- PRGO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Perrigo (PRGO) DEF 14ADefinitive proxy

Filed: 22 Mar 24, 2:22pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

PERRIGO COMPANY PLC

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|

|

|

|

|

| NOTICE OF 2024 ANNUAL GENERAL MEETING |

|

|

|

|

|

NOTICE OF 2024 ANNUAL GENERAL MEETING

Thursday, May 2, 2024

10:00 a.m. (Irish Time)

The 2024 Annual General Meeting (“AGM”) of Shareholders of Perrigo Company plc (“Company” or “Perrigo”) will be held on Thursday, May 2, 2024, at 10:00 a.m. (Irish Time) at, 70 Sir John Rogerson's Quay, Grand Canal Dock, Dublin 2, D02 R296, Ireland.

Meeting Agenda:

Proposals 1 – 4 are ordinary resolutions requiring the approval of a simple majority of the votes cast at the meeting. Proposal 5 is a special resolution requiring the approval of not less than 75% of the votes cast. All proposals are more fully described in this Proxy Statement.

In addition to the above proposals, the business of the AGM shall include the consideration of the Company’s Irish Statutory Financial Statements for the fiscal year ended December 31, 2023, along with the related directors’ and auditor’s reports and a review of the Company’s affairs.

ADMISSION TO THE ANNUAL GENERAL MEETING

The well-being of all attendees and participants at the AGM is a primary concern for the Company. To promote the health and safety of attendees, we may impose additional procedures or limitations on meeting attendance based on applicable governmental requirements or recommendations or facility requirements. Such additional procedures or limitations may include, but are not limited to, limits on the number of attendees to promote social distancing and requiring the use of face masks.

We encourage all shareholders to vote their shares by proxy in advance of the AGM to ensure you can vote and be represented at the AGM if attending in person is not feasible or not recommended. This can be done in advance of the AGM by using one of the voting options detailed in the accompanying proxy statement.

If you wish to attend the AGM, you must be a shareholder as of the record date, March 4, 2024. If you plan on attending the meeting, you may obtain admission tickets at the registration desk immediately prior to the meeting. Shareholders whose shares are registered in the name of a broker, bank or other nominee should bring proof or a certificate of ownership to the meeting.

Your vote is important. Please consider the issues presented in this Proxy Statement and vote your shares as soon as possible. To do so, you should promptly sign, date, and return the enclosed proxy card or proxy voting instruction form or vote by telephone or Internet following the instructions on the proxy card or instruction form.

A shareholder entitled to attend and vote at the AGM is entitled, using the form provided (or the form in section 184 of the Irish Companies Act 2014), to appoint one or more proxies to attend, speak and vote instead of him or her at the AGM. A proxy need not be a shareholder of record.

By order of the Board of Directors

Kyle L. Hanson

Executive Vice President, General Counsel

and Company Secretary

March 22, 2024

We are once again pleased to take advantage of the Securities and Exchange Commission rule allowing companies to furnish proxy materials to their shareholders over the Internet. This e-proxy process expedites shareholders’ receipt of proxy materials while reducing the costs and the environmental impact of our AGM. On or about March 22, 2024, we mailed to our beneficial owners and consenting shareholders of record a notice of internet availability of proxy materials containing instructions on how to access our proxy statement, Annual Report and Irish Statutory Financial Statements and how to vote online. All other shareholders will receive a paper copy of the proxy statement, proxy card, Annual Report and Irish Statutory Financial Statements by mail unless otherwise notified by us or our transfer agent.

The notice of internet availability contains instructions on how you can (i) receive a paper copy of the proxy statement, proxy card, Annual Report and Irish Statutory Financial Statements if you only received a notice by mail or (ii) elect to receive your proxy statement, Annual Report and Irish Statutory Financial Statements over the Internet if you received them by mail this year.

This Proxy Statement, the Annual Report on Form 10-K and Irish Statutory Financial Statements for the fiscal year ended December 31, 2023, are available at www.proxydocs.com/PRGO.

Table of Contents |

|

| |

|

| Page |

|

ii | |||

1 | |||

5 | |||

11 | |||

15 | |||

16 | |||

18 | |||

20 | |||

21 | |||

Compensation Discussion and Analysis |

| ||

22 | |||

23 | |||

25 | |||

26 | |||

27 | |||

28 | |||

32 | |||

33 | |||

34 | |||

Currency-neutral Adjusted Operating Income used for PSUs (PSU OI) | 34 | ||

36 | |||

37 | |||

41 | |||

42 | |||

44 | |||

45 | |||

45 | |||

47 | |||

54 | |||

54 | |||

55 | |||

56 | |||

61 | |||

| |||

62 | |||

72 | |||

73 | |||

4. Renew the Board’s authority to issue shares under Irish law | 74 | ||

5. Renew the Board’s authority to opt-out of statutory pre-emption rights under Irish law | 75 | ||

77 | |||

78 | |||

79 | |||

83 |

|

The proxy statement, form of proxy and voting instructions are being mailed to shareholders starting on or about March 22, 2024.

|

|

|

PERRIGO • 2024 PROXY STATEMENT |

| i |

|

|

|

|

|

|

|

| Proxy Summary |

|

|

|

|

|

|

Proxy Summary

Here are highlights of important information you will find in this proxy statement. As this is only a summary, we encourage you to review the complete proxy statement before you vote.

Our Annual General Meeting

Logistics

Date and Time May 2, 2024 at 10:00 a.m. (Irish Time) | Location 70 Sir John Rogerson's Quay, Grand Canal Dock Dublin 2, D02 R296, Ireland | |

Record Date March 4, 2024 | Shareholders on the close of business on the record date may vote on all matters. | |

Proposals

Resolutions Proposed for Shareholder Vote | Board Vote | Page Reference for Additional Details | ||

1. Election of directors | FOR each nominee | 62 | ||

2. Ratify, in a non-binding advisory vote, the appointment of Ernst & Young LLP as the Company’s independent auditor, and authorize, in a binding vote, the Board of Directors, acting through the Audit Committee, to fix the remuneration of the auditor | FOR | 72 | ||

| ||||

3. Advisory vote on executive compensation | FOR | 73 | ||

| ||||

4. Renew the Board’s authority to issue shares under Irish law | FOR | 74 | ||

| ||||

5. Renew the Board’s authority to opt-out of statutory pre-emption rights under Irish law | FOR | 75 | ||

|

| |||

|

|

|

|

|

Governance

• Annual director elections • 9 of 10 director nominees are independent • All committee members are independent • Board of Directors is diverse in gender, ethnicity, experience and skills • Regular Board refreshment • Independent directors regularly meet in executive session |

| • Separate independent Chair and Chief Executive Officer roles • Annual Board and committee assessments • Robust stock ownership guidelines • Majority voting for directors • No shareholder rights plan • Board level risk oversight • Anti-hedging and anti-pledging policies • Regular shareholder engagement |

| ||

|

|

|

|

ii |

| PERRIGO • 2024 PROXY STATEMENT |

|

|

|

Proxy Summary

Board Refreshment

The Nominating & Governance Committee recommends individuals as director nominees based on various criteria, including their business and professional background, integrity, diversity, understanding of our business, demonstrated ability to make independent analytical inquiries and the willingness and ability to devote the necessary time to Board and committee duties. A director’s qualifications in meeting these criteria are considered at least each time the director is recommended for Board membership. Should a new director be needed to satisfy specific criteria or to fill a vacancy, the Nominating & Governance Committee will initiate a search for potential director nominees, and it will seek input from other Board members, including the CEO and Chairman of the Board, as well as any senior management or outside advisers assisting in identifying and evaluating candidates. The average tenure of our directors is approximately 5 years as of the date of the AGM.

The following have been recent refreshments made to our Board:

Executive Transition / Succession Planning

The Company is led by an Executive Leadership Team (“ELT”) which consists of the Chief Executive Officer ("CEO") and his direct reports. Perrigo and its Board of Directors have long-partnered on a robust Executive Leadership Team Talent Review and Succession planning process. In May 2023, Murray S. Kessler notified the Company of his intent to retire. The Board implemented its succession plan, and on June 8, 2023 appointed Patrick Lockwood-Taylor, a 30-year experienced executive in consumer self-care, as President, CEO and Director, at which time Mr. Kessler retired from those same positions, but remained with the Company in an advisory role to assist with the transition until July 31, 2023.

Additionally, Triona Schmelter was appointed Executive Vice President and President, Consumer Self-Care Americas in September 2023 replacing James Dillard III. Ms. Schmelter was chosen as a key leader with a proven track-record in not only the Consumer Products space but also leading significant business transformation. We continually conduct Talent Reviews and create succession plans for these key roles.

2023 Performance Update1

After completing its transformation to a pure play consumer self-care company in 2022, Perrigo progressed its self-care journey in 2023. The Company has refined its strategy to focus on 1) delivering consumer-preferred brands and innovation, 2) driving category growth with our consumers, 3) powering our business with our world-class, quality assured supply chain, and 4) evolving to a single operating model across business lines and geographies. The goal is to deliver sustainable, value accretive growth by ‘consumerizing’, simplifying and scaling the organization, while earning a top-tier total shareholder return.

In addition to these strategic advancements, the Company maintained its financial momentum in 2023 by 1) achieving record net sales from continuing operations, 2) delivering double-digit gross profit, operating income and EPS improvement year-over-year, and 3) expanding year-over-year and sequential gross and operating margins every quarter during the year. These successes were achieved despite the evolving U.S. regulatory environment within the infant formula industry, which impacted our infant formula business during the year.

|

|

|

PERRIGO • 2024 PROXY STATEMENT |

| iii |

|

|

|

Other strategic highlights include:

Other commercial and business highlights:

