As filed with the Securities and Exchange Commission on December 5, 2014.

Registration No. 333-200371

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

Form F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

METLIFE CHILE ACQUISITION CO. S.A.

(Exact name of Registrant as specified in its charter)

| | | | |

| Republic of Chile | | 6399 | | Not Applicable |

| (State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer

Identification Number) |

Agustinas 640, 22nd floor

Santiago, Chile

Postcode 8320219

Telephone: +(56-2) 2 2826 3000

(Address, including Zip code, and telephone number, including area code, of Registrant’s principal executive offices)

C T Corporation System

111 Eighth Avenue

New York, New York 10011

Telephone: (212) 894-8800

(Name, address, including Zip code, and telephone number, including area code, of agent for service)

Copies to:

| | |

Brian V. Breheny Skadden, Arps, Slate, Meagher & Flom LLP 1440 New York Avenue, N.W. Washington, D.C. 20005 Telephone: (202) 371-7000 | | Paola Lozano Skadden, Arps, Slate, Meagher & Flom LLP Four Times Square New York, New York 10036 Telephone: (212) 735-3000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

MetLife Chile Acquisition Co. S.A., the registrant whose name appears on the cover of this registration statement, expects to change its name to Administradora de Fondos de Pensiones ProVida S.A. upon effectiveness of the merger described in the prospectus that forms a part of this registration statement.

The information contained herein is subject to completion or amendment. No securities may be sold until a registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities, nor shall there be any sale of these securities, in any jurisdiction in which such offer, solicitation or sale is not permitted or would be unlawful.

PRELIMINARY PROSPECTUS—Subject to Amendment and Completion—Dated December 5, 2014

Merger of

Administradora de Fondos de Pensiones ProVida S.A.

with and into

MetLife Chile Acquisition Co. S.A.

to be renamed

ADMINISTRADORA DE FONDOS DE PENSIONES PROVIDA S.A.

THIS IS NOT A PROXY STATEMENT. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

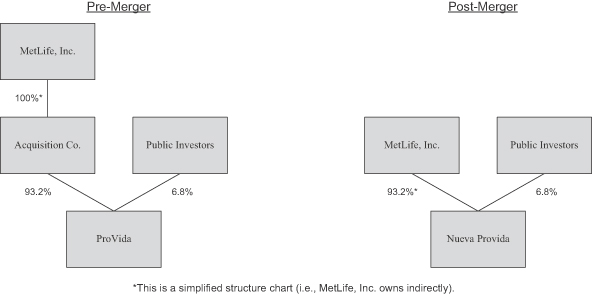

This prospectus relates to the shares of common stock of MetLife Chile Acquisition Co. S.A., a Chilean closed corporation (sociedad anónima cerrada), to be issued by MetLife Chile Acquisition Co. to holders of common stock of Administradora de Fondos de Pensiones ProVida S.A., a Chilean corporation (sociedad anónima) (“ProVida”) upon effectiveness of the merger of ProVida with and into MetLife Chile Acquisition Co. (referred to in this prospectus as “Acquisition Co.” prior to effectiveness of the merger, and as “Nueva ProVida” after effectiveness of the merger). The merger agreement (acuerdo de fusión), dated as of November 14, 2014, and amended and restated on December 3, 2014, entered into by and among MetLife Chile Acquisition Co., Inversiones MetLife Holdco Dos Limitada, a Chilean limited liability company (sociedad de responsabilidad limitada), Inversiones MetLife Holdco Tres Limitada, a Chilean limited liability company (sociedad de responsabilidad limitada), and MetLife Chile Inversiones Limitada, a Chilean limited liability company (sociedad de responsabilidad limitada), provides, among other things, for ProVida to be merged with and into Acquisition Co., with Acquisition Co. being the surviving company and ProVida ceasing to exist. The business carried out by Nueva ProVida and its subsidiaries following the merger will be the same business carried out by ProVida and its subsidiaries prior to the merger. Nueva ProVida will assume all of the assets, liabilities and equity, and succeed to all the rights and obligations of ProVida. The name of the surviving company shall be “Administradora de Fondos de Pensiones ProVida S.A.”

You are receiving this prospectus because, upon effectiveness of the merger, subject to your withdrawal rights under Chilean law, each outstanding share of common stock, without nominal (par) value of ProVida (collectively, the “ProVida Shares”) that you own at the effective time of the merger will be converted into one share of common stock, without nominal (par) value of Nueva ProVida (collectively, the “Nueva ProVida Shares”). The Nueva ProVida Shares to be offered and sold in the United States are being registered with the United States Securities and Exchange Commission (the “SEC”). The Nueva ProVida Shares will be registered in the National Securities Registry of the Chilean Superintendency of Securities (Superintendencia de Valores y Seguros, the “SVS”). The Nueva ProVida Shares will not be listed in any securities exchange in the United States but application will be made for the admission of the Nueva ProVida Shares to trading on the Santiago Stock Exchange, the Chilean Electronic Stock Exchange and the Valparaiso Stock Exchange. The ProVida American Depositary Receipt program, or ADR program, has been terminated and Nueva ProVida does not currently intend to establish an ADR program. Notwithstanding such termination, if you have not surrendered your ProVida American Depositary Shares (“ADSs”) or American Depositary Receipts (“ADRs”) to The Bank of New York Mellon (as depositary for the former ProVida ADR program) (“The Bank of New York Mellon”), your right to surrender your ADSs and receive ProVida Shares underlying the ProVida ADSs will, upon effectiveness of the merger, become a right to receive the same number of Nueva ProVida Shares BUT you should carefully review

the Section entitled “PART THREE—THE MERGER—Effects of the Merger on ProVida ADR Holders,” beginning on page 25 of this prospectus which contains important information that may impact your right to receive Nueva ProVida Shares.

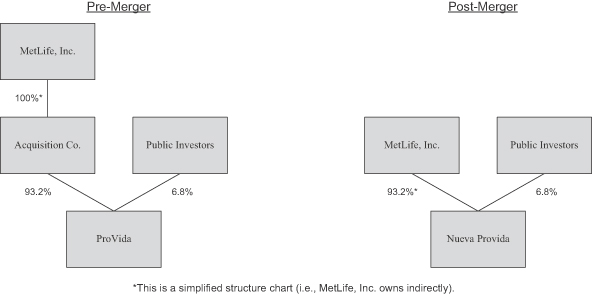

ProVida’s shareholders will not be diluted as a consequence of the merger, and therefore, upon effectiveness of the merger, subject to any exercise of withdrawal rights, ProVida shareholders (other than Acquisition Co. and its affiliates), are expected to hold Nueva ProVida Shares representing the same percentage held in the aggregate by such shareholders in ProVida immediately prior to the effective time of the merger, and MetLife, Inc. and its affiliates are expected to own the same percentage held in the aggregate by such parties in ProVida immediately prior to the effective time of the merger.

The merger cannot be effected unless, among other things, ProVida shareholders approve the merger of ProVida with and into Acquisition Co. as contemplated by the merger agreement. The bylaws of ProVida require the approval of at least two-thirds of the votes cast at a ProVida special shareholders’ meeting where at least a majority of the issued share capital of ProVida is present or represented at the meeting following the first call for such meeting, or, if held on the second call, any number of shareholders. Acquisition Co. has requested that ProVida holds a special shareholders’ meeting to vote on the merger. The special shareholders’ meeting is expected to be held on December 29, 2014. You should be aware that as of the date of this prospectus Acquisition Co. owns approximately 93.2% of the ProVida Shares and Acquisition Co. will vote these shares in favor of the merger at the ProVida special shareholders’ meeting. As a result, approval of the merger by ProVida’s shareholders is assured. The merger is also subject to approval by at least two-thirds of the shareholders of Acquisition Co. MetLife, Inc. indirectly owns 100% of the shares of Acquisition Co. and will vote these shares in favor of the merger. As a result, approval of the merger by Acquisition Co.’s shareholders is assured.

Once all the required approvals have been obtained or waived (where legally permissible), the merger is currently expected to be consummated on or before December 31, 2015.

The accompanying disclosure documents (including the merger agreement, included as Annex A to this prospectus, and the Notice of Special Shareholders’ Meeting of ProVida to be held on December 29, 2014, included as Annex B to this prospectus) contain detailed information about the merger and the special shareholders’ meeting of ProVida. This document is a prospectus for the Nueva ProVida Shares that will be offered in the United States to ProVida shareholders (other than Acquisition Co. and its affiliates) in connection with the merger.We encourage ProVida shareholders to read carefully this prospectus, including the section entitled “PART TWO—RISK FACTORS,” beginning on page 11 of this prospectus.

THESE MATERIALS DO NOT CONSTITUTE A “PROXY STATEMENT” AND WE ARE NOT SOLICITING THAT YOU GRANT ACQUISITION CO. OR ANY OF ITS AFFILIATES A PROXY TO VOTE YOUR PROVIDA SHARES AT THE SPECIAL SHAREHOLDERS’ MEETING OF PROVIDA EXPECTED TO BE HELD ON DECEMBER 29, 2014. PROVIDA IS A FOREIGN PRIVATE ISSUER. AS SUCH, PROVIDA SHARES ARE NOT SUBJECT TO, AMONG OTHERS, SECTION 14(A) OF THE EXCHANGE ACT. IF YOU WISH TO VOTE YOUR PROVIDA SHARES YOU MUST ATTEND THE SPECIAL SHAREHOLDERS’ MEETING OF PROVIDA EXPECTED TO BE HELD ON DECEMBER 29, 2014 IN PERSON OR BY POWER OF ATTORNEY GRANTED IN ACCORDANCE WITH CHILEAN LAW.

