UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

AMERICAN REALTY CAPITAL HOSPITALITY TRUST, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

405 Park Avenue, 14th Floor

New York, New York 10022

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 30, 2016

April [•], 2016

To the Stockholders of American Realty Capital Hospitality Trust, Inc.:

I am pleased to invite our stockholders to the 2016 Annual Meeting of Stockholders (“Annual Meeting”) of American Realty Capital Hospitality Trust, Inc., a Maryland corporation (the “Company”). The Annual Meeting will be held on June 30, 2016 at The Core Club, located at 66 E. 55th Street, New York, NY 10022, commencing at 9:00 a.m. (local time). At the Annual Meeting, you will be asked to consider and vote upon (i) the election of four members of the Board of Directors, (ii) the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2016, (iii) the approval of an amendment to delete Section 8.5 from the Company’s articles of amendment and restatement (the “Charter”), (iv) the approval of an amendment to delete Article XIV from the Charter, and (v) such other matters as may properly come before the Annual Meeting and any postponement or adjournment thereof.

Our Board of Directors has fixed the close of business on April 18, 2016 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting or any postponement or adjournment thereof. Record holders of shares of our common stock, par value $0.01 per share, at the close of business on the record date are entitled to notice of and to vote at the Annual Meeting.

For further information regarding the matters to be acted upon at the Annual Meeting, I urge you to carefully read the accompanying proxy statement. We make proxy materials available to our stockholders on the Internet. You can access proxy materials at www.proxyvote.com. You also may authorize your proxy via the Internet or by telephone by following the instructions on that website. In order to authorize your proxy via the Internet or by telephone, you must have the stockholder identification number that appears on the materials sent to you. If you received a Notice of Internet Availability of Proxy Materials, you also may request a paper or an e-mail copy of our proxy materials and a paper proxy card by following the instructions included in the notice. If you attend the Annual Meeting, you may vote in person if you wish, even if you previously have submitted your proxy.

You are cordially invited to attend the Annual Meeting. Regardless of whether you own a few or many shares and whether you plan to attend the Annual Meeting in person or not, it is important that your shares be voted on matters that come before the Annual Meeting. Your vote is important.

| | By Order of the Board of Directors, | |

| | | |

| | /s/ Jonathan P. Mehlman | |

| | Jonathan P. Mehlman | |

| | Chief Executive Officer and President | |

AMERICAN REALTY CAPITAL HOSPITALITY TRUST, INC.

TABLE OF CONTENTS

American Realty Capital Hospitality Trust, Inc.

405 Park Avenue, 14th Floor

New York, New York 10022

PROXY STATEMENT

The proxy card, together with this proxy statement (this “Proxy Statement”) and our Annual Report on Form 10-K for the year ended December 31, 2015 (our “2015 10-K”), is solicited by and on behalf of the board of directors (the “Board of Directors” or the “Board”) of American Realty Capital Hospitality Trust, Inc., a Maryland corporation (the “Company”), for use at the 2016 Annual Meeting of Stockholders (the “Annual Meeting”) and at any postponement or adjournment thereof. References in this Proxy Statement to “we,” “us,” “our,” “our company” or like terms also refer to the Company, and references in this Proxy Statement to “you” refer to the stockholders of the Company. The mailing address of our principal executive offices is 405 Park Avenue, 14th Floor, New York, New York 10022. This Proxy Statement, the proxy card, Notice of Annual Meeting and our 2015 10-K have either been mailed to you or been made available to you on the Internet. Mailing to our stockholders commenced on or about April [•], 2016.

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting To Be Held on June 30, 2016

This Proxy Statement, the Notice of Annual Meeting and our 2015 10-K are available at:

www.proxyvote.com

INFORMATION ABOUT THE MEETING AND VOTING

What is the date of the Annual Meeting and where will it be held?

The Annual Meeting will be held on June 30, 2016, commencing at 9:00 a.m. (local time) at The Core Club, located at 66 E. 55th Street, New York, NY 10022.

What will I be voting on at the Annual Meeting?

At the Annual Meeting, you will be asked to:

| 1. | elect four directors for a term of one year, until our 2017 annual meeting of stockholders and until their successors are duly elected and qualify; |

| 2. | ratify the appointment of KPMG LLP (“KPMG”) as the Company’s independent registered public accounting firm for the year ending December 31, 2016; |

| 3. | approve an amendment to delete Section 8.5 from the Company’s charter (the “Charter”); |

| 4. | approve an amendment to delete Article XIV from the Charter; and |

| 5. | consider and act on such matters as may properly come before the Annual Meeting and any postponement or adjournment thereof. |

The Board of Directors does not know of any matters that may be considered at the Annual Meeting other than the matters set forth above.

Why did I receive a notice in the mail regarding the Internet availability of the proxy materials instead of a paper copy of the proxy materials?

As permitted by rules adopted by the U.S. Securities and Exchange Commission (“SEC”), we are making this Proxy Statement and our 2015 10-K available to our stockholders electronically via the Internet. On or about April [•], 2016, we began mailing to many of our stockholders a Notice of Internet Availability of Proxy Materials (“Notice”) containing instructions on how to access this Proxy Statement and our 2015 10-K online, as well as instructions on how to vote. If you received a Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you request a copy. Instead, the Notice instructs you on how to access and review all of the important information contained in this Proxy Statement and our 2015 10-K. The Notice also instructs you on how you may vote via the Internet. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice.

Who can vote at the Annual Meeting?

The record date for the determination of holders of shares of our common stock, par value $0.01 per share (“Common Stock”), entitled to notice of and to vote at the Annual Meeting, or any postponement or adjournment of the Annual Meeting, is the close of business on April 18, 2016. As of the record date, [•] shares of our Common Stock were issued and outstanding and entitled to vote at the Annual Meeting.

How many votes do I have?

Each share of Common Stock entitles the holder to one vote on each matter considered at the Annual Meeting or any postponement or adjournment thereof. The proxy card shows the number of shares of Common Stock you are entitled to vote.

