DESCRIPTION OF ORDINARY SHARES The summary of the general terms and provisions of the shares of Perrigo Company plc (“Perrigo”) set forth below does not purport to be complete and is subject to and qualified by reference to the Irish Companies Act 2014 (the “Companies Act”) and Perrigo's memorandum and articles of association (as amended). The statements made under this caption include summaries of certain provisions contained in our memorandum and articles of association (as amended). For additional information, please read the memorandum and articles of association and the applicable provisions of the Companies Act. Capital Structure Authorized Share Capital Perrigo's authorized share capital is €10,000,000 and $1,000, divided into 10,000,000,000 ordinary shares of €0.001 each and 10,000,000 preferred shares of $0.0001 each. Perrigo may issue shares subject to the maximum authorized share capital contained in its memorandum and articles of association. The authorized share capital may be increased or reduced by a resolution approved by a simple majority of the votes cast at a general meeting of its shareholders at which a quorum is present (referred to under Irish law as an “ordinary resolution”). The shares comprising the authorized share capital of Perrigo may be divided into shares of such nominal value as the resolution shall prescribe. As a matter of Irish company law, the directors of a company may issue new ordinary or preferred shares without shareholder approval once authorized to do so by the articles of association or by an ordinary resolution adopted by the shareholders at a general meeting. The authorization may be granted for a maximum period of five years, at which point it must be renewed by the shareholders by an ordinary resolution. Perrigo's shareholders historically have adopted an ordinary resolution at the annual general meeting of Perrigo authorizing the board of directors to issue up to approximately 33% of the aggregate nominal value of the issued share capital of Perrigo, and Perrigo expects to propose the renewal of this authorization on a regular basis at its annual general meetings in subsequent years, which is currently the customary practice in Ireland. The rights and restrictions to which the ordinary shares are subject are prescribed in Perrigo’s articles of association. Perrigo’s articles of association permit the board of directors, without shareholder approval, to determine certain terms of each series of the preferred shares issued by Perrigo, including the number of shares, designations, relative voting rights, dividend rights, liquidation and other rights and redemption, repurchase or exchange rights. Irish law does not recognize fractional shares held of record. Accordingly, Perrigo’s articles of association do not provide for the issuance of fractional shares of Perrigo, and the official Irish register of Perrigo does not reflect any fractional shares. Whenever an alteration or reorganization of the share capital of Perrigo would result in any Perrigo shareholder becoming entitled to fractions of a share, Perrigo board of directors may, on behalf of those shareholders that would become entitled to fractions of a share, arrange for the sale of the shares representing fractions and the distribution of the net proceeds of the sale in due proportion among the shareholders who would have been entitled to such fractions. For the purpose of any such sale, the board of directors may authorize any person to transfer the shares representing fractions to the purchaser, who shall not be bound to see to the application of the purchase money, nor shall the purchaser’s title to the shares be affected by any irregularity or invalidity in the proceedings relating to the sale. Preemption Rights, Share Warrants and Options

Under Irish law, certain statutory preemption rights apply automatically in favor of shareholders where shares are to be issued for cash. Perrigo initially opted out of these preemption rights in its articles of association adopted in December 2013 as permitted under Irish company law. Because Irish law requires this opt-out to be renewed every five years by a resolution approved by not less than 75% of the votes of the shareholders of Perrigo cast at a general meeting at which a quorum is present (referred to under Irish law as a “special resolution”), Perrigo’s articles of association provide that this opt-out must be so renewed. If the opt-out is not renewed, shares issued for cash must be offered to existing shareholders of Perrigo on a pro rata basis to their existing shareholding before the shares can be issued to any new shareholders. The statutory preemption rights do not apply where shares are issued for non-cash consideration (such as in a share-for-share acquisition) and do not apply to the issue of non-equity shares (that is, shares that have the right to participate only up to a specified amount in any income or capital distribution) or where shares are issued pursuant to an employee option or similar equity plan. Perrigo's shareholders passed a special resolution at the 2019 annual general meeting of Perrigo on April 26, 2019 authorizing the board of directors to opt out of preemption rights with respect to the issuance of equity securities up to an aggregate nominal value of €13,587 (13,587,306 shares) (being equivalent to approximately 10% of the aggregate nominal value of the issued ordinary share capital of Perrigo as of February 26, 2019) for a period of 18 months from April 26, 2019 (provided that with respect to 6,793,653 of such shares (being equivalent to approximately 5% of the issued ordinary share capital of Perrigo as of February 26, 2019), such allotment is to be used for the purposes of an acquisition or a specified capital investment). The articles of association of Perrigo provide that, subject to any shareholder approval requirement under any laws, regulations or the rules of any stock exchange to which Perrigo is subject, the board of directors is authorized, from time to time, in its discretion, to grant such persons, for such periods and upon such terms as the board deems advisable, options to purchase such number of shares of any class or classes or of any series of any class as the board may deem advisable, and to cause warrants or other appropriate instruments evidencing such options to be issued. The Companies Act provides that directors may issue share warrants or options without shareholder approval once authorized to do so by the articles of association or an ordinary resolution of shareholders. Perrigo is subject to the rules of The New York Stock Exchange and the [U.S. Internal Revenue Code of 1986, as amended] Perrigo to confirm that require shareholder approval of certain equity plans and share issuances. Perrigo's board of directors may authorize the issuance of shares upon exercise of warrants or options without shareholder approval or authorization (up to the relevant authorized share capital limit). Dividends Under Irish law, dividends and distributions may only be made from distributable reserves. Distributable reserves generally means accumulated realized profits less accumulated realized losses and includes reserves created by way of capital reduction. In addition, no distribution or dividend may be made unless the net assets of Perrigo are equal to, or in excess of, the aggregate of Perrigo’s called up share capital plus undistributable reserves and the distribution does not reduce Perrigo’s net assets below such aggregate. Undistributable reserves include the share premium account, the par value of Perrigo shares acquired by Perrigo and the amount by which Perrigo’s accumulated unrealized profits, so far as not previously utilized by any capitalization, exceed Perrigo’s accumulated unrealized losses, so far as not previously written off in a reduction or reorganization of capital. The determination as to whether or not Perrigo has sufficient distributable reserves to fund a dividend must be made by reference to “relevant financial statements” of Perrigo. The “relevant financial statements” will be either the last set of unconsolidated annual audited financial statements or other financial statements properly prepared in accordance with the Companies Act that give a “true and fair

view” of Perrigo’s unconsolidated financial position and accord with accepted accounting practice. The “relevant financial statements” must be filed in the Companies Registration Office (the official public registry for companies in Ireland). Perrigo’s memorandum and articles of association authorize the directors to declare dividends to the extent they appear justified by profits without shareholder approval. The board of directors may also recommend a dividend to be approved and declared by Perrigo shareholders at a general meeting. No dividend issued may exceed the amount recommended by the directors. Dividends may be declared and paid in the form of cash or non-cash assets, including shares, and may be paid in U.S. dollars or any other currency. All holders of ordinary shares of Perrigo will participate pro rata in respect of any dividend which may be declared in respect of ordinary shares by Perrigo. The directors of Perrigo may deduct from any dividend payable to any shareholder any amounts payable by such shareholder to Perrigo in relation to the shares of Perrigo. The directors may also issue shares with preferred rights to participate in dividends declared by Perrigo. The holders of preferred shares may, depending on their terms, rank senior to Perrigo ordinary shares in terms of dividend rights and/or be entitled to claim arrears of a declared dividend out of subsequently declared dividends in priority to ordinary shareholders. Bonus Shares Under the articles of association, the board of directors may resolve to capitalize any amount credited to any reserve available for distribution or the share premium account or other of our undistributable reserves for issuance and distribution to shareholders as fully paid up bonus shares on the same basis of entitlement as would apply in respect of a dividend distribution. Share Repurchases, Redemptions and Conversions Overview Perrigo’s memorandum and articles of association provide that any ordinary share which Perrigo has agreed to acquire shall be deemed to be a redeemable share, unless the board resolves otherwise. Accordingly, for Irish company law purposes, the repurchase of ordinary shares by Perrigo will technically be effected as a redemption of those shares as described below under “Repurchases and Redemptions by Perrigo.” If the articles of association of Perrigo did not contain such provisions, all repurchases by Perrigo would be subject to many of the same rules that apply to purchases of Perrigo ordinary shares by subsidiaries described below under “Purchases by Subsidiaries of Perrigo” including the shareholder approval requirements described below and the requirement that any on-market purchases be effected on a “recognized stock exchange”. No constituent document of Perrigo places limitations on the right of nonresident or foreign owners to vote or hold Perrigo ordinary shares. Repurchases and Redemptions by Perrigo Under Irish law, a company may issue redeemable shares and redeem them out of distributable reserves or the proceeds of a new issue of shares for that purpose. Perrigo may only issue redeemable shares if the nominal value of the issued share capital that is not redeemable is not less than 10% of the nominal value of the total issued share capital of Perrigo. All redeemable shares must also be fully-paid. Redeemable shares may, upon redemption, be cancelled or held in treasury. Based on the provision of Perrigo’s

