As filed with the U.S. Securities and Exchange Commission on June 3, 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-22872

Steben Select Multi-Strategy Master Fund

(Exact name of registrant as specified in charter)

9711 Washingtonian Blvd.

Suite 400

Gaithersburg, Maryland 20878

(Address of principal executive offices) (Zip code)

Francine J. Rosenberger, Esq.

c/o Steben & Company, Inc.

9711 Washingtonian Blvd.

Suite 400

Gaithersburg, Maryland 20878

(Name and address of agent for service)

(240) 631-7600

Registrant’s telephone number, including area code

Date of fiscal year end:March 31

Date of reporting period:March 31, 2019

Item 1. Reports to Stockholders.

| Annual Report

March 31, 2019 |

Steben Select Multi-Strategy Master Fund

Advised By:

Steben & Company, Inc.

9711 Washingtonian Blvd.

Suite 400

Gaithersburg,MD 20878

240.631.7600

www.steben.com

Table of Contents

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Trustees

Steben Select Multi-Strategy Master Fund:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Steben Select Multi-Strategy Master Fund (the Master Fund), including the schedule of investments, as of March 31, 2019, the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the related notes (collectively, the financial statements) and the financial highlights for each of the years in the five-year period then ended. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Master Fund as of March 31, 2019, the results of its operations and cash flows for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Master Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Master Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Such procedures also included confirmation of securities owned as of March 31, 2019, by correspondence with custodians, investees and transfer agents. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

Emphasis of Matter

As discussed in Note 1 to the financial statements, the Board of Trustees of the Master Fund has approved the closure and commencement of liquidation of the Master Fund, whereby the Master Fund has ceased its investment operations and commenced liquidation of its assets (the “Liquidation”) on March 4, 2019. In light of the Master Funds’ portfolio holdings, the Master Fund currently anticipates that the Liquidation will be complete by mid-year 2019. Our opinion is not modified with respect to this matter.

We have served as the auditor of one or more Steben investment companies since 2014.

Columbus, Ohio

May 24, 2019

| Steben Select Multi-Strategy Master Fund | 1 | AnnualReport to Shareholders |

Steben Select Multi-Strategy Master Fund

Statement of Assets and Liabilities

March 31, 2019

| ASSETS | | | |

| Investments in Portfolio Funds, at fair value (cost $3,428,961) | | $ | 4,121,790 | |

| Short-term investments (cost $428,762) | | | 428,762 | |

| Receivable for investments sold | | | 37,825,970 | |

| Dividends receivable | | | 954 | |

| | | | | |

| Total Assets | | | 42,377,476 | |

| | | | | |

| LIABILITIES | | | | |

| Investment management fees payable | | | 58,605 | |

| Accrued operating services fee payable | | | 7,034 | |

| Redemptions payable | | | 33,738,717 | |

| | | | | |

| Total Liabilities | | | 33,804,356 | |

| | | | | |

| NET ASSETS | | $ | 8,573,120 | |

| | | | | |

| Shares outstanding | | | | |

| ($0.01 par value; unlimited shares authorized) | | | 800,729 | |

| | | | | |

| Net asset value per share (net assets/shares outstanding) | | $ | 10.71 | |

| | | | | |

| COMPONENTS OF NET ASSETS | | | | |

| Paid in capital | | $ | 11,324,704 | |

| Total distributable earnings (deficit) | | | (2,751,584 | ) |

| Net Assets | | $ | 8,573,120 | |

| | | | | |

See accompanying Notes to Financial Statements.

| Steben Select Multi-Strategy Master Fund | 2 | AnnualReport to Shareholders |

Steben Select Multi-Strategy Master Fund

Statement of Operations

For the Year Ended March 31, 2019

| INVESTMENT INCOME | | | |

| Dividend income | | $ | 59,114 | |

| | | | | |

| EXPENSES | | | | |

| Investment management fees (Note 6) | | | 741,359 | |

| Operating services fee (Note 6) | | | 88,974 | |

| | | | | |

| Total Expenses | | | 830,333 | |

| | | | | |

| Net Investment Loss | | | (771,219 | ) |

| | | | | |

| NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | |

| Net realized gain on investments(a) | | | 9,507,378 | |

| Net change in unrealized appreciation/depreciation on investments | | | (9,275,199 | ) |

| Net Realized and Unrealized Gain on Investments | | | 232,179 | |

| | | | | |

| Net Decrease in Net Assets from Operations | | $ | (539,040 | ) |

| | | | | |

(a)Includes realized gains on in-kind transactions of $1,598,195.

See accompanying Notes to Financial Statements.

| Steben Select Multi-Strategy Master Fund | 3 | AnnualReport to Shareholders |

Steben Select Multi-Strategy Master Fund

Statements of Changes in Net Assets

| | | Year Ended

March 31, 2019 | | | Year Ended

March 31, 2018 | |

| FROM OPERATIONS | | | | | | | | |

| Net investment loss | | $ | (771,219 | ) | | $ | (847,239 | ) |

| Net realized gain on investments | | | 9,507,378 | | | | 1,215,716 | |

| Change in unrealized appreciation/depreciation on investments | | | (9,275,199 | ) | | | 1,808,594 | |

| Net Increase (Decrease) in Net Assets from Operations | | | (539,040 | ) | | | 2,177,071 | |

| | | | | | | | | |

| FROM DISTRIBUTIONS | | | | | | | | |

| Distributions to Shareholders | | | — | | | | (1,630,585 | ) |

| | | | | | | | | |

| FROM CAPITAL TRANSACTIONS | | | | | | | | |

| Proceeds from sales of shares | | | 2,750,000 | | | | 3,740,000 | |

| Proceeds from reinvestment of distributions | | | — | | | | 1,630,585 | |

| In-kind redemptions of hedge fund investments | | | (13,890,810 | ) | | | — | |

| Redemptions | | | (41,343,791 | ) | | | (8,450,000 | ) |

| Net Decrease in Net Assets from Capital Transactions | | | (52,484,601 | ) | | | (3,079,415 | ) |

| | | | | | | | | |

| Total Decrease in Net Assets | | | (53,023,641 | ) | | | (2,532,929 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 61,596,761 | | | | 64,129,690 | |

| End of year | | $ | 8,573,120 | | | $ | 61,596,761 | |

| | | | | | | | | |

| SHARE TRANSACTIONS | | | | | | | | |

| Shares sold | | | 259,034 | | | | 341,726 | |

| Shares reinvested | | | — | | | | 150,018 | |

| Shares redeemed in-kind | | | (1,297,402 | ) | | | — | |

| Shares redeemed | | | (3,880,641 | ) | | | (790,885 | ) |

| Total share transactions | | | (4,919,009 | ) | | | (299,141 | ) |

| | | | | | | | | |

See accompanying Notes to Financial Statements.