Neither the SEC nor any foreign or state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if this prospectus is accurate or adequate. Any representation to the contrary is a criminal offense.

This prospectus is dated December 5, 2014 and is first being mailed to ProVida shareholders in the United States on or about December 9, 2014.

ABOUT THIS DOCUMENT

This prospectus, which forms part of a registration statement on Form F-4 filed with the SEC by Acquisition Co. (File No. 333 - 200371), constitutes a prospectus of Acquisition Co. under Section 5 of the Securities Act with respect to the Nueva ProVida Shares to be issued in the United States to ProVida shareholders (other than Acquisition Co. and its affiliates) upon effectiveness of the merger.

(i)

TABLE OF CONTENTS

(ii)

(iii)

(iv)

PART ONE—SUMMARY

QUESTIONS AND ANSWERS ABOUT THE MERGER AND THE NUEVA PROVIDA SHARES

The following are certain questions that you may have regarding the merger and the related matters to be considered at the ProVida special shareholders’ meeting and brief answers to those questions. Acquisition Co. urges you to read the remainder of this prospectus carefully, including without limitation the merger agreement, a copy of which is attached to this prospectus as Annex A, because the information in this section does not provide all the information that might be important to you with respect to the merger.

| | Q: | What are the reasons for the merger? |

| | A: | Acquisition Co., the controlling shareholder of ProVida, has proposed the merger in order to simplify the corporate structure of the MetLife group following the acquisition by MetLife, Inc. and its affiliates of approximately 93.2% of ProVida. Acquisition Co. also believes that the merger of ProVida into Acquisition Co. will result in significant tax efficiencies for the benefit of all shareholders of Nueva ProVida, including such shareholders that are not affiliated with Acquisition Co. Among other things, as a result of the merger, Nueva ProVida may allocate positive tax goodwill (hereinafter, the “Tax Goodwill”) originated upon the merger among the non-monetary assets that Nueva ProVida receives as a consequence of the merger, up to the market value of such non-monetary assets. Under Chilean tax law, provided the proposed merger is initiated before January 1, 2015 and is consummated on or before December 31, 2015, the portion of the Tax Goodwill that may not be distributed among the non-monetary assets (the excess above their fair market value) will be considered, for tax purposes, as a deferred expense and must be deducted in equal parts by Nueva ProVida over a term of 10 consecutive commercial exercises (or years), counted from the commercial exercise (or year) in which the Tax Goodwill was generated. If the merger is not consummated by December 31, 2015, the excess amount of the Tax Goodwill shall be recorded by Acquisition Co. as an intangible asset that cannot be depreciated or amortized for tax purposes until Acquisition Co. is dissolved or liquidated. |

| | Q: | What law is applicable to the merger? |

| | A: | The merger is governed by Law 18.046 (Ley de Sociedades Anónimas, hereinafter, “LSA” or “Chilean Corporations Law”) and its Regulations (Reglamento de Sociedades Anónimas, hereinafter, “RSA”); and the Decree Law 3,500 and its Regulations, which regulate the Chilean pensions system (hereinafter, “DL 3,500” and “Reglamento DL 3,500,” respectively). Also, the merger must be implemented in accordance with the terms set forth in the merger agreement. |

| | A: | The merger is the absorption of ProVida by Acquisition Co. under Article 99 of the LSA and Article 43 of the DL 3,500. |

| | | Upon completion of the merger, (i) ProVida will cease to exist and Acquisition Co., as absorbing entity, will become Nueva ProVida and will assume all of the assets, liabilities and equity, and succeed to all of the rights and obligations of ProVida and (ii) the holders of ProVida Shares (other than Acquisition Co. and its affiliates) will receive one Nueva ProVida Share in exchange for each ProVida Share they hold immediately prior to the effectiveness of the merger. |

| | Q: | What will happen in the merger transaction? |

| | A: | The merger transaction consists of a series of steps and is governed by the merger agreement, Article 99 of the LSA and Article 43 of the DL3,500. The principal steps of the merger transaction are the approval of the merger by special shareholders’ meetings of ProVida and Acquisition Co., the authorization by the |

1

| | Chilean Pension Funds Superintendency (Superintendencia de Pensiones, the “SP”) of the merger, the issuance of the appropriate resolution and certificate in accordance with the provisions of Article 131 of the LSA and Article 52 of Reglamento DL 3,500, and the merger by absorption of ProVida with and into Acquisition Co. followed by the assumption by Nueva ProVida of all of the outstanding ProVida Shares in exchange for newly-issued shares of Nueva ProVida. See “PART THREE—The Merger,” beginning on page 18 for more information regarding the steps and agreements involved in the merger. |

| | Q: | What is the current status of the merger? |

| | A: | As of the date of this prospectus, the merger agreement has been agreed to and signed by Acquisition Co.’s shareholders, on the one hand, and Acquisition Co. as controlling shareholder of ProVida, on the other hand. Also, the merger agreement has been approved by the board of directors of Acquisition Co. Shareholders of both ProVida and Acquisition Co. will be asked to approve the merger at special shareholders’ meetings and, once such approval is received, the companies will need to complete all regulatory formalities to consummate the merger, including effectuating the exchange of Nueva ProVida Shares for outstanding ProVida Shares. Acquisition Co. owns approximately 93.2% of ProVida Shares and Acquisition Co. will vote these shares in favor of the merger at the ProVida special shareholders’ meeting. MetLife, Inc. indirectly owns 100% of the shares of Acquisition Co. and will vote these shares in favor of the merger. As a result, approval of the merger is assured. |

| | Q: | What will happen to my shares in the merger? |

| | A: | ProVida Shares will be extinguished and the holders thereof (other than Acquisition Co. and its affiliates) will receive one Nueva ProVida Share for each ProVida Share that they own. |

| | Q: | What is the exchange ratio in the merger and how was it calculated? |

| | A: | The exchange ratio was determined to be one Nueva ProVida Share for one ProVida Share. The exchange ratio was agreed to in the merger agreement by the controlling shareholders of both ProVida and Acquisition Co. The exchange ratio in the merger of ProVida Shares to Nueva ProVida Shares was also determined by an international accounting firm (the “Financial Expert,” as defined below), in accordance with Article 156 of the RSA, after reviewing the information and documents of each of ProVida and Acquisition Co. The exchange ratio will be presented for approval to the shareholders of ProVida and Acquisition Co. at the special shareholders’ meetings. |

| | Q: | Will I have to pay brokerage commissions? |

| | A: | You will not have to pay brokerage commissions if your ProVida Shares are registered in your name. However, if your securities are held through a bank, broker or other custodian linked to a stock exchange, you should inquire as to whether any other transaction fee or service charges may be charged by any such person in connection with the merger or the exchange of your ProVida Shares for the Nueva ProVida Shares. |

| | Q: | What shareholder approvals are needed? |

| | A: | The merger of ProVida with Acquisition Co. will require the affirmative vote of holders of two-thirds of the outstanding ProVida Shares present or represented at a special shareholders’ meeting of ProVida and the affirmative vote of holders of two-thirds of the outstanding common shares of Acquisition Co. present or represented at a special shareholders’ meeting of Acquisition Co. In order to validly hold special shareholders’ meetings of ProVida and Acquisition Co., at least a majority of the issued share capital of each of ProVida and Acquisition Co. must be present or represented at the meeting at the first call, or, if held on the second call, any number of shareholders. Acquisition Co. owns approximately |

