UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2018

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Cheniere Energy Partners LP Holdings, LLC

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | 001-36234 | 36-4767730 |

| (State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | |

700 Milam Street, Suite 1900 Houston, Texas | | 77002 |

| (Address of principal executive offices) | | (Zip Code) |

(713) 375-5000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | |

Large accelerated filer x | Accelerated filer ¨ |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

| | | | Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of May 1, 2018, the registrant had 231,700,000 common shares outstanding.

CHENIERE ENERGY PARTNERS LP HOLDINGS, LLC

TABLE OF CONTENTS

DEFINITIONS

As used in this quarterly report, the terms listed below have the following meanings:

Common Industry and Other Terms

|

| | |

| EPC | | engineering, procurement and construction |

| GAAP | | generally accepted accounting principles in the United States |

| LNG | | liquefied natural gas, a product of natural gas that, through a refrigeration process, has been cooled to a liquid state, which occupies a volume that is approximately 1/600th of its gaseous state |

| SEC | | U.S. Securities and Exchange Commission |

| Train | | an industrial facility comprised of a series of refrigerant compressor loops used to cool natural gas into LNG |

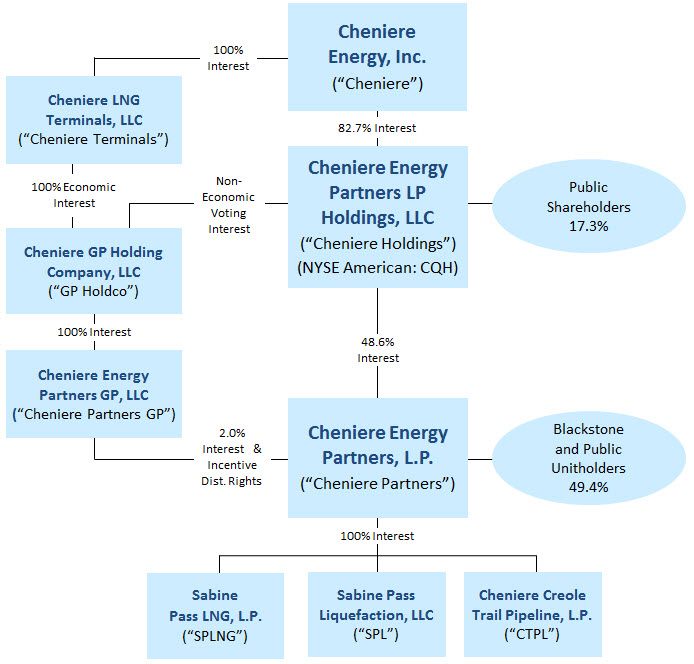

Abbreviated Legal Entity Structure

The following diagram depicts our abbreviated legal entity structure as of March 31, 2018, including our ownership of certain subsidiaries, and the references to these entities used in this quarterly report:

Unless the context requires otherwise, references to “Cheniere Holdings,” the “Company,” “we,” “us” and “our” are intended to refer to Cheniere Energy Partners LP Holdings, LLC.

| |

| PART I. | FINANCIAL INFORMATION |

| |

| ITEM 1. | CONSOLIDATED FINANCIAL STATEMENTS |

CHENIERE ENERGY PARTNERS LP HOLDINGS, LLC

CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

|

| | | | | | | | |

| | | March 31, | | December 31, |

| | | 2018 | | 2017 |

| ASSETS | | (unaudited) | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 1,516 |

| | $ | 659 |

|

| Other current assets | | 344 |

| | 55 |

|

| Total current assets | | 1,860 |

| | 714 |

|

| | | | | |

| Deferred tax asset, net | | 3,812 |

| | — |

|

| Other non-current assets | | 73 |

| | — |

|

| Total assets | | $ | 5,745 |

| | $ | 714 |

|

| | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | |

| Current liabilities | | | | |

| Accounts payable and accrued liabilities | | $ | 468 |

| | $ | 76 |

|

| | | | | |

| Shareholders’ equity | | | | |

| Common shares: unlimited shares authorized, 231.7 million shares issued and outstanding at March 31, 2018 and December 31, 2017 | | 664,931 |

| | 664,931 |

|

| Director voting share: 1 share authorized, issued and outstanding at March 31, 2018 and December 31, 2017 | | — |

| | — |

|

| Additional paid-in-capital | | (271,757 | ) | | (271,757 | ) |

| Accumulated deficit | | (387,897 | ) | | (392,536 | ) |

| Total shareholders’ equity | | 5,277 |

|

| 638 |

|

| Total liabilities and shareholders’ equity | | $ | 5,745 |

| | $ | 714 |

|

The accompanying notes are an integral part of these consolidated financial statements.

