Washington, D.C. 20549

9711 Washingtonian Blvd.

Francine J. Rosenberger, Esq.

c/o Steben & Company, Inc.

9711 Washingtonian Blvd.

Item 1. Reports to Stockholders.

Steben Select Multi-Strategy Master Fund

Financial Statements

September 30, 2013

TABLE OF CONTENTS

| Steben Select Multi-Strategy Master Fund | |

| | | |

| | | |

| Financial Statements | |

| | Statement of Assets and Liabilities | 2 |

| | Statement of Operations | 3 |

| | Statement of Changes in Net Assets | 4 |

| | Statement of Cash Flows | 5 |

| | Schedule of Investments | 6 - 8 |

| | Notes to Financial Statements | 9 - 18 |

| | Financial Highlights | 19 |

| | | |

| | | |

| | | |

| | | |

| | | |

| Approval of Investment Management Agreement | |

| Additional Information | |

Steben Select Multi-Strategy Master Fund

Statement of Assets and Liabilities

September 30, 2013 (Unaudited)

| ASSETS | | | |

| | | | |

| Investments, at fair value (cost $5,200,011) | | $ | 5,216,266 | |

| Investments made in advance | | | 1,000,000 | |

| Dividends receivable | | | 7 | |

| Total Assets | | | 6,216,273 | |

| | | | | |

| LIABILITIES | | | | |

| Management fees payable | | | 9,740 | |

| Accrued operating services fee payable | | | 1,169 | |

| Subscriptions received in advance | | | 1,000,000 | |

| Total Liabilities | | | 1,010,909 | |

| | | | | |

| NET ASSETS | | $ | 5,205,364 | |

| | | | | |

| Shares outstanding | | | | |

| ($0.01 par value; unlimited shares authorized) | | | 521,572 | |

| | | | | |

| Net asset value per share (net assets/shares outstanding) | | $ | 9.98 | |

| | | | | |

| COMPONENTS OF NET ASSETS | | | | |

| Paid in capital | | $ | 5,200,000 | |

Accumulated net investment loss | | | (10,891 | ) |

| Net unrealized appreciation on investments | | | 16,255 | |

| Total Net Assets | | $ | 5,205,364 | |

See accompanying notes to financial statements

Steben Select Multi-Strategy Master Fund

Period August 1, 2013 (Commencement of Operations)

to September 30, 2013 (1)

| INVESTMENT INCOME | | | |

| Dividend income | | $ | 18 | |

| | | | | |

| EXPENSES | | | | |

| Management fees (Note 6) | | | 9,740 | |

| Operating services fee (Note 6) | | | 1,169 | |

| Total Expenses | | | 10,909 | |

| Net Investment Loss | | | (10,891 | ) |

| | | | | |

| NET UNREALIZED GAIN ON INVESTMENTS | | | | |

| Net change in unrealized appreciation/depreciation on investments | | | 16,255 | |

| | | | | |

| Net Increase in Net Assets Resulting from Operations | | $ | 5,364 | |

| | | | | |

(1) Unaudited. | | | | |

See accompanying notes to financial statements

Steben Select Multi-Strategy Master Fund

Statement of Changes in Net Assets

Period August 1, 2013 (Commencement of Operations)

to September 30, 2013 (1)

| FROM OPERATIONS | | | |

| Net investment loss | | $ | (10,891 | ) |

| Net change in unrealized appreciation/depreciation on investments | | | 16,255 | |

| Net Increase in Net Assets Resulting From Operations | | | 5,364 | |

| | | | | |

| INCREASE FROM TRANSACTIONS IN NET ASSETS | | | | |

| Proceeds from sales shares | | | 5,100,000 | |

| | | | | |

| Total Increase in Net Assets | | | 5,105,364 | |

| | | | | |

| NET ASSETS | | | | |

| Beginning of period | | | 100,000 | |

| End of period | | $ | 5,205,364 | |

| | | | | |

| Accumulated net investment loss | | $ | (10,891 | ) |

| | | | | |

| CHANGE IN SHARES | | | | |

| Shares sold | | | 511,572 | |

| | | | | |

(1) Unaudited. | | | | |

See accompanying notes to financial statements

Steben Select Multi-Strategy Master Fund

Statement of Cash Flows

Period August 1, 2013 (Commencement of Operations)

to September 30, 2013 (1)

| CASH FLOWS FROM OPERATING ACTIVITIES | |

| Net increase in net assets resulting from operations | | | |

| Adjustments to reconcile net increase in net assets resulting | | | |

from operations to net cash from operating activities: | | $ | 5,364 | |

Purchases of investments | | | (5,000,000 | ) |

| Purchases of money market fund | | | (200,011 | ) |

| Net change in unrealized appreciation/depreciation on investments | | | (16,255 | ) |

| Changes in operating assets and liabilities: | | | | |

| Investments made in advance | | | (1,000,000 | |

| Dividends receivable | | | (7 | ) |

| Management fees payable | | | 9,740 | |

| Accrued operating services fee payable | | | 1,169 | |

| Subscriptions received in advance | | | 1,000,000 | |

| Net Cash Used in Operating Activities | | | (5,200,000 | ) |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | |

| Proceeds from sales of shares | | | 5,100,000 | |

| | | | | |

| Net Change in Cash and Cash Equivalents | | | (100,000 | ) |

| | | | | |

| CASH AND CASH EQUIVALENTS | | | | |

| Beginning of period | | | 100,000 | |

| | | | | |

| End of period | | $ | - | |

| | | | | |

(1) Unaudited. | | | | |

See accompanying notes to financial statements

Steben Select Multi-Strategy Master Fund

Schedule of Investments

September 30, 2013 (Unaudited)

| | | | | | | | | | | Redemptions |

| | | Percentage of | | | | | | | | | | Notice Period |

Long-Term Investment Funds1: | | Net Assets | | | Cost | | | Fair Value | | Frequency | | Number of Days |

| | | | | | | | | | | | | |

Equity Long/Short Strategy: The Collectors' Fund LP | | 19.30 | % | $ | 1,000,000 | | $ | 1,004,675 | | Quarterly | | 45 |

| Visium Global Fund, LP | | 19.56 | | | 1,000,000 | | | 1,018,188 | | Monthly | | 30 |

| | | 38.86 | | | 2,000,000 | | | 2,022,863 | | | | |

Equity Market-Neutral Strategy: Voloridge Trading Fund LP | | 19.28 | | | 1,000,000 | | | 1,003,417 | | Monthly | | 5 |

| | | | | | | | | | | | | |

Fixed-Income Relative Value Strategy: The Obsidian (Offshore) Fund - Class V Series 08 13 | | 19.57 | | | 1,000,000 | | | 1,018,702 | | Monthly | | 60 |

