2022 Annual Meeting of Stockholders SEPTEMBER 2022 Hines Global Income Trust Omar Thowfeek, Managing Director - Investments

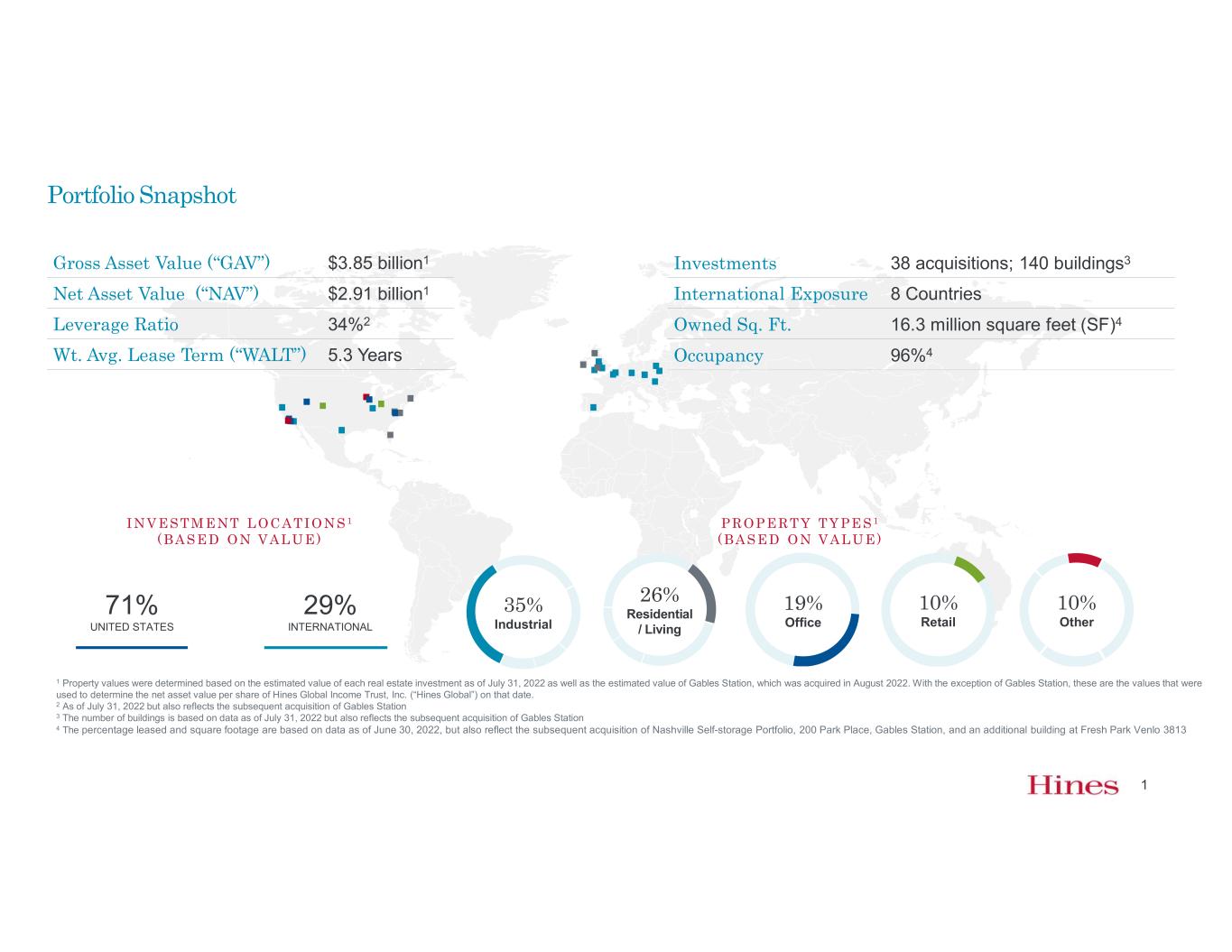

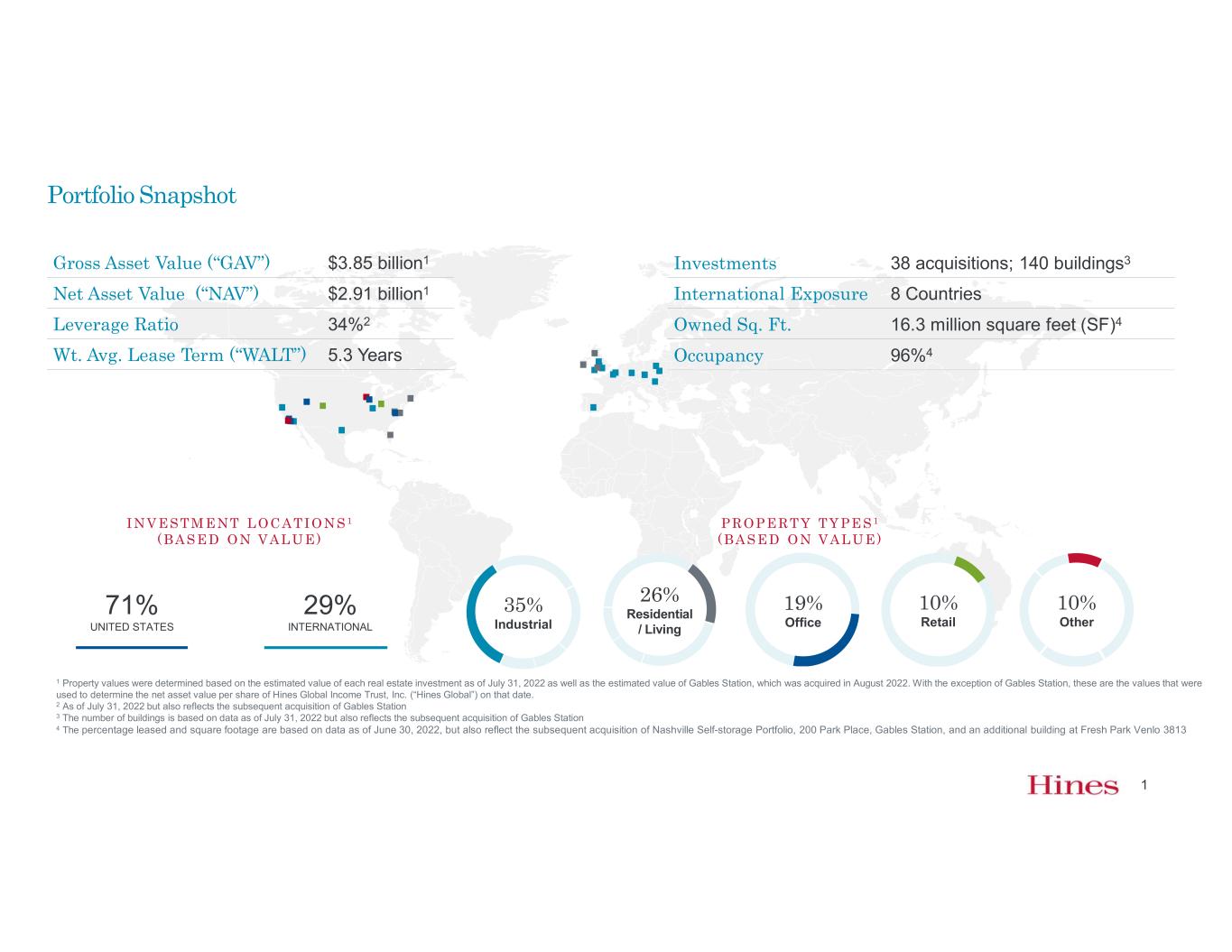

Portfolio Snapshot 1 1 Property values were determined based on the estimated value of each real estate investment as of July 31, 2022 as well as the estimated value of Gables Station, which was acquired in August 2022. With the exception of Gables Station, these are the values that were used to determine the net asset value per share of Hines Global Income Trust, Inc. (“Hines Global”) on that date. 2 As of July 31, 2022 but also reflects the subsequent acquisition of Gables Station 3 The number of buildings is based on data as of July 31, 2022 but also reflects the subsequent acquisition of Gables Station 4 The percentage leased and square footage are based on data as of June 30, 2022, but also reflect the subsequent acquisition of Nashville Self-storage Portfolio, 200 Park Place, Gables Station, and an additional building at Fresh Park Venlo 3813 Gross Asset Value (“GAV”) $3.85 billion1 Net Asset Value (“NAV”) $2.91 billion1 Leverage Ratio 34%2 Wt. Avg. Lease Term (“WALT”) 5.3 Years Investments 38 acquisitions; 140 buildings3 International Exposure 8 Countries Owned Sq. Ft. 16.3 million square feet (SF)4 Occupancy 96%4 IN VES TM ENT L OC ATIO N S 1 (BAS ED O N VAL U E) 71% UNITED STATES 29% INTERNATIONAL P ROP ERT Y TY PE S 1 (BAS ED O N VAL U E) 19% Office 26% Residential / Living 10% Retail 35% Industrial 10% Other

