McGraw‐Hill Global Education Holdings Q4‐2015 Investor Update March 30, 2016 Final

Important Notice Forward‐Looking Statements This presentation includes statements that are, or may be deemed to be, “forward‐looking statements.” These forward‐looking statements can be identified by the use of forward‐looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “intends,” “plans,” “may,” “will” or “should” or, in each case, their negative or other variations or comparable terminology. These forward‐looking statements include all matters that are not historical facts. They appear in a number of places throughout this presentation and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth, strategies and the industry in which we operate. By their nature, forward‐looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward‐looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate, may differ materially from those made in or suggested by the forward‐looking statements contained in this presentation. In addition, even if our results of operations, financial condition and liquidity, and the development of the industry in which we operate are consistent with the forward‐looking statements contained in this presentation, those results of operations, financial condition and liquidity or developments may not be indicative of results or developments in subsequent periods. Any forward‐looking statements we make in this presentation speak only as of the date of such statement, and we undertake no obligation to update such statements. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data. Non‐GAAP Financial Measures Certain financial information included herein, including Adjusted Revenue, EBITDA and Adjusted EBITDA, are not presentations made in accordance with U.S. GAAP, and use of such terms varies from others in the same industry. Non‐GAAP financial measures should not be considered as alternatives to income from continuing operations, income from operations or any other performance measures derived in accordance with U.S. GAAP as measures of operating performance or cash flows as measures of liquidity. Non‐GAAP financial measures have important limitations as analytical tools, and you should not consider them in isolation or as substitutes for results as reported under U.S. GAAP. This presentation includes a reconciliation of certain non‐ GAAP financial measures to the most directly comparable financial measures calculated in accordance with U.S. GAAP. 2

Q4 & 2015 Business Highlights 3

A successful year of digital performance, strong free cash flow generation and incremental cost savings − Strong digital growth in Higher Ed nearly offset the total print decline in 2015 − Sales of digital units in Higher Ed exceeded print units for first time in 2015, a significant milestone in the digital transformation − Expanded Higher Ed market share 160 bps over the 2012‐2015 period (1) Strengthened market leadership position in adaptive learning with double‐digit growth across key digital platforms and products − Meeting the needs of instructors and students with Higher Ed adaptive learning solutions by driving better outcomes and affordability for the student − Own and control all of our key adaptive technology solutions Stabilization of International business on a constant currency basis continues as we increasingly leverage digital capabilities to adapt and localize content (e.g., ALEKS) Growth of Professional digital subscriptions on the Access platform increased in 2015 with retention rates in excess of 90% 2015 Performance Highlights Note (1) Management Practice, Inc. 4

Digital transition continues with another year of strong digital activations and user engagement – Sales of digital units surpassed print units in Higher Ed in 2015 Proprietary e‐commerce site is now the largest single sales channel for Higher Ed – E‐commerce Adjusted Revenue of $140 million was up 34% Y/Y in 2015 – Direct‐to‐student e‐commerce channel improves sales visibility and predictability while facilitating future product innovation and delivery – Increasing digital purchases expected to reduce average return rate for the business overall Direct‐to‐student digital transition is favorably impacting the business but is also altering our selling patterns for digital and print and continuing to impact Y/Y comparability − As we drive our digital first strategy, students are increasingly purchasing digital solutions directly from our proprietary e‐commerce channel at the start of the semester (primarily September and January) − As sales transition from the traditional distribution channel to our proprietary e‐commerce channel, sales are shifting from Q4 to Q1 and from Q2 to Q3 Higher Ed Digital Adjusted Revenue Growth Continues Note Adjusted Revenue previously referred to as Cash Revenue; Adjusted EBITDA previously referred to as Post‐Plate Adjusted Cash EBITDA; Pre‐publication investment previously referred to as plate investment. 5

0.7 0.8 0.9 2013 2014 2015 2.2 2.6 3.0 2013 2014 2015 Strong Momentum Across Higher Ed Adaptive Offerings Strong growth in paid activations continued across Connect and ALEKS in 2015 – Connect/LearnSmart and ALEKS paid activations grew 16% and 10% Y/Y respectively in 2015 Engagement among instructors and students expanded significantly in 2015 with 1,400+ adaptive titles now available (vs. 40 in 2012) – 10 million instructor assignments created through Connect, +47% Y/Y – 89 million student assignments submitted through Connect, +14% Y/Y – 5 billion questions answered through LearnSmart since inception in 2009 Connect/LearnSmart Paid Activations Higher Ed ALEKS Paid Activations (1) 16% 11 ’13‐15 CAGR Note (1) ALEKS is offered to both Higher Ed and K‐12 students; figures above are Higher Ed only. ALEKS reported 1.7M total paid activations across K‐12 and Higher Ed in 2015. LearnSmart is typically delivered via Connect and sold as a bundle. 17% ’13‐15 CAGR (Millions) 6

2015 Financial Update 77

FY 2015 Financial Performance Driven by Digital Transition Adjusted EBITDA of $362 million grew 1% Y/Y, +3% on a constant currency basis, as margin improvement from digital sales and ongoing benefits from cost savings initiatives more than offset slightly lower Adjusted Revenue Total Adjusted Revenue of $1.3 billion declined by 3%, a decline of 1% on constant currency basis, largely as a result of the strong U.S. dollar and ongoing transition to digital which is altering our selling patterns for digital and print offerings – Expanded market share for a third consecutive year despite lower sales industry‐wide, a smaller front‐list (driven by the extension of publishing cycles for certain titles) and lower print ordering from the traditional distribution channel – Expect front‐list in Higher Ed to expand in 2017‐2018 due to an increase in new editions Digital Adjusted Revenue increased 13% Y/Y in 2015 largely due to strong growth in Higher Ed – Favorable digital sales growth has continued through Q1‐16 – Actioned $100 million of run‐rate cost savings since 2013; $74 million in the P&L through Q4‐15 International Adjusted Revenue growth turned positive in 2015 on a constant currency basis 8

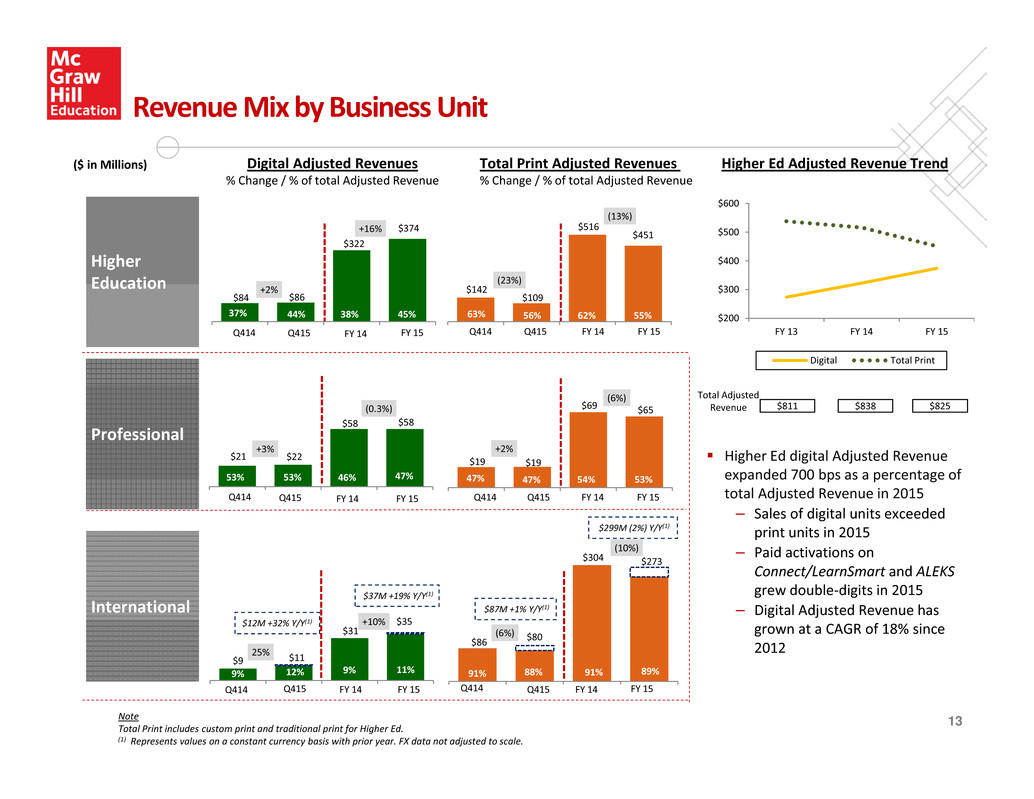

Higher Ed Adj. Revenue Mix Driven by Increasing Digital Sales Higher Ed digital Adjusted Revenue increased 16% Y/Y in 2015 − Higher Ed digital Adjusted Revenue expanded 700 bps as a percentage of total Adjusted Revenue vs. the prior year Digital sales through proprietary e‐commerce site have grown significantly – Largest single distribution channel on net sales basis – $140 million in e‐commerce revenue increased at a 52% CAGR since 2012 – Digital represented 90%+ of total revenue from this channel in 2015 – E‐commerce channel promotes a direct relationship with the student, lower returns, earlier cash collection and improves visibility and predictability $40 $67 $105 $140 2012 2013 2014 2015 Higher Ed Adjusted Revenue Mix Higher Ed Proprietary e‐commerce Revenue 56% ($ in Millions) ’12‐15 CAGR 18% ’12‐15 Digital Adjusted Revenue CAGR 29% 34% 38% 45% 71% 66% 62% 55% 2012 2013 2014 2015 Digital Total Print $780 $811 $838 $825 9Note Totals may not sum due to rounding. 52%

