Pawnee Terminal Acquisition July 2015 Exhibit 99.2 |

2 Cautionary Note Forward Looking Statements Certain statements and information in this presentation may constitute "forward-looking statements." Certain expressions including "believe," “intends,” "expect," or other similar expressions are intended to identify Arc Logistics Partners LP’s (the “Partnership”) current expectations, opinions, views or beliefs concerning future developments and their potential effect on the Partnership. While management believes that these forward-looking statements are reasonable when made, there can be no assurance that future developments affecting the Partnership will be those that it anticipates. The forward-looking statements involve significant risks and uncertainties (some of which are beyond the Partnership's control) and assumptions that could cause actual results to differ materially from the Partnership's historical experience and its present expectations or projections. Important factors that could cause actual results to differ materially from forward looking statements include but are not limited to: (i) adverse economic, capital markets and political conditions; (ii) changes in the marketplace for the Partnership's services; (iii) changes in supply and demand of crude oil and petroleum products; (iv) actions and performance of the Partnership's customers, vendors or competitors; (v) changes in the cost of or availability of capital; (vi) unanticipated capital expenditures in connection with the construction, repair or replacement of the Partnership's assets; (vii) operating hazards, unforeseen weather events or matters beyond the Partnership's control; (viii) inability to consummate acquisitions, pending or otherwise, on acceptable terms and successfully integrate acquired businesses into the Partnership’s operations; (ix) effects of existing and future laws or governmental regulations; and (x) litigation. Additional information concerning these and other factors that could cause the Partnership's actual results to differ from projected results can be found in the Partnership's public periodic filings with the Securities and Exchange Commission, including the Partnership's Annual Report on Form 10-K for the year ended December 31, 2014 and any updates thereto in the Partnership’s subsequent quarterly reports on Form 10-Q and current reports on Form 8-K. In addition, there are significant risks and uncertainties relating to the Partnership’s acquisition of UET Midstream, LLC (“UET Midstream”), including (a) the representations, warranties and indemnifications by United Energy Trading, LLC and Hawkeye Midstream, LLC are limited in the contribution agreement governing the acquisition, and the Partnership’s diligence into UET Midstream and the business has been limited and, as a result, the assumptions upon which the Partnership’s estimates of future results of the business have been based may prove to be incorrect in a number of material ways, which could result in the Partnership not realizing the expected benefits of the acquisition and/or being exposed to material liabilities, (b) using debt to finance, in part, the acquisition will materially increase the Partnership’s indebtedness, (c) the ability of the Partnership to successfully integrate UET Midstream’s operations and realize anticipated benefits of the acquisition, (d) the potential impact of the announcement or consummation of the acquisition on relationships, including with employees, suppliers, customers and competitors, (e) certain portions of the crude oil terminal remain under construction, and therefore, completion of the construction of the terminal could be delayed, actual completion costs could exceed expected completion costs and the terminal may fail to operate efficiently or reliably, (f) the Partnership’s ability to attract and maintain customers in a limited number of geographic areas; (g) seasonal weather conditions adversely affecting drilling activities in the Denver-Julesburg Basin and UET Midstream’s ability to operate the business and (h) certain of UET Midstream’s customers are dependent on a limited number of crude oil producers, and a material reduction in production, for any reason, by these producers could adversely affect the desire of the current customers to renew their existing contracts or the ability of UET Midstream to attract replacement customers. These factors are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of the forward-looking statements contained herein. Other unknown or unpredictable factors could also have material adverse effects on the Partnership’s future results. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date thereof. The Partnership undertakes no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise. The Partnership does not, as a matter of course, disclose projections as to future operations, earnings or other results. However, the Partnership has included herein certain prospective financial information, including estimated EBITDA. This information was not prepared with a view toward disclosure, but, in the view of the Partnership’s management, was prepared on a reasonable basis, reflects the best currently available estimates and judgments and presents, to the best of the Partnership’s knowledge and belief, the expected course of action and expected future financial performance of the assets. However, this information is not fact and should not be relied upon as being indicative of future results, and readers of this presentation are cautioned not to place undue reliance on the prospective financial information. |