Other financial highlights of fiscal year 2023 results from continuing operations include:

|

|

|

iv |

| PERRIGO • 2024 PROXY STATEMENT |

|

|

|

Proxy Summary

|

|

|

PERRIGO • 2024 PROXY STATEMENT |

| v |

|

|

|

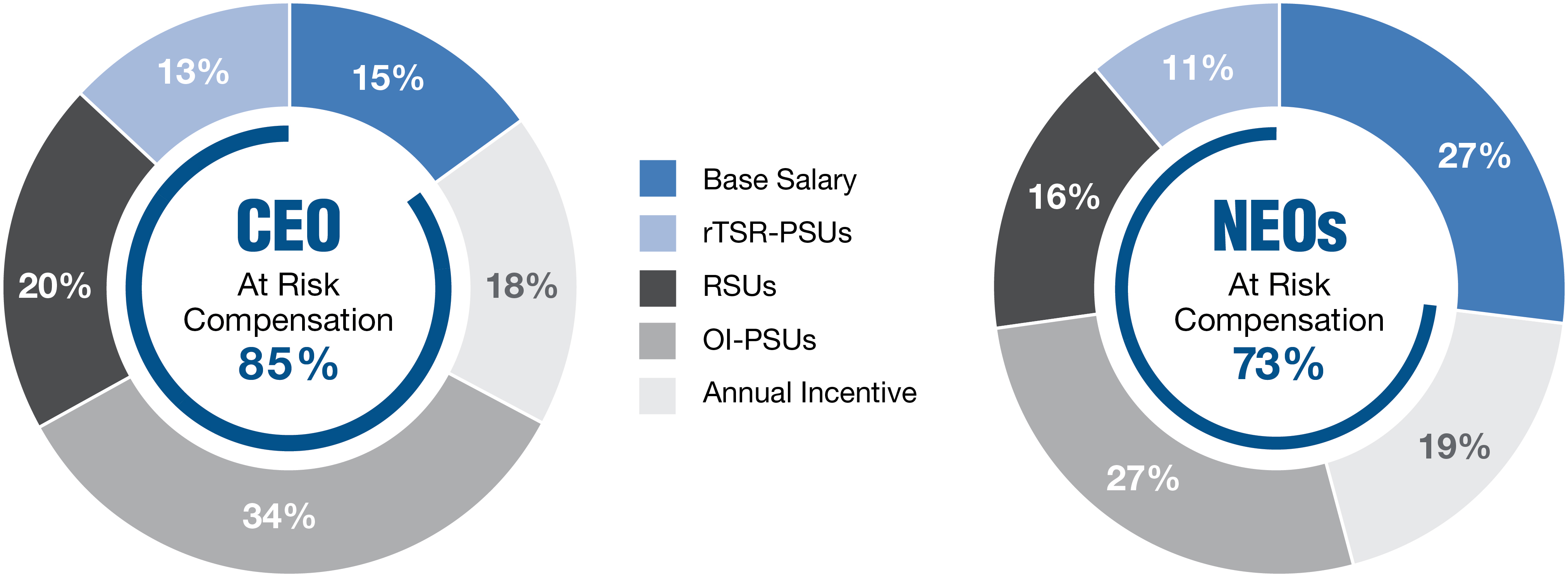

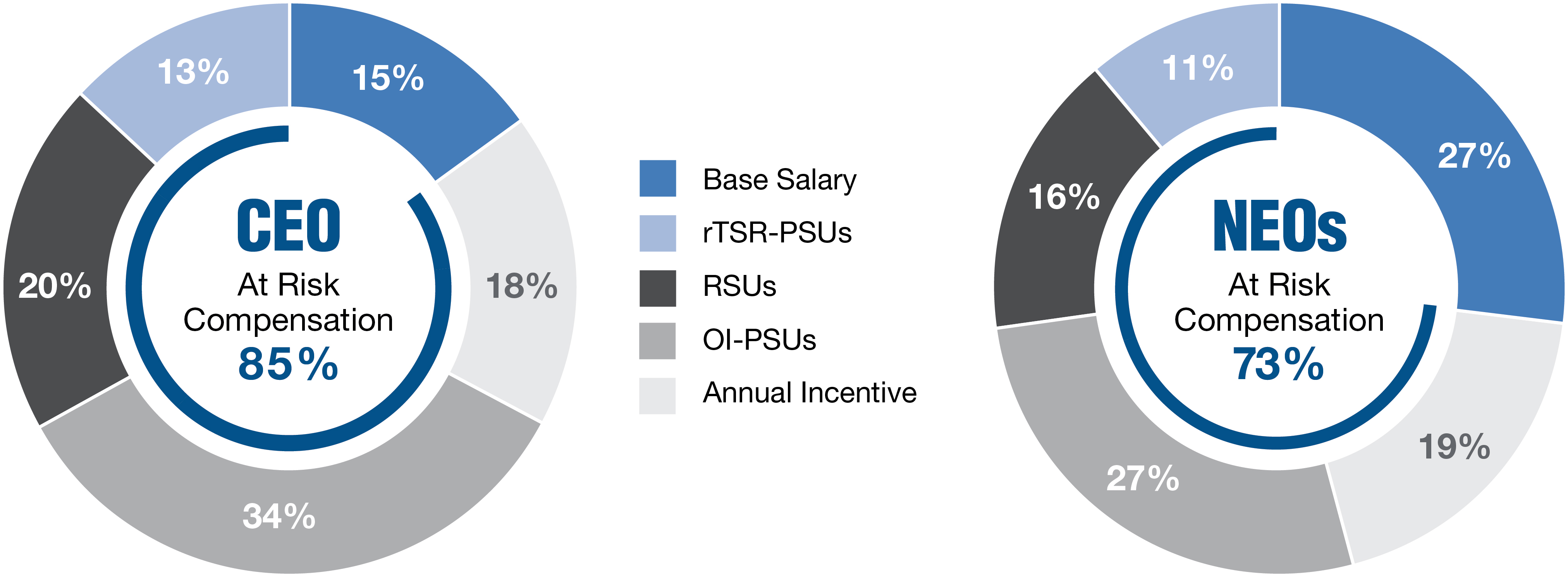

Executive Compensation

Executive Compensation Principles

As a Consumer Self-Care market leader, the Company is focused on our new corporate vision, purpose statement and blueprint to build 'One Perrigo'. Our ability to successfully execute our business strategies will depend in large part on continuing to have the right executive leadership team to guide Perrigo and ensure the long-term success of the company.

For this reason, our executive compensation program is designed to attract, inspire, and retain the highest level of executive talent. Further, our programs are structured to closely align with our business objectives and commitment to shareholder value creation by having the vast majority of our executives' compensation being at risk, not guaranteed, and linked to performance in order to be realized.

|

|

|

|

|

| |

|

|

|

|

|

|

|

| What We Do |

| What We Do Not Do |

| ||

|

|

|

|

|

|

|

|

| Pay-for-Performance philosophy that emphasizes variable, at-risk, performance based, equitable pay |

|

| Permit hedging or pledging of Perrigo stock

Provide significant perquisites

|

|

|

| Directly align executive compensation with shareholder returns through long-term operational, financial, and share price performance |

|

| Provide “single trigger” change in control cash severance benefits

|

|

|

|

|

| Provide excise tax gross-up on any change in control payments |

| |

|

| Mitigate risk by conducting independent annual risk assessments

|

|

|

|

|

|

| Incorporate plan design features that cap maximum level of payouts, use multiple performance metrics and include claw back provisions |

|

|

|

|

|

|

|

|

|

|

|

|

| Have rigorous stock ownership guidelines |

|

|

|

|

|

|

|

|

|

|

|

|

| Use an independent compensation consultant |

|

|

|

|

|

|

|

|

|

|

|

|

| Regularly review annual share utilization and potential dilution from equity compensation plans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

vi |

| PERRIGO • 2024 PROXY STATEMENT |

|

|

|

Proxy Summary

Program Design

2023 Compensation Highlights

|

|

|

PERRIGO • 2024 PROXY STATEMENT |

| vii |

|

|

|

Questions and Answers and Voting Information

Please see the Questions and Answers and Voting Information section beginning on page 79 for important information about voting, the proxy materials, and deadlines for submitting shareholder proposals and director nominees for the 2025 Annual General Meeting of Shareholders. Additional questions may be directed to Perrigo Company plc, Attn: General Counsel, Sharp Building, Hogan Place, Dublin 2, D02 TY74, Ireland or GeneralMeeting@perrigo.com.

|

|

|

viii |

| PERRIGO • 2024 PROXY STATEMENT |

|

|

|

|

|

|

|

|

| Corporate Governance |

|

|

|

|

|

Corporate Governance

General

We manage our business under the direction of our Board of Directors. The Chief Executive Officer ("CEO") is a member of, and reports directly to, our Board, and members of our executive leadership team ("ELT") regularly advise our Board on those business segments for which each executive has management responsibility. Our Board is kept informed through discussions with our CEO and other officers, by reviewing materials provided to them, by visiting our facilities and by participating in Board and committee meetings.

Corporate Governance Guidelines

The Board of Directors has adopted Corporate Governance Guidelines that are available on our website (www.Perrigo.com) under the heading Investors – Corporate Governance – Governance Guidelines. The Board may amend these guidelines from time to time. We will mail a copy of these guidelines to any shareholder upon written request to our Company Secretary, Kyle L. Hanson, at Sharp Building, Hogan Place, Dublin 2, D02 TY74, Ireland or by email at GeneralMeeting@perrigo.com. As part of our ongoing commitment to corporate governance, we periodically review our corporate governance policies and practices for compliance with the provisions of the Sarbanes-Oxley Act of 2002 and the rules and regulations of both the U.S. Securities and Exchange Commission (“SEC”) and the New York Stock Exchange (“NYSE”).

Code of Conduct

Our Code of Conduct acknowledges that a reputation for ethical, moral and legal business conduct is one of Perrigo’s most valuable assets. In addition to acknowledging special ethical and legal obligations for financial reporting, the Code of Conduct requires that our employees, officers and directors comply with laws and other legal requirements, adhere to our policies and procedures, avoid conflicts of interest, protect corporate opportunities and confidential information, conduct business in an honest and ethical manner and otherwise act with integrity and in Perrigo’s best interest. Our Code of Conduct is available on our website (www.Perrigo.com) under the heading – Corporate Responsibility - Policies & Practices – Code of Conduct, and we will promptly post any amendments to or waivers of the Code on our website. We will mail a copy of our Code of Conduct to any shareholder upon request to our Company Secretary, Kyle L. Hanson, at Sharp Building, Hogan Place, Dublin 2, D02 TY74, Ireland, or at GeneralMeeting@perrigo.com.

Director Independence

Our Corporate Governance Guidelines provide that a substantial majority of our directors should meet NYSE independence requirements. A director will not be considered independent unless the Board of Directors determines that the director meets the NYSE independence requirements and has no relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Based on its most recent annual review of director independence, the Board of Directors has determined that ten of our current eleven directors are independent, including Bradley A. Alford, Orlando D. Ashford, Julia M. Brown, Katherine C. Doyle, Adriana Karaboutis, Jeffrey B. Kindler, Erica L. Mann, Albert A. Manzone, Donal O’Connor, Geoffrey M. Parker. Patrick Lockwood-Taylor is not independent under these standards because he is currently serving as an officer of Perrigo.

In making its independence determination, the Board of Directors has broadly considered all relevant facts and circumstances and concluded that there are no material relationships that would impair these directors’ independence.

|

|

|

PERRIGO • 2024 PROXY STATEMENT |

| 1 |

|

|

|

Board Oversight of Risk

While management is responsible for day-to-day risk management, the Board of Directors is responsible for the overall risk oversight, including cybersecurity and Environmental, Social and Governance (“ESG”) risks, and the Audit Committee is responsible for the overall framework for the risk assessment and enterprise risk management (“ERM”) process for the Company. The Board’s committees take the lead in discrete areas of risk oversight when appropriate. For example, the Audit Committee is primarily responsible for risk oversight relating to financial statements; the Talent & Compensation Committee is primarily responsible for risk oversight relating to executive compensation and the Company’s compensation policies and practices, along with corporate culture and diversity; and the Nominating & Governance Committee is primarily responsible for risk oversight relating to corporate governance and cybersecurity, along with sustainability and environmental matters. These committees report to the Board of Directors on risk management matters.

