- ARMK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Aramark (ARMK) DEF 14ADefinitive proxy

Filed: 20 Dec 19, 4:06pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement. | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)). | |

| ☒ | Definitive Proxy Statement. | |

| ☐ | Definitive Additional Materials. | |

| ☐ | Soliciting Material Pursuant to§240.14a-12. | |

Aramark

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required | |||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Notice of 2020 Annual Meeting of Shareholders And Proxy Statement Aramark

Notice of 2020 Annual Meeting of Shareholders And Proxy Statement Aramark

2020 Annual Meeting of Shareholders Wednesday, January 29, 2020 at 10:00 AM EST The Rittenhouse Hotel 210 W. Rittenhouse Square, Philadelphia, PA 19103

Letter from Our Chairman

Dear Fellow Shareholders,

2019 has been a year of progress for Aramark that included solid revenue growth, higher earnings, greater procurement scale and strong free cash flow that drove increased financial flexibility. The Board has taken a number of actions to invigorate the Company’s culture and position Aramark to unlock the future economic potential of the business. We are committed to creating sustainable shareholder value through execution against a focused strategy, prudent risk management, robust succession planning, sound corporate governance, effective executive compensation programs, and environmental and social responsibility initiatives. Below we highlight a few areas of particular significance.

New Leadership

The Board recently appointed industry veteran John Zillmer as Chief Executive Officer and a member of the Board of Directors. John has a proven track record of driving market-leading business results, including 23 years of prior experience at Aramark. Following his initial tenure at Aramark, John served as Chairman and CEO of Allied Waste Industries, where his transformation of the company became an industry benchmark, and as Chairman and CEO at Univar, where he advanced corporate culture and drove substantial operational improvements. The Board is excited to welcome John back to the Company and to work closely with him as Aramark charts a dynamic path forward.

Board Composition

As part of our evolution of the Board, we appointed four new independent directors: Susan Cameron, former Chairman and CEO of Reynolds American Inc.; Paul Hilal, founder and CEO of Mantle Ridge LP; Karen King, former Executive Vice President and Chief Field Officer of McDonald’s Corporation; and Art Winkleblack, former Executive Vice President and Chief Financial Officer of H.J. Heinz Company. An additional independent director, Greg Creed, Chief Executive Officer of Yum! Brands, will stand for election at our upcoming Annual Meeting.

These new directors join our existing directors who bring a range of skills and industry experience, including demonstrated expertise in driving transformational cultural change and organic operating performance in their respective leadership positions.

As part of our leadership framework, I assumed the role of independent Chairman of the Board. In addition, Paul Hilal, Aramark’s largest shareholder, now serves as Vice Chairman, with considerable experience as an owner-steward.

I would like to thank the recently retired directors for their many contributions and years of dedicated service to the Company.

Say-on-Pay

The arrival of a new CEO has provided an opportunity to address shareholder feedback on CEO pay. To this end, the compensation package for the CEO recognizes an appropriate level of pay consistent with market competitive practices, while retaining strong pay for performance alignment and elements of our overall compensation program. We have also addressed other aspects of our compensation program applicable to all of our named executive officers, as detailed in this proxy statement.

Sustainability Plan

Our new sustainability plan, Be Well. Do Well., accelerates our sustainability efforts and centers on positively impacting bothpeopleandplanet. As part of this strategy, we identified priorities that align with our business objectives, with a focus on efforts to help people and our planet, as we serve the Company’s client partners, employees, shareholders and other stakeholders.

Employee engagement is a priority of our plan, as we advance our diverse and inclusive culture. In 2019, we introduced programs that benefit our employees, including targeted wage increases, expanding training and development, and scholarships for our employees and their children.

Well Positioned for the Future

The Board, Leadership Team and I firmly believe that now is the time to pursue a more accelerated revenue growth strategy, while balancing other important financial drivers of the business. We are confident that our plan will propel future success and deliver meaningful value for all stakeholders.

It is a privilege to serve as your Chairman and I greatly value your support of Aramark. On behalf of my fellow directors, we look forward to updating you on the Company’s progress in the coming year.

Sincerely,

Stephen I. Sadove

Chairman of the Board

A Message from Our Chief Executive Officer

Dear Fellow Shareholders,

I want to thank Steve Sadove and the Board for the opportunity to return to Aramark, a company where I spent 23 years earlier in my career, and a company that I have always greatly admired and respected. While market trends and dynamics have changed considerably since I was Global President of Aramark’s Food & Support Services, one constant remains – the extraordinary pride of the Aramark associates who passionately serve our valued business partners and customers every day. This entrepreneurial spirit is what brought me back to Aramark at such an exciting time in our 80+ year history.

I applaud the organization for tripling procurement scale, growing the portfolio, and strengthening the balance sheet. While still early in my time back with the Company, I am confident there is substantial opportunity to move the business forward and create significant value for all of our stakeholders.

My immediate priority is to nurture a hospitality culture that solidifies the foundation for our accelerated growth strategies. This means a renewed commitment to engaging and supporting our diverse employee base; sharpening our focus on quality and innovation; and operating with integrity, day in and day out.

I greatly appreciate the honor to lead this iconic company and look forward to charting Aramark’s future success with our valued team members and partners.

Sincerely,

John Zillmer

Board of Directors

Left to Right:

Art Winkleblack, Daniel Heinrich, Susan Cameron, Paul Hilal, John Zillmer, Stephen Sadove, Irene Esteves, Calvin Darden, Karen King, Richard Dreiling

Notice of 2020 Annual Meeting of Shareholders

DATE AND TIME:

Wednesday, January 29, 2020 at 10:00 am (Eastern Standard Time)

PLACE:

The Rittenhouse Hotel, 210 W. Rittenhouse Square, Philadelphia, PA 19103

ITEMS OF BUSINESS:

| PROPOSAL 1. | To elect the 11 director nominees listed in the proxy statement to serve until the 2021 annual meeting of shareholders and until their respective successors have been duly elected and qualified; | |

PROPOSAL 2. |

To consider and vote upon a proposal to ratify the appointment of KPMG LLP as Aramark’s independent registered public accounting firm for the fiscal year ending October 2, 2020; | |

PROPOSAL 3. |

To hold anon-binding advisory vote on executive compensation; | |

PROPOSAL 4. |

To approve the Company’s Second Amended and Restated 2013 Stock Incentive Plan; and | |

PROPOSAL 5. |

To approve the Company’s Second Amended and Restated Certificate of Incorporation to permit the holders of at least fifteen percent (15%) of the Company’s outstanding shares of common stock to call special meetings of shareholders for any purpose permissible under applicable law and to delete certain obsolete provisions. |

To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

RECORD DATE:

The Board of Directors has fixed December 9, 2019 as the record date for the meeting. This means that only shareholders as of the close of business on that date are entitled to receive this notice of the meeting and vote at the meeting and any adjournments or postponements of the meeting.

HOW TO VOTE:

Shareholders of record can vote their shares by using the Internet or the telephone or by attending the meeting in person and voting by ballot. Instructions for voting by using the Internet or the telephone are set forth in the Notice of Internet Availability that has been provided to you. Shareholders of record who received a paper copy of the proxy materials also may vote their shares by marking their votes on the proxy card provided, signing and dating it, and mailing it in the envelope provided, or by attending the meeting in person and voting by ballot.

| By Order of the Board of Directors, |

Harold B. Dichter |

| Secretary |

December 20, 2019

|

|

This summary highlights information contained elsewhere in this proxy statement, which is first being sent or made available to shareholders on or about December 20, 2019. You should read the entire proxy statement carefully before voting. For more information regarding the Company’s 2019 performance, please review Aramark’s Annual Report.

VOTING MATTERS AND BOARD RECOMMENDATIONS

Proposal

|

Board’s Recommendation

| |

Proposal 1. Election of 11 Director Nominees (page 3)

| FOR Each Director Nominee

| |

Proposal 2. Ratification of KPMG LLP as Independent Registered Public Accounting Firm for 2020 (page 23)

| FOR

| |

Proposal 3. Advisory Approval of Executive Compensation (page 26)

| FOR

| |

Proposal 4. Approval of Company Second Amended and Restated 2013 Stock Incentive Plan (page 74)

| FOR

| |

Proposal 5. Approval of Company Second Amended and Restated Certificate of Incorporation to permit holders of at least fifteen percent (15%) of the Company’s outstanding shares of common stock to call special meetings of shareholders for any purpose permissible under applicable law and to delete certain obsolete provisions (page 83)

| FOR

|

2020 ANNUAL MEETING OF SHAREHOLDERS

Date and Time: | Wednesday, January 29, 2020 at 10:00 am EST | |

Record Date: | December 9, 2019 | |

Place: | The Rittenhouse Hotel, 210 W. Rittenhouse Square, Philadelphia, PA 19103 | |

| 2 |  |

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

PROPOSAL SUMMARY

What Are You Voting On?