Pawnee Terminal Acquisition Overview Arc Logistics Partners LP (the “Partnership”) has acquired from United Energy Trading, LLC and Hawkeye Midstream, LLC (collectively, the “Sellers”) all of the limited liability company interests of UET Midstream, LLC (“UET Midstream”), the owner and operator of terminal and development assets in Weld County, Colorado, for an adjusted purchase price of approximately $76.6 million, consisting of cash and common units. The acquired assets include a substantially completed crude oil terminal (the “Pawnee Terminal”) and land for future development opportunities Pawnee Terminal: Crude oil terminal commenced operations on May 1 and has 200,000 bbls of existing storage capacity with room for expansion Serves as the primary injection point to Pony Express Pipeline, LLC’s Northeast Colorado Lateral (“PXP-NECL”) with ultimate delivery to Cushing, Oklahoma Operating under several five-year contracts, with full-term take-or-pay commitments 9.4 acres of land for development opportunities to support future commercial opportunities Partnership is assuming responsibility and control of all remaining construction post-closing The Pawnee Terminal is expected to immediately contribute an estimated initial minimum contracted EBITDA (1) of $9.0 million to $9.5 million on an annualized basis Represents a 9.5x acquisition multiple (purchase plus remaining capital expenditures) using the mid-point of projected first year EBITDA Adjusted purchase price of approximately $76.6 million plus estimated additional capital expenditures of $11.0 million Increasing volume commitments and associated revenues will reduce acquisition multiple to less than 8.0x in 2018E Immediately accretive to distributable cash flow per unit 3 1. Estimated initial minimum contracted EBITDA attributable to the Pawnee Terminal. Projection assumes minimum contracted revenue, minimum volumes and forecasted operating expenses for the estimated annual period following the Pawnee Terminal acquisition. Please see reconciliation pages in the appendix for further detail. |

Pawnee Terminal Pawnee Terminal Overview 4 Commercial operations began on May 1, 2015 Current inbound receipt capacity up to 150,000 bbls/d via truck unloading and gathering systems Currently throughputting approximately 45,000 bbls/d 200,000 bbls of commingled storage capacity Permits in place for construction of a third tank for additional storage capacity Supported by five-year commercial agreements Fee-based throughput agreements Take-or-pay commitments with annual volumetric increases Partnership controlling the completion of the remaining construction Remaining construction work principally includes punch list related activities Other projected terminal upgrades include installation of a third tank and a fire protection system Pawnee Terminal Development opportunities The Partnership is also acquiring additional development land to expand terminal operations in the Denver-Julesberg Basin Site is located 11.5 miles south of the Pawnee Terminal Will provide enhanced accessibility for customers Receipt of initial permits to construct a 100,000 bbl terminal to support additional commercial opportunities Capable of connecting to PXP-NECL |

Strategic Rationale 5 Expansion into PADD IV Expansion of crude oil logistics assets Platform in PADD IV with identified future growth opportunities Opportunity for the Partnership to expand and develop commercial relationships with NE Weld County, CO crude oil producers Long-term Strategic Value Newly constructed crude oil terminal in the Denver-Julesberg Basin Only non-producer owned connection to PXP-NECL Only non-proprietary access point to an interstate pipeline within 75 miles Take-or-pay contracts with a weighted average contract life of five years generating stable, fee-based cash flow Customer base includes a mix of independent marketers, independent refiners and diversified E&P companies Platform for Growth Take-or-pay volume commitments increasing 7% annually Estimated NE Colorado crude oil production growth of approximately 9% year- over-year through 2025 Take-or-pay volume commitments align Pawnee Terminal commercial profile with customers’ access to anticipated crude oil production growth Opportunity to acquire up to 25% of certain local crude oil gathering project developed by the Sellers, at cost The Partnership will also retain a ROFR to acquire the remaining 75% owned by the Sellers Acquiring land to support future terminal development opportunities |

Execution of Long-Term Strategic Objectives 6 The Partnership’s Statistics 2014 PF Joliet (1) / Pawnee % Increase over FYE 2014 Adjusted EBITDA (2) $30.2 mm $54.3 (3) mm 80% Weighted Average Contract Life 3.0 Years 3.2 Years 7% Capacity Under Contract 71% 82% 15% Revenue Under “Take-or-Pay” 73% 85% 17% Storage Capacity (bbls) 6.4 mm 6.9 mm 8% 1. Except for the calculation of Adjusted EBITDA, which is calculated using the Partnership’s 60% ownership interest in the Joliet Terminal, the operating statistics below are based on 100% of the Joliet Terminal. 2. Adjusted EBITDA is a non-GAAP measure. Please see reconciliation pages in the appendix to this presentation. 3. Represents the mid-point of the EBITDA ranges provided. Transaction represents the continued execution of the Partnership’s strategic objectives to support its customers’ long-term commercial needs while creating long-term value for its unitholders |