2

| | 93.2% of the ProVida Shares and will vote these shares in favor of the merger at the ProVida special shareholders’ meeting. MetLife, Inc. indirectly owns 100% of the shares of Acquisition Co. and will vote these shares in favor of the merger. As a result, approval of the merger is assured. |

| | Q: | Do I have appraisal rights in connection with the merger? |

| | A: | No. Pursuant to the Chilean Corporations Law, ProVida shareholders who dissent from approval of the merger will not have appraisal rights. However, ProVida shareholders who vote against approval of the merger during the special shareholders’ meeting, or who have not attended such meeting but indicate afterward their disagreement with the merger by delivering a written notice to ProVida, will have the right to withdraw from ProVida in accordance with Article 69 of the LSA, provided that they send a written notice of their objection to the merger and expressly declare their intention to withdraw from ProVida within 30 calendar days from the date on which the merger is approved by vote of the ProVida shareholders. Dissenting shareholders shall be entitled to receive from ProVida a cash payment per share equivalent to the weighted average of the sales prices per share for the ProVida Shares as reported on the Chilean stock exchanges on which the shares are quoted for the 60-trading day period that is between the 90th trading day and the 30th trading day preceding the shareholders’ meeting giving rise to the withdrawal right. If, because of the volume, frequency, number and diversity of the buyers and sellers, the SVS determines that the ProVida Shares are not actively traded on a stock exchange, the price per share paid to the dissenting shareholder shall be the book value per share. Book value per share for this purpose shall be equal to the paid capital of ProVida plus (x) reserves and (y) profits, less losses, divided by the total number of shares outstanding, whether fully paid or not. For the purpose of making this calculation, the most recent available consolidated statements of financial position are used as adjusted to reflect inflation up to the date of the shareholders’ meeting which gave rise to the withdrawal right. As of the date of this prospectus, ProVida Shares are actively traded on Chilean stock exchanges. Pursuant to the Chilean Corporations Law, ProVida shall make the cash payment to, or for the account of, withdrawing shareholders, if any, within 60 calendar days from the day on which the merger is approved by vote of the ProVida shareholders. Withdrawal rights are not dependent on completion of the merger, except that such rights are not available and no such payment will be due if the merger is revoked by vote of either the ProVida or Acquisition Co. shareholders within 60 calendar days from the date the merger was first approved by vote of such shareholders. |

| | | If you hold ProVida Shares, you may exercise your right of withdrawal either by voting your shares against the merger at the shareholders’ meeting and by sending a written notice of withdrawal to ProVida within 30 calendar days from the date of the shareholders’ meeting or, if you do not attend the shareholders’ meeting, by sending a written notice of withdrawal to ProVida within 30 calendar days from the date of the shareholders’ meeting. This means that ProVida must receive your written notice on or before January 28, 2015. This notice of withdrawal must specifically state that you are electing to withdraw from ProVida because you disagree with the merger of ProVida with and into Acquisition Co. as approved at the ProVida shareholders’ meeting. You must send your notice of withdrawal by certified or registered mail to ProVida or, alternatively, arrange for a Chilean notary public to present and certify your notice of withdrawal to the ProVida board of directors.If you are a ProVida shareholder and you vote in favor of the merger, you will NOT have any right of withdrawal under Chilean law. |

If you hold ADSs and wish to exercise your withdrawal rights, in addition to following the process set forth above, you will need to first surrender your ADSs to The Bank of New York Mellon in exchange for the underlying shares of ProVida. See “PART THREE—THE MERGER—Effects of the Merger on ProVida ADR holders,” beginning on page 25.

| | Q: | If the approval of the merger is assured, why should I vote? |

| | A: | You should vote to preserve your right to receive a cash payment. As discussed above, ProVida shareholders who vote against approval of the merger and who provide ProVida with the required |

3

| | notice of withdrawal will have the right to withdraw from ProVida and to receive from ProVida a cash payment. Note that, if you are unable to vote but indicate afterward your disagreement with the merger by delivering a written notice to ProVida as discussed above, you still may exercise your right of withdrawal. |

| | Q: | Are there risks associated with the merger that I should consider in deciding whether to vote for the merger? |

| | A: | Yes. There are risks related to the merger transaction that are discussed in this document. See, in particular, the detailed description of the risks associated with the merger in “PART TWO—RISK FACTORS,” beginning on page 11. |

| | Q: | May the merger be reversed? |

| | A: | Since the merger must be approved by ProVida and Acquisition Co. shareholders, and authorized by the SP, the merger could be reversed while these authorizations are pending. For purposes of reversing the merger, shareholders of either ProVida or Acquisition Co. shall meet again in a specially convened shareholders’ meeting and override the approval already given by the same quorum, within 60 calendar days from the date the merger was first approved by vote of such shareholders. Likewise, if one of the required regulatory authorizations is not granted, the merger shall be declared an impossibility. However, once the merger has received its last regulatory authorization, it may not be reversed. |

| | Q: | Why am I receiving this document? |

| | A: | In connection with the merger, Acquisition Co. is required by the Securities Act to deliver this document to all shareholders of ProVida within the United States because, upon effectiveness of the merger, subject to your withdrawal rights under Chilean law, each ProVida Share that you own at the effective time of the merger will be converted into one Nueva ProVida Share. As a shareholder of ProVida you will be entitled to vote at the special shareholders’ meeting that has been called in order for the shareholders of ProVida to approve the merger. As discussed above, you may have certain withdrawal rights under Chilean law if you vote against the merger and provide ProVida with the required notice of withdrawal. |

| | Q: | What are the U.S. federal income tax consequences of the merger? |

| | A: | The merger will be treated for U.S. federal income tax purposes as a reorganization within the meaning of Section 368(a) of Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, a U.S. Holder (as defined below) of ProVida Shares generally will not recognize any gain or loss on the exchange of ProVida Shares for Nueva ProVida Shares. |

| | | See “PART THREE—THE MERGER—MATERIAL UNITED STATES TAX CONSEQUENCES—U.S. Federal Income Tax Consequences to U.S. Holders of the Merger,” beginning on page 30 for a more complete discussion of the U.S. federal income tax consequences of the merger. |

| | Q: | What are the Chilean tax consequences of the merger? |

| | A: | The exchange of ProVida Shares for Nueva ProVida Shares will not result in the recognition of income, gain or loss to Foreign Holders (as defined below) for Chilean income tax purposes, except to the extent of any cash paid to dissenting shareholders upon their exercise of the right to withdraw from ProVida. The term “Foreign Holders” is explained in “PART THREE—THE MERGER—Material Chilean Tax Consequences,” beginning on page 33. You should read this section carefully. |

4

| | | Your tax consequences will depend upon your personal situation. We urge you to consult a tax advisor concerning the possible tax consequences of the merger and the subsequent ownership of Nueva ProVida Shares. |

| | Q: | What will be the accounting treatment of the merger? |

| | A: | The merger will be accounted for as an acquisition of a non-controlling interest. |

| | Q: | When will the merger be completed? |

| | A: | The special shareholders’ meeting of ProVida is expected to be held on December 29, 2014, and the special shareholders’ meeting of Acquisition Co. on or around such date. Acquisition Co. owns approximately 93.2% of the ProVida Shares and will vote these shares in favor of the merger at the ProVida shareholders’ meeting. MetLife, Inc. indirectly owns 100% of the shares of Acquisition Co. and will vote these shares in favor of the merger. As a result, approval of the merger is assured. Upon shareholder approval of the merger, Acquisition Co. and ProVida will seek the required regulatory approval of the merger from the SP. |

| | | After all of the approvals to the completion of the merger have been received, ProVida will merge into Acquisition Co., and ProVida will cease to exist as a separate entity. Nueva ProVida will set a date for the exchange of ProVida Shares for Nueva ProVida Shares. Nueva ProVida will then publish in a national Chilean newspaper a notice stating when the exchange of shares will occur and when and where ProVida shareholders will be able to exchange certificates representing ProVida Shares for certificates representing Nueva ProVida Shares. On the date of the exchange, all ProVida Shares will automatically be converted by operation of Chilean law into Nueva ProVida Shares in accordance with the exchange ratio. The merger is currently expected to be consummated on or before December 31, 2015. |

| | Q: | Are any other approvals necessary for the completion of the merger? |

| | A: | Except for the approvals of the shareholders of each of Acquisition Co. and ProVida and the authorization by the SP, there are no other approvals necessary to complete the merger. |

| | Q: | What is the record date for the special shareholders’ meeting? |

| | A: | According to Article 62 of LSA and ProVida’s bylaws, only ProVida shareholders who are registered on ProVida’s shareholders registry as of midnight five business days prior to a shareholders’ meeting will be entitled to attend and vote at such meeting. The record date will therefore be December 22, 2014. |

| | Q: | Where and when is the special shareholders’ meeting to approve the merger being held? |

| | A: | ProVida will hold its special shareholders’ meeting at 10:00 a.m., Chilean time, on December 29, 2014, at the headquarters of ProVida located at Pedro de Valdivia 100, 1st Floor, Providencia, Santiago, Chile. |

| | | Acquisition Co. will hold its special shareholders’ meeting on or around December 29, 2014, at the headquarters of Acquisition Co. located at Agustinas 640, 22nd floor, Santiago, Chile. |

| | Q: | Do I have to attend the special shareholders’ meeting of ProVida in person to vote? |

| | A: | A holder of ProVida Shares may attend the special shareholders’ meeting in person or by means of a power of attorney granted in accordance with Chilean law to an attorney-in-fact who must attend the meeting in person and vote the shares on such holder’s behalf. |

