ITEM 1. REPORTS TO STOCKHOLDERS.

The Report to Shareholders is attached herewith.

| | THE 504 FUND (Formerly known as the Pennant 504 Fund)* SEMI-ANNUAL REPORT (UNAUDITED) FOR THE SIX MONTHS ENDED DECEMBER 31, 2014 |

| * | Name change effective October 31, 2014. |

| | THE 504 FUND

SHAREHOLDER LETTER

FEBRUARY 25, 2015

|

Dear Shareholders:

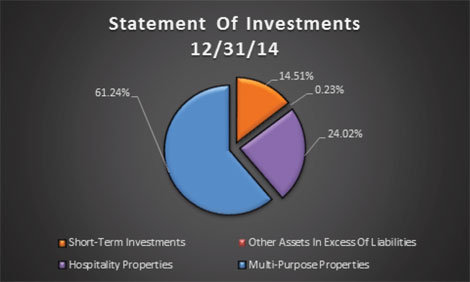

On December 31, 2014, The 504 Fund has completed just over one year of operation as a non-diversified closed-end mutual fund. With its primary goal of investing at least 80% of its portfolio in 504 first lien loans representing the non-guaranteed portion of U.S. Small Business Administration (“SBA”) Section 504 transactions, your fund has made great strides by deploying 85.3% of its assets in these loans, or $34 million of the Fund’s net assets of $39.8 million.

Key highlights of the Fund’s operations for the six months ended on December 31, 2014 include:

| ● | The portfolio now holds 23 504 first lien loans, up from 12 on June 30, 2014. |

| ● | The weighted average current yield of the 504 first lien loans in the portfolio was 5.40%. |

| ● | The weighted average yield-to-maturity of the 504 first lien loans in the portfolio was 5.37%. |

| ● | The SEC 30-day net fund yield was 2.09%. |

| ● | The weighted average effective duration of the 504 first lien loans in the portfolio was 2.47 yearsi. |

| ● | For comparative purposes, the 2-year U.S. Treasury was priced to a yield-to-maturity of approximately 0.67%, while the 3-year U.S. Treasury was priced to a yield-to-maturity of approximately 1.07%. |

| ● | The portfolio management team continues its attentiveness to credit quality. At the calendar year-end the Fund’s 504 first lien loan portfolio had a weighted average credit score of 731. |

| ● | In terms of portfolio diversification - |

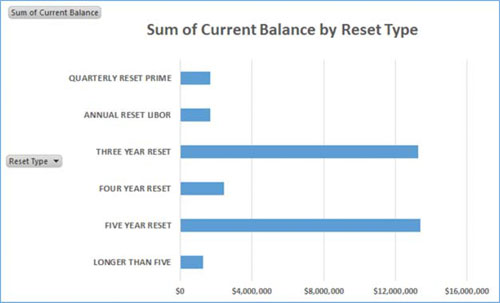

As an investment strategy the portfolio management team has been focused on the prospect of rising interest rates by investing in 504 first lien loans with variable coupons that will reset at various points in time. We believe this strategy will help address interest rate risk. The following chart represents the loan portfolio coupon reset characteristics.

| | THE 504 FUND

SHAREHOLDER LETTER (CONTINUED)

FEBRUARY 25, 2015

|

The Fund’s wholesaling agent for institutions qualifying for regulatory consideration of their investment under the Community Reinvestment Act of 1977 is Sandler O’Neill & Partners, L.P. (“Sandler”). Sandler continues to meet with various financial intermediaries to explain the Fund’s attributes, including the Fund’s investment objective to enable institutional Fund investors that are subject to regulatory examination for CRA compliance to claim favorable regulatory consideration of their investment under the Community Reinvestment Act of 1977.

Finally, the Fund intends to utilize leverage in the Fund’s portfolio in the near future. Once implemented, the availability of leverage should allow the Fund to more easily match the funding of new portfolio investments with the availability of cash equivalents. This is an important factor for the Fund as excess cash drags down the yield on the portfolio.

As always, the professional staff of the Fund is grateful for your investment and hope you are pleased with the pace of success over the last year.

Sincerely,

Mark A. Elste, CFA

President & Chairman

| i | Duration is a calculation that seeks to measure the price sensitivity of a debt security, or of a fund that invests in debt securities, to changes in interest rates. Future interest and principal payments are discounted to reflect their present value and then are multiplied by the number of years they will be received to produce a value expressed in years. Effective duration takes into account call features and sinking fund prepayments that may shorten the life of a debt security. |

The price of a debt security generally moves in the opposite direction from interest rates (i.e., if interest rates go up, the value of the bond will go down, and vice versa).

Past performance is not guarantee of future results.

| | THE 504 FUND

TABLE OF CONTENTS |

| | |

| Schedule of Investments | 1 |

| Statement of Assets and Liabilities | 3 |

| Statement of Operations | 4 |

| Statements of Changes in Net Assets | 5 |

| Statement of Cash Flows | 6 |

| Financial Highlights | 7 |

| Notes to Financial Statements | 8 |

| Other Information | 15 |

| Trustees and Officers | 16 |

| | THE 504 FUND

SCHEDULE OF INVESTMENTS

DECEMBER 31, 2014 (UNAUDITED)

|

| 504 First Lien Loans — (85.26%) | Interest Rate | Maturity | | Principal | | | Fair Value | |

| Hospitality Properties - (24.02%) | | | | | | | |

| D S Hospitality, LLC, California | 1 Year Libor + 5.16% (5.43% Floor) | 3/15/2044 | | $ | 1,663,172 | | | $ | 1,689,484 | |

