Exhibit 99.2

THERAVANCE BIOPHARMA ® , THERAVANCE ® , the Cross/Star logo and MEDICINES THAT MAKE A DIFFERENCE ® are registered trademarks of the Theravance Biopharma group of companies (in the U.S. and certain other countries). All third party trademarks used herein are the property of their respective owners. Third Quarter 2023 Financial Results and Business Update November 7 , 2023 © 2023 Theravance Biopharma. All rights reserved.

Forward - Looking Statements This presentation contains certain "forward - looking" statements as that term is defined in the Private Securities Litigation Ref orm Act of 1995 regarding, among other things, statements relating to goals, plans, objectives, expectations and future events. Theravance Biopharma, Inc. (the “Company”) intends such fo rward - looking statements to be covered by the safe harbor provisions for forward - looking statements contained in Section 21E of the Securities Exchange Act of 1934, as amended, an d the Private Securities Litigation Reform Act of 1995. Examples of such statements include statements relating to: the Company’s repurchase of its ordinary shares by way of an open ma rket share repurchase program, the impact of recent headcount reductions in connection with focusing investments in research, the Company’s governance policies and plans, the Co mpa ny’s expectations regarding its allocation of resources and maintenance of expenditures, the Company’s goals, designs, strategies, plans and objectives, future YUPELRI sal es, the ability to provide value to shareholders, the Company’s regulatory strategies and timing of clinical studies, possible safety, efficacy or differentiation of our investiga tio nal therapy, and contingent payments due to the Company from the sale of the Company’s TRELEGY ELLIPTA royalty interests to Royalty Pharma. These statements are based on the current es timates and assumptions of the management of the Company as of the date of this presentation and are subject to risks, uncertainties, changes in circumstances, assumptions an d o ther factors that may cause the actual results of the Company to be materially different from those reflected in the forward - looking statements. Important factors that could cause ac tual results to differ materially from those indicated by such forward - looking statements include, among others, risks related to: whether the milestone thresholds can be achieved, delay s or difficulties in commencing, enrolling or completing clinical studies, the potential that results from clinical or non - clinical studies indicate the Company’s product candidates or product are unsafe, ineffective or not differentiated, risks of decisions from regulatory authorities that are unfavorable to the Company, dependence on third parties to conduct clinical st udi es, delays or failure to achieve and maintain regulatory approvals for product candidates, risks of collaborating with or relying on third parties to discover, develop, manufacture a nd commercialize products, and risks associated with establishing and maintaining sales, marketing and distribution capabilities with appropriate technical expertise and supporti ng infrastructure, ability to retain key personnel, the impact of the Company’s recent restructuring actions on its employees, partners and others, the ability of the Company to protect and t o e nforce its intellectual property rights, volatility and fluctuations in the trading price and volume of the Company’s shares, and general economic and market conditions. Other risks affecting the Company are in the Company’s Form 10 - Q filed with the SEC on August 9, 2023, and other periodic report s filed with the SEC. In addition to the risks described above and in Theravance Biopharma's filings with the SEC, other unknown or unpredictable factors also could affect Theravance Bi opharma’s results. No forward - looking statements can be guaranteed, and actual results may differ materially from such statements. Given these uncertainties, you should not place un due reliance on these forward - looking statements. Theravance Biopharma assumes no obligation to update its forward - looking statements on account of new information, future events or otherwise, except as required by law. Non - GAAP Financial Measures Theravance Biopharma provides a non - GAAP profitability target and a non - GAAP metric in this presentation. Theravance Biopharma b elieves that the non - GAAP profitability target and non - GAAP net loss from operations provide meaningful information to assist investors in assessing prospects for future performan ce and actual performance as they provide better metrics for analyzing the performance of its business by excluding items that may not be indicative of core operating results an d the Company's cash position. Because non - GAAP financial targets and metrics, such as non - GAAP profitability and non - GAAP net loss from operations, are not standardized, it ma y not be possible to compare these measures with other companies' non - GAAP targets or measures having the same or a similar name. Thus, Theravance Biopharma’s non - GAAP measures should be considered in addition to, not as a substitute for, or in isolation from, the company's actual GAAP results and other targets. 2

Introduction Rick E Winningham Chief Executive Officer Ampreloxetine Overview Rick E Winningham Chief Executive Officer Richard A. Graham Senior Vice President, Research and Development YUPELRI ® Update Rhonda F. Farnum Senior Vice President, Chief Business Officer Financial Update Aziz Sawaf Senior Vice President, Chief Financial Officer Closing Remarks Rick E Winningham Chief Executive Officer Agenda 3

Strategic Objectives: Q3 and YTD Progress 4 1. In the US, Viatris is leading the commercialization of YUPELRI, and Theravance Biopharma co - promotes the product under a prof it and loss sharing arrangement (65% to Viatris; 35% to Theravance Biopharma). 2 . Non - GAAP profit is expected to consist of GAAP income before taxes less share - based compensation expense and non - cash interest expense. See the section titled "Non - GAAP Financial Measures" on Slide 2 for more information. 3. The first milestone payment, of $50.0 million, will be triggered if Royalty Pharma receives $240.0 million or more in roya lty payments from GSK with respect to 2023 TRELEGY global net sales, which we would expect to occur in the event TRELEGY global net sales reach approximately $2.863 billion. AAS, International Symposium on The Autonomic Nervous System; MDS, International Congress on Parkinson’s Disease and Movement Di sorders; PIFR, peak inspiratory flow rate. Financial ‣ Q3 GAAP Net Loss of ($9.0M), Non - GAAP 2 Loss of ($0.7M) vs. ($7.4M) in Q2’23; improvement driven by expense initiatives and increased YUPELRI Net Sales ‣ $325M Capital Return Program on track for 2023 completion; $31M completed Q3 and $30M remaining ‣ TRELEGY: $675M Net Sales in Q3’23 (+22% Y/Y); $2.0B YTD 3 ‣ Continuing Phase 3 CYPRESS trial enrollment and adding sites globally ‣ New data presented at MDS in August; additional data to be presented in November at AAS Ampreloxetine ‣ Total Q3 YUPELRI reported net sales reached $58.3M up 9% Y/Y 1 ‣ Continued retail script growth and market share gains ‣ PIFR - 2 enrollment completed; disclosure anticipated in Jan ‘24 ‣ Positive China study results with filing anticipated mid - 2024

51. In the US,Viatris is leading the commercialization of YUPELRI, and Theravance Biopharma co promotes the product under a profit and loss sharing arrangement (65% to Viatris ; 35% to Theravance Biopharma). 2. NonGAAP net loss from continuing operations consists of GAAP net loss before taxes excluding share based compensation expense and n on cash interest expense; see reconciliation on Slide 20 and the section titled "NonGAAP Financial Measures" on Slide 2 for more information. 3 . As of September 30, 2023, the Company is eligible to receive from Viatris potential global development, regulatory and sales milestone payments (excludingChina and adjacent territories) totaling up to $205.0 million in the aggregate; refer to our SEC filings for further informat ion . 4 . As of September 30, 2023; Theravance Biopharma eligible to receive potential development andsales milestones totaling $52.5 million related to Viatris ' development and commercialization of nebulized revefenacin in China and adjacent territories, with $45.0 million associated with YUPELRI monotherapy and $7.5million associated with future potential combination products; refer to our SEC filings for further information. 5. Refer to our SEC filings for further information. ODD, Orphan Drug Designation; PIFR, peak inspiratory flow rate.Theravance Today: Focused on Value CreationoU.S. YUPELRI CoPromote 1 : Last Twelve Months' sales of $216M as of 9/30/23oProfitable, with expanding profit margins; PIFR2 data in Jan 2024oAmpreloxetine: wholly owned Phase 3 rare neuro asset with ODD; top line data expected 2025o$134M cash and no debt; Q3 2023 NonGAAP Loss of $0.7M 2oPotential milestones and royalties:oTRELEGY: Up to $250M in sales milestones through 2026; royalties returning in 2029oYUPELRI:oUS Monotherapy: Up to $150M in sales milestones3oChina Monotherapy: Up to $45M in development and sales milestones, low doubledigit tiered royalties 4oOUS (exChina): Low double digit to mid teens royalties 5Growing YUPELRI , Maximizing Ampreloxetine, Maintaining Financial Strength1234

Ampreloxetine Value Proposition 6 1. UCSD Neurological Institute (25K - 75K, with ~10K new cases per year); NIH National Institute of Neurological Disorders and Str oke (15K - 50K). 2. Delveinsight MSA Market Forecast (2023); Symptoms associated with orthostatic hypotension in pure autonomic failure and mu lti ple systems atrophy, CJ Mathias (1999). 3. Source: Thelansis nOH Market Report 2023; TBPH Internal Analysis . MSA, multiple system atrophy; nOH, neurogenic orthostatic hypotension. • Significant Commercial Potential: • 35K - 45K MSA Patients with Symptomatic nOH in the US 1,2 • ~ 5x the Addressable Population with the inclusion of Europe, Japan and China 3

7 Source: Thelansis nOH Market Report 2023; TBPH Internal Analysis 1 China & Japan United States Europe Ampreloxetine Worldwide Opportunity: Multiple System Atrophy (MSA) Patients with Symptomatic nOH MSA patients: ~50K Total Addressable Pop. w/ nOH: ~35 - 45K MSA patients: ~65K Total Addressable Pop. w/ nOH: ~45 - 60K MSA patients: ~150K Total Addressable Pop. w/ nOH: ~90 - 105K 1 2 3 1 2 3

Ampreloxetine Value Proposition81. UCSD Neurological Institute (25K-75K, with ~10K new cases per year); NIH National Institute of Neurological Disorders and Stroke (15K-50K).2. Delveinsight MSA Market Forecast (2023); Symptoms associated with orthostatic hypotension in pure autonomic failure and multiple systems atrophy, CJ Mathias (1999).3. Source: Thelansis nOH Market Report 2023; TBPH Internal Analysis.4. Reflects Theravance Biopharma's expectations for ampreloxetine based on clinical trial data to date. Ampreloxetine is in development and not approved for any indication. Data on file.MSA, multiple system atrophy; nOH, neurogenic orthostatic hypotension.o Significant Commercial Potential:o 35K-45K MSA Patients with Symptomatic nOH in the US1,2o ~ 5x the Addressable Population with the inclusion of Europe, Japan and China3o Wholly-Owned by Theravance with Potential to Partner OUSo Granted IP protection to 2037 in the USo Orphan Drug Designation Receivedo Highly Differentiated Efficacy and Safety, Addressing Key Unmet Needs4o High Probability of Success