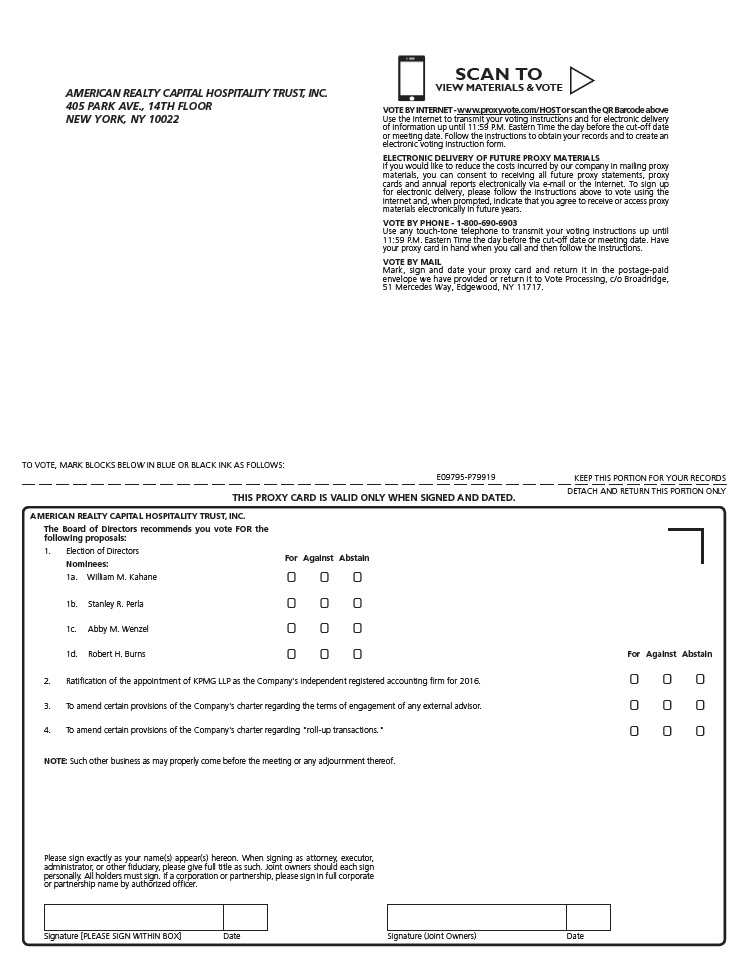

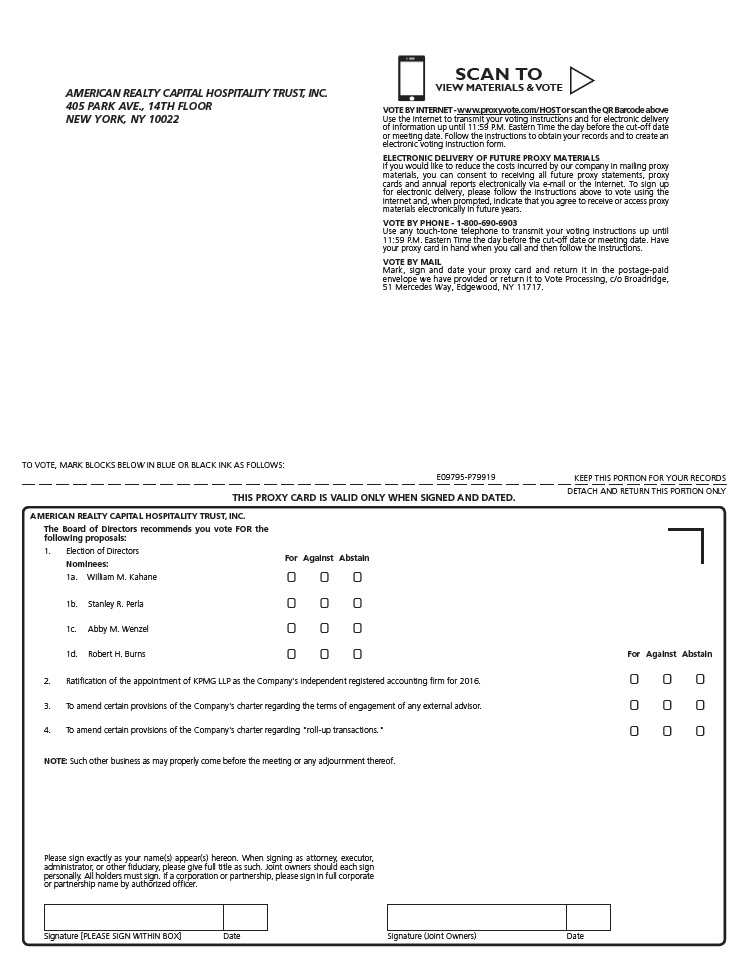

How may I vote?

You may vote in person at the Annual Meeting or by proxy. Instructions for in person voting, including directions to the Annual Meeting, can be obtained by calling our proxy solicitor, Broadridge Investor Communication Solutions, Inc. (“Broadridge”) at (855) 928-4496. Stockholders may submit their votes by proxy by mail by completing, signing, dating and returning their proxy card in the enclosed envelope. Stockholders also have the following two options for authorizing a proxy to vote their shares:

| · | via the Internet atwww.proxyvote.comat any time prior to 11:59 p.m. Eastern Time on June 29, 2016, and follow the instructions provided on the proxy card; or |

| · | by telephone, by calling (800) 690-9603 at any time prior to 11:59 p.m. Eastern Time on June 29, 2016, and follow the instructions provided on the proxy card. |

For those stockholders with Internet access, we encourage you to authorize a proxy to vote your shares via the Internet, a convenient means of authorizing a proxy that also provides cost savings to us. In addition, when you authorize a proxy to vote your shares via the Internet or by telephone prior to the Annual Meeting date, your proxy authorization is recorded immediately and there is no risk that postal delays will cause your vote by proxy to arrive late and, therefore, not be counted. For further instructions on authorizing a proxy to vote your shares, see your proxy card. You may also vote your shares at the Annual Meeting. If you attend the Annual Meeting, you may vote in person, and any proxies that you authorized by mail or by Internet or telephone will be superseded by the vote that you cast at the Annual Meeting.

How will proxies be voted?

Shares represented by valid proxies will be voted at the Annual Meeting in accordance with the directions given. If the enclosed proxy card is signed and returned without any directions given, the shares will be voted “FOR”: (i) election of the four director nominees named in this Proxy Statement for a term of one year, until our 2017 annual meeting of stockholders and until their successors are duly elected and qualify; (ii) ratification of the appointment of KPMG as the Company’s independent registered public accounting firm for the year ending December 31, 2016; (iii) approval of an amendment to delete Section 8.5 from the Charter; and (iv) approval of an amendment to delete Article XIV from the Charter.

The Board of Directors does not intend to present, and has no information indicating that others will present, any business at the Annual Meeting other than as set forth in the attached Notice of Annual Meeting of Stockholders. However, if other matters requiring the vote of our stockholders come before the Annual Meeting, it is the intention of the persons named in the proxy card to vote the proxies held by them in their discretion.

How can I change my vote or revoke a proxy?

You have the unconditional right to revoke your proxy at any time prior to the voting thereof by (i) submitting a later-dated proxy either by telephone, via the Internet or in the mail to our proxy solicitor at the following address: Broadridge Investor Communication Solutions, Inc., 51 Mercedes Way, Edgewood, NY 11717; or (ii) by attending the Annual Meeting and voting in person. No written revocation of your proxy shall be effective, however, unless and until it is received at or prior to the Annual Meeting.

What if I return my proxy card but do not mark it to show how I am voting?

If your proxy card is signed and returned without specifying your choices, your shares will be voted as recommended by the Board of Directors.

What vote is required to approve each item?

There is no cumulative voting in the election of our directors. Each director is elected by the affirmative vote of the holders of a majority of all shares of Common Stock who are present in person or by proxy at the meeting. Each share may be voted for as many individuals as there are directors to be elected and for whose election the share is entitled to be voted. For purposes of the election of directors, abstentions and broker non-votes will count toward the presence of a quorum but will have the same effect as votes cast against each director. The proposal to ratify the appointment of KPMG as the Company’s independent registered public accounting firm requires the affirmative vote of at least a majority of all the votes cast on the proposal. For purposes of ratification of the appointment of KPMG as the Company’s independent registered public accounting firm, abstentions and broker non-votes will count toward the presence of a quorum but will have no effect on the proposal. The proposals to approve amendments to the Charter require the affirmative vote of at least a majority of all the votes entitled to be cast on the proposal. For purposes of approval of the amendments to the Charter, abstentions and broker non-votes will count toward the presence of a quorum but will have the same effect as votes cast against the proposals.

What is a “broker non-vote”?

A “broker non-vote” occurs when a broker who holds shares for the beneficial owner does not vote on a proposal because the broker does not have discretionary voting authority for that proposal and has not received instructions from the beneficial owner of the shares.

Are stockholders entitled to appraisal rights in connection with any of the proposals?

None of the proposals, if approved, entitle stockholders to appraisal rights under Maryland law or the Charter.

What constitutes a “quorum”?

The presence at the Annual Meeting, in person or represented by proxy, of stockholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting constitutes a quorum. Abstentions and broker non-votes will be counted as present for the purpose of establishing a quorum.

Will you incur expenses in soliciting proxies?

We are soliciting the proxy on behalf of the Board of Directors, and we will pay all costs of preparing, assembling and mailing the proxy materials. We have retained Broadridge to aid in the solicitation of proxies. Broadridge will receive a fee of approximately $[•] for proxy solicitation services provided for us, which includes the reimbursement for certain costs and out-of-pocket expenses incurred in connection with their services, all of which will be paid by us. We will request banks, brokers, custodians, nominees, fiduciaries and other record holders to make available copies of this Proxy Statement to people on whose behalf they hold shares of Common Stock and to request authority for the exercise of proxies by the record holders on behalf of those people. In compliance with the regulations of the SEC, we will reimburse such persons for reasonable expenses incurred by them in making available proxy materials to the beneficial owners of shares of our Common Stock.

As the date of the Annual Meeting approaches, certain stockholders whose votes have not yet been received may receive a telephone call from a representative of Broadridge. Votes that are obtained telephonically will be recorded in accordance with the procedures described below. The Board of Directors believes that these procedures are reasonably designed to ensure that both the identity of the stockholder casting the vote and the voting instructions of the stockholder are accurately determined.