articles of association described above, shareholder approval will not be required to redeem Perrigo ordinary shares. Perrigo may also be given an additional general authority by its shareholders to purchase its own shares on-market by way of ordinary resolution which would take effect on the same terms and be subject to the same conditions as applicable to purchases by Perrigo’s subsidiaries as described below. Repurchased and redeemed shares may be cancelled or held as treasury shares. The nominal value of treasury shares held by Perrigo at any time must not exceed 10% of the aggregate of the par value and share premium received in respect of the allotment of Perrigo shares together with the par value of any shares acquired by Perrigo. Perrigo may not exercise any voting rights in respect of any shares held as treasury shares. Treasury shares may be cancelled by Perrigo or re-issued subject to certain conditions. Purchases by Subsidiaries of Perrigo Under Irish law, an Irish or non-Irish subsidiary may purchase shares of Perrigo either on-market or off- market. For a subsidiary of Perrigo to make on-market purchases of Perrigo ordinary shares, the shareholders of Perrigo must provide general authorization for such purchase by way of ordinary resolution. However, as long as this general authority has been granted, no specific shareholder authority for a particular on-market purchase by a subsidiary of Perrigo ordinary shares is required. For an off- market purchase by a subsidiary of Perrigo, the proposed purchase contract must be authorized by special resolution of the shareholders before the contract is entered into. The person whose shares are to be bought back cannot vote in favor of the special resolution and, from the date of the notice of the meeting at which the resolution approving the contract is to be proposed, the purchase contract must be on display or must be available for inspection by shareholders at the registered office of Perrigo. In order for a subsidiary of Perrigo to make an on-market purchase of Perrigo’s ordinary shares, such ordinary shares must be purchased on a “recognized stock exchange”. The New York Stock Exchange, on which the ordinary shares of Perrigo are listed, is specified as a recognized stock exchange for this purpose by Irish company law. The Tel Aviv Stock Exchange, on which the ordinary shares of Perrigo are also listed, is not a recognized stock exchange for the purposes of Irish company law. The number of ordinary shares of Perrigo held by the subsidiaries of Perrigo at any time will count as treasury shares and will be included in any calculation of the permitted treasury share threshold of 10% of the aggregate of the par value and share premium in respect of the allotment of Perrigo shares together with the par value of any shares acquired by Perrigo. While a subsidiary holds ordinary shares of Perrigo, it cannot exercise any voting rights in respect of those ordinary shares. The acquisition of the ordinary shares of Perrigo by a subsidiary must be funded out of distributable reserves of the subsidiary. Lien on Ordinary Shares, Calls on Ordinary Shares and Forfeiture of Ordinary Shares Perrigo’s articles of association provide that Perrigo will have a first and paramount lien on every ordinary share for all moneys payable, whether presently due or not, in respect of such Perrigo ordinary share. Subject to the terms of their allotment, the board may call for any unpaid amounts in respect of any ordinary shares to be paid, and if payment is not made, the ordinary shares may be forfeited. These provisions are standard inclusions in the articles of association of an Irish company limited by shares such as Perrigo and will only be applicable to ordinary shares of Perrigo that have not been fully paid up.

DESCRIPTION OF DEBT SECURITIES 4.900% Notes due 2030 6.125% Notes due 2032 5.375% Notes due 2032 5.300% Notes due 2043 4.900% Notes due 2044 Notes Perrigo Finance Unlimited Company (“Perrigo Finance”), a public unlimited company incorporated under the laws of Ireland and an indirect wholly-owned finance subsidiary of Perrigo whose primary purpose is to finance the business and operations of Perrigo and its affiliates, has issued certain notes as described below. The following description of these notes is a summary only. This summary is not complete and is qualified in its entirety by reference to the Indentures defined herein and filed as Exhibits to our Annual Report on Form 10-K. In the following summaries, references to the “Company,” “we,” “us” and “our” refer only to Perrigo and not any of its subsidiaries. 2013 Notes due November 15, 2043 General On November 8, 2013, Perrigo issued $400.0 million aggregate principal amount of its 5.300% senior notes due 2043 (the “2043 Notes”). The 2043 Notes are governed by a base indenture dated as of November 8, 2013 and a first supplemental indenture (collectively, the “2043 Notes Indenture”). The 2043 Notes are our unsecured and unsubordinated obligations, ranking equally in right of payment to all of our existing and future unsecured and unsubordinated indebtedness. The 2043 Notes are not entitled to mandatory redemption or sinking fund payments. Capitalized terms used but not defined in this section have the meanings ascribed thereto in the 2043 Notes Indenture. Ranking The 2043 Notes: are the unsecured, senior obligations of Perrigo Finance and rank equally with all of Perrigo Finance’s other unsecured senior indebtedness; are effectively subordinated to any existing or future secured obligations of Perrigo Finance, to the extent of the value of the collateral securing such other obligations; are senior in right of payment to any obligations of Perrigo Finance that are by their terms expressly subordinated or junior in right of payment to the notes; and are structurally subordinated to the obligations of the subsidiaries of Perrigo Finance that do not guarantee the notes. The guarantees of the 2043 Notes: are the senior obligations of each Guarantor; rank equally in right of payment with any existing and future senior indebtedness of each Guarantor; are senior in right of payment to any obligations of each Guarantor that are by their terms expressly subordinated or junior in right of payment to the guarantees of the notes; and

are effectively subordinated to any existing or future secured obligations of each Guarantor, to the extent of the value of the collateral securing such obligations. Principal and Interest The 2043 Notes will mature on November 15, 2043, bear interest at the annual rate of 5.30% and accrue interest from November 8, 2013 or from the most recent date to which interest has been paid or provided for. Interest is payable semi-annually, on May 15 and November 15, beginning on May 15, 2014, to each person in whose name the notes are registered at the close of business on each May 1 and November 1 (whether or not that date is a business day as that term is defined in the 2043 Notes Indenture). We compute interest on the 2043 Notes on the basis of a 360-day year consisting of twelve 30-day months. Redemption Optional Redemption All or a portion of the 2043 Notes may be redeemed at our option at any time or from time to time. The redemption price to be redeemed on any redemption date will be equal to the greater of the following amounts: 100% of the principal amount of the notes of that series being redeemed on the redemption date; and the sum of the present values of the remaining scheduled payments of principal and interest on the applicable series of notes being redeemed on that redemption date (not including any portion of any payments of interest accrued to the redemption date), discounted to the redemption date on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the Adjusted Treasury Rate, plus 25 basis points, as determined by the applicable Independent Investment Banker, plus, in each case, accrued and unpaid interest, on the applicable series of notes to the redemption date. Notwithstanding the foregoing, installments of interest on the applicable series of notes that are due and payable on interest payment dates falling on or prior to a redemption date will be payable on the interest payment date to the registered holders as of the close of business on the relevant record date according to the applicable series of notes and the 2043 Notes Indenture. In addition, we will have the right to redeem in whole at any time or in part from time to time, at our option, the 2043 Notes on or after May 15, 2043 (six months prior to their maturity date), in each case, at a redemption price equal to 100% of the aggregate principal amount of the notes of the applicable series being redeemed plus, in each case, accrued and unpaid interest, if any, to, but excluding, the redemption date. Tax Redemption Perrigo Finance may redeem the notes of any series in whole, but not in part, at its discretion at any time upon giving not less than 30 nor more than 60 days’ notice to the note holders (which notice will be irrevocable) at a redemption price equal to 100% of the principal amount thereof, together with accrued and unpaid interest, if any, to the date fixed by Perrigo Finance for redemption (a “Tax Redemption Date”) (subject to the right of holders of record on the relevant record date to receive interest due on the relevant interest payment date) and Additional Amounts (as defined in section 1015 of the base

indenture), if any, then due and which will become due on the Tax Redemption Date as a result of the redemption or otherwise, if Perrigo Finance determines that, as a result of: (1) any change in, or amendment to, any law or treaty (or any regulations or rulings promulgated thereunder) of a Relevant Taxing Jurisdiction affecting taxation; or (2) any amendment to or any change in the application, administration or interpretation of such laws, treaties, regulations or rulings (including by virtue of a holding, judgment or order by a court of competent jurisdiction or a change in published administrative practice) (each of the foregoing in clauses (1) and (2), a “Change in Tax Law”), Perrigo Finance, with respect to the 2043 Notes or any Guarantor, with respect to its guarantee, as the case may be, is, or on the next interest payment date in respect of the notes would be, required to pay Additional Amounts. Offer to Purchase Upon Change of Control Triggering Event If a change of control triggering event occurs with respect to the 2043 Notes, unless we have exercised our option to redeem the applicable notes as described above, we will be required to make an offer (the “change of control offer”) to each holder of the notes as to which the change of control triggering event has occurred to repurchase all or any part (equal to $2,000 or an integral multiple of $1,000 in excess thereof) of that holder’s applicable notes on the terms set forth in such notes. In the change of control offer, we will be required to offer payment in cash equal to 101% of the aggregate principal amount of notes repurchased, plus accrued and unpaid interest on the applicable notes repurchased to, but not including, the date of repurchase (the “change of control payment”). Within 30 days following any change of control triggering event or, at our option, prior to any change of control triggering event, but after public announcement of the transaction that constitutes or may constitute the change of control triggering event, a notice will be mailed (or, to the extent permitted or required by applicable DTC procedures or regulations, sent electronically) to holders of the applicable notes and the trustee describing the transaction that constitutes or may constitute the change of control triggering event and offering to repurchase the 2043 Notes on the date specified in the notice, which date will be no earlier than 30 days and no later than 60 days from the date such notice is mailed or sent (the “change of control payment date”). The notice will, if mailed or sent prior to the date of consummation of the change of control, state that the offer to purchase is conditioned on the change of control triggering event occurring with respect to the applicable notes on or prior to the change of control payment date. On the change of control payment date, we will, to the extent lawful: accept for payment all applicable notes or portions of such notes properly tendered pursuant to the applicable change of control offer; deposit with the paying agent an amount equal to the change of control payment in respect of all such notes or portions of notes properly tendered; and deliver or cause to be delivered to the trustee the applicable notes properly accepted together with an officer’s certificate stating the aggregate principal amount of the applicable notes or portions of such notes being repurchased and that all conditions precedent provided for in the 2043 Notes Indenture to the change of control offer and to the repurchase by us of the applicable notes pursuant to the change of control offer have been met.