Differentiated Profile in Symptomatic nOH in MSA: High Unmet Need, Significant Potential Impact 1. Merola A, et al., Mov Disord 2018 . 2. Claassen DO, et al., BMC Neurol 2018. 3. NORTHERA ® (droxidopa) [package insert]. Deerfield, IL: Lundbeck. 2014. 4 . ProAmatine® (midodrine hydrochloride) [Warning Ref 4052798]. Lexington, MA: Shire. 2017. 5. Reflects Theravance Biopharma's expectations for ampreloxetine based on clinical trial data to date. Ampreloxetine is in development and not approved for any indication. Data on file. MSA, multiple system atrophy; nOH, neurogenic orthostatic hypotension. 9 High Unmet Need Ampreloxetine’s Differentiated Effects 5 1 2 1 2 Symptomatic nOH is characterized by unremitting symptoms requiring patients to avoid sitting or standing Evidence points to a substantial negative impact of nOH symptoms: Data support a clinically - important, durable effect, with no signal for supine hypertension observed 3 Well tolerated, once - daily therapy may lead to greater patient adherence Improvements demonstrated across six cardinal symptoms experienced by MSA patients with nOH 3 Current therapies have not demonstrated a durable effect on nOH symptoms and carry a Black Box warning for supine hypertension 3,4 • 87% of patients report a reduced ability to perform daily activities and 59% report a negative impact on their quality of life 1,2 • 42% claim it has robbed them of their independence 1,2

Ampreloxetine: High Probability of Success 10 ‣ Technical: Strong mechanistic rationale supported by late - stage clinical data • Intact peripheral nerves in MSA patients • NE increase prevents decrease in blood pressure which leads to improvement in debilitating symptoms • Clinically meaningful (1.6 - point) benefit on OHSA composite score relative to placebo in a 22 - week study • Overall PTS on the higher end of benchmarks for rare diseases and neurology programs 1 ‣ Regulatory: FDA alignment on CYPRESS, supportive work complete • Interpretation of the Ph3 study 0170, design of CYPRESS, and OHSA composite as primary endpoint • Successful CYPRESS study fulfills requirement for a full approval • CMC, non - clinical pharmacology/toxicology, and clinical pharmacology programs 1. Source: Clinical Development Success Rates and Contributing Factors 2011 – 2020, BIO, Informa and QLS, 2021 ; TBPH Internal Analysis CMC, chemistry, manufacturing and controls; MSA, multiple system atrophy; NE, norepinephrine; OHSA, Orthostatic Hypotension S ymp tom Assessment; PTS, probability of technical success.

FDA - approved for maintenance treatment of COPD First and only once - daily, LAMA (long - acting muscarinic agent) nebulized maintenance medicine for COPD Co - promotion agreement with VIATRIS TM (35% / 65% Profit Share)

YUPELRI Value Proposition121. In the US, Viatris is leading the commercialization of YUPELRI, and Theravance Biopharma co-promotes the product under a profit and loss sharing arrangement (65% to Viatris; 35% to Theravance Biopharma). 2. As ofSeptember 30, 2023, the Company is eligible to receive from Viatris potential global development, regulatory and sales milestone payments (excluding China and adjacent territories) totaling up to $205.0 million in theaggregate; refer to our SEC filings for further information. 3. As of September 30, 2023; Theravance Biopharma eligible to receive potential development and sales milestones totaling $52.5 million related to Viatris'development and commercialization of nebulized revefenacin in China and adjacent territories, with $45.0 million associated with YUPELRI monotherapy and $7.5 million associated with future potential combinationproducts; refer to our SEC filings for further information. 4. Refer to our SEC filings for further information. COPD, chronic obstructive pulmonary disease; LAMA, long-acting muscarinic agent; PIFR, peak inspiratory flow rate.o Only Once-Daily Nebulized LAMA COPD Maintenance Medicineo Significant Commercial Opportunity Going Forward:o U.S. YUPELRI Co-Promote1: Last Twelve Months' sales of $216M as of 9/30/23o Profitable, with expanding profit marginso PIFR-2 data in Jan'24o Significant potential milestones and royalties:o US Monotherapy: Up to $150M in sales milestones2o China Monotherapy: Up to $45M in development and sales milestones, low double-digittiered royalties3o OUS (ex-China): Low double-digit to mid-teens royalties4o IP protection granted to 2039 in the US

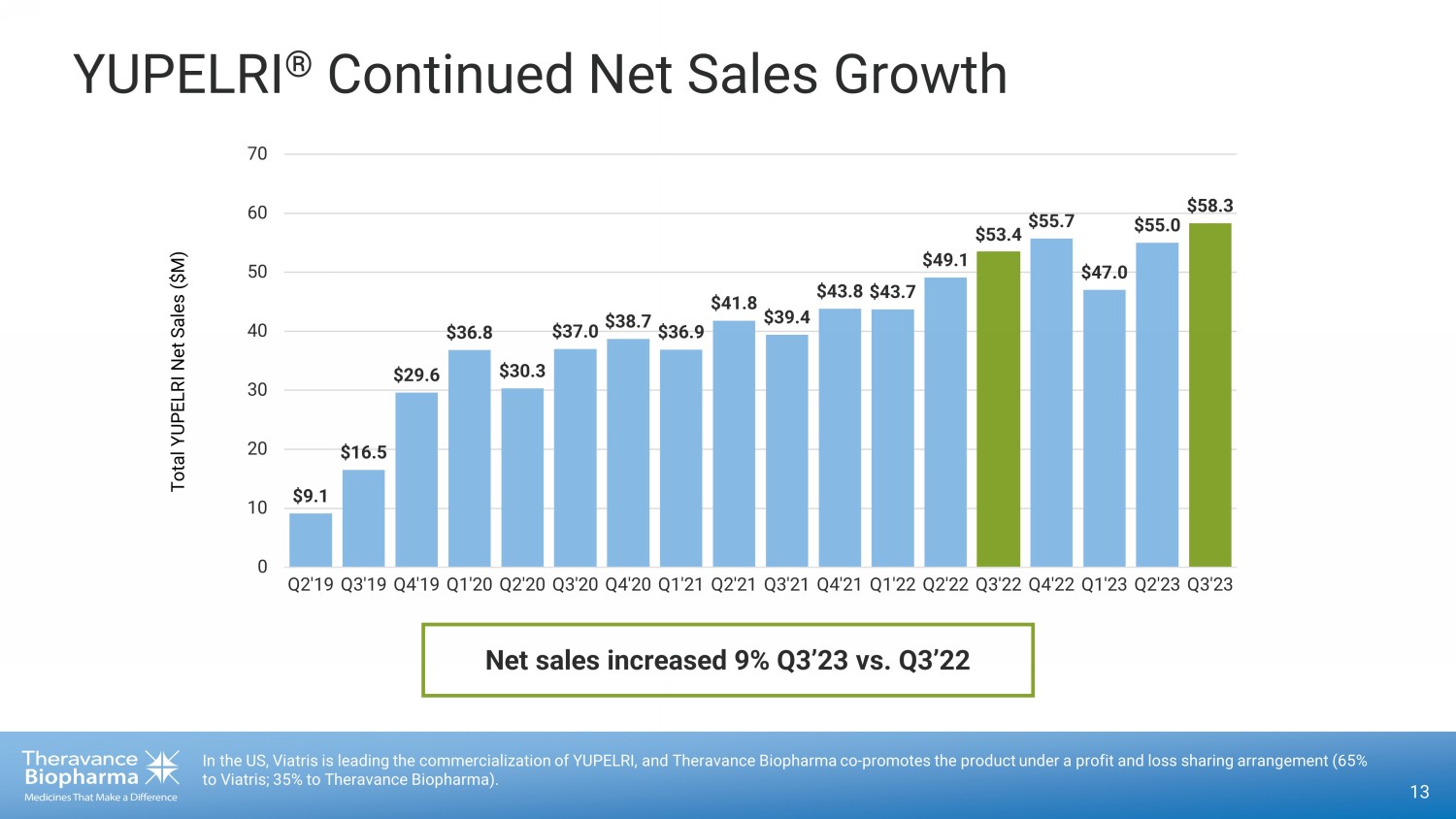

YUPELRI ® Continued Net Sales Growth 13 In the US, Viatris is leading the commercialization of YUPELRI, and Theravance Biopharma co - promotes the product under a profit and loss sharing arrangement (65% to Viatris; 35% to Theravance Biopharma). $9.1 $16.5 $29.6 $36.8 $30.3 $37.0 $38.7 $36.9 $41.8 $39.4 $43.8 $43.7 $49.1 $53.4 $55.7 $47.0 $55.0 $58.3 0 10 20 30 40 50 60 70 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Total YUPELRI Net Sales ($M) Net sales increased 9% Q3’23 vs. Q3’22