5

| | | Acquisition Co. owns approximately 93.2% of the ProVida Shares and it will vote these shares in favor of the merger at ProVida shareholders’ meeting. |

| | Q: | What do I have to do to monetize my investment in ProVida if I own through ProVida ADSs? |

| | A: | You may sell your ADSs at any time prior to March 18, 2015. Also prior to such date, you may surrender your ADSs to The Bank of New York Mellon in exchange for the underlying ProVida Shares, or Nueva ProVida Shares if the merger becomes effective prior to March 18, 2015. You would then be free to hold such shares or to sell such shares on any exchange on which such shares trade. Note that delivery of the underlying shares may require you to have a bank account in Chile as well as your local bank/agent to have instructions to receive such shares from The Bank of New York Mellon’s custodian. You or your broker must contact your bank/agent to ensure that the necessary receipt instructions are in place. However, after March 17, 2015, The Bank of New York Mellon may sell the shares underlying any ADSs that have not then been surrendered. The Bank of New York Mellon shall thereafter hold un-invested the net proceeds of any such sale, for the pro-rata benefit of the holders of any such outstanding ADSs. You could then receive your proportionate share of such net proceeds upon surrender of your ADSs. Note that The Bank of New York Mellon will charge you fees for surrender of the ADSs, either to receive delivery of deposited ProVida Shares or Nueva ProVida Shares or to receive the proceeds of the sale of those shares. If you contact The Bank of New York Mellon at 212-815-2721 or 212-815-2722, they would be glad to assist you with any further questions that you may have. |

| | Q: | What do I have to do to continue my investment in ProVida if I own through ADSs? |

| | A: | Notwithstanding the termination of the ADR program, prior to March 18, 2015, you may surrender your ADSs to The Bank of New York Mellon in exchange for the underlying ProVida Shares, or Nueva ProVida Shares if the merger becomes effective prior to March 18, 2015. You would then be free to hold such shares. Note that delivery of the underlying shares may require you to have a bank account in Chile as well as your local bank/agent to have instructions to receive such shares from The Bank of New York Mellon’s custodian. You or your broker must contact your bank/agent to ensure that the necessary receipt instructions are in place. Note that The Bank of New York Mellon will charge you fees for the surrender of ADSs to receive delivery of deposited ProVida Shares or Nueva ProVida Shares. If you contact The Bank of New York Mellon at 212-815-2721 or 212-815-2722, they would be glad to assist you with any further questions that you may have. |

| | Q: | Will The Bank of New York Mellon vote ProVida Shares underlying ADSs at the ProVida special shareholders’ meeting? |

| | A: | The Bank of New York Mellon will not vote ProVida Shares underlying ADSs at the ProVida special shareholders’ meeting. |

| | Q: | Will ProVida solicit proxies to vote shares of the holders at the special shareholders’ meeting? |

| | A: | No. ProVida will not solicit proxies to vote the shares of the holders at the special shareholders’ meeting. This document is not a proxy statement and we ask you not to deliver proxies to ProVida or Acquisition Co. |

| | Q: | Who can help answer my questions? |

| | A: | If you have any questions about the proposed restructuring or merger, you should contact ProVida’s general counsel, Andrés Veszprémy Schilling, by telephone at +(562) 2351-1187 or by e-mail at aveszpremy@provida.cl. |

6

SUMMARY

The following is a summary that highlights information contained in this prospectus. This summary may not contain all of the information that is important to you. Acquisition Co. encourages you to read carefully this entire prospectus, including the merger agreement, a copy of which is attached to this prospectus as Annex A, for a more complete description of the merger agreement and the transactions contemplated thereby.

In this document, references to “$,” “dollars,” “USD,” US$ or “U.S. dollars” are to United States dollars; references to “ThUS$” are thousands of US dollars and “MUS$” are millions of US dollars; references to “pesos” or “Ch$” are to Chilean pesos, references to “Ch$ million” or “MCh$” are to millions of Chilean pesos; and references to “UF” are to Unidades de Fomento. The Unidad de Fomento is a unit of account that is linked to, and is adjusted daily to reflect changes in, the Chilean consumer price index. As of December 3, 2014, one UF was equivalent to Ch$24,578.14.

The Parties (see page 18)

Administradora de Fondos de Pensiones ProVida S.A.

Administradora de Fondos de Pensiones ProVida S.A. (“ProVida”), Tax Identification Number (TIN) 98.000.400-7, is a corporation (sociedad anónima) incorporated under the laws of Chile, authorized to exist and operate as a pension fund administrator (“AFP”) whose exclusive purpose is the management of pension funds, subject to the oversight and control of the SP.

ProVida was created by public deed dated on March 3, 1981, duly executed at the Santiago Notarial Office of Mr. Patricio Zaldívar Mackenna, amended by public deed dated March 25, 1981, executed in the presence of the same notary. ProVida was authorized to exist under Resolution No. E-006-81 dated April 1, 1981, issued by the SP, the certificate of which was recorded on page 6,060 entry number 3,268, in the Commerce Registry of Santiago for the year 1981 and published in the Chilean Official Gazette No. 30,932 on April 3, 1981.

As required by Chilean laws governing pension fund administrators, the exclusive line of business of ProVida is to collect contributions made by its participants and to invest and manage it in pension funds (Article 23, DL 3,500; Article 52,Reglamento DL 3,500), along with the delivery of benefits authorized by law (for example, it provides life and disability benefits for its participants, as well as a senior pension for participants).

The mailing address and telephone number of ProVida’s principal executive offices are:

Administradora de Fondos de Pensiones ProVida S.A.

Pedro de Valdivia 100, 1st floor

Providencia, Santiago, Chile

Postcode 7510185

Telephone: (56 2) 2 2351 1200

MetLife Chile Acquisition Co. S.A.

MetLife Chile Acquisition Co. S.A. (before the effectiveness of the merger, “Acquisition Co.,” or, after the effectiveness of the merger, “Nueva ProVida”), TIN 76.265.736-8, is a closely-held corporation (sociedad anónima cerrada) incorporated under the laws of Chile, and it is a wholly-owned, indirect subsidiary of MetLife, Inc. It was incorporated by public deed dated February 22, 2013, executed at the Santiago Notarial Office of Mr. Iván Torrealba Acevedo. An excerpt of such instrument was recorded on page 16,784 entry number 11,041 in the Commerce Registry of Santiago for the year 2013, and published in the Chilean Official Gazette No. 40,493 on February 23, 2013.