Digital Sales Remain Strong through Mid‐March 2016 10Note An activation occurs when a user accesses a purchased digital product for the first time. Digital transition continues to drive changes in the seasonality of the Higher Ed business Growth in digital activations and e‐commerce revenue has continued through Q1‐16 – Paid activations on Connect/LearnSmart were 1.2 million, up 12% Y/Y, YTD March 15, 2016 – Revenue from the proprietary e‐commerce channel was over $60 million, up 37% Y/Y, YTD March 15, 2016

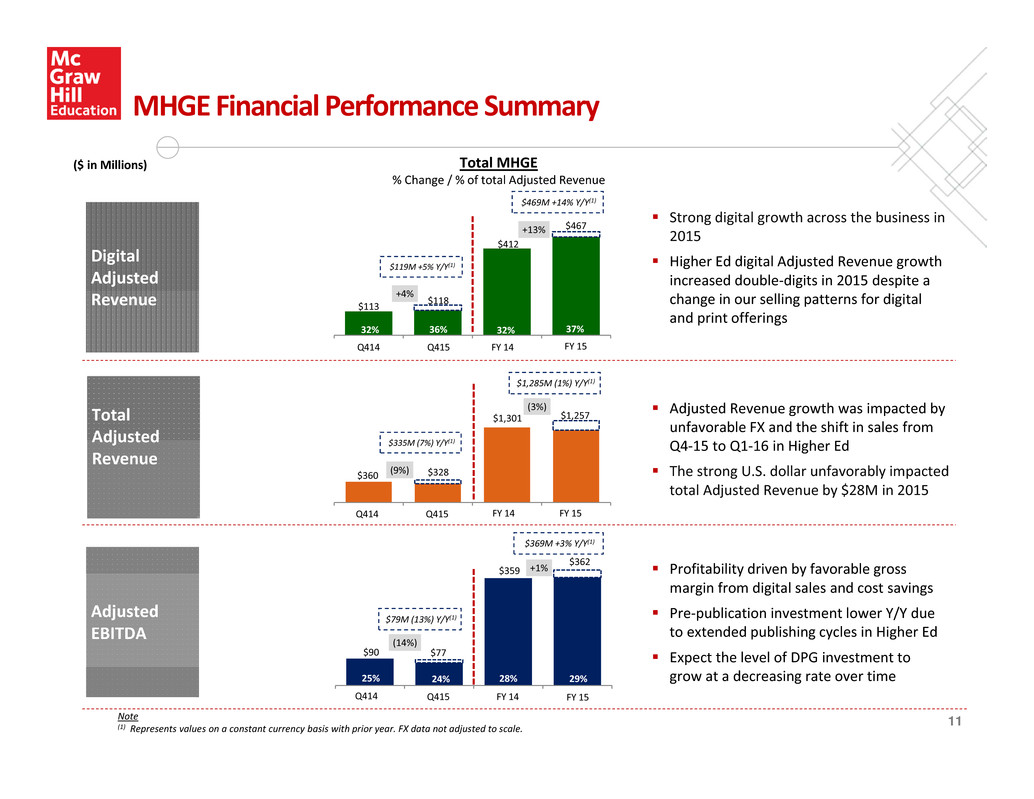

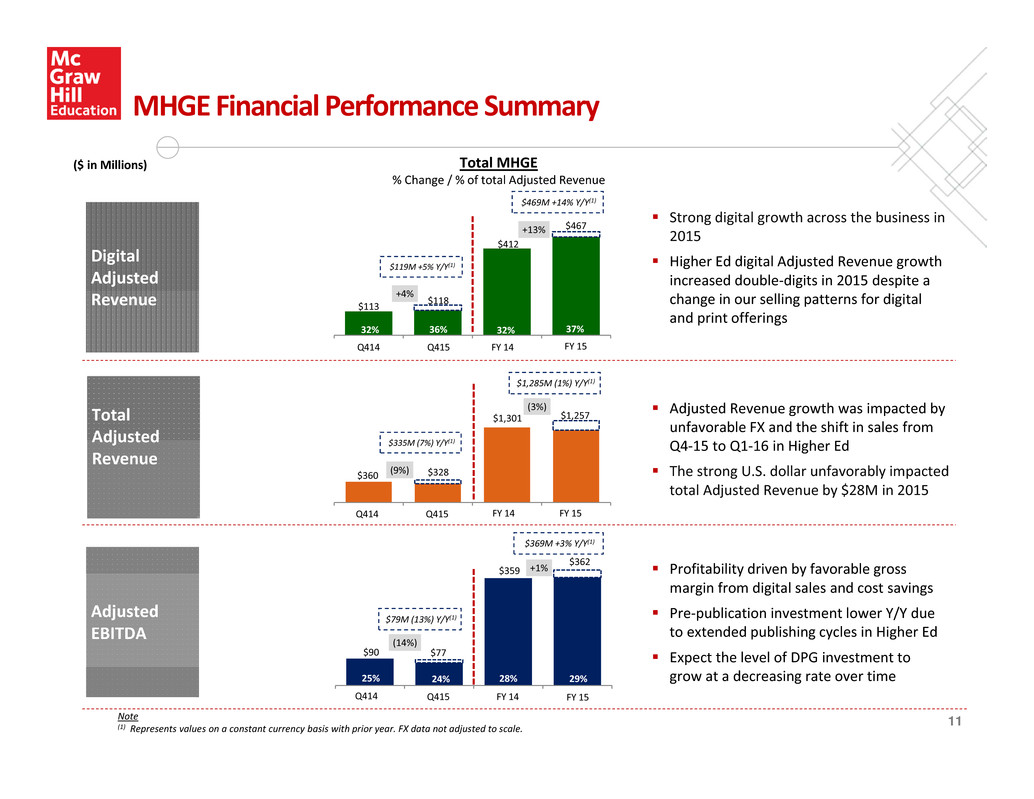

$90 $77 $359 $362 25% 24% 28% 29% (14%) +1% $79M (13%) Y/Y(1) $360 $328 $1,301 $1,257 (9%) (3%) $335M (7%) Y/Y(1) $113 $118 $412 $467 32% 36% 32% 37% +4% +13% MHGE Financial Performance Summary Strong digital growth across the business in 2015 Higher Ed digital Adjusted Revenue growth increased double‐digits in 2015 despite a change in our selling patterns for digital and print offerings Adjusted Revenue growth was impacted by unfavorable FX and the shift in sales from Q4‐15 to Q1‐16 in Higher Ed The strong U.S. dollar unfavorably impacted total Adjusted Revenue by $28M in 2015 Profitability driven by favorable gross margin from digital sales and cost savings Pre‐publication investment lower Y/Y due to extended publishing cycles in Higher Ed Expect the level of DPG investment to grow at a decreasing rate over time Total Adjusted Revenue Digital Adjusted Revenue Adjusted EBITDA ($ in Millions) Total MHGE % Change / % of total Adjusted Revenue Q414 Q415 FY 14 FY 15 Q414 Q415 FY 14 FY 15 Q414 Q415 FY 14 FY 15 11Note(1) Represents values on a constant currency basis with prior year. FX data not adjusted to scale. $469M +14% Y/Y(1) $119M +5% Y/Y(1) $1,285M (1%) Y/Y(1) $369M +3% Y/Y(1)