We will not be required to make a change of control offer upon the occurrence of a change of control triggering event if a third party makes such an offer in the manner, at the times and otherwise in compliance with the requirements for an offer made by us and the third party repurchases all applicable notes properly tendered and not withdrawn under its offer. For purposes of the change of control offer provisions: “Change of control” means the occurrence of any of the following: (1) the consummation of any transaction (including, without limitation, any merger or consolidation) the result of which is that any “person” (as that term is used in Section 13(d)(3) of the Exchange Act), other than us or one of our subsidiaries, becomes the beneficial owner (as defined in Rules 13d-3 and 13d-5 under the Exchange Act), directly or indirectly, of more than 50% of our (or our Affiliate Transferee’s) voting stock or other voting stock into which our (or our Affiliate Transferee’s) voting stock is reclassified, consolidated, exchanged or changed, measured by voting power rather than number of shares; or (2) the direct or indirect sale, transfer, conveyance or other disposition (other than by way of merger or consolidation), in one or a series of related transactions, of all or substantially all of our (or our Affiliate Transferee’s) assets and the assets of our (or our Affiliate Transferee’s) subsidiaries, taken as a whole, to one or more “persons” (as that term is defined in the 2043 Notes Indenture), other than us or one of our (or our Affiliate Transferee’s) subsidiaries. Notwithstanding the foregoing, a transaction referenced in clause (1) of this definition will not be deemed to be a change of control if (i) we become a direct or indirect wholly- owned subsidiary of a holding company and (ii)(A) the direct or indirect holders of the voting stock of such holding company immediately following that transaction are substantially the same as the holders of our voting stock immediately prior to that transaction or (B) immediately following that transaction no “person” (as that term is used in Section 13(d)(3) of the Exchange Act) (other than a holding company satisfying the requirements of this sentence) is the beneficial owner, directly or indirectly, of more than 50% of the voting stock of such holding company. Notwithstanding the foregoing, a transaction referenced in clause (2) of this definition will not be deemed a change of control if (i) we become a direct or indirect wholly-owned subsidiary of a holding company, (ii) the transferee of all or substantially all of our assets and the assets of our subsidiaries, taken as a whole, is also a direct or indirect wholly-owned subsidiary of such holding company (such transferee, our “Affiliate Transferee”), (iii) such holding company provides a full and unconditional guarantee of the notes and (iv)(A) the direct or indirect holders of the voting stock of such holding company immediately following that transaction are substantially the same as the holders of our voting stock immediately prior to that transaction or (B) immediately following that transaction no “person” (as that term is used in Section 13(d)(3) of the Exchange Act) (other than a holding company satisfying the requirements of this sentence) is the beneficial owner, directly or indirectly, of more than 50% of the voting stock of such holding company. “Change of control triggering event” means the occurrence of both a change of control and a rating event. Limitations on Liens The 2043 Notes Indenture provides that we will not and we will not permit any Restricted Subsidiary to create, incur, issue, assume or guarantee any Debt secured by a Lien upon or with respect to any Principal Property or on the capital stock of any Restricted Subsidiary unless: we provide that the notes will be secured by such Lien equally and ratably with such other Debt; or the aggregate amount of: o all of such secured Debt,

o together with all Attributable Debt in respect of Sale and Lease-Back Transactions existing at such time, with the exception of transactions which are not subject to the Limitations on Sale and Lease-Back Transactions, o does not exceed 15% of our Consolidated Net Tangible Assets. o This limitation does not apply to any Debt secured by: o any Lien existing on the date of the 2043 Notes Indenture; o any Lien in our favor or in favor of any Restricted Subsidiary; o any Lien existing on any asset of any entity at the time such entity becomes a Restricted Subsidiary or at the time such entity is merged or consolidated with or into us or a Restricted Subsidiary, as long as such Lien does not attach to any of our or our Restricted Subsidiaries’ other assets; o any Lien on any asset which exists at the time of the acquisition of the asset; o any Lien on any asset or improvement to an asset securing Debt incurred or assumed for the purpose of financing all or any part of the cost of acquiring or improving such asset, if such Lien attaches to such asset concurrently with or within 180 days after its acquisition or improvement and the principal amount of the Debt secured by any such Lien, together with all other Debt secured by a Lien on such property, does not exceed the purchase price of such property or the cost of such improvement; o any Lien incurred in connection with pollution control, industrial revenue or any similar financing; o Liens imposed by law for taxes, fees, assessments or other governmental charges that are not delinquent or for which (a) the validity or amount thereof is being contested in good faith by appropriate proceedings and Perrigo Finance or such Restricted Subsidiary has set aside on its books adequate reserves with respect thereto in accordance with generally accepted accounting principles or (b) the failure to make payment pending such contest could not reasonably be expected to result in a material adverse effect on the business, operations, affairs, financial condition, assets or properties of Perrigo Finance and its Subsidiaries taken as a whole (such, a “Material Adverse Effect”); o any (i) minor survey exceptions, minor encumbrances, minor title defects or irregularities, easements, zoning restrictions, rights-of-way and similar encumbrances on real property imposed by law or arising in the ordinary course of business and (ii) leases, subleases, licenses or sublicenses granted to others in the ordinary course of business, that in each case do not materially detract from the value of the affected property or interfere with the ordinary conduct of business of Perrigo Finance or any Restricted Subsidiary; o any Liens, pledges or deposits made in the ordinary course of business in compliance with workers’ compensation, unemployment insurance and other social security and similar laws or regulations; o any Lien on any Debt of any joint ventures; o judgment Liens in respect of judgments for the payment of money aggregating to less than the greater of $75,000,000 and 3% of Consolidated Net Tangible Assets; o carriers’, warehousemen’s, mechanics’, materialmen’s, repairmen’s and other like Liens, or property securing payment for services rendered in respect of such property, in each case that are imposed by law, arising in the ordinary course of business and securing obligations that are not overdue by more than 30 days or for which (a) the validity or amount thereof is being contested in good faith by appropriate proceedings, (b) Perrigo Finance or such Restricted Subsidiary has set aside on its books adequate reserves with respect thereto in accordance with generally accepted accounting principles and (c) the failure to make payment pending such contest could not reasonably be expected to result in a Material Adverse Effect; any Liens or deposits incurred to secure the performance of bids, trade contracts, leases, statutory obligations, surety and appeal bonds, performance

bonds and other obligations of a like nature, in each case in the ordinary course of business; o statutory and contractual Liens in favor of landlords on real property leased by Perrigo Finance or any Restricted Subsidiary, provided that Perrigo Finance or such Restricted Subsidiary is current with respect to payment of all rent and other amounts due to such landlord under any lease of such real property, except where the failure to be current in payment would not, individually or in the aggregate, be reasonably likely to result in a Material Adverse Effect; or o any extension, renewal, substitution or replacement of any of the Liens not restricted under “Limitations on Liens” if the principal amount of the Debt secured thereby is not increased and is not secured by any additional assets. Definition: “Debt” means (a) any notes, bonds, debentures or similar evidences of indebtedness for money borrowed and (b) any guarantees thereof; without any duplication, of any individual corporation, partnership, joint venture, association, joint-stock company, trust, unincorporated organization or government or any agency or political subdivision thereof. “Lien” means any mortgage, pledge, security interest or other lien or encumbrance. Events of Default, Waiver and Notice An event of default is defined as being: 1. default in payment of any interest on or any additional amounts payable in respect of the notes of such series which remains uncured for a period of 30 days; 2. default in payment of principal (and premium, if any) on the notes of such series when due either at maturity, upon redemption, by declaration or otherwise; 3. default in the payment of the purchase price of any notes of such series we are required to purchase as described under “Offer to Purchase Upon Change of Control Triggering Event”; 4. our default in the performance or breach of any other covenant or warranty in respect of the notes of such series in the 2043 Notes Indenture which shall not have been remedied for a period of 90 days after notice; and 5. the taking of certain actions by us or a court relating to our bankruptcy, insolvency or reorganization. Modification, Amendment and Waiver Together with the trustee, we may, when authorized by our board of directors, modify the 2043 Notes Indenture with respect to the 2043 Notes without the consent of the holders for limited purposes, including, but not limited to, adding to our covenants or events of default, curing ambiguities or correcting any defective provisions with respect to the notes of such series. Except as described in the prior sentence, the 2043 Notes Indenture provides that we and the trustee may modify and amend the 2043 Notes Indenture with the consent of the holders of a majority in principal amount of the outstanding notes affected by the modification or amendment, provided that no such modification or amendment may, without the consent of the holder of each outstanding note of such series affected by the modification or amendment: change the stated maturity of the principal of, or any installment of interest on or any additional amounts payable with respect to, the notes of such series or change the redemption price;

