PART II – INFORMATION REQUIRED IN OFFERING CIRCULAR

An Offering Statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the Offering Statement filed with the Securities and Exchange Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation, or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the Offering Statement in which such Final Offering Circular was filed may be obtained.

REGULATION A OFFERING CIRCULAR UNDER THE SECURITIES ACT OF 1933

PRELIMINARY OFFERING CIRCULAR DATED FEBRUARY [ ], 2021, SUBJECT TO COMPLETION

COLABS INT’L CORP

3,000,000 Shares of Common Stock

18593 Main Street

Huntington Beach, CA 92648

(888) 878-5536

www.colabsintl.com

CoLabs Int’l, Corp., a Nevada corporation (the “Company,” “we,” “us,” or “our”) is offering up to 3,000,000 (the “Maximum Offering”) shares (the “Shares”) of our Common Stock, par value $0.001 per share (the “Common Stock”) to be sold in this offering (the “Offering”). The Shares are being offered at a purchase price of $6.50 per Share on a “best efforts” basis. (See “Securities Being Offered” for a discussion of certain items required by Item 14 of Part II of Form 1-A.)

We are selling our Shares through a Tier 2 offering pursuant to Regulation A (Regulation A+) under the Securities Act of 1933, as amended (the “Securities Act”), and we intend to sell the Shares either directly to investors or through registered broker-dealers who are paid commissions. This Offering will terminate on the earlier of (i) March 1, 2022, (ii) the date on which the Maximum Offering is sold, or (iii) when our Board of Directors elect to terminate the Offering (in each such case, the “Termination Date”).

There is currently no escrow established for this Offering, although management reserves the right to establish an escrow and engage an escrow agent in its discretion without a subsequent offering circular supplement or prior notice to investors. We will hold closings upon the receipt of investors’ subscriptions and acceptance of such subscriptions by us. If, on the initial closing date, we have sold less than the Maximum Offering, then we may hold one or more additional closings for additional sales, until the Termination Date.

Subscriptions made by investors pursuant to subscription agreements in this Offering are irrevocable. There is no aggregate minimum requirement for the Offering to become effective; therefore, we reserve the right, subject to applicable securities laws, to begin applying “dollar one” of the proceeds from the Offering towards our business strategy, including, without limitation: marketing staff and campaigns; raw materials and inventory; research and development expenses; testing and lab equipment; legal fees for business matters and protection of intellectual property and related regulatory costs; leasing additional administrative facilities; working capital; offering expenses; and other uses, as more specifically set forth in the “Use of Proceeds” section of this offering circular (the “Offering Circular”).

We expect to commence the sale of the Shares as of the date on which the offering statement of which this Offering Circular is a part (the “Offering Statement”) is qualified by the United States Securities and Exchange Commission (the “SEC”).

Investing in our Common Stock involves a high degree of risk. These are speculative securities. You should purchase these securities only if you can afford a complete loss of your investment. (See “Risk Factors” for a discussion of certain risks that you should consider in connection with an investment in our Common Stock.)

THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE SEC; HOWEVER, THE SEC HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

| | | Price to Public(1)(4) | | | Compensation to the Selling Group | | | Proceeds to the Company(2) | |

| Per Share(3) | | $ | 6.50 | | | $ | 0.065 | | | $ | 6.435 | |

| Total | | $ | 19,500,000 | | | $ | 195,000 | | | $ | 19,305,000 | |

| | (1) | The minimum investment amount for each subscription is 100 Shares or $650. We have the option in our sole discretion to accept less than the minimum investment. The Offering is being made directly to investors by our management on a “best efforts” basis. We have engaged Dalmore Group, LLC, member FINRA/SIPC (“Dalmore”), to act as the broker-dealer of record in connection with this Offering, but not as underwriting or placement agent. This includes a 1% commission but does not include the one-time set-up fee of $5,000 for out-of-pocket expenses or the $20,000 consulting fee payable by us to Dalmore. See “Plan of Distribution” for details. We have not engaged any other commissioned sales agents, placement agents, or underwriters in connection with this Offering. To the extent that we do so, we will file a supplement to the Offering Statement of which this Offering Circular is a part. |

| | (2) | The amounts shown in the “Proceeds to the Company” column are before deducting Offering costs to be borne by us, estimated to be approximately $2,535,000, including legal, accounting, printing, due diligence, marketing, selling, and other costs incurred in the Offering of the Shares. (See “Use of Proceeds” and “Plan of Distribution and Selling Securityholders.”) |

| | | |

| | (3) | The Shares are being offered pursuant to Regulation A of Section 3(b) of the Securities Act for Tier 2 offerings. The Shares are only being issued to purchasers who satisfy the requirements set forth in Regulation A. |

| | | |

| | (4) | We are offering shares on a continuous basis. See “Plan of Distribution and Selling Securityholders.” |

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN TEN PERCENT (10%) OF THE GREATER OF YOUR ANNUAL INCOME OR YOUR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A+. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

This Offering Circular contains all of the representations by us concerning this Offering, and no person shall make different or broader statements than those contained herein. Investors are cautioned not to rely upon any information not expressly set forth in this Offering Circular.

Sale of the Shares of our Common Stock will commence on approximately [ ], 2021.

The Company is following the “Offering Circular” format of disclosure under Regulation A+.

The date of this Offering Circular is [ ], 2021

TABLE OF CONTENTS

IMPORTANT INFORMATION ABOUT THIS OFFERING CIRCULAR

We are offering to sell, and seeking offers to buy, our securities only in jurisdictions where such offers and sales are permitted. Please carefully read the information in this offering circular and any accompanying offering circular supplements, which we refer to collectively as the “Offering Circular.” You should rely only on the information contained in the Offering Circular. We have not authorized anyone to provide you with any information other than the information contained in this Offering Circular. The information contained in this Offering Circular is accurate only as of its date or as of the respective dates of any documents or other information incorporated herein by reference, regardless of the time of its delivery or of any sale or delivery of our securities. Neither the delivery of this Offering Circular nor any sale or delivery of our securities shall, under any circumstances, imply that there has been no change in our affairs since the date of this Offering Circular. This Offering Circular will be updated and made available for delivery to the extent required by the federal securities laws.

This Offering Circular is part of the Offering Statement that we are filing with the SEC using a continuous offering process. Periodically, we may provide an offering circular supplement that would add, update, or change information contained in this Offering Circular. Any statement that we make in this Offering Circular will be modified or superseded by any inconsistent statement made by us in a subsequent offering circular supplement. The Offering Statement filed with the SEC includes exhibits that provide more detailed descriptions of the matters discussed in this Offering Circular. You should read this Offering Circular and the related exhibits filed with the SEC and any offering circular supplement, together with additional information contained in our annual reports, semi-annual reports, and other reports and information statements that we will file periodically with the SEC. The Offering Statement and all supplements and reports that we have filed or will file in the future can be read at the SEC website, www.sec.gov.

Unless otherwise indicated, data contained in this Offering Circular concerning our business is based on information from various public sources. Although we believe that such data is generally reliable, such information is inherently imprecise, and our estimates and expectations based on this data involve a number of assumptions and limitations. As a result, you are cautioned not to give undue weight to such data, estimates or expectations.

In this Offering Circular, unless the context indicates otherwise, references to the “Company,” “we,” “our,” and “us” refer to the activities of and the assets and liabilities of the business and operations of CoLabs Int’l, Corp., a Nevada corporation.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements under “Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Description of Business,” and elsewhere in this Offering Circular constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends, and similar matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” and “would” or the negatives of these terms, or other comparable terminology.