We are asking our shareholders to elect 11 director nominees listed below to serve on the Board for aone-year term. Information about the Board and each director nominee is included in this section.

Voting Recommendation

The Board recommends that you vote “FOR” each director nominee listed below. After consideration of the individual qualifications, skills and experience of each of our director nominees and his or her prior contributions to the Board, if applicable, it believes a Board composed of the 11 director nominees would be well-balanced and effective.

The Board, upon recommendation from the Nominating and Corporate Governance Committee (the “Nominating Committee”), has nominated 11 directors for election at the Annual Meeting. Each of the directors elected at the annual meeting will hold office until the annual meeting of shareholders to be held in 2021 or until his or her successor has been elected and qualified, or until his or her earlier death, resignation, removal or disqualification.

Unless contrary instructions are given, the shares represented by a properly executed proxy will be voted “FOR” each of the director nominees presented below. If, at the time of the meeting, one or more of the director nominees has become unavailable to serve, shares represented by proxies will be voted for the remaining director nominees and for any substitute director nominee or nominees designated by the Board of Directors, unless the size of the Board is reduced. The Board knows of no reason why any of the director nominees will be unavailable or unable to serve. Proxies cannot be voted for a greater number of persons than the director nominees listed.

The Board of Directors recommends a vote "FOR" each nominee for director

| 3 |

OVERVIEW OF OUR DIRECTOR NOMINEES

Each of our 11 nominees has extensive leadership experience and relevant expertise and, except for Mr. Creed, currently serves as a director for the Company. The Board undergoes an annual self-assessment and review to ensure that it has a balanced mix of skills and attributes to best oversee our business.

Director |

Age |

Background |

Current Committee Memberships | |||

Susan M. Cameron |

61 |

Former Chairman and Chief Executive Officer, Reynolds American Inc. |

Compensation and Human Resources Nominating and Corporate Governance | |||

Greg Creed |

62 |

Chief Executive Officer, Yum! Brands, Inc.

|

None, New Director Nominee | |||

Calvin Darden |

69 |

Former Senior Vice President, U.S. Operations, United Parcel Service, Inc. |

Audit and Corporate Practices Finance | |||

Richard W. Dreiling |

66 |

Former Chairman and Chief Executive Officer, Dollar General Corporation |

Compensation and Human Resources Nominating and Corporate Governance | |||

Irene M. Esteves |

60 |

Former Chief Financial Officer, Time Warner Cable Inc.

|

Audit and Corporate Practices Finance | |||

Daniel J. Heinrich |

63 |

Former Executive Vice President and Chief Financial Officer, The Clorox Company |

Audit and Corporate Practices Finance | |||

Paul C. Hilal |

53 |

Founder and Chief Executive Officer, Mantle Ridge LP |

Compensation and Human Resources Nominating and Corporate Governance | |||

Karen M. King |

63 |

Former Executive Vice President, Chief Field Officer, McDonald’s Corp.

|

Audit and Corporate Practices Finance | |||

Stephen I. Sadove |

68 |

Former Chairman and Chief Executive Officer, Saks Incorporated |

Compensation and Human Resources Nominating and Corporate Governance | |||

Arthur B. Winkleblack |

62 |

Former Executive Vice President and Chief Financial Officer, H.J. Heinz Company |

Audit and Corporate Practices Nominating and Corporate Governance | |||

John J. Zillmer |

64 |

Chief Executive Officer, Aramark

|

None | |||

| 4 |  |

The following information describes certain information regarding our director nominees as of December 9, 2019.

Director Nominee Composition

TENURE70-3 years2 4-6 years 2 7 + years 2yrs. Average Tenure 40%Diversity 3 Women / 2 Ethnically Diverse

Director Nominee Skills, Experience, and Background

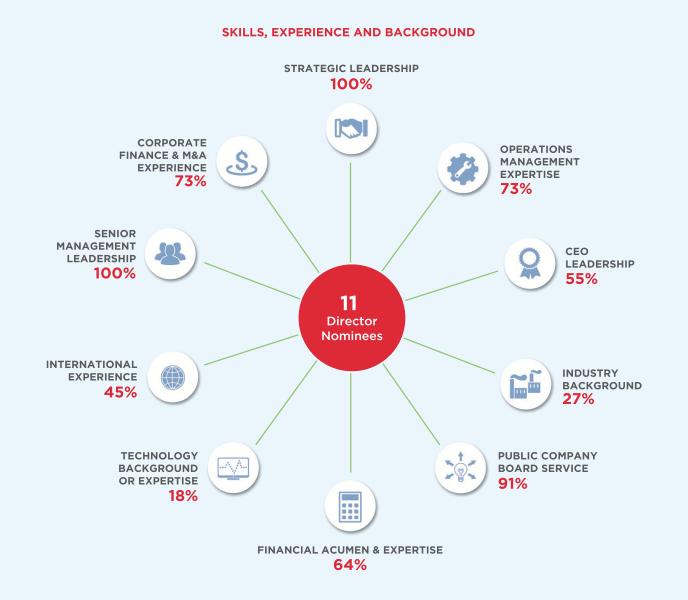

The Board regularly reviews the skills, experience, and background that it believes are desirable to be represented on the Board and, in conjunction with the Board’s refreshment process described below, has recentlyre-evaluated these skills and qualifications to better align with the Company’s strategic vision, and business and operations. The following is a description of some of these skills, experience, and background:

Strategic Leadership Experience driving strategic direction and growth of an organization Industry Background Knowledge of or experience in one or more of the Companys specific industries (e.g., food, facilities management, and uniform services) Financial Acumen & Expertise Experience or expertise in financial accounting and reporting or the financial management of a major organization Senior Management Leadership Experience serving in a senior leadership role of a major organization (e.g., Chief Financial Officer, General Counsel, President, or Division Head) CEO Leadership Experience serving as the Chief Executive Officer of a major organization Operations Management Expertise Experience or expertise in managing the operations of a business or major organization Public Company Board Service Experience as a board member of another publicly-traded company Corporate Finance & M&A Experience Experience in corporate lending or borrowing, capital markets transactions, significant mergers or acquisitons, private equity, or investment banking Technology Background or Expertise Experience or expertise in information technology or the use of digital media or technology to facilitate business objectives International Experience Experience doing business internationally

| 5 |

The following is a summary of some of the skills, experience, and background that our director nominees bring to the Board:

SKILLS, EXPERIENCE AND BACKGROUND STRATEGIC LEADERSHIP 100% CORPORATE FINANCE & M&A EXPERIENCE 73% SENIOR MANAGEMENT LEADERSHIP 100% INTERNATIONAL EXPERIENCE 45% TECHNOLOGY BACKGROUND OR EXPERTISE 18% FINANCIAL ACUMEN & EXPERTISE 64% PUBLIC COMPANY BOARD SERVICE 91% INDUSTRY BACKGROUND 27% CEO LEADERSHIP 55% OPERATIONS MANAGEMENT EXPERTISE 73%

