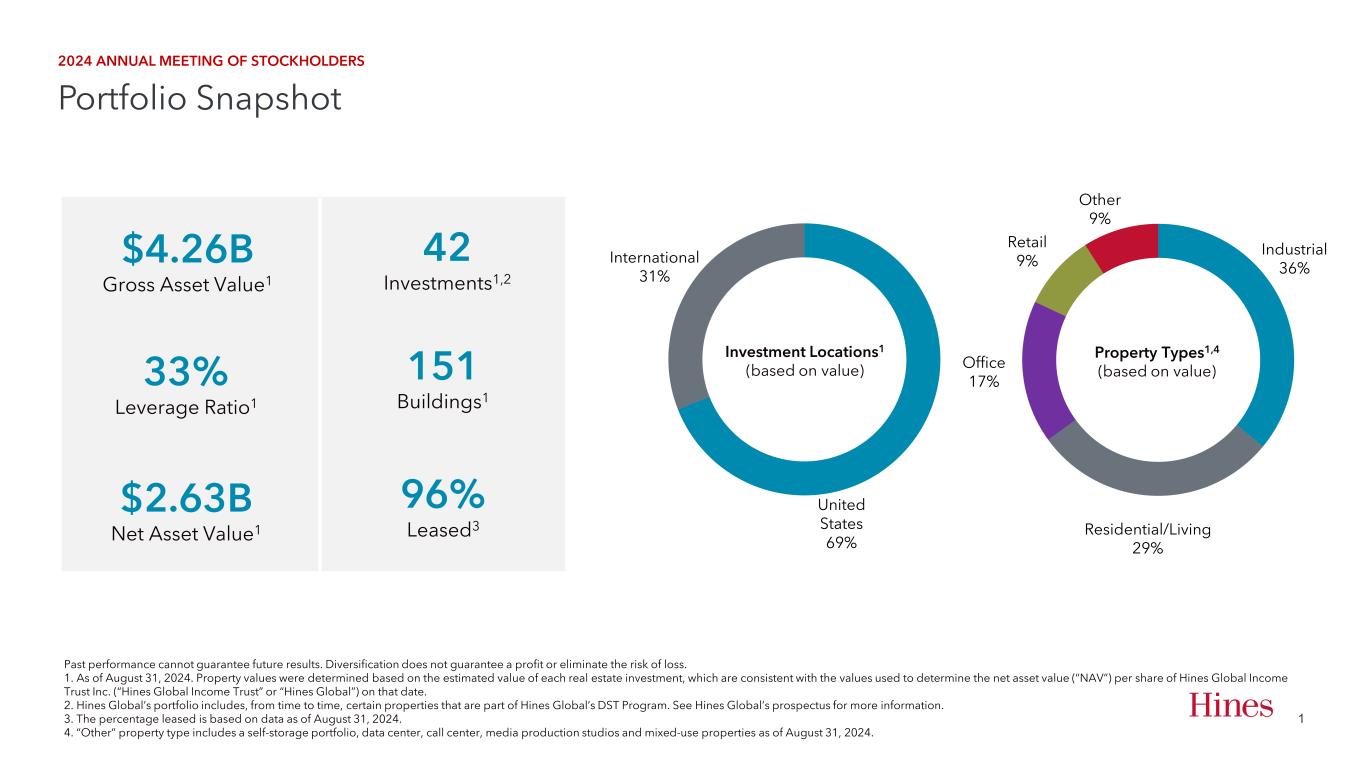

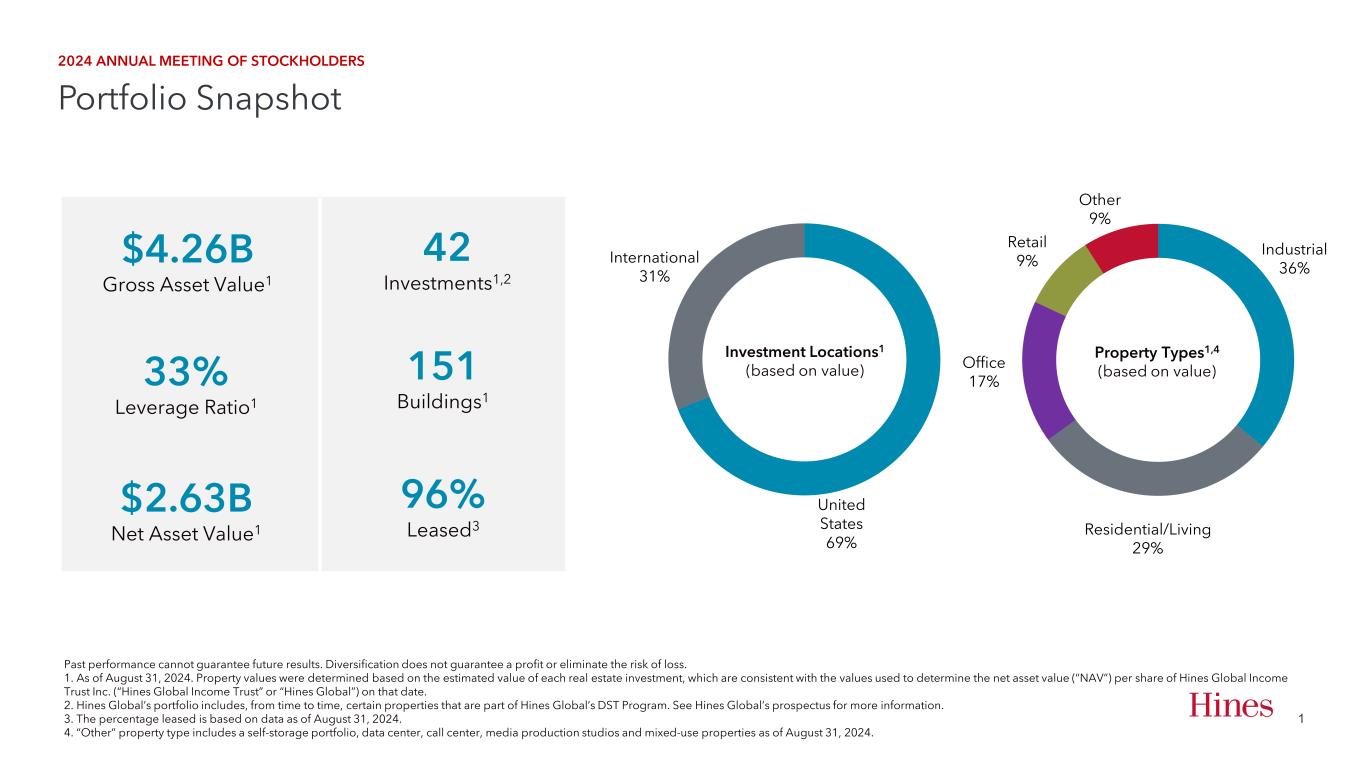

Past performance cannot guarantee future results. Diversification does not guarantee a profit or eliminate the risk of loss. 1. As of August 31, 2024. Property values were determined based on the estimated value of each real estate investment, which are consistent with the values used to determine the net asset value (“NAV”) per share of Hines Global Income Trust Inc. (“Hines Global Income Trust” or “Hines Global”) on that date. 2. Hines Global’s portfolio includes, from time to time, certain properties that are part of Hines Global’s DST Program. See Hines Global’s prospectus for more information. 3. The percentage leased is based on data as of August 31, 2024. 4. “Other” property type includes a self-storage portfolio, data center, call center, media production studios and mixed-use properties as of August 31, 2024. $4.26B Gross Asset Value1 33% Leverage Ratio1 $2.63B Net Asset Value1 42 Investments1,2 151 Buildings1 96% Leased3 2024 ANNUAL MEETING OF STOCKHOLDERS Portfolio Snapshot United States 69% International 31% Investment Locations1 (based on value) Industrial 36% Residential/Living 29% Office 17% Retail 9% Other 9% Property Types1,4 (based on value) 1

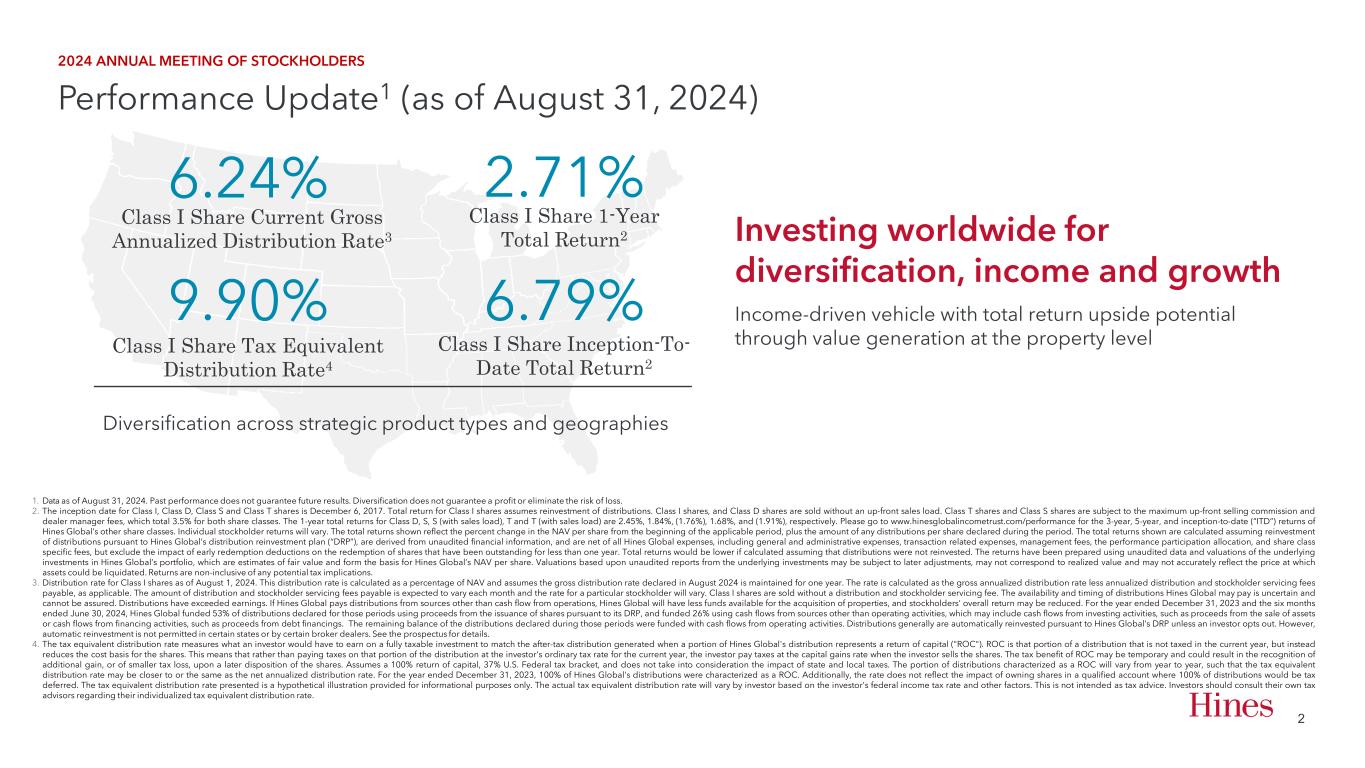

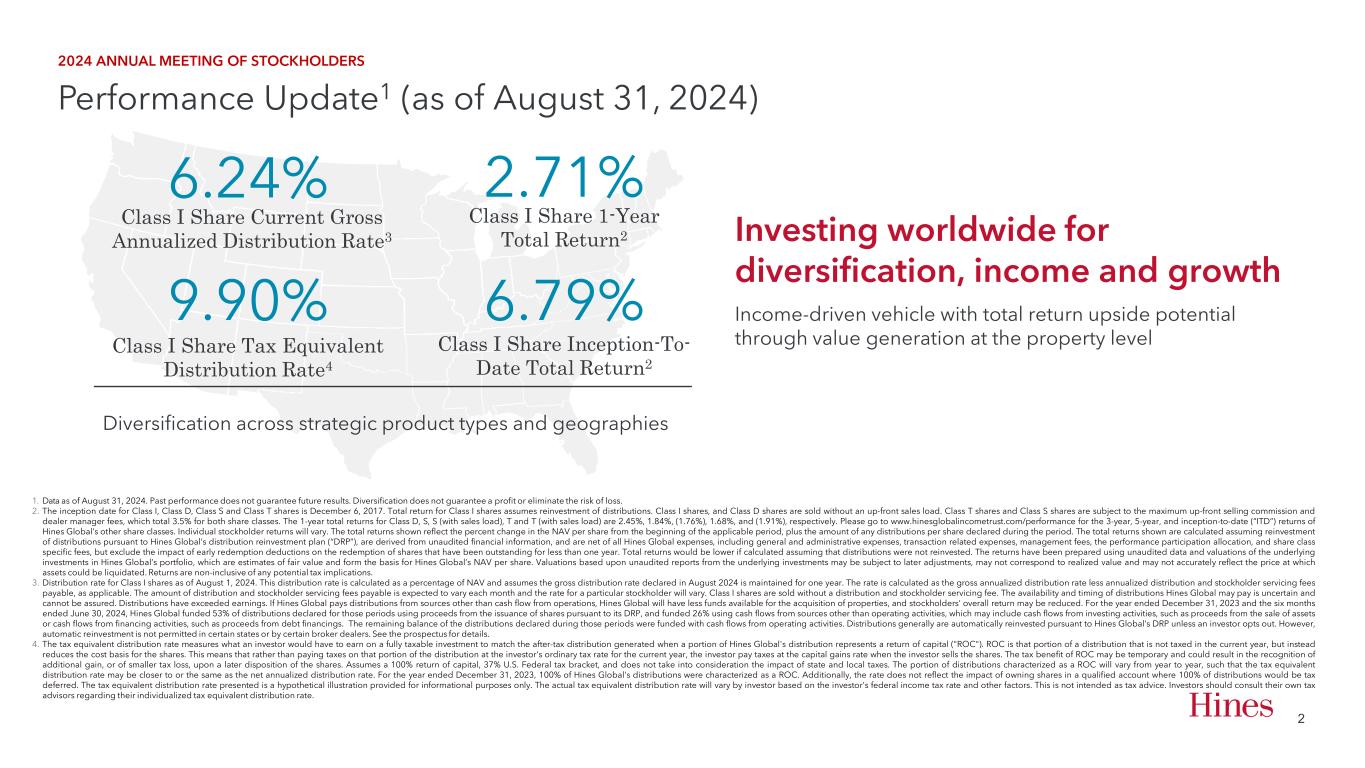