reduce the principal amount of, or interest on, the notes of such series or reduce the amount of principal which could be declared due and payable prior to the stated maturity; impair the right to enforce any payment on or after the stated maturity or redemption date; change the place or currency of any payment of principal or interest on the notes of such series; reduce the percentage in principal amount of the outstanding notes of such series, the consent of outstanding notes of such series necessary to waive any past default to less than a majority; whose holders is required to modify or amend the 2043 Notes Indenture; reduce the percentage of outstanding notes of such series necessary to waive any past default to less than a majority; modify the provisions in the 2043 Notes Indenture relating to adding provisions or changing or eliminating provisions of the 2043 Notes Indenture or modifying rights of holders of notes of such series to waive defaults under the Indenture; or adversely affect the right to repayment of the notes of such series at the option of the holders. Currency Indemnity The U.S. dollar is the sole currency of account and payment for all sums payable by us under or in connection with the 2043 Notes, including damages. If, for the purposes of obtaining judgment in any court in any jurisdiction in connection with the notes, it becomes necessary to convert into a particular currency the amount due under or in connection with the notes, then conversion shall be made at the rate of exchange prevailing on the day the decision became enforceable (or if such day is not a business day, the next preceding business day) at the place where it was rendered. Our obligations under or in connection with the notes will be discharged only to the extent that the relevant holder is able to purchase in the London foreign exchange markets in accordance with normal banking procedures, on the date of the relevant receipt or recovery by it (or, if it is not practicable to make such purchase on such date, on the first date on which it is practicable to do so), U.S. dollars in the amount originally due to it (whether pursuant to any judgment or otherwise) with any other currency paid to that holder. If the holder cannot purchase U.S. dollars in the amount originally to be paid, we will indemnify the holder for any resulting loss or damage sustained by it and pay the difference. The holder, however, will agree that, if the amount of U.S. dollars purchased exceeds the amount originally to be paid to such holder, the holder will reimburse the excess to us. The holder will not be obligated to make this reimbursement if we are in default of our obligations under the notes. The indemnity undertaken by us in favor of the holders as described above will constitute an obligation separate and independent from the other obligations contained in the 2043 Notes Indenture, shall give rise to a separate and independent cause of action, shall apply irrespective of any waiver granted by the holder of any 2043 Note or the trustee from time to time and shall continue in full force and effect notwithstanding any judgment or order for a liquidated sum in respect of an amount due under or in connection with the 2043 Notes or under any judgment or order. Trustee Wells Fargo Bank, National Association serves as trustee, paying agent, and security registrar under the 2043 Notes Indenture.

2014 Notes due December 15, 2044 General On December 2, 2014, Perrigo Finance issued $400.0 million in aggregate principal amount of 4.900% senior notes (the “2014 Notes”) that will mature on December 15, 2044. The 2014 Notes are governed by a base indenture dated December 2, 2014 (the “2014 Base Indenture”) and first supplemental indenture dated December 2, 2014 (collectively with the Base Indenture, the “2014 Indenture”). Capitalized terms used but not defined in this summary of the 2014 Notes will have the meanings ascribed thereto in the 2014 Indenture. The 2014 Notes were issued in book-entry form, in denominations of $200,000 and integral multiples of $1,000 in excess of $200,000. The notes are not subject to any sinking fund and will not be convertible into or exchangeable for any of equity interests of Perrigo Finance or Perrigo. There are no restrictions under the 2014 Notes on our ability to obtain funds from our subsidiaries. The capitalized terms used within this section shall bear the meanings set forth in the 2014 Indenture. Ranking The 2014 Notes are unsecured, senior obligations of Perrigo Finance and rank equally with all of its other unsecured senior indebtedness; effectively subordinated to any existing or future secured obligations of Perrigo Finance, to the extent of the value of the collateral securing such other obligations; senior in right of payment to any obligations of Perrigo Finance that are by their terms expressly subordinated or junior in right of payment to the notes; and structurally subordinated to the obligations of our other subsidiaries. Interest The 2014 Notes bear interest at the annual rate of 4.900%. Interest on the 2014 Notes is payable semi- annually in arrears in June and December of each year, beginning in June 2015. Interest is computed on the basis of a 360-day year consisting of twelve 30-day months. Redemptions Perrigo Finance may redeem the 2014 Notes in whole or in part at any time for cash at the make-whole redemption prices described in the 2014 Indenture . All or a portion of the 2014 Notes, may be redeemed at our option at any time or from time to time. The redemption price to be redeemed on any redemption date will be equal to the greater of the following amounts: 100% of the principal amount of the notes of that series being redeemed on the redemption date; and the sum of the present values of the remaining scheduled payments of principal and interest on the applicable series of notes being redeemed on that redemption date (not including any portion of any payments of interest accrued to the redemption date), discounted to the redemption date on a semiannual basis (assuming a 360-day year consisting of twelve 30-day months) at the Adjusted Treasury Rate (as defined in 2014 Indenture), plus 30 basis points in the case of the 2044 notes, as determined by the applicable independent investment banker, plus, in each case, accrued and unpaid interest, if any, on the applicable series of notes to the redemption date. Notwithstanding the foregoing, installments of interest on the applicable series of notes that are due and payable on interest payment dates falling on or prior to a redemption date will be payable on the interest

payment date to the registered holders as of the close of business on the relevant record date according to the applicable series of notes and the 2014 Indenture. In addition, Perrigo Finance has the right to redeem, at Perrigo’s option, in whole or in part, the 2014 Notes at any time on or after June 15, 2044 (six months prior to their maturity date), at a redemption price equal to 100% of the aggregate principal amount of the notes being redeemed plus, in each case, accrued and unpaid interest, if any, to, but excluding, the redemption date. If Perrigo Finance chooses to redeem less than all of the notes, the particular notes to be redeemed shall be selected by the trustee not more than 45 days prior to the redemption date. Subject to applicable DTC procedures or regulations, the trustee will select the notes to be redeemed by such method as the trustee shall deem appropriate. Perrigo Finance may also redeem the 2014 Notes in whole, but not in part, at its discretion at any time upon giving not less than 30 nor more than 60 days’ notice to the holders (which notice will be irrevocable) at a redemption price equal to 100% of the principal amount thereof, together with accrued and unpaid interest, if any, to, but excluding, the date fixed by Perrigo Finance for redemption (a “Tax Redemption Date”) (subject to the right of holders of record on the relevant record date to receive interest due on the relevant interest payment date) and all Additional Amounts, if any, then due and which will become due on the Tax Redemption Date as a result of the redemption or otherwise, if as a result of: (1) any change in, or amendment to, any law, treaty, regulations or rulings of a relevant taxing jurisdiction affecting taxation; or (2) any change in, or amendment to, the application, administration or interpretation of such laws, treaties, regulations or rulings (including by virtue of a holding, judgment or order by a court of competent jurisdiction or a change in published administrative practice ) (each of the foregoing in clauses (1) and (2), a “Change in Tax Law”), Perrigo Finance, with respect to the notes, or Perrigo, with respect to its guarantee, as the case may be, has become, is, or on the next interest payment date in respect of the notes would be, required to pay Additional Amounts and such obligation cannot be avoided by taking reasonable measures available to Perrigo Finance. If a change of control (as defined below) triggering event occurs with respect to the 2014 Notes, unless Perrigo had exercised the option to redeem the notes as described above, Perrigo will be required to make an offer (the “change of control offer”) to each holder of the notes of the applicable series as to which the change of control triggering event has occurred to repurchase all or any part (equal to $200,000 or an integral multiple of $1,000 in excess thereof) of that holder’s applicable notes on the terms set forth in such notes. In the change of control offer, we will be required to offer payment in cash equal to 101% of the aggregate principal amount of notes repurchased, plus accrued and unpaid interest and Additional Amounts, if any, on the applicable notes repurchased to, but not including the date of repurchase (the “change of control payment”). Within 30 days following any change of control triggering event or, at our option, prior to any change of control triggering event, but after public announcement of the transaction that constitutes or may constitute the change of control triggering event, a notice will be mailed (or, to the extent permitted or required by applicable DTC procedures or regulations, sent electronically) to holders of the applicable notes and the trustee describing the transaction that constitutes or may constitute the change of control triggering event and offering to repurchase the notes on the date specified in the notice, which date will be no earlier than 30 days and no later than 60 days from the date such notice is mailed or sent (the “change of control payment date”). We will not be required to make a change of control offer upon the occurrence of a change of control triggering event if a third party makes such an offer in the manner, at the times and otherwise in

compliance with the requirements for an offer made by us and the third party repurchases all applicable notes properly tendered and not withdrawn under its offer. Definition: “Change of control” means the occurrence of any of the following: (1) the consummation of any transaction (including, without limitation, any merger or consolidation) the result of which is that any “person” (as that term is used in Section 13(d)(3) of the Exchange Act), becomes the beneficial owner (as defined in Rules 13d-3 and 13d-5 under the Exchange Act), directly or indirectly, of more than 50% of the voting stock of Perrigo (or Perrigo’s Affiliate Transferee (as defined in Section 6.03(f) of the first supplemental indenture)) or other voting stock into which the voting stock of Perrigo (or Perrigo’s Affiliate Transferee) is reclassified, consolidated, exchanged or changed, measured by voting power rather than number of shares; or (2) the direct or indirect sale, transfer, conveyance or other disposition (other than by way of merger or consolidation), in one or a series of related transactions, of all or substantially all of the assets of Perrigo (or Perrigo’s Affiliate Transferee) and the assets of the subsidiaries of Perrigo (or Perrigo’s Affiliate Transferee), taken as a whole, to one or more “persons” (as that term is defined in the 2014 Indenture), other than Perrigo or a subsidiary of Perrigo (or Perrigo’s Affiliate Transferee). Notwithstanding the foregoing, a transaction referenced in clause (1) of this definition will not be deemed to be a change of control if (i) Perrigo becomes a direct or indirect wholly- owned subsidiary of a holding company and (ii)(A) the direct or indirect holders of the voting stock of such holding company immediately following that transaction are substantially the same as the holders of Perrigo’s voting stock immediately prior to that transaction or (B) immediately following that transaction no “person” (as that term is used in Section 13(d)(3) of the Exchange Act) (other than a holding company satisfying the requirements of this sentence) is the beneficial owner, directly or indirectly, of more than 50% of the voting stock of such holding company. Notwithstanding the foregoing, a transaction referenced in clause (2) of this definition will not be deemed a change of control if (i) Perrigo becomes a direct or indirect wholly-owned subsidiary of a holding company, (ii) the transferee of all or substantially all of Perrigo’s assets and the assets of Perrigo’s subsidiaries, taken as a whole, is also a direct or indirect wholly-owned subsidiary of such holding company (such transferee, Perrigo’s “Affiliate Transferee”), (iii) such holding company provides a full and unconditional guarantee of the notes (whereupon such holding company shall be substituted as “Perrigo” for the purposes of the notes and 2014 Indenture (without the release of the guarantee of the entity formerly considered to be “Perrigo”) and (iv)(A) the direct or indirect holders of the voting stock of such holding company immediately following that transaction are substantially the same as the holders of Perrigo’s voting stock immediately prior to that transaction or (B) immediately following that transaction no “person” (as that term is used in Section 13(d)(3) of the Exchange Act) (other than a holding company satisfying the requirements of this sentence) is the beneficial owner, directly or indirectly, of more than 50% of the voting stock of such holding company. Limitations on Liens The 2014 Indenture provides that Perrigo will not and Perrigo will not permit any Restricted Subsidiary to create, incur, issue, assume or guarantee any Debt secured by a Lien upon or with respect to any Principal Property of Perrigo or any Restricted Subsidiary, or on the capital stock of any Restricted Subsidiary held by Perrigo or any other Restricted Subsidiary unless: the notes will be secured by such Lien equally and ratably with such other Debt; or the aggregate amount of: o all of such secured Debt, o together with all Attributable Debt of Perrigo and its Restricted Subsidiaries in respect of Sale and Lease-Back Transactions existing at such time, with the exception of transactions which are not subject to the limitation under Limitations on sale and lease-

