1 October 2015 Creating Value for Shareholders: Now and For the Long Term Exhibit 99.3

2 Forward Looking Statements Certain statements in this presentation are forward-looking statements. These statements relate to future events or the Company’s future financial performance and involve known and unknown risks, uncertainties and other factors that may cause the actual results, levels of activity, performance or achievements of the Company or its industry to be materially different from those expressed or implied by any forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential” or other comparable terminology. The Company has based these forward-looking statements on its current expectations, assumptions, estimates and projections. While the Company believes these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond the Company’s control, including future actions that may be taken by Mylan in furtherance of its unsolicited offer; the timing, amount and cost of share repurchases; and the ability to execute and achieve the desired benefits of announced initiatives. These and other important factors, including those discussed under “Risk Factors” in the Company’s Form 10-K for the year ended June 27, 2015, as well as the Company’s subsequent filings with the SEC, may cause actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. The forward-looking statements in this presentation are made only as of the date hereof, and unless otherwise required by applicable securities laws, the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise Non-GAAP Measures This presentation contains non-GAAP measures. The reconciliation of those measures to the most comparable GAAP measures is included at the end of this presentation. A copy of this presentation, including the reconciliations, is available on our website at www.perrigo.com. Non-GAAP guidance for calendar 2015 excludes among other items listed on Table I, restructuring, unusual litigation charges, along with costs associated with an unsolicited offer to acquire the Perrigo Company plc by Mylan N.V.("Mylan"). At this time, a reconciliation to GAAP for these measures for calendar 2015 is impracticable to provide given the uncertainty and potential variability of these items. The unavailable reconciling items could significantly impact the Company's financial results Additional Information and Where to Find It This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. In response to the exchange offer commenced by Mylan N.V., Perrigo has filed a solicitation/recommendation statement on Schedule 14D-9 with the Securities and Exchange Commission (“SEC”). Security holders are urged to read the solicitation/recommendation statement and other relevant materials if and when they become available because they will contain important information. The solicitation/recommendation statement and other SEC filings made by Perrigo may be obtained (when available) without charge at the SEC’s website at www.sec.gov and at the investor relations section of the Perrigo website at perrigo.investorroom.com. Shareholders may also obtain copies of the information by contacting Mackenzie Partners, Inc. at 212-929-5500 or 800-322-2885 Toll-Free in North America or by email at PRGO@mackenziepartners.com Irish Takeover Rules The directors of Perrigo accept responsibility for the information contained in this presentation. To the best of the knowledge and belief of the directors of Perrigo (who have taken all reasonable care to ensure such is the case), the information contained in this presentation is in accordance with the facts and does not omit anything likely to affect the import of such information. Save for the Perrigo calendar year 2015 guidance and the Perrigo 2016 calendar year guidance (in respect of which additional information required by the Irish Takeover Rules has been mailed to Perrigo shareholders, to the extent required), no statement in this communication is intended to constitute a profit forecast for any period nor should any statements be interpreted to mean that earnings or earnings per share will necessarily be greater or lesser than those for the relevant preceding financial periods for Mylan or Perrigo as appropriate. No statement in this communication constitutes an asset valuation. A person interested in 1% or more of any class of relevant securities of Perrigo or Mylan may have disclosure obligations under Rule 8.3 of the Irish Takeover Rules. Important Information

3 Perrigo's Superior Value Proposition Review of 3Q CY15 Earnings | CY15 Guidance Accelerating Shareholder Value | CY16 Guidance Strong Recommendation of Perrigo’s Board: Reject the Offer by Taking No Action

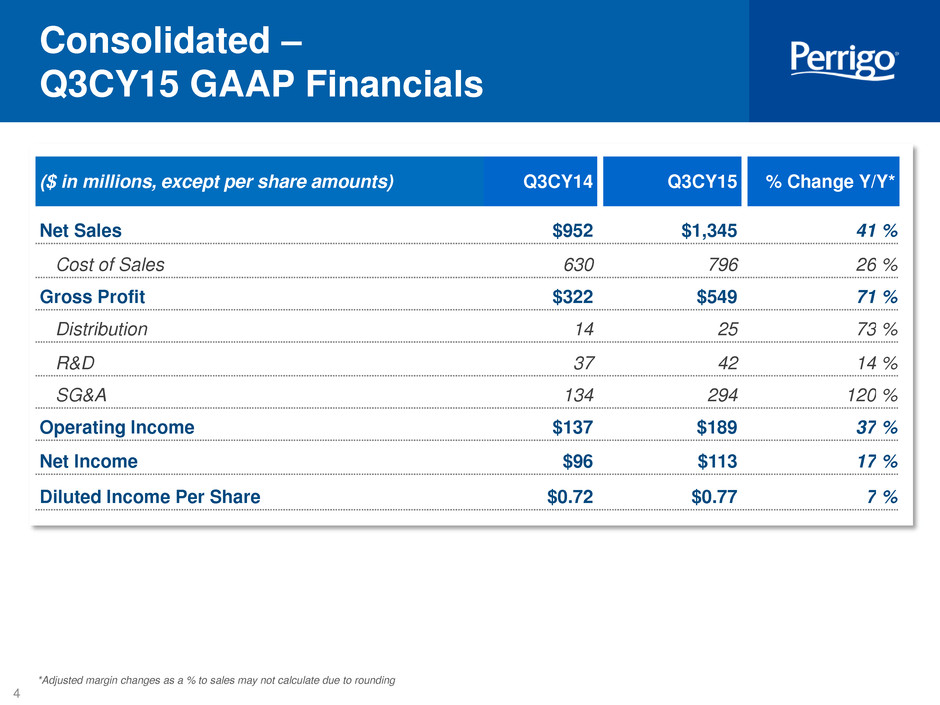

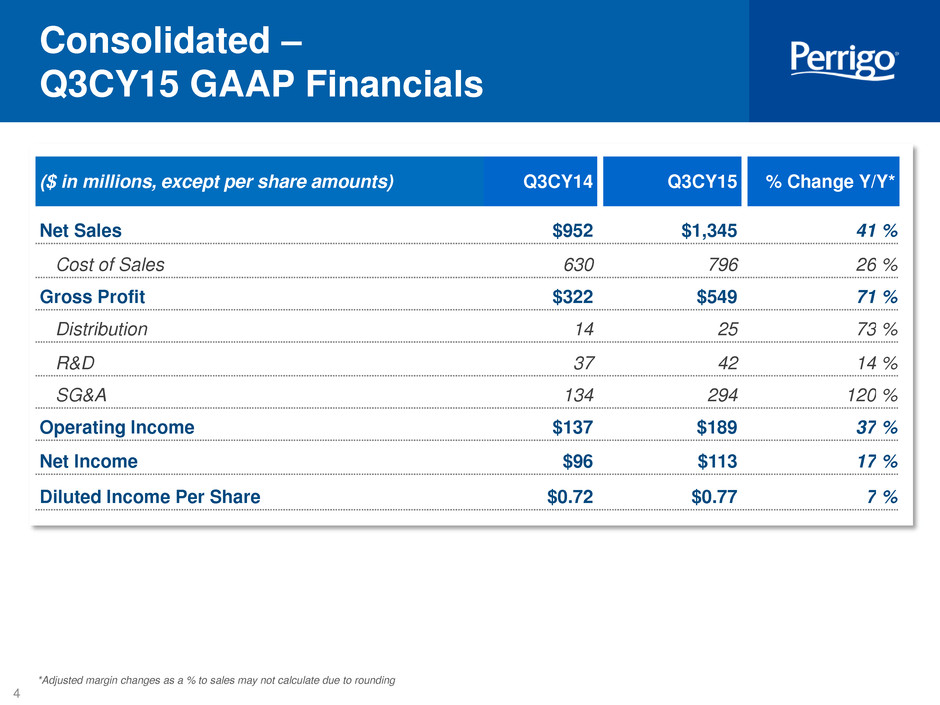

4 *Adjusted margin changes as a % to sales may not calculate due to rounding Consolidated – Q3CY15 GAAP Financials ($ in millions, except per share amounts) Q3CY14 Q3CY15 % Change Y/Y* Net Sales $952 $1,345 41 % Cost of Sales 630 796 26 % Gross Profit $322 $549 71 % Distribution 14 25 73 % R&D 37 42 14 % SG&A 134 294 120 % Operating Income $137 $189 37 % Net Income $96 $113 17 % Diluted Income Per Share $0.72 $0.77 7 %

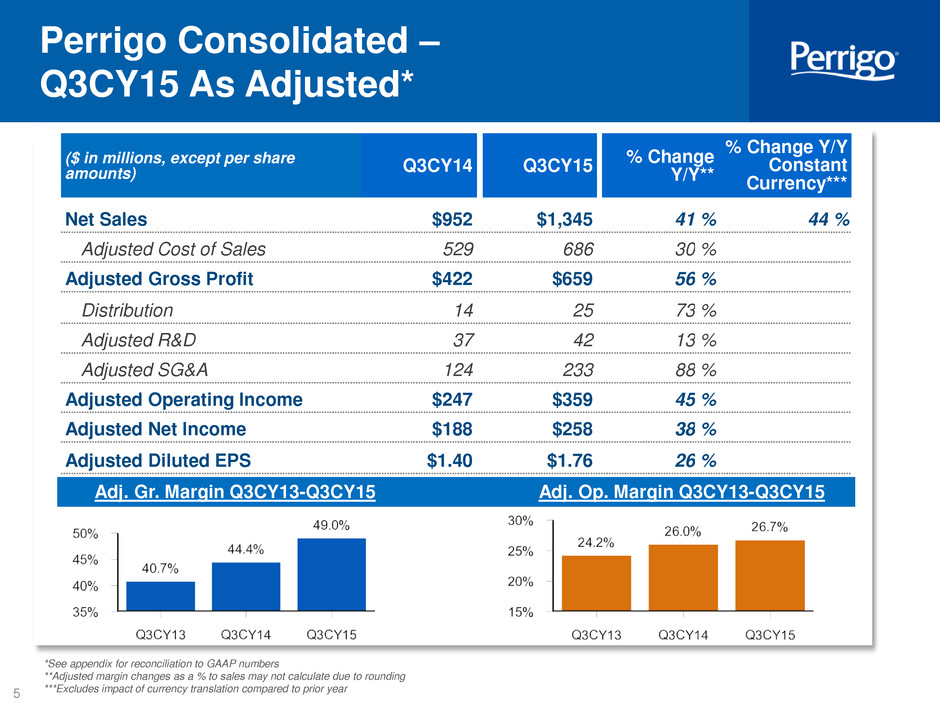

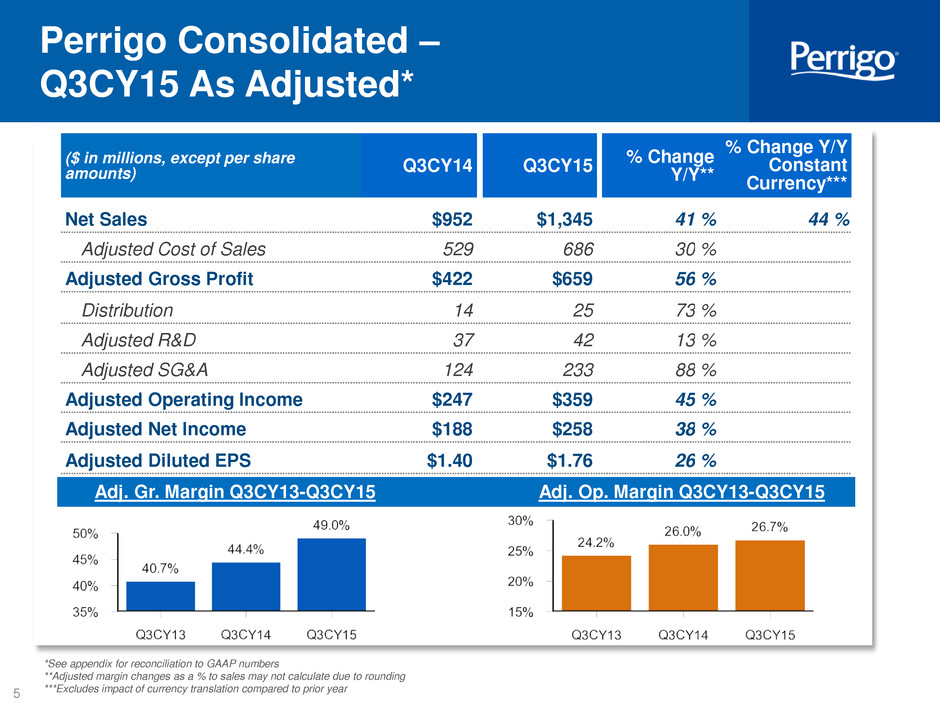

5 *See appendix for reconciliation to GAAP numbers **Adjusted margin changes as a % to sales may not calculate due to rounding ***Excludes impact of currency translation compared to prior year Perrigo Consolidated – Q3CY15 As Adjusted* Adj. Gr. Margin Q3CY13-Q3CY15 Adj. Op. Margin Q3CY13-Q3CY15 ($ in millions, except per share amounts) Q3CY14 Q3CY15 % Change Y/Y** % Change Y/Y Constant Currency*** Net Sales $952 $1,345 41 % 44 % Adjusted Cost of Sales 529 686 30 % Adjusted Gross Profit $422 $659 56 % Distribution 14 25 73 % Adjusted R&D 37 42 13 % Adjusted SG&A 124 233 88 % Adjusted Operating Income $247 $359 45 % Adjusted Net Income $188 $258 38 % Adjusted Diluted EPS $1.40 $1.76 26 %

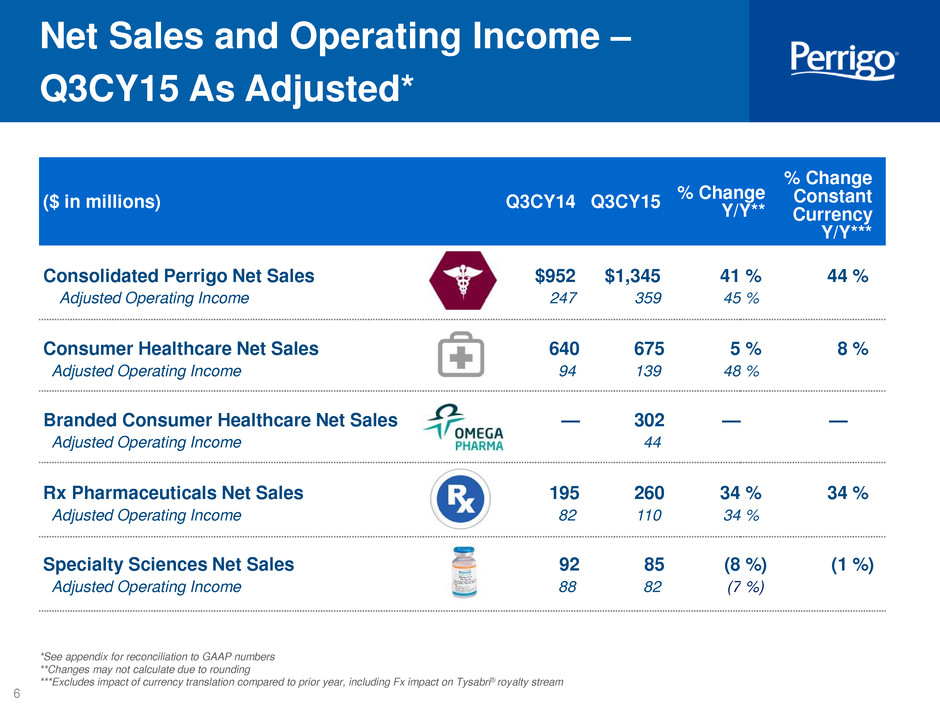

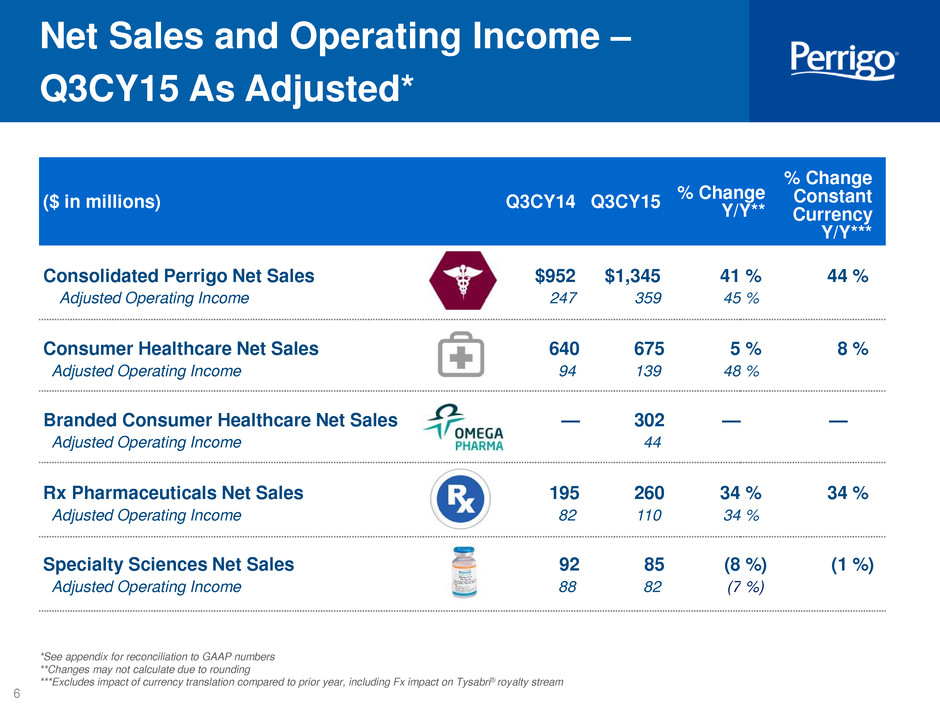

6 Net Sales and Operating Income – Q3CY15 As Adjusted* ($ in millions) Q3CY14 Q3CY15 % Change Y/Y** % Change Constant Currency Y/Y*** Consolidated Perrigo Net Sales $952 $1,345 41 % 44 % Adjusted Operating Income 247 359 45 % Consumer Healthcare Net Sales 640 675 5 % 8 % Adjusted Operating Income 94 139 48 % Branded Consumer Healthcare Net Sales — 302 — — Adjusted Operating Income 44 Rx Pharmaceuticals Net Sales 195 260 34 % 34 % Adjusted Operating Income 82 110 34 % Specialty Sciences Net Sales 92 85 (8 %) (1 %) Adjusted Operating Income 88 82 (7 %) *See appendix for reconciliation to GAAP numbers **Changes may not calculate due to rounding ***Excludes impact of currency translation compared to prior year, including Fx impact on Tysabri® royalty stream