Hines Global has Grown at a Fast Pace1 2 $1.7BN $1.9BN $2.7BN $3.85BN $0.0BN $0.5BN $1.0BN $1.5BN $2.0BN $2.5BN $3.0BN $3.5BN $4.0BN $4.5BN FY 2019 FY 2020 FY 2021 2022 YTD HINES GLOBAL GAV TRACK RECORD $406M $228M $586M $718M $16M $32M $42M $26M $0M $100M $200M $300M $400M $500M $600M $700M $800M 2019 2020 2021 2022 YTD Equity raised Redemptions CAPITAL RAISING ACTIVITY DEMONSTRATED TRACK RECORD UNDERPINS FUTURE GROWTH POTENTIAL +46% +42% +10% 1 Data as of July 31, 2022, but also reflects the subsequent acquisition of Gables Station Past performance does not guarantee future results.

9 Investments Closed ~$1.05 Billion in GAV Acquisition Update –As of August 31, 2022 Central City Coventry, UK Industrial $40.6M Closed Mar ‘22 Liberty Station San Diego, CA Office $120.0M Closed Jan ‘22 200 Park Place Houston, TX Office $145.0M Closed July ‘22 Waverly Place Cary, NC Retail $88.5M Closed June ‘22 Wells Fargo Center Hillsboro, OR Other – Call Center $38.8M Closed April ‘22 Burbank Studios Burbank, CA Other - Land $42.5M Closed Feb ‘22 1315 N Branch Chicago, IL Office $47.0M Closed Feb ‘22 Nashville Self Storage Nashville, TN Other- Storage $102.0M Closed July ‘22 Gables Station Coral Gables, FL Living $429.3M Closed Aug ‘22 YTD Acquisition Profile 41% 30% 17% 8% 4% GAV by Sector Living Office Other Retail Industrial 3