You should not place undue reliance on forward-looking statements. The cautionary statements set forth in this Offering Circular, including in “Risk Factors” and elsewhere, identify important factors which you should consider in evaluating our forward-looking statements. These factors include, among other things:

| ● | The success of our products and product candidates will require significant capital resources and years of research and development efforts; |

| | |

| ● | Our ability to obtain regulatory approval and market acceptance of our products; |

| | |

| ● | Our ability to protect our intellectual property and to develop, maintain, and enhance a strong brand; |

| | |

| ● | Our ability to compete and succeed in a highly competitive and evolving industry; |

| | |

| ● | Our ability to raise capital and the availability of future financing; |

| | |

| ● | Our ability to manage our research and development, planned expansion and growth, and operating expenses; and |

| | |

| ● | Our reliance on third parties to conduct our manufacturing and distribution operations. |

Although the forward-looking statements in this Offering Circular are based on our beliefs, assumptions, and expectations, taking into account all information currently available to us, we cannot guarantee future transactions, results, performance, achievements, or outcomes. No assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or that deviations from them will not be material and adverse. We undertake no obligation, other than as may be required by law, to re-issue this Offering Circular or otherwise make public statements updating our forward-looking statements.

SUMMARY

This summary highlights selected information contained elsewhere in this Offering Circular. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our Common Stock. You should carefully read the entire Offering Circular, including the risks associated with an investment in the Company discussed in the “Risk Factors” section of this Offering Circular, before making an investment decision. Some of the statements in this Offering Circular are forward-looking statements. (See the section entitled “Cautionary Statement Regarding Forward-Looking Statements” above.)

Company Information

CoLabs Int’l, Corp. (the “Company,” “CoLabs,” “we,” “our,” and “us”) was formed on August 5, 2008 under the laws of the State of Nevada and is headquartered in Huntington Beach, California. We are a majority-woman owned biotechnology and pharmaceutical manufacturing company. We develop commercially unique and innovative targeted skin delivery systems for topical pharmacology. We currently have 26 issued patents and eight filed pending patents covering our technology.

We are authorized to issue up to 50,000,000 Shares of Common Stock, par value $0.001 per share. As of the date of this Offering Circular, there are 15,800,000 Shares issued and outstanding.

Our mailing address is CoLabs Int’l, Corp., 18593 Main Street, Huntington Beach, CA 92648, and our telephone number is (888) 878-5536. Our website address is www.colabsintl.com. The information contained in our website or accessible thereby is not incorporated into this Offering Circular.

Our Business

We are a mid-stage biotech company, having developed patented, tested formulations. Using our intellectual property, we have tested, commercialized, and manufactured products since 2008. We believe that our unique and scientifically advanced technology makes us a global leader in targeted epidermal delivery systems for cosmeceuticals, fragrances, antibacterial/anti-viral sanitizers/cleaners, and most importantly, topical pharmacology.

We market products through the internet, retailers, distributors, and in dermatologists’ offices. Additionally, we develop marketing relationships whereby we supply formulatory guidance and base formulations directly to our partners for distribution. As a supplier, we sell ingredients and/or finished products into this expanding distribution channel. We have also expanded sunscreen, pest repellents, and sanitizers/soap distribution for our Klēnskin™ products internationally.

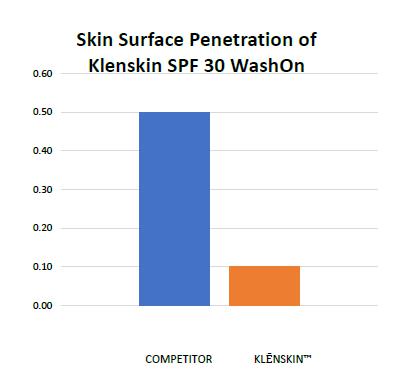

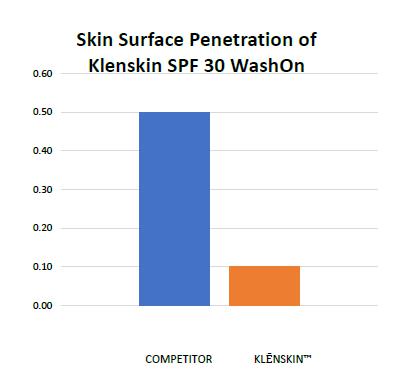

Our QuantaSphere® (QS®) Technology formulations provide advanced proprietary, epidermal therapeutic effects that are unique and market disruptive. As such, our products are consumer friendly. QS® Technology blends consumer needs for a healthy lifestyle with our targeted, eco-friendly, multi-tasking efficacy. Our innovative QS® Technology is vastly superior for non-transdermal delivery and importantly, is technologically adaptive, thereby, limiting toxicity for a vast variety of applications.

Our technology places drugs into micro-sized, electrostatically charged encapsulates as well as into other types of micro-encapsulates. These encapsulates are then suspended in uniquely designed formulations. This formulation of a highly advanced micro-technology can: target the delivery of topically applied drugs; limit unwanted absorption of chemicals, drugs, and cosmetics through the skin; and provide a designed release of active ingredients with a prescribed depth of skin penetration.

We have already developed commercially and manufactured unique and innovative targeted skin delivery systems for topical pharmacology. Our technology limits unwanted side effects that can occur as a result of absorption through the skin. The penetration of chemicals through the skin can have serious impact on the body’s organs and systems. Our current applications include anti-bacterial/viral sanitizers/soaps, sunscreens, fragrances, pest-repellents, and healing cosmetic lotions. For consumers, we provide elegant skin delivery and enhanced consumer safety of topically applied drugs and cosmetics. This combined end purpose is the unique foundation of our technology.

Intellectual Property

We currently have 26 issued patents and eight filed pending patents covering our technology. The patents each possess broad claims with multiple applications and ingredient bases thereby providing us with legal infringement enforcement protection. We also have trade secrets inherent in our complex formulations which make duplication of products and specific base formulations extremely difficult.

Risks Related to Our Business

Our business and our ability to execute our business strategy are subject to a number of risks as more fully described in the section titled “Risk Factors”. These risks include, among others:

| | ● | Our ability to meet our product development and commercialization milestones; |

| | | |

| | ● | Our ability to develop and protect our intellectual property and to develop, maintain and enhance a strong brand; |

| | | |

| | ● | Our ability to compete and succeed in a highly competitive and evolving industry and navigate the changing regulatory environment around our existing and planned products; |

| | | |

| | ● | Our ability to raise sufficient capital and the availability of future financing; |

| | | |

| | ● | Our ability to manage our research, development, expansion, growth, and operating expenses; |

| | | |

| | ● | Unpredictable events, such as the COVID-19 outbreak, and associated business disruptions could seriously harm our future revenues and financial condition, delay our operations, increase our costs and expenses, and impact our ability to raise capital; |

| | | |

| | ● | Regulatory risks and changes in applicable laws, regulations, and guidelines; and |

| | | |

| | ● | Our reliance on third parties to conduct our manufacturing and distribution operations. |

REGULATION A+

We are offering our Common Stock pursuant to rules of the SEC mandated under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). These offering rules are often referred to as “Regulation A+.” We are relying upon “Tier 2” of Regulation A+, which allows us to offer of up to $75 million in a 12-month period.

In accordance with the requirements of Tier 2 of Regulation A+, we are required to publicly file annual, semiannual, and current event reports with the SEC.