| 6 |  |

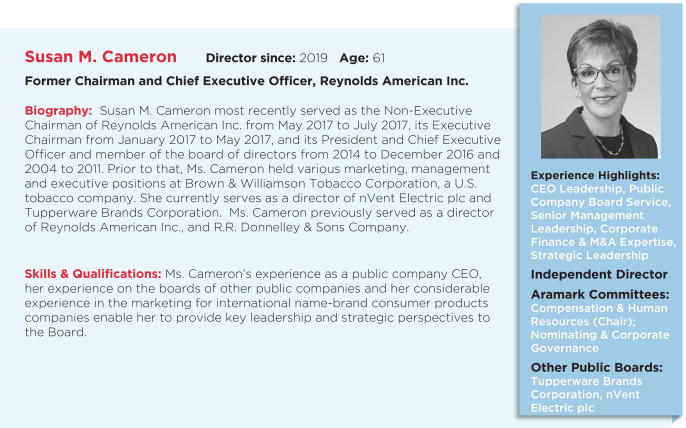

Susan M. Cameron Director since: 2019 Age: 61 Former Chairman and Chief Executive Officer, Reynolds American Inc. Biography: Susan M. Cameron most recently served as the Non-Executive Chairman of Reynolds American Inc. from May 2017 to July 2017, its Executive Chairman from January 2017 to May 2017, and its President and Chief Executive Officer and member of the board of directors from 2014 to December 2016 and 2004 to 2011. Prior to that, Ms. Cameron held various marketing, management and executive positions at Brown & Williamson Tobacco Corporation, a U.S. tobacco company. She currently serves as a director of nVent Electric plc and Tupperware Brands Corporation. Ms. Cameron previously served as a director of Reynolds American Inc., and R.R. Donnelley & Sons Company. Skills & Qualifications: Ms. Cameron's experience as a public company CEO, her experience on the boards of other public companies and her considerable experience in the marketing for international name-brand consumer products companies enable her to provide key leadership and strategic perspectives to the Board. Experience Highlights: CEO Leadership, Public Company Board Service, Senior Management Leadership, Corporate Finance & M&A Expertise, Strategic Leadership Independent Director Aramark Committees: Compensation & Human Resources (Chair); Nominating & Corporate Governance Other Public Boards: Tupperware Brands Corporation, nVent Electric plc

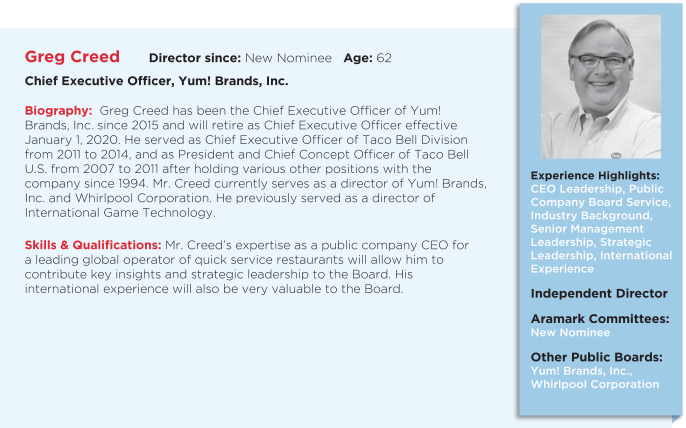

Greg Creed Director since: New Nominee Age: 62 Chief Executive Officer, Yum! Brands, Inc. Biography: Greg Creed has been the Chief Executive Officer of Yum! Brands, Inc. since 2015 and will retire as Chief Executive Officer effective January 1, 2020. He served as Chief Executive Officer of Taco Bell Division from 2011 to 2014, and as President and Chief Concept Officer of Taco Bell U.S. from 2007 to 2011 after holding various other positions with the company since 1994. Mr. Creed currently serves as a director of Yum! Brands, Inc. and Whirlpool Corporation. He previously served as a director of International Game Technology. Skills & Qualifications: Mr. Creed's expertise as a public company CEO for a leading global operator of quick service restaurants will allow him to contribute key insights and strategic leadership to the Board. His international experience will also be very valuable to the Board. Experience Highlights: CEO Leadership, Public Company Board Service, Industry Background, Senior Management Leadership, Strategic Leadership, International Experiance Independent Director Aramark Committees: New Nominee Other Public Boards: Yum! Brands, Inc., Whirlpool Corporation

| 7 |

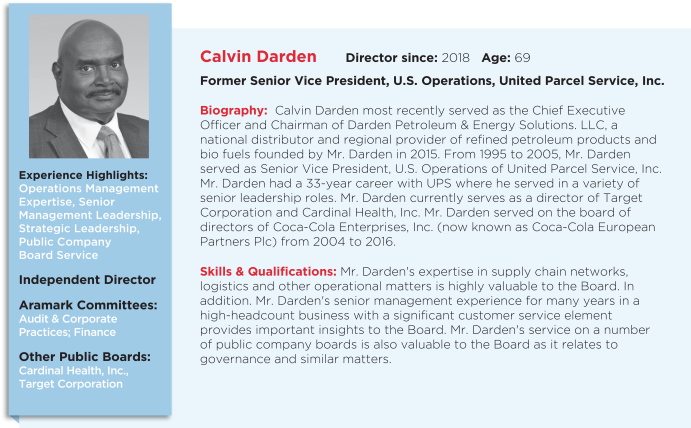

Experience Highlights: Operations Management Expertise, Senior Management Leadership, Strategic Leadership, Public Company Board Service Independent Director Aramark Committees: Audit & Corporate Practices; Finance Other Public Boards: Cardinal Health, Inc., Target Corporation Calvin Darden Director since: 2018 Age: 69 Former Senior Vice President, U.S. Operations, United Parcel Service, Inc. Biography: Calvin Darden most recently served as the Chief Executive Officer and Chairman of Darden Petroleum & Energy Solutions. LLC, a national distributor and regional provider of refined petroleum products and bio fuels founded by Mr. Darden in 2015. From 1995 to 2005, Mr. Darden served as Senior Vice President, U.S. Operations of United Parcel Service, Inc. Mr. Darden had a 33-year career with UPS where he served in a variety of senior leadership roles. Mr. Darden currently serves as a director of Target Corporation and Cardinal Health, Inc. Mr. Darden served on the board of directors of Coca-Cola Enterprises, Inc. (now known as Coca-Cola European Partners Plc) from 2004 to 2016. Skills & Qualifications: Mr. Darden's expertise in supply chain networks, logistics and other operational matters is highly valuable to the Board. In addition. Mr. Darden's senior management experience for many years in a high-headcount business with a significant customer service element provides important insights to the Board. Mr. Darden's service on a number of public company boards is also valuable to the Board as it relates to governance and similar matters.

Experience Highlights: CEO Leadership - Former, Strategic Leadership, Operations Management Expertise, Public Company Board Service Independent Director Aramark Committees: Compensation & Human Resources; Nominating & Corporate Governance Other Public Boards: Kellogg Company, Lowe's Companies, Inc., PulteGroup, Inc. Richard W. Dreiling Director since: 2016 Age: 66 Former Chairman and Chief Executive Officer, Dollar General Corporation Biography: Richard Dreiling is the former Chairman and Chief Executive Officer of Dollar General Corporation, serving as Chief Executive Officer from January 2008 until June 2015 and Chairman of the board of directors from December 2008 until January 2016. Before joining Dollar General, Mr. Dreiling served as Chief Executive Officer, President and a director of Duane Reade Holdings, Inc. and Duane Reade Inc., from November 2005 until January 2008, and as Chairman of the Board of Duane Reade from March 2007 until January 2008. Prior to that, Mr. Dreiling, beginning in March 2005, served as Executive Vice President - Chief Operating Officer of Longs Drug Stores Corporation, an operator of a chain of retail drug stores on the West Coast and Hawaii, after having joined Longs in July 2003 as Executive Vice President and Chief Operations Officer. From 2000 to 2003, Mr. Dreiling served as Executive Vice President - Marketing, Manufacturing and Distribution at Safeway, Inc. Prior to that, Mr. Dreiling served from 1998 to 2000 as President of Vons, a southern California food and drug division of Safeway. Mr. Dreiling is a director of Kellogg Company, Lowe's Companies, Inc., and PulteGroup, Inc. Skills & Qualifications: Mr. Dreiling's over 40 years of retail industry experience at all operating levels has added significant value to the Board. Mr. Dreiling has served as Chief Executive Officer of a large public company and brings to the Board very valuable insight and leadership attributes as a result of that experience.

| 8 |  |

Irene M. Esteves Director since: 2015 Age: 60 Former Chief Financial Officer, Time Warner Cable Inc. Biography: Irene M. Esteves most recently served as Chief Financial Officer of Time Warner Cable Inc. from July 2011 to May 2013. She previously served as Executive Vice President and Chief Financial Officer of XL Group plc. Prior to that, Ms. Esteves was Senior Vice President and Chief Financial Officer of Regions Financial Corporation. She currently serves as a director of KKR Real Estate Finance Trust Inc., R.R. Donnelley & Sons Company, and Spirit AeroSystems Holdings Inc. and previously served as a director of Level 3 Communications, Inc. and tw telecom inc. Skills & Qualifications: Ms. Esteves' experience as a public company CFO and her over 20 years of experience overseeing global finance, risk management, and corporate strategy for U.S. and multi-national companies make her well qualified to serve on the Board. The Board has determined Ms. Esteves to be an audit committee financial expert and her accounting experience and skills are important to the Company. Experience Highlights: Senior Management Leadership, Financial Acumen & Expertise, Corporate Finance & M&A, Strategic Leadership Independent Director Aramark Committees: Audit & Corporate Practices; Finance (Chair) Other Public Boards: KKR Real Estate Finance Trust Inc., R.R. Donnelley & Sons Company, Spirit AeroSystems Holdings Inc.

