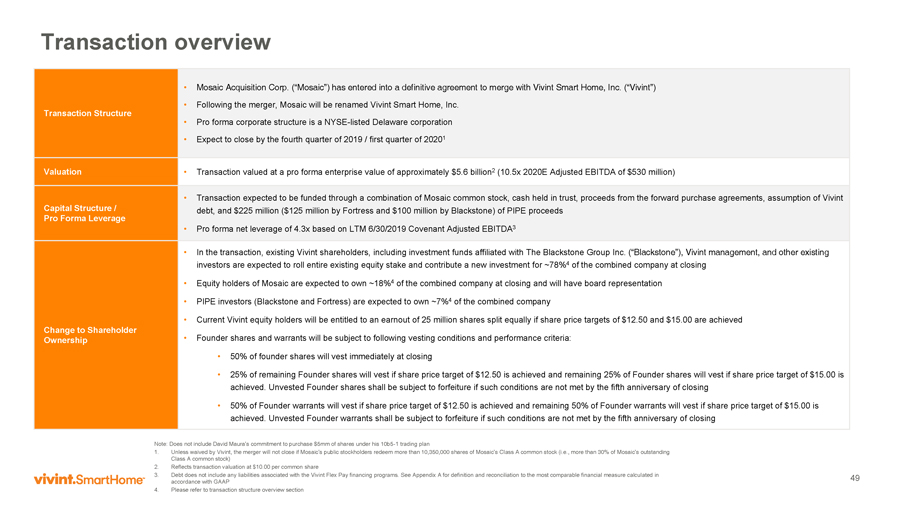

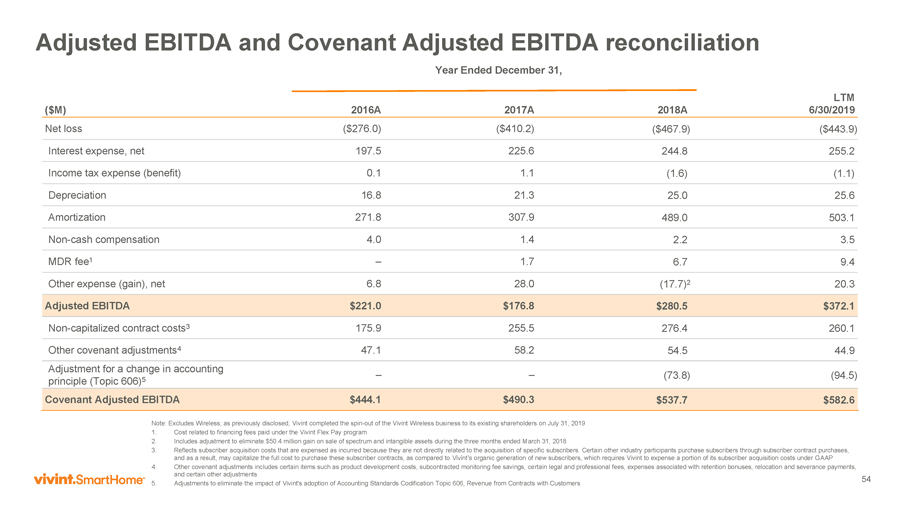

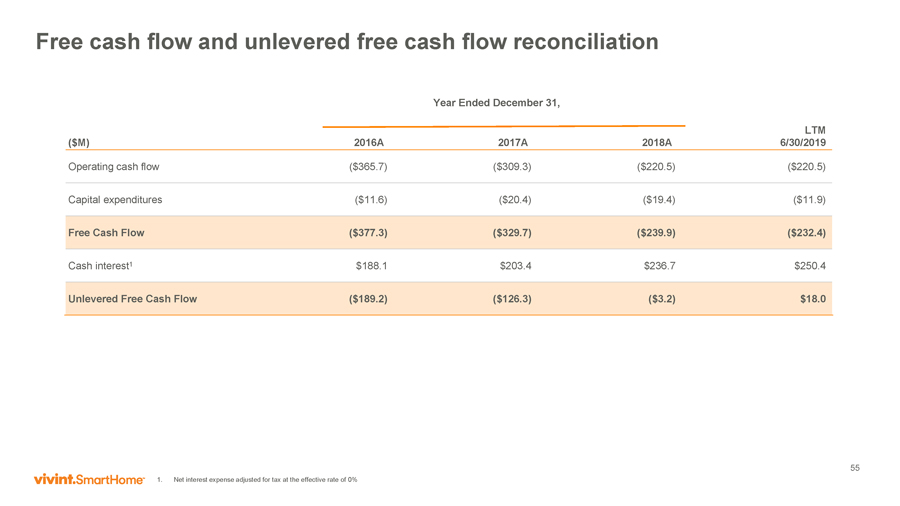

Explanatory Note and Disclaimers Disclaimers The recipient of this presentation shall not use it for any purpose other than expressly authorized by Mosaic Acquisition Corp. (“Mosaic”) and Vivint Smart Home, Inc. (“Vivint”). Any reproduction or distribution of this presentation, in whole or in part, or the disclosure of its contents, without the prior consent of Mosaic and Vivint is prohibited. This presentation is being made in respect of the proposed merger transaction involving Mosaic and Vivint. Mosaic filed a registration statement on FormS-4 with the SEC, which includes a proxy statement of Mosaic, a consent solicitation statement of Vivint and a prospectus of Mosaic, and each party will file or has filed other documents with the SEC regarding the proposed transaction. A definitive proxy statement/consent solicitation statement/prospectus will also be sent to the stockholders of Mosaic and Vivint, seeking any required stockholder approval. Before making any voting or investment decision, investors and security holders of Mosaic and Vivint are urged to carefully read the entire registration statement and proxy statement/consent solicitation statement/ prospectus, when they become available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to these documents, because they contain important information about the proposed transaction. The documents filed by Mosaic with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by Mosaic may be obtained free of charge from Mosaic at www.mosaicac.com. Alternatively, these documents, when available, can be obtained free of charge from Mosaic upon written request to Mosaic Acquisition Corp., 375 Park Avenue, New York, New York 10152, Attn: Secretary, or by calling (212)763-0153. Mosaic, Vivint and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Mosaic, in favor of the approval of the merger. Information regarding Mosaic’s directors and executive officers is contained in Mosaic’s Annual Report on Form10-K for the year ended December 31, 2018 and its Quarterly Report on Form10-Q for the quarterly periods ended March 31, 2019, and June 30, 2019, which are filed with the SEC. Information regarding Vivint’s directors and executive officers (who serve in equivalent roles at APX Group Holdings, Inc.) is contained in APX Group Holdings, Inc. Annual Report on Form10-K for the year ended December 31, 2018 and its Quarterly Report on Form10-Q for the quarterly periods ended March 31, 2019, and June 30, 2019, which are filed with the SEC. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the registration statement and the proxy statement/consent solicitation statement/prospectus and other relevant documents filed with the SEC when they become available. Free copies of these documents may be obtained as described in the preceding paragraph. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of any securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such other jurisdiction. This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, Mosaic’s and Vivint’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning our possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. These statements may be preceded by, followed by or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates” or “intends” or similar expressions. Such forward-looking statements involve risks and uncertainties that may cause actual events, results or performance to differ materially from those indicated by such statements. Certain of these risks are identified and discussed in Mosaic’s Form10-K for the year ended December 31, 2018 under Risk Factors in Part I, Item 1A. These risk factors will be important to consider in determining future results and should be reviewed in their entirety. These forward-looking statements are expressed in good faith, and Mosaic and Vivint believe there is a reasonable basis for them. However, there can be no assurance that the events, results or trends identified in these forward-looking statements will occur or be achieved. Forward-looking statements speak only as of the date they are made, and neither Mosaic nor Vivint is under any obligation, and expressly disclaim any obligation, to update, alter or otherwise revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Readers should carefully review the statements set forth in the reports, which Mosaic has filed or will file from time to time with the SEC. In addition to factors previously