THE OFFERING

Issuer: | | CoLabs Int’l, Corp., a Nevada corporation |

| | | |

Securities Offered: | | A maximum of 3,000,000 shares of Common Stock, par value $0.001 (the “Shares”) at an offering price of $6.50 per Share. |

| | | |

Common Stock Outstanding Before the Offering(1): | | 15,800,000 |

| | | |

Common Stock to be Outstanding After the Offering: | | 18,800,000 |

| Price per Share: | | $6.50 |

| | | |

| Maximum Offering: | | 3,000,000 Shares |

| | | |

| Use of Proceeds: | | If we sell all of the 3,000,000 Shares being offered, our net proceeds (after deducting fees and commissions and estimated offering expenses) will be approximately $17,015,000. We will use these net proceeds for marketing staff and campaigns; raw materials and inventory; research and development expenses; testing and lab equipment; legal fees for general business and protection of intellectual property and related regulatory costs; leasing additional administrative facilities; working capital, Offering expenses; and such other purposes described in the “Use of Proceeds” section of this Offering Circular. |

| | | |

| Risk Factors: | | Investing in our Shares involve a high degree of risk. (See “Risk Factors.”) |

| | (1) | Excludes 5,650,000 Shares issuable upon exercise of stock options outstanding which have a weighted average exercise price of $1.11 per share. |

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this Offering Circular, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the price of our Common Stock could decline and you may lose all or part of your investment. (See “Cautionary Statement Regarding Forward Looking Statements” above for a discussion of forward-looking statements and the significance of such statements in the context of this Offering Circular.)

The continued impact of the COVID-19 pandemic and related risks could have a material adverse impact on our research and development programs and financial condition.

The degree to which COVID-19 continues to impact our business operations, research and development programs, and financial condition will depend on future developments, including the ultimate duration and/or severity of the outbreak and any resurgences, actions by government authorities to contain the spread of the virus, the timing, availability, and effectiveness of any vaccines, and when and to what extent normal economic and operating conditions can resume.

In the first two quarters of 2020, several of our orders were cancelled due to certain lockdown measures. We also postponed our marketing programs until we were able to ascertain the impact of the COVID-19 pandemic. In addition, our production was postponed due to supply line shortages.

We received a $61,000 PPP loan (defined below) under the CARES Act and a $42,000 Economic Injury Disaster Loan pursuant to the Small Business Administration (SBA) authorized under Section 7(b) of the Small Business Act, as amended.

The full impact of the COVID-19 outbreak remains highly uncertain and subject to change. Though several vaccines have been approved for COVID-19, current surges in the infection rate have led to additional state and local mandated lockdowns. Personal protection equipment guidelines are being followed in our facility according to state regulations and federal guidelines.

The consequences of this pandemic have been already felt and the future remains uncertain. We have modified our marketing efforts to focus on internet sales as opposed to advertising with direct contact with potential users. We have had to seek alternative suppliers of raw materials due to potential shortages caused by transportation issues and production closures by suppliers in various countries.

Our ability to operate without continued significant negative operational impact from the COVID-19 pandemic depends in part on our ability to protect our employees and our supply chain. We have endeavored to follow the recommended actions of government and health authorities to protect our employees. The uncertainty resulting from the pandemic could continue to result in disruptions to our workforce and supply chain (for example, an inability of a key supplier or transportation supplier to source and transport materials) that could negatively impact our operations. Further, it is unknowable whether future governmental orders and other actions to combat the pandemic such as the imposition of the shelter-in-place and other public health orders, may exacerbate the effects of the risks described below.

The SBA may not forgive in whole or in part our PPP loan and we may have to make payments on the PPP loan.

On May 6, 2020, we were granted a loan (the “PPP loan”) from Cross River Bank in the aggregate amount of $61,000, pursuant to the Paycheck Protection Program (the “PPP”) under the CARES Act. The PPP loan agreement is dated May 6, 2020, matures on May 6, 2022, bears interest at a rate of 1% per annum, is unsecured and guaranteed by the SBA. In accordance with the PPP Flexibility Act passed in June 2020, if we apply for loan forgiveness within ten months after the end of the covered period, then no payments are due until the SBA remits payment of a forgiveness amount or determines that no forgiveness is authorized. If we do not submit a request for forgiveness within ten months after the end of the covered period, we will begin making payments on the PPP loan. The PPP loan may be prepaid at any time prior to maturity with no prepayment penalties. Funds from the PPP loan may only be used for qualifying expenses as described in the CARES Act, including qualifying payroll costs, qualifying group health care benefits, qualifying rent and debt obligations, and qualifying utilities. We intend to use the entire loan amount for qualifying expenses. Under the terms of the PPP, certain amounts of the loan may be forgiven if they are used for qualifying expenses. We intend to apply for forgiveness of the PPP loan with respect to these qualifying expenses, however, we cannot be assured that such forgiveness of any portion of the PPP loan will occur.

We may not be able to successfully implement our growth strategy.

Our future growth, profitability, and cash flows depend upon our ability to successfully implement our business strategy, which, in turn, is dependent upon a number of key initiatives, including our ability to:

| | - | Develop effective distribution partnerships to present and market products to consumers in vast regional markets; |

| | - | Continually satisfy and perpetuate a loyal consumer base; |

| | - | Continue the growth of product sales to global markets and expand new product pipelines for new market sectors; |

| | - | Preemptively enter advanced technologies into the marketplace before competitors are able to scientifically compete; |

| | - | Design a focused and defined marketing plan, as well as have a capable marketing staff to execute the plan; |

| | - | Concentrate and develop our expertise while keeping the team directed and focused; |

| | - | Rapidly develop new technologies and formulations with the related intellectual property (“IP”) through efficiencies achieved by a focused staff and limited regulatory delays; and |

| | - | Adaptively use new marketing technologies and mediums. |

(See “Our Business – Critical Success Factors: Components to Success.”)

There can be no assurance that we can successfully achieve any or all of the above initiatives in the manner or time period that we expect. We cannot provide any assurance that we will realize, in full or in part, the anticipated benefits we expect our strategy will achieve. The failure to realize those benefits would have a material adverse effect on our business, financial condition, and results of operations.

Investment in us is highly speculative.

Investment in us is speculative and by investing, each investor assumes the risk of losing a substantial portion or all of their investment. There is no guarantee of any return on an Investor’s investment. Only investors who are able to bear the loss of their entire investment, and who otherwise meet the qualifications discussed in this Offering Circular, should consider investing in the Shares.

The biotech research industry is highly competitive, and if we are unable to compete effectively our results will suffer.

We face vigorous competition from companies throughout the world, including large multinational consumer products companies that have many brands under ownership, with many distribution channels. Competition in this industry is based on the introduction of new products, pricing of products, brand awareness, technology, perceived value and quality, innovation, presence and visibility, promotional activities, advertising, editorials, e-commerce, and mobile-commerce initiatives and other activities. We must compete with a high volume of new product introductions and existing products by diverse companies across several different distribution channels.

Many multinational consumer companies have greater financial, technical, or marketing resources, longer operating histories, greater brand recognition, or larger customer bases than we do and may be able to respond more effectively to changing business and economic conditions than we can. We may be unsuccessful in our growth strategy in the event that we are not able to reach our target market or collaborate with our strategic partners. In addition, our competitors, many of whom have greater resources than we do, may be better able to produce similar products or technologies and withstand longer amounts of time without sales.