Global Macro Strategy: Graham Absolute Return Ltd. | | 18.66 | | | 1,000,000 | | | 971,273 | | Quarterly | | 30 |

| | | | | | | | | | | | | |

| Total Long-Term Investment Funds: | | 96.37 | | | 5,000,000 | | | 5,016,255 | | | | |

| | | | | | | | | | | | | |

| Short-Term Investment: | | | | | | | | | | | | |

| Money Market Fund: | | | | | | | | | | | | |

Fidelity Institutional Money Market Portfolio - Class I, 0.04% 2 | 3.84 | | | 200,011 | | | 200,011 | | | | |

| | | | | | | | | | | | |

| Total Investments | | 100.21 | % | $ | 5,200,011 | | $ | 5,216,266 | | | | |

| | | | | | | | | | | | | |

1 All investments are non-income producing.

2 7-Day Yield.

See accompanying notes to financial statements

Steben Select Multi-Strategy Master Fund

Schedule of Investments, Continued

September 30, 2013 (Unaudited)

Equity Long/Short. Portfolio Funds employing a long/short equity strategy seek to profit from stock selection, based primarily on fundamental or quantitative company analysis. Such Portfolio Fund Managers buy stocks they believe to be underpriced in the expectation that they will increase in value (called “going long”) and sell short stocks they believe to be overpriced in the expectation that they will decrease in value (called “going short”). A Portfolio Fund’s net market exposure (that is the value of the allocation to long positions minus that to short positions) may be net long (with a larger allocation to long than short positions), balanced or net short. Portfolio Fund Managers have the flexibility to set and adjust this net market exposure based on their preferred investment style, their bullishness or bearishness on the broad direction of equity indices, as well as the attractiveness of the investment opportunity set. It is common for long/short equity portfolios to be net long much of the time, but the size of this net long exposure will typically be lower than that of a traditional long-only equity fund. In cases where a Portfolio Fund Manager has a high degree of conviction in a long or short position, the Portfolio Fund’s allocation to that stock may be more concentrated than is typical in a traditional long-only equity fund. Portfolio Funds may have a broad global mandate (including developed and emerging markets), or they may specialize in stocks in a particular geographic area, industry, or market capitalization segment. Portfolio Fund Managers can use leverage to amplify potential gains and losses.

Equity Market-Neutral. Equity market-neutral strategies seek to profit from forecasting the relative performance of individual stocks against other comparable peer stocks, while taking little net market exposure. Portfolio Fund Managers typically use sophisticated quantitative trading models to implement their strategies. They buy stocks that their models forecast will outperform peer stocks and sell short those that are expected to underperform. The accuracy of these model forecasts for any single given stock tends to be low, so Portfolio Fund Managers generally build diversified portfolios of hundreds of stocks or more in an attempt to improve the aggregate predictive success of the strategy. Portfolio Funds are constructed to be close to market-neutral either on a dollar basis (meaning the total value of long positions is roughly equal to the short positions) or on a beta basis (meaning the sensitivity of the long positions to a move in the broad stock index is roughly equal in size to the sensitivity of the short positions). This means that relative price movements among stocks, rather than movements in the broad stock market index, will usually drive strategy returns. Portfolio Fund Managers also may choose to balance evenly their long and short portfolio exposure to other risk or style factors such as market capitalization, geography and sector exposure. Significant leverage may be applied to increase potential gains and losses.

Fixed-Income Relative Value. These strategies attempt to take advantage of pricing inefficiencies between similar or related fixed-income instruments. To execute this strategy, a Portfolio Fund Manager typically will invest in undervalued or higher yielding fixed-income instruments, while seeking to hedge some types of risk, such as interest rate risk, with offsetting short positions in lower yielding, fairly valued or overvalued instruments with similar characteristics. Mispricing in related fixed- income instruments can arise for microeconomic reasons, such as an imbalance in supply and demand for certain issues, or for macroeconomic reasons, such as central bank policy. Portfolio Funds have the potential to profit from a positive yield differential between a long position and its short hedge, as well as from any favorable price appreciation of the undervalued long position relative to the short position. The universe of fixed-income instruments is broad, is not limited to any range of maturity, and includes U.S. and foreign sovereign debt securities, mortgage-backed securities, asset-backed securities, corporate credit as well as related derivatives in all of these sectors. Such securities may be investment grade, below investment grade (commonly known as "junk bonds") and distressed. The use of derivatives such as swaps, futures and options is extensive. Significant leverage may be used to increase potential profits and losses.