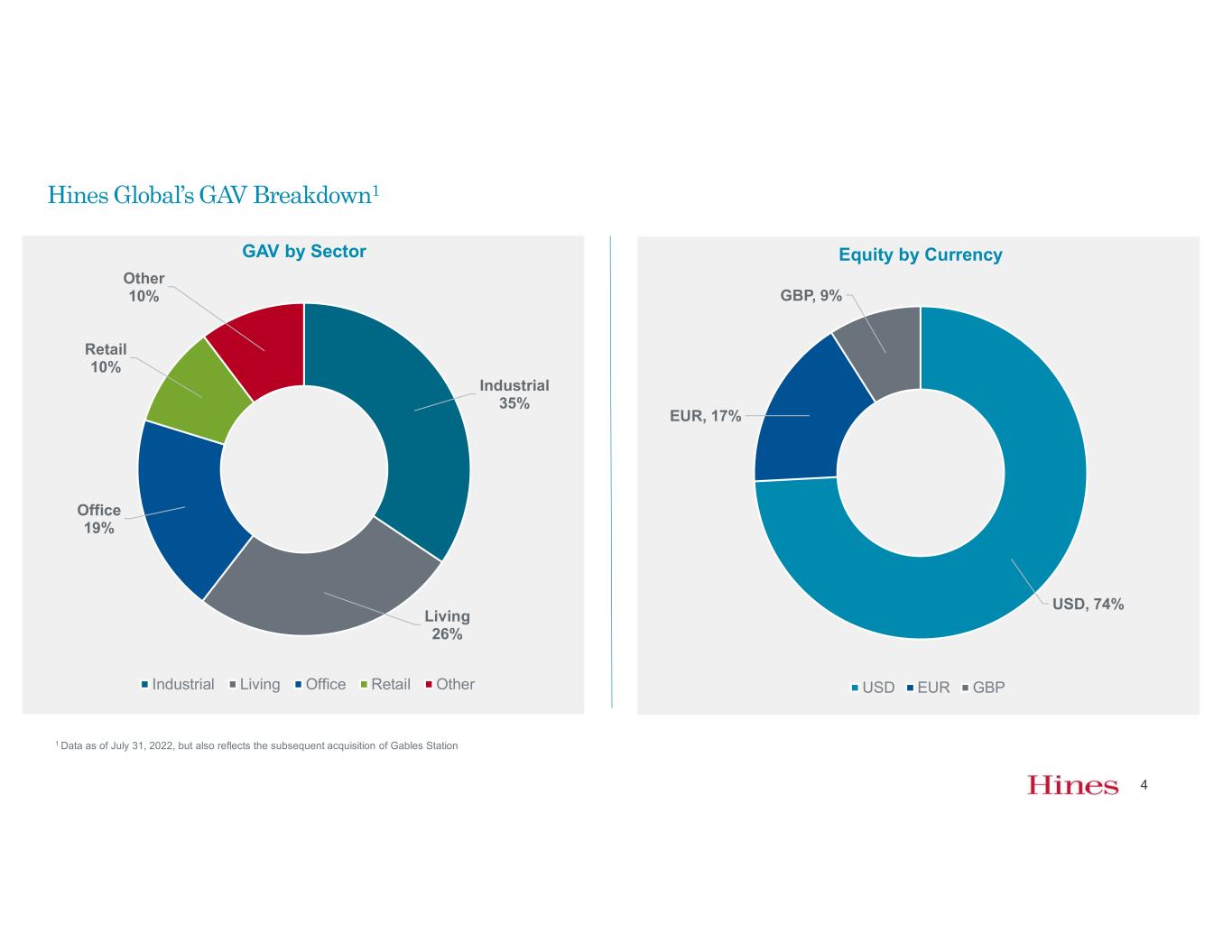

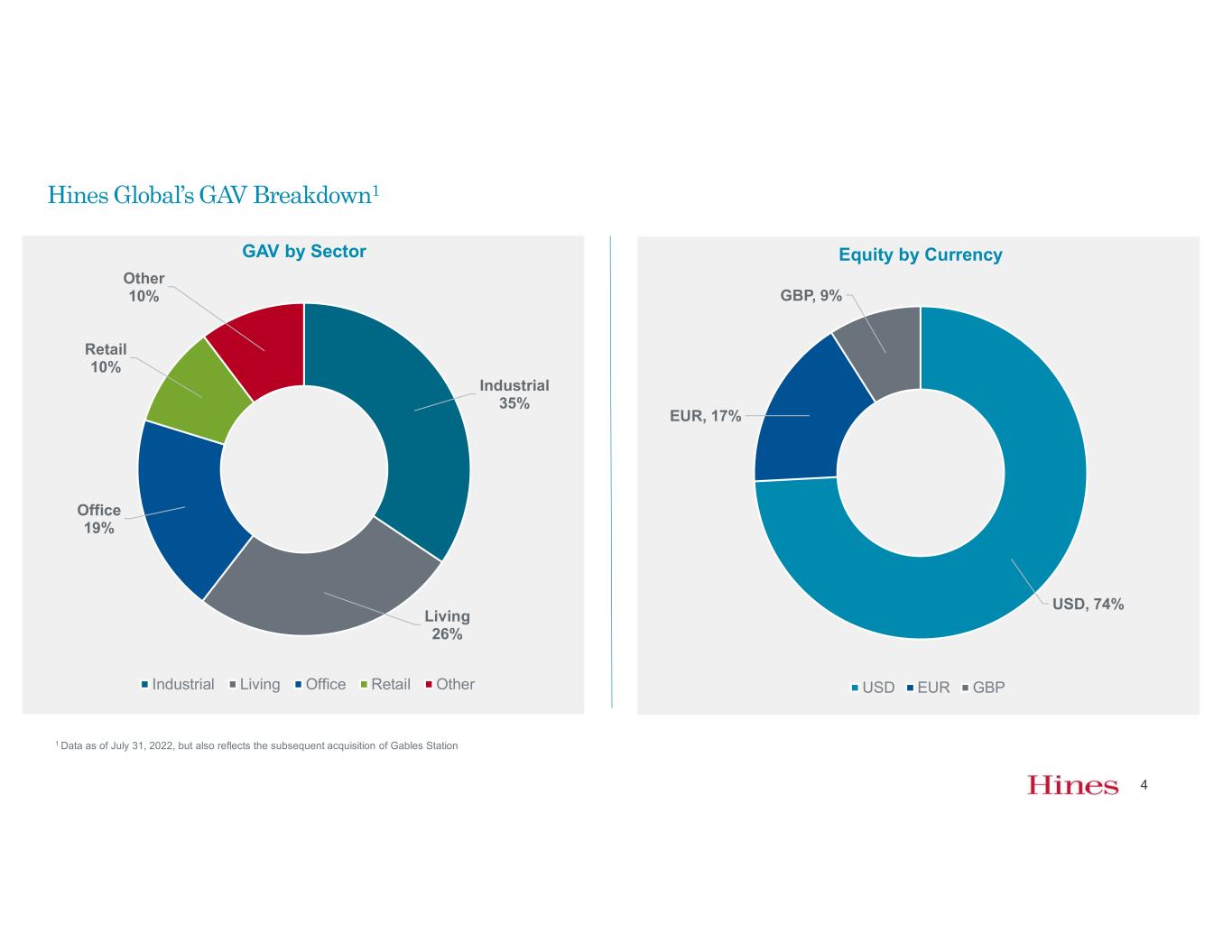

Hines Global’s GAV Breakdown1 Industrial 35% Living 26% Office 19% Retail 10% Other 10% GAV by Sector Industrial Living Office Retail Other 1 Data as of July 31, 2022, but also reflects the subsequent acquisition of Gables Station USD, 74% EUR, 17% GBP, 9% Equity by Currency USD EUR GBP 4

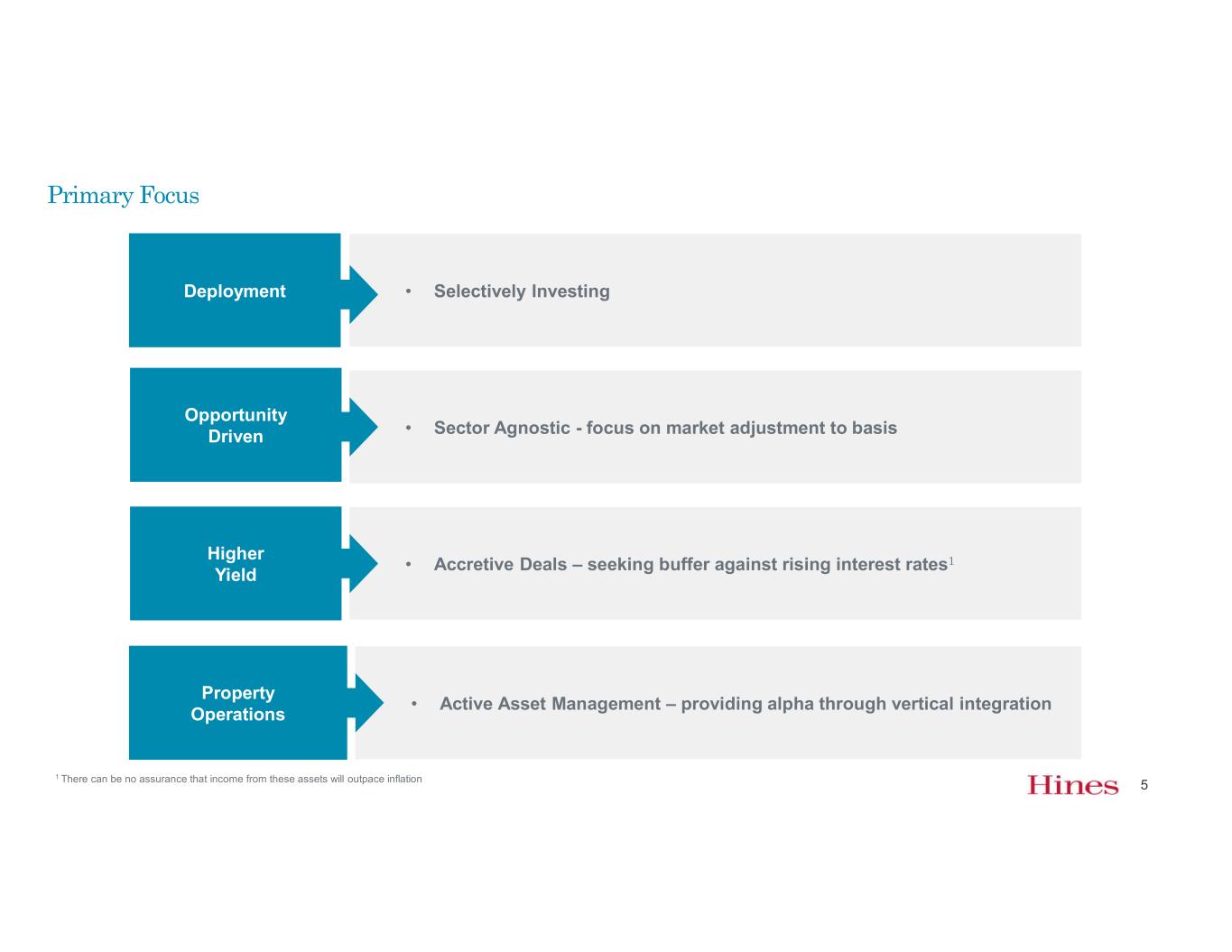

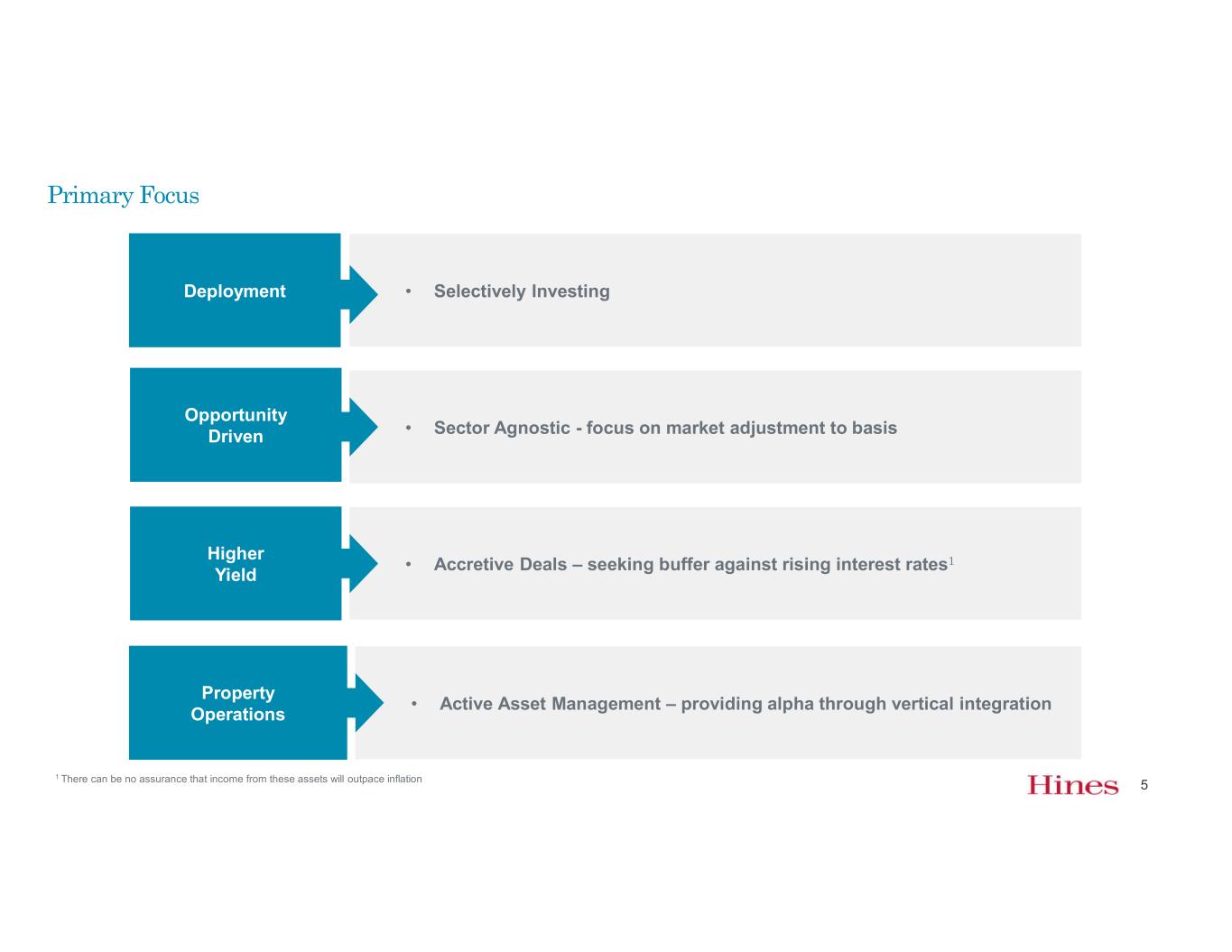

Primary Focus 5 • Sector Agnostic - focus on market adjustment to basis Deployment Opportunity Driven Higher Yield • Selectively Investing • Accretive Deals – seeking buffer against rising interest rates1 Property Operations • Active Asset Management – providing alpha through vertical integration 1 There can be no assurance that income from these assets will outpace inflation