back transactions, “does not exceed 15% of Perrigo’s Consolidated Net Tangible Assets. This limitation will not apply to any Debt secured by: any Lien existing on the Issue Date; any Lien in Perrigo’s favor or in favor of any Restricted Subsidiary; any Lien existing on any asset of any entity at the time such entity becomes a Restricted Subsidiary or at the time such entity is merged or consolidated with or into Perrigo Finance, Perrigo or a Restricted Subsidiary, as long as such Lien does not attach to any of the other assets of Perrigo or any Restricted Subsidiary; any Lien on any property or assets or shares of stock or Debt which exists at the time of the acquisition thereof; Liens on any property or assets or shares of stock or Debt securing the payment of all or any part of the purchase price or construction cost thereof (including improvements thereon) or securing any Debt incurred or assumed for the purpose of financing all or any part of the purchase price or construction cost thereof if such Lien attaches concurrently with or within 180 days after the acquisition of such property or assets or shares of stock or Debt or the completion of any such construction, whichever is later, provided the principal amount of the Debt secured by any such Lien, together with all other Debt secured by a Lien on such property or assets or shares of stock or Debt, does not exceed the purchase price of such property or assets or shares of stock or Debt or the cost of such improvement; any Lien incurred or assumed in connection with pollution control, industrial revenue or any similar financing; Liens imposed by law for taxes, fees, assessments or other governmental charges that are not delinquent or for which (a) the validity or amount thereof is being contested in good faith by appropriate proceedings and Perrigo or such Restricted Subsidiary has set aside on its books adequate reserves with respect thereto in accordance with GAAP or (b) the failure to make payment pending such contest could not reasonably be expected to result in a material adverse effect on the business, operations, affairs, financial condition, assets or properties of the Perrigo and its Subsidiaries taken as a whole (such, a “Material Adverse Effect”); any (i) minor survey exceptions, minor encumbrances, minor title defects or irregularities, easements, zoning restrictions, rights-of-way and similar encumbrances on real property imposed by law or arising in the ordinary course of business and (ii) leases, subleases, licenses or sublicenses granted to others in the ordinary course of business, that in each case do not materially detract from the value of the affected property or interfere with the ordinary conduct of business of the Perrigo or any Restricted Subsidiary; any Liens, pledges or deposits made in the ordinary course of business in compliance with workers’ compensation, unemployment insurance and other social security and similar laws or regulations; any Lien on any Debt of any joint ventures; judgment Liens in respect of judgments for the payment of money aggregating to less than the greater of $75,000,000 and 3% of Perrigo’s Consolidated Net Tangible Assets; carriers’, warehousemen’s, mechanics’, materialmen’s, repairmen’s and other like Liens, or property securing payment for services rendered in respect of such property, in each case that are imposed by law, arising in the ordinary course of business and securing obligations that are not overdue by more than 30 days or for which (a) the validity or amount thereof is being contested in good faith by

appropriate proceedings, (b) the Issuer or such Restricted Subsidiary has set aside on its books adequate reserves with respect thereto in accordance with generally accepted accounting principles and (c) the failure to make payment pending such contest could not reasonably be expected to result in a Material Adverse Effect; any Liens or deposits incurred to secure the performance of bids, trade contracts, leases, statutory obligations, surety and appeal bonds, performance bonds and other obligations of a like nature, in each case in the ordinary course of business; statutory and contractual Liens in favor of landlords on real property leased by the Perrigo or any Restricted Subsidiary, provided that Perrigo or such Restricted Subsidiary is current with respect to payment of all rent and other amounts due to such landlord under any lease of such real property, except where the failure to be current in payment would not, individually or in the aggregate, be reasonably likely to result in a Material Adverse Effect; or any extension, renewal, substitution or replacement of any of the Liens not restricted under “Limitations on liens” if the Debt secured thereby is not increased and is not secured by any additional assets (plus improvements on such property and any other property or assets not then constituting a Principal Property). Events of default, waiver and notice An event of default with respect to the 2014 Notes will occur in the event of: default in payment of any interest on or any Additional Amounts payable in respect of the notes of such series which remains uncured for a period of 30 days; default in payment of principal (and premium, if any) on the notes of such series when due either at maturity, upon redemption, by declaration or otherwise; default in the payment of the purchase price of any notes of such series we are required to purchase as described under “Offer to purchase upon change of control triggering event”; default by Perrigo Finance or Perrigo in the performance or breach of any other covenant or warranty in respect of the notes of such series in the 2014 Indenture which shall not have been remedied for a period of 90 days after notice by the trustee or holders of at least 25% in principal amount of the outstanding notes of such series; the guarantee of the notes of such series is held in any judicial proceeding to be unenforceable or invalid or ceases for any reason to be in full force and effect, or Perrigo, or any responsible officer acting on behalf of Perrigo, denies or disaffirms its obligations under the guarantee of the notes of such series; and the taking of certain actions by Perrigo Finance or Perrigo or a court relating to bankruptcy, insolvency or reorganization. Whether an event of default (other than an event of default specified in clause (6) above) has occurred will be determined on a series-by-series basis. Modification, Amendment and Waiver Together with the trustee, Perrigo Finance and Perrigo may, when authorized by their respective boards of directors, modify the 2014 Indenture with respect to the notes of any series without the consent of the holders of the notes of such series for limited purposes, including, but not limited to, adding to the covenants or events of default, curing ambiguities or correcting any defective provisions with respect to the notes of such series.

Except as described in the prior sentence, the 2014 Indenture or the supplemental indentures, as applicable, provides that Perrigo Finance, Perrigo and the trustee may modify and amend the 2014 Indenture with respect to the notes of any series with the consent of the holders of a majority in principal amount of the outstanding notes of such series affected by the modification or amendment, provided that no such modification or amendment may, without the consent of the holder of each outstanding note of such series affected by the modification or amendment: change the stated maturity of the principal of, or any installment of interest on or any Additional Amounts payable with respect to, the notes of such series; reduce the principal amount of, or interest on or any Additional Amounts payable with respect to, the notes of such series, reduce the amount of principal which could be declared due and payable prior to the stated maturity or reduce the premium payable upon the redemption thereof; impair the right to enforce any payment on or after the stated maturity or redemption date; change the place or currency of any payment of principal of, premium or interest on, or any Additional Amounts payable with respect to, the notes of such series; modify in a manner adverse in any material respect to the holder of the outstanding notes of such series the terms and conditions of Perrigo under its guarantee with respect to such notes or the 2014 Indenture; reduce the percentage in principal amount of the outstanding notes of such series, the consent of whose holders is required to modify or amend the 2014 Indenture; reduce the percentage of outstanding notes of such series necessary to waive any past default to less than a majority; or modify the provisions in the 2014 Indenture relating to adding provisions or changing or eliminating provisions of the 2014 Indenture or modifying rights of holders of notes of such series to waive compliance with any term of the 2014 Indenture. Trustee Wells Fargo Bank, National Association serves as trustee, paying agent, and security registrar under the 2014 Indenture.