Global Macro. Global macro strategies seek to generate returns by identifying mispriced assets around the world, using macroeconomic analysis. These Portfolio Funds have a broad authority to invest long or short across geographies, including both developed and emerging markets, as well as across asset classes, including equities, fixed-income, credit, currencies, physical commodities and derivatives of all of these. Some Portfolio Fund Managers may however choose to participate in only a subset of these markets based on their experience and expertise. Portfolio Fund Managers may analyze economic data, fiscal and monetary policy, asset valuations, price trends and other factors in determining their investment view. Portfolio Fund positions can be “directional” or “relative value”. Directional trades involve long or short positions that seek to participate in the absolute rise or fall in prices of individual markets. For example, a short position in gold futures would profit from an absolute decline in gold prices. In contrast, a relative value trade seeks to participate in the relative outperformance of one asset against another through a long position in one asset paired against a short position in another. For example, a position in 10-Year U.S. Treasury Notes and a short position in 10-Year Japanese Government Bonds would profit from the relative outperformance of U.S. against Japanese bonds. Global macro strategies may use significant leverage, especially in relative value positions. Such leverage may not be financial leverage involving borrowed money, but rather may be economic leverage that is implicit in derivative instruments.

See accompanying notes to financial statements

Steben Select Multi-Strategy Master Fund

Schedule of Investments, Continued

September 30, 2013 (Unaudited)

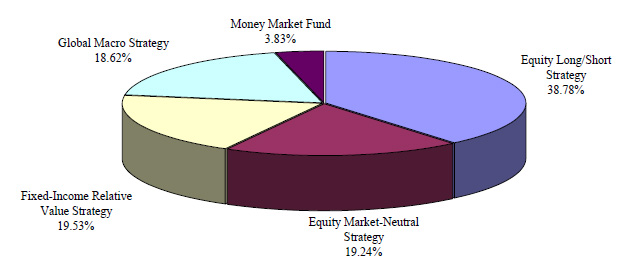

Strategy Allocation Breakdown

(as a % of total investments)

See accompanying notes to financial statements

Steben Select Multi-Strategy Master Fund

Notes to Financial Statements

September 30, 2013 (Unaudited)

(1) ORGANIZATION

Steben Select Multi-Strategy Master Fund (the “Master Fund”) is a newly-formed Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified closed-end management investment company and serves as a master fund in a master-feeder structure. The Master Fund has authorized unlimited common shares of beneficial interest (“Shares”), which may be issued in more than one class or series. Shares in the Master Fund are issued solely in private placement transactions that do not involve any “public offering” within the meaning of Section 4(2) of, and/or Regulation D under the Securities Act of 1933 (“Securities Act”). Investments in the Master Fund generally may be made only by U.S. and foreign investment companies or other investment vehicles that include persons who are “accredited investors” (“Shareholders”), as defined in Regulation D under the Securities Act.

The Master Fund’s objective is to seek capital appreciation with low long-term correlation to traditional public equity and fixed income markets. The Master Fund is a “fund of funds” and seeks to achieve its investment objective, primarily by allocating its assets, directly or indirectly, among investment partnerships, managed funds, securities, swaps and other assets held in segregated accounts and other investment funds, which may include investment funds commonly referred to as hedge funds, (collectively, “Portfolio Funds”) that are managed by third- party investment managers (“Portfolio Fund Managers”) that employ a variety of alternative investment strategies.

The Board of Trustees (the “Board” and each member a “Trustee”) is authorized to engage an investment adviser and it has selected Steben & Company, Inc. (the “Investment Manager”), to manage and oversee the Master Fund’s portfolio and operations, pursuant to an investment management agreement (the “Investment Management Agreement”). The Investment Manager is a Maryland corporation that is registered as an investment adviser under the Investment Advisers Act of 1940, as amended. Under the Investment Management Agreement, the Investment Manager is responsible for developing, implementing, and supervising the Master Fund’s investment program subject to the supervision of the Board.

Under the Master Fund’s organizational documents, the Master Fund’s Trustees and officers are indemnified against certain liabilities arising out of the performance of their duties to the Master Fund. In the normal course of business, the Master Fund enters into contracts with service providers, which also provide for indemnifications by the Master Fund. The Master Fund’s maximum exposure under these arrangements is unknown, as this would involve any future potential claims that may be made against the Master Fund.

(2) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND PRACTICES

(a) BASIS OF ACCOUNTING

The accounting and reporting policies of the Master Fund conform with U.S. generally accepted accounting principles (“U.S. GAAP”).

Steben Select Multi-Strategy Master Fund

Notes to Financial Statements

September 30, 2013 (Unaudited)

(2) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND PRACTICES (continued)

(b) VALUATION

The Master Fund will calculate its Net Asset Value (“NAV”) as of the close of regular trading on the New York Stock Exchange (ordinarily 4:00 P.M.) on the last business day of each calendar month and such other dates as the Board may determine, including in connection with repurchase of Shares, in accordance with the procedures and policies established by the Board. The NAV of the Master Fund will equal the value of the total assets of the Master Fund, less all of its liabilities, including accrued fees and expenses.

The Investment Manager’s Valuation Committee implements the valuation of the Master Fund’s investments, including interests in the Portfolio Funds, in accordance with written policies and procedures (the “Valuation Procedures”) that the Board of the Master Fund has approved for purposes of determining the value of securities held by the Master Fund, including the fair value of the Master Fund’s investments in Portfolio Funds. The Investment Manager’s Valuation Committee consists of members of the Board, additional officers of the Master Fund, and one or more representatives of the Investment Manager.

Investments are carried at fair value. The fair value of the Portfolio Funds has been estimated using the NAV as reported by the Portfolio Fund Managers of the respective Portfolio Funds. Financial Accounting Standards Board (“FASB”) guidance provides for the use of NAV as a “Practical Expedient” for estimating fair value of the Portfolio Funds. NAV reported by each Portfolio Fund is used as a practical expedient to estimate the fair value of the Master Fund’s interest therein and their classification within Level 2 or 3 is based on the Master Fund’s ability to redeem its interest in the near term and liquidate the underlying portfolios.