Unlocking Value through Targeted Asset Selection 6 Institutional product in Tier 1 office markets, positioned for flight to quality Next-generation differentiated office product in dynamic locations Well-located, medium-term WALT office with potential to rezone and redevelop OfficeLivingIndustrial Retail Open-air grocery-anchored centers Strong trade area demographic & demand drivers E-commerce resistant & experiential tenancy Waverly Cary, NCTorrance, CA WaypointMiramar San Diego, CA Living product in well- amenitized micro location Positive demand drivers including proximity to employment nodes and good school districts Urban and suburban product with high barriers, limited supply pipeline, near transit Flexible product with strong occupational demand Well-located in urban infill areas or along transport routes Distribution centers servicing large catchment areas with strong labor base Covered land play with optionality to redevelop in the future Alternative asset classes spanning data centers, mixed-use, media and self- storage Opportunity to create scale through portfolio aggregation plays Lean on compelling fundamentals, technology, demographic trends and counter cyclical investments WGN Studios Chicago, ILMiami, FL Gables Station Other

1 Data as of July 31, 2022. Past performance does not guarantee future results. Please see our Current Report on Form 8-K filed with the SEC on August 17, 2022 for additional information concerning the methodology used to determine, and the limitations of, the NAV per share as of July 31, 2022. Please see our Current Reports on Form 8-K for additional information concerning the NAV per share determined as of prior dates. 2 Prior to February 29, 2016, $8.92 was considered to be the “net investment value” per share of our common stock, which was equal to the offering price per share of $10.00 in effect at that time, as arbitrarily determined by our board of directors, net of the applicable selling commissions, dealer manager fees and issuer costs. 3 We have not generated and we may continue to be unable to generate sufficient cash flows from operations to fully fund distributions. Therefore, some or all of our distributions have been and may continue to be paid at least partially from other sources. See next slide for more information. NAV and Distributions1 7 $8.92 $8.92 $8.92 $8.92 $8.92 $8.92 $9.03 $9.03 $9.03 $9.65 $9.65 $9.65 $9.69 $9.69 $9.82 $9.91 $9.94 $10.10 $10.11 $10.15 $10.31 $9.84 $9.72 $9.73 $10.12 $10.10 $10.15 $10.25 $10.26 $10.50 $10.85 $11.19 $11.29 $11.24 $8.00 $8.50 $9.00 $9.50 $10.00 $10.50 $11.00 $11.50 $0.56 $0.58 $0.60 $0.62 $0.64 $0.66 $0.68 $0.70 $0.72 N A V P e r S h a re 1 G ro ss A n n u a lize d D istrib u tio n R a te P e r S h a re 3 Gross Annualized Distribution Rate NAV Per Share 2 2 2 222

Hines Global Income Trust1 8 Diversification across strategic product types and geographies Investing worldwide for diversification, income and growth Income-driven vehicle with total return upside potential through alpha generation at the property level Class I Share ITD Total Return Months with Positive Returns Current Gross Annualized Distribution Rate 16.16% 2 5.56% 3 9.79% 2 91 of 94 1 Year Total Return 1 Data as of July 31, 2022. Past performance does not guarantee future results. Diversification does not guarantee a profit or eliminate the risk of loss. 2 Total return for Class I shares assumes reinvestment of distributions. The 1-year total return for Class D,S,S (with sales load),T and T (with sales load) are 15.88%, 15.20%, 11.19%, 15.03%, and 11.02%, respectively. The total returns shown reflect the percent change in the NAV per share from the beginning of the applicable period, plus the amount of any distributions per share declared during the period. The total returns shown are calculated assuming reinvestment of distributions pursuant to Hines Global’s distribution investment plan, are derived from unaudited financial information, and are net of all Hines Global expenses, including general and administrative expenses, transaction related expenses, management fees, the performance participation allocation, and share class specific fees, but exclude the impact of early redemption deductions on the redemption of shares that have been outstanding for less than one year. Total returns would be lower if calculated assuming that distributions were not reinvested. The returns have been prepared using unaudited data and valuations of the underlying investments in Hines Global’s portfolio, which are estimates of fair value and form the basis for Hines Global’s NAV per share. Valuations based upon unaudited reports from the underlying investments may be subject to later adjustments, may not correspond to realized value and may not accurately reflect the price at which assets could be liquidated. Actual returns realized by individual stockholders will vary. Returns are non-inclusive of any potential tax implications. 3 Distribution rate for Class I shares as of 7/31/2022. The gross annualized distribution rate is calculated as the gross distribution rate declared for the applicable month multiplied by 12, and assumes the rate is maintained for one year. The availability and timing of distributions Hines Global may pay is uncertain and cannot be assured. Distributions have exceeded earnings. Some or all of Hines Global's distributions have been and may continue to be paid at least partially from sources other than cash flows from operations, such as proceeds from Hines Global's debt financings, proceeds from Hines Global's offerings, cash advances by Hines Global's Advisor, HGIT Advisors LP, cash resulting from a waiver or deferral of fees and/or proceeds from the sale of assets. Hines Global has not placed a cap on the amount of distributions that may be paid from any of these sources. If Hines Global continues to pay distributions from sources other than cash flow from operations, Hines Global will have less funds available for the acquisition of properties, and your overall return may be reduced. For the six months ended June 30, 2022, and for the year ended December 31, 2021, Hines Global funded 95% and 41%, respectively, of total distributions with cash flows from other sources such as cash flows from investing activities, which includes proceeds from the sale of real estate. Distributions generally are automatically reinvested pursuant to Hines Global's distribution reinvestment plan ("DRP") unless an investor opts out. However, automatic reinvestment is not permitted in certain states or by certain broker dealers.

Industrial Portfolio 1 Data as of July 31, 2022, but also reflects the subsequent acquisition of Gables Station 9 Portfolio aggregation continues with off-market/market approaches; location remains key Eastgate Park Prague, Czech Republic DSG Bristol Bristol, United Kingdom 6000 Schertz Parkway Schertz, TX Industrial rent growth has undergone a structural shift due in part to an increase in the E-commerce penetration rate GAV $1.33B % of GAV 35% WALT 4.9 Yrs. Occupancy 96% No. of assets 16 PERFORMANCE DRIVERS Flexible product with strong occupational demand Well-located in urban infill areas or along transport routes Distribution centers servicing large catchment areas with strong labor base Covered land play with optionality to redevelop in the future PERFORMANCE METRICS 1