| Steben Select Multi-Strategy Master Fund | 4 | AnnualReport to Shareholders |

Steben Select Multi-Strategy Master Fund

Statement of Cash Flows

For the Year Ended March 31, 2019

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

| Net decrease in net assets from operations | | $ | (539,040 | ) |

| Adjustments to reconcile net decrease in net assets resulting from operations to net cash provided by operating activities: | | | | |

| Purchases of investments | | | (14,906,640 | ) |

| Sales of investments | | | 52,937,950 | |

| Net sales of short-term investments | | | 4,321,428 | |

| Change in unrealized appreciation/depreciation on investments | | | 9,275,199 | |

| Net realized gain on investments | | | (9,507,378 | ) |

| | | | | |

| Changes in operating assets and liabilities: | | | | |

| Investments made in advance | | | 2,000,000 | |

| Receivable for investments sold | | | (37,825,970 | ) |

| Dividends receivable | | | 6,876 | |

| Investment management fees payable | | | (6,564 | ) |

| Accrued operating services fee payable | | | (787 | ) |

| Net cash provided by Operating Activities | | | 5,755,074 | |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | |

| Proceeds from sales of shares | | | 2,750,000 | |

| Redemptions, net of change in redemptions payable | | | (8,505,074 | ) |

| Net Cash used in Financing Activities | | | (5,755,074 | ) |

| | | | | |

| Change in Cash | | | — | |

| | | | | |

| CASH | | | | |

| Beginning of year | | | — | |

| End of year | | $ | — | |

| | | | | |

| NON-CASH FINANCING ACTIVITIES | | | | |

| In-kind redemptions of hedge fund investments | | $ | 13,890,810 | |

See accompanying Notes to Financial Statements.

| Steben Select Multi-Strategy Master Fund | 5 | AnnualReport to Shareholders |

Steben Select Multi-Strategy Master Fund

Schedule of Investments

March 31, 2019

| Investments in Portfolio Funds(1): | | Percentage

of Net

Assets | | Cost | | | Fair Value | | | Redemption Frequency | | Notice

Period

Number

of Days | |

| Fixed-Income Relative Value Strategy: | | | | | | | | | | | | | | | | | | |

| The Obsidian (Offshore) Fund – Class V Master Series, 2,218 shares(2) | | | 48.08 | % | | $ | 3,428,961 | | | $ | 4,121,790 | | | Monthly | | | 60 | |

| | | | | | | | | | | | | | | | | | | |

| Total Investments in Portfolio Funds: | | | 48.08 | | | | 3,428,961 | | | | 4,121,790 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Short-term investments: | | | | | | | | | | | | | | | | | | |

| Money Market Fund: | | | | | | | | | | | | | | | | | | |

| STIT-Government & Agency Portfolio - Institutional Class (428,762 shares), 2.32%(3)(4) | | | 5.00 | | | | 428,762 | | | | 428,762 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Total Investments in Portfolio Funds and Short-term investments | | | 53.08 | % | | $ | 3,857,723 | | | $ | 4,550,552 | | | | | | | |

(1) All Portfolio Funds are non-income producing.

(2) Offshore Portfolio Fund.

(3) Annualized 7-Day Yield.

(4) Income Producing.

See accompanying Notes to Financial Statements.

| Steben Select Multi-Strategy Master Fund | 6 | AnnualReport to Shareholders |

Steben Select Multi-Strategy Master Fund

Portfolio Fund Strategies

March 31, 2019 (Unaudited)

Fixed-Income Relative Value.These strategies attempt to take advantage of pricing inefficiencies between similar or related fixed-income instruments. To execute this strategy, a Portfolio Fund Manager typically will invest in undervalued or higher yielding fixed-income instruments, while seeking to hedge some types of risk, such as interest rate risk, with offsetting short positions in lower yielding, fairly valued or overvalued instruments with similar characteristics. Mispricing in related fixed-income instruments can arise for microeconomic reasons, such as an imbalance in supply and demand for certain issues, or for macroeconomic reasons, such as central bank policy. Portfolio Funds have the potential to profit from a positive yield differential between a long position and its short hedge, as well as from any favorable price appreciation of the undervalued long position relative to the short position. The universe of fixed-income instruments is broad, is not limited to any range of maturity, and includes U.S. and foreign sovereign debt securities, mortgage-backed securities, asset-backed securities, corporate credit as well as related derivatives in all of these sectors. Such securities may be investment grade, below investment grade (commonly known as "junk bonds") and distressed. The use of derivatives such as swaps, futures and options is extensive. Significant leverage may be used to increase potential profits and losses.

| Steben Select Multi-Strategy Master Fund | 7 | AnnualReport to Shareholders |

Steben Select Multi-Strategy Master Fund

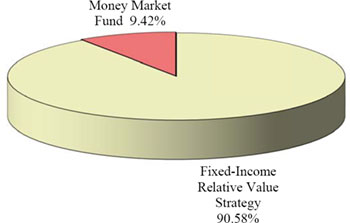

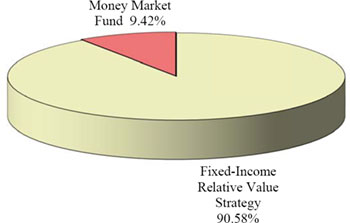

Strategy Allocation Breakdown

March 31, 2019 (Unaudited)

| Strategy Allocation Breakdown (Unaudited) |

| (as a % of total investments) |

| March 31, 2019 |

| Steben Select Multi-Strategy Master Fund | 8 | AnnualReport to Shareholders |

Steben Select Multi-Strategy Master Fund

Notes to Financial Statements

March 31, 2019

1. Organization

Steben Select Multi-Strategy Master Fund (the “Master Fund”) is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified closed-end management investment company and serves as a master fund in a master-feeder structure. Steben Select Multi-Strategy Partners, LP serves as a feeder fund in the master-feeder structure. The Master Fund has authorized unlimited common shares of beneficial interest (“Shares”), which may be issued in more than one class or series. Shares in the Master Fund are issued solely in private placement transactions that do not involve any “public offering” within the meaning of Section 4(2) of, and/or Regulation D under the Securities Act of 1933 (“Securities Act”). Investments in the Master Fund generally may be made only by U.S. and foreign investment companies or other investment vehicles that include persons who are “accredited investors” (“Shareholders”), as defined in Regulation D under the Securities Act.

The Board of Trustees of the Master Fund (the “Board”) has approved the closure and commencement of liquidation of the Master Fund, whereby the Master Fund has ceased its investment operations and commenced liquidation of its assets (the “Liquidation”) on March 4, 2019. In light of the Funds’ portfolio holdings, the Master Fund currently anticipates that the Liquidation will be complete by mid-year 2019.

The Master Fund’s investment objective is to seek capital appreciation with low long-term correlation to traditional public equity and fixed income markets. The Master Fund is a “fund of funds” and seeks to achieve its investment objective, primarily by allocating its assets, directly or indirectly, among investment partnerships, managed funds, securities, swaps and other assets held in segregated accounts and other investment funds, which may include investment funds commonly referred to as hedge funds, (collectively, “Portfolio Funds”) that are managed by third-party investment managers (“Portfolio Fund Managers”) that employ a variety of alternative investment strategies.

The Board of Trustees (the “Board” and each member a “Trustee”) is authorized to engage an investment adviser and it has selected Steben & Company, Inc. (the “Investment Manager”), to manage and oversee the Master Fund’s portfolio and operations, pursuant to an investment management agreement (the “Investment Management Agreement”). The Investment Manager is a Maryland corporation that is registered as an investment adviser under the Investment Advisers Act of 1940, as amended, and is registered with the Commodity Futures Trading Commission (the “CFTC”) as a commodity pool operator and a swap firm, and is a member of the National Futures Association as well as with the Securities and Exchange Commission (the “SEC”) as a broker-dealer. Under the Investment Management Agreement, the Investment Manager is responsible for developing, implementing, and supervising the Master Fund’s investment program subject to the supervision of the Board.