2020 Notes due June 15, 2030 General On June 19, 2020, Perrigo Finance issued $750.0 million in aggregate principal amount of 3.150% Senior Notes due 2030 the (“2020 Notes”) and received net proceeds of $737.1 million after the underwriting discount and offering expenses. The 2020 Notes will mature on June 15, 2030 and are governed by the 2014 Base Indenture and the third supplemental indenture, dated June 15, 2030 (collectively with the 2014 Base Indenture, the “2020 Indenture”). The 2020 Notes will mature on June 15, 2030. Capitalized terms used but not defined in this section have the meanings ascribed thereto in the 2020 Indenture. The 2020 Notes were issued in book-entry form, in denominations of $200,000 and integral multiples of $1,000 in excess of $200,000. The notes will not be subject to any sinking fund and are not be convertible into or exchangeable for any of equity interests of Perrigo Finance or Perrigo. We may, without the consent of the holders of the notes, issue additional debt securities under the 2020 Indenture having the same ranking and the same interest rate, maturity and other terms as the notes in all respects (except for the issue date, issue price, if applicable, payment of interest accruing prior to the issue date of such additional debt securities or, if applicable, the first payment of any interest following the issue date of such additional debt securities). Any such additional debt securities and the notes will constitute a single series of notes under the 2020 Indenture; provided, that any additional debt securities that are not fungible for U.S. federal income tax purposes with the notes shall be issued under a separate CUSIP number. Ranking The 2020 Notes: are the unsecured, senior obligations of Perrigo Finance and rank equally with all of Perrigo Finance’s other unsecured senior indebtedness; are effectively subordinated to any future secured indebtedness of Perrigo Finance, to the extent of the value of the collateral securing such other indebtedness; are senior in right of payment to any indebtedness of Perrigo Finance that is by its terms expressly subordinated or junior in right of payment to the notes; and are structurally subordinated to all indebtedness and other liabilities of Perrigo Finances’ subsidiaries, if any. The guarantee of the 2020 Notes: is the unsecured, senior obligation of Perrigo and ranks equally with all of Perrigo’s other unsecured senior indebtedness; is effectively subordinated to any future secured indebtedness of Perrigo, to the extent of the value of the collateral securing such indebtedness; is senior in right of payment to any indebtedness of Perrigo that is by its terms expressly subordinated or junior in right of payment to the guarantee of the notes; and is structurally subordinated to all indebtedness and other liabilities of Perrigo’s subsidiaries (other than Perrigo Finance). Interest Interest on the 2020 Notes is payable semi-annually in arrears on June 15 and December 15 of each year, beginning on December 15, 2020. Due to credit ratings downgrades by S&P and Moody’s in the third

quarter of 2021, the first quarter of 2022, the second quarter of 2023 and the second quarter of 2024 respectively, the interest of the 2020 Notes stepped up from 3.150% to 3.900%, starting after December 15, 2021, from 3.900% to 4.400% starting after June 15, 2022, from 4.400% to 4.650% starting after June 15, 2023 and from 4.650% to 4.900% starting after June 15, 2024. We will compute interest on the notes on the basis of a 360-day year consisting of twelve 30-day months. Redemption Optional Redemption Prior to March 15, 2030 (three months prior to the maturity date of the 2020 Notes), all or a portion of the notes may be redeemed at our option at any time or from time to time. The redemption price for the notes to be redeemed on any redemption date will be equal to the greater of the following amounts: 100% of the principal amount of the notes to be redeemed; and the sum of the present values of the remaining scheduled payments of principal and interest on the notes to be redeemed (calculated as if such notes matured on the Par Call Date), exclusive of interest accrued to, but excluding, the redemption date, discounted to the redemption date on a semiannual basis (assuming a 360-day year consisting of twelve 30-day months) at the Adjusted Treasury Rate, plus 40 basis points, as determined by the applicable Independent Investment Banker, plus, in each case, accrued and unpaid interest, if any, on the 2020 Notes to be redeemed to, but excluding, the redemption date. The 2020 Indenture provides that, with respect to any redemption, we will notify the trustee of the redemption price promptly after the calculation and that the trustee will not be responsible for such calculation. In addition, on or after the Par Call Date, we will have the right to redeem the notes, at our option, in whole or in part, at a redemption price equal to 100% of the aggregate principal amount of the 2020 Notes to be redeemed plus accrued and unpaid interest, if any, to, but excluding, the redemption date. In each case, installments of interest on the notes that are due and payable on interest payment dates falling on or prior to a redemption date will be payable on the interest payment date to the registered holders as of the close of business on the relevant record date according to the notes and the 2020 Indenture. “Par Call Date” means March 15, 2030 (three months prior to the maturity date of the notes). Notice of any redemption will be mailed (or, to the extent permitted or required by applicable procedures or regulations of The Depository Trust Company (“DTC”), sent electronically) at least 10 days but not more than 60 days before the redemption date to each holder of the notes to be redeemed. Unless we default in payment of the redemption price, on and after the redemption date, interest will cease to accrue on the 2020 Notes or portions thereof called for redemption. Tax Redemption Perrigo Finance may redeem the notes in whole, but not in part, at its discretion at any time upon giving not less than 15 days nor more than 60 days’ notice to the holders of the notes (which notice will be

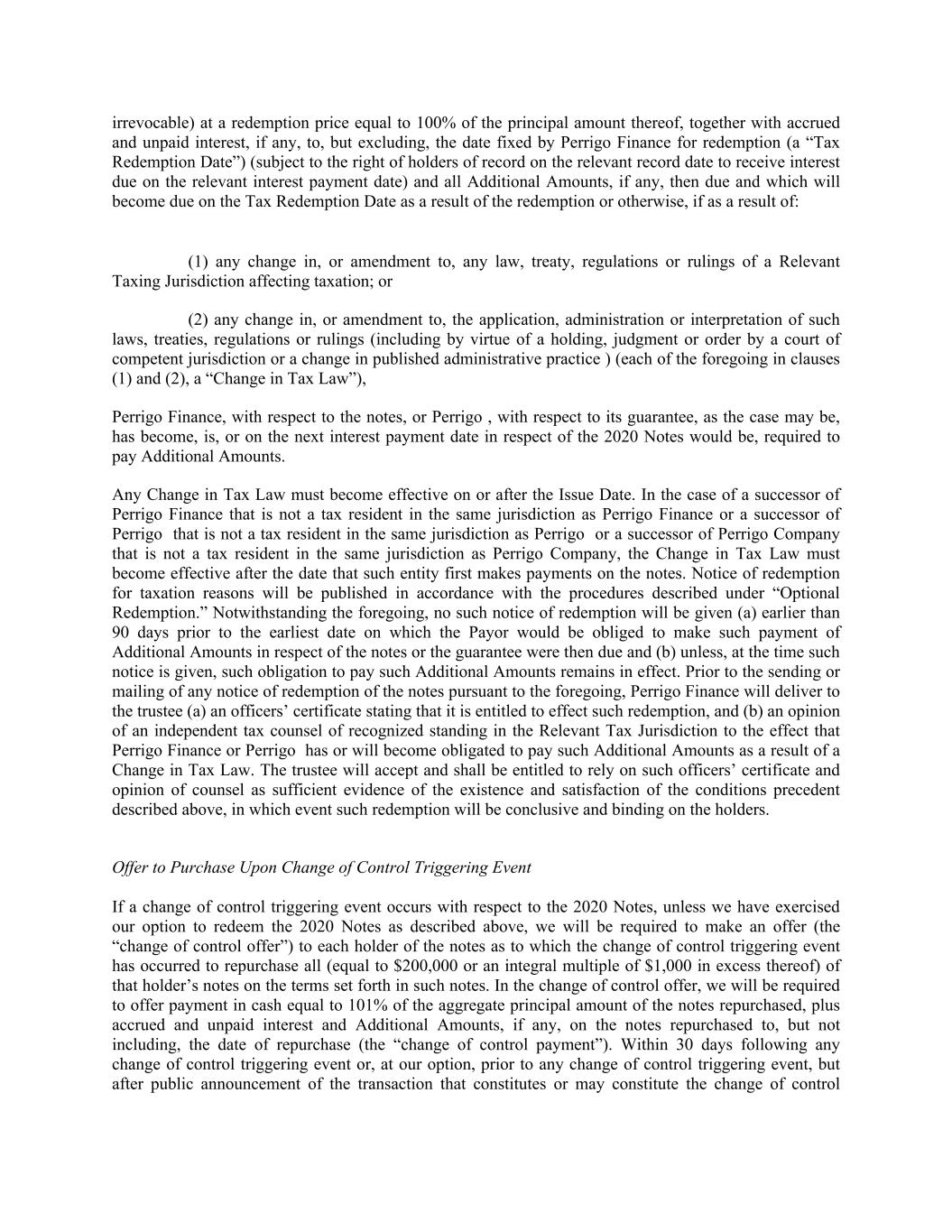

irrevocable) at a redemption price equal to 100% of the principal amount thereof, together with accrued and unpaid interest, if any, to, but excluding, the date fixed by Perrigo Finance for redemption (a “Tax Redemption Date”) (subject to the right of holders of record on the relevant record date to receive interest due on the relevant interest payment date) and all Additional Amounts, if any, then due and which will become due on the Tax Redemption Date as a result of the redemption or otherwise, if as a result of: (1) any change in, or amendment to, any law, treaty, regulations or rulings of a Relevant Taxing Jurisdiction affecting taxation; or (2) any change in, or amendment to, the application, administration or interpretation of such laws, treaties, regulations or rulings (including by virtue of a holding, judgment or order by a court of competent jurisdiction or a change in published administrative practice ) (each of the foregoing in clauses (1) and (2), a “Change in Tax Law”), Perrigo Finance, with respect to the notes, or Perrigo , with respect to its guarantee, as the case may be, has become, is, or on the next interest payment date in respect of the 2020 Notes would be, required to pay Additional Amounts. Any Change in Tax Law must become effective on or after the Issue Date. In the case of a successor of Perrigo Finance that is not a tax resident in the same jurisdiction as Perrigo Finance or a successor of Perrigo that is not a tax resident in the same jurisdiction as Perrigo or a successor of Perrigo Company that is not a tax resident in the same jurisdiction as Perrigo Company, the Change in Tax Law must become effective after the date that such entity first makes payments on the notes. Notice of redemption for taxation reasons will be published in accordance with the procedures described under “Optional Redemption.” Notwithstanding the foregoing, no such notice of redemption will be given (a) earlier than 90 days prior to the earliest date on which the Payor would be obliged to make such payment of Additional Amounts in respect of the notes or the guarantee were then due and (b) unless, at the time such notice is given, such obligation to pay such Additional Amounts remains in effect. Prior to the sending or mailing of any notice of redemption of the notes pursuant to the foregoing, Perrigo Finance will deliver to the trustee (a) an officers’ certificate stating that it is entitled to effect such redemption, and (b) an opinion of an independent tax counsel of recognized standing in the Relevant Tax Jurisdiction to the effect that Perrigo Finance or Perrigo has or will become obligated to pay such Additional Amounts as a result of a Change in Tax Law. The trustee will accept and shall be entitled to rely on such officers’ certificate and opinion of counsel as sufficient evidence of the existence and satisfaction of the conditions precedent described above, in which event such redemption will be conclusive and binding on the holders. Offer to Purchase Upon Change of Control Triggering Event If a change of control triggering event occurs with respect to the 2020 Notes, unless we have exercised our option to redeem the 2020 Notes as described above, we will be required to make an offer (the “change of control offer”) to each holder of the notes as to which the change of control triggering event has occurred to repurchase all (equal to $200,000 or an integral multiple of $1,000 in excess thereof) of that holder’s notes on the terms set forth in such notes. In the change of control offer, we will be required to offer payment in cash equal to 101% of the aggregate principal amount of the notes repurchased, plus accrued and unpaid interest and Additional Amounts, if any, on the notes repurchased to, but not including, the date of repurchase (the “change of control payment”). Within 30 days following any change of control triggering event or, at our option, prior to any change of control triggering event, but after public announcement of the transaction that constitutes or may constitute the change of control