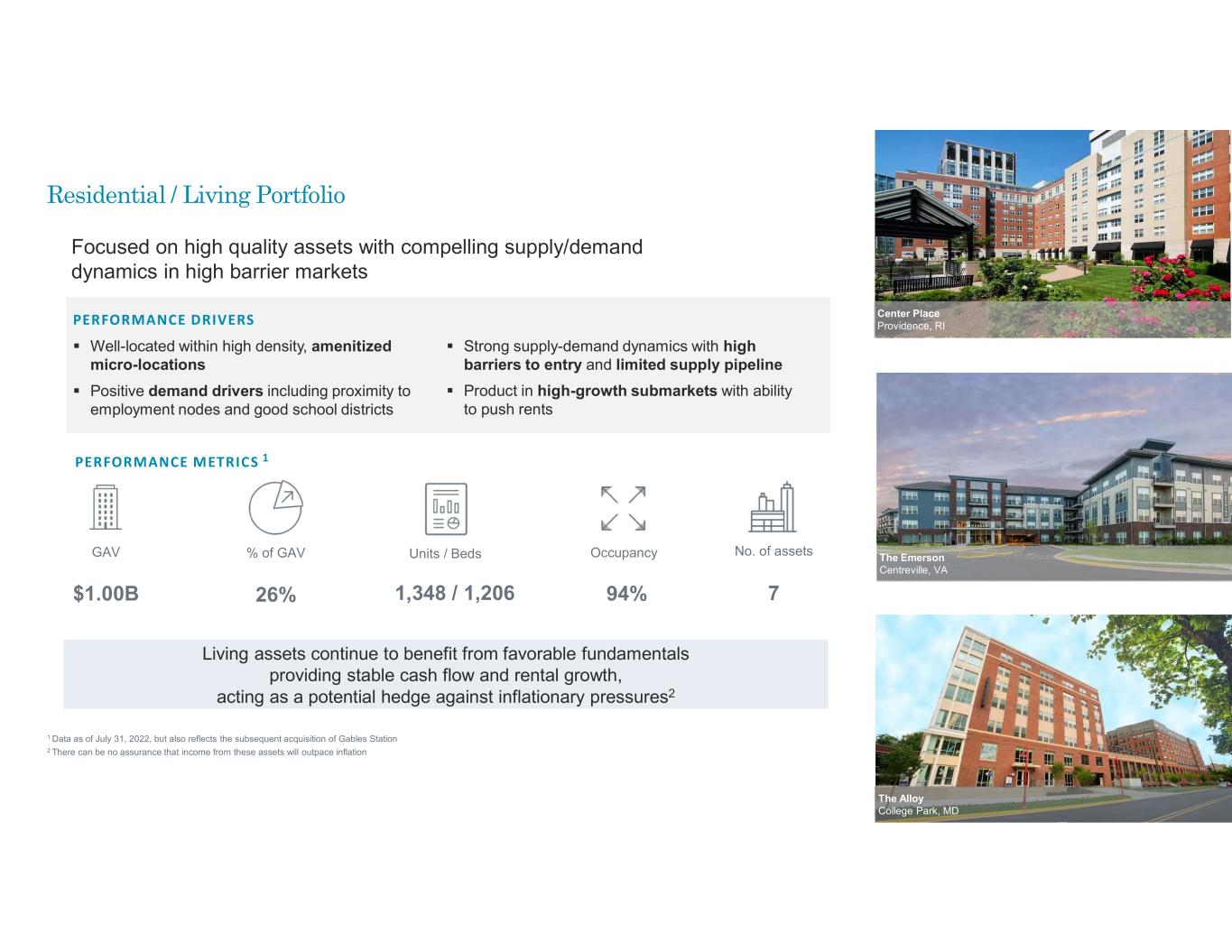

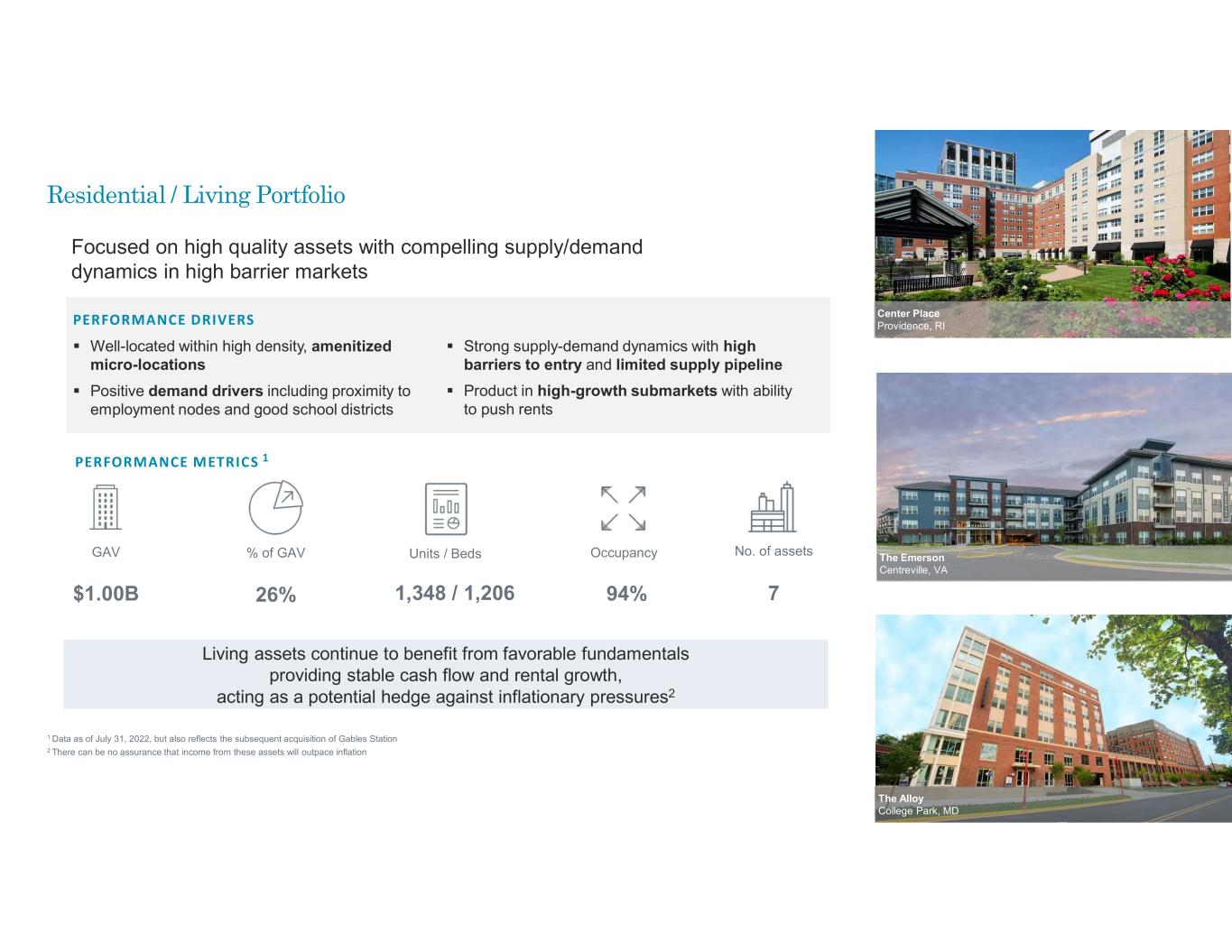

Residential / Living Portfolio 1 Data as of July 31, 2022, but also reflects the subsequent acquisition of Gables Station 2 There can be no assurance that income from these assets will outpace inflation 10 Focused on high quality assets with compelling supply/demand dynamics in high barrier markets The Alloy College Park, MD The Emerson Centreville, VA Center Place Providence, RI Living assets continue to benefit from favorable fundamentals providing stable cash flow and rental growth, acting as a potential hedge against inflationary pressures2 GAV $1.00B % of GAV 26% Units / Beds Occupancy 94% No. of assets 7 PERFORMANCE DRIVERS Well-located within high density, amenitized micro-locations Positive demand drivers including proximity to employment nodes and good school districts Strong supply-demand dynamics with high barriers to entry and limited supply pipeline Product in high-growth submarkets with ability to push rents PERFORMANCE METRICS 1 1,348 / 1,206

Liberty Station San Diego, CA Next–Gen Office Portfolio 1 Data as of July 31, 2022, but also reflects the subsequent acquisition of Gables Station Unlocking Value and Generating Alpha in a Post-Covid Office Environment 1315 N North Branch Chicago, IL 1015 Half Street Washington, D.C. Asset selection driven by a top-down, bottom-up approach GAV $740M % of GAV 19% WALT 7.1 Yrs. Occupancy 95% No. of assets 6 PERFORMANCE DRIVERS Post-Covid “flight to quality” for best / trophy offices in tier 1 liquid markets Differentiated product, with next-generation qualities in dynamic locations Covered land plays with medium term WALT with potential to re-zone and redevelop Attractive risk-reward premium compared to other asset classes in current environment PERFORMANCE METRICS 1

Retail Portfolio 1 Data as of July 31, 2022, but also reflects the subsequent acquisition of Gables Station Outperformance rooted in locational attributes and optimal tenancy mix Briargate Crossing Colorado Springs, CO Rookwood Commons and Pavilion Cincinnati, OH Waverly Place Cary, NC Optimized retail recovered more quickly from the GFC, and Hines Global believes it will continue to outperform going forward GAV $383M % of GAV 10% WALT 5.2 Yrs. Occupancy 93% No. of assets 3 PERFORMANCE DRIVERS Target investment profile focused on grocery- anchored and open-air centers Assets with future densification optionality Retail located in strong trade areas with compelling demographics and demand drivers Centers comprised of E-commerce resistant and experiential tenancy PERFORMANCE METRICS 1

