Exhibit 3.1

PLAN OF CONVERSION

OF

AKOUSTIS TECHNOLOGIES, INC., A NEVADA CORPORATION

INTO

AKOUSTIS TECHNOLOGIES, INC., A DELAWARE CORPORATION

THIS PLAN OF CONVERSION, dated as of December 15, 2016 (including all of the Exhibits attached hereto, this “Plan”), is hereby adopted by Akoustis Technologies, Inc., a Nevada corporation, in order to set forth the terms, conditions and procedures governing the conversion of Akoustis Technologies, Inc. from a Nevada corporation to a Delaware corporation pursuant to Section 265 of the General Corporation Law of the State of Delaware, as amended (the “DGCL”), and Section 92A.120 and 92A.250 of the Nevada Revised Statutes, as amended (the “NRS ”).

RECITALS

WHEREAS, Akoustis Technologies, Inc. is a corporation organized and existing under the laws of the State of Nevada (the “Converting Entity”);

WHEREAS, the Board of Directors of the Converting Entity has determined that it would be advisable and in the best interests of the Converting Entity and its stockholders for the Converting Entity to convert from a Nevada corporation to a Delaware corporation pursuant to Section 265 of the DGCL and Sections 92A.120 and 92A.250 of the NRS;

WHEREAS, the form, terms and provisions of this Plan have been authorized, approved and adopted by the Board of Directors of the Converting Entity;

WHEREAS, the Board of Directors of the Converting Entity has submitted this Plan to the stockholders of the Converting Entity for approval; and

WHEREAS, this Plan has been authorized, approved and adopted by the holders of a majority of the voting power of the stockholders of the Converting Entity.

NOW, THEREFORE, the Converting Entity hereby adopts this Plan as follows:

PLAN OF CONVERSION

| 1. | Conversion; Effect of Conversion. |

| (a) | Upon the Effective Time (as defined in Section 3 below), the Converting Entity shall be converted from a Nevada corporation to a Delaware corporation pursuant to Section 265 of the DGCL and Sections 92A.120 and 92A.250 of the NRS (the “Conversion”) and the Converting Entity, as converted to a Delaware corporation (the “Converted Entity”), shall thereafter be subject to all of the provisions of the DGCL, except that notwithstanding Section 106 of the DGCL, the existence of the Converted Entity shall be deemed to have commenced on the date the Converting Entity commenced its existence in the State of Nevada. |

| (b) | Upon the Effective Time, by virtue of the Conversion and without any further action on the part of the Converting Entity or its stockholders, the Converted Entity shall, for all purposes of the laws of the State of Delaware, be deemed to be the same entity as the Converting Entity existing immediately prior to the Effective Time. Upon the Effective Time, by virtue of the Conversion and without any further action on the part of the Converting Entity or its stockholders, for all purposes of the laws of the State of Delaware, all of the rights, privileges and powers of the Converting Entity existing immediately prior to the Effective Time, and all property, real, personal and mixed, and all debts due to the Converting Entity existing immediately prior to the Effective Time, as well as all other things and causes of action belonging to the Converting Entity existing immediately prior to the Effective Time, shall remain vested in the Converted Entity and shall be the property of the Converted Entity and the title to any real property vested by deed or otherwise in the Converting Entity existing immediately prior to the Effective Time shall not revert or be in any way impaired by reason of the Conversion; but all rights of creditors and all liens upon any property of the Converting Entity existing immediately prior to the Effective Time shall be preserved unimpaired, and all debts, liabilities and duties of the Converting Entity existing immediately prior to the Effective Time shall remain attached to the Converted Entity upon the Effective Time, and may be enforced against the Converted Entity to the same extent as if said debts, liabilities and duties had originally been incurred or contracted by the Converted Entity in its capacity as a corporation of the State of Delaware. The rights, privileges, powers and interests in property of the Converting Entity existing immediately prior to the Effective Time, as well as the debts, liabilities and duties of the Converting Entity existing immediately prior to the Effective Time, shall not be deemed, as a consequence of the Conversion, to have been transferred to the Converted Entity upon the Effective Time for any purpose of the laws of the State of Delaware. |

| (c) | The Conversion shall not be deemed to affect any obligations or liabilities of the Converting Entity incurred prior to the Conversion or the personal liability of any person incurred prior to the Conversion. |

| (d) | Upon the Effective Time, the name of the Converted Entity shall remain unchanged and continue to be “Akoustis Technologies, Inc.” |

| (e) | The Converting Entity intends for the Conversion to constitute a tax-free reorganization qualifying under Section 368(a) of the Internal Revenue Code of 1986, as amended. This Plan is adopted as a “plan of reorganization” within the meaning of Treasury Regulations Sections 1.368-1(c) and 1.368-2(g). |

| 2. | Filings. As promptly as practicable following the adoption of this Plan by the Board of Directors and the stockholders of the Converting Entity, the Converting Entity shall cause the Conversion to be effective by: |

| (a) | executing and filing (or causing the execution and filing of) Articles of Conversion, substantially in the form ofExhibit A hereto (the “Nevada Articles of Conversion”), with the Secretary of State of the State of Nevada pursuant to Section 92A.205 of the NRS; |

| (b) | executing and filing (or causing the execution and filing of) a Certificate of Conversion, substantially in the form ofExhibit B hereto (the “Delaware Certificate of Conversion”), with the Secretary of State of the State of Delaware pursuant to Sections 103 and 265 of the DGCL; and |

| (c) | executing and filing (or causing the execution and filing of) a Certificate of Incorporation of the Converted Entity, substantially in the form ofExhibit C hereto (the “Delaware Certificate of Incorporation”), with the Secretary of State of the State of Delaware pursuant to Sections 103 and 265 of the DGCL. |

| 3. | Effective Time. The Conversion shall become effective either (a) upon the last to occur of the filing of the Nevada Articles of Conversion, the Delaware Certificate of Conversion and the Delaware Certificate of Incorporation or (b) upon such later date and time as specified in such documents, which date must not be more than 90 days after the date on which the Nevada Articles of Conversion are filed (the time of the effectiveness of the Conversion, the “Effective Time”). |

| 4. | Effect of Conversion. |

| (a) | Effect on Common Stock. Upon the Effective Time, by virtue of the Conversion and without any further action on the part of the Converting Entity or its stockholders, each share of Common Stock, $0.001 par value per share, of the Converting Entity (“Converting Entity Common Stock”) that is issued and outstanding immediately prior to the Effective Time shall convert into one issued and outstanding share of Common Stock, $0.001 par value per share, of the Converted Entity (“Converted Entity Common Stock”). |

| (b) | Effect on Preferred Stock. Upon the Effective Time, by virtue of the Conversion and without any further action on the part of the Converting Entity or its stockholders, each share of Preferred Stock, $0.001 par value per share, of the Converting Entity (“Converting Entity Preferred Stock”) that is issued and outstanding immediately prior to the Effective Time (if any) shall convert into one issued and outstanding share of Preferred Stock, $0.001 par value per share, of the Converted Entity Preferred Stock. |

| (c) | Effect on Outstanding Stock Options. Upon the Effective Time, by virtue of the Conversion and without any further action on the part of the Converting Entity or its stockholders, each option to acquire shares of Converting Entity Common Stock outstanding immediately prior to the Effective Time shall convert into an equivalent option to acquire, upon the same terms and conditions (including the vesting schedule and exercise price per share applicable to each such option) as were in effect immediately prior to the Effective Time, the same number of shares of Converted Entity Common Stock. |

| (d) | Effect on Outstanding Warrants or Other Rights. Upon the Effective Time, by virtue of the Conversion and without any further action on the part of the Converting Entity or its stockholders, each warrant or other right to acquire shares of Converting Entity Common Stock outstanding immediately prior to the Effective Time shall convert into an equivalent warrant or other right to acquire, upon the same terms and conditions (including the vesting schedule and exercise price per share applicable to each such warrant or other right) as were in effect immediately prior to the Effective Time, the same number of shares of Converted Entity Common Stock. |

