Filed Pursuant to Rule 424(b)(3)

Registration No. 333-251136

HINES GLOBAL INCOME TRUST, INC.

SUPPLEMENT NO. 8, DATED SEPTEMBER 20, 2022

TO THE PROSPECTUS, DATED APRIL 18, 2022

This prospectus supplement (this “Supplement”) is part of and should be read in conjunction with the prospectus of Hines Global Income Trust, Inc., dated April 18, 2022 (the “Prospectus”), as supplemented by Supplement No.1, dated May 16, 2022, Supplement No. 2, dated May 17, 2022, Supplement No. 3, dated June 15, 2022, Supplement No. 4 dated July 15, 2022, Supplement No. 5 dated August 15, 2022, Supplement No. 6 dated August 17, 2022 and Supplement No. 7 dated September 16, 2022. Unless otherwise defined herein, capitalized terms used in this Supplement shall have the same meanings as in the Prospectus.

The purposes of this Supplement are as follows:

A.to announce the launch of our DST Program;

B.to update our organizational chart;

C.to disclose the amendment of the Advisory Agreement;

D.to disclose the amendment of the Partnership Agreement;

E.to update the “Risk Factors” section of the Prospectus;

F.to update the “Conflicts of Interest” Section of the Prospectus; and

G.to update the description of our Valuation Policy and Procedures.

A.Launch of DST Program

DST Program

We, through the Operating Partnership, have commenced a program to raise up to $1 billion in capital through private placements exempt from registration under Section 506(b) of the Securities Act through the sale of beneficial interests in specific Delaware statutory trusts (each, a “DST”) holding real properties, which may include properties currently indirectly owned by the Operating Partnership (the “DST Program”).

Under the DST Program, each private placement will offer interests in one or more real properties placed into one or more Delaware statutory trust(s) by the Operating Partnership or its affiliates (the “DST Properties”). Properties in which underlying interests are sold to investors pursuant to such private placements will be leased back by an indirect wholly owned subsidiary of the Operating Partnership on a long-term basis of up to 20 years. The lease agreements will be fully guaranteed by the Operating Partnership. Additionally, the Operating Partnership will retain a fair market value purchase option giving it the right, but not the obligation, to acquire the beneficial interests in the Delaware statutory trusts from the investors at a later time in exchange for units of interest in the Operating Partnership, or “OP Units” (the “FMV Option”).

We expect that the DST Program will give us the opportunity to expand and diversify our capital raising strategies by offering what we believe to be an attractive and unique investment product for investors that may be seeking replacement properties to complete like kind exchange transactions under Section 1031 of the Code. We expect to use the net proceeds of these private placements to make investments in accordance with our investment strategy and policies, to provide liquidity to our investors and for general corporate purposes (which may include repayment of our debt or any other corporate purposes we deem appropriate). The specific amounts of the net proceeds that are used for such purposes, and the priority of such uses, will depend on the amount and timing of receipt of such proceeds and what we deem to be the best use of such proceeds at such time.

DST Dealer Managers

In connection with the DST Program, Hines Real Estate Exchange, LLC, an indirect wholly-owned subsidiary of the Operating Partnership, has entered into a dealer manager agreement with our Dealer Manager and Orchard Securities, Inc., a Utah corporation that is unaffiliated with us or our Sponsor (“Orchard” and, together with our Dealer Manager, the “DST Dealer Managers”). Pursuant to the DST dealer manager agreement, the DST Dealer Managers agreed to act as co-dealer managers with respect to the private placements in the DST Program.

Hines Real Estate Exchange will pay certain upfront fees and reimburse certain related expenses to the DST Dealer Managers with respect to capital raised through the DST Program. Orchard will be paid a co-dealer manager fee as compensation for services rendered by Orchard as a DST Dealer Manager. Likewise, our Dealer Manager will be paid placement fees or commissions in an aggregate amount of up to 6.0%. In addition, with respect to certain classes of interests (or the corresponding classes of OP Units or shares for which they may be exchanged in certain circumstances) Hines Real Estate Exchange (or, if the interests are exchanged, in connection with the corresponding OP Units or shares, the Operating Partnership or the Company, respectively) will pay the DST Dealer Managers ongoing fees in amounts up to 1% of the equity investment or net asset value thereof per year. The DST Dealer Managers may reallow or advance such commissions, ongoing fees and a portion of such co-dealer manager fees to participating broker dealers. In addition, Hines Real Estate Exchange will be obligated to reimburse the DST Dealer Managers for certain expenses incurred in connection with the performance of their services as DST Dealer Managers.

