Se nt in el O ne Q 4 F Y 20 22 Q4 FY2022 Letter to Shareholders March 15, 2022

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 1 To Our Shareholders Fiscal 2022 was a groundbreaking year for SentinelOne. We sustained a triple-digit revenue and ARR growth rate throughout the year, delivering ARR growth of 123% and rapidly approaching $300 million in ARR. Our results demon- strate the exceptional execution of Sentinels around the world and the strength of our AI-driven, autonomous XDR platform. We remained relentlessly focused on innovation and execution. With our best-in-class Singularity XDR plat- form, we are protecting more enterprises today than ever before at faster speed, greater scale, higher accuracy, and more automation. Our fourth quarter results exceeded our expectations across the board. Our success with large enterprises was particularly strong, further magnified by fourth quarter seasonality. In the fourth quarter, we added a record number of $100K plus ARR customers, a record number of million-dollar plus ARR customers, and closed our largest ever net new customer contract – one of the most influential and leading global internet companies. Fiscal 2022 was an investment year for SentinelOne, yet we made significant progress towards our long-term prof- itability targets. Throughout the year, we paired phenomenal growth with steady margin improvement. We ended the fourth quarter with double-digit year-over-year improvement in both our non-GAAP gross and operating margin. Given the significant market opportunity ahead, we remain committed to investing in the growth of our business in a disciplined manner. In fiscal 2023, we expect to continue making progress towards our long-term profitability targets. Our business is performing extremely well with broad-based strength across new customer adds, existing customer renewals, and upsells. We are still in the early innings of a large and expanding total market opportunity driven by the proliferation of hybrid work environments, digital transformation, and an evolving threat landscape. We demonstra- bly strengthened and expanded our platform offerings this past year, positioning the company for further success. Our fiscal 2023 guidance reflects our expectation for strong secular tailwinds, relevance of our innovation, and execution excellence. Elevated Threat Environment The threat landscape is evolving and expanding. The persistence and sophistication of new attacks continues – we entered 2021 on the heels of Sunburst and exited the year battling Log4j. Most recently, the potential for cyber warfare has significantly increased in the light of geopolitical tensions, further escalating an already elevated threat environment. At SentinelOne, we’re uncovering some of the most sophisticated attacks across the world. Threat sharing and col- laboration are essential to our collective mission against cyber attacks. Our global footprint and intelligence team at SentinelLabs puts us in a unique position to not only protect our customer base in real-time but also produce novel research to educate and arm the cybersecurity community at large. Further, we’re able to leverage the power of our partner ecosystem to help on the front lines with leading Incident Response providers like Mandiant, KPMG, and Kroll. Most recently, we published research on HermeticWiper, an attack that we named, related to escalating cyberat- tacks surrounding the Ukraine conflict. Our publication was followed by an alert notice from Cybersecurity and Infra- structure Agency (CISA) and covered by media and infosec experts around the world, highlighting the significance of SentinelLabs research. Cybersecurity lives at the nexus of government affairs, public policy, commercial pursuits, and individual rights. Cybersecurity is an operational necessity for organizations of all sizes in all geographies. 01

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 2 We are XDR: Prevention, Detection, and Response for the Enterprise Legacy AV represents the past, EDR the present, and XDR is the future. While the majority of enterprises still utilize legacy AV solutions, we have entered the XDR phase. At SentinelOne, we established the foundations of XDR by pioneering the world’s first purpose-built AI-powered, autonomous cybersecurity platform. Our platform delivers the critical and comprehensive capabilities customers need: speed, scale, deep visibility, automated detection and response, rich integrations, and operational simplicity. Enterprises are increasingly selecting SentinelOne for the best-in-class XDR. In fiscal 2022, we further strengthened and expanded our XDR leadership. Building on our foundations in endpoint, IoT, and cloud workloads, we significantly broadened our platform offering to include a cutting-edge data backend, Mobile, IoT discovery and control (Ranger Pro), the ability to send any protection command from the cloud to any asset (Remote Script Orchestration, RSO), and our patented customizable detection rules engine (Storyline Active Re- sponse, STAR). Our platform approach is resonating with customers and is contributing meaningfully to our financial performance. For instance, over one-third of our fourth-quarter new business was driven by our Singularity modules and DataSet, up from about 20% last year. Our Cloud and Data Retention modules achieved the highest growth, each delivering phenomenal year-over-year growth of over 10X. Building upon the acquisition of Scalyr, we recently launched DataSet. Our new data analytics solution expands be- yond cybersecurity use cases delivering a limitless enterprise data platform for live data queries, analytics, insights, and retention. Instantaneous, easy-to-use, and efficient understanding of an enterprise's digital footprint is the key to making better business decisions. And today, we are further expanding our addressable market and extending our XDR platform capabilities with our planned strategic acquisition of Attivo Networks, Inc (Attivo). We’re adding another growth vector to our platform. Iden- tity will join endpoint, cloud, IoT, and data as part of our platform. Attivo is a premier and highly differentiated solution that will enable us to provide cybersecurity in one of the most critical and dynamic parts of enterprise security today, the identity perimeter. We believe it is the best and most comprehensive identity security platform in the market today. With Attivo’s user-centric identity capabilities, we will be able to support an even more holistic zero trust framework. We are continuously expanding our XDR offerings by further integrating more ecosystem partners and offering more advanced data capabilities. This allows us to provide complete customer flexibility for data retention, analytics, industry-leading efficacy, and real-time, autonomous protection. As we enter a new fiscal year, there has never been a greater enterprise need for a modern cybersecurity platform, translating to a tremendous business opportunity for SentinelOne. We are excited about working with some of the world’s leading and largest organizations to transform their cybersecurity with Singularity XDR.

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 3 Full Year FY2022 Highlights • Revenue grew by 120% to $205 million compared to $93 million in fiscal 2021. • GAAP gross margin was 60%, compared to 58% in fiscal 2021. Our non-GAAP gross margin was 63%, compared to 58% in fiscal 2021. • GAAP operating margin was (130)%, compared to (124)% in fiscal 2021. Our non-GAAP operating margin was (85)%, compared to (107%) in fiscal 2021. Annualized Recurring Revenue (ARR) $ million, year over year growth Revenue $ million, year over year growth Gross Margin % of revenue, GAAP & Non-GAAP Operating Margin % of revenue, GAAP & Non-GAAP Q4 FY2022 Highlights • Annualized Recurring Revenue (ARR) grew 123% year-over-year to $292 million at the end of our fiscal fourth quarter. Revenue in the quarter grew 120% year-over-year to $66 million. • We added over 700 customers sequentially in our fiscal fourth quarter. Total customer count grew by more than 70% year-over-year to over 6,700 at quarter-end. Customers with ARR over $100K grew 137% year-over-year to 520. Dollar-based net revenue retention rate was 129%. • Fiscal fourth quarter GAAP gross margin was 63%, up 9 percentage points year-over-year. Non-GAAP gross margin was 66%, up 12 percentage points year-over-year. • Fiscal fourth quarter GAAP operating margin was (108)%, up 16 percentage points year-over- year. Non-GAAP operating margin was (66)%, up 38 percentage points year-over-year. $67 FY20 FY21 90% $131 $292 FY22 96% 123% $46 107% $93 $205 100% 120% FY20 FY21 FY22 60% 63% GAAP Non-GAAP 61% 58% 61% 58% FY20 FY21 FY22 (130)% (85)% (161)% (124)%(152)% (107)% GAAP Non-GAAP FY20 FY21 FY22

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 4 At SentinelLabs, our advanced threat research division, we perform threat research, discover vulnerabilities, and monitor emerging threat trends to share with the market. We help both customers and the broader cybersecurity defense community understand cyber risk and stay ahead of adversaries. The battle never ends, and the below showcases several discoveries we made throughout 2021. January Broke news of macOS.OSAMiner, a long-running cryptominer campaign targeting macOS users that was undetected for at least five years. We showed how researchers can reverse these opaque executables and revealed previously hidden IoCs. February Revealed a privilege escalation vulnerability, CVE-2021-24092, in Microsoft’s flagship security product, Windows Defender. The bug had remained unreported for 12 years and likely affected around a billion devices. March Discovery of XcodeSpy, a targeted attack on iOS software developers using Apple’s Xcode IDE. A malicious Xcode project was found to be installing a customized backdoor with the ability to record the victim’s microphone, camera and keyboard. April While Windows vulnerabilities are a fairly common occurrence, SentinelLabs’ report of a new NTLM relay attack was, surprisingly, classed as a “Won’t Fix” by Microsoft in April. The vulnerability affects every Windows system and could allow attackers to escalate privileges from user to domain admin. May Identified flaws impacting hundreds of millions of Dell computers. We also detected a new threat actor, Agrius, operating against targets in Israel. June SentinelLabs discovered that the same threat actor ‘NobleBaron’ was engaged in supply-chain attack activity via a poisoned update installer for electronic keys used by the Ukrainian government. July Iran’s train system was paralyzed by an attack from a mysterious wiper. SentinelLabs was able to reconstruct the majority of the attack chain and sketch the outline of a new adversary. Also, we discovered a high severity flaw in HP, Samsung, and Xerox printer drivers – and offered an in-depth analysis of Conti ransomware. August Produced a ground-breaking report on the origin, use and ecosystem of ShadowPad. It was a busy month; we also disclosed a massive macOS adware campaign undetected by Apple, a ransomware campaign targeting healthcare providers, and HotCobalt – a denial-of-service vulnerability affecting Cobalt Strike. September Broke the story of a Turkish-nexus threat actor that targeted journalists to place malware and incriminating docu- ments on their devices immediately prior to their arrest. October Explored the links between Karma and other well-known malware families such as NEMTY and JSWorm. Meanwhile, SentinelLab’s investigation into Spook ransomware found that the operator published details of all victims regardless of whether they paid or not. November Attack against pro-democracy activists in Hong Kong with a novel macOS malware dubbed “Macma”. SentinelLabs dove in and revealed further IoCs not previously reported to aid defenders and threat hunters. December Discovered and disclosed multiple vulnerabilities in AWS and other major cloud services that implement USB over Ethernet in millions of AWS customer environments.

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 5 Technology Highlights Expanded XDR Capabilities We are committed to continuous innovation, automation, and securing data wherever it resides. In fiscal 2022, we significantly broadened our platform capabilities by introducing several mission-critical innovations. We developed Remote Script Orchestration (RSO), enabling enterprises to remotely manage and automate custom endpoints re- sponses. We introduced Storyline Active Response (STAR), cloud-based automated hunting, detection, and response engine. We enhanced our IoT capabilities with Ranger Pro, enabling automated discovery and deployment across more connected devices, solving the prevailing problem of unprotected devices and deployment gaps by automatical- ly deploying Singularity XDR across organizations. We launched Singularity Mobile, a new AI-powered mobile security solution delivering autonomous threat protection, detection, and response for iOS, Android, and Chrome OS devices. We also acquired Scalyr, integrated the cutting-edge backend into our security architecture, and in February 2022 launched externalization of the technology under the DataSet brand. And, we will further broaden our XDR platform with the announced acquisition of Attivo, a leading Identity Threat Detection & Response technology to expedite en- terprise Zero Trust adoption. Bringing Identity to XDR with Attivo Networks Identity is a critical component of the enterprise perimeter and Zero Trust framework. Attivo’s leading identity offer- ings help organizations keep passwords safe, admin privileges restricted, and user identity intact. Misused credentials are now one of the top techniques used in breaches. If an attacker can't compromise the endpoint, they will often look to the next layer of vulnerability - a user’s credentials. If successful, attackers can install backdoors, exfiltrate data, and change security policies. Attivo has clear product-market fit with an established customer and revenue base. Its differentiated and battle-test- ed solution is already trusted by over 300 customers (as of CY22), from Fortune 500 enterprises to government enti- ties. Attivo, as part of SentinelOne, will help organizations reduce their attack surface not only at the device level, but now the human identity level, too. This acquisition aligns with our M&A strategy. First, it expands our addressable market into a $4 billion dollar (Gartner, August 2021) and growing Identity Security market (as of CY22). And within this market, Attivo is gaining share by growing its ARR by over 50%. Second, Attivo’s user-centric identity security is highly complementary and value-add for our XDR platform and customers. It opens new customer and cross sell opportunities. Third, it has a compelling finan- cial profile and strong cultural fit - additive to our hypergrowth and accretive to GAAP and Non-GAAP gross margins. Attivo’s Identity Platform is comprised of three differentiated security technologies: • Identity Threat Detection and Response: Attivo’s Identity Suite delivers holistic prevention, detection, and response providing real-time identity security including credential theft, privilege escalation, lateral movement, data cloaking, identity exposure, and more for zero trust cybersecurity. • Identity Infrastructure Assessment: Attivo’s identity visibility tool provides instant Active Directory visibility of misconfigurations, suspicious password changes, credential harvesting, unauthorized access, and more. 02