Moses Lake Investors, LLC, Washington 1 | Prime + 2.25% (5.50% Floor) | 10/1/2039 | | | 994,408 | | | | 1,033,180 | |

| Papago Inn, LLC, Washington | 5 Year Libor + 3.65% (5.65% Floor) | 1/15/2025 | | | 1,440,551 | | | | 1,454,366 | |

| U.S. Retail Ventures, LLC, Texas | 3 Year Libor + 4.50% (6.00% Floor) | 12/27/2038 | | | 2,623,116 | | | | 2,568,739 | |

| YC Anchorage Hotel Group, L.P., Alaska | 3 Year Libor + 5.18% (6.18% Floor) | 5/15/2044 | | | 2,889,556 | | | | 2,841,937 | |

| Total Hospitality Properties | | | | | | | | | 9,587,706 | |

| | | | | | | | | | | |

| Multi-Purpose Properties — (61.24%) | | | | | | | | | |

| 1250 Philadelphia, LLC, California | 5 Year Libor + 4.00% (5.93% Floor) | 10/15/2039 | | | 2,542,695 | | | | 2,658,439 | |

413 East 53rd Street, LLC,

New York | 3 Year Libor + 4.17% (4.95% Floor) | 2/1/2044 | | | 1,707,588 | | | | 1,701,492 | |

| 7410-7428 Bellaire, LLC, California | 5 Year Libor + 4.00% (5.78% Floor) | 9/15/2039 | | | 2,438,998 | | | | 2,537,460 | |

| Anthony Ghostine, Kristina J. Ghostine, California | 3 Year Libor + 5.15% (6.30% Floor) | 12/1/2044 | | | 405,900 | | | | 403,298 | |

| CARUBA Properties, LLC, New Jersey | 6.00% (6.00% Floor) | 9/2/2036 | | | 620,571 | | | | 634,733 | |

| CV Investment Properties, LLC, Arizona | 5 Year Libor + 4.75% (6.00% Floor) | 10/30/2038 | | | 638,639 | | | | 662,038 | |

| Edward Adourian, LLC, California | 6.66% (6.66% Floor) | 3/15/2039 | | | 499,816 | | | | 514,490 | |

Greenland Group US, LLC,

New Jersey | 6.38% (6.38% Floor) | 2/1/2037 | | | 332,176 | | | | 344,487 | |

| Grigorian Investments, LLC, California | 5 Year Libor +4.50% (6.33% Floor) | 9/15/2039 | | | 543,357 | | | | 561,521 | |

| Laubec 36, LLC, New York | 7.00% (7.00% Floor) | 10/1/2025 | | | 1,254,497 | | | | 1,311,389 | |

| None of Your Business, LLC, Illinois | 3 Year Libor + 5.00% (6.25% Floor) | 9/15/2044 | | | 498,572 | | | | 515,010 | |

| | THE 504 FUND

SCHEDULE OF INVESTMENTS (CONTINUED)

DECEMBER 31, 2014 (UNAUDITED) |

| 504 First Lien Loans — (continued) | Interest Rate | Maturity | | Principal | | | Fair Value | |

Multi-Purpose Properties — (continued) | | | | | | | |

| Palomar Oaks Corp., California | 5 Year Libor + 4.50% (6.28% Floor) | 2/1/2039 | | $ | 1,333,884 | | | $ | 1,349,184 | |

| PATC, LLC, California | 3 Year Libor + 3.25% (4.36% Floor) | 9/15/2044 | | | 4,115,879 | | | | 4,125,592 | |

| PennRose Studios LLC, California | 3 Year Libor + 5.40% (6.63% Floor) | 1/1/2045 | | | 914,400 | | | | 913,659 | |

Ruby View Investments, LLC, Oregon 1 | 5 Year Libor + 4.00% (6.50% Floor) | 6/26/2037 | | | 2,104,711 | | | | 2,182,143 | |

| Rug Palace, Inc. dba Rug Palace Expo, California | Prime + 2.25% (5.50% Floor) | 2/15/2044 | | | 691,628 | | | | 693,627 | |

Stanley Avenue Realty, LLC,

New York | 4 Year Libor + 3.12% (4.77% Floor) | 9/15/2044 | | | 1,937,757 | | | | 1,944,152 | |

| ZC Park, LLC, Arizona | 5 Year Libor + 4.00% (5.88% Floor) | 10/15/2044 | | | 1,345,417 | | | | 1,395,749 | |

| Total Multi-Purpose Properties | | | | | | | | | 24,448,463 | |

| | | | | | | | | | | |

| Total 504 First Lien Loans (identified cost of $34,240,377) | | | | | | $ | 34,036,169 | |

| | | Shares | | | Value | |

| Short-Term Investments — (14.51%) | | | | | | |

| Federated Government Obligations Fund 0.01% * | | | 5,792,181 | | | | 5,792,181 | |

| Total Short-Term Investments (Cost $5,792,181) | | | | | | | 5,792,181 | |

| | | | | | | | | |

Total Investments — (99.77%) (Cost $40,032,558) | | | | 39,828,350 | |

| Other Assets in Excess of Liabilities — (0.23%) | | | | 92,017 | |

| Net Assets — (100.00%) | | | $ | 39,920,367 | |

| 1 | Represents an investment in the 504 First Lien Loan through a participation agreement with a financial institution. A participation agreement typically results in a contractual relationship only with a financial institution, not with the borrower. |

| * | The rate shown is the annualized 7-day yield as of December 31, 2014. |

Percentages shown represent value as a percentage of net assets.