It is difficult for us to predict the timing and scale of our competitors’ activities in these areas or whether new competitors will emerge in this industry. In addition, further technological breakthroughs, including new and enhanced technologies which increase competition in the online retail market, new product offerings by competitors, and the strength and success of our competitors’ marketing programs may impede our growth and the implementation of our business strategy.

Our ability to compete also depends on the continued strength of our brand and products, the success of our marketing, innovation and execution strategies, the continued diversity of our product offerings, the successful management of new product introductions and innovations, strong operational execution, including in order fulfillment, and our success in entering new markets and expanding our business in existing geographies. If we are unable to continue to compete effectively, it would have a material adverse effect on our business, financial condition, and results of operations.

A disruption in our operations could materially and adversely affect our business.

Our operations, including those of our third-party manufacturers and suppliers, are subject to the risks inherent in such activities, including industrial accidents, environmental events, strikes and other labor disputes, disruptions in information systems, product quality control, safety, licensing requirements. and other regulatory issues, as well as natural disasters, pandemics (such as the COVID-19 pandemic), border disputes, acts of terrorism, and other external factors over which we and our third-party manufacturers and suppliers have no control. If our third-party manufacturers continue to be adversely affected by COVID-19 restrictions, leading to delays in production times, it will directly affect our business and operations. The loss of, or damage to, the manufacturing facilities of our third-party manufacturers and suppliers and could materially and adversely affect our business, financial condition, and results of operations.

We do not manufacture our products ourselves and rely on a number of third-party suppliers, manufacturers, and other vendors, which may lead to delayed production and could have a material adverse effect on our business, results of operation, and financial condition.

We use multiple third-party suppliers and manufacturers to source and manufacture substantially all of our products. With them, we now have the capacity to produce our product on a large-scale, contract-manufacturing basis. We are reliant on FDA licensed facilities to manufacture our products at a high level of quality control. The ability of these third parties to supply and manufacture our products may be affected by:

| | - | competing orders from other companies; |

| | - | varied quality control and regulatory actions; |

| | - | economic or business interests or goals that are inconsistent with ours; |

| | - | actions taken contrary to our instructions, requests, policies, or objectives; |

| | - | being unable or unwilling to fulfill their obligations under relevant purchase orders, including obligations to meet our production deadlines, quality standards, pricing guidelines and product specifications, or to comply with applicable regulations, including those regarding the safety and quality of products and ingredients and good manufacturing practices; |

| | - | their financial difficulties; |

| | - | not complying with FDA requirements; |

| | - | raw material or labor shortages; |

| | - | COVID-19 restrictions; |

| | - | increases in raw material or labor costs which may affect our costs; and |

| | - | engaging in activities or employing practices that may harm our reputation. |

Should our suppliers or manufacturers be unable to achieve our required levels of production according to our specifications, in a timely manner or on budget, our profitability may be adversely affected. Further, failure to produce as specified as a result of a manufacturing process or ingredients can lead to costly recalls with public relations issues. The occurrence of any of these events, alone or together, could have a material adverse effect on our business, financial condition, and results of operations.

In addition, such problems may require us to find new third-party suppliers or manufacturers, and there can be no assurance that we would be successful in finding new third-party suppliers or manufacturers. If we experience any supply chain disruptions caused by our manufacturing process or by our inability to locate suitable third-party manufacturers or suppliers, or if our manufacturers or raw material suppliers experience problems with product quality or disruptions or delays in the manufacturing process or delivery of the finished products or the raw materials or components used to make such products, our business, financial condition, and results of operations could be materially and adversely affected.

Our success depends, in part, on our retention of key members of our senior management team and ability to attract and retain qualified personnel.

Our success depends, in part, on our ability to recruit and retain key employees, including our executive officers, product development, operations, customer service, sales and marketing personnel. We are a small company that relies on a few key employees, any one of whom would be difficult to replace, and because we are a small company, we believe that the loss of key employees may be more disruptive to us than it would be to a larger company. Our success also depends, in part, on our continuing ability to identify, hire, train, and retain other highly qualified personnel. In addition, we may be unable to effectively plan for the succession of senior management, including our CEO and COO. The loss of key personnel or the failure to attract and retain qualified personnel may have a material adverse effect on our business, financial condition, and results of operations.

Our management has broad discretion as to the use of proceeds from this Offering.

The net proceeds from this Offering will be used as described under “Use of Proceeds.” We reserve the right to use the funds obtained from this Offering for other purposes not presently contemplated which we deem to be in our best interests and our shareholders in order to address changed circumstances and opportunities. As a result of the foregoing, our success may be affected by the judgment of our management with respect to the application and allocation of the net proceeds of the Offering. Investors are entrusting their funds to our management, upon whose judgment and discretion the Investors must depend, with only limited information concerning management’s specific intentions.

There is no assurance of successful expansion of operations.

We intend to increase the scope and the scale of our operations, including the hiring of additional personnel, which will result in higher operating expenses. We anticipate that our operating expenses will continue to increase. Expansion of our operations may also make significant demands on our management, finances, and other resources. Our ability to manage the anticipated future growth, should it occur, will depend upon a significant expansion of our accounting and other internal management systems and the implementation and subsequent improvement of a variety of systems, procedures, and controls. We cannot assure that significant problems in these areas will not occur. Failure to expand these areas and implement and improve such systems, procedures, and controls in an efficient manner at a pace consistent with our business could have a material adverse effect on our business, financial condition, and results of operations. We cannot assure potential investors that attempts to expand our marketing, sales, manufacturing, and customer support efforts will succeed or generate additional sales or profits in any future period. As a result of the expansion of our operations and the anticipated increase in our operating expenses, along with the difficulty in forecasting revenue levels, we expect to continue to experience significant fluctuations in our results of operations.

We are subject to international business uncertainties.

We are currently developing our international sales and distribution channels. We intend to sell to customers outside of the U.S. and maintain our relationships in other foreign countries where we have suppliers and manufacturers. Further, we may establish additional relationships in other countries to grow our operations. The lack of consumer awareness of our products, differences in consumer preferences and trends between the U.S. and other jurisdictions, the risk of inadequate intellectual property protections and differences in packaging, labeling, and related laws, rules, and regulations are all inherent risks that need to be evaluated to do business in new territories. We cannot be assured that our international efforts will be successful. International sales and increased international operations may be subject to risks such as:

| | - | difficulties in staffing and managing foreign operations; |

| | - | burdens of complying with a wide variety of laws and regulations, including more stringent regulations relating to data privacy and security; |

| | - | adverse tax effects and foreign exchange controls making it difficult to repatriate earnings and cash; |

| | - | political and economic instability; |

| | - | terrorist activities and natural disasters; |

| | - | trade restrictions; |

| | - | differing employment practices and laws and labor disruptions; |

| | - | the imposition of government controls; |

| | - | an inability to use or to obtain and/or defend and hence provide adequate intellectual property protection for our key brands and products; |

| | - | tariffs and customs duties and the classifications of our goods by applicable governmental bodies; |

| | - | a legal system subject to undue influence or corruption; |

| | - | a business culture in which illegal sales practices may be prevalent; |

| | - | logistics and sourcing; |

| | - | military conflicts: and |

| | - | the effects of governmental regulatory responses to pandemics. |

The occurrence of any of these risks could negatively affect our international business and consequently our overall business, financial condition, and results of operations.

If we are unable to obtain and maintain sufficient intellectual property protection for our products, or if the scope of the intellectual property protection is not sufficiently broad, our competitors could develop and commercialize products similar or identical to ours, and our ability to successfully commercialize our products may be adversely affected.