In all cases where a telephonic proxy is solicited, the call is recorded and the Broadridge representative is required to confirm each stockholder’s full name, address and zip code, and to confirm that the stockholder has received the proxy materials. If the stockholder is a corporation or other entity, the Broadridge representative is required to confirm that the person is authorized to direct the voting of the shares. If the information solicited agrees with the information provided to Broadridge, then the Broadridge representative has the responsibility to explain the process, read the proposal listed on the proxy card and ask for the stockholder’s instructions on the proposal. Although the Broadridge representative is permitted to answer questions about the process, he or she is not permitted to recommend to the stockholder how to vote, other than to read any recommendation set forth in this Proxy Statement. Broadridge will record the stockholder’s instructions on the card. Within 72 hours, the stockholder will be sent a letter to confirm his or her vote and asking the stockholder to call Broadridge immediately if his or her instructions are not correctly reflected in the confirmation.

What does it mean if I receive more than one proxy card?

Some of your shares may be registered differently or held in a different account. You should authorize a proxy to vote the shares in each of your accounts by mail, by telephone or via the Internet. If you mail proxy cards, please sign, date and return each proxy card to guarantee that all of your shares are voted. If you hold your shares in registered form and wish to combine your stockholder accounts in the future, you should call our Investor Relations department at (866) 902-0063. Combining accounts reduces excess printing and mailing costs, resulting in cost savings to us that benefit you as a stockholder.

What if I receive only one set of proxy materials although there are multiple stockholders at my address?

The SEC has adopted a rule concerning the delivery of documents filed by us with the SEC, including proxy statements and annual reports. The rule allows us to send a single set of any annual report, proxy statement, proxy statement combined with a prospectus or information statement to any household at which two or more stockholders reside if they share the same last name or we reasonably believe they are members of the same family. This procedure is referred to as “Householding.” This rule benefits both you and us. It reduces the volume of duplicate information received at your household and helps us reduce expenses. Each stockholder subject to Householding will continue to receive a separate proxy card or voting instruction card.

We will promptly deliver, upon written or oral request, a separate copy of our 2015 10-K or Proxy Statement as applicable, to a stockholder at a shared address to which a single copy was previously delivered. If you received a single set of disclosure documents for this year, but you would prefer to receive your own copy, you may direct requests for separate copies by calling our Investor Relations department at (866) 902-0063 or by mailing a request to American Realty Capital Hospitality Trust, Inc., 405 Park Avenue, 14th Floor, New York, New York 10022, Attention: Investor Relations. Likewise, if your household currently receives multiple copies of disclosure documents and you would like to receive one set, please contact us.

Whom should I call for additional information about voting by proxy or authorizing a proxy by telephone or Internet to vote my shares?

Please call Broadridge, our proxy solicitor, at (855) 928-4496.

Whom should I call with other questions?

If you have additional questions about this Proxy Statement or the Annual Meeting or would like additional copies of this Proxy Statement, or our 2015 10-K or any documents relating to any of our future stockholder meetings, please contact: American Realty Capital Hospitality Trust, Inc., 405 Park Avenue — 14th Floor, New York, New York 10022, Attention: Investor Relations, Telephone: (866) 902-0063, E-mail: investorrelations@ar-global.com, website:www.archospitalityreit.com.

How do I submit a stockholder proposal for next year’s annual meeting or proxy materials, and what is the deadline for submitting a proposal?

In order for a stockholder proposal to be properly submitted for presentation at our 2017 annual meeting and included in the proxy materials for next year’s annual meeting, we must receive written notice of the proposal at our executive offices no later than [•]. Any proposal received after the applicable time in the previous sentence will be considered untimely. All proposals must contain the information specified in, and otherwise comply with, our bylaws. Proposals should be sent via registered, certified or express mail to: American Realty Capital Hospitality Trust, Inc., 405 Park Avenue, 14th Floor, New York, New York 10022, Attention: Edward T. Hoganson, Chief Financial Officer, Treasurer and Secretary. For additional information, see “Stockholder Proposals for the 2017 Annual Meeting.”

UNLESS SPECIFIED OTHERWISE, THE PROXIES WILL BE VOTED “FOR”: (I) ELECTION OF THEfour NOMINEES NAMED IN THIS PROXY STATEMENT TO SERVE AS DIRECTORS OF THE COMPANY FOR A TERM OF ONE YEAR, UNTIL THE COMPANY’S 2017 ANNUAL MEETING OF STOCKHOLDERS AND UNTIL HIS OR HER SUCCESSOR IS DULY ELECTED AND QUALIFIES; (II) RATIFICATION OF THE APPOINTMENT OF KPMG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2016; (III) APPROVAL OF AN AMENDMENT TO DELETE SECTION 8.5 FROM THE CHARTER; AND (IV) APPROVAL OF AN AMENDMENT TO DELETE ARTICLE XIV FROM THE CHARTER. IN THE DISCRETION OF THE PROXY HOLDERS, THE PROXIES WILL ALSO BE VOTED “FOR” OR “AGAINST” SUCH OTHER MATTERS AS MAY PROPERLY COME BEFORE THE ANNUAL MEETING. MANAGEMENT IS NOT AWARE OF ANY OTHER MATTERS TO BE PRESENTED FOR ACTION AT THE ANNUAL MEETING.

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

The Board of Directors, including our independent directors, is responsible for monitoring and supervising the performance of our day-to-day operations, including supervising our advisor, American Realty Capital Hospitality Advisors, LLC (the “Advisor”). Directors are elected annually by our stockholders, and there is no limit on the number of times a director may be elected to office. Each director serves for a term of one year, until the next annual meeting of stockholders or (if longer) until his or her successor is duly elected and qualifies. The Charter and bylaws provide that the number of directors may be fixed by a resolution of the Board of Directors; provided, however, that from the commencement of the Company’s initial public offering (the “IPO”) the number of directors shall never be less than three nor greater than ten. The number of directors on our Board is currently fixed at four.

The Board of Directors has proposed the following nominees for election as directors, each to serve for a term of one year, until our 2017 annual meeting of stockholders and until his or her successor is duly elected and qualifies: Messrs. William M. Kahane, Robert H. Burns and Stanley R. Perla and Ms. Abby M. Wenzel. Each nominee currently serves as a director of the Company.

The proxy holder named on the proxy card intends to vote “FOR” the election of each of the four nominees. If you do not wish your shares to be voted for any particular nominee, please identify the exception(s) in the designated space provided on the proxy card or, if you are authorizing a proxy to vote your shares by telephone or the Internet, follow the instructions provided when you authorize a proxy. Directors will be elected by the affirmative vote of the holders of a majority of all shares of Common Stock who are present in person or by proxy at the Annual Meeting, provided that a quorum is present.

We know of no reason why any nominee will be unable to serve if elected. If, at the time of the Annual Meeting, one or more of the nominees should become unable to serve, shares represented by proxies will be voted for the remaining nominees and for any substitute nominee or nominees designated by the Board of Directors. No proxy will be voted for a greater number of persons than the number of nominees described in this Proxy Statement.

Nominees

The table set forth below lists the names and ages of each of the nominees as of the date of this Proxy Statement and the position and office that each nominee currently holds with the Company:

| Name | | Age | | Position |

| | | | | |

| William M. Kahane | | 67 | | Executive Chairman |

| | | | | |

| Stanley R. Perla | | 72 | | Lead Independent Director; Audit Committee Chair |

| | | | | |

| Abby M. Wenzel | | 56 | | Independent Director |

| | | | | |

| Robert H. Burns | | 86 | | Independent Director |

Business Experience of Nominees

William M. Kahane

Mr. Kahane has served as a director of the Company since February 2014 and was appointed executive chairman in December 2014. Mr. Kahane previously served as the chief executive officer and president of the Company from August 2013 to November 2014. Mr. Kahane has served as a director of New York REIT, Inc. (“NYRT”) since its formation in October 2009 and was appointed as executive chairman in December 2014 and served in such position until June 2015. Mr. Kahane also previously served as NYRT’s president and treasurer, and the president and treasurer of the NYRT advisor and the NYRT property manager from its formation in October 2009 until March 2012. Mr. Kahane has served as a director of Healthcare Trust, Inc. (“HTI”) since March 2013, including as executive chairman from December 2014 until February 2015. Mr. Kahane has served as a director of Global Net Lease, Inc. (“GNL”) since February 2015, including as executive chairman from February 2015 until March 2015. He also previously served an executive officer of GNL, the GNL advisor and the GNL property manager from October 2014 until February 2015. Mr. Kahane has served as chief executive officer and director of AR Capital Acquisition Corp. since August 2014. Mr. Kahane previously served as a director of American Realty Capital - Retail Centers Of America, Inc. (“RCA”) from its formation in July 2010, including as chairman from November 2014, until December 2015. Mr. Kahane also previously served as an executive officer of RCA and the RCA advisor from November 2014, including as chief executive office from December 2014, until December 2015. Mr. Kahane also previously served as an executive officer of RCA and the RCA advisor from their respective formations in July 2010 and May 2010 until March 2012. Mr. Kahane served as the chief executive officer and president of American Realty Capital Daily Net Asset Value Trust, Inc. (“DNAV”), the DNAV advisor and the DNAV property manager and as chairman of the board of directors of DNAV from December 2014 until December 2015. Mr. Kahane also previously served as a director of DNAV from September 2010 until March 2012 and as chief operating officer and secretary of DNAV, the DNAV advisor and the DNAV property manager from November 2014 until December 2014. Mr. Kahane served as a director of American Realty Capital New York City REIT, Inc. (“NYCR”) from its formation in December 2013, including as executive chairman from December 2014, until November 2015. Mr. Kahane served as an executive officer of American Finance Trust, Inc. (“AFIN”), the AFIN advisor and the AFIN property manager from November 2014, including as chief executive officer from December 2014, until May 2015. Mr. Kahane also previously served as executive chairman of the AFIN board of directors from February 2015 until November 2015. Mr. Kahane served as executive chairman of the board of directors of American Realty Capital Global Trust II, Inc. (“Global II”) from December 2014 until November 2015 and previously served as an executive officer of Global II, the Global II advisor and the Global II property manager from October 2014 until December 2014. Mr. Kahane previously served as a director of Realty Finance Trust, Inc. from November 2014, including as chairman from December 2014, until June 2015. Mr. Kahane served as executive chairman of the board of directors of American Realty Capital Healthcare Trust III, Inc. from December 2014 until November 2015. Mr. Kahane served as a director of Phillips Edison - ARC Grocery Center REIT II, Inc. (“PECO II”) from August 2013 until January 2015. Mr. Kahane served as a director of Business Development Corporation of America since its formation in May 2010 until December 2015 and as an executive officer from May 2010 until March 2012.

Mr. Kahane served as a director of American Realty Capital Healthcare Trust, Inc. (“HT”) from its formation in August 2010 until January 2015 when HT closed its merger with Ventas, Inc. Mr. Kahane previously served as an executive officer of HT, the HT advisor and the HT property manager from their respective formations in August 2010 until March 2012. He also served as a director and executive officer of American Realty Capital Properties, Inc. (“ARCP”) (now known as VEREIT, Inc.) from December 2010 until March 2012. Additionally, Mr. Kahane served as an executive officer of ARCP’s former manager from November 2010 until March 2012 and served as a director of ARCP from February 2013 to June 2014. Mr. Kahane served as an executive officer of American Realty Capital Trust, Inc. (“ARCT”), the ARCT advisor and the ARCT property manager from their formation in August 2007 until the close of ARCT’s merger with Realty Income Corporation in January 2013. He also served as a director of ARCT from August 2007 until January 2013. Mr. Kahane served as an executive officer of American Realty Capital Trust III, Inc. (“ARCT III”), the ARCT III advisor, and the ARCT III property manager from their formation in October 2010 until April 2012. Mr. Kahane served as a director of RCS Capital Corporation (“RCAP”) from February 2013 until December 2014, and served as chief executive officer of RCAP from February 2013 until September 2014. RCAP filed for Chapter 11 bankruptcy in January 2016. Mr. Kahane served as a director of Cole Real Estate Income Strategy (Daily NAV), Inc. (“Cole DNAV”) from February 2014 until December 2014, and served as a director of Cole Credit Property Trust, Inc. (“CCPT”) from May 2014 until February 2014. Mr. Kahane has served as an executive officer of the United Development Funding Income Fund V (“UDF V”) advisor since April 2015, and previously served as a member of the board of trustees of UDF V from October 2014 until November 2015. Mr. Kahane has served as a member of the investment committee of Aetos Capital Asia Advisors, a $3 billion series of opportunistic funds focusing on assets primarily in Japan and China, since 2008. Mr. Kahane began his career as a real estate lawyer practicing in the public and private sectors from 1974 to 1979 where he worked on the development of hotel properties in Hawaii and California. From 1981 to 1992, Mr. Kahane worked at Morgan Stanley & Co., or Morgan Stanley, specializing in real estate, including the lodging sector becoming a managing director in 1989. In 1992, Mr. Kahane left Morgan Stanley to establish a real estate advisory and asset sales business known as Milestone Partners which continues to operate and of which Mr. Kahane is currently the chairman. Mr. Kahane was a trustee at American Financial Realty Trust (“AFRT”) from April 2003 to August 2006, during which time Mr. Kahane served as chairman of the finance committee of AFRT’s board of trustees. Mr. Kahane served as a managing director of GF Capital Management & Advisors LLC (“GF Capital”), a New York-based merchant banking firm, where he directed the firm’s real estate investments, from 2001 to 2003. GF Capital offers comprehensive wealth management services through its subsidiary TAG Associates LLC, a leading multi-client family office and portfolio management services company with approximately $5 billion of assets under management. Mr. Kahane also was on the board of directors of Catellus Development Corp., a NYSE growth-oriented real estate development company from 1997 to 2005, where he served as non-executive chairman from 1999 to 2001. Mr. Kahane received a B.A. from Occidental College, a J.D. from the University of California, Los Angeles Law School and an MBA from Stanford University’s Graduate School of Business.

We believe that Mr. Kahane’s experience as a director or executive officer of the companies described above and his significant investment banking experience in real estate make him well qualified to serve as a member of our Board of Directors.

Stanley R. Perla

Stanley R. Perla has served as an independent director of the Company since January 2014 and, in December 2014, he was appointed as lead independent director. Mr. Perla has also served as an independent director of AFIN since April 2013 and as a trustee of American Real Estate Income Fund since May 2012. Mr. Perla previously served as an independent director of Global II from August 2014 until January 2016. Mr. Perla served as an independent director of DNAV from March 2012 until April 2013. Mr. Perla, a licensed certified public accountant, was with the firm of Ernst & Young LLP for 35 years, from September 1967 to June 2003, the last 25 of which he was a partner. From July 2003 to May 2008, he was the director of Internal Audit for Vornado Realty Trust and from June 2008 to May 2011, he was the managing partner of Cornerstone Accounting Group, a public accounting firm specializing in the real estate industry and a consultant to them from June 2011 to March 2012. Since May 2012, Mr. Perla has provided consulting services to Friedman LLP, a public accounting firm. His area of expertise for the past 40 years has been real estate and he was also responsible for the auditing of public and private companies. Mr. Perla served as Ernst & Young’s national director of real estate accounting, as well as on Ernst & Young’s national accounting and auditing committee. He is an active member of the National Association of Real Estate Investment Trusts and the National Association of Real Estate Companies. In addition, Mr. Perla has been a frequent speaker on real estate accounting issues at numerous real estate conferences. Mr. Perla has served as a member of the board of directors and the chair of the audit committee of Madison Harbor Balanced Strategies, Inc. since January 2004 and GTJ REIT, Inc. since January 2013. Mr. Perla previously served as a director and chair of the audit committee for American Mortgage Acceptance Company from January 2004 to April 2010 and Lexington Realty Trust from August 2003 to November 2006. Mr. Perla earned an M.B.A. in Taxation and a B.B.A. in Accounting from Baruch College.

We believe that Mr. Perla’s extensive experience as partner at Ernst & Young LLP, as the director of Internal Audit at Vornado Realty Trust, as a managing partner of Cornerstone Accounting Group, his experience as a director of the companies described above and his over 40 years of experience in real estate, make him well qualified to serve as a member of our Board of Directors.