See accompanying notes to financial statements.

| | THE 504 FUND

STATEMENT OF ASSETS AND LIABILITIES

DECEMBER 31, 2014 (UNAUDITED)

|

| Assets: | | | |

| Investments in 504 First Lien Loans, at fair value (cost $34,240,377) | | $ | 34,036,169 | |

| Short-term investments, at fair value (cost $5,792,181) | | | 5,792,181 | |

| Cash | | | 1,390 | |

| Receivables: | | | | |

| Interest | | | 109,822 | |

| Prepaid insurance | | | 19,922 | |

| Prepaid registration | | | 19,980 | |

| Other prepaid assets | | | 11,941 | |

| Total assets | | | 39,991,405 | |

| | | | | |

| Liabilities: | | | | |

| Payables: | | | | |

| Due to adviser | | | 29,689 | |

| Audit | | | 23,669 | |

| Fund accounting and administration | | | 6,823 | |

| Legal | | | 4,864 | |

| Transfer agent | | | 1,801 | |

| Custodian | | | 1,231 | |

| Accrued other expenses | | | 2,961 | |

| Total liabilities | | | 71,038 | |

| | | | | |

| Net Assets | | $ | 39,920,367 | |

| | | | | |

| Net Assets Consist of: | | | | |

| Capital (unlimited shares authorized, no par value) | | $ | 40,272,462 | |

| Distributions in excess of net investment income | | | (146,823 | ) |

| Accumulated net realized loss | | | (1,064 | ) |

| Accumulated net unrealized depreciation on investments | | | (204,208 | ) |

| Net Assets | | $ | 39,920,367 | |

| | | | | |

| Shares | | | | |

| Net assets applicable to outstanding shares | | $ | 39,920,367 | |

| Number of outstanding shares | | | 4,055,300 | |

| Net asset and redemption price value per share | | $ | 9.84 | |

Maximum offering price per share (Net asset value per share divided by 0.98)1 | | $ | 100.04 | |

| 1 | Reflects a maximum sales charge of 2.00%. |

See accompanying notes to financial statements.

| | THE 504 FUND

STATEMENT OF OPERATIONS

FOR THE SIX MONTHS ENDED

DECEMBER 31, 2014 (UNAUDITED) |

| Investment Income: | | | |

| Interest | | $ | 732,542 | |

| Total investment income | | | 732,542 | |

| | | | | |

| Expenses: | | | | |

| Management fees | | | 402,022 | |

| Offering costs | | | 156,731 | |

| Legal expense | | | 78,401 | |

| Accounting and administration expenses | | | 41,842 | |

| Trustees’ expense | | | 29,994 | |

| Insurance expense | | | 29,447 | |

| Audit expense | | | 20,669 | |

| Registration expense | | | 12,186 | |

| Printing expense | | | 9,744 | |

| Transfer agent expense | | | 9,345 | |

| Custodian expense | | | 6,050 | |

| Miscellaneous | | | 4,285 | |

| Total expenses | | | 800,716 | |

| Less: | | | | |

| Waiver of management fees | | | 298,188 | |

| Net expenses | | | 502,528 | |

| Net investment gain | | | 230,014 | |

| | | | | |

| Net change in unrealized depreciation on investments | | | (135,906 | ) |

| Net unrealized depreciation on investments | | | (135,906 | ) |

| | | | | |

| Net Increase in Net Assets Resulting from Operations | | $ | 94,108 | |

See accompanying notes to financial statements.

| | THE 504 FUND

STATEMENTS OF CHANGES IN NET ASSETS

FOR THE SIX MONTHS ENDED

DECEMBER 31, 2014 (UNAUDITED) |

| | | Six Months Ended

December 31, 2014

(Unaudited) | | | Period Ended

June 30, 2014* | |

| Decrease in Net Assets From: | | | | | | |

| Operations: | | | | | | |

| Net investment gain (loss) | | $ | 230,014 | | | $ | (223,961 | ) |

| Net unrealized depreciation on investments | | | (135,906 | ) | | | (68,302 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 94,108 | | | | (292,263 | ) |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| From net investment income | | | (376,920 | ) | | | — | |

| Total distributions to shareholders | | | (376,920 | ) | | | — | |

| | | | | | | | | |

| Capital Share Transactions: | | | | | | | | |

| Shares sold | | | — | | | | 40,090,000 | |

| Reinvestments of distributions | | | 305,442 | | | | — | |

| Net increase from capital share transactions | | | 305,442 | | | | 40,090,000 | |

| | | | | | | | | |

| Total increase in net assets | | | 22,630 | | | | 39,797,737 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 39,897,737 | | | | 100,000 | |

| End of period | | $ | 39,920,367 | | | $ | 39,897,737 | |

| | | | | | | | | |

| Accumulated net investment income | | $ | — | | | $ | — | |

| | | | | | | | | |

| Transactions in Shares: | | | | | | | | |

| Beginning of period | | | 4,024,265 | | | | 10,000 | |

| Shares sold | | | — | | | | 4,014,265 | |

| Reinvestments of distributions | | | 31,035 | | | | — | |

| Net increase | | | 31,035 | | | | 4,024,265 | |

| * | Commenced operations on December 16, 2013. |

See accompanying notes to financial statements.