DST Administrative Trustee and Asset Manager

All material management authority with respect to each DST will be exercised by such DST’s administrative trustee (each, an “Administrative Trustee”), which in each case will be an indirect subsidiary of the Advisor. In addition, each Administrative Trustee will delegate its asset management duties, including any fees payable with respect to the performance of such duties, to an indirect subsidiary of the Advisor (each, an “Asset Manager”). The applicable Administrative Trustee will have primary responsibility for performing administrative actions in connection with the applicable DST and related DST Property and will have the sole power to determine when it is appropriate for a DST to sell a DST Property.

While the intention is to sell 100% of the interests in the DST Properties to third parties, Hines Real Estate Exchange (our subsidiary) may hold an interest for a period of time and therefore could be subject to the following fees and reimbursements to be paid to the Administrative Trustee and the Asset Manager. For its services, the Asset Manager will receive, through the Administrative Trustee, a management fee equal to 1.0% of the gross rents payable to the DST. The Administrative Trustee and Asset Manager will also receive reimbursements of certain expenses associated with the establishment, maintenance and operation of the DST, the management of the DST Properties and the sale of any DST Property to a third party. In addition, in the event the FMV Option is not exercised and there is a disposition of a DST Property to a third party, the applicable Asset Manager will receive a disposition fee equal to 2.0% of the gross sales price for assisting with the disposal of the DST Property, but in no event will the total disposition fee and any brokerage commissions payable by the DST exceed 3.0% of the gross sales price. In addition, if our sponsor or an affiliate thereof acts as the property manager for the DST Property, they may receive a property management fee and a leasing fee specific to each DST Property.

Furthermore, to the extent that the Operating Partnership exercises its FMV Option to acquire the interests from the investors in exchange for OP Units, and such investors subsequently submit such OP Units for redemption pursuant to the terms of our Operating Partnership, a redemption fee of up to 1.0% of the amount otherwise payable to a limited partner upon redemption may be paid to the Administrative Trustee, subject to the terms of the applicable DST Program offering documents.

