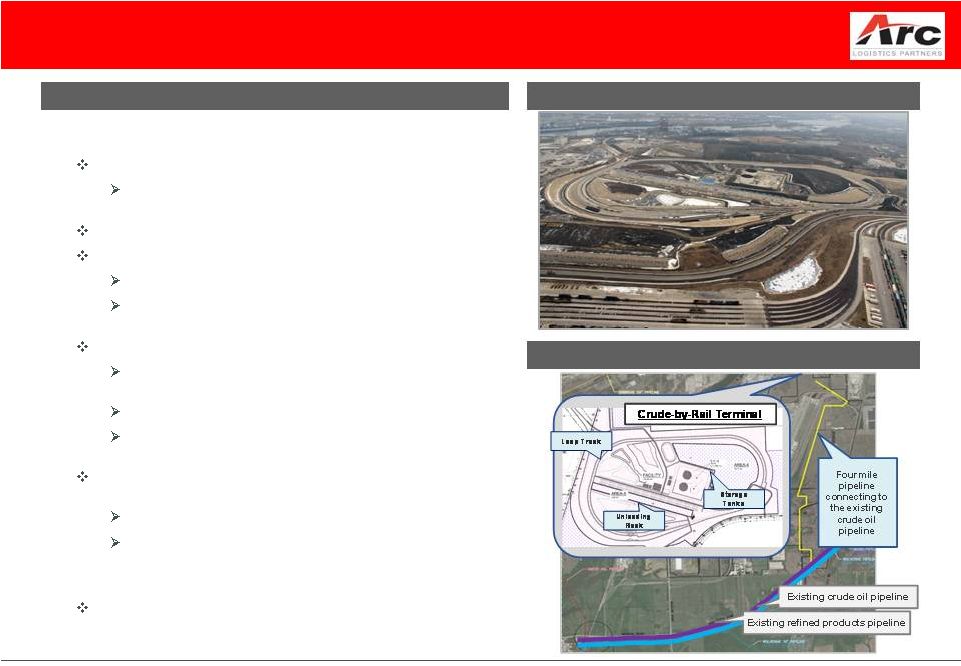

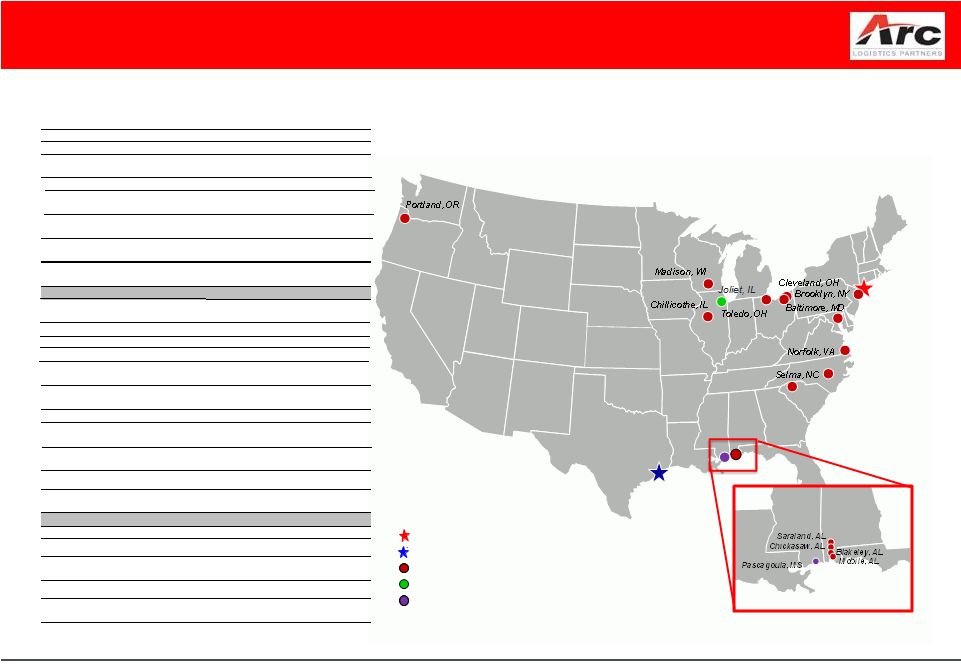

Cautionary Note Forward-Looking Statements 2 Certain statements and information in this presentation constitute "forward-looking statements." Certain expressions including "believe," "expect,“ “intends,” or other similar expressions are intended to identify Arc Logistics Partners LP’s (the “Partnership,” or “Arc Logistics”) current expectations, opinions, views or beliefs concerning future developments and their potential effect on the Partnership. While management believes that these forward-looking statements are reasonable when made, there can be no assurance that future developments affecting the Partnership will be those that it anticipates. The forward-looking statements involve significant risks and uncertainties (some of which are beyond the Partnership's control) and assumptions that could cause actual results to differ materially from the Partnership's historical experience and its present expectations or projections. Important factors that could cause actual results to differ materially from forward looking statements include but are not limited to: (i) adverse economic, capital markets and political conditions; (ii) changes in the market place for the Partnership's services; (iii) changes in supply and demand of crude oil and petroleum products; (iv) actions and performance of the Partnership's customers, vendors or competitors; (v) changes in the cost of or availability of capital; (vi) unanticipated capital expenditures in connection with the construction, repair or replacement of the Partnership's assets; (vii) operating hazards, unforeseen weather events or matters beyond the Partnership's control; (viii) effects of existing and future laws or governmental regulations; and (ix) litigation. Additional information concerning these and other factors that could cause the Partnership's actual results to differ from projected results can be found in the Partnership's public periodic filings with the Securities and Exchange Commission, including the Partnership's Annual Report on Form 10-K for the year ended December 31, 2013 and any updates thereto in the Partnership’s subsequent quarterly reports on Form 10-Q and current reports on Forms 8-K. In addition, there are significant risks and uncertainties relating to the Partnership’s pending acquisition of Joliet Bulk, Barge & Rail LLC (“JBBR”) and, if the Partnership acquires JBBR, its ownership of JBBR, including (a) the acquisition may not be consummated, (b) the representations, warranties and indemnifications by CenterPoint Properties Trust (“CenterPoint” or the “Seller”) are limited in the purchase and sale agreement, and the Partnership’s diligence into the business has been limited and, as a result, the assumptions on which its estimates of future results of the business have been based may prove to be incorrect in a number of material ways, which could result in the Partnership not realizing the expected benefits of the acquisition and/or being exposed to material liabilities, (c) using debt to finance, in part, the acquisition will substantially increase the Partnership’s indebtedness, (d) the ability of the Partnership to successfully integrate JBBR’s operations and realize anticipated benefits of the