Certain securities and other financial instruments in which the Portfolio Funds invest may not have readily ascertainable market prices and will be valued by the Portfolio Fund Managers. Such valuations generally will be conclusive with respect to the Master Fund, even though a Portfolio Fund Manager may face a conflict of interest in valuing the securities, as their value will impact the Portfolio Fund Manager’s compensation. Generally, neither the Investment Manager nor the Board will be able to confirm independently the accuracy of the valuations made by the Portfolio Fund Managers. The net asset values or other valuation information received by the Investment Manager from the Portfolio Funds will typically be estimates only, subject to revision through the end of each Portfolio Fund’s annual audit. The valuations reported by the Portfolio Fund Managers, upon which the Master Fund willl calculate its NAV, may be subject to later adjustments based on information reasonably available at that time. To the extent that subsequently adjusted valuations or revisions to Portfolio Fund net asset values adversely affect the Master Fund’s NAV, the outstanding Shares of the Master Fund will be adversely affected by prior repurchases to the benefit of Shareholders who previously had Shares repurchased at a NAV per share higher than the adjusted amount. Conversely, any increases in the net asset value resulting from such subsequently adjusted valuations will be entirely for the benefit of the outstanding Shares and to the detriment of Shareholders who previously had Shares repurchased at a NAV per share lower than the adjusted amount.

Steben Select Multi-Strategy Master Fund

Notes to Financial Statements

September 30, 2013 (Unaudited)

(2) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND PRACTICES (continued)

(b) VALUATION (continued)

Under the Valuation Procedures, if the Master Fund, acting reasonably and in good faith, determines that a Portfolio Fund Manager cannot provide valuation of a Portfolio Fund or if the Master Fund determines that the valuation provided by a Portfolio Fund Manager does not represent the fair value of the Master Fund’s interest in a Portfolio Fund, the Master Fund may utilize any other reasonable valuation methodology to determine the fair value of the Portfolio Fund. Although redemptions of interests in Portfolio Funds normally are subject to advance notice requirements, Portfolio Funds typically will make available NAV information to holders representing the price at which, even in the absence of redemption activity, the Portfolio Fund would have effected a redemption if any such requests had been timely made or if, in accordance with the terms of the Portfolio Fund’s governing documents, it would be necessary to effect a mandatory redemption. In the absence of specific transaction activity in interests in a particular Portfolio Fund, the Master Fund would consider whether it was appropriate, in light of all relevant circumstances, to value such a position at its NAV as reported by the Portfolio Fund, or whether to adjust such value to reflect a premium or discount to such NAV.

In making a fair value determination, the Master Fund will consider all appropriate information reasonably available to it at the time and that the Investment Manager believes to be reliable. The Master Fund may consider factors such as, among others: (i) the price at which recent purchases for or redemptions of the Portfolio Fund’s interests were effected; (ii) information provided to the Master Fund by a Portfolio Fund Manager, or the failure to provide such information as the Portfolio Fund Manager agreed to provide in the Portfolio Fund’s offering materials or other agreements with the Master Fund; (iii) relevant news and other sources; and (iv) market events. In addition, when a Portfolio Fund imposes extraordinary restrictions on redemptions, or when there have been no recent subscriptions for Portfolio Fund interests, the Master Fund may determine that it is appropriate to apply a discount to the NAV reported by the Portfolio Fund. The Board reviews all valuation adjustments, which would be undertaken pursuant to the Board-approved policy and procedures.

To the extent that the Investment Manager invests the assets of the Master Fund in securities or other instruments that are not investments in Portfolio Funds (e.g., directly or through separate accounts), the Master Fund will generally value such assets as described below. Securities traded: (1) on one or more of the U.S. national securities exchanges or the OTC Bulletin Board will be valued at their last sales price; and (2) on the NASDAQ Stock Market will be valued at the NASDAQ Official Closing Price (“NOCP”), at the close of trading on the exchanges or markets where such securities are traded for the business day as of which such value is being determined. Securities traded on the NASDAQ Stock Market for which the NOCP is not available will be valued at the mean between the closing bid and asked prices in this market. Securities traded on a foreign securities exchange will generally be valued at their closing prices on the exchange where such securities are primarily traded and such valuations translated into U.S. dollars at the current exchange rate. If an event occurs between the close of the foreign exchange and the computation of the Master Fund’s NAV that would materially affect the value of the security, the value of such security will be adjusted to its fair value. Except as specified above, the value of a security, derivative, or synthetic security that is not actively traded on an

Steben Select Multi-Strategy Master Fund

Notes to Financial Statements

September 30, 2013 (Unaudited)

(2) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND PRACTICES (continued)

(b) VALUATION (continued)

exchange shall be determined by an unaffiliated pricing service that may use actual trade data or procedures using market indices, matrices, yield curves, specific trading characteristics of certain groups of securities, pricing models, or combinations of these. The Investment Manager’s Valuation Committee will monitor the value assigned to each security by the pricing service to determine if it believes the value assigned to a security is correct. If the Investment Manager’s Valuation Committee believes that the value received from the pricing service is incorrect, then the value of the security will be its fair value as determined in accordance with the Valuation Procedures. The Master Fund does not value derivative investments using notional amounts for purposes of determining the Master Fund’s net asset value.

(c) FAIR VALUE MEASUREMENTS

The Master Fund follows fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the period. These standards define fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value hierarchy is organized into three levels based upon the assumptions (referred to as “inputs”) used in pricing the asset or liability. These standards state that “observable inputs” reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from independent sources and “unobservable inputs” reflect an entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability. These inputs are summarized in the three broad levels listed below:

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities that the Master Fund has the ability to access.

Level 2 - Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly or investments that cannot be fully redeemed at the NAV in the “near term”. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Master Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available or investments that cannot be fully redeemed at the NAV in the “near term”; these are investments that generally have one or more of the following characteristics: gated redemptions, suspended redemptions, or have lock-up periods greater than quarterly (or monthly for underlying investments where the Master Fund owns more than 25% of the Portfolio Fund’s total net assets).

Steben Select Multi-Strategy Master Fund

Notes to Financial Statements

September 30, 2013 (Unaudited)

(2) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND PRACTICES (continued)

(c) FAIR VALUE MEASUREMENTS (continued)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in these securities. See Note 3 – Investments.

