May Collections Update June 1, 2020

This document may contain “forward-looking” statements as defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements concern and are based upon, among other things, the possible expansion of the company’s portfolio; the sale of properties; the performance of its operators/tenants and properties; its ability to enter into agreements with new viable tenants for vacant space or for properties that the company takes back from financially troubled tenants, if any; its occupancy rates; its ability to acquire, develop and/or manage properties; the ability to successfully manage the risks associated with international expansion and operations; its ability to make distributions to shareholders; its policies and plans regarding investments, financings and other matters; its tax status as a real estate investment trust; its critical accounting policies; its ability to appropriately balance the use of debt and equity; its ability to access capital markets or other sources of funds; its ability to meet its earnings guidance; and its ability to finance and complete, and the effect of, future acquisitions. When the company uses words such as “may,” “will,” “intend,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate” or similar expressions, it is making forward-looking statements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties. The company’s expected results may not be achieved, and actual results may differ materially from expectations. This may be a result of various factors, including, but not limited to: the unknown duration and economic, operational, and financial impacts of the global outbreak of the COVID-19 pandemic and the actions taken by governmental authorities in connection with the pandemic on the Company’s business; material differences between actual results and the assumptions, projections and estimates of occupancy rates, rental rates, operating expenses and required capital expenditures; the status of the economy; the status of capital markets, including the availability and cost of capital; issues facing the healthcare industry, including compliance with, and changes to, regulations and payment policies, responding to government investigations and punitive settlements and operators’/tenants’ difficulty in cost-effectively obtaining and maintaining adequate liability and other insurance; changes in financing terms; competition within the healthcare, seniors housing and life science industries; negative developments in the operating results or financial condition of operators/tenants, including, but not limited to, their ability to pay rent and repay loans; the company’s ability to transition or sell facilities with profitable results; the failure to make new investments as and when anticipated; acts of God affecting the company’s properties; the company’s ability to re-lease space at similar rates as vacancies occur; the failure of closings to occur as and when anticipated, including the receipt of third-party approvals and healthcare licenses without unexpected delays or conditions; the company’s ability to timely reinvest sale proceeds at similar rates to assets sold; operator/tenant or joint venture partner bankruptcies or insolvencies; the cooperation of joint venture partners; government regulations affecting Medicare and Medicaid reimbursement rates and operational requirements; regulatory approval and market acceptance of the products and technologies of life science tenants; liability or contract claims by or against operators/tenants; unanticipated difficulties and/or expenditures relating to future acquisitions and the integration of multi-property acquisitions; environmental laws affecting the company’s properties; changes in rules or practices governing the company’s financial reporting; the movement of U.S. and foreign currency exchange rates; and legal and operational matters, including real estate investment trust qualification and key management personnel recruitment and retention. Finally, the company assumes no obligation to update or revise any forward-looking statements or to update the reasons why actual results could differ from those projected in any forward-looking statements. 1

