Credit Suisse Energy Summit Brent Smolik Chairman, President & Chief Executive Officer February 14, 2017 R 0 G 153 B 0 R 204 G 153 B 0 R 0 G 134 B 234 R 255 G 102 B 0 R 165 G 165 B 165 R 102 G 0 B 51 R 0 G 69 B 124

2 Cautionary Statement Regarding Forward-Looking Statements This presentation includes certain forward-looking statements and projections of EP Energy. EP Energy has made every reasonable effort to ensure that the information and assumptions on which these statements and projections are based are current, reasonable, and complete. However, a variety of factors could cause actual results to differ materially from the projections, anticipated results or other expectations expressed, including, without limitation, the volatility of and current sustained low oil, natural gas, and NGL prices; the supply and demand for oil, natural gas and NGLs; changes in commodity prices and basis differentials for oil and natural gas; EP Energy’s ability to meet production volume targets; the uncertainty of estimating proved reserves and unproved resources; the future level of service and capital costs; the availability and cost of financing to fund future exploration and production operations; the success of drilling programs with regard to proved undeveloped reserves and unproved resources; EP Energy’s ability to comply with the covenants in various financing documents; EP Energy’s ability to obtain necessary governmental approvals for proposed E&P projects and to successfully construct and operate such projects; actions by the credit rating agencies; credit and performance risks of EP Energy’s lenders, trading counterparties, customers, vendors, suppliers, and third party operators; general economic and weather conditions in geographic regions or markets served by EP Energy, or where operations of EP Energy are located, including the risk of a global recession and negative impact on oil and natural gas demand; the uncertainties associated with governmental regulation, including any potential changes in federal and state tax laws and regulation; competition; and other factors described in EP Energy’s Securities and Exchange Commission filings. While EP Energy makes these statements and projections in good faith, neither EP Energy nor its management can guarantee that anticipated future results will be achieved. Reference must be made to those filings for additional important factors that may affect actual results. EP Energy assumes no obligation to publicly update or revise any forward-looking statements made herein or any other forward-looking statements made by EP Energy, whether as a result of new information, future events, or otherwise. This presentation presents certain production and reserves-related information on an "equivalency" basis. Equivalent volumes are computed with natural gas converted to barrels at a ratio of six Mcf to one Bbl. These conversions are based on energy equivalency conversion methods primarily applicable at the burner tip and do not represent value equivalencies at the wellhead. Although these conversion factors are industry accepted norms, they are not reflective of price or market value differentials between product types. This presentation refers to certain non-GAAP financial measures such as “Adjusted General and Administrative Expenses” and “Adjusted EBITDAX”. Definitions of these measures and reconciliation between U.S. GAAP and non-GAAP financial measures are included in the appendix to this presentation.

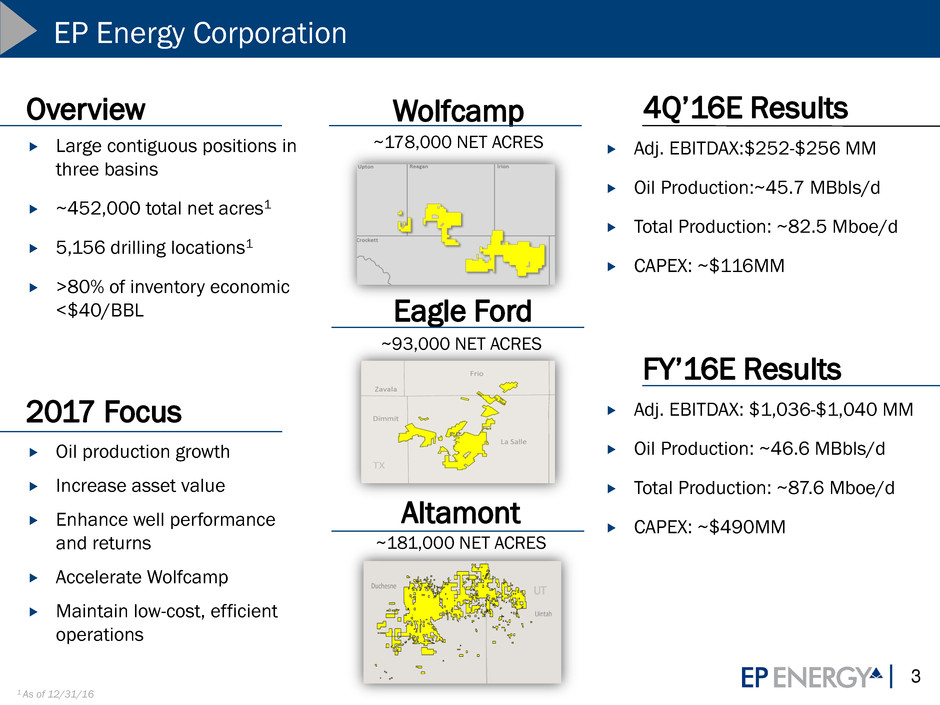

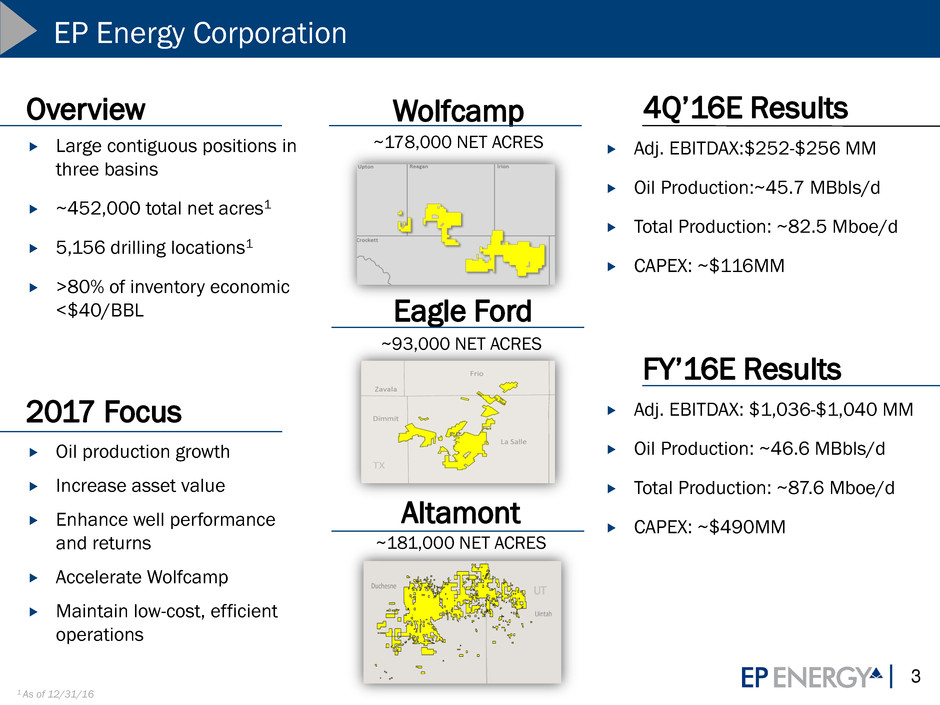

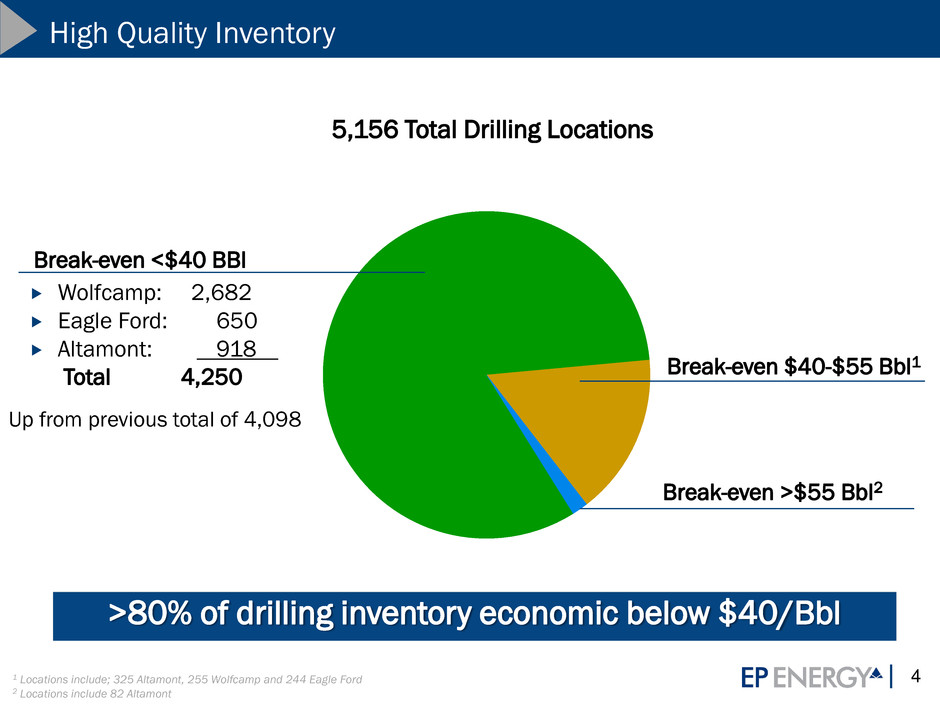

3 FY’16E Results 4Q’16E Results Wolfcamp ~93,000 NET ACRES Eagle Ford Altamont EP Energy Corporation 2017 Focus Oil production growth Increase asset value Enhance well performance and returns Accelerate Wolfcamp Maintain low-cost, efficient operations ~178,000 NET ACRES ~181,000 NET ACRES UT 1 As of 12/31/16 Large contiguous positions in three basins ~452,000 total net acres1 5,156 drilling locations1 >80% of inventory economic <$40/BBL Overview Adj. EBITDAX:$252-$256 MM Oil Production:~45.7 MBbls/d Total Production: ~82.5 Mboe/d CAPEX: ~$116MM Adj. EBITDAX: $1,036-$1,040 MM Oil Production: ~46.6 MBbls/d Total Production: ~87.6 Mboe/d CAPEX: ~$490MM