| (e) | Effect on Stock Certificates. All of the outstanding certificates representing shares of Converting Entity Common Stock immediately prior to the Effective Time shall be deemed for all purposes to continue to evidence ownership of and to represent the same number of shares of Converted Entity Common Stock. |

| (f) | Effect on Employee Benefit, Equity Incentive or Other Similar Plans. Upon the Effective Time, by virtue of the Conversion and without any further action on the part of the Converting Entity or its stockholders, each employee benefit plan, equity incentive plan or other similar plan to which the Converting Entity is a party shall continue to be a plan of the Converted Entity. To the extent that any such plan provides for the issuance of Converting Entity Common Stock, upon the Effective Time, such plan shall be deemed to provide for the issuance of Converted Entity Common Stock. |

| (g) | Effect of Conversion on Directors and Officers. Upon the Effective Time, by virtue of the Conversion and without any further action on the part of the Converting Entity or its stockholders, the members of the Board of Directors and the officers of the Converting Entity holding their respective offices in the Converting Entity existing immediately prior to the Effective Time shall continue in their respective offices as members of the Board of Directors and officers, respectively, of the Converted Entity. |

| 5. | Further Assurances. If, at any time after the Effective Time, the Converted Entity shall determine or be advised that any deeds, bills of sale, assignments, agreements, documents or assurances or any other acts or things are necessary, desirable or proper, consistent with the terms of this Plan, (a) to vest, perfect or confirm, of record or otherwise, in the Converted Entity its right, title or interest in, to or under any of the rights, privileges, immunities, powers, purposes, franchises, properties or assets of the Converting Entity existing immediately prior to the Effective Time, or (b) to otherwise carry out the purposes of this Plan, the Converted Entity and its officers and directors (or their designees), are hereby authorized to solicit in the name of the Converted Entity any third-party consents or other documents required to be delivered by any third party, to execute and deliver, in the name and on behalf of the Converted Entity, all such deeds, bills of sale, assignments, agreements, documents and assurances and do, in the name and on behalf of the Converted Entity, all such other acts and things necessary, desirable or proper to vest, perfect or confirm its right, title or interest in, to or under any of the rights, privileges, immunities, powers, purposes, franchises, properties or assets of the Converting Entity existing immediately prior to the Effective Time and otherwise to carry out the purposes of this Plan. |

| 6. | Delaware Bylaws. As promptly as practicable following the Effective Time, the Board of Directors of the Converted Entity shall adopt bylaws of the Converted Entity, substantially in the form ofExhibit D hereto. |

| 7. | Copy of Plan of Conversion. After the Conversion, a copy of this Plan will be kept on file at the offices of the Converted Entity, and any stockholder of the Converted Entity (or former stockholder of the Converting Entity) may request a copy of this Plan at no charge at any time. |

| 8. | Amendment. This Plan may be amended or modified by the Board of Directors of the Converting Entity at any time prior to the Effective Time, provided that such action would be in the best interests of the Converting Entity and its stockholders, and provided further that, if stockholder approval has already been obtained, such amendment complies with Section 92A.120 of the NRS. |

| 9. | Termination. At any time prior to the Effective Time, this Plan may be terminated and the transactions contemplated hereby may be abandoned by action of the Board of Directors of the Converting Entity if, in the opinion of the Board of Directors of the Converting Entity, such action would be in the best interests of the Converting Entity and its stockholders. In the event of termination of this Plan, this Plan shall become void and of no further force or effect. |

| 10. | Third-Party Beneficiaries. This Plan shall not confer any rights or remedies upon any person other than as expressly provided herein. |

| 11. | Severability. Whenever possible, each provision of this Plan will be interpreted in such manner as to be effective and valid under applicable law, but if any provision of this Plan is held to be prohibited by or invalid under applicable law, such provision will be ineffective only to the extent of such prohibition or invalidity, without invalidating the remainder of this Plan. |

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the undersigned hereby causes this Plan to be duly executed as of the date hereof.

| AKOUSTIS TECHNOLOGIES, INC., | ||||

| a Nevada corporation | ||||

| By: | /s/ Jeffrey B. Shealy | |||

| Name: | Jeffrey B. Shealy | |||

| Title: | President and Chief Executive Officer | |||

[Signature Page to Plan of Conversion]

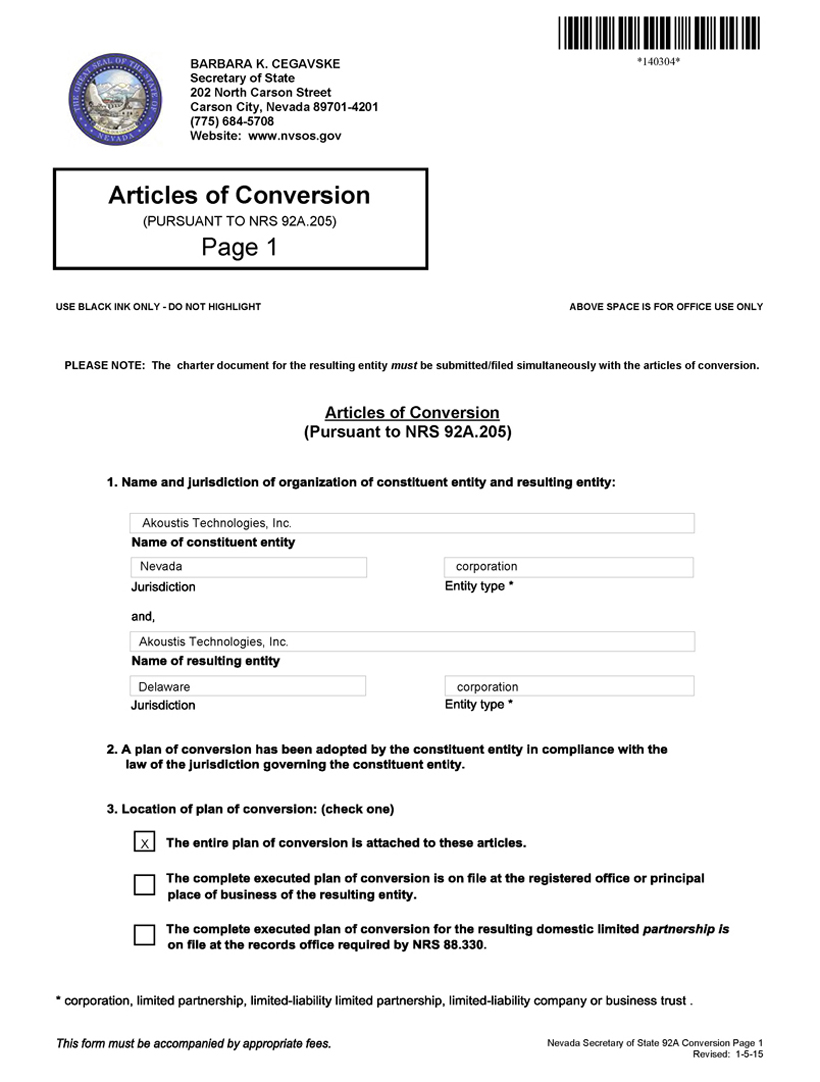

EXHIBIT A

STATE OF NEVADA ARTICLES OF CONVERSION

BARBARA K. CEGAVSKE

Secretary of State

202 North Carson Street

Carson City, Nevada 89701-4201

(775) 684-5708

Website: www.nvsos.gov

Articles of Conversion

(PURSUANT TO NRS 92A.205)

Articles of Conversion

(Pursuant to NRS 92A.205)

| 1. | Name and jurisdiction of organization of constituent entity and resulting entity: |

Name of constituent entity:Akoustis Technologies, Inc.