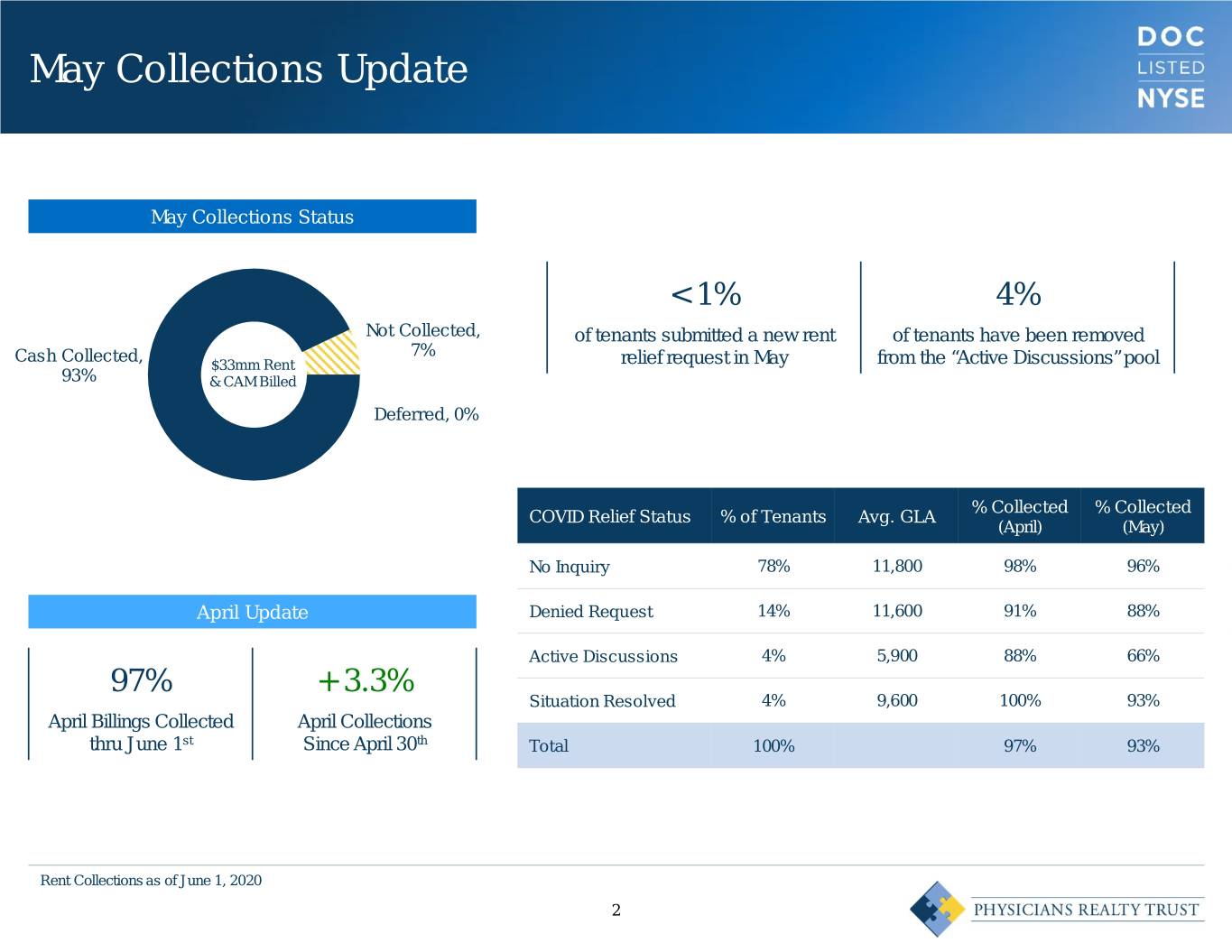

May Collections Update May Collections Status < 1% 4% Not Collected, of tenants submitted a new rent of tenants have been removed Cash Collected, 7% $33mm Rent relief request in May from the “Active Discussions” pool 93% & CAM Billed Deferred, 0% % Collected % Collected COVID Relief Status % of Tenants Avg. GLA (April) (May) No Inquiry 78% 11,800 98% 96% April Update Denied Request 14% 11,600 91% 88% Active Discussions 4% 5,900 88% 66% 97% + 3.3% Situation Resolved 4% 9,600 100% 93% April Billings Collected April Collections thru June 1st Since April 30th Total 100% 97% 93% Rent Collections as of June 1, 2020 2