Our success depends in large part on our ability to obtain and maintain patent protection in the U.S. and other countries with respect to our products. We seek to protect our proprietary position by filing patent applications in the U.S. and abroad related to our technologies, however, we cannot predict:

| | - | if and when patents may issue based on our patent applications; |

| | - | the scope of protection of any patent issuing based on our patent applications; |

| | - | whether the claims of any patent issuing based on our patent applications will protect our products and their intended uses or prevent others from commercializing competitive technologies or products; |

| | - | whether or not third parties will find ways to invalidate or circumvent our patent rights; |

| | - | whether or not others will obtain patents claiming aspects similar to those covered by our patents and patent applications; and/or |

| | - | whether we will need to initiate litigation or administrative proceedings to enforce and/or defend our patent rights which will be costly whether we win or lose. |

Obtaining and enforcing patents is expensive and time-consuming, and we may not be able to file and prosecute all necessary or desirable patent applications, or maintain and/or enforce patents that may issue based on our patent applications, at a reasonable cost or in a timely manner. It is also possible that we will fail to identify patentable aspects of our research and development results before it is too late to obtain patent protection. Although we enter into non-disclosure and confidentiality agreements with parties who have access to patentable aspects of our research and development output, such as our employees, corporate collaborators, outside scientific collaborators, contract research organizations, contract manufacturers, consultants, advisors, and other third parties, any of these parties may breach these agreements and disclose such results before a patent application is filed, thereby jeopardizing our ability to seek patent protection.

We may not identify relevant third-party patents or may incorrectly interpret the relevance, scope, or expiration of a third-party patent which might adversely affect our ability to develop and market our products.

We cannot guarantee that any of our patent searches or analyses, including the identification of relevant patents, the scope of patent claims, or the expiration of relevant patents, are complete or thorough, nor can we be certain that we have identified each and every third-party patent and pending application in the U.S. and abroad that is relevant to or necessary for the commercialization of our products in any jurisdiction.

The scope of a patent claim is determined by an interpretation of the law, the written disclosure in a patent, and the patent’s prosecution history. Our interpretation of the relevance or the scope of a patent or a pending application may be incorrect, which may negatively impact our ability to market our products. We may incorrectly determine that our products are not covered by a third-party patent or may incorrectly predict whether a third party’s pending application will issue with claims of relevant scope. Our determination of the expiration date of any patent in the U.S. or abroad that we consider relevant may be incorrect, which may negatively impact our ability to develop and market our products. Our failure to identify and correctly interpret relevant patents may negatively impact our ability to develop and market our products.

In the future, we may need to obtain additional licenses of third-party technology that may not be available to us or are available only on commercially unreasonable terms, and which may cause us to operate our business in a more costly or otherwise adverse manner that was not anticipated.

From time to time we may be required to license technology from additional third parties to further develop or commercialize our own technology and products. Should we be required to obtain licenses to any third-party technology, including any such patents required to manufacture, use, or sell our products and technology, such licenses may not be available to us on commercially reasonable terms, or at all. The inability to obtain any third-party license required to develop or commercialize any of our products or technology could cause us to abandon any related efforts, which could seriously harm our business and operations.

We may become involved in lawsuits alleging that we have infringed the intellectual property rights of third parties or to protect or enforce our patents or other intellectual property, which litigation could be expensive, time consuming, and adversely affect our ability to develop or commercialize our products.

The coverage of patents is subject to interpretation by the courts, and the interpretation is not always uniform. There is a substantial amount of intellectual property litigation in the biotechnology and pharmaceutical industries, and we may become party to, or threatened with, litigation or other adversarial proceedings regarding intellectual property rights. Third parties may assert infringement claims against us based on existing or future intellectual property rights. If we were sued for patent infringement, we would need to demonstrate that our technology, products, or methods either do not infringe the patent claims of the relevant patent or that the patent claims are invalid or unenforceable, and we may not be able to do this. Proving invalidity may be difficult. For example, in the U.S., proving invalidity in court requires a showing of clear and convincing evidence to overcome the presumption of validity enjoyed by issued patents. If we are found to infringe a third party’s intellectual property rights, we could be forced, including by court order, to cease developing, manufacturing, or commercializing the infringing product. Alternatively, we may be required to obtain a license from such third party in order to use the infringing technology and continue developing, manufacturing, or marketing the infringing product. However, we may not be able to obtain any required license on commercially reasonable terms or at all. Even if we were able to obtain a license, it could be non-exclusive, thereby giving our competitors access to the same technologies licensed to us. In addition, we could be found liable for monetary damages, including treble damages and attorneys’ fees if we are found to have willfully infringed a patent. A finding of infringement could prevent us from commercializing our products or force us to cease some of our business operations, which could materially harm our business.

In addition, we may find that competitors are infringing our patents, trademarks, copyrights, or other intellectual property. To counter infringement or unauthorized use, we may be required to file infringement claims, which can be expensive and time consuming and divert the time and attention of our management and scientific personnel. Any claims we assert against perceived infringers could provoke these parties to assert counterclaims against us alleging that we infringe their patents, in addition to counterclaims asserting that our patents are invalid or unenforceable, or both. In any patent infringement proceeding, there is a risk that a court will decide that a patent of ours is invalid or unenforceable, in whole or in part, and that we do not have the right to stop the other party from using the invention at issue. There is also a risk that, even if the validity of such patents is upheld, the court will construe the patent’s claims narrowly or decide that we do not have the right to stop the other party from using the invention at issue on the grounds that our patent claims do not cover the invention. An adverse outcome in a litigation or proceeding involving our patents could limit our ability to assert our patents against those parties or other competitors, and may curtail or preclude our ability to exclude third parties from making and selling similar or competitive products. Any of these occurrences could adversely affect our competitive business position, business prospects, and financial condition. Similarly, if we assert trademark infringement claims, a court may determine that the marks we have asserted are invalid or unenforceable, or that the party against whom we have asserted trademark infringement has superior rights to the marks in question. In this case, we could ultimately be forced to cease use of such trademarks. Even if we establish infringement, the court may decide not to grant an injunction against further infringing activity and instead award only monetary damages, which may or may not be an adequate remedy.

Furthermore, because of the substantial amount of discovery required in connection with intellectual property litigation, there is a risk that some of our confidential information could be compromised by disclosure during litigation. There could also be public announcements of the results of hearings, motions, or other interim proceedings or developments. Moreover, we cannot assure you that we will have sufficient financial or other resources to defend or pursue such litigation, which typically lasts for years before a conclusion. Even if we are successful in such a proceeding, we may incur substantial costs and the time and attention of our management and personnel could be diverted during a proceeding, which could have a material adverse effect on our business and operations. In addition, we may not have sufficient resources to bring an action to a successful conclusion.

Because of the expense and uncertainty of litigation, we may not be in a position to enforce our intellectual property rights against third parties.

Because of the expense and uncertainty of litigation, we may conclude that even if a third party is infringing our issued patent, any patents that may be issued as a result of our pending or future patent applications or other intellectual property rights, the risk-adjusted cost of bringing and enforcing such a claim or action may be too high or not in the best interest of our company or our stockholders. In such cases, we may decide that the more prudent course of action is to simply monitor the situation or initiate or seek some other non-litigious action or solution.

We may be subject to claims that our employees, consultants, or independent contractors have wrongfully used or disclosed confidential information of third parties.

