December 4, 2024 Q3 FY2025 Letter to Shareholders

Q3 FY2025 Letter to SharehoLderS 2 Table of Contents to our Shareholders 3 technology highlights 6 Go-to-Market highlights 7 Q3 FY2025 Financials 9 Guidance 13 Closing 14

Q3 FY2025 Letter to SharehoLderSSENTINELONE 3 01 To Our Shareholders Our Q3 results exceeded our growth expectations, demonstrating strong execution and business momentum. We delivered top-tier revenue growth, best-in-class gross margins, and continued operating leverage. Impor- tantly, our net new ARR growth re-accelerated back to positive territory. This momentum reflects a stronger competitive position and customer interest in SentinelOne. In Q3, total ARR grew 29% year-over-year (y/y) to $860 million, and revenue grew 28% y/y to $211 million. Net new ARR of $54 million exceeded our expectations and grew over 20% sequentially, significantly outpacing our historical Q3 seasonality. Net new ARR grew 4% year-over-year in Q3, reflecting a 14 percentage point improvement compared to the growth rate in Q2. Based on our business momentum, we remain on track to deliver stronger net new ARR growth in the second half of this fiscal year compared to the first half. There is more awareness, consideration, and interest in SentinelOne than ever before. We are also raising our revenue guidance for the fiscal year ‘25 and now expect 32% growth, up from 31% previously. We delivered GAAP and non-GAAP gross margin of 75% and 80%, respectively. In parallel, our GAAP and non- GAAP operating margins expanded by 8 and 6 percentage points y/y, respectively. For a second consecutive quarter, we delivered positive non-GAAP net income. We also achieved positive operating cash flow and first positive free cash flow on a trailing-twelve month basis. Importantly, we expect to achieve positive free cash flow for the fiscal year ‘25. Demand in Q3 was broad based, driven by increasing customer interest in our platform. We’re beginning to see notable strength with new and large customer additions. We’re securing an increasing number of busi- nesses of all sizes and geographies, from large enterprises and federal agencies to small- and medium-sized businesses. In Q3, we added a record number of $100,000 plus ARR customers, which grew 24% y/y. Our customers with more than $1 million in ARR grew even faster. Overall, our success with large enterprises and platform adoption continues to drive higher ARR per customer, which reached a new record in Q3. In parallel, we continued to maintain healthy expansion rates with our existing customer base. The long term growth potential with our installed base remains substantial. At our first investor session at OneCon24, we discussed how Singularity has evolved from an endpoint-centric solution to now one of the broadest, most performant, and reliable enterprise security platforms in the market. Among platform solutions, we continue to see outsized growth from our Cloud, Data, and AI. As one of our newer capabilities, Purple AI remains a true source of platform differentiation and growth. The market re- sponse and interest in Purple has been extremely positive, making Purple one of the fastest growing solutions in SentinelOne’s history. In addition, endpoint remains a cornerstone of enterprise security and a key driver of our business. Enterprises are distinctly more focused on the combination of security performance and reliabil- ity. We’re engaging with an increasing number of large enterprises. To maximize our long term success and scale, we’re strategically expanding our market presence. For in- stance, our partnership with Lenovo to bundle the Singularity Platform and Purple AI on enterprise PCs aims to enhance endpoint security at scale. In the federal arena, we’re expanding our presence by securing an increasing number of wins with agencies and we recently achieved FedRamp High for both endpoint security and AI SIEM. We also deepened our partnership with AWS, enabling customers to run Purple AI on Amazon Bedrock. Additionally, we’re enabling our MSSP partners to adopt more of the Singularity platform with solu- tions like Singularity Data Lake and Purple AI as well as a new suite of agentless CNAPP solutions. We continue to strengthen our position as a technology leader through cutting-edge innovations. Gen-AI is proving to be a game-changer for security use cases, acting as a force multiplier for security analysts. For Purple AI, we recently introduced advanced Gen-AI security capabilities for auto alert triage, threat hunting, and investigation. These tools empower security analysts to process and manage hundreds or even thousands of alerts in just minutes, giving them a decisive edge in the fight against emerging threats.

Q3 FY2025 Letter to SharehoLderSSENTINELONE 4 At OneCon, we unveiled AI SIEM, the foundation for real-time, autonomous cybersecurity. Far beyond a next- gen SIEM, Singularity’s AI SIEM ingests and synthesizes data across the security ecosystem to deliver full visibility, real-time detection, accelerated investigations, and autonomous responses. This empowers enter- prises to supercharge security operations. Paired with Purple AI and our new hyper-automation capabilities, including next-gen SOAR, AI SIEM streamlines workflows with no-code simplicity. Our technology redefines the legacy SIEM space, unlocking new opportunities for the future. In Cloud Security, adoption of our leading cloud workload protection remains strong. Our combination of agent-based and agentless solutions provides a comprehensive approach to securing cloud environments. Expanding on our industry-leading CNAPP capabilities, we recently introduced AI Security Posture Manage- ment (AI-SPM) to safeguard AI services in the workplace. Singularity AI-SPM offers visibility into AI usage, detects misconfigurations and vulnerabilities, and identifies potential attack paths. This enables SentinelOne customers to harness AI's transformative power and competitive advantages with confidence, knowing their AI data and applications are secure. Overall, our improving execution, expanding market presence, and leading platform capabilities are driving higher customer engagements and interest in SentinelOne than ever before. We’re working hand in hand with customers and partners to test, trial, and deploy the Singularity Platform. Security solutions are strategic and mission critical for enterprises. We’re building intelligent, autonomous cybersecurity for the future and posi- tioning the company for long term share gains across diverse growth opportunities. Q3 FY2025 Highlights (All metrics are compared to the third quarter of fiscal year 2024, unless otherwise noted) • revenue grew 29% to $211 million, compared to $164 million. arr grew 29% to $860 million, compared to $664 million. • We added a record number of $100,000 plus arr customers, which grew 24% year-over year to 1,310. • GaaP gross margin was 75%, compared to 73%. Non-GaaP gross margin was 80%, compared to 79%. • GaaP operating margin was (42)%, compared to (50)%. Non-GaaP operating margin was (5)%, compared to (11)%. • Operating cash flow margin was (3)%, compared to (14)%. Free cash flow margin was (6)%, compared to (16)%. Trailing-twelve month operating cash flow margin was 4%, compared to (15)%. Trailing-twelve month free cash flow margin was 1%, compared to (17)%. • Cash, cash equivalents, and investments were $1.1 billion as of october 31, 2024.

Q3 FY2025 Letter to SharehoLderSSENTINELONE 5 SentinelLabs operates as an open venue for threat researchers, committed to sharing the latest threat intelli- gence with a growing community of cyber defenders. By providing novel findings from the world of malware, exploits, advanced persistent threats (APTs), and cybercrime, the SentinelLabs team helps global enterprises and government bodies stay ahead of their adversaries. Research Highlights SentinelLabs observed significant shifts in the adversary threat landscape with a notable expansion of finan- cially motivated threat actors and an overall acceleration in their pace of cyber operations. We’ve tackled this issue at multiple levels: At the hacktivist tier, we reported on NullBulge, a group adopting hacktivist persona rebelling against AI to mask criminal intentions. The group leveraged the software supply chain by adding malicious code to publicly available repositories like GitHub and Hugging Face, leading unsuspecting victims to import malicious librar- ies and infect large enterprise targets. On the ransomware front, our research on Kryptina RaaS highlighted how it evolved from a free tool offered on public forums to being actively used in enterprise attacks under the Mallox ransomware family. We also revealed that FIN7 is concealing its activities under multiple pseudonyms. FIN7 has leveraged automated SQL-injection attacks and attempted to deploy novel EDR bypass techniques to target industries including hospitality, energy, finance, high-tech, and retail. At the highest tier, North Korean-aligned threat actors continue to lead the explosive expansion of the cyber- criminal ecosystem with an unending stream of cryptocurrency heists and reports of fake IT workers infil- trating established companies. Our research uncovered a recent BlueNoroff campaign dubbed ‘Hidden Risk’ targeting cryptocurrency businesses with multi-stage MacOS malware to enable further thefts. Following the disclosure of domains seized by the FBI, SentinelLabs researchers discovered additional infrastructure and companies utilized to launder fake IT worker profits. In March 2024, the U.S. Treasury Department reported that the illicit profits of these schemes are funding the North Korean weapons of mass destruction program. Not to be outdone by cybercriminals, Chinese cyber operations have recently taken center stage with notable intrusions into telecommunications networks and suspected war prepositioning. These efforts are also being bolstered by attempts to influence U.S. policies to weaken response posture. Our analysis of narratives around Volt Typhoon reflects China’s ongoing efforts to undermine support for U.S. surveillance and defense activities by fueling debate over Section 702. Chinese reporting also pushes to remove foreign technology providers like Microsoft from Chinese government systems and deflects attention away from recent incidents of Chinese espionage in both Europe and the United States.