Management periodically presents to the Board of Directors its view of the major risks facing the Company, which may include a dedicated ERM presentation. Matters such as risk appetite and management of risk are also discussed at this meeting. In addition, risk is regularly addressed in a wide range of Board discussions, including those related to segment or business unit activities, specific corporate functions (such as treasury, intellectual property, capital allocation and taxation matters), acquisitions, divestitures and consideration of other extraordinary transactions. As part of these discussions, our directors ask questions, offer insights and challenge management to continually improve its risk assessment and management of identified risks. Additionally, independent directors have the opportunity to meet in executive sessions with management and compliance leaders. The Board has full access to management as well as the ability to engage advisors to assist the Board in its risk oversight role.

The following chart provides a summary overview of key areas of risk oversight for the Board and management.

|

|

|

|

|

| Board of Directors |

|

| |

| Oversees Major Risks

| |||

Strategic and Competitiveness – Financial – Brand and Reputational – Legal and Regulatory | ||||

Operational – Cybersecurity – ESG – Organizational Succession Planning | ||||

|

|

|

2 |

| PERRIGO • 2024 PROXY STATEMENT |

|

|

|

Corporate Governance

|

|

|

|

|

|

| Management |

|

|

|

| Key Risk Responsibilities |

|

|

• Business units identify and manage business risks |

| • Central functions design risk framework, including setting boundaries and monitoring risk appetite |

| • Internal Audit provides independent assurance on design and effectiveness of internal controls and governance practices |

Board Leadership

Our governance documents provide the Board with flexibility to select the appropriate leadership structure for the Company. In making leadership structure determinations, the Board considers many factors, including the specific needs of the business and what is in the best interests of the Company’s shareholders.

Our current leadership structure consists of a separate Chairman of the Board and CEO, and strong, active independent directors. The Board believes that the Company and its shareholders are well-served by this leadership structure at this time. In addition, having three independent Board Committees chaired by independent directors provides a formal structure for strong, independent oversight of the President and CEO and the rest of the Company’s management team.

Chairman of the Board

We have had a separate, independent Chairman of the Board since 2016, and Mr. Ashford has held the position since May 2022. The role of the Chairman includes:

The Chairman is selected from those Perrigo directors who are independent and who have not been a former executive officer of Perrigo. The Chairman position is for an initial term of three years, subject to annual reviews by our Nominating & Governance Committee, annual re-election of that director at the intervening AGMs, and an annual appointment by the independent directors.

Shareholder Engagement

We believe that ongoing, transparent communication with our shareholders is critical to our long-term success. We have a robust shareholder engagement program, and we maintain active, year-round communication with our shareholders and prospective shareholders through a number of forums, including quarterly earnings presentations, investor conferences, securities filings, phone calls, correspondence and individual meetings. These meetings enable two-way dialogue between our shareholders and the Company and provide a forum for our leadership to listen to our shareholders’ perspectives, answer any questions and engage in dialogue on any feedback they may have.

|

|

|

PERRIGO • 2024 PROXY STATEMENT |

| 3 |

|

|

|

We were able to conduct meaningful dialogue with many of our top shareholders, as well as numerous other current and prospective shareholders, on topics such as our business performance and overall corporate strategy, capital allocation, industry and market trends, corporate governance, M&A strategy, ESG, human capital and executive compensation. Throughout 2023, senior management and the investor relations team met with many representatives of current and potential institutional investors representing trillions of dollars in assets under management.

We supplemented the above with targeted outreach to shareholders to engage on overall business strategy, executive compensation, and ESG matters. As part of that engagement, which occurred in late 2023 and early 2024, we reached out to our top 25 investors, representing 67.9% of shares outstanding. We had conversations with 9 of those investors, representing 39.8% of shares outstanding. Company participants included members from investor relations, legal, HR, sustainability & ESG, and finance. Additionally, our Chairman of the Board and Chair of the Talent & Compensation Committee ("TCC") attended several of the meetings representing 22.6% of shares outstanding. We also held meetings with two top proxy advisors.

As part of these engagement efforts, we shared the feedback received from our shareholders during last year's engagement, and the actions we have taken or plan to take to address this feedback. We also shared some proactive information related to our executive compensation philosophy and structure and solicited additional feedback. Specific details on what we heard and how we responded can be found in our Compensation Discussion and Analysis on page 21. In addition to feedback on the compensation program, investors were supportive of our approach and progress on ESG initiatives.

Our shareholders have provided us with valuable feedback and external viewpoints that inform the way we think about our business and strategy, and we are committed to a continuing transparent dialogue.

Anti-Hedging and Anti-Pledging Policies

Our insider trading policy prohibits executive officers and directors of the Company from trading in options, warrants, puts and calls or similar instruments on Company securities and holding Company securities in margin accounts, as well as from pledging Company securities as collateral for a loan. In addition, the policy prohibits Company directors and all employees, including executive officers, from selling Company securities “short”, engaging in “short sales against the box”, and entering into hedging or monetization transactions or similar arrangements with respect to Company securities.

Political Activities and Expenditures

Perrigo recognizes that investors and other stakeholders may be interested in our political activities and expenditures. With this in mind, we provide the following information:

|

|

|

4 |

| PERRIGO • 2024 PROXY STATEMENT |

|

|

|

|

|

|

|

|

| Environmental, Social & Governance (“ESG”) |

|

|

|

|

|

Environmental, Social & Governance (“ESG”)

ESG Strategy & Risk Oversight

At Perrigo, we consider sustainability critical to our business and growth strategy. We are dedicated to conducting our business in a socially, environmentally, and fiscally responsible manner while maintaining transparency in our reporting. We believe that our short- and long-term success is directly linked to responsibly managing our environmental impact, respecting human rights, creating an authentic work environment where our people can thrive, and producing high-quality, affordable products that make consumers' lives better.

Aiming to integrate our ESG strategy into our overall business strategy, we have established the ESG governance structure of Perrigo to facilitate strategic alignment. Oversight of ESG responsibilities is assigned to relevant Board committees, ensuring we conduct regular reviews of significant ESG issues and progress.

Our Nominating & Governance Committee is responsible for sustainability and ESG initiatives, managing risk oversight pertaining to corporate governance, sustainability, and environmental matters. To support these initiatives our President and CEO, along with our Vice President of Sustainability & ESG and other Company leaders, consistently engage with the Board, providing regular consultations and updates on sustainability topics.

Performance objectives are assigned to members of the leadership team to further integrate sustainability into our daily operations. One such goal for our CEO and key executives is to reduce at least 368 metric tons of virgin packaging materials from our products within calendar year 2023, and that goal was exceeded with a reduction of 452 metric tons. Additionally, renewable energy and utility reduction targets are assigned to the EVP of Operations and Supply Chain, while Diversity, Equity and Inclusion ("DEI") objectives are assigned to multiple members of the Perrigo Executive Leadership Team.

Under the leadership of our Vice President of Sustainability and ESG, our ESG team is composed of experts responsible for steering the strategy, implementation, and reporting of our global ESG and sustainability initiatives, encompassing areas such as climate change, packaging and human rights. The Global Sustainability team maintains regular communication with internal and external stakeholders, gathering valuable perspectives that inform our strategies, program decisions, and focus.

Reporting and Disclosures:

We report our progress against our commitments and programs each year in our annual sustainability and ESG report. Over the last few years, we have adopted multiple frameworks to guide our efforts, including:

Additional information about our sustainability efforts and commitments, including our annual sustainability report, our Sustainability and Accounting Standards (SASB) Index, and Task Force on Climate-related Financial Disclosures (TCFD), can be found in the sustainability section of our website: www.Perrigo.com - Our Commitment to the Environment. References to reports and the website are for informational purposes only, and neither the sustainability report nor other information on our website is incorporated by reference herein.

|

|

|

PERRIGO • 2024 PROXY STATEMENT |

| 5 |

|

|

|

Environmental, Social and Governance Highlights

Since 2021, we revitalized and continuously updated our environmental sustainability strategy, emphasizing three key pillars: climate and operations, plastics and packaging, and our supply chain. This realignment ensures a sharper focus and greater alignment with global standards and the growing array of customer sustainability programs.

Climate & Energy: In 2021, we committed to attain net-zero carbon emissions by 2040. Recognizing the challenges this goal presents in a manufacturing environment, we pledged to reduce our own emissions by 42% by 2030. Additionally, we aim to transition to 100% renewable energy in our own operations by 2026. In 2022, over 9% of our total electricity usage came from renewable sources and we secured multiple new agreements that took effect in calendar year 2023.

Water Stewardship: We are measuring our impacts in the areas where our influence is the greatest—the communities in which we operate. In 2022, we withdrew 291 million gallons of fresh water for our manufacturing sites. Approximately 3% of these came from regions considered high-water stress by the World Resource Institute.

Packaging: We are promoting a circular economy. As a fast-moving consumer goods company, packaging is core to our business and our products. We have set goals to improve consumer recyclability, increase recycled content and reduce packaging material usage through design innovations. In 2023, our executive ESG goal was to reduce at least 368 metric tons of virgin packaging in the year and we exceeded this goal with 452 metric tons of reduction.

Human Rights: We are committed to the fight against modern slavery, child labor, unsafe working conditions and any other form of human rights abuse. We maintain a robust set of ethical standards that apply to all employees of Perrigo globally, as well as any contractors, suppliers, and other third parties doing business on our behalf. In 2022, we conducted more than 170 third-party ethical and social audits, 50 supplier visits and 120 formal self-assessments of our sites and suppliers within the supply chain.

People & Communities: As a philanthropic leader in the community, we are dedicated to cultivating a culture that makes lives better, not just through our products but also through our actions. We firmly believe that community engagement not only directly benefits our associates but also contributes to building morale. In 2022, our contributions amounted to a total of $5.1 million in cash and products worldwide. Our primary initiatives centered on supporting employees in Ukraine and providing disaster relief for Hurricane Ian.

For more details, see the Sustainability and ESG report available on www.Perrigo.com. The next Sustainability and ESG report will be published mid-year and will cover the performance data for calendar year 2023.

|

|

|

6 |

| PERRIGO • 2024 PROXY STATEMENT |

|

|

|

Environmental, Social & Governance (“ESG”)

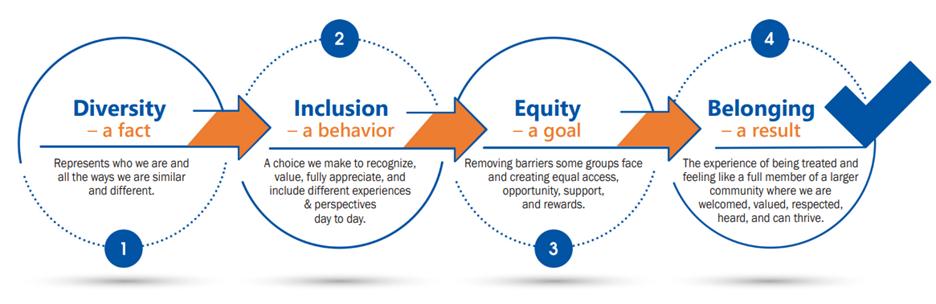

Building a Winning Culture through Belonging

Where all colleagues feel welcomed, valued, respected, and heard, and part of a thriving global community.