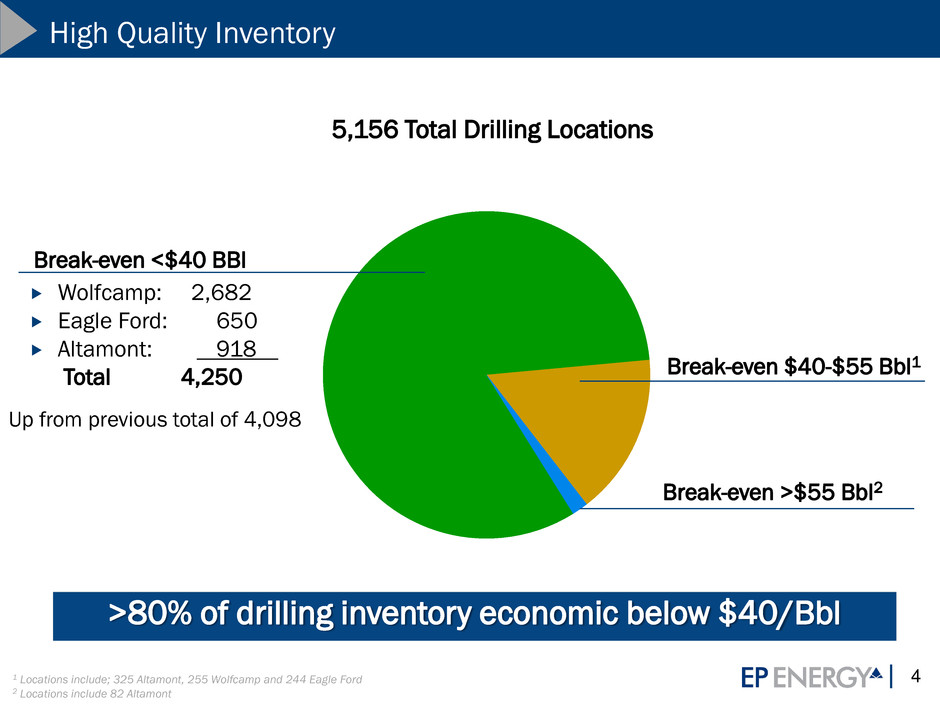

4 High Quality Inventory Wolfcamp: 2,682 Eagle Ford: 650 Altamont: 918 Total 4,250 Break-even <$40 BBl Break-even $40-$55 Bbl1 5,156 Total Drilling Locations >80% of drilling inventory economic below $40/Bbl Up from previous total of 4,098 Break-even >$55 Bbl2 1 Locations include; 325 Altamont, 255 Wolfcamp and 244 Eagle Ford 2 Locations include 82 Altamont

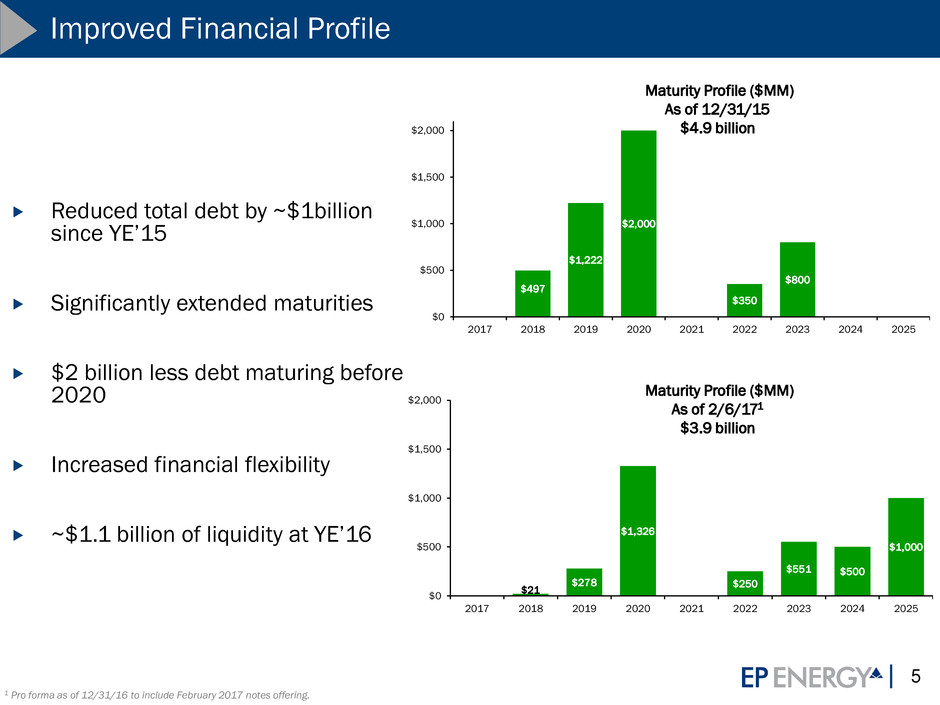

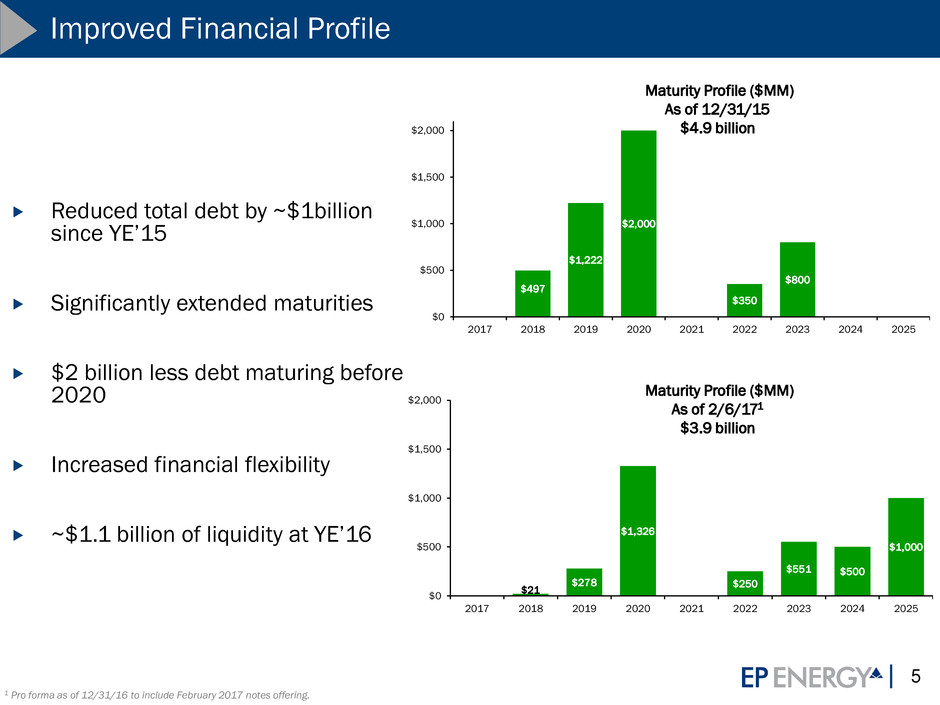

5 Improved Financial Profile Maturity Profile ($MM) As of 12/31/15 $4.9 billion Maturity Profile ($MM) As of 2/6/171 $3.9 billion 1 Pro forma as of 12/31/16 to include February 2017 notes offering. Reduced total debt by ~$1billion since YE’15 Significantly extended maturities $2 billion less debt maturing before 2020 Increased financial flexibility ~$1.1 billion of liquidity at YE’16 $1,222 $497 $2,000 $350 $800 $0 $500 $1,000 $1,500 $2,000 2017 2018 2019 2020 2021 2022 2023 2024 2025 $278 $21 $500 $1,000 $1,326 $250 $551 $0 $500 $1,000 $1,500 $2,000 2017 2018 2019 2020 2021 2022 2023 2024 2025

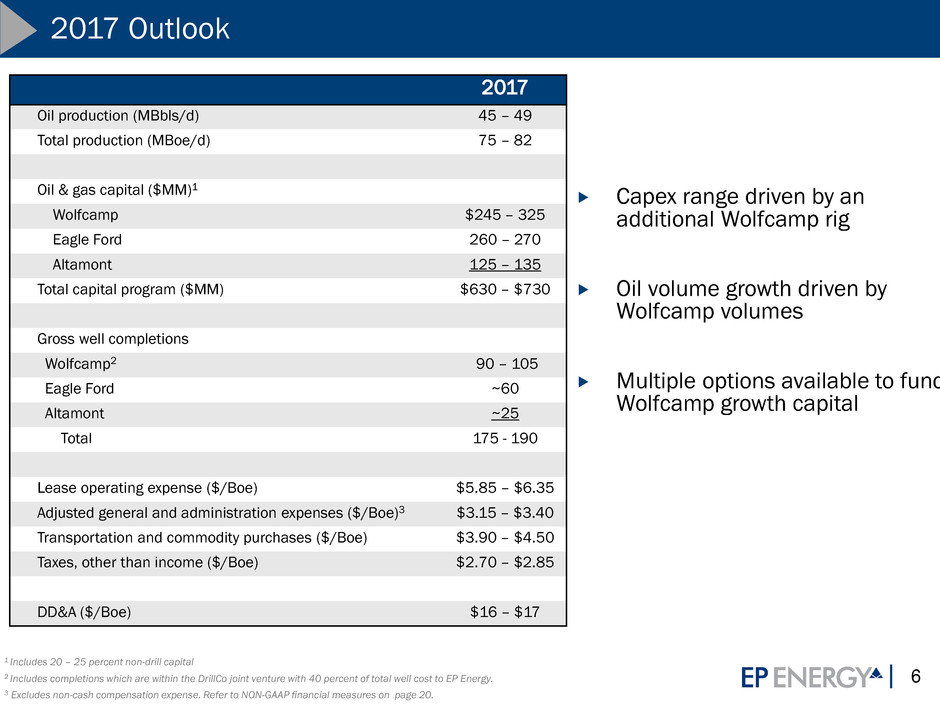

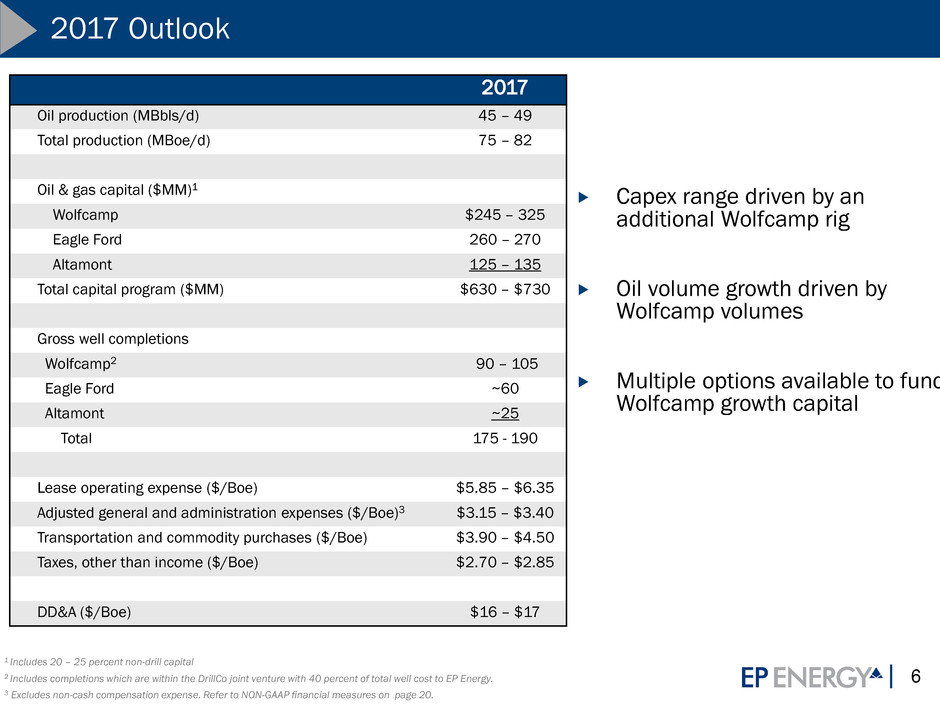

6 2017 Outlook 1 Includes 20 – 25 percent non-drill capital 2 Includes completions which are within the DrillCo joint venture with 40 percent of total well cost to EP Energy. 3 Excludes non-cash compensation expense. Refer to NON-GAAP financial measures on page 20. 2017 Oil production (MBbls/d) 45 – 49 Total production (MBoe/d) 75 – 82 Oil & gas capital ($MM)1 Wolfcamp $245 – 325 Eagle Ford 260 – 270 Altamont 125 – 135 Total capital program ($MM) $630 – $730 Gross well completions Wolfcamp2 90 – 105 Eagle Ford ~60 Altamont ~25 Total 175 - 190 Lease operating expense ($/Boe) $5.85 – $6.35 Adjusted general and administration expenses ($/Boe)3 $3.15 – $3.40 Transportation and commodity purchases ($/Boe) $3.90 – $4.50 Taxes, other than income ($/Boe) $2.70 – $2.85 DD&A ($/Boe) $16 – $17 Capex range driven by an additional Wolfcamp rig Oil volume growth driven by Wolfcamp volumes Multiple options available to fund Wolfcamp growth capital 2017 Outlook