2024 ANNUAL MEETING OF STOCKHOLDERS Performance Update1 (as of August 31, 2024) 2 Diversification across strategic product types and geographies Investing worldwide for diversification, income and growth Income-driven vehicle with total return upside potential through value generation at the property levelClass I Share Tax Equivalent Distribution Rate4 Class I Share Current Gross Annualized Distribution Rate3 6.24% 9.90% Class I Share Inception-To- Date Total Return2 2.71% 6.79% Class I Share 1-Year Total Return2 1. Data as of August 31, 2024. Past performance does not guarantee future results. Diversification does not guarantee a profit or eliminate the risk of loss. 2. The inception date for Class I, Class D, Class S and Class T shares is December 6, 2017. Total return for Class I shares assumes reinvestment of distributions. Class I shares, and Class D shares are sold without an up-front sales load. Class T shares and Class S shares are subject to the maximum up-front selling commission and dealer manager fees, which total 3.5% for both share classes. The 1-year total returns for Class D, S, S (with sales load), T and T (with sales load) are 2.45%, 1.84%, (1.76%), 1.68%, and (1.91%), respectively. Please go to www.hinesglobalincometrust.com/performance for the 3-year, 5-year, and inception-to-date (“ITD”) returns of Hines Global’s other share classes. Individual stockholder returns will vary. The total returns shown reflect the percent change in the NAV per share from the beginning of the applicable period, plus the amount of any distributions per share declared during the period. The total returns shown are calculated assuming reinvestment of distributions