2

CHENIERE ENERGY PARTNERS LP HOLDINGS, LLC

CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per share data)

(unaudited)

|

| | | | | | | | |

| | | Three Months Ended March 31, |

| | | 2018 | | 2017 |

| Equity income from investment in Cheniere Partners | | $ | 119,936 |

| | $ | 5,084 |

|

| | | | | |

| Expenses | | |

| | |

| General and administrative expense | | 349 |

| | 346 |

|

| General and administrative expense—affiliate | | 269 |

| | 264 |

|

| Total expenses | | 618 |

| | 610 |

|

| | | | | |

| Income before income taxes | | 119,318 |

| | 4,474 |

|

| Income tax benefit | | 3,488 |

| | — |

|

| | | | | |

| Net income | | $ | 122,806 |

| | $ | 4,474 |

|

| | | | | |

| Net income per common share—basic and diluted | | $ | 0.53 |

| | $ | 0.02 |

|

| | | | | |

| Weighted average number of common shares outstanding—basic and diluted | | 231,700 |

| | 231,700 |

|

| | | | | |

| Cash dividends declared per common share | | $ | 0.510 |

| | $ | 0.020 |

|

The accompanying notes are an integral part of these consolidated financial statements.

3

CHENIERE ENERGY PARTNERS LP HOLDINGS, LLC

CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY

(in thousands)

(unaudited)

|

| | | | | | | | | | | | | | | | | | |

| | Common Stock | | | | | | |

| | Shares | | Amount | | Additional Paid-in-Capital | | Accumulated Deficit | | Total Shareholders’

Equity |

| Balance at December 31, 2017 | 231,700 |

| | $ | 664,931 |

| | $ | (271,757 | ) | | $ | (392,536 | ) | | $ | 638 |

|

| Dividends to shareholders | — |

| | — |

| | — |

| | (118,167 | ) | | (118,167 | ) |

| Net income | — |

| | — |

| | — |

| | 122,806 |

| | 122,806 |

|

| Balance at March 31, 2018 | 231,700 |

| | $ | 664,931 |

| | $ | (271,757 | ) | | $ | (387,897 | ) | | $ | 5,277 |

|

The accompanying notes are an integral part of these consolidated financial statements.

4

CHENIERE ENERGY PARTNERS LP HOLDINGS, LLC

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

|

| | | | | | | |

| | Three Months Ended March 31, |

| | 2018 | | 2017 |

| Cash flows from operating activities | | | |

| Net income | $ | 122,806 |

| | $ | 4,474 |

|

| Adjustments to reconcile net income to net cash used in operating activities: | | | |

| Income from equity investment | (119,936 | ) | | (5,084 | ) |

| Deferred income taxes | (3,812 | ) | | — |

|

| Changes in operating assets and liabilities: | | | |

| Accounts payable and accrued liabilities | 391 |

| | 19 |

|

| Accrued liabilities—affiliate | — |

| | 264 |

|

| Other, net | (361 | ) | | (211 | ) |

| Net cash used in operating activities | (912 | ) | | (538 | ) |

| | | | |

| Cash flows from investing activities | |

| | |

| Distributions from equity investment | 119,936 |

| | 5,084 |

|

| | | | |

| Cash flows from financing activities | |

| | |

| Dividends paid to shareholders | (118,167 | ) | | (4,634 | ) |

| | | | |

| Net increase (decrease) in cash and cash equivalents | 857 |

| | (88 | ) |

| Cash and cash equivalents—beginning of period | 659 |

| | 219 |

|

| Cash and cash equivalents—end of period | $ | 1,516 |

| | $ | 131 |

|

The accompanying notes are an integral part of these consolidated financial statements.

5

CHENIERE ENERGY PARTNERS LP HOLDINGS, LLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

NOTE 1—NATURE OF BUSINESS

We are a limited liability company formed by Cheniere (NYSE American: LNG) to hold its limited partner interests in Cheniere Partners, a publicly traded limited partnership (NYSE American: CQP). Our only business consists of owning and holding Cheniere Partners’ limited partner common units and subordinated units (collectively, the “Cheniere Partners units”), along with cash or other property that we receive as distributions in respect of such units, and, accordingly, our consolidated operating results and financial condition are dependent on the performance of Cheniere Partners. We expect to have no significant assets or operations other than those related to our interest in Cheniere Partners. As of March 31, 2018, we owned a 48.6% limited partner interest in Cheniere Partners.

NOTE 2—BASIS OF PRESENTATION

The accompanying unaudited Consolidated Financial Statements of Cheniere Holdings have been prepared in accordance with GAAP for interim financial information and with Rule 10-01 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements and should be read in conjunction with the Consolidated Financial Statements and accompanying notes included in our annual report on Form 10-K for the year ended December 31, 2017. In our opinion, all adjustments, consisting only of normal recurring adjustments necessary for a fair presentation, have been included.

Results of operations for the three months ended March 31, 2018 are not necessarily indicative of the results of operations that will be realized for the year ending December 31, 2018.

Accounting for Investment in Cheniere Partners

We have determined that Cheniere Partners is a variable interest entity. As of both March 31, 2018 and December 31, 2017, we owned a 48.6% limited partner interest in Cheniere Partners. In addition to the Cheniere Partners units, we own a non-economic voting interest in GP Holdco, which holds a 100% indirect interest in Cheniere Partners GP. This non-economic voting interest in GP Holdco allows us to control the appointment of four of the eleven members to the board of directors of Cheniere Partners GP to oversee the operations of Cheniere Partners. Cheniere owns the sole share entitled to vote in the election of our directors (the “Director Voting Share”). If Cheniere relinquishes the Director Voting Share, which it may do in its sole discretion, or ceases to own greater than 25% of our outstanding shares, our non-economic voting interest in GP Holdco would be extinguished and we would cease to control GP Holdco. Cheniere may, at any time and without our consent, relinquish the Director Voting Share, which would cause our non-economic voting interest in GP Holdco to be extinguished. Because Cheniere may relinquish the Director Voting Share at any time and we have no variable interest in GP Holdco, we have determined that we cannot consolidate Cheniere Partners and must account for our investment in the Cheniere Partners units that we own using the equity method of accounting.