Q3 FY2025 Letter to SharehoLderSSENTINELONE 6 02 Technology Highlights Industry Awards and Distinctions SentinelOne continues to be recognized as a leader and innovator across our key platform solutions, rein- forcing our commitment to delivering cutting-edge cybersecurity solutions. For the fourth consecutive year, SentinelOne was named a Leader in Gartner’s Magic Quadrant for Endpoint Protection and earned top honors at the 2024 SC Media Awards, securing both Best Enterprise Security Solution and Best Endpoint Security Solution. For Cloud Security, SentinelOne advanced further than any other vendor in the Frost & Sullivan Radar for CWP Platforms, receiving recognition for maximum stability, high performance, strong scalability, and rapid response capabilities. Singularity Cloud Security was also named CRN Product of the Year for Technology & Customer Need. In the realm of AI-driven cybersecurity, Purple AI earned the CyberScoop Innovation Award, underscoring its role in driving the future of automated threat detection and response. These accolades highlight our dedica- tion to innovation and excellence in protecting our customers. Advancing Security Through Unification of Data and AI At OneCon24, we unveiled significant advancements in cybersecurity technology, emphasizing AI-driven solu- tions to enhance security operations. Our innovations underscore SentinelOne's commitment to advancing autonomous security operations and providing organizations with the modern tools needed to effectively com- bat emerging cyber threats. We introduced Singularity AI SIEM, a cloud-native, no-index Security Information and Event Management system that leverages AI and automation to transform Security Operations Centers (SOCs). By ingesting and synthesizing data from across the security ecosystem, it provides real-time detection on streaming data, accelerates investigation, and automates responses. Built on an open ecosystem, AI SIEM integrates seam- lessly with both SentinelOne's offerings and third-party tools, offering expanded visibility and automated workflows across the enterprise. Our newly launched Singularity Hyperautomation introduces a no-code, intelligent automation solution tai- lored to meet unique SOC requirements. With over 100 integrations and numerous out-of-the-box work- flows, it efficiently addresses common cyber threats such as ransomware mitigation and insider threats. Its user-friendly, drag-and-drop interface allows for the creation of custom workflows and task automation, integrating seamlessly into analyst workflows. Singularity Hyperautomation enables intelligent automations for threat hunting and investigations, enhancing response efficiency. Expanded capabilities of Purple AI serves as an advanced AI security analyst, automating alert triage, hunt- ing, and investigations. It translates natural language security questions into structured queries, summarizes event logs, and guides analysts through complex investigations. The introduction of new capabilities, such as Auto-Alert Triage and Auto-Investigations, prioritizes top alerts and automates investigation steps, signifi- cantly reducing alert fatigue and investigation times. These features empower security teams to respond to threats with greater speed and accuracy. Expanding Cloud Security Products and Market Presence We’ve launched AI Security Posture Management (AI-SPM), which is designed to provide comprehensive vis- ibility into deployed AI resources, addressing the unique security challenges posed by artificial intelligence systems. AI-SPM enables organizations to discover AI pipelines and models, configure security checks on AI

Q3 FY2025 Letter to SharehoLderSSENTINELONE 7 03 services, and leverage Verified Exploit Paths™ to identify potential vulnerabilities. This proactive approach ensures that AI deployments are secure and compliant with industry standards. Recognizing the evolving needs of Managed Security Service Providers (MSSPs), we expanded our CNAPP offerings to deliver autonomous security solutions tailored for service providers. By integrating AI-driven threat detection and response capabilities, Singularity Cloud empowers MSSPs to efficiently manage and secure their clients' cloud environments. Our comprehensive cloud security offerings within a single platform enhance operational efficiency and provide scalable security solutions that adapt to the dynamic nature of cloud infrastructures. Go-To-Market Highlights We continued to scale our business through our leading AI-powered Singularity Platform and our partner- supported go-to-market. We maintained strong momentum with large enterprises and strategic partners. Our growth also was balanced across geographies, and our vast channel ecosystem continues to magnify our reach and drive platform adoption. To maximize our long term success and scale, we’re strategically expanding our market presence. Here are several examples: • We’re broadening our reach and scale by partnering with Lenovo, the world’s largest PC manufacturer in the world. Together, Lenovo will bundle the Singularity Platform and Purple AI on new enterprise PC shipments to enhance security and autonomous protection for millions of endpoints across the world in the coming years. • We achieved FedRAMP High for both the endpoint and Singularity Data Lake, significantly expanding our presence in the Federal arena. Going through rigorous testing over multiple years, this designation is a testament of our performance and ability to meet the most demanding security requirements. • We’ve expanded our partnership with AWS. Now, AWS customers that choose SentinelOne can run Purple AI on Amazon Bedrock. We continue to deepen our relationship with Amazon, enabling customers to choose and deploy Singularity through one of the largest cloud providers in the world. • Finally, we’re enabling our MSSP partners to adopt more of the Singularity Platform. This helps them improve efficiency, enhance security, and expand their business potential. In addition to early interest in Singularity Data Lake and Purple AI, we recently launched our suite of agentless CNAPP solutions for MSSPs, including CSPM, CIEM, and more.

Q3 FY2025 Letter to SharehoLderSSENTINELONE 8 Customer Growth Our customer growth in Q3 was broad-based across businesses of all sizes and geographies. We added a record number of customers with ARR of $100,000 or more, which grew 24% y/y to 1,310. Further, customers with more than $1 million in ARR grew even faster, reaching another company record. Similarly, our ARR per customer continued to grow by a double-digit percentage y/y, reaching a new record and reflecting broader platform adoption with large enterprises Q3'24 Q3'25 $100K+ ARR Customers at quarter end 1,060 24% 1,310 Platform Adoption & Expansion New and existing customers are adopting more of the Singularity Platform. Traction with our platform capa- bilities is leading to new growth channels and diversifying our business mix. Our emerging solutions like Cloud, Data, and AI continued to outpace the overall company growth rate in Q3. For instance, Purple AI is proving to be truly transformative and we’re seeing great customer traction. Purple AI is now our fastest growing solution and the attach rate of Purple AI across all eligible endpoints doubled compared to Q2. Retention and expansion remained resilient across our customer base, comfortably in expansion territory. Similar to last quarter, a larger portion of our business mix was driven by new customer additions in the quar- ter, which we believe will open doors for significant expansion over time.

Q3 FY2025 Letter to SharehoLderSSENTINELONE 9 04 Q3 FY2025 Financials Our Q3 performance was driven by strong demand from new and existing customers, as well as large and mid-sized enterprises seeking to modernize their cybersecurity. Revenue & Annualized Recurring Revenue (ARR) Revenue grew 28% y/y to $211 million in Q3. International revenue represented 37% of total revenue, reflecting growth of 28% y/y. ARR grew 29% y/y to $860 million at the end of Q3. Net new ARR of $54 million, with growth accelerating to 4% y/y, was driven by strong demand for SentinelOne’s AI-powered security and team execution. The growth was also broad-based across new customer additions, existing customer renewals, and upsells. Q4'24Q3'24 Q1'25 Q2'25 Q3'25Q4'24Q3'24 Q1'25 Q2'25 Q3'25 Annualized Recurring Revenue $ million, year over year growth Revenue $ million, year over year growth $164 28% $174 $186 $199 $211 29% $664 $724 $762 $806 $860

Q3 FY2025 Letter to SharehoLderSSENTINELONE 10 Gross Profit & Margin Gross profit was $157 million, or 75% of revenue, compared to 73% of revenue a year ago. Non-GAAP gross profit was $168 million, or 80% of revenue, compared to 79% of revenue a year ago. This y/y increase was driven primarily by increasing scale, data efficiencies, and customers’ growing platform adoption. GAAP Non-GAAP Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 Gross Margin % of revenue, GAAP & Non-GAAP 78% 79% 72% 73% 80% 75% 80% 75% 79% 73% Operating Expenses Total operating expenses were $247 million, including $68 million of stock-based compensation (SBC) expense, employer payroll tax on employee stock transactions, amortization of acquired intangible assets, and acquisition-related compensation costs. Total operating expenses increased 22% y/y, primarily due to an in- crease in headcount and SBC. Non-GAAP operating expenses were $178 million, representing 85% of revenue, compared to $148 million, or 90% of revenue, a year ago. Non-GAAP operating expenses grew 20% y/y, driven by an increase in headcount. Research and development expenses were $70 million, up 35% y/y. On a non-GAAP basis, research and devel- opment expenses increased 29% y/y to $47 million and represented 22% of revenue, compared to 22% a year ago. The y/y increase was primarily due to higher headcount. Sales and marketing expenses were $124 million, up 26% y/y. On a non-GAAP basis, sales and marketing expenses increased 25% y/y to $103 million and represented 49% of revenue, compared to 50% a year ago. The y/y increase was primarily due to an increase in headcount. General and administrative expenses were $52 million, up 2% y/y primarily due to higher headcount. On a non-GAAP basis, general and administrative expenses declined 4% y/y to $29 million and represented 14% of revenue, compared to 18% a year ago.