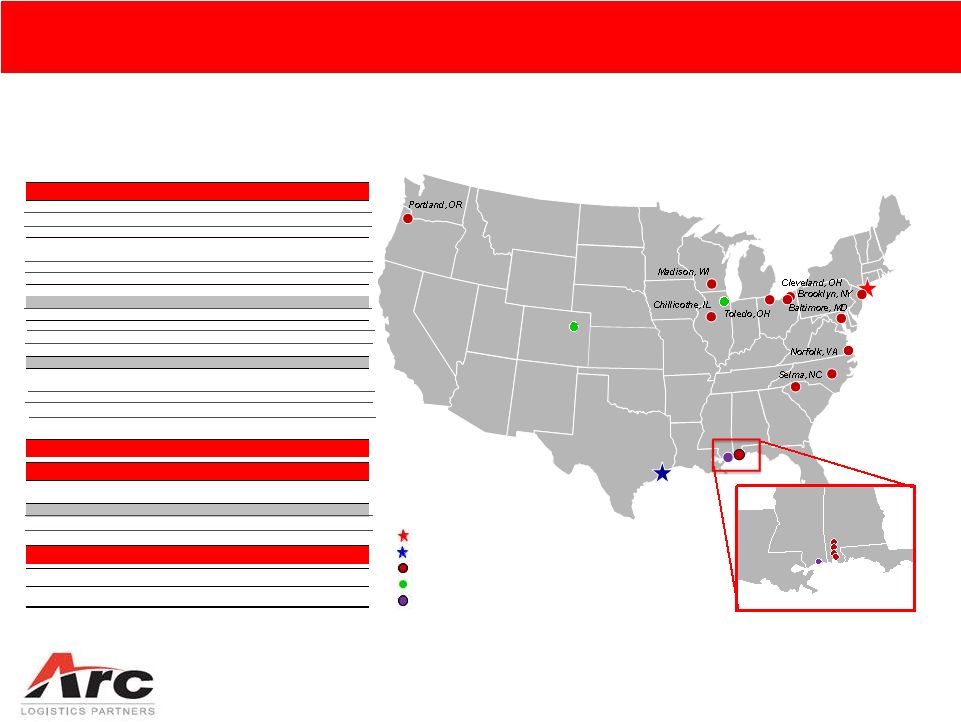

Expansion of Diversified Portfolio of Logistics Assets 7 The Partnership continues to acquire logistics assets that serve as a critical link between supply and local demand locations 1. The capacity represents our 50% share of the 884,000 barrels of available total storage capacity of the Baltimore, MD terminal and the 165,000 barrels of available total storage capacity of the Spartanburg, SC terminal. The terminals are co-owned with and operated by CITGO Petroleum Corporation. 2. The physical location of this terminal is in Mobile, AL. 3. The physical location of this terminal is in Chesapeake, VA. 4. Represents 100% of the Joliet Terminal. 5. The capacity represents the full capacity of the LNG Facility. We own a 10.3% interest in Gulf LNG Holdings, which owns the LNG Facility. Joliet, IL 2015 Acquisitions Information provided as of July 9, 2015 Pawnee, CO 14 mbpd 18 mbpd Location Capacity Products Terminals Baltimore, MD (1) 442 mbbls Gasoline; Distillates; Ethanol Blakeley, AL (2) 708 mbbls Crude Oil; Asphalt; Fuel Oil; Chemicals Brooklyn, NY 63 mbbls Gasoline; Ethanol Chickasaw, AL 609 mbbls Crude Oil; Distillates; Fuel Oil; Crude Tall Oil Chillicothe, IL 273 mbbls Gasoline; Distillates; Ethanol; Biodiesel Cleveland, OH – North 426 mbbls Gasoline; Distillates; Ethanol; Biodiesel Cleveland, OH – South 191 mbbls Gasoline; Distillates; Ethanol; Biodiesel Joliet, IL (4) 300 mbbls Crude Oil; Dry bulk Madison, WI 150 mbbls Gasoline; Distillates; Ethanol; Biodiesel Mobile, AL – Main 1,093 mbbls Crude Oil; Asphalt; Fuel Oil Mobile, AL – Methanol 294 mbbls Methanol Norfolk, VA (3) 213 mbbls Gasoline; Distillates; Ethanol Pawnee, CO 200 mbbls Crude Oil Portland, OR 1,466 mbbls Crude Oil; Asphalt; Aviation Gas; Distillates Selma, NC 171 mbbls Gasoline; Distillates; Ethanol; Biodiesel Spartanburg, SC (1) 83 mbbls Gasoline; Distillates; Ethanol Toledo, OH 244 mbbls Gasoline; Distillates; Aviation Gas; Ethanol; Biodiesel Total Terminals 6,925 mbbls Crude Oil Loading / Transloading Facilities Chickasaw, AL 9 mbpd Crude Oil; Distillates; Fuel Oil; Crude Tall Oil; Chemicals Joliet, IL (4) 85 mbpd Crude Oil Portland, OR Crude Oil Saraland, AL Crude Oil; Chemicals Total Transloading 126 mbpd LNG Facility Pascagoula, MS (5) 320,000 M 3 Liquefied natural gas Saraland, AL Chickasaw, AL Blakeley, AL Mobile, AL Pascagoula, MS Terminals and Transloading Facilities Arc Terminals Headquarters Arc Logistics Headquarters NG Facility |