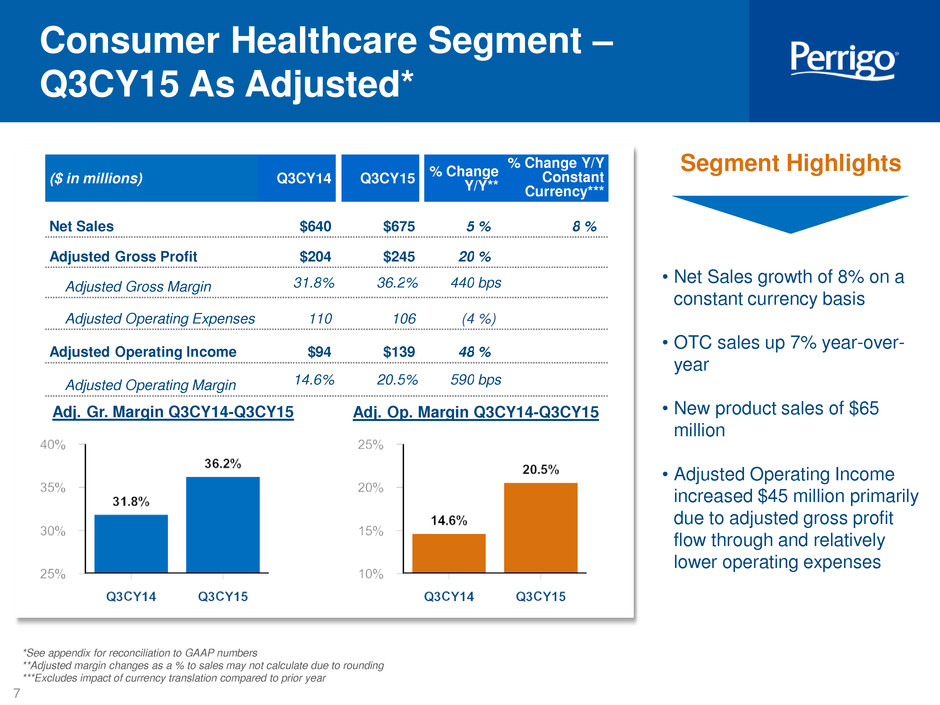

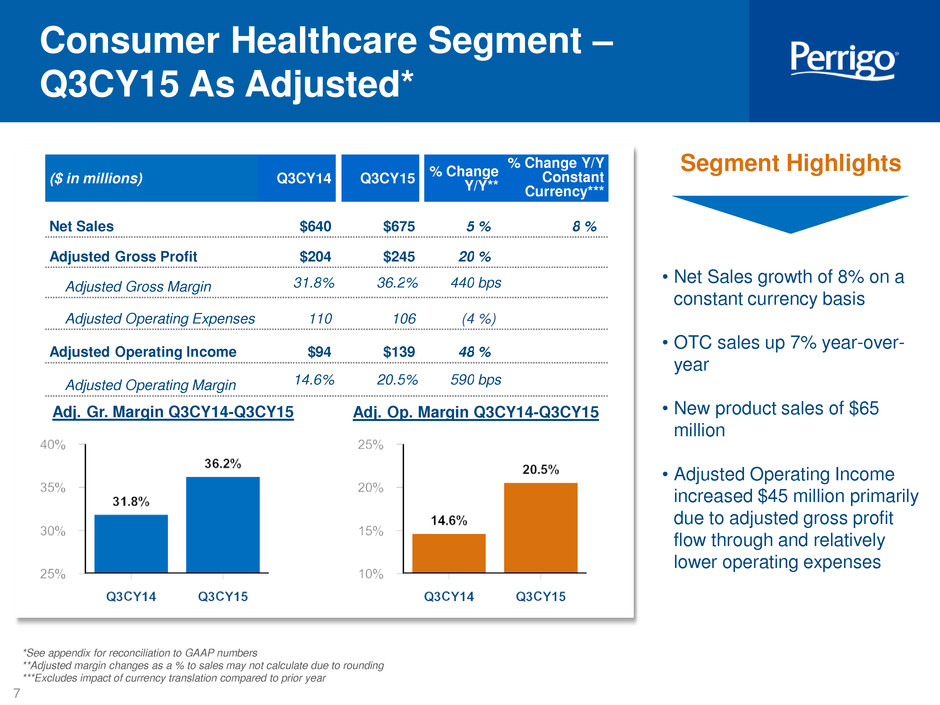

7 *See appendix for reconciliation to GAAP numbers **Adjusted margin changes as a % to sales may not calculate due to rounding ***Excludes impact of currency translation compared to prior year Consumer Healthcare Segment – Q3CY15 As Adjusted* Segment Highlights Adj. Gr. Margin Q3CY14-Q3CY15 Adj. Op. Margin Q3CY14-Q3CY15 ($ in millions) Q3CY14 Q3CY15 % Change Y/Y** % Change Y/Y Constant Currency*** Net Sales $640 $675 5 % 8 % Adjusted Gross Profit $204 $245 20 % Adjusted Gross Margin 31.8 % 36.2 % 440 bps Adjusted Operating Expenses 110 106 (4 %) Adjusted Operating Income $94 $139 48 % Adjusted Operating Margin 14.6 % 20.5 % 590 bps • Net Sales growth of 8% on a constant currency basis • OTC sales up 7% year-over- year • New product sales of $65 million • Adjusted Operating Income increased $45 million primarily due to adjusted gross profit flow through and relatively lower operating expenses

8 *See appendix for reconciliation to GAAP numbers Branded Consumer Healthcare Segment – Q3CY15 As Adjusted* ($ in millions) Q3CY15 Net Sales $302 Adjusted Gross Profit $169 Adjusted Gross Margin 56.0 % Adjusted Operating Expenses 125 Adjusted Operating Income $44 Adjusted Operating Margin 14.6 % Segment Highlights • Top 20 brands grew 6% compared to last year • New product sales of $31 million Adj. Gr. Margin Q3CY15 Adj. Op. Margin Q3CY15

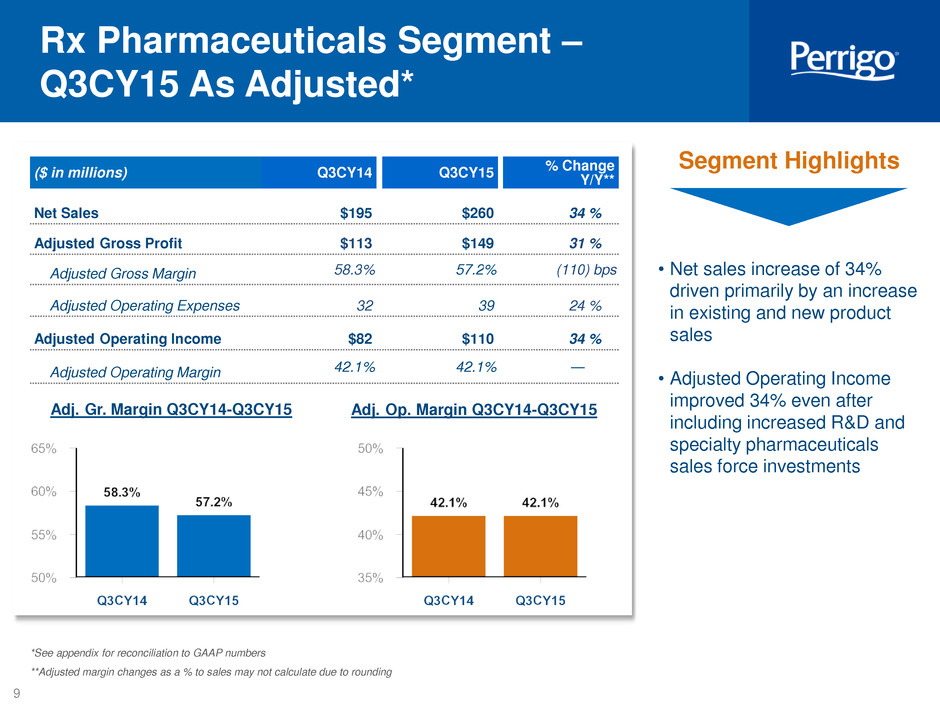

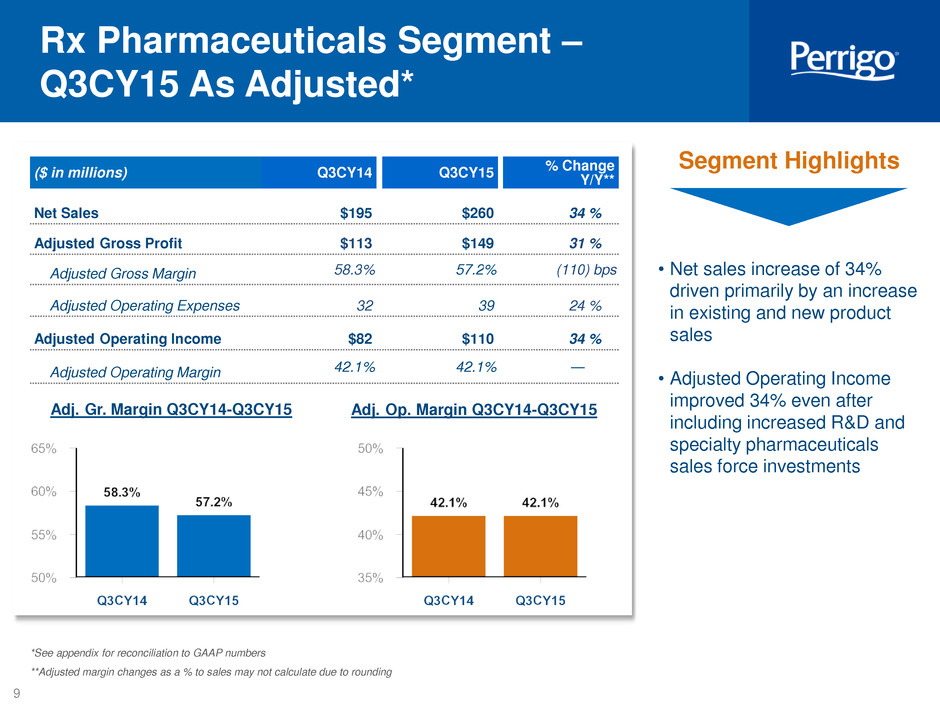

9 *See appendix for reconciliation to GAAP numbers **Adjusted margin changes as a % to sales may not calculate due to rounding Rx Pharmaceuticals Segment – Q3CY15 As Adjusted* ($ in millions) Q3CY14 Q3CY15 % Change Y/Y** Net Sales $195 $260 34 % Adjusted Gross Profit $113 $149 31 % Adjusted Gross Margin 58.3 % 57.2 % (110 ) bps Adjusted Operating Expenses 32 39 24 % Adjusted Operating Income $82 $110 34 % Adjusted Operating Margin 42.1 % 42.1 % — Segment Highlights • Net sales increase of 34% driven primarily by an increase in existing and new product sales • Adjusted Operating Income improved 34% even after including increased R&D and specialty pharmaceuticals sales force investments Adj. Gr. Margin Q3CY14-Q3CY15 Adj. Op. Margin Q3CY14-Q3CY15

10 *See appendix for reconciliation to GAAP numbers **Adjusted margin changes as a % to sales may not calculate due to rounding ***Excludes impact of currency translation compared to prior year **** Data according to Biogen Inc. Specialty Sciences Segment – Q3CY15 As Adjusted* • There were 13 shipping weeks in Q3CY15 versus 14 shipping weeks in Q3CY14 Segment Highlights ($ in millions) Q3CY14 Q3CY15 % Change Y/Y** % Change Y/Y Constant Currency*** Net Sales $92 $85 (8 %) (1 %) Adjusted Gross Profit $92 $85 (8 %) Adjusted Gross Margin 100.0 % 100.0 % — Adjusted Operating Expenses 4 3 (35 )% Adjusted Operating Income $88 $82 (7 %) Adjusted Operating Margin 95.6 % 96.9 % 130 bps Global Tysabri® Performance (in millions)**** $275 $284 $226 $196 $501 $480 Q3CY14 Q3CY15US

11 CALENDAR YEAR 2015 – Consolidated Guidance Calendar Year 2015 10/22/2015 Guidance** Calendar Year* 2014 (Recast) Net Sales $5.30BN - $5.45BN (9 months of Omega) $4.17BN Adjusted DSG&A as % of Net Sales*** ~17.5% 12.9% Adjusted R&D as % of Net Sales*** ~3.5% 3.9% Adjusted Operating Margin ~28% 27.1% Capital Expenditures $125MM - $140MM $142MM Interest Expense ~$165MM $110MM Adjusted Effective Tax Rate ~17% 17.3% Adjusted Diluted EPS $7.65 - $7.85/share $6.27/share Adjusted Diluted Shares Outstanding 144MM 135MM *See Appendix for reconciliation of CY 2014 Non-GAAP measures to GAAP **Includes only 9 months for Omega acquisition translated at €1:$1.09 ***Percentages for CY2015 are +/- 75 basis points ****Quarterly Diluted Shares Outstanding is 147M for Q2 –Q4 CY 2015

12 Perrigo's Superior Value Proposition Review of 3Q CY15 Earnings | CY15 Guidance Accelerating Shareholder Value | CY16 Guidance Strong Recommendation of Perrigo’s Board: Reject the Offer by Taking No Action

13 Organic Net Sales Goal Consumer Healthcare Net Sales 5% - 10% Branded Consumer Healthcare Net Sales 5% - 10% Rx Pharmaceuticals Net Sales 8% - 12% Consolidated Perrigo 5% - 10% CY2016 Segment Revenue Guidance

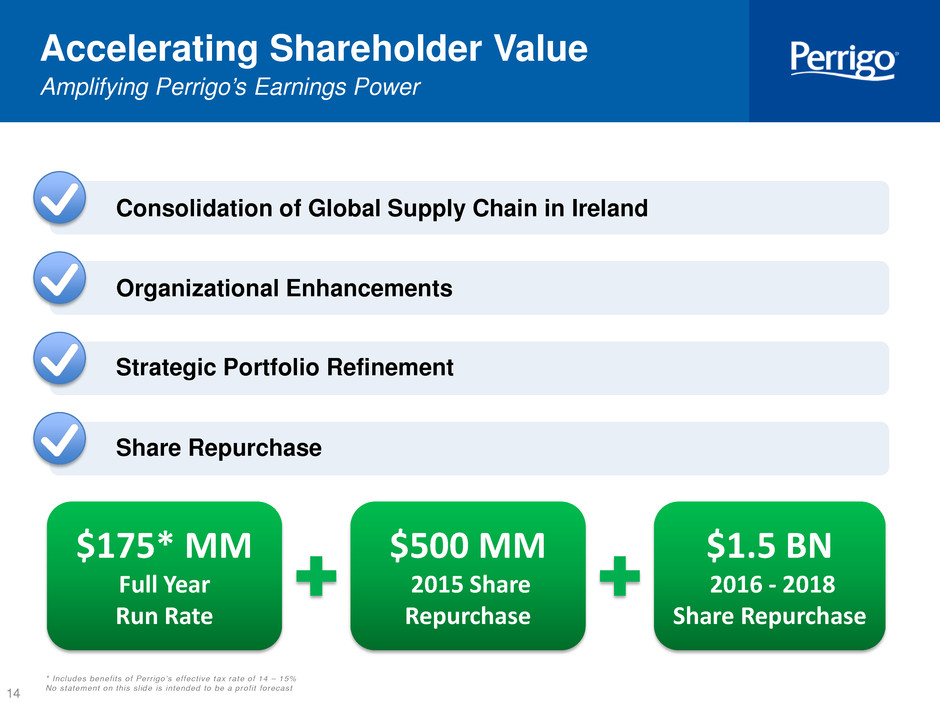

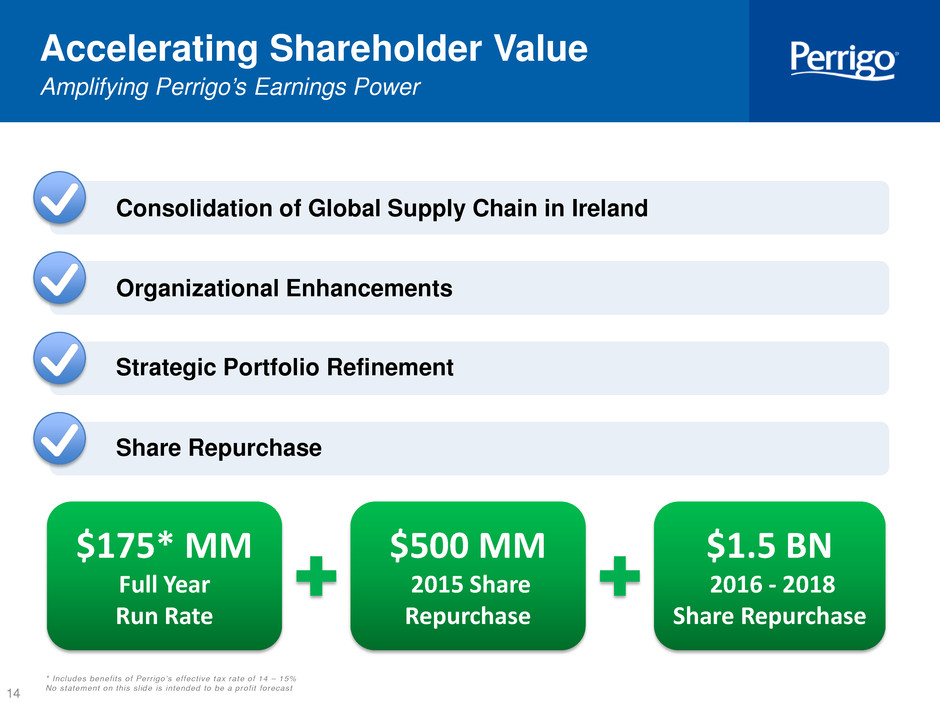

14 Consolidation of Global Supply Chain in Ireland Organizational Enhancements Strategic Portfolio Refinement $500 MM 2015 Share Repurchase Share Repurchase $175* MM Full Year Run Rate * Includes benefits of Perrigo’s effective tax rate of 14 – 15% No statement on this slide is intended to be a profit forecast Accelerating Shareholder Value Amplifying Perrigo’s Earnings Power $1.5 BN 2016 - 2018 Share Repurchase