Q3 FY2025 Letter to SharehoLderSSENTINELONE 11 R&D S&M G&A Q3'24 Q3'25Q3'24 Q3'25 Operating Expenses % of revenue, GAAP & Non-GAAP GAAP NON-GAAP 33% 59% 25% 22% 50% 18% 32% 60% 31% 49% 22% 14% Operating & Net Income (Loss) GAAP operating margin was (42)%, compared to (50)% a year ago. Non-GAAP operating margin was (5)%, compared to (11)% a year ago. The improvement in operating margin resulted from revenue growth outpacing expense increases. GAAP net income margin was (37)%, compared to (43)% a year ago. Non-GAAP net income margin was 0%, compared to (5)% a year ago. The increase resulted from revenue growth outpacing expense increases. EBIT EBIT Margin % Q3'24 Q3'25 Q3'24 Q3'25 Operating Income (Loss) & Margin $ million and % of revenue, GAAP & Non-GAAP GAAP NON-GAAP $(89) $(11) (11)% (5)% (42)% (50)% $(81) $(18)

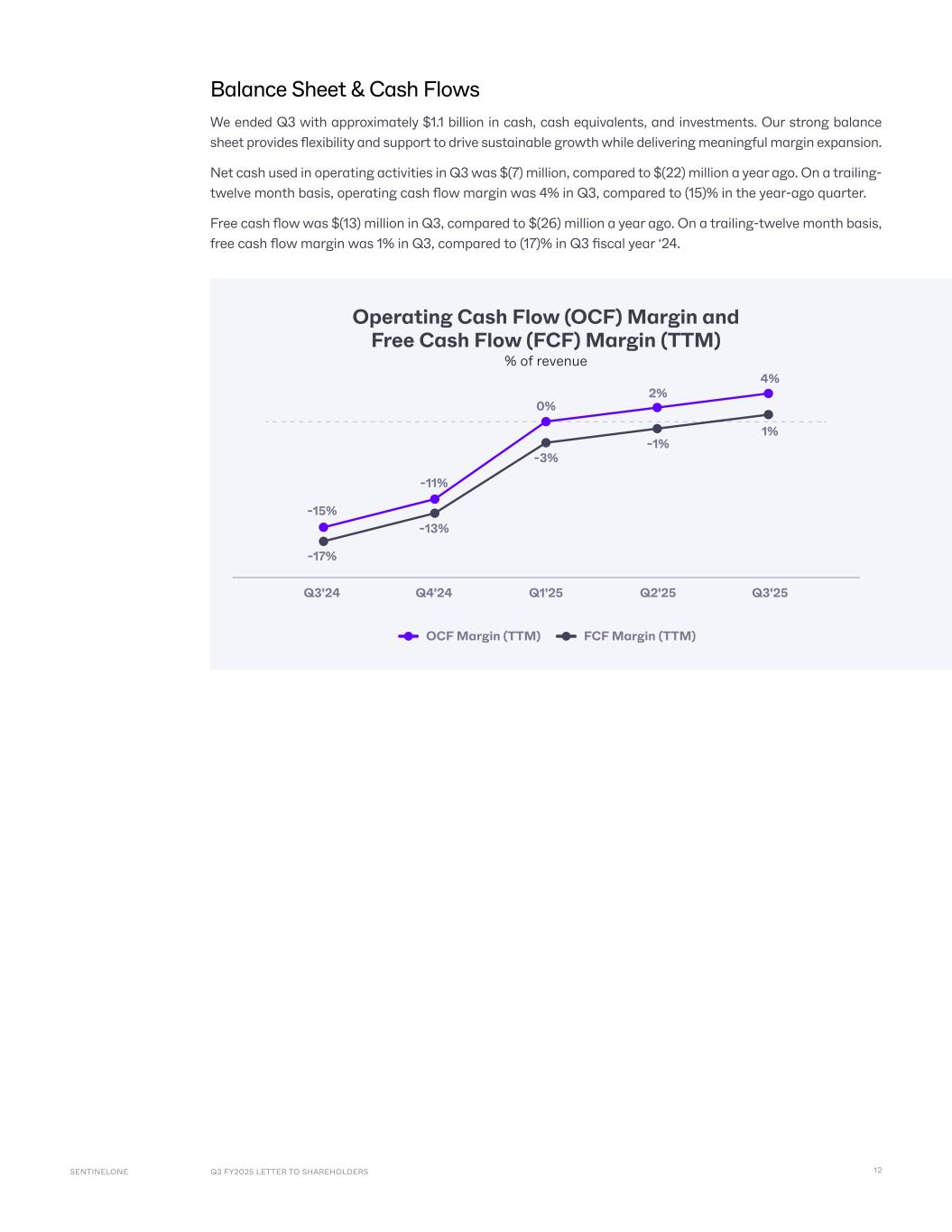

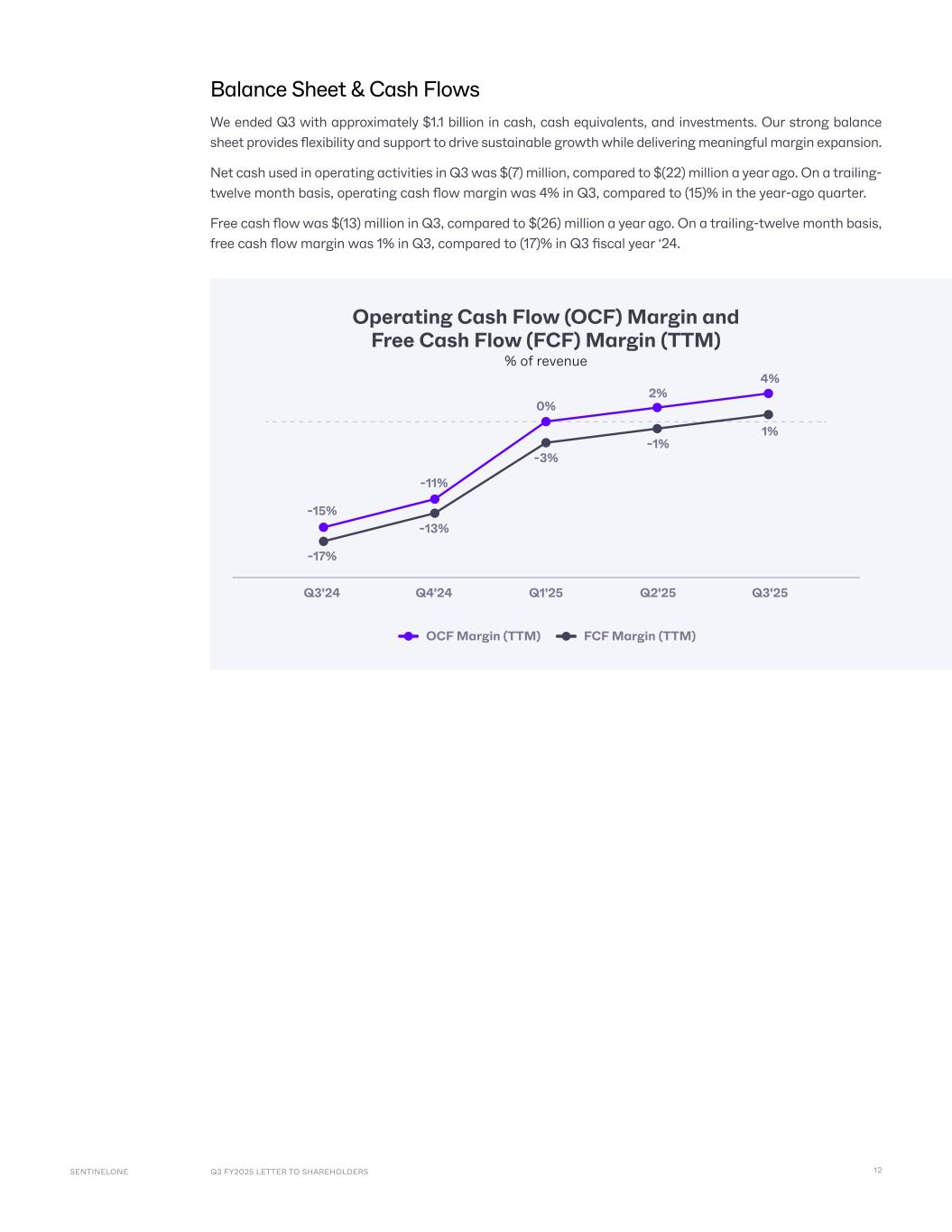

Q3 FY2025 Letter to SharehoLderSSENTINELONE 12 Balance Sheet & Cash Flows We ended Q3 with approximately $1.1 billion in cash, cash equivalents, and investments. Our strong balance sheet provides flexibility and support to drive sustainable growth while delivering meaningful margin expansion. Net cash used in operating activities in Q3 was $(7) million, compared to $(22) million a year ago. On a trailing- twelve month basis, operating cash flow margin was 4% in Q3, compared to (15)% in the year-ago quarter. Free cash flow was $(13) million in Q3, compared to $(26) million a year ago. On a trailing-twelve month basis, free cash flow margin was 1% in Q3, compared to (17)% in Q3 fiscal year ‘24. -17% -13% -15% -11% -3% -1% 1% 0% 2% 4% Operating Cash Flow (OCF) Margin and Free Cash Flow (FCF) Margin (TTM) % of revenue Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 OCF Margin (TTM) FCF Margin (TTM)