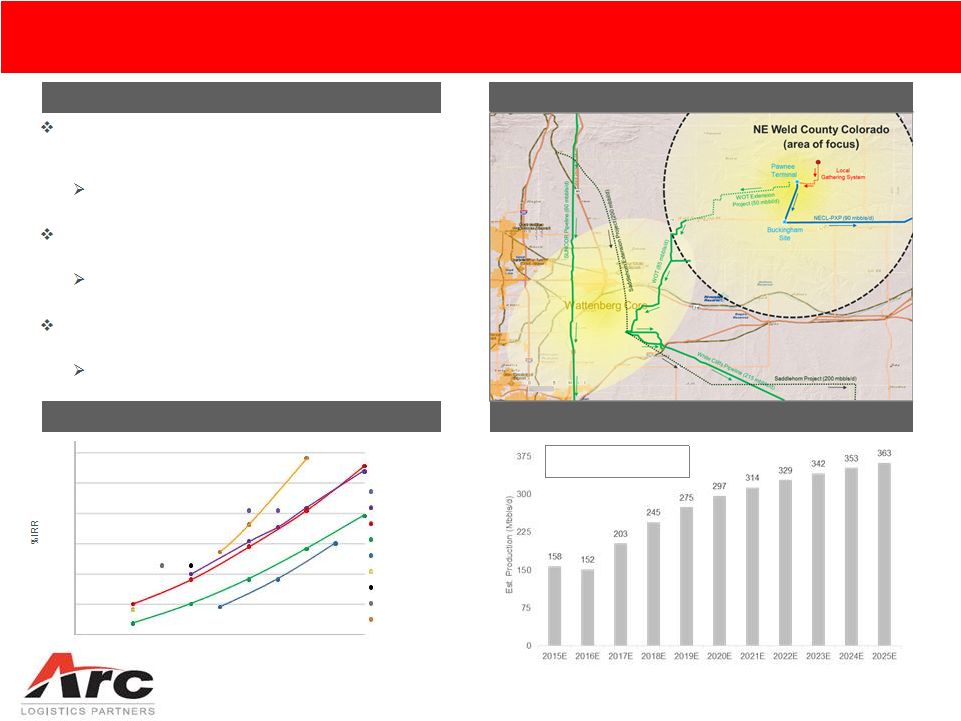

Overview NE Weld County Colorado Overview 8 2015E NE Weld County Colorado production of 158,000 bbls/d expected to grow to 363,000 bbls/d by 2025E Production focuses on a lower gravity crude oil than the Wattenberg Core High-focus region for several large independent producers Production remains economic during certain low crude oil pricing environments Limited existing takeaway capacity in NE Weld County Colorado Saddlehorn and Grand Mesa projects focused on Wattenberg Core production NE Weld County Colorado Production Growth Sources: Energy Analysts International, Inc; RBN Energy, LLC.; Company Presentations. NE Weld County Colorado Producer Returns Pawnee Terminal Location Overview Annual Production Growth Forecast: 8.7% 0.0% 11.0% 22.0% 33.0% 44.0% 55.0% 66.0% $30.00 $40.00 $50.00 $60.00 $70.00 $80.00 Producer A Producer B Producer C Producer C - sub play Producer D Producer E Producer G Producer F Producer H |