Jurisdiction: Nevada

Entity type: Corporation

Name of resulting entity:Akoustis Technologies, Inc.

Jurisdiction: Delaware

Entity type: Corporation

| 2. | A plan of conversion has been adopted by the constituent entity in compliance with the law of the jurisdiction governing the constituent entity. |

| 3. | Location of plan of conversion: (check one) |

| þ | The entire plan of conversion is attached to these articles. |

| ¨ | The complete executed plan of conversion is on file at the registered office or principal place of business of the resulting entity. |

| ¨ | The complete executed plan of conversion for the resulting domestic limited partnership is on file at the records office required by NRS 88.330. |

| 4. | Forwarding address where copies of process may be sent by the Secretary of State of Nevada (if a foreign entity is the resulting entity in the conversion): |

Akoustis Technologies, Inc.

9805 Northcross Center Court, Suite H

Huntersville, NC 28078

| 5. | Effective date and time of filing: (optional) (must not be later than 90 days after the certificate is filed) |

| Date: | Time: |

| 6. | Signatures — must be signed by: |

1. If constituent entity is a Nevada entity: an officer of each Nevada corporation; all general partners of each Nevada limited partnership or limited-liability limited partnership; a manager of each Nevada limited-liability company with managers or one member if there are no managers; a trustee of each Nevada business trust; a managing partner of a Nevada limited-liability partnership (a.k.a. general partnership governed by NRS chapter 87).

2. If constituent entity is a foreign entity: must be signed by the constituent entity in the manner provided by the law governing it.

Name of constituent entity: Akoustis Technologies, Inc.

| Signature | Title | Date |

EXHIBIT B

STATE OF DELAWARE

CERTIFICATE OF CONVERSION

FROM A NON-DELAWARE CORPORATION

TO A DELAWARE CORPORATION

PURSUANT TO SECTION 265 OF THE

DELAWARE GENERAL CORPORATION LAW

| 1.) | The jurisdiction where the Non-Delaware Corporation first formed is Nevada. |

| 2.) | The jurisdiction immediately prior to filing this Certificate is Nevada. |

| 3.) | The date the Non-Delaware Corporation first formed is April 10, 2013. |

| 4.) | The name of the Non-Delaware Corporation immediately prior to filing this Certificate is Akoustis Technologies, Inc. |

| 5.) | The name of the Corporation as set forth in the Certificate of Incorporation is Akoustis Technologies, Inc. |

IN WITNESS WHEREOF, the undersigned being duly authorized to sign on behalf of the converting Non-Delaware Corporation has executed this Certificate on the day of , A.D. .

| AKOUSTIS TECHNOLOGIES, INC., | ||||

| a Nevada corporation | ||||

| By: | ||||

| Name: | Jeffrey B. Shealy | |||

| Title: | President and Chief Executive Officer | |||

EXHIBIT C

CERTIFICATE OF INCORPORATION

OF

AKOUSTIS TECHNOLOGIES, INC.

The undersigned, a natural person (the “Sole Incorporator”), for the purpose of organizing a corporation to conduct business and promote the purposes hereinafter stated, under the provisions and subject to the requirements of the laws of the State of Delaware hereby certifies that:

ARTICLE I

CORPORATE NAME

The name of this corporation is Akoustis Technologies, Inc. (the “Corporation”).

ARTICLE II

REGISTERED OFFICE AND AGENT

The address of the Corporation’s registered office in the State of Delaware is to be located at 1675 South State Street, Suite B, Dover, Delaware 19901, Kent County. The registered agent in charge thereof is Capitol Services, Inc.

ARTICLE III

CORPORATE PURPOSES AND POWERS

The purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of Delaware (“DGCL”).

ARTICLE IV

CAPITAL STOCK

4.1 Number of Authorized Shares; Par Value. The aggregate number of shares which the Corporation shall have authority to issue is fifty million (50,000,000) shares, of which forty-five million (45,000,000) shares shall be designated as common stock, par value $0.001 per share, and of which five million (5,000,000) shall be designated as preferred stock, par value $0.001 per share.

4.2 Preferred Stock. The preferred stock may be issued at any time or from time to time, in any one or more series, and any such series shall be comprised of such number of shares and may have such voting powers, whole or limited, or no voting powers, and such designations, preferences and relative, participating, options or other special rights and qualifications, limitations or restrictions thereof, including liquidation preferences, as shall be stated and expressed in the resolution or resolutions of the board of directors of the Corporation (the “Board of Directors”), with the Board of Directors being hereby expressly vested with such power and authority to the full extent now or hereafter permitted by law.

4.3 No shareholder shall be entitled as a matter of right to subscribe for or receive additional shares of any class of stock of the Corporation, whether now or hereafter authorized, or any bonds, debentures or securities convertible into stock, but such additional shares of stock or other securities convertible into stock may be issued or disposed of by the Board of Directors to such persons and on such terms as in its discretion it shall deem advisable.

ARTICLE V

DIRECTORS

5.1 The business and affairs of the Corporation shall be managed by or under the direction of the Board of Directors, which shall consist of at least one (1) director. Provided that the Corporation has at least one (1) director, the number of directors may at any time or times be increased or decreased as provided in the Bylaws of the Corporation.

5.2 Elections of directors need not be done by written ballot unless the Bylaws of the Corporation shall otherwise provide.

5.3 The Board of Directors is expressly authorized to adopt, alter, amend or repeal the Bylaws of the Corporation. In addition to the powers and authority hereinbefore or by statute expressly conferred upon them, the directors are hereby empowered to exercise all such powers and do all such acts and things as may be exercised or done by the Corporation, subject, nevertheless, to the provisions of the DGCL, this Certificate of Incorporation, and any Bylaws adopted by the stockholders;provided,however, that no Bylaws hereafter adopted by the stockholders shall invalidate any prior act of the directors which would have been valid if such Bylaws had not been adopted.

ARTICLE VI

DIRECTOR AND OFFICER LIABILITY

The liability of directors for monetary damages shall be eliminated to the fullest extent under applicable law. Neither the amendment nor repeal of this Article VI, nor the adoption of any provision of this Certificate of Incorporation inconsistent with this Article VI shall eliminate or reduce the effect of such provisions, in respect of any matter occurring prior to such amendment, repeal or adoption of an inconsistent provision or in respect of any act or omission or any matter occurring prior to such amendment, repeal or adoption of an inconsistent provision, regardless of when any cause of action, suit or claim relating to any such matter accrued or matured or was commenced, and such provision shall continue to have effect in respect of such act, omission or matter as if such provision had not been so amended or repealed or if a provision inconsistent therewith had not been so adopted.

ARTICLE VII

INDEMNIFICATION

7.1 Power to Indemnify. The Corporation shall indemnify to the fullest extent permitted, from time to time, by applicable law any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative in nature by reason of the fact that such person is or was a director, officer, employee or agent of the Corporation, or, while a director, officer, employee or agent of the Corporation, is or was serving at the request of the Corporation as a director, officer, member, manager, partner, trustee, fiduciary, employee or agent of another corporation, limited liability company, partnership, joint venture, trust, employee benefit plan or other enterprise, against expenses (including attorneys’ fees), judgments, fines, penalties and amounts paid in settlement actually and reasonably incurred in connection with such action, suit or proceeding. The Corporation shall have the power to enter into agreements providing any such indemnity.

7.2 Expenses. The Corporation shall advance to a director, officer, employee or agent of the Corporation expenses incurred in connection with defending any action, suit or proceeding referred to above or in the Bylaws at any time before the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of the indemnified person to repay such amount if it shall ultimately be determined that he is not entitled to be indemnified by the Corporation as authorized in this Article VII or as provided in the Bylaws. The Corporation shall have the power to enter into agreements providing for such advancement of expenses.

7.3 Non-exclusivity. The indemnification and other rights provided for in this Article VII shall not be exclusive of any provision with respect to indemnification or the payment of expenses in the Bylaws or any other contract or agreement between the Corporation and any officer, director, employee or agent of the Corporation or any other person.