triggering event, a notice will be mailed (or, to the extent permitted or required by applicable DTC procedures or regulations, sent electronically) to holders of the notes and the trustee describing the transaction that constitutes or may constitute the change of control triggering event and offering to repurchase the notes on the date specified in the notice, which date will be no earlier than 30 days and no later than 60 days from the date such notice is mailed or sent (the “change of control payment date”). The notice will, if mailed or sent prior to the date of consummation of the change of control, state that the offer to purchase is conditioned on the change of control triggering event occurring with respect to the notes on or prior to the change of control payment date. On the change of control payment date, we will, to the extent lawful: accept for payment all notes or portions of such notes properly tendered pursuant to the applicable change of control offer; deposit with the paying agent an amount equal to the change of control payment in respect of all notes or portions of the notes properly tendered; and deliver or cause to be delivered to the trustee the notes properly accepted together with an officers’ certificate stating the aggregate principal amount of the notes or portions of such notes being repurchased and that all conditions precedent provided for in the 2020 Indenture to the change of control offer and to the repurchase by us of the notes pursuant to the change of control offer have been met. We will not be required to make a change of control offer upon the occurrence of a change of control triggering event if a third party makes such an offer in the manner, at the times and otherwise in compliance with the requirements for an offer made by us and the third party repurchases all notes properly tendered and not withdrawn under its offer. For purposes of the change of control offer provisions of the 2020 Notes, the following terms are applicable: “Change of control” means the occurrence of any of the following: (1) the consummation of any transaction (including, without limitation, any merger or consolidation) the result of which is that any “person” (as that term is used in Section 13(d)(3) of the Exchange Act), becomes the beneficial owner (as defined in Rules 13d-3 and 13d-5 under the Exchange Act), directly or indirectly, of more than 50% of the voting stock of Perrigo (or Perrigo’s Affiliate Transferee) or other voting stock into which the voting stock of Perrigo (or Perrigo’s Affiliate Transferee) is reclassified, consolidated, exchanged or changed, measured by voting power rather than number of shares; or (2) the direct or indirect sale, transfer, conveyance or other disposition (other than by way of merger or consolidation), in one or a series of related transactions, of all or substantially all of the assets of Perrigo (or Perrigo’s Affiliate Transferee) and the assets of the subsidiaries of Perrigo (or Perrigo’s Affiliate Transferee), taken as a whole, to one or more “persons” (as that term is defined in the 2020 Indenture), other than Perrigo or a subsidiary of Perrigo (or Perrigo’s Affiliate Transferee (as defined in Section 6.03(f) of the third supplemental indenture)). Notwithstanding the foregoing, a transaction referenced in clause (1) of this definition will not be deemed to be a change of control if (i) Perrigo becomes a direct or indirect wholly-owned subsidiary of a holding company and (ii) the direct or indirect holders of the voting stock of such holding company immediately following that transaction are substantially the same as the holders of Perrigo’s voting stock immediately prior to that transaction. Notwithstanding the foregoing, a transaction referenced in clause (2) of this definition will not be deemed a change of control if (i) Perrigo becomes a direct or indirect wholly-owned subsidiary of a holding company, (ii) the transferee of all or substantially all of Perrigo’s assets and the assets of Perrigo’s subsidiaries, taken as a whole, is also a direct or indirect wholly-owned subsidiary of such holding company (such transferee, Perrigo’s “Affiliate Transferee”),