The Master Fund invests in Portfolio Funds, and classifies those investments as Level 2 or Level 3 depending on the Master Fund’s ability to redeem its interest in the near term. Portfolio Fund investments for which the Master Fund can liquidate its investment within 90 days are classified as Level 2.

(d) CASH EQUIVALENTS

The Master Fund considers all unpledged temporary cash investments of sufficient credit quality with a maturity date at the time of purchase of three months or less to be cash equivalents.

(e) INVESTMENT INCOME RECOGNITION

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis and dividends are recorded on the ex-dividend date. Realized and unrealized gains and losses are included in the determination of income.

(f) FEDERAL INCOME TAXES

The Master Fund intends to comply with the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”) in order to qualify as a regulated investment company (“RIC”). If so qualified, the Master Fund will not be subject to federal income tax to the extent it distributes substantially all of its net investment income and net capital gains to its shareholders.

The Master Fund has adopted financial reporting rules regarding recognition and measurement of tax positions taken or expected to be taken on a tax return. Management has reviewed all open tax years and major jurisdictions and concluded that no provision for income tax would be required in the Master Fund’s financial statements. The Master Fund’s Federal and state income and Federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

(g) USE OF ESTIMATES

The preparation of the statement of assets and liabilities in accordance with U.S. GAAP requires management to make estimates and assumptions relating to the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates and such differences may be significant.

Steben Select Multi-Strategy Master Fund

Notes to Financial Statements

September 30, 2013 (Unaudited)

(2) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND PRACTICES (continued)

(h) ORGANIZATION AND OFFERING COSTS

Organizational expenses consist primarily of costs to establish the Master Fund and enable it to legally conduct business. Under an operating services agreement (the “Operating Services Agreement”), the Investment Manager shall pay all expenses incurred by the Master Fund in connection with the organization and offering of Shares of the Master Fund. These expenses may not be recouped by the Investment Manager.

(i) FUND EXPENSES

Pursuant to the Operating Services Agreement with the Master Fund, the Investment Manager has contractually agreed to pay all of the Master Fund’s ordinary operating expenses so long as Steben & Company, Inc. remains the Investment Manager, including the Master Fund’s organizational and offering expenses but not the following Master Fund expenses: the Management Fee, borrowing costs, interest expenses, brokerage commissions and other transaction and investment-related costs, portfolio fund and portfolio fund manager fees and expenses, taxes and governmental fees, acquired fund fees and expenses, shareholder servicing fees, litigation and indemnification expenses, judgments and other extraordinary expenses not incurred in the ordinary course of the Master Fund’s business. The Operating Services Agreement may be terminated at any time by the Board or upon 60 days written notice by the Master Fund or the Investment Manager. See Note 6 – Related Party Transactions.

(j) SHAREHOLDER ACCOUNTS

Prior to the end of each month, the Master Fund receives Shareholder contributions with an effective subscription date of the first day of the following month.

The Master Fund, in turn, makes contributions to certain Portfolio Funds, which have effective subscription dates of the first day of the following month. These amounts are reported as "Subscriptions received in advance" and "Investments made in advance", respectively.

(k) DISTRIBUTION POLICY

Dividends will generally be paid at least annually on the Master Fund’s Shares in amounts representing substantially all of the net investment income, if any, earned each year. Payments will vary in amount, depending on investment income received and expenses of operation. It is likely that many of the Portfolio Funds in whose securities the Master Fund invests will not pay any dividends, and this, together with the Master Fund’s expenses, means that there can be no assurance the Master Fund will have substantial income or pay dividends.

It is anticipated that any gains or appreciation in the Master Fund’s investments will be treated as ordinary income. Such amounts will generally be distributed at least annually and such distributions would be taxed as ordinary income dividends to Shareholders that are subject to tax.

It is anticipated that substantially all of any taxable net capital gain realized on investments will be paid to Shareholders at least annually. The NAV per share (or portion

Steben Select Multi-Strategy Master Fund

Notes to Financial Statements

September 30, 2013 (Unaudited)

(2) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND PRACTICES (continued)

(k) DISTRIBUTION POLICY (continued)

thereof) that a Shareholder owns will be reduced by the amount of the distributions or dividends that the Shareholder actually or constructively receives from that share (or portion thereof).

Pursuant to a dividend reinvestment plan established by the Master Fund (the “Dividend Reinvestment Plan”), each Shareholder will automatically be a participant under the Dividend Reinvestment Plan and have all income distributions, whether dividend distributions and/or capital gains distributions, automatically reinvested in additional Shares. Election not to participate in the Dividend Reinvestment Plan and to receive all income distributions, whether dividend distributions or capital gain distributions, in cash may be made by notice to a Shareholder’s intermediary (who should be directed to inform the Maser Fund). A Shareholder is free to change this election at any time. If however, a Shareholder requests to change its election with 95 days prior to a distribution. the request will be effective only with respect to distributions after the 95-day period. A Shareholder whose Shares are registered in the name of a nominee (such as an Intermediary) must contact the nominee regarding its status under the Dividend Reinvestment Plan, including whether such nominee will participate on such Shareholder’s behalf as such nominee will be required to make any such election.

Generally, for U.S. federal income tax purposes, Shareholders receiving Shares under the Dividend Reinvestment Plan will be treated as having received a distribution equal to the amount payable to them in cash as a distribution had the Shareholder not participated in the Dividend Reinvestment Plan.

Shares will be issued pursuant to the dividend reinvestment plan at their NAV determined on the next valuation date following the record date (the last date of a dividend period on which an investor can purchase Shares and still be entitled to receive the dividend). There is no sales load or other charge for reinvestment. A request must be received by the Master Fund before the record date to be effective for that dividend or capital gain distribution. The Master Fund may terminate the Dividend Reinvestment Plan at any time upon written notice to the participants in the Dividend Reinvestment Plan. The Master Fund may amend the Dividend Reinvestment Plan at any time upon 30 day’s written notice to the participants. Any expenses of the Dividend Reinvestment Plan will be borne by the Master Fund.