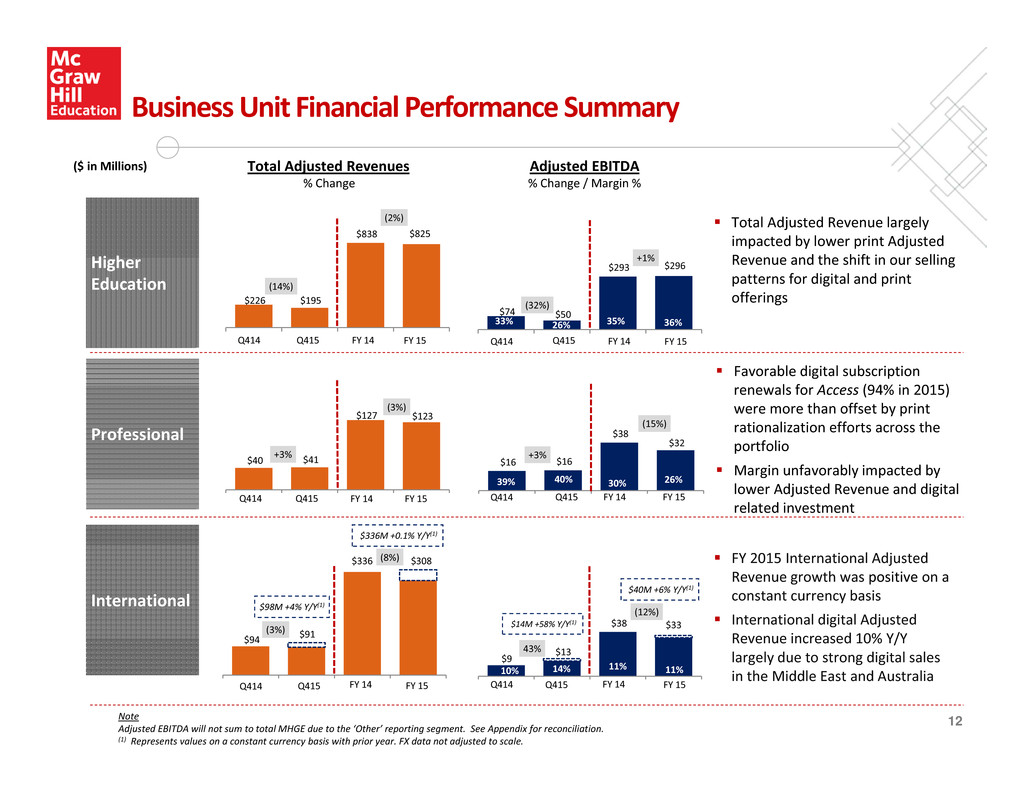

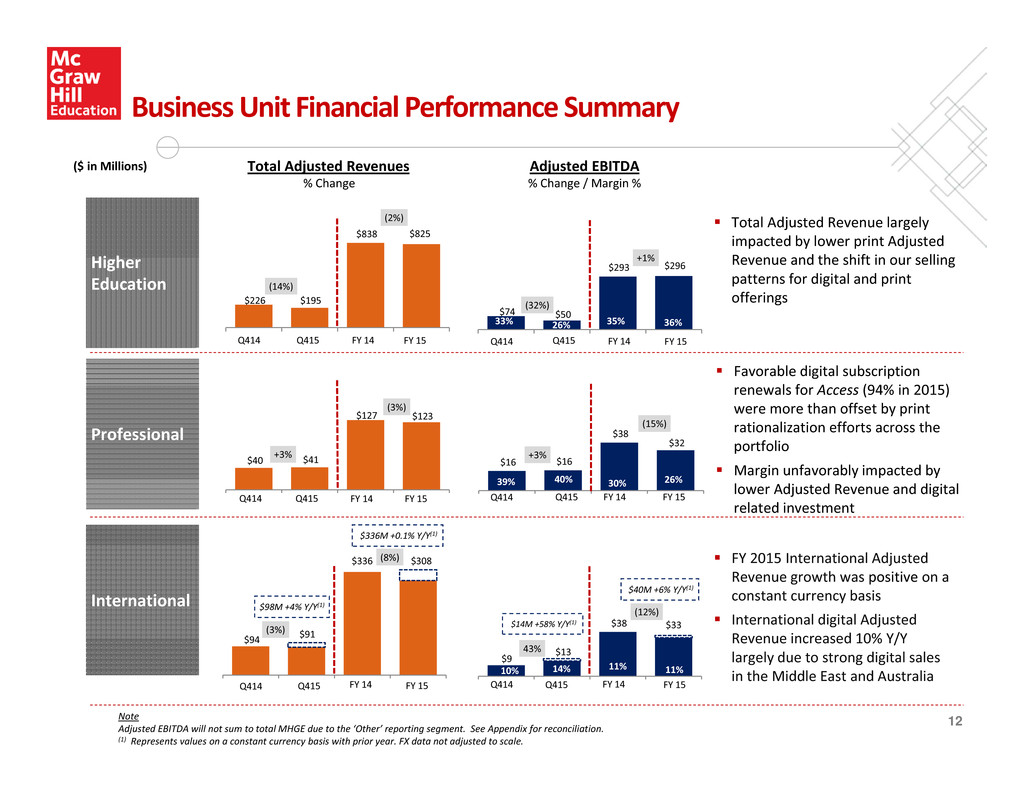

$9 $13 $38 $33 10% 14% 11% 11% 43% (12%) $94 $91 $336 $308 (3%) (8%) $98M +4% Y/Y(1) $16 $16 $38 $32 39% 40% 30% 26% +3% (15%) $40 $41 $127 $123 +3% (3%) $74 $50 $293 $296 33% 26% 35% 36% (32%) +1% $226 $195 $838 $825 (14%) (2%) Total Adjusted Revenue largely impacted by lower print Adjusted Revenue and the shift in our selling patterns for digital and print offerings Favorable digital subscription renewals for Access (94% in 2015) were more than offset by print rationalization efforts across the portfolio Margin unfavorably impacted by lower Adjusted Revenue and digital related investment FY 2015 International Adjusted Revenue growth was positive on a constant currency basis International digital Adjusted Revenue increased 10% Y/Y largely due to strong digital sales in the Middle East and Australia Note Adjusted EBITDA will not sum to total MHGE due to the ‘Other’ reporting segment. See Appendix for reconciliation. (1) Represents values on a constant currency basis with prior year. FX data not adjusted to scale. Business Unit Financial Performance Summary ($ in Millions) Total Adjusted Revenues % Change Adjusted EBITDA % Change / Margin % Higher Education Professional International Q414 Q415 FY 14 FY 15 Q414 Q415 FY 14 FY 15 Q414 Q415 FY 14 FY 15 Q414 Q415 FY 14 FY 15 Q414 Q415 FY 14 FY 15 Q414 Q415 FY 14 FY 15 $336M +0.1% Y/Y(1) $14M +58% Y/Y(1) $40M +6% Y/Y(1) 12