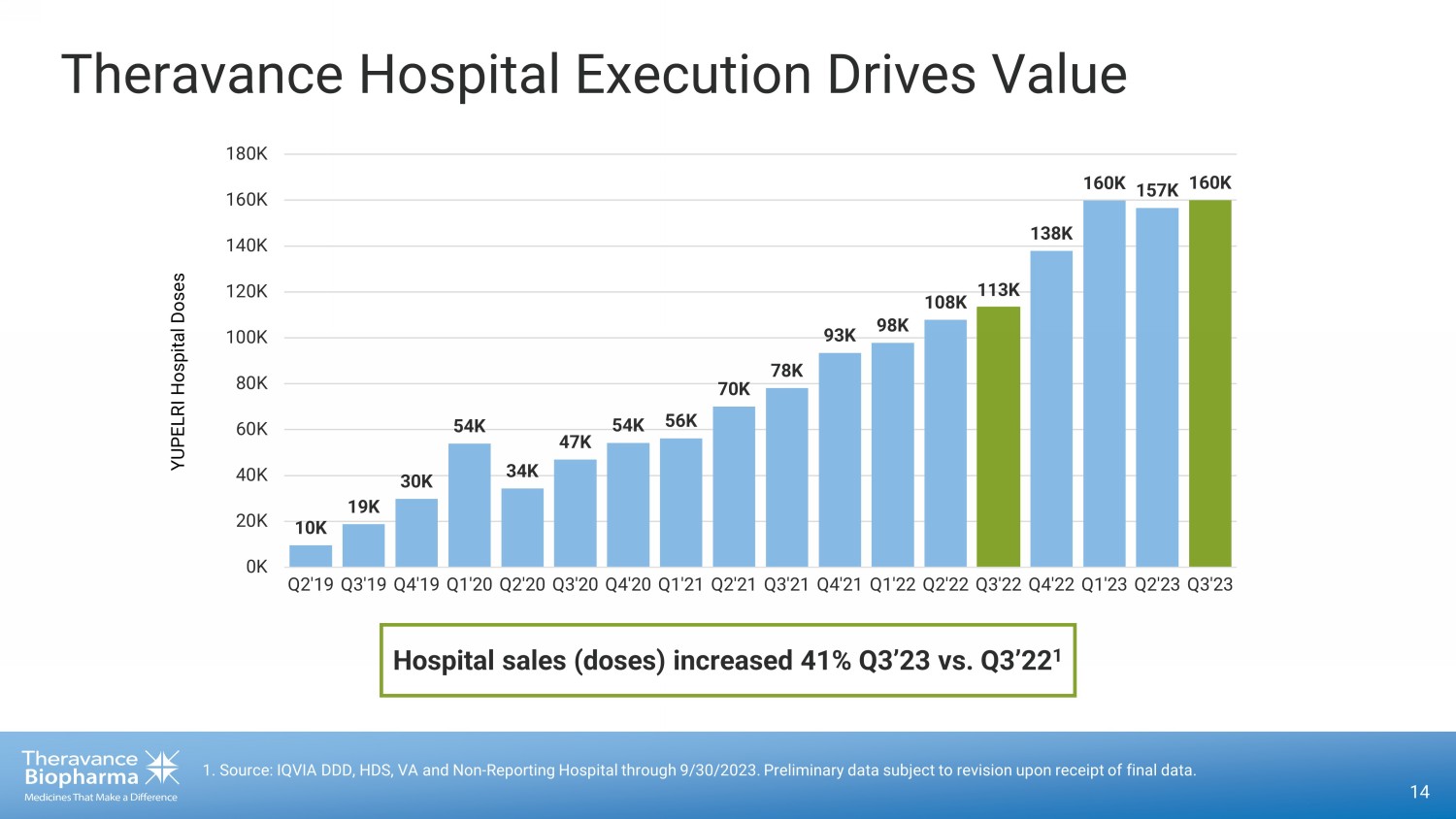

Theravance Hospital Execution Drives Value 14 1. Source: IQVIA DDD, HDS, VA and Non - Reporting Hospital through 9/30/2023. Preliminary data subject to revision upon receipt of final data. 10K 19K 30K 54K 34K 47K 54K 56K 70K 78K 93K 98K 108K 113K 138K 160K 157K 160K 0K 20K 40K 60K 80K 100K 120K 140K 160K 180K Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 YUPELRI Hospital Doses Hospital sales (doses) increased 41% Q3’23 vs. Q3’22 1

YUPELRI ® Market Share Gains Continue 15 1. Joint VTRS/TBPH Market Research (Aug’23). * Hospital LA - NEB Market Share - IQVIA DDD through 9/30/2023. †Community LA - NEB Market Share includes Retail + DME / Med B FFS through July’23. 7.6% 7.6% 8.6% 9.5% 10.7% 11.3% 11.6% 13.3% 12.5% 14.9% 15.2% 16.1% 0% 5% 10% 15% 20% 25% 30% 35% Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Hospital LA - NEB Market Share* YUPELRI Hospital LA-NEB Market Share Patients continue treatment in the community setting which is inclusive of both the retail and DME channels 18.7% 19.7% 21.4% 22.5% 23.2% 24.1% 25.3% 26.4% 27.1% 28.0% 29.0% 30.2% 0% 5% 10% 15% 20% 25% 30% 35% Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Community LA - NEB Market Share † YUPELRI Community LA-NEB Market Share Most patients who receive YUPELRI in the hospital are discharged with an Rx 1 LA - NEB Market: YUPELRI, BROVANA, LONHALA, PERFOROMIST, arformoterol, formoterol Hospital LA - NEB Market Share Community LA - NEB Market Share

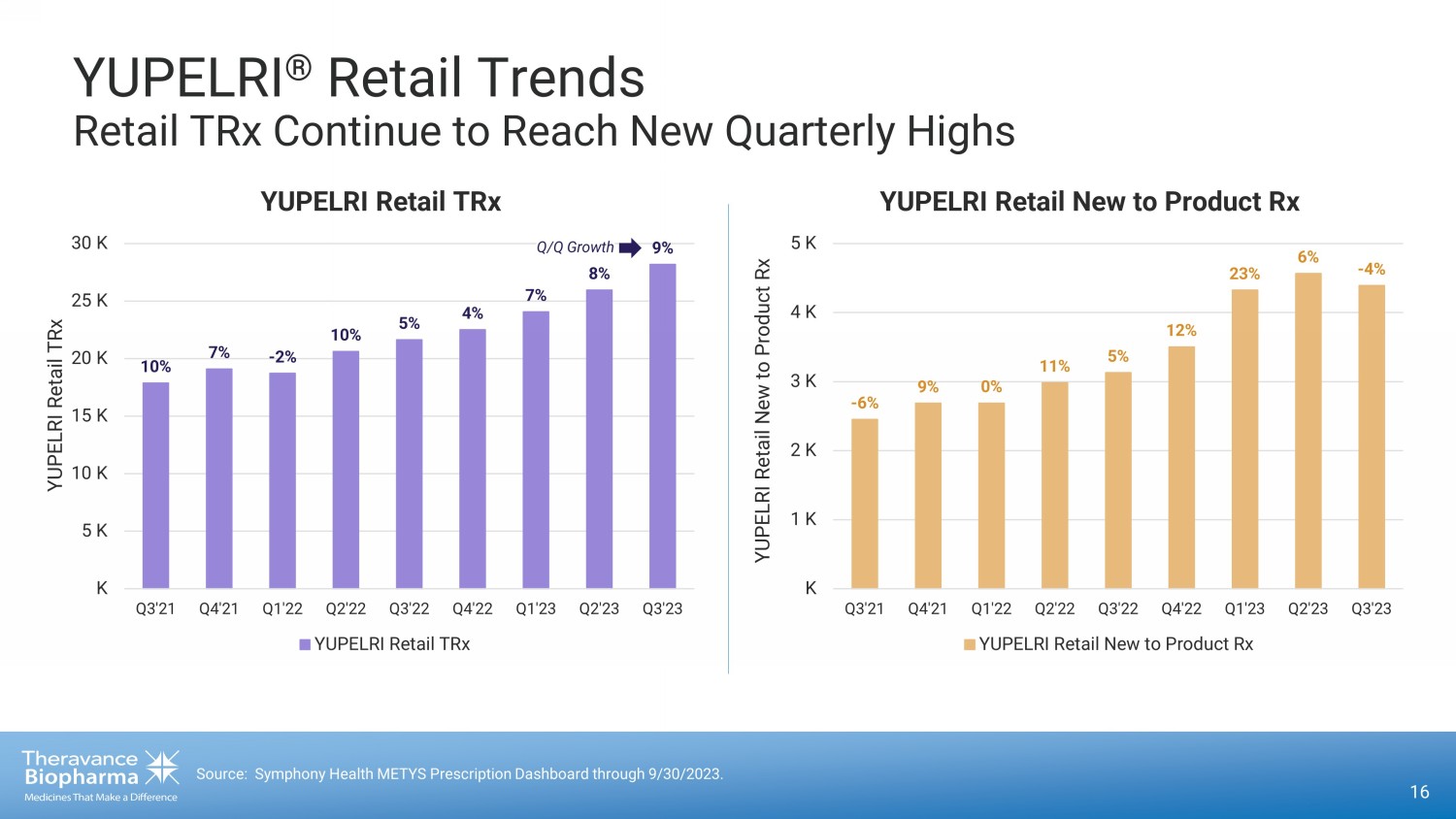

16 Source: Symphony Health METYS Prescription Dashboard through 9/30/2023. 10% 7% - 2% 10% 5% 4% 7% 8% 9% K 5 K 10 K 15 K 20 K 25 K 30 K Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 YUPELRI Retail TRx YUPELRI Retail TRx YUPELRI Retail TRx YUPELRI ® Retail Trends Retail TRx Continue to Reach New Quarterly Highs Q /Q Growth - 6% 9% 0% 11% 5% 12% 23% 6% - 4% K 1 K 2 K 3 K 4 K 5 K Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 YUPELRI Retail New to Product Rx YUPELRI Retail New to Product Rx YUPELRI Retail New to Product Rx