7.4 Future Changes. Neither the amendment nor repeal of this Article VII, nor the adoption of any provision of this Certificate of Incorporation inconsistent with this Article VII, shall eliminate or reduce the effect of such provisions in respect of any act or omission or any matter occurring prior to such amendment, repeal or adoption of an inconsistent provision regardless of when any cause of action, suit or claim relating to any such matter accrued or matured or was commenced, and such provision shall continue to have effect in respect of such act, omission or matter as if such provision had not been so amended or repealed or if a provision inconsistent therewith had not been so adopted.

| 2 |

ARTICLE VIII

AMENDMENT OR REPEAL

The Corporation reserves the right to amend, alter, change or repeal any provision contained in this Certificate of Incorporation, in the manner now or hereafter prescribed by statute and by this Certificate of Incorporation, and all rights conferred upon stockholders herein are granted subject to this reservation.

ARTICLE IX

SOLE INCORPORATOR

The name and mailing address of the Sole Incorporator are as follows:

Jeffrey B. Shealy

Akoustis Technologies, Inc.

9805 Northcross Center Court, Suite H

Huntersville, North Carolina 28078

IN WITNESS WHEREOF, the undersigned, for the purpose of forming a corporation under the laws of the State of Delaware, do make, file and record this Certificate, and do certify that the facts herein stated are true, and I have accordingly hereunto set my hand this day of , A.D. .

| By: | ||||

| Name: | Jeffrey B. Shealy | |||

| Title: | Incorporator | |||

| 3 |

EXHIBIT D

AKOUSTIS TECHNOLOGIES, INC.

Incorporated Under the Laws of the

State of Delaware

BY-LAWS

Effective

ARTICLE I

OFFICES

Akoustis Technologies, Inc. (the “Corporation”) shall maintain a registered office in the State of Delaware. The Corporation may also have other offices at such places, either within or without the State of Delaware, as the Board of Directors may from time to time designate or the business of the Corporation may require.

ARTICLE II

STOCKHOLDERS

Section 1.Place of Meetings. Meetings of the stockholders for the election of directors or for any other purpose shall be held on such date, at such time and at such place, either within or without the State of Delaware, as shall be designated from time to time by the Board of Directors and stated in the notice of the meeting or in a duly executed waiver of notice thereof. Only if so determined by the Board of Directors, in its sole discretion, (a) stockholders may participate in a meeting of stockholders by means of a telephone conference or similar methods of communication by which all persons participating in the meeting can hear each other and/or (b) a meeting of stockholders may be held not at any place, but may instead be held solely by means of electronic communication, as provided in Section 211 of the General Corporation Law of the State of Delaware (the “DGCL”).

Section 2.Annual Meeting. The Annual Meeting of Stockholders shall be held on such date and at such time as shall be designated from time to time by the Board of Directors and stated in the notice of the meeting, at which meeting the stockholders shall elect a Board of Directors and transact only such other business as is properly brought before the meeting in accordance with these By-Laws. Notice of the Annual Meeting stating the date, time and place of the meeting shall be given as permitted by law to each stockholder entitled to vote at such meeting not less than ten (10) nor more than sixty (60) days before the date of the meeting.

Section 3.Special Meetings. Unless otherwise prescribed by law or the Certificate of Incorporation of the Corporation (such Certificate, as amended from time to time, including resolutions adopted from time to time by the Board of Directors establishing the designation, rights, preferences and other terms of any class or series of capital stock, the “Certificate of Incorporation”), special meetings of the stockholders may be called, only at the request of a majority of the Board of Directors, by the Chairman of the Board, if any, the Chief Executive Officer, if any, the President or the Secretary. Notice of a Special Meeting stating the purpose or purposes for which the meeting is called and the date, time and place of the meeting, and the means of electronic communications, if any, by which stockholders and proxies shall be deemed to be present in person and vote, shall be given not less than ten (10) nor more than sixty (60) days before the date of the meeting to each stockholder entitled to vote at such meeting. Only such business as is specified in the notice of special meeting shall come before such meeting.

Section 4.Quorum. Except as otherwise provided by law or by the Certificate of Incorporation, the holders of shares of capital stock issued and outstanding entitled to vote thereat representing at least a majority of the votes entitled to be cast thereat, present in person or represented by proxy, shall constitute a quorum at all meetings of the stockholders for the transaction of business. Whether or not a quorum is present, the chairman of the meeting, or the stockholders entitled to vote thereat, present or represented by proxy, holding shares representing at least a majority of the votes so present or represented and entitled to be cast thereon, shall have the power to adjourn the meeting from time to time, without notice other than announcement at the meeting. At such adjourned meeting at which a quorum shall be present or represented, any business may be transacted which might have been transacted at the meeting as originally noticed. If the adjournment is for more than thirty (30) days, or if after the adjournment a new record date is fixed for the adjourned meeting, a notice of the adjourned meeting shall be given to each stockholder entitled to vote at the meeting. When a quorum is once present, it is not broken by the subsequent withdrawal of any stockholder.

Section 5.Appointment of Inspectors of Election. The Board of Directors shall, in advance of sending to the stockholders any notice of a meeting of the holders of any class of shares, appoint one or more inspectors of election (“inspectors”) to act at such meeting or any adjournment or postponement thereof and make a written report thereof. The Board of Directors may designate one or more persons as alternate inspectors to replace any inspector who fails to act. If no inspector or alternate is so appointed or if no inspector or alternate is able to act, the Chairman of the Board, or if none, the Secretary shall appoint one or more inspectors to act at such meeting. Each inspector, before entering upon the discharge of such inspector’s duties, shall take and sign an oath faithfully to execute the duties of inspector with strict impartiality and according to the best of such inspector’s ability.

Section 6.Voting. Except as otherwise provided by law or by the Certificate of Incorporation, each stockholder of record of any class or series of stock other than the common stock, par value $0.001 per share, of the Corporation (“Common Stock”) shall be entitled on each matter submitted to a vote at each meeting of stockholders to such number of votes for each share of such stock as may be fixed in the Certificate of Incorporation, and each stockholder of record of Common Stock shall be entitled at each meeting of stockholders to one vote for each share of such stock, in each case, registered in such stockholder’s name on the books of the Corporation on the date fixed pursuant to Section 5 of Article VI of these By-Laws as the record date for the determination of stockholders entitled to notice of and to vote at such meeting, or if no such record date shall have been so fixed, then at the close of business on the day next preceding the day on which notice of such meeting is given, or if notice is waived, at the close of business on the day next preceding the day on which the meeting is held.

Each stockholder entitled to vote at any meeting may vote either in person or by proxy duly appointed.

At all meetings of stockholders, all matters, except as otherwise provided by law, the Certificate of Incorporation or these By-Laws, shall be determined by the affirmative vote of the stockholders present in person or represented by proxy holding shares representing at least a majority of the votes so present or represented and entitled to be cast thereon, and where a separate vote by class is required, a majority of the votes represented by the shares of the stockholders of such class present in person or represented by proxy and entitled to be cast thereon shall be the act of such class.

The vote on any matter, including the election of directors, shall be by written ballot, or, if authorized by the Board of Directors, in its sole discretion, by electronic ballot given in accordance with a procedure set out in the notice of such meeting. Each ballot shall state the number of shares voted.

Proxy cards shall be returned in envelopes addressed to the inspectors, who shall receive, inspect and tabulate the proxies. Comments on proxies, consents or ballots shall be transcribed and provided to the Secretary with the name and address of the stockholder. Nothing in this Article II shall prohibit the inspector from making available to the Corporation, prior to, during or after any annual or special meeting, information as to which stockholders have not voted and periodic status reports on the aggregate vote.