We could in the future be subject to claims that we or our employees have inadvertently or otherwise used or disclosed alleged trade secrets or other confidential information of former employers or competitors. Although we try to ensure that our employees and consultants do not use the intellectual property, proprietary information, know-how or trade secrets of others in their work for us, we may become subject to claims that we caused an employee to breach the terms of his or her non-competition or non-solicitation agreement, or that we or these individuals have, inadvertently or otherwise, used or disclosed the alleged trade secrets or other proprietary information of a former employer or competitor.

While we may litigate to defend ourselves against these claims, even if we are successful, litigation could be a distraction to management and result in substantial costs. If our defenses to these claims fail, in addition to requiring us to pay monetary damages, a court could prohibit us from using technologies or features that are essential to our products, if such technologies or features are found to incorporate or be derived from the trade secrets or other proprietary information of the former employers. Moreover, any such litigation or the threat thereof may adversely affect our reputation, our ability to form strategic alliances or sublicense our rights to collaborators, engage with scientific advisors or hire employees or consultants, each of which would have an adverse effect on our business, results of operations, and financial condition.

We may not be able to protect our intellectual property rights throughout the world.

Patents are of national or regional effect, and filing, prosecuting, and defending patents on all of our products throughout the world would be prohibitively expensive. As such, we may not be able to prevent third parties from producing our inventions in all countries outside the U.S., or from selling or importing products made using our inventions in and into the U.S. or other jurisdictions. Further, the legal systems of certain countries, particularly certain developing countries, do not favor the enforcement of patents and other intellectual property protection, particularly those relating to pharmaceuticals or biologics, which could make it difficult for us to stop the infringement of our patents or marketing of competing products in violation of our proprietary rights generally. In addition, certain developing countries have compulsory licensing laws under which a patent owner may be compelled to grant licenses to third parties. This could limit our potential revenue opportunities. Accordingly, our efforts to enforce our intellectual property rights around the world may be inadequate to obtain a significant commercial advantage from the intellectual property that we develop or license.

We may rely on trade secret and proprietary know-how which can be difficult to trace and enforce and, if we are unable to protect the confidentiality of our trade secrets, our business and competitive position would be harmed.

In addition to seeking patents for some of our technology and products, we may also rely on trade secrets, including unpatented know-how, technology, and other proprietary information, to maintain our competitive position. Elements of our products and technology, including processes for their preparation and manufacture, may involve proprietary know-how, information, or technology that is not covered by patents, and thus for these aspects we may consider trade secrets and know-how to be our primary intellectual property. Any disclosure, either intentional or unintentional, by our employees, the employees of third parties with whom we share facilities or third party consultants and vendors that we engage to perform research, clinical trials, or manufacturing activities, or misappropriation by third parties (such as through a cybersecurity breach) of our trade secrets or proprietary information could enable competitors to duplicate or surpass our technological achievements, thus eroding our competitive position in our market.

Trade secrets and know-how can be difficult to protect. We require our employees to enter into written employment agreements containing provisions of confidentiality and obligations to assign to us any inventions generated in the course of their employment. We and any third parties with whom we share facilities enter into written agreements that include confidentiality and intellectual property obligations to protect each party’s property, potential trade secrets, proprietary know-how, and information. We further seek to protect our potential trade secrets, proprietary know-how, and information in part, by entering into non-disclosure and confidentiality agreements with parties who are given access to them, such as our corporate collaborators, outside scientific collaborators, contract research organizations, contract manufacturers, consultants, advisors, and other third parties. With our consultants, contractors, and outside scientific collaborators, these agreements typically include invention assignment obligations. Despite these efforts, any of these parties may breach the agreements and disclose our proprietary information, including our trade secrets, and we may not be able to obtain adequate remedies for such breaches. Enforcing a claim that a party illegally disclosed or misappropriated a trade secret is difficult, expensive, and time-consuming, and the outcome is unpredictable. In addition, some courts inside and outside the U.S. are less willing or unwilling to protect trade secrets. If any of our trade secrets were to be lawfully obtained or independently developed by a competitor or other third party, we would have no right to prevent them from using that technology or information to compete with us. If any of our trade secrets were to be disclosed to or independently developed by a competitor or other third party, our competitive position would be harmed.

Rapid technological change could make our products obsolete.

Pharmaceutical technologies have historically undergone, and will most likely continue to undergo, rapid and significant change and improvement. Our future will depend in large part on our ability to maintain our competitive position with respect to these rapidly evolving technologies. Any pharmaceutical products or processes that we develop may become obsolete before we recover expenses incurred in connection with their development. Obsolescence of our products and technology would materially and adversely affect our business, financial condition, and results of operations.

Changes in regulations could increase our costs and affect our profitability.

Our activities are highly regulated and subject to government oversight. Various federal, state, provincial and local laws and regulations govern drug approvals, manufacturing, and marketing, as well as licensing, trade, tax, and environmental matters. Governing bodies regularly issue new regulations and changes to existing regulations. Also the regulatory response to a pandemic may adversely affect sales, distribution, and shipping, as well as creating many other potential issues. Our need to comply with new or revised regulations or their interpretation and application including proposed requirements designed to enhance safety or to regulate imported ingredients, could materially and adversely affect our product sales, financial condition, and results of operations.

We may not meet our product development milestones.

We may not meet our product development and commercialization milestones, and may meet adverse competition, marketing restrictions, supply obstacles, pricing restrictions, regulatory issues, and other sales impediments in targeted markets. If any of these events hinder our market development, it will reduce our overall sales and adversely affect our financial condition.

Any event affecting our access to components may affect our production.

Base components used in our formulations may become readily unavailable, restricted, face increased tariffs, realize increased transportation or distribution costs, or have supply issues, which will result in the development of our products becoming more expensive. Any of these events or others would restrict our ability to manufacture products at competitive pricing levels, thereby adversely increasing our costs of production and marketability of our products.

We may enter into agreements with customers and partners that may require us to share our intellectual property rights.

We may enter into agreements with customers and partners that may require us to share our intellectual property rights. Entering into these relationships poses a number of risks, including but not limited to: disputes may arise in the future with respect to the ownership of intellectual property rights; disagreements with corporate partners could delay or terminate the development or commercialization of products, or result in litigation or arbitration; we cannot effectively control whether contractors or partners will devote sufficient resources to our partnership or products; partners with marketing rights may choose to devote fewer resources to the marketing of our products than they do to others; and partners have discretion in electing whether to work with us. Given these risks, any partnership or business relationship may not be successful. Failure of these efforts could delay our product development of impair commercialization of our products. If any of the aforementioned events were to occur, it will adversely affect sales forecasts and market expansion.

Any failure in testing will affect our business plan.

Any failures, missteps, or delays in our testing of our products during any phase of the development through manufacturing processes, could negatively affect our customer relationships, jeopardize sales, increase our costs, delay product production and sales, and give us legal exposure.

Additional Risks of Investment. The additional items set forth below, individually or in combination with some or all of the risk factors set forth above, could cause actual results to differ materially from those contemplated by management:

| | ● | The possibility that we will not fully realize the anticipated benefits of our business know how, IP, objectives, acquisitions, and other business strategy; |

| | ● | Our inability to execute our business plan; |

| | ● | Our reliance on one or more suppliers to provide raw materials; |

| | ● | The slowing or lack of growth of sunscreen and skincare markets due to competition or other factors; |

| | ● | Adverse changes in general economic and business conditions; |

| | ● | Our financial condition and liquidity, as well as our future cash flow and earnings; |

| | ● | Our inability to manage our operating expenses; |

| | ● | The adverse effect, interpretation, or application of new or existing laws, regulations, and court decisions; |

| | ● | The lack of availability of operational or developmental funding with terms or in amounts that our business would require; |

| | ● | Developments in technology by our competitors that we cannot match; |

| | ● | Our inability to develop our technology in a timely manner or in a direction that the market will accept; |

| | ● | Catastrophic events and natural disasters such as pandemics, fires, and floods; |

| | ● | Acts of war, political and economic upheavals, and terrorist activities; and |

| | ● | Other economic, political, and technological risks and uncertainties. Importantly these may include other regulatory, quality control, staffing, production, legal, transportation and other unforeseen issues. |

DILUTION

As of the date of this Offering Circular, an aggregate of 15,800,000 Shares are issued and outstanding. In addition, we have 5,650,000 stock options outstanding.