Financial Update

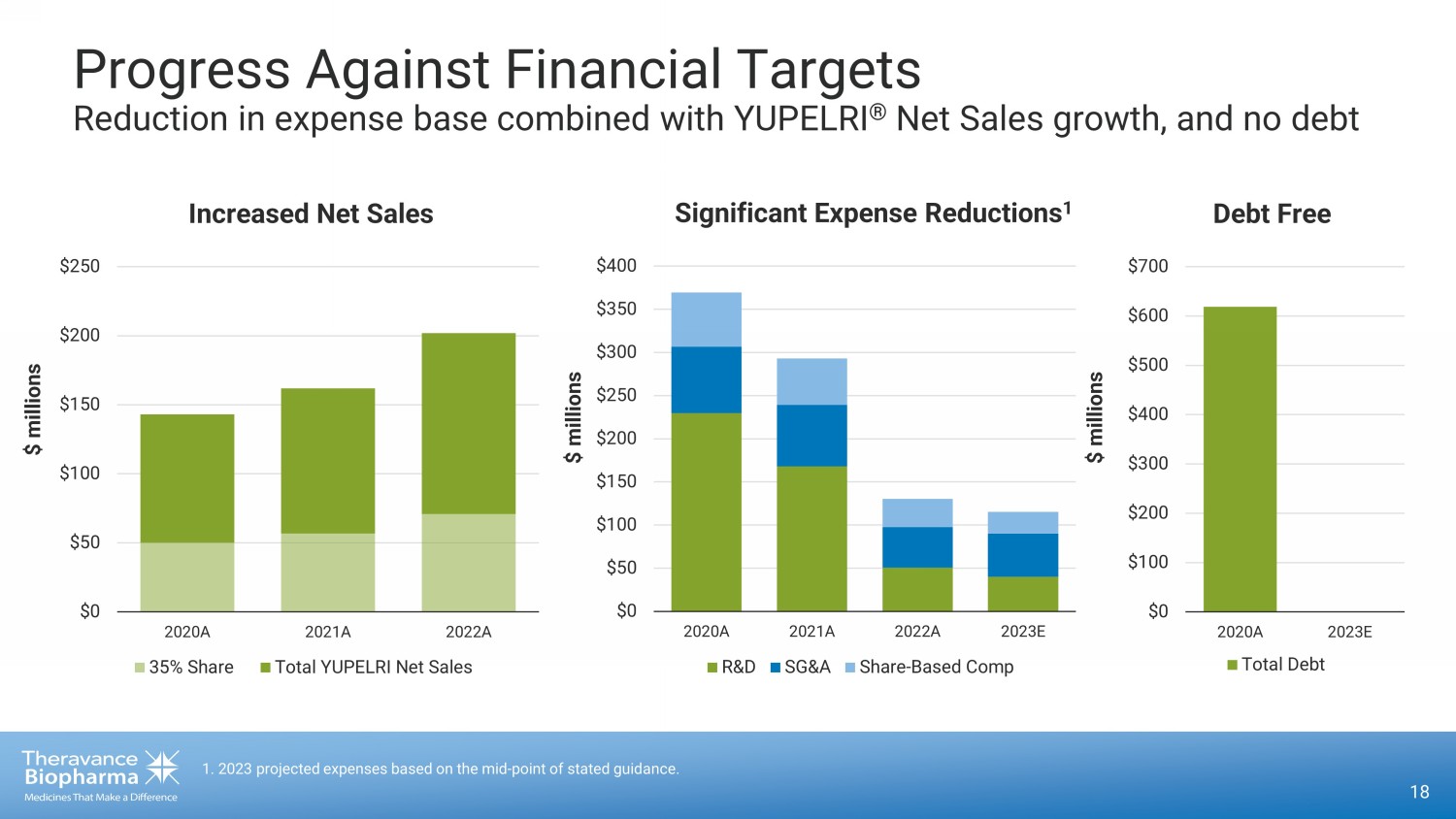

18 1 . 2023 projected expenses based on the mid - point of stated guidance. Progress Against Financial Targets Reduction in expense base combined with YUPELRI ® Net Sales growth, and no debt $0 $50 $100 $150 $200 $250 $300 $350 $400 2020A 2021A 2022A 2023E R&D SG&A Share-Based Comp Significant Expense Reductions 1 $ millions $ millions $0 $50 $100 $150 $200 $250 2020A 2021A 2022A 35% Share Total YUPELRI Net Sales Increased Net Sales $0 $100 $200 $300 $400 $500 $600 $700 2020A 2023E Total Debt $ millions Debt Free

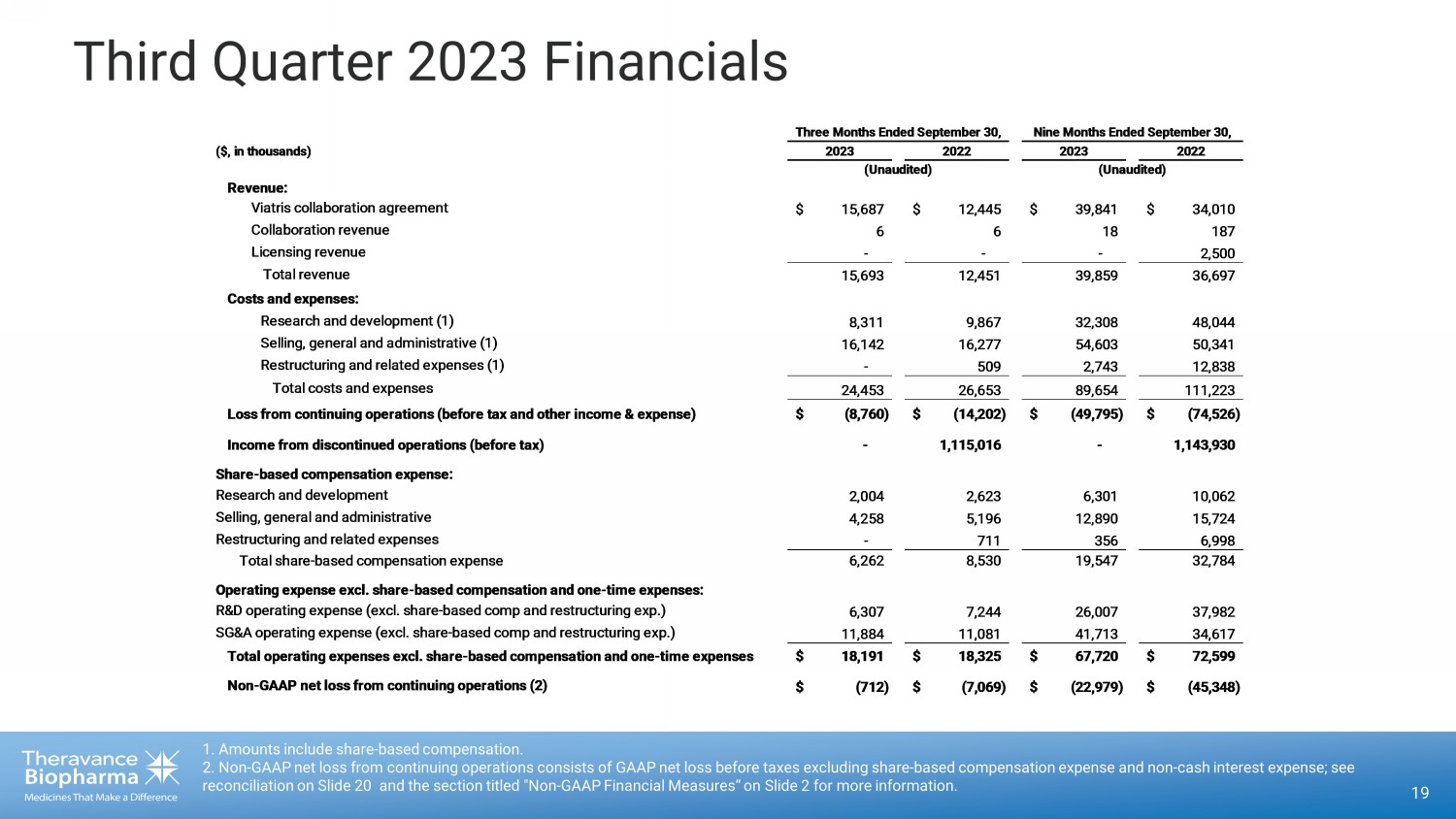

Third Quarter 2023 Financials 19 1. Amounts include share - based compensation. 2. Non - GAAP net loss from continuing operations consists of GAAP net loss before taxes excluding share - based compensation expens e and non - cash interest expense; see reconciliation on Slide 20 and the section titled "Non - GAAP Financial Measures“ on Slide 2 for more information. ($, in thousands) Revenue: Viatris collaboration agreement $ 15,687 $ 12,445 $ 39,841 $ 34,010 Collaboration revenue 6 6 18 187 Licensing revenue - - - 2,500 Total revenue 15,693 12,451 39,859 36,697 Costs and expenses: Research and development (1) 8,311 9,867 32,308 48,044 Selling, general and administrative (1) 16,142 16,277 54,603 50,341 Restructuring and related expenses (1) - 509 2,743 12,838 Total costs and expenses 24,453 26,653 89,654 111,223 Loss from continuing operations (before tax and other income & expense) $ (8,760) $ (14,202) $ (49,795) $ (74,526) Income from discontinued operations (before tax) - 1,115,016 - 1,143,930 Share-based compensation expense: Research and development 2,004 2,623 6,301 10,062 Selling, general and administrative 4,258 5,196 12,890 15,724 Restructuring and related expenses - 711 356 6,998 Total share-based compensation expense 6,262 8,530 19,547 32,784 Operating expense excl. share-based compensation and one-time expenses: R&D operating expense (excl. share-based comp and restructuring exp.) 6,307 7,244 26,007 37,982 SG&A operating expense (excl. share-based comp and restructuring exp.) 11,884 11,081 41,713 34,617 Total operating expenses excl. share-based compensation and one-time expenses$ 18,191 $ 18,325 $ 67,720 $ 72,599 Non-GAAP net loss from continuing operations (2) $ (712) $ (7,069) $ (22,979) $ (45,348) Three Months Ended September 30, 2023 2022 (Unaudited) Nine Months Ended September 30, 2023 2022 (Unaudited)

Third Quarter 2023 Financials (Cont’d) 20 See the section titled "Non - GAAP Financial Measures" on Slide 2 for more information. GAAP Net Loss from Continuing Operations $ (8,950) $ (16,023) $ (46,683) $ (78,568) Adjustments: Share-based compensation expense 6,262 8,530 19,547 32,784 Non-cash interest expense 609 424 1,727 424 Income tax expense (benefit) 1,367 - 2,430 12 Non-GAAP Net Loss from Continuing Operations $ (712) $ (7,069) $ (22,979) $ (45,348) Non-GAAP Net Loss per Share from Continuing Operations Net loss - basic and diluted $ (0.01) $ (0.09) $ (0.40) $ (0.60) Shares used to compute per share calculations - basic and diluted 52,361 75,515 57,287 75,678 (Unaudited) Reconciliation of GAAP to Non-GAAP Net Loss from Continuing Operations (In thousands, except per share data) Three Months Ended September 30, Nine Months Ended September 30, 2023 2022 2023 2022 (Unaudited)