(3) INVESTMENTS

The following are the classes of investments grouped by the fair value hierarchy for those investments measured at fair value on a recurring basis at September 30, 2013. The Portfolio Funds below were valued using the practical expedient:

Steben Select Multi-Strategy Master Fund

Notes to Financial Statements

September 30, 2013 (Unaudited)

(3) INVESTMENTS (continued)

| | | Quoted Prices in | | Significant Other | | | | | |

| | | Active Markets for | | Observable | | Significant | | | |

| | | Identical Assets | | Inputs | | Unobservable Inputs | | | |

| Description | | (Level 1) | | (Level 2) | | (Level 3) | | Total | |

| Portfolio Funds | | | | | | | | | |

Equity Long/Short Strategy | | $ | - | | $ | 2,022,863 | | $ | | | $ | 2,022,863 | |

| Equity Market-Neutral Strategy | | | - | | | 1,003,417 | | | - | | | 1,003,417 | |

| Fixed-Income Relative Value Strategy | | | - | | | 1,018,702 | | | - | | | 1,018,702 | |

| Global Macro Strategy | | | - | | | 971,273 | | | - | | | 971,273 | |

| Total Portfolio Funds | | | - | | | 5,016,255 | | | - | | | 5,016,255 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Short-Term Investment | | | 200,011 | | | - | | | - | | | 200,011 | |

| | | | | | | | | | | | | | |

| Total Investments | | $ | 200,011 | | $ | 5,016,255 | | $ | - | | $ | 5,216,266 | |

The Master Fund discloses transfers between levels based on valuations at the end of the reporting period. From August 1, 2013 (commencement of operations) to September 30, 2013, there were no transfers in or out of Level 1, Level 2 or Level 3 of the fair value hierarchy. Transfers between Levels 2 and 3 in the fair value hierarchy generally relate to changes in liquidity provisions of the Portfolio Funds.

In December 2011, the FASB issued Accounting Standards Update (“ASU”) No. 2011-11 “Disclosures about Offsetting Assets and Liabilities.” ASU No. 2011-11 requires disclosures to make financial statements that are prepared under U.S. GAAP more comparable to those prepared under IFRS. The new disclosure requirements mandate that entities disclose both gross and net information about instruments and transactions eligible for offset in the Statement of Assets and Liabilities as well as instruments and transactions subject to an agreement similar to a master netting arrangement. In addition, ASU No. 2011-11 requires disclosure of collateral received and posted in connection with netting agreements or similar arrangements. New disclosures are required for annual reporting periods beginning on or after January 1, 2013 and interim periods within those annual periods.

In January 2013, the FASB issued ASU No. 2013-01 “Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities.” ASU No. 2013-01 clarifies that ordinary trade receivables and payables are not included in the scope of ASU No. 2011-11. ASU No. 2011-11 applies only to derivatives, repurchase agreements and reverse repurchase agreements, and securities borrowing and lending that are offset in accordance with specific criteria contained in the FASB Accounting Standards Codification.

The Master Fund is not required to disclose the applicable requirements of this accounting standard in its Statement of Assets and Liabilities due to not directly investing in derivatives and other financial instruments. As such, no additional disclosures have been made on behalf of the Master Fund.

Steben Select Multi-Strategy Master Fund

Notes to Financial Statements

September 30, 2013 (Unaudited)

(4) INVESTMENT RISKS AND UNCERTAINTIES

Portfolio Funds consist of non-traditional, not readily marketable investments, some of which may be structured as offshore limited partnerships, venture capital funds, hedge funds, private equity funds and common trust funds. The underlying investments of such funds, whether invested in stock or other securities, are generally not currently traded in a public market and typically are subject to restrictions on resale. Values determined by Portfolio Fund Managers and general partners of underlying securities that are thinly traded or not traded in an active market may be based on historical cost, appraisals, a review of the investees’ financial results, financial condition and prospects, together with comparisons to similar companies for which quoted market prices are available or other estimates that require varying degrees of judgment.

Investments are carried at fair value provided by the respective Portfolio Fund Managers. Because of the inherent uncertainty of valuations, the estimated fair values may differ from the values that would have been used had a ready market for such investments existed or had such investments been liquidated, and those differences could be material.

(5) CONCENTRATION, LIQUIDITY AND OFF-BALANCE SHEET RISK

The Master Fund Invests primarily in Portfolio Funds that are not registered under the 1940 Act and invest in actively traded securities, illiquid securities, derivatives and other financial instruments using different strategies and investment techniques, including leverage, which may involve significant risks. These Portfolio Funds may invest a high percentage of their assets in specific sectors of the market in order to achieve a potentially greater investment return. As a result, the Portfolio Funds may be more susceptible to economic, political, and regulatory developments in a particular sector of the market, positive or negative, and may experience increased volatility of the Portfolio Funds' net asset value.

Various risks are also associated with an investment in the Master Fund, including risks relating to the fund-of-funds structure of the Master Fund, risks relating to compensation arrangements and risks relating to limited liquidity, as described below.

Redemption restrictions exist for Portfolio Funds whereby the Portfolio Fund Managers may suspend redemption either in their sole discretion or other factors. Such factors include the magnitude of redemptions requested, portfolio valuation issues or market conditions.

In the normal course of business, the Portfolio Funds in which the Master Fund invests trade various financial instruments and enter into various investment activities with off-balance sheet risk. These include, but are not limited to, short selling activities, writing option contracts, contracts for differences, and interest rate, credit default and total return equity swap contracts. The Master Fund's risk of loss in these Portfolio Funds is limited to the value of its own investments reported in these financial statements by the Master Fund. The Master Fund itself does not invest directly in securities with off-balance sheet risk.