pursuant to Hines Global’s distribution reinvestment plan (“DRP”), are derived from unaudited financial information, and are net of all Hines Global expenses, including general and administrative expenses, transaction related expenses, management fees, the performance participation allocation, and share class specific fees, but exclude the impact of early redemption deductions on the redemption of shares that have been outstanding for less than one year. Total returns would be lower if calculated assuming that distributions were not reinvested. The returns have been prepared using unaudited data and valuations of the underlying investments in Hines Global’s portfolio, which are estimates of fair value and form the basis for Hines Global’s NAV per share. Valuations based upon unaudited reports from the underlying investments may be subject to later adjustments, may not correspond to realized value and may not accurately reflect the price at which assets could be liquidated. Returns are non-inclusive of any potential tax implications. 3. Distribution rate for Class I shares as of August 1, 2024. This distribution rate is calculated as a percentage of NAV and assumes the gross distribution rate declared in August 2024 is maintained for one year. The rate is calculated as the gross annualized distribution rate less annualized distribution and stockholder servicing fees payable, as applicable. The amount of distribution and stockholder servicing fees payable is expected to vary each month and the rate for a particular stockholder will vary. Class I shares are sold without a distribution and stockholder servicing fee. The availability and timing of distributions Hines Global may pay is uncertain and cannot be assured. Distributions have exceeded earnings. If Hines Global pays distributions from sources other than cash flow from operations, Hines Global will have less funds available for the acquisition of properties, and stockholders’ overall return may be reduced. For the year ended December 31, 2023 and the six months ended June 30, 2024, Hines Global funded 53% of distributions declared for those periods using proceeds from the issuance of shares pursuant to its DRP, and funded 26% using cash flows from sources other than operating activities, which may include cash flows from investing activities, such as proceeds from the sale of assets or cash flows from financing activities, such as proceeds from debt financings. The remaining balance of the distributions declared during those periods were funded with cash flows from operating activities. Distributions generally are automatically reinvested pursuant to Hines Global’s DRP unless an investor opts out. However, automatic reinvestment is not permitted in certain states or by certain broker dealers. See the prospectus for details. 