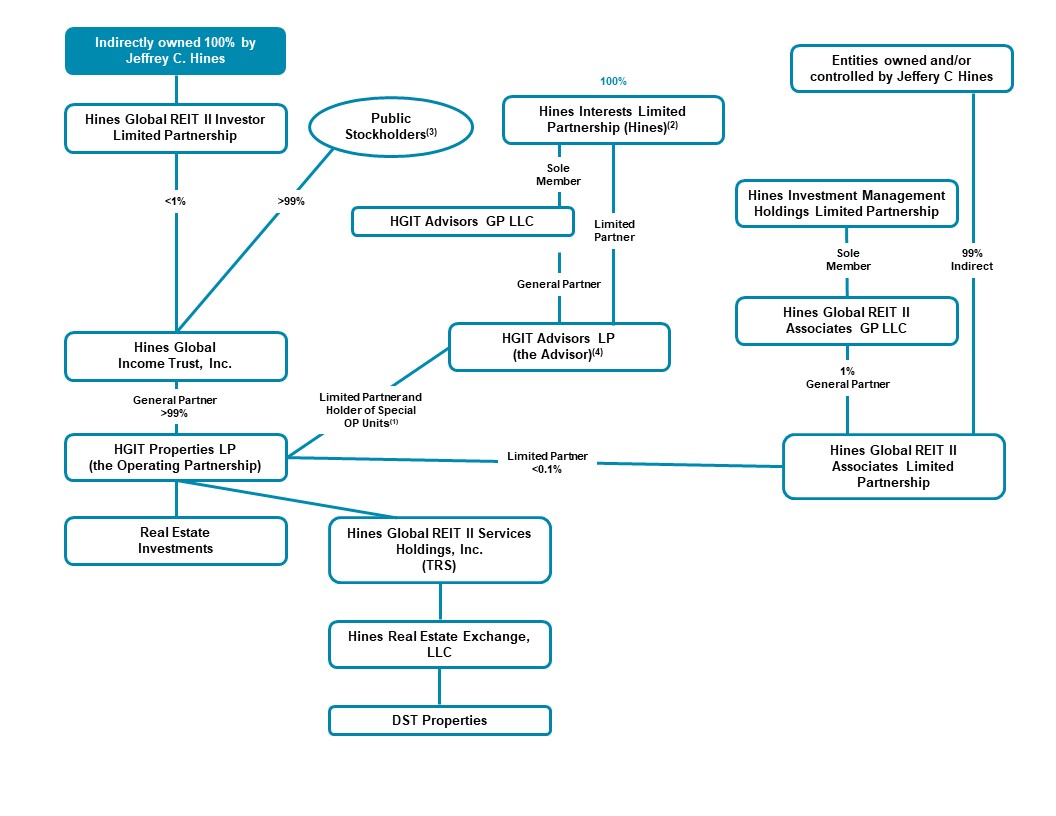

B.Update to Organizational Structure Chart

The following chart updates and replaces the structure chart on pages 15 and 78 of the Prospectus.

(1)Please see the “Management Compensation” section of this prospectus for a description of the compensation paid to the Dealer Manager and the Advisor and its affiliates.

(2)Please see “Conflicts of Interest” for a description of the other direct participation programs sponsored and managed by Hines and its affiliates.

(3)Please see “Security Ownership of Certain Beneficial Owners and Management” for information concerning the number of shares of our common stock owned by our officers and directors as of April 1, 2022.

(4)Certain subsidiaries of the Advisor have been omitted.

C.Update to Advisory Agreement

The following updates the description of the Advisory Agreement and the asset management fee payable to the Advisor throughout the Prospectus, including, without limitation, the description of the asset management fee in the first paragraph of the sections titled “Prospectus Summary—Management Compensation—Asset Management Fee and Expense Reimbursements—our Advisor,” “Management—Our Advisor and Our Advisory Agreement—Compensation—Asset Management Fee,” and “Management Compensation—Asset Management Fee and Expense Reimbursements—our Advisor” on pages 20, 82 and 96 of the Prospectus.

On September 14, 2022, we, the Operating Partnership and the Advisor entered into the Second Amended and Restated Advisory Agreement (the “Advisory Agreement”) with the Advisor. The Advisory Agreement amends and restates the prior version of the agreement to, among other things, amend the calculation of the asset management fee in connection with the launch of the DST Program. As amended, the asset management fee will be a monthly fee in an amount equal to 0.0625% per month of (a) the value of the Company’s real estate investments and (b) the aggregate proceeds received by us or our subsidiary for selling interests in properties in the DST Program to third party investors, net of up-front fees and expense

reimbursements payable out of the gross sale proceeds from the sale of such interests (the “DST Proceeds”) at the end of each month. In no event will the asset management fee exceed an amount equal to 1/12th of 1.25% of (i) the Company’s net asset value and (ii) the aggregate DST Proceeds at the end of the applicable month.

In addition, the Advisory Agreement was amended to include certain terms and provisions related to the facilitation of the Company’s launch of the DST Program

D.Update to Partnership Agreement

The following updates and supplements the description of the Partnership Agreement throughout the Prospectus, including without limitation, the section titled “The Operating Partnership” beginning on page 158 of the Prospectus.

On September 14, 2022, in connection with the launch of the DST Program, we, on our own behalf as general partner and on behalf of the limited partners of the Operating Partnership, entered into the Sixth Amended and Restated Limited Partnership Agreement of HGIT Properties LP (the “Partnership Agreement”). The Partnership Agreement amends the prior limited partnership agreement of the Operating Partnership in order to facilitate the issuance of OP Units in exchange for beneficial interests in Delaware statutory trusts issued pursuant to the DST Program (in the event the Operating Partnership exercises the FMV Option in the future), including an amendment to specify a process by which any such future holders of OP Units could request redemption and withdraw such requests.

E.Update to Risk Factors Section

1.The following supersedes and replaces the first full risk factor on page 56 of the Prospectus.

We have issued shares of common stock as dividends and may issue preferred shares or separate classes or series of common shares, which issuance could adversely affect the holders of our common shares.