15 Supply Chain Globalization Capturing Benefits of Global Platform Full Year Run Rate: $105* million * Includes benefits of Perrigo’s effective tax rate of 14 – 15% No statement on this slide is intended to be a profit forecast Consolidating supply chain, procurement and portfolio management center of excellence in Ireland Optimizing global supply chain Leveraging full value of Perrigo’s global footprint and world- class, multi-source supply chain capabilities

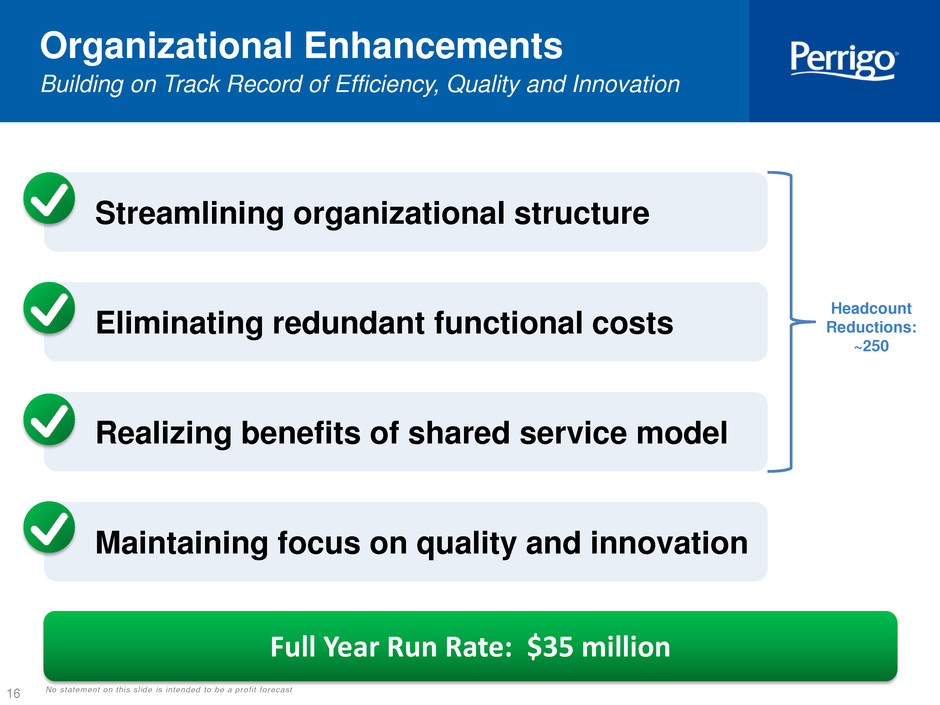

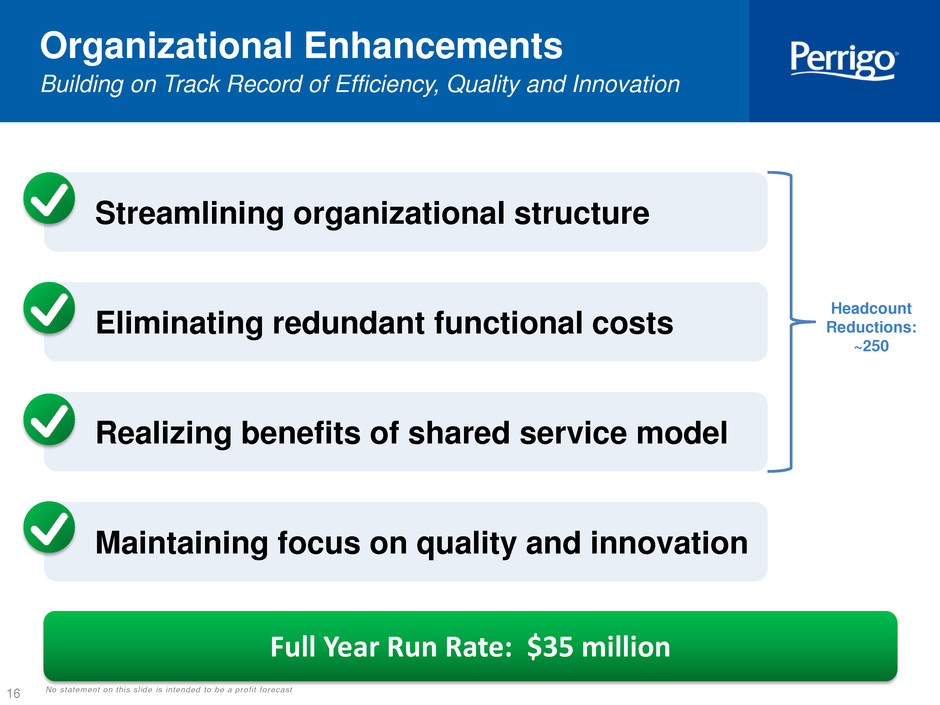

16 Organizational Enhancements Building on Track Record of Efficiency, Quality and Innovation Full Year Run Rate: $35 million No statement on this slide is intended to be a profit forecast Streamlining organizational structure Eliminating redundant functional costs Realizing benefits of shared service model Maintaining focus on quality and innovation Headcount Reductions: ~250

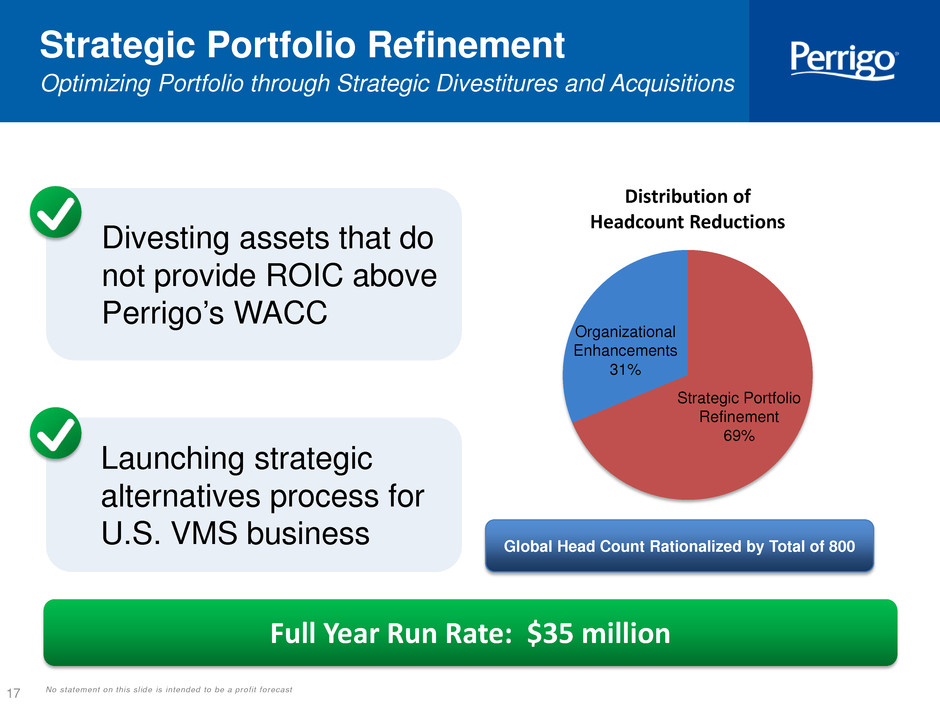

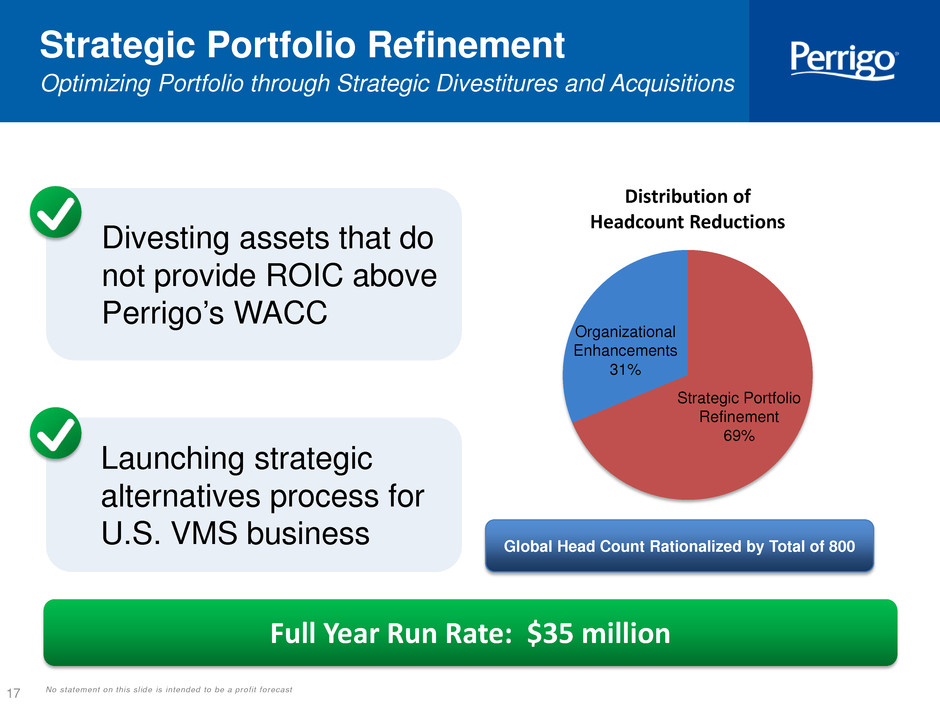

17 Strategic Portfolio Refinement Optimizing Portfolio through Strategic Divestitures and Acquisitions Full Year Run Rate: $35 million Global Head Count Rationalized by Total of 800 Distribution of Headcount Reductions Divesting assets that do not provide ROIC above Perrigo’s WACC Launching strategic alternatives process for U.S. VMS business Organizational Enhancements 31% Strategic Portfolio Refinement 69% No statement on this slide is intended to be a profit forecast