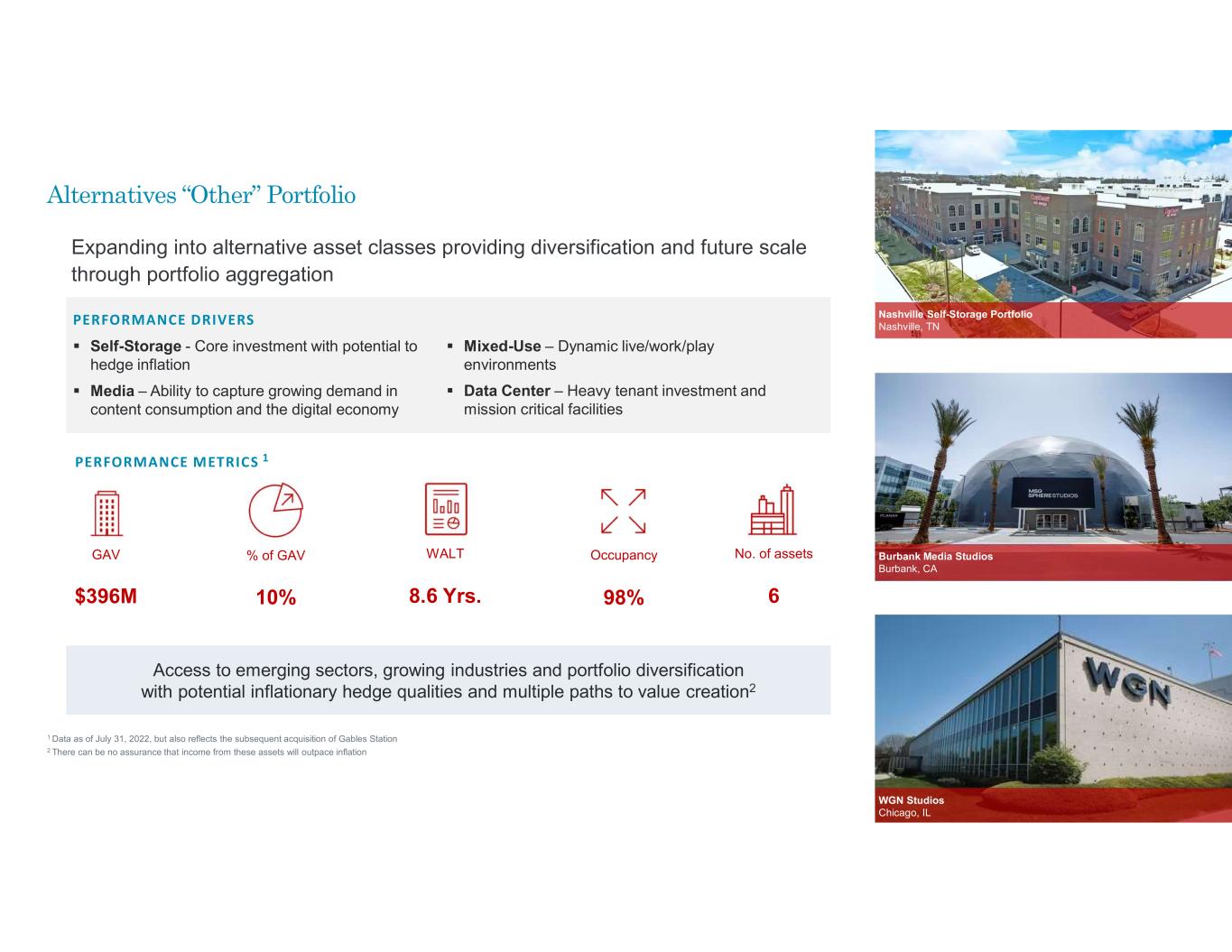

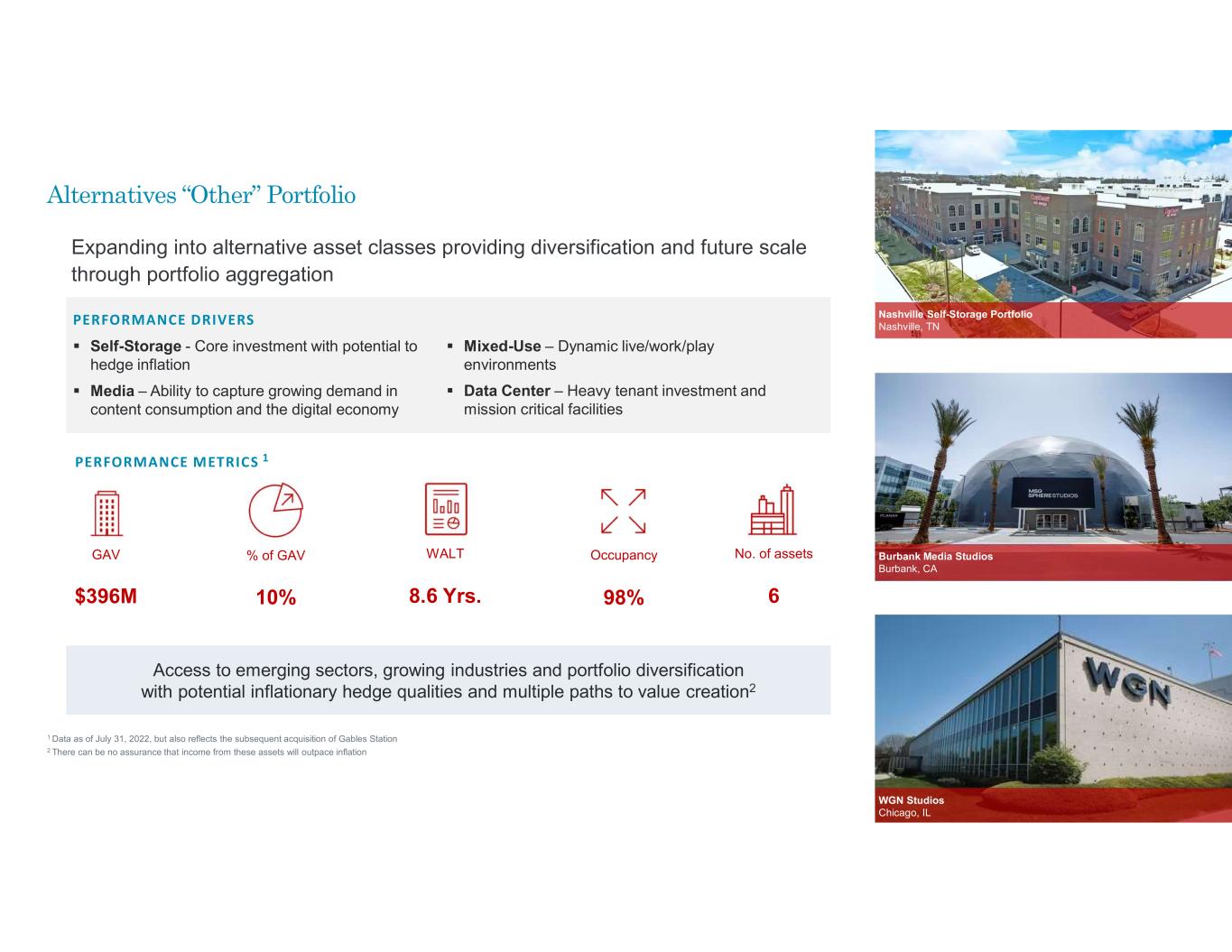

Alternatives “Other” Portfolio 1 Data as of July 31, 2022, but also reflects the subsequent acquisition of Gables Station 2 There can be no assurance that income from these assets will outpace inflation 13 Expanding into alternative asset classes providing diversification and future scale through portfolio aggregation WGN Studios Chicago, IL Burbank Media Studios Burbank, CA Nashville Self-Storage Portfolio Nashville, TN Access to emerging sectors, growing industries and portfolio diversification with potential inflationary hedge qualities and multiple paths to value creation2 GAV $396M % of GAV 10% WALT 8.6 Yrs. Occupancy 98% No. of assets 6 PERFORMANCE DRIVERS Self-Storage - Core investment with potential to hedge inflation Media – Ability to capture growing demand in content consumption and the digital economy Mixed-Use – Dynamic live/work/play environments Data Center – Heavy tenant investment and mission critical facilities PERFORMANCE METRICS 1