Daniel J. Heinrich Director since: 2013 Age: 63 Former Executive Vice President and Chief Financial Officer, The Clorox Company Biography: Daniel J. Heinrich most recently served as Executive Vice President and Chief Financial Officer at The Clorox Company from June 2009 to November 2011. He started with Clorox in 2001 as Vice President and Controller and served in that role until 2003. In 2003, he became Vice President and Chief Financial Officer and in 2009 he became Senior Vice President and Chief Financial Officer. Prior to joining Clorox, his roles included Senior Vice President and Treasurer of Transamerica Finance Corporation; Senior Vice President, Controller and Treasurer of Granite Management Company; Senior Vice President, Controller and Chief Accounting Officer of First Nationwide Bank; and as an accountant and then Senior Audit Manager at Ernst & Young LLP. Mr. Heinrich serves as a director of Edgewell Personal Care, Inc. (formerly Energizer Holdings, Inc.), Ball Corporation, and privately-held E. & J. Gallo Winery. He previously served as a director of Advanced Medical Optics and privately-held G3 Enterprises, Inc. Skills & Qualifications: The Board greatly values Mr. Heinrich's extensive financial and business background and his tenure as a public company CFO. The Board has determined Mr. Heinrich to be an audit committee financial expert and his accounting experience and skills are important to the Company. In addition, Mr. Heinrich brings to the Board significant experience on information technology issues. Experience Highlights: Senior Management Leadership, Financial Acumen & Expertise, Corporate Finance & M&A, Public Company Board Service Independent Director Aramark Committees: Audit & Corporate Practices (Chair); Finance Other Public Boards: Edgewell Personal Care, Inc., Ball Corporation

| 9 |

Experience Highlights: Strategic Leadership, Public Company Board Service, Financial Acumen & Expertise, Senior Management Leadership Independent Director Aramark Committees: Compensation & Human Resources; Nominating & Corporate Governance Other Public Boards: CSX Corproation Paul C. Hilal Director since: 2019 Age: 53 Founder and Chief Executive Officer, Mantle Ridge LP Biography: Paul C. Hilal is the Founder and Chief Executive Officer of Mantle Ridge LP. Prior to founding Mantle Ridge, Mr. Hilal was a Partner and Senior Investment Professional at Pershing Square Capital Management from 2006 to 2016. He serves as Vice Chairman on the board of directors of CSX Corporation. Mr. Hilal was formerly on the boards of three other public companies, including Canadian Pacific Railway Limited, where he chaired the Compensation Committee; Ceridan Corporation; and WorldTalk Communications, where he served as Chairman of the Board. Skills & Qualifications: Mr. Hilal's experience as a value investor, capital allocator, and engaged steward during corporate transformations, provides the Board with valuable financial acumen and experience. In addition, Mr. Hilal's experience on the boards of a number of public companies allows him to provide a key strategic perspective to the Board.

Experience Highlights: Senior Management Leadership, Strategic Leadership, Operations Management Expertise, Human Resources Experience Independent Director Aramark Committees: Audit & Corporate Practices; Finance Other Public Boards: None Karen M. King Director since: 2019 Age: 63 Former Executive Vice President, Chief Field Officer, McDonald's Corp. Biography: Karen M. King is the former Executive Vice President, Chief Field Officer of McDonald's Corp. from 2015 to 2016. Prior to that, Ms. King held various management and executive positions at McDonald's Corp. since 1994, including having served as its Chief People Officer, President, East Division, Vice-President, Strategy and Business Development and General Manager and Vice President, Florida Region, among others. Skills & Qualifications: Ms. King's substantial experience and expertise in field operations and talent development for a high head count business in the quick service food industry provides the Board with key insights and perspective on operations, consumer focused marketing and service delivery.

| 10 |  |

Experience Highlights: CEO Leadership - Former, Operations Management Expertise, Strategic Leadership, Public Company Board Service Independent Director Aramark Committees: Compensation & Human Resources; Nominating & Corporate Governance Other Public Boards: Colgate- Palmolive, Company, Park Hotels & Resorts Inc., Movado Group, Inc. Stephen I. Sadove Director since: 2013 Age: 68 Former Chairman and Chief Executive Officer, Saks Incorporated Biography: Stephen I. Sadove is currently head of Stephen Sadove & Associates and a founding partner of JW Levin Partners. He served as Chief Executive Officer of Saks Incorporated from 2006 until November 2013 and Chairman and CEO from May 2007 until November 2013. He was Chief Operating Officer of Saks from 2004 to 2006. Prior to joining Saks in 2002, Mr. Sadove was with Bristol-Myers Squibb Company from 1991 to 2002, first as President, Clairol from 1991 to 1996, then President, Worldwide Beauty Care from 1996 to 1997, then President, Worldwide Beauty Care and Nutritionals from 1997 to 1998, and finally, Senior Vice President and President, Worldwide Beauty Care. He was employed by General Foods Corporation from 1975 to 1991 in various managerial roles, most recently as Executive Vice President and General Manager, Desserts Division from 1989 until 1991. Mr. Sadove currently serves as a director of Colgate-Palmolive Company, Park Hotels & Resorts Inc., and Movado Group, Inc. and previously served as director of Ruby Tuesday, Inc., J.C. Penney Company, Inc. and privately-held Buy It Mobility. Skills & Qualifications: Mr. Sadove's extensive knowledge of financial and operational matters in the retail industry, including technology matters, and his experience as a public company Chief Executive Officer are highly valuable to the Board. In addition, Mr. Sadove's service on a number of public company boards provides important insights to the Board on governance and similar matters.

Experience Highlights: Senior Management Leadership, Financial Acumen & Expertise, Corporate Finance & M&A, Strategic Leadership, Public Company Board Service Independent Director Aramark Committees: Audit & Corporate Practices; Nominating & Corporate Governance (Chair) Other Public Boards: The Wendy's Company, Performance Food Group Company, Inc., Church & Dwight Co., Inc. Arthur B. Winkleblack Director since: 2019 Age: 62 Former Executive Vice President and Chief Financial Officer, H.J. Heinz Company Biography: Arthur B. Winkleblack most recently provided financial, strategic planning and capital markets consulting services for Ritchie Bros. Auctioneers, where he has served as Senior Advisor to the CEO from 2014 to 2019. From 2002 to 2013, he served as Executive Vice President and Chief Financial Officer of H.J. Heinz Company. From 1999 to 2001, Mr. Winkleblack worked at Indigo Capital as Acting Chief Operating Officer of Perform.com and Chief Executive Officer of Freeride.com. Prior to that, he served as Executive Vice President and Chief Financial Officer of C. Dean Metropoulos Group from 1998 to 1999, as Vice President and Chief Financial Officer of Six Flags Entertainment Corporation from 1996 to 1998 and as Vice President and Chief Financial Officer of Commercial Avionics Systems, a division of AlliedSignal, Inc., from 1994 to 1996. Previously, he held various finance, strategy and business planning roles at PepsiCo, Inc. from 1982 to 1994. Mr. Winkleblack currently serves as a director of The Wendy's Company, Performance Food Group (PFG) Company, Inc. and Church & Dwight Co., Inc. He previously served as a director of RTI International Metals. Skills & Qualifications: Ms. Winkleblack's experience as a public company CFO enables him to provide key financial and accounting related insight to the Board as well as a strategic business perspective. The Board has determined Mr. Winkleblack to be an audit committee financial expert and his accounting experience and skills are important to the Company.