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 6 • Identity-Powered Deception: Attivo’s Deception Suite lures attackers into revealing themselves. Through misdirection of the attack with tactics including breadcrumbs and decoy accounts, files and IPs, organizations gain the advantage of time to detect, analyze, and stop an attacker without impacting enterprise assets. Attivo will put us front and center in the identity security market. Listening to customers and following many of the largest incidents in cybersecurity over the past few years, identity is a critical vector in delivering the most complete XDR platform. Not only is it a natural fit within our platform, it will complement our network of strategic service provid- ers extremely well. Please see the presentation published on our Investor Relations website for more detail. Launched DataSet Every aspect of SentinelOne’s autonomous cybersecurity is underpinned in data analytics. The way we solve cyber- security with data inspired us to apply our expertise beyond cybersecurity to a range of enterprise use cases. Building upon the acquisition of Scalyr, we launched DataSet in February 2022, a revolutionary live enterprise data platform for data queries, analytics, insights, and retention. DataSet expands our capabilities beyond cybersecurity use cases. DataSet takes a security-first perspective to data analytics. It is a cloud-native flexible enterprise data platform built for petabyte scale. By eliminating data schema requirements from the ingestion process and index limitations from querying, DataSet can process massive amounts of live data in real-time, delivering log management, data analytics, and alerting with unparalleled speed, performance, and efficiency – built on a security and privacy-first foundation. As a SaaS platform, it can be deployed in minutes and is easy to operate. DataSet platform is built for the cloud and offered as a cloud service, freeing up engineering resources from managing data refineries. Enterprises are selecting DataSet to unlock the power of their own data, including Doordash, Copart, Asana, TomTom, and others. Customers choose DataSet for speed, scalability, and technology-driven cost advantages. DataSet’s tech- nology is heavily battle-tested and already in production at hundreds of enterprises, with SentinelOne among them, analyzing trillions of events 24/7/365. Zero Trust We are enabling customers to reduce the attack surface and enhance security capabilities beyond perimeter de- fenses. To help enterprises successfully adopt a Zero Trust security model, SentinelOne has partnered with leading vendors to deliver validated Zero Trust capabilities. Our joint solution offerings with Zscaler, Mimecast, ServiceNow, and many others, demonstrate the strength of Singularity XDR as an open and ecosystem-friendly platform that brings together best-of-breed solutions to fill security gaps. For instance, in one of many of our recent joint solutions, Zscaler data is ingested into Singularity XDR and can then be queried and filtered, allowing security teams to quickly triage and respond to attacks. This seamless integration ena- bles enhanced end-to-end visibility, contextual awareness on abnormal activity, automated response, and conditional access. In addition, it allows security teams to reduce risk by responding faster to suspicious activity, both in terms of investigation and remediation. Through the integration, joint customers no longer need to pivot between consoles and now enjoy automated and unified policy orchestration.

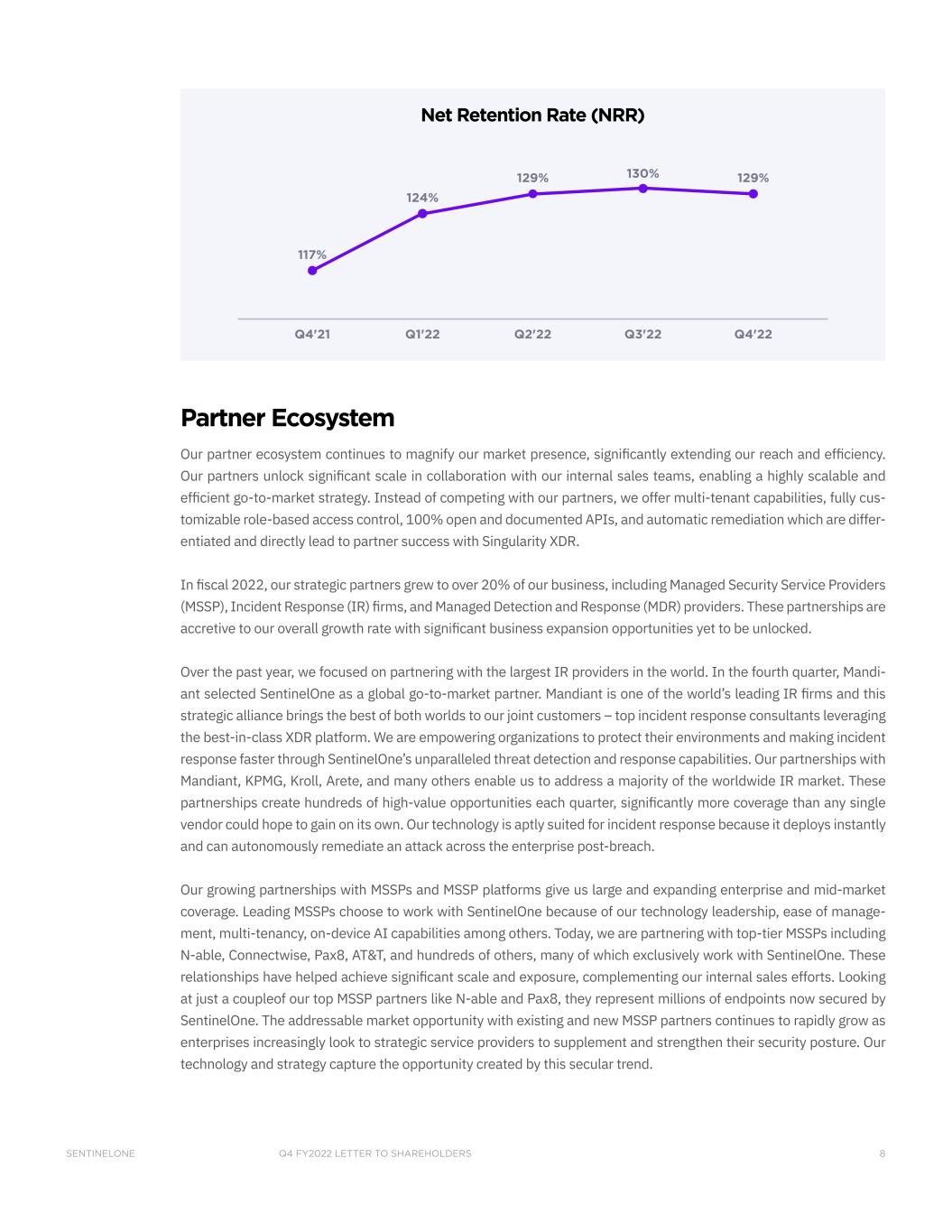

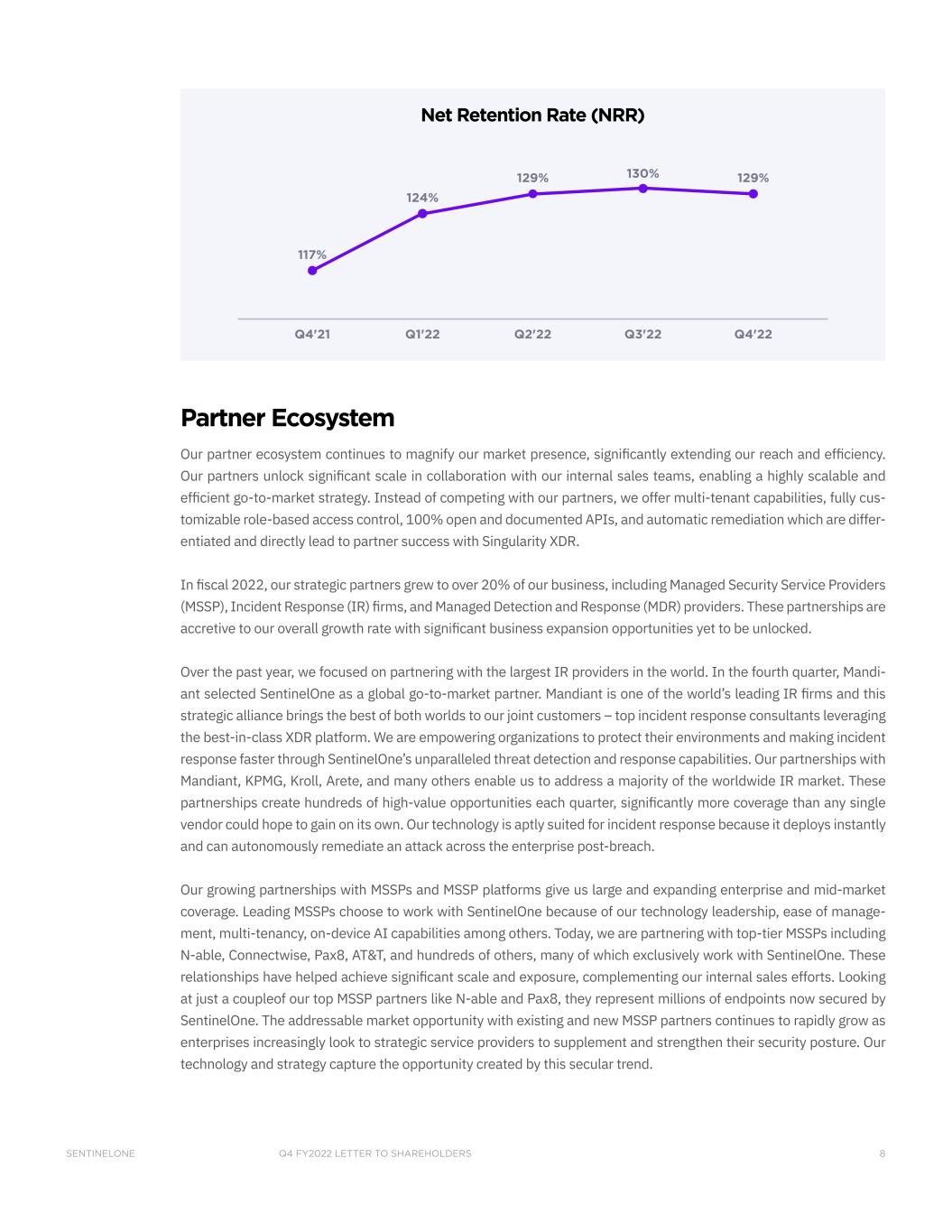

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 7 Go-To-Market Highlights Our go-to-market teams delivered an exceptional fourth quarter across the board. We continued to scale our business on the back of leading endpoint protection, machine speed EDR, XDR innovations, and our powerful partner-support- ed go-to-market. In the fourth quarter, our ARR grew 123% year-over-year, driven by a combination of new customer growth and existing customer renewals and upsells. Customer Growth Our momentum with large enterprises was exceptionally strong. We added a record number of $100K plus ARR cus- tomers, a record number of million-dollar plus ARR customers, and signed our largest ever net new customer con- tract – one of the fastest growing and most influential global internet companies. Our total customer count grew by more than 70% year-over-year, exceeding 6,700 in our fiscal fourth quarter, as we continued to secure both large enterprises and medium-sized businesses. Customers with ARR over $100K grew 137% year-over-year to 520. Our business mix from customers with ARR of over $100K continued to increase as a result of a record success with larger enterprises, strategic channel partners, and increasing adoption of modules. 219 520 Q4'21 Q4'22 137% 3,900+ 6,700+ Q4'21 Q4'22 >70% Customers > $100K ARR at quarter end Total Customers at quarter end Retention & Expansion We’re seeing strong retention and expansion within our existing customer base. Gross retention rates remained very strong in our fiscal fourth quarter. Our NRR of 129% remained extremely healthy and well above our target of over 120%. We continue to balance new customer growth with cross-selling new capabilities. Our NRR was driven by agent expansion, cross-sell of adjacent XDR modules, and upsell from platform tiers. While early, we’re pleased with customer interest and adoption of our modules. Our Singularity modules and DataSet represented over one-third of our business in the quarter, up from about 20% last year. Both our cloud workload protection and data retention modules delivered year-over-year growth of 10X, reflecting demand for our best-in-class runtime protection for cloud workloads and unparalleled data retention capabilities. 03