The equity method of accounting requires that our investment in Cheniere Partners be shown in our Consolidated Balance Sheets as a single amount. Our initial investment in Cheniere Partners is recognized at cost. This carrying amount is increased or decreased to recognize our share of income or loss of Cheniere Partners after the date of our initial investment in the Cheniere Partners units. The carrying amount is also adjusted to reflect the distributions received from Cheniere Partners and accretion of basis differences resulting from our proportionate share of the net assets of Cheniere Partners exceeding the carrying value of our investment in Cheniere Partners as a result of changes in our liquidation rights and priorities following the conversion of our interests in Cheniere Partners from Cheniere Partners Class B units (“Class B units”) into common units.

As a result of our historical negative investment in Cheniere Partners and because we are not obligated to fund losses, we had a zero investment balance in Cheniere Partners as of both March 31, 2018 and December 31, 2017 and had suspended the use of the equity method for additional losses. Equity method losses that we incur increase the suspended loss amount and equity method income decrease the suspended loss amount. Distributions we receive from Cheniere Partners increase the suspended loss amount. Only upon recovery of all suspended losses through future earnings will equity income or loss be reported on our Consolidated Statements of Income and future distributions and our allocated share of income or losses impact the carrying amount of our investment in Cheniere Partners.

CHENIERE ENERGY PARTNERS LP HOLDINGS, LLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

After giving effect to our equity ownership in Cheniere Partners as though we had acquired the Cheniere Partners units as a result of a merger of entities under common control, along with activity impacting the basis of our investment in Cheniere Partners, we had suspended losses of approximately $740 million and $785 million as of March 31, 2018 and December 31, 2017, respectively. The difference between our reported zero investment in Cheniere Partners as of both March 31, 2018 and December 31, 2017 and our ownership in Cheniere Partners’ reported net assets was due primarily to suspended losses and equity gains from Cheniere Partners’ sales of common units that were not recognized by us. Included in this balance is a remaining basis difference of approximately $219 million as of March 31, 2018 associated with Class B unit conversion which is being accreted into the suspended loss account over a remaining period of approximately 31.3 years corresponding to the remaining estimated useful lives of the underlying net assets of Cheniere Partners to which the basis difference has been assigned.

Due to our zero investment balance in, and suspended losses of, Cheniere Partners as of both March 31, 2018 and December 31, 2017, we have historically and will continue to recognize distributions that we receive as a gain on our Consolidated Statements of Income until recovery of all suspended losses.

NOTE 3—CAPITALIZATION

Our authorized capital structure consists of common shares and the Director Voting Share. None of our owners shall be liable for our debts, liabilities or obligations beyond such owner’s capital contribution. At March 31, 2018, our issued capitalization consisted of 231.7 million common shares, of which 191.5 million common shares were owned by Cheniere and its affiliates and 40.2 million common shares were owned by the public, and one Director Voting Share owned by Cheniere. We are authorized to issue an unlimited number of common shares. Additional classes or series of securities may be created with the approval of our Board of Directors, provided that any such additional class or series must be approved by a vote of holders of a majority of our outstanding shares.

NOTE 4—INVESTMENT IN CHENIERE PARTNERS

Our business consists of owning the following Cheniere Partners units, along with cash or other property that we receive as distributions in respect of such units:

Common Units

As of March 31, 2018, we owned 104.5 million common units. The common units are entitled to quarterly cash distributions from Cheniere Partners. To the extent that Cheniere Partners is unable to pay the initial quarterly distribution in the future, arrearages in the amount of the initial quarterly distribution (or the difference between the initial quarterly distribution and the amount of the distribution actually paid to common unitholders) may accrue with respect to the common units.

Subordinated Units

As of March 31, 2018, we owned 135.4 million subordinated units. The subordinated units will convert on a one-for-one basis into common units at the expiration of the subordination period as described in the Fourth Amended and Restated Agreement of Limited Partnership of Cheniere Partners, dated as of February 14, 2017. The subordinated units were not entitled to receive distributions until all common units had received at least the initial quarterly distribution, including any arrearages that were accrued. Cheniere Partners did not make any cash distributions on its subordinated units with respect to the quarter ended June 30, 2010 through the quarter ended June 30, 2017, but resumed making cash distributions with respect to the quarter ended September 30, 2017.

NOTE 5—SUMMARIZED FINANCIAL INFORMATION FOR CHENIERE PARTNERS

Our consolidated operating results and financial condition are dependent on the performance and cash distributions of Cheniere Partners. The following tables are summarized Consolidated Statements of Income and Consolidated Balance Sheets information for Cheniere Partners. Additional information on Cheniere Partners’ operating results and financial position are contained in its quarterly report on Form 10-Q for the quarter ended March 31, 2018, which is included in this filing as Exhibit 99.1 and incorporated herein by reference.