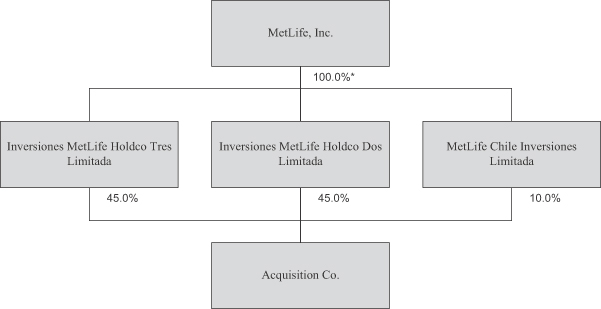

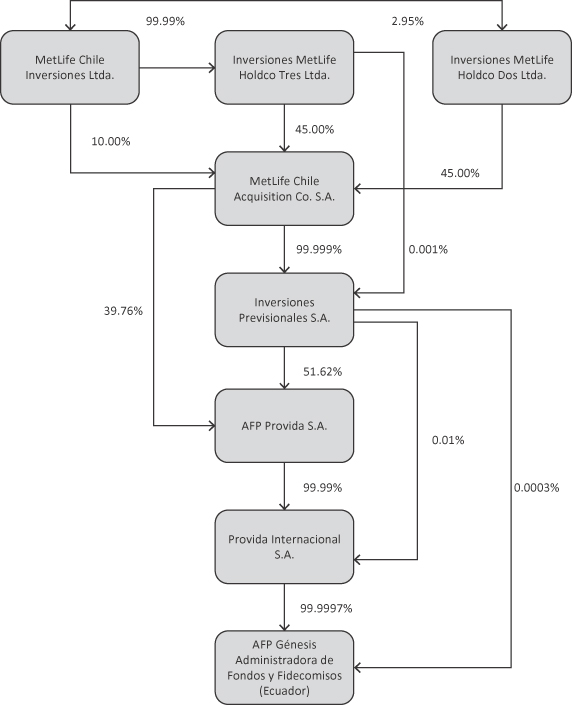

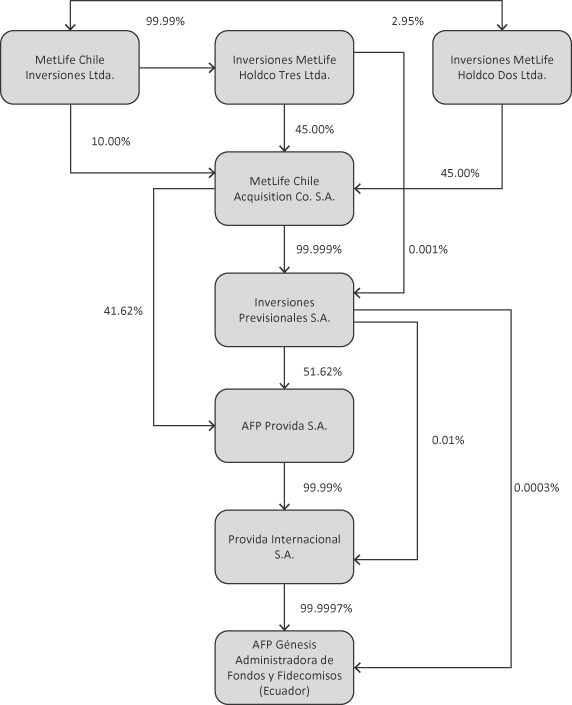

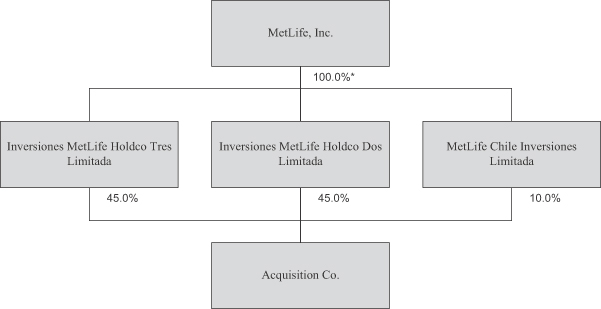

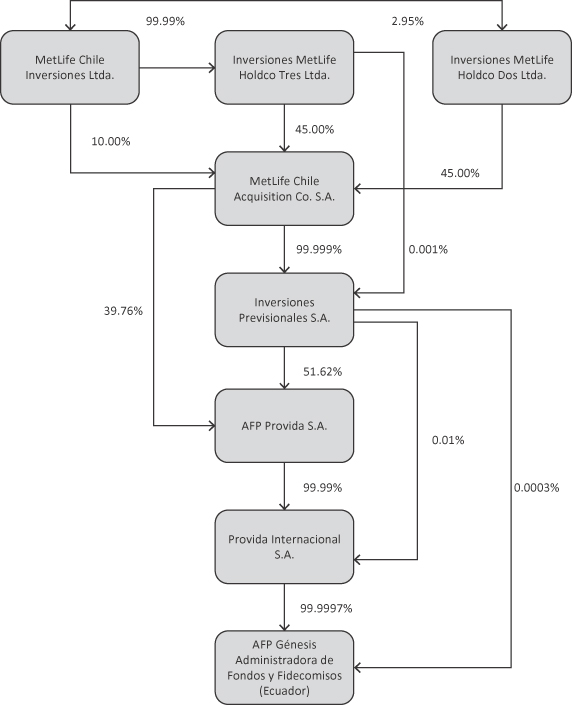

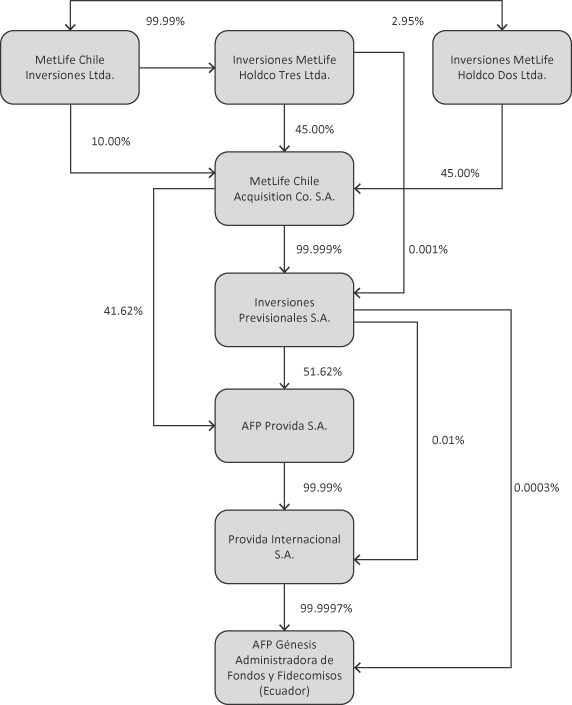

As of the date of this prospectus, Acquisition Co.’s capital stock is divided into 308,928,816 shares of common stock, pursuant to an amendment of the bylaws approved on November 12, 2014 that is in process of being registered and published. Such shares are wholly and directly owned by three (3) subsidiaries of MetLife, Inc., as

7

follows: (i) Inversiones MetLife Holdco Dos Limitada, which owns a 45% equity interest in Acquisition Co.; (ii) Inversiones MetLife Holdco Tres Limitada, which owns a 45% equity interest in Acquisition Co.; and (iii) MetLife Chile Inversiones Limitada, which owns a 10% equity interest in Acquisition Co.

The board of directors of Acquisition Co. is composed of three members, who currently are Randal W. Haase (President), Ronald Mayne-Nicholls Secul, and Pablo Iacobelli del Río. The Chief Executive Officer of Acquisition Co. is Ronald Mayne-Nicholls Secul.

The mailing address and telephone number of Acquisition Co.’s principal executive offices are:

MetLife Chile Acquisition Co. S.A.

Agustinas 640, 18th floor

Santiago, Chile

Postcode 8320219

Telephone (562) 2 2826 3000

The Merger (see page 18)

Pursuant to the merger agreement, ProVida will be merged with and into Acquisition Co. with Acquisition Co. being the surviving company. Under the terms of the merger agreement, Acquisition Co. will absorb ProVida pursuant to Article 99 of the LSA. Acquisition Co. will be the surviving corporation, and ProVida will cease to exist as a separate entity. Upon effectiveness of the merger, Acquisition Co. is expected to change its name to “Administradora de Fondos de Pensiones ProVida S.A.” and, upon the publication in the Chilean Official Gazette of the approval by the SP of the merger, will assume, by universal succession, all of the assets, liabilities and equity, and will succeed to all of the rights and obligations, of ProVida.

After all of the approvals to the completion of the merger have been received, Nueva ProVida will set a date for the exchange of ProVida Shares (other than those held by Acquisition Co. and its affiliates) for Nueva ProVida Shares. On the date of the exchange, each ProVida Share will be converted into one Nueva ProVida Share.

Effective Date and Completion of the Merger

Once the merger is approved by the shareholders of each of ProVida and Acquisition Co., and all of the authorizations for the completion of the merger are satisfied, the absorption merger of ProVida into Acquisition Co. shall be effective on the date indicated by the SP in the resolution that contains the authorization of the SP for the merger (the “Effective Date”).

On the Effective Date, Nueva ProVida shall proceed to register in its shareholders’ registry all the persons who were registered in the shareholders’ registry of ProVida as of midnight on the immediately preceding day. Nueva ProVida shall also register the transfer forms duly submitted to ProVida previously, to the extent not yet registered, whereupon shareholders of ProVida shall be deemed to be shareholders of Nueva ProVida for all applicable purposes.

The board of directors of Nueva ProVida shall set a date, which could be the Effective Date or thereafter, to perform the actual exchange of the certificates representing the shares issued by ProVida for the certificates representing the shares issued by Nueva ProVida. As of midnight on the date on which such exchange occurs, the former shares issued by ProVida shall no longer be traded on any securities exchange, and the Nueva ProVida Shares shall begin trading.

Merger Consideration (see page 25)

In the merger, each holder of ProVida Shares (other than Acquisition Co. and its affiliates) will receive one Nueva ProVida Share for each ProVida Share, which we refer to as the exchange ratio. Nueva ProVida will pay no additional consideration in cash or in kind to the shareholders of ProVida in connection with the merger.

8

The Nueva ProVida Shares to be issued in the merger will have similar rights (including the right to receive dividends) as the ProVida Shares prior to the merger, as set forth in ProVida’s bylaws. However, the Nueva ProVida bylaws contain a “squeeze-out” mechanism. Under this squeeze-out mechanism, if (i) the controlling shareholder of Nueva ProVida launches a tender offer for 100% of the Nueva ProVida Shares, (ii) in such tender offer the controlling shareholder of Nueva ProVida acquires at least 15.0% of the issued and outstanding Nueva ProVida Shares from non-related shareholders, and (iii) as a result the controlling shareholder of Nueva ProVida reaches 95.0% or more of the then outstanding Nueva ProVida Shares; then such controlling shareholder would be entitled to require that the remaining shareholders of Nueva ProVida sell their Nueva ProVida Shares to such person in accordance with Chilean law.

ProVida’s shareholders will not be diluted as a consequence of the merger, and therefore, upon effectiveness of the merger, subject to any exercise of withdrawal rights, ProVida shareholders (other than Acquisition Co. and its affiliates), are expected to hold Nueva ProVida Shares representing the same percentage held in the aggregate by such shareholders in ProVida immediately prior to the effective time of the merger, and MetLife, Inc. and its affiliates are expected to own the same percentage held in the aggregate by such parties in ProVida immediately prior to the effective time of the merger.

Shareholders of ProVida Entitled to Vote; Vote Required (see page 28)

Pursuant to Article 62 of the LSA and ProVida’s bylaws, only those shareholders whose shares are registered in the shareholders registry as of midnight five business days prior to the date of the meeting may take part in the ProVida special shareholders’ meeting and exercise their rights to speak and vote. Therefore, all ProVida shareholders who hold ProVida Shares of record as of midnight on December 22, 2014 will be entitled to attend and vote at the special shareholders’ meeting to approve the merger.

ProVida’s bylaws provide that holders may cast one vote for each ProVida Share that they own on December 22, 2014.

For those shareholders who will not attend the special shareholders’ meeting in person, Chilean law permits all shareholders entitled to vote to be duly represented by means of a power of attorney granted in accordance with Chilean law to an attorney-in-fact who must attend the meeting in person and vote the shares on such holder’s behalf.