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 8 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 117% 124% 129% 129%130% Net Retention Rate (NRR) Partner Ecosystem Our partner ecosystem continues to magnify our market presence, significantly extending our reach and efficiency. Our partners unlock significant scale in collaboration with our internal sales teams, enabling a highly scalable and efficient go-to-market strategy. Instead of competing with our partners, we offer multi-tenant capabilities, fully cus- tomizable role-based access control, 100% open and documented APIs, and automatic remediation which are differ- entiated and directly lead to partner success with Singularity XDR. In fiscal 2022, our strategic partners grew to over 20% of our business, including Managed Security Service Providers (MSSP), Incident Response (IR) firms, and Managed Detection and Response (MDR) providers. These partnerships are accretive to our overall growth rate with significant business expansion opportunities yet to be unlocked. Over the past year, we focused on partnering with the largest IR providers in the world. In the fourth quarter, Mandi- ant selected SentinelOne as a global go-to-market partner. Mandiant is one of the world’s leading IR firms and this strategic alliance brings the best of both worlds to our joint customers – top incident response consultants leveraging the best-in-class XDR platform. We are empowering organizations to protect their environments and making incident response faster through SentinelOne’s unparalleled threat detection and response capabilities. Our partnerships with Mandiant, KPMG, Kroll, Arete, and many others enable us to address a majority of the worldwide IR market. These partnerships create hundreds of high-value opportunities each quarter, significantly more coverage than any single vendor could hope to gain on its own. Our technology is aptly suited for incident response because it deploys instantly and can autonomously remediate an attack across the enterprise post-breach. Our growing partnerships with MSSPs and MSSP platforms give us large and expanding enterprise and mid-market coverage. Leading MSSPs choose to work with SentinelOne because of our technology leadership, ease of manage- ment, multi-tenancy, on-device AI capabilities among others. Today, we are partnering with top-tier MSSPs including N-able, Connectwise, Pax8, AT&T, and hundreds of others, many of which exclusively work with SentinelOne. These relationships have helped achieve significant scale and exposure, complementing our internal sales efforts. Looking at just a coupleof our top MSSP partners like N-able and Pax8, they represent millions of endpoints now secured by SentinelOne. The addressable market opportunity with existing and new MSSP partners continues to rapidly grow as enterprises increasingly look to strategic service providers to supplement and strengthen their security posture. Our technology and strategy capture the opportunity created by this secular trend.

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 9 Q4 FY2022 Financials Our strong growth trajectory continued in the fiscal fourth quarter. Year-over-year ARR growth was 123% and reached $292 million at the end of Q4. Our triple-digit growth was driven by strong demand from new and existing customers as well as large and mid-sized enterprises seeking to modernize and automate their cybersecurity technology. Our GAAP and non-GAAP gross and operating margin meaningfully improved year-over-year, driven by higher revenue, increased scale, and improved efficiencies. Annualized Recurring Revenue (ARR) & Revenue Fiscal fourth quarter marked another consecutive quarter of hypergrowth. Our ARR grew 123% year-over-year to $292 million at the end of our fiscal fourth quarter. Our net new ARR reached a record of $56 million. The strength was broad-based across new customer adds, existing customer renewals, and upsells. Total revenue grew 120% year-over-year to $66 million in our fiscal fourth quarter. International revenue represented 31% of total revenue, reflecting growth of 140% year-over-year. Our global go-to-market expansion in Europe, Middle East, Africa, and Asia Pacific as well as growing brand awareness contributed to strong growth across all major inter- national geographies. $131 $161 $198 $237 $29296% 116% 127% 131% 123% $30 $37 $46 $56 96% 108% 121% 128% 120% $66 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Annualized Recurring Revenue $ million, year over year growth Revenue $ million, year over year growth 04

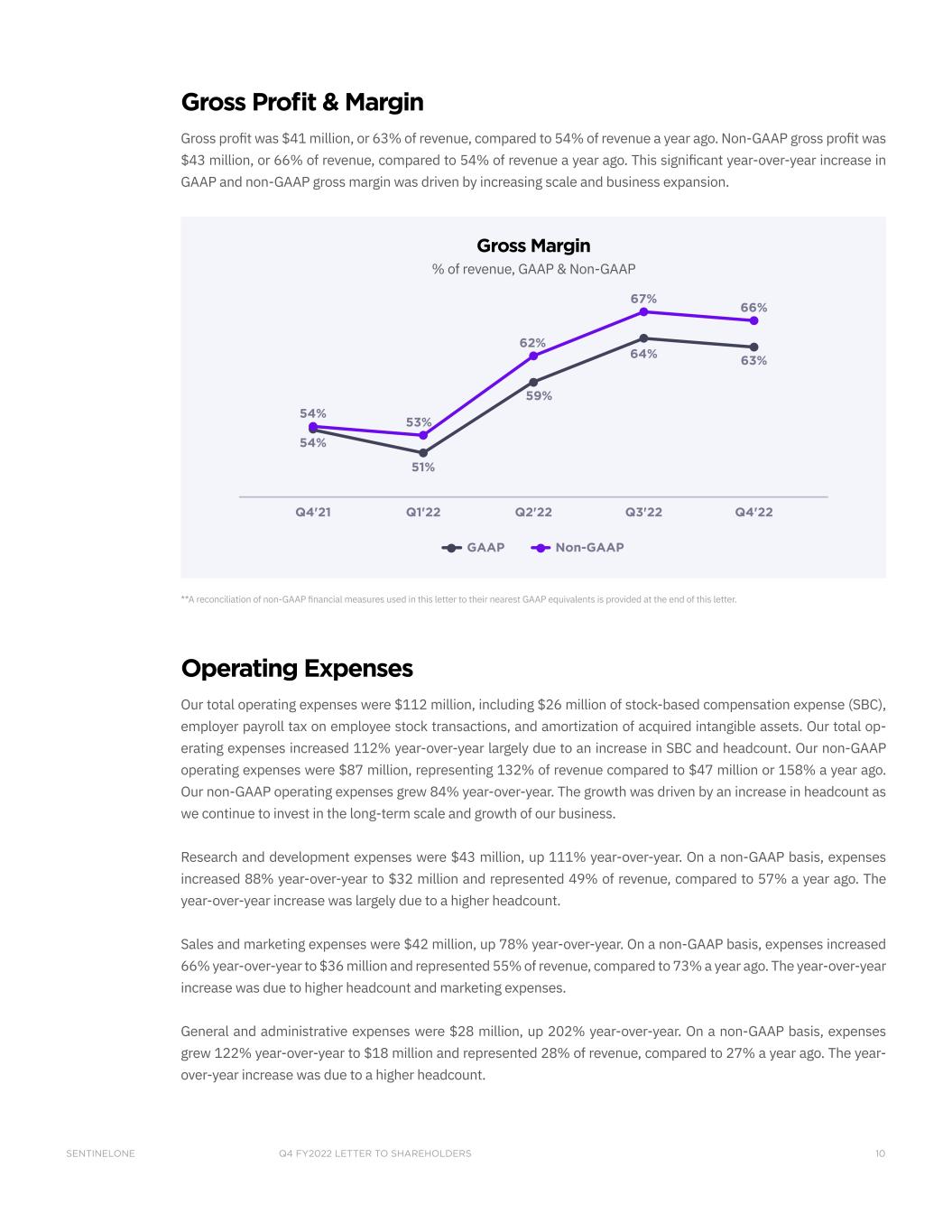

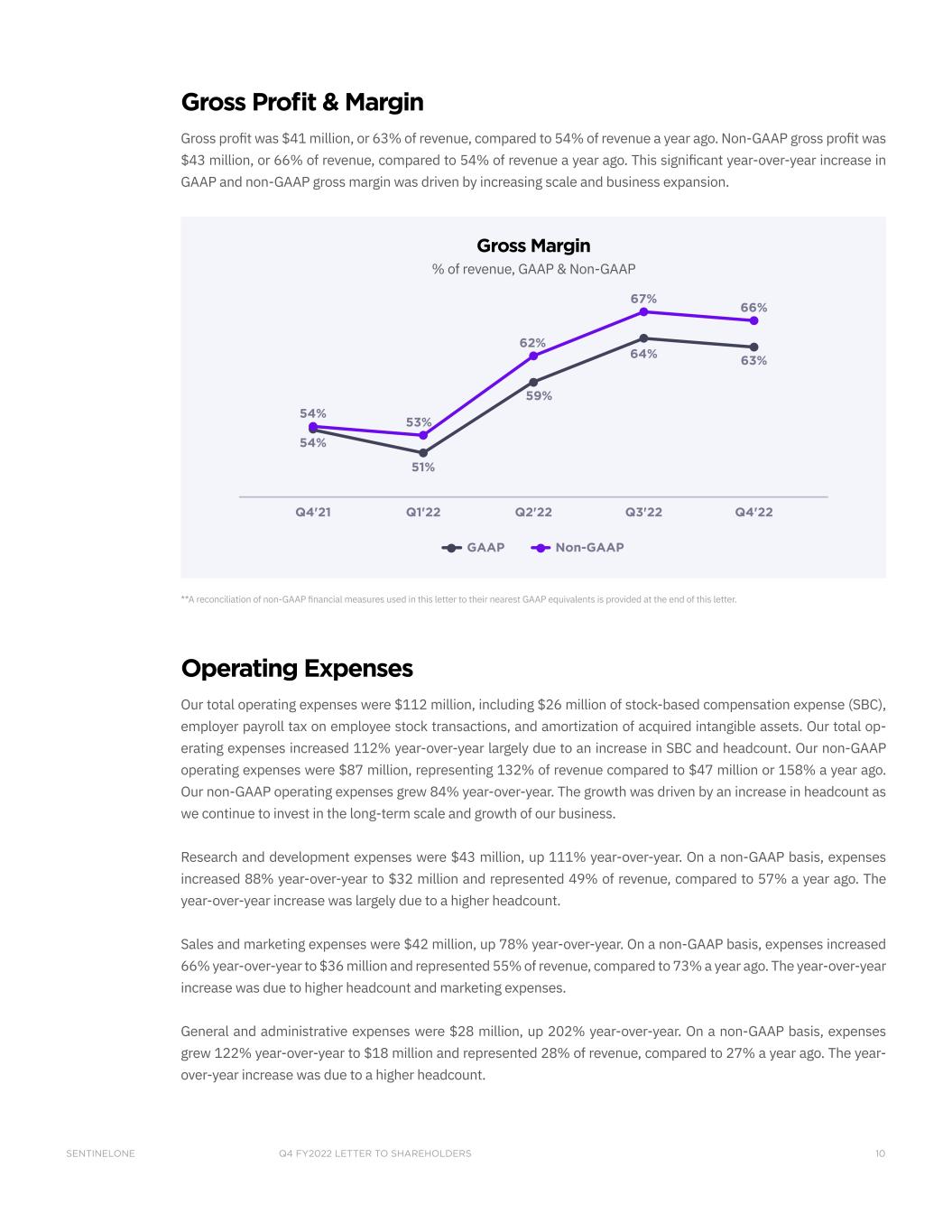

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 10 Gross Profit & Margin Gross profit was $41 million, or 63% of revenue, compared to 54% of revenue a year ago. Non-GAAP gross profit was $43 million, or 66% of revenue, compared to 54% of revenue a year ago. This significant year-over-year increase in GAAP and non-GAAP gross margin was driven by increasing scale and business expansion. 63% 66% GAAP Non-GAAP 54% 51% 59% 64% 54% 53% 62% 67% Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Gross Margin % of revenue, GAAP & Non-GAAP **A reconciliation of non-GAAP financial measures used in this letter to their nearest GAAP equivalents is provided at the end of this letter. Operating Expenses Our total operating expenses were $112 million, including $26 million of stock-based compensation expense (SBC), employer payroll tax on employee stock transactions, and amortization of acquired intangible assets. Our total op- erating expenses increased 112% year-over-year largely due to an increase in SBC and headcount. Our non-GAAP operating expenses were $87 million, representing 132% of revenue compared to $47 million or 158% a year ago. Our non-GAAP operating expenses grew 84% year-over-year. The growth was driven by an increase in headcount as we continue to invest in the long-term scale and growth of our business. Research and development expenses were $43 million, up 111% year-over-year. On a non-GAAP basis, expenses increased 88% year-over-year to $32 million and represented 49% of revenue, compared to 57% a year ago. The year-over-year increase was largely due to a higher headcount. Sales and marketing expenses were $42 million, up 78% year-over-year. On a non-GAAP basis, expenses increased 66% year-over-year to $36 million and represented 55% of revenue, compared to 73% a year ago. The year-over-year increase was due to higher headcount and marketing expenses. General and administrative expenses were $28 million, up 202% year-over-year. On a non-GAAP basis, expenses grew 122% year-over-year to $18 million and represented 28% of revenue, compared to 27% a year ago. The year- over-year increase was due to a higher headcount.