Except as otherwise provided by law, the Certificate of Incorporation or these By-Laws, any action required or permitted to be taken at a meeting of stockholders may be taken without a meeting if, before or after the action, a written consent thereto is signed by stockholders holding shares representing at least a majority of the votes entitled to vote thereon, except that if a different proportion of voting power is required for such action at a meeting, then that proportion of written consents is required.

Section 7.List of Stockholders Entitled to Vote. The officer of the Corporation who has charge of the stock ledger of the Corporation shall prepare and make, at least ten (10) days before every meeting of stockholders, a complete list of the stockholders entitled to vote at the meeting, arranged in alphabetical order and showing the address of each stockholder and the number of shares registered in the name of each stockholder. Nothing contained in this Section shall require the Corporation to include electronic mail addresses or other electronic contact information on such list. Such list shall be open to the examination of any stockholder, for any purpose germane to the meeting, during ordinary business hours, for a period of at least ten (10) days prior to the meeting, either (i) on a reasonably accessible electronic network, provided that the information required to gain access to such list is provided with the notice of the meeting, or (ii) during ordinary business hours, at the principal place of business of the Corporation. In the event that the Corporation determines to make the list available on an electronic network, the Corporation may take reasonable steps to ensure that such information is available only to stockholders of the Corporation. If the meeting is to be held at a place, the list shall also be produced and kept at the time and place of the meeting during the whole time thereof and may be inspected by any stockholder of the Corporation who is present. If the meeting is to be held solely by means of remote communication, then the list shall also be open to the examination of any stockholder during the whole time of the meeting on a reasonably accessible electronic network, and the information required to access such list shall be provided with the notice of the meeting.

| 2 |

Section 8.Stock Ledger. The stock ledger of the Corporation shall be the only evidence as to who are the stockholders entitled to examine the stock ledger, the list required by Section 7 of this Article II or the books of the Corporation, or to vote in person or by proxy at any meeting of stockholders.

Section 9.Advance Notice of Stockholder-Proposed Business at Annual Meeting. To be properly brought before the Annual Meeting, business must be either (a) specified in the notice of meeting (or any supplement thereto) given by or at the direction of the Board of Directors, (b) otherwise properly brought before the meeting by or at the direction of the Board of Directors or (c) otherwise properly brought before the meeting by a stockholder of record. For business to be properly brought before an Annual Meeting by a stockholder, the stockholder must have given timely notice thereof in writing to the Secretary of the Corporation and must have been a stockholder of record at such time. To be timely, a stockholder’s notice must be delivered to or mailed and received at the principal executive offices of the Corporation not less than ninety (90) nor more than one hundred twenty (120) days prior to the one year anniversary of the date of the Annual Meeting of the previous year;provided, however, that in the event that the Annual Meeting is called for a date that is not within thirty (30) days before or after such anniversary date, notice by the stockholder in order to be timely must be so received not earlier than one hundred twenty (120) days prior to such Annual Meeting and not later than the close of business on the tenth (10th) day following the day on which notice of the date of the Annual Meeting was mailed or public disclosure of the date of the Annual Meeting was made, whichever first occurs. A stockholder’s notice to the Secretary shall set forth as to each matter the stockholder proposes to bring before the Annual Meeting (i) a brief description of the business desired to be brought before the Annual Meeting and the reasons for conducting such business at the Annual Meeting, (ii) the name and address, as they appear on the Corporation’s books, of the stockholder proposing such business, (iii) the class and number of shares of the Corporation that are beneficially owned by the stockholder, (iv) any material interest of the stockholder in such business and (v) any other information relating to the person or the proposal that is required to be disclosed pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (or any successor provision or law) or applicable law.

Notwithstanding anything in these By-Laws to the contrary, no business shall be conducted at an Annual Meeting except in accordance with the procedures set forth in this Section 9;provided, however, that nothing in this Section 9 shall be deemed to preclude discussion by any stockholder of any business properly brought before the Annual Meeting. The chairman of an Annual Meeting shall, if the facts warrant, determine and declare to the meeting that business was not properly brought before the meeting in accordance with the provisions of this Section 9 and if he should so determine, he shall so declare to the meeting and any such business not properly brought before the meeting shall not be transacted.

Section 10.Nomination of Directors; Advance Notice of Stockholder Nominations. Only persons who are nominated in accordance with the procedures set forth in this Section 10 shall be eligible for election as directors at a meeting of stockholders. Nominations of persons for election to the Board of Directors of the Corporation at the Annual Meeting or at any special meeting of stockholders called in the manner set forth in Section 3 of this Article II for the purpose of electing directors may be made at a meeting of stockholders by or at the direction of the Board of Directors, by any nominating committee or person appointed for such purpose by the Board of Directors, or by any stockholder of record of the Corporation entitled to vote for the election of directors at the meeting who complies with the notice procedures set forth in this Section 10. Such nominations, other than those made by, or at the direction of, or under the authority of the Board of Directors, shall be made pursuant to timely notice in writing to the Secretary of the Corporation by a stockholder of record at such time. To be timely, a stockholder’s notice shall be delivered to or mailed and received at the principal executive offices of the Corporation (a) in the case of an Annual Meeting, not less than ninety (90) nor more than one hundred twenty (120) days prior to the one year anniversary of the date of the Annual Meeting of the previous year;provided, however, that in the event that the Annual Meeting is called for a date that is not within thirty (30) days before or after such anniversary date, notice by the stockholder in order to be timely must be so received not earlier than one hundred twenty (120) days prior to such Annual Meeting and not later than the close of business on the tenth (10th) day following the day on which notice of the date of the Annual Meeting was mailed or public disclosure of the date of the Annual Meeting was made, whichever first occurs; and (b) in the case of a special meeting of stockholders called in the manner set forth in Section 3 of this Article II for the purpose of electing directors, not earlier than one hundred twenty (120) days prior to such special meeting and not later than the close of business on the tenth (10th) day following the day on which notice of the date of the special meeting was mailed or public disclosure of the date of the special meeting was made, whichever first occurs. Such stockholder’s notice to the Secretary shall set forth (a) as to each person whom the stockholder proposes to nominate for election or re-election as a director, (i) the name, age, business address and residence address of the person, (ii) the principal occupation or employment of the person, (iii) the class and number of shares of capital stock of the Corporation, if any, which are beneficially owned by the person and (iv) any other information relating to the person that is required to be disclosed in solicitations for proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (or any successor provision or law) or applicable law; and (b) as to the stockholder giving the notice (i) the name and record address of the stockholder and (ii) the class and number of shares of capital stock of the Corporation which are beneficially owned by the stockholder.

| 3 |

The chairman of the meeting shall, if the facts warrant, determine and declare to the meeting that a nomination was not made in accordance with the foregoing procedures and, if he should so determine, he shall so declare to the meeting and the defective nomination shall be disregarded.

ARTICLE III

DIRECTORS

Section 1.Number; Resignation; Removal. Except as otherwise required by the Certificate of Incorporation, the number of directors which shall constitute the whole Board of Directors shall be fixed from time to time by resolution of the Board of Directors, but shall not be less than one. Except as provided in Section 2 of this Article III and in the Certificate of Incorporation, a nominee for director shall be elected to the Board of Directors by a plurality of the votes cast at the Annual Meeting of Stockholders. A director may resign at any time upon notice to the Corporation. A director may be removed, with or without cause, by the affirmative vote of holders of shares of capital stock issued and outstanding entitled to vote at an election of directors representing at least a majority of the votes entitled to be cast thereon.

Section 2.Vacancies. Vacancies and newly created directorships resulting from any increase in the authorized number of directors may be filled by a majority of the remaining directors then in office, though less than a quorum, or by a sole remaining director, and the directors so elected shall hold office until the next Annual Meeting of stockholders and until their successors are duly elected and qualified, or until their earlier resignation or removal. If there are no directors in office, then an election of directors may be held in the manner provided by the DGCL. No decrease in the number of directors constituting the Board of Directors shall shorten the term of any incumbent director.

