Exhibit 3.14

THIRD AMENDED AND RESTATED LIMITED LIABILITY COMPANY AGREEMENT OF QEP MIDSTREAM PARTNERS GP, LLC (a Delaware Limited Liability Company) THE MEMBERSHIP INTERESTS ISSUED UNDER THIS AGREEMENT HAVE BEEN OR WILL BE ACQUIRED FOR INVESTMENT AND HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR UNDER ANY STATE SECURITIES OR “BLUE SKY” LAWS. ANY SUCH MEMBERSHIP INTERESTS MAY NOT BE TRANSFERRED EXCEPT IN COMPLIANCE WITH THE ABOVE DESCRIBED SECURITIES LAWS OR IN ACCORDANCE WITH AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF SUCH LAWS. THE MEMBERSHIP INTERESTS ISSUED UNDER THIS AGREEMENT ARE SUBJECT TO ADDITIONAL TRANSFER RESTRICTIONS UNDER THIS AGREEMENT.

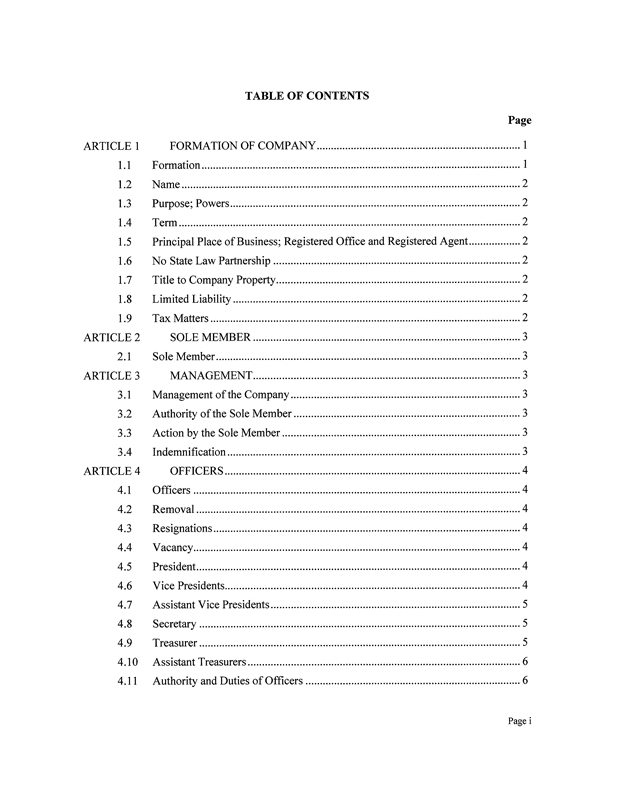

TABLE OF CONTENTS

Page ARTICLE 1 FORMATION OF COMPANY 11. 1 Formation 11. 2 Name 2 1.3 Purpose; Powers 21. 4 Term 21. 5 Principal Place of Business; Registered Office and Registered Agent 21. 6 No State Law Partnership 21. 7 Title to Company Property 21. 8 Limited Liability 21.9 Tax Matters 2 ARTICLE 2 SOLE MEMBER 3 2.1 Sole Member 3 ARTICLE 3 MANAGEMENT 3 3.1 Management of the Company 3 3.2 Authority of the Sole Member 3 3.3 Action by the Sole Member 3 3.4 Indemnification 3 ARTICLE 4 OFFICERS 4 4.1 Officers 4 4.2 Removal 4 4.3 Resignations 4 4.4 Vacancy 4 4.5 President 4 4.6 Vice Presidents 4 4.7 Assistant Vice Presidents 5 4.8 Secretary 5 4.9 Treasurer 5 4.10 Assistant Treasurers 6 4.11 Authority and Duties of Officers 6 Page i