disclosed in Mosaic’s reports filed with the SEC and those identified elsewhere in this presentation, the following factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance: ability to meet the closing conditions to the merger, including approval by stockholders of Mosaic and Vivint on the expected terms and schedule and the risk that regulatory approvals required for the merger are not obtained or are obtained subject to conditions that are not anticipated; delay in closing the merger; failure to realize the benefits expected from the proposed transaction; the effects of pending and future legislation; risks related to disruption of management time from ongoing business operations due to the proposed transaction; business disruption following the transaction; risks related to Mosaic’s or Vivint’s indebtedness; other consequences associated with mergers, acquisitions and divestitures and legislative and regulatory actions and reforms; risks of the smart home and security industry, including risks of and publicity surrounding the sales, subscriber origination and retention process; the highly competitive nature of the smart home and security industry and product introductions and promotional activity by competitors; litigation, complaints, product liability claims and/or adverse publicity; cost increases or shortages in smart home and security technology products or components; the introduction of unsuccessful new smart home services; privacy and data protection laws, privacy or data breaches, or the loss of data; the impact of the Vivint Flex Pay plan to Vivint’s business, results of operations, financial condition, regulatory compliance and customer experience; and Vivint Smart Home’s ability to successfully compete in retail sales channels. Any financial projections in this presentation are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Mosaic’s and Vivint’s control. While all projections are necessarily speculative, Mosaic and Vivint believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection extends from the date of preparation. The assumptions and estimates underlying the projected results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projections. The inclusion of projections in this presentation should not be regarded as an indication that Mosaic and Vivint, or their representatives, considered or consider the projections to be a reliable prediction of future events. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. This presentation is not intended to beall-inclusive or to contain all the information that a person may desire in considering an investment in Mosaic and is not intended to form the basis of an investment decision in Mosaic. All subsequent written and oral forward-looking statements concerning Mosaic and Vivint, the proposed transaction or other matters and attributable to Mosaic and Vivint or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Vivint and related marks are registered trademarks or trademark applications of, or are otherwise owned or used by, Vivint, Inc., Vivint’s indirect wholly-owned subsidiary. Any trademarks, trade names or service marks of other companies appearing herein are, to the knowledge, the property of their respective owners. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but the absence of such references does not indicate the registration status of the trademarks, service marks and trade names and is not intended to indicate, in any way, that Mosaic or Vivint will not assert, to the fullest extent under applicable law, the rights or the right of the applicable licensor to such trademarks, service marks and trade names. Certain information contained herein has been derived from sources prepared by third parties. While such information is believed to be reliable for the purposes used herein, none of Mosaic, Vivint, their respective affiliates, nor their respective directors, officers, employees, members, partners, shareholders or agents makes any representation or warranty with respect to the accuracy of such information. Statement RegardingNon-GAAP Financial Measures This presentation includes Adjusted EBITDA, Covenant Adjusted EBITDA, Free Cash Flow and Unlevered Free Cash Flow, which are supplemental measures that are not required by, or presented in accordance with, accounting principles generally accepted in the United States (“GAAP”). See the Appendix A to this presentation for definitions of thesenon-GAAP measures and reconciliations to the most comparable financial measures calculated in accordance with GAAP. 3