7 Recent Achievements Improved well performance Reduced capital and operating costs University Lands (UL) sliding scale royalty agreement Increased activities Production growth 150-well drilling joint venture ~30 billion barrels of oil resource Wolfcamp: Significant Value Enhancement 1 Map includes USGS study results showing productive A, B and C benches: USGS Fact Sheet 2016-3092; 11/15/16 ² As of 12/31/16 ~50 miles EPE Wolfcamp Acreage1 EPE Wolfcamp ~178,000 net acres2 in S. Midland Basin 2,937 drilling locations2 Wolfcamp A, B and C

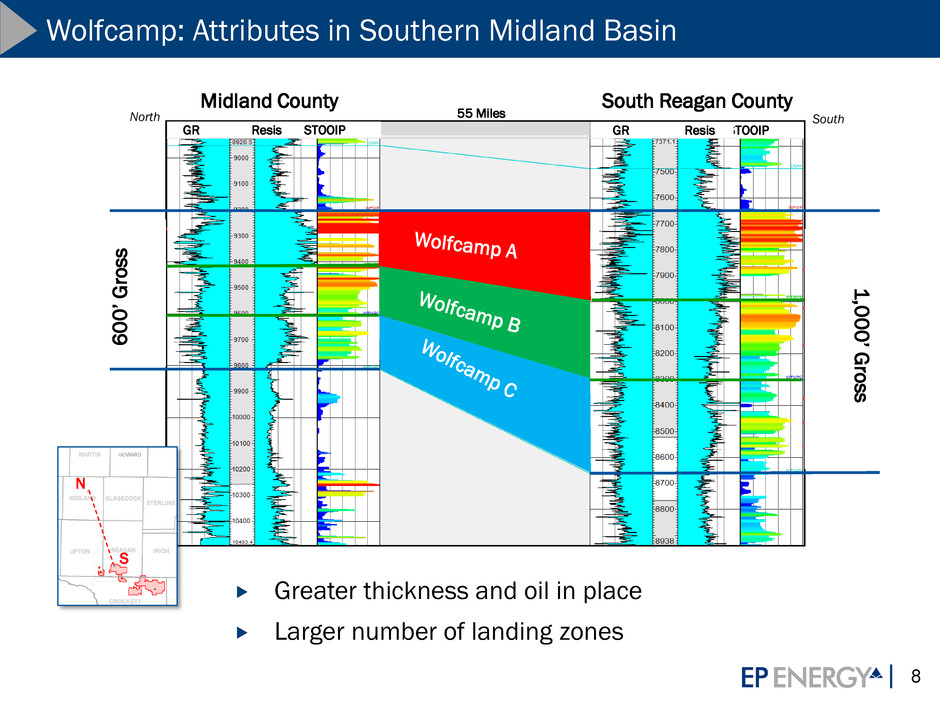

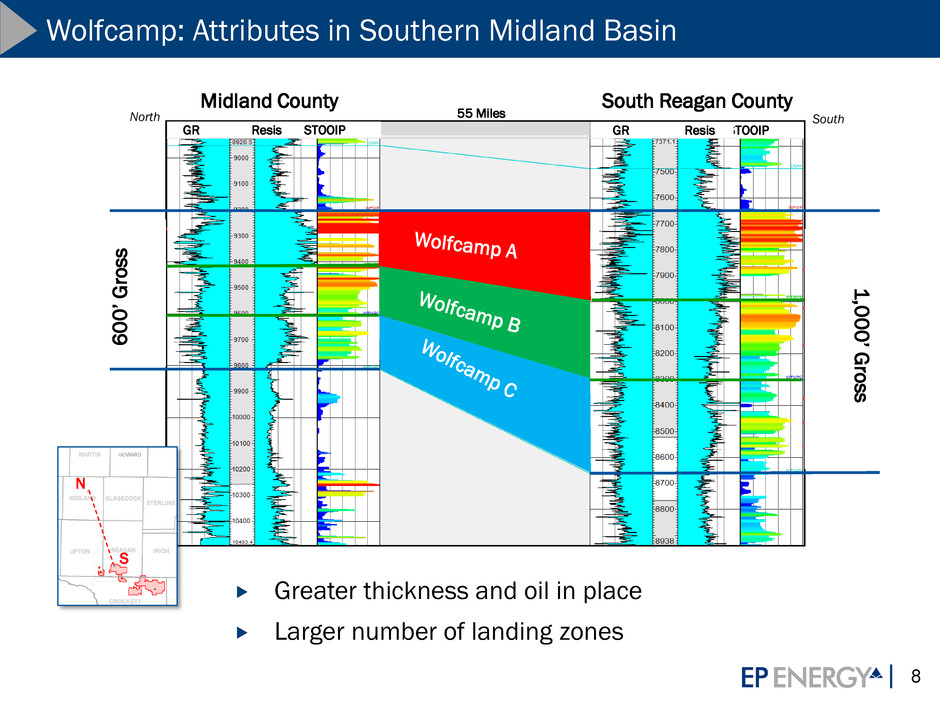

8 Midland County South Reagan County GR Resis STOOIP GR Resis STOOIP 55 Miles 6 0 0 ’ G ro ss 1, 0 0 0’ G ro ss S N Wolfcamp: Attributes in Southern Midland Basin Greater thickness and oil in place Larger number of landing zones North South

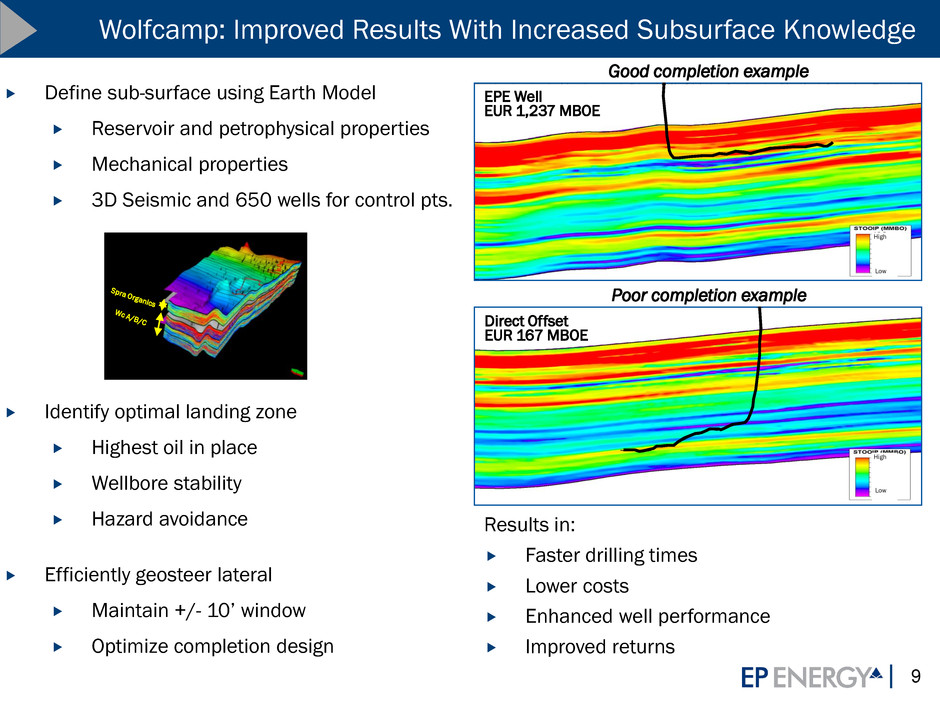

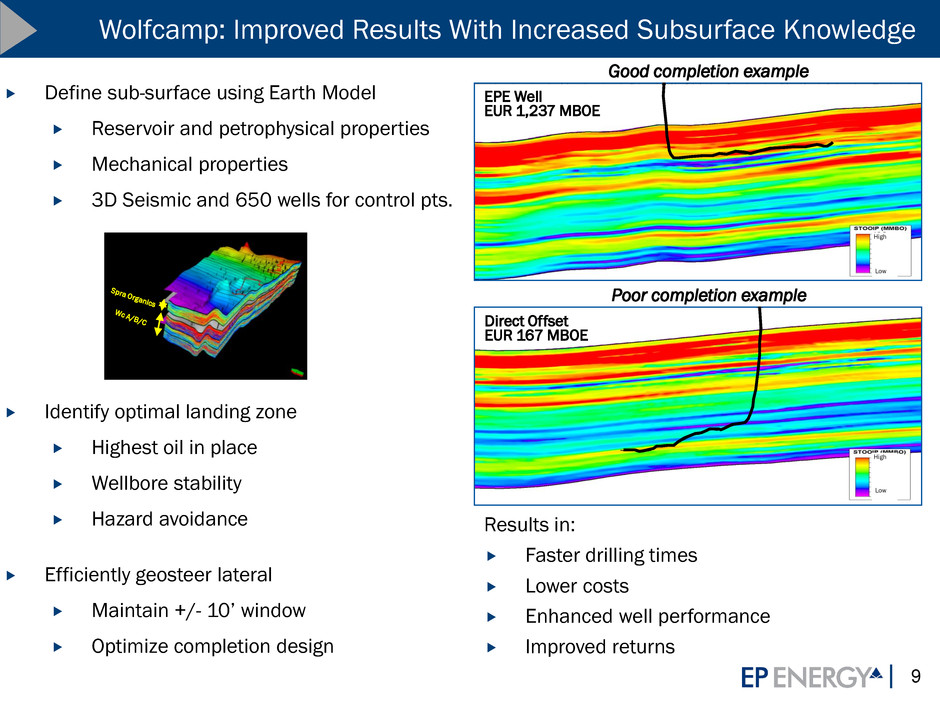

9 Define sub-surface using Earth Model Reservoir and petrophysical properties Mechanical properties 3D Seismic and 650 wells for control pts. Identify optimal landing zone Highest oil in place Wellbore stability Hazard avoidance Efficiently geosteer lateral Maintain +/- 10’ window Optimize completion design Wolfcamp: Improved Results With Increased Subsurface Knowledge Direct Offset EUR 167 MBOE Low High Poor completion example EPE Well EUR 1,237 MBOE Low High Good completion example Results in: Faster drilling times Lower costs Enhanced well performance Improved returns