Section 3.Duties and Powers. The business of the Corporation shall be managed by or under the direction of the Board of Directors which may exercise all such powers of the Corporation and do all such lawful acts and things as are not by statute or by the Certificate of Incorporation or by these By-Laws directed or required to be exercised or done solely by the stockholders.

Section 4.Meetings. The Board of Directors of the Corporation may hold meetings, both regular and special, either within or without the State of Delaware. Regular meetings of the Board of Directors may be held without notice at such time and at such place as may from time to time be determined by the Board of Directors. Special meetings of the Board of Directors may be called by the Chairman of the Board, if any, the Chief Executive Officer, if any, the President or any director. Notice thereof stating the date, time and place of the meeting shall be given to each director either (i) by mail or courier not less than forty-eight (48) hours before the date of the meeting or (ii) by telephone, telegram or facsimile or electronic transmission, not less than twenty-four (24) hours before the time of the meeting or on such shorter notice as the person or persons calling such meeting may deem necessary or appropriate in the circumstances (provided that notice of any meeting need not be given to any director who shall either submit, before or after such meeting, a waiver of notice or attend the meeting without protesting, at the beginning thereof, the lack of notice).

Section 5.Quorum. Except as may be otherwise provided by law, the Certificate of Incorporation or these By-Laws, a majority of the entire Board of Directors shall be necessary to constitute a quorum for the transaction of business, and the vote of a majority of the directors present at a meeting at which a quorum is present shall be the act of the Board of Directors. Whether or not a quorum is present at a meeting of the Board of Directors, a majority of the directors present may adjourn the meeting to such time and place as they may determine without notice other than an announcement at the meeting.

| 4 |

Section 6.Action without a Meeting. Unless otherwise provided by the Certificate of Incorporation or these By-Laws, any action required or permitted to be taken by the Board of Directors or any committee thereof may be taken without a meeting if all members of the Board of Directors or the committee consent in writing or by electronic transmission to the adoption of a resolution authorizing the action. The resolution and the consents thereto in writing or by electronic transmission by the members of the Board of Directors or committee shall be filed with the minutes of the proceedings of the Board of Directors or such committee.

Section 7.Participation by Telephone. Unless otherwise provided by the Certificate of Incorporation or these By-Laws, any one or more members of the Board of Directors or any committee thereof may participate in a meeting of the Board of Directors or such committee by means of a conference telephone or other communications equipment allowing all persons participating in the meeting to hear each other. Participation by such means shall constitute presence in person at the meeting.

Section 8.Compensation. The directors may be paid their expenses, if any, for attendance at each meeting of the Board of Directors or any committee thereof and may be paid compensation as a director, committee member or chairman of any committee and for attendance at each meeting of the Board of Directors or committee thereof. No such payment shall preclude any director from serving the Corporation in any other capacity and receiving compensation therefore or entering into transactions otherwise permitted by the Certificate of Incorporation, these By-Laws or applicable law.

Section 9.Resignation. Any director may resign at any time. Such resignation shall be made in writing or by electronic transmission and shall take effect at the time specified therein, or, if no time be specified, at the time of its receipt by the Chairman of the Board, if any, the Chief Executive Officer, if any, the President or the Secretary. The acceptance of a resignation shall not be necessary to make it effective unless so specified therein.

ARTICLE IV

COMMITTEES

Section 1.Committees. The Board of Directors may designate one or more committees, each committee to consist of one or more of the directors of the Corporation. The Board of Directors may designate one or more directors as alternate members of any committee, who may replace any absent or disqualified member at any meeting of any such committee. In the absence or disqualification of a member of a committee, and in the absence of a designation by the Board of Directors of an alternate member to replace the absent or disqualified member, the member or members thereof present at any meeting and not disqualified from voting, whether or not such member or member constitute a quorum, may by unanimous vote appoint another member of the Board of Directors to act at the meeting in the place of any absent or disqualified member. Any committee, to the extent allowed by law and provided in the resolution establishing such committee or in these By-Laws, shall have and may exercise all the powers and authority of the Board of Directors in the management of the business and affairs of the Corporation, including the power to adopt any Certificate of merger, conversion, exchange or domestication, the authority to issue shares and the authority to declare a dividend, except as limited by the DGCL or other applicable law, but no such committee shall have power or authority in reference to the following matters: (i) approving or adopting, or recommending to the stockholders, any action or matter expressly required by the DGCL to be submitted to stockholders for approval or (ii) adopting, amending or repealing any By-Law of the Corporation. All acts done by any committee within the scope of its powers and duties pursuant to these By-Laws and the resolutions adopted by the Board of Directors shall be deemed to be, and may be certified as being, done or conferred under authority of the Board of Directors. The Secretary or any Assistant Secretary is empowered to certify that any resolution duly adopted by any such committee is binding upon the Corporation and to execute and deliver such certifications from time to time as may be necessary or proper to the conduct of the business of the Corporation.

Section 2.Resignation. Any member of a committee may resign at any time. Such resignation shall be made in writing or by electronic transmission and shall take effect at the time specified therein, or, if no time be specified, at the time of its receipt by the Chairman of the Board, if any, the Chief Executive Officer, if any, the President or the Secretary. The acceptance of a resignation shall not be necessary to make it effective unless so specified therein.

| 5 |

Section 3.Quorum. A majority of the members of a committee shall constitute a quorum. The vote of a majority of the members of a committee present at any meeting at which a quorum is present shall be the act of such committee.

Section 4.Record of Proceedings. Each committee shall keep a record of its acts and proceedings, and shall report the same to the Board of Directors when and as required by the Board of Directors.

Section 5.Organization, Meetings, Notices. A committee may hold its meetings at the principal office of the Corporation, or at any other place upon which a majority of the committee may at any time agree. Each committee may make such rules as it may deem expedient for the regulation and carrying on of its meetings and proceedings.

ARTICLE V

OFFICERS

Section 1.General. The officers of the Corporation shall be elected by the Board of Directors and shall consist of a President, a Secretary and a Treasurer. The Board of Directors, in its discretion, may also elect and specifically identify as officers of the Corporation a Chairman of the Board, a Chief Executive Officer, a Chief Financial Officer, a Controller, one or more vice presidents, assistant secretaries and assistant treasurers, and such other officers and agents as in its judgment may be necessary or desirable. Any number of offices may be held by the same person, unless otherwise prohibited by law, the Certificate of Incorporation or these By-Laws. The officers of the Corporation need not be stockholders or directors of the Corporation. Any office named or provided for in this Article V (including, without limitation, Chairman of the Board, Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer and Controller) may, at any time and from time to time, be held by one or more persons. If an office is held by more than one person, each person holding such office shall serve as a co-officer (with the appropriate corresponding title) and shall have general authority, individually and without the need for any action by any other co-officer, to exercise all the powers of the holder of such office of the Corporation specified in these By-Laws and shall perform such other duties and have such other powers as may be prescribed by the Board of Directors or such other officer specified in this Article V.

Section 2.Election; Removal; Remuneration. The Board of Directors at its first meeting held after each Annual Meeting of Stockholders shall elect the officers of the Corporation who shall hold their offices for such terms and shall exercise such powers and perform such duties as shall be determined from time to time by the Board of Directors and may elect additional officers and may fill vacancies among the officers previously elected at any subsequent meeting of the Board of Directors; and all officers of the Corporation shall hold office until their successors are chosen and qualified, or until their earlier resignation or removal. Any officer elected by the Board of Directors may be removed at any time, either for or without cause, by the affirmative vote of a majority of the Board of Directors.