In early 2023, Perrigo created our next 3-year strategy and introduced the concept of belonging to the organization. Belonging is considered by many to be one of the most effective DEI measures, sitting at the intersection of DEI and engagement. Higher levels of belonging lead to significant increases in engagement, satisfaction, performance, how we handle adversity, well-being and more. We believe that building a winning culture through belonging helps us do our best work for ourselves, each other, and the consumers we serve.

2023 Strategy Focused Action Examples:

Strategy Focus | Build Inclusive Mindsets | Manage Talent Equitably | Enable Leaders & Embed Accountability

|

Intended Outcome (long-term) | All colleagues clearly understand what a culture of belonging looks like and can recognize characteristics within their own team.

| All colleagues can thrive because our talent systems & processes drive decisions and achieve results that are equitable. | All leaders clearly understand how to utilize DEI as a lens to make strategic decisions that influence belonging. |

Action Examples | Belonging campaign • Defined belonging & educated workforce • Introduced “Everyday Actions to Build Belonging” • Leader discussion guides & FAQs • “About Me” Belonging profiles • Microaggressions & microaffirmations workshop | Engagement survey • Implemented improved engagement survey tool & process • Measured 6 DEI categories: Belonging, Collaboration, Recognition, Inclusion, Speak My Mind, & Diversity Commitment • Identified baseline & designed improvement action plans | Conversations That Matter • Connected DEI to Perrigo’s Culture Framework • Provided leaders 7 goals related to DEI in 2023 in the form of “Conversations That Matter” • Example goal – Everyone on your team knows how we define inclusion and understands the behaviors that support it |

|

|

|

PERRIGO • 2024 PROXY STATEMENT |

| 7 |

|

|

|

Diversity Data: (From 2019 to Year End 2023)

Independent Board Diversity 20% |

Executive Leadership Team 9% |

Global Female Leaders 41% |

Global Female Total 50% | |||

U.S. People of Color 19 |

U.S. Veteran 3% |

U.S. Disability 4% |

Countries 35 | |||

* Reflects self-disclosed gender and/or race/ethnicity reporting

2024 Priorities:

Strategy Focus | Build Inclusive Mindsets | Manage Talent Equitably | Enable Leaders & Embed Accountability

|

Intended Outcome (long-term) | All colleagues clearly understand what a culture of belonging looks like and can recognize characteristics within their own team.

| All colleagues can thrive because our talent systems & processes drive decisions and achieve results that are equitable. | All leaders clearly understand how to utilize DEI as a lens to make strategic decisions that influence belonging. |

Priority Focus: | Partner with leaders to further implement drivers of increased belonging and greater cultural competency. Prioritize teams with below benchmark belonging scores. | Adding new methods and processes to source and select best-in-class talent that enables us to serve all consumers. Train Talent Acquisition and Leaders on improved selection. | Conduct focus groups to understand what drives retention for Perrigo. Partner with leaders to influence belonging and retention actions. Improve exit interview process. |

Success Measure: | Business Unit and Team scores against benchmark levels as reported by Engagement survey partner and belonging score increases by 2%. | Increase in applicant flow of talent from historically underrepresented U.S communities leading to increased representation of underrepresented communities.

| Increase retention of colleagues that identify with historically underrepresented U.S. communities. |

TOGETHER, we make lives better! |

|

|

|

|

8 |

| PERRIGO • 2024 PROXY STATEMENT |

|

|

|

Environmental, Social & Governance (“ESG”)

Human Capital Management

Perrigo has updated its vision, "To Provide the Best Self-Care for Everyone" and its purpose to "Make lives Better Through Trusted Health and Wellness Solutions, Accessible to All". We are passionate about making lives better. At Perrigo, we believe that the continuous personal and professional development of our people is an important component of our ability to attract, retain, and motivate top talent, which are all important aspects of our self-care strategy. Our global workforce consists of more than 9,100 full time and part time employees spread across 33 countries, of which approximately 20% were covered by collective agreements as of December 31, 2023. We continuously endeavor to provide a diverse, inclusive, and safe work environment so our colleagues can bring their best to work, every day. Each of us is responsible for upholding Perrigo’s Core Values – Integrity, Respect, Responsibility, and Curiosity and our Culture Framework.

Total Rewards

Our Total Rewards philosophy is to continuously attract, engage and inspire our People by designing Total Rewards that reinforce Belonging at Perrigo and align with our Values and Winning Culture, helping to fulfill Perrigo's Vision. Our total rewards package delivers competitive pay, cash-based incentives, broad-based stock grants, retirement benefits, leading healthcare, paid time off, and on-site services, amongst other benefits.

Well-being

Perrigo is pleased to offer all colleagues and their household members well-being programs including mindfulness training, life coaching, free counseling services, legal & financial guidance and referrals, education resources and more.

We continue to enhance our global well-being offering to include a global Employee Assistance Program (“EAP”) to further empower the emotional self-care and well-being of our people and their families at no cost to them. The EAP focuses on providing resources and professional support in the areas of physical, emotional, financial, work-life, community, and educational well-being.

Additionally, we are proud to continue our “HEALTHYyou” well-being program that supports our colleagues and their families in maintaining and improving their health as they navigate their own self-care and well-being journeys. This program is highly valued by our colleagues, and it continues to be recognized externally by receiving the “Best and Brightest in Wellness™ Award every year since 2017.

Health & Safety

Perrigo’s commitment to self-care starts with our own team. Protecting our people on the job is imperative. From our aggressive safety goals to our behavior-based Perrigo Auditing Safety System (“PASS”) observations program, our programs are some of the most robust and transparent in the industry. We work hard to exceed regulations, ensure our employees are well-trained and foster safe workplace environments. Doing so allows us to continuously deliver high-quality self-care products to our customers and consumers.

Growth

We are committed to engaging our colleagues and to fostering a belonging culture, where our people feel enabled to contribute their best to Perrigo’s self-care vision. This includes initiatives supporting overall job satisfaction and personal and professional skill development.

Our development philosophy focuses on a 70-20-10 approach, which provides a practical, blended framework for learning to support individual long-term success (where individuals obtain 70% of their knowledge from job-related experiences, 20% from interactions with others, and 10% from formal educational events).

The primary means of learning and development of our colleagues is through meaningful and challenging work. We have a robust process for identifying talent and matching them with opportunities to stretch through our talent review process.

|

|

|

PERRIGO • 2024 PROXY STATEMENT |

| 9 |

|

|

|

We continue to develop a healthy pipeline of diverse internal talent to progress through the organization and have healthy rates of retention. These are strong indicators of our ability to grow capability internally.

Personal development and learning are guided by ongoing conversations and feedback as part of our performance management philosophy. Our leaders are encouraged to hold regular career development conversations with our colleagues and support them to find job related experiences to help them get one step closer to reaching their potential. Our approach resulted in 935 promotions in 2023. Additionally, 360 people made lateral moves to grow their career experience.

Continuous Learning

We start this process with our new colleagues who are all given a structured orientation and onboarding for faster integration. We also empower colleagues to take control of their own development by providing access to our GROWyou personal development curriculum. We expanded access to personal and professional skill development by continuing to partner with LinkedIn Learning. This platform supplements our curriculum by offering colleagues 24/7 access to over 18,000 on-demand self-study courses. Growing our colleagues through ongoing challenging work opportunities and feedback relies on continually improving the quality of our leadership. We continue to improve our ability to identify our future leaders and provide development for them through our Leadership in Action development program. Last year 72 leaders completed the program.

We also piloted the first two of our suite of leadership development programs in 2023 - Aspire for aspiring leaders and Impact for first time leaders. 190 colleagues participated in the pilot programs in 2023.

Engagement

Perrigo regularly conducts global engagement surveys to gather feedback from colleagues to identify strengths and opportunities within our culture. Additionally, we use a variety of channels to facilitate open and direct communication, including regular open forums and town hall meetings with our executive leadership team.

In 2023 we introduced a new survey program where we routinely track six topics, Growth, Belonging, Well-Being, Purpose, Empowerment and Clarity. In addition, we track an overall measure of engagement "eSat" which stands for engagement and satisfaction Score. eSat scores range from 0 (worst) to 100 (best), with 50 being the middle, and reflect the average response to the question: “How happy are you working at your company?”. This question has proven to have the highest correlation with the drivers of engagement, along with outcomes such as retention and productivity. The eSat question is asked with every engagement survey so that engagement can be tracked continually. Our eSat score in 2023 was 70.

|

|

|

10 |

| PERRIGO • 2024 PROXY STATEMENT |

|

|

|

|

|

|

|

|

| Board of Directors and Committees |

|

|

|

|

|

Board of Directors and Committees

Perrigo’s Board of Directors met 6 times during 2023. The Board of Directors has standing Audit, Talent & Compensation and Nominating & Governance Committees, and there were a total of 20 formal committee meetings during 2023. Each director attended at least 75% of the regularly scheduled and special meetings of the Board and Board committees on which he or she served during 2023.

We encourage all of our directors to attend our annual general meetings, and all directors then serving participated in the AGM in 2023.

The Board has adopted a charter for each of the Audit, Talent & Compensation and Nominating & Governance Committees that specifies the composition and responsibilities of each committee. Copies of the charters are available on our website (www.Perrigo.com) under Investors – Corporate Governance – Committees and are available in print to shareholders upon request to our Company Secretary, Kyle L. Hanson, Sharp Building, Hogan Place, Dublin 2, D02 TY74, Ireland, or GeneralMeeting@perrigo.com.

Audit Committee

During 2023, the Audit Committee met 7 times. The Audit Committee currently consists of the following independent directors: Donal O’Connor (Chair), Katherine C. Doyle and Geoffrey M. Parker.

The Audit Committee monitors our accounting and financial reporting principles, policies and internal controls. It is directly responsible for the compensation and oversight of the work of the independent registered public accounting firm in the preparation and issuance of audit reports and related work, including the resolution of any disagreements between management and the independent registered public accounting firm regarding financial reporting. It is also responsible for overseeing the work of our internal audit function. Additional information on the committee and its activities is set forth in the Audit Committee Report on page 61.