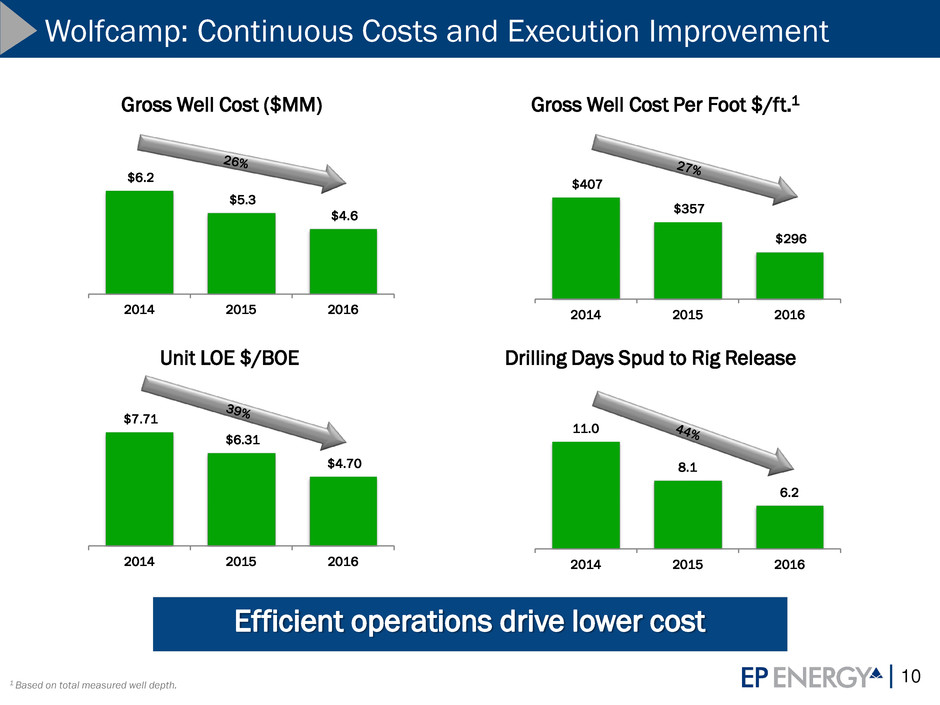

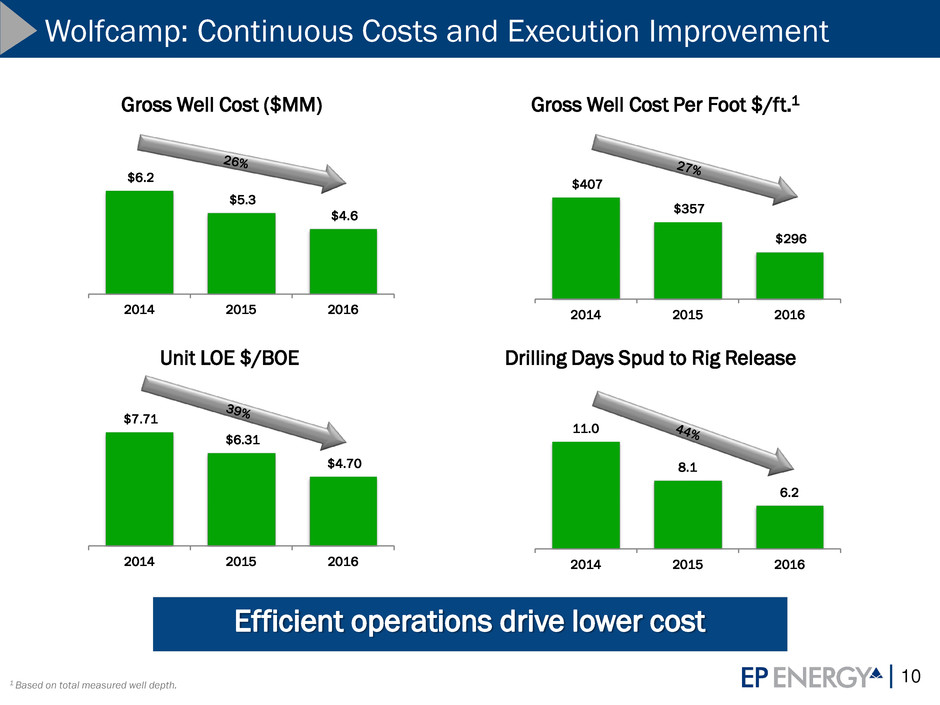

10 $407 $357 $296 2014 2015 2016 $6.2 $5.3 $4.6 2014 2015 2016 1 Based on total measured well depth. Gross Well Cost ($MM) $7.71 $6.31 $4.70 2014 2015 2016 Unit LOE $/BOE 11.0 8.1 6.2 2014 2015 2016 Drilling Days Spud to Rig Release Gross Well Cost Per Foot $/ft.1 Wolfcamp: Continuous Costs and Execution Improvement Efficient operations drive lower cost

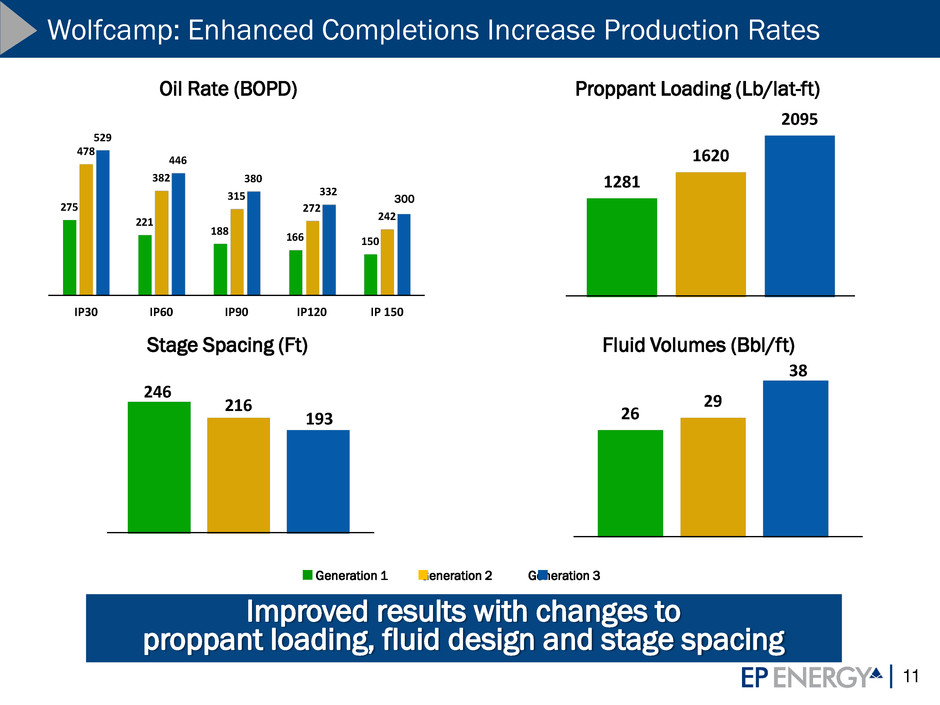

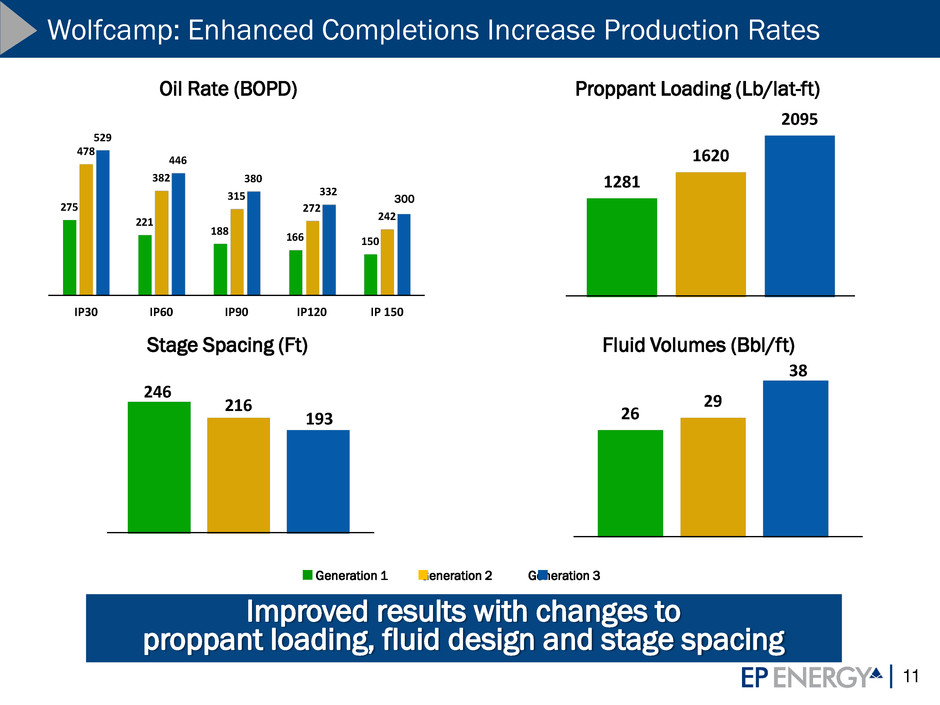

11 246 216 193 Wolfcamp: Enhanced Completions Increase Production Rates Improved results with changes to proppant loading, fluid design and stage spacing 26 29 38 1281 1620 2095 275 221 188 166 150 478 382 315 272 242 529 446 380 332 298 IP30 IP60 IP90 IP120 IP 150 Generation 1 Generation 2 Generation 3 Oil Rate (BOPD) Proppant Loading (Lb/lat-ft) Stage Spacing (Ft) Fluid Volumes (Bbl/ft) 300