Steben Select Multi-Strategy Master Fund

Notes to Financial Statements

September 30, 2013 (Unaudited)

(6) RELATED PARTY TRANSACTIONS

(a) INVESTMENT MANAGEMENT FEE

Under the terms of the Investment Management Agreement between the Investment Manager and the Master Fund, the Investment Manager is entitled to receive a management fee at an annualized rate, based on the month-end net assets (excluding any liabilities related to borrowings) of the Master Fund of 1.25%, accrued and payable monthly. Since the commencement of operations on August 1, 2013 through September 30, 2013, the Master Fund incurred $9,740 in management fees.

(b) OPERATING SERVICES FEE

The Master Fund pays to the Investment Manager, as compensation for the services provided by the Investment Manager and its agents under the Operating Services Agreement, an annualized fee of 0.15%, which is paid monthly, based on the month-end net assets of the Master Fund. Since the commencement of operations on August 1, 2013 through September 30, 2013, the Master Fund incurred $1,169 in operating services fees.

(7) COMPENSATION FOR TRUSTEES

The independent Trustees are paid annual compensation for service on the Board and its Committees in an annual amount of $15,000 each. Such compensation encompasses attendance and participation at Board and Committee meetings, including telephonic meetings, if any. There are currently two independent Trustees. The Audit Committee Chairman and the Audit Committee Financial Expert also receives an annual amount of $15,000. In the interest of recruiting and retaining independent Trustees of high quality, the Board intends to periodically review such compensation and may modify it as the Board deems appropriate. In addition, the Master Fund reimburses each independent Trustee for travel and other expenses incurred in connection with attendance at such meetings. Other Officers (apart from the CCO) and Trustees of the Master Fund who are “interested persons” by virtue of their affiliation with the Investment Manager receive no compensation in such role.

(8) INVESTMENT TRANSACTIONS

Since the commencement of operations on August 1, 2013 through September 30, 2013 (excluding short-term securities), the aggregate purchases of investments were $5,000,000 and sales of investments were $0. The Master Fund did not purchase long-term U.S. Government securities as a part of its investment strategy since the commencement of operations on August 1, 2013 through September 30, 2013.

(9) SUBSEQUENT EVENTS

The Master Fund has adopted financial reporting rules regarding subsequent events, which requires an entity to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed at the date of the balance sheet. Management has evaluated the Master Fund’s related events and transactions that occurred subsequent to September 30, 2013 and determined that there were no significant subsequent events that would require adjustment to or additional disclosure in these financial statements.

Steben Select Multi-Strategy Master Fund

Financial Highlights

| | | |

| | Period from August 1, 2013(Commencement of Operations) through | |

| | September 30, 2013 (1) | |

| | | |

| PER SHARE OPERATING PERFORMANCE | | |

| Net Asset Value, beginning of period | $10.00 | |

| | | |

| Loss from investment operations: | | |

| Net Investment Loss | (0.02) | |

| Net Realized and Unrealized Gain on Investments | 0.00 | |

| Net Asset Value, end of period | $9.98 | |

| | | |

| TOTAL RETURN - NET | (0.20)% (2) | |

| RATIOS/SUPPLEMENTAL DATA | | |

| Net Assets, end of period ($000's) | $5,205 | |

| Portfolio Turnover | 0.00% (2) | |

| | | |

| Ratio of Net Investment Loss to Average Net Assets | (1.40)% (3) | |

| | | |

| Ratio of Expenses to Average Net Assets | 1.40% (3) | |

Net investment loss per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences.

The ratios above do not include the proportionate share of income or loss from its investment in other funds.

The ratio of expenses to average net assets do not include expenses of the Portfolio Funds in which the Master Fund invests.

Due to the timing of capital share transactions, the per share amount of loss from investment operations varies from amounts shown in the statement of operations.

(1) Unaudited.

(2) Not Annualized.

(3) Annualized.

See accompanying notes to financial statements

Approval of Investment Management Agreement

Overview | At an organizational meeting held on July 18, 2013, the Board of Trustees for the Steben Select Multi-Strategy Master Fund (“Master Fund”), including its independent Trustees, approved the investment management agreement (the “Agreement”) between the Master Fund and Steben & Company, Inc. (“Investment Manager” or “Steben”).

In preparation for review of the Agreement, the Board requested the Investment Manager provide substantial and detailed information which the Board determined to be reasonably necessary to evaluate the Agreement. The Investment Manager provided information relevant to the approval of the Agreement, including: (1) the nature and extent of the advisory and other services to be provided to the Master Fund by Steben; (2) Steben’s experience and personnel; (3) Steben’s financial condition; (4) information regarding the underlying Portfolio Funds, including their past performance; (5) the proposed advisory fee rates for the Master Fund; (6) benefits to be realized by Steben; and (7) the estimated profits and losses to Steben under the Agreement. The Board also received a presentation by the proposed portfolio management and research and due diligence teams addressing Steben’s investment philosophies, investment strategies, personnel and operations as they relate to the Master Fund.

The Trustees used this information, as well as other information that the Investment Manager and other service providers submitted to the Board, to help them decide whether to approve the Agreement. The Board posed questions to various management personnel of Steben regarding certain key aspects of the materials submitted in support of the approval of the Agreement. The Board also received a detailed memorandum from K&L Gates, counsel to the independent Trustees, regarding the responsibilities of the Board members in connection with their consideration of the Agreement.

With respect to the approval of the Agreement, the Board considered the overall fairness of the Agreement and factors it deemed relevant with respect to the Master Fund, including, but not limited to: (1) the nature, extent and quality of services to be provided to the Master Fund; (2) the investment performance of the underlying Portfolio Funds; (3) the costs of the services to be provided to the Master Fund and the expected profits and losses to be realized by Steben from its relationship with the Master Fund; (4) the extent to which economies of scale will be realized as the Master Fund grows; (5) whether the level of fee rates reflects those economies of scale for the benefit of Master Fund investors; (6) comparisons of services and fees with contracts entered into by Steben with other clients (such as pension funds and other institutional investors); and (7) any other benefits derived by Steben from its relationship with the Master Fund.