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 11 GAAP NON-GAAP Q4'21 Q4'22 57% 49% 73% 55% 27% 28% Q4'21 Q4'22 68% 65% 79% 64% 31% 42% R&D S&M G&A Operating Expenses % of revenue, GAAP & Non-GAAP **A reconciliation of non-GAAP financial measures used in this letter to their nearest GAAP equivalents is provided at the end of this letter. Operating & Net Income (Loss) GAAP operating margin was (108)%, compared to (124)% a year ago. Non-GAAP operating margin was (66)% com- pared to (104)% a year ago. The improvement in operating margin was a result of revenue growth outpacing the increase in our expenses. $(37) $(71) Q4'21 Q4'22 EBIT EBIT Margin % $(31) $(43) Q4'21 Q4'22 GAAP NON-GAAP (104)% (66)% (124)% (108)% Operating Income (Loss) & Margin $ million and % of revenue, GAAP & Non-GAAP **A reconciliation of non-GAAP financial measures used in this letter to their nearest GAAP equivalents is provided at the end of this letter.

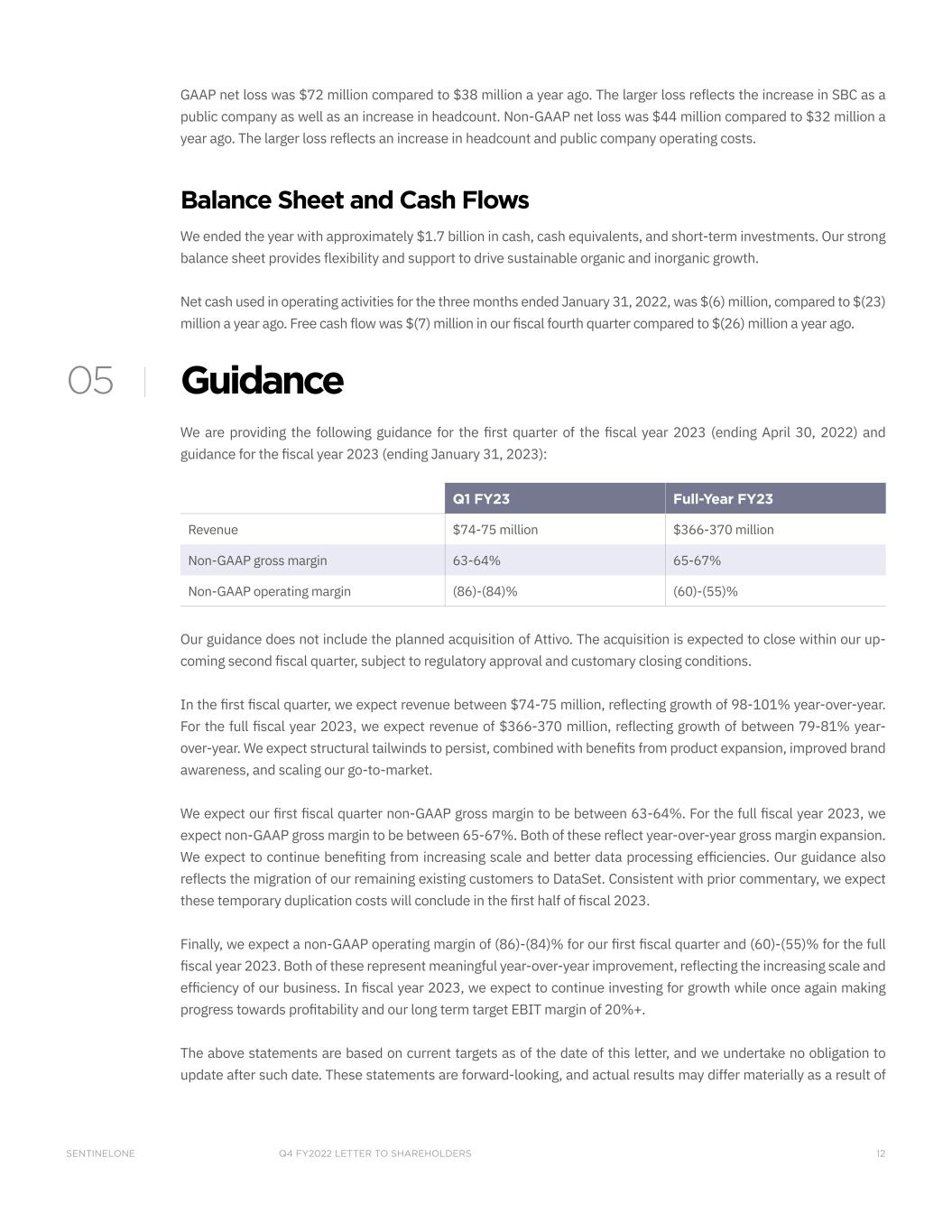

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 12 GAAP net loss was $72 million compared to $38 million a year ago. The larger loss reflects the increase in SBC as a public company as well as an increase in headcount. Non-GAAP net loss was $44 million compared to $32 million a year ago. The larger loss reflects an increase in headcount and public company operating costs. Balance Sheet and Cash Flows We ended the year with approximately $1.7 billion in cash, cash equivalents, and short-term investments. Our strong balance sheet provides flexibility and support to drive sustainable organic and inorganic growth. Net cash used in operating activities for the three months ended January 31, 2022, was $(6) million, compared to $(23) million a year ago. Free cash flow was $(7) million in our fiscal fourth quarter compared to $(26) million a year ago. Guidance We are providing the following guidance for the first quarter of the fiscal year 2023 (ending April 30, 2022) and guidance for the fiscal year 2023 (ending January 31, 2023): Q1 FY23 Full-Year FY23 Revenue $74-75 million $366-370 million Non-GAAP gross margin 63-64% 65-67% Non-GAAP operating margin (86)-(84)% (60)-(55)% Our guidance does not include the planned acquisition of Attivo. The acquisition is expected to close within our up- coming second fiscal quarter, subject to regulatory approval and customary closing conditions. In the first fiscal quarter, we expect revenue between $74-75 million, reflecting growth of 98-101% year-over-year. For the full fiscal year 2023, we expect revenue of $366-370 million, reflecting growth of between 79-81% year- over-year. We expect structural tailwinds to persist, combined with benefits from product expansion, improved brand awareness, and scaling our go-to-market. We expect our first fiscal quarter non-GAAP gross margin to be between 63-64%. For the full fiscal year 2023, we expect non-GAAP gross margin to be between 65-67%. Both of these reflect year-over-year gross margin expansion. We expect to continue benefiting from increasing scale and better data processing efficiencies. Our guidance also reflects the migration of our remaining existing customers to DataSet. Consistent with prior commentary, we expect these temporary duplication costs will conclude in the first half of fiscal 2023. Finally, we expect a non-GAAP operating margin of (86)-(84)% for our first fiscal quarter and (60)-(55)% for the full fiscal year 2023. Both of these represent meaningful year-over-year improvement, reflecting the increasing scale and efficiency of our business. In fiscal year 2023, we expect to continue investing for growth while once again making progress towards profitability and our long term target EBIT margin of 20%+. The above statements are based on current targets as of the date of this letter, and we undertake no obligation to update after such date. These statements are forward-looking, and actual results may differ materially as a result of 05

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 13 many factors. Refer to the Forward-Looking Statements safe harbor below for information on the factors that could cause our action results to differ materially from these forward-looking statements. Guidance for non-GAAP financial measures excludes stock-based compensation expense, employer payroll tax on employee stock transactions, and amortization expense of acquired intangible assets. We have not provided the for- ward-looking most directly comparable GAAP measures because certain items are out of our control or cannot be reasonably predicted. Accordingly, a reconciliation for non-GAAP gross margin and non-GAAP operating margin is not available without unreasonable effort. However, it is important to note that material changes to reconciling items could have a significant effect on future GAAP results. We have provided a reconciliation of other GAAP to non-GAAP metrics in tables at the end of this letter. Closing We will host a conference call at 2:00pm Pacific time/5:00pm Eastern time today to discuss further details of our fiscal fourth quarter results. A live webcast and replay will be available on SentinelOne’s Investor Relations website at investors.sentinelone.com. Thank you for taking the time to read our shareholder letter, and we look forward to your questions on our call this afternoon. Our Investor Relations team will be participating in the upcoming Wolfe Research Virtual “March Madness” Software Conference on Tuesday, March 22, 2022. The conference webcast details will be available on our Investor Relations website ahead of the event. Sincerely, Tomer Weingarten President and CEO Nicholas Warner COO Dave Bernhardt CFO 06

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 14 Forward-Looking Statements This letter and the live webcast which will be held at 2:00 pm, EST on March 15, 2022, contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which statements involve risks and uncertainties, including statements regarding our future growth, and future financial and operating performance, including our financial outlook for the first quarter of fiscal 2023 and full-year fiscal 2023, including non-GAAP gross profit and non-GAAP operating margin, our planned acquisition of Attivo Networks, Inc. (“Attivo”), the timing of such acquisition and the impact on financial results; statements regarding total addressable market, business strategy, acquisitions, and strategic investments, the COVID-19 pandemic, our reputation and performance in the market, general market trends, and our objectives are forward-looking statements. These forward-looking statements are made as of the date they were first issued and were based on current expectations, estimates, forecasts, and projections as well as the beliefs and assumptions of management. The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “target,” “plan,” “expect,” or the negative of these terms and similar expressions are intended to identify forward-looking statements. However, not all forward-looking statements contain these identifying words. There are a significant number of factors that could cause our actual results to differ materially from statements made in this letter and live webcast, including: our limited operating history; our history of losses; intense competition in the market we compete in; fluctuations in our operating results; network or security incidents against us; our ability to successfully integrate any acquisitions and strategic investments, including the planned acquisition and integration of Attivo; defects, errors or vulnerabilities in our platform; risks associated with managing our rapid growth; the continu- ing impact of the COVID-19 pandemic on our and our customers’ business; our ability to attract new and retain exist- ing customers, or renew and expand our relationships with them; the ability of our platform to effectively interoperate within our customers’ IT infrastructure; disruptions or other business interruptions that affect the availability of our platform; the failure to timely develop and achieve market acceptance of new products, and subscriptions as well as existing products, subscriptions and support offerings; rapidly evolving technological developments in the market for security products and subscription and support offerings; length of sales cycles; risks of securities class action litiga- tion; general market, political, economic, and business conditions, including those related to the continuing impact of COVID-19 and the effects of the recent conflict in Ukraine. Additional risks and uncertainties that could affect our financial results are included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” set in our filings and reports with the SEC, including our final prospectus filed with the SEC pursuant to Rule 424(b), dated June 29, 2021, our most recently filed Quarterly Report on Form 10-Q, our Annual Report on Form 10-K that will be filed for our 2022 fiscal year, and other filings and reports that we may file from time to time with the SEC, copies of which are available on our website at investors.sentinelone.com and on the SEC’s website at www.sec.gov. You should not rely on these forward-looking statements, as actual outcomes and results may differ materially from those contemplated by these forward-looking statements as a result of such risks and uncertainties. All forward-look- ing statements in this letter and the live webcast are based on information and estimates available to us at the time of this letter, and we do not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date of this letter and live webcast or to reflect new information or the occurrence of unexpected events, except as required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our for- ward-looking statements.