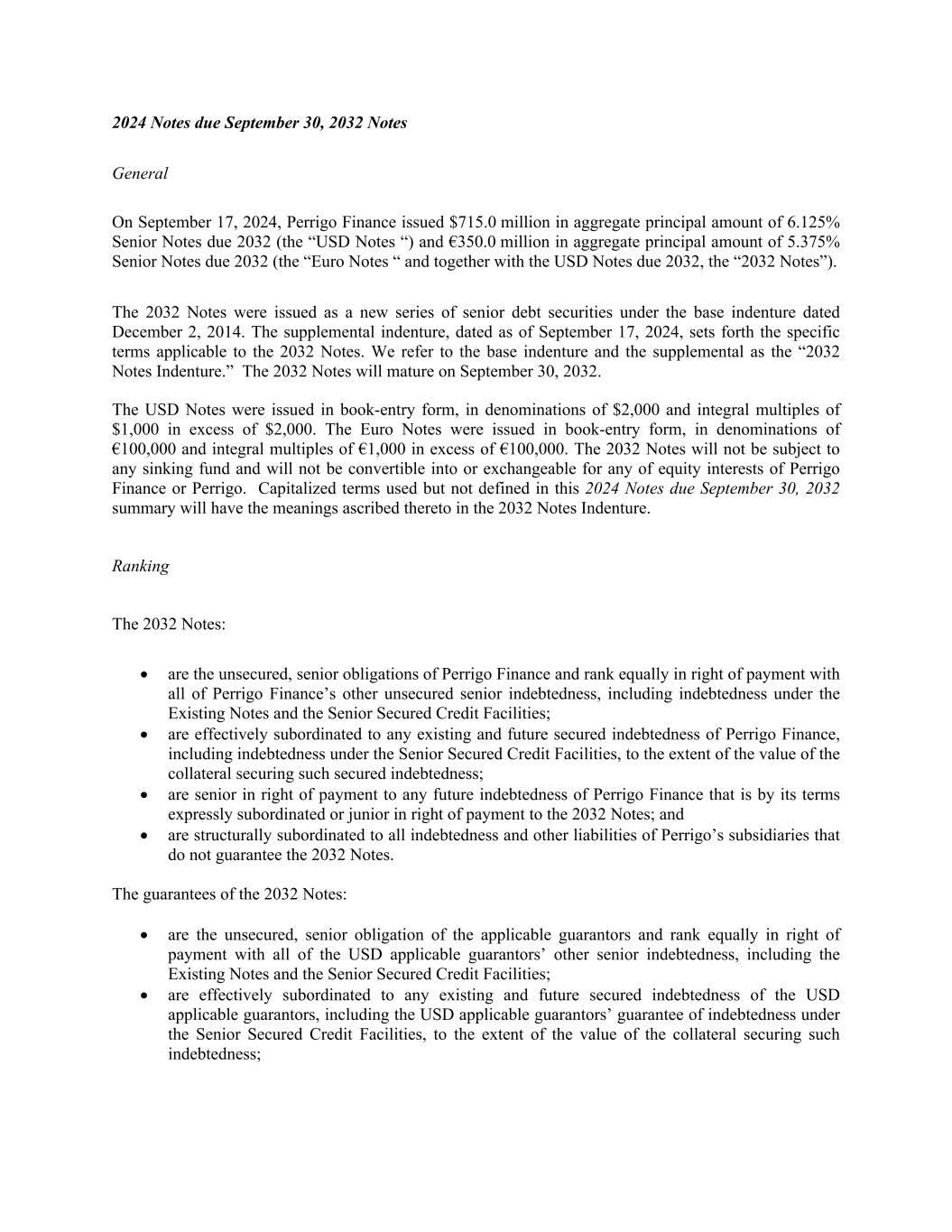

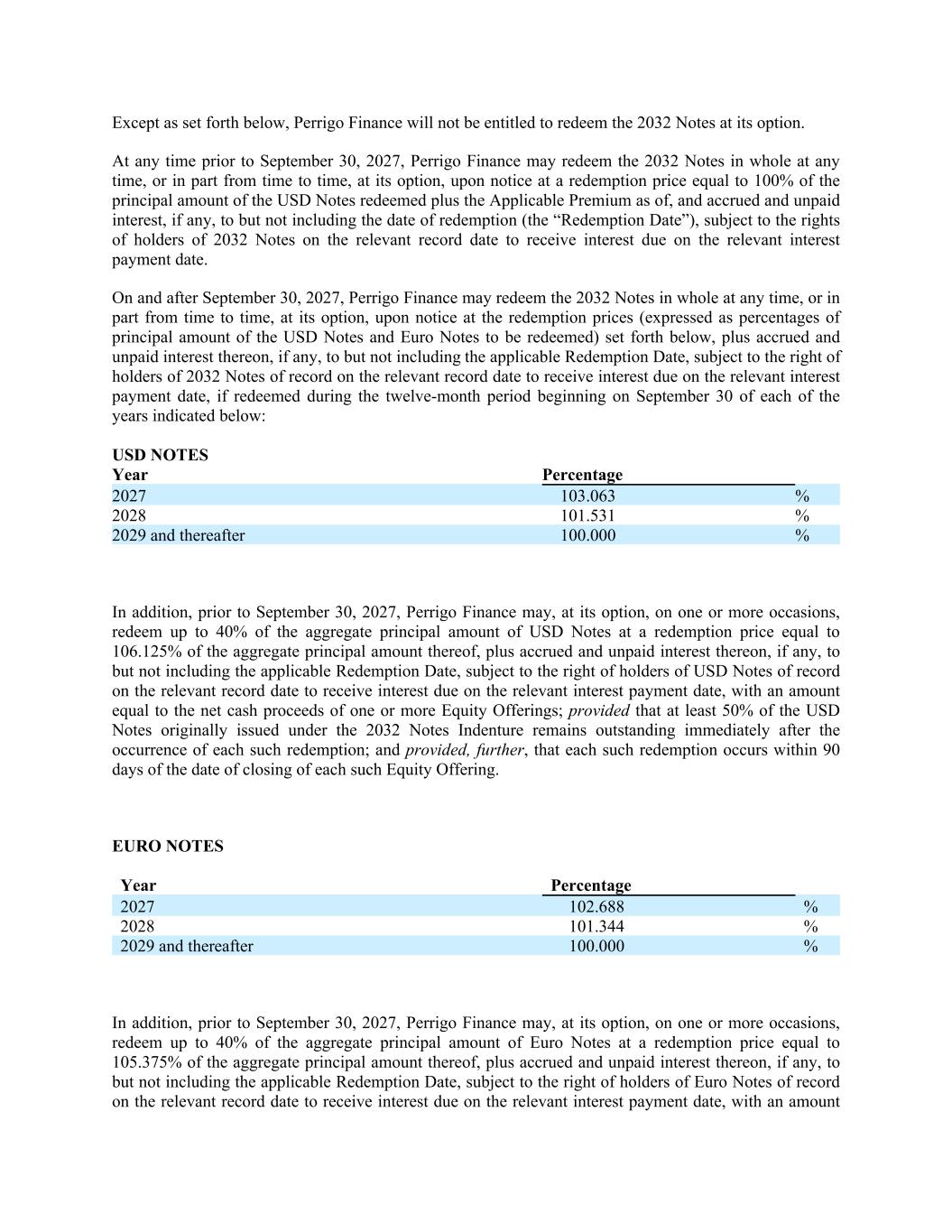

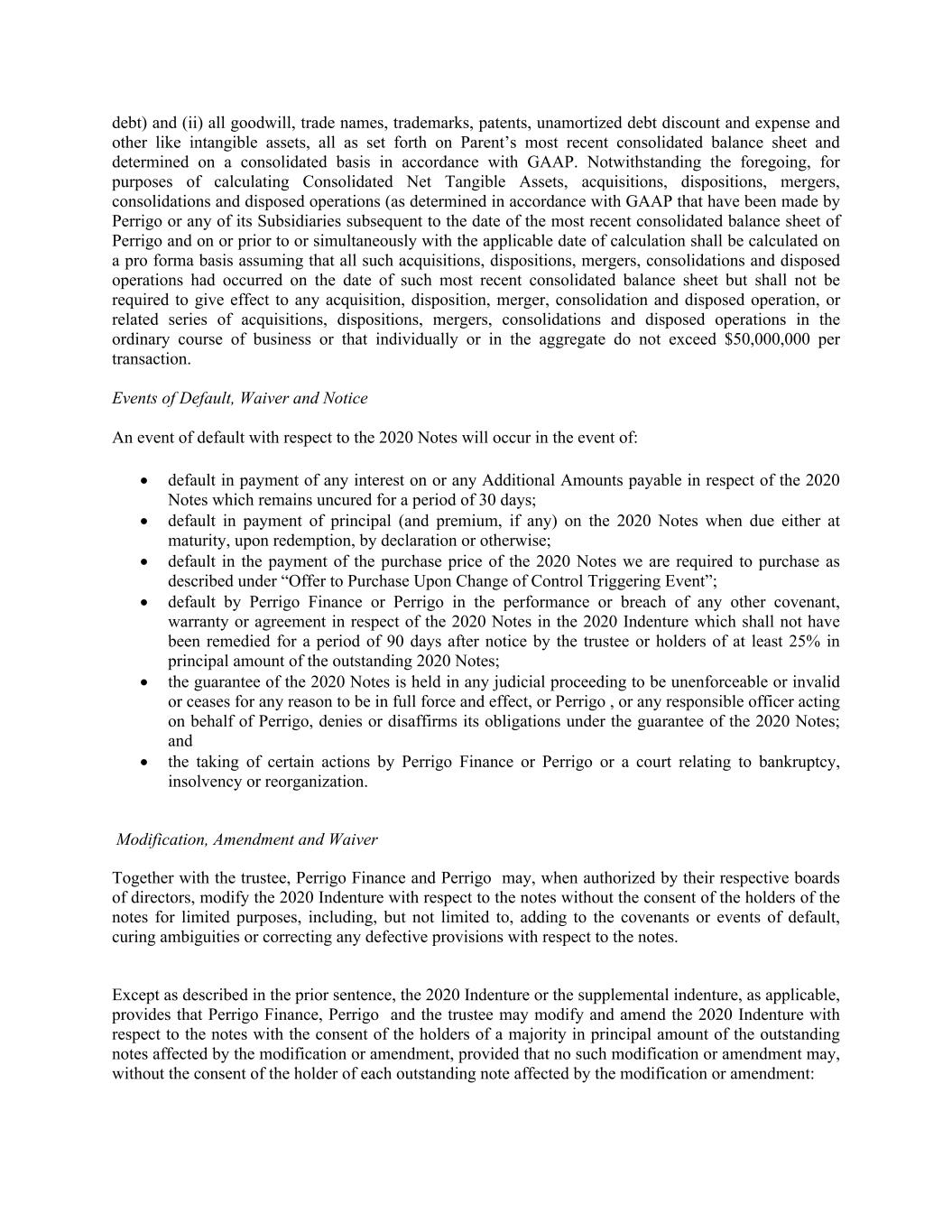

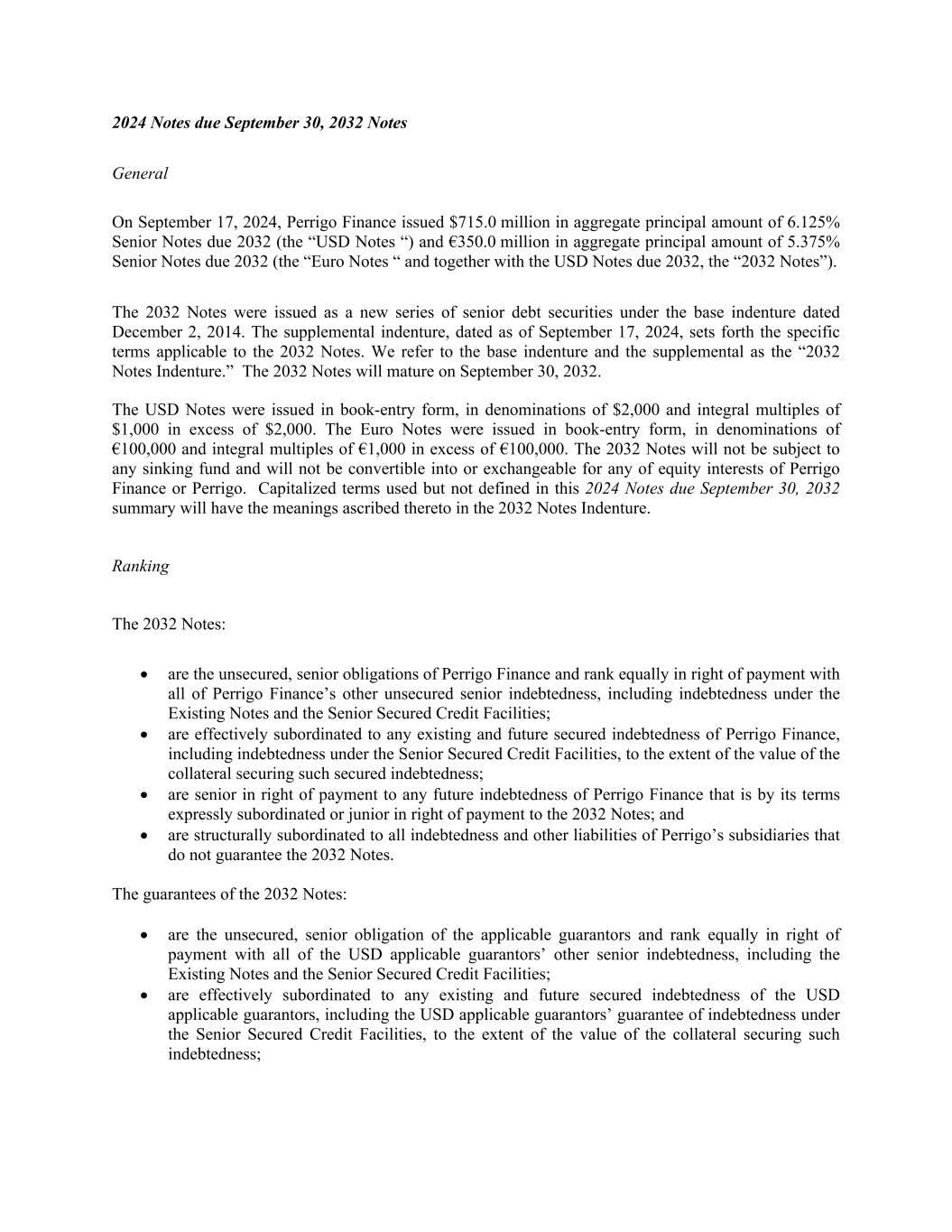