Abby M. Wenzel

Abby M. Wenzel has served as an independent director of the Company since September 2013. Ms. Wenzel has also served as an independent director of NYCR since March 2014 and as an independent director of GNL since March 2012. Ms. Wenzel also served as independent director of American Realty Capital Trust IV, Inc. (“ARCT IV”) from May 2012 until the close of ARCT IV’s merger with ARCP in January 2014, after which point Ms. Wenzel was no longer associated with ARCT IV as an independent director nor affiliated with ARCT IV in any manner. Ms. Wenzel has been a member of the law firm of Cozen O’Connor, resident in the New York office, since April 2009, as a member in the Business Law Department. Since January 2014, Ms. Wenzel has served as co-chair of the Real Estate Group. Ms. Wenzel has extensive experience representing developers, funds and investors in connection with their acquisition, disposition, ownership, use, and financing of real estate. Ms. Wenzel also practices in the capital markets practice area, focusing on capital markets, finance and sale-leaseback transactions. She has represented commercial banks, investment banks, insurance companies, and other financial institutions, as well as the owners, in connection with permanent, bridge, and construction loans, as well as senior preferred equity investments, interim financings and mezzanine financings. She has also represented lenders in connection with complex multiproperty/multistate corporate sales. Prior to joining Cozen O’Connor, Ms. Wenzel was a partner with Wolf Block LLP, managing partner of its New York office and chair of its structured finance practice from October 1999 until April 2009. Ms. Wenzel currently serves as a trustee on the board of Community Service Society, a 160-year-old institution with a primary focus on identifying and supporting public policy innovations to support the working poor in New York City to realize social, economic, and political opportunities. Ms. Wenzel received her law degree from New York University School of Law and her undergraduate degree from Emory University.

We believe that Ms. Wenzel’s experience as a director of the companies described above and her experience representing clients in connection with their acquisition, disposition, ownership, use, and financing of real estate, as well as her position as co-chair of the Real Estate Group at Cozen O’Connor make her well qualified to serve on our Board of Directors.

Robert H. Burns

Robert H. Burns has served as an independent director of the Company since September 2014. Mr. Burns has also served as an independent director of NYRT since October 2009 and as an independent director of Global II since February 2015. Mr. Burns also served as an independent director of HT from March 2012 until the close of HT’s merger with Ventas, Inc. in January 2015. Mr. Burns served as an independent director of ARCT III from January 2011 until March 2012 and as an independent director of AFIN from January 2013 until September 2014. He also served as an independent director of ARCT from January 2008 until January 2013 when ARCT closed its merger with Realty Income Corporation. Mr. Burns is a hotel industry veteran with an international reputation and over thirty years of hotel, real estate, food and beverage and retail experience. He founded and built the luxurious Regent International Hotels brand, which he sold in 1992. From 1970 to 1992, Mr. Burns served as chairman and chief executive officer of Regent International Hotels, where he was personally involved in all strategic and major operating decisions. Mr. Burns and his team of professionals performed site selection, obtained land use and zoning approvals, performed all property due diligence, financed each project by raising both equity and arranging debt, oversaw planning, design and construction of each hotel property, and managed each asset. Each Regent hotel typically contained a significant food and beverage element and high-end retail component, frequently including luxury goods such as clothing, jewelry, as well as retail shops. Mr. Burns opened the first Regent hotel in Honolulu, Hawaii, in 1970. From 1970 to 1979, the company opened and managed a number of prominent hotels, but gained international recognition in 1980 with the opening of The Regent Hong Kong, which had many amenities and attracted attention throughout the world. In all, Mr. Burns developed over 18 major hotel projects including the Four Seasons Hotel in New York City, the Beverly Wilshire Hotel in Beverly Hills, the Four Seasons Hotel in Milan, Italy, and the Four Seasons Hotel in Bali, Indonesia. Mr. Burns currently serves as chairman of Barings’ Chrysalis Emerging Markets Fund, a position he has held since 1991, and as a director of Barings’ Asia Pacific Fund, a position he has held since 1986. Additionally, he has been a member of the executive committee of the board of directors of Jazz at Lincoln Center in New York City since 2000. He also chairs the Robert H. Burns Foundation which he founded in 1992. The Robert H. Burns Foundation funds the education of Asian students at American schools. Mr. Burns frequently lectures at Stanford Business School. Mr. Burns served as a faculty member at the University of Hawaii from 1963 to 1994 and as president of the Hawaii Hotel Association from 1968 to 1970. Mr. Burns began his career in Sheraton’s Executive Training Program in 1958, and advanced within Sheraton and then within Westin Hotels from 1962 to 1963. He later spent eight years with Hilton International Hotels from 1963 to 1970. Mr. Burns graduated from the School of Hotel Management at Michigan State University in 1958 and the University of Michigan’s Graduate School of Business in 1960 after serving three years in the U.S. Army in Korea. For the past five years Mr. Burns has devoted his time to owning and operating Villa Feltrinelli on Lago di Garda, a small, luxury hotel in northern Italy, and working on developing hotel projects in Asia, focusing on Vietnam and China.

We believe that Mr. Burns’ experience as a director or executive officer of the companies described above and his experience as a real estate developer for over 40 years, during which he developed over 18 major hotel projects, make him well qualified to serve as a member of our Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION OF WILLIAM M. KAHANE, ABBY M. WENZEL, ROBERT H. BURNS AND STANLEY R. PERLA AS MEMBERS OF THE BOARD OFDIRECTORS, each to serve for a term of one year, until THE COMPANY’S 2017 annual meeting of stockholders and until his or her successor is duly elected and qualifies.

Information About the Board of Directors and its Committees

The Board of Directors ultimately is responsible for the management and control of our business and operations. Our current executive officers are employees of affiliates of the Advisor. We have no employees and have retained the Advisor to manage our day-to-day operations. The Advisor is controlled by AR Capital IX, LLC (the “Sponsor”), which is wholly owned by AR Capital, LLC (“AR Capital”). Mr. William M. Kahane, our executive chairman, has shared control of AR Capital and its successor business, AR Global Investments, LLC (“AR Global”).

The Board of Directors held a total of 27 meetings, including actions by written consent, during the year ended December 31, 2015. Our directors and nominees attended approximately 91% of all meetings while they were members of the Board of Directors. A majority of our directors attended the 2015 annual stockholders’ meeting. We anticipate that all directors and nominees will attend the Annual Meeting. We encourage all directors and director nominees to attend our annual meetings of stockholders.

The Board of Directors has approved and organized an audit committee and a conflicts committee. The Company does not currently have a compensation committee or nominating and corporate governance committee. The independent directors carry out the responsibilities typically associated with compensation committees and nominating and corporate governance committees.

Leadership Structure of the Board of Directors

William M. Kahane serves as our executive chairman of the Board and Jonathan P. Mehlman serves as our chief executive officer and president. As chief executive officer of the Company and the Advisor, Mr. Mehlman is responsible for our daily operations and implementing our business strategy. The Board believes that its leadership structure, which separates the chairman and chief executive officer roles, is appropriate at this time in light of the inherent differences between the two roles. This division of authority and responsibilities also allows our chief executive officer to focus his time on running our daily operations and our chairman to focus his time on organizing the work of the Board and presiding over meetings of the Board. The Board of Directors may modify this structure to best address our circumstances for the benefit of our stockholders when appropriate.

Stanley R. Perla serves as the lead independent director of the Company. The Board of Directors appointed a lead independent director to provide an additional measure of balance, ensure the Board’s independence, and enhance the Board’s ability to fulfill its management oversight responsibilities.

The lead independent director chairs meetings or executive sessions of the independent directors, reviews and comments on Board of Directors’ meeting agendas, represents the views of the independent directors to management, facilitates communication among the independent directors and between management and the independent directors, acts as a liaison with service providers, officers, attorneys and other directors generally between meetings, serves as a representative and speaks on behalf of the Company at external seminars, conferences, in the media and otherwise, and otherwise assumes such responsibilities as may be assigned to him or her by the Board. Consistent with current practices, the Company compensates Mr. Perla for acting as lead independent director.

Oversight of Risk Management

The Board of Directors has an active role in overseeing the management of risks applicable to the Company. The entire Board is actively involved in overseeing risk management for the Company through its approval of all property acquisitions, incurrence and assumptions of debt, its oversight of the Company’s executive officers and the Advisor and managing risks associated with the independence of the members of the Board. The conflicts committee reviews and approves all transactions with parties affiliated with our Advisor or Sponsor and resolves other conflicts of interest between the Company and its subsidiaries, on the one hand, and the Sponsor, any director, the Advisor or their respective affiliates, on the other hand. The audit committee oversees management of accounting, financial, legal and regulatory risks.