Section 3.Voting Securities Owned by the Corporation. Powers of attorney, proxies, waivers of notice of meetings, consents and other instruments relating to securities owned by the Corporation may be executed in the name of and on behalf of the Corporation by the Chairman of the Board, if any, the Chief Executive Officer, if any, the President or the Secretary, and any such officer may, in the name and on behalf of the Corporation, take all such action as any such officer may deem advisable to vote in person or by proxy at any meeting of security holders of any company, partnership or other entity in which the Corporation may own securities, or to execute written consents in lieu thereof, and at any such meeting, or in giving any such consent, shall possess and may exercise any and all rights and powers incident to the ownership of such securities and which, as the owner thereof, the Corporation might have exercised and possessed if present. The Board of Directors may, by resolution, from time to time confer like powers upon any other person or persons.

Section 4.Chairman of the Board. The Chairman of the Board, if any, may be, but need not be, a person other than the Chief Executive Officer or the President of the Corporation. The Chairman of the Board may be, but need not be, an officer or employee of the Corporation. The Chairman of the Board shall preside at meetings of the Board of Directors and shall establish agendas for such meetings. In addition, the Chairman of the Board shall assure that matters of significant interest to stockholders and the investment community are addressed by management.

| 6 |

Section 5.Chief Executive Officer. The Chief Executive Officer, if any, shall, subject to the direction of the Board of Directors, have general and active control of the affairs and business of the Corporation and general supervision of its officers, officials, employees and agents. The Chief Executive Officer shall preside at all meetings of the stockholders and shall preside at all meetings of the Board of Directors and any committee thereof of which he or she is a member, unless the Board of Directors or such committee shall have chosen another chairman. The Chief Executive Officer shall see that all orders and resolutions of the Board are carried into effect, and in addition, the Chief Executive Officer shall have all the powers and perform all the duties generally appertaining to the office of the chief executive officer of a corporation. The Chief Executive Officer shall designate the person or persons who shall exercise his powers and perform his duties in his absence or disability and the absence or disability of the President.

Section 6.President. The President shall have such powers and perform such duties as are prescribed by the Chief Executive Officer or the Board of Directors, and in the absence or disability of the Chief Executive Officer, the President shall have the powers and perform the duties of the Chief Executive Officer, except to the extent the Board of Directors shall have otherwise provided. In addition, the President shall have such powers and perform such duties generally appertaining to the office of the president of a corporation, except to the extent the Chief Executive Officer, if any, or the Board of Directors shall have otherwise provided.

Section 7.Vice President. The Vice Presidents of the Corporation shall perform such duties and have such powers as may, from time to time, be assigned to them by the Board of Directors, the Chief Executive Officer, if any, the President or these By-Laws.

Section 8.Secretary. The Secretary shall attend all meetings of the Board of Directors and of the stockholders and record all votes and the minutes of all proceedings in a book to be kept for that purpose, and shall perform like duties for any committee appointed by the Board of Directors. The Secretary shall keep in safe custody the seal of the Corporation and affix it to any instrument when so authorized by the Board of Directors. The Secretary shall give or cause to be given, notice of all meetings of stockholders and special meetings of the Board of Directors and shall perform generally all the duties usually appertaining to the office of secretary of a corporation and shall perform such other duties and have such other powers as may be prescribed by the Board of Directors or these By-Laws. The Board of Directors may give general authority to any other officer to affix the seal of the Corporation and to attest the affixing by his or her signature.

Section 9.Assistant Secretary. The Assistant Secretary shall be empowered and authorized to perform all of the duties of the Secretary in the absence or disability of the Secretary and shall perform such other duties and have such other powers as may be prescribed by the Board of Directors, the Secretary or these By-Laws.

Section 10.Chief Financial Officer. The Chief Financial Officer, if any, shall have responsibility for the administration of the financial affairs of the Corporation and shall exercise supervisory responsibility for the performance of the duties of the Treasurer and the Controller, if any. The Chief Financial Officer shall render to the Board of Directors, at its regular meetings, or when the Board of Directors so requires, an account of all of the transactions effected by the Treasurer and the Controller, if any, and of the financial condition of the Corporation. The Chief Financial Officer shall generally perform all the duties usually appertaining to the affairs of a chief financial officer of a corporation and shall perform such other duties and have such other powers as may be prescribed by the Board of Directors or these By-Laws.

Section 11.Treasurer. The Treasurer shall have the custody of the corporate funds and securities and shall cause to be kept full and accurate accounts of receipts and disbursements in books belonging to the Corporation and shall deposit all monies and other valuable effects in the name and to the credit of the Corporation in such depositories as may be designated by persons authorized by the Board of Directors. The Treasurer shall disburse the funds of the Corporation as may be ordered by the Board of Directors, taking proper vouchers for such disbursements, and shall render to the Chairman of the Board, if any, the Chief Executive Officer, if any, the President and the Board of Directors whenever they may require it, an account of all of the transactions effected by the Treasurer and of the financial condition of the Corporation. The Treasurer may be required to give a bond for the faithful discharge of his or her duties. The Treasurer shall generally perform all duties appertaining to the office of treasurer of a corporation and shall perform such other duties and have such other powers as may be prescribed by the Board of Directors, the Chief Executive Officer, if any, the President or these By-Laws.

| 7 |

Section 12.Assistant Treasurer. The Assistant Treasurer shall be empowered and authorized to perform all the duties of the Treasurer in the absence or disability of the Treasurer and shall perform such other duties and have such other powers as may be prescribed by the Board of Directors, the Treasurer or these By-Laws.

Section 13.Controller. The Controller, if any, shall prepare and have the care and custody of the books of account of the Corporation. The Controller shall keep a full and accurate account of all monies, received and paid on account of the Corporation, and shall render a statement of the Controller’s accounts whenever the Board of Directors shall require. The Controller shall generally perform all the duties usually appertaining to the affairs of the controller of a corporation and shall perform such other duties and have such other powers as may be prescribed by the Board of Directors, the Chief Financial Officer, if any, the President or these By-Laws. The Controller may be required to give a bond for the faithful discharge of his or her duties.

Section 14.Additional Powers and Duties. In addition to the foregoing especially enumerated duties and powers, the several officers of the Corporation shall perform such other duties and exercise such further powers as the Board of Directors may, from time to time, determine or as may be assigned to them by any superior officer.

Section 15.Other Officers. The Board of Directors may designate such other officers having such duties and powers as it may specify from time to time.

ARTICLE VI

CAPITAL STOCK

Section 1.Form of Certificate; Uncertificated Shares. The shares of the Corporation shall be represented by certificates, provided that the Board of Directors may provide by resolution or resolutions that some or all of any or all classes or series of its stock may be uncertificated shares. Any such resolution shall not apply to shares represented by a certificate until such certificate is surrendered to the Corporation. Every holder of stock in the Corporation represented by a certificate shall be entitled to have a certificate signed in the name of the Corporation (i) by the Chairman of the Board, if any, the Chief Executive Officer, if any, the President or any Vice President and (ii) by the Treasurer or an Assistant Treasurer or the Secretary or an Assistant Secretary, representing the number of shares registered in certificate form. Except as otherwise provided by law or these By-Laws, the rights and obligations of the holders of uncertificated shares and the rights and obligations of the holders of certificates representing stock of the same class and series shall be identical.

Section 2.Signatures. Any signature required to be on a certificate may be a facsimile. In case any officer, transfer agent or registrar who has signed or whose facsimile signature has been placed upon a certificate shall have ceased to be such officer, transfer agent or registrar before such certificate is issued, it may be issued by the Corporation with the same effect as if such person were such officer, transfer agent or registrar at the date of issue.

Section 3.Lost, Stolen or Destroyed Certificates. The Board of Directors may direct a new certificate to be issued in place of any certificate theretofore issued by the Corporation alleged to have been lost, stolen or destroyed, upon the making of an affidavit of that fact by the person claiming the certificate of stock to be lost, stolen or destroyed. When authorizing such issue of a new certificate, the Board of Directors may, in its discretion and as a condition precedent to the issuance thereof, require the owner of such lost, stolen or destroyed certificate, or his legal representative, to advertise the same in such manner as the Board of Directors shall require and/or to give the Corporation a bond in such sum as it may direct as indemnity against any claim that may be made against the Corporation with respect to the certificate alleged to have been lost, stolen or destroyed.