If you purchase Shares in this Offering, your ownership interest in our Common Stock will be diluted immediately, to the extent of the difference between the price to the public charged for each Share in this Offering and the net tangible book value per share of our Common Stock after this Offering.

Our net tangible book value as of September 30, 2020 was $(9,000) or $0.00 per share based on 15,550,000 outstanding Shares as of such date. Net tangible book value per share equals the amount of our total tangible assets less total liabilities, divided by the total number of Shares outstanding, all as of the date specified.

If the Maximum Offering, at an offering price of $6.50 per Share, is sold in this Offering, after deducting approximately $2,485,000 in sales commissions and estimated Offering expenses payable by us, our pro forma as adjusted net tangible book value would be approximately $17,015,000, or $0.92 per Share. This amount represents an immediate increase in pro forma net tangible book value of $0.92 per share to our existing stockholders prior to this Offering, and an immediate dilution in pro forma net tangible book value of approximately $5.58 per share to new investors purchasing Shares in this Offering at a price of $6.50 per Share.

The following table illustrates the per share dilution to new investors discussed above, assuming the sale of the Maximum Offering.

| Funding Level | | $ | 19,500,000 | |

| Offering Price | | $ | 6.50 | |

| Pro forma net tangible book value per share of Common Stock before the Offering | | $ | 0.00 | |

| Increase per share attributable to investors in this Offering | | $ | 6.50 | |

| Pro forma net tangible book value per share of Common Stock after the Offering | | $ | 0.92 | |

| Dilution to investors in the Offering | | $ | 5.58 | |

The following tables set forth, assuming the sale of the Maximum Offering, the total number of Shares previously sold to existing stockholders as of the date of this Offering Circular including Shares issued for services, the total number of Shares to be sold to investors in this Offering, the total consideration paid for the foregoing (based on cash actually received and the value of Shares issued for services) and the respective percentages applicable to such purchased shares and consideration paid, based on an average price of $2.80 per Share paid by our existing stockholders, and $6.50 per Share paid by new investors in this Offering. The tables below do not include any exercise of outstanding awards.

| | | Shares Purchased | | | Total Consideration | |

| | | Number | | | Percentage | | | Amount | | | Percentage | |

| Assuming 100% of Shares Sold: | | | | | | | | | | | | | | | | |

| Existing stockholders | | | 15,800,000 | | | | 84 | % | | $ | 5,640,000 | | | | 22 | % |

| New Investors | | | 3,000,000 | | | | 16 | % | | $ | 19,500,000 | | | | 78 | % |

| Total | | | 18,800,000 | | | | 100 | % | | $ | 25,140,000 | | | | 100 | % |

PLAN OF DISTRIBUTION AND SELLING SECURITYHOLDERS

This Offering Circular is part of an Offering Statement that we filed with the SEC, using a continuous offering process. Periodically, as we have material developments, we will provide an Offering Circular supplement that may add, update, or change information contained in this Offering Circular. Any statement that we make in this Offering Circular will be modified or superseded by any inconsistent statement made by us in a subsequent Offering Circular supplement. The Offering Statement we filed with the SEC includes exhibits that provide more detailed descriptions of the matters discussed in this Offering Circular. You should read this Offering Circular and the related exhibits filed with the SEC and any Offering Circular supplement, together with additional information contained in our annual reports, semi-annual reports and other reports and information statements that we will file periodically with the SEC. See the section entitled “Where You Can Find More Information” for more details.

The Shares are being offered pursuant to Regulation A of Section 3(b) of the Securities Act of 1933, as amended, for Tier 2 offerings, by our management on a “best-efforts” basis directly to purchasers who satisfy the requirements set forth in Regulation A. We have the option in our sole discretion to accept less than the minimum investment from any subscriber. There is no aggregate minimum to be raised in order for the Offering to become effective, and therefore the Offering will be conducted on a “rolling basis.” This means we are entitled to begin applying “dollar one” of the proceeds from the Offering towards our business strategy, research and development expenses, offering expenses, sales commissions, working capital, and other uses, as more specifically set forth in the “Use of Proceeds to Issuer.”.

Our Offering will expire on the first to occur of (a) the sale of the Maximum Offering, (b) March 1, 2022 or (c) when our Board elects to terminate the Offering.

We are offering the Common Stock for sale in all states. We have engaged Dalmore, a broker-dealer registered with the SEC and a member of FINRA, to act as the broker-dealer of record in connection with this Offering, but not for underwriting or placement agent services. Dalmore will:

| | ● | Review investor information, including KYC (“Know Your Customer”) data, AML (“Anti Money Laundering”) and other compliance background checks, and provide a recommendation to us whether or not to accept investor as a customer; |

| | | |

| | ● | Review each investor’s subscription agreement to confirm such investor’s participation in the Offering, and provide a determination to us whether or not to accept the use of the subscription agreement for the investor’s participation; |

| | | |

| | ● | Contact and/or notify us, if needed, to gather additional information or clarification on an investor; |

| | | |

| | ● | Not provide any investment advice nor any investment recommendations to any investor; |

| | | |

| | ● | Keep investor details and data confidential and not disclose to any third-party except as required by regulators or pursuant to the terms of the agreement (e.g. as needed for AML and background checks); and |

| | | |

| | ● | Coordinate with third-party providers to ensure adequate review and compliance. |

As compensation for the services listed above, we have agreed to pay Dalmore $5,000 as a one-time set up fee, plus a commission equal to 1% of the amount raised in the Offering to support the Offering. In addition, we have agreed to engage Dalmore as a consultant to provide ongoing general consulting services relating to the Offering, such as coordination with third party vendors and general guidance with respect to the Offering. We will pay a one-time consulting fee of $20,000, which will be due and payable immediately after FINRA issues a No Objection Letter. Assuming that the maximum offering amount is sold, we estimate that the total fees we will pay to Dalmore will be approximately $220,000.

Generally speaking, Rule 3a4-1 provides an exemption from the broker-dealer registration requirements of the Securities Exchange Act of 1934 (the “Exchange Act”) for persons associated with an issuer that participate in an offering of the issuer’s securities. None of our officers or directors are subject to any statutory disqualification, as that term is defined in Section 3(a)(39) of the Exchange Act. None of our officers or directors will be compensated in connection with his or her participation in the Offering by the payment of commissions or other remuneration based either directly or indirectly on transactions in our securities. None of our officers or directors are, or have been within the past 12 months, a broker or dealer, and none of them are, or have been within the past 12 months, an associated person of a broker or dealer. Upon completion of the Offering, our officers or directors will continue to primarily perform substantial duties for us or on our behalf otherwise than in connection with transactions in securities. None of our officers or directors will participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance on Exchange Act Rule 3a4-1(a)(4)(i) or (iii) except that for securities issued pursuant to Rule 415 under the Securities Act, the 12 months shall begin with the last sale of any security included within one Rule 415 registration.