Under the Master Fund’s organizational documents, the Master Fund’s Trustees and officers are indemnified against certain liabilities arising out of the performance of their duties to the Master Fund. In the normal course of business, the Master Fund enters into contracts with service providers, which also provide for indemnifications by the Master Fund. The Master Fund’s maximum exposure under these arrangements is unknown, as this would involve any future potential claims that may be made against the Master Fund.

| 2. | Summary of Significant Accounting Policies and Practices |

a. Basis of Accounting|The accounting and reporting policies of the Master Fund conform with U.S. generally accepted accounting principles (“U.S. GAAP”). The Master Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”.

b. Valuation |

Share Valuation.The Master Fund will calculate its Net Asset Value (“NAV”) as of the close of regular trading on the New York Stock Exchange (ordinarily 4:00 P.M.) on the last business day of each calendar month and such other dates as the Board may determine, including in connection with repurchase of Shares, in accordance with the procedures and policies established by the Board. The NAV of the Master Fund will equal the value of the total assets of the Master Fund, less all of its liabilities, including accrued fees and expenses.

| Steben Select Multi-Strategy Master Fund | 9 | AnnualReport to Shareholders |

Steben Select Multi-Strategy Master Fund

Notes to Financial Statements

March 31, 2019

Investment Valuation.The Investment Manager’s Valuation Committee implements the valuation of the Master Fund’s investments, including interests in the Portfolio Funds, in accordance with written policies and procedures (the “Valuation Procedures”) that the Board of the Master Fund has approved for purposes of determining the value of securities held by the Master Fund, including the fair value of the Master Fund’s investments in Portfolio Funds. The Investment Manager’s Valuation Committee consists of members of the Board, additional officers of the Master Fund, and one or more representatives of the Investment Manager.

Investments are carried at fair value. As a general matter, the fair value of the Master Fund’s investment in a Portfolio Fund represents the amount that the Master Fund can reasonably expect to receive if the Master Fund’s investment was sold at its reported NAV. Determination of fair value involves subjective judgment and amounts ultimately realized may vary from estimated values. The fair value of the Portfolio Funds has been estimated using the NAV as reported by the Portfolio Fund Managers of the respective Portfolio Funds. FASB guidance provides for the use of NAV as a “Practical Expedient” for estimating fair value of the Portfolio Funds. NAV reported by each Portfolio Fund is used as a practical expedient to estimate the fair value of the Master Fund’s interest therein.

Certain securities and other financial instruments in which the Portfolio Funds invest may not have readily ascertainable market prices and will be valued by the Portfolio Fund Managers. Such valuations generally will be conclusive with respect to the Master Fund, even though a Portfolio Fund Manager may face a conflict of interest in valuing the securities, as their value will impact the Portfolio Fund Manager’s compensation. Generally, neither the Investment Manager nor the Board will be able to confirm independently the accuracy of the valuations made by the Portfolio Fund Managers. The net asset values or other valuation information received by the Investment Manager from the Portfolio Funds will typically be estimates only, subject to revision through the end of each Portfolio Fund’s annual audit. The valuations reported by the Portfolio Fund Managers, upon which the Master Fund will calculate its NAV, may be subject to later adjustment based on information reasonably available at that time. To the extent that subsequently adjusted valuations or revisions to Portfolio Fund net asset values adversely affect the Master Fund’s NAV, the outstanding Shares of the Master Fund will be adversely affected by prior repurchases to the benefit of Shareholders who previously had Shares repurchased at a NAV per share higher than the adjusted amount. Conversely, any increases in the net asset value resulting from such subsequently adjusted valuations will be entirely for the benefit of the outstanding Shares and to the detriment of Shareholders who previously had Shares repurchased at a NAV per share lower than the adjusted amount.

Under the Valuation Procedures, if the Master Fund, acting reasonably and in good faith, determines that a Portfolio Fund Manager cannot provide valuation of a Portfolio Fund or if the Master Fund determines that the valuation provided by a Portfolio Fund Manager does not represent the fair value of the Master Fund’s interest in a Portfolio Fund, the Master Fund may utilize any other reasonable valuation methodology to determine the fair value of the Portfolio Fund. Although redemptions of interests in Portfolio Funds normally are subject to advance notice requirements, Portfolio Funds typically will make available NAV information to holders representing the price at which, even in the absence of redemption activity, the Portfolio Fund would have effected a redemption if any such requests had been timely made or if, in accordance with the terms of the Portfolio Fund’s governing documents, it would be necessary to effect a mandatory redemption. In the absence of specific transaction activity in interests in a particular Portfolio Fund, the Master Fund would consider whether it was appropriate, in light of all relevant circumstances, to value such a position at its NAV as reported by the Portfolio Fund, or whether to adjust such value to reflect a premium or discount to such NAV.

In making a fair value determination, the Master Fund will consider all appropriate information reasonably available to it at the time and that the Investment Manager believes to be reliable. The Master Fund may consider factors such as, among others: (i) the price at which recent purchases for or redemptions of the Portfolio Fund’s interests were effected; (ii) information provided to the Master Fund by a Portfolio Fund Manager, or the failure to provide such information as the Portfolio Fund Manager agreed to provide in the Portfolio Fund’s offering materials or other agreements with the Master Fund; (iii) relevant news and other sources; and (iv) market events. In addition, when a Portfolio Fund imposes extraordinary restrictions on redemptions, or when there have been no recent subscriptions for Portfolio Fund interests, the Master Fund may determine that it is appropriate to apply a discount to the NAV reported by the Portfolio Fund. The Board reviews all valuation adjustments, which would be undertaken pursuant to the Board-approved policy and procedures.

| Steben Select Multi-Strategy Master Fund | 10 | AnnualReport to Shareholders |

Steben Select Multi-Strategy Master Fund

Notes to Financial Statements

March 31, 2019

To the extent that the Investment Manager invests the assets of the Master Fund in securities or other instruments that are not investments in Portfolio Funds (e.g., directly or through separate accounts), the Master Fund will generally value such assets as described below. Securities traded: (1) on one or more of the U.S. national securities exchanges or the OTC Bulletin Board will be valued at their last sales price; and (2) on the NASDAQ Stock Market will be valued at the NASDAQ Official Closing Price (“NOCP”), at the close of trading on the exchanges or markets where such securities are traded for the business day as of which such value is being determined. Securities traded on the NASDAQ Stock Market for which the NOCP is not available will be valued at the mean between the closing bid and asked prices in this market. Securities traded on a foreign securities exchange will generally be valued at their closing prices on the exchange where such securities are primarily traded and such valuations translated into U.S. dollars at the current exchange rate. If an event occurs between the close of the foreign exchange and the computation of the Master Fund’s NAV that would materially affect the value of the security, the value of such security will be adjusted to its fair value. Except as specified above, the value of a security, derivative, or synthetic security that is not actively traded on an exchange shall be determined by an unaffiliated pricing service that may use actual trade data or procedures using market indices, matrices, yield curves, specific trading characteristics of certain groups of securities, pricing models, or combinations of these. The Investment Manager’s Valuation Committee will monitor the value assigned to each security by the pricing service to determine if it believes the value assigned to a security is correct. If the Investment Manager’s Valuation Committee believes that the value received from the pricing service is incorrect, then the value of the security will be its fair value as determined in accordance with the Valuation Procedures.

Investments in money market funds have been valued using the NAV per unit based on quoted market prices.

c. CFTC Regulation |On August 13, 2013, the CFTC adopted rules to harmonize conflicting SEC and CFTC disclosure, reporting and recordkeeping requirements for registered investment companies that do not meet an exemption from the definition of commodity pool. The harmonization rules provide that the CFTC will accept the SEC’s disclosure, reporting, and recordkeeping regime as substituted compliance for substantially all of the otherwise applicable CFTC regulations as long as such investment companies meet the applicable SEC requirements.