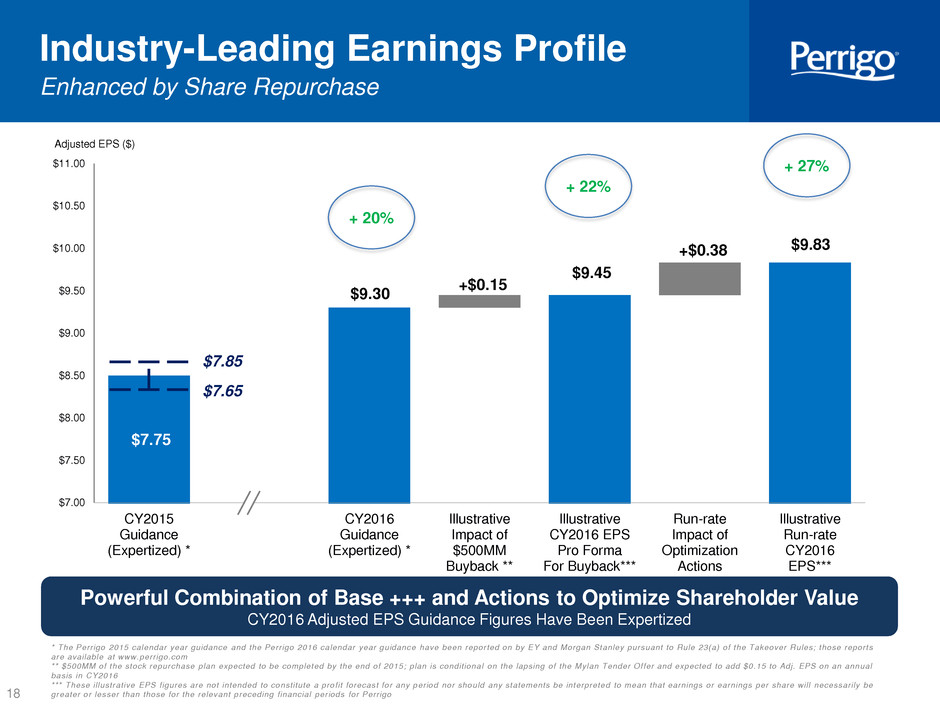

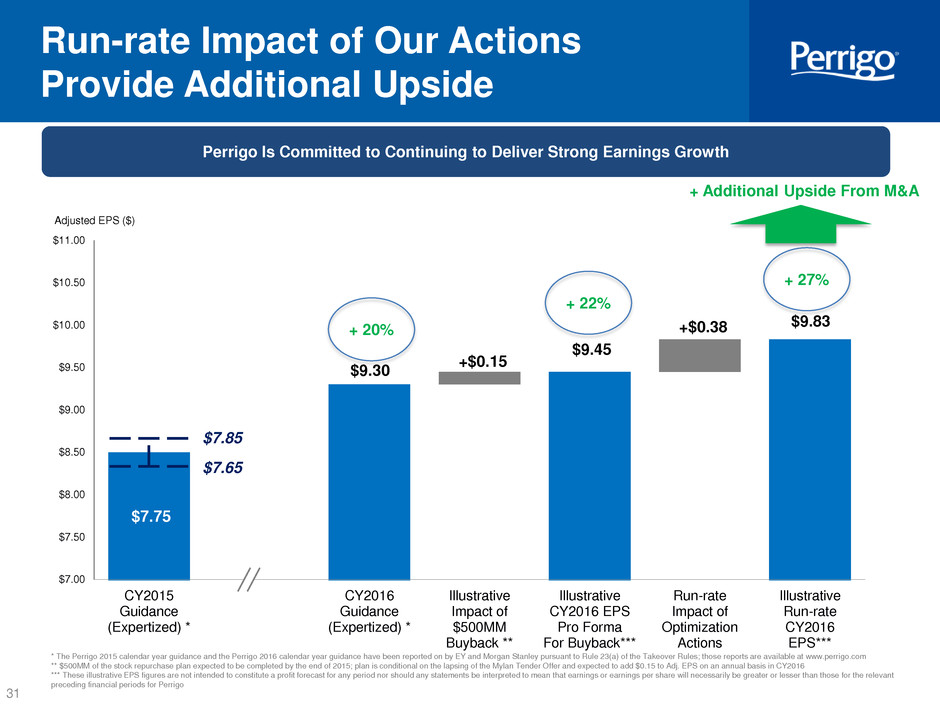

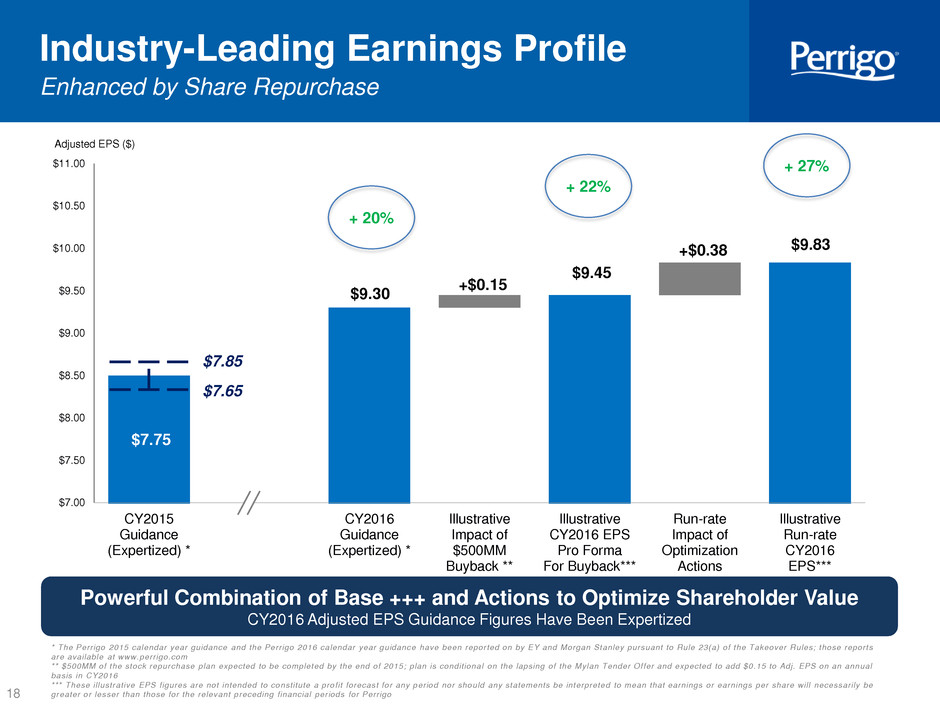

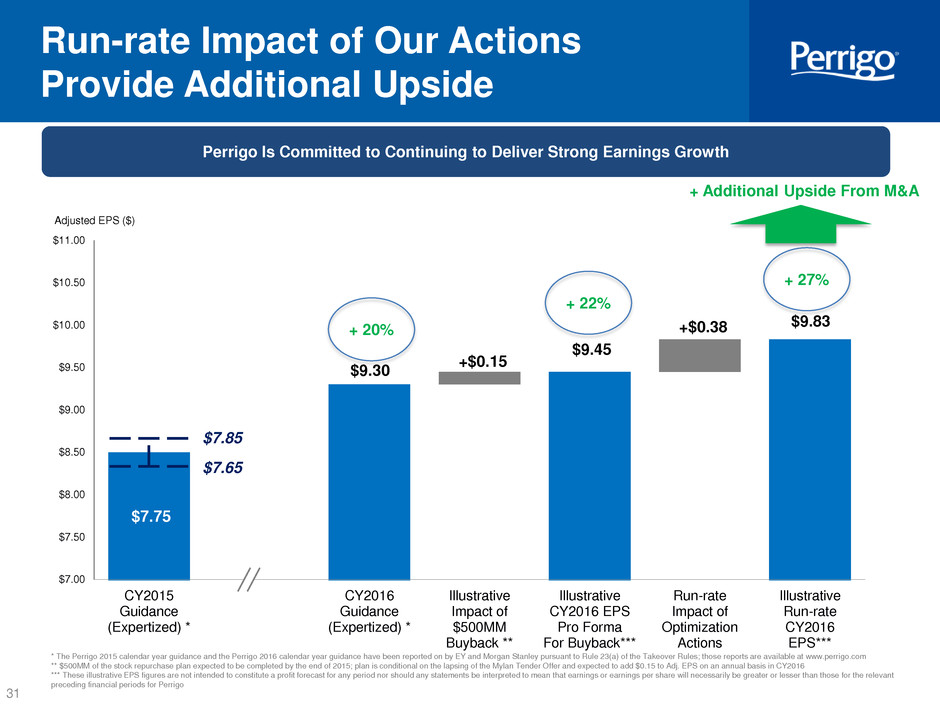

18 $7.75 $9.30 +$0.15 $9.45 +$0.38 $9.83 $7.00 $7.50 $8.00 $8.50 $9.00 $9.50 $10.00 $10.50 $11.00 CY2015 Guidance (Expertized) * CY2016 Guidance (Expertized) * Illustrative Impact of $500MM Buyback ** Illustrative CY2016 EPS Pro Forma For Buyback*** Run-rate Impact of Optimization Actions Illustrative Run-rate CY2016 EPS*** Industry-Leading Earnings Profile Enhanced by Share Repurchase Powerful Combination of Base +++ and Actions to Optimize Shareholder Value CY2016 Adjusted EPS Guidance Figures Have Been Expertized $7.65 $7.85 * The Perrigo 2015 calendar year guidance and the Perrigo 2016 calendar year guidance have been reported on by EY and Morgan Stanley pursuant to Rule 23(a) of the Takeover Rules; those reports are available at www.perrigo.com ** $500MM of the stock repurchase plan expected to be completed by the end of 2015; plan is conditional on the lapsing of the Mylan Tender Offer and expected to add $0.15 to Adj. EPS on an annual basis in CY2016 *** These il lustrative EPS figures are not intended to constitute a profit forecast for any period nor should any statements be interpreted to mean that earnings or earnings per share will necessarily be greater or lesser than those for the relevant preceding financial periods for Perrigo Adjusted EPS ($) + 20% + 22% + 27%

19 Actions to Accelerate Shareholder Value Clear and Readily Achievable Fundamental Amplification of Perrigo’s Earnings Power * Includes run-rate impact of supply chain globalizat ion benefits, operational eff iciencies and strategic portfolio enhancements, benefits of Perrigo’s effective tax rate of 14 – 15%, not all of which are expected to be fully effected in 2016. No statement on this slide is intended to be a profit forecast $500 MM 2015 Share Repurchase $175* MM Full Year Run Rate $1.5 BN 2016 - 2018 Share Repurchase Already Being Executed Near- and Long-Term Benefits Specific and Immediate Actions

20 Perrigo's Superior Value Proposition Review of 3Q CY15 Earnings | CY15 Guidance Accelerating Shareholder Value | CY16 Guidance Strong Recommendation of Perrigo’s Board: Reject the Offer by Taking No Action

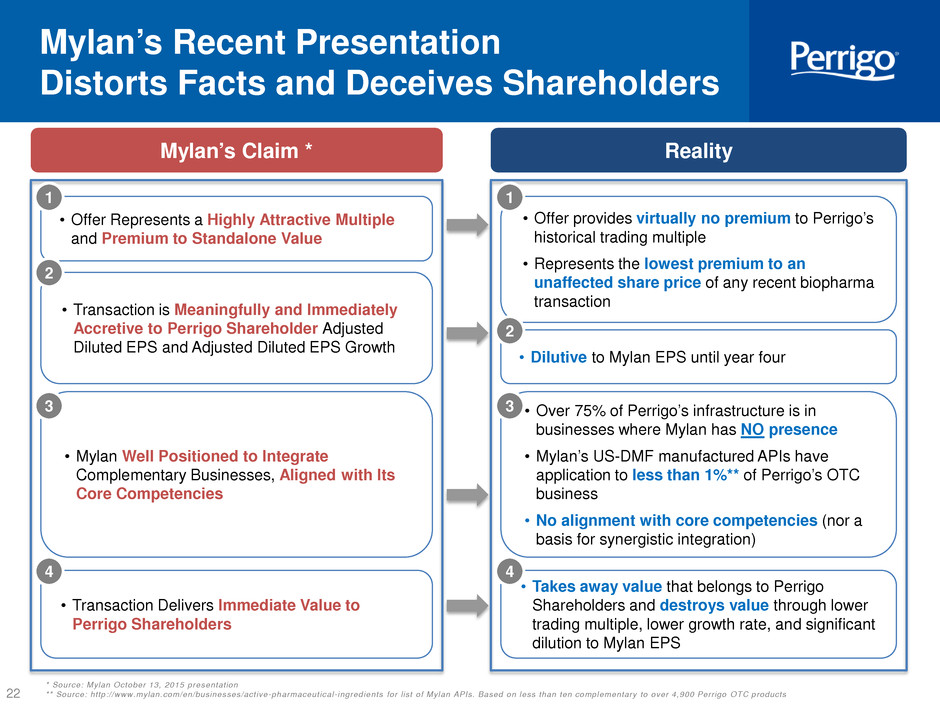

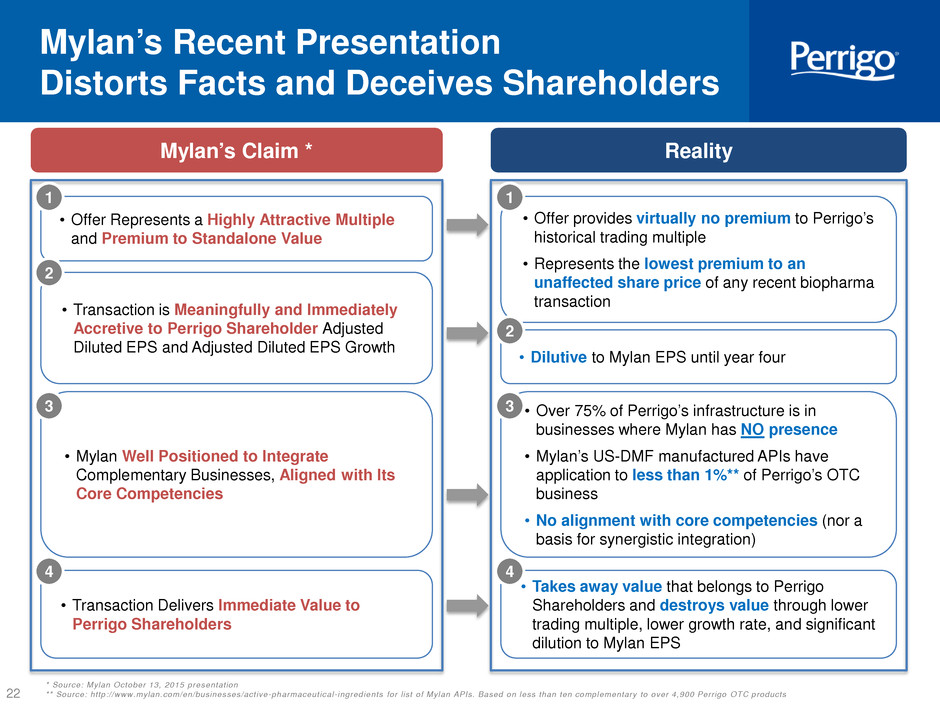

21 Mylan’s October 13 Presentation Unrealistically interprets value of the Mylan offer Deceives shareholders Distorts facts Represent belief statements of Perrigo Board

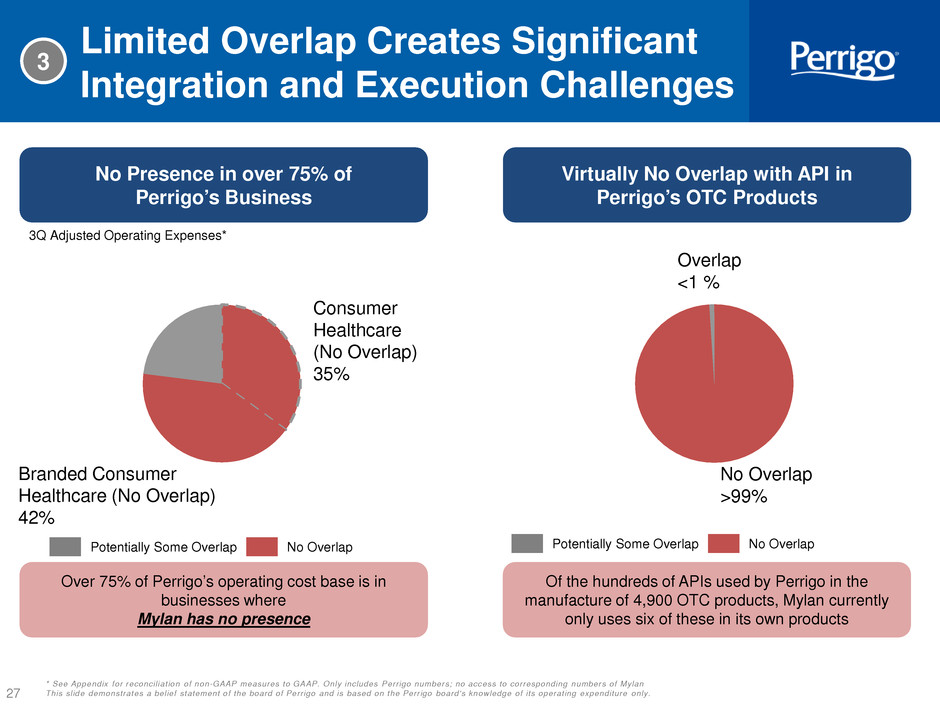

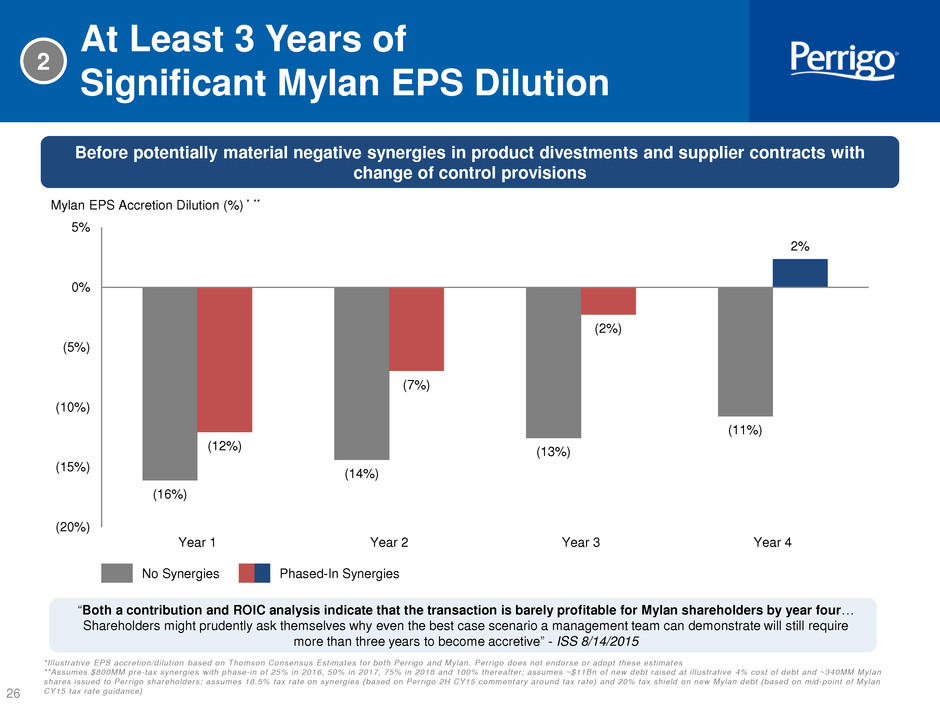

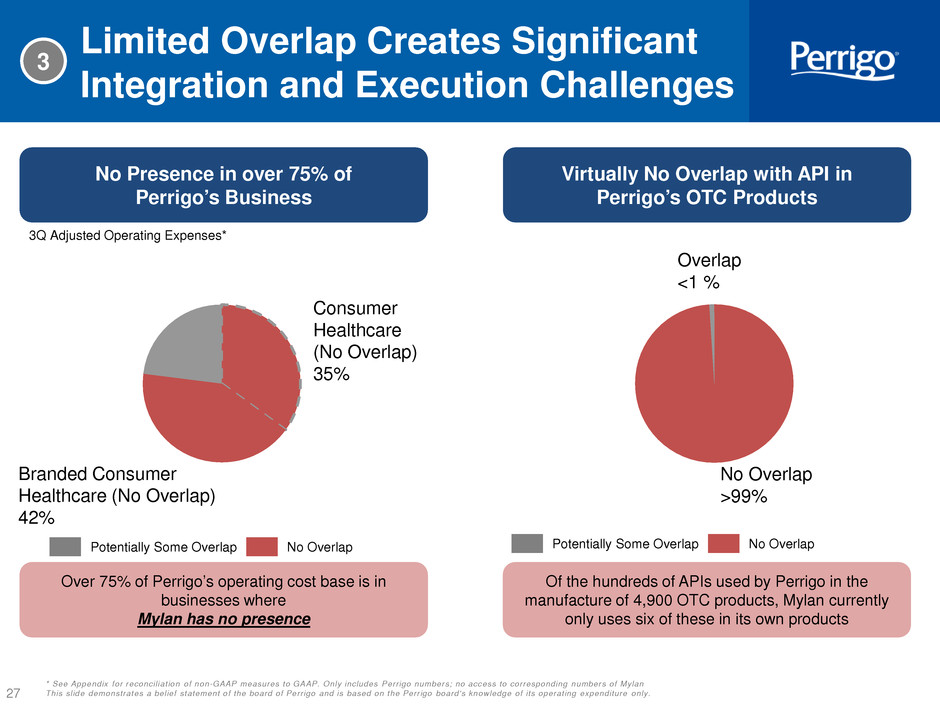

22 Mylan’s Recent Presentation Distorts Facts and Deceives Shareholders * Source: Mylan October 13, 2015 presentation ** Source: http://www.mylan.com/en/businesses/act ive-pharmaceut ical- ingredients for l ist of Mylan APIs. Based on less than ten complementary to over 4,900 Perrigo OTC products Reality • Offer provides virtually no premium to Perrigo’s historical trading multiple • Represents the lowest premium to an unaffected share price of any recent biopharma transaction • Dilutive to Mylan EPS until year four • Over 75% of Perrigo’s infrastructure is in businesses where Mylan has NO presence • Mylan’s US-DMF manufactured APIs have application to less than 1%** of Perrigo’s OTC business • No alignment with core competencies (nor a basis for synergistic integration) • Takes away value that belongs to Perrigo Shareholders and destroys value through lower trading multiple, lower growth rate, and significant dilution to Mylan EPS 1 2 3 4 Mylan’s Claim * • Offer Represents a Highly Attractive Multiple and Premium to Standalone Value • Transaction is Meaningfully and Immediately Accretive to Perrigo Shareholder Adjusted Diluted EPS and Adjusted Diluted EPS Growth • Mylan Well Positioned to Integrate Complementary Businesses, Aligned with Its Core Competencies • Transaction Delivers Immediate Value to Perrigo Shareholders 1 2 3 4