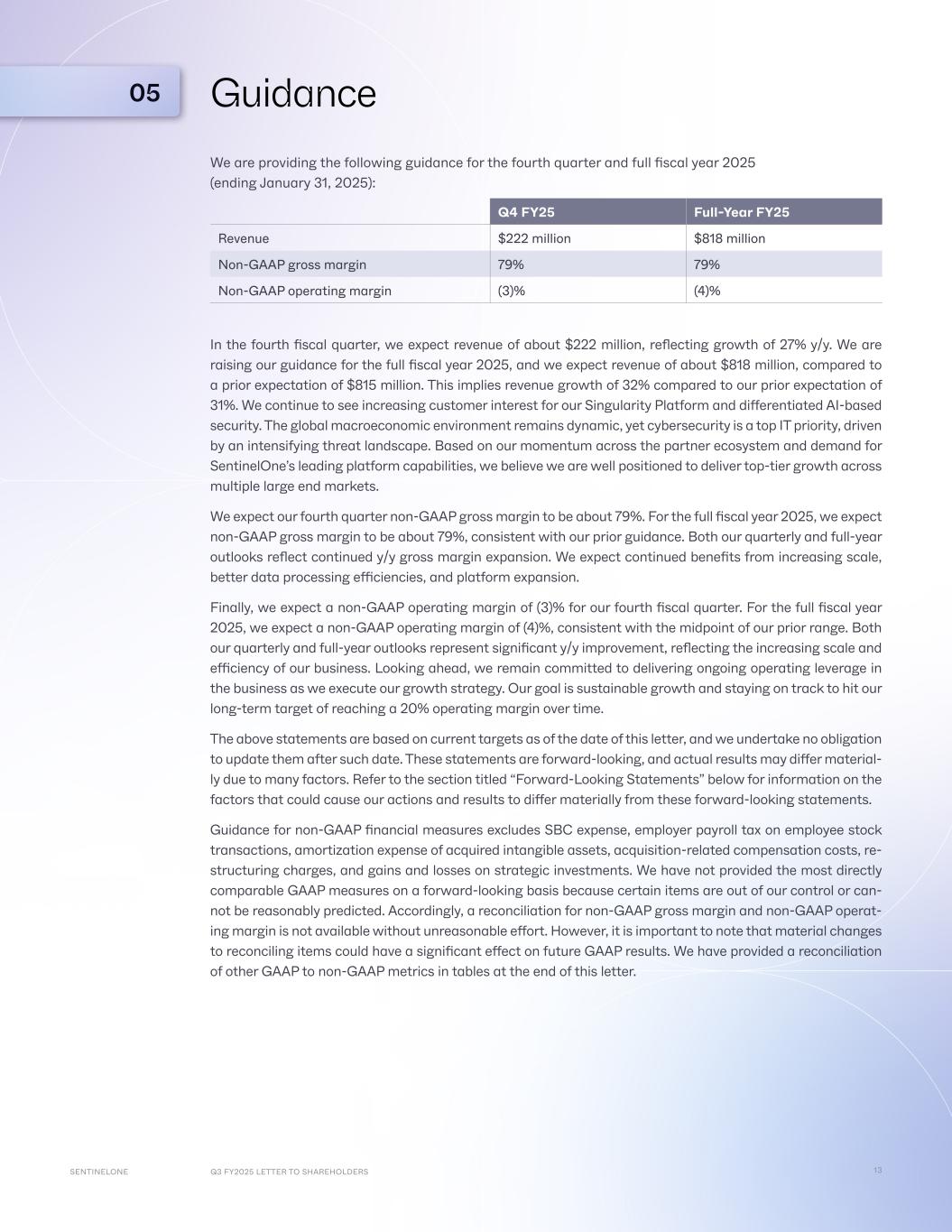

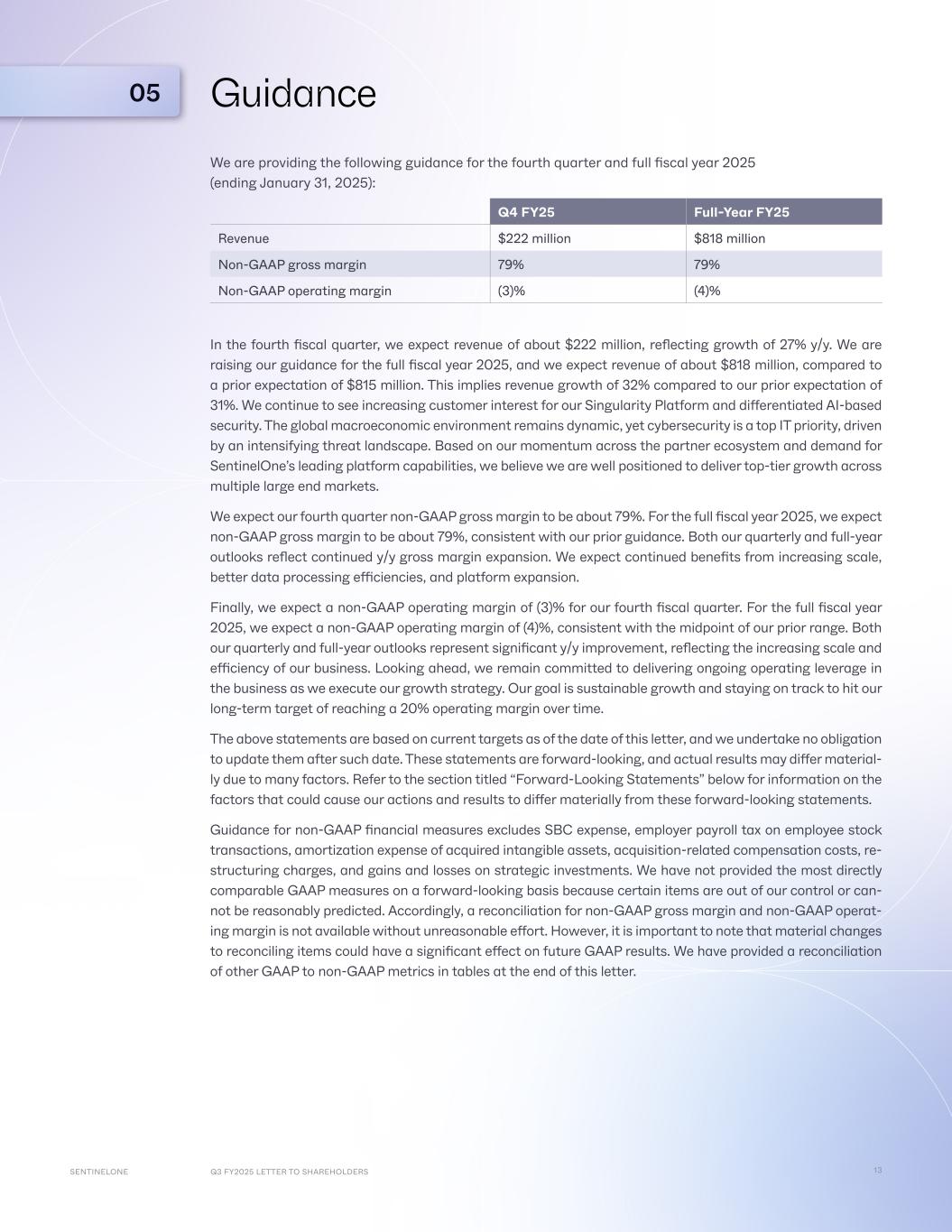

Q3 FY2025 Letter to SharehoLderSSENTINELONE 13 05 Guidance We are providing the following guidance for the fourth quarter and full fiscal year 2025 (ending January 31, 2025): Q4 FY25 Full-Year FY25 Revenue $222 million $818 million Non-GAAP gross margin 79% 79% Non-GAAP operating margin (3)% (4)% In the fourth fiscal quarter, we expect revenue of about $222 million, reflecting growth of 27% y/y. We are raising our guidance for the full fiscal year 2025, and we expect revenue of about $818 million, compared to a prior expectation of $815 million. This implies revenue growth of 32% compared to our prior expectation of 31%. We continue to see increasing customer interest for our Singularity Platform and differentiated AI-based security. The global macroeconomic environment remains dynamic, yet cybersecurity is a top IT priority, driven by an intensifying threat landscape. Based on our momentum across the partner ecosystem and demand for SentinelOne’s leading platform capabilities, we believe we are well positioned to deliver top-tier growth across multiple large end markets. We expect our fourth quarter non-GAAP gross margin to be about 79%. For the full fiscal year 2025, we expect non-GAAP gross margin to be about 79%, consistent with our prior guidance. Both our quarterly and full-year outlooks reflect continued y/y gross margin expansion. We expect continued benefits from increasing scale, better data processing efficiencies, and platform expansion. Finally, we expect a non-GAAP operating margin of (3)% for our fourth fiscal quarter. For the full fiscal year 2025, we expect a non-GAAP operating margin of (4)%, consistent with the midpoint of our prior range. Both our quarterly and full-year outlooks represent significant y/y improvement, reflecting the increasing scale and efficiency of our business. Looking ahead, we remain committed to delivering ongoing operating leverage in the business as we execute our growth strategy. Our goal is sustainable growth and staying on track to hit our long-term target of reaching a 20% operating margin over time. The above statements are based on current targets as of the date of this letter, and we undertake no obligation to update them after such date. These statements are forward-looking, and actual results may differ material- ly due to many factors. Refer to the section titled “Forward-Looking Statements” below for information on the factors that could cause our actions and results to differ materially from these forward-looking statements. Guidance for non-GAAP financial measures excludes SBC expense, employer payroll tax on employee stock transactions, amortization expense of acquired intangible assets, acquisition-related compensation costs, re- structuring charges, and gains and losses on strategic investments. We have not provided the most directly comparable GAAP measures on a forward-looking basis because certain items are out of our control or can- not be reasonably predicted. Accordingly, a reconciliation for non-GAAP gross margin and non-GAAP operat- ing margin is not available without unreasonable effort. However, it is important to note that material changes to reconciling items could have a significant effect on future GAAP results. We have provided a reconciliation of other GAAP to non-GAAP metrics in tables at the end of this letter.

Q3 FY2025 Letter to SharehoLderSSENTINELONE 14 06 Closing We will host a conference call at 2:00 p.m. Pacific Time / 5:00 p.m. Eastern Time today to discuss details of our Q3 results. The live webcast and replay of the event can be accessed on SentinelOne’s Investor Relations website at investors.sentinelone.com, along with the related earnings release materials. Thank you for taking the time to read our shareholder letter. Sincerely, Tomer Weingarten Barbara Larson CEO and Co-founder CFO

Q3 FY2025 Letter to SharehoLderSSENTINELONE 15 Forward-Looking Statements This letter and the live webcast, which will be held at 2:00 p.m. Pacific Time / 5:00 p.m. Eastern Time on December 4, 2024, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which state- ments involve risks and uncertainties, including but not limited to statements regarding our future growth, ex- ecution, competitive position, and future financial and operating performance, including our financial outlook for the fourth quarter of fiscal year 2025 and our full fiscal year 2025, including non-GAAP gross margin and non-GAAP operating margin; timing for profitability (on a non-GAAP basis); and general market trends. The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “proj- ect,” “target,” “plan,” “expect,” or the negative of these terms and similar expressions are intended to identify forward-looking statements. However, not all forward-looking statements contain these identifying words. There are a significant number of factors that could cause our actual results to differ materially from state- ments made in this press release, including but not limited to: our limited operating history; our history of loss- es; intense competition in the market we compete in; fluctuations in our operating results; actual or perceived network or security incidents against us; our ability to successfully integrate any acquisitions and strategic investments; actual or perceived defects, errors or vulnerabilities in our platform; risks associated with man- aging our rapid growth; general global market, political, economic, and business conditions, including those related to declining global macroeconomic conditions, the change in the U.S. presidential administration, ac- tual or perceived instability in the banking sector, supply chain disruptions, a potential recession, inflation, interest rate volatility and geopolitical uncertainty, including the effects of the conflicts in the Middle East, Ukraine and tensions between China and Taiwan; our ability to attract new and retain existing customers, or renew and expand our relationships with them; the ability of our platform to effectively interoperate within our customers' IT infrastructure; disruptions