| | THE 504 FUND

STATEMENT OF CASH FLOWS

FOR THE SIX MONTHS ENDED

DECEMBER 31, 2014 (UNAUDITED) |

| Cash Flows From Operating Activities: | | | |

| Net increase in net assets resulting from operations | | $ | 94,108 | |

| Adjustments to reconcile net increase in net assets from operations to net cashprovided by operating activities: | | | | |

| Net purchases of investments | | | (17,612,880 | ) |

| Proceeds from principal payments | | | 210,526 | |

| Net purchase of short-term investments | | | 17,028,731 | |

| Net change in unrealized depreciation on investments | | | 135,906 | |

| Decrease in due from adviser | | | 122,153 | |

| Decrease in interest receivable | | | 1,554 | |

| Decrease in principal receivable | | | 12,104 | |

| Increase in prepaid insurance | | | (6,346 | ) |

| Increase in prepaid registration | | | (8,160 | ) |

| Decrease in deferred offing costs | | | 156,731 | |

| Increase in other prepaid assets | | | (11,941 | ) |

| Increase in due to adviser | | | 29,689 | |

| Decrease in legal payable | | | (47,803 | ) |

| Decrease in audit payable | | | (14,331 | ) |

| Decrease in accounting and administration payable | | | (17,282 | ) |

| Decrease in transfer agent payable | | | (935 | ) |

| Decrease in trustees payable | | | (1,896 | ) |

| Increase in other expenses payable | | | 2,709 | |

| Increase in custodian payable | | | 231 | |

| Net cash provided by operating activities | | | 72,868 | |

| | | | | |

| Cash Flows From Financing Activities: | | | | |

| Distribution to shareholders | | | (376,920 | ) |

| Reinvestment of distributions | | | 305,442 | |

| Net cash provided by financing activities | | | (71,478 | ) |

| | | | | |

| Net change in cash | | | 1,390 | |

| | | | | |

| Cash at Beginning of Period | | | — | |

| Cash at End of Period | | $ | 1,390 | |

See accompanying notes to financial statements.

| | THE 504 FUND

FINANCIAL HIGHLIGHTS |

| | |

| | |

Per share income and capital changes for a share outstanding throughout the period.

| | | Six Months Ended

December 31, 2014

(Unaudited) | | | Period Ended

June 30, 2014* | |

| Net asset value, beginning of period | | $ | 9.91 | | | $ | 10.00 | |

| | | | | | | | | |

| Income from Investment Operations: | | | | | | | | |

| Net investment gain | | | 0.11 | | | | (0.06 | ) |

| Net unrealized depreciation on investments | | | (0.18 | ) | | | (0.03 | ) |

| Total from investment operations | | | (0.07 | ) | | | (0.09 | ) |

| | | | | | | | | |

| Net asset value, end of period | | $ | 9.84 | | | $ | 9.91 | |

| | | | | | | | | |

| Total return | | | 0.14 | %1 | | | (0.90 | )%1 |

| | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 39,920 | | | $ | 39,898 | |

| Ratio of expenses to average net assets | | | | | | | | |

| Before waiver | | | 3.98 | %2 | | | 4.66 | %2 |

| Expense waiver | | | (1.48 | )%2 | | | (2.16 | )%2 |

| Total expenses after expense waiver | | | 2.50 | %2 | | | 2.50 | %2 |

| Ratio of net investment gain to average net assets | | | 1.14 | %2 | | | (1.21 | )%2 |

| Portfolio turnover rate | | | 0.00 | %1 | | | 0.00 | %1 |

| * | Commenced operations on December 16, 2013. |

See accompanying notes to financial statements.

| | THE 504 FUND

NOTES TO FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2014 |

1. Organization

The 504 Fund (formerly known as The Pennant 504 Fund, the “Fund”) was organized as a Delaware statutory trust on July 29, 2013 and is registered with the Securities and Exchange Commission (the “SEC”) as a closed-end, non-diversified management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”) that operates as an “interval fund.” The Fund is managed by Pennant Management, Inc. (the “Adviser”), a Wisconsin corporation registered under the Investment Advisers Act of 1940, as amended. Certain trustees and officers of the Fund are also directors and officers of the Adviser, which is a wholly owned subsidiary of U.S. Fiduciary Services, Inc. 504 Fund Advisors, LLC, an affiliate of the Adviser, provides assistance with credit analysis and ongoing consulting with respect to the Fund’s investments to the Adviser, and is compensated for such services by the Adviser. The offering of the Fund’s shares of beneficial interest in the Fund (the “Shares”) is registered under the Securities Act of 1933, as amended (the “Securities Act”). Shares are offered at the offering price plus the sales load (up to 2.00%) and are expected to be offered on a continuous basis monthly (generally as of the last business day of each month) at the net asset value (“NAV”) per share plus the sales load. There are an unlimited number of authorized Shares.

The Fund’s investment objectives are to provide current income, consistent with the preservation of capital, and to enable institutional fund investors that are subject to regulatory examination for CRA compliance to claim favorable regulatory consideration of their investment under the Community Reinvestment Act of 1977, as amended (the “CRA”). The Fund seeks to achieve its objectives by investing primarily in a portfolio of 504 First Lien Loans secured by owner-occupied commercial real estate which represent the non-guaranteed portions of U.S. Small Business Administration Section 504 transactions (“504 First Lien Loans”).

2. Accounting Policies

The preparation of the financial statements in accordance with accounting principles generally accepted in the United States (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates. In the normal course of business, the Fund has entered into contracts that contain a variety of representations which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss to be remote.

Investment Valuation – Investments for which market quotations are readily available are valued at current fair value, and all other investments are valued at fair value as determined in good faith by the Fund’s Board of Trustees (“the Board”), in accordance with the policies and procedures (the “Valuation Procedures”) adopted by the Board. The Board has a standing valuation committee (the “Valuation Committee”) that is composed of members of the Adviser, as appointed by the Board. The Valuation Committee operates under the Valuation Procedures approved by the Board. The Fund’s Valuation Committee makes quarterly reports to the Board concerning investments for which market quotations are not readily available. Investments in money market funds (short-term investments) are valued at the closing NAV per share.

| | THE 504 FUND

NOTES TO FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2014 |

2. Accounting Policies (continued)

504 First Lien Loans – The fair values of 504 First Lien Loans are analyzed using a pricing methodology designed to incorporate, among other things, the present value of the projected stream of cash flows on such investments (the “discounted cash flow” methodology). This pricing methodology takes into account a number of relevant factors, including changes in prevailing interest rates, yield spreads, the borrower’s creditworthiness, the debt service coverage ratio, lien position, delinquency status, frequency of previous late payments and the projected rate of prepayments. Newly purchased loans are initially fair valued at cost and subsequently analyzed using the discounted cash flow methodology. Loans with a pending short payoff will be fair valued at the anticipated recovery rate. Valuations of 504 First Lien Loans are determined no less frequently than weekly by the Board’s Valuation Committee.