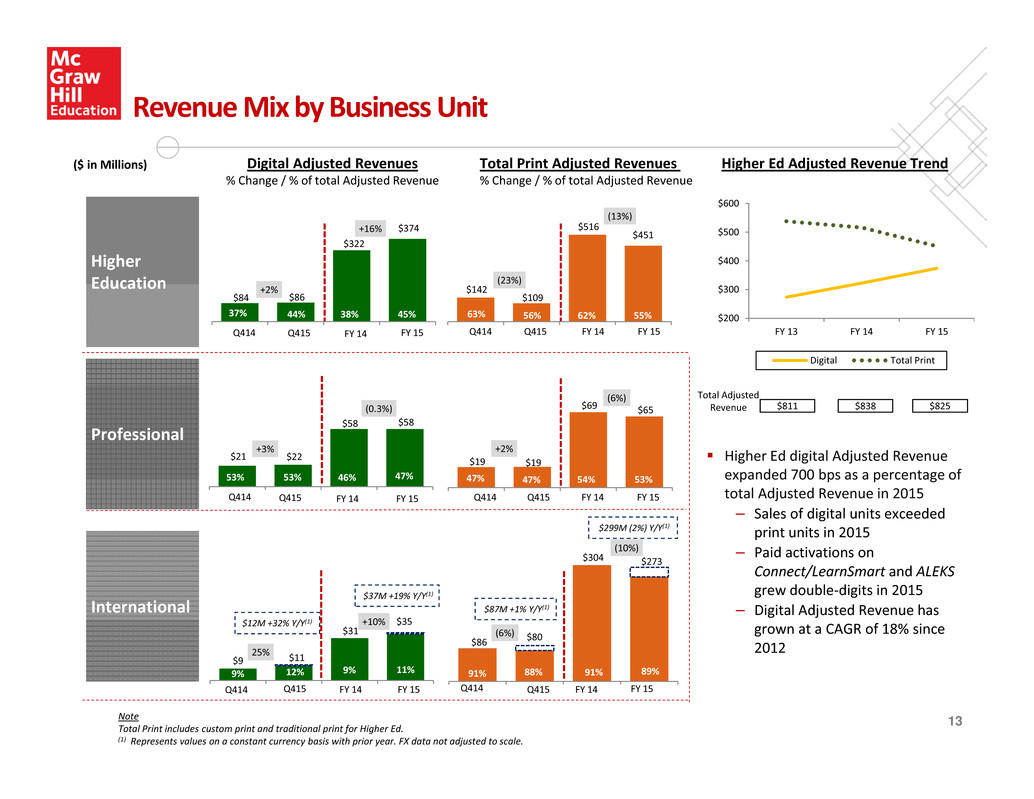

$9 $11 $31 $35 9% 12% 9% 11% 25% +10% Higher Ed digital Adjusted Revenue expanded 700 bps as a percentage of total Adjusted Revenue in 2015 – Sales of digital units exceeded print units in 2015 – Paid activations on Connect/LearnSmart and ALEKS grew double‐digits in 2015 – Digital Adjusted Revenue has grown at a CAGR of 18% since 2012$86 $80 $304 $273 91% 88% 91% 89% (6%) (10%) $19 $19 $69 $65 47% 47% 54% 53% +2% (6%) $21 $22 $58 $58 53% 53% 46% 47% +3% (0.3%) $142 $109 $516 $451 63% 56% 62% 55% (23%) (13%) $84 $86 $322 $374 37% 44% 38% 45% +2% +16% Revenue Mix by Business Unit ($ in Millions) Digital Adjusted Revenues % Change / % of total Adjusted Revenue Total Print Adjusted Revenues % Change / % of total Adjusted Revenue Higher Ed Adjusted Revenue Trend Higher Education Professional International $811 $838 $825 Total Adjusted Revenue Q414 Q415 FY 14 FY 15 Q414 Q415 FY 14 FY 15 Q414 Q415 FY 14 FY 15 Q414 Q415 FY 14 FY 15 Q414 Q415 FY 14 FY 15 Q414 Q415 FY 14 FY 15 Note Total Print includes custom print and traditional print for Higher Ed. (1) Represents values on a constant currency basis with prior year. FX data not adjusted to scale. $200 $300 $400 $500 $600 FY 13 FY 14 FY 15 Digital Total Print $37M +19% Y/Y(1) $12M +32% Y/Y(1) $87M +1% Y/Y(1) $299M (2%) Y/Y(1) 13

9.75% Notes Due 2021 $800.0 4.75% (Floating) Term Loan Due 2019 673.9 Revolving Credit Facility Due 2018 ($240M) ‐ Total Indebtedness $1,473.9 Cash and Cash Equivalents (311.2) Net Indebtedness at December 31, 2015 $1,162.7 Last Twelve Months Covenant EBITDA (1) $426.7 Net First Lien Leverage Ratio (2) 2.72x 8.5% Holdco Notes Due 2019 (3) $500.0 Pro Forma for Holdco Debt 3.90x Cash and Cash Equivalents $311.2 Revolving Credit Facilities $240.0 Outstanding Letters of Credit ‐ Outstanding Borrowings ‐ Available Under Credit Facilities at December 31, 2015 $240.0 Total Liquidity at December 31, 2015 $551.2 Indebtedness Liquidity Capital Structure & Liquidity Update Strong cash generation in 2015 – $311M of cash at year‐end and total liquidity of $551M – Bank revolver fully available as of December 31, 2015 and today Net leverage of 2.7x as of December 31st – Net leverage including HoldCo debt of 3.9x Semiannual interest payment of $21.25M paid on February 2, 2016 for HoldCo debt Principal pre‐payment of $72.5M will be paid on April 1. – Company will have prepaid approximately $189M of term debt out of cash flow through April 2016 Company will dividend $21.25M in Q2‐16 to MHGE Parent to ensure cash available for August interest payment of HoldCo debt ($ in Millions) Note: Debt balances exclude unamortized Original Issue Discount (OID). Totals may not foot due to rounding. (1) Covenant definition of EBITDA is Pre‐publication Adjusted EBITDA ($409 million) plus Pro Forma cost savings ($18 million). (2) Net First Lien Leverage covenant of 7.00x takes effect only if 20% of revolving line of credit is drawn. (3) On April 6, 2015, the company issued an incremental $100 million of HoldCo debt due in 2019. 14