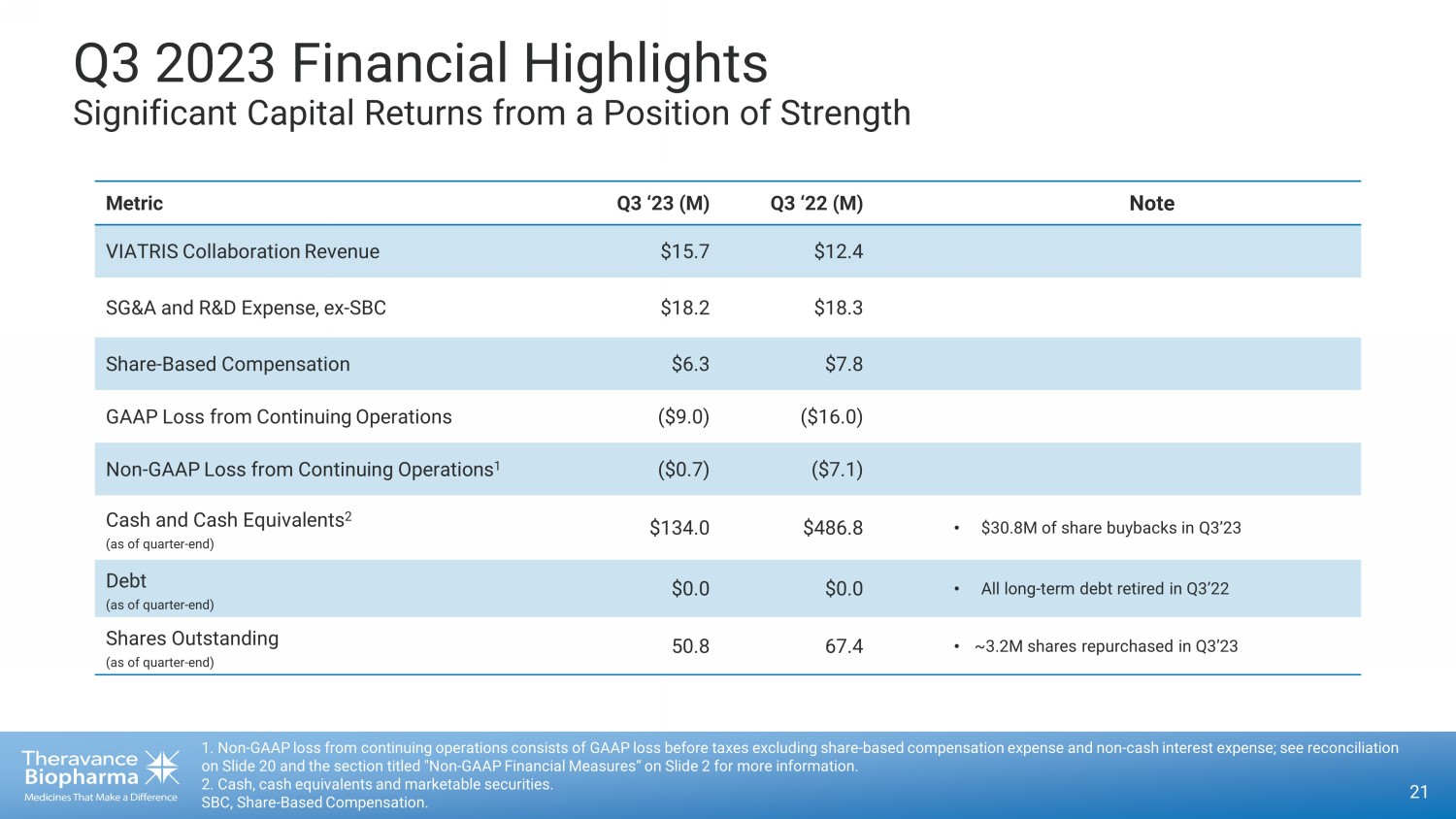

Q3 2023 Financial Highlights Significant Capital Returns from a Position of Strength 21 1. Non - GAAP loss from continuing operations consists of GAAP loss before taxes excluding share - based compensation expense and no n - cash interest expense; see reconciliation on Slide 20 and the section titled "Non - GAAP Financial Measures“ on Slide 2 for more information. 2. Cash, cash equivalents and marketable securities. SBC, Share - Based Compensation. Metric Q3 ‘23 (M) Q3 ‘22 (M) Note VIATRIS Collaboration Revenue $15.7 $12.4 SG&A and R&D Expense, ex - SBC $18.2 $18.3 Share - Based Compensation $6.3 $7.8 GAAP Loss from Continuing Operations ($9.0) ($16.0) Non - GAAP Loss from Continuing Operations 1 ($0.7) ($7.1) Cash and Cash Equivalents 2 (as of quarter - end) $134.0 $486.8 • $30.8M of share buybacks in Q3’23 Debt (as of quarter - end) $0.0 $0.0 • All long - term debt retired in Q3’22 Shares Outstanding (as of quarter - end) 50.8 67.4 • ~3.2M shares repurchased in Q3’23

2023 Financial Guidance Expected to Generate Non - GAAP 1 Profit in 2H 2023 22 1. Non - GAAP profit is expected to consist of GAAP income before taxes less share - based compensation expense and non - cash interes t expense; see the section titled "Non - GAAP Financial Measures" on Slide 2 for more information. 2. No further severance and termination costs expected. • 2023 OPEX Guidance Range: • R&D: $35M - $45M • SG&A: $45M - $55M • Guidance Excludes: • Non - cash share - based compensation • Non - recurring costs 2 : • $1.6M in Q1’23 associated with headcount reduction • $1.2M in Q2’23 associated with lab equipment sale • Share - Based Compensation: • Q3’23 down 25% Y/Y, excluding restructuring costs, and 36%, including restructuring costs

Q3’23 Net Sales of $ 675M | YTD Net Sales of $2.0B 4 Outer - Year Royalties 3 return in 2029: TRELEGY ELLIPTA Milestones and Royalties GSK’s TRELEGY ELLIPTA (FF/UMEC/VI): First and only once - daily single inhaler triple therapy 23 1. If both milestones are achieved in a given year, Theravance Biopharma will only earn the higher milestone. 2. Based on 10 0% of TRELEGY ELLIPTA royalties. 3. 85 % of TRELEGY ELLIPTA royalties return to Theravance Biopharma beginning July 1, ್ 2029 ್ for sales ex - U.S., and January 1, ್ 2031 ್ for sales within the U.S.; U.S. royalties expected to end late 2032; ex - U.S. royalties expected to end mid - 2030s and are country specific. 4. Source: GSK - reported Net Sales in USD. FF, Fluticasone Furoate; UMEC, Umeclidinium; VI, Vilanterol. Mid - Term Value Long - Term Value • Ex - US royalties return Jul. 1, ௗ 2029 • US royalties return after Jan. 1, ௗ 2031 • Paid directly from Roy alty Pharma Up to $250M of Sales - based milestones 1,2 between 2023 – 2026: GSK remains exclusively responsible for commercialization of TRELEGY ELLIPTA

24Theravance'sFuture: Focused on Value CreationoGrow YUPELRIoSuccessfully develop and commercializeampreloxetine worldwide:oRetain US rightsoPartner exUSoAchieve Up to $250M in TRELEGY sales milestones, with royalties returning in 2029oAchieve Potential YUPELRI milestones and royaltiesoMaintain financial strength and efficiently deploy available capitalGrowYUPELRI , Maximize Ampreloxetine , Optimize Financial Returns12345

Rick E Winningham Chairman and Chief Executive Officer Aziz Sawaf, CFA Senior Vice President, Chief Financial Officer Rhonda F. Farnum Senior Vice President, Chief Business Officer Richard A. Graham Senior Vice President, Research and Development Q&A Session

YUPELRI ® (revefenacin) inhalation solution YUPELRI ® inhalation solution is indicated for the maintenance treatment of patients with chronic obstructive pulmonary disease (COPD) . Important Safety Information (US) YUPELRI is contraindicated in patients with hypersensitivity to revefenacin or any component of this product . YUPELRI should not be initiated in patients during acutely deteriorating or potentially life - threatening episodes of COPD, or for the relief of acute symptoms, i . e . , as rescue therapy for the treatment of acute episodes of bronchospasm . Acute symptoms should be treated with an inhaled short - acting beta 2 - agonist . As with other inhaled medicines, YUPELRI can produce paradoxical bronchospasm that may be life - threatening . If paradoxical bronchospasm occurs following dosing with YUPELRI, it should be treated immediately with an inhaled, short - acting bronchodilator . YUPELRI should be discontinued immediately and alternative therapy should be instituted . YUPELRI should be used with caution in patients with narrow - angle glaucoma . Patients should be instructed to immediately consult their healthcare provider if they develop any signs and symptoms of acute narrow - angle glaucoma, including eye pain or discomfort, blurred vision, visual halos or colored images in association with red eyes from conjunctival congestion and corneal edema . Worsening of urinary retention may occur . Use with caution in patients with prostatic hyperplasia or bladder - neck obstruction and instruct patients to contact a healthcare provider immediately if symptoms occur . Immediate hypersensitivity reactions may occur after administration of YUPELRI . If a reaction occurs, YUPELRI should be stopped at once and alternative treatments considered . The most common adverse reactions occurring in clinical trials at an incidence greater than or equal to 2 % in the YUPELRI group, and higher than placebo, included cough, nasopharyngitis, upper respiratory infection, headache and back pain . Coadministration of anticholinergic medicines or OATP 1 B 1 and OATP 1 B 3 inhibitors with YUPELRI is not recommended . YUPELRI is not recommended in patients with any degree of hepatic impairment . 26 OATP, organic anion transporting polypeptide.