Previously, in November 2012, the CFTC issued relief for fund of fund operators, including advisers to registered investment companies that may otherwise be required to register with the CFTC as commodity pool operators but do not have access to information from the investment funds in which they are invested in order to determine whether such registration is required. This relief delayed the registration date for such operators until the later of June 30, 2013 or six months from the date the CFTC issues revised guidance on the application of certain thresholds with respect to investments in commodities held by funds of funds.

In July 2013, the Investment Manager claimed no-action relief from the CFTC registration with respect to its operation of the Master Fund. Although the CFTC now has adopted harmonization rules applicable to investment companies that are deemed to be commodity pools, the CFTC has not yet issued guidance on how funds of funds are to determine whether they are deemed to be commodity pools. As of March 31, 2019, the Master Fund is not considered a commodity pool and continues to rely on the fund of fund no-action relief.

d. Security Transactions and Investment Income Recognition |Purchases and sales of investments are recorded on a trade-date basis. Interest income is recorded on the accrual basis and dividends are recorded on the ex-dividend date. Realized gains or losses on the disposition of investments are accounted for based on the specific identification method. Investments that are held by the Master Fund are marked to fair value at the date of the financial statements, and the corresponding change in unrealized appreciation/depreciation is included in the Statement of Operations. Other investment fund distributions are recorded based on the detail provided with the distribution notice, as applicable. Distributions can be from income, return of capital, or capital gains.

| Steben Select Multi-Strategy Master Fund | 11 | AnnualReport to Shareholders |

Steben Select Multi-Strategy Master Fund

Notes to Financial Statements

March 31, 2019

e. Federal Income Taxes |The Master Fund intends to continue to qualify as a Regulated Investment Company (“RIC”) by complying with the provisions available to certain investment companies, as defined in Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), and to make distributions from net investment income and from net realized capital gains sufficient to relieve it from all, or substantially all, federal income and excise taxes. Investments in foreign securities may result in foreign taxes being withheld by the issuer of such securities. The Master Fund files a state tax return in Delaware.

The Master Fund has a tax year end of October 31st.

The Master Fund has adopted financial reporting rules regarding recognition and measurement of tax positions taken or expected to be taken on a tax return. Management evaluates the tax positions taken or expected to be taken in the course of preparing the Master Fund’s tax returns to determine whether the tax positions are more-likely-than-not to be sustained when examined by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense and asset or liability in the current year. Management has determined there are no material uncertain income tax positions through October 31, 2018. The Master Fund’s Federal and state income and Federal excise tax returns for tax years 2015 through 2018 remain open for examination by tax authorities based on varying statutes of limitations.

As of October 31, 2018 (the Master Fund’s tax year end), the tax cost of investments and components of distributable earnings on a tax basis were as follows:

| Cost basis of investments for federal income tax purposes | | $ | 59,403,613 | |

| Gross tax unrealized appreciation | | | 8,652,176 | |

| Gross tax unrealized depreciation | | | (9,377,924 | ) |

| Net tax unrealized depreciation | | | (725,748 | ) |

| Other accumulated gain/(loss) | | | (3,125,620 | ) |

| Total accumulated gain/(loss) | | $ | (3,851,368 | ) |

The difference between book-basis and tax-basis unrealized appreciation/depreciation is primarily attributable to realization for tax purposes of unrealized gains/losses on investments in passive foreign investment companies and tax treatment of partnership investments.

Under current law, capital losses and specified ordinary losses realized after October 31 and non-specified ordinary losses incurred after December 31 (ordinary losses collectively known as “qualified late year ordinary loss”) may be deferred and treated as occurring on the first business day of the following fiscal year. At October 31, 2018, the Master Fund deferred qualified late year ordinary losses of $1,873,314, and had short-term capital loss carryover of $1,252,306 with an indefinite expiration.

The Master Fund distributed $1,630,585 out of ordinary income during the period November 1, 2017 through October 31, 2018 and distributed $966,561 out of ordinary income during the period November 1, 2016 through October 31, 2017.

GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. These reclassifications relate to different book and tax treatment of investments in partnerships. For the tax year ended October 31, 2018, the Master Fund’s permanent differences resulted in reclassification of $(152,643) in total distributable earnings (deficit) and $152,643 in paid in capital.

| Steben Select Multi-Strategy Master Fund | 12 | AnnualReport to Shareholders |

Steben Select Multi-Strategy Master Fund

Notes to Financial Statements

March 31, 2019

f. Use of Estimates |The preparation of the financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions relating to the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates and such differences may be significant.

g. Fund Expenses |Pursuant to the Operating Services Agreement with the Master Fund, the Investment Manager has contractually agreed to pay all of the Master Fund’s ordinary operating expenses so long as Steben & Company, Inc. remains the Investment Manager, including the Master Fund’s organizational and offering expenses but not the following Master Fund expenses: the Management Fee, borrowing costs, interest expenses, brokerage commissions and other transaction and investment-related costs, portfolio fund and portfolio fund manager fees and expenses, taxes and governmental fees, acquired fund fees and expenses, shareholder servicing fees, litigation and indemnification expenses, judgments and other extraordinary expenses not incurred in the ordinary course of the Master Fund’s business. The Operating Services Agreement may be terminated at any time by the Board or upon 60 days written notice by the Master Fund or the Investment Manager. See Note 6 – Related Party Transactions.

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services”), provides accounting, administrative and transfer agency services to the Master Fund. U.S. Bank, N.A. provides custodian services to the Master Fund.

h. Shareholder Accounts |

Effective March 4, 2019 as a result of the Liquidation, the Master Fund no longer offers or sells Shares to new investors or existing shareholders (except through reinvested dividends if any), and the Master Fund will no longer conduct repurchase offers.

i. Dividends and Distributions to Shareholders |Dividends will generally be paid at least annually on the Master Fund’s Shares in amounts representing substantially all of the net investment income, if any, earned each year. Payments will vary in amount, depending on investment income received and expenses of operation. It is likely that many of the Portfolio Funds in whose securities the Master Fund invests will not pay any dividends, and this, together with the Master Fund’s expenses, means that there can be no assurance the Master Fund will have substantial income or pay dividends.

It is anticipated that any gains or appreciation in the Master Fund’s investments will be treated as ordinary income or long term capital gains. Such amounts will generally be distributed at least annually and such distributions would be taxed as ordinary income dividends or long term capital gains to Shareholders that are subject to tax.

It is anticipated that substantially all of any taxable net capital gain realized on investments will be paid to Shareholders at least annually. The NAV per share (or portion thereof) that a Shareholder owns will be reduced by the amount of the distributions or dividends that the Shareholder actually or constructively receives from that share (or portion thereof).

Pursuant to a dividend reinvestment plan established by the Master Fund (the “Dividend Reinvestment Plan”), each Shareholder will automatically be a participant under the Dividend Reinvestment Plan and have all income distributions, whether dividend distributions and/or capital gains distributions, automatically reinvested in additional Shares.

Generally, for U.S. federal income tax purposes, Shareholders receiving Shares under the Dividend Reinvestment Plan will be treated as having received a distribution equal to the amount payable to them in cash as a distribution had the Shareholder not participated in the Dividend Reinvestment Plan.

The Master Fund did not make any distributions during the fiscal year ended March 31, 2019, and paid $1,630,585 out of ordinary income during the fiscal year ended March 31, 2018.

| Steben Select Multi-Strategy Master Fund | 13 | AnnualReport to Shareholders |

Steben Select Multi-Strategy Master Fund

Notes to Financial Statements

March 31, 2019

j. Reclassification |Certain prior period amounts and disclosures may have been reclassified to conform to the current period’s financial presentation.