CHENIERE ENERGY PARTNERS LP HOLDINGS, LLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

|

| | | | | | | | |

| Summarized Cheniere Partners Consolidated Statements of Income Information |

| (in millions) |

| (unaudited) |

| | | Three Months Ended March 31, |

| | | 2018 | | 2017 |

| Revenues (including transactions with affiliates) | | $ | 1,593 |

| | $ | 891 |

|

| Operating costs and expenses (including transactions with affiliates) | | (1,085 | ) | | (672 | ) |

| Other expense | | (173 | ) | | (172 | ) |

| Net income | | $ | 335 |

| | $ | 47 |

|

|

| | | | | | | | |

| Summarized Cheniere Partners Consolidated Balance Sheets Information |

| (in millions) |

| | | March 31, | | December 31, |

| | | 2018 | | 2017 |

| | | (unaudited) | | |

| Current assets | | $ | 2,065 |

| | $ | 2,139 |

|

| Non-current assets | | 15,400 |

| | 15,414 |

|

| Total assets | | $ | 17,465 |

| | $ | 17,553 |

|

| | | | | |

| Current liabilities | | $ | 649 |

| | $ | 829 |

|

| Non-current liabilities | | 16,091 |

| | 16,085 |

|

| Partners’ equity | | 725 |

| | 639 |

|

| Total liabilities and partners’ equity | | $ | 17,465 |

| | $ | 17,553 |

|

NOTE 6—RELATED PARTY TRANSACTIONS

Services Agreement

We, Cheniere and Cheniere Terminals, a wholly owned subsidiary of Cheniere, entered into a services agreement (the “Services Agreement”) pursuant to which we pay Cheniere a fixed fee of $1.0 million per year (payable quarterly in installments of $250,000 per quarter, in arrears), subject to adjustment for inflation, for certain general and administrative services, including the services of our officers who are also officers of Cheniere. In addition, we pay directly for, or reimburse Cheniere for, certain third-party general and administrative expenses. Cheniere also provides us with cash management services, including treasury services with respect to the payment of dividends and allocation of reserves for taxes. Under the Services Agreement, we recorded general and administrative expense—affiliate of $0.3 million during each of the three months ended March 31, 2018 and 2017.

The Services Agreement has a term of one year and automatically renews for additional one-year terms unless notice of nonrenewal is provided by any party to the agreement at least 90 days prior to the next renewal date. Upon the occurrence of certain events resulting in the separation of us and Cheniere, our officers and directors who are also directors and officers of Cheniere would resign. Within 60 days after such a separation event, we may provide notice to Cheniere to terminate the Services Agreement, and the Services Agreement will terminate 90 days after the delivery date of the notice. If we provide notice to terminate at any time after such a separation event, we may request that Cheniere continue to provide services to us for a period of up to six months from the termination notice date.

Tax Sharing Agreement

We have entered into a Tax Sharing Agreement (the “Tax Sharing Agreement”) with Cheniere that governs the respective rights, responsibilities and obligations of Cheniere and us with respect to tax attributes, tax liabilities and benefits, the preparation and filing of tax returns, the control of audits and other tax proceedings and other matters regarding taxes. Under the terms of the Tax Sharing Agreement, for each period in which we or any of our subsidiaries are consolidated or combined with Cheniere for purposes of any tax return, Cheniere will prepare a pro forma tax return for us as if we filed our own consolidated, combined or unitary income tax return, which includes an initial deemed net operating loss (“NOL”) carryforward amount. We will be required to reimburse Cheniere for any taxes shown on such pro forma tax returns.

CHENIERE ENERGY PARTNERS LP HOLDINGS, LLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

Although we and Cheniere are each generally responsible for managing those disputes that relate to the taxes for which both are responsible, the Tax Sharing Agreement provides that Cheniere will have the responsibility and discretion to prepare and file all consolidated, combined or unitary income tax returns on our behalf (including the making of any tax elections), to respond to and conduct all tax proceedings (including tax audits) relating to such tax returns and to determine the reimbursement amounts in connection with any pro forma tax returns.

NOTE 7—INCOME TAXES

We are a limited liability company that has elected to be treated as a corporation for U.S. federal income tax purposes. The provision for income taxes, taxes payable and deferred income tax balances has been recorded as if we had filed all tax returns on a separate return basis.

Our federal taxable income or loss is included in the consolidated federal income tax return of Cheniere. We have entered into a Tax Sharing Agreement with Cheniere as discussed in Note 6—Related Party Transactions. Any amounts due to Cheniere under the Tax Sharing Agreement in excess of our income tax provision will be recorded as an equity distribution.

At the end of 2017, we were in an overall net deferred tax asset position for federal and state tax purposes prior to the application of the valuation allowance. Based on the income realized in the current quarter and our projected forecast for income throughout the remainder of 2018, we expect to transition from a net deferred tax asset position to a net deferred tax liability position over the course of 2018 for federal tax purposes. However, we expect to remain in an overall net deferred tax asset position for state tax purposes prior to the application of the valuation allowance. As a result, we recorded a $2.8 million income tax provision offset by a $6.3 million discrete income tax benefit.