The Board of Directors has determined that each member of the Audit Committee (1) meets the audit committee independence requirements of the NYSE listing standards and the rules and regulations of the SEC and (2) is able to read and understand fundamental financial statements, as required by the NYSE listing standards. The Board has also determined that Donal O’Connor, Katherine C. Doyle and Geoffrey M. Parker have the requisite attributes of an “Audit Committee Financial Expert” under the SEC’s rules and that such attributes were acquired through relevant education and work experience.

Talent & Compensation Committee

During 2023, the Talent & Compensation Committee (“TCC”) met 7 times. The TCC currently consists of the following independent directors: Jeffrey B. Kindler (Chair), Bradley A. Alford, Erica L. Mann and Albert A. Manzone.

The TCC reviews and recommends to the Board compensation arrangements for the CEO and non-employee directors. It also reviews and approves the annual compensation for executive officers, including salaries, annual incentives, and long-term incentive compensation. The TCC administers Perrigo’s annual incentive and long-term incentive plans. The TCC also reviews and makes recommendations to the Board regarding corporate culture, diversity, equity, and inclusion initiatives.

The TCC engaged Frederic W. Cook & Company, Inc. (“FW Cook”) as its independent consultant to provide independent, outside perspective and consulting services on Perrigo’s executive compensation and non-employee director programs. Additionally, FW Cook assists the TCC in considering and analyzing market practices, trends, and management’s compensation recommendations. Perrigo did not retain FW Cook to perform any other compensation-related or consulting services for the Company. Interactions between FW Cook and management were generally limited to discussions on

|

|

|

PERRIGO • 2024 PROXY STATEMENT |

| 11 |

|

|

|

behalf of the TCC or as required to compile information at the TCC’s direction. Based on these factors, its own evaluation of FW Cook’s independence pursuant to the requirements approved and adopted by the SEC and the NYSE, and information provided by FW Cook, the TCC has determined that the work performed by FW Cook did not raise any conflicts of interest.

Additional information regarding the processes and procedures of the TCC is presented in the Compensation Discussion and Analysis, beginning on page 21.

Nominating & Governance Committee

During 2023, the Nominating & Governance Committee met formally 6 times. In addition, members of the Nominating & Governance Committee met together with advisors regularly in connection with board refreshment, management succession, and self-assessment planning activities. The Nominating & Governance Committee currently consists of the following independent directors: Adriana Karaboutis (Chair), Orlando D. Ashford, Katherine C. Doyle and Donal O'Connor.

The Nominating & Governance Committee identifies and recommends to the Board qualified director nominees. This committee also develops and recommends to the Board the Corporate Governance Guidelines applicable to Perrigo, leads the Board in its annual review of Board performance and makes recommendations to the Board with respect to the assignment of individual directors to various committees as well as succession planning.

Board oversight of global cybersecurity and information security risk

The Nominating & Governance Committee meets separately in advance of each regular Board meeting and when needed in the event of a specific cyber threat. The Chair of the Nominating & Governance Committee regularly reports out to the Board on key matters considered by the Committee.

The Nominating & Governance Committee routinely engages with relevant management on a range of cybersecurity-related topics, including the threat environment and vulnerability assessments, policies and practices, technology trends and regulatory developments from the Chief Information Officer (“CIO”) and Chief Information Security Officer (“CISO”). The Board is periodically briefed on related cybersecurity matters from other executives from Legal, Privacy, IT, and external experts related to breach management, external attestation of the company’s cyber practices and processes, and evolving cyber matters that may inform the company’s cyber strategy and approach.

The Board of Directors is responsible for understanding and regularly reviewing the entity’s cyber risk management strategy and execution. The Board’s Nominating & Governance Committee, comprised solely of independent Directors, is charged with oversight of risks related to global cybersecurity and operational resiliency. The Board includes at least one member with cybersecurity and technology experience.

As part of its objective, independent oversight of the key risks facing our company, the Board ensures that management is protecting the company’s data and systems, with a keen focus on global cybersecurity and information security risk which are critical components of our risk management program.

We use a risk-based, “all threats” and “defense in depth” approach to identify, protect, detect, respond to and recover from cyber threats. Recognizing that no single technology, process or business control can effectively prevent or mitigate all risks, we employ multiple technologies, processes and controls, all working independently but as part of a cohesive strategy to minimize risk. This strategy is regularly tested by external parties through auditing, penetration testing, and other exercises designed to assess and test our cyber health, resiliency and the effectiveness of our program.

|

|

|

12 |

| PERRIGO • 2024 PROXY STATEMENT |

|

|

|

Board of Directors and Committees

Executive Sessions of Independent Directors

The independent members of the Board of Directors hold regularly scheduled meetings in executive session without management, and they also meet in executive session with the CEO on a regular basis.

Board and Committee Self-Assessments

The Board and the Audit, Talent & Compensation and Nominating & Governance Committees have historically conducted annual self-assessments, either through the use of extensive internal questionnaires or third parties. Through this process, directors evaluate the composition, effectiveness, processes and skills of the Board and individual Committees and identify areas that may merit further focus or consideration. The results of the assessments are reviewed and discussed by members of the Nominating & Governance Committee, which then reports to and leads a discussion with the full Board.

Shareholder Communications with Directors

Shareholders and other interested parties may communicate with any of our directors or with the independent directors as a group by writing to them in care of our Company Secretary, Kyle L. Hanson, at Sharp Building, Hogan Place, Dublin 2, D02 TY74, Ireland. Relevant communications will be distributed to the appropriate directors depending on the facts and circumstances outlined in the communication. In accordance with the policy adopted by our independent directors, any communications that allege or report significant or material fiscal improprieties or complaints about internal accounting controls or other accounting or auditing matters will be immediately sent to the Chair of the Audit Committee and, after consultation with the Chair, may be sent to the other members of the Audit Committee. In addition, the Chairman of the Board will be advised promptly of any communications that allege misconduct on the part of Perrigo management or that raise legal or ethical concerns about Perrigo’s practices or compliance concerns about Perrigo’s policies. The General

|

|

|

PERRIGO • 2024 PROXY STATEMENT |

| 13 |

|

|

|

Counsel maintains a log of all such communications, which is available for review by any Board member upon his or her request.

Director Nominations

The Nominating & Governance Committee is responsible for screening and recommending candidates for service as a director and considering recommendations offered by shareholders in accordance with our Articles of Association. The Board as a whole is responsible for approving nominees. The Nominating & Governance Committee recommends individuals as director nominees based on various criteria, including their business and professional background, integrity, diversity, understanding of our business, demonstrated ability to make independent analytical inquiries and the willingness and ability to devote the necessary time to Board and committee duties. A director’s qualifications in meeting these criteria are considered at least each time the director is recommended for Board membership. Should a new director be needed to satisfy specific criteria or to fill a vacancy, the Nominating & Governance Committee will initiate a search for potential director nominees, and it will seek input from other Board members, including the CEO and Chairman of the Board, as well as any senior management or outside advisers assisting in identifying and evaluating candidates.

Shareholders may nominate candidates for consideration at an annual general meeting by following the process described in the Articles of Association and summarized in this proxy statement under “Voting Information – How do I submit a shareholder proposal or director nomination for the next AGM?”

Upon a change in a director’s job responsibility, including retirement, our Corporate Governance Guidelines require the director to tender his or her resignation from the Board. The Nominating & Governance Committee will consider the change in circumstance and make a recommendation to the Board to accept or reject the offer of resignation.

Proxy Access

Proxy access has been a part of Perrigo since 2017 and allows eligible shareholders to include their own director nominees in Perrigo’s proxy materials along with the candidates nominated by the Board. This right is summarized in this proxy statement under “Voting Information – How do I use proxy access to nominate a director candidate for the next AGM?”

Board Refreshment

As set out within the 'Director Nominations' section, the Board is committed to thoughtful board refreshment and ongoing board succession planning. Albert A. Manzone was appointed to the board in July 2022. Patrick Lockwood-Taylor was appointed to the Board in July 2023, following his appointment as President & CEO. Julia M. Brown was appointed to the Board in November 2023.

As of the date of the AGM, the average tenure of our non-employee directors will be approximately 5 years.

Stock Ownership

Under our Corporate Governance Guidelines, each director who is not a Perrigo employee is required to attain stock ownership at a level equal to six times their annual cash retainer. Non-employee directors are subject to the same definition of stock ownership and retention requirements as executive officers. The details of the Stock Ownership Guidelines (“SOGs”) are described in the Compensation Discussion and Analysis – Other Policies, Practices and Guidelines – Executive Stock Ownership Guidelines section, on page 37. All of our non-employee directors and named executive officers are in compliance with these guidelines, either by satisfying applicable ownership levels or complying with the retention requirements.

|

|

|

14 |

| PERRIGO • 2024 PROXY STATEMENT |

|

|

|

|

|

|

|

|

| Certain Relationships and Related-Party Transactions |

|

|

|

|

|

Our Code of Conduct precludes our directors, officers and employees from engaging in any type of activity, such as related-party transactions, that might create an actual or perceived conflict of interest. In addition, our Board of Directors adopted a Related-Party Transaction Policy that requires that all covered related-party transactions be approved or ratified by the Nominating & Governance Committee. Under that policy, each executive officer, director or director nominee must promptly notify the Chair of the Nominating & Governance Committee and our General Counsel in writing of any actual or prospective related-party transaction covered by the policy. The Nominating & Governance Committee, with input from our Legal Department, reviews the relevant facts and approves or disapproves the transaction. In reaching its decision, the Nominating & Governance Committee considers the factors outlined in the policy, a copy of which is available on our website (www.Perrigo.com) under the heading Investors – Corporate Governance – Related-Party Transaction Policy.

In addition, on an annual basis, each director and executive officer completes a directors’ and officers’ questionnaire that requires disclosure of any transactions with Perrigo in which he or she, or any member of his or her immediate family, has a direct or indirect material interest in Perrigo. The Nominating & Governance Committee reviews the information provided in response to these questionnaires.

Based on its review of applicable materials, the Nominating & Governance Committee has determined that there are no transactions that require disclosure in this proxy statement.

|

|

|

PERRIGO • 2024 PROXY STATEMENT |

| 15 |

|

|

|

|

|

|

|

| Director Compensation |

|

|

|

|

|

|

Director Compensation

The Talent & Compensation Committee reviews and makes a recommendation to the Board regarding non-employee director compensation. In determining the level and mix of compensation for non-employee directors, the Talent & Compensation Committee considers our executive compensation peer group and other market data, practices and trends as well as information and analyses provided by FW Cook, its independent consultant.

In 2023, there were no changes to the level and mix of compensation for non-employee directors. All of our non-employee directors were paid an annual cash retainer, and a supplemental annual cash retainer was also paid to committee chairs, the Chairman, and non-chair committee members all as described below.