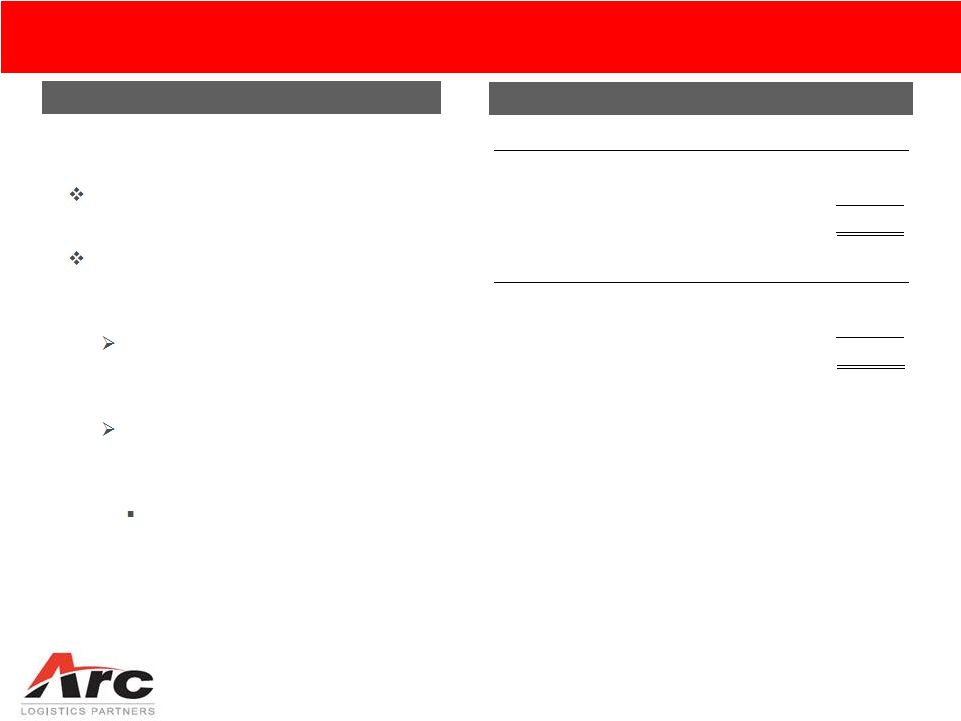

Transaction Structure Financing Overview 9 Acquisition of all the limited liability company interests of UET Midstream Adjusted purchase price of approximately $76.6 million Consideration of approximately $44.3 million in cash and approximately $32.3 million in common units Approximately 1.746 million common units issued to the Sellers at $18.50 per unit Cash portion financed with borrowings under existing revolving credit facility Facility upsized to $300.0 million to provide Partnership with additional liquidity Sources and Uses of Capital ($million) Sources of Capital ARCX common units 32.3 $ Credit facility borrowings 55.3 Total sources of capital 87.6 $ Uses of Capital Purchase UET Midstream 76.6 $ Estimated capital expenditures 11.0 Total uses of capital 87.6 $ |