The estimated discrete income tax benefit was recorded as a result of the retroactive reinstatement of the investment tax credit that had expired on December 31, 2016. We are not presently a taxpayer for federal income tax purposes as a result of our ability to utilize prior year NOL carryforwards.

NOTE 8—DISTRIBUTIONS RECEIVED AND DIVIDENDS PAID

The following provides a summary of distributions received from Cheniere Partners during the three months ended March 31, 2018 and 2017:

|

| | | | | | | | | | | | | | |

| Date Paid | | Period Covered by Distribution | | Distribution Per Common Unit | | Distribution Per Subordinated Unit | | Total Distribution Received (in thousands) |

| February 14, 2018 | | October 1 - December 31, 2017 | | $ | 0.500 |

| | $ | 0.500 |

| | $ | 119,936 |

|

| February 13, 2017 | | October 1 - December 31, 2016 | | 0.425 |

| | — |

| | 5,084 |

|

On April 27, 2018, Cheniere Partners declared a $0.55 distribution per common unit and subordinated unit for the period from January 1, 2018 to March 31, 2018. The distribution attributable to our interest in Cheniere Partners, totaling $131.9 million, is to be paid to us on May 15, 2018. We have used the distributions from Cheniere Partners to establish cash reserves to pay general and administrative expenses (including affiliate) and to pay dividends.

The following provides a summary of dividends paid by us during the three months ended March 31, 2018 and 2017:

|

| | | | | | | | | | |

| Date Paid | | Period Covered by Dividend | | Dividend Per Share | | Total Dividend Paid (in thousands) |

| March 1, 2018 | | October 1 - December 31, 2017 | | $ | 0.510 |

| | $ | 118,167 |

|

| February 28, 2017 | | October 1 - December 31, 2016 | | 0.020 |

| | 4,634 |

|

| |

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Information Regarding Forward-Looking Statements

This quarterly report contains certain statements that are, or may be deemed to be, “forward-looking statements.” All statements, other than statements of historical or present facts or conditions, included herein or incorporated herein by reference are “forward-looking statements.” Because substantially all of our assets consist of our interest in the limited partner interests of Cheniere Partners, many of these statements primarily relate to Cheniere Partners’ business. Included among “forward-looking statements” are, among other things:

| |

| • | statements regarding our ability to pay dividends to our shareholders; |

| |

| • | statements regarding Cheniere Partners’ ability to pay distributions to its unitholders; |

| |

| • | statements regarding our anticipated tax rates and operating expenses; |

| |

| • | statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of LNG imports into or exports from North America and other countries worldwide or purchases of natural gas, regardless of the source of such information, or the transportation or other infrastructure or demand for and prices related to natural gas, LNG or other hydrocarbon products; |

| |

| • | statements regarding any financing transactions or arrangements, or ability to enter into such transactions; |

| |

| • | statements relating to the construction of Cheniere Partners’ Trains, including statements concerning the engagement of any EPC contractor or other contractor and the anticipated terms and provisions of any agreement with any EPC or other contractor, and anticipated costs related thereto; |

| |

| • | statements regarding any agreement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total LNG regasification, natural gas liquefaction or storage capacities that are, or may become, subject to contracts; |

| |

| • | statements regarding Cheniere Partners’ planned development and construction of additional Trains, including the financing of such Trains; |

| |

| • | statements that Cheniere Partners’ Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities; |

| |

| • | statements regarding our or Cheniere Partners’ business strategy, strengths, business and operation plans or any other plans, forecasts, projections, or objectives, including anticipated revenues, capital expenditures, maintenance and operating costs and cash flows, any or all of which are subject to change; |

| |

| • | statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, requirements, permits, applications, filings, investigations, proceedings or decisions; |

| |

| • | statements regarding Cheniere Partners’ anticipated LNG and natural gas marketing activities; and |

| |

| • | any other statements that relate to non-historical or future information. |

All of these types of statements, other than statements of historical or present facts or conditions, are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” “continue,” the negative of such terms or other comparable terminology. The forward-looking statements contained in this quarterly report are largely based on our and Cheniere Partners’ expectations, which reflect estimates and assumptions made by management of the respective entities. These estimates and assumptions reflect our and Cheniere Partners’ best judgment based on currently known market conditions and other factors. Although we and Cheniere Partners believe that such estimates are reasonable, they are inherently uncertain and involve a number of risks and uncertainties beyond our control. In addition, assumptions may prove to be inaccurate. We caution that the forward-looking statements contained in this quarterly report are not guarantees of future performance and that such statements may not be realized or the forward-looking statements or events may not occur. Actual results may differ materially from those anticipated or implied in forward-looking statements as a result of a variety of factors described in this quarterly report and in the other reports and other information that we file with the SEC, including those discussed under “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2017. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these risk factors. These forward-looking statements speak only as of the date made, and other than as required by law, we undertake no obligation to update or

revise any forward-looking statement or provide reasons why actual results may differ, whether as a result of new information, future events or otherwise.