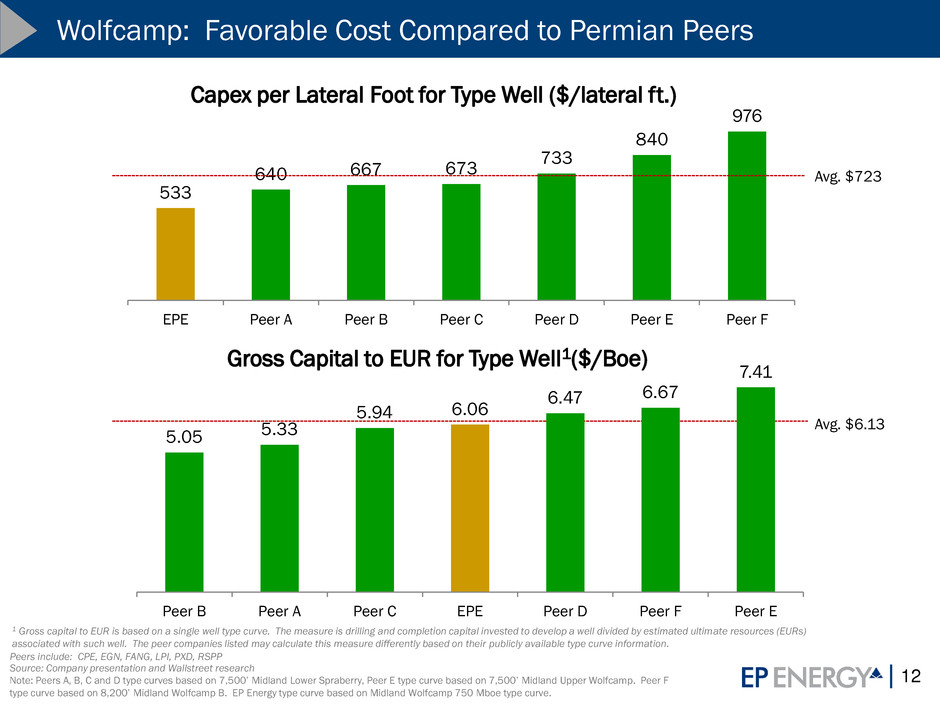

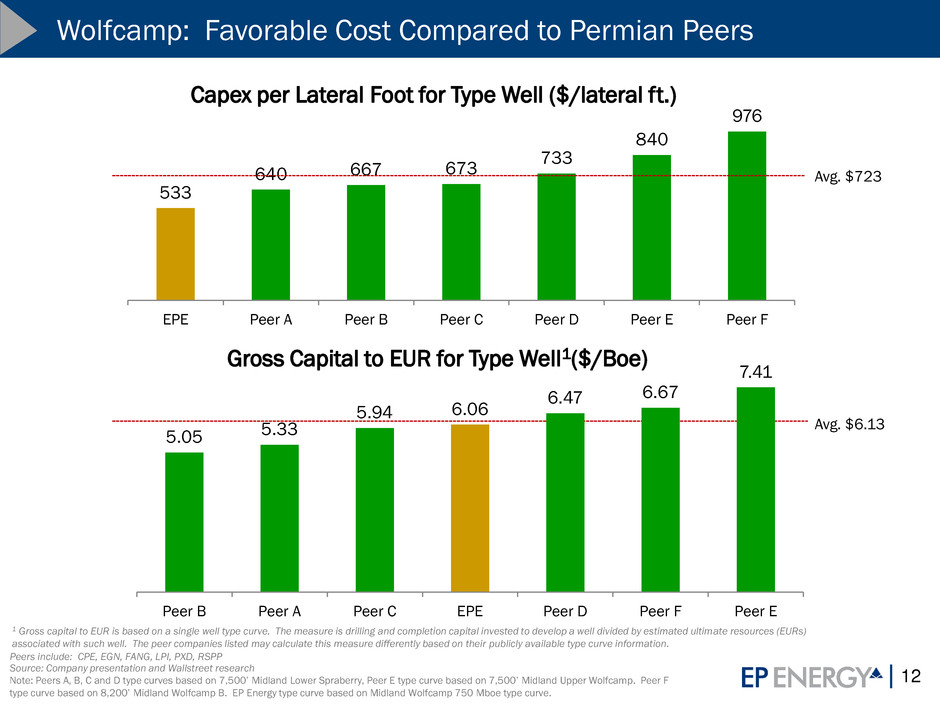

12 Wolfcamp: Favorable Cost Compared to Permian Peers 533 640 667 673 733 840 976 EPE Peer A Peer B Peer C Peer D Peer E Peer F Gross Capital to EUR for Type Well1($/Boe) Avg. $6.13 5.05 5.33 5.94 6.06 6.47 6.67 7.41 Peer B Peer A Peer C EPE Peer D Peer F Peer E Capex per Lateral Foot for Type Well ($/lateral ft.) Avg. $723 Source: Company presentation and Wallstreet research Peers include: CPE, EGN, FANG, LPI, PXD, RSPP Note: Peers A, B, C and D type curves based on 7,500’ Midland Lower Spraberry, Peer E type curve based on 7,500’ Midland Upper Wolfcamp. Peer F type curve based on 8,200’ Midland Wolfcamp B. EP Energy type curve based on Midland Wolfcamp 750 Mboe type curve. 1 Gross capital to EUR is based on a single well type curve. The measure is drilling and completion capital invested to develop a well divided by estimated ultimate resources (EURs) associated with such well. The peer companies listed may calculate this measure differently based on their publicly available type curve information.

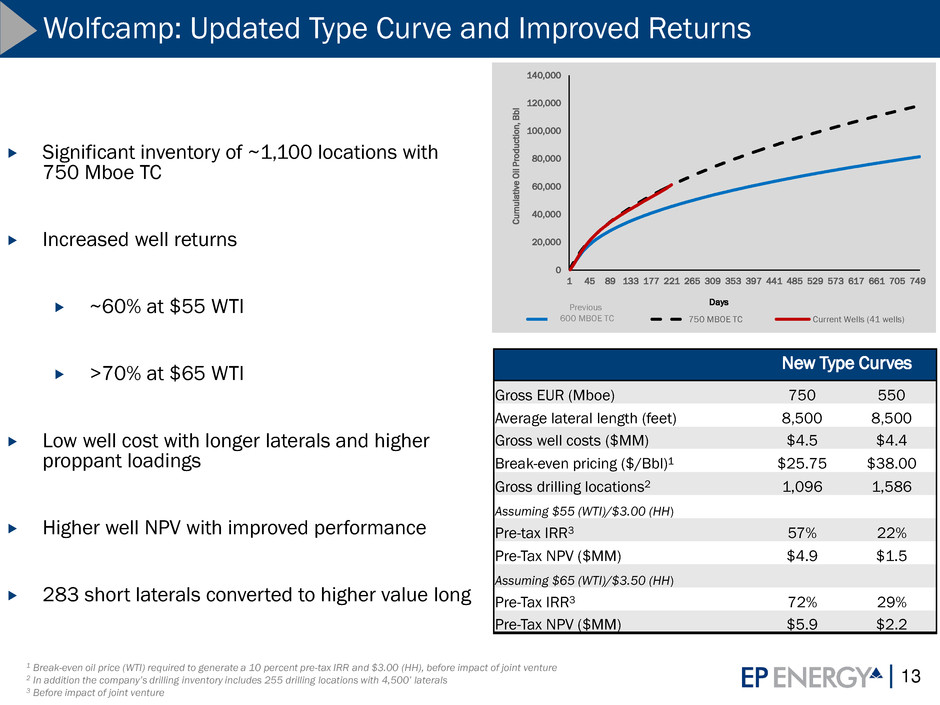

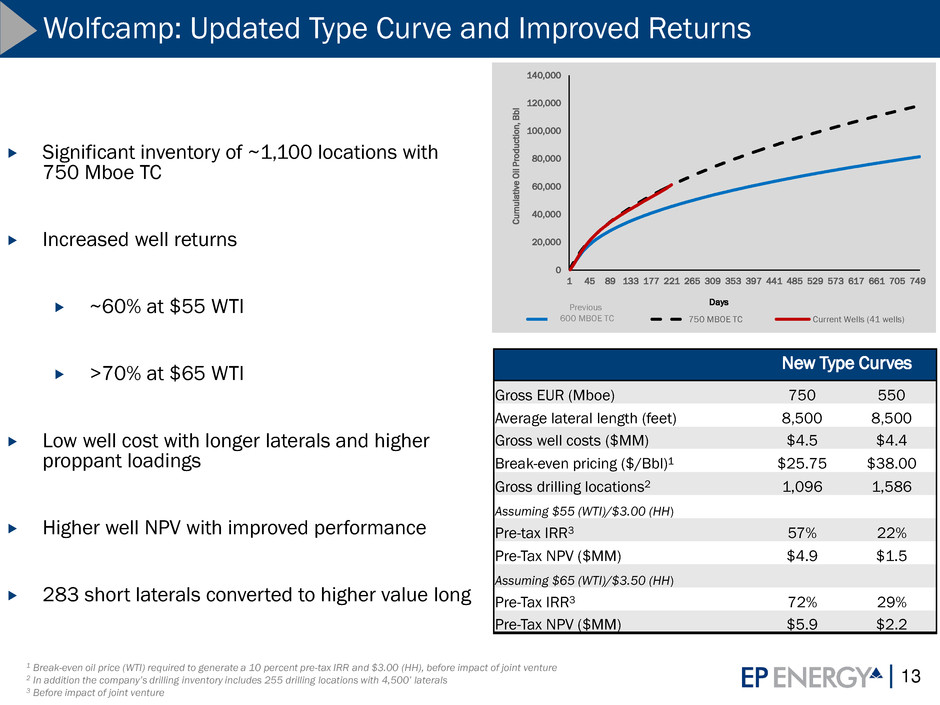

13 Wolfcamp: Updated Type Curve and Improved Returns 1 Break-even oil price (WTI) required to generate a 10 percent pre-tax IRR and $3.00 (HH), before impact of joint venture 2 In addition the company’s drilling inventory includes 255 drilling locations with 4,500’ laterals 3 Before impact of joint venture New Type Curves Gross EUR (Mboe) 750 550 Average lateral length (feet) 8,500 8,500 Gross well costs ($MM) $4.5 $4.4 Break-even pricing ($/Bbl)1 $25.75 $38.00 Gross drilling locations2 1,096 1,586 Assuming $55 (WTI)/$3.00 (HH) Pre-tax IRR3 57% 22% Pre-Tax NPV ($MM) $4.9 $1.5 Assuming $65 (WTI)/$3.50 (HH) Pre-Tax IRR3 72% 29% Pre-Tax NPV ($MM) $5.9 $2.2 Significant inventory of ~1,100 locations with 750 Mboe TC Increased well returns ~60% at $55 WTI >70% at $65 WTI Low well cost with longer laterals and higher proppant loadings Higher well NPV with improved performance 283 short laterals converted to higher value long 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 1 45 89 133 177 221 265 309 353 397 441 485 529 573 617 661 705 749 C u m u la ti ve O il P ro d u ct io n , B b l 600 MBOE TC 750 MBOE TC Current Wells (41 wells) Days Previous 600 MBOE TC