acquisition, (e) the potential impact of the announcement or consummation of the pending acquisition on relationships, including with employees, suppliers, customers and competitors, (f) the Partnership's obligation to close the acquisition is not conditioned on the completion of its debt or equity financing, and if the Partnership fails to satisfy its obligation to consummate the acquisition after all conditions precedent to such obligation have been satisfied, it is reasonably possible that such event would have a material adverse effect on the Partnership's ability to pay cash distributions to its unitholders (at least in the short-term), (g) following the consummation of the acquisition, JBBR will depend on one customer for substantially all of its revenue, there is no guarantee that JBBR will be able to attract and retain additional customers or develop additional sources of revenue, and the loss of this customer could materially adversely affect the Partnership’s results of operations and cash flow, (h) upon closing of the acquisition, the JBBR rail unloading terminal will be a newly constructed facility, and following commencement of operations, the facility may not operate efficiently or reliably, which could adversely affect the Partnership’s results of operations and cash flows, (i) the loading and unloading (including by rail) of crude oil and other petroleum products is subject to many risks and operational hazards, and the transportation of crude by rail may be subject to increased regulation, (j) following the closing of the acquisition, the Partnership’s 60% ownership interest in JBBR will be held, indirectly, through a joint venture company (referred to herein as the “JBBR Joint Venture Company”) that will own 100% of JBBR, and the consent of GE Energy Financial Services, Inc. or an affiliate thereof (which will own the remaining 40% of JBBR Joint Venture Company) will be required with respect to certain business decisions relative to the operation, ownership and governance of JBBR Joint Venture Company as well as its subsidiaries, including JBBR. These factors are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of the forward-looking statements contained herein. Other unknown or unpredictable factors could also have material adverse effects on the Partnership’s future results. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date thereof. The Partnership undertakes no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise. The Partnership does not, as a matter of course, disclose projections as to future operations, earnings or other results. However, the Partnership has included herein certain prospective financial information, including estimated EBITDA. This information was not prepared with a view toward disclosure, but, in the view of the Partnership’s management, was prepared on a reasonable basis, reflects the best currently available estimates and judgments and presents, to the best of the Partnership’s knowledge and belief, the expected course of action and expected future financial performance of the assets. However, this information is not fact and should not be relied upon as being indicative of future results, and readers of this presentation are cautioned not to place undue reliance on the prospective financial information. |