or other business interruptions that affect the availability of our plat- form including cybersecurity incidents; the failure to timely develop and achieve market acceptance of new products and subscriptions as well as existing products, subscriptions and support offerings; rapidly evolving technological developments in the market for security products and subscription and support offerings; length of sales cycles; and risks of securities class action litigation. Additional risks and uncertainties that could affect our financial results are included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” set forth in our filings and reports with the Securities and Exchange Commission (SEC), including our most recent- ly filed Annual Report on Form 10-K dated March 27, 2024, subsequent Quarterly Reports on Form 10-Q and other filings and reports that we may file from time to time with the SEC, copies of which are available on our website at investors.sentinelone.com and on the SEC’s website at www.sec.gov. You should not rely on these forward-looking statements, as actual outcomes and results may differ materially from those contemplated by these forward-looking statements as a result of such risks and uncertainties. All forward-looking statements in this press release are based on information and estimates available to us as of the date hereof, and were based on current expectations, estimates, forecasts, and projections as well as the beliefs and assumptions of management. We do not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date of this press release or to reflect new information or the occurrence of unexpected events, except as required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Non-GAAP Financial Measures In addition to our results determined in accordance with GAAP, we believe the following non-GAAP measures are useful in evaluating our operating performance. We use the following non-GAAP financial information to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that non- GAAP financial information, when taken collectively, with the financial information presented in accordance with GAAP, may be helpful to investors because it provides consistency and comparability with past financial

Q3 FY2025 Letter to SharehoLderSSENTINELONE 16 performance. However, non-GAAP financial information is presented for supplemental informational purpos- es only, has limitations as an analytical tool, and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. Other companies, including companies in our industry, may calculate similarly titled non-GAAP measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. In addition, the utility of free cash flow as a measure of our liquidity is limited as it does not represent the total increase or decrease in our cash balance for a given period. Reconciliations between non-GAAP financial measures to the most directly comparable financial measure stated in accordance with GAAP are contained at the end of the earnings press release following the accom- panying financial data. Investors are encouraged to review the related GAAP financial measures and the rec- onciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures and not rely on any single financial measure to evaluate our business. Non-GAAP Gross Profit and Non-GAAP Gross Margin We define non-GAAP gross profit and non-GAAP gross margin as GAAP gross profit and GAAP gross mar- gin, respectively, excluding SBC expense, employer payroll tax on employee stock transactions, amortiza- tion of acquired intangible assets, acquisition-related compensation costs and restructuring charges. We believe non-GAAP gross profit and non-GAAP gross margin provide our management and investors consis- tency and comparability with our past financial performance and facilitate period-to-period comparisons of operations, as these measures generally eliminate the effects of certain variables unrelated to our overall operating performance. Non-GAAP Loss from Operations and Non-GAAP Operating Margin We define non-GAAP loss from operations and non-GAAP operating margin as GAAP loss from operations and GAAP operating margin, respectively, excluding SBC expense, employer payroll tax on employee stock transactions, amortization of acquired intangible assets, acquisition-related compensation costs and restruc- turing charges. We believe non-GAAP loss from operations and non-GAAP operating margin provide our man- agement and investors consistency and comparability with our past financial performance and facilitate pe- riod-to-period comparisons of operations, as these metrics generally eliminate the effects of certain variables unrelated to our overall operating performance. Non-GAAP Net Income (Loss) and Non-GAAP Net Income (Loss) per Share, Basic and Diluted We define non-GAAP net income (loss) as GAAP net income (loss) excluding SBC expense, employer payroll tax on employee stock transactions, amortization of acquired intangible assets, acquisition-related compen- sation costs, restructuring charges and gains and losses on strategic investments. We define non-GAAP net income (loss) per share, basic and diluted, as non-GAAP net income (loss) divided by the weighted average common shares outstanding, which includes the dilutive effect of potentially diluted common stock equiva- lents outstanding during the period. We believe that excluding these items from non-GAAP net income (loss) and non-GAAP net income (loss) per share, diluted, provides management and investors with greater visibility into the underlying performance of our core business operating results. Dilutive shares applying the treasury stock method During periods in which we incur a net loss under a GAAP basis, we exclude certain potential common stock equivalents from our GAAP diluted shares because their effect would have been anti-dilutive. In periods where we have net income on a non-GAAP basis, these common stock equivalents would have been dilutive. Accord- ingly, we have included the impact of these common stock equivalents in the calculation of our non-GAAP diluted net income per share applying the treasury stock method.