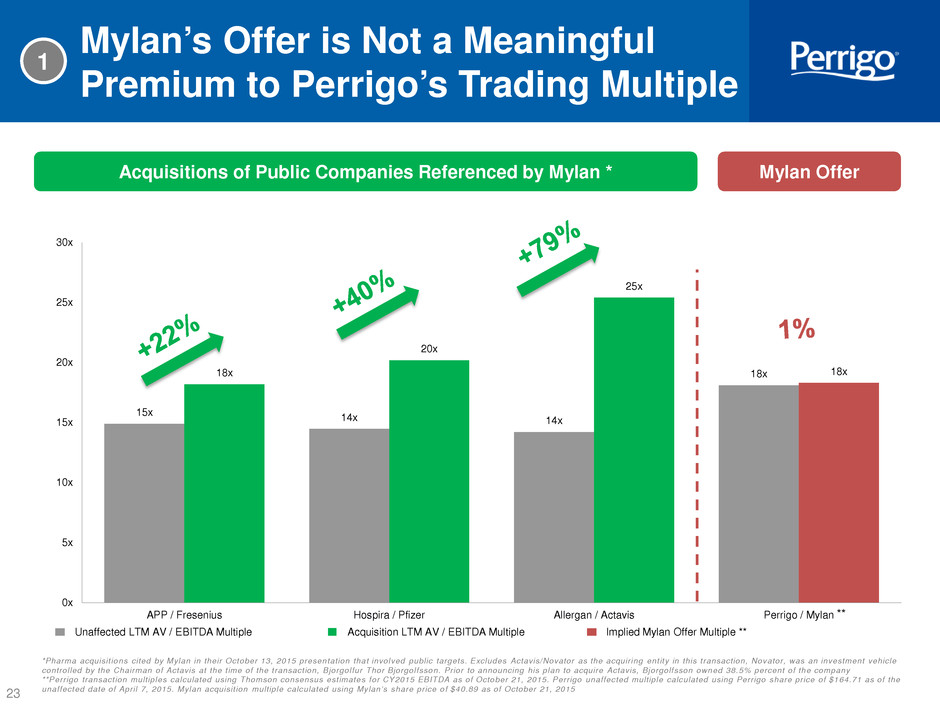

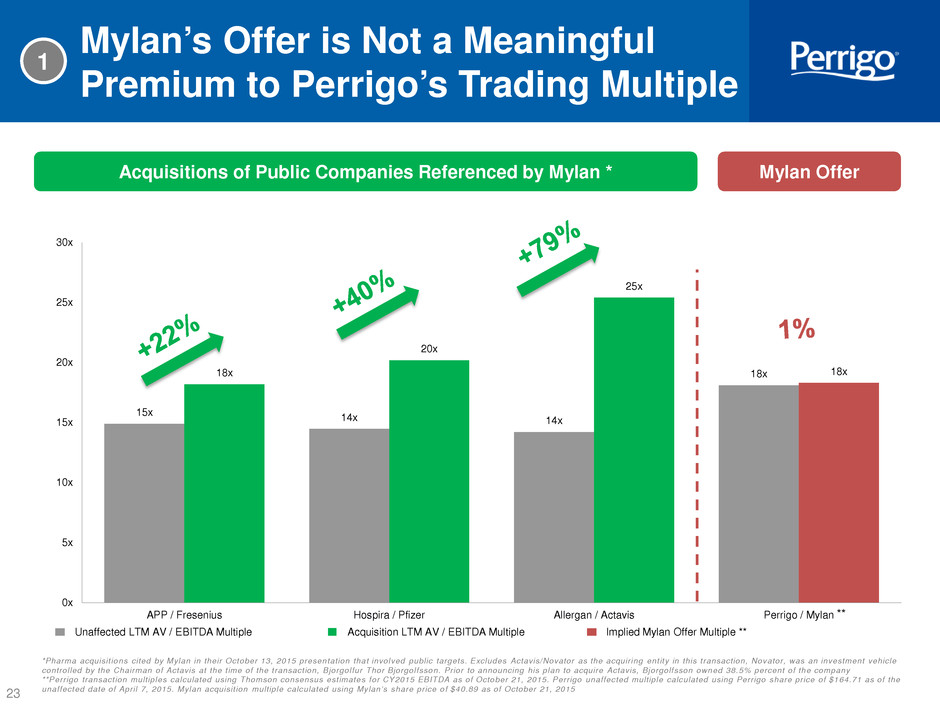

23 15x 14x 14x 18x 18x 20x 25x 18x 0x 5x 10x 15x 20x 25x 30x APP / Fresenius Hospira / Pfizer Allergan / Actavis Perrigo / Mylan Mylan’s Offer is Not a Meaningful Premium to Perrigo’s Trading Multiple *Pharma acquisit ions cited by Mylan in their October 13, 2015 presentation that involved public targets. Excludes Actavis/Novator as the acquir ing entity in this transaction, Novator, was an investment vehicle controlled by the Chairman of Actavis at the time of the transaction, Bjorgolfur Thor Bjorgolfsson. Prior to announcing his plan to acquire Actavis, Bjorgolfsson owned 38.5% percent of the company **Perrigo transaction multiples calculated using Thomson consensus estimates for CY2015 EBITDA as of October 21, 2015. Perrigo unaffected multiple calculated using Perrigo share price of $164.71 as of the unaffected date of April 7, 2015. Mylan acquisit ion multiple calculated using Mylan’s share price of $40.89 as of October 21, 2015 Unaffected LTM AV / EBITDA Multiple Acquisition LTM AV / EBITDA Multiple 1 Implied Mylan Offer Multiple ** ** Acquisitions of Public Companies Referenced by Mylan * Mylan Offer

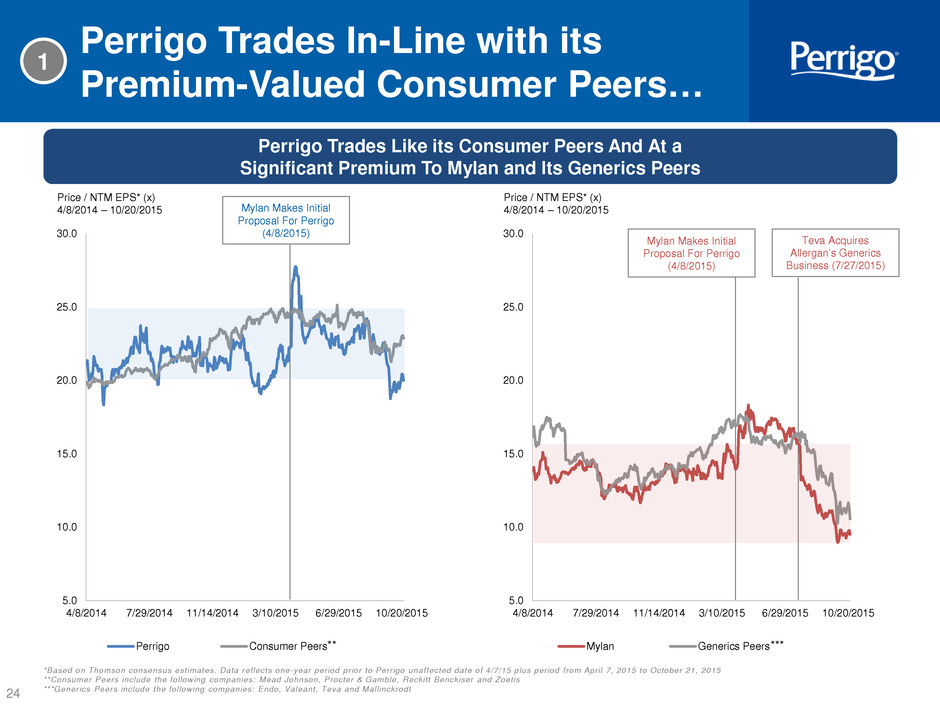

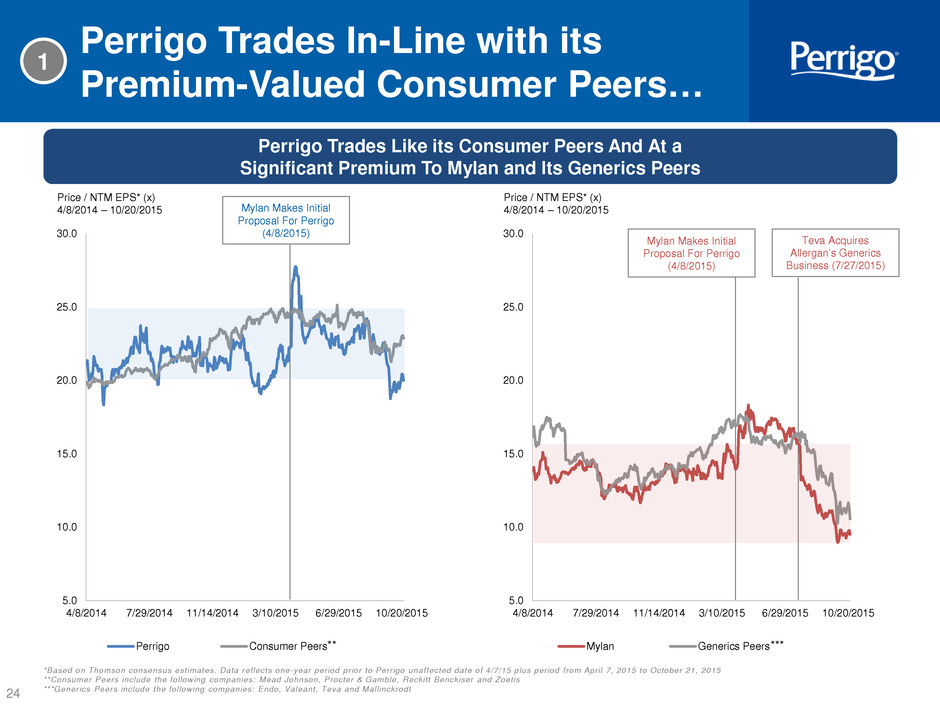

24 5.0 10.0 15.0 20.0 25.0 30.0 4/8/2014 7/29/2014 11/14/2014 3/10/2015 6/29/2015 10/20/2015 Perrigo Consumer Peers Perrigo Trades In-Line with its Premium-Valued Consumer Peers… 1 ** *** *Based on Thomson consensus estimates. Data reflects one-year period prior to Perrigo unaffected date of 4/7/15 plus period from April 7, 2015 to October 21, 2015 **Consumer Peers include the following companies: Mead Johnson, Procter & Gamble, Reckitt Benckiser and Zoetis ***Generics Peers include the following companies: Endo, Valeant, Teva and Mallinckrodt Perrigo Trades Like its Consumer Peers And At a Significant Premium To Mylan and Its Generics Peers Price / NTM EPS* (x) 4/8/2014 – 10/20/2015 Price / NTM EPS* (x) 4/8/2014 – 10/20/2015 Teva Acquires Allergan’s Generics Business (7/27/2015) Mylan Makes Initial Proposal For Perrigo (4/8/2015) Mylan Makes Initial Proposal For Perrigo (4/8/2015) 5.0 10.0 15.0 20.0 25.0 30.0 4/8/2014 7/29/2014 11/14/2014 3/10/2015 6/29/2015 10/20/2015 Mylan Generics Peers

25 …and at a Consistently High Premium to Mylan’s Valuation 1 Price / NTM EPS* (x) 4/8/2014 – 10/20/2015 Perrigo Trades at a Persistent and Significant Premium to Mylan Mylan Makes Initial Proposal For Perrigo (4/8/2015) 5.0 10.0 15.0 20.0 25.0 30.0 4/8/2014 7/29/2014 11/14/2014 3/10/2015 6/29/2015 10/20/2015 Perrigo Mylan ~10x Multiple Differential *Based on Thomson consensus estimates. Data reflects one-year period prior to Perrigo unaffected date of 4/7/15 plus period from April 7, 2015 to October 21, 2015

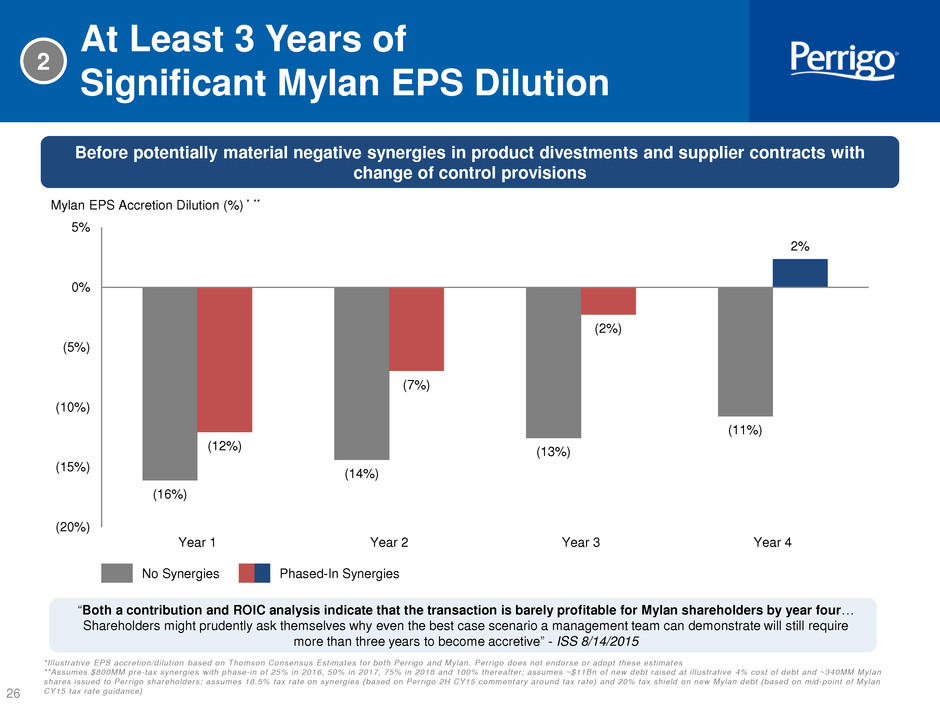

26 (16%) (14%) (13%) (11%) (12%) (7%) (2%) 2% (20%) (15%) (10%) (5%) 0% 5% Year 1 Year 2 Year 3 Year 4 Before potentially material negative synergies in product divestments and supplier contracts with change of control provisions *Il lustrative EPS accretion/dilut ion based on Thomson Consensus Estimates for both Perrigo and Mylan. Perrigo does not endorse or adopt these estimates **Assumes $800MM pre-tax synergies with phase-in of 25% in 2016, 50% in 2017, 75% in 2018 and 100% thereafter; assumes ~$11Bn of new debt raised at il lustrative 4% cost of debt and ~340MM Mylan shares issued to Perrigo shareholders; assumes 18.5% tax rate on synergies (based on Perrigo 2H CY15 commentary around tax rate) and 20% tax shield on new Mylan debt (based on mid-point of Mylan CY15 tax rate guidance) Mylan EPS Accretion Dilution (%) * ** No Synergies Phased-In Synergies At Least 3 Years of Significant Mylan EPS Dilution “Both a contribution and ROIC analysis indicate that the transaction is barely profitable for Mylan shareholders by year four… Shareholders might prudently ask themselves why even the best case scenario a management team can demonstrate will still require more than three years to become accretive” - ISS 8/14/2015 2

27 Limited Overlap Creates Significant Integration and Execution Challenges * See Appendix for reconcil iat ion of non-GAAP measures to GAAP. Only includes Perrigo numbers; no access to corresponding numbers of Mylan This slide demonstrates a belief statement of the board of Perrigo and is based on the Perrigo board's knowledge of its operating expenditure only. 3 No Presence in over 75% of Perrigo’s Business Over 75% of Perrigo’s operating cost base is in businesses where Mylan has no presence Consumer Healthcare (No Overlap) 35% Branded Consumer Healthcare (No Overlap) 42% 3Q Adjusted Operating Expenses* Virtually No Overlap with API in Perrigo’s OTC Products Of the hundreds of APIs used by Perrigo in the manufacture of 4,900 OTC products, Mylan currently only uses six of these in its own products No Overlap >99% Overlap <1 % Potentially Some Overlap No Overlap Potentially Some Overlap No Overlap

28 Third Parties Agree With Us “As a stakeholder company, Mylan deserves and will likely get a governance discount.” - Bernstein, September 8, 2015 “We see more value in PRGO standalone.” - RBC, October 14, 2015 Mylan Perrigo 4 “There is an open question of how to value Mylan shares as intrinsically, they have no value.” - Bernstein, August 7, 2015 “We continue to believe that PRGO standalone will drive higher returns for shareholders both in the near and longer term than the MYL tender offer.” - Guggenheim, September 24, 2015 “This stock would be much higher without that bid…If Mylan would just go away then Joe Papa can work his magic and Perrigo would go much higher.” - Jim Cramer, CNBC, October 6, 2015 “As stated earlier, we highly doubt it that MYL shareholders will ever see a value close to $90 in a normal investment time horizon, which we would think should cause some anger towards management and the board.” - Cowen & Co August 6, 2015

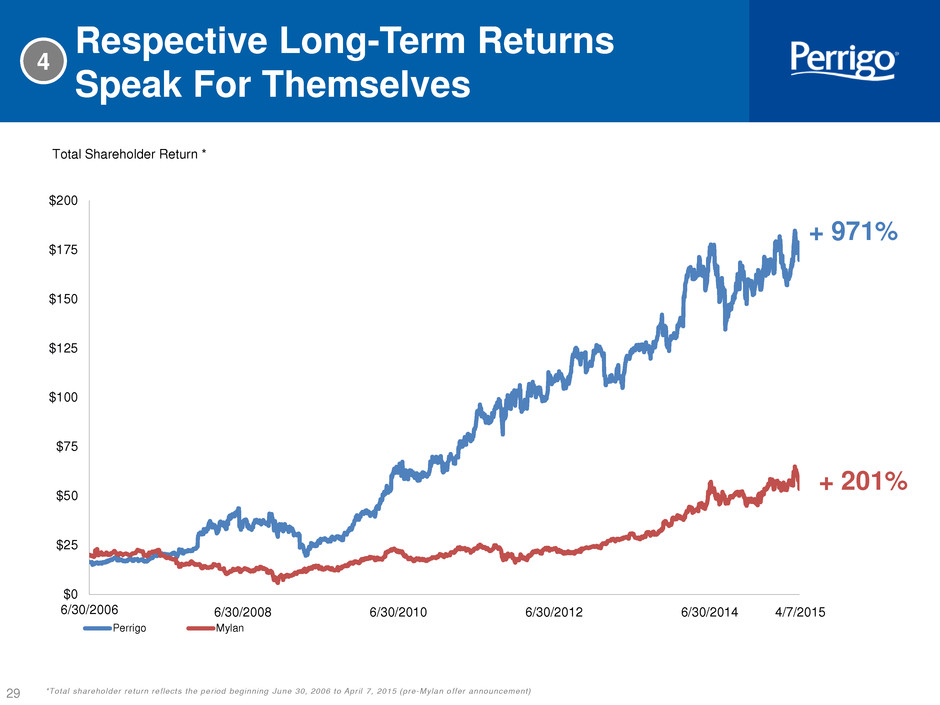

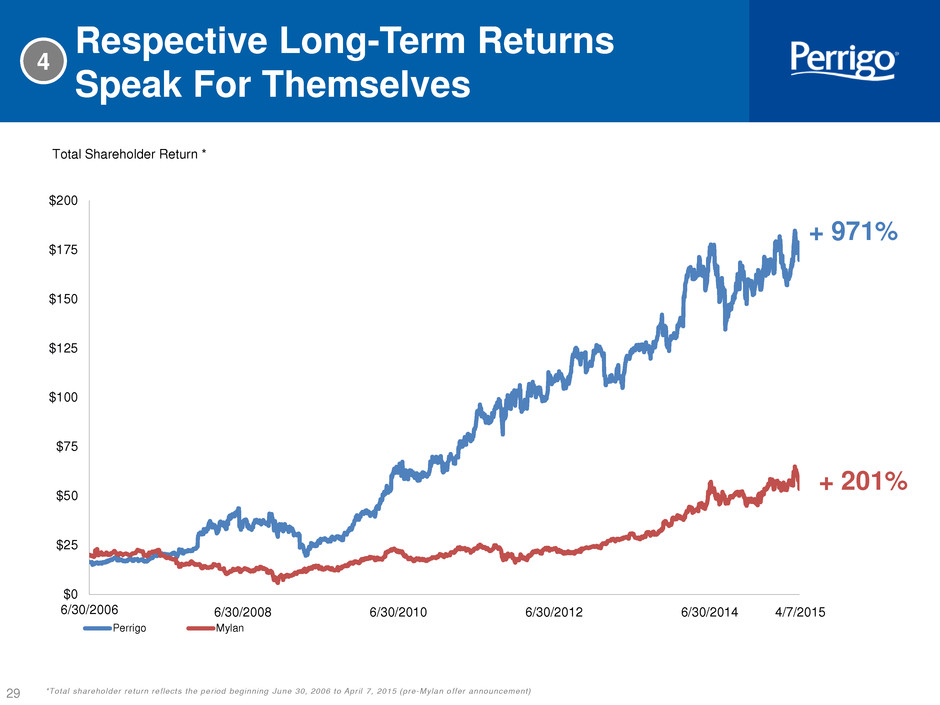

29 Respective Long-Term Returns Speak For Themselves $0 $25 $50 $75 $100 $125 $150 $175 $200 6/30/2006 Perrigo Mylan 4/7/2015 + 971% + 201% *Total shareholder return reflects the period beginning June 30, 2006 to April 7, 2015 (pre-Mylan offer announcement) 6/30/2014 6/30/2012 6/30/2010 6/30/2008 Total Shareholder Return * 4