Introduction

The following discussion and analysis presents management’s view of our business, financial condition and overall performance and should be read in conjunction with our Consolidated Financial Statements and the accompanying notes. This information is intended to provide investors with an understanding of our past performance, current financial condition and outlook for the future. Our discussion and analysis includes the following subjects:

| |

| • | Our Relationship with Cheniere Partners |

| |

| • | Liquidity and Capital Resources |

| |

| • | Off-Balance Sheet Arrangements |

| |

| • | Summary of Critical Accounting Estimates |

| |

| • | Recent Accounting Standards |

Our Business

We are a Delaware limited liability company that has elected to be treated as a corporation for U.S. federal income tax purposes. Our primary business purpose is to:

| |

| • | own and hold Cheniere Partners’ limited partner common units and subordinated units (collectively, the “Cheniere Partners units”); |

| |

| • | pay dividends on our shares from the distributions that we receive from Cheniere Partners, less income taxes and any reserves established by our Board of Directors (our “Board”) to pay our company expenses and amounts due under our services agreement (the “Services Agreement”) with a wholly owned subsidiary of Cheniere, to service and reduce indebtedness that we may incur and for company purposes, in each case as permitted by our limited liability company agreement (“LLC Agreement”); |

| |

| • | simplify tax reporting requirements for investors by issuing a Form 1099-DIV with respect to the dividends received on our shares rather than a Schedule K-1 that would be received as a unitholder of Cheniere Partners; and |

| |

| • | designate members of the board of directors of Cheniere Partners GP to oversee the operations of Cheniere Partners. |

Our business consists of owning the following Cheniere Partners units, along with cash or other property that we receive as distributions in respect of such units:

Common Units

As of March 31, 2018, we owned 104.5 million common units. The common units are entitled to quarterly cash distributions from Cheniere Partners. To the extent that Cheniere Partners is unable to pay the initial quarterly distribution in the future, arrearages in the amount of the initial quarterly distribution (or the difference between the initial quarterly distribution and the amount of the distribution actually paid to common unitholders) may accrue with respect to the common units.

Subordinated Units

As of March 31, 2018, we owned 135.4 million subordinated units. The subordinated units were not entitled to receive distributions until all common units had received at least the initial quarterly distribution, including any arrearages that may have accrued. Cheniere Partners did not make any cash distributions on its subordinated units with respect to the quarter ended June 30, 2010 through the quarter ended June 30, 2017, but resumed making cash distributions with respect to the quarter ended September 30, 2017. The subordinated units will convert on a one-for-one basis into common units at the expiration of the

subordination period as described in the Fourth Amended and Restated Agreement of Limited Partnership of Cheniere Partners, dated as of February 14, 2017.

Our Relationship with Cheniere Partners

As of March 31, 2018, we owned approximately 48.6% of the outstanding Cheniere Partners units. As a result of our non-economic voting interest in GP Holdco, which holds a 100% interest in Cheniere Partners GP, we control GP Holdco and indirectly control the appointment of four of the eleven members of the board of directors of Cheniere Partners GP to oversee the operations of Cheniere Partners. Cheniere owns the sole share entitled to vote in the election of our directors (the “Director Voting Share”). If Cheniere relinquishes the Director Voting Share, which it may do in its sole discretion, or ceases to own greater than 25% of our outstanding shares, our non-economic voting interest in GP Holdco would be extinguished and we would cease to control GP Holdco. Because our only assets are limited partner interests in Cheniere Partners and we are therefore dependent on the operating results and financial condition of Cheniere Partners, we believe that the discussion and analysis of Cheniere Partners’ financial condition and operating results is important to our shareholders. Therefore, Cheniere Partners’ quarterly report on Form 10-Q for the quarter ended March 31, 2018 has been included in this filing as Exhibit 99.1 and incorporated herein by reference (the “Cheniere Partners Quarterly Report”).

Liquidity and Capital Resources

As of March 31, 2018, we had cash and cash equivalents of $1.5 million. Our capital structure consists only of common shares, of which 191.5 million shares are owned by Cheniere and 40.2 million shares are owned by the public, and one Director Voting Share which is held by Cheniere. We are authorized to issue an unlimited number of additional common shares. Additional classes or series of securities may be created with the approval of our Board, provided that any such additional class or series must be approved by a vote of holders of a majority of our outstanding shares. Our shareholders will not have preemptive or preferential rights to acquire additional common shares or other classes of our securities.

Cheniere provides certain general and administrative services pursuant to the Services Agreement. We pay Cheniere a fixed fee of $1.0 million per year (payable quarterly in installments of $250,000 per quarter, in arrears), subject to adjustment for inflation, for certain general and administrative services, including the services of our directors and officers who are also directors and executive officers of Cheniere. In addition, we pay directly for, or reimburse Cheniere for, certain third-party general and administrative expenses. Cheniere also provides us with cash management services, including treasury services with respect to the payment of dividends and allocation of reserves for taxes. Under the Services Agreement, we recorded general and administrative expense—affiliate of $0.3 million during each of the three months ended March 31, 2018 and 2017.

We believe that the cash distributions we will receive on the Cheniere Partners units will be sufficient to fund our working capital requirements for the next twelve months. On April 27, 2018, Cheniere Partners declared a $0.55 distribution per common unit and subordinated unit to be paid on May 15, 2018 for the period from January 1, 2018 to March 31, 2018.

Dividends

Our LLC Agreement requires us to pay dividends on our shares equal to the amount of cash that we receive as distributions in respect of the Cheniere Partners units that we own, less income taxes and reserves established by our Board. See Note 8—Distributions Received and Dividends Paid of our Notes to Consolidated Financial Statements for a summary of dividends paid by us.