In order to effect the merger, ProVida shareholders and Acquisition Co. shareholders must approve the merger of ProVida into Acquisition Co. as contemplated by the merger agreement. The merger requires the approval of at least two-thirds of the votes cast at each of the ProVida special shareholders’ meeting and the Acquisition Co. special shareholders’ meeting, where at least a majority of the issued share capital of each respective company is present or represented at the meeting at the first call of such meeting, or, if held on the second call, any number of shareholders. Acquisition Co. owns approximately 93.2% of the ProVida Shares and will vote these shares in favor of the merger at the ProVida special shareholders’ meeting. As a result, approval of the merger by ProVida’s shareholders is assured. MetLife, Inc. indirectly owns 100% of the shares of Acquisition Co. and will vote these shares in favor of the merger. As a result, approval of the merger by Acquisition Co.’s shareholders is assured.

Directors and Management of the Surviving Company After the Merger (see page 23)

The surviving company shall be known as “Administradora de Fondos de Pensiones ProVida S.A.” upon the effectiveness of the merger. The executive offices of Nueva ProVida will be located at Pedro de Valdivia 100, 1st floor, Providencia, Santiago, Chile, Postcode 7510185. Upon effectiveness of the merger, the senior management and the directors of Acquisition Co. shall resign and the senior management and directors of ProVida shall become the senior management and directors of Nueva ProVida.

9

Bylaws of the Surviving Company

Prior to or upon effectiveness of the merger, the bylaws of the surviving company will be adjusted to those of a single-purpose corporation engaged in the management of pension funds and to those of a publicly held corporation registered in the securities registry kept by the SVS, which shall also be approved at the special shareholders’ meeting of ProVida. It is expected that the bylaws will be substantially the same as those of ProVida, including the same name, the same corporate purpose, and the same administration; provided, however, that the bylaws of the surviving company will include a squeeze-out right, which was approved at a special shareholders’ meeting of Acquisition Co. (see “PART FOUR—INFORMATION ABOUT METLIFE CHILE ACQUISITION CO. S.A.—History and Development of Acquisition Co.,” beginning on page 44).

Ownership of Nueva ProVida After the Merger (see page 21)

ProVida’s shareholders will not be diluted as a consequence of the merger, and therefore, upon effectiveness of the merger, subject to any exercise of withdrawal rights, ProVida shareholders (other than Acquisition Co. and its affiliates) are expected to hold Nueva ProVida Shares representing the same percentage held in the aggregate by such shareholders in ProVida immediately prior to the effective time of the merger, and MetLife, Inc. and its affiliates are expected to own the same percentage held in the aggregate by such parties in ProVida immediately prior to the effective time of the merger.

The Nueva ProVida Shares issued pursuant to the merger shall have similar rights including with respect to dividends and distributions, as ProVida Shares prior to the merger. However, the Nueva ProVida bylaws contain a “squeeze-out” mechanism. Under this squeeze-out mechanism, if (i) the controlling shareholder of Nueva ProVida launches a tender offer for 100% of the Nueva ProVida Shares, (ii) in such tender offer acquires at least 15.0% of the issued and outstanding Nueva ProVida Shares from non-related shareholders, and (iii) as a result reaches 95.0% or more of the then outstanding Nueva ProVida Shares, then such controlling shareholder would be entitled to require that the remaining shareholders of Nueva ProVida sell their Nueva ProVida Shares to such person in accordance with Chilean law.

Security Ownership by Management of ProVida and Acquisition Co. (see page 28)

As of the date of this prospectus, no member of the board of directors or any member of the senior management of either ProVida or Acquisition Co. is the beneficial owner of more than one percent of the shares of either ProVida or Acquisition Co.

Admission to Trading and Listing of Nueva ProVida Shares (see page 28)

Nueva ProVida is not required to ensure that the Nueva ProVida Shares are admitted to trading and listed on the New York Stock Exchange (“NYSE”) or to enter into a deposit agreement for the issuance of American depositary shares representing such shares. It is not currently expected that the Nueva ProVida Shares will be voted or traded on the NYSE. The Nueva ProVida Shares will be listed on the Santiago Stock Exchange (Bolsa de Comercio de Santiago), the Chilean Electronic Stock Exchange (Bolsa Electrónica de Chile) and the Valparaiso Stock Exchange (Bolsa de Valores de Valparaiso).

Appraisal/Withdrawal Rights in the Merger (see page 29)

ProVida shareholders will not have any appraisal rights under Chilean law or under ProVida’s bylaws in connection with the merger, and neither ProVida nor Acquisition Co. will independently provide ProVida shareholders with any such rights. However, ProVida shareholders who vote against approval of the merger and who provide ProVida with the required notice of withdrawal, or who have not attended such meeting but indicate afterward their disagreement with the merger by delivering a written notice to ProVida within 30 calendar days after such meeting, will have the right to withdraw from ProVida in accordance with Article 69 of the LSA. See “PART THREE—THE MERGER—Appraisal Rights/Withdrawal Rights of ProVida Shareholders,” beginning on page 23.

10

PART TWO—RISK FACTORS

In addition to the other information included in this prospectus, including the matters addressed under “Cautionary Statement Concerning Forward-Looking Statements,” you should carefully consider the following risks before deciding whether to vote to adopt the merger of ProVida into Acquisition Co. as contemplated by the merger agreement. ProVida’s or Nueva ProVida’s business, financial condition or results of operation could be materially and adversely affected by any of these risks.

Risks Related to the Merger

The effectiveness of the merger is subject to certain approvals and authorizations that may delay or even frustrate the whole merger proposal.

ProVida is a special-purpose company subject to the oversight and control of the Chilean Pensions Superintendency or SP. As a pension fund administrator or AFP, ProVida must comply with Decree Law 3,500 and its Regulations, which regulate the Chilean pensions system. In all those matters not regulated by Decree Law 3,500 and its Regulations, AFPs are governed “by the law applicable to publicly held corporations” (Article 132 LSA; Article 52 RSA).

Consequently, the proposed merger will require prior authorizations granted by the SP, including approval to operate Acquisition Co. as an AFP and approval of the merger.

The processes of obtaining the SP resolution that authorizes Acquisition Co. to operate as an AFP could take a longer period of time than estimated.

During the process to obtain authorization from the SP for Acquisition Co. to operate as an AFP, petitioners may be requested to submit certain documents concerning the suitability of the company and the background of the constituents, according to Article 24A of DL 3,500. The list of documents to be submitted is detailed in the rules issued by the SP. However, the SP has the authority to request any other document that it shall consider necessary for the purposes of complying with provisions of Article 24A of DL 3,500. The exercise of this authority could delay the process of the merger.

The filing required for approval by the SP of Acquisition Co.’s operation as an AFP will be evaluated in light of the “convenience” of operating a new AFP.

According to Article 130 of LSA, the operation of an AFP requires the submission of a filing to the SP, detailing the new company’s structure, line of business, financial and other information. The assessment of the filing, performed by the Superintendent of Pensions, shall be made particularly in accordance with the “convenience” of operating a new AFP. No assurance can be given that the SP will grant its approval.

Investors who own ProVida Shares but who do not wish to hold Nueva ProVida Shares may sell the Nueva ProVida Shares they receive or expect to receive in the merger. This may put downward pressure on the market price of the Nueva ProVida Shares that you will receive in the merger.

For a number of reasons, some shareholders of ProVida may wish to sell their ProVida Shares prior to completion of the merger or to sell the Nueva ProVida Shares that they will receive in the merger. These sales or the prospect of future sales could adversely affect the market price for ProVida Shares and Nueva ProVida Shares.

The value of the Nueva ProVida Shares at the time you receive them could be less than at the time you vote on the merger.

In the merger, each ProVida Share will be exchanged for one Nueva ProVida Share. The exchange ratio will not be adjusted to reflect any changes in the business, operations or prospects of ProVida or Nueva ProVida, market reactions to the merger, general market and economic conditions or any other factors between the date the merger is approved and the date it is consummated.

11

Nueva ProVida may be unable to fully realize the anticipated benefits of the merger.

No assurance can be given that the benefits expected to be achieved by Nueva ProVida will be realized. The tax benefits may not be realized if, among other reasons, (i) the merger is not considered to be initiated before January 1, 2015 according to the interpretation of the Chilean Tax Administration (Servicio de Impuestos Internos, the “Chilean Tax Administration”) or (ii) the merger is not consummated on or before December 31, 2015. The value of the Nueva ProVida Shares could be adversely affected to the extent Nueva ProVida fails to realize the Chilean tax benefits.

Risks Related to Chile

Political developments in Chile may adversely affect Nueva ProVida.

ProVida and several of its subsidiaries are Chilean companies with all or a substantial portion of their operations located in Chile. As of September 30, 2014, 99.9% of ProVida’s assets and operations, on a consolidated basis, were located in Chile. In addition, approximately 98.8% of ProVida’s sales and revenue, on a consolidated basis, are derived from sales in Chile. Nueva ProVida is expected to continue ProVida’s operations. Therefore, Nueva ProVida’s business strategies, financial condition and results of operations could be adversely affected by changes in policies of the Chilean government, other political developments in or affecting Chile, and regulatory and legal changes or administrative practices of Chilean authorities, over which Nueva ProVida will have no control.

A downturn in the Chilean economy may adversely affect Nueva ProVida.