The Master Fund follows fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the period. These standards define fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value hierarchy is organized into three levels based upon the assumptions (referred to as “inputs”) used in pricing the asset or liability. These standards state that “observable inputs” reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from independent sources and “unobservable inputs” reflect an entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability. These inputs are summarized in the three broad levels listed below:

Level 1 - Unadjusted quoted prices in active markets for identical investments and registered investment companies where the value per share (unit) is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date.

Level 2 - Investments with other significant observable inputs.

Level 3 - Investments with significant observable inputs (which may include the Master Fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in these securities.

The following are the classes of investments grouped by the fair value hierarchy for those investments measured at fair value on a recurring basis at March 31, 2019. The Portfolio Funds below were valued using the NAV as the practical expedient:

| Description | | (Level 1) | | | (Level 2) | | | (Level 3) | | | Total | |

| Investments in Portfolio Funds* | | $ | – | | | $ | – | | | $ | – | | | $ | 4,121,790 | |

| | | | | | | | | | | | | | | | |

| Short-term Investments Money Market Fund | | | 428,762 | | | | – | | | | – | | | | 428,762 | |

| Total Investments in Portfolio Funds and Short-Term Investments | | $ | 428,762 | | | $ | – | | | $ | – | | | $ | 4,550,552 | |

*The Master Fund invests in Portfolio Funds which were measured using the NAV practical expedient and have not been classified in the fair value hierarchy. The amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the Master Fund's financial statements.

For the fiscal year ended March 31, 2019, there were no transfers in or out of Level 1, Level 2 or Level 3 of the fair value hierarchy.

In August 2018, FASB issued ASU 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”). The primary focus of ASU 2018-13 is to improve the effectiveness of the disclosure requirements for fair value measurements. The changes affect all companies that are required to include fair value measurement disclosures. In general, the amendments in ASU 2018-13 are effective for all entities for fiscal years and interim periods within those fiscal years, beginning after December 15, 2019, with early adoption permitted. The Master Fund early adopted the removed or modified disclosures. Management does not believe that adoption of the remaining updates will materially impact the Fund’s financial statements.

| Steben Select Multi-Strategy Master Fund | 14 | AnnualReport to Shareholders |

Steben Select Multi-Strategy Master Fund

Notes to Financial Statements

March 31, 2019

The following table provides a summary of the valuation policy of investments for each hedge fund investment that constitutes 5% or more of the Fund’s net assets at March 31, 2019.

Name of

Underlying

Portfolio

Fund | Fair

Value as

a % of

Master

Fund’s

Net Assets | Investment

Strategy of

the

Underlying

Portfolio

Fund | Underlying Portfolio Fund

Valuation Policy of Investments | Does the

Underlying Portfolio

Fund

Employ

Debt for

Investing? |

| The Obsidian (Offshore) Fund – Class V Master Series | 48.08% | Fixed-Income Relative Value | The underlying portfolio fund determines the fair value of its financial instruments at market value using independent dealers or pricing services under policies approved by the underlying portfolio fund’s investment manager.�� Equity investments in affiliated entities are recorded at fair value and are based upon the underlying portfolio fund’s percentage ownership of the net assets of each affiliated entity, which is a practical expedient for valuation. In determining the fair value of the debt and equity investments, the underlying portfolio fund’s investment manager uses an enterprise value approach to determine the fair value of the entire affiliated entity and allocates the fair value between the investments. This value represents the exit price under current market conditions as though both the debt and equity investments were sold to maximize the value of the entire investment position. The underlying portfolio fund values its fixed income investments on the basis of last available bid prices or current market quotations provided by independent dealers or pricing services. Loan interests are valued at the mean of the bid prices from one or more dealers as obtained from a pricing service. In determining the value of a particular investment, pricing services may use certain information with respect to transactions in such investments, quotations from dealers, pricing matrices, market transactions in comparable investments, various relationships observed in the market between investments and calculated yield measures based on valuation technology commonly employed in the market for such investments. Asset-backed and mortgage-backed securities are valued using independent pricing services using models that consider estimated cash flows of each tranche of the security, establish a benchmark yield and develop an estimated tranche specific spread to the benchmark yield based on the unique attributes of the tranche. The estimated cash flows of each tranche may be adjusted for liquidity, credit market, prepayment speeds, default rates, loss severities, and other assumptions made by the pricing service. Futures contracts traded on exchanges are valued at their last sale price. Forward currency exchange contracts are valued at the mean between the bid and ask prices which are determined as of the close of business on the reporting date. Interpolated values are derived when the valuation date of the contract is an interim date for which quotations are not available. “To-be-announced” commitments are valued on the basis of last available bid prices of current market quotations provided by pricing services. Swap contracts are valued utilizing price quotes received daily using the underlying portfolio fund’s pricing services or through brokers, which are derived using swap curves and models that incorporate a | Yes |

| Steben Select Multi-Strategy Master Fund | 15 | AnnualReport to Shareholders |

Steben Select Multi-Strategy Master Fund

Notes to Financial Statements

March 31, 2019

Name of

Underlying

Portfolio

Fund | Fair

Value as

a % of

Master

Fund’s

Net Assets | Investment

Strategy of

the

Underlying

Portfolio

Fund | Underlying Portfolio Fund

Valuation Policy of Investments | Does the

Underlying Portfolio

Fund

Employ

Debt for

Investing? |

| | | | number of market data factors, such as discounted cash flows, trades, values of the underlying reference instruments, yield curves, credit curves, measures of volatility, prepayment rates and correlation of such inputs. Municipal investments, including commitments to purchase such investments on a “when-issued” basis, are valued at the bid price on the basis of prices provided by dealers or pricing services. In determining the value of a particular investment, pricing services may use certain information with respect to transactions in such investments, indicative bids from dealers, pricing matrices, market transactions in comparable investments and information with respect to various relationships between investments. Equity investments traded on a recognized securities exchange are valued at the last reported sale price that day. For equity investments traded on more than one exchange, the last reported sale price on the exchange where the stock is primarily traded is used. Equity investments traded on a recognized exchange for which there were no sales on that day are valued at the last available bid or ask price. If no bid or ask price is available, the prior day’s last reported sales price will be used, unless it is determined that such prior day’s price no longer reflects the fair value of the security. Exchange-traded options contracts are valued at the mean between the last bid and ask prices at the close of the options contracts market in which the options contracts trade. An exchange-traded options contract for which there is no mean price is valued at the last bid or ask price. If no bid or ask price is available, the prior day’s price will be used, unless it is determined that the prior day’s price no longer reflects the fair value of the options contract. Over-the-counter options contracts, including options on swap contracts, are valued using an independent pricing service using a mathematical model, which incorporates a number of market data factors, such as the trades and prices of the underlying instruments. In the event that these methods of valuation results in a price for an investment that is deemed not to be representative of the fair value of such investment, or if a price is not available, the investment will be valued by the underlying portfolio fund’s investment manager, in accordance with a policy approved by the underlying portfolio fund’s investment manager as reflecting fair value (“Fair Value Assets”). When determining the price for a Fair Value Asset, the underlying portfolio fund’s investment manager seeks to determine the price that the underlying portfolio fund might reasonably expect to receive from the current sale of that asset in an arm’s length transaction. | |

| 4. | Investment Risks and Uncertainties |

Portfolio Funds consist of non-traditional, not readily marketable investments, some of which may be structured as offshore limited partnerships, venture capital funds, hedge funds, private equity funds and common trust funds. The underlying investments of such funds, whether invested in stock or other securities, are generally not currently traded in a public market and typically are subject to restrictions on resale. Values determined by Portfolio Fund Managers and general partners of underlying securities that are thinly traded or not traded in an active market may be based on historical cost, appraisals, a review of the investees’ financial results, financial condition and prospects, together with comparisons to similar companies for which quoted market prices are available or other estimates that require varying degrees of judgment.