Appendix: Key Terms & Financial Detail 15

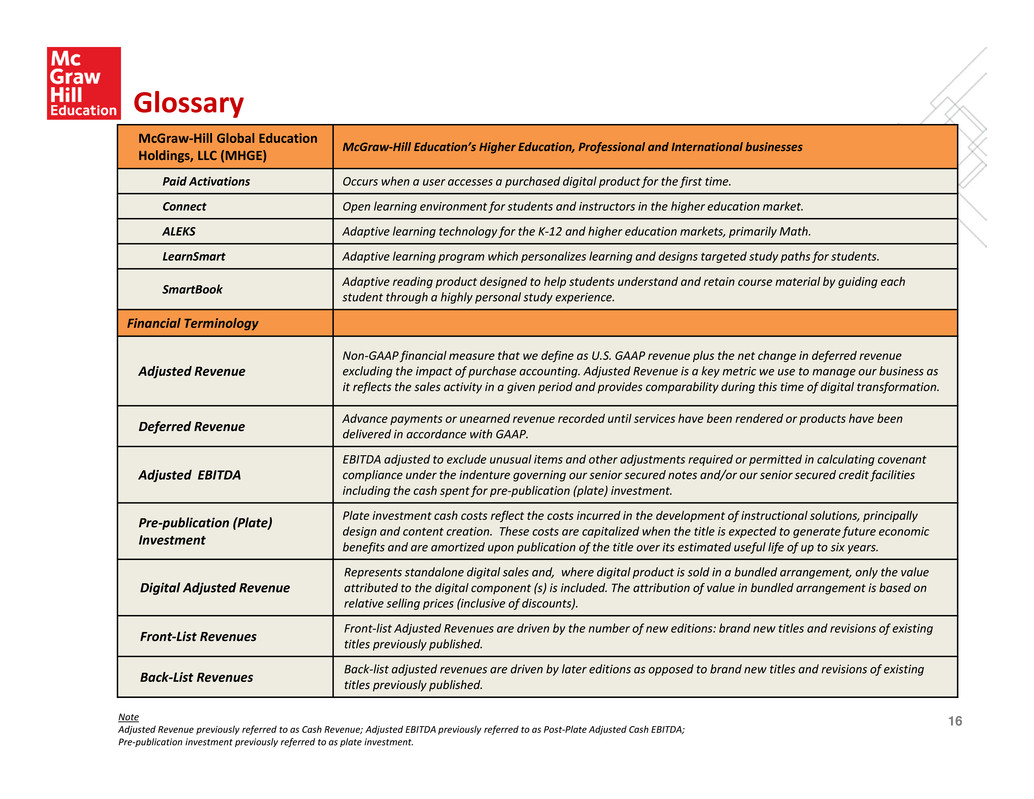

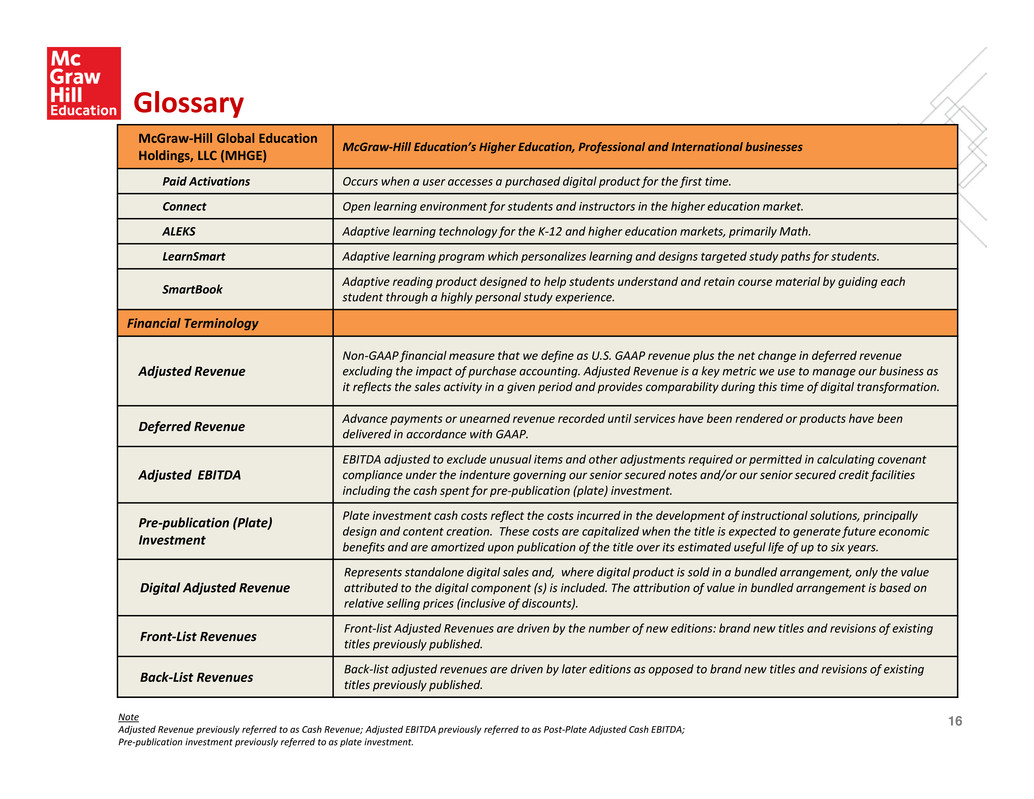

Glossary McGraw‐Hill Global Education Holdings, LLC (MHGE) McGraw‐Hill Education’s Higher Education, Professional and International businesses Paid Activations Occurs when a user accesses a purchased digital product for the first time. Connect Open learning environment for students and instructors in the higher education market. ALEKS Adaptive learning technology for the K‐12 and higher education markets, primarily Math. LearnSmart Adaptive learning program which personalizes learning and designs targeted study paths for students. SmartBook Adaptive reading product designed to help students understand and retain course material by guiding each student through a highly personal study experience. Financial Terminology Adjusted Revenue Non‐GAAP financial measure that we define as U.S. GAAP revenue plus the net change in deferred revenue excluding the impact of purchase accounting. Adjusted Revenue is a key metric we use to manage our business as it reflects the sales activity in a given period and provides comparability during this time of digital transformation. Deferred Revenue Advance payments or unearned revenue recorded until services have been rendered or products have been delivered in accordance with GAAP. Adjusted EBITDA EBITDA adjusted to exclude unusual items and other adjustments required or permitted in calculating covenant compliance under the indenture governing our senior secured notes and/or our senior secured credit facilities including the cash spent for pre‐publication (plate) investment. Pre‐publication (Plate) Investment Plate investment cash costs reflect the costs incurred in the development of instructional solutions, principally design and content creation. These costs are capitalized when the title is expected to generate future economic benefits and are amortized upon publication of the title over its estimated useful life of up to six years. Digital Adjusted Revenue Represents standalone digital sales and, where digital product is sold in a bundled arrangement, only the value attributed to the digital component (s) is included. The attribution of value in bundled arrangement is based on relative selling prices (inclusive of discounts). Front‐List Revenues Front‐list Adjusted Revenues are driven by the number of new editions: brand new titles and revisions of existing titles previously published. Back‐List Revenues Back‐list adjusted revenues are driven by later editions as opposed to brand new titles and revisions of existing titles previously published. Note Adjusted Revenue previously referred to as Cash Revenue; Adjusted EBITDA previously referred to as Post‐Plate Adjusted Cash EBITDA; Pre‐publication investment previously referred to as plate investment. 16