ProVida conducts its operations in Chile and Nueva ProVida is expected to continue such operations. Accordingly, the results of Nueva ProVida’s operations and financial condition are sensitive to and dependent upon the level of economic activity in Chile. Chile’s recent rates of gross domestic product growth may decline in the future, and future developments in or affecting the Chilean economy could impair Nueva ProVida’s ability to proceed with its business plan or materially adversely affect its business, financial condition or results of operations.

Risks Related to Nueva ProVida

The economic situation in Chile will significantly affect Nueva ProVida’s results.

The main source of Nueva ProVida’s revenues from operations will come from the monthly fees charged to its contributors for mandatory contributions made in contributors’ individual capitalization accounts, which are compulsory for every salaried worker as long as there is a labor contract in force. These represented 95.2% of the total revenues from operations of ProVida for the nine months ended September 30, 2014. As a result, the economic situation in Chile related to economic activity indicators and employment conditions will significantly affect Nueva ProVida’s results.

Macroeconomic conditions affect the financial capacity of employers and/or entrepreneurs, which might produce a drop in the number of employee contributors or a lack of capacity for creating new jobs, and decrease the salary of workers. Therefore, both variables—number of employee contributors and average salary—determine the salary base of the contributors and affect Nueva ProVida’s results. An increase in the unemployment rate negatively affects Nueva ProVida’s results and, depending on its magnitude, the impact could be significant.

Additionally, Nueva ProVida’s financial condition and operations results could also be adversely affected by changes in the economic policies implemented by the Chilean Government, political or economic developments in Chile or those affecting Chile. Changes in the development of the Chilean economy could adversely affect Nueva ProVida’s ability to develop its business strategy.

12

Natural disasters occurring in Chile could be another factor affecting the country’s economy and thus Nueva ProVida’s results if they affect the unemployment level in the country, result in tax increases or cause significant damage to Nueva ProVida’s assets.

Pension funds are global investors, which are affected by the economies of neighboring countries as well as by worldwide economic development.

Pension funds, such as those to be managed by Nueva ProVida, are global investors and are therefore affected by both the economies of neighboring countries as well as by worldwide economic factors. In recent years, pension fund returns have been subject to volatility in international and local financial markets, where foreign investments represented 45.0% of ProVida’s total assets under management as of September 30, 2014.

The worldwide economy could affect Nueva ProVida’s returns obtained on mandatory investments and therefore its net profit.

Nueva ProVida will have limitations on significantly increasing its market position.

According to official statistics released by the SP, ProVida has maintained a leading position in the private pension system since its incorporation, which has led to a market share of 35% in terms of number of participants and 28% in terms of assets under management. Nueva ProVida is expected to continue ProVida’s operations. Given its position in this market and its relative size, it is highly probable that competitors will take steps toward attracting participants from Nueva ProVida and persuading them to transfer their funds and make contributions to other AFPs, limiting Nueva ProVida from significantly increasing its market share. A decrease in Nueva ProVida’s participant portfolio could have a negative impact on its revenues from operations.

Nueva ProVida will be limited in its ability to improve the performance of its assets under management.

ProVida’s assets under management, totaling MCh$27,389,600 (US$45.7 billion) as of September 30, 2014, are very large with respect to the size of the local capital market measured by its total capitalization. Nueva ProVida is expected to continue ProVida’s operations. This reduces Nueva ProVida’s flexibility to significantly modify its portfolio structures, and consequently to improve the return offered to its participants. Additionally, in situations of instability or uncertainty in the markets, Nueva ProVida’s reactive capacity is likely to be limited. In this context, Nueva ProVida cannot ensure that it will be able to maintain a sufficient rate of return on its pension funds to decrease the number of participant transfers. Any decrease in Nueva ProVida’s participant portfolio could have a negative impact on its revenues from operations.

Additionally, if pension fund returns managed by Nueva ProVida do not achieve the legal minimum return established by law, due to any instability or uncertainty in capital markets as described above, Nueva ProVida could lose part of its mandatory investments aimed at covering this difference. See “PART FIVE—INFORMATION ABOUT ADMINISTRADORA DE FONDOS DE PENSIONES PROVIDA S.A.—Business Overview—Principal activities—Investment services for participants’ contributions in the pension funds,” beginning on page 56. This portion must be replenished in a maximum term of 15 days to fulfill the legal requirement to maintain a reserve equal to 1% of the value of each pension fund under management and to continue with its business with the consequent reduction in Nueva ProVida’s equity.

Nueva ProVida will be operated in a regulated market in which its flexibility to manage its business is limited.

Nueva ProVida’s operations will be regulated by the Pension Law and, to the extent applicable, the Chilean Corporations Law. The Pension Law defines the scope of the business of pension fund administrators, which will only permit Nueva ProVida to engage in the administration of its pension funds and the rendering of related benefits. Nueva ProVida will also be authorized to establish local related corporations that may complement its line of business or invest in pension fund administrators or entities located in other countries whose business is related to pension matters.

13

Regarding pension fund investments, Nueva ProVida must invest such assets in accordance with the types of instruments and within the ranges of assets and maximum percentages allocated per investment and fund type authorized by the Pension Law.

In addition, the Pension Law requires each AFP to maintain a minimum reserve fund known as mandatory investment equal to 1% of the value of each pension fund under management in order to provide a minimum return on investments for each of its pension funds. This minimum return is based on a weighted average of the return by all pension funds in the AFP system in a 36-month period. This requirement has been designated in accordance with different portfolio compositions, giving those with a higher component of variable income and therefore higher volatility (funds Type A and B), a larger margin to achieve the requirement. If a fund’s return for a certain month is lower than the minimum return, the AFP must cover the difference within a five-day period. To do so, the AFP is permitted to apply funds from the mandatory investments, and in that event, such amount must be refunded within 15 days. In accordance with the Pension Law, if an AFP fails to comply with either the minimum return requirement or the minimum reserve fund requirement, it may eventually be required to be dissolved. See “PART FIVE—INFORMATION ABOUT ADMINISTRADORA DE FONDOS DE PENSIONES PROVIDA S.A.—Business Overview—Principal activities—Investment services for participants’ contributions in the pension funds,” beginning on page 56.

The Pension Reform Law (as defined below) increased the investment limits for the pension funds. However, Nueva ProVida cannot ensure that it will be able to fulfill minimum return requirements or the minimum reserve.

Nueva ProVida’s business and results of operations may be affected by changes in laws, regulations or Chilean Government proposals.

On January 16, 2008, the Pension Reform Law in relation to the private pension system (the “Pension Reform Law”) was approved and was published as the Republic Law (N° 20,255) in the Chilean Official Gazette on March 17, 2008. The first changes in the system started to be implemented on July 1, 2008. Changes introduced by the reform cover four areas: coverage improvement, new industrial organization, investments and new institutional framework.

As a result of the implementation of the Pension Reform Law, there is a bidding process for all new participants entering the system every two years beginning in July 2010 and for a 24-month period, whereby the AFP offering the lowest variable fee is awarded the new participant`s accounts. This fee must be lower than the lowest fee operating in the industry and must apply to the AFP’s entire portfolio and not only to the portion awarded.

The approved reform consolidates the current private pension system and is considered to provide an adequate legal framework for AFPs to continue developing their activities. The mandated coverage improvement offers a new business opportunity for AFPs. Additionally, the flexibility to invest in alternatives raises the possibility of increased competition.

However, future changes in laws or regulations in Chile may have a negative effect on Nueva ProVida’s financial results.

In addition, Nueva ProVida will be subject to changes in tax laws. On September 29, 2014, Law No. 20,780 was published in the Chilean Official Gazette (the “Tax Reform”), introducing significant changes to the Chilean taxation system and strengthening the powers of the Chilean Tax Administration to control and prevent tax avoidance. The Tax Reform contemplates, among other matters, changes to the corporate tax regime to create two tax regimes. Starting on January 1, 2017, Chilean companies will be able to opt between two tax systems: (i) the partially integrated regime (sistema parcialmente integrado); or (ii) the attributable taxation regime (sistema derenta atribuida). In both regimes, the corporate tax rate will be gradually increased to 24% in 2016 (21% in 2014, 22.5% in 2015 and 24% in 2016). Starting January 1, 2017, the corporate tax rate will be increased to 25% if the attributable taxation regime is chosen. If the regime chosen is the partially-integrated one the corporate tax will be 25.5% in 2017 and 27% in 2018.

14

Even though the abovementioned election must be made for tax purposes between June and December of 2016, for purposes of its financial statements from 2014 onwards, it is expected that Nueva ProVida will register its liabilities and assets for deferred taxes according to the corporate tax rate that will be applicable under the attributable taxation regime. If Nueva ProVida finally elects the partially integrated regime for tax purposes in 2016, Nueva ProVida shall adjust the book results of its financial statements.

Nueva ProVida will be exposed to the credit risk of its insurers such that the risk of failure of an insurer to pay any required shortfall amount is borne by ProVida.

Under the Pension Reform Law, the pension fund administrators together must purchase insurance for their affiliates, called life and disability insurance (SIS). The right to provide such insurance is awarded through a bidding process, which is carried out by all AFPs.