Income – Interest income is recorded on the basis of interest accrued, adjusted for amortization of premium or accretion of discount. Fees associated with loan amendments are recognized immediately. Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities. 504 First Lien Loans will be placed in non-accrual status and related interest income reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful as identified by the Adviser as part of the valuation process.

Distributions to Shareholders – The Fund expects to declare and pay dividends of net investment income quarterly and net realized capital gains annually. Unless shareholders specify otherwise, dividends will be reinvested in shares of the Fund.

Use of Estimates – The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Fund intends to elect and to qualify each year to be treated as a regulated investment company under the provisions of Subchapter M of the Internal Revenue Code of 1986, as amended. In order to so qualify, the Fund must meet certain requirements with respect to the sources of its income, the diversification of its assets and the distribution of its income. If the Fund qualifies as a regulated investment company, it will not be subject to federal income or excise tax on income it distributes in a timely manner to its shareholders in the form of investment company taxable income or net capital gain distributions.

Accounting for Uncertainty in Income Taxes (the “Income Tax Statement”) requires an evaluation of tax positions taken (or expected to be taken) in the course of preparing a Fund’s tax return to determine whether these positions meet a “more-likely-than-not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained by a taxing authority upon examination. A tax position that meets the “more-likely-than-not” recognition threshold is measured to determine the amount of benefit to recognize in the financial statements. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations.

The Income Tax Statement requires management of the Fund to analyze all open tax years for all major jurisdictions, which the Fund considers to be its federal income tax filings. The open tax years include the current year plus the prior three tax years, or all years if the Fund has been in existence for less than three years. As of and during the six months ended December 31, 2014, the Fund did not record a liability for any unrecognized tax benefits. The Fund has no examination in progress and is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Expenses – Fund expenses that are specifically attributed to the Fund are charged to the Fund and recorded on an accrual basis.

| | THE 504 FUND

NOTES TO FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2014 |

2. Accounting Policies (continued)

Fair Value Measurements – Under generally accepted accounting principles for fair value measurements, a three-tier hierarchy to prioritize the assumptions, referred to as inputs, is used in valuation techniques to measure fair value. The three-tier hierarchy of inputs is summarized in the three broad levels listed below.

| ● | Level 1 – Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| ● | Level 2 – Other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.); and |

| ● | Level 3 – Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investment). |

The following table sets forth information about the levels within the fair value hierarchy at which the Fund’s investments are measured as of December 31, 2014:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Hospitality Properties | | $ | — | | | $ | — | | | $ | 9,587,706 | | | $ | 9,587,706 | |

| Multi-Purpose Properties | | | — | | | | — | | | | 24,448,463 | | | | 24,448,463 | |

| Short-Term Investments | | | 5,792,181 | | | | — | | | | — | | | | 5,792,181 | |

| Total Investments | | $ | 5,792,181 | | | $ | — | | | $ | 34,036,169 | | | $ | 39,828,350 | |

For the six months ended December 31, 2014, there were no transfers into or out of Level 1, Level 2 or Level 3.

Should a transfer between Levels occur, it is the Fund’s Policy to recognize transfers in and out of all Levels at the end of reporting period.

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining value:

| Investments | | Balance as of

June 30, 2014 | | | Purchase and

funding of

investments | | | Proceeds from

principal

payments and

sales of portfolio

investments | | | Unrealized

Appreciation

(Depreciation) on

investments | | | Amortization of

discount

and

premium | | | Balance as of

December 31,

2014 | |

| Hospitality Properties | | $ | 7,237,560 | | | $ | 2,478,247 | | | $ | (61,263 | ) | | $ | (66,391 | ) | | $ | (447 | ) | | $ | 9,587,706 | |

| Multi-Purpose Properties | | | 9,532,161 | | | | 15,134,633 | | | | (143,231 | ) | | | (69,515 | ) | | | (5,585 | ) | | | 24,448,463 | |

| Total Investments | | $ | 16,769,721 | | | $ | 17,612,880 | | | $ | (204,494 | ) | | $ | (135,906 | ) | | $ | (6,032 | ) | | $ | 34,036,169 | |

| | THE 504 FUND

NOTES TO FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2014 |

2. Accounting Policies (continued)

The following is a summary of quantitative information about significant unobservable valuation inputs for Level 3 Fair Value Measurements for investments held as of December 31, 2014:

Type of Level 3

Investments | | Fair Value as of

December 31,

2014 | | Valuation

Technique | Unobservable

Inputs | | Weighted

Average | | | Range | | | Impact to Fair

Value from an

Increase in

Input | |

Hospitality Properties | | $ | 9,587,706 | | Discounted

Cash Flows | Purchase Price | | $ | 100.76 | | | $ | 100-104 | | | Decrease | |

| | | | | | | Debt Service Coverage Ratio | | | 1.85 | | | | 1.27-3.18 | | | N/A* | |

| | | | | | | Effective Loan To Value Ratio | | | 48 | % | | | 46%-53 | % | | Decrease | |

| | | | | | | Average Personal Credit Score | | | 717 | | | | 687-753 | | | N/A* | |