Questions |

Appendix |

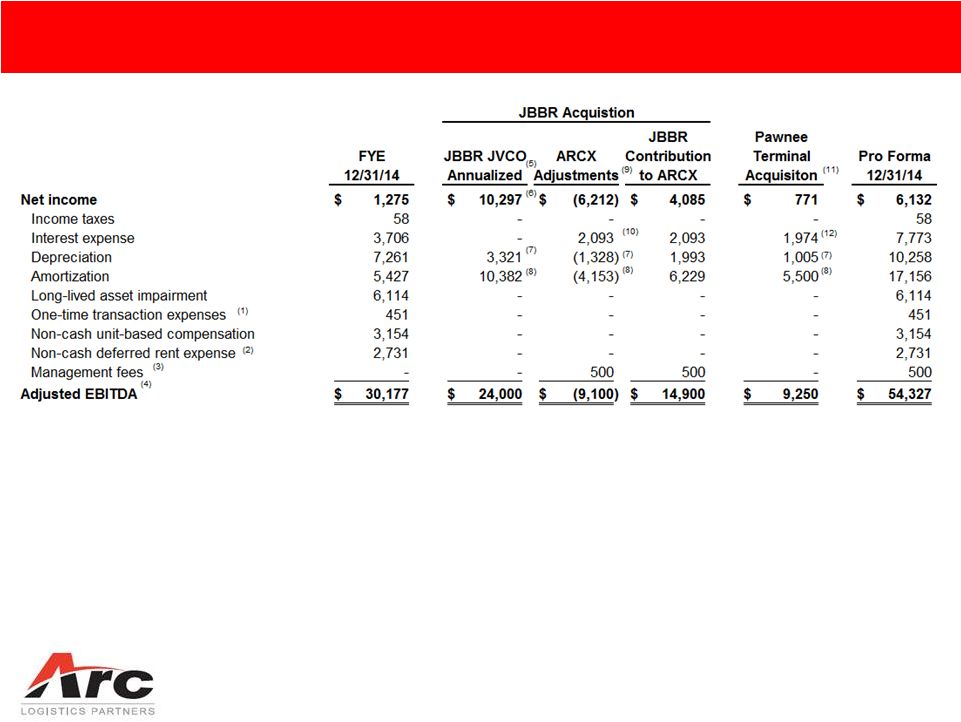

12 Non-GAAP Financial Measures Non-GAAP Financial Measures The Partnership defines Adjusted EBITDA as net income before interest expense, income taxes and depreciation and amortization expense, as further adjusted for other non-cash charges and other charges that are not reflective of our ongoing operations. Adjusted EBITDA is a non-GAAP financial measure that management and external users of the Partnership's consolidated financial statements, such as industry analysts, investors, lenders and rating agencies may use to assess (i) the performance of the Partnership's assets without regard to the impact of financing methods, capital structure or historical cost basis of the Partnership's assets; (ii) the viability of capital expenditure projects and the overall rates of return on alternative investment opportunities; (iii) the Partnership's ability to make distributions; (iv) the Partnership's ability to incur and service debt and fund capital expenditures; and (v) the Partnership's ability to incur additional expenses. The Partnership believes that the presentation of Adjusted EBITDA provides useful information to investors in assessing its financial condition and results of operations. The Partnership defines distributable cash flow as Adjusted EBITDA less (i) cash interest expense paid; (ii) cash income taxes paid; (iii) maintenance capital expenditures paid; and (iv) equity earnings from the Partnership’s interests in Gulf LNG Holdings Group, LLC (the “LNG Interest”); plus (v) cash distributions from the LNG Interest. Distributable cash flow is a non-GAAP financial measure that management and external users of the Partnership’s consolidated financial statements may use to evaluate whether the Partnership is generating sufficient cash flow to support distributions to its unitholders as well as measure the ability of the Partnership’s assets to generate cash sufficient to support its indebtedness and maintain its operations. The GAAP measure most directly comparable to Adjusted EBITDA and distributable cash flow is net income. Adjusted EBITDA and distributable cash flow should not be considered as an alternative to net income. Adjusted EBITDA and distributable cash flow have important limitations as analytical tools because they exclude some but not all items that affect net income. Readers should not consider Adjusted EBITDA or distributable cash flow in isolation or as a substitute for analysis of the Partnership's results as reported under GAAP. Additionally, because Adjusted EBITDA and distributable cash flow may be defined differently by other companies in the Partnership's industry, its definitions of Adjusted EBITDA and distributable cash flow may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. Please see the reconciliation of net income to Adjusted EBITDA in the accompanying tables. |

13 1) The one-time transaction expenses relate to due diligence and transaction expenses incurred in connection with acquisition related activity as described in the Partnership’s credit facility. 2) The non-cash deferred expense relates to the accounting treatment for the Portland Terminal lease transaction. 3) Pursuant to the management services agreement executed by GEFS and Arc Logistics, Arc Logistics is paid an annual fee of $500,000. 4) Adjusted EBITDA is a non-GAAP financial measure. 5) Mid-point of the projected EBITDA range for 100% of the Joliet Terminal between $24 million to $26 million, or $25 million. 6) Estimated net income attributable to 100% JBBR. Projection assumes minimum contracted revenue, minimum volumes and forecasted 3rd party operating expenses for the twelve months following May 14, 2015. 7) Estimated depreciation based on a preliminary purchase price allocation developed by management. 8) Estimated amortization based on a preliminary purchase price allocation developed by management. 9) Required adjustments to reflect the Partnership's 60% ownership in the joint venture which includes any costs associated with the debt financing. 10) Assumes $64.6 million of additional indebtedness at an interest rate of 3.5%. 11) Mid-point of the projected EBITDA range between $9.0 million to $9.5 million, or $9.3 million. 12) Assumes $56.4 million of additional indebtedness at an interest rate of 3.5%. Reconciliation to Adjusted EBITDA |