| 11 |

Experience Highlights: CEO Leadership, Strategic Leadership, Operations, Management Expertise, Public Company Board Service Aramark Committees: None Other Public Boards: CSX Corporation, Veritiv Corporation, Ecolab, Inc. John J. Zillmer Director since: 2019 Age: 64 Chief Executive Officer, Aramark Biography: John J. Zillmer has been our Chief Executive Officer ("CEO") since October 2019. Prior to joining us, Mr. Zillmer served as Chief Executive Officer and Executive Chairman of Univar from 2009 until 2012. Prior to that, Mr. Zillmer served as Chairman and Chief Executive Officer of Allied Waste Industries from 2005 to 2008 and various positions at Aramark, including Vice President of Operating Systems, Regional Vice President, Area Vice President, Executive Vice President Business Dining Services, President of Business Services Group, President of International and President of Global Food and Support Services, from 1986 to 2005. Mr. Zillmer serves on the board of directors as Non-Executive Chairman of CSX Corporation, as well as board of directors of Veritiv Corporation and Ecolab, Inc. Mr. Zillmer was formerly on the board of directors of Performance Food Group (PFG) Company, Inc. and Reynolds American Inc. Skills & Qualifications: Having served as our CEO since October 2019 and with over 30 years of experience in the managed food and services hospitality industry, including 23 years with Aramark, Mr. Zillmer's extensive knowledge of the Company and the industries in which it is engaged are invaluable to the Board. In addition, Mr. Zillmer's experience prior to joining Aramark as a Chief Executive Officer of two public companies provides key leadership experience and perspective and is greatly valued by the Board.

| 12 |  |

Recent Developments

On October 6, 2019, the Company entered into a Stewardship Framework Agreement (the “Stewardship Framework Agreement”) with MR BridgeStone Advisor LLC (“Mantle Ridge”), on behalf of itself and its affiliated funds (such funds, together with Mantle Ridge, collectively, the “Mantle Ridge Group”), which have a combined beneficial ownership interest in approximately 9.6% of the Company’s outstanding shares of common stock and an additional economic interest of approximately 10%. Pursuant to the Stewardship Framework Agreement, former directors of the company, Mr. Pierre-Olivier Beckers-Vieujant, Ms. Lisa Bisaccia, Ms. Patricia B. Morrison and Mr. John A. Quelch each resigned from the Board of Directors and each of Messrs. Zillmer, Hilal and Winkleblack and Mses. Cameron and King were elected to the Board, and they and Mr. Creed are nominated for election to the Board at the 2020 Annual Meeting pursuant to the Stewardship Framework Agreement. Pursuant to the Stewardship Framework Agreement, Mr. Hilal was also appointed Vice Chairman of the Board.

Pursuant to the Stewardship Framework Agreement, the Company agreed to limit the size of the Board to eleven directors until the end of the Company’s fiscal year ending September 30, 2022, agreed to permit Mr. Hilal to designate himself or another individual to be appointed to the Board during the term of the Stewardship Framework Agreement, and also agreed to include for consideration by the Company’s shareholders at the 2020 annual meeting a proposal to amend the Company’s Amended and Restated Certificate of Incorporation to permit shareholders of at least 15% of the outstanding shares of common stock to call a special meeting of shareholders.

Board Structure and Leadership

The Board manages or directs the business and affairs of the Company, as provided by Delaware law, and conducts its business through meetings of the Board and four standing committees: the Audit and Corporate Practices Committee (the “Audit Committee”), the Compensation and Human Resources Committee (the “Compensation Committee”), the Nominating and Corporate Governance Committee (the “Nominating Committee”) and the Finance Committee. The Board is currently led by Mr. Sadove, our Chairman and Mr. Hilal, our Vice Chairman.

The Board, upon the recommendation of the Nominating Committee, has determined that, at this time, having a separate Chairman and Chief Executive Officer is the best board organization for Aramark. 10 of the 11 Board nominees, if elected, will be independent directors. The Board’s committees are composed solely of, and chaired by, independent directors. Our independent directors meet at each regularly scheduled Board meeting in separate executive sessions, without Mr. Zillmer present, chaired by the Chairman.

Aramark’s strong Board, with an independent Chairman and Vice Chairman and independent committee chairs, ensures that the Board, and not the Chief Executive Officer alone, determines the Board’s areas of focus.

Director Independence and Independence Determinations

Under our Corporate Governance Guidelines and NYSE rules, a director is not independent unless the Board affirmatively determines that he or she does not have a direct or indirect material relationship with the Company or any of its subsidiaries.

The Board has established guidelines of director independence to assist it in making independence determinations, which conform to the independence requirements in the NYSE listing standards. In addition to applying these guidelines, which are set forth in our Corporate Governance Guidelines (which may be found on the Corporate Governance page of the Investor Relations section on our website at www.aramark.com), the Board will consider all relevant facts and circumstances in making an independence determination. Our Corporate Governance Guidelines provide that none of the following relationships will disqualify any director or nominee from being considered “independent” and such relationships will be deemed to be an immaterial relationship with Aramark:

| • | A director’s or a director’s immediate family member’s ownership of five percent or less of the equity of an organization that has a relationship with Aramark; |

| • | A director’s service as an executive officer or director of or employment by, or a director’s immediate family member’s service as an executive officer of, a company that makes payments to or receives payments from Aramark for property or services in an amount which, in any fiscal year, is less than the greater of $1 million or two percent of such other company’s consolidated gross revenues; or |

| 13 |

| • | A director’s service as an executive officer of a charitable organization that received annual contributions from Aramark and its Foundation that have not exceeded the greater of $1 million or two percent of the charitable organization’s annual gross revenues (Aramark’s automatic matching of employee contributions will not be included in the amount of Aramark’s contributions for this purpose). |

The policy of the Board is to review the independence of all directors at least annually. Earlier in fiscal 2019, the Nominating Committee and Board evaluated the independence of each of Messrs. Beckers-Vieujant, Darden, Dreiling, Heinrich, Mehra, Sadove and Ms. Bisaccia, Ms. Esteves and Ms. Morrison and determined that each of them was independent under the guidelines for director independence set forth in our Corporate Governance Guidelines and for purposes of applicable NYSE standards. In connection with the Stewardship Framework Agreement, the Nominating Committee and the Board evaluated the independence of the new directors elected to the Board in October 2019 as well as Mr. Creed, a new nominee for election at the Annual Meeting. In addition, following the end of fiscal 2019 the Nominating Committee undertook its annual review of director independence and made a recommendation to the Board of Directors regarding director independence. In making both independence determinations, the Nominating Committee and the Board considered various transactions and relationships between Aramark and the directors or nominees or between Aramark and certain entities affiliated with a director or nominee. The Nominating Committee and the Board considered that Mr. Creed will be employed until December 31, 2019 by an organization that does business with Aramark, where such transactional relationship was for the purchase or sale of goods and services in the ordinary course of Aramark’s business, and the amount received by Aramark or such company in each of the previous three years did not exceed the greater of $1 million and 1% of either Aramark’s or such organization’s consolidated gross revenues. As a result of this review, the Board affirmatively determined that each of Messrs. Creed, Darden, Dreiling, Heinrich, Hilal, Sadove and Winkleblack, and Mses. Cameron, Esteves and King is independent under the guidelines for director independence set forth in our Corporate Governance Guidelines and for purposes of applicable NYSE standards. In addition, at the committee level, the Board has also determined that each member of the Audit Committee is “independent” for purposes of Rule10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and each member of the Compensation Committee is independent for purposes of applicable NYSE standards.

Board Assessment

The Board is focused on enhancing its performance through a rigorous assessment process of the effectiveness of the Board and its committees in order to increase shareholder value. We have designed our Board evaluation process to solicit input and perspective from all of our directors on various matters, including:

| • | the effectiveness of the Board and its operations; |

| • | the Board’s leadership structure; |

| • | board composition, including the directors’ capabilities, experiences and knowledge; |

| • | the quality of Board interactions; and |

| • | the effectiveness of the Board’s committees. |

As set forth in its charter, the Nominating Committee oversees the Board and committee evaluation process. Annually, the Chairman, the Vice Chairman and the Nominating Committee will determine the appropriate form of evaluation and consider the design of the process to ensure it is both meaningful and effective. In 2017, the Board initially engaged an independent third party to assist with the evaluation of the Board and the Audit, Compensation, Nominating and Finance Committees and intends to do so in the future from time to time. In 2018 and in 2019, prior to the execution of the Stewardship Framework Agreement, the Board conducted a self-evaluation process in which the Lead Director and CEO conducted interviews with the independent directors.