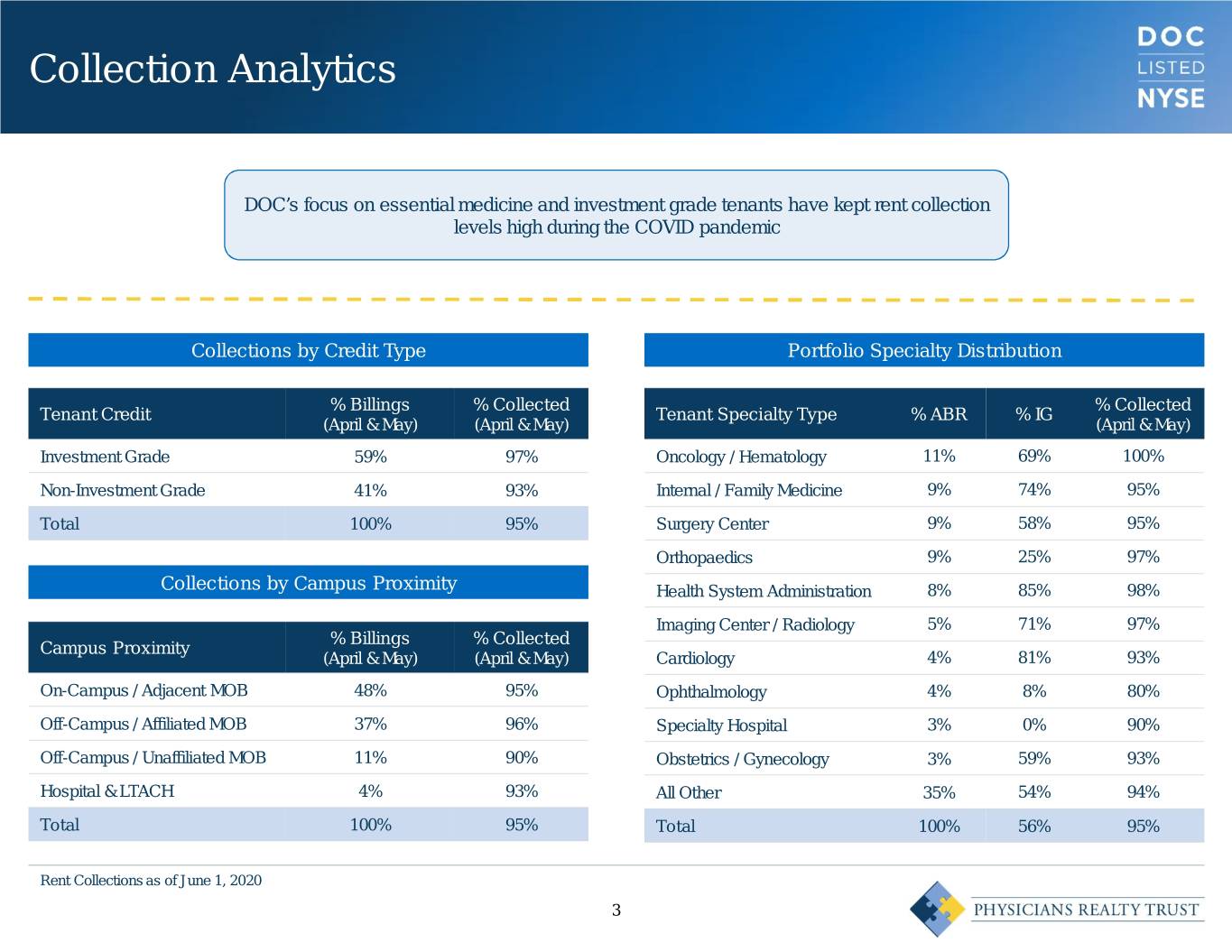

Collection Analytics DOC’s focus on essential medicine and investment grade tenants have kept rent collection levels high during the COVID pandemic Collections by Credit Type Portfolio Specialty Distribution % Billings % Collected % Collected Tenant Credit Tenant Specialty Type % ABR % IG (April & May) (April & May) (April & May) Investment Grade 59% 97% Oncology / Hematology 11% 69% 100% Non-Investment Grade 41% 93% Internal / Family Medicine 9% 74% 95% Total 100% 95% Surgery Center 9% 58% 95% Orthopaedics 9% 25% 97% Collections by Campus Proximity Health System Administration 8% 85% 98% Imaging Center / Radiology 5% 71% 97% % Billings % Collected Campus Proximity (April & May) (April & May) Cardiology 4% 81% 93% On-Campus / Adjacent MOB 48% 95% Ophthalmology 4% 8% 80% Off-Campus / Affiliated MOB 37% 96% Specialty Hospital 3% 0% 90% Off-Campus / Unaffiliated MOB 11% 90% Obstetrics / Gynecology 3% 59% 93% Hospital & LTACH 4% 93% All Other 35% 54% 94% Total 100% 95% Total 100% 56% 95% Rent Collections as of June 1, 2020 3