Q3 FY2025 Letter to SharehoLderSSENTINELONE 17 Free Cash Flow Free cash flow is a non-GAAP financial measure that we define as net cash provided by (used in) operating activities less cash used for purchases of property and equipment and capitalized internal-use software. We believe that free cash flow is a useful indicator of liquidity that provides information to management and in- vestors, even if negative, as it provides useful information about the amount of cash generated (or consumed) by our operating activities that is available (or not available) to be used for other strategic initiatives. For exam- ple, if free cash flow is negative, we may need to access cash reserves or other sources of capital to invest in strategic initiatives. While we believe that free cash flow is useful in evaluating our business, free cash flow is a non-GAAP financial measure that has limitations as an analytical tool, and free cash flow should not be con- sidered as an alternative to, or substitute for, net cash provided by (used in) operating activities in accordance with GAAP. The utility of free cash flow as a measure of our liquidity is limited as it does not represent the total increase or decrease in our cash balance for any given period and does not reflect our future contractual commitments. In addition, other companies, including companies in our industry, may calculate free cash flow differently or not at all, which reduces the usefulness of free cash flow as a tool for comparison. Expenses Excluded from Non-GAAP Measures Stock-based compensation expense SBC expense is a non-cash expense that varies in amount from period to period and is dependent on market forces that are often beyond our control. As a result, management excludes this item from our internal operat- ing forecasts and models. Management believes that non-GAAP measures adjusted for SBC expense provide investors with a basis to measure our core performance against the performance of other companies without the variability created by stock-based compensation as a result of the variety of equity awards used by other companies and the varying methodologies and assumptions used. Employer payroll tax on employee stock transactions Employer payroll tax expenses related to employee stock transactions are tied to the vesting or exercise of underlying equity awards and the price of our common stock at the time of vesting, which varies in amount from period to period and is dependent on market forces that are often beyond our control. As a result, man- agement excludes this item from our internal operating forecasts and models. Management believes that non- GAAP measures adjusted for employer payroll taxes on employee stock transactions provide investors with a basis to measure our core performance against the performance of other companies without the variability created by employer payroll taxes on employee stock transactions as a result of the stock price at the time of employee exercise. Amortization of acquired intangible assets Amortization of acquired intangible asset expense is tied to the intangible assets that were acquired in con- junction with acquisitions, which results in non-cash expenses that may not otherwise have been incurred. Management believes excluding the expense associated with intangible assets from non-GAAP measures allows for a more accurate assessment of our ongoing operations and provides investors with a better com- parison of period-over-period operating results. Acquisition-related compensation costs Acquisition-related compensation costs include cash-based compensation expenses resulting from the employment retention of certain employees established in accordance with the terms of each acquisition. Acquisition-related cash-based compensation costs have been excluded as they were specifically negotiat- ed as part of the acquisitions in order to retain such employees and relate to cash compensation that was made either in lieu of stock-based compensation or where the grant of stock-based compensation awards was not practicable. In most cases, these acquisition-related compensation costs are not factored into

Q3 FY2025 Letter to SharehoLderSSENTINELONE 18 management's evaluation of potential acquisitions or our performance after completion of acquisitions, because they are not related to our core operating performance. In addition, the frequency and amount of such charges can vary significantly based on the size and timing of acquisitions and the maturities of the businesses being acquired. Excluding acquisition-related compensation costs from non-GAAP measures provides investors with a basis to compare our results against those of other companies without the vari- ability caused by purchase accounting. Restructuring charges Restructuring charges primarily relate to severance payments, employee benefits, stock-based compensa- tion, impairment charges related to excess facilities, and inventory write-offs. These restructuring charges are excluded from non-GAAP financial measures because they are the result of discrete events that are not considered core operating activities. We believe that it is appropriate to exclude restructuring charges from non-GAAP financial measures because it enables the comparison of period-over-period operating results from continuing operations. Gains and losses on strategic investments Gains and losses on strategic investments relate to the subsequent changes in the recorded value of our stra- tegic investments. These gains and losses are excluded from non-GAAP financial measures because they are the result of discrete events that are not considered core operating activities. We believe that it is appropriate to exclude gains and losses from strategic investments from non-GAAP financial measures because it enables the comparison of period-over-period net income (loss). Key Business Metrics We monitor the following key metrics to help us evaluate our business, identify trends affecting our business, formulate business plans and make strategic decisions. Annualized Recurring Revenue (ARR) We believe that ARR is a key operating metric to measure our business because it is driven by our ability to acquire new subscription, consumption and usage-based customers and to maintain and expand our relation- ship with existing customers. ARR represents the annualized revenue run rate of our subscription and con- sumption and usage-based agreements at the end of a reporting period, assuming agreements are renewed on their existing terms for customers that are under contracts with us. ARR is not a forecast of future revenue, which can be impacted by contract start and end dates, usage, renewal rates, and other contractual terms. Customers with ARR of $100,000 or More We believe that our ability to increase the number of customers with ARR of $100,000 or more is an indicator of our market penetration and strategic demand for our platform. We define a customer as an entity that has an active subscription for access to our platform. We count Managed Service Providers (MSPs), MSSPs, Managed Detection and Response firms (MDRs), and Original Equipment Manufacturers (OEMs), who may purchase our products on behalf of multiple companies, as a single customer. We do not count our reseller or distributor channel partners as customers. Definitions Customers: We define a customer as an entity that has an active subscription for access to our platform. We count MSPs, MSSPs, MDRs, and OEMs, who may purchase our product on behalf of multiple companies, as a single customer. We do not count our reseller or distributor channel partners as customers.

Q3 FY2025 Letter to SharehoLderSSENTINELONE 19 October 31, January 31, 2024 2024 ASSETS Current assets: Cash and cash equivalents $235,742 $256,651 Short-term investments 424,517 669,305 Accounts receivable, net 164,603 214,322 Deferred contract acquisition costs, current 60,272 54,158 Prepaid expenses and other current assets 105,857 102,895 Total current assets 990,991 1,297,331 Property and equipment, net 68,125 48,817 Operating lease right-of-use assets 16,584 18,474 Long-term investments 463,542 204,798 Deferred contract acquisition costs, non-current 77,362 71,640 Intangible assets, net 113,729 122,903 Goodwill 629,636 549,411 Other assets 7,051 8,033 Total assets $2,367,020 $2,321,407 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable $9,706 $6,759 Accrued liabilities 122,518 104,671 Accrued payroll and benefits 69,624 74,345 Operating lease liabilities, current 5,120 4,689 Deferred revenue, current 400,515 399,603 Total current liabilities 607,483 590,067 Deferred revenue, non-current 97,526 114,930 Operating lease liabilities, non-current 14,975 18,239 Other liabilities 7,513 4,128 Total liabilities 727,497 727,364 STOCKHOLDERS’ EQUITY Preferred stock — — Class A common stock 29 27 Class B common stock 3 3 Additional paid-in capital 3,193,601 2,934,607 Accumulated other comprehensive income (loss) 2,587 (1,550) Accumulated deficit (1,556,697) (1,339,044) Total stockholders’ equity 1,639,523 1,594,043 Total liabilities and stockholders’ equity $2,367,020 $2,321,407 SENTINELONE, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands) (unaudited)

Q3 FY2025 Letter to SharehoLderSSENTINELONE 20 Three Months Ended Oct. 31, Nine Months Ended Oct. 31, 2024 2023 2024 2023 Revenue $210,648 $164,165 $595,940 $446,979 Cost of revenue(1) 53,260 43,765 154,096 131,015 Gross profit 157,388 120,400 441,844 315,964 OPERATING EXPENSES Research and development(1) 70,453 52,306 192,376 161,730 Sales and marketing(1) 123,713 98,249 359,160 295,682 General and administrative(1) 52,342 51,239 139,409 151,425 Restructuring(1) — 74 — 4,329 Total operating expenses 246,508 201,868 690,945 613,166 Loss from operations (89,120) (81,468) (249,101) (297,202) Interest income 12,696 11,877 37,631 33,901 Interest expense (38) (1) (110) (1,213) Other income (expense), net (378) 605 (838) 1,655 Loss before income taxes (76,840) (68,987) (212,418) (262,859) Provision for income taxes 1,524 1,317 5,235 3,852 Net loss $(78,364) $(70,304) $(217,653) $(266,711) Net loss per share attributable to Class A and Class B common stockholders, basic and diluted $(0.25) $(0.24) $(0.70) $(0.91) Weighted-average shares used in computing net loss per share attributable to Class A and Class B common stockholders, basic and diluted 316,987,303 296,650,848 312,583,956 292,755,742 (1) INCLUDES STOCK-BASED COMPENSATION EXPENSE AS FOLLOWS Cost of revenue $5,810 $4,329 $16,243 $12,570 Research and development 22,816 15,634 61,092 45,876 Sales and marketing 18,612 14,085 55,568 40,362 General and administrative 22,950 20,865 60,515 65,560 Restructuring — — — (1,060) Total stock-based compensation expense $70,188 $54,913 $193,418 $163,308 SENTINELONE, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except share and per share data) (unaudited)