Board Committees and Meetings

The Board held 11 meetings during fiscal 2019. During fiscal 2019, each director attended at least 75% of the aggregate of all Board meetings and all meetings of committees on which he or she served, in each case with respect to the portion of fiscal 2019 that they each served. All Aramark directors standing for election are expected to attend the annual meeting of shareholders. All of the directors who were elected at the 2019 Annual Meeting attended the meeting.

| 14 |  |

Each of our four standing committees operates under a written charter approved by the Board. The charters of each of our standing committees are available in the Investor Relations section of our website at www.aramark.com.

The current composition of each Board committee is set forth below:

| Director | Audit Committee* | Compensation Committee | Finance Committee | Nominating Committee | ||||

John J. Zillmer

| ||||||||

Susan M. Cameron

|

Chair

|

X

| ||||||

Calvin Darden

|

X

|

X

| ||||||

Richard W. Dreiling

|

X

|

X

| ||||||

Irene M. Esteves

|

X#@

|

Chair

| ||||||

Daniel J. Heinrich

|

Chair#

|

X

| ||||||

Paul C. Hilal, Vice Chairman

|

X

|

X

| ||||||

Karen M. King

|

X

|

X

| ||||||

Stephen I. Sadove, Chairman

|

X

|

X

| ||||||

Arthur B. Winkleblack

|

X#

|

Chair

| ||||||

Meetings in fiscal 2019

|

9

|

4

|

4

|

4

|

| * | All members of the Audit Committee are financially literate within the meaning of the NYSE listing standards |

| # | Qualifies as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of RegulationS-K |

| @ | Ms. Esteves currently serves on the audit committee of three other public companies. The Board has determined that the simultaneous service by Ms. Esteves on the audit committee of three additional public companies would not impair her ability to effectively serve on the Audit and Corporate Practices Committee. |

| 15 |

| Committee | Responsibilities | |

Audit and Corporate Practices Committee | • Prepares the audit committee report required by the U.S. Securities and Exchange Commission (the “SEC”) to be included in our proxy statement

• Assists the Board in overseeing and monitoring the quality and integrity of our financial statements

• Overseesthe Company’s management of enterprise risk and monitors our compliance with legal and regulatory requirements

• Oversees the work of the internal auditors andthe qualifications, independence, and performance of our independent registered public accounting firm | |

Compensation and Human Resources Committee | • Sets our compensation program and compensation of our executive officers and recommends the compensation program for our directors

• Monitors our incentive and equity-based compensation plans and reviews our contribution policy and practices for our retirement benefit plans

• Prepares the compensation committee report required to be included in our proxy statement and annual report under the rules and regulations of the SEC

| |

Nominating and Corporate Governance Committee | • Identifies individuals qualified to become new members of the Board, consistent with criteria approved by the Board of Directors

• Reviews the qualifications of incumbent directors to determine whether to recommend them for reelection and selecting, or recommending that the Board select, the director nominees for the next annual meeting of shareholders

• Identifies Board members qualified to fill vacancies on any Board committee and recommends that the Board appoint the identified member or members to the applicable committee

• Reviews and recommends to the Board applicable corporate governance guidelines

• Oversees the evaluation of the Board and handles such other matters that are specifically delegated to the Committee by the Board from time to time

| |

Finance Committee | • Reviewsour long-term business and financial strategies and plans

• Reviews with management and recommends to the Board our overall financial plans, including operating budget, capital expenditures, acquisitions and divestitures, securities issuances, incurrences of debt and the performance of our retirement benefit plans and recommends to the Board specific transactions involving these matters

• Approves certain financial commitments and acquisitions and divestitures by the Company up to specified levels

|

| 16 |  |

Oversight of Risk Management

Aramark’s management is responsible forday-to-day risk management activities. The Board, acting directly and through its committees, is responsible for the oversight of Aramark’s risk management.

Our Audit Committee periodically reviews our accounting, reporting and financial practices, including the integrity of our financial statements, the surveillance of administrative and financial controls and our compliance with legal and regulatory requirements. In addition, our Audit Committee reviews risks related to compliance with ethical standards, including our Business Conduct Policy, the Company’s approach to enterprise risk management and operational risks, including those related to information security and system disruption. With respect to cybersecurity, the Audit Committee monitors Aramark’s cybersecurity risk profile, receives periodic updates from management on all matters related to cybersecurity and reports out to the full Board. Through its regular meetings with management, including the accounting, finance, legal, information technology and internal audit functions, our Audit Committee reviews and discusses the risks related to its areas of oversight and reports to the Board with regard to its review. Our Finance Committee focuses on financial risks associated with the Company’s capital structure and acquisitions and divestitures that the Company is considering. Our Compensation Committee oversees compensation-related risk management, as discussed further in this proxy statement under “Compensation Matters-Compensation Discussion and Analysis-Compensation Risk Disclosure.” Our Nominating Committee oversees risks associated with board structure and other corporate governance policies and practices. Our Finance, Compensation and Nominating Committees also regularly report their findings to the Board.

Our Chief Executive Officer and other executive officers regularly report to thenon-executive directors and the Audit, the Compensation, the Nominating and the Finance Committees to ensure effective and efficient oversight of our activities and to assist in proper risk management and the ongoing evaluation of management controls. In addition, the Board receives periodic detailed operating performance reviews from management. Our vice president of internal audit reports functionally and administratively to our chief financial officer and directly to the Audit Committee. We believe that the leadership structure of the Board provides appropriate risk oversight of our activities.

Sustainability

The Board oversees and supports Aramark’s sustainability goals. Aramark’s new sustainability plan, Be Well. Do Well., accelerates the Company’s sustainability efforts and centers on positively impacting both people and planet.

As part of this strategy, we identified priorities that align with our business objectives. Our approach is to foster growth and longevity and to create long-term stakeholder value by considering every dimension of how our Company operates – ethical, economic, and environmental. Through this plan, we strive to contribute to bettering our world by making a positive impact on people and the planet. This includes commitments to engage our employees; empower healthy consumers; support local communities; source ethically, inclusively and responsibly; operate efficiently; and to effectively manage food waste, packaging, emissions and other activities that could adversely impact the environment and planet.

We are fostering a culture of purpose. One that empowers employee volunteerism, addresses food insecurity in our communities, leverages plant-forward menus to improve health and minimize our environmental footprint and scales environmental commitments and social practices. Using these objectives as guideposts, we are focused on developing solutions, approaches and commitment that align with our mission. Our core beliefs guide behavior, influence strategy and help the Company look holistically at issues that mean the most to our stakeholders.

As a global company, we connect with millions of people every day. Our size and reach affords us the opportunity to influence purchase decisions, engage consumers and minimize environmental impacts in hundreds of locations and local communities around the world. We are focused on ensuring we are operating effectively, seeking new and innovative ways to enhance our practices, and offering our expertise to thousands of clients and consumers worldwide, while making a positive impact on people and planet.

| 17 |

Management Succession Planning

The Board’s responsibilities include succession planning for the Chief Executive Officer and other executive officer positions. The Compensation Committee oversees the development and implementation of our succession plans. At least once annually, the Chief Executive Officer provides the Board with an assessment of senior managers and their potential to succeed to the position of Chief Executive Officer. This assessment will be developed in consultation with the Chairman and the Chair of the Compensation Committee. The Compensation Committee is also responsible forfollow-up actions with respect to succession planning as may be delegated by the Board from time to time. High potential executives meet regularly with the members of the Board.

Executive Sessions

From time to time, and, consistent with our Corporate Governance Guidelines, at least semi-annually, the Board meets in executive session without members of management present. The Chairman presides at these executive sessions.

Code of Conduct

We have a Business Conduct Policy that applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer and principal accounting officer, which is available on the Investor Relations section of our website at www.aramark.com. Our Business Conduct Policy contains a “code of ethics,” as defined in Item 406(b) of RegulationS-K. We will make any legally required disclosures regarding amendments to, or waivers of, provisions of our code of ethics on our Internet website.

Committee Charters and Corporate Governance Guidelines

The charters of the Compensation Committee, the Nominating Committee, the Audit Committee and the Finance Committee and our Corporate Governance Guidelines are available under the Investor Relations section of our website at www.aramark.com. Please note that all references to our website in this Proxy Statement are intended to be inactive textual references only.