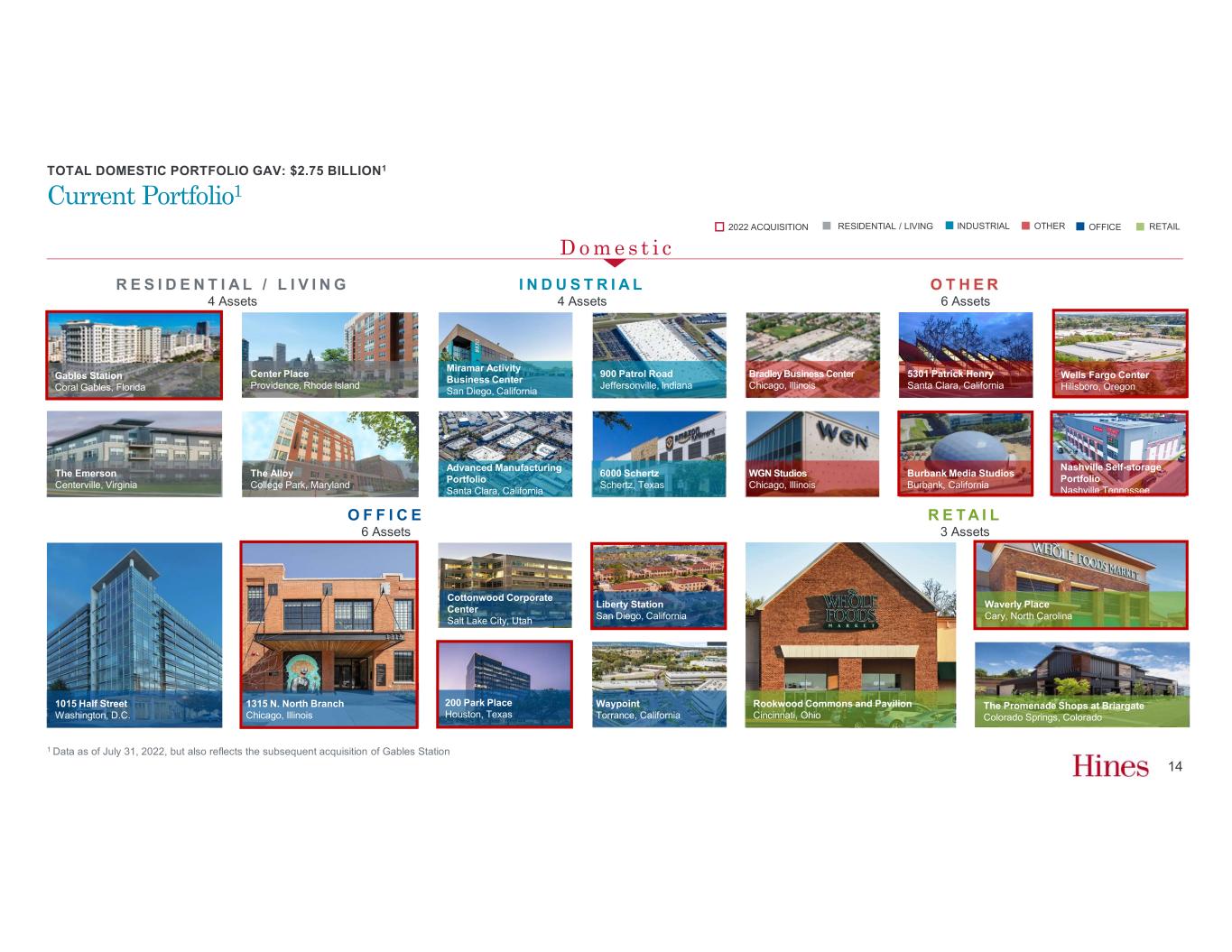

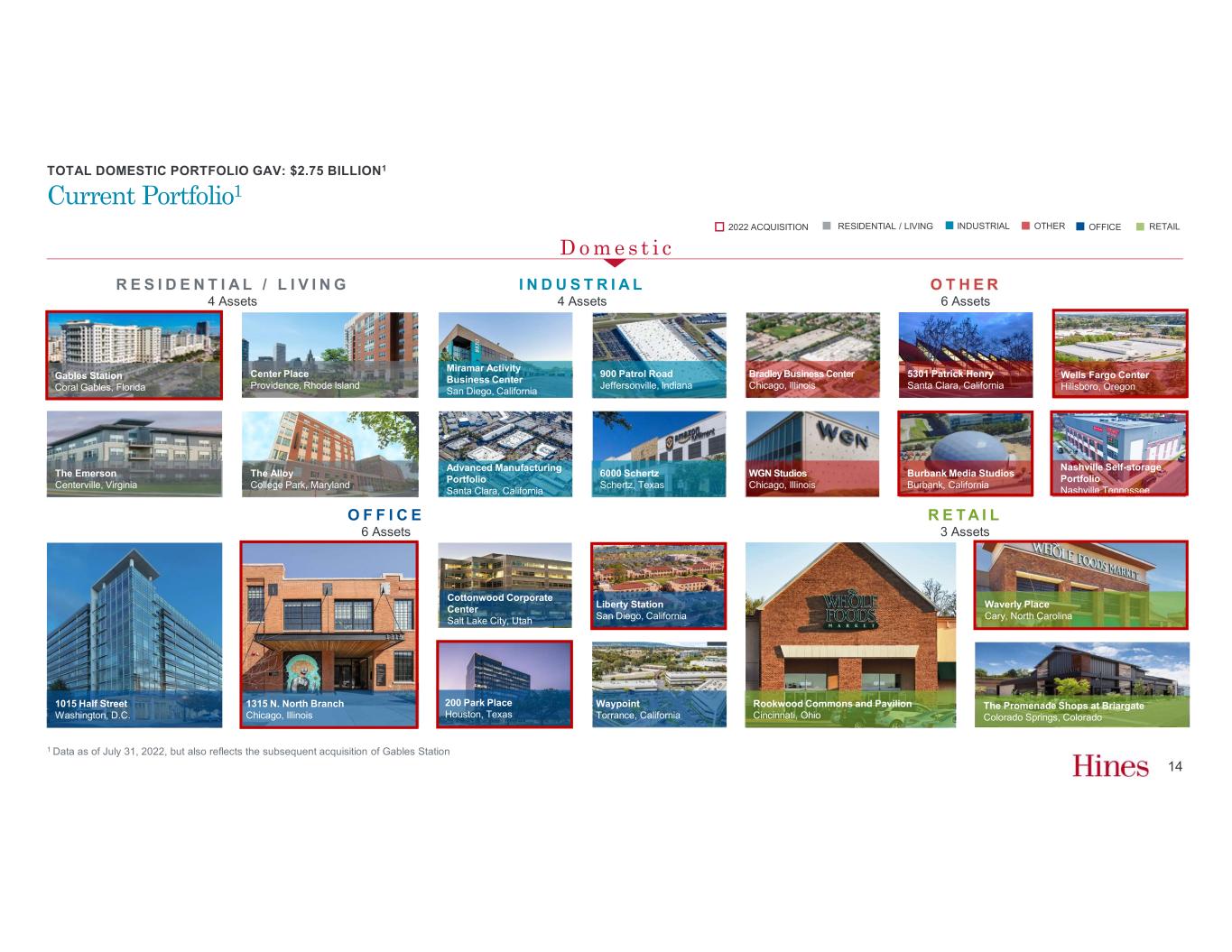

Current Portfolio1 TOTAL DOMESTIC PORTFOLIO GAV: $2.75 BILLION1 1 Data as of July 31, 2022, but also reflects the subsequent acquisition of Gables Station D o m e s t i c O F F I C E 6 Assets I N D U S T R I A L 4 Assets R E T A I L 3 Assets R E S I D E N T I A L / L I V I N G 4 Assets 6 Assets INDUSTRIAL OFFICERESIDENTIAL / LIVING RETAILOTHER Cottonwood Corporate Center Salt Lake City, Utah 1015 Half Street Washington, D.C. Waypoint Torrance, California Liberty Station San Diego, California 1315 N. North Branch Chicago, Illinois Rookwood Commons and Pavilion Cincinnati, Ohio The Promenade Shops at Briargate Colorado Springs, Colorado Waverly Place Cary, North Carolina The Emerson Centerville, Virginia 6000 Schertz Schertz, Texas 900 Patrol Road Jeffersonville, Indiana Advanced Manufacturing Portfolio Santa Clara, California Miramar Activity Business Center San Diego, California Wells Fargo Center Hillsboro, Oregon Bradley Business Center Chicago, Illinois WGN Studios Chicago, Illinois 5301 Patrick Henry Santa Clara, California Burbank Media Studios Burbank, California The Alloy College Park, Maryland Center Place Providence, Rhode Island Nashville Self-storage Portfolio Nashville,Tennessee 200 Park Place Houston, Texas Gables Station Coral Gables, Florida 2022 ACQUISITION 14