30 $3.03 $4.01 $4.99 $5.61 $6.39 $7.28 $2 $3 $4 $5 $6 $7 $8 FY 6/2010 FY 6/2011 FY 6/2012 FY 6/2013 FY 6/2014 FY 6/2015 Perrigo Has A Long History of Delivering Strong Adjusted EPS Growth Adjusted EPS ($)* * Adjusted EPS reflects Perrigo reported figures; see Appendix for reconcil iat ion of non-GAAP to GAAP EPS. FY refers to f iscal years ended June and all amounts based on continuing operations 32% Growth 24% Growth 12% Growth 14% Growth 14% Growth

31 Run-rate Impact of Our Actions Provide Additional Upside Perrigo Is Committed to Continuing to Deliver Strong Earnings Growth + Additional Upside From M&A $7.75 $9.30 +$0.15 $9.45 +$0.38 $9.83 $7.00 $7.50 $8.00 $8.50 $9.00 $9.50 $10.00 $10.50 $11.00 CY2015 Guidance (Expertized) * CY2016 Guidance (Expertized) * Illustrative Impact of $500MM Buyback ** Illustrative CY2016 EPS Pro Forma For Buyback*** Run-rate Impact of Optimization Actions Illustrative Run-rate CY2016 EPS*** $7.65 $7.85 Adjusted EPS ($) + 20% + 22% + 27% * The Perrigo 2015 calendar year guidance and the Perrigo 2016 calendar year guidance have been reported on by EY and Morgan Stanley pursuant to Rule 23(a) of the Takeover Rules; those reports are available at www.perrigo.com ** $500MM of the stock repurchase plan expected to be completed by the end of 2015; plan is conditional on the lapsing of the Mylan Tender Offer and expected to add $0.15 to Adj. EPS on an annual basis in CY2016 *** These illustrative EPS figures are not intended to constitute a profit forecast for any period nor should any statements be interpreted to mean that earnings or earnings per share will necessarily be greater or lesser than those for the relevant preceding financial periods for Perrigo

32 Perrigo Provides a Premium to Mylan’s Offer Without Integration Risk 2016 Mylan 2016 Perrigo $200MM* $112MM** Perrigo Shareholders’ Share 40%*** 100% Adjusted Net Income Impact $65MM**** $94MM Current NTM P/E Trading Multiple 8.7x 18.3x Capitalized Value $0.6BN $1.7BN $65 $94 $- $120 Mylan Perrigo $0.60 $1.70 $- $2 Mylan Perrigo Adjusted Net Income Impact ($MM) Capitalized Value ($BN) * Assumes Mylan pre-tax synergies of $800MM with phase-in of 25% in 2016 ** Includes operational and tax benefits expected to be realized *** Based on Mylan Proxy statement **** Tax effected at same il lustrative 19% as used on page 31 of the Mylan October Investor Presentation No statement on this slide is intended to be a profit forecast

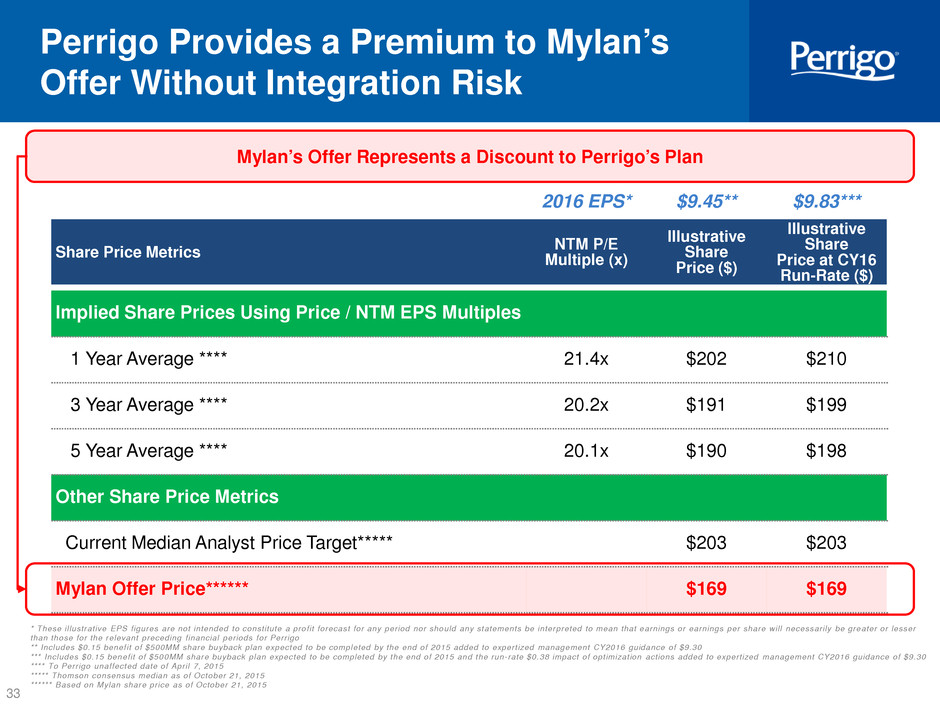

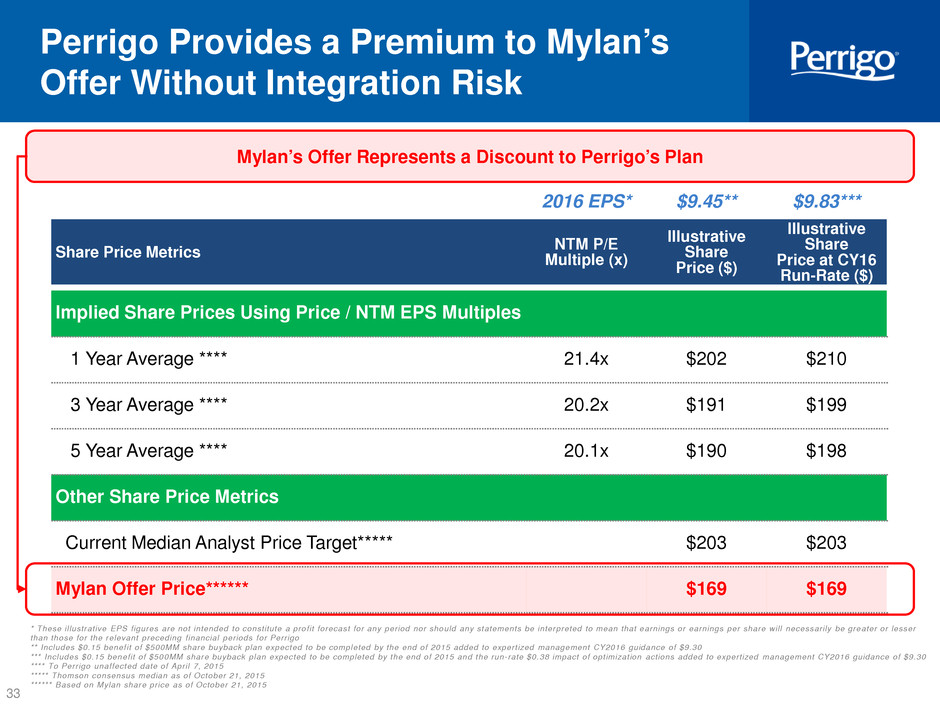

33 Perrigo Provides a Premium to Mylan’s Offer Without Integration Risk * These il lustrative EPS figures are not intended to constitute a profit forecast for any period nor should any statements be interpreted to mean that earnings or earnings per share will necessarily be greater or lesser than those for the relevant preceding financial periods for Perrigo ** Includes $0.15 benefit of $500MM share buyback plan expected to be completed by the end of 2015 added to expertized management CY2016 guidance of $9.30 *** Includes $0.15 benefit of $500MM share buyback plan expected to be completed by the end of 2015 and the run-rate $0.38 impact of optimizat ion actions added to expertized management CY2016 guidance of $9.30 **** To Perrigo unaffected date of April 7, 2015 ***** Thomson consensus median as of October 21, 2015 ****** Based on Mylan share price as of October 21, 2015 Mylan’s Offer Represents a Discount to Perrigo’s Plan 2016 EPS* $9.45** $9.83*** Share Price Metrics NTM P/E Multiple (x) Illustrative Share Price ($) Illustrative Share Price at CY16 Run-Rate ($) Implied Share Prices Using Price / NTM EPS Multiples 1 Year Average **** 21.4x $202 $210 3 Year Average **** 20.2x $191 $199 5 Year Average **** 20.1x $190 $198 Other Share Price Metrics Current Median Analyst Price Target***** $203 $203 Mylan Offer Price****** $169 $169

34 Perrigo Continues to Deliver Superior Value to Shareholders 3Q results demonstrate continued strong organic growth 10% organic growth in 3Q* Shareholder value optimization plan will deliver additional earnings power in CY16 and beyond by: − Consolidation of Global Supply Chain in Ireland − Organizational Enhancements − Strategic Portfolio Refinement $175MM** Full Year Run-Rate Strong CY16 guidance reflecting shareholder value optimization and ongoing strong operating performance $9.83*** Run-Rate Adjusted EPS Share buyback plan to return capital to shareholders $500MM in 2015 $1.5Bn in 2016-2018 Continued focus on value creating M&A, supported by a strong balance sheet 27 Deals Since FY2007 * As a percentage of consolidated Net Sales using constant currency. See appendix for reconcil iat ion of non-GAAP measures to GAAP ** Includes benefits of Perrigo’s effective tax rate of 14 – 15%. Not intended to constitute a profit forecast *** Illustrative run-rate EPS figure including the effect of the $500MM share repurchase to be completed by the end of calendar 2015 and the optimization actions described earlier. This illustrative EPS figure is not intended to constitute a profit forecast for any period nor should any statements be interpreted to mean that earnings or earnings per share will necessarily be greater or lesser than those for the relevant preceding financial periods for Perrigo

35 Strong Recommendation of Perrigo’s Board: Reject the Offer Mylan’s Offer is a Bad Deal for Perrigo’s Shareholders Reject Mylan’s Offer: Do Not Tender Perrigo Will Deliver Superior Value Creation Mylan’s Offer Substantially Undervalues Perrigo and Will Destroy Shareholder Value

36 Value Proposition Premium P/E Multiple Consistent Execution High Organic Growth Strong Governance Disciplined M&A Outsized Shareholder Returns Questions?

Contacts Arthur J. Shannon Vice President, Investor Relations and Global Communications (269) 686-1709 ajshannon@perrigo.com Bradley Joseph Director, Investor Relations and Global Communications (269) 686-3373 bradley.joseph@perrigo.com

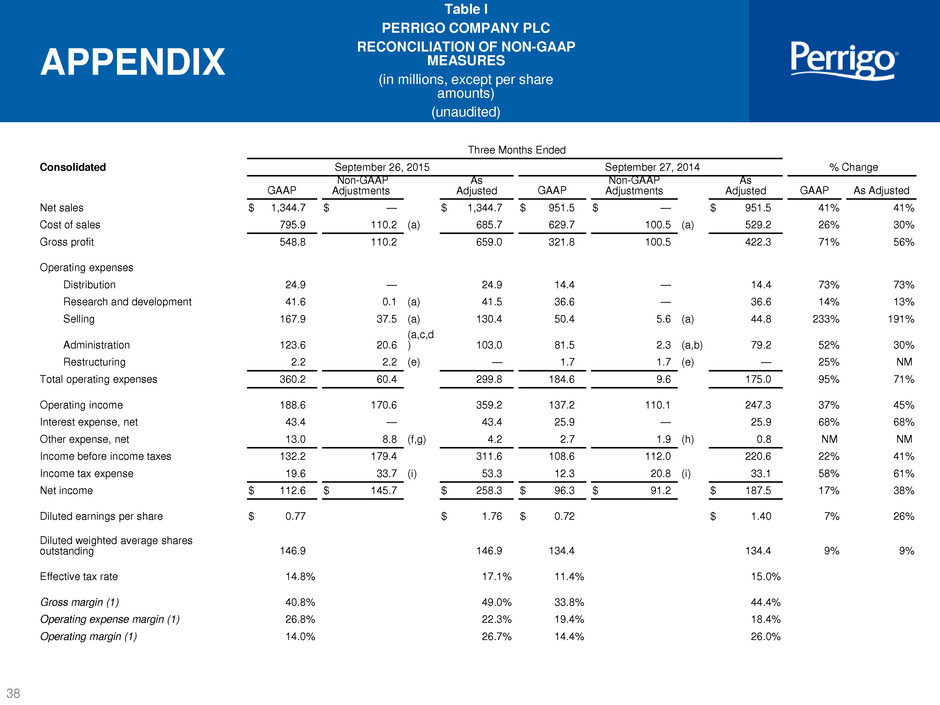

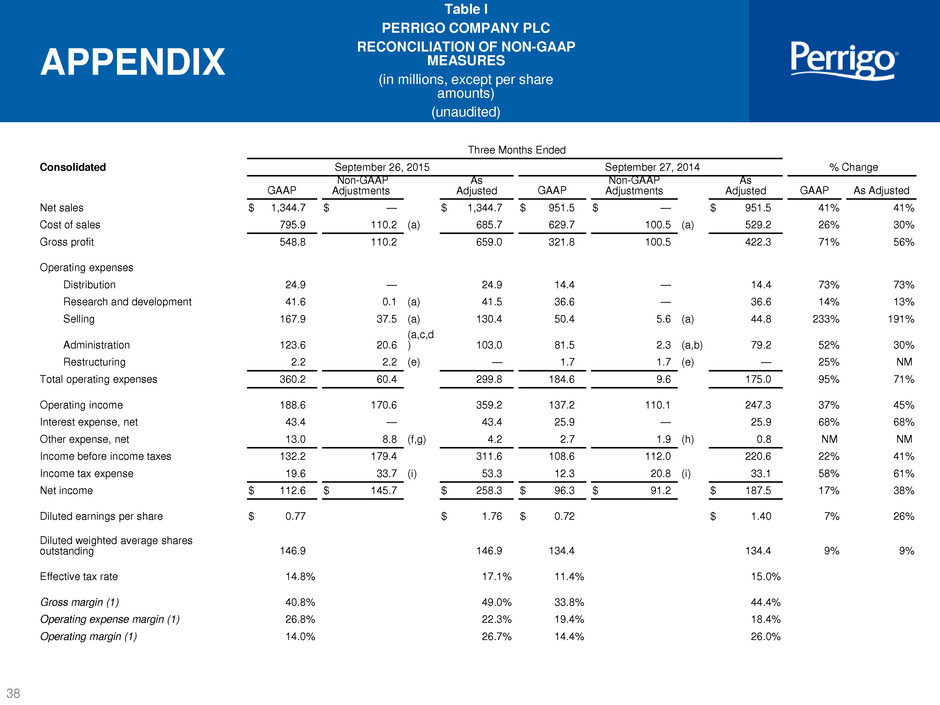

38 APPENDIX Table I PERRIGO COMPANY PLC RECONCILIATION OF NON-GAAP MEASURES (in millions, except per share amounts) (unaudited) Three Months Ended Consolidated September 26, 2015 September 27, 2014 % Change GAAP Non-GAAP Adjustments As Adjusted GAAP Non-GAAP Adjustments As Adjusted GAAP As Adjusted Net sales $ 1,344.7 $ — $ 1,344.7 $ 951.5 $ — $ 951.5 41 % 41 % Cost of sales 795.9 110.2 (a) 685.7 629.7 100.5 (a) 529.2 26 % 30 % Gross profit 548.8 110.2 659.0 321.8 100.5 422.3 71 % 56 % Operating expenses Distribution 24.9 — 24.9 14.4 — 14.4 73 % 73 % Research and development 41.6 0.1 (a) 41.5 36.6 — 36.6 14 % 13 % Selling 167.9 37.5 (a) 130.4 50.4 5.6 (a) 44.8 233 % 191 % Administration 123.6 20.6 (a,c,d ) 103.0 81.5 2.3 (a,b) 79.2 52 % 30 % Restructuring 2.2 2.2 (e) — 1.7 1.7 (e) — 25 % NM Total operating expenses 360.2 60.4 299.8 184.6 9.6 175.0 95 % 71 % Operating income 188.6 170.6 359.2 137.2 110.1 247.3 37 % 45 % Interest expense, net 43.4 — 43.4 25.9 — 25.9 68 % 68 % Other expense, net 13.0 8.8 (f,g) 4.2 2.7 1.9 (h) 0.8 NM NM Income before income taxes 132.2 179.4 311.6 108.6 112.0 220.6 22 % 41 % Income tax expense 19.6 33.7 (i) 53.3 12.3 20.8 (i) 33.1 58 % 61 % Net income $ 112.6 $ 145.7 $ 258.3 $ 96.3 $ 91.2 $ 187.5 17 % 38 % Diluted earnings per share $ 0.77 $ 1.76 $ 0.72 $ 1.40 7 % 26 % Diluted weighted average shares outstanding 146.9 — 146.9 134.4 134.4 9 % 9 % Effective tax rate 14.8 % 17.1 % 11.4 % 15.0 % Gross margin (1) 40.8 % 49.0 % 33.8 % 44.4 % Operating expense margin (1) 26.8 % 22.3 % 19.4 % 18.4 % Operating margin (1) 14.0 % 26.7 % 14.4 % 26.0 %