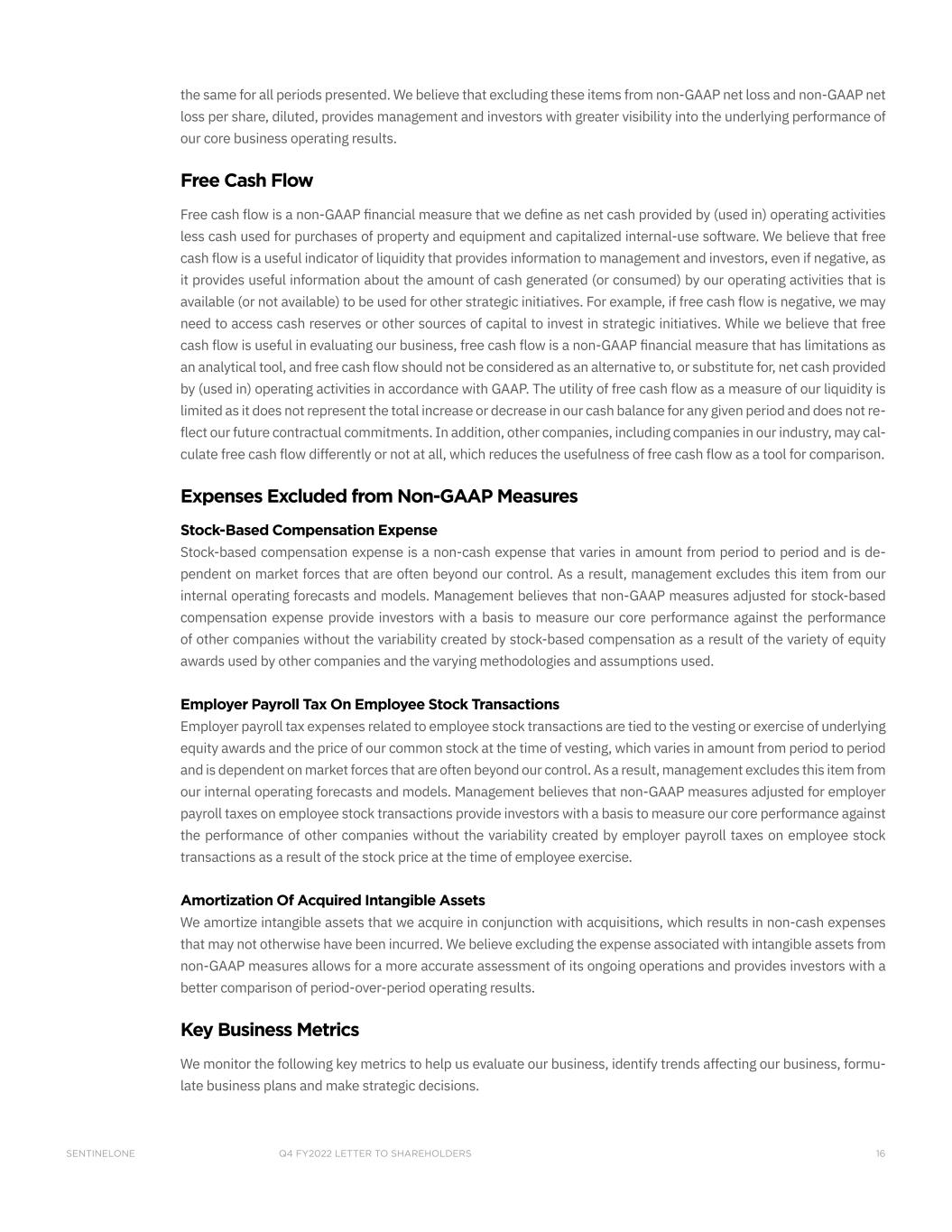

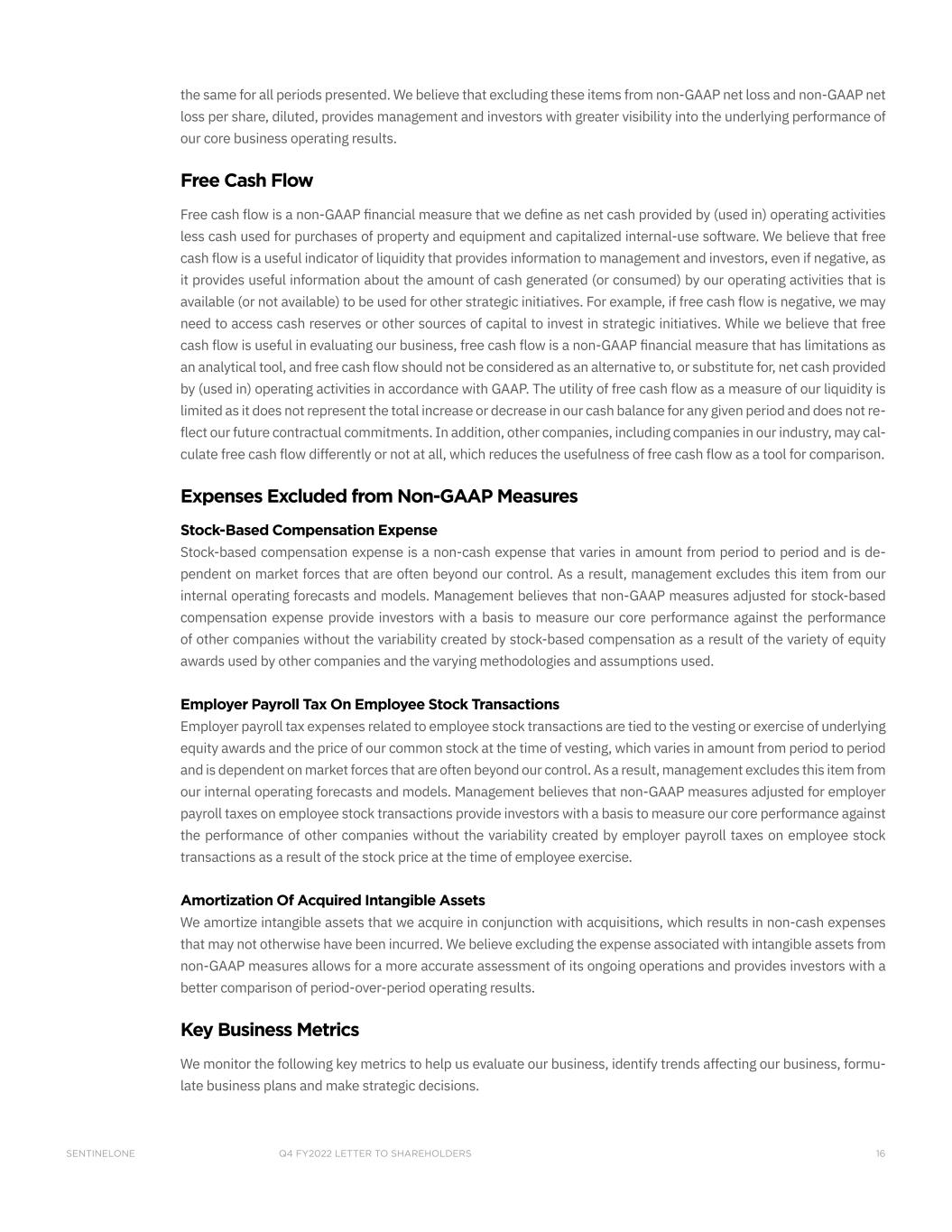

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 15 Non-GAAP Financial Measures In addition to our results determined in accordance with GAAP, we believe the following non-GAAP measures are useful in evaluating our operating performance. We use the following non-GAAP financial information to evaluate our ongoing operations and for internal planning and forecasting purposes. Non-GAAP financial information excludes stock-based compensation expense, employer payroll tax expense related to employee stock transactions and amor- tization of acquired intangible assets. We believe that non-GAAP financial information, when taken collectively, with the financial information presented in accordance with GAAP, may be helpful to investors because it provides con- sistency and comparability with past financial performance. However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool, and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. Other companies, including companies in our industry, may calculate similarly titled non-GAAP measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. In addition, the utility of free cash flow as a measure of our liquidity is limited as it does not represent the total increase or decrease in our cash balance for a given period. Reconciliations between non-GAAP financial measures to the most directly comparable financial measure stated in accordance with GAAP are contained at the end of the earnings press release following the accompanying financial data. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non- GAAP financial measures to their most directly comparable GAAP financial measures and not rely on any single finan- cial measure to evaluate our business. Non-GAAP Gross Profit and Non-GAAP Gross Margin We define non-GAAP gross profit and non-GAAP gross margin as GAAP gross profit and GAAP gross margin, respec- tively, excluding expenses related to stock-based compensation, employer payroll tax on employee stock transac- tions, and amortization of acquired intangible assets. We believe non-GAAP gross profit and non-GAAP gross mar- gin provide our management and investors consistency and comparability with our past financial performance and facilitate period-to-period comparisons of operations, as these measures eliminate the effects of certain variables unrelated to our overall operating performance. Non-GAAP Loss from Operations and Non-GAAP Operating Margin We define non-GAAP loss from operations and non-GAAP operating margin as GAAP loss from operations and GAAP operating margin, respectively, excluding stock-based compensation expense, employer payroll tax on employee stock transactions, and amortization of acquired intangible assets. We believe non-GAAP loss from operations and non-GAAP operating margin provide our management and investors consistency and comparability with our past fi- nancial performance and facilitate period-to-period comparisons of operations, as these metrics generally eliminate the effects of certain variables unrelated to our overall operating performance. Non-GAAP Net Loss and Non-GAAP Net Loss per Share, Basic and Diluted We define non-GAAP net loss as GAAP net loss excluding stock-based compensation expense, employer payroll tax on employee stock transactions, and amortization of acquired intangible assets. We define non-GAAP net loss per share, basic and diluted, as non-GAAP net loss divided by the weighted-average common shares outstanding. Since we have reported net losses for all periods presented, we have excluded all potentially dilutive securities from the calculation of net loss per share as their effect is anti-dilutive and accordingly, basic and diluted net loss per share is

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 16 the same for all periods presented. We believe that excluding these items from non-GAAP net loss and non-GAAP net loss per share, diluted, provides management and investors with greater visibility into the underlying performance of our core business operating results. Free Cash Flow Free cash flow is a non-GAAP financial measure that we define as net cash provided by (used in) operating activities less cash used for purchases of property and equipment and capitalized internal-use software. We believe that free cash flow is a useful indicator of liquidity that provides information to management and investors, even if negative, as it provides useful information about the amount of cash generated (or consumed) by our operating activities that is available (or not available) to be used for other strategic initiatives. For example, if free cash flow is negative, we may need to access cash reserves or other sources of capital to invest in strategic initiatives. While we believe that free cash flow is useful in evaluating our business, free cash flow is a non-GAAP financial measure that has limitations as an analytical tool, and free cash flow should not be considered as an alternative to, or substitute for, net cash provided by (used in) operating activities in accordance with GAAP. The utility of free cash flow as a measure of our liquidity is limited as it does not represent the total increase or decrease in our cash balance for any given period and does not re- flect our future contractual commitments. In addition, other companies, including companies in our industry, may cal- culate free cash flow differently or not at all, which reduces the usefulness of free cash flow as a tool for comparison. Expenses Excluded from Non-GAAP Measures Stock-Based Compensation Expense Stock-based compensation expense is a non-cash expense that varies in amount from period to period and is de- pendent on market forces that are often beyond our control. As a result, management excludes this item from our internal operating forecasts and models. Management believes that non-GAAP measures adjusted for stock-based compensation expense provide investors with a basis to measure our core performance against the performance of other companies without the variability created by stock-based compensation as a result of the variety of equity awards used by other companies and the varying methodologies and assumptions used. Employer Payroll Tax On Employee Stock Transactions Employer payroll tax expenses related to employee stock transactions are tied to the vesting or exercise of underlying equity awards and the price of our common stock at the time of vesting, which varies in amount from period to period and is dependent on market forces that are often beyond our control. As a result, management excludes this item from our internal operating forecasts and models. Management believes that non-GAAP measures adjusted for employer payroll taxes on employee stock transactions provide investors with a basis to measure our core performance against the performance of other companies without the variability created by employer payroll taxes on employee stock transactions as a result of the stock price at the time of employee exercise. Amortization Of Acquired Intangible Assets We amortize intangible assets that we acquire in conjunction with acquisitions, which results in non-cash expenses that may not otherwise have been incurred. We believe excluding the expense associated with intangible assets from non-GAAP measures allows for a more accurate assessment of its ongoing operations and provides investors with a better comparison of period-over-period operating results. Key Business Metrics We monitor the following key metrics to help us evaluate our business, identify trends affecting our business, formu- late business plans and make strategic decisions.