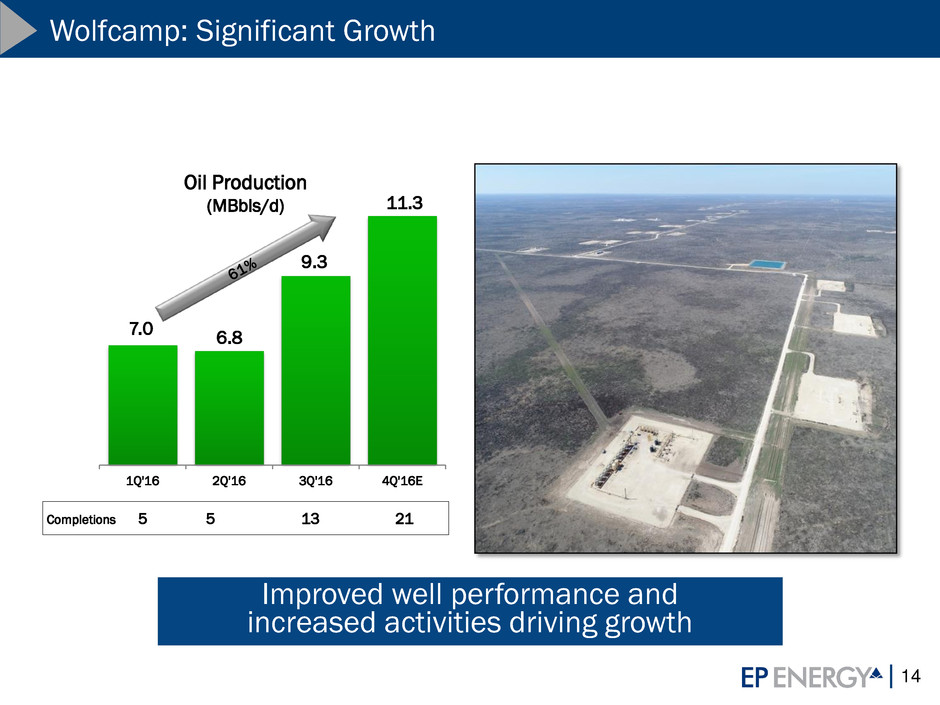

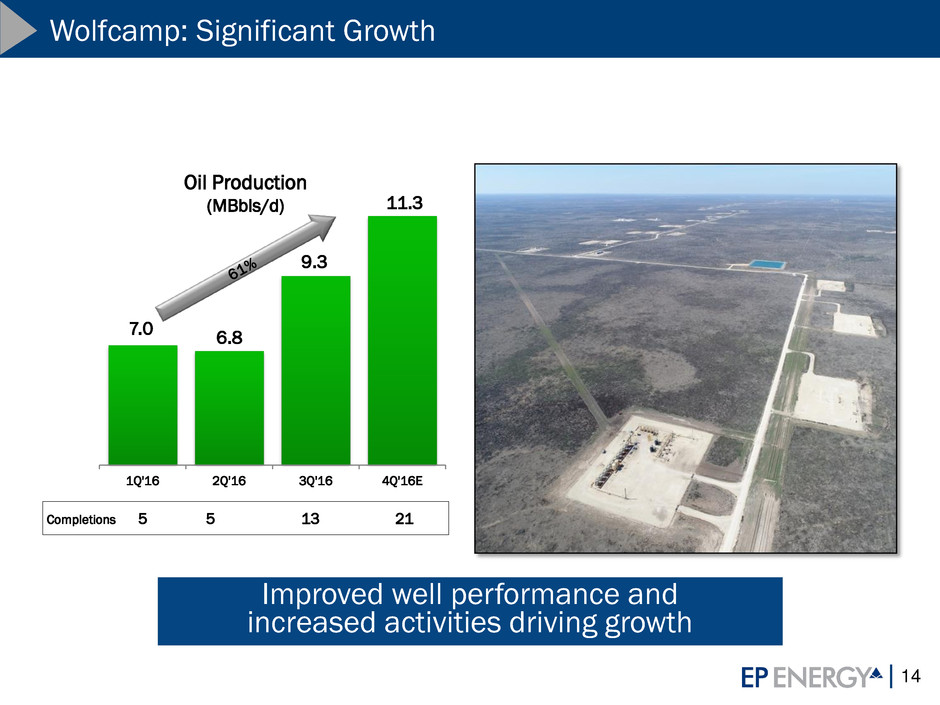

14 Wolfcamp: Significant Growth 7.0 6.8 9.3 11.3 1Q'16 2Q'16 3Q'16 4Q'16E Oil Production (MBbls/d) Completions 5 5 13 21 Improved well performance and increased activities driving growth

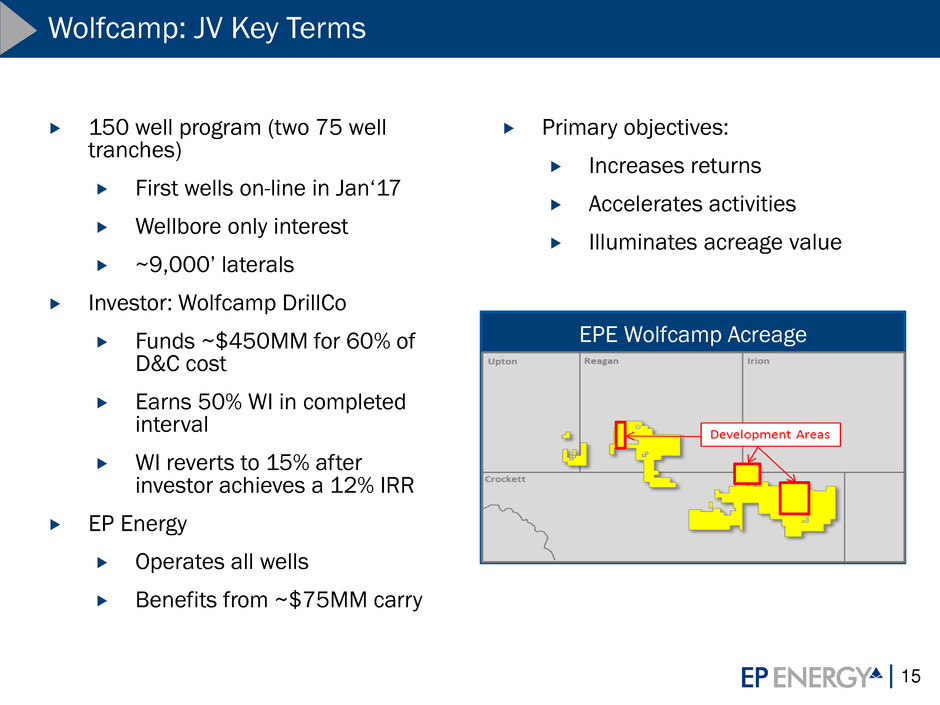

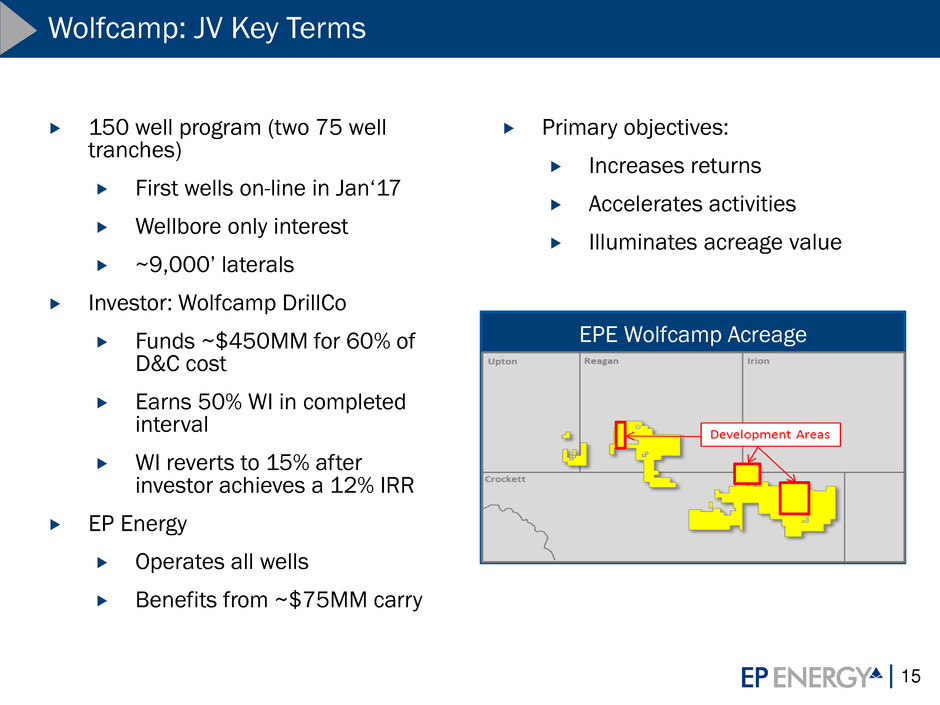

15 EPE Wolfcamp JV Key Terms EPE Wolfcamp Acreage 150 well program (two 75 well tranches) First wells on-line in Jan‘17 Wellbore only interest ~9,000’ laterals Investor: Wolfcamp DrillCo Funds ~$450MM for 60% of D&C cost Earns 50% WI in completed interval WI reverts to 15% after investor achieves a 12% IRR EP Energy Operates all wells Benefits from ~$75MM carry Primary objectives: Increases returns Accelerates activities Illuminates acreage value Wolfcamp: JV Key Terms

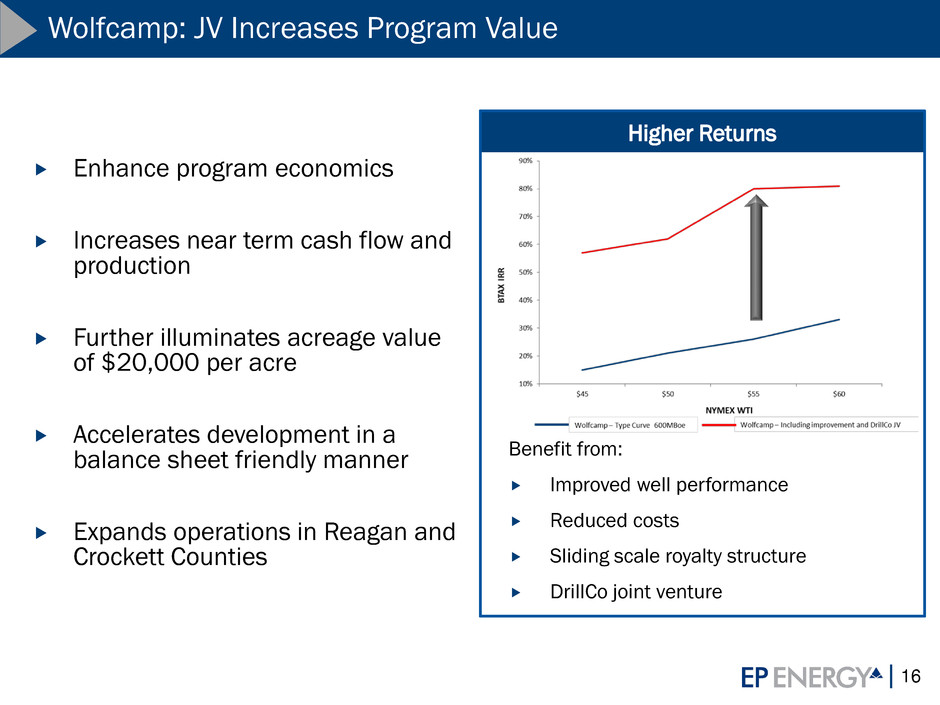

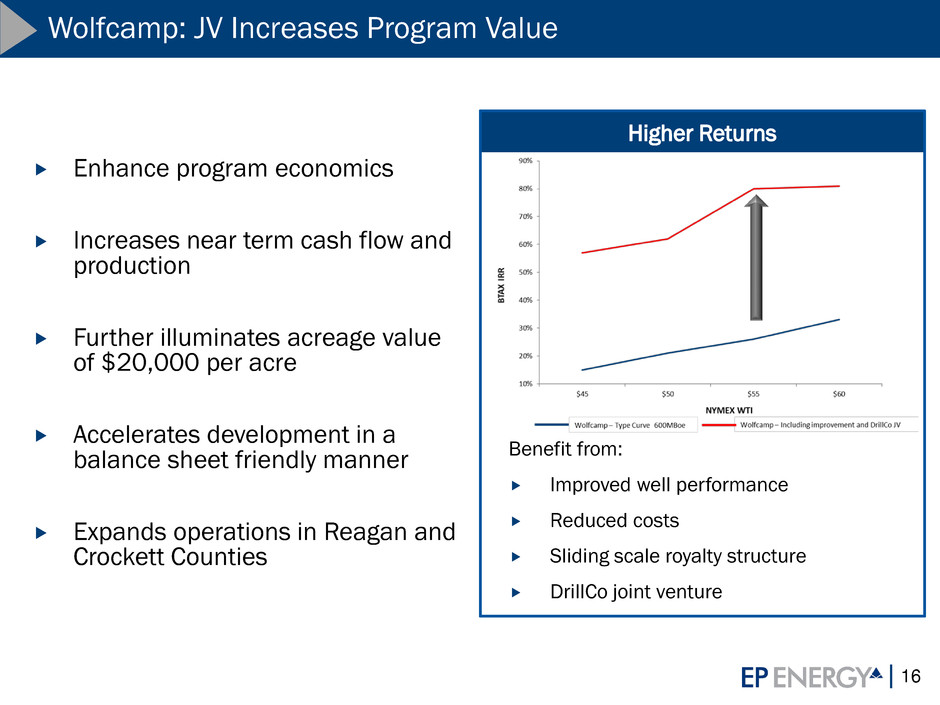

16 Wolfcamp: JV Increases Program Value Higher Returns Enhance program economics Increases near term cash flow and production Further illuminates acreage value of $20,000 per acre Accelerates development in a balance sheet friendly manner Expands operations in Reagan and Crockett Counties Benefit from: Improved well performance Reduced costs Sliding scale royalty structure DrillCo joint venture