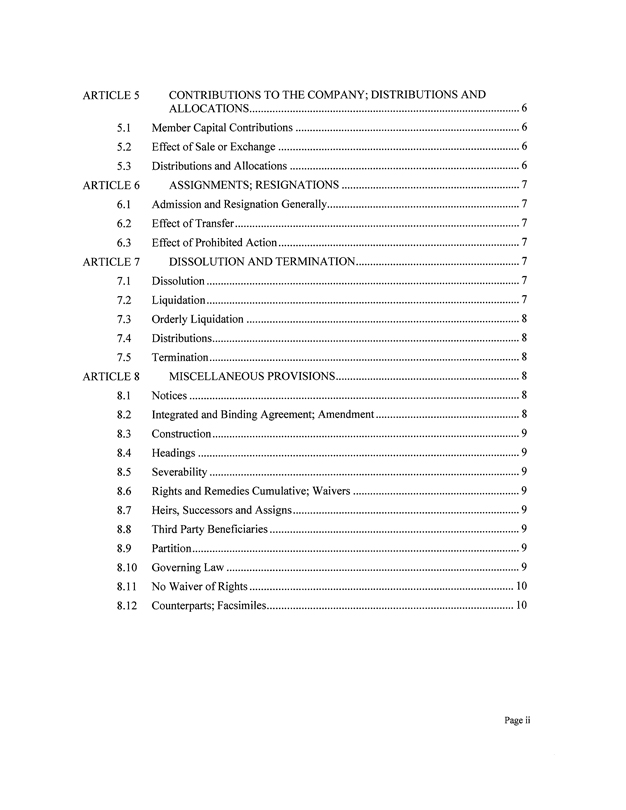

ARTICLE 5 CONTRIBUTIONS TO THE COMPANY; DISTRIBUTIONS AND ALLOCATIONS 6 5.1 Member Capital Contributions 6 5.2 Effect of Sale or Exchange 6 5.3 Distributions and Allocations 6 ARTICLE 6 ASSIGNMENTS; RESIGNATIONS 7 6.1 Admission and Resignation Generally 7 6.2 Effect of Transfer 7 6.3 Effect of Prohibited Action 7 ARTICLE 7 DISSOLUTION AND TERMINATION 7 7.1 Dissolution 7 7.2 Liquidation 7 7.3 Orderly Liquidation 8 7.4 Distributions 8 7.5 Termination 8 ARTICLE 8 MISCELLANEOUS PROVISIONS 8 8.1 Notices 8 8.2 Integrated and Binding Agreement; Amendment 8 8.3 Construction 9 8.4 Headings 9 8.5 Severability 9 8.6 Rights and Remedies Cumulative; Waivers 9 8.7 Heirs, Successors and Assigns 9 8.8 Third Party Beneficiaries 9 8.9 Partition 9 8.10 Governing Law 9 8.11 No Waiver of Rights 10 8.12 Counterparts; Facsimiles 10 Page ii

THIRD AMENDED AND RESTATED LIMITED LIABILITY COMPANY AGREEMENT OF QEP MIDSTREAM PARTNERS GP, LLC

This Third Amended and Restated Limited Liability Company Agreement (this “Agreement’) of QEP MIDSTREAM PARTNERS GP, LLC, a Delaware limited liability company (the “Company”), effective as of July 22, 2015, immediately following the Effective Time (as defined in Exhibit A) is entered into by QEP Field Services, LLC, a Delaware limited liability company, the Company’s sole member (the “Sole Member”).

RECITALS

A. Capitalized terms not otherwise defined herein shall have the meanings given them on Exhibit A to this Agreement.

B. The Company was formed as a limited liability company pursuant to a Certificate of Formation (the “Certificate of Formation”) filed with the Secretary of State of Delaware on April 13, 2013 in accordance with the provisions of the Delaware Limited Liability Company Act (such statute and any successor statute, as amended from time to time, being herein called the “Act”);

C. QEP Field Services Company (“QEP Field Services”), a Delaware corporation and the initial member of the Company, previously executed the Limited Liability Company Agreement of the Company effective April1 9, 2013 (the “Original Agreement”);

D. QEP Field Services previously executed the First Amended and Restated Limited Liability Company Agreement of the Company effective August 14, 2013 (the “First A&R LLC Agreement”)

E. As of October 19, 2014, QEP Field Services and Tesoro Logistics LP, a Delaware limited partnership (“TLLP”), executed a Membership Interest Purchase Agreement pursuant to which, among other things, TLLP agreed to acquire all of the outstanding membership interests of QEP Field Services, LLC (“QEPFS’’), a Delaware limited liability company;

F. Effective December 2, 2014, QEP Field Services and the Sole Member executed an Assignment Agreement pursuant to which the membership interests of the Company were transferred from QEP Field Services to the Sole Member;

G. QEPFS executed the Second Amended and Restated Limited Liability Company Agreement of the Company effective December 2, 2014 (the “Second A&R LLC Agreement”);

H. On April 6, 2015, the Company, the Sole Member, TLLP, Tesoro Logistics GP, LLC, QEP Midstream Partners, LP (“QEPM’), and TLLP Merger Sub LLC entered into an Agreement and Plan of Merger (the “Merger Agreement”) pursuant to which TLLP Merger Sub LLC would merger with and into QEPM with QEPM as the surviving entity (the “Merger”);

I. The undersigned now desire to execute this Agreement to amend and restate the Second A&R LLC Agreement and set forth the terms and conditions under which the management, business, and financial affairs of the Company will be conducted.

AGREEMENT

NOW, THEREFORE, in consideration of the foregoing recitals and the mutual promises, covenants and conditions herein contained, the receipt and sufficiency of which are hereby acknowledged, the undersigned parties hereby covenant and agree as follows:

ARTICLE I FORMATION OF COMPANY

1.1 Formation. The Company has been organized as a Delaware limited liability company by the filing of its Certificate of Formation under and pursuant to the Act. To the extent any provision of this Agreement conflicts with any provision of the Certificate of Formation, the provisions of the Certificate of Formation govern.

