whether certain of our claims are eligible for patenting. If we are unable to procure additional U.S. patents or to enforce our existing U.S. patents, we would be vulnerable to competition in the United States.

19

Table of Contents

Third-party claims of intellectual property infringement may prevent or delay our product discovery and development efforts.

Our commercial success depends in part on avoiding infringement of the patents and proprietary rights of third parties. There is a substantial amount of litigation involving patents and other intellectual property rights in the biotechnology and pharmaceutical industries, as well as administrative proceedings for challenging patents, including interference and reexamination proceedings before the Patent and Trademark Office or oppositions and other comparable proceedings in foreign jurisdictions. Recently, under U.S. patent reform, new procedures includinginter partes review and post grant review have been implemented. This reform is untried and untested and will bring uncertainty to the possibility of challenge to our patents in the future. Numerous U.S. and non-U.S. issued patents and pending patent applications, which are owned by third parties, exist in the fields in which we are developing our product candidates. As the biotechnology and pharmaceutical industries expand and more patents are issued, the risk increases that our product candidates may give rise to claims of infringement of the patent rights of others.