Chairman Annual Cash Retainer: (in lieu of director retainer) | $150,000 | |

Director Annual Cash Retainer | $75,000 | |

Committee Member Retainer: | ||

Audit | $12,500 | |

Talent & Compensation | $12,500 | |

Nominating & Governance | $ 8,000 | |

Committee Chair Retainer: (in lieu of member retainer) | ||

Audit | $25,000 | |

Talent & Compensation | $25,000 | |

Nominating & Governance | $16,000 | |

For 2023, our Chairman of the Board and other non-employee directors received annual equity awards in the form of restricted stock units having a value of approximately $375,000 and $300,000, respectively. These awards vest one year from the grant date and are intended to directly link the majority of director compensation to shareholders’ interests. For Directors who are appointed mid-year, we routinely provide a pro-rated grant.

Directors who are Perrigo employees receive no compensation for their service as directors.

|

|

|

16 |

| PERRIGO • 2024 PROXY STATEMENT |

|

|

|

Director Compensation

The following table summarizes the 2023 compensation of our non-employee directors who served during the year.

Director Compensation

Name |

| Fees Earned or |

| Stock Awards |

| Total | |||

O'Connor, Donal |

| 105,304 |

|

| 299,992 |

|

| 405,296 |

|

Parker, Geoffrey M. |

| 87,500 |

|

| 299,992 |

|

| 387,492 |

|

Samuels, Theodore 2 |

| 32,771 |

|

| — |

|

| 32,771 |

|

Alford, Bradley A. |

| 87,500 |

|

| 299,992 |

|

| 387,492 |

|

Kindler, Jeffrey B. |

| 100,000 |

|

| 299,992 |

|

| 399,992 |

|

Karaboutis, Adriana |

| 91,000 |

|

| 299,992 |

|

| 390,992 |

|

Mann, Erica L. |

| 87,500 |

|

| 299,992 |

|

| 387,492 |

|

Doyle, Katherine C. |

| 92,804 |

|

| 299,992 |

|

| 392,796 |

|

Ashford, Orlando D. |

| 158,000 |

|

| 374,990 |

|

| 532,990 |

|

Manzone, Albert A. |

| 87,500 |

|

| 299,992 |

|

| 387,492 |

|

Brown, Julia M. 3 |

| 12,534 |

|

| — |

|

| 12,534 |

|

|

|

|

PERRIGO • 2024 PROXY STATEMENT |

| 17 |

|

|

|

|

|

|

|

| Ownership of Perrigo Ordinary Shares |

|

|

|

|

|

|

Directors, Nominees and Executive Officers

The following table shows how many Perrigo ordinary shares the directors, nominees, and named executive officers, individually and collectively, beneficially owned as of March 4, 2024. The percent of class owned is based on Perrigo ordinary shares outstanding as of that date. The named executive officers are the individuals listed on page 22.

Beneficial ownership is a technical term broadly defined by the SEC to mean more than ownership in the usual sense. In general, beneficial ownership includes any shares a shareholder can vote or transfer and stock options and restricted stock units that are vested currently or become vested within 60 days. Except as otherwise noted, the shareholders named in this table have sole voting and investment power for all shares shown as beneficially owned by them.

| Ordinary Shares |

| Shares Acquirable Within 60 |

| Total |

| Percent | |||

Director |

|

|

|

|

|

|

| |||

Bradley A. Alford |

| 31,453 |

|

| 8,764 |

|

| 40,217 |

| * |

Orlando D. Ashford |

| 10,037 |

|

| — |

|

| 10,037 |

| * |

Julia M. Brown |

| — |

|

| — |

|

| — |

| * |

Katherine C. Doyle |

| 10,406 |

|

| — |

|

| 10,406 |

| * |

Adriana Karaboutis |

| 17,922 |

|

| — |

|

| 17,922 |

| * |

Jeffrey B. Kindler |

| 18,450 |

|

| 8,764 |

|

| 27,214 |

| * |

Patrick Lockwood-Taylor |

| 20,500 |

|

| — |

|

| 20,500 |

| * |

Erica L. Mann |

| 12,901 |

|

| — |

|

| 12,901 |

| * |

Albert A. Manzone |

| 2,848 |

|

| — |

|

| 2,848 |

| * |

Donal O'Connor (2) |

| 22,128 |

|

| 8,764 |

|

| 30,892 |

| * |

Geoffrey M. Parker (3) |

| 47,084 |

|

| — |

|

| 47,084 |

| * |

Named Executive Officers Other Than Directors |

|

|

|

|

|

|

| |||

Murray S. Kessler |

| — |

|

| 217,655 |

|

| 217,655 |

| * |

Eduardo Bezerra |

| 8,428 |

|

| 4,870 |

|

| 13,298 |

| * |

James Dillard III |

| 25,130 |

|

| 27,546 |

|

| 52,676 |

| * |

Svend Andersen (4) |

| 82,424 |

|

| 56,851 |

|

| 139,275 |

| * |

Kyle L. Hanson |

| 8,766 |

|

| 3,518 |

|

| 12,284 |

| * |

Ronald Janish (5) |

| 25,163 |

|

| 42,869 |

|

| 68,032 |

| * |

Directors and Executive Officers as a Group (20 Persons) (6) |

| 279,338 |

|

| 240,907 |

|

| 520,245 |

| 0.4% |

* Less than 1%.

|

|

|

18 |

| PERRIGO • 2024 PROXY STATEMENT |

|

|

|

Ownership of Perrigo Ordinary Shares

Other Principal Shareholders

The following table shows all shareholders other than directors, nominees and named executive officers that we know to be beneficial owners of more than 5% of Perrigo’s ordinary shares. The percent of class owned is based on 135,515,939 Perrigo ordinary shares outstanding as of March 4, 2024.

Name and Address of Beneficial Owner | Ordinary Shares Beneficially Owned | Percent of Class | ||||||||

The Vanguard Group(1) 100 Vanguard Blvd. Malvern, PA 19355 | 14,994,309 | 11.07% | ||||||||

BlackRock Inc.(2) 55 East 52nd Street New York, NY 10055 | 13,342,622 | 9.85% | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PERRIGO • 2024 PROXY STATEMENT |

| 19 |

|

|

|

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934 requires that Perrigo’s executive officers, directors and 10% shareholders file reports of ownership and changes of ownership of Perrigo ordinary shares with the SEC. Based on a review of copies of these reports filed with the SEC and written representations from executive officers and directors, all filing requirements were met during 2023, such that there were no delinquent reports in 2023.

|

|

|

20 |

| PERRIGO • 2024 PROXY STATEMENT |

|

|

|

|

|

|

|

|

| Executive Compensation |

|

|

|

|

|

Executive Compensation

Compensation Discussion and Analysis

Introduction

After completing its transformation to a pure play consumer self-care company in 2022, Perrigo progressed its self-care journey in 2023. The Company has refined its strategy to focus on 1) delivering consumer-preferred brands and innovation, 2) driving category growth with our consumers, 3) powering our business with our world-class, quality assured supply chain, and 4) evolving to a single operating model across business lines and geographies. The goal is to deliver sustainable, value accretive growth by ‘consumerizing’, simplifying and scaling the organization, while earning a top-tier total shareholder return.

In addition to these strategic advancements, the Company maintained its financial momentum in 2023 by 1) achieving record net sales from continuing operations, 2) delivering double-digit gross profit, operating income and EPS improvement year-over-year, and 3) expanding year-over-year and sequential gross and operating margins every quarter during the year. These successes were achieved despite the evolving U.S. regulatory environment within the infant formula industry, which impacted our infant formula business during the year.

Other strategic highlights include:

Other commercial and business highlights:

|

|

|

PERRIGO • 2024 PROXY STATEMENT |

| 21 |

|

|

|

Other financial highlights of fiscal year 2023 results from continuing operations include:

Our Named Executive Officers for 2023

Perrigo’s named executive officers (“NEO”) for 2023 were:

Named Executive Officer | Position | |

Patrick Lockwood-Taylor | President and Chief Executive Officer | |

Murray S. Kessler |

| Former President and Chief Executive Officer |

Eduardo Bezerra |

| Executive Vice President and Chief Financial Officer |

James Dillard III | Former Executive Vice President and President, Consumer Self-Care Americas | |

Svend Andersen | Executive Vice President and President, Consumer Self-Care International | |

Kyle L. Hanson | Executive Vice President, General Counsel, and Company Secretary | |

Ronald Janish | Executive Vice President, Global Operations & Supply Chain Chief Transformation Officer |

This Compensation Discussion and Analysis provides information about our executive compensation program, factors that were considered in making compensation decisions for our NEOs, and details on our programs designed to drive Perrigo’s performance into the future.

|

|

|

22 |

| PERRIGO • 2024 PROXY STATEMENT |

|

|

|

Executive Compensation

2023 Say-on-Pay Voting Results

At our 2023 AGM, our shareholders approved our executive compensation, with 67.2% of the votes cast voting in favor of the say-on-pay proposal. While approved by a majority, this was a decline relative to the prior year and was below the level the Talent & Compensation Committee ("TCC") felt was acceptable. As part of our engagement efforts following our AGM, we explicitly included executive compensation as part of our proposed agenda to proactively solicit our investors feedback and have a dialogue on our executive compensation program.

We reached out to our top 25 investors, representing 67.9% of shares outstanding. We had conversations with 9 of those investors representing 39.8% of shares outstanding. Company participants included members from investor relations, legal, HR, sustainability & ESG, and finance.

Additionally, several of these meetings were attended by our Chair of the TCC and Chairman of Board of Directors representing 22.6% of shares outstanding. We also reached out to and engaged with two top proxy advisors. Our Chair of the TCC also joined those meetings.