Selling Security Holders

No securities are being sold for the account of security holders; all net proceeds of this Offering will go to the Company.

USE OF PROCEEDS TO ISSUER

If the Maximum Offering is sold, the maximum gross proceeds from the sale of our Common Stock in this Offering will be $19,500,000. The net proceeds from the total Maximum Offering are expected to be approximately $17,015,000 after the payment of sales commissions and Offering costs (including filing fees and legal, accounting, printing, due diligence, marketing, selling, and other costs incurred in the Offering, which we intend to pay using a portion of the proceeds of this Offering). The budget for Offering costs is an estimate only and the actual Offering costs may differ. The following table represents management’s best estimate of the uses of the gross proceeds received from the sale of Common Stock in this Offering assuming the Maximum Offering. Management expects to use the unallocated proceeds from the sale of Common Stock in this Offering in roughly the same proportions reflected in the following table for the purposes specified below on a going-forward basis.

| Marketing- Staff and Campaigns | | $ | 9,760,000 | | | | 50 | % |

| Administrative Facilities | | $ | 1,365,000 | | | | 7 | % |

| Research and Development; Testing and Lab Equipment | | $ | 1,170,000 | | | | 6 | % |

| Raw Materials and Inventory | | $ | 780,000 | | | | 4 | % |

| Legal, IP, and Regulatory Costs | | $ | 585,000 | | | | 3 | % |

| Executive Compensation | | $ | 235,000 | | | | 1 | % |

| Working Capital | | $ | 2,925,000 | | | | 15 | % |

| Offering Expenses | | $ | 2,485,000 | | | | 13 | % |

| Sales Commissions | | $ | 195,000 | | | | 1 | % |

| TOTAL | | $ | 19,500,000 | | | | 100 | % |

Marketing- Staff and Campaigns. A majority of the proceeds from this Offering is intended to be used to initiate and bolster our marketing efforts, either through the direct expansion of hiring additional senior management and marketing support staff, or through an acquisition of a marketing company. Our efforts will include increasing brand awareness and retail expansion in order to propel sales for the sectors that we have targeted. (See “Our Business.”) Additionally, we intend to retain additional staff to directly support the ingredient sales to our partners who already have prime market positions and can promote our next generation formulations added into their products.

Administrative Facilities. In connection with our intention to expand our administrative staff and our production, we intend to use a portion of the proceeds from this Offering to lease both additional administrative office space for the staff and warehouse space to store finished products and raw materials.

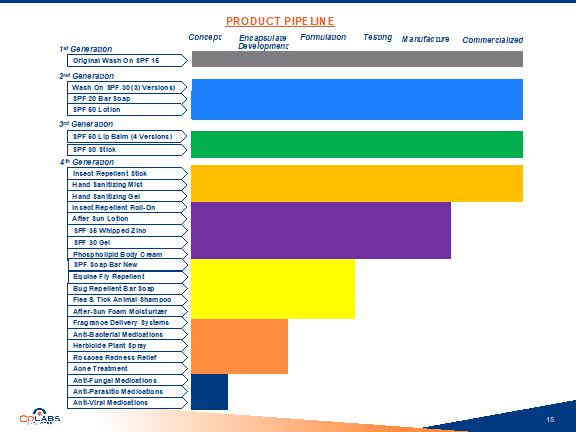

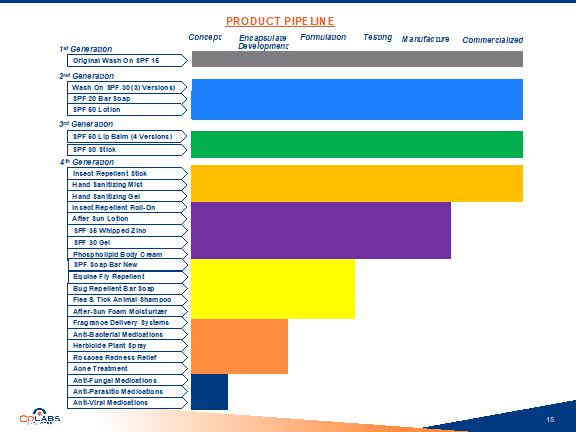

Research and Development; Testing and Lab Equipment. Research and Development (“R&D”) is expected to remain at a level of <10% of future revenues. Our system has evolved with new R&D efficiencies and a designed inherent flexibility. This means that new, highly effective, low cost consumer retail formulations can be rapidly developed for testing. It is not expected that we will face major financial commitments for new generational cosmeceutical projects. Some retail and Over the Counter (“OTC”) formulations may be designed, tested, and deployed into markets in as little as an 18 to 36 month time frame. We will also use certain proceeds to fund R&D, product testing, and the commercialization of new pipeline products.

Raw Materials and Inventory. We intend to use a portion of the proceeds of this Offering for costs of our raw materials and manufacturing inventory.

Legal, IP, and Regulatory Costs. We intend to initially list our Shares on the OTC Markets. In connection therewith, legal costs related to our disclosure and regulatory filings will substantially increase. Additional costs may also be incurred in a potential up listing process onto a senior exchange. We also have legal costs related to producing and developing our pharmaceuticals. Further, we have ongoing R&D which may require further IP and trademark fillings both domestically and internationally. We also have ongoing fees associated with maintaining existing IP and the processing of our pending patent applications.

Executive Compensation. We intend to use a portion of the proceeds raised in this Offering to fund the compensation payable to our executive officers, as described under “Compensation of Directors and Executive Officers.” We may pay our directors cash compensation and compensate them with the proceeds of this Offering.

Working Capital. We anticipate that our operating capital needs will increase along with an increase of our staff and production. We intend to use a portion of the proceeds of this Offering to cover the additional costs of maintaining, shipping, and logistically delivering products prior to final payments for the sale of these goods being received.

Offering Expenses. We intend to use a portion of the proceeds from this Offering for the expenses related to this Offering, including legal, accounting, marketing, printing, and regulatory fees and expenses.

Sales Commissions. We intend to use a portion of the proceeds from this Offering to pay sales commissions in the estimated amount of $0.065 for every Share. Therefore, if the Maximum Offering of $19,500,000 is sold, the total compensation to the selling group will be $195,000.

Our plan of operations for the next few years includes advancing the development, sales, and marketing of our product line, as well as investing in our infrastructure and our continued R&D. The amounts set forth above are our current estimates for such development, and we cannot be certain that actual costs will not vary from these estimates. Our management has significant flexibility and broad discretion in applying the proceeds received in this Offering. We cannot assure you that our assumptions, expected costs and expenses and estimates will prove to be accurate or that unforeseen events, problems, or delays will not occur that would require us to seek additional debt and/or equity funding, which may not be available on favorable terms or at all. (See “Risk Factors.”)

This expected use of the proceeds from this Offering represents our intentions based upon our current financial condition, results of operations, business plans and conditions. As of the date of this Offering Circular, we cannot predict with certainty all of the particular uses for the proceeds to be received upon the closing of this Offering or the amounts that we will actually spend on the uses set forth above. The amounts and timing of our actual expenditures may vary significantly depending on numerous factors. As a result, our management will retain broad discretion over the allocation of the proceeds from this Offering.

We believe that if we raise the Maximum Offering, we will have sufficient capital to finance our operations for the next 12 months. However, if we do not sell the Maximum Offering or if our operating and development costs are higher than expected, we may need to obtain additional financing prior to that time.