Copies of our Business Conduct Policy, the charters of the Compensation Committee, the Nominating Committee, the Audit Committee and the Finance Committee and our Corporate Governance Guidelines also are available at no cost to any shareholder who requests them by writing or telephoning us at the following address or telephone number:

Aramark

2400 Market Street

Philadelphia, PA 19103

Attention: Investor Relations

Telephone:(215) 409-7287

Director Nomination Process

The Nominating Committee does not set specific, minimum qualifications that directors must meet in order for the Nominating Committee to recommend them to the Board. Rather, it believes that each director and director candidate should be evaluated based on his or her individual merits, taking into account Aramark’s needs and the composition of the Board. In nominating a slate of directors, the Nominating Committee’s objective is to select individuals with skills and experience that can be of assistance in operating our business. The Nominating Committee will consider candidates recommended by shareholders and all candidates are evaluated in the same manner regardless of who recommended such candidate for nomination. When reviewing the qualifications of potential director candidates, the Nominating Committee considers:

| • | whether individual directors possess the following personal characteristics: integrity, education, accountability, business judgment, business experience, reputation and high performance standards, and |

| • | all other factors it considers appropriate, which may include accounting and financial expertise; industry knowledge; corporate governance background; executive compensation background; strategic leadership experience; senior management experience; prior public company board service; international experience or background; age, gender and ethnic and racial background; civic and community relationships; existing commitments to other businesses; potential conflicts of interest with other pursuits; legal considerations, such as antitrust issues; and the size, composition and combined expertise of the existing Board. |

| 18 |  |

The Board believes that, as a whole, it should strive to possess the following core competencies: accounting and finance, management, crisis response, industry knowledge, international leadership and strategy/vision, among others. While the Board does not have a formal policy with regard to diversity, the Nominating Committee and the Board strive to ensure that the Board is composed of individuals who together possess a breadth and depth of experience relevant to the Board’s oversight of Aramark’s business and strategy. The Company’s Corporate Governance Guidelines provide that, except as may be approved by the Nominating Committee, no person may serve as anon-employee director if he or she would be 75 years or older at the commencement of such term as a director.

Each of Messrs. Zillmer, Creed, Hilal and Winkleblack and Mses. Cameron and King are nominated for election at the 2020 Annual Meeting in accordance with the Stewardship Framework Agreement. Prior to their election to the Board, each of Messrs. Creed and Winkleblack and Mses. Cameron and Ms. King entered into an Engagement and Indemnity Agreement with Mantle Ridge pursuant to which Mantle Ridge agreed to pay each of them certain amounts, and reimburse them for expenses incurred, in connection with their time and efforts relating to potentially joining the Board. The Engagement Agreements however do not provide for any agreements or obligations among Mantle Ridge or any of them with respect to any period following their joining the Board. Mr. Zillmer was party to a consulting agreement with Mantle Ridge that terminated when Mr. Zillmer was appointed to serve as the Chief Executive Officer of the Company.

Proxy Access

In August 2017, the Board approved an amendment and restatement of the Company’sBy-laws to implement proxy access. OurBy-laws, as amended, permit a shareholder, or a group of up to 20 shareholders, that has continuously owned for three years at least 3% of the Company’s outstanding common shares, to nominate and include in the Company’s annual meeting proxy materials up to the greater of two directors or 20% of the number of directors serving on the Board, provided that the shareholder(s) and the nominee(s) satisfy the requirements specified in ourBy-laws. For further information regarding submission of a director nominee using the Company’s proxy accessBy-law provision, see “General Information – 2021 Annual Shareholders Meeting – How can I nominate a director or submit a Shareholder proposal for the 2021 Annual Meeting of Shareholders?”.

| 19 |

Board Refreshment

The Board and the Nominating Committee regularly consider the long-term make up of our Board and how the members of our Board change over time. The Board and Nominating Committee also consider the skills, experience, and backgrounds needed for the Board as our business and the industries and sectors in which we do business evolve. The Board and Nominating Committee also understand the importance of Board refreshment and aim to strike a balance between the knowledge that comes from longer-term service on the Board with the new experience, ideas and energy that can come from adding directors to the Board. In connection with our entry into the Stewardship Framework Agreement, the Nominating Committee and Board recommended and elected five new directors to the Board and four of our directors retired. Pursuant to the Stewardship Framework Agreement, the Company also agreed to nominate Mr. Creed for election to the Board. Assuming the election of this year’s proposed director nominees, since the Company’s initial public offering, and in connection with the exit of the private equity sponsors and the Stewardship Framework Agreement, we will have added 12 new independent directors to the Board and have had 12 directors step down or not stand forre-election. We believe the average tenure for our director nominees of approximately 2 years reflects the new and independent Board that is well-positioned to continue the Company’s growth.

HOW WE THINK ABOUT BOARD REFRESHMENT + Skills, Expertise & Experience +Annual Board Evaluation + Retirement Age = Board Evolution BOARD REFRESHMENT: Since IPO 13 New Directors Elected 5 Women Directors Elected 2 Ethnically Diverse Directors Elected 12 Independent Directors Added

Annual Cash Compensation for Board Service

In fiscal 2019, eachnon-employee director received compensation at an annual rate of $100,000 for service on the Board, payable quarterly in arrears. The Lead Director was eligible to receive an additional annual retainer of $50,000, and the chairpersons of the Audit Committee, Compensation Committee, Nominating Committee and Finance Committee were eligible to receive an additional annual retainer of $20,000, provided, in each case, that such committee chairperson was anon-employee director. Directors who join the Board during the fiscal year or serve as a committee chairperson for a portion of the fiscal year receive a prorated amount of the relevant annual cash compensation. In connection with our separation of the Chairman and Chief Executive Officer roles, the Board determined that thenon-employee Chairman of the Board will also be entitled to receive an additional annual cash retainer of $100,000.

In fiscal 2019, Messrs. Beckers-Vieujant, Heinrich and Sadove and Mses. Bisaccia and Esteves each received additional fees for serving as Lead Director, Chairman and/or chairing the Nominating, Audit, Compensation or Finance Committee. Mr. Sadove is entitled to receive the additional fee for service as Chairman of the Board beginning August 25, 2019, the date he became Chairman of the Board.

Annual Deferred Stock Unit Grant

Under the Company’s current director compensation policy, which has been in effect since January 1, 2016,non-employee directors are eligible for an annual grant of deferred stock units (“DSUs”) with a value of $160,000 on the date of the annual meeting of shareholders. Directors have the right to elect whether the DSUs granted will deliver shares on: (i) the vesting date of the DSUs or (ii) the first day of the seventh month after the date the director ceases to serve on the Board.

| 20 |  |

In accordance with the director compensation policy, each member of the Board who was not an employee of the Company received a grant of approximately $160,000 worth of DSUs under the Amended and Restated 2013 Management Stock Incentive Plan (the “2013 Stock Plan”) in January 2019. These DSUs will vest on the day prior to the Company’s first annual meeting of shareholders that occurs after the grant date, subject to the director’s continued service on the Board through the vesting date, and will be settled in shares of the Company’s common stock pursuant to each director’s election as described above. In connection with the retirement of Messrs. Beckers-Vieujant and Quelch, and Mses. Bisaccia and Morrison from the Board, the Board accelerated the vesting of the DSUs that they had been granted on the date of the 2019 annual meeting of shareholders.

Directors who are appointed to the Board during the year will be entitled to a prorated grant of DSUs for the year they join the Board. Accordingly, Messrs. Hilal and Winkleblack, and Mses. Cameron and King will be entitled to a grant of additional DSUs on the date of the 2020 Annual Meeting based on their period of service on the Board prior to the 2020 Annual Meeting. All DSUs accrue dividend equivalents from the date of grant until the date of settlement. The Chairman of the Board is also entitled to an additional grant of DSUs with a value of $100,000 on the date of each annual meeting of shareholders. Mr. Sadove will be entitled to a pro rata portion of such additional DSUs for his period of service as Chairman prior to the 2020 Annual Meeting that will be granted on the date of the 2020 Annual Meeting.

Ownership Guidelines

Effective November 11, 2015, the Board of Directors has adopted a minimum ownership guideline, providing that each director must retain at least five times the value of the annual cash retainer in shares of common stock or DSUs, and that the required level of ownership be attained five years after the later of the date of approval of the guidelines and the director’s start date.