Audit Committee

The Board of Directors established our audit committee on September 25, 2013. Our audit committee held six meetings, including action by written consent, during the year ended December 31, 2015. Our audit committee members attended all meetings held while they were members of the audit committee. The charter of the audit committee is available to any stockholder who requests it c/o American Realty Capital Hospitality Trust, Inc., 405 Park Avenue, 14th Floor, New York, NY 10022. The audit committee charter is also available on the Company’s website atwww.archospitalityreit.com/corporate-governance.html. Our audit committee consists of Mr. Perla, Ms. Wenzel and Mr. Burns, each of whom is “independent” within the meaning of the applicable (i) provisions set forth in the Charter and (ii) requirements set forth in the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the applicable SEC rules. Mr. Perla is the chair of our audit committee. The Board has determined that Mr. Perla is qualified as an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K and the rules and regulations of the SEC.

The audit committee, in performing its duties, monitors:

| · | our financial reporting process; |

| · | the integrity of our financial statements; |

| · | compliance with legal and regulatory requirements; |

| · | the independence and qualifications of our independent registered public accounting firm and internal auditors, as applicable; and |

| · | the performance of our independent registered public accounting firm and internal auditors, as applicable. |

The audit committee’s report on our financial statements for the year ended December 31, 2015 is discussed below under the heading “Audit Committee Report.”

Oversight of Compensation

The Company does not have any employees and compensation of directors is set by the Board, including our independent directors. In carrying out these responsibilities, the Board may delegate any or all of its responsibilities to a subcommittee to the extent consistent with the Charter, our bylaws and any other applicable laws, rules and regulations. However, the Board does not believe that any marked efficiencies or enhancements would be achieved by the creation of a separate compensation committee at this time.

Oversight of Nominations and Corporate Governance

The Company does not have a standing nominating and corporate governance committee. The Board believes that because of the size and composition of the Board, it is more efficient and cost effective for the Board, including our independent directors, to perform the duties of a nominating and corporate governance committee. The entire Board, including our independent directors, is responsible for (i) identifying qualified individuals to become directors of the Company, (ii) recommending director candidates to fill vacancies on the Board and to stand for election by the stockholders at the annual meeting, (iii) recommending committee assignments, (iv) periodically assessing the performance of the Board and (v) reviewing and recommending appropriate corporate governance policies and procedures for the Company, including developing and recommending a code of business conduct and ethics for the Company’s executive officers and senior financial officers and annually reviewing such code.

The Board of Directors believes that diversity is an important attribute of the members who comprise our Board of Directors and that the members should represent an array of backgrounds and experiences. In making its determinations, the Board reviews the appropriate experience, skills and characteristics required of directors in the context of our business. This review includes, in the context of the perceived needs of the Board at that time, issues of knowledge, experience, judgment and skills relating to the understanding of the real estate industry, accounting or financial expertise. This review also includes the candidate’s ability to attend regular Board meetings and to devote a sufficient amount of time and effort in preparation for such meetings. The Board also gives consideration to the Board having a diverse and appropriate mix of backgrounds and skills and each nominee’s ability to exercise independence of thought, objective perspective and mature judgment and understanding of our business operations and objectives.

The Board of Directors will consider candidates nominated by stockholders provided that the stockholder submitting a nomination has complied with procedures set forth in the Company’s bylaws. See “Stockholder Proposals for the 2017 Annual Meeting” for additional information regarding stockholder nominations of director candidates.

Oversight of Conflicts of Interest

The Board of Directors established a conflicts committee in August 2015. Our conflicts committee held five meetings, including action by written consent, during the year ended December 31, 2015. The members of the conflicts committee are Ms. Wenzel and Messrs. Burns and Perla, each of whom is independent for purposes of the rules and regulations of the SEC and under the Charter. The charter of the conflicts committee is available to any stockholder who sends a request to American Realty Capital Hospitality Trust, Inc., 405 Park Avenue, 14th Floor, New York, NY 10022. The conflicts committee charter is also available on the Company’s website atwww.archospitalityreit.com/corporate-governance.html.

Pursuant to the conflicts committee charter, the conflicts committee has the authority to: (a) review and evaluate the terms and conditions, and to determine the advisability of any transactions (“Related Party Transactions”) and conflict of interest (“Conflict”) situations between us, on the one hand, and any of the Sponsor, the Advisor, a director, an officer or any affiliate thereof, on the other hand; (b) to negotiate the terms and conditions of any Related Party Transaction, and, if the conflicts committee deems appropriate, but subject to the limitations of applicable law, to approve the execution and delivery of documents in connection with any Related Party Transaction on our behalf; (c) to determine whether the relevant Related Party Transaction is fair to, and in our best interest and the best interest of our stockholders, and (d) to recommend to the Board of Directors what action, if any should be taken by the Board of Directors with respect to any Related Party Transaction pursuant to the Charter.

Prior to establishing the conflicts committee, the independent directors reviewed the material transactions between the Sponsor, the Advisor and their respective affiliates, on the one hand, and us, on the other hand. Either the independent directors or the conflicts committee has determined that all our transactions and relationships with our Sponsor, Advisor and their respective affiliates during the year ended December 31, 2015 were fair and were approved in accordance with the applicable Company policies.

In order to reduce or eliminate certain potential conflicts of interest, the Charter contains a number of restrictions related to transactions with our Sponsor, our Advisor, any of our directors, any of our officers, any of their respective affiliates or certain of our stockholders. See “Certain Relationships and Related Transactions.”

Director Independence

Under our Charter, a majority of the members of our Board of Directors must be “independent” except for a period of up to 60 days after the death, resignation or removal of an independent director. An “independent director” is defined under the Charter as one who is not associated and has not been associated within the last two years, directly or indirectly, with our Sponsor or Advisor. A director is deemed to be associated with our Sponsor or Advisor if he or she: (a) owns an interest in our Sponsor, Advisor or any of their affiliates; (b) is employed by our Sponsor, Advisor or any of their affiliates; (c) is an officer or director of the Sponsor, Advisor or any of their affiliates; (d) performs services, other than as a director, for us; (e) is a director for more than three REITs organized by our Sponsor or advised by our Advisor; or (f) has any material business or professional relationship with our Sponsor, Advisor or any of their affiliates. A business or professional relationship is considered material per se if the gross revenue derived by the director from our Sponsor and our Advisor and affiliates exceeds 5% of the director’s (i) annual gross revenue, derived from all sources, during either of the last two years, or (ii) net worth, on a fair market value basis. An indirect relationship includes circumstances in which a director’s spouse, parents, children, siblings, mothers- or fathers-in-law, sons- or daughters-in-law, or brothers- or sisters-in-law, is or has been associated with our Sponsor, Advisor, any of their affiliates or us.

The Board of Directors has considered the independence of each director and nominee for election as a director in accordance with the elements of independence set forth above and in the listing standards of the NASDAQ Stock Market (“NASDAQ”) even though our shares are not listed on NASDAQ. Based upon information solicited from each nominee, the Board of Directors has affirmatively determined that Ms. Wenzel, Mr. Burns and Mr. Perla have no material relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company) other than as a director of the Company and are “independent” within the meaning of the NASDAQ’s director independence standards and audit committee independence standards, as currently in effect. Our Board of Directors has determined that each of our independent directors satisfies the elements of independence set forth above and in the listing standards of the NASDAQ and under our Charter.

Family Relationships

There are no familial relationships between any of our directors and executive officers.

Communications with the Board of Directors

The Company’s stockholders may communicate with the Board of Directors by sending written communications addressed to such person or persons in care of American Realty Capital Hospitality Trust, Inc., 405 Park Avenue, 14th Floor, New York, New York 10022, Attention: Jonathan P. Mehlman, Chief Executive Officer and President. Mr. Mehlman will deliver all appropriate communications to the Board of Directors no later than the next regularly scheduled meeting of the Board of Directors. If the Board of Directors modifies this process, the revised process will be posted on the Company’s website.