Holders of our common stock do not have preemptive rights to any shares issued by us in the future. With the authorization of our board of directors, we declared special daily stock dividends for the period from October 1, 2014 through June 30, 2015, which may have diluted the value of our shares. In addition, we may issue, without stockholder approval, preferred shares or a class or series of common shares with rights that could adversely affect the holders of our common shares. Upon the affirmative vote of a majority of our directors (including, in the case of preferred shares, a majority of our independent directors), our charter authorizes our board of directors (without any further action by our stockholders) to issue preferred shares or common shares in one or more classes or series, and to fix the voting rights (subject to certain limitations), liquidation preferences, distribution rates, conversion rights, redemption rights and terms, including sinking fund provisions, and certain other rights and preferences with respect to such classes or series of shares. If we ever create and issue preferred shares with a distribution preference over common shares, payment of any distribution preferences of outstanding preferred shares would reduce the amount of funds available for the payment of distributions on the common shares. In addition, we may cause the Operating Partnership to issue a substantial number of additional OP Units in connection with the exercise of an FMV Option to purchase a property under the DST Program or otherwise, acquire properties, consummate a merger, business combination or another significant transaction. Further, holders of preferred shares are normally entitled to receive a preference payment in the event we liquidate, dissolve or wind up before any payment is made to the common stockholders, likely reducing the amount common stockholders would otherwise receive upon such an occurrence. We could also designate and issue shares in a class or series of common shares with similar rights. In addition, under certain circumstances, the issuance of preferred shares or a separate class or series of common shares may render more difficult or tend to discourage:

•a merger, tender offer or proxy contest;

•the assumption of control by a holder of a large block of our securities; and/or

•the removal of incumbent management.

2.The following is added to the end of the “Risks Related to Organizational Structure” section beginning on page 55 of the Prospectus.

The Operating Partnership’s private placements of beneficial interests in specific Delaware statutory trusts under our DST Program could subject us to liabilities from litigation or otherwise.

We, through the Operating Partnership, have commenced a program to raise capital in private placements exempt from registration under Section 506(b) of the Securities Act through the sale of beneficial interests in specific Delaware statutory trusts, or DSTs, holding real properties, which may include properties currently indirectly owned by the Operating Partnership.

These interests may serve as replacement properties for investors seeking to complete like-kind exchange transactions under Section 1031 of the Code. Properties in which underlying interests are sold to investors pursuant to such private placements will be leased-back by the Operating Partnership or a wholly owned subsidiary thereof, as applicable, and fully guaranteed by the Operating Partnership, although there can be no assurance that the Operating Partnership can or will fulfill these guarantee obligations. Additionally, the Operating Partnership will be given the FMV Option with respect to each DST in the DST Program, giving it the right, but not the obligation, to acquire the interests in the DST from the investors at a later time in exchange for OP Units. Investors who acquired interests pursuant to such private placements may have been seeking certain tax benefits that depend on the interpretation of, and compliance with, federal and state income tax laws and regulations. As the general partner of the Operating Partnership, we may become subject to liability, from litigation or otherwise, as a result of such transactions, including in the event an investor fails to qualify for any desired tax benefits.

The Operating Partnership’s private placements of beneficial interests in specific Delaware statutory trusts under our DST Program will not shield us from risks related to the performance of the real properties held through such structures.

Pursuant to the DST Program, the Operating Partnership intends to place certain of its existing real properties and/or acquire new properties to place into specific DSTs and then sell interests, via its TRS, in such trusts to third party investors. We will hold long-term leasehold interests in the property pursuant to master leases that are fully guaranteed by our Operating Partnership, while the third party investors indirectly hold some or all of the interests in the real estate. There can be no assurance that the Operating Partnership can or will fulfill these guarantee obligations. Although we will hold the FMV Option to reacquire the real estate through a purchase of interests in the DST, the purchase price will be based on the then current fair market value of the third party investor’s interest in the real estate, which will be greatly impacted by the rental terms fixed by the long term master lease. Under the lease we are responsible for subleasing the property to occupying customers until the earlier of the expiration of the master lease or our exercise of the FMV Option, which means that we bear the risk that the underlying cash flow from the property and all capital expenditures may be less than the master lease payments at such time. Therefore, even though we will no longer own the underlying real estate, because of the fixed terms of the long-term master lease guaranteed by our Operating Partnership, negative performance by the underlying properties could affect cash available for distributions to our stockholders and will likely have an adverse effect on our results of operations and NAV.