Section 4.Transfers. Stock of the Corporation shall be transferable in the manner prescribed by law and in these By-Laws. Transfers of stock shall be made on the books of the Corporation only by the holder of record or by such person’s attorney duly authorized, and upon the surrender of properly endorsed certificates for a like number of shares (or, with respect to uncertificated shares, by delivery of duly executed instructions or in any other manner permitted by applicable law).

Section 5.Record Date. In order that the Corporation may determine the stockholders entitled to notice of or to vote at any meeting of stockholders or any adjournment thereof, or entitled to express consent to corporate action, or entitled to receive payment of any dividend or other distribution or allotment of any rights, or entitled to exercise any rights in respect of any change, conversion or exchange of stock or for the purpose of any other lawful action, the Board of Directors may fix, in advance, a record date, which shall not be more than sixty (60) days nor less than ten (10) days before the date of such meeting, nor more than sixty (60) days prior to any other action. A determination of stockholders of record entitled to notice of or to vote at a meeting of stockholders shall apply to any adjournment of the meeting, unless the Board of Directors fixes a new record date for the adjourned meeting.

| 8 |

Section 6.Beneficial Owners. The Corporation shall be entitled to recognize the exclusive right of the person registered on its books as the owner of a share to receive dividends and to vote as such owner, and to hold liable for calls and assessments a person registered on its books as the owner of shares, and shall not be bound to recognize any equitable or other claim to or interest in such share or shares on the part of any other person, whether or not it shall have express or other notice thereof, except as otherwise provided by law.

Section 7.Dividends. Subject to the provisions of the Certificate of Incorporation or applicable law, dividends upon the capital stock of the Corporation, if any, may be declared by the Board of Directors at any regular or special meeting, and may be paid in cash, in property, or in shares of capital stock. Before payment of any dividend, there may be set aside out of any funds of the Corporation available for dividends such sum or sums as the Board of Directors from time to time, in its absolute discretion, deems proper as a reserve or reserves to meet contingencies, or for equalizing dividends, or for repairing or maintaining any property of the Corporation or for any proper purpose, and the Board of Directors may modify or abolish any such reserve.

Section 8.Common Stock. The voting, dividend and liquidation rights of the holders of shares of Common Stock are subject to, and qualified by, the rights of the holders of the preferred stock, if any, of the Corporation. Each share of Common Stock shall be treated identically as all other shares of Common Stock with respect to dividends, distributions, rights in liquidation and in all other respects.

ARTICLE VII

INDEMNIFICATION

Section 1.Indemnification Respecting Third Party Claims. The Corporation, to the full extent and in a manner permitted by Delaware law as in effect from time to time, shall indemnify, in accordance with the provisions of this Article, any person (including the heirs, executors, and administrators of any such person) who was or is made a party to or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding (including any appeal thereof), whether civil, criminal, administrative, or investigative (other than an action by or in the right of the Corporation or by any corporation, limited liability company, partnership, joint venture, trust, employee benefit plan or other enterprise of which the Corporation owns, directly or indirectly through one or more other entities, a majority of the voting power or otherwise possesses a similar degree of control), by reason of the fact that such person is or was a director, officer, employee or agent of the Corporation, or is or was serving at the request of the Corporation as a director, officer, member, manager, partner, trustee, fiduciary, employee or agent (a “Subsidiary Officer”) of another corporation, limited liability company, partnership, joint venture, trust, employee benefit plan or other enterprise (any such entity for which a Subsidiary Officer so serves, an “Associated Entity”), against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding if such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of the Corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was unlawful;provided, however, that (i) the Corporation shall not be obligated to indemnify a person who is or was a director, officer, employee or agent of the Corporation or a Subsidiary Officer of an Associated Entity against expenses incurred in connection with an action, suit, proceeding or investigation to which such person is threatened to be made a party but does not become a party unless the incurring of such expenses was authorized by or under the authority of the Board of Directors and (ii) the Corporation shall not be obligated to indemnify against any amount paid in settlement unless the Board of Directors has consented to such settlement. The termination of any action, suit or proceeding by judgment, order, settlement or conviction or upon a plea ofnolocontendere or its equivalent shall not, of itself, create a presumption that the person did not act in good faith and in a manner which such person reasonably believed to be in or not opposed to the best interests of the Corporation, or with respect to any criminal action or proceeding, that such person had reasonable cause to believe that his conduct was unlawful. Notwithstanding anything to the contrary in the foregoing provisions of this Section 1, a person shall not be entitled, as a matter of right, to indemnification pursuant to this Section 1 against costs or expenses incurred in connection with any action, suit or proceeding commenced by such person against the Corporation or any Associated Entity or any person who is or was a director, officer, fiduciary, employee or agent of the Corporation or a Subsidiary Officer of any Associated Entity (including, without limitation, any action, suit or proceeding commenced by such person to enforce such person’s rights under this Article, unless and only to the extent that such person is successful on the merits of such claim), but such indemnification may be provided by the Corporation in a specific case as permitted by Section 7 below in this Article.

| 9 |

Section 2.Indemnification Respecting Derivative Claims. The Corporation, to the full extent and in a manner permitted by Delaware law as in effect from time to time, shall indemnify, in accordance with the provisions of this Article, any person (including the heirs, executors, and administrators of any such person) who was or is made a party to or is threatened to be made a party to any threatened, pending or completed action or suit (including any appeal thereof) brought by or in the right of the Corporation to procure a judgment in its favor by reason of the fact that such person is or was a director, officer, employee or agent of the Corporation, or is or was serving at the request of the Corporation as a Subsidiary Officer of an Associated Entity, against expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection with the defense or settlement of such action or suit if such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of the Corporation, except that no indemnification shall be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the Corporation unless, and only to the extent that, the Court of Chancery or the court in which such action or suit was brought determines upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the Court of Chancery or such other court shall deem proper;provided, however, that the Corporation shall not be obligated to indemnify a director, officer, employee or agent of the Corporation or a Subsidiary Officer of an Associated Entity against expenses incurred in connection with an action or suit to which such person is threatened to be made a party but does not become a party unless the incurrence of such expenses was authorized by or under the authority of the Board of Directors. Notwithstanding anything to the contrary in the foregoing provisions of this Section 2, a person shall not be entitled, as a matter of right, to indemnification pursuant to this Section 2 against expenses incurred in connection with any action or suit in the right of the Corporation commenced by such person, but such indemnification may be provided by the Corporation in any specific case as permitted by Section 7 below in this Article.

Section 3.Determination of Entitlement to Indemnification. Any indemnification to be provided under either of Section 1 or 2 above in this Article (unless ordered by a court of competent jurisdiction or advanced as provided in Section 5 of this Article) shall be made by the Corporation only as authorized in the specific case upon a determination that indemnification of the director, officer, employee or agent is proper under the circumstances. Such determination must be made (a) by the stockholders, (b) by a majority vote of the directors who are not parties to the action, suit or proceeding, even though less than a quorum, (c) by a committee of such directors designated by majority vote of such directors, even though less than a quorum, or (d) if there are no such directors, or if such directors so elect, by independent legal counsel in a written opinion. In the event a request for indemnification is made by any person referred to in Section 1 or 2 above in this Article, the Corporation shall use its reasonable best efforts to cause such determination to be made not later than sixty (60) days after such request is made after the final disposition of such action, suit or proceeding.

Section 4.Right to Indemnification upon Successful Defense and for Service as a Witness. (a) Notwithstanding the other provisions of this Article, to the extent that a present or former director or officer has been successful on the merits or otherwise in defense of any action, suit or proceeding referred to in either of Section 1 or 2 above in this Article, or in defense of any claim, issue or matter therein, such person shall be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection therewith.