About YUPELRI ® (revefenacin) Inhalation Solution YUPELRI ® (revefenacin) inhalation solution is a once - daily nebulized LAMA approved for the maintenance treatment of COPD in the US . Market research by Theravance Biopharma indicates approximately 9 % of the treated COPD patients in the US use nebulizers for ongoing maintenance therapy . 1 LAMAs are a cornerstone of maintenance therapy for COPD and YUPELRI ® is positioned as the first once - daily single - agent bronchodilator product for COPD patients who require, or prefer, nebulized therapy . YUPELRI ® ’s stability in both metered dose inhaler and dry powder device formulations suggest that this LAMA could also serve as a foundation for novel handheld combination products . 27 1. TBPH market research (N=160 physicians); refers to US COPD patients. COPD, chronic obstructive pulmonary disease; LAMA, long - acting muscarinic antagonist.

Appendix

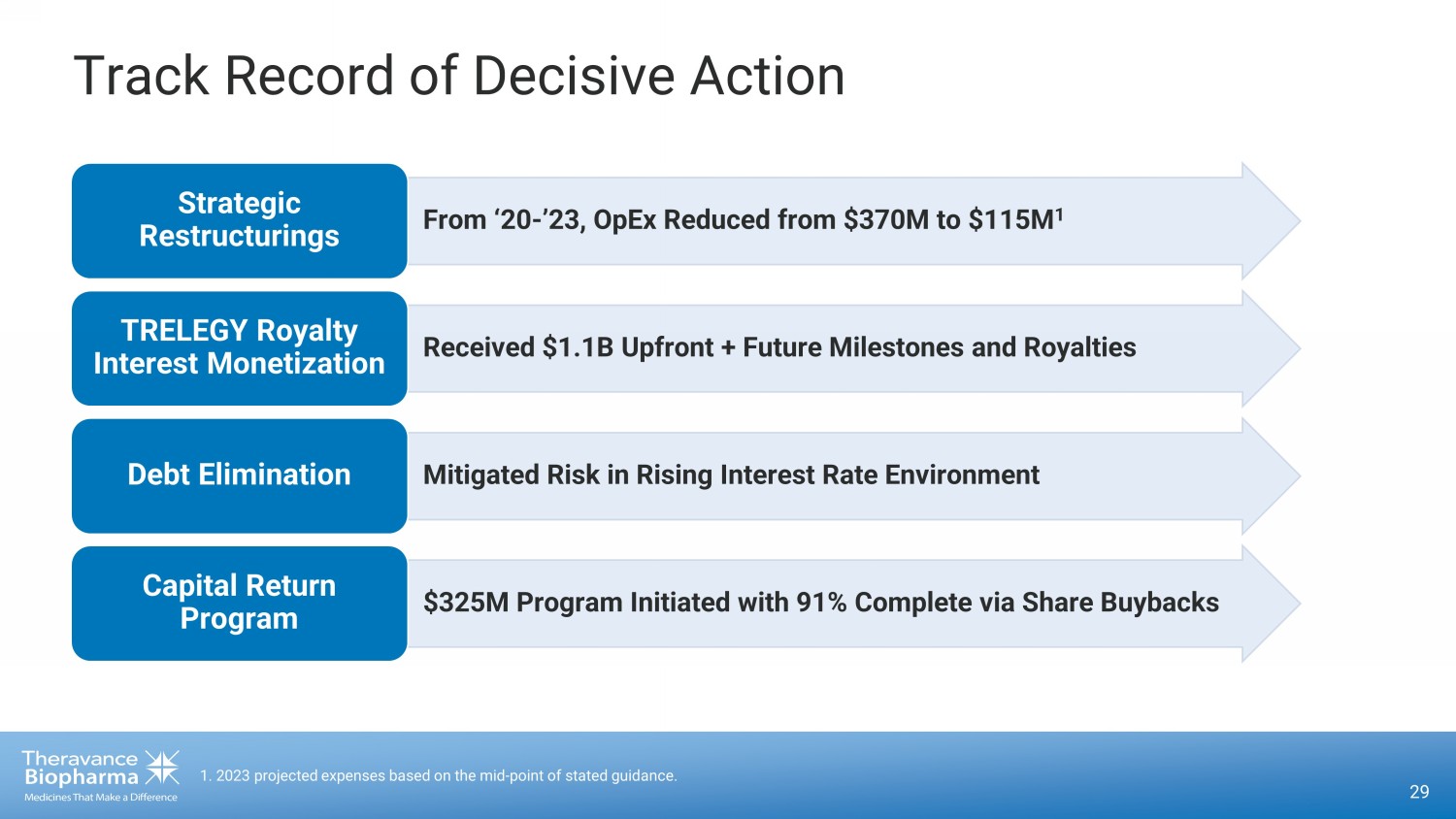

29 1. 2023 projected expenses based on the mid - point of stated guidance. From ‘20 - ’23, OpEx Reduced from $370M to $115M 1 Strategic Restructurings Received $1.1B Upfront + Future Milestones and Royalties TRELEGY Royalty Interest Monetization Mitigated Risk in Rising Interest Rate Environment Debt Elimination $325M Program Initiated with 91% Complete via Share Buybacks Capital Return Program Track Record of Decisive Action

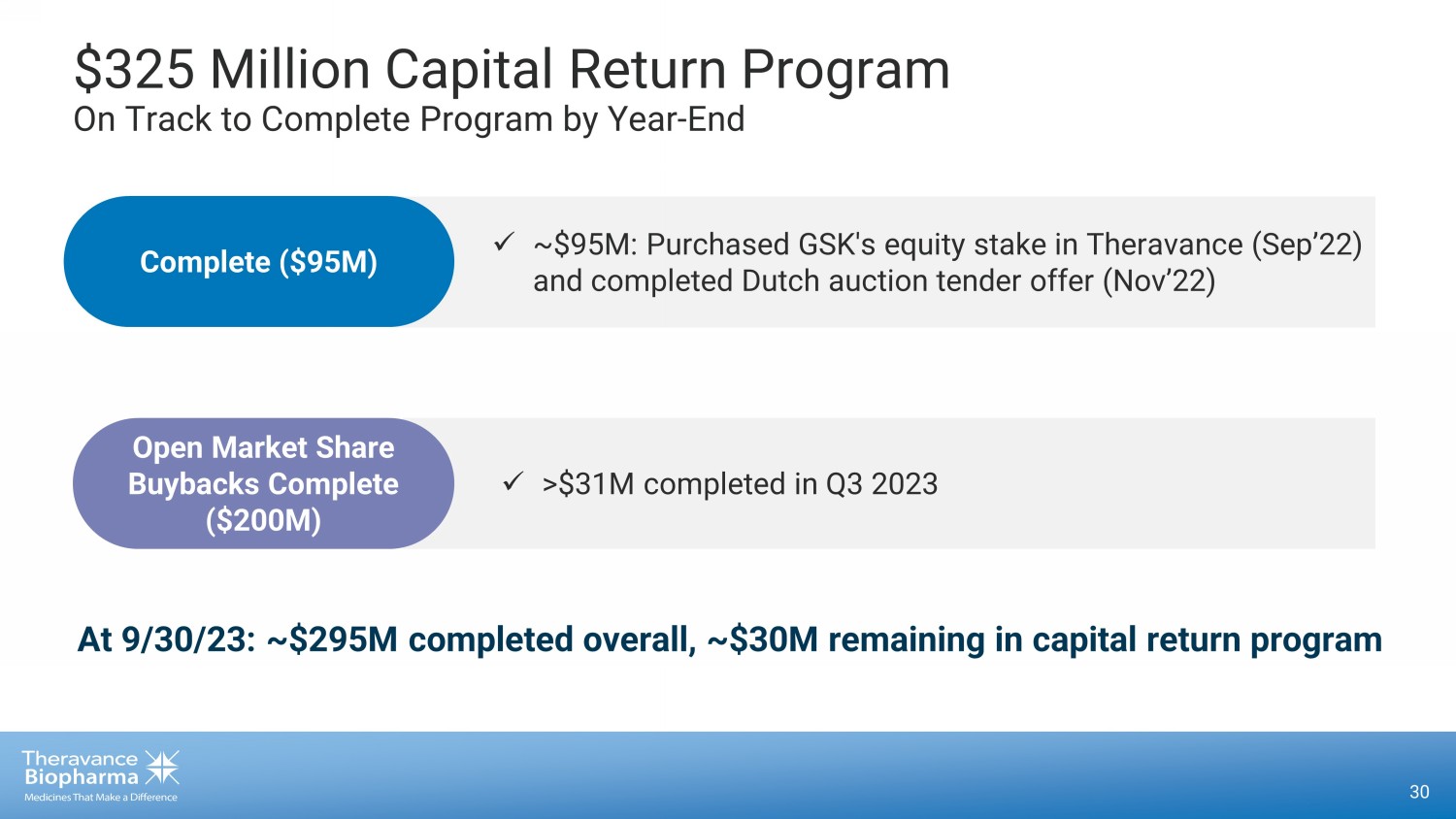

x ~$95M: Purchased GSK's equity stake in Theravance (Sep’22) and completed Dutch auction tender offer (Nov’22) x >$31M completed in Q3 2023 $325 Million Capital Return Program On Track to Complete Program by Year - End 30 Complete ($95M) Open Market Share Buybacks Complete ($200M) At 9/30/23: ~$295M completed overall, ~$30M remaining in capital return program

YUPELRI ® PIFR - 2: Phase 4 Randomized, Double - Blind, Parallel - Group Study: Anticipated top - line disclosures 31 Phase 4, Randomized, Double - Blind, Parallel˗Group Study in Adults With Severe - to - Very - Severe COPD and Suboptimal Inspiratory Flo w Rate. *Dry powder inhaler (Spiriva ® HandiHaler ® ). AE, adverse event; COPD, chronic obstructive pulmonary disease; FEV 1 , forced expiratory volume in 1 second; PIFR, peak inspiratory flow rate; SAE, serious adverse event. 1. Description of patient population and study conduct (e.g., demographic and baseline characteristics and patient disposition) 2. Summary of efficacy of revefenacin in comparison to tiotropium , including: • Primary Efficacy Endpoint • Day 85 trough FEV 1 change from baseline (CFB) • Key Secondary Efficacy Endpoints • Average trough FEV 1 CFB across Days 30, 60, and 85 • Other associated spirometry endpoints 3. Description of the safety profile of revefenacin in comparison to tiotropium , with analyses on treatment - emergent AEs and SAEs. Data Disclosures Expected Jan ‘24 Randomization 1:1 Results YUPELRI ® SPIRIVA ® via HH* 1x/ day treatment: 12 weeks Run - in Sample size ‣ N = Up to 488 GOLD 3 and 4 patients