4. The tax equivalent distribution rate measures what an investor would have to earn on a fully taxable investment to match the after-tax distribution generated when a portion of Hines Global's distribution represents a return of capital ("ROC"). ROC is that portion of a distribution that is not taxed in the current year, but instead reduces the cost basis for the shares. This means that rather than paying taxes on that portion of the distribution at the investor's ordinary tax rate for the current year, the investor pay taxes at the capital gains rate when the investor sells the shares. The tax benefit of ROC may be temporary and could result in the recognition of additional gain, or of smaller tax loss, upon a later disposition of the shares. Assumes a 100% return of capital, 37% U.S. Federal tax bracket, and does not take into consideration the impact of state and local taxes. The portion of distributions characterized as a ROC will vary from year to year, such that the tax equivalent distribution rate may be closer to or the same as the net annualized distribution rate. For the year ended December 31, 2023, 100% of Hines Global's distributions were characterized as a ROC. Additionally, the rate does not reflect the impact of owning shares in a qualified account where 100% of distributions would be tax deferred. The tax equivalent distribution rate presented is a hypothetical illustration provided for informational purposes only. The actual tax equivalent distribution rate will vary by investor based on the investor's federal income tax rate and other factors. This is not intended as tax advice. Investors should consult their own tax advisors regarding their individualized tax equivalent distribution rate.