Q3 FY2025 Letter to SharehoLderSSENTINELONE 21 Nine Months Ended Oct. 31, 2024 2023 CASH FLOW FROM OPERATING ACTIVITIES Net loss $(217,653) $(266,711) Adjustments to reconcile net loss to net cash provided by (used in) operating activities: Depreciation and amortization 31,825 28,549 Amortization of deferred contract acquisition costs 48,297 34,699 Non-cash operating lease costs 2,981 3,010 Stock-based compensation expense 193,418 163,308 Loss on disposal of assets 1,481 1,116 Accretion of discounts and amortization of premiums on investments, net (10,536) (16,289) Net gain on strategic investments (345) (2,706) Other 302 (479) Changes in operating assets and liabilities, net of effects of acquisitions Accounts receivable 49,980 18,846 Prepaid expenses and other assets 5,987 10,075 Deferred contract acquisition costs (60,133) (47,289) Accounts payable 2,975 1,935 Accrued liabilities 14,557 (220) Accrued payroll and benefits (4,702) (1,998) Operating lease liabilities (3,925) (4,650) Deferred revenue (17,163) 16,311 Other liabilities (217) 301 Net cash provided by (used in) operating activities 37,129 (62,192) CASH FLOW FROM INVESTING ACTIVITIES Purchases of property and equipment (1,666) (1,117) Purchases of intangible assets (149) (3,436) Capitalization of internal-use software (19,795) (9,687) Purchases of investments (597,614) (462,539) Sales and maturities of investments 594,879 504,340 Cash paid for acquisitions, net of cash acquired (61,553) — Net cash (used in) provided by investing activities (85,898) 27,561 CASH FLOW FROM FINANCING ACTIVITIES Repurchase of early exercised stock options (21) — Proceeds from exercise of stock options 22,888 17,366 Proceeds from issuance of common stock under the employee stock purchase plan 8,800 6,416 Net cash provided by financing activities 31,667 23,782 NET CHANGE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH (17,102) (10,849) CASH, CASH EQUIVALENTS, AND RESTRICTED CASH–BEGINNING OF PERIOD 322,086 202,406 CASH, CASH EQUIVALENTS, AND RESTRICTED CASH–END OF PERIOD $304,984 $191,557 SENTINELONE, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) (unaudited)

Q3 FY2025 Letter to SharehoLderSSENTINELONE 22 Three Months Ended Oct. 31, Nine Months Ended Oct. 31, 2024 2023 2024 2023 COST OF REVENUE RECONCILIATION GAAP cost of revenue $53,260 $43,765 $154,096 $131,015 Stock-based compensation expense (5,810) (4,329) (16,243) (12,570) Employer payroll tax on employee stock transactions (158) (114) (497) (240) Amortization of acquired intangible assets (4,195) (5,139) (13,861) (15,250) Acquisition-related compensation (38) (128) (350) (379) Inventory write-offs due to restructuring — — — (720) Non-GAAP cost of revenue $43,059 $34,055 $123,145 $101,856 GROSS PROFIT RECONCILIATION GAAP gross profit $157,388 $120,400 $441,844 $315,964 Stock-based compensation expense 5,810 4,329 16,243 12,570 Employer payroll tax on employee stock transactions 158 114 497 240 Amortization of acquired intangible assets 4,195 5,139 13,861 15,250 Acquisition-related compensation 38 128 350 379 Inventory write-offs due to restructuring — — — 720 Non-GAAP gross profit $167,589 $130,110 $472,795 $345,123 GROSS MARGIN RECONCILIATION GAAP gross margin 75% 73% 74% 71% Stock-based compensation expense 3% 3% 3% 3% Employer payroll tax on employee stock transactions —% —% —% —% Amortization of acquired intangible assets 2% 3% 2% 3% Acquisition-related compensation —% —% —% —% Inventory write-offs due to restructuring —% —% —% —% Non-GAAP gross margin* 80% 79% 79% 77% RESEARCH AND DEVELOPMENT EXPENSE RECONCILIATION GAAP research and development expense $70,453 $52,306 $192,376 $161,730 Stock-based compensation expense (22,816) (15,634) (61,092) (45,876) Employer payroll tax on employee stock transactions (164) (116) (775) (467) Acquisition-related compensation (790) (297) (2,366) (920) Non-GAAP research and development expense $46,683 $36,259 $128,143 $114,467 SENTINELONE, INC. Reconciliation of GAAP to Non-GAAP Financial Measures (in thousands, except percentages and per share data) (unaudited)

Q3 FY2025 Letter to SharehoLderSSENTINELONE 23 Three Months Ended Oct. 31, Nine Months Ended Oct. 31, 2024 2023 2024 2023 SALES AND MARKETING EXPENSE RECONCILIATION GAAP sales and marketing expense $123,713 $98,249 $359,160 $295,682 Stock-based compensation expense (18,612) (14,085) (55,568) (40,362) Employer payroll tax on employee stock transactions (290) (177) (1,583) (751) Amortization of acquired intangible assets (2,253) (1,955) (6,710) (5,816) Acquisition-related compensation (27) (125) (100) (538) Non-GAAP sales and marketing expense $102,531 $81,907 $295,199 $248,215 GENERAL AND ADMINISTRATIVE EXPENSE RECONCILIATION GAAP general and administrative expense $52,342 $51,239 $139,409 $151,425 Stock-based compensation expense (22,950) (20,865) (60,515) (65,560) Employer payroll tax on employee stock transactions (335) (242) (1,318) (668) Amortization of acquired intangible assets — — — (2) Acquisition-related compensation (1) (2) (1) (383) Non-GAAP general and administrative expense $29,056 $30,130 $77,575 $84,812 RESTRUCTURING EXPENSE RECONCILIATION GAAP restructuring expense $— $74 $— $4,329 Other restructuring charges — (74) — (5,389) Stock-based compensation expense — — — 1,060 Non-GAAP restructuring expense $— $— $— $— OPERATING LOSS RECONCILIATION GAAP operating loss $(89,120) $(81,468) $(249,101) $(297,202) Stock-based compensation expense 70,188 54,913 193,418 163,308 Employer payroll tax on employee stock transactions 947 649 4,173 2,126 Amortization of acquired intangible assets 6,448 7,094 20,571 21,068 Acquisition-related compensation 856 552 2,817 2,220 Inventory write-offs due to restructuring — — — 720 Other restructuring charges — 74 — 5,389 Non-GAAP operating loss $(10,681) $(18,186) $(28,122) $(102,371) SENTINELONE, INC. Reconciliation of GAAP to Non-GAAP Financial Measures (in thousands, except percentages and per share data) (unaudited)

Q3 FY2025 Letter to SharehoLderSSENTINELONE 24 Three Months Ended Oct. 31, Nine Months Ended Oct. 31, 2024 2023 2024 2023 OPERATING MARGIN RECONCILIATION GAAP operating margin (42)% (50)% (42)% (66)% Stock-based compensation expense 33% 33% 32% 37% Employer payroll tax on employee stock transactions —% —% 1% —% Amortization of acquired intangible assets 3% 4% 3% 5% Acquisition-related compensation —% —% —% —% Inventory write-offs due to restructuring —% —% —% —% Other restructuring charges —% —% —% 1% Non-GAAP operating margin* (5)% (11)% (5)% (23)% NET LOSS RECONCILIATION GAAP net loss $(78,364) $(70,304) $(217,653) $(266,711) Stock-based compensation expense 70,188 54,913 193,418 163,308 Employer payroll tax on employee stock transactions 947 649 4,173 2,126 Amortization of acquired intangible assets 6,448 7,094 20,571 21,068 Acquisition-related compensation 856 552 2,817 2,220 Inventory write-offs due to restructuring — — — 720 Other restructuring charges — 74 — 5,389 Net gain on strategic investments — (703) (345) (2,703) Non-GAAP net income (loss) $75 $(7,725) $2,981 $(74,583) GAAP basic and diluted shares 316,987,303 296,650,848 312,583,956 292,755,742 Dilutive shares under the treasury stock method 18,066,319 — 19,385,520 — Non-GAAP diluted shares 335,053,622 296,650,848 331,969,476 292,755,742 DILUTED EPS RECONCILIATION GAAP net loss per share, basic and diluted $(0.25) $(0.24) $(0.70) $(0.91) Stock-based compensation expense 0.21 0.19 0.58 0.56 Employer payroll tax on employee stock transactions — — 0.01 0.01 Amortization of acquired intangible assets 0.02 0.02 0.06 0.07 Acquisition-related compensation — — 0.01 0.01 Inventory write-offs due to restructuring — — — — Other restructuring charges — — — 0.02 Net gain on strategic investments — — — (0.01) Adjustment to fully diluted earnings per share (1) 0.02 — 0.05 — Non-GAAP net income (loss) per share, diluted $— $(0.03) $0.01 $(0.25) SENTINELONE, INC. Reconciliation of GAAP to Non-GAAP Financial Measures (in thousands, except percentages and per share data) (unaudited) *Certain figures may not sum due to rounding. (1) For periods in which we had diluted non-GAAP net income per share, the sum of the impact of individual reconciling items may not total to diluted non-GAAP net income per share because the basic share counts used to calculate GAAP net loss per share differ from the diluted share counts used to calculate non-GAAP net income per share, and because of rounding differences. The GAAP net loss per share calculation uses a lower share count as it excludes dilutive shares which are included in calculating the non-GAAP net income per share.