COMPENSATION AND OTHER INFORMATION CONCERNING OFFICERS,

DIRECTORS AND CERTAIN STOCKHOLDERS

Compensation of Executive Officers

We currently have no employees. Our Advisor performs our day-to-day management functions. American Realty Capital Hospitality Properties, LLC or one of its subsidiaries (collectively, the “Property Manager”), serves as our property manager and the Property Manager has retained Crestline Hotels & Resorts, LLC (“Crestline”) to provide services, including locating investments, negotiating financing and operating certain hotel assets in our portfolio. Our current executive officers, Jonathan P. Mehlman and Edward T. Hoganson, are all employees of affiliates of the Advisor and do not receive any compensation directly from the Company for the performance of their duties as executive officers of the Company. Moreover, we do not reimburse the Advisor and its affiliates that are involved in the management of our operations, including the Property Manager, for salaries, bonuses or benefits to be paid to our executive officers. We also do not reimburse Crestline or any third-party sub-property manager for general overhead costs or for the wages and salaries and other employee-related expenses of employees of such sub-property managers other than employees or subcontractors who are engaged in the on-site operation, management, maintenance or access control of our properties, and, in certain circumstances, who are engaged in off-site activities. As a result, we do not have, and our Board has not considered, a compensation policy or program for our executive officers and has not included in this Proxy Statement a “Compensation Discussion and Analysis,” a report with respect to executive compensation, a non-binding stockholder advisory vote on compensation of executives or a non-binding stockholder advisory vote on the frequency of the stockholder vote on executive compensation. See “Certain Relationships and Related Transactions” for a discussion of fees and expense reimbursements payable to the Advisor, the Property Manager, Crestline and their affiliates, which are related parties.

Directors and Executive Officers

The following table presents certain information as of the date of this Proxy Statement concerning each of our directors and executive officers serving in such capacity:

| Name | | Age | | Positions Held |

| | | | | |

| William M. Kahane | | 67 | | Executive Chairman |

| | | | | |

| Jonathan P. Mehlman | | 49 | | Chief Executive Officer and President |

| | | | | |

| Edward T. Hoganson | | 48 | | Chief Financial Officer, Treasurer and Secretary |

| | | | | |

| Stanley R. Perla | | 72 | | Lead Independent Director; Audit Committee Chair |

| | | | | |

| Abby M. Wenzel | | 56 | | Independent Director |

| | | | | |

| Robert H. Burns | | 86 | | Independent Director |

William M. Kahane

Please see “Proposal No. 1 — Election Of Directors—Business Experience of Nominees” for biographical information about Mr. Kahane.

Jonathan P. Mehlman

Jonathan P. Mehlman has served as chief executive officer and president of our company, the Advisor and the Property Manager since December 2014. Previously, Mr. Mehlman served as executive vice president and chief investment officer of our company, the Advisor and the Property Manager from their formation in July 2013 until December 2014. Mr. Mehlman has 22 years of experience in the real estate investment banking and capital markets with significant focus in the hospitality sector. Within the real estate industry, Mr. Mehlman has acted as a Mergers and Acquisitions advisor, investment banker and lender and has many years of experience coordinating transaction activity for public and private global hotel brands and U.S. hotel REITs. From August 2012 until January 2013, Mr. Mehlman was co-head of the real estate advisory group at KPMG before joining American Realty Capital in January 2013 as an executive vice president and managing director. From September 2009 through August 2011, Mr. Mehlman was co-head of the lodging and gaming investment banking business for Citadel Securities, an affiliate of The Citadel Group, a Chicago-based hedge fund. From August 2008 to September 2009, Mr. Mehlman served as head of the real estate advisory group at HSBC. From 2005 to 2008, Mr. Mehlman led the hospitality investment banking effort for Citigroup Global Markets. From 1993 to 2005, he worked at Deutsche Bank Securities and its predecessor company, Bankers Trust Company, in the real estate investment banking group, specializing in the business development and client coverage within the hospitality sector and for real estate private equity sponsors. Mr. Mehlman received his bachelor of arts in history of art from the University of Michigan as well as a master in business administration with a focus in real estate and finance from the University of North Carolina.

Edward T. Hoganson

Edward T. Hoganson has served as the chief financial officer, treasurer and secretary of the Company, the Advisor and the Property Manager since December 2014. Mr. Hoganson previously served as executive vice president of Crestline from 2007 to December 2014. Mr. Hoganson was responsible for financial oversight and new business development efforts at Crestline, including management contracts for third-party owners, acquisitions and co-investments. Mr. Hoganson was also responsible for the firm’s asset management programs. Prior to serving as executive vice president for Crestline, Mr. Hoganson was senior vice president of acquisitions for Sunrise Senior Living from 2004 until 2007, and earlier Mr. Hoganson led the asset management efforts for Highland Hospitality Corporation from 2003 until 2004, including during its initial public offering in 2003. Mr. Hoganson has more than 15 years of financial and hospitality industry experience. He began his career with Deloitte & Touche in 1989 and then joined Marriott International where he held various finance positions from 1993 until 1999. Mr. Hoganson earned his undergraduate degree from Yale University, his MBA in finance from the Wharton School at the University of Pennsylvania, and his Masters of Arts in International Relations from the Lauder Institute at the University of Pennsylvania. Mr. Hoganson serves as an affiliate faculty member at George Mason University, lecturing on hospitality finance.

Stanley R. Perla

Please see “— Business Experience of Nominees” for biographical information about Mr. Perla.

Abby M. Wenzel

Please see “— Business Experience of Nominees” for biographical information about Ms. Wenzel.

Robert H. Burns

Please see “— Business Experience of Nominees” for biographical information about Mr. Burns.

Compensation of Directors

We pay to each of our independent directors the fees described in the table below. All directors also receive reimbursement of reasonable out-of-pocket expenses incurred in connection with attendance at meetings of our Board of Directors.

If a director also is our employee or an employee of our Advisor or any of its affiliates or is otherwise not independent, we do not pay compensation for services rendered as a director.

| Name | | Fees Earned or Paid in Cash ($) | | Restricted Shares |

| | | | | |

| Independent Directors | | A yearly retainer of $30,000 for each independent director and an additional yearly retainer of $55,000 for the lead independent director; $2,000 for each meeting of the Board or any committee personally attended by the directors ($2,500 for attendance by the chairperson of the audit committee at each meeting of the audit committee) and $1,500 for each meeting attended via telephone; $750 per transaction reviewed and voted upon electronically up to a maximum of $2,250 for three or more transactions reviewed and voted upon per electronic vote. If there is a Board meeting and one or more committee meetings in one day, the director’s fees may not exceed $2,500 ($3,000 for the chairperson of the audit committee if there is a meeting of such committee). We may issue shares of Common Stock in lieu of cash to pay fees earned by our directors, at each director's election. There are no restrictions on the shares issued since these payments in lieu of cash relate to fees earned for services performed. | | Pursuant to our employee and director incentive restricted share plan (the “RSP”), each independent director receives an automatic grant of 1,333 restricted shares of Common Stock (“restricted shares”) on the date of each annual stockholders’ meeting. Each independent director is also granted 1,333 restricted shares on the date of initial election to the Board of Directors. The restricted shares vest over a five-year period following the first anniversary of the date of grant in increments of 20% per annum. |

| Name | | Fees Earned or Paid in Cash ($) | | Restricted Shares |

| | | | | |

| | | We also pay a fee to each independent director for each external seminar, conference, panel, forum or other industry-related event attended in person and in which the independent director actively participates, solely in his or her capacity as an independent director of the Company, in the following amounts: $2,500 for each day of an external seminar, conference, panel, forum or other industry-related event that does not exceed four hours, or $5,000 for each day of an external seminar, conference, panel, forum or other industry-related event that exceeds four hours. In either of the above cases, we will reimburse, to the extent not otherwise reimbursed, an independent director’s reasonable expenses associated with attendance at such external seminar, conference, panel, forum or other industry-related event. An independent director cannot be paid or reimbursed for attendance at a single external seminar, conference, panel, forum or other industry-related event by us and another company for which he or she is a director. | | |

The following table sets forth information regarding compensation of our independent directors paid during the year ended December 31, 2015:

Name | | Fees Paid

in Cash

($) | | | Stock

Awards

($)(1) | | | Option

Awards

($) | | | Non-Equity

Incentive Plan

Compensation

($) | | | Changes in

Pension Value

and

Nonqualified

Deferred

Compensation Earnings

($) | | | All Other

Compensation

($)(2) | | | Total

Compensation

($) | |

| Abby M. Wenzel | | | 64,000 | | | | 30,000 | (5) | | | — | | | | — | | | | — | | | | 1,248 | | | | 95,248 | |

| Stanley R. Perla | | | 134,917 | (3) | | | 30,000 | (6) | | | — | | | | — | | | | — | | | | 1,248 | | | | 166,165 | |

| Robert H. Burns | | | 88,550 | (4) | | | 30,000 | (7) | | | — | | | | — | | | | — | | | | 1,248 | | | | 119,798 | |

| (1) | Value of restricted shares granted during the year ended December 31, 2015 calculated based on $22.50 per share which was equal to the proceeds, net of selling commissions and dealer manager fees and before expenses, to us of a share of Common Stock sold in the IPO. Awards vest over a five-year period following the first anniversary of the date of grant. |

| (2) | The amount reported as “All Other Compensation” represents the value of distributions received on restricted shares granted during the year ended December 31, 2015. |

| (3) | Mr. Perla received $20,000 in fees paid in shares of Common Stock in lieu of cash payments. |

| (4) | Mr. Burns received $23,800 in fees paid in shares of Common Stock in lieu of cash payments. |

| (5) | Represents 1,333 restricted shares granted on July 13, 2015. As of December 31, 2015, Ms. Wenzel held 3,466 unvested restricted shares. |

| (6) | Represents 1,333 restricted shares granted on July 13, 2015. As of December 31, 2015, Mr. Perla held 3,466 unvested restricted shares. |

| (7) | Represents 1,333 restricted shares granted on July 13, 2015. As of December 31, 2015, Mr. Burns held 2,399 unvested restricted shares. |

Share-Based Compensation

Restricted Share Plan

In December 2013, with prior approval of the then-sole stockholder of the Company, the Board of Directors adopted the RSP, which provides for the automatic grant of 1,333 restricted shares to each of the independent directors, without any further action by the Board of Directors or the stockholders, on the date of initial election to the Board of Directors and on the date of each annual stockholders’ meeting. Restricted shares issued to independent directors vest over a five-year period following the first anniversary of the date of grant in increments of 20% per annum. The RSP provides the Board of Directors with the ability to grant awards of restricted shares to the Company’s directors, officers and employees (if the Company ever has employees), employees of the Advisor and its affiliates, employees of entities that provide services to the Company, directors of the Advisor or of entities that provide services to the Company, certain consultants to the Company and the Advisor and its affiliates or to entities that provide services to the Company.

The total number of shares of common stock granted under the RSP may not exceed 5.0% of the outstanding shares of Common Stock on a fully diluted basis at any time, and in any event will not exceed 4,000,000 shares (as such number may be adjusted for stock splits, stock dividends, combinations and similar events). As of December 31, 2015, 3,986,670 shares of Common Stock were available for grant as awards under the RSP.

Restricted share awards entitle the recipient to receive shares of Common Stock from the Company under terms that provide for vesting over a specified period of time or upon attainment of pre-established performance objectives. Such awards would typically be forfeited with respect to the unvested shares upon the termination of the recipient’s employment or other relationship with the Company.Restricted share awards are awarded to our directors in private placements, exempt from registration under the Securities Act. Restricted shares may not, in general, be sold or otherwise transferred until restrictions are removed and the shares have vested. Holders of restricted shares may receive distributions prior to the time that the restrictions have lapsed. Any distributions payable in shares of Common Stock are or will be subject to the same restrictions as the underlying restricted shares.

STOCK OWNERSHIP BY DIRECTORS, OFFICERS AND CERTAIN STOCKHOLDERS

The following table sets forth information regarding the beneficial ownership of Common Stock as of April 15, 2016, in each case including shares of Common Stock which may be acquired by such persons within 60 days, by:

| · | each person known by the Company to be the beneficial owner of more than 5% of its outstanding shares of Common Stock based solely upon the amounts and percentages contained in the public filings of such persons; |

| · | each of the Company’s named executive officers and directors; and |

| · | all of the Company’s executive officers and directors as a group. |

Beneficial Owner(1) | | Number of

Shares

Beneficially

Owned | | | Percent of

Class |

| William M. Kahane(2) | | | 31,110 | | | * |

| Jonathan P. Mehlman | | | 6,139 | | | * |

| Edward T. Hoganson | | | 248 | | | * |

| Abby M. Wenzel(3) | | | 3,999 | | | * |

| Stanley R. Perla(4) | | | 4,444 | | | * |

| Robert H. Burns(5) | | | 3,760 | | | * |

| All directors and executive officers as a group (six persons) | | | 49,700 | | | * |

| (1) | The business address of each individual or entity listed in the table is 405 Park Avenue — 14th Floor, New York, New York 10022. |

| (2) | The shares beneficially owned by Mr. Kahane represent 110 shares directly owned by Mr. Kahane and 31,000 shares wholly owned and controlled, directly or indirectly, by AR Capital, LLC. William M. Kahane has shared control of AR Capital, LLC and thereby has shared voting and investment power over shares wholly owned and controlled by AR Capital, LLC. |

| (3) | Includes 3,199 unvested restricted shares. |

| (4) | Includes 3,199 unvested restricted shares. |

| (5) | Includes 2.399 unvested restricted shares. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Jonathan Mehlman, our chief executive officer and president, also is the chief executive officer and president of our Advisor and our Property Manager. Edward Hoganson, our chief financial officer, treasurer and secretary, is also the chief financial officer, treasurer and secretary of our Advisor and our Property Manager.

Our Advisor is owned and controlled directly or indirectly by our Sponsor. William M. Kahane, our executive chairman, has shared control of our Sponsor, the parent of our Sponsor, AR Capital, and AR Global, the successor to AR Capital’s business. AR Capital indirectly owns 95% of the membership interests in our Property Manager and Mr. Mehlman, our chief executive officer and president, directly owns the other 5% of the membership interests in our Property Manager. AR Capital directly owns 60% of the membership interests in Crestline.

Realty Capital Securities, LLC (the “Former Dealer Manager”), RCS Advisory Services, LLC (“RCS Advisory”), American National Stock Transfer, LLC (“ANST”) and SK Research, LLC (“SK Research”) are subsidiaries of RCAP. Until transactions entered into in connection with filing for Chapter 11 bankruptcy in January 2016, Mr. Kahane also shared control of RCAP. Prior to or in connection with this bankruptcy, all arrangements between either us or AR Capital and its affiliates, on the one hand, and subsidiaries of RCAP, on the other hand, were terminated.

Advisor

We have entered into the advisory agreement with the Advisor (the “Advisory Agreement”), pursuant to which the Advisor manages our day-to-day operations.

For asset management services provided by the Advisor prior to October 1, 2015, the Advisor was entitled to receive performance-based restricted, forfeitable units of limited partnership in our operating partnership, American Realty Capital Hospitality Operating Partnership, L.P. (the “Operating Partnership”), entitled “Class B Units” (“Class B Units”) on a quarterly basis in an amount equal to:

| · | The cost of the Company’s assets multiplied by |

| · | The value of one share of Common Stock as of the last day of such calendar quarter, which was equal to $22.50 (the IPO price prior to its suspension minus selling commissions and dealer manager fees). |

On November 11, 2015, we amended the Advisory Agreement effective as of October 1, 2015. Under this amendment, we agreed to pay asset management fees monthly in cash (subject to certain coverage limitations during the pendency of the IPO), or shares of Common Stock, or a combination of both, at the Advisor’s election, and Class B Units were no longer issued to the Advisor with respect to periods commencing on or after September 30, 2015. The monthly asset management fee is equal to:

| · | The cost of our assets (until we establish our estimated net asset value per share of Common Stock (“Estimated Per-Share NAV”), then the lower of the cost of our assets and the fair value of our assets), multiplied by |

We expect to establish our Estimated Per-Share NAV no later than July 2, 2016, which is 150 days following the second anniversary of the date that we broke escrow in the IPO. After we have initially established our Estimated Per-Share NAV, we expect to update it periodically, at the discretion of the Board of Directors, provided that such updated estimates will be made at least once annually.