Director Deferred Compensation Plan

Non-employee directors are able to elect with respect to all or a portion of their cash board retainer fees to (i) receive all or a portion of such cash fees in the form of DSUs or (ii) defer all or a portion of such cash fees under our 2005 Deferred Compensation Plan. The DSUs that a director elects to receive in lieu of cash fees will be awarded under our 2013 Stock Plan and will be fully vested on grant and settled in shares of our common stock on the first day of the seventh month after the director ceases to serve on the Board. Cash amounts that a director elects to defer under the unfunded 2005 Deferred Compensation Plan are credited at an interest rate based on Moody’s Long Term Corporate Baa Bond Index rate for October of the previous year, which was 5.07% beginning January 1, 2019. From October 1, 2018 until December 31, 2018, we credited amounts deferred with an interest rate equal to 4.32%. The 2005 Deferred Compensation Plan permits participants to select a payment date and payment schedule at the time they make their deferral election, subject to a three-year minimum deferral period. All or a portion of the amount then credited to a deferral account may be withdrawn, if the withdrawal is necessary in light of a severe financial hardship.

The interest rate for 2005 Deferred Compensation Plan will be adjusted on January 1, 2020, based on the Moody’s Long Term Corporate Baa Bond Index rate for October 2019 which was 3.93%.

Other Benefits

All directors are eligible for an annual matching contribution to a college or othernon-profit organization in an amount up to $10,000 and directors are also eligible for matching contributions in an amount up to $10,000 in response to natural disasters through the Company’s community involvement efforts to the same extent as employees of the Company.

| 21 |

Director Compensation Table for Fiscal 2019

The following table sets forth compensation information for ournon-employee directors in fiscal 2019.

| Name | Fees Earned or Paid in Cash(1) ($) | Stock ($) | Option ($) | Change in Pension Value and Nonqualified Deferred Earnings(3) ($) | All Other Compensa- tion(4)($) | Total ($) | ||||||||||||||||||

Pierre-Olivier Beckers-Vieujant

|

|

113,242

|

|

|

160,001

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

273,243

|

| ||||||

Lisa G. Bisaccia

|

|

101,868

|

|

|

160,001

|

|

|

—

|

|

|

1,217

|

|

|

—

|

|

|

263,086

|

| ||||||

Calvin Darden

|

|

100,000

|

|

|

160,001

|

|

|

—

|

|

|

153

|

|

|

—

|

|

|

260,154

|

| ||||||

Richard W. Dreiling

|

|

100,000

|

|

|

160,001

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

260,001

|

| ||||||

Irene M. Esteves

|

|

120,000

|

|

|

160,001

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

280,001

|

| ||||||

Daniel J. Heinrich

|

|

120,000

|

|

|

160,001

|

|

|

—

|

|

|

—

|

|

|

12,727

|

|

|

292,728

|

| ||||||

Sanjeev K. Mehra

|

|

57,912

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

21,453

|

|

|

79,365

|

| ||||||

Patricia B. Morrison

|

|

100,000

|

|

|

160,001

|

|

|

—

|

|

|

—

|

|

|

10,000

|

|

|

270,001

|

| ||||||

John A. Quelch

|

|

100,000

|

|

|

160,001

|

|

|

—

|

|

|

—

|

|

|

10,000

|

|

|

270,001

|

| ||||||

Stephen I. Sadove

|

|

155,907

|

|

|

160,001

|

|

|

—

|

|

|

—

|

|

|

12,727

|

|

|

328,635

|

| ||||||

| (1) | Includes base director fees at an annual rate of $100,000, as well as a Lead Director fee at an annual rate of $50,000 for Mr. Sadove, which applied from January 30, 2019 through August 25, 2019, and a Chairman fee at an annual rate of $100,000 for Mr. Sadove that applied for the period from August 25, 2019 through the end of the 2019 fiscal year. Committee chairperson fees at an annual rate of $20,000pro-rated based on their time served were provided to each of Messrs. Beckers-Vieujant, Heinrich, Mehra, and Sadove and Mses. Bisaccia and Esteves. Messrs. Dreiling, Mehra, and Quelch and Ms. Esteves elected to defer 100% of their cash retainers (inclusive of fees) into DSUs. Ms. Bisaccia and Mr. Darden elected to defer their cash retainers (inclusive of fees) into the 2005 Deferred Compensation Plan, 100% and 20% respectively. |

| (2) | Represents the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 with respect to the 4,908 DSUs granted on January 30, 2019 (which had a grant date fair value of $32.60 per DSU). As of the end of fiscal 2019, directors held the following deferred stock units (including dividend equivalent units), all of which are vested except for those granted on January 30, 2019 and related dividend equivalents: |

| Name | DSUs and Equivalents | Name | DSUs and Equivalents | |||||||||||

Pierre-Olivier Beckers-Vieujant

|

|

22,750

|

|

Daniel J. Heinrich

|

|

28,996

|

| |||||||

Lisa G. Bisaccia

|

|

22,603

|

|

Sanjeev K. Mehra

|

|

—

|

| |||||||

Calvin Darden

|

|

8,519

|

|

Patricia B. Morrison

|

|

4,955

|

| |||||||

Richard W. Dreiling

|

|

28,196

|

|

John A. Quelch

|

|

28,196

|

| |||||||

Irene M. Esteves

|

|

33,914

|

|

Stephen I. Sadove

|

|

28,996 |

| |||||||

For additional information on the valuation assumptions and more discussion with respect to the deferred stock units, refer to Note 11 to our audited consolidated financial statements in our Annual Report onForm 10-K for the fiscal year ended September 27, 2019.

| (3) | Includes amounts earned on deferred compensation in excess of 120% of the applicable federal rate, based upon the above-market return at the time the rate basis was set. |

| (4) | The following are included in this column: |

| (a) | Charitable contributions of $10,000 made in the name of or on behalf of each of Messrs. Quelch, Mehra, and Sadove and Ms. Morrison in accordance with the Company’s director charitable contribution matching program. Additionally, includes contributions for disaster relief of $10,000 made in the name of or on behalf of Messrs. Heinrich and Mehra. |

| (b) | The dollar value of dividend equivalents accrued on deferred stock units granted prior to February 5, 2014 (the date the Company announced the payment of its first quarterly dividend), where dividends were not factored into the grant date fair value required to be reported for such awards. The total value of dividend equivalents accrued on deferred stock units for the directors during fiscal 2019, in each case for awards granted prior to February 5, 2014, is as follows: for Mr. Heinrich, $2,727, for Mr. Mehra, $1,453, and for Mr. Sadove, $2,727. For awards granted on or after February 5, 2014, the value of dividend equivalents allocated to deferred stock units in the form of additional units with the same vesting terms as the original awards is not included in this column because their value is factored into the grant date fair value of awards. Additional units awarded in connection with dividend adjustments are subject to vesting and delivery conditions as part of the underlying awards. |

| 22 |  |

PROPOSAL NO. 2 – RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

PROPOSAL SUMMARY

What Are You Voting On?

We are asking our shareholders to ratify the appointment of KPMG LLP (“KPMG”) to serve as the Company’s independent registered public accounting firm for fiscal 2020, which ends October 2, 2020. Although the Audit Committee has the sole authority to appoint the Company’s independent registered public accounting firm, the Audit Committee and the Board submit the selected firm to the Company’s shareholders as a matter of good corporate governance.

Voting Recommendation

The Board recommends that you vote “FOR” the ratification of the appointment of KPMG as the Company’s independent registered public accounting firm for fiscal 2020.

The Audit Committee has selected KPMG to serve as the Company’s independent registered public accounting firm for fiscal 2020. Although action by the shareholders on this matter is not required, the Audit Committee values shareholder views on the Company’s independent registered public accounting firm and believes it is appropriate to seek shareholder ratification of this selection. If the shareholders do not ratify the appointment of KPMG, the selection of the independent registered public accounting firm may be reconsidered by the Audit Committee. Even if the selection is ratified, the Audit Committee in its discretion may select a different independent registered public accounting firm at any time of the year if it determines that such a change would be in the best interests of the Company and its shareholders. The Company has been advised that representatives of KPMG are scheduled to attend the Annual Meeting, and they will have an opportunity to make a statement if the representatives desire to do so. It is expected that the KPMG representatives will also be available to respond to appropriate questions.

The shares represented by your properly executed proxy will be voted “FOR” this proposal, which would be your vote to ratify the selection of KPMG LLP as our independent registered public accounting firm, unless you specify otherwise.

The Board recommends that you vote "FOR" the ratification of the appointment of KPMG