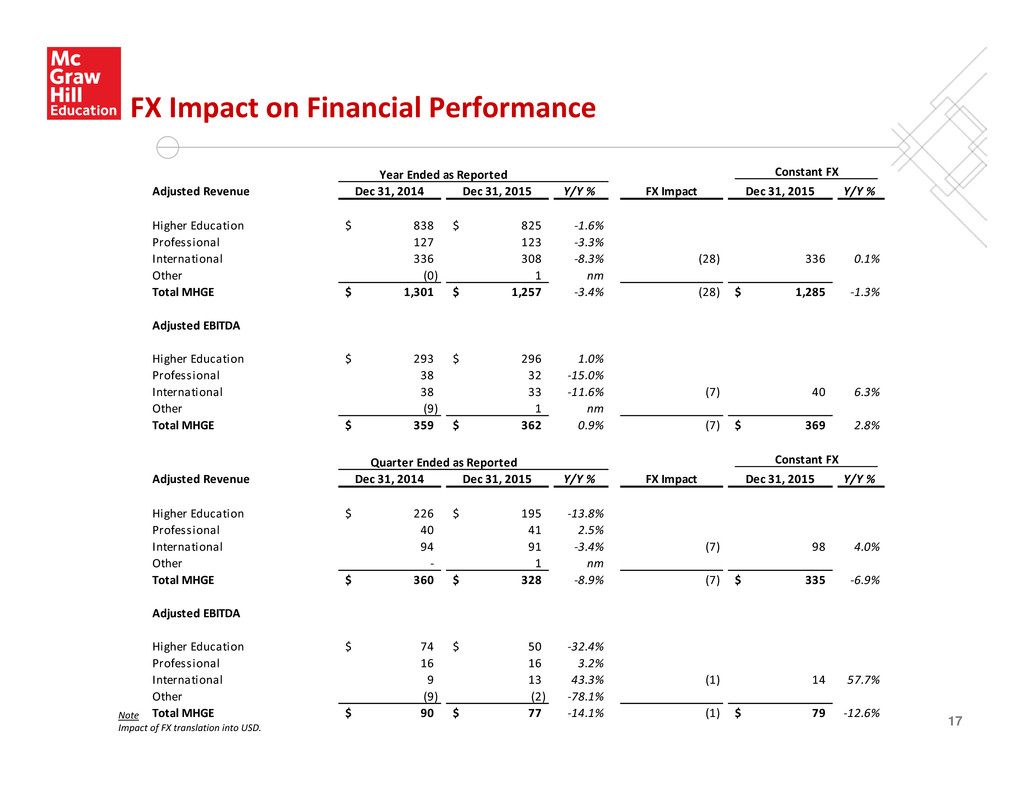

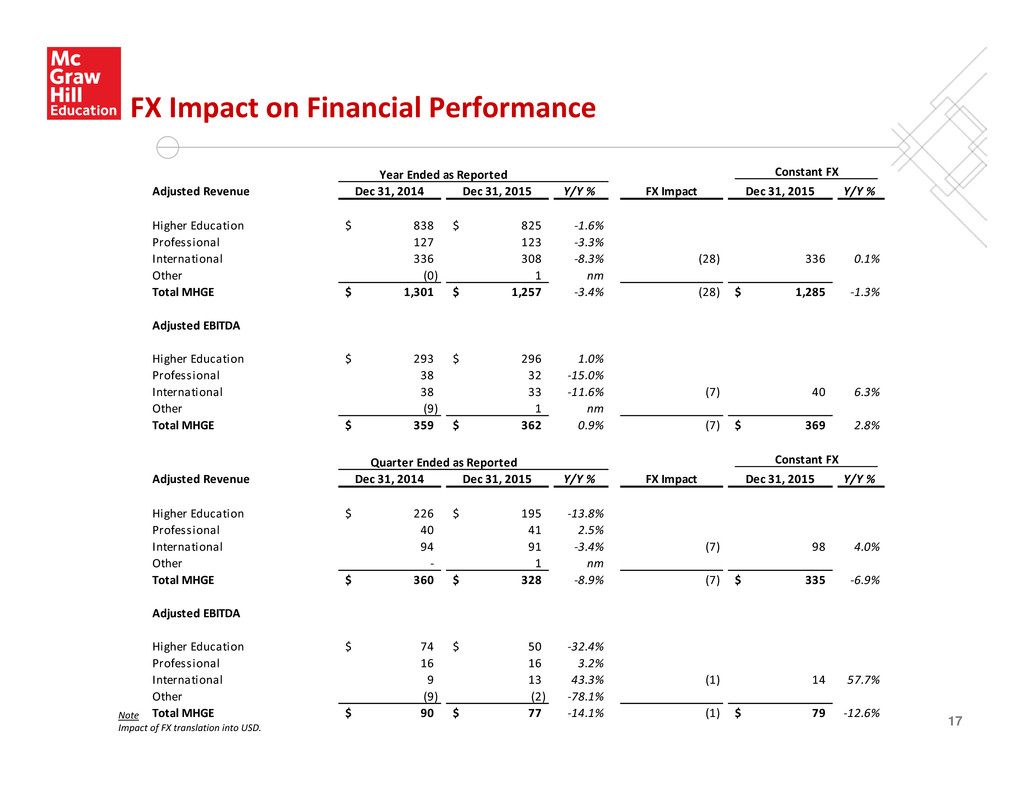

FX Impact on Financial Performance Note Impact of FX translation into USD. 17 Constant FX Adjusted Revenue Dec 31, 2014 Dec 31, 2015 Y/Y % FX Impact Dec 31, 2015 Y/Y % Higher Education 838$ 825$ ‐1.6% Professional 127 123 ‐3.3% International 336 308 ‐8.3% (28) 336 0.1% Other (0) 1 nm Total MHGE 1,301$ 1,257$ ‐3.4% (28) 1,285$ ‐1.3% Adjusted EBITDA Higher Education 293$ 296$ 1.0% Professional 38 32 ‐15.0% International 38 33 ‐11.6% (7) 40 6.3% Other (9) 1 nm Total MHGE 359$ 362$ 0.9% (7) 369$ 2.8% Constant FX Adjusted Revenue Dec 31, 2014 Dec 31, 2015 Y/Y % FX Impact Dec 31, 2015 Y/Y % Higher Education 226$ 195$ ‐13.8% Professional 40 41 2.5% International 94 91 ‐3.4% (7) 98 4.0% Other ‐ 1 nm Total MHGE 360$ 328$ ‐8.9% (7) 335$ ‐6.9% Adjusted EBITDA Higher Education 74$ 50$ ‐32.4% Professional 16 16 3.2% International 9 13 43.3% (1) 14 57.7% Other (9) (2) ‐78.1% Total MHGE 90$ 77$ ‐14.1% (1) 79$ ‐12.6% Year Ended as Reported Quarter Ended as Reported

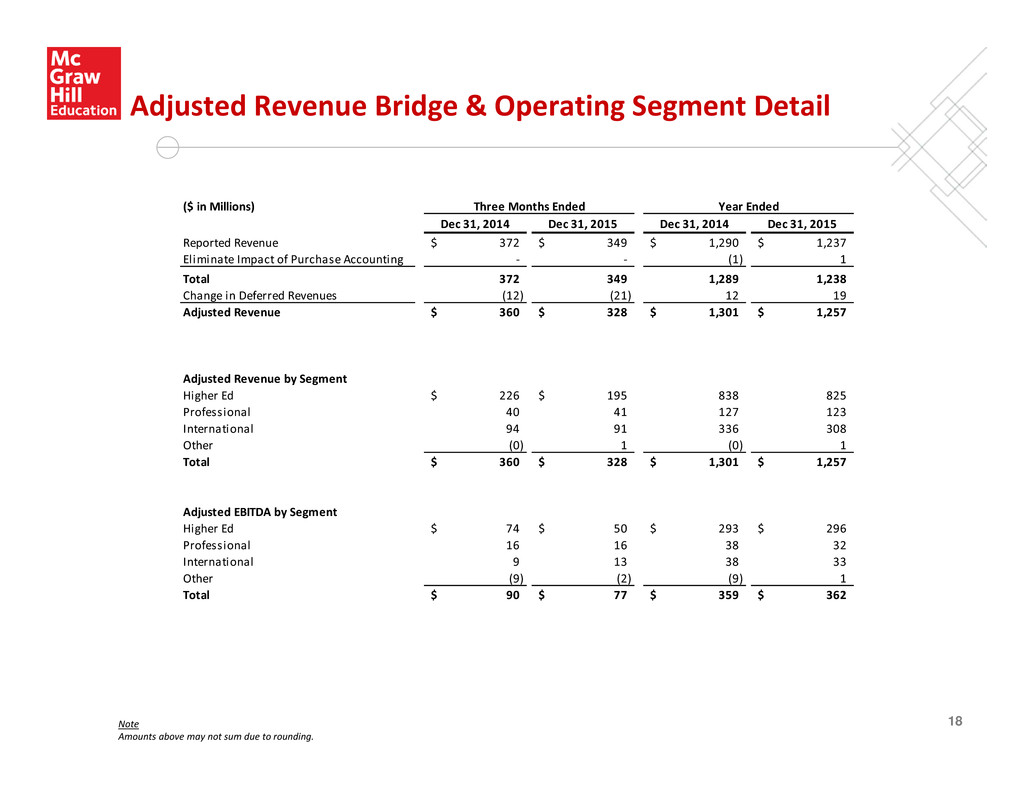

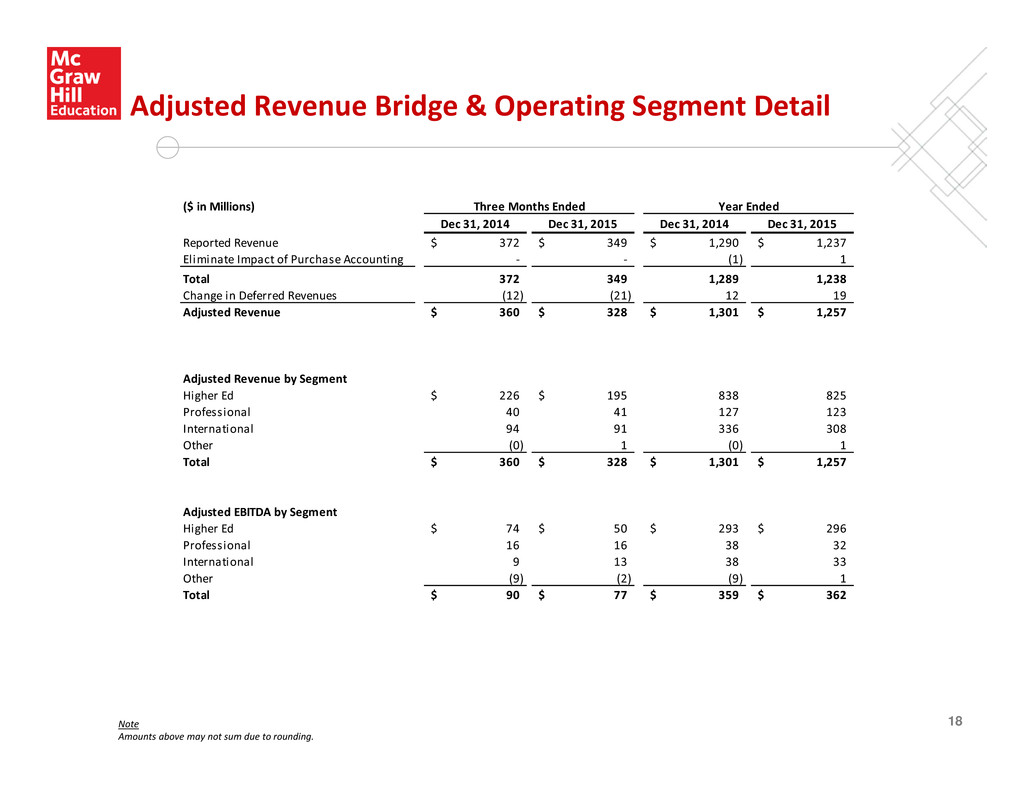

Adjusted Revenue Bridge & Operating Segment Detail Note Amounts above may not sum due to rounding. 18 ($ in Millions) Dec 31, 2014 Dec 31, 2015 Dec 31, 2014 Dec 31, 2015 Reported Revenue 372$ 349$ 1,290$ 1,237$ Eliminate Impact of Purchase Accounting ‐ ‐ (1) 1 Total 372 349 1,289 1,238 Change in Deferred Revenues (12) (21) 12 19 Adjusted Revenue 360$ 328$ 1,301$ 1,257$ Adjusted Revenue by Segment Higher Ed 226$ 195$ 838 825 Professional 40 41 127 123 International 94 91 336 308 Other (0) 1 (0) 1 Total 360$ 328$ 1,301$ 1,257$ Adjusted EBITDA by Segment Higher Ed 74$ 50$ 293$ 296$ Professional 16 16 38 32 International 9 13 38 33 Other (9) (2) (9) 1 Total 90$ 77$ 359$ 362$ Three Months Ended Year Ended