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 17 Annualized Recurring Revenue (ARR) We believe that ARR is a key operating metric to measure our business because it is driven by our ability to acquire new subscription customers and to maintain and expand our relationship with existing subscription customers. ARR represents the annualized revenue run rate of our subscription contracts at the end of a reporting period, assuming contracts are renewed on their existing terms for customers that are under subscription contracts with us. ARR is not a forecast of future revenue, which can be impacted by contract start and end dates and renewal rates. Customers with ARR of $100,000 or More We believe that our ability to increase the number of customers with ARR of $100,000 or more is an indicator of our market penetration and strategic demand for our platform. We define a customer as an entity that has an active sub- scription for access to our platform. We count Managed Service Providers (MSPs), Managed Security Service Providers (MSSPs), Managed Detection & Response firms (MDRs), and Original Equipment Manufacturers (OEMs), who may pur- chase our products on behalf of multiple companies, as a single customer. We do not count our reseller or distributor channel partners as customers. Dollar-Based Net Retention Rate (NRR) We believe that our ability to retain and expand the revenue generated from our existing customers is an indicator of the long-term value of our customer relationships and our potential future business opportunities. Dollar-based net retention rate measures the percentage change in our ARR derived from our customer base at a point in time. To cal- culate these metrics, we first determine Prior Period ARR, which is ARR from the population of our customers as of 12 months prior to the end of a particular reporting period. We calculate Net Retention ARR as the total ARR at the end of a particular reporting period from the set of customers that are used to determine Prior Period ARR. Net Retention ARR includes any expansion and is net of contraction and attrition associated with that set of customers. NRR is the quotient obtained by dividing Net Retention ARR by Prior Period ARR. Definitions Customers: We define a customer as an entity that has an active subscription for access to our platform. We count MSPs, MSSPs, MDRs, and OEMs, who may purchase our product on behalf of multiple companies, as a single custom- er. We do not count our reseller or distributor channel partners as customers.

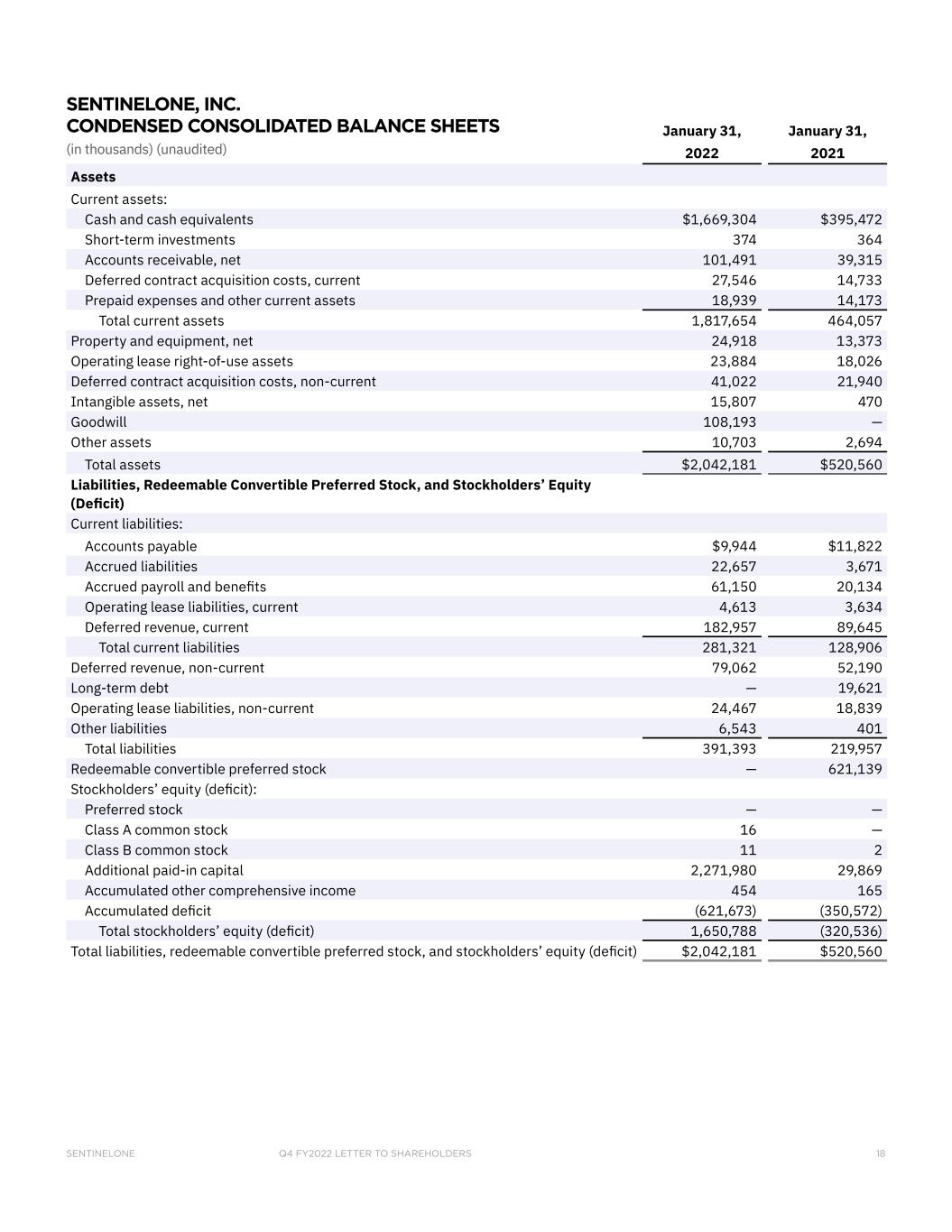

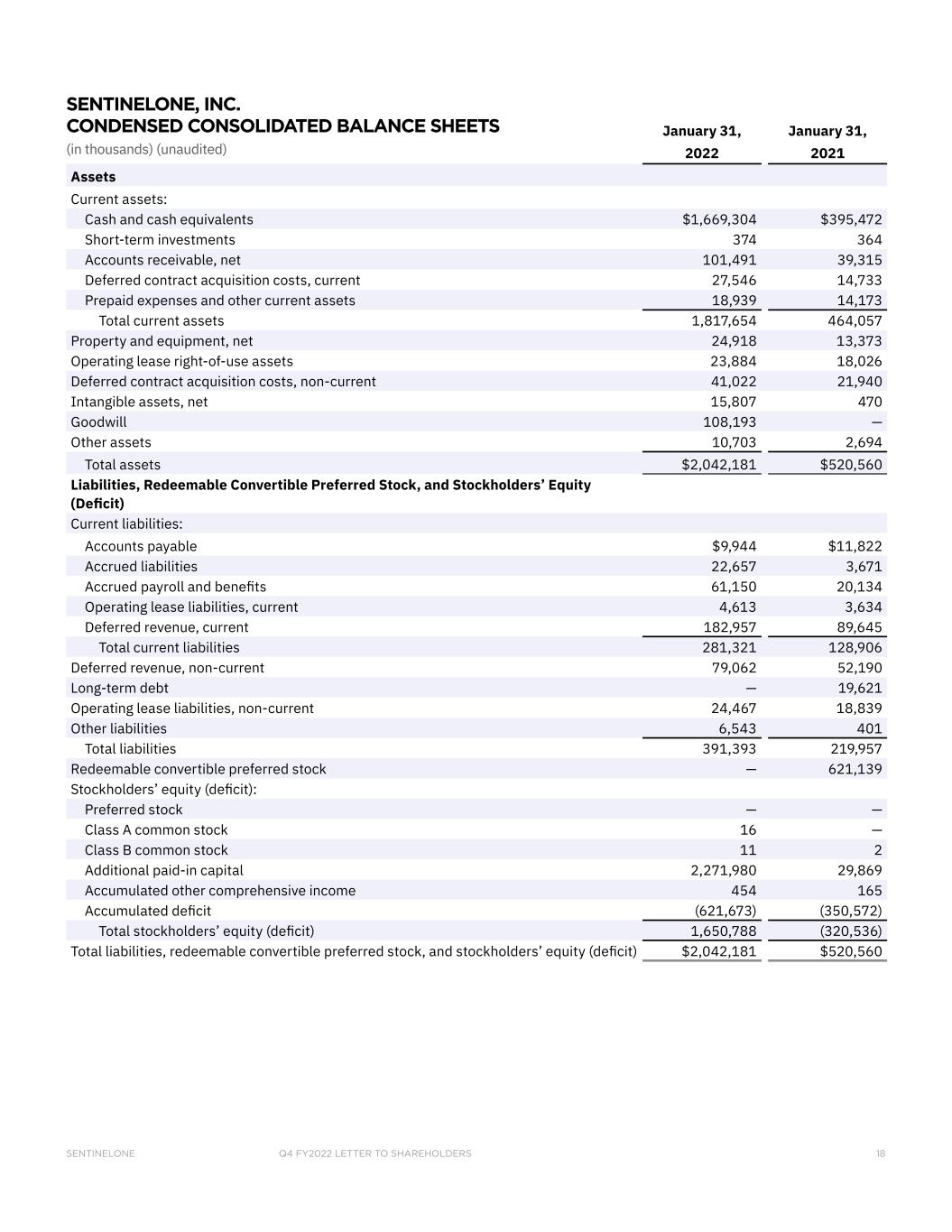

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 18 January 31, January 31, 2022 2021 Assets Current assets: Cash and cash equivalents $1,669,304 $395,472 Short-term investments 374 364 Accounts receivable, net 101,491 39,315 Deferred contract acquisition costs, current 27,546 14,733 Prepaid expenses and other current assets 18,939 14,173 Total current assets 1,817,654 464,057 Property and equipment, net 24,918 13,373 Operating lease right-of-use assets 23,884 18,026 Deferred contract acquisition costs, non-current 41,022 21,940 Intangible assets, net 15,807 470 Goodwill 108,193 — Other assets 10,703 2,694 Total assets $2,042,181 $520,560 Liabilities, Redeemable Convertible Preferred Stock, and Stockholders’ Equity (Deficit) Current liabilities: Accounts payable $9,944 $11,822 Accrued liabilities 22,657 3,671 Accrued payroll and benefits 61,150 20,134 Operating lease liabilities, current 4,613 3,634 Deferred revenue, current 182,957 89,645 Total current liabilities 281,321 128,906 Deferred revenue, non-current 79,062 52,190 Long-term debt — 19,621 Operating lease liabilities, non-current 24,467 18,839 Other liabilities 6,543 401 Total liabilities 391,393 219,957 Redeemable convertible preferred stock — 621,139 Stockholders’ equity (deficit): Preferred stock — — Class A common stock 16 — Class B common stock 11 2 Additional paid-in capital 2,271,980 29,869 Accumulated other comprehensive income 454 165 Accumulated deficit (621,673) (350,572) Total stockholders’ equity (deficit) 1,650,788 (320,536) Total liabilities, redeemable convertible preferred stock, and stockholders’ equity (deficit) $2,042,181 $520,560 SENTINELONE, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands) (unaudited)