32 Substantial Opportunity for Further YUPELRI ® Growth Long - Acting Nebulized Maintenance Patients Patients Using Short - Acting Nebulized Therapy ~200K Current Long - Acting Neb Patients ~200K Patients Inappropriately Using Short - Acting Nebulized Treatments for Maintenance Therapy Current COPD Patients on Nebulized Therapy COPD Patients Who Could Benefit from Nebulized Therapy 1. Addressable patient population quantifies the number of patients within the intended target profile. Sources: Citeline Pharma Custom Intelligence Primary Research April 2023, Symphony Health METYS Prescription Dashboard, Solut ion sRx Med B FFS. COPD, chronic obstructive pulmonary disease; PIFR, peak inspiratory flow rate. ~1.5M Patients on Handheld - Only Maintenance Regimens who Remain Symptomatic ~2M Patients for Whom YUPELRI May Be Appropriate ~60K patients estimated to be on YUPELRI currently Addressable Patient Population (U.S.) 1 Suboptimal PIFR Cognitive Impairment Dexterity Challenges

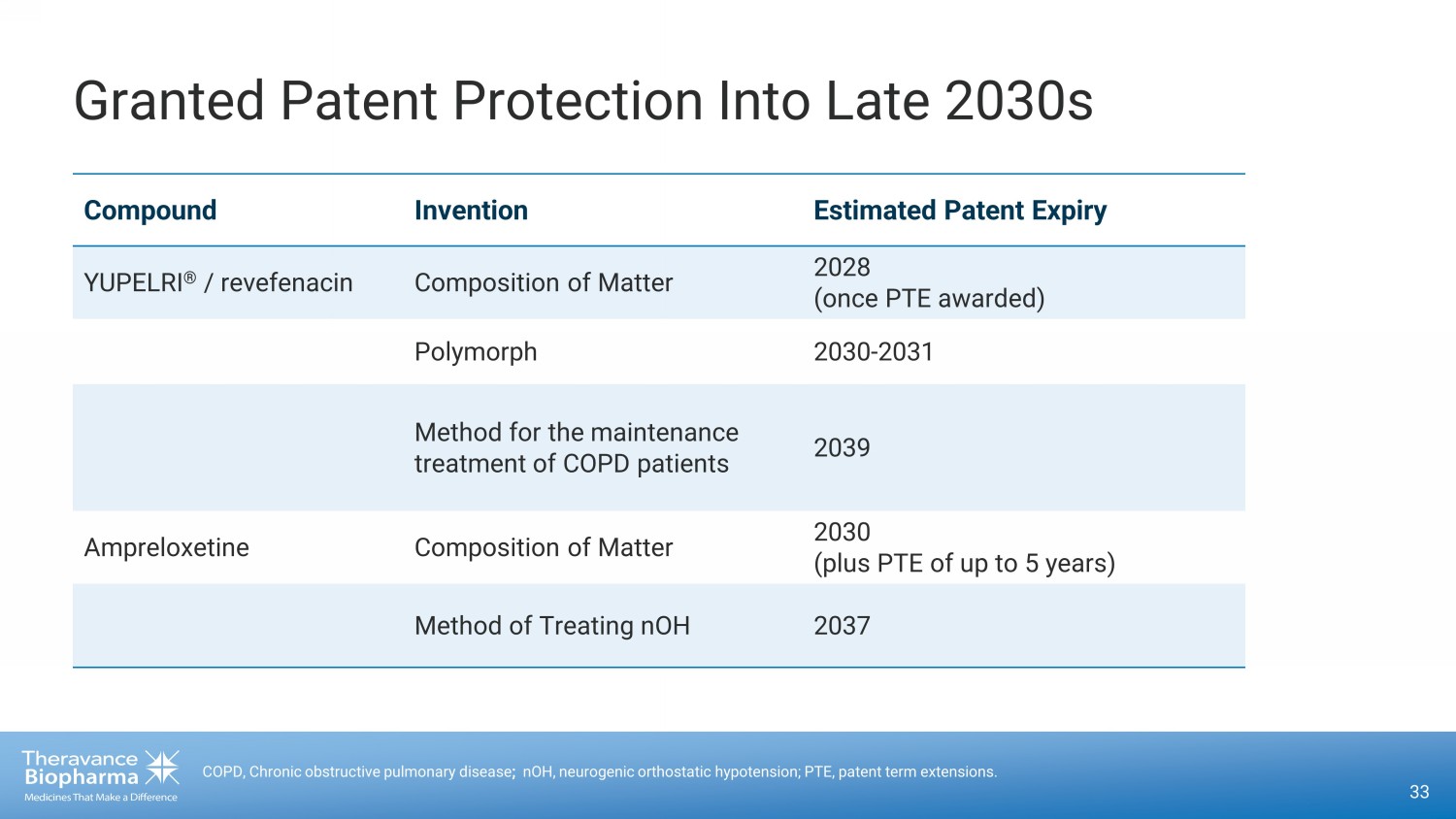

Granted Patent Protection Into Late 2030s 33 COPD, Chronic obstructive pulmonary disease ; nOH, neurogenic orthostatic hypotension; PTE, patent term extensions. Compound Invention Estimated Patent Expiry YUPELRI ® / revefenacin Composition of Matter 2028 (once PTE awarded) Polymorph 2030 - 2031 Method for the maintenance treatment of COPD patients 2039 Ampreloxetine Composition of Matter 2030 (plus PTE of up to 5 years) Method of Treating nOH 2037

34 Viatris Collaboration Agreement Revenue Theravance Entitled to Share of US profits (65% to Viatris; 35% to Theravance) 1. Any reimbursement from Viatris attributed to the 65% cost - sharing of our R&D expenses is characterized as a reduction of R&D expense. 2. Amount included as a receivable on the balance sheet as “Receivables from collaborative arrangements.” Viatris Collaboration Agreement Revenue Cash amount receivable from Viatris 1,2 Payment of shared Viatris expenses (35%) Reimbursement of shared Theravance expenses (65%) 35% of YUPELRI ® Net Sales Collaboration Revenue, in any given period can fluctuate by the absolute and relative expenses incurred by Viatris and Theravance, in addition to the Net Sales generated in the period