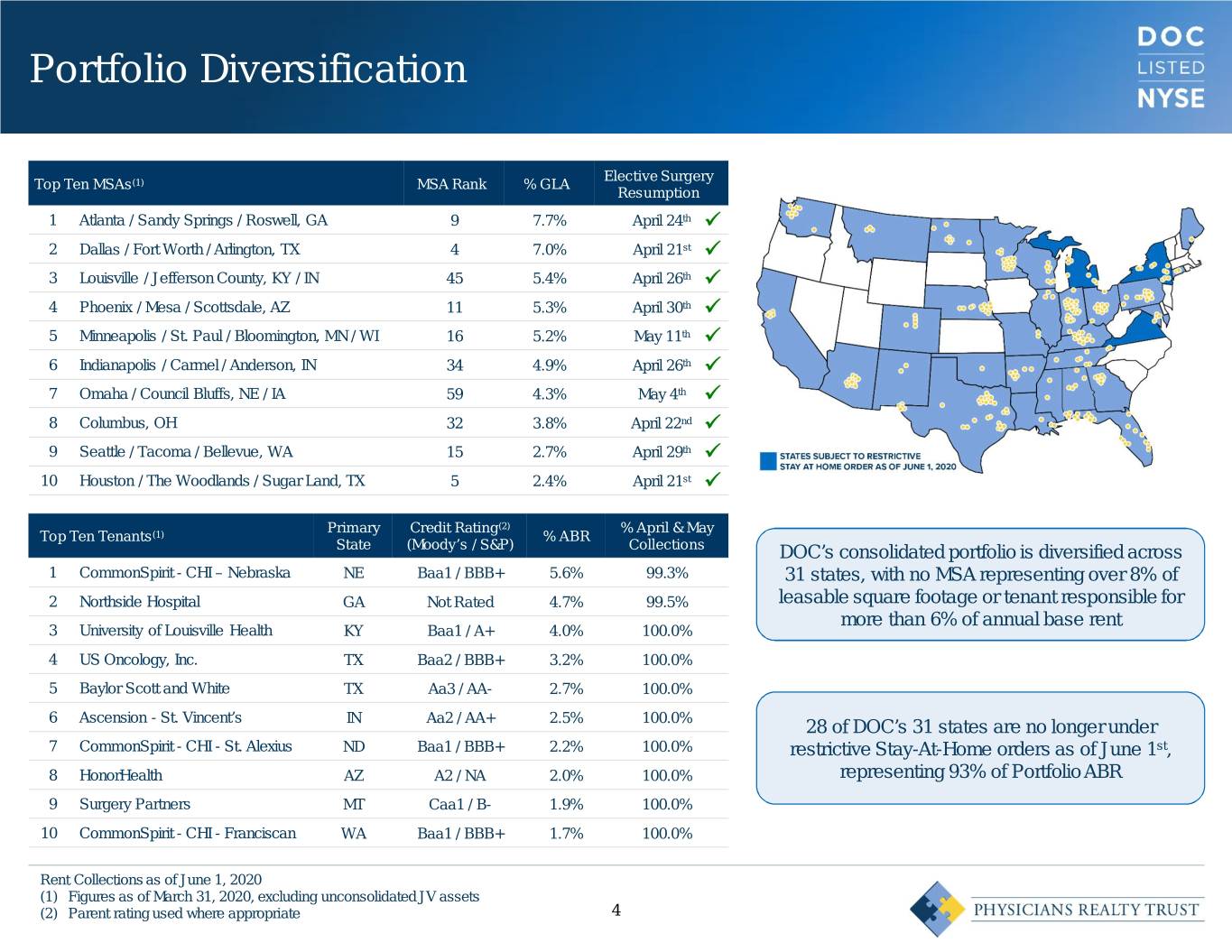

Portfolio Diversification Elective Surgery Top Ten MSAs(1) MSA Rank % GLA Resumption 1 Atlanta / Sandy Springs / Roswell, GA 9 7.7% April 24th ü 2 Dallas / Fort Worth / Arlington, TX 4 7.0% April 21st ü 3 Louisville / Jefferson County, KY / IN 45 5.4% April 26th ü 4 Phoenix / Mesa / Scottsdale, AZ 11 5.3% April 30th ü 5 Minneapolis / St. Paul / Bloomington, MN / WI 16 5.2% May 11th ü 6 Indianapolis / Carmel / Anderson, IN 34 4.9% April 26th ü 7 Omaha / Council Bluffs, NE / IA 59 4.3% May 4th ü 8 Columbus, OH 32 3.8% April 22nd ü 9 Seattle / Tacoma / Bellevue, WA 15 2.7% April 29th ü 10 Houston / The Woodlands / Sugar Land, TX 5 2.4% April 21st ü Primary Credit Rating(2) % April & May Top Ten Tenants(1) % ABR State (Moody’s / S&P) Collections DOC’s consolidated portfolio is diversified across 1 CommonSpirit - CHI – Nebraska NE Baa1 / BBB+ 5.6% 99.3% 31 states, with no MSA representing over 8% of 2 Northside Hospital GA Not Rated 4.7% 99.5% leasable square footage or tenant responsible for more than 6% of annual base rent 3 University of Louisville Health KY Baa1 / A+ 4.0% 100.0% 4 US Oncology, Inc. TX Baa2 / BBB+ 3.2% 100.0% 5 Baylor Scott and White TX Aa3 / AA- 2.7% 100.0% 6 Ascension - St. Vincent’s IN Aa2 / AA+ 2.5% 100.0% 28 of DOC’s 31 states are no longer under 7 CommonSpirit - CHI - St. Alexius ND Baa1 / BBB+ 2.2% 100.0% restrictive Stay-At-Home orders as of June 1st, 8 HonorHealth AZ A2 / NA 2.0% 100.0% representing 93% of Portfolio ABR 9 Surgery Partners MT Caa1 / B- 1.9% 100.0% 10 CommonSpirit - CHI - Franciscan WA Baa1 / BBB+ 1.7% 100.0% Rent Collections as of June 1, 2020 (1) Figures as of March 31, 2020, excluding unconsolidated JV assets (2) Parent rating used where appropriate 4