| Steben Select Multi-Strategy Master Fund | 16 | AnnualReport to Shareholders |

Steben Select Multi-Strategy Master Fund

Notes to Financial Statements

March 31, 2019

Investments are carried at fair value provided by the respective Portfolio Fund Managers. Because of the inherent uncertainty of valuations, the estimated fair values may differ from the values that would have been used had a ready market for such investments existed or had such investments been liquidated, and those differences could be material.

| 5. | Concentration, Liquidity and Off-Balance Sheet Risk |

The Master Fund invests primarily in Portfolio Funds that are not registered under the 1940 Act and invest in actively traded securities, illiquid securities, derivatives and other financial instruments using different strategies and investment techniques, including leverage, which may involve significant risks. These Portfolio Funds may invest a high percentage of their assets in specific sectors of the market in order to achieve a potentially greater investment return. As a result, the Portfolio Funds may be more susceptible to economic, political, and regulatory developments in a particular sector of the market, positive or negative, and may experience increased volatility of the Portfolio Funds' net asset value.

Various risks are also associated with an investment in the Master Fund, including risks relating to the fund-of-funds structure of the Master Fund, risks relating to compensation arrangements and risks relating to limited liquidity, as described below.

Redemption restrictions exist for Portfolio Funds whereby the Portfolio Fund Managers may suspend redemption either in their sole discretion or other factors. Such factors include the magnitude of redemptions requested, portfolio valuation issues or market conditions.

In the normal course of business, the Portfolio Funds in which the Master Fund invests trade various financial instruments and enter into various investment activities with off-balance sheet risk. These include, but are not limited to, short selling activities, writing option contracts, contracts for differences, and interest rate, credit default and total return equity swap contracts. The Master Fund's risk of loss in these Portfolio Funds is limited to the value of its own investments reported in these financial statements by the Master Fund. The Master Fund itself does not invest directly in securities with off-balance sheet risk.

| 6. | Related Party Transactions |

a. Investment Management Fee |Under the terms of the Investment Management Agreement between the Investment Manager and the Master Fund, the Investment Manager is entitled to receive a management fee at an annualized rate, based on the month-end net assets of the Master Fund of 1.25%, accrued and payable monthly. For the fiscal year ended March 31, 2019, the Master Fund incurred $741,359 in management fees.

b. Operating Services Fee |The Master Fund pays to the Investment Manager, as compensation for the services provided by the Investment Manager and its agents under the Operating Services Agreement, an annualized fee of 0.15%, which is paid monthly, based on the month-end net assets of the Master Fund. For the fiscal year ended March 31, 2019, the Master Fund incurred $88,974 in operating services fees.

| 7. | Compensation for Trustees |

The independent Trustees are paid annual compensation for service on the Board and its Committees for the portfolios overseen in the complex of funds advised by the Investment Manager “SCI Advised Funds” in an annual amount of $25,000 each. Such compensation encompasses attendance and participation at Board and Committee meetings, including telephonic meetings, if any. There are currently two independent Trustees. The Audit Committee Chairman and the Audit Committee Financial Expert also receives an annual amount of $15,000. In the interest of recruiting and retaining independent Trustees of high quality, the Board intends to periodically review such compensation and may modify it as the Board deems appropriate. In addition, through the Operating Services Agreement, the Investment Manager reimburses each independent Trustee for travel and other expenses incurred in connection with attendance at such meetings. Other Officers (apart from the CCO) and Trustees of the Master Fund who are “interested persons” by virtue of their affiliation with the Investment Manager receive no compensation in such role.

| Steben Select Multi-Strategy Master Fund | 17 | AnnualReport to Shareholders |

Steben Select Multi-Strategy Master Fund

Notes to Financial Statements

March 31, 2019

| 8. | Investment Transactions |

During the fiscal year ended March 31, 2019 (excluding short-term securities), the aggregate purchases of investments were $14,906,640 and sales of investments were $66,828,760. The Master Fund did not purchase long-term U.S. Government securities as a part of its investment strategy during the fiscal year ended March 31, 2019.

As result of the Liquidation, the Master Fund has redeemed its final hedge fund investment effective April 30, 2019. Additionally, it will be processing a liquidating tender to Select Partners effective April 30, 2019.

The Master Fund has adopted financial reporting rules regarding subsequent events, which requires an entity to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed at the date of the balance sheet. Management has evaluated the Master Fund’s related events and transactions that occurred subsequent to March 31, 2019 and through the date the financial statements were issued and determined that there were no additional significant subsequent events that would require adjustment to or additional disclosure in these financial statements.

| Steben Select Multi-Strategy Master Fund | 18 | AnnualReport to Shareholders |

Steben Select Multi-Strategy Master Fund

Financial Highlights

| | | Year Ended March 31, 2019 | | | Year Ended March 31, 2018 | | | Year Ended March 31, 2017 | | | Year Ended March 31, 2016 | | | Year Ended March 31, 2015 | |

| PER SHARE OPERATING PERFORMANCE | | | | | | | | | | | | | | | | | | | | |

| Net Asset Value, beginning of year | | $ | 10.77 | | | $ | 10.65 | | | $ | 10.75 | | | $ | 11.36 | | | $ | 10.80 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net Investment Loss | | | (0.15 | )(1) | | | (0.15 | )(1) | | | (0.15 | )(1) | | | (0.16 | )(1) | | | (0.16 | )(1) |

| Net Realized and Unrealized Gain on Investments | | | 0.09 | | | | 0.56 | | | | 0.21 | | | | 0.35 | | | | 1.64 | |

| Total From Investment Operations | | | (0.06 | ) | | | 0.41 | | | | 0.06 | | | | 0.19 | | | | 1.48 | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | — | | | | (0.29 | ) | | | (0.08 | ) | | | (0.78 | ) | | | (0.87 | ) |

| From net realized gains | | | — | | | | — | | | | (0.08 | ) | | | (0.02 | ) | | | (0.05 | ) |

| Total distributions | | | — | | | | (0.29 | ) | | | (0.16 | ) | | | (0.80 | ) | | | (0.92 | ) |

| Net Asset Value, end of year | | $ | 10.71 | | | $ | 10.77 | | | $ | 10.65 | | | $ | 10.75 | | | $ | 11.36 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | (0.58 | )% | | | 3.78 | % | | | 0.58 | % | | | 1.74 | % | | | 14.26 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | |

| Net Assets, end of year ($000’s) | | $ | 8,573 | | | $ | 61,597 | | | $ | 64,130 | | | $ | 57,285 | | | $ | 44,092 | |

| Portfolio Turnover | | | 28.50 | % | | | 10.68 | % | | | 44.29 | % | | | 6.25 | % | | | 0.00 | % |

| Ratio of Net Investment Loss to Average Net Assets | | | (1.30 | )%(2) | | | (1.36 | )%(2) | | | (1.38 | )%(2) | | | (1.40 | )%(2) | | | (1.40 | )%(2) |

| Ratio of Expenses to Average Net Assets | | | 1.40 | %(2)(3) | | | 1.40 | %(2)(3) | | | 1.40 | %(2)(3) | | | 1.40 | %(2)(3) | | | 1.40 | %(2)(3) |

(1) Net investment loss per share represents net investment loss divided by the average shares outstanding throughout the period.