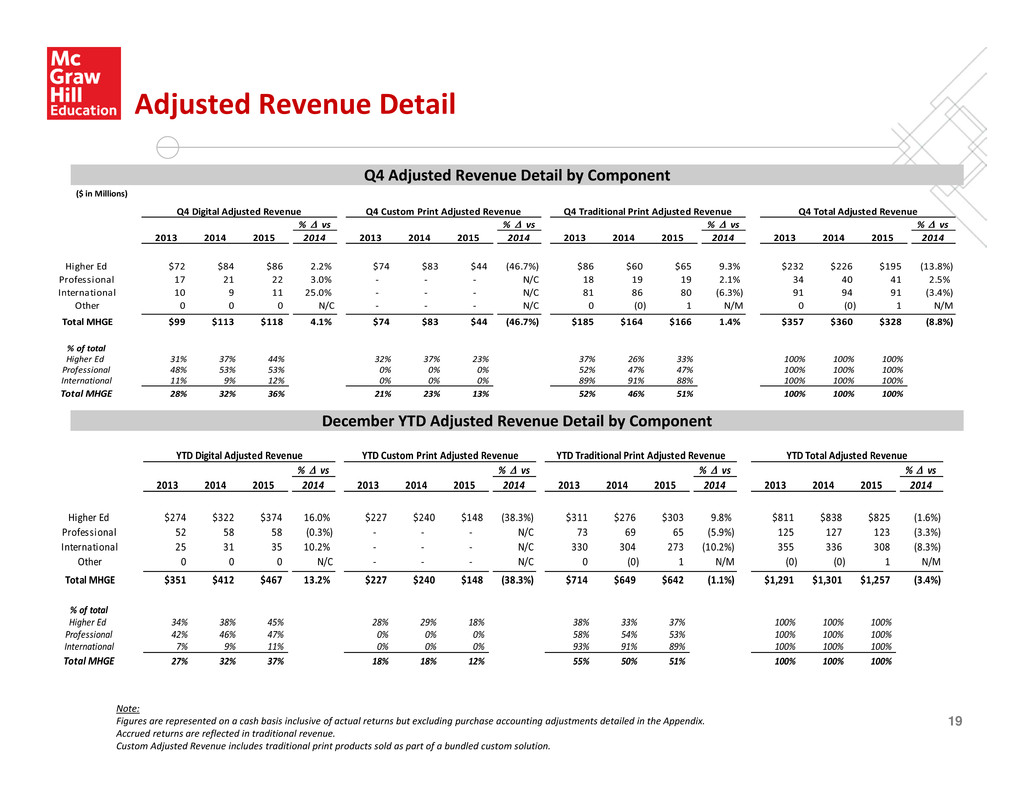

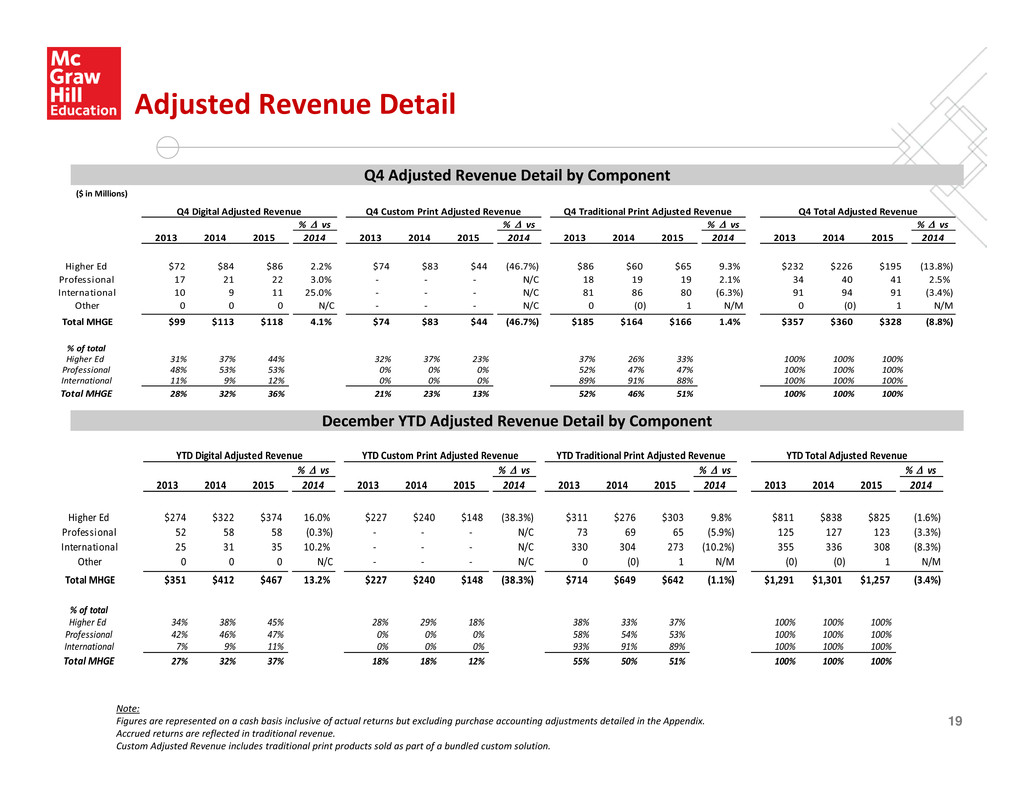

Adjusted Revenue Detail Note: Figures are represented on a cash basis inclusive of actual returns but excluding purchase accounting adjustments detailed in the Appendix. Accrued returns are reflected in traditional revenue. Custom Adjusted Revenue includes traditional print products sold as part of a bundled custom solution. Q4 Adjusted Revenue Detail by Component 19 December YTD Adjusted Revenue Detail by Component ($ in Millions) Q4 Digital Adjusted Revenue Q4 Custom Print Adjusted Revenue Q4 Traditional Print Adjusted Revenue Q4 Total Adjusted Revenue 2013 2014 2015 2014 2013 2014 2015 2014 2013 2014 2015 2014 2013 2014 2015 2014 Higher Ed $72 $84 $86 2.2% $74 $83 $44 (46.7%) $86 $60 $65 9.3% $232 $226 $195 (13.8%) Professional 17 21 22 3.0% ‐ ‐ ‐ N/C 18 19 19 2.1% 34 40 41 2.5% International 10 9 11 25.0% ‐ ‐ ‐ N/C 81 86 80 (6.3%) 91 94 91 (3.4%) Other 0 0 0 N/C ‐ ‐ ‐ N/C 0 (0) 1 N/M 0 (0) 1 �� N/M Total MHGE $99 $113 $118 4.1% $74 $83 $44 (46.7%) $185 $164 $166 1.4% $357 $360 $328 (8.8%) % of total Higher Ed 31% 37% 44% 32% 37% 23% 37% 26% 33% 100% 100% 100% Professional 48% 53% 53% 0% 0% 0% 52% 47% 47% 100% 100% 100% International 11% 9% 12% 0% 0% 0% 89% 91% 88% 100% 100% 100% Total MHGE 28% 32% 36% 21% 23% 13% 52% 46% 51% 100% 100% 100% % vs % vs % vs % vs YTD Digital Adjusted Revenue YTD Custom Print Adjusted Revenue YTD Traditional Print Adjusted Revenue YTD Total Adjusted Revenue 2013 2014 2015 2014 2013 2014 2015 2014 2013 2014 2015 2014 2013 2014 2015 2014 Higher Ed $274 $322 $374 16.0% $227 $240 $148 (38.3%) $311 $276 $303 9.8% $811 $838 $825 (1.6%) Professional 52 58 58 (0.3%) ‐ ‐ ‐ N/C 73 69 65 (5.9%) 125 127 123 (3.3%) International 25 31 35 10.2% ‐ ‐ ‐ N/C 330 304 273 (10.2%) 355 336 308 (8.3%) Other 0 0 0 N/C ‐ ‐ ‐ N/C 0 (0) 1 N/M (0) (0) 1 N/M Total MHGE $351 $412 $467 13.2% $227 $240 $148 (38.3%) $714 $649 $642 (1.1%) $1,291 $1,301 $1,257 (3.4%) % of total Higher Ed 34% 38% 45% 28% 29% 18% 38% 33% 37% 100% 100% 100% Professional 42% 46% 47% 0% 0% 0% 58% 54% 53% 100% 100% 100% International 7% 9% 11% 0% 0% 0% 93% 91% 89% 100% 100% 100% Total MHGE 27% 32% 37% 18% 18% 12% 55% 50% 51% 100% 100% 100% % vs % vs % vs % vs