As discussed below, the Board considered many factors and a significant amount of information in evaluating whether the Agreement and the fees provided therein with respect to the Master Fund should be approved. The Board was advised by independent legal counsel with respect to its deliberations regarding the approval of the Agreement. The discussion below is not intended to be all-inclusive or intended to touch on every fact that the Board took into consideration regarding the approval of the Agreement. The determination to approve the Agreement was made on the basis of each Trustee’s business judgment after consideration of all the information presented. It is important to recognize that individual Trustees may have given different weight to certain factors and assigned various degrees of materiality to information received in connection with the approval process.

Nature, Extent and Quality of Advisory Services | The Board reviewed Steben’s investment strategies for the Master Fund. The Board considered that Steben will be responsible for making investment decisions on behalf of the Master Fund and noted Steben’s robust due diligence process and team to evaluate underlying Portfolio Funds. In this connection, the Board considered information regarding the background and experience of key investment personnel; Steben’s focus on complex asset categories; Steben’s experience as a sponsor of multi-manager alternative investment products; the depth and experience Steben personnel have in investment and operational due diligence; Steben’s investment process, analysis and monitoring of the underlying Portfolio Funds; the Investment Manager’s significant compliance and tax reporting effort; and Steben’s oversight of sales. The Board also considered financial information regarding Steben.

The Board considered that Steben will be responsible for oversight of compliance with the Master Fund’s policies and objectives, oversight of the Master Fund’s compliance with applicable law, and implementation of Board directives as they relate to the Master Fund. The Board noted that Steben would oversee and interact with the Master Fund’s service providers.

The Board concluded that the nature, extent and quality of the management and advisory service to be provided were appropriate and thus supported a decision to approve the Agreement.

Investment Performance | With respect to the Master Fund, the Board considered the performance of each of the intended initial underlying Portfolio Funds and various indices. On the basis of the Board’s assessment, the Board concluded that the Investment Manager was capable of generating a level of investment performance that is appropriate in light of the Master Fund’s investment objectives, policies and strategies.

Costs of Advisory Services and Level of Profitability | The Board considered the proposed advisory fee rate payable by the Master Fund to Steben under the Agreement, comparisons to the advisory fee rates of comparable funds, comparisons to the fee rate Steben receives on its pooled funds, the projected expense ratio of the Master Fund and the expense ratio of comparable funds. In addition, the Board noted the proposed operating agreement between the Master Fund and Steben would serve as a contractual expense limitation.

The Board evaluated the Investment Manager’s projected costs, profits and losses in providing services to the Master Fund. The Board noted that Steben projected losses relating to the services it will provide to the Master Fund. In analyzing the cost of services and profitability of the Investment Manager, the Board considered the potential revenues earned and expenses, noting that the analysis necessarily was based on estimates and projections of Master Fund asset accumulation, and that the Board would be able to make a much more complete assessment following the commencement of actual operations following the initial two-year period of the Agreement. The Board took into account the significant investment by and cost to the Investment Manager regarding service infrastructure to support the Master Fund and its investors.

On the basis of the Board’s review of the fees to be charged by the Investment Manager for investment advisory and related services, the relatively unique, and highly specialized nature of the Master Fund’s investment program, the Investment Manager’s financial information, and the estimated costs associated with managing the Master Fund, the Board concluded that the level of investment management fees is appropriate in light of the services to be provided, the management fees and estimated overall expense ratios of comparable investment companies, and the cap on expenses established by an operating services agreement.

Economies of Scale | While noting that the management fees will not decrease as the level of Master Fund assets increase, the Board concluded that the management fees are reasonable, reflect the Master Fund’s complex operations, and that the Master Fund is initially organized and starting up operations. The Board noted that it will have the opportunity to periodically re-examine whether the Master Fund have achieved economies of scale, as well as the appropriateness of management fees payable to the Investment Manager, in the future.

Benefits | In evaluating compensation, the Board considered other benefits that may be realized by the Investment Manager from its relationship with the Master Fund. In this connection, the Board noted, among other things, that Steben will receive compensation through an operating services agreement and pay all of the Master Fund’s operating expenses. The Board noted that the Investment manager would not realize “soft dollar” benefits from its relationship with the Master Fund. The Board concluded that other benefits derived by the Investment Manager from its relationship with the Master Fund, to the extent such benefits are identifiable or determinable, are reasonable and fair, result from the provision of appropriate services to the Master Fund and its investors, and are consistent with industry practice and the best interests of the Master Fund and its shareholders.

Other Considerations | The Board determined that the Investment Manager has made a substantial commitment both to the recruitment and retention of high quality personnel, monitoring and investment decision-making and provision of investor service, and as well as the financial, compliance and operational resources reasonably necessary to manage the Master Fund in a professional manner that is consistent with the best interests of the Master Fund and its shareholders.

Additional Information

Proxy Voting Policies and Procedures

A description of the policies and procedures that the Master Fund uses to determine how to vote proxies relating to portfolio securities, as well as information on how the Master Fund voted proxies (if any) relating to portfolio securities during the most recent 12-month period ended June 30 after commencement of operations will be available on Form N-PX without charge by calling 1-800-726-3400, or on the SEC’s website at http://www.sec.gov.

Portfolio Holdings Disclosure

The Master Fund will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Master Fund’s Forms N-Q will be available on the SEC’s website at www.sec.gov, and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-732-0330.

Item 2. Code of Ethics.

Item 3. Audit Committee Financial Expert.

Item 4. Principal Accountant Fees and Services.

Item 5. Audit Committee of Listed Registrants.

Item 6. Investments.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Item 11. Controls and Procedures.

Item 12. Exhibits.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Kenneth E. Steben, Chief Executive Officer

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

Kenneth E. Steben, Chief Executive Officer