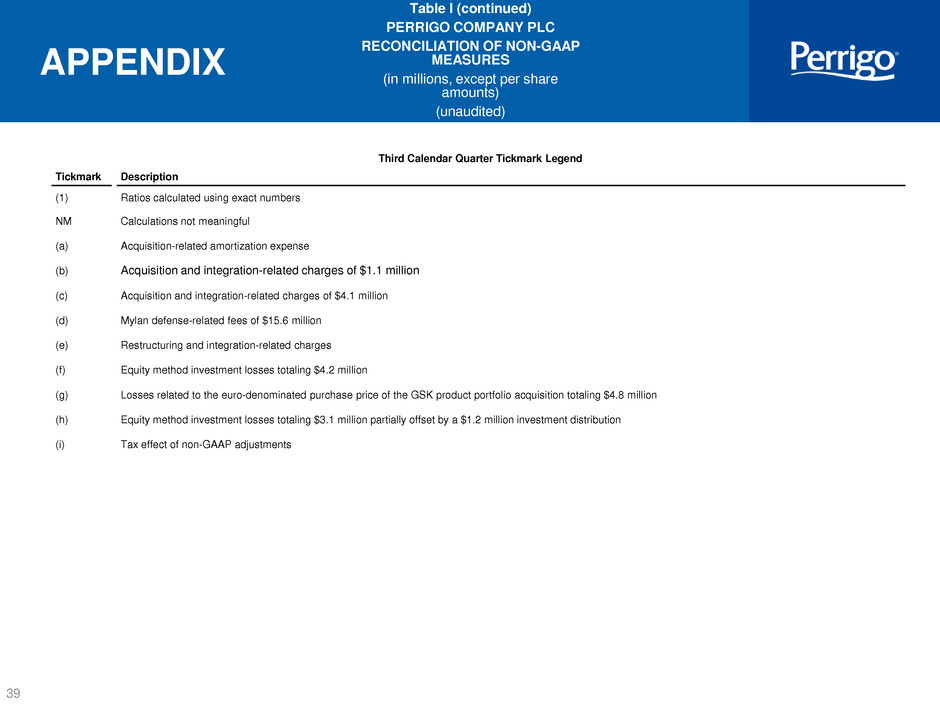

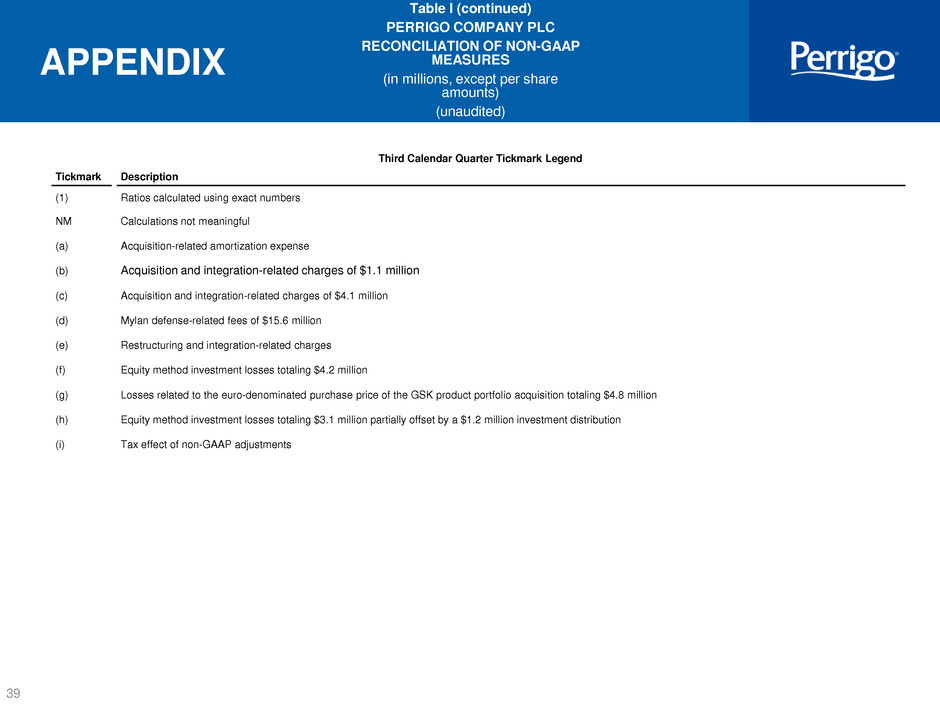

39 APPENDIX Table I (continued) PERRIGO COMPANY PLC RECONCILIATION OF NON-GAAP MEASURES (in millions, except per share amounts) (unaudited) Third Calendar Quarter Tickmark Legend Tickmark Description (1) Ratios calculated using exact numbers NM Calculations not meaningful (a) Acquisition-related amortization expense (b) Acquisition and integration-related charges of $1.1 million (c) Acquisition and integration-related charges of $4.1 million (d) Mylan defense-related fees of $15.6 million (e) Restructuring and integration-related charges (f) Equity method investment losses totaling $4.2 million (g) Losses related to the euro-denominated purchase price of the GSK product portfolio acquisition totaling $4.8 million (h) Equity method investment losses totaling $3.1 million partially offset by a $1.2 million investment distribution (i) Tax effect of non-GAAP adjustments

40 APPENDIX Table II PERRIGO COMPANY PLC REPORTABLE SEGMENTS RECONCILIATION OF NON-GAAP MEASURES (in millions) (unaudited) Three Months Ended Consumer Healthcare September 26, 2015 September 27, 2014 % Change GAAP Non-GAAP Adjustments As Adjusted GAAP Non-GAAP Adjustments As Adjusted GAAP As Adjusted Net sales $ 675.2 $ — $ 675.2 $ 640.3 $ — $ 640.3 5 % 5 % Cost of sales 444.2 13.8 (a) 430.4 447.3 10.6 (a) 436.7 -1 % -1 % Gross profit 231.0 13.8 244.8 193.0 10.6 203.6 20 % 20 % Operating expenses 113.7 7.6 (a,b) 106.1 118.2 8.2 (a,b) 110.0 -4 % -4 % Operating income $ 117.3 $ 21.4 $ 138.7 $ 74.8 $ 18.8 $ 93.6 57 % 48 % Gross margin (1) 34.2 % 36.2 % 30.1 % 31.8 % Operating margin (1) 17.4 % 20.5 % 11.7 % 14.6 % (1) Ratios calculated using exact numbers (a) Acquisition-related amortization expense (b) Restructuring charges and other integration-related expenses

41 APPENDIX Table II (continued) PERRIGO COMPANY PLC REPORTABLE SEGMENTS RECONCILIATION OF NON-GAAP MEASURES (in millions) (unaudited) Three Months Ended Branded Consumer Healthcare September 26, 2015 GAAP Non-GAAP Adjustments As Adjusted Net sales $ 302.2 $ — $ 302.2 Cost of sales 137.9 5.0 (a) 132.9 Gross profit 164.3 5.0 169.3 Operating expenses 159.9 34.8 (a,b) 125.1 Operating income $ 4.4 $ 39.8 $ 44.2 Gross margin (1) 54.4 % 56.0 % Operating margin (1) 1.4 % 14.6 % (1) Ratios calculated using exact numbers (a) Acquisition-related amortization expense (b) Acquisition and integration-related charges

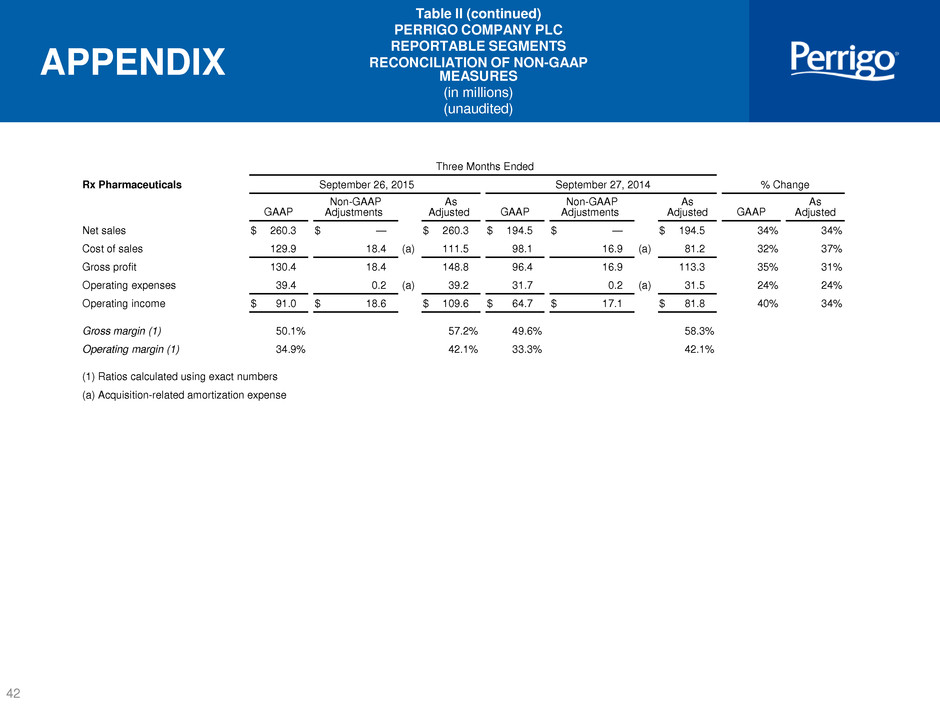

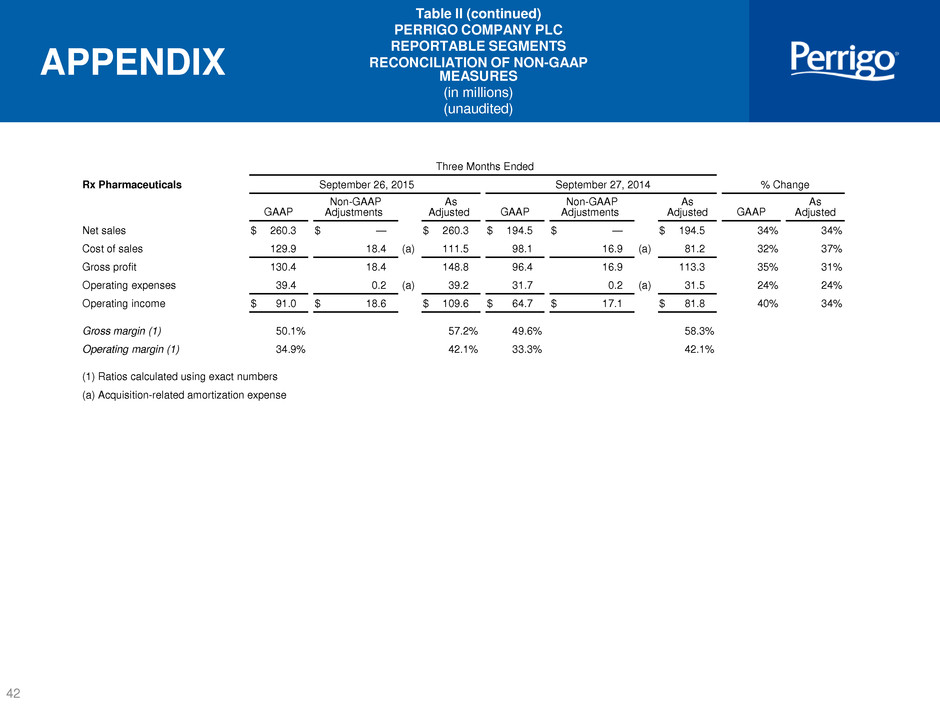

42 APPENDIX Table II (continued) PERRIGO COMPANY PLC REPORTABLE SEGMENTS RECONCILIATION OF NON-GAAP MEASURES (in millions) (unaudited) Three Months Ended Rx Pharmaceuticals September 26, 2015 September 27, 2014 % Change GAAP Non-GAAP Adjustments As Adjusted GAAP Non-GAAP Adjustments As Adjusted GAAP As Adjusted Net sales $ 260.3 $ — $ 260.3 $ 194.5 $ — $ 194.5 34 % 34 % Cost of sales 129.9 18.4 (a) 111.5 98.1 16.9 (a) 81.2 32 % 37 % Gross profit 130.4 18.4 148.8 96.4 16.9 113.3 35 % 31 % Operating expenses 39.4 0.2 (a) 39.2 31.7 0.2 (a) 31.5 24 % 24 % Operating income $ 91.0 $ 18.6 $ 109.6 $ 64.7 $ 17.1 $ 81.8 40 % 34 % Gross margin (1) 50.1 % 57.2 % 49.6 % 58.3 % Operating margin (1) 34.9 % 42.1 % 33.3 % 42.1 % (1) Ratios calculated using exact numbers (a) Acquisition-related amortization expense

43 APPENDIX Table II (continued) PERRIGO COMPANY PLC REPORTABLE SEGMENTS RECONCILIATION OF NON-GAAP MEASURES (in millions) (unaudited) Three Months Ended Specialty Sciences September 26, 2015 September 27, 2014 % Change GAAP Non-GAAP Adjustments As Adjusted GAAP Non-GAAP Adjustments As Adjusted GAAP As Adjusted Net sales $ 84.5 $ — $ 84.5 $ 91.9 $ — $ 91.9 -8 % -8 % Cost of sales 72.5 72.5 (a) — 72.5 72.5 (a) — — % NM Gross profit 12.0 72.5 84.5 19.4 72.5 91.9 -38 % -8 % Operating expenses 3.0 0.3 (a) 2.7 4.5 0.4 (a) 4.1 -33 % -35 % Operating income $ 9.0 $ 72.8 $ 81.8 $ 14.9 $ 72.9 $ 87.8 -39 % -7 % Gross margin (1) 14.2 % 100.0 % 21.1 % 100.0 % Operating margin (1) 10.7 % 96.9 % 16.2 % 95.6 % (1) Ratios calculated using exact numbers NM - Calculations are not meaningful (a) Acquisition-related amortization expense

44 APPENDIX Table III PERRIGO COMPANY PLC REPORTABLE SEGMENTS (in millions) (unaudited) Consolidated Q3 CY13 Net sales $ 933.4 Reported gross profit $ 356.3 Acquisition-related amortization 23.5 Adjusted gross profit $ 379.8 Adjusted gross margin 40.7 % Reported operating income $ 179.7 Acquisition-related amortization 29.9 Acquisition and integration-related charges 12.0 Litigation settlement 2.5 Restructuring charges 2.1 Adjusted operating income $ 226.2 Adjusted operating margin 24.2 %

45 APPENDIX Table IV PERRIGO COMPANY PLC (in millions) (unaudited) Three Months Ended September 26, 2015 September 27, 2014 % Change $ Change Net sales $ 1,344.7 $ 951.5 Less: Acquisitions made in the past 12 months (1) (316.9 ) — Organic net sales 1,027.8 951.5 8 % $ 76.3 Foreign exchange impact 19.0 — Organic net sales on a constant currency basis $ 1,046.8 $ 951.5 10 % $ 95.3 (1) Net sales from the acquisition of a product portfolio from Lumara Health, Inc. on October 31, 2014; the acquisition of Omega Pharma Invest N.V. on March 30, 2015; the acquisition of Gelcaps Exportadora de Mexico, S.A. de C.V. on May 12, 2015; the acquisition of products from GlaxoSmithKline Consumer Healthcare on August 28, 2015, the acquisition of the ScarAway® brand on August 31, 2015; and the Naturwohl Pharma GmbH acquisition on September 15, 2015.