(2) Ratios are calculated by dividing the indicated amount by average net assets measured at the end of each month during each period presented.

(3) The ratio of expenses to average net assets does not include expenses of the Portfolio Funds that are paid indirectly by the Master Fund as a result of its ownership of the Portfolio Funds.

See accompanying Notes to Financial Statements.

| Steben Select Multi-Strategy Master Fund | 19 | AnnualReport to Shareholders |

Steben Select Multi-Strategy Master Fund

Trustee and Officer Information(Unaudited)

The Fund’s operations are managed under the direction and oversight of the Fund’s Board. Each Trustee serves for an indefinite term or until he or she reaches mandatory retirement, if any, as established by the Board. The Board appoints officers of the Fund who are responsible for the Fund’s and day-to-day business decisions based on policies set by the Board. Biographical information for the current Trustees and Officers, including age, principal occupations for the past five years, the length of time served as Trustee, and any other Director/ Trusteeships is set forth below. The Fund is part of the Steben Funds Complex, which is comprised of the Fund, Steben Select Multi-Strategy Master Fund and the Steben Alternative Investment Funds. The address of each Trustee and officer listed below is 9711 Washingtonian Blvd., Suite 400, Gaithersburg, MD 20878. The Statement of Additional Information includes additional information about Trustees and Officers and is available, without charge by visitingwww.steben.com

| Name and Age | Position(s)

with Fund | Principal Occupation(s)

During the Past 5 Years | Other Directorships

During the Past 5 Years |

| Independent Trustees* | | |

Andrew Putterman# Age: 59 | Trustee (Since 2018) | Principal, 1812 Park, LLC (financial consulting) (2014 to present); Advisory Director, Silver Lane Advisors (2016 to present); Advisory Board Member, Vestigo Ventures 1 GP, LLC (2016 to present); Managing Director, B+ Institutional Services, LLC (2014 to 2015); Independent Board Member, Princeton Private Equity Fund (2014 to 2015); Chairman Emeritus, Fortigent LLC (financial services) (2013 to 2014); Managing Director, LPL Financial (financial services) (2012 to 2014); The Private Trust Company (January 2013 to December 2013); President and Chief Executive Officer, Fortigent LLC (2006 to 2012 and 2013, respectively). | Trustee of Absolute Shares Trust (which consists of 12 funds), since 2014; Steben Managed Futures Cayman Fund Ltd.; Steben Alternative Investment Funds, Steben Select Multi-Strategy Master Fund (investment companies). |

Mark E. Schwartz# Age: 71 | Trustee (Since 2013) | Managing Director, Bronfman E.L. Rothschild (investment adviser) March 2017 to present; formerly, President, TriCapital Advisors, Inc., 2006 to February 2017. | Appointed Trustee of University of Maryland College Park Foundation since 2015; Steben Managed Futures Cayman Fund Ltd.; Steben Alternative Investment Funds, Steben Select Multi-Strategy Master Fund (investment companies). |

| | | | |

| Interested Trustees* | | | |

Kenneth E. Steben** Age: 64 | Chairman of the Board, Trustee and Chief Executive Officer (Since 2013) | President and Chief Executive Officer since 1989 of Steben & Company, Inc. | Steben Managed Futures Cayman Fund Ltd.; Steben Alternative Investment Funds, Steben Select Multi-Strategy Master Fund (investment companies). |

* There is no stated term of office for the Fund’s Trustees. Each Trustee serves until his or her successor is elected and qualifies or until his or her death, resignation, or removal as provided in the Declaration of Trust, Bylaws or by statute.

** Mr. Steben is an “interested person”, as defined in the Investment Company Act, due to his position as President and Chief Executive Officer of the Investment Manager.

# Member of the Audit Committee and the Governance and Nominating Committee.

| Steben Select Multi-Strategy Master Fund | 20 | AnnualReport to Shareholders |

Steben Select Multi-Strategy Master Fund

Trustee and Officer Information(Unaudited)

Officers of the Fund Who Are Not Trustees

| Name and Age | Position(s)

with Fund | Principal Occupation(s)

During the Past 5 Years |

Carl A. Serger Age: 59 | Chief Financial Officer (Since 2013) | Chief Financial Officer, SCI, since December 2009; Senior VP, CFO and COO, Peracon, Inc. (electronic transactions platform) from 2007 to 2009; Senior VP and CFO, Ebix Inc., (financial technology company) from 2006 to 2007; CFO, Senior VP and Treasurer, Finetre Corporation (financial technology company) from 1999 to 2006. |

Francine J. Rosenberger Age: 51 | Chief Compliance Officer (“CCO”) and Secretary (Since 2013) | General Counsel, SCI, since January 2013; Partner, K&L Gates LLP (law firm) from 2003 to January 2013. |

| Steben Select Multi-Strategy Master Fund | 21 | AnnualReport to Shareholders |

Steben Select Multi-Strategy Master Fund

Additional Information

March 31, 2019 (Unaudited)

Proxy Voting Policies and Procedures

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, as well as information on how the Fund voted proxies (if any) relating to portfolio securities during the most recent 12-month period ended June 30 after commencement of operations will be available on Form N-PX without charge by calling 1-800-726-3400, or on the SEC’s website at http://www.sec.gov.

Portfolio Holdings Disclosure

The Master Fund each files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the SEC’s website at www.sec.gov, and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-732-0330.

Privacy Policy

The Fund collects non-public information about you from the following sources:

| • | information we receive about you on applications or other forms; |

| • | information you give us orally; and |

| • | information about your transactions with us or others. |

We do not disclose any non-public personal information about our customers or former customers without the customer’s authorization, except as required by law or in response to inquiries from governmental authorities. We also disclose that information is provided to unaffiliated third parties (such as to the investment adviser to the Fund, and to brokers and custodians) only as permitted by law and only as needed for them to assist us in providing agreed services to you. All shareholder records will be disposed of in accordance with applicable law. We maintain physical, electronic and procedural safeguards to guard your nonpublic personal information.

In the event that you hold shares of the Fund through a financial intermediary, including, but not limited to, a broker-dealer, bank or trust company, the privacy policy of your financial intermediary would govern how your non-public personal information would be shared by those entities with nonaffiliated third parties.

| Steben Select Multi-Strategy Master Fund | 22 | AnnualReport to Shareholders |

This page intentional left blank.

| Steben Select Multi-Strategy Master Fund | 23 | AnnualReport to Shareholders |

Delivery of Documents

If you invest in the Fund through a financial institution, you may be able to receive the Fund’s regulatory mailings, such as the Annual Report and Semi-Annual Report, by e-mail. If you are interested in this option, please go to www.icsdelivery.com and search for your financial institution’s name or contact your financial institution directly.