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 19 Three Months Ended January 31, Year Ended January 31, 2022 2021 2022 2021 Revenue $65,636 $29,868 $204,799 $93,056 Cost of revenue(1) 24,249 13,835 81,677 39,332 Gross profit 41,387 16,033 123,122 53,724 Operating expenses: Research and development(1) 42,644 20,178 136,274 62,444 Sales and marketing(1) 42,115 23,713 160,576 77,740 General and administrative(1) 27,719 9,185 93,504 29,059 Total operating expenses 112,478 53,076 390,354 169,243 Loss from operations (71,091) (37,043) (267,232) (115,519) Interest income 59 25 202 231 Interest expense (2) (312) (787) (1,401) Other income (expense), net (259) (302) (2,280) (424) Loss before provision for income taxes (71,293) (37,632) (270,097) (117,113) Provision for income taxes 416 209 1,004 460 Net loss $(71,709) $(37,841) $(271,101) $(117,573) Net loss per share attributable to Class A and Class B common stockholders, basic and diluted $(0.27) $(1.00) $(1.56) $(3.31) Weighted-average shares used in computing net loss per share attributable to Class A and Class B common stockholders, basic and diluted 265,775,986 37,808,067 174,051,203 35,482,444 (1) Includes stock-based compensation expense as follows: Cost of revenue $1,192 $107 $3,618 $308 Research and development 10,361 3,123 35,358 6,590 Sales and marketing 4,660 1,783 15,460 3,835 General and administrative 9,483 1,065 33,453 5,179 Total stock-based compensation expense $25,696 $6,078 $87,889 $15,912 SENTINELONE, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except share and per share data) (unaudited)

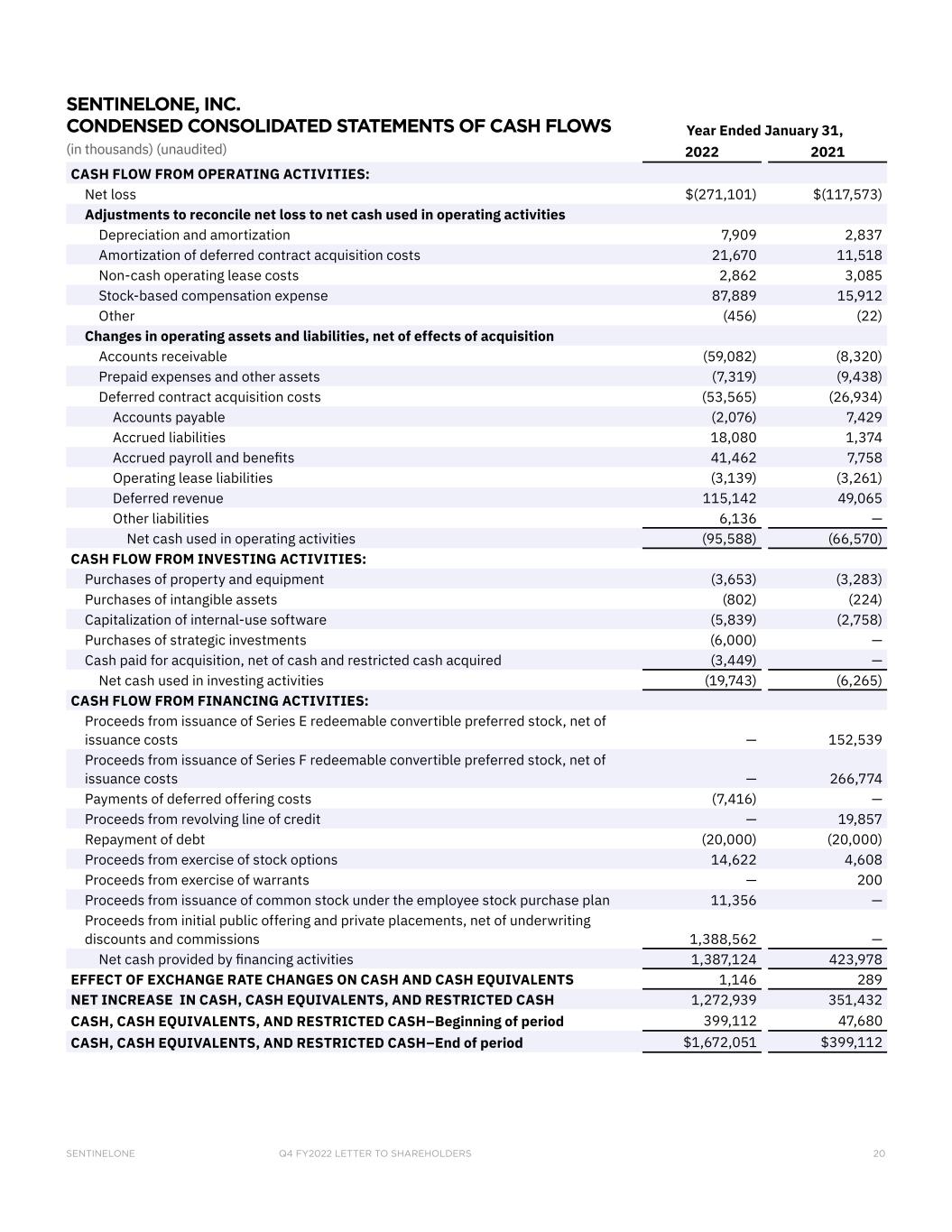

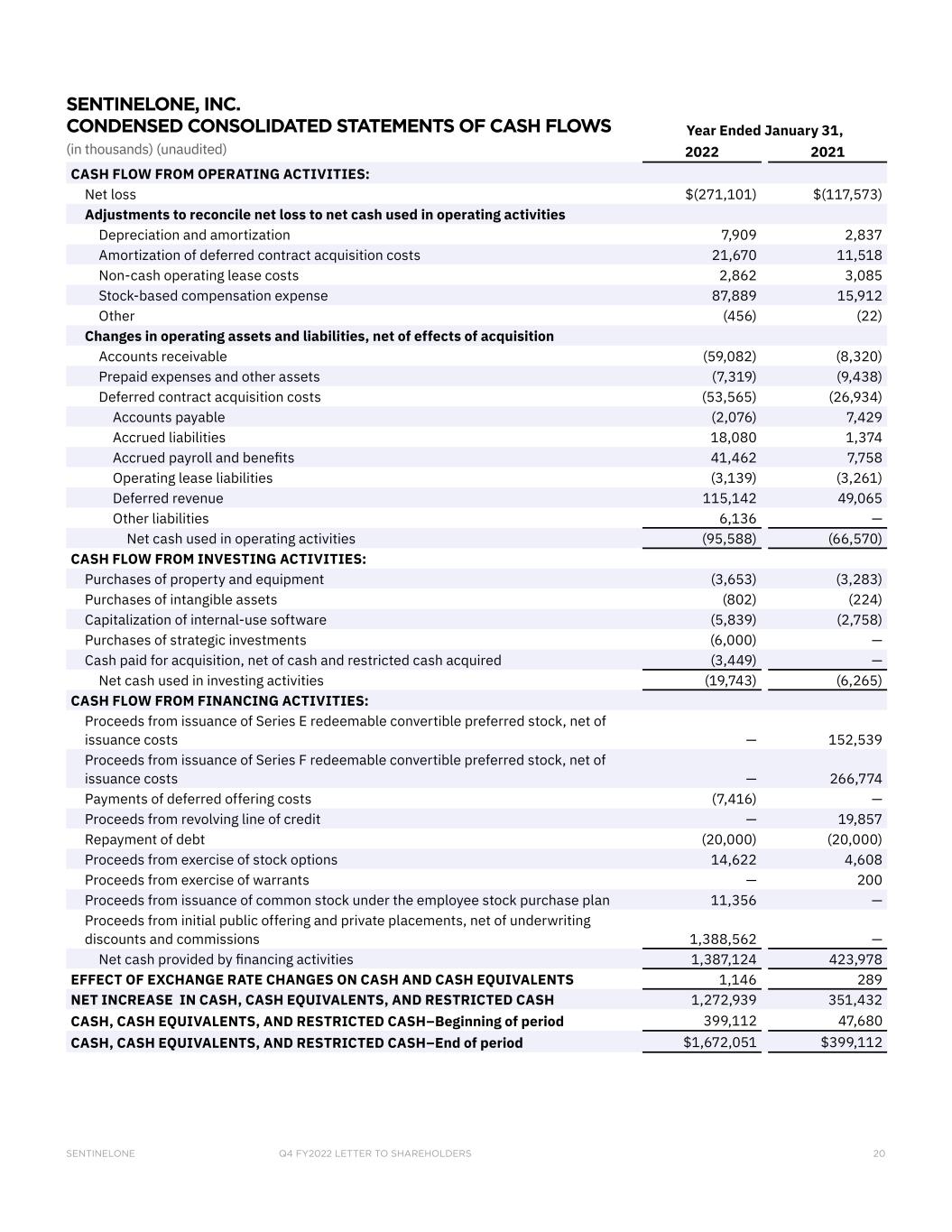

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 20 Year Ended January 31, 2022 2021 CASH FLOW FROM OPERATING ACTIVITIES: Net loss $(271,101) $(117,573) Adjustments to reconcile net loss to net cash used in operating activities Depreciation and amortization 7,909 2,837 Amortization of deferred contract acquisition costs 21,670 11,518 Non-cash operating lease costs 2,862 3,085 Stock-based compensation expense 87,889 15,912 Other (456) (22) Changes in operating assets and liabilities, net of effects of acquisition Accounts receivable (59,082) (8,320) Prepaid expenses and other assets (7,319) (9,438) Deferred contract acquisition costs (53,565) (26,934) Accounts payable (2,076) 7,429 Accrued liabilities 18,080 1,374 Accrued payroll and benefits 41,462 7,758 Operating lease liabilities (3,139) (3,261) Deferred revenue 115,142 49,065 Other liabilities 6,136 — Net cash used in operating activities (95,588) (66,570) CASH FLOW FROM INVESTING ACTIVITIES: Purchases of property and equipment (3,653) (3,283) Purchases of intangible assets (802) (224) Capitalization of internal-use software (5,839) (2,758) Purchases of strategic investments (6,000) — Cash paid for acquisition, net of cash and restricted cash acquired (3,449) — Net cash used in investing activities (19,743) (6,265) CASH FLOW FROM FINANCING ACTIVITIES: Proceeds from issuance of Series E redeemable convertible preferred stock, net of issuance costs — 152,539 Proceeds from issuance of Series F redeemable convertible preferred stock, net of issuance costs — 266,774 Payments of deferred offering costs (7,416) — Proceeds from revolving line of credit — 19,857 Repayment of debt (20,000) (20,000) Proceeds from exercise of stock options 14,622 4,608 Proceeds from exercise of warrants — 200 Proceeds from issuance of common stock under the employee stock purchase plan 11,356 — Proceeds from initial public offering and private placements, net of underwriting discounts and commissions 1,388,562 — Net cash provided by financing activities 1,387,124 423,978 EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS 1,146 289 NET INCREASE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH 1,272,939 351,432 CASH, CASH EQUIVALENTS, AND RESTRICTED CASH–Beginning of period 399,112 47,680 CASH, CASH EQUIVALENTS, AND RESTRICTED CASH–End of period $1,672,051 $399,112 SENTINELONE, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) (unaudited)