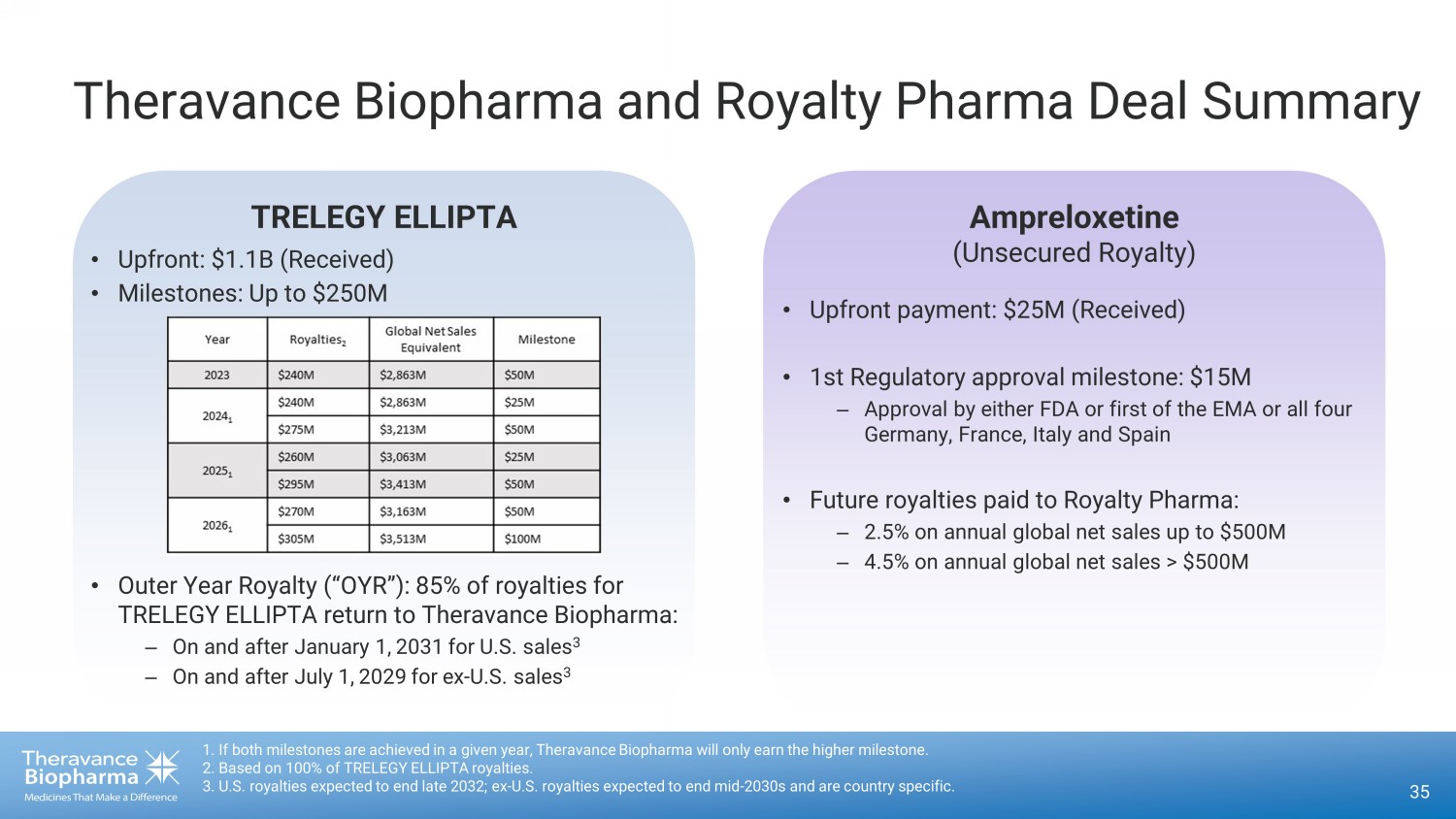

TRELEGY ELLIPTA Theravance Biopharma and Royalty Pharma Deal Summary • Upfront: $1.1B (Received) • Milestones: Up to $250M 35 1. If both milestones are achieved in a given year, Theravance Biopharma will only earn the higher milestone. 2. Based on 100% of TRELEGY ELLIPTA royalties. 3. U.S. royalties expected to end late 2032; ex - U.S. royalties expected to end mid - 2030s and are country specific. Ampreloxetine (Unsecured Royalty) • Outer Year Royalty (“OYR”): 85% of royalties for TRELEGY ELLIPTA return to Theravance Biopharma: – On and after January 1, ௗ 2031 ௗ for U.S. sales 3 – On and after July 1, ௗ 2029 ௗ for ex - U.S. sales 3 • Upfront payment: $25M (Received) • 1st Regulatory approval milestone: $15M – Approval by either FDA or first of the EMA or all four Germany, France, Italy and Spain • Future royalties paid to Royalty Pharma: – 2.5% on annual global net sales up to $500M – 4.5% on annual global net sales > $500M

High Unmet Need Supports Significant Commercial Potential 36 Reflects Theravance Biopharma's expectations for ampreloxetine based on clinical trial data to date. Ampreloxetine is in deve lop ment and not approved for any indication. Data on file. 1. UCSD Neurological Institute (25K - 75K, with ~10K new cases per year); NIH National Institute of Neurological Disorders and Stroke (15K - 50K). 2. Delveinsight MSA M arket Forecast (2023); Symptoms associated with orthostatic hypotension in pure autonomic failure and multiple systems atrophy, CJ Mathias (1999). 3. NORTHERA ® (droxidopa) [package insert]. Deerfield, IL: Lundbeck. 2014. 4. ProAmatine® (midodrine hydrochloride) [Warning Ref 4052798]. Lexington, MA: Shire. 2017. 5. Low, AJMC, 2015. 6. 2022 MAT Rapid Payer Response KOL and High - Volume Prescriber Research. 7. Ky mes, Autonomic Neuroscience: Basic and Clinical, 2020. MSA, multiple system atrophy; nOH, neurogenic orthostatic hypotension . 35K – 45K MSA patients with nOH symptoms 1, 2 Addressable US Patient Population Droxidopa 3 Midodrine 4 Efficacy / Durability Dizziness/lightheadedness only; efficacy not proven beyond 2 weeks Surrogate: systolic blood pressure increase 1 min after standing Dosing 3x daily, titrated 3x daily Safety Black box warning for supine hypertension Current Treatment Landscape • No approved therapy has demonstrated a durable effect on nOH symptoms 3,4 • In about half of patients with nOH, supine hypertension complicates management 5 • Many MSA patients remain inadequately managed for nOH symptoms, despite available therapies 6 • Long - term adherence remains low, despite genericization of approved treatments 6,7 Ampreloxetine’s Potential Ampreloxetine Broad, durable symptom improvements demonstrated out to 6 weeks, relative to placebo 1x 10mg pill daily No signal for supine hypertension

37 BL, baseline; CI, confidence interval; MSA, multiple system atrophy; OHSA, orthostatic hypotension symptom assessment; RWD, r and omized withdrawal. Demonstrated Durable, Clinically - significant Symptom Improvements in MSA Patients 33 34 31 32 64 42 20 20 18 20 0 0 4 0 4 8 12 16 18 20 22 2 4 6 8 0169 4 - week double - blind 0170 6 - week RWD period 0170 16 - week open label period Placebo, n= Ampreloxetine, n= Week OHSA Composite Score Mean (95% CI) BL BL BL Ampreloxetine Placebo

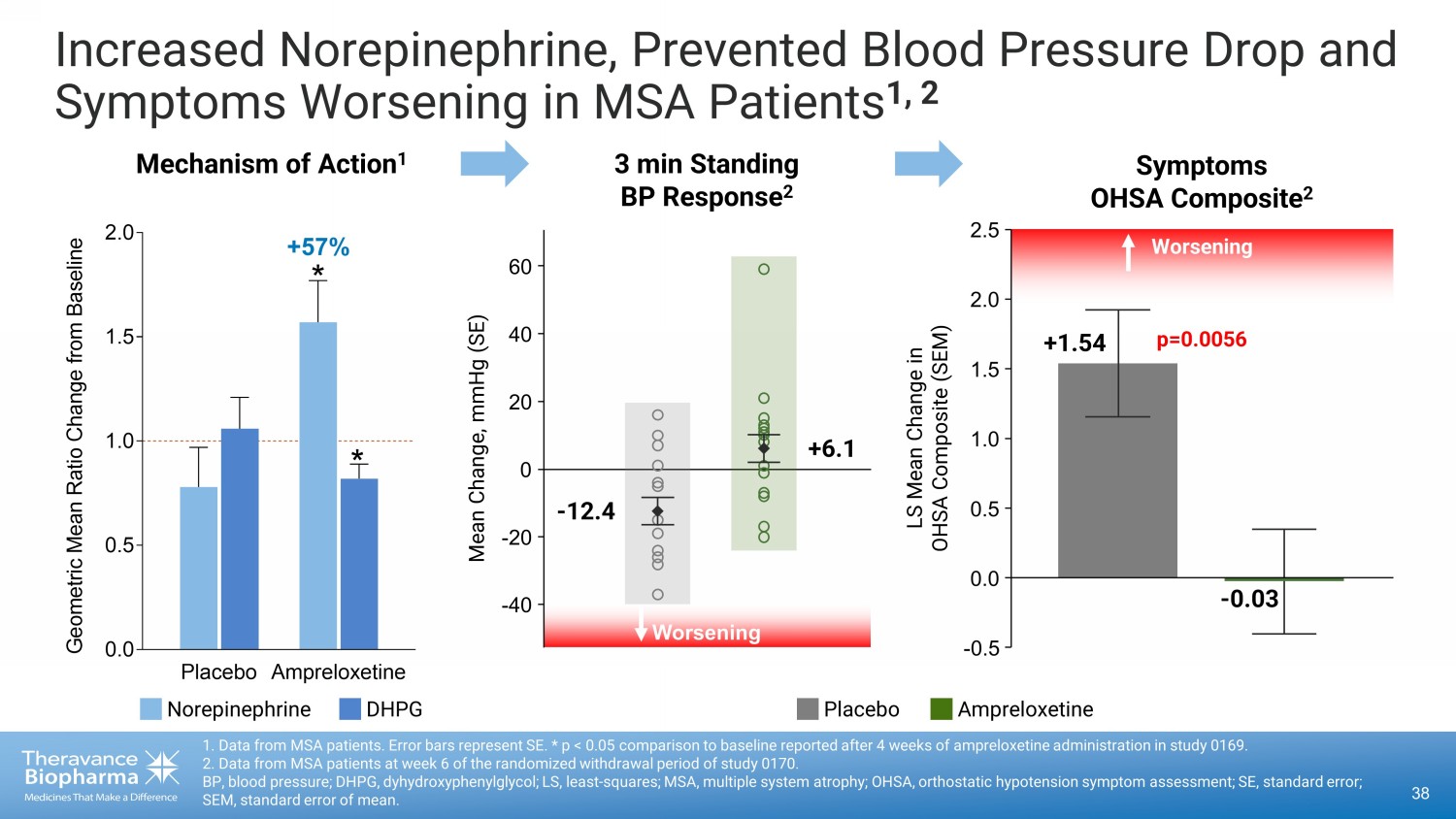

Increased Norepinephrine, Prevented Blood Pressure Drop and Symptoms Worsening in MSA Patients 1, 2 38 1. Data from MSA patients. Error bars represent SE. * p < 0.05 comparison to baseline reported after 4 weeks of ampreloxetine ad ministration in study 0169. 2. Data from MSA patients at week 6 of the randomized withdrawal period of study 0170. BP, blood pressure; DHPG, dyhydroxyphenylglycol; LS, least - squares; MSA, multiple system atrophy; OHSA, orthostatic hypotension symptom assessment; SE, standard error; SEM, standard error of mean. Placebo Ampreloxetine 0.0 0.5 1.0 1.5 2.0 G e o m e t r i c M e a n R a t i o C h a n g e f r o m B a s e l i n e Mechanism of Action 1 3 min Standing BP Response 2 * * +57% - 0.03 p=0.0056 LS Mean Change in OHSA Composite (SEM) Worsening +1.54 Symptoms OHSA Composite 2 0.0 - 0.5 0.5 1.0 1.5 2.0 2.5 - 40 - 20 0 20 40 60 Worsening - 12.4 +6.1 Mean Change, mmHg (SE) Placebo Ampreloxetine Norepinephrine DHPG

Data from MSA patients at week 6 of the randomized withdrawal period of study 0170. Standing SBP measured at 3 min and supine SB P measured at 10 min. Line represents the mean +/ - standard deviation. MSA, multiple system atrophy; SBP, systolic blood pressure; SD, standard deviation. Prevented Worsening of Standing SBP in MSA Patients with No Impact on Supine SBP Placebo Ampreloxetine -40 -20 0 20 40 60 M e a n C h a n g e , m m H g ( S D ) Supine SBP No Difference + 1.6 + 0.5 • Standing blood pressure improvement of 18.5 mmHg compared to placebo during randomized withdrawal phase • No difference in supine blood pressure relative to placebo -40 -20 0 20 40 60 M e a n C h a n g e , m m H g ( S D ) - 12.4 + 6.1 Standing SBP Worsening No Signal for Supine Hypertension Observed in Safety Database of Over 800 Patients and Healthy Subjects 39