Sources and Uses of Cash

The following table summarizes the sources and uses of our cash and cash equivalents for the three months ended March 31, 2018 and 2017 (in thousands). Additional discussion of these items follows the table.

|

| | | | | | | |

| | Three Months Ended March 31, |

| | 2018 | | 2017 |

| Operating cash flows | | | |

| Net cash used in operating activities | $ | (912 | ) | | $ | (538 | ) |

| | | | |

| Investing cash flows | | | |

| Net cash provided by investing activities | 119,936 |

| | 5,084 |

|

| | | | |

| Financing cash flows | | | |

| Net cash used in financing activities | (118,167 | ) | | (4,634 | ) |

| | | | |

| Net increase (decrease) in cash and cash equivalents | 857 |

| | (88 | ) |

| Cash and cash equivalents—beginning of period | 659 |

| | 219 |

|

| Cash and cash equivalents—end of period | $ | 1,516 |

| | $ | 131 |

|

Operating Cash Flows

Operating cash outflows during the three months ended March 31, 2018 and 2017 were $0.9 million and $0.5 million, respectively, primarily as a result of the payment of general and administrative expenses (including affiliate).

Investing Cash Flows

Investing cash inflows during the three months ended March 31, 2018 and 2017 were $119.9 million and $5.1 million, respectively, as a result of distributions from Cheniere Partners. The increase in distributions received in 2018 compared to 2017 was due to the additional 92.5 million common units owned by us subsequent to the conversion of the Class B units on August 2, 2017 and the increase in distributions per unit received from Cheniere Partners, from the $0.425 per common unit initial distribution to $0.50 per unit for both common units and subordinated units for the quarter ended December 31, 2017.

Financing Cash Flows

Financing cash outflows during the three months ended March 31, 2018 and 2017 were $118.2 million and $4.6 million, respectively, as a result of dividends paid to our common shareholders in accordance with our LLC Agreement as described above. The increase in dividends paid in 2018 compared to 2017 was due to increased distributions that we received on our Cheniere Partners units in 2018.

Results of Operations

Equity Income from Investment in Cheniere Partners

We use the equity method of accounting for our limited partner ownership interest in Cheniere Partners. The equity method of accounting requires that our investment in Cheniere Partners be shown in our Consolidated Balance Sheets as a single amount. Our initial investment in Cheniere Partners was recognized at cost, and this carrying amount is increased or decreased to recognize our share of income or loss of Cheniere Partners after the date of our initial investment in the Cheniere Partners units. As a result of our historical negative investment in Cheniere Partners and because we are not obligated to fund losses, we had a zero investment balance in Cheniere Partners recorded on the Consolidated Balance Sheets as of both March 31, 2018 and December 31, 2017 and had suspended the use of the equity method for any additional losses. The suspended loss account will be increased or decreased by our share of Cheniere Partners’ future losses or earnings, respectively. We had suspended losses of approximately $740 million and $785 million as of March 31, 2018 and December 31, 2017, respectively. Due to our zero investment balance in, and suspended losses of, Cheniere Partners as of both March 31, 2018 and December 31, 2017, we have historically and will continue to recognize distributions that we receive as a gain on our Consolidated Statements of Income and a corresponding entry will be made to increase the suspended loss account. Once we have recovered all suspended losses through our share of Cheniere Partners’ future earnings,

the equity income or loss from our share of Cheniere Partners’ future earnings will be reported on our Consolidated Statements of Income. In addition, future distributions we receive from Cheniere Partners would then reduce the carrying amount of our investment in Cheniere Partners. We recognized $119.9 million and $5.1 million for the three months ended March 31, 2018 and 2017, respectively, of equity income from our investment in Cheniere Partners resulting from quarterly distributions that Cheniere Partners paid to us. The increase in distributions received in 2018 compared to 2017 was due to distributions paid on our subordinated units, the additional 92.5 million common units owned by us subsequent to the conversion of the Class B units on August 2, 2017 and the increase in distributions per unit received from Cheniere Partners, from the $0.425 per common unit initial distribution to $0.50 per unit for both common units and subordinated units for the quarter ended December 31, 2017.

The following table summarizes Consolidated Statements of Income information for Cheniere Partners. Additional information on Cheniere Partners’ operating results and financial position are contained in the Cheniere Partners Quarterly Report.

|

| | | | | | | | |

| Summarized Cheniere Partners Consolidated Statements of Income Information |

| (in millions) |

| (unaudited) |

| | | Three Months Ended March 31, |

| | | 2018 | | 2017 |

| Revenues (including transactions with affiliates) | | $ | 1,593 |

| | $ | 891 |

|

| Operating costs and expenses (including transactions with affiliates) | | (1,085 | ) | | (672 | ) |

| Other expense | | (173 | ) | | (172 | ) |

| Net income | | $ | 335 |

| | $ | 47 |

|

General and Administrative Expenses (including affiliate)

Our general and administrative expenses (including affiliate) are associated with managing our business and affairs. We incurred total general and administrative expenses (including affiliate) of $0.6 million for each of the three months ended March 31, 2018 and 2017. These expenses included $0.3 million for each of the three months ended March 31, 2018 and 2017 related to services provided by Cheniere under the Services Agreement necessary for the conduct of our business, such as accounting, legal, tax, information technology and other expenses.