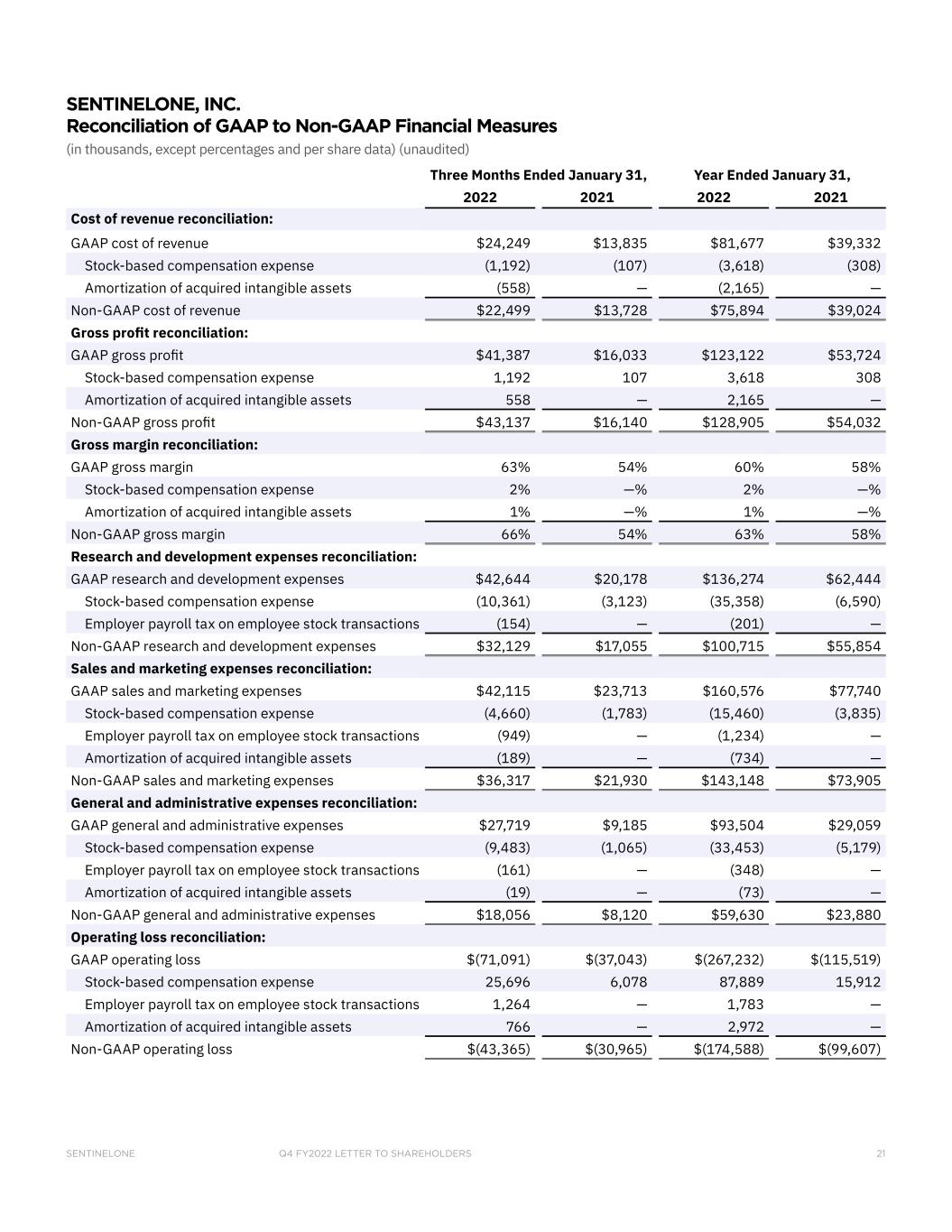

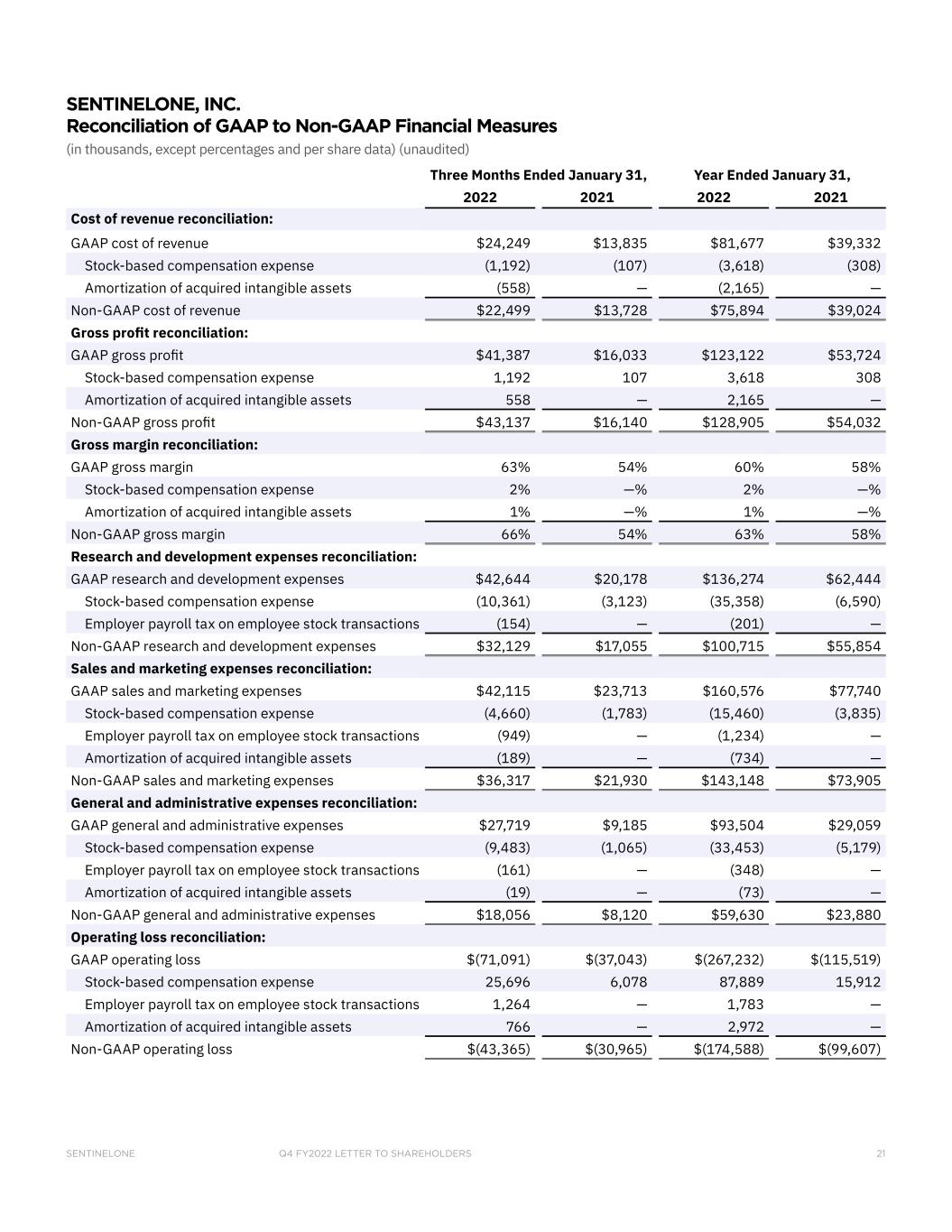

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 21 Three Months Ended January 31, Year Ended January 31, 2022 2021 2022 2021 Cost of revenue reconciliation: GAAP cost of revenue $24,249 $13,835 $81,677 $39,332 Stock-based compensation expense (1,192) (107) (3,618) (308) Amortization of acquired intangible assets (558) — (2,165) — Non-GAAP cost of revenue $22,499 $13,728 $75,894 $39,024 Gross profit reconciliation: GAAP gross profit $41,387 $16,033 $123,122 $53,724 Stock-based compensation expense 1,192 107 3,618 308 Amortization of acquired intangible assets 558 — 2,165 — Non-GAAP gross profit $43,137 $16,140 $128,905 $54,032 Gross margin reconciliation: GAAP gross margin 63% 54% 60% 58% Stock-based compensation expense 2% —% 2% —% Amortization of acquired intangible assets 1% —% 1% —% Non-GAAP gross margin 66% 54% 63% 58% Research and development expenses reconciliation: GAAP research and development expenses $42,644 $20,178 $136,274 $62,444 Stock-based compensation expense (10,361) (3,123) (35,358) (6,590) Employer payroll tax on employee stock transactions (154) — (201) — Non-GAAP research and development expenses $32,129 $17,055 $100,715 $55,854 Sales and marketing expenses reconciliation: GAAP sales and marketing expenses $42,115 $23,713 $160,576 $77,740 Stock-based compensation expense (4,660) (1,783) (15,460) (3,835) Employer payroll tax on employee stock transactions (949) — (1,234) — Amortization of acquired intangible assets (189) — (734) — Non-GAAP sales and marketing expenses $36,317 $21,930 $143,148 $73,905 General and administrative expenses reconciliation: GAAP general and administrative expenses $27,719 $9,185 $93,504 $29,059 Stock-based compensation expense (9,483) (1,065) (33,453) (5,179) Employer payroll tax on employee stock transactions (161) — (348) — Amortization of acquired intangible assets (19) — (73) — Non-GAAP general and administrative expenses $18,056 $8,120 $59,630 $23,880 Operating loss reconciliation: GAAP operating loss $(71,091) $(37,043) $(267,232) $(115,519) Stock-based compensation expense 25,696 6,078 87,889 15,912 Employer payroll tax on employee stock transactions 1,264 — 1,783 — Amortization of acquired intangible assets 766 — 2,972 — Non-GAAP operating loss $(43,365) $(30,965) $(174,588) $(99,607) SENTINELONE, INC. Reconciliation of GAAP to Non-GAAP Financial Measures (in thousands, except percentages and per share data) (unaudited)

Q4 FY2022 LETTER TO SHAREHOLDERSSENTINELONE 22 Three Months Ended January 31, Year Ended January 31, 2022 2021 2022 2021 Operating margin reconciliation: GAAP operating margin (108)% (124)% (130)% (124)% Stock-based compensation expense 39% 20% 43% 17% Employer payroll tax on employee stock transactions 2% —% 1% —% Amortization of acquired intangible assets 1% —% 1% —% Non-GAAP operating margin (66)% (104)% (85)% (107)% Net loss reconciliation: GAAP net loss $(71,709) $(37,841) $(271,101) $(117,573) Stock-based compensation expense 25,696 6,078 87,889 15,912 Employer payroll tax on employee stock transactions 1,264 — 1,783 — Amortization of acquired intangible assets 766 — 2,972 — Non-GAAP net loss $(43,983) $(31,763) $(178,457) $(101,661) Basic and diluted EPS reconciliation: GAAP loss per share, basic and diluted $(0.27) $(1.00) $(1.56) $(3.31) Stock-based compensation expense 0.10 0.16 0.50 0.45 Employer payroll tax on employee stock transactions — — 0.01 — Amortization of acquired intangible assets — — 0.02 — Non-GAAP loss per share, basic and diluted $(0.17) $(0.84) $(1.03) $(2.87) Three Months Ended January 31, Year Ended January 31, 2022 2021 2022 2021 GAAP net cash used in operating activities $(5,585) $(23,294) $(95,588) $(66,570) Less: Purchases of property and equipment (385) (1,649) (3,653) (3,283) Less: Capitalized internal-use software (1,106) (628) (5,839) (2,758) Free cash flow $(7,076) $(25,571) $(105,080) $(72,611) Net cash used in investing activities $(7,773) $(2,319) $(19,743) $(6,265) Net cash provided by financing activities $17,348 $1,812 $1,387,124 $423,978 SENTINELONE, INC. Reconciliation of GAAP to Non-GAAP Financial Measures (in thousands, except percentages and per share data) (unaudited) SENTINELONE, INC. Reconciliation of Cash Used in Operating Activities to Free Cash Flow (in thousands) (unaudited)

sentinelone.com © SentinelOne 2022