During these calls we received candid feedback from our shareholders and took the opportunity to have a robust discussion on our executive compensation program. Feedback from our shareholders varied with many supporting the overall compensation program. Other investors also noted there was room for improvement in our disclosures when discussing our compensation program and the rationale behind certain decisions. During these calls, a few central themes emerged. What we heard and how responded is below:

What We Heard | How We Responded | |

|

| |

|

| |

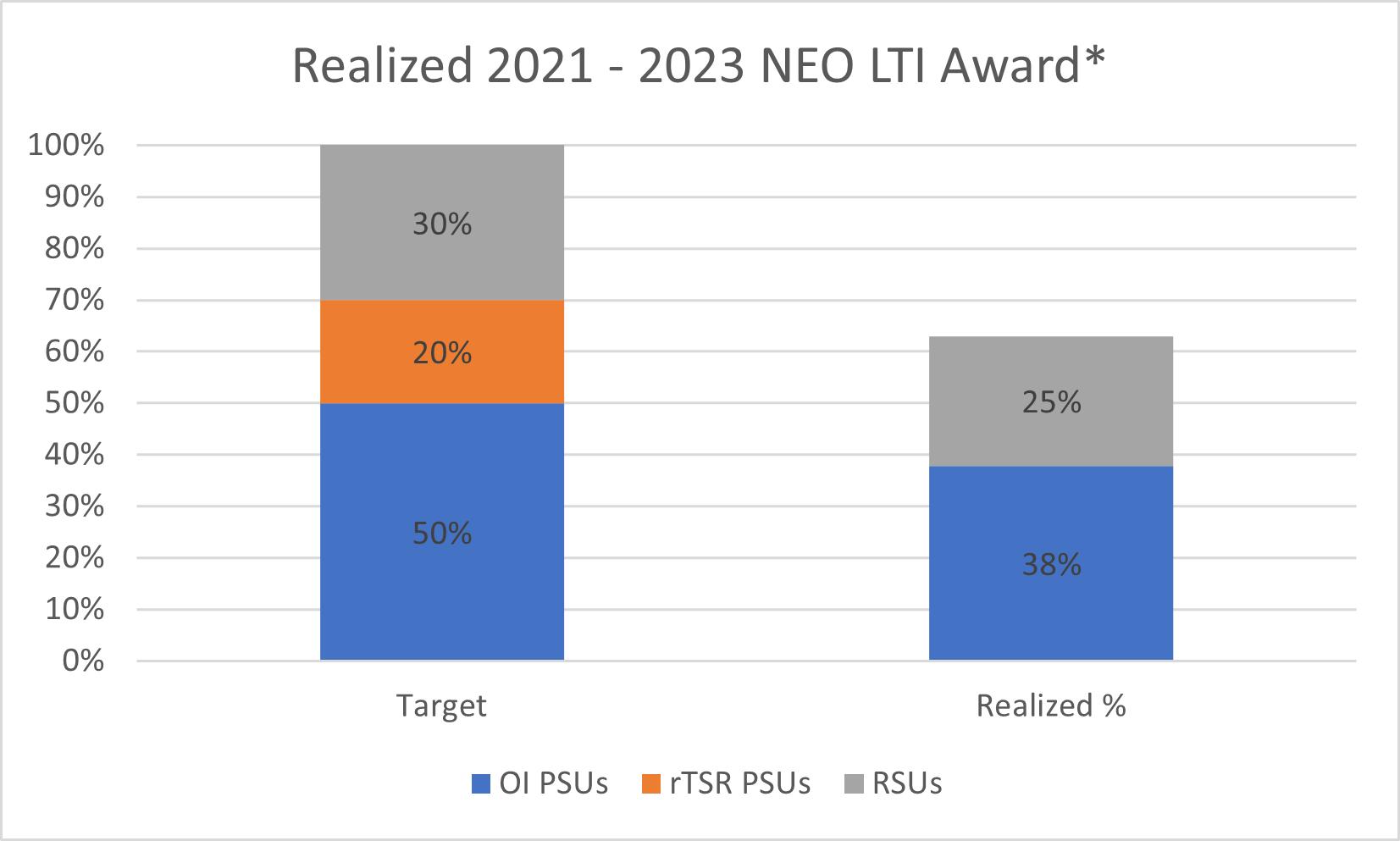

While many shareholders appreciated the enhanced disclosure of performance goals for our PSU-OIs included in our 2023 proxy statement describing the 2021-2023 PSU OI program, they indicated a preference towards measurement of cumulative 3-year performance rather than year-over-year growth. | Beginning with the 2024 LTIP award, PSU OI awards will be based on a cumulative three-year OI goal as opposed to three annual goals that are based on growth over prior year actual results. The PSU OI goals continue to be aligned with 3/5/7 growth objectives, as described in more detail below. Additional details on the 2023 PSU OI program are provided in the Long-Term Incentive Award opportunities on page 33. Goals under the most recently completed PSU OI program are found on page 35.

| |

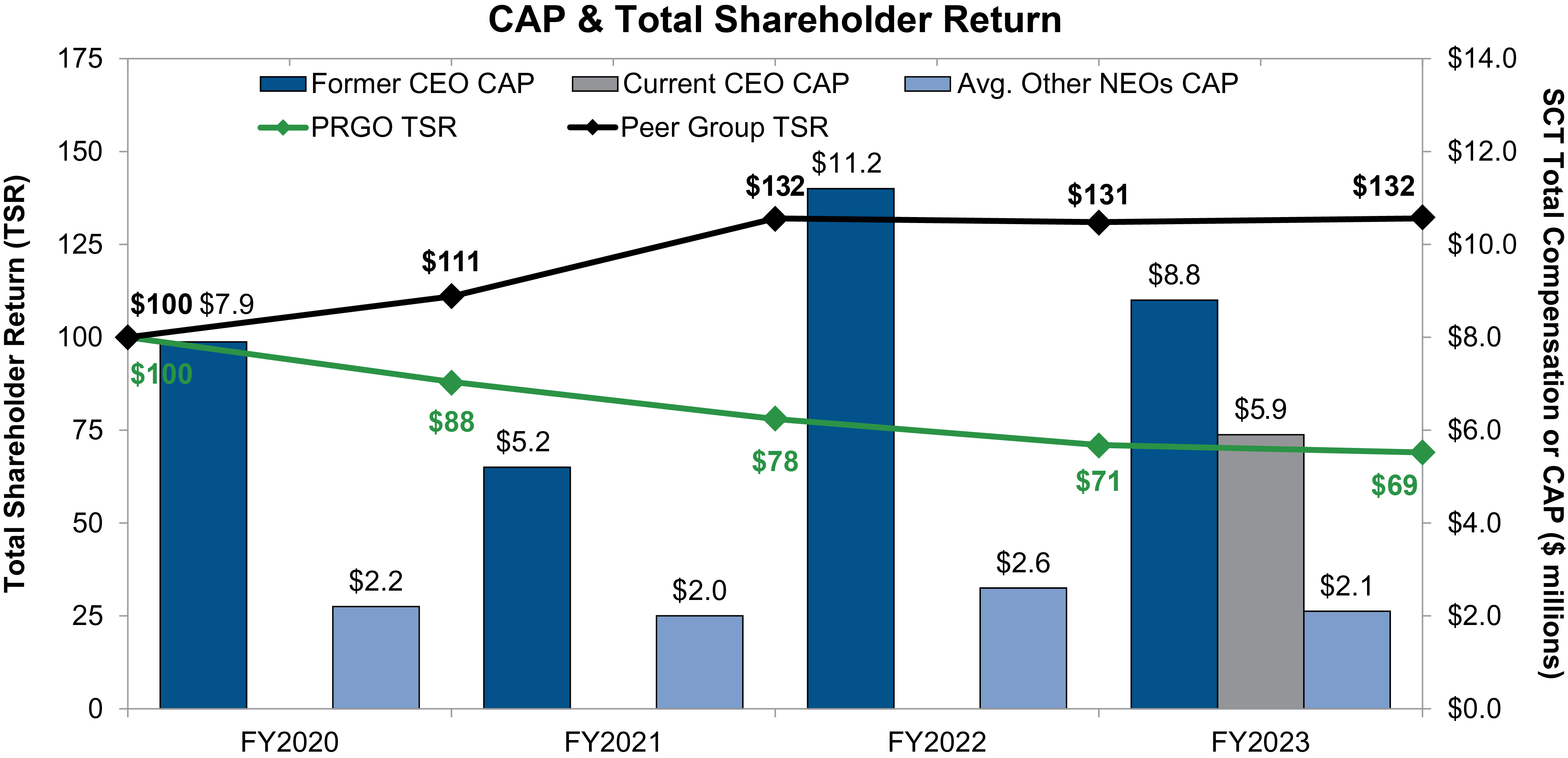

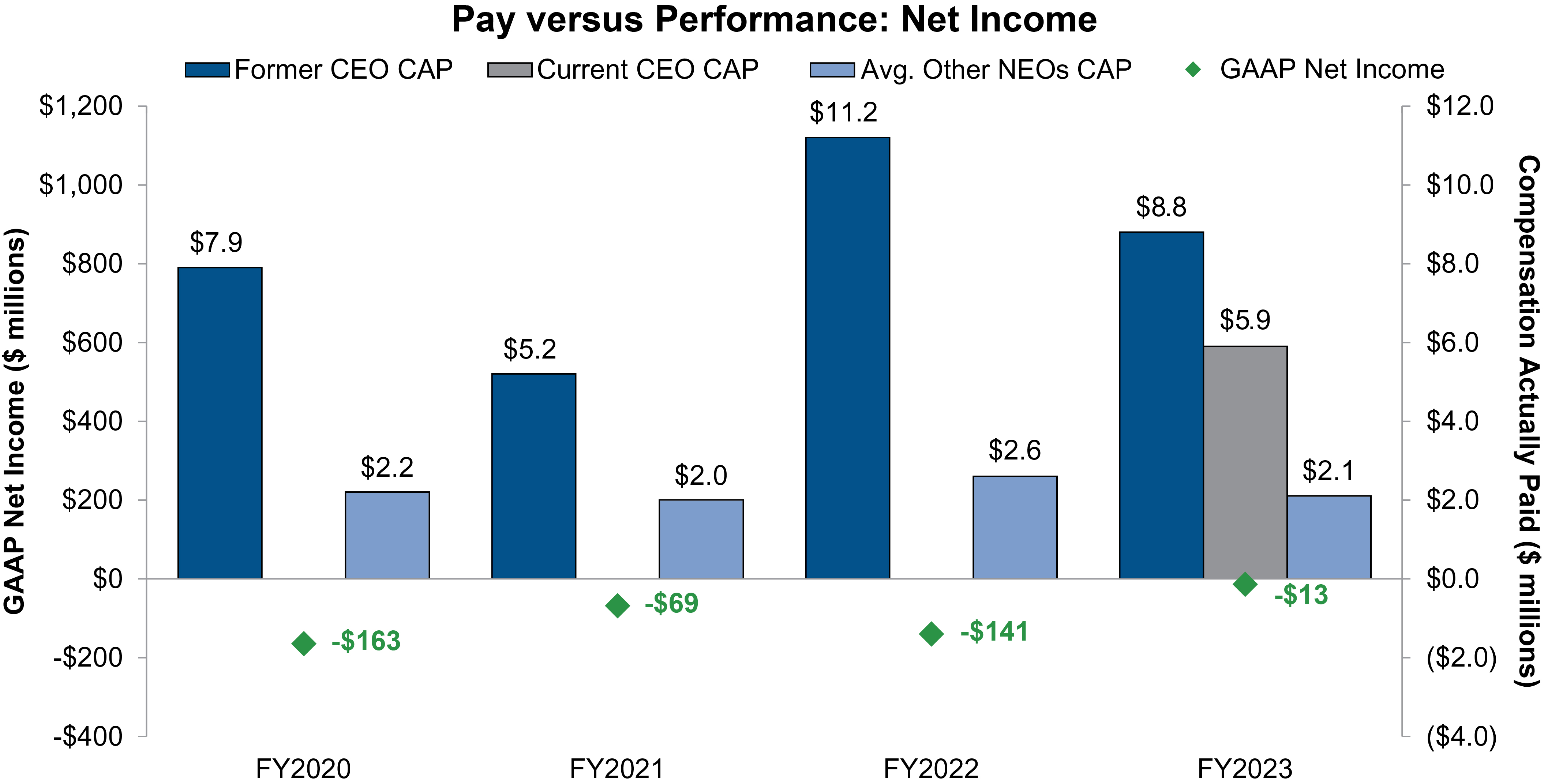

Some shareholders expressed concern over a perceived misalignment between the level of CEO pay and Company performance. |

| Target TDC for our former CEO, Mr. Kessler, was above median, reflecting his 20+ years of experience as a public-company CEO, proven track record, and strong leadership throughout our strategic transformation. Although Mr. Kessler’s target TDC ranked high, earned pay delivery was aligned with Company performance, in particular with respect to the long-term equity compensation, which was the largest proportion of CEO compensation. Implementation of our CEO succession plan provided the opportunity to set Mr. Lockwood-Taylor’s starting target TDC between the 25th percentile and median of peer company CEOs. While earned pay delivery will continue to be aligned with Company performance, this lower level of target TDC should mitigate the perceived pay-for-performance misalignment.