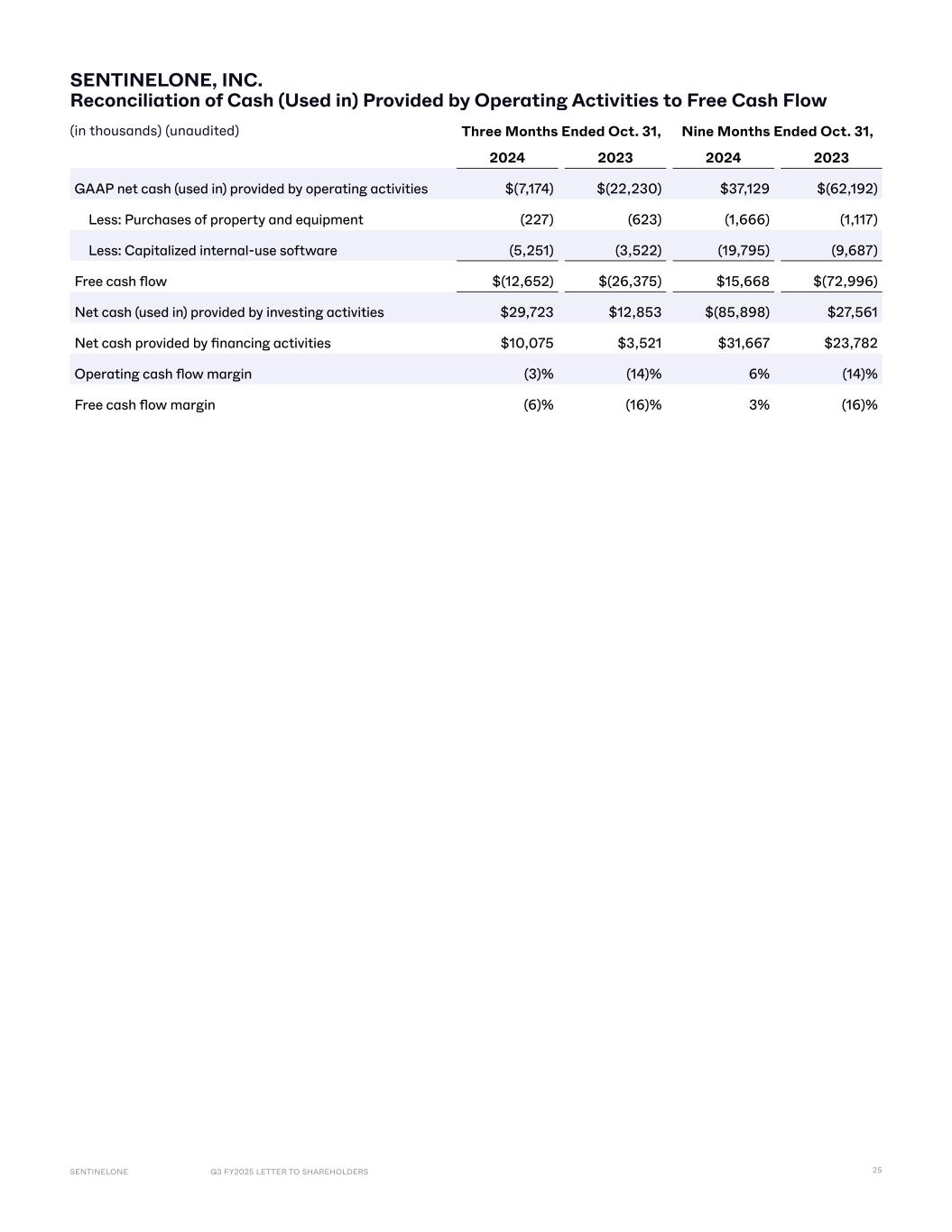

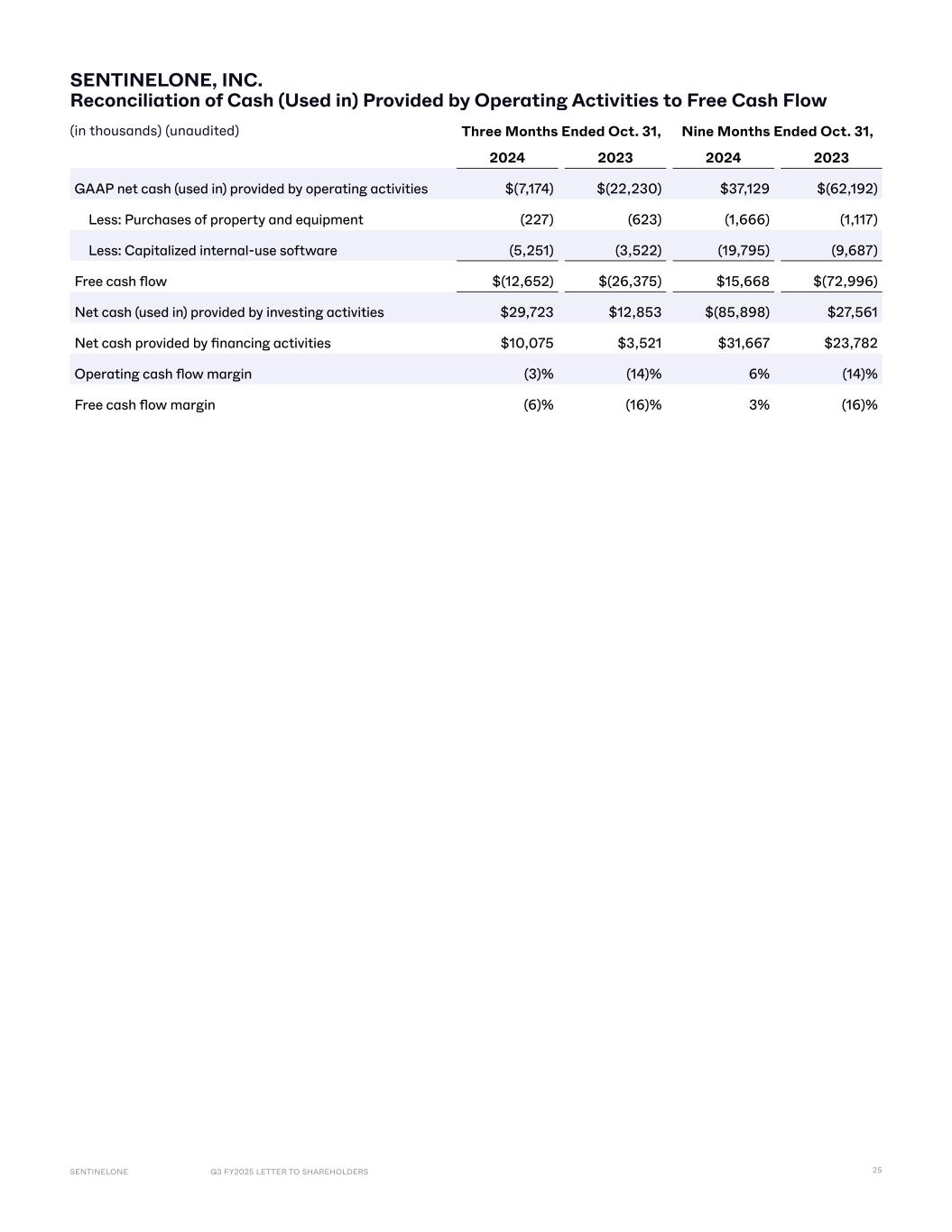

Q3 FY2025 Letter to SharehoLderSSENTINELONE 25 Three Months Ended Oct. 31, Nine Months Ended Oct. 31, 2024 2023 2024 2023 GAAP net cash (used in) provided by operating activities $(7,174) $(22,230) $37,129 $(62,192) Less: Purchases of property and equipment (227) (623) (1,666) (1,117) Less: Capitalized internal-use software (5,251) (3,522) (19,795) (9,687) Free cash flow $(12,652) $(26,375) $15,668 $(72,996) Net cash (used in) provided by investing activities $29,723 $12,853 $(85,898) $27,561 Net cash provided by financing activities $10,075 $3,521 $31,667 $23,782 Operating cash flow margin (3)% (14)% 6% (14)% Free cash flow margin (6)% (16)% 3% (16)% SENTINELONE, INC. Reconciliation of Cash (Used in) Provided by Operating Activities to Free Cash Flow (in thousands) (unaudited)

Contact Us investors@sentinelone.com sentinelone.com © Sentinelone 2024 About SentinelOne Sentinelone (NYSe:S) is pioneering autonomous cybersecurity to prevent, detect, and respond to cyber attacks faster and with higher accuracy than ever before. our Singularity Xdr platform protects and empowers leading global enterprises with real-time visibility into attack surfaces, cross-platform correlation, and aI-powered response. achieve more capability with less complexity.