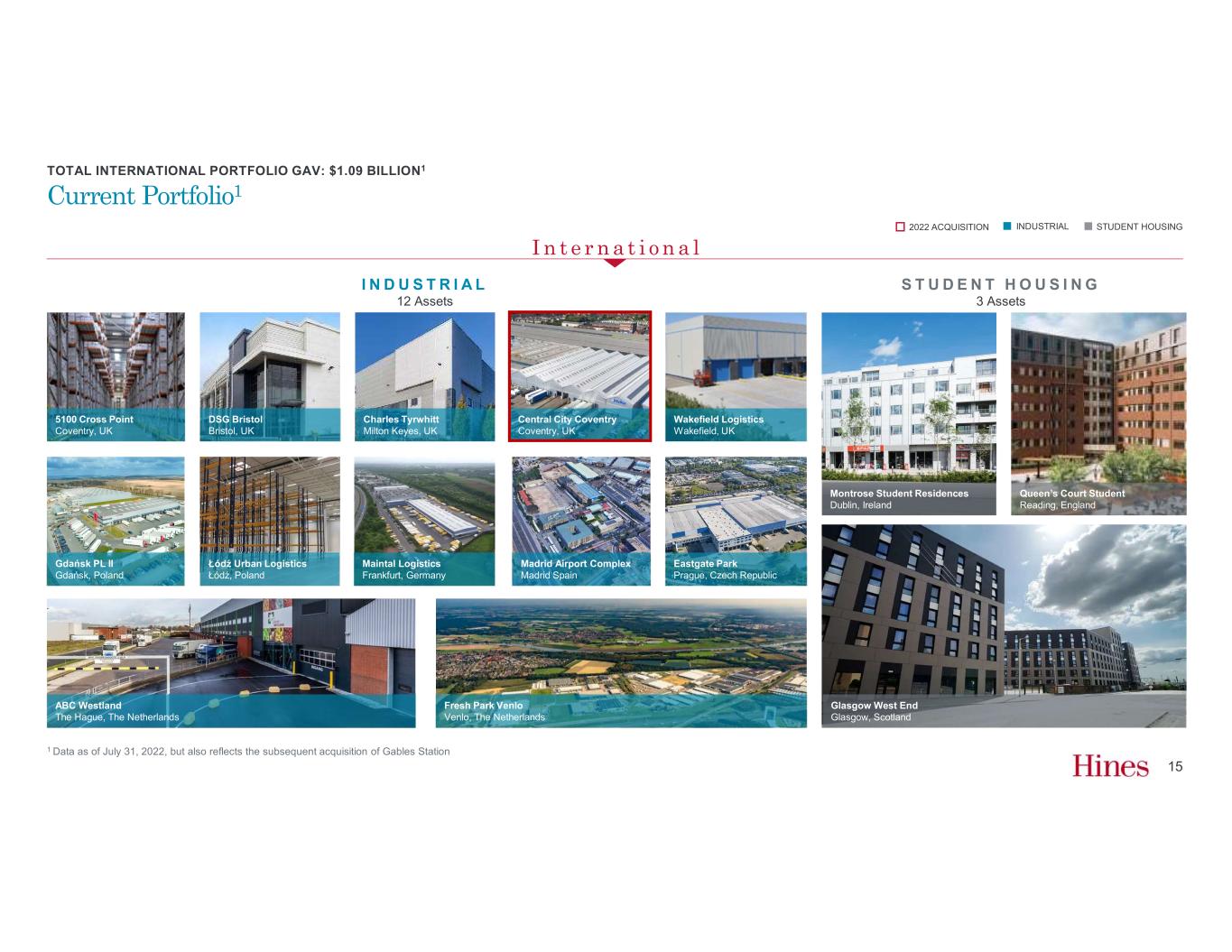

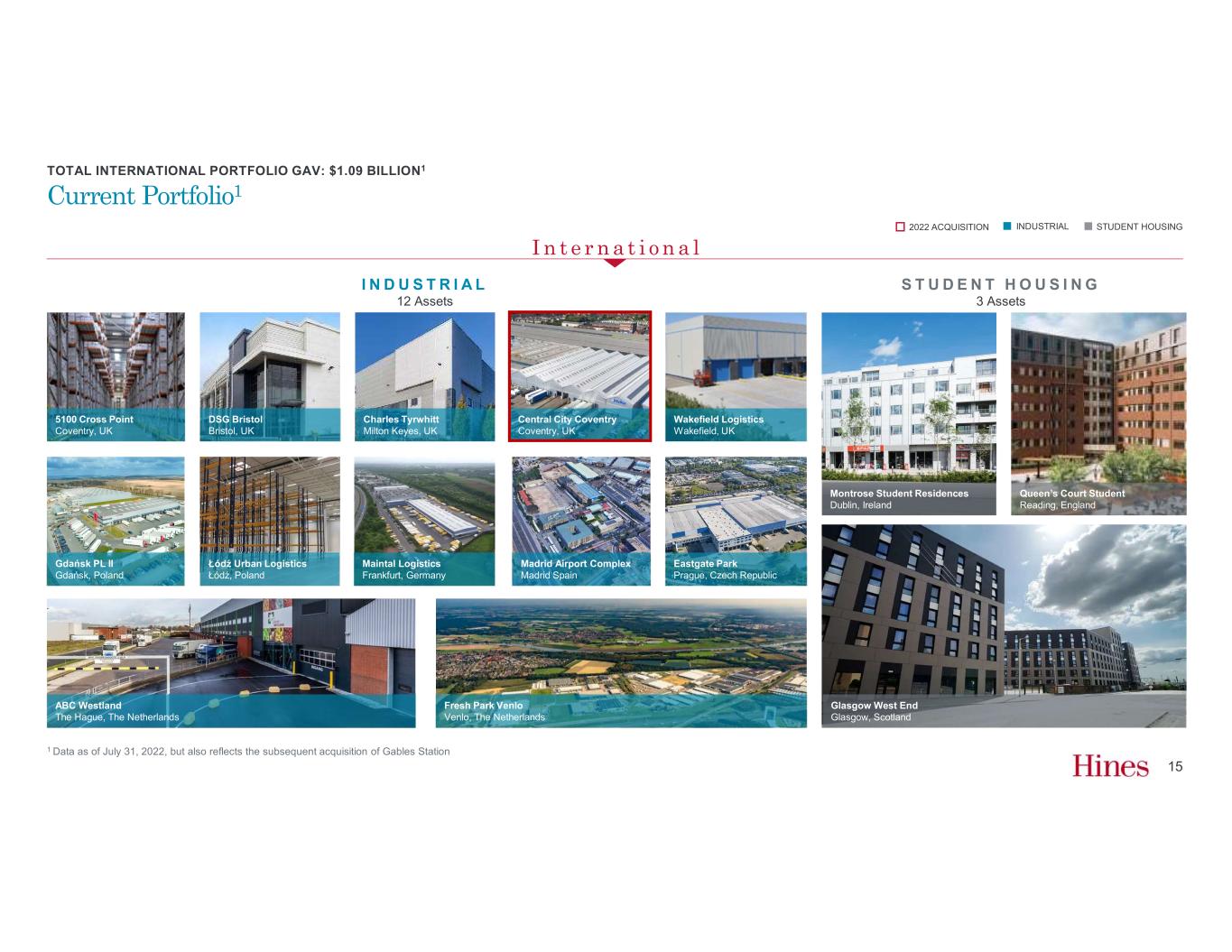

Current Portfolio1 TOTAL INTERNATIONAL PORTFOLIO GAV: $1.09 BILLION1 1 Data as of July 31, 2022, but also reflects the subsequent acquisition of Gables Station I N D U S T R I A L 12 Assets S T U D E N T H O U S I N G 3 Assets INDUSTRIAL STUDENT HOUSING Glasgow West End Glasgow, Scotland Queen’s Court Student Reading, England Montrose Student Residences Dublin, Ireland 5100 Cross Point Coventry, UK DSG Bristol Bristol, UK Charles Tyrwhitt Milton Keyes, UK Wakefield Logistics Wakefield, UK Fresh Park Venlo Venlo, The Netherlands Gdańsk PL II Gdańsk, Poland Maintal Logistics Frankfurt, Germany Łódź Urban Logistics Łódź, Poland ABC Westland The Hague, The Netherlands Madrid Airport Complex Madrid Spain Eastgate Park Prague, Czech Republic Central City Coventry Coventry, UK I n t e r n a t i o n a l 2022 ACQUISITION 15