Additional information on the changes to total compensation and the agreement with Patrick Lockwood-Taylor can be found on page 39.

|

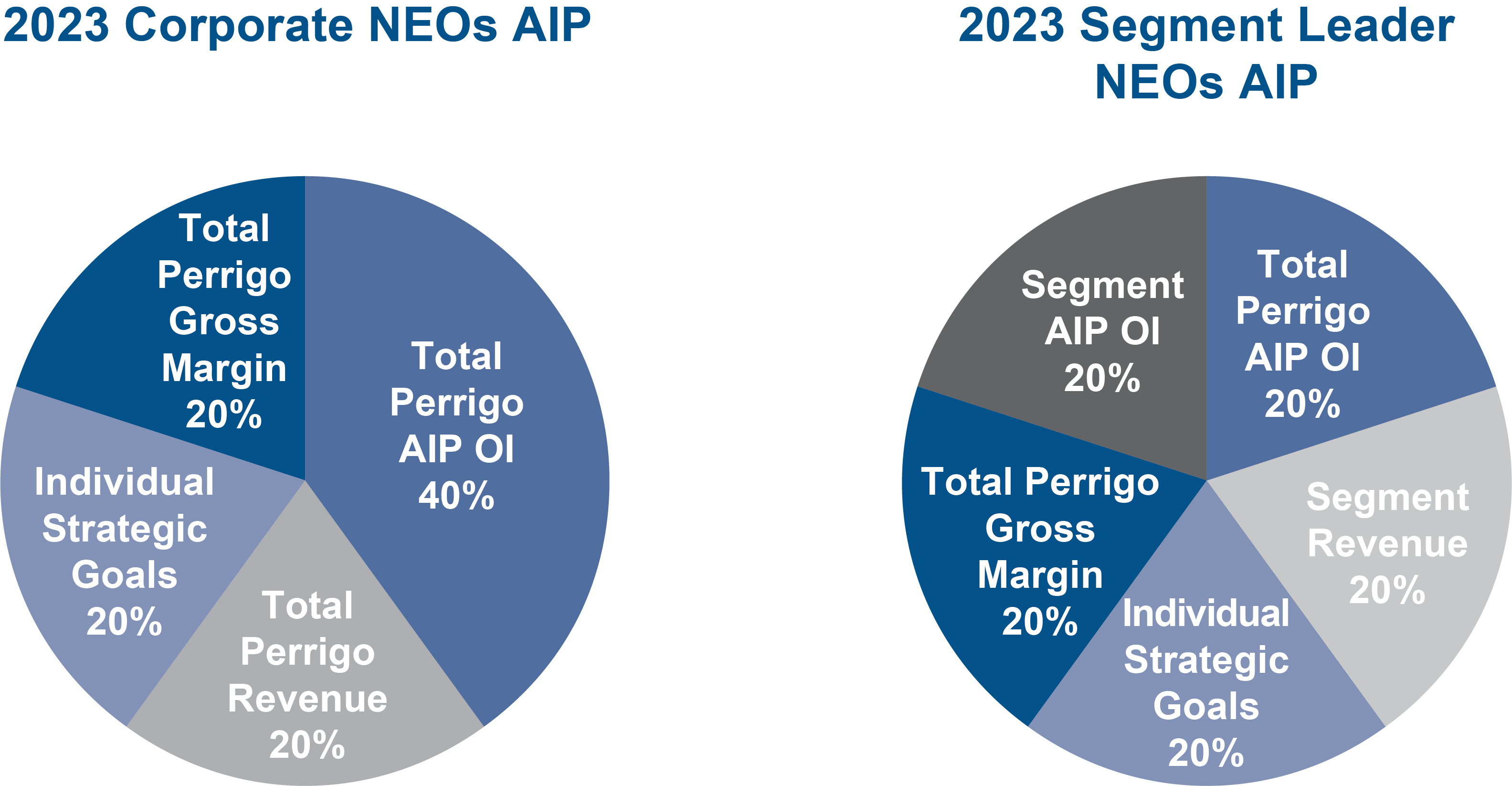

Shareholders appreciated the additional color we provided on the importance of our 3/5/7 long-term growth objectives related to our metric selection and goal setting for our incentive plans. | We have enhanced the discussion around the design and goal setting with the AIP and LTIP. As part of the self-care transformation plan to recapture “The Perrigo Advantage” which was unveiled in 2019, the company communicated our strategy to achieve repeatable “3/5/7” growth, i.e., 3% annual Net Sales growth, 5% annual adjusted operating income growth, and 7% annual adjusted diluted Earnings Per Share (“EPS”) growth. Consistently achieving these growth goals would represent successful completion of the self-care transformation and aligns with our long-term strategy. We believe these metrics most effectively align pay and performance and are the same metrics used by our shareholders to evaluate performance. Therefore, we use Net Sales growth and annual adjusted operating income (at the company and segment level, as applicable) as the financial measures in our AIP, and we use adjusted operating income growth as a key measure in our LTIP. While adjusted diluted EPS growth is an important aspect of our 3/5/7 strategy, we have not yet incorporated it into our AIP or LTIP because the strategic focus on profitable growth makes Operating Income the optimal metric for the LTIP. We will continue to consider other metrics for future plan design. | |

|

|

|

PERRIGO • 2024 PROXY STATEMENT |

| 23 |

|

|

|

What We Heard | How We Responded | |

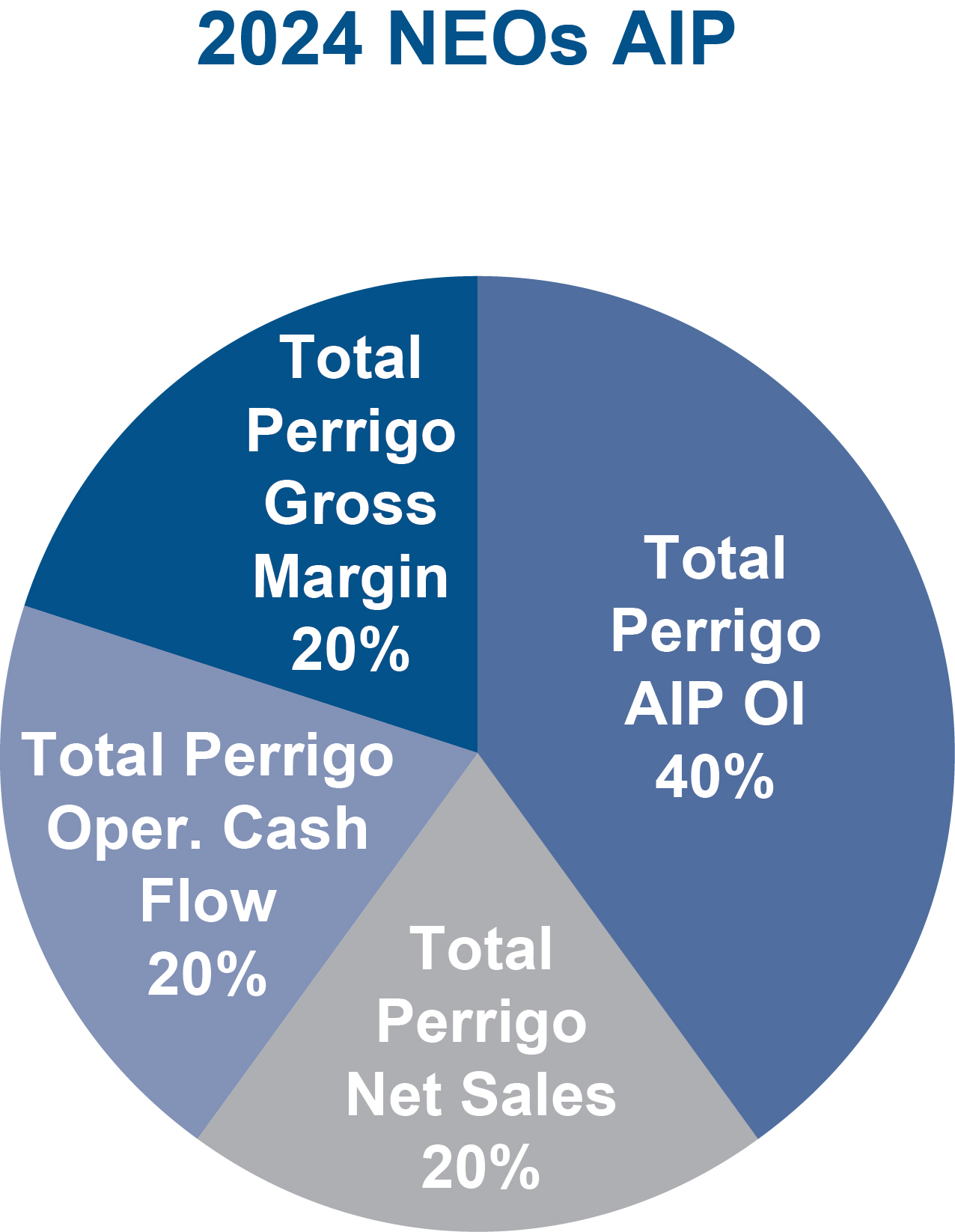

Shareholders expressed an interest in having more diversified metrics across the LTI and AIP (Perrigo’s Short-Term Incentive plan). | We use Adjusted OI (at the Company and segment level, as applicable) as one of several metrics in our AIP. We also use Adjusted OI growth, measured over three years, as a performance metric in our LTIP. We use Adjusted OI in both the AIP and LTIP because it is a measure of operational performance that incentive plan participants understand and can influence, supports our 3/5/7 strategy, and is linked to shareholder value creation. However, we balance this measure with multiple other measures in our AIP and LTIP. Beginning with the 2023 AIP incentive plan, we added an additional incentive plan metric; Adjusted Gross Margin. In response to shareholder feedback and to align with our near-term financial goals, we are incorporating an additional metric into the 2024 AIP; Operating Cash Flow. This further diversifies the performance metrics used across the AIP and LTIP.

| |