17 Wolfcamp: Growth Potential 8.6 Wolfcamp Oil Production (MBbls/d) 2016E 2017E 2018E Highest program returns Currently two JV rigs active Expect to add 3rd rig mid-year 2017 Largest drilling inventory with 2,900+ locations 8.6

Credit Suisse Energy Summit Brent Smolik Chairman, President & Chief Executive Officer February 14, 2017 R 0 G 153 B 0 R 204 G 153 B 0 R 0 G 134 B 234 R 255 G 102 B 0 R 165 G 165 B 165 R 102 G 0 B 51 R 0 G 69 B 124

19 Appendix

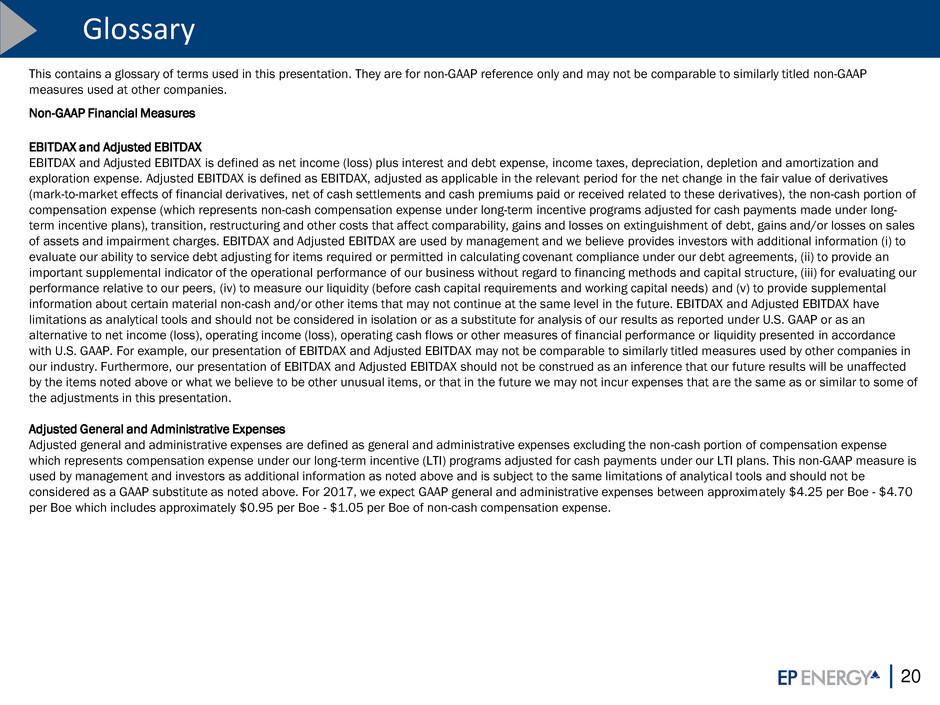

20 Glossary This contains a glossary of terms used in this presentation. They are for non-GAAP reference only and may not be comparable to similarly titled non-GAAP measures used at other companies. Non-GAAP Financial Measures EBITDAX and Adjusted EBITDAX EBITDAX and Adjusted EBITDAX is defined as net income (loss) plus interest and debt expense, income taxes, depreciation, depletion and amortization and exploration expense. Adjusted EBITDAX is defined as EBITDAX, adjusted as applicable in the relevant period for the net change in the fair value of derivatives (mark-to-market effects of financial derivatives, net of cash settlements and cash premiums paid or received related to these derivatives), the non-cash portion of compensation expense (which represents non-cash compensation expense under long-term incentive programs adjusted for cash payments made under long- term incentive plans), transition, restructuring and other costs that affect comparability, gains and losses on extinguishment of debt, gains and/or losses on sales of assets and impairment charges. EBITDAX and Adjusted EBITDAX are used by management and we believe provides investors with additional information (i) to evaluate our ability to service debt adjusting for items required or permitted in calculating covenant compliance under our debt agreements, (ii) to provide an important supplemental indicator of the operational performance of our business without regard to financing methods and capital structure, (iii) for evaluating our performance relative to our peers, (iv) to measure our liquidity (before cash capital requirements and working capital needs) and (v) to provide supplemental information about certain material non-cash and/or other items that may not continue at the same level in the future. EBITDAX and Adjusted EBITDAX have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our results as reported under U.S. GAAP or as an alternative to net income (loss), operating income (loss), operating cash flows or other measures of financial performance or liquidity presented in accordance with U.S. GAAP. For example, our presentation of EBITDAX and Adjusted EBITDAX may not be comparable to similarly titled measures used by other companies in our industry. Furthermore, our presentation of EBITDAX and Adjusted EBITDAX should not be construed as an inference that our future results will be unaffected by the items noted above or what we believe to be other unusual items, or that in the future we may not incur expenses that are the same as or similar to some of the adjustments in this presentation. Adjusted General and Administrative Expenses Adjusted general and administrative expenses are defined as general and administrative expenses excluding the non-cash portion of compensation expense which represents compensation expense under our long-term incentive (LTI) programs adjusted for cash payments under our LTI plans. This non-GAAP measure is used by management and investors as additional information as noted above and is subject to the same limitations of analytical tools and should not be considered as a GAAP substitute as noted above. For 2017, we expect GAAP general and administrative expenses between approximately $4.25 per Boe - $4.70 per Boe which includes approximately $0.95 per Boe - $1.05 per Boe of non-cash compensation expense.

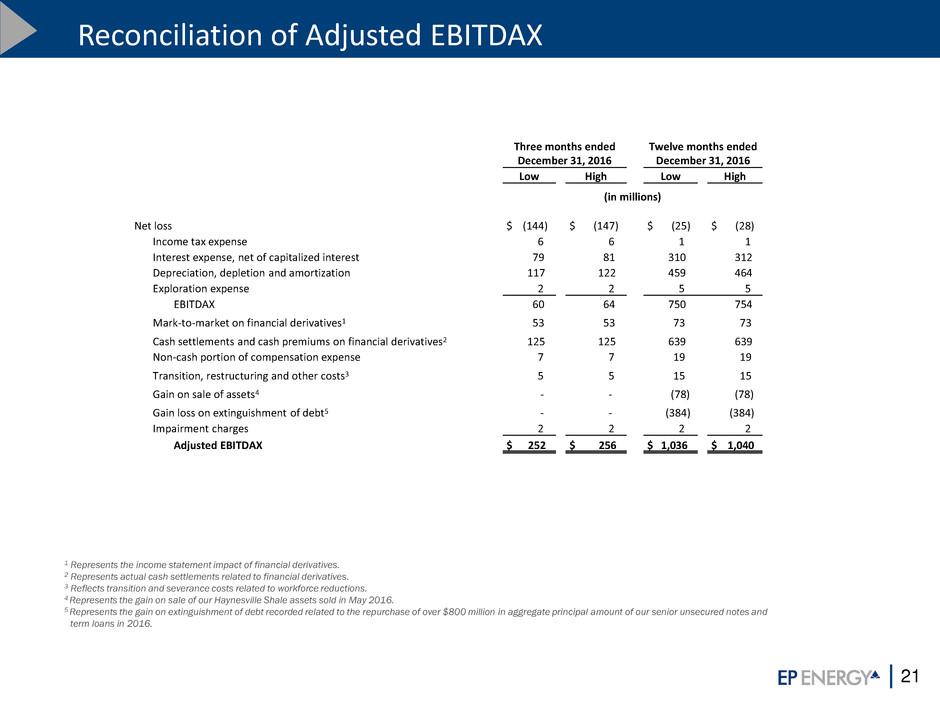

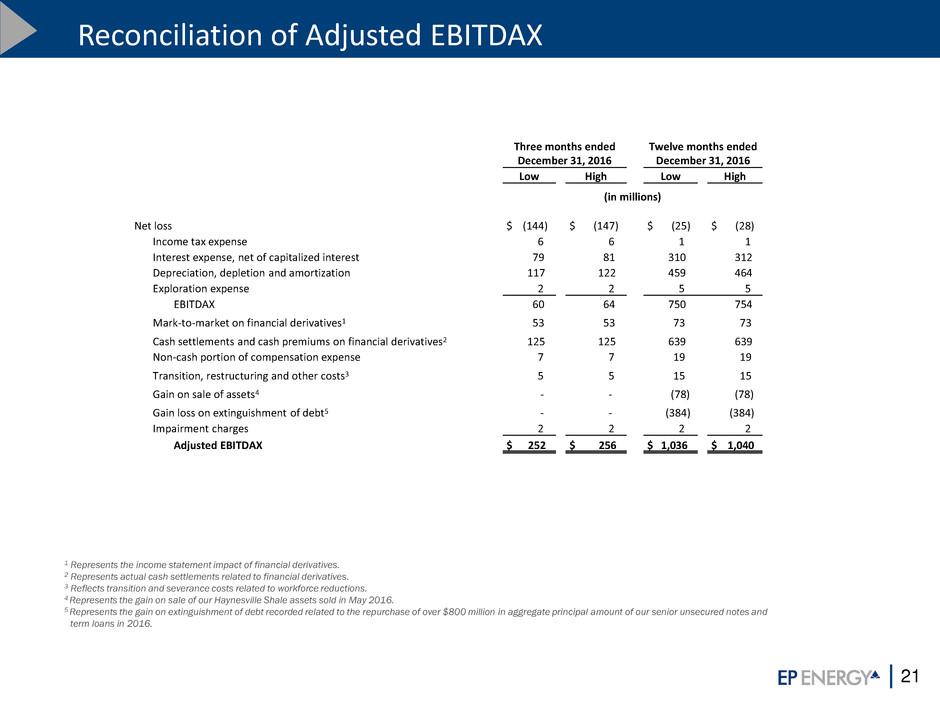

21 Reconciliation of Adjusted EBITDAX 1 Represents the income statement impact of financial derivatives. 2 Represents actual cash settlements related to financial derivatives. 3 Reflects transition and severance costs related to workforce reductions. 4 Represents the gain on sale of our Haynesville Shale assets sold in May 2016. 5 Represents the gain on extinguishment of debt recorded related to the repurchase of over $800 million in aggregate principal amount of our senior unsecured notes and term loans in 2016. Three months ended December 31, 2016 Twelve months ended December 31, 2016 Low High Low High (in millions) Net loss $ (144) $ (147) $ (25) $ (28) Income tax expense 6 6 1 1 Interest expense, net of capitalized interest 79 81 310 312 Depreciation, depletion and amortization 117 122 459 464 Exploration expense 2 2 5 5 EBITDAX 60 64 750 754 Mark-to-market on financial derivatives1 53 53 73 73 Cash settlements and cash premiums on financial derivatives2 125 125 639 639 Non-cash portion of compensation expense 7 7 19 19 Transition, restructuring and other costs3 5 5 15 15 Gain on sale of assets4 - - (78) (78) Gain loss on extinguishment of debt5 - - (384) (384) Impairment charges 2 2 2 2 Adjusted EBITDAX $ 252 $ 256 $ 1,036 $ 1,040