Q4‐15 Income Statement Excluding Impact of Transaction 20 ($ in Millions) 2014 2015 2014 2015 2014 2015 Revenue 372$ 349$ ‐$ ‐$ 372$ 349$ Cost of goods sold 107 101 ‐ ‐ 107 101 Gross profit 265 249 ‐ ‐ 265 249 Operating expenses Operating & administration expenses 195 156 ‐ ‐ 195 156 Depreciation 5 9 ‐ ‐ 5 9 Amortization of intangibles 24 24 (22) (22) 2 2 Transaction costs 0 ‐ (0) ‐ ‐ ‐ Total operating expenses 224 189 (23) (22) 201 168 (Loss) income from operations 41 59 23 22 64 81 Interest (income) expense, net 31 32 (31) (32) ‐ ‐ Other (income) (1) (1) 1 1 ‐ ‐ (Loss) income from operations before taxes on income 12 28 52 53 64 81 Income tax (benefit) provision (6) 7 20 21 15 28 Net (loss) income 17 21 32 32 49 53 Less: Net loss attributable to noncontrolling interests ‐ ‐ ‐ ‐ ‐ ‐ Net loss (income) attributable to McGraw‐Hill Global Education Intermediate Holdings, LLC 17$ 21$ 32$ 32$ 49$ 53$ Adjusted EBITDA 90$ 77$ 90$ 77$ Adjusted Revenue Bridge Revenue per above 372 349 Change in deferred revenue per Adjusted Revenue schedule (12) (21) Adjusted Revenue 360 328 Operating Expense Bridge Total Operating Expenses Per Above 201 168 Less: Depreciation & Amortization of intangibles (6) (11) Less: Acquisition costs ‐ ‐ Less: Amortization of prepublication costs (18) (16) Less: Restructuring and cost savings implementation charges (13) (4) Less: Other adjustments (15) (1) Adjusted Operating Expenses 148 134 Reported Transaction Impact Excluding Impact From Transaction Three Months Ended Dec 31, Three Months Ended Dec 31, Three Months Ended Dec 31, Note Eliminates the effects of the application of purchase accounting associated with the Founding Acquisition (as defined in our SEC filings), driven by the step‐up of acquired inventory, write‐down of deferred revenue, establishment of finite lived intangible assets and the related financing transactions.

FY 2015 Income Statement Excluding Impact of Transaction 21 ($ in Millions) 2014 2015 2014 2015 2014 2015 Revenue 1,290$ 1,237$ (1)$ 1$ 1,289$ 1,238$ Cost of goods sold 359 345 3 361 345 Gross profit 932 892 (4) 1 928 893 Operating expenses Operating & administration expenses 683 593 ‐ ‐ 683 593 Depreciation 16 29 ‐ ‐ 16 29 Amortization of intangibles 103 93 (96) (86) 8 8 Transaction costs 4 ‐ (4) ‐ ‐ ‐ Total operating expenses 806 715 (100) (86) 706 629 (Loss) income from operations 126 177 96 86 221 264 Interest (income) expense, net 146 131 (146) (131) ‐ ‐ Other (income) (12) (10) 12 10 ‐ ‐ (Loss) income from operations before taxes on income (8) 57 229 207 221 264 Income tax (benefit) provision (11) 20 89 80 77 100 Net (loss) income 4 37 140 127 144 164 Less: Net loss attributable to noncontroll ing interests 0 ‐ ‐ ‐ 0 ‐ Net loss (income) attributable to McGraw‐Hill Global Education Intermediate Holdings, LLC 4$ 37$ 140$ 127$ 144$ 164$ Adjusted EBITDA 359$ 362$ 359$ 362$ Adjusted Revenue Bridge Revenue per above 1,289 1,238 Change in deferred revenue per Adjusted Revenue schedule 12 19 Adjusted Revenue 1,301 1,257 Operating Expense Bridge Total Operating Expenses Per Above 706 629 Less: Depreciation & Amortization of intangibles (23) (36) Less: Acquisition costs (3) ‐ Less: Amortization of prepublication costs (64) (58) Less: Restructuring and cost savings implementation charges (31) (17) Less: Other adjustments (55) (14) Adjusted Operating Expenses 530 504 Reported Transaction Impact Excluding Impact From Transaction Year Ended Dec 31, Year Ended Dec 31, Year Ended Dec 31, Note Eliminates the effects of the application of purchase accounting associated with the Founding Acquisition (as defined in our SEC filings), driven by the step‐up of acquired inventory, write‐down of deferred revenue, establishment of finite lived intangible assets and the related financing transactions.

EBITDA and Adjusted EBITDA EBITDA, a measure used by management to assess operating performance, is defined as income from continuing operations plus interest, income taxes, depreciation and amortization, including amortization of prepublication costs (“plate investment”). Adjusted EBITDA is defined as EBITDA adjusted to exclude unusual items and other adjustments required or permitted in calculating covenant compliance under the indenture governing our senior secured notes and/or our senior secured credit facilities. Adjusted EBITDA reflects the impact of cash spent for plate investment. Plate investment costs, reflecting the cost of developing education content, are capitalized and amortized. These costs are capitalized when the title is expected to generate probable future economic benefits and are amortized upon publication of the title over its estimated useful life of up to six years. Adjusted EBITDA reflects EBITDA as defined in the First Lien Credit Agreement and the Bond Indenture. Each of the above described EBITDA‐based measures is not a recognized term under U.S. GAAP and does not purport to be an alternative to income from continuing��operations as a measure of operating performance or to cash flows from operations as a measure of liquidity. Additionally, each such measure is not intended to be a measure of free cash flows available for management’s discretionary use, as it does not consider certain cash requirements such as interest payments, tax payments and debt service requirements. Such measures have limitations as analytical tools, and you should not consider any of such measures in isolation or as substitutes for our results as reported under U.S. GAAP. Management compensates for the limitations of using non‐GAAP financial measures by using them to supplement U.S. GAAP results to provide a more complete understanding of the factors and trends affecting the business than U.S. GAAP results alone. Because not all companies use identical calculations, these EBITDA‐based measures may not be comparable to other similarly titled measures of other companies. Management believes EBITDA is helpful in highlighting trends because EBITDA excludes the results of decisions that are outside the control of operating management and can differ significantly from company to company depending on long‐term strategic decisions regarding capital structure, the tax rules in the jurisdictions in which companies operate, and capital investments. In addition, EBITDA provides more comparability between the historical operating results and operating results that reflect purchase accounting and the capital structure. Management believes that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA and Adjusted EBITDA are appropriate to provide additional information to investors about certain material non‐cash items and about unusual items that we do not expect to continue at the same level in the future. 22

Adjusted EBITDA Reconciliation ($ in Millions) Dec 31, 2014 Dec 31, 2015 Dec 31, 2014 Dec 31, 2015 Net Income 17$ 21$ 4$ 37$ Interest (income) expense, net 31 32 146 131 Provision for (benefit from) taxes on income (6) 7 (11) 20 Depreciation, amortization and pre‐publication investment amortization 47 49 183 180 EBITDA 89$ 110$ 321$ 367$ Deferred revenue (a) (12) (21) 12 19 Restructuring and cost savings implementation charges (b) 13 4 31 17 Sponsor fees (c) 1 1 4 4 Purchase accounting (d) ‐ ‐ (3) ‐ Transaction costs (e) (0) ‐ 4 ‐ Acquisition costs (f) (0) ‐ 3 ‐ Physical separation costs (g) 14 ‐ 24 ‐ Other (h) 1 (1) 15 2 Pre‐publication investment cash costs (i) (15) (15) (50) (46) Adjusted EBITDA 90$ 77$ 359$ 362$ Year EndedThree Months Ended 23Note Amounts above may not sum due to rounding.

Adjusted EBITDA Footnotes Notes: (a) We receive cash up‐front for most product sales but recognize revenue (primarily related to digital sales) over time recording a liability for deferred revenue at the time of sale. This adjustment represents the net effect of converting deferred revenues (inclusive of deferred royalties) to a cash basis assuming the collection of all receivable balances. (b) Represents severance and other expenses associated with headcount reductions and other cost savings initiated as part of our formal restructuring initiatives to create a flatter and more agile organization. (c) Beginning in 2014, $3.5 million of annual management fees was recorded and payable to Apollo. The amount recorded in the Successor period from March 23, 2013 to December 31, 2013 was $0.9 million. (d) Represents the effects of the application of purchase accounting associated with the Founding Acquisition, driven by the step‐up of acquired inventory. The deferred revenue adjustment recorded as a result of purchase accounting has been considered in the deferred revenue adjustment. (e) The amount represents the transaction costs associated with the Founding Acquisition. (f) The amount represents costs incurred for acquisitions subsequent to the Founding Acquisition including ALEKS and LearnSmart. (g) The amount represents costs incurred to physically separate our operations from MHC. These physical separation costs were incurred subsequent to the Founding Acquisition and concluded in 2014. (h) For the year ended December 31, 2015, the amount represents (i) non‐cash incentive compensation expense; (ii) elimination of the gain of $4.8 million on the sale of an investment in an equity security and (iii) other adjustments required or permitted in calculating covenant compliance under our debt agreements. For the year ended December 31, 2014, the amount represents (i) cash distributions to noncontrolling interest holders of $0.2 million; (ii) non‐cash incentive compensation expense; (iii) elimination of non‐cash gain of $7.3 million in LearnSmart; and (iv) other adjustments required or permitted in calculating covenant compliance under our debt agreements. (i) Represents the cash cost for pre‐publication investment during the period excluding discontinued operations. 24