Multi-Purpose Properties | | | 24,448,463 | | Discounted

Cash Flows | Purchase Price | | $ | 102.60 | | | $ | 100-105 | | | Decrease | |

| | | | | | | Debt Service Coverage Ratio | | | 1.67 | | | | 1.00-3.28 | | | N/A* | |

| | | | | | | Effective Loan To Value Ratio | | | 50 | % | | | 37%-63 | % | | Decrease | |

| | | | | | | Average Personal Credit Score | | | 748 | | | | 686-819 | | | N/A* | |

| Total Investments | | $ | 34,036,169 | | | | | | | | | | | | | | |

| * | A decrease in the input would result in a decrease in fair value. |

| | THE 504 FUND

NOTES TO FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2014 |

3. Concentration of Risk

504 First Lien Loans Risk – The Fund predominantly invests in fixed or variable rate 504 First Lien Loans arranged through private negotiations between a small business borrower (the “Borrower”) and one or more 504 First Lien Loan lenders. 504 First Lien Loans are secured by collateral and have a claim on the assets of the Borrower that is senior to the second lien held by a certified development company and any claims held by unsecured creditors. The 504 First Lien Loans the Fund will invest in are not rated. 504 First Lien Loans are subject to a number of risks, including credit risk, liquidity risk, valuation risk and interest rate risk. Although the 504 First Lien Loans in which the Fund will invest will be secured by collateral, there can be no assurance that such collateral can be readily liquidated or that the liquidation of such collateral would satisfy the Borrower’s obligation in the event of non-payment of scheduled interest or principal, which could result in substantial loss to the Fund. In the event of the bankruptcy or insolvency of a Borrower, the Fund could experience delays or limitations with respect to its ability to realize the benefits of the collateral securing a 504 First Lien Loan. In the event of a decline in the value of the already pledged collateral, the Fund will be exposed to the risk that the value of the collateral will not at all times equal or exceed the amount of the Borrower’s obligations under the 504 First Lien Loan. In general, the secondary trading market for 504 First Lien Loans is not fully-developed. No active trading market may exist for certain 504 First Lien Loans, which may make it difficult to value them. Illiquidity and adverse market conditions may mean that the Fund may not be able to sell certain 504 First Lien Loans quickly or at a fair price. To the extent that a secondary market does exist for certain 504 First Lien Loans, the market for them may be subject to irregular trading activity, wide bid/ask spreads and extended trade settlement periods.

Credit Risk – Credit risk is the risk that one or more debt instruments in the Fund’s portfolio will decline in price or fail to pay interest or principal when due because the borrower experiences a decline in its financial status. Losses may occur because the market value of a debt security is affected by the creditworthiness of the borrower and by general economic and specific industry conditions.

Valuation Risk – Unlike publicly traded equity securities that trade on national exchanges, there is no central place or exchange for fixed income instruments or 504 First Lien Loans to trade. Fixed income instruments and 504 First Lien Loans generally trade on an ‘‘over-the-counter’’ market which may be anywhere in the world where the buyer and seller can settle on a price. Due to the lack of centralized information and trading, the Adviser’s judgment plays a greater role in the valuation process and the valuation of fixed income instruments and 504 First Lien Loans. Uncertainties in the conditions of the financial market, unreliable reference data, lack of transparency and inconsistency of valuation models and processes may lead to inaccurate asset pricing. In addition, other market participants may value instruments differently than the Fund. As a result, the Fund may be subject to the risk that when a fixed income instrument is sold in the market, the amount received by the Fund is less than the value that such fixed income instrument is carried at on the Fund’s financial statements.

For other risks associated with the Fund and its investments please refer to the Risks section in the prospectus.

4. Periodic Repurchase Offers

The Fund will make periodic offers to repurchase a portion of its outstanding shares at NAV per share. The Fund has adopted a fundamental policy to make repurchase offers once every twelve months. The Fund will offer to repurchase 5% of its outstanding shares, unless the Board has approved a higher amount (but not more than 25%) of the outstanding shares. The Fund does not currently expect to charge a repurchase fee. The Fund expects the next repurchase offer to be issued in December 2015.

| | THE 504 FUND

NOTES TO FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2014 |

5. Administration, Distribution, Transfer Agency and Custodian Agreements.

The Fund and its administrator, UMB Fund Services, Inc. (“UMBFS” or the “Administrator”), are parties to an administration agreement under which the Administrator provides administrative and fund accounting services.

UMBFS also serves as the transfer agent and dividend disbursing agent for the Fund.

UMB Bank, N.A. acts as custodian (the “Custodian”) for the Fund. The Custodian plays no role in determining the investment policies of the Fund or which securities are to be purchased and sold by the Fund.

The Adviser and Foreside Fund Services, LLC, the Fund’s distributor, are parties to a distribution agreement with the Fund.

6. Investment Advisory Agreement

The Fund has entered into an investment advisory agreement (the “Investment Advisory Agreement”) with the Adviser. Under the Investment Advisory Agreement, the Adviser makes investment decisions for the Fund and continuously reviews, supervises and administers the investment program of the Fund, subject to the supervision of, and policies established by, the Board. For providing these services, the Adviser will receive a fee from the Fund, accrued daily and paid monthly, at an annual rate equal to 2.00% of the Fund’s average daily net assets. However, the Adviser has contractually agreed to waive or reduce its management fees and/or reimburse expenses of the Fund to ensure that total annual Fund operating expenses after fee waiver and/or expense reimbursement (exclusive of any interest, taxes, brokerage commissions, acquired fund fees and expenses and extraordinary expenses and inclusive of organizational and offering costs) will not exceed 2.50% of the average net assets of the Fund (the “Operating Expenses Limitation Agreement”). Under the terms of the Investment Advisory Agreement and the Operating Expenses Limitation Agreement, any such reductions made by the Adviser in its fees or payment of expenses which are the Fund’s obligation are subject to reimbursement by the Fund to the Adviser for a period of three fiscal years following the end of the fiscal year in which such reduction or payment was accrued. Organization costs amounting to $213,643 are also subject to reimbursement by the Fund to the Adviser for a period of three years from the date on which such expenses were incurred, if so requested by the Adviser, if the aggregate amount actually paid by the Fund toward the operating expenses for such fiscal year (taking into account the reimbursement) does not exceed the applicable limitation on Fund expenses. Such reimbursement may not be paid prior to the Fund’s payment of current ordinary operating expenses, and would expire by December 2016. The Operating Expenses Limitation Agreement is in effect through at least December 31, 2015, and may be terminated only by, or with the consent of, the Board.

As of December 31, 2014, the Adviser’s fees and expenses subject to reimbursement was as follows:

| December 16, 2016 | June 30, 2017 | June 30, 2018 |

| $ 213,643 | $ 372,327 | $ 298,188 |

At December 31, 2014, offering costs of $338,502 have been amortized to expense over twelve months on a straight-line basis from December 16, 2013, commencement of operations, to December 16, 2014. During the six months ended December 31, 2014, $156,731 of the total offering costs was amortized to expense.

7. Investment Transactions

For the six months ended December 31, 2014, there were long term purchases of $17,612,880 and no sales in the Fund.

| | THE 504 FUND

NOTES TO FINANCIAL STATEMENTS

(UNAUDITED)

DECEMBER 31, 2014 |

8. Federal Tax Information

At December 31, 2014, gross unrealized appreciation/depreciation of investments owned by the Fund, based on cost for federal income tax purposes were as follows:

| Cost of investments | | $ | 0,032,558 | |

| Gross unrealized appreciation | | $ | 55,562 | |

| Gross unrealized depreciation | | | (259,770 | ) |

| Net unrealized appreciation on investments | | $ | (204,208 | ) |

As of June 30, 2014 the components of accumulated earnings (deficit) on a tax basis for the Fund were as follows:

| Undistributed ordinary income | | $ | — | |

| Undistributed long-term gains | | | — | |

| Tax accumulated earnings | | | — | |

| Accumulated capital and other losses | | $ | (981 | ) |

| Unrealized depreciation on investments | | | (68,302 | ) |

| Total accumulated earnings (deficit) | | $ | (69,283 | ) |

9. Control Ownership

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities creates a presumption of control of the Fund, under Section 2(a)(9) of the 1940 Act. As of December 31, 2014, Northwest Federal Credit Union had ownership in the Fund in the amount of 74.68%.

10. Subsequent Events

The Fund has evaluated the events and transactions through the date the financial statements were issued and determined there were no subsequent events that required adjustments to our disclosure in the financial statements except for the following:

Effective March 1, 2015, 504 Fund Advisors, LLC (“504 Fund Advisors”) will replace Pennant Management, Inc. (“Pennant”) as the investment adviser to The 504 Fund. Pennant notified the Board that Pennant agreed to transfer and assign its rights, duties and responsibilities under its investment advisory agreement with the Fund (the “Prior Agreement”) to 504 Fund Advisors.

The Board approved an interim investment advisory agreement between the Fund and 504 Fund Advisors at an in-person meeting held on February 17-18, 2015. The Board also approved a permanent investment advisory agreement between the Fund and 504 Fund Advisors, subject to approval by shareholders of the Fund.

The annual advisory fee rate of 1.75% to be paid to 504 Fund Advisors under the interim and permanent advisory agreements is lower than the annual advisory fee rate of 2.00% that Pennant would have received from the Fund under the Prior Agreement. The Board also approved a new operating expenses limitation agreement between the Fund and 504 Fund Advisors that will lower the Fund’s total annual expenses (after fee waiver and expense reimbursement) to 1.75% through January 1, 2018.

| | THE 504 FUND

OTHER INFORMATION (UNAUDITED)

DECEMBER 31, 2014

|

Proxy Voting

For a description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, please call 800-996-2862 and request a Statement of Additional Information. One will be mailed to you free of charge. The Statement of Additional Information is also available on the SEC’s website at http://www.sec.gov.

Information on how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge, upon request, by calling 877-997-9971 or by accessing the SEC’s website http://www.sec.gov.

Disclosure of Portfolio Holdings

The Fund files a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the SEC’s website at www.sec.gov, and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

| | THE 504 FUND

TRUSTEES AND OFFICERS (UNAUDITED)

DECEMBER 31, 2014

|

Information pertaining to the Trustees and officers of the Fund is set forth below. Trustees who are not “interested persons” of the Fund as that term is defined in the 1940 Act are referred to as “Independent Trustees.” The business address of each Trustee or officer is c/o The 504 Fund, 11270 West Park Place, Suite 1025, Milwaukee, Wisconsin 53224. The Statement of Additional Information includes additional information about the Trustees and is available, without charge, upon request by calling 1-800-996-2862.

Name and

Year of Birth | Position with Fund and Length of Term | Principal Occupations

in the Past 5 Years | Number of

Portfolios in

Fund Complex Overseen By

Trustee | Other Directorships Held in the Past 5 Years |

| Interested Trustee | | | | |

Mark A. Elste, CFA1 Born: 1954 | Chairman of the Board of Trustees, Interested Trustee, President and Principal Executive Officer (Indefinite term; since 2013) | Chief Executive Officer, Pennant Management, Inc. (since 1992); Senior Executive Vice President, Chief Operating Officer and Director, U.S. Fiduciary Services, Inc. (financial services holding company) (since 2004); Director, Waretech, Inc. (wholly-owned subsidiary of U.S. Fiduciary Services, Inc.) (since 2006); Director, USF Affiliate Services, Inc. (wholly-owned subsidiary of U.S. Fiduciary Services, Inc.) (since 2006); Director, GreatBanc Trust Company (Illinois trust company) (since 2004); Chief Executive Officer and Managing Member, 504 Fund Advisors, LLC (since 2013); Director, Salem Trust Company (Florida trust company) (2006 to 2014) | 1 | CIB Marine Bancshares, Inc. (bank holding company) (since 2011) |

| Independent Trustees | | | | |

J. Clay Singleton,

Ph.D., CFA Born: 1947 | Trustee

(Indefinite term; since 2013) | Professor of Finance, Crummer Graduate School of Business, Rollins College (since 2002); Consultant, Director of Indexes, PCE Investment Bankers (2005 to 2011) | 1 | Independent Trustee, USFS Funds Trust (an open-end investment company with two series) (2013 to 2014) |

| | THE 504 FUND

TRUSTEES AND OFFICERS (UNAUDITED)

DECEMBER 31, 2014

|

Name and

Year of Birth | Position with Fund and Length of Term | Principal Occupations

in the Past 5 Years | Number of

Portfolios in

Fund Complex Overseen By

Trustee | Other Directorships Held in the Past 5 Years |

Cornelius J. Lavelle Born: 1944 | Trustee

(Indefinite term; since 2013) | Retired; Director-Institutional Equities, Citigroup Global Markets Inc. (multinational financial services firm) (1997 to 2009) | 1 | Independent Trustee, Broadview Funds Trust (an open-end investment company with one series) (since 2013); Independent Trustee, USFS Funds Trust (an open-end investment company with two series) (2013 to 2014) |

George Stelljes, III Born: 1961 | Trustee

(Indefinite term; since 2013) | Retired; President, Chief Investment Officer and Director of the Gladstone Companies (family of public and private investment funds) (2002 to 2013) | 1 | Director, Gladstone Capital Corporation (business development company) (resigned 2013); Director, Gladstone Commercial Corporation (real estate investment trust) (resigned 2013); Director, Gladstone Investment Corporation (business development company (resigned 2013); Director, Gladstone Land Corporation (real estate investment company) (resigned 2012) |

| Other Officers | | | | |

| Scott M. Conger Born: 1968 | Secretary, Chief Compliance Officer and AML Compliance Officer (Indefinite term; since 2013) | Senior Vice President and Chief Compliance Officer, Pennant Management, Inc. (since 2011); Chief Compliance Officer, 504 Fund Advisors LLC (investment advisory team) (since 2013); Director, Treasury Analysis, Stone Pillar Advisors, Ltd. (financial services) (2010 to 2011); Vice President, Amcore Bank, N.A. (2006 to 2010) | N/A | N/A |

| | THE 504 FUND

TRUSTEES AND OFFICERS (UNAUDITED)

DECEMBER 31, 2014

|

Name and

Year of Birth | Position with Fund and Length of Term | Principal Occupations

in the Past 5 Years | Number of

Portfolios in

Fund Complex Overseen By

Trustee | Other Directorships Held in the Past 5 Years |

| Walter J. Yurkanin Born: 1965 | Treasurer and Principal Financial Officer (Indefinite term; since 2013) | Chief Legal Officer, Chief Risk Officer and Secretary, U.S. Fiduciary Services, Inc. (since 2012); Director, President, Chief Executive Officer, Chief Legal Officer, Chief Risk Officer and Secretary, USF Affiliate Services, Inc. (wholly-owned subsidiary of U.S. Fiduciary Services, Inc.) (since 2013); Director and Chief Executive Officer, Waretech, Inc. (wholly-owned subsidiary of U.S. Fiduciary Services, Inc.) (since 2013); Secretary of GreatBanc Trust Company (Illinois trust company), Salem Trust Company (Florida trust company) and Pennant Management, Inc. (since 2013); Senior Vice President and General Counsel, U.S. Fiduciary Services, Inc. (2012 to 2013); General Counsel and Compliance Officer, Breakwater Trading, LLC (financial services) (2006 to 2012) | N/A | N/A |

| 1 | Mr. Elste is deemed to be an “interested person” of the Fund as that term is defined in the 1940 Act by virtue of his positions with the Adviser. |

THIS PAGE INTENTIONALLY LEFT BLANK

THE 504 FUND

11270 West Park Place, Suite 1025

Milwaukee, WI 53224

INVESTMENT ADVISOR

Pennant Management, Inc.

11270 West Park Place, Suite 1025

Milwaukee, WI 53224

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen Fund Audit Services

1350 Euclid Ave., Suite 800

Cleveland, OH 44115

LEGAL COUNSEL

Godfrey & Kahn S.C.

780 North Water Street

Milwaukee, WI 53202

CUSTODIAN

UMB Bank, N.A.

1010 Grand Boulevard

Kansas City, MO 64106

DISTRIBUTOR

Foreside Fund Services, LLC

Three Canal Plaza, Suite 100

Portland, Maine 04101

TRANSFER AGENT

UMB Fund Services, Inc.

235 West Galena Street

Milwaukee, WI 53212

There can be no assurance that the Fund will achieve its investment objectives. An investment in the Fund is an appropriate investment only for those investors who can tolerate a high degree of risk and do not require a liquid investment. Investors may lose some or all of their investment in the Fund. The Fund is not designed to be a complete investment program and may not be a suitable investment for all investors. The risk factors described are the principal risk factors associated with an investment in the Fund, as well as those factors associated with an investment in an investment company with similar investment objectives and investment policies.

This report is submitted for the general information of the shareholders of the Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding the Fund’s risks, objectives, fees, expenses and experience of its management and other considerations.