We may own beneficial interests in DSTs owning real property that will be subject to the agreements under our DST Program, which may have an adverse effect on our results of operations, relative to if the DST Program agreements did not exist.

In connection with our DST Program, we may own beneficial interests in DSTs owning real property that are subject to the terms of the agreements governing our DST Program. The DST Program agreements limit our ability to encumber, lease or dispose of our beneficial interests. Such agreements could affect our ability to turn our beneficial interests into cash and could affect cash available for distributions to our stockholders. The DST Program agreements could also impair our ability to take actions that would otherwise be in the best interests of our stockholders and, therefore, may have an adverse effect on our results of operations and NAV, relative to if the DST Program agreements did not exist.

Properties that are placed into the DST Program and later reacquired may be less liquid than other assets, which could impair our ability to utilize cash proceeds from sales of such properties for other purposes such as paying down debt, distributions, or additional investments.

DST Properties may later be reacquired through exercise of the FMV Option granted to our Operating Partnership. In such cases, the investors who become limited partners in the Operating Partnership (the “DST Investors”) will generally remain tied to the applicable DST Property in terms of basis and built in gain. As a result, if the applicable DST Property is subsequently sold, unless we effectuate a like kind exchange under Section 1031 of the Code, then tax will be triggered on the DST Investors’ built in gain. Although we are not contractually obligated to do so, we may seek to execute a 1031 exchange in such situations rather than trigger gain. Any replacement property acquired in connection with a 1031 exchange will similarly be tied to the DST Investors with similar considerations if such replacement property ever is sold. As a result of these factors, placing properties into the DST Program may limit our ability to access liquidity from such properties or replacement properties through sale without triggering taxes due to the built in gain tied to DST Investors. Such reduced liquidity could impair our ability to utilize cash proceeds from sales for other purposes such as paying down debt, paying distributions, funding redemptions or making additional investments.

F.Update to Conflicts of Interest Section

The following subsection is added to the “Conflicts of Interests” section, immediately before the “Lack of Separate Representation” subsection on page 113 of the Prospectus.

DST Program

The Advisor is related to our Dealer Manager, the Administrative Trustee and the Asset Manager. These relationships may create conflicts of interest with respect to decisions regarding whether to place properties into the DST Program. The Advisor, Dealer Manager, Administrative Trustee and Asset Manager will receive fees and expense reimbursements in connection with their roles in the DST Program (which costs are expected to be substantially paid by the private investors in that program).

G.Update to the Valuation Policy and Procedures

The following subsection is added to the “Description of Capital Stock—Valuation Policy and Procedures” section, immediately after the “Valuation of Liabilities” subsection on page 141 of the Prospectus.

Valuation of Assets and Liabilities Associated with the DST Program

We have initiated the DST Program to raise capital in private placements through the sale of beneficial interests in specific DST Properties. DST Properties may be sourced from real properties currently indirectly owned by the Operating Partnership or may be newly acquired. Pursuant to the DST Program, we, through a subsidiary of our Operating Partnership, will hold a long-term leasehold interest in each DST Property pursuant to a master lease that is guaranteed by the Operating Partnership, while third-party investors own some or all of the DST Property through a DST. Under the master lease, the Operating Partnership acts as a landlord to the occupying tenants and is responsible for subleasing the DST Property to such tenants, which means that we bear the risk that the underlying cash flow received by us from the DST Property may be less than the master lease payments made by us. Additionally, the Operating Partnership will retain a FMV Option purchase option giving it the right, but not the obligation, to acquire the beneficial interests in the DSTs from the investors at a later time in exchange for units in the Operating Partnership.

Due to our continuing involvement with the DST Properties through the master lease arrangements and the FMV Option, we will include DST Properties in our determination of NAV at fair market value in the same manner as described under “Valuation of Assets—Real Estate Properties” above. Accordingly, the sale of interests in a DST Property has no initial net effect to our NAV. Thereafter, our Advisor will value the real property subject to the master lease liability quarterly using a discounted cash flow methodology. Therefore, any differences between the fair value of the underlying real property and the fair value of the real property subject to the master lease obligations will accrue into our NAV not less frequently than quarterly.