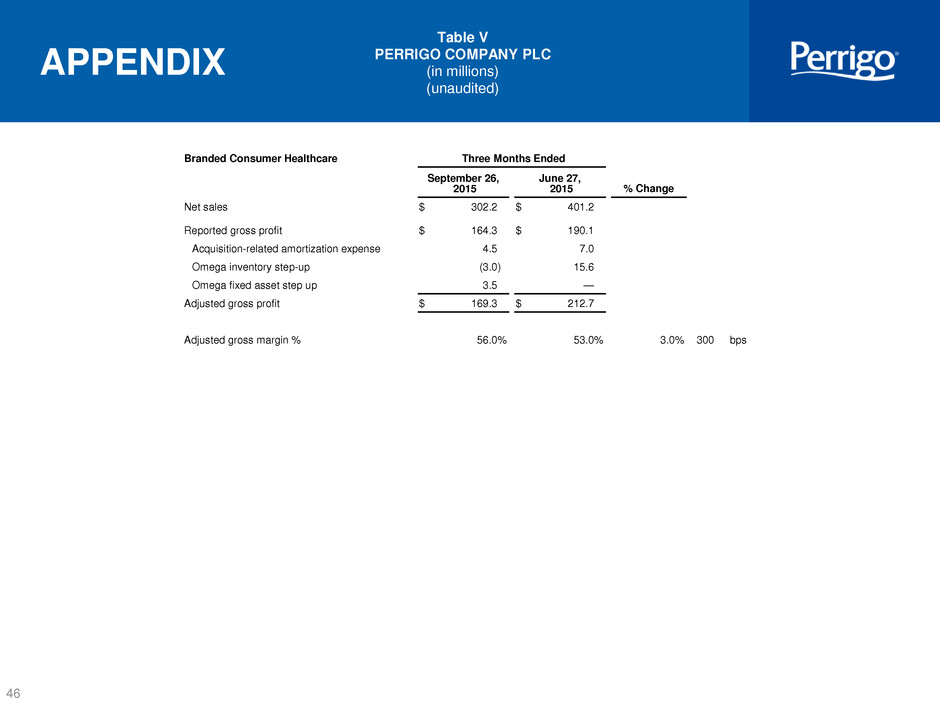

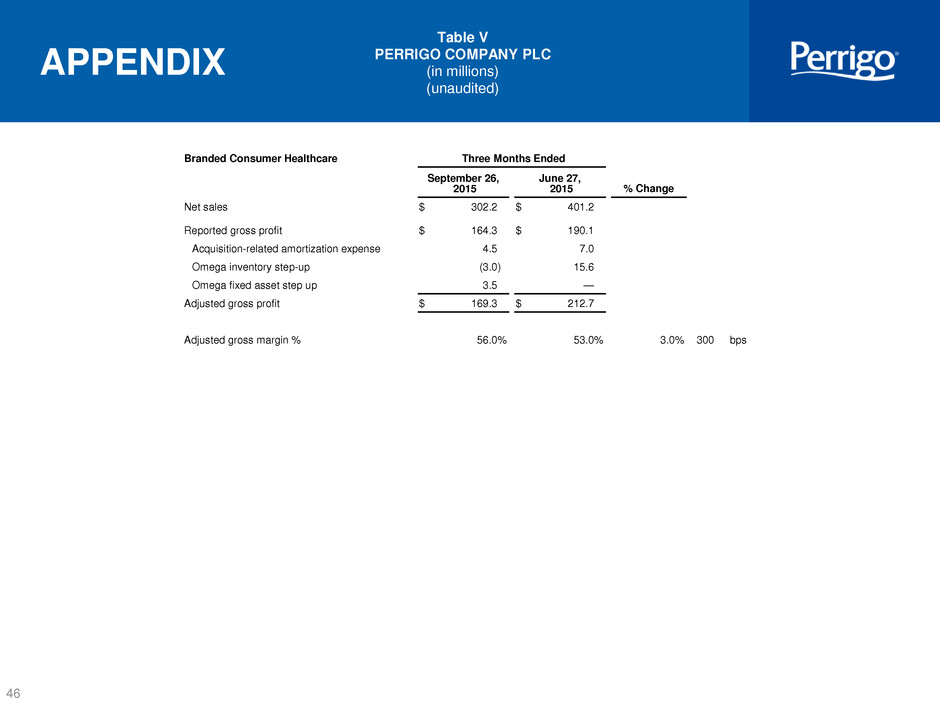

46 APPENDIX Table V PERRIGO COMPANY PLC (in millions) (unaudited) Branded Consumer Healthcare Three Months Ended September 26, 2015 June 27, 2015 % Change Net sales $ 302.2 $ 401.2 Reported gross profit $ 164.3 $ 190.1 Acquisition-related amortization expense 4.5 7.0 Omega inventory step-up (3.0 ) 15.6 Omega fixed asset step up 3.5 — Adjusted gross profit $ 169.3 $ 212.7 Adjusted gross margin % 56.0 % 53.0 % 3.0 % 300 bps

47 APPENDIX Table VI PERRIGO COMPANY PLC (in millions) (unaudited) Twelve Months Ended Consolidated December 27, 2014 GAAP (1) Non-GAAP Adjustments (1) As Adjusted (1) Net sales $ 4,171.6 $ — $ 4,171.6 Cost of sales 2,735.3 395.5 (a) 2,339.7 Gross profit 1,436.3 395.5 1,831.9 Operating expenses Distribution 57.2 — 57.2 Research and development 172.6 10.0 (b) 162.6 Selling 206.4 22.4 (a) 184.0 Administration 343.7 44.8 (a,c,d,e,f) 298.9 Restructuring 34.1 34.1 (g) — Total operating expenses 814.0 111.3 702.7 Operating income 622.3 506.8 1,129.2 Interest expense, net 109.2 5.0 (h) 104.2 Other expense, net 69.3 63.6 (i,j,k) 5.7 Loss on sale of investment 12.7 12.7 — Loss on extinguishment of debt 9.6 9.6 (l) — Income before income taxes 421.5 597.7 1,019.3 Income tax expense 75.2 101.5 (m) 176.6 Net income $ 346.3 $ 496.2 $ 842.7 Diluted earnings per share $ 2.57 $ 6.27 Diluted weighted average shares outstanding 135.0 (0.6 ) (n) 134.4

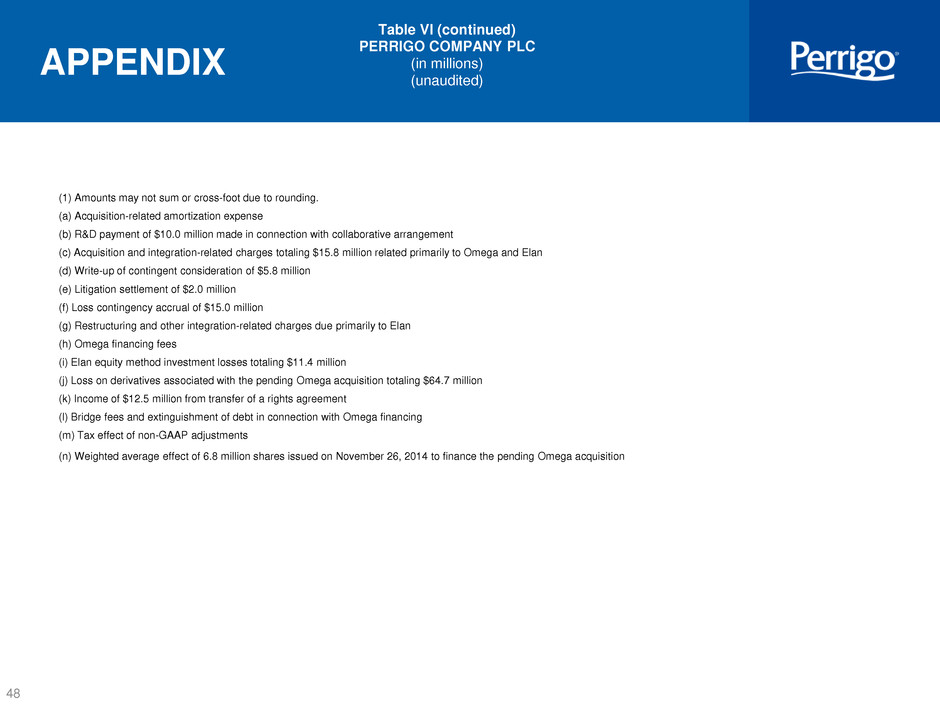

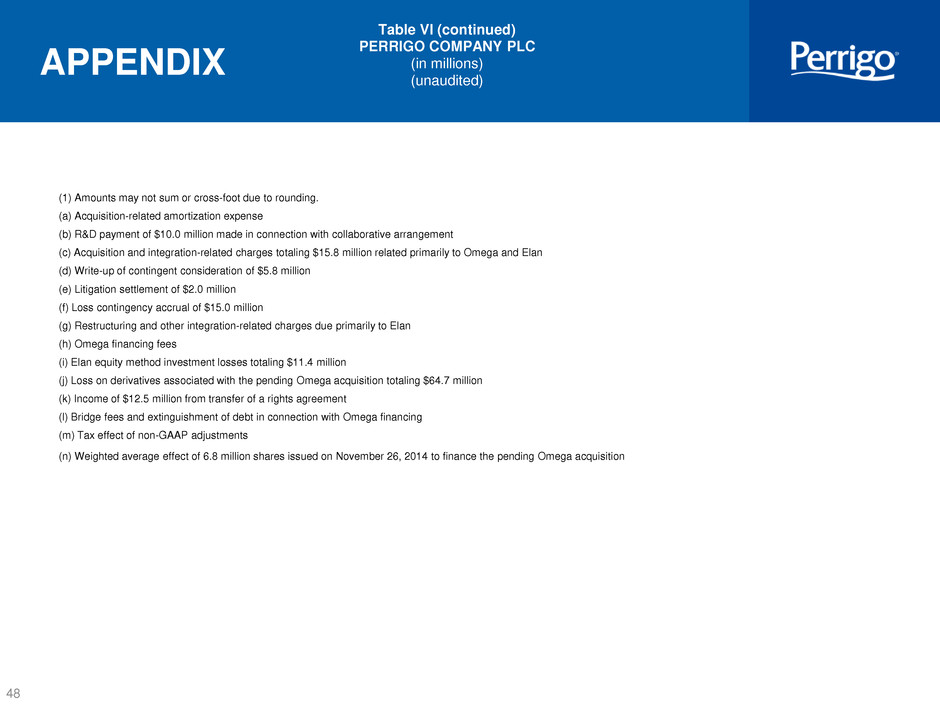

48 APPENDIX Table VI (continued) PERRIGO COMPANY PLC (in millions) (unaudited) (1) Amounts may not sum or cross-foot due to rounding. (a) Acquisition-related amortization expense (b) R&D payment of $10.0 million made in connection with collaborative arrangement (c) Acquisition and integration-related charges totaling $15.8 million related primarily to Omega and Elan (d) Write-up of contingent consideration of $5.8 million (e) Litigation settlement of $2.0 million (f) Loss contingency accrual of $15.0 million (g) Restructuring and other integration-related charges due primarily to Elan (h) Omega financing fees (i) Elan equity method investment losses totaling $11.4 million (j) Loss on derivatives associated with the pending Omega acquisition totaling $64.7 million (k) Income of $12.5 million from transfer of a rights agreement (l) Bridge fees and extinguishment of debt in connection with Omega financing (m) Tax effect of non-GAAP adjustments (n) Weighted average effect of 6.8 million shares issued on November 26, 2014 to finance the pending Omega acquisition

49 APPENDIX FY 2010* FY 2011* FY 2012* FY 2013 FY 2014 FY 2015 Consolidated Reported net income $ 224.4 $ 340.6 $ 393.0 $ 441.9 $ 205.3 $ 128.0 Acquisition and other integration-related costs (1) 7.8 2.0 5.9 5.8 292.2 127.7 Acquisition-related amortization (1) 18.1 32.1 49.2 63.1 220.4 375.1 Payments made in connection with an R&D collaborative arrangement and an R&D agreement (1) — — — — — 24.6 Consulting and legal fees associated with Mylan defense (1) — — — — — 13.4 Goodwill impairment (1) — — — — — 6.8 Losses on derivatives associated with foreign-currency-denominated acquisitions (1) — — — — — 259.9 Impact of acquisitions on deferred tax balances — — — — — 46.5 Inventory step-ups (1) 6.9 — 17.0 7.2 — 10.8 Restructuring charges (1) 9.3 0.7 5.7 1.7 4.5 1.9 Losses on equity method investments (1) — — — — — 10.1 Transfer of rights agreement (1) — — — — — (12.5 ) Losses on terminated interest rate swaps (1) — — — — — 3.6 Litigation settlement (1) — — — — 12.9 1.3 Write-offs and sales of in-process R&D (1) 14.6 — (1.4 ) 5.6 5.1 — Other adjustments (1) — — — 4.4 (0.9 ) 4.1 Adjusted net income $ 281.1 $ 375.4 $ 469.4 $ 525.3 $ 740.4 $ 1,001.3 Diluted earnings per share Reported $ 2.42 $ 3.64 $ 4.18 $ 4.68 $ 1.77 $ 0.92 Adjusted $ 3.03 $ 4.01 $ 4.99 $ 5.61 $ 6.39 $ 7.28 Diluted weighted average shares outstanding 92.8 93.5 94.1 94.5 115.6 139.8 Weighted average effect of 6.8 million shares issued on November 26, 2014 to finance the Omega acquisition (2.3 ) Adjusted diluted weighted average shares outstanding 137.5 (1) Net of taxes *All information based on continuing operations. FY 10 - FY 15 Adjusted diluted EPS CAGR FY 15: $7.28 ^ (1/5) - 1 = 19.2 % FY 10: $3.03 Table VII PERRIGO COMPANY PLC (in millions) (unaudited)

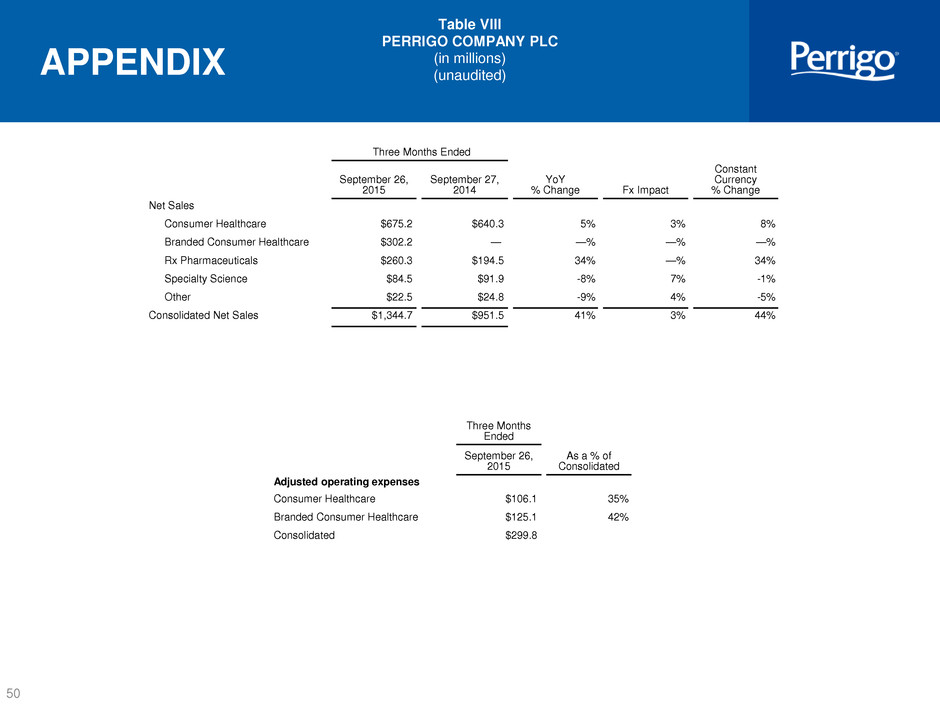

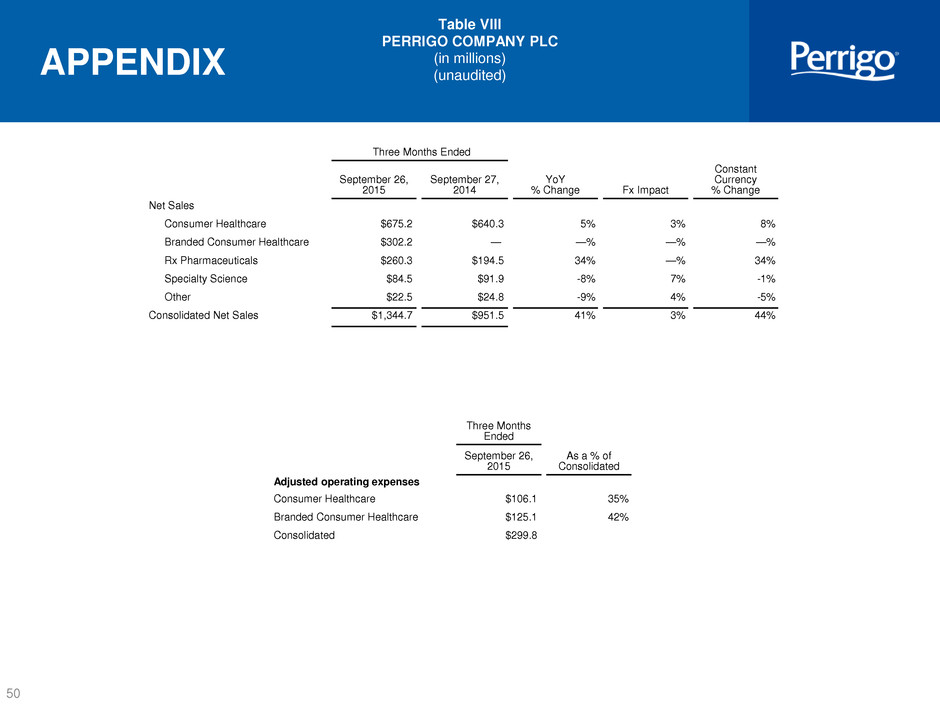

50 APPENDIX Three Months Ended September 26, 2015 September 27, 2014 YoY % Change Fx Impact Constant Currency % Change Net Sales Consumer Healthcare $675.2 $640.3 5 % 3 % 8 % Branded Consumer Healthcare $302.2 — — % — % — % Rx Pharmaceuticals $260.3 $194.5 34 % — % 34 % Specialty Science $84.5 $91.9 -8 % 7 % -1 % Other $22.5 $24.8 -9 % 4 % -5 % Consolidated Net Sales $1,344.7 $951.5 41 % 3 % 44 % Three Months Ended September 26, 2015 As a % of Consolidated Adjusted operating expenses Consumer Healthcare $106.1 35 % Branded Consumer Healthcare $125.1 42 % Consolidated $299.8 Table VIII PERRIGO COMPANY PLC (in millions) (unaudited)