In the case of bankruptcy of all involved insurance companies, the State guarantees the necessary additional contributions to complete the required amount to finance the life and disability pension through the State guarantee. The coverage of such guarantee is 100% of the prevailing minimum pension and 75% of the excess of the pension with a maximum of UF 45 per month (MCh$1 approximately) for each beneficiary or pensioner.

The significant share ownership of Nueva ProVida’s principal shareholder may have an adverse effect on the future market value of Nueva ProVida Shares.

Upon effectiveness of the merger, MetLife, Inc. and its affiliates are expected to continue to beneficially own in the aggregate approximately 93.2% of the Nueva ProVida Shares. A disposition by MetLife, Inc. and its affiliates of a significant number of Nueva ProVida Shares, or the perception that such a disposition might occur, could adversely affect the trading price of Nueva ProVida Shares on the Santiago Stock Exchange, the Valparaíso Stock Exchange and the Electronic Stock Exchange.

Nueva ProVida’s principal shareholder will be able to exercise significant control over Nueva ProVida, which may result in conflicts of interest.

Upon effectiveness of the merger, MetLife, Inc. and its affiliates are expected to continue to beneficially own approximately 93.2% of the outstanding Nueva ProVida Shares and will continue to be in a position to direct Nueva ProVida’s management and to determine the result of substantially all matters submitted for a vote to Nueva ProVida shareholders, including the election of a majority of the members of Nueva ProVida’s board of directors, determining the amount of dividends distributed by Nueva ProVida (subject to the legally mandated minimum of 30% of net income), adopting amendments to Nueva ProVida’s bylaws, enforcing or waiving Nueva ProVida’s rights under existing agreements, leases and contractual arrangements and entering into agreements with entities affiliated with MetLife, Inc. The interests of MetLife, Inc. and its affiliates may conflict with your interests as a holder of Nueva ProVida Shares.

15

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements based on estimates and assumptions. Forward-looking statements include, among other things, statements concerning the business, capital expenditures, competition and sales, future financial condition, results of operations and prospects of ProVida and Acquisition Co. (and Nueva ProVida, upon effectiveness of the merger).

Certain statements contained in this prospectus are forward-looking statements and are not based on historical fact, such as statements containing the words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect” and similar words, or are tied to future periods. These forward-looking statements are subject to risks, uncertainties and assumptions.

Factors that could cause actual results to differ materially and adversely include, but are not limited to:

| | • | | General economic conditions in Chile and Latin America and the other countries in which ProVida has and Nueva ProVida will have significant business activities or investments, including the United States; |

| | • | | The availability of financing at reasonable terms to Chilean companies, including ProVida and Nueva ProVida; |

| | • | | The failure of governmental authorities to approve the proposed transactions described in this prospectus; |

| | • | | The monetary and interest rate policies of the central bank of Chile (the “Chilean Central Bank”); |

| | • | | Unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices; |

| | • | | Changes in Chilean and foreign laws, regulations and taxes; |

| | • | | Changes in regulations affecting AFPs; |

| | • | | The inability to hedge certain risks economically; |

| | • | | The adequacy of loss reserves; |

| | • | | Changes in consumer spending and saving habits; |

| | • | | Success in managing the risks involved in the foregoing; and |

| | • | | Other factors discussed under “Risk Factors” in this prospectus. |

Forward-looking statements speak only as of the date they are made. ProVida and Acquisition Co. (and Nueva ProVida, upon effectiveness of the merger) undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict all of these factors. In light of these limitations, you should not place undue reliance on forward-looking statements contained in this prospectus.

16

EXCHANGE RATES

The following table sets forth, for the periods and dates indicated, certain information concerning the exchange rate between the Chilean peso and the US dollar. Such exchange rates are provided solely for convenience and are not necessarily the exchange rates used by Acquisition Co. and ProVida in the preparation of the financial statements included in this prospectus. No representation is made to the effect that the Chilean peso could have been, or could be, converted into US dollars at the exchange rates indicated below or at any other exchange rate. There can be no assurance that the Chilean peso will not depreciate or appreciate again in the future.

Nominal Rate of Exchange

(Chilean pesos per US$1.00)

| | | | | | | | | | | | |

Year | | Average | | | High | | | Low | |

2009 | | | 559.67 | | | | 643.87 | | | | 491.09 | |

2010 | | | 510.38 | | | | 549.17 | | | | 468.37 | |

2011 | | | 483.36 | | | | 533.74 | | | | 455.91 | |

2012 | | | 486.75 | | | | 519.69 | | | | 469.65 | |

2013 | | | 495.00 | | | | 533.95 | | | | 466.50 | |

Source: Chilean Central Bank.

Nominal Rate of Exchange

(Chilean pesos per US$1.00)

| | | | | | | | | | | | |

Month in 2014 | | Average | | | High | | | Low | |

January | | | 537.03 | | | | 550.53 | | | | 524.61 | |

February | | | 554.41 | | | | 563.32 | | | | 546.94 | |

March | | | 563.84 | | | | 573.24 | | | | 550.53 | |

April | | | 554.64 | | | | 563.76 | | | | 544.96 | |

May | | | 555.40 | | | | 566.88 | | | | 548.04 | |

June | | | 553.06 | | | | 559.12 | | | | 549.59 | |

July | | | 558.21 | | | | 570.51 | | | | 548.72 | |

August | | | 579.05 | | | | 593.28 | | | | 571.75 | |

September | | | 593.47 | | | | 601.66 | | | | 585.29 | |

October | | | 589.98 | | | | 599.22 | | | | 576.65 | |

November | | | 592.46 | | | | 600.37 | | | | 576.50 | |

Source: Chilean Central Bank.

According to the latest information published by the Chilean Central Bank as of the date of issuance of this prospectus, the exchange rate on December 3, 2014 was Ch$614.77 per US$1.00.

17

PART THREE—THE MERGER

THE MERGER

The following is a description of the material aspects of the merger. While ProVida and Acquisition Co. believe that the following description covers the material terms of the merger, the description may not contain all of the information that is important to you. ProVida and Acquisition Co. encourage you to read carefully this entire prospectus, including the merger agreement, a copy of which is attached to this prospectus as Annex A, for a more complete understanding of the merger agreement and the transactions contemplated thereby.

The Parties

Acquisition Co. is a Chilean closed corporation (sociedad anónima cerrada) organized under the laws of Chile that is a wholly-owned, indirect subsidiary of MetLife, Inc. It was formed solely for the purpose of acquiring ProVida Shares and ADSs. For further information, see “PART FOUR—INFORMATION ABOUT METLIFE CHILE ACQUISITION CO. S.A.—History and Development of Acquisition Co.,” beginning on page 44.

ProVida is a corporation (sociedad anónima) organized under the laws of Chile and designated thereunder as a pension fund administrator or AFP. As required by Chilean laws governing pension fund administrators, the exclusive line of business of ProVida is to collect contributions made by its participants and to invest and manage the contributions in pension funds (Article 23, DL 3,500; Article 52, Reglamento DL 3,500), along with the delivery of benefits authorized by law (for example, it provides life and disability benefits for its participants, as well as a senior pension for participants). For further information, see “PART FIVE—INFORMATION ABOUT ADMINISTRADORA DE FONDOS DE PENSIONES PROVIDA S.A.—History and Development of ProVida,” beginning on page 51.

General Information Concerning the Merger

On the Effective Date, ProVida will merge into Acquisition Co. by way of absorption by Acquisition Co. of ProVida, without liquidation of ProVida. The surviving company will be known as “Administradora de Fondos de Pensiones ProVida S.A.” upon the effectiveness of the merger. ProVida shareholders (other than Acquisition Co. and its affiliates) will receive the merger consideration upon the terms set forth in the merger agreement and as further described under “PART THREE—THE MERGER AGREEMENT— Merger Consideration,” beginning on page 25.

Background of the Merger

On September 29, 2014, the new Chilean Tax Law 20,780 was enacted. Upon the law’s enactment, Acquisition Co. and its affiliates, together with its advisors, started evaluating potential effects of such law on Acquisition Co. and its affiliates, as well as on ProVida.

On November 12, 2014, a special shareholders’ meeting of Acquisition Co. approved a decrease in the number of shares into which the capital of Acquisition Co. is divided, from 2,081,600,000 to 308,928,816, without reducing its corporate capital or affecting the rights and preferences of shares in Acquisition Co. Such amendment is in the process of being registered in the Registry of Commerce and published in the Chilean Official Gazette.

Also on November 12, 2014, the board of directors of Acquisition Co. approved the merger agreement and sent it to its shareholders for their consideration. Afterwards, the merger agreement was executed by and among Acquisition Co.’s shareholders (Inversiones MetLife Holdco Dos Limitada, Inversiones MetLife Holdco Tres Limitada, and MetLife Chile Inversiones Limitada) on the one hand, and Acquisition Co. (as ProVida’s controlling shareholder) on the other hand. A duly appointed representative of Acquisition Co. then delivered a letter to the Chairman of the board of directors of ProVida, requesting the convening of a special shareholders’ meeting for approval of the merger. Afterwards, on December 3, the merger agreement was amended by Acquisition Co. and the other parties to the merger agreement, and a restated version of it was approved. The merger agreement sets forth mutual obligations for the completion of the merger by absorption of ProVida into Acquisition Co.

18