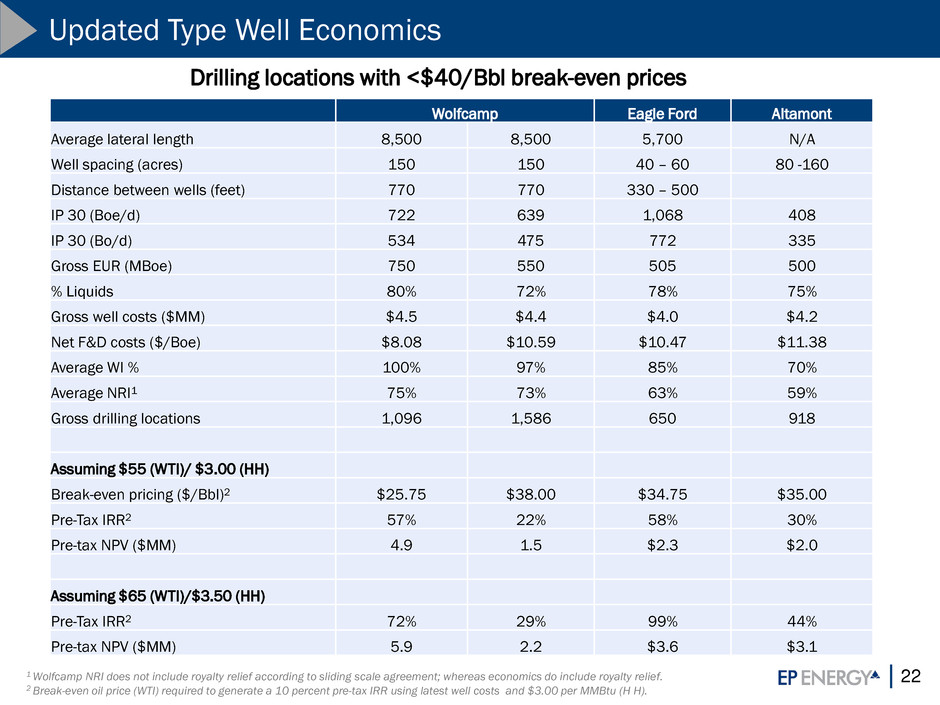

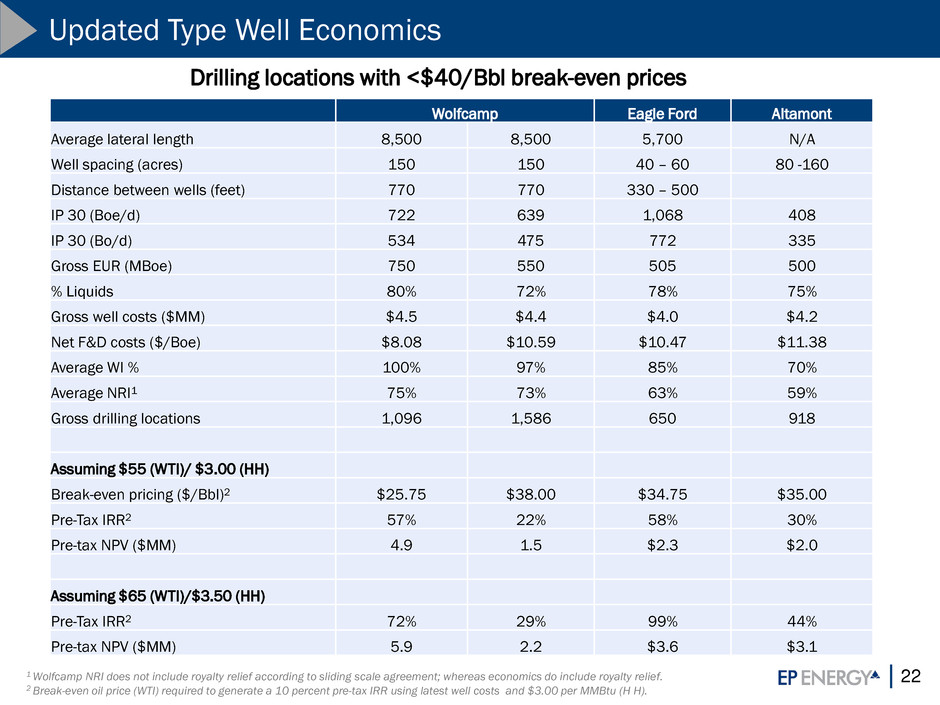

22 Updated Type Well Economics Wolfcamp Eagle Ford Altamont Average lateral length 8,500 8,500 5,700 N/A Well spacing (acres) 150 150 40 – 60 80 -160 Distance between wells (feet) 770 770 330 – 500 IP 30 (Boe/d) 722 639 1,068 408 IP 30 (Bo/d) 534 475 772 335 Gross EUR (MBoe) 750 550 505 500 % Liquids 80% 72% 78% 75% Gross well costs ($MM) $4.5 $4.4 $4.0 $4.2 Net F&D costs ($/Boe) $8.08 $10.59 $10.47 $11.38 Average WI % 100% 97% 85% 70% Average NRI1 75% 73% 63% 59% Gross drilling locations 1,096 1,586 650 918 Assuming $55 (WTI)/ $3.00 (HH) Break-even pricing ($/Bbl)2 $25.75 $38.00 $34.75 $35.00 Pre-Tax IRR2 57% 22% 58% 30% Pre-tax NPV ($MM) 4.9 1.5 $2.3 $2.0 Assuming $65 (WTI)/$3.50 (HH) Pre-Tax IRR2 72% 29% 99% 44% Pre-tax NPV ($MM) 5.9 2.2 $3.6 $3.1 1 Wolfcamp NRI does not include royalty relief according to sliding scale agreement; whereas economics do include royalty relief. 2 Break-even oil price (WTI) required to generate a 10 percent pre-tax IRR using latest well costs and $3.00 per MMBtu (H H). Drilling locations with <$40/Bbl break-even prices

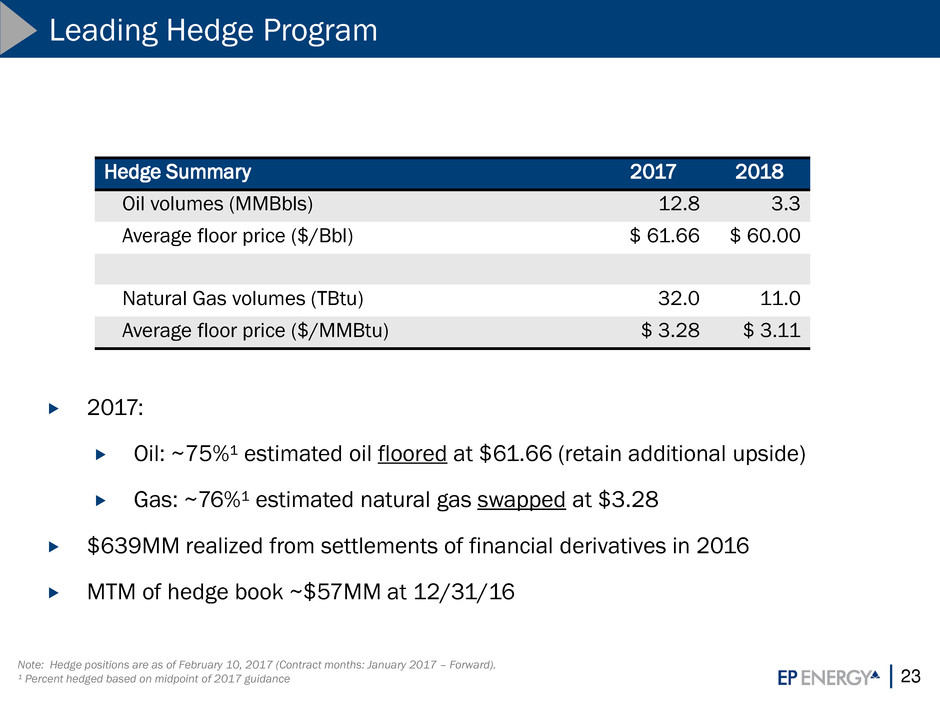

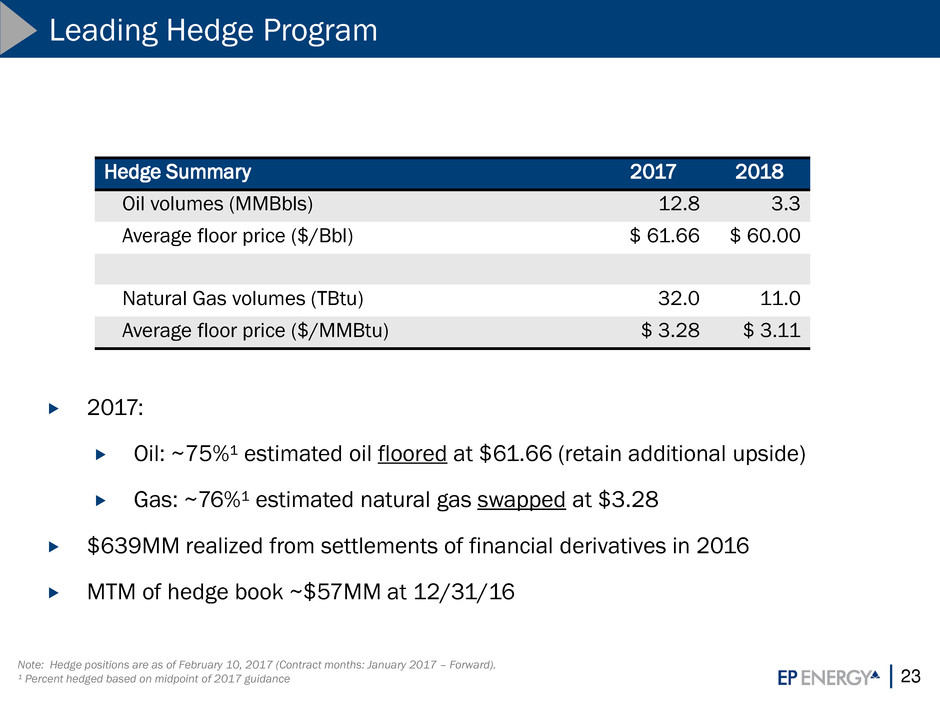

23 Leading Hedge Program Hedge Summary 2017 2018 Oil volumes (MMBbls) 12.8 3.3 Average floor price ($/Bbl) $ 61.66 $ 60.00 Natural Gas volumes (TBtu) 32.0 11.0 Average floor price ($/MMBtu) $ 3.28 $ 3.11 Note: Hedge positions are as of February 10, 2017 (Contract months: January 2017 – Forward). ¹ Percent hedged based on midpoint of 2017 guidance 2017: Oil: ~75%¹ estimated oil floored at $61.66 (retain additional upside) Gas: ~76%¹ estimated natural gas swapped at $3.28 $639MM realized from settlements of financial derivatives in 2016 MTM of hedge book ~$57MM at 12/31/16

24 2016 Completed Wells By Quarter Program 1Q 2Q 3Q 4Q FY Eagle Ford 16 8 10 5 39 Wolfcamp 5 5 13 21 44 Altamont 2 2 7 4 15 Total company 23 15 30 30 98