1.2 Name. The name of the Company is “QEP Midstream Partners GP, LLC”. All Company business shall be conducted in that name or such other names that comply with applicable law as the Sole Member may select from time to time.

1.3 Purpose; Powers. The purpose of the Company is to engage in any lawful business or activity in which a limited liability company may be engaged under the Act.

1.4 Term. The Company commenced upon the filing of the Certificate of Formation with the Secretary of State of the State of Delaware and shall continue in existence as a separate legal entity until the Company is terminated in accordance with this Agreement and a certificate of dissolution is filed in accordance with the Act.

1.5 Principal Place of Business; Registered Office and Registered Agent.

(a) The principal place of business of the Company shall be at the address set forth opposite its name on Exhibit B to this Agreement. The Sole Member, at any time and from time to time, may change the location of the Company’s principal place of business and may establish such additional place or places of business of the Company as the Sole Member determines to be necessary or desirable.

(b) The Company’s initial registered office and initial registered agent shall be as provided in the Certificate of Formation. The registered office and registered agent may be changed from time to time by filing the address of the new registered office and/or the name of the new registered agent pursuant to the Act.

1.6 No State Law Partnership. The Company shall not be considered a partnership (including, without limitation, a limited partnership) or joint venture. In the event there is more than one member of the Company (each, a “Member”), no Member shall be a partner or joint venturer of any other Member for any purposes, and this Agreement shall not be construed to suggest otherwise.

1.7 Title to Company Property. All property owned by the Company shall be owned by the Company as an entity. Insofar as permitted by applicable law, no Member shall have any ownership interest in any Company property in its individual name or right, and each Member’s Membership Interest shall be personal property for all purposes.

1.8 Limited Liability. No Member or agent of the Company shall have any personal obligation for any debt, obligation or liability of the Company, to the maximum extent that such limitation on liability is permitted by the Act.

1.9 Tax Matters. To be effective as of July 22, 2015, the Company shall file an election on Form 8832, Entity Classification Election, to change its classification from a disregarded entity to an association taxable as a corporation for U.S. federal income tax purposes in accordance with Treas. Reg. § 301.7701-3(c)(l), and each officer is authorized to file such election and execute and file such other documents as may be necessary to make such election effective.

ARTICLE 2

SOLE MEMBER

2.1 Sole Member. The name, address and Membership Interests of the Sole Member are set forth on Exhibit B attached hereto.

ARTICLE 3

MANAGEMENT

3.1 Management of the Company. Except to the extent otherwise provided for herein, the powers of the Company shall be exercised by and under the authority of, and the business and affairs of the Company shall be managed by the Sole Member. Notwithstanding anything to the contrary contained in this Agreement and any provision of law that otherwise so empowers the Company, without the consent of the Sole Member, the Company shall not do any of the following:

(a) admit a new Member or create new Membership Interests; (b) amend the Certificate of Formation or this Agreement; or (c) dissolve, wind-up or liquidate, in whole or in part.

3.2 Authority of the Sole Member. The Sole Member has the power to do any and all acts necessary, convenient or incidental to or for the furtherance of the purposes described herein, including all powers, statutory or otherwise, possessed by Members under the Act.

3.3 Action by the Sole Member. The Sole Member may take any action permitted or required to be taken without a meeting, without prior notice and without a vote if a written consent, setting forth the action so taken, shall be signed by the Sole Member. A consent transmitted by the Sole Member by electronic transmission shall be deemed to be signed for the purposes of this Section 3.3.

3.4 Indemnification.

(a) Notwithstanding any other provisions of this Agreement, whether express or implied, or any obligation or duty at law or in equity, none of the Sole Member and any officers, directors, stockholders, partners, members, employees, affiliates, representatives or agents of the Company or the Sole Member (each, an “Indemnified Party”) shall be liable or accountable in damages or otherwise to the Company for any act or omission done or omitted by an Indemnified Party in good faith, unless such act or omission constitutes bad faith, gross negligence or willful misconduct. To the fullest extent permitted by law, the Company shall indemnify and hold harmless each Indemnified Party from and against any and all losses, liabilities, damages, costs, expenses, judgments, claims and demands whatsoever arising out of or in any way relating to such Indemnified Party’s position with the Company or any act or omission of the Indemnified Party’ in connection with the Company, except to the extent such loss, liability, damage, cost, expense, judgment, claim or demand results from such Indemnified Party’s bad faith, gross negligence or willful misconduct.

(b) In accordance with the Merger Agreement, all rights to indemnification, advancement of expenses and exculpation from liabilities for acts or omissions occurring prior to the Effective Time (including transactions contemplated by the Merger Agreement) that existed at the time of the execution of the Merger Agreement in favor of any QEPM D&O Indemnified Party (as defined in the Merger Agreement) as provided in the governing documents of the Company (including the Second A&R LLC Agreement), under applicable Delaware law, or otherwise, shall continue in full force and effect in accordance with their terms following the Effective Time.