Income Tax Benefit

At the end of 2017, we were in an overall net deferred tax asset position for federal and state tax purposes prior to the application of the valuation allowance. Based on the income realized in the current quarter and our projected forecast for income throughout the remainder of 2018, we expect to transition from a net deferred tax asset position to a net deferred tax liability position over the course of 2018 for federal tax purposes. However, we expect to remain in an overall net deferred tax asset position for state tax purposes prior to the application of the valuation allowance. As a result, we recorded a $2.8 million income tax provision offset by a $6.3 million discrete income tax benefit.

The estimated discrete income tax benefit was recorded as a result of the retroactive reinstatement of the investment tax credit that had expired on December 31, 2016. We are not presently a taxpayer for federal income tax purposes as a result of our ability to utilize prior year net operating loss carryforwards.

Off-Balance Sheet Arrangements

We have interests in an unconsolidated variable interest entity as discussed in Note 2—Basis of Presentation of our Notes to Consolidated Financial Statements in this quarterly report, which we consider to be an off-balance sheet arrangement.

Summary of Critical Accounting Estimates

The preparation of our Consolidated Financial Statements in conformity with GAAP requires management to make certain estimates and assumptions that affect the amounts reported in the Consolidated Financial Statements and the accompanying notes. There have been no significant changes to our critical accounting estimates from those disclosed in our annual report on Form 10-K for the year ended December 31, 2017.

Recent Accounting Standards

There are currently no new accounting standards that have been issued that will have a significant impact on our financial position, results of operations or cash flows upon adoption.

| |

| ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

The nature of our business and operations is such that no activities or transactions are conducted or entered into by us that would require us to have a discussion under this item.

For a discussion of these matters as they pertain to Cheniere Partners, please read Part II, Item 3. “Quantitative and Qualitative Disclosures About Market Risk” in the Cheniere Partners Quarterly Report on Form 10-Q for the quarter ended March 31, 2018, which is included in this filing as Exhibit 99.1 and incorporated herein by reference, as activities of Cheniere Partners have an impact on our consolidated operating results and financial position.

ITEM 4. CONTROLS AND PROCEDURES

We maintain a set of disclosure controls and procedures that are designed to ensure that information required to be disclosed by us in the reports filed by us under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms. As of the end of the period covered by this report, we evaluated, under the supervision and with the participation of our management, including our Chief Executive Officer and our Chief Financial Officer, the effectiveness of our disclosure controls and procedures pursuant to Rule 13a-15 of the Exchange Act. Based on that evaluation, our Chief Executive Officer and our Chief Financial Officer concluded that our disclosure controls and procedures are effective.

During the most recent fiscal quarter, there have been no changes in our internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II. OTHER INFORMATION

We may in the future be involved as a party to various legal proceedings, which are incidental to the ordinary course of business. We regularly analyze current information and, as necessary, provide accruals for probable liabilities on the eventual disposition of these matters. In the opinion of management, as of March 31, 2018, there were no pending legal matters that would reasonably be expected to have a material impact on our consolidated operating results, financial position or cash flows.

|

| | |

| Exhibit No. | | Description |

| 10.1* | | Change orders to the Lump Sum Turnkey Agreement for the Engineering, Procurement and Construction of the Sabine Pass LNG Stage 3 Liquefaction Facility, dated as of May 4, 2015, between SPL and Bechtel Oil, Gas and Chemicals, Inc.: (i) the Change Order CO-00025 BOG and LNG Rundown, dated January 19, 2018, (ii) the Change Order CO-00026 Design Analysis of Existing East & West Jetty Piping and Structure for Simultaneous Loading, dated February 1, 2018, (iii) the Change Order CO-00027 Performance and Attendance Bonus (PAB) Transfer from Stage 2, dated February 1, 2018, and (iv) the Change Order CO-00028 Existing Jetty Structural Steel Supply, dated February 27, 2018 |

| 31.1* | | |

| 31.2* | | |

| 32.1** | | |

| 32.2** | | |

| 99.1* | | |

| 101.INS* | | XBRL Instance Document |

| 101.SCH* | | XBRL Taxonomy Extension Schema Document |

| 101.CAL* | | XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.DEF* | | XBRL Taxonomy Extension Definition Linkbase Document |

| 101.LAB* | | XBRL Taxonomy Extension Labels Linkbase Document |

| 101.PRE* | | XBRL Taxonomy Extension Presentation Linkbase Document |

|

| |

| * | Filed herewith. |

| ** | Furnished herewith. |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| | | |

| | | CHENIERE ENERGY PARTNERS LP HOLDINGS, LLC |

| | | | |

| Date: | May 3, 2018 | By: | /s/ Michael J. Wortley |

| | | | Michael J. Wortley |

| | | | Executive Vice President and Chief Financial Officer |

| | | | (on behalf of the registrant and

as principal financial officer) |

| | | | |

| Date: | May 3, 2018 | By: | /s/ Leonard Travis |

| | | | Leonard Travis |

| | | | Vice President and Chief Accounting Officer |

| | | | (on behalf of the registrant and

as principal accounting officer) |