To obtain more information about the Fund:

| |  |

| | | |

By E-mail: info@steben.com | | On the Internet: Visit our website atwww.steben.com |

| | | |

| |  |

| | |

By Telephone: Call (800) 726-3400 | | By Mail: Steben Select Multi-Strategy Fund c/o U.S. Bank Global Fund Services P.O. Box 701 Milwaukee, WI 53201-0701 |

| | | |

Availability of Quarterly Portfolio Schedules In addition to the Schedule of Investments provided in each semi-annual and annual report, the Fund files a complete schedule of its portfolio holdings with the Securities and Exchange Commission (“SEC”) on Form N-Q as of the first and third fiscal quarters. The Fund’s Forms N-Q are available on the SEC’s website atwww.sec.gov. The Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Section, 100 F Street, NE, Washington, D.C. 20549-1520. Information regarding the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330. A complete schedule of the Fund’s portfolio holdings is also available onwww.steben.com approximately sixty days after the end of each quarter. | | Availability of Proxy Voting Policy and Records A description of the policies and procedures the Fund uses to determine how to vote proxies relating to portfolio securities is available in the Fund’s Statement of Additional Information, is available free of charge on the Fund’s websitewww.steben.com and by calling 1-800-726-3400 or by accessing the SEC’s website atwww.sec.gov. The Fund’s proxy voting record for the most recent year ended June 30 is filed annually with the SEC on Form N-PX. The Fund’s Forms N-PX are available on the SEC’s website atwww.sec.gov. The Fund’s proxy voting record may also be obtained by calling 1-800-726-3400. |

| Fund Service Providers: | | |

| | | |

Custodian U.S. Bank, N.A. Milwaukee, Wisconsin | Transfer Agent U.S. Bank Global

Fund Services Milwaukee, Wisconsin | Independent

Registered Public

Accounting Firm KPMG LLP Columbus, Ohio |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report. A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Andrew Putterman is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. “All other fees” refer to the aggregate fees billed for products and services provided by the principal accountant other than “Audit fees”, “Audit-related fees” and “Tax fees”. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | FYE 3/31/2019 | FYE 3/31/2018 |

| Audit Fees | $30,000 | $28,500 |

| Audit-Related Fees | $0 | $0 |

| Tax Fees | $11,130 | $10,795 |

| All Other Fees | $0 | $0 |

The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre–approve all audit and non–audit services of the registrant, including services provided to any entity affiliated with the registrant.

The percentage of fees billed by KPMG LLP applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | FYE 3/31/2019 | FYE 3/31/2018 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years. The audit committee of the Board of Trustees has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser is compatible with maintaining the principal accountant’s independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

| Non-Audit Related Fees | FYE 3/31/2019 | FYE 3/31/2018 |

| Registrant | $11,130 | $10,795 |

| Registrant’s Investment Adviser | $0 | $0 |

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

The Master Fund invests a substantial portion of its assets in securities of Portfolio Funds. These securities do not typically convey traditional voting rights to the holder and the occurrence of corporate governance or other notices for this type of investment is substantially less than that encountered in connection with registered equity securities. However, Steben & Company, Inc. (the “Investment Manager”) and/or the Master Fund may, under some circumstances, receive proxies from certain Portfolio Funds and other issuers. The Board of Trustees has delegated to the Investment Manager authority to vote all proxies relating to the Master Fund’s portfolio securities pursuant to the Statement of Policies and Procedures for Proxy Voting set out in the Master Fund’s Registration Statement effective July 30, 2018. Information on how the Master Fund voted proxies (if any) relating to portfolio securities during the most recent 12-month period ending June 30 will be available on Form N-PX without charge by calling 800-726-3400, or on the SEC’s website at http://www.sec.gov.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Investment

Committee

Member / Portfolio

Manager | Type of Accounts | Total # of

Accounts

Managed | Total Assets

(000,000’s

omitted) | # of

Accounts

Managed for

which

Advisory

Fee is Based

on

Performance | Total Assets

for which

Advisory

Fee is Based

on

Performance

(000,000’s

omitted) |

| Kenneth E. Steben | Registered Investment Companies | 1 | $69 | 0 | $0 |

| Other Pooled Investment Vehicles | 2 | $282 | 0 | $0 |

| Other Accounts | 0 | $0 | 0 | $0 |

| John Dolfin | Registered Investment Companies | 1 | $69 | 0 | $0 |

| Other Pooled Investment Vehicles | 2 | $282 | 0 | $0 |

| Other Accounts | 0 | $0 | 0 | $0 |

| Basak Akiska | Registered Investment Companies | 1 | $69 | 0 | $0 |

| Other Pooled Investment Vehicles | 2 | $282 | 0 | $0 |

| Other Accounts | 0 | $0 | 0 | $0 |

Biographical Information

Kenneth E. Steben is the President and Chief Executive Officer of the Investment Manager. Mr. Steben received his Bachelor’s Degree in Interdisciplinary Studies, with a concentration in Accounting in 1979 from Maharishi University of Management. He holds his Series 3, 5, 7, 24, 63 and 65 FINRA licenses, and has been a CFTC listed Principal and registered as an Associated Person of the Investment Manager since March 15, 1989.

John Dolfin is the Chief Investment Officer of the Investment Manager. Mr. Dolfin earned a Bachelor’s degree in Philosophy, Politics and Economics from Oxford University in 1993, and a Masters in Economics from Yale University in 1996. Previously, he served as Director and Head of Macro and CTA Strategies at Merrill Lynch Wealth Management, a financial advisory firm, from July 2006 to June 2010. More recently, he served as Managing Director in the Liquid Strategies Group at SAFANAD Inc., an investment management firm, from June 2010 to February 2011. From March to July 2011, he was engaged in various personal projects. Mr. Dolfin has been a CFA charter holder since 2005 and has been a CFTC listed Principal of the Investment Manager since July 2, 2012.

Basak Akiska is Director of Operational Due Diligence at the Investment Manager. Ms. Akiska earned a Bachelor’s degree in Management from University of Massachusetts Amherst in 1999 and a Masters in Accounting from University of Virginia in 2000. Previously, she served as Senior Due Diligence Analyst at FRM/MAN Investments, a financial advisory firm, from June 2006 to February 2013. Prior to that, Ms. Akiska served as an Internal Audit Manager at XL Capital, and as an Audit Manager at Ernst & Young LLP., an independent public accounting firm. Ms. Akiska acquired her CPA license in 2004 (currently inactive).

Securities Ownership of Investment Committee Members

No member of the Investment Committee owns shares of the Steben Select Multi-Strategy Master Fund.

Conflicts of Interest of the Investment Manager

As an investment adviser and fiduciary, the Investment Manager owes its clients and shareholders an undivided duty of loyalty. The Investment Manager recognizes that conflicts of interest are inherent in its business and accordingly has developed policies and procedures (including oversight monitoring) reasonably designed to detect, manage and mitigate the effects of actual or potential conflicts of interest in the area of employee personal trading, managing multiple accounts for multiple clients, including the Master Fund, and allocating investment opportunities. Investment professionals, including the Portfolio Managers and research analysts, are subject to the above-mentioned policies and oversight monitoring to ensure that all clients are treated equitably. The Investment Manager places the interests of its clients first and expects all of its employees to meet their fiduciary duties.

Employee Personal Trading. The Investment Manager has adopted a Code of Ethics that is designed to detect and prevent conflicts of interest when investment professionals and other personnel of the Investment Manager own, buy or sell securities that may be owned by, or bought or sold for, clients. Personal securities transactions by an employee may raise a potential conflict of interest when an employee owns or trades in a security that is owned or considered for purchase or sale by a client, or recommended for purchase or sale by an employee to a client. Subject to the reporting requirements and other limitations of its Code of Ethics, the Investment Manager permits its employees to engage in personal securities transactions, and also allows them to acquire investments in certain funds managed by the Investment Manager. The Investment Manager’s Code of Ethics requires disclosure of all personal accounts and maintenance of brokerage accounts with designated broker-dealers approved by the Investment Manager.