ARTICLE4

OFFICERS

4.1 Officers. The Sole Member may periodically appoint officers of the Company which shall include a President, one or more Vice Presidents (which may include Executive Vice Presidents, Senior Vice Presidents and other categories of Vice Presidents), a Secretary, a Treasurer, and such other officers as may be appointed in accordance with the provisions set forth herein. The Sole Member from time to time may appoint other officers or agents (including, without limitation, one or more Assistant Vice Presidents, one or more Assistant Secretaries or one or more Assistant Treasurers), to hold office for such period, have such authority and perform such duties as are provided in this Agreement or as may be provided by the Sole Member. Any number of offices may be held by the same person, provided that the offices of President and Secretary may not be held by the same person. As of the date and time hereof, the persons set forth on Exhibit C shall be the officers of the Company.

4.2 Removal. Any officer may be removed by the Sole Member at any time, with or without cause. The term of an officer’s service, as well as the salary and other compensation, if any, to be paid an officer shall be determined by the Sole Member. Such officer shall have only the limited authority so delegated to such officer by the Sole Member or this Agreement.

4.3 Resignations. Any officer may resign at any time by giving written or electronic notice of such resignation to the Sole Member. Any such resignation shall take effect at the time

specified therein or, if no time be specified, upon receipt thereof by the Sole Member. Unless specified therein, the acceptance of such resignation shall not be necessary to make it effective.

4.4 Vacancy. A vacancy in any office by reason of death, incapacity, resignation, removal or otherwise shall be filled by the Sole Member (or by an officer to whom authority to fill such vacancy has been delegated by the Sole Member) for the unexpired portion of the term in the manner prescribed by this Agreement.

4.5 President. The President shall be the chief executive officer of the Company. Subject to the direction of the Sole Member, the President shall have general charge of the business affairs and property of the Company and shall have general supervision over the officers and agents of the Company. The President shall see that all orders of the Sole Member are carried into effect. The President may sign and execute in the name of the Company deeds, mortgages, bonds, contracts, agreements and other instruments duly authorized by the Sole Member, except in cases where the signing and execution thereof shall be expressly delegated by the Sole Member or by statute to some other officer or agent. The President shall perform such other duties as are given to him or her by this Agreement or as from time to time may be assigned to him or her by the Sole Member.

4.6 Vice Presidents. In the absence or disability of the President, any Vice President designated by the President (or in the absence of such designation, the Vice President designated by the Sole Member) shall perform all the duties ofthe President and, when so acting, shall have all the powers of and be subject to all restrictions upon the President. Any Vice President may also sign and execute in the name of the Company deeds, mortgages, bonds, contracts, agreements and other instruments duly authorized by the Sole Member, except in cases where the signing and execution thereof shall be expressly delegated by the Sole Member or by statute to some other officer or agent. Each Vice President shall perform such other duties as are given to him or her by this Agreement or as from time to time may be assigned to him or her by the Sole Member or the President.

4.7 Assistant Vice Presidents. At the request of any Vice President or in his or her absence or disability, the Assistant Vice President designated by the Sole Member shall perform all the duties of the Vice President and, when so acting, shall have all the powers of and be subject to all restrictions upon the Vice President. The Assistant Vice Presidents shall perform such other duties as from time to time may be assigned to them by the Sole Member.

4.8 Secretary. The Secretary shall:

(a) Record all the proceedings of the meetings of the Sole Member and any committees in a book or books to be kept for that purpose;

(b) Cause all notices to be duly given in accordance with the provisions of this

Agreement and as required by statute;

(c) Be custodian ofthe records ofthe Company;

(d) See that the lists, books, reports, statements, certificates and other documents and records required by statute are properly kept and filed; and

(e) In general, perform all duties incident to the office of Secretary and such other duties as are given to him or her by this Agreement or as from time to time may be assigned to him or her by the Sole Member or the President. At the request of the Secretary or in his or her absence or disability, the Assistant Secretary designated by the Sole Member shall perform all the duties of the Secretary and, when so acting, shall have all the powers of and be subject to all restrictions upon the Secretary. The Assistant Secretaries shall perform such other duties as from time to time may be assigned to them by the Sole Member.

4.9 Treasurer. The Treasurer shall:

(a) Have charge of and supervision over and be responsible for the funds, securities, receipts and disbursements ofthe Company;

(b) Cause the moneys and other valuable effects of the Company to be deposited in the name and to the credit of the Company in such banks or trust companies or with such bankers or other depositaries as shall be selected or to be otherwise dealt with in such manner as the Sole Member may direct;

(c) Cause the funds of the Company to be disbursed by checks or drafts upon the authorized depositaries of the Company, and cause to be taken and preserved proper vouchers for all moneys disbursed;

(d) Render to the Sole Member or the President, whenever requested, a statement of the financial condition of the Company and of all his or her transactions as Treasurer;

(e) Cause to be kept at the Company’s principal office correct books of account of all its business and transactions and such duplicate books of account as he or she shall determine, and upon application cause such books or duplicates thereof to be exhibited to any director;

(f) Be empowered, from time to time, to require from the officers or agents of the Company, reports or statements giving such information as he or she may desire with respect to any and all financial transactions of the Company; and

(g) In general, perform all duties incident to the office of Treasurer and such other duties as are given to him or her by this Agreement or as from time to time may be assigned to him or her by the Sole Member or the President.

4.10 Assistant Treasurers. At the request of the Treasurer or in his or her absence or disability, the Assistant Treasurer designated by the Sole Member shall perform all the duties of the Treasurer and, when so acting, shall have all the powers of and be subject to all restrictions upon the Treasurer. The Assistant Treasurers shall perform such other duties as from time to time may be assigned to them by the Sole Member.

4.11 Authority and Duties of Officers. In addition to the foregoing authority and duties, all officers of the Company shall respectively have such authority and perform such

duties in the management of the business of the Company as may be designated from time to time by the Sole Member. The President, subject to the approval of the Sole Member, may prescribe in writing the powers, authority and duties of any officers of the Company (other than the President), which he or she may deem advisable or appropriate, and may authorize any officer of the Company to delegate further in writing, with such limitations as the President or such delegating officer may deem advisable or appropriate, the powers, authority and duties delegated to such officer.

ARTICLE 5

CONTRIBUTIONS TO THE COMPANY; DISTRIBUTIONS AND ALLOCATIONS

5.1 Member Capital Contributions. QEP Field Services, as predecessor in interest to the Sole Member, contributed, as its initial Capital Contribution, the cash, and/or other property set forth on Exhibit B attached hereto. The Sole Member may, but is not required to, make any additional Capital Contributions.

5.2 Effect of Sale or Exchange. In the event of a permitted sale, exchange, or other assignment of a Membership Interest, the capital account of the assignor shall become the capital account of the assignee to the extent it relates to the assigned Membership Interest.

5.3 Distributions and Allocations. All distributions of cash or other property (except upon the Company’s dissolution, which shall be governed by the applicable provisions of the Act and Article 7) shall be made to the Sole Member. All amounts withheld pursuant to the Code or any provisions of state or local tax law with respect to any payment or distribution to the Member from the Company shall be treated as amounts distributed to the Member pursuant to this Section 5.3. Notwithstanding any provision to the contrary contained in this Agreement, the Company shall not be required to make a distribution to a Member on account of its interest in the Company if such distribution would violate Section 18-607 of the Act or any other applicable law.

ARTICLE 6

ASSIGNMENTS; RESIGNATIONS

6.1 Admission and Resignation Generally.

(a) Admission of Additional Members. The Company shall not admit a new Member unless all of the following requirements are satisfied: (i) the Sole Member grants prior written consent to the admission of the additional member; (ii) the Company and the Sole Member amend or replace this Agreement as may be necessary or appropriate for the purpose of addressing any issues raised by joint or multiple ownership of the Company; and (iii) each Person who seeks to be admitted as a member of the Company executes the then-current limited liability company agreement of the Company, as amended or replaces as described above, and makes any required capital contributions to the Company in full.

(b) Resignation. The Sole Member shall not resign or withdraw from the Company except as the result of a transfer of its entire Membership Interest in the Company in accordance with this Agreement.

6.2 Effect of Transfer. If the Sole Member transfers its entire interest in the Company in accordance with this Agreement, such transfer shall operate, upon completion, as the complete resignation or withdrawal of the Sole Member from the Company.

6.3 Effect of Prohibited Action. Any assignment in violation of this Article 6 shall be, to the fullest extent permitted by law, void and of no force or effect whatsoever.

ARTICLE 7

DISSOLUTION AND TERMINATION

7.1 Dissolution. Subject to the other provisions of this Agreement, the Company shall only be dissolved upon the first to occur of the following: (a) the written instructions of the Sole Member; (b) the entry of a decree of judicial dissolution under Section 18-802 of the Act; or (c) the sale or other transfer of all, or substantially all, of the Company’s assets outside of the ordinary course of business.

7.2 Liquidation. Upon the dissolution ofthe Company, it shall wind up its affairs and distribute its assets in accordance with Section 7.4 hereof and the Act by either or a combination of the following methods as the Sole Member (or the Person or Persons carrying out the liquidation) shall determine:

(a) selling the Company’s assets and, after the satisfaction of Company liabilities, distributing the net proceeds therefrom to the Sole Member, and/or

(b) subject to the satisfaction of Company liabilities, distributing the Company’s assets to the Sole Member in kind, with the Sole Member accepting an undivided interest in the Company’s assets in satisfaction of its Membership Interests.

7.3 Orderly Liquidation. A reasonable time as determined by the Sole Member (or the Person or Persons carrying out the liquidation) shall be allowed for the orderly liquidation of the assets of the Company and the discharge of liabilities to the creditors so as to minimize any losses attendant upon dissolution.

7.4 Distributions. Upon dissolution, the Company assets (including any cash on hand) shall be distributed in the following order and in accordance with the following priorities:

(a) first, to any creditors of the Company;

(b) second, to known and reasonably estimated costs of dissolution and winding up;

(c) third, to any reserves established by the Sole Member, in its sole discretion, for contingent liabilities of the Company; and

(d) fourth, to the Sole Member.

7.5 Termination. The Company shall terminate when (a) all of the assets of the Company, after payment of or due provision for all debts, liabilities and obligations of the Company, shall have been distributed to the Sole Member in the manner provided for in this Agreement and (b) the Certificate of Formation shall have been canceled in the manner required by the Act. The existence of the Company as a separate legal entity shall continue until cancellation of the Certificate of Formation as provided in the Act.

ARTICLE 8

MISCELLANEOUS PROVISIONS

8.1 Notices. All notices, requests, demands and other communications required to or permitted to be given under this Agreement shall be in writing and shall be conclusively deemed to have been duly given (a) when hand delivered; (b) two business days after the same have been deposited in a United States post office via certified mail/return receipt requested; (c) the day sent by facsimile transmission; or (d) the next business day after same have been deposited with a national overnight delivery service (e.g., Federal Express)— in each case addressed to the parties at the address set forth on Exhibit B to this Agreement. A party hereto may change or supplement the addresses on Exhibit B, or designate additional addresses, for purposes of this Section 8.1 by giving the Company and the other parties hereto written notice of the new address in the manner set forth above.

8.2 Integrated and Binding Agreement; Amendment. This Agreement contains the entire understanding and agreement among the parties hereto with respect to the subject matter hereof, and there are no other agreements, understandings, representations or warranties among the parties hereto other than those set forth herein. This Agreement may be amended only as provided in this Agreement. Notwithstanding any other provision of this Agreement the parties hereto agree that this Agreement constitutes a legal, valid and binding agreement, and is enforceable against each of them in accordance with its terms.

8.3 Construction. Whenever the singular number is used in this Agreement and when required by the context, the same shall include the plural, and the masculine gender shall include the feminine and neuter genders, and vice versa.

8.4 Headings. The headings in this Agreement are inserted for convenience only and are in no way intended to describe, interpret, define, or limit the scope, extent, or intent of this Agreement or any provision hereof.

8.5 Severability. If any term or provision of this Agreement is determined to be illegal, unenforceable or invalid, in whole or in part for any reason, such illegal, unenforceable or invalid provision or part thereof shall be stricken from this Agreement and such provision shall not affect the legality, enforceability or validity of the remainder of this Agreement. If any provision or part thereof of this Agreement is stricken in accordance with the provisions of this Section 8.5, then such stricken provision shall be replaced, to the extent possible, with a legal, enforceable and valid provision that is as similar in tenor to the stricken provision as is legally possible.

8.6 Rights and Remedies Cumulative; Waivers. The rights and remedies provided by this Agreement are cumulative and the use of any one right or remedy by any party shall not preclude or waive the right to use any or all other remedies, and are given in addition to any other rights the parties may have by law, statute, ordinance or otherwise. The failure of any party to seek redress for violation of or to insist upon the strict performance of any covenant or condition of this Agreement shall not prevent a subsequent act, which would have originally constituted a violation, from having the effect of an original violation.

8.7 Heirs, Successors and Assigns. Each and all of the covenants, terms, provisions and agreements herein contained shall be binding upon, and inure to the benefit of, the parties hereto and, to the extent permitted by this Agreement, their respective heirs, legal representatives, successors and assigns.

8.8 Third Party Beneficiaries. The parties to this Agreement shall be entitled to all of the privileges, benefits and rights contained herein; no other party shall be a third party beneficiary or have any rights hereunder or be able to enforce any provision contained herein.

8.9 Partition. The Sole Member agrees that the assets of the Company are not and will not be suitable for partition. Accordingly, the Sole Member hereby irrevocably waives (to the fullest extent permitted by law) any and all rights that it may have, or may obtain, to maintain any action for partition of any of the assets of the Company.

8.10 Governing Law. This Agreement shall be construed, enforced and interpreted in accordance with the laws of the State of Delaware, without regard to conflicts of law provisions and principles thereof.

8.11 No Waiver of Rights. The rights and remedies of the parties to this Agreement are cumulative and not alternative. Neither the failure nor any delay by any party in exercising any right, power or privilege under this Agreement will operate as a waiver thereof, and no single or partial exercise by a party of its rights hereunder shall preclude any other or future exercise thereof or the exercise of any other right, power or privilege.

8.12 Counterparts; Facsimiles. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original (including copies sent to a party by facsimile transmission) as against the party signing such counterpart, but which together shall constitute one and the same instrument. Signatures transmitted via facsimile, or PDF format through electronic mail (“e-mail”), shall be considered authentic and binding.

[Signatures to follow.]

IN WITNESS WHEREOF, the undersigned have executed this Agreement as of the day and year first above written.

THE SOLE MEMBER:

QEP FIELD SERVICES, LLC, a Delaware limited liability company

By:/s/ Phillip M. Anderson

Name: Phillip M. Anderson

Title: President

EXHIBIT A DEFINITIONS

The following definitions shall for all purposes, unless otherwise clearly indicated to the contrary, apply to the terms used in this Agreement.

“Act” shall have the meaning set forth in the recitals of this Agreement.

“Agreement” shall have the meaning set forth in the Preamble.

“Capital Contribution” shall mean any contribution to the capital of the Company by a Member in cash, property or services, or a binding obligation to contribute cash, property or services, whenever made.

“Certificate of Formation” shall have the meaning set forth in the Recitals to this

Agreement.

“Code” shall mean the Internal Revenue Code of 1986, as amended, or corresponding provisions of subsequent superseding federal revenue laws and the rules and regulations promulgated thereunder.

“Company” shall have the meaning set forth in the Preamble.

“Effective Time” shall have the meaning such term is given in the Merger Agreement.

“Indemnified Party” shall have the meaning set forth in Section 3.4 of this Agreement.

“Member” shall have the meaning set forth in Section 1.6, and shall include any Person admitted as an additional member or a substitute member of the Company pursuant to the provisions of this Agreement, each in its capacity as a member of the Company.

“Membership Interest” shall mean a Member’s limited liability company interest in the Company and the other rights and obligations with respect thereto as set forth in this Agreement. Each Member’s respective Membership Interest is set forth beside the Member’s name in Exhibit B of this Agreement.

“Merger Agreement” shall have the meaning set forth in the Recitals to this Agreement.

“Person” shall mean any individual, corporation, partnership, limited liability company, joint venture, association, joint stock company, trust (including any beneficiary thereof), unincorporated organization, or government or any agency or political subdivision thereof.

“Sole Member” shall have the meaning set forth in the Preamble, and shall include any Person admitted as a substitute Sole Member pursuant to the provisions of this Agreement, each in its capacity as a Member.

Exhibit A-I

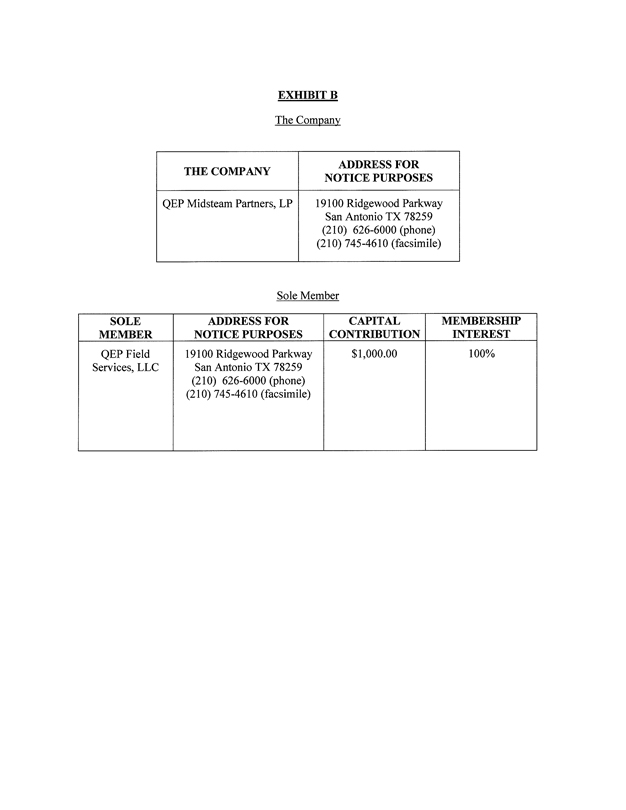

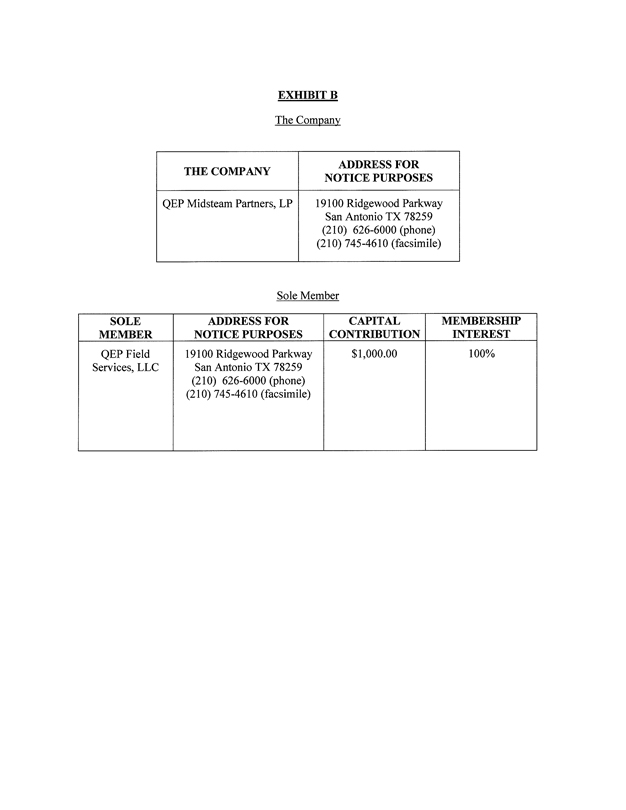

EXHIBIT B

The Company

THE COMPANY ADDRESS FOR NOTICE PURPOSES QEP Midsteam Partners, LP 19100 Ridgewood Parkway San Antonio TX 78259 (210) 626-6000 (phone) (210) 745-4610 (facsimile)

Sole Member

SOLE MEMBER ADDRESS FOR NOTICE PURPOSES CAPITAL CONTRIBUTION MEMBERSHIP INTEREST QEP Field Services, LLC 19100 Ridgewood Parkway San Antonio TX 78259 (210) 626-6000 (phone) (210) 745-4610 (facsimile) $1,000.00100%

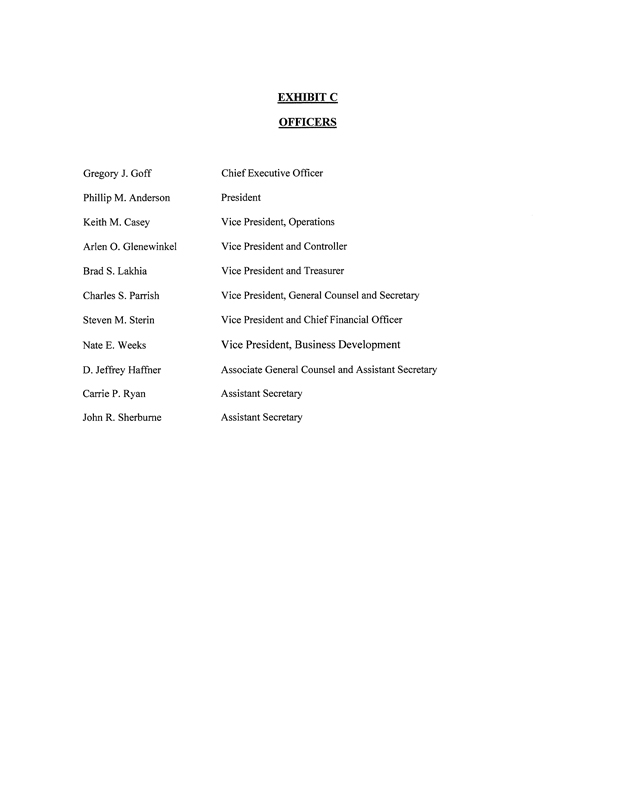

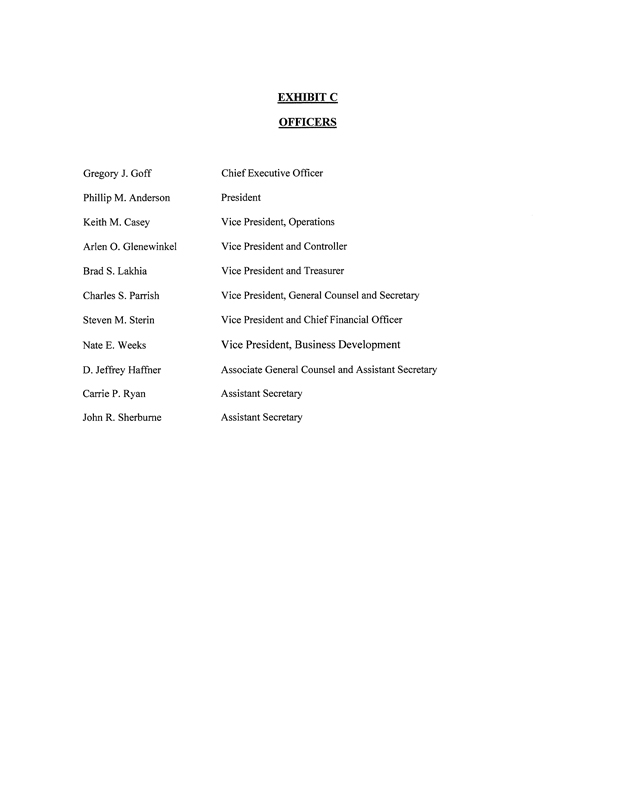

EXHIBIT C

OFFICERS

Gregory J. Goff Chief Executive Officer Phillip M. Anderson President Keith M. Casey Vice President, Operations Arlen O. Glenewinkel Vice President and Controller Brad S. Lakhia Vice President and Treasurer Charles S. Parrish Vice President, General Counsel and Secretary Steven M. Sterin Vice President and Chief Financial Officer Nate E. Weeks Vice President, Business Development D. Jeffrey Haffner Associate General Counsel and Assistant Secretary Carrie P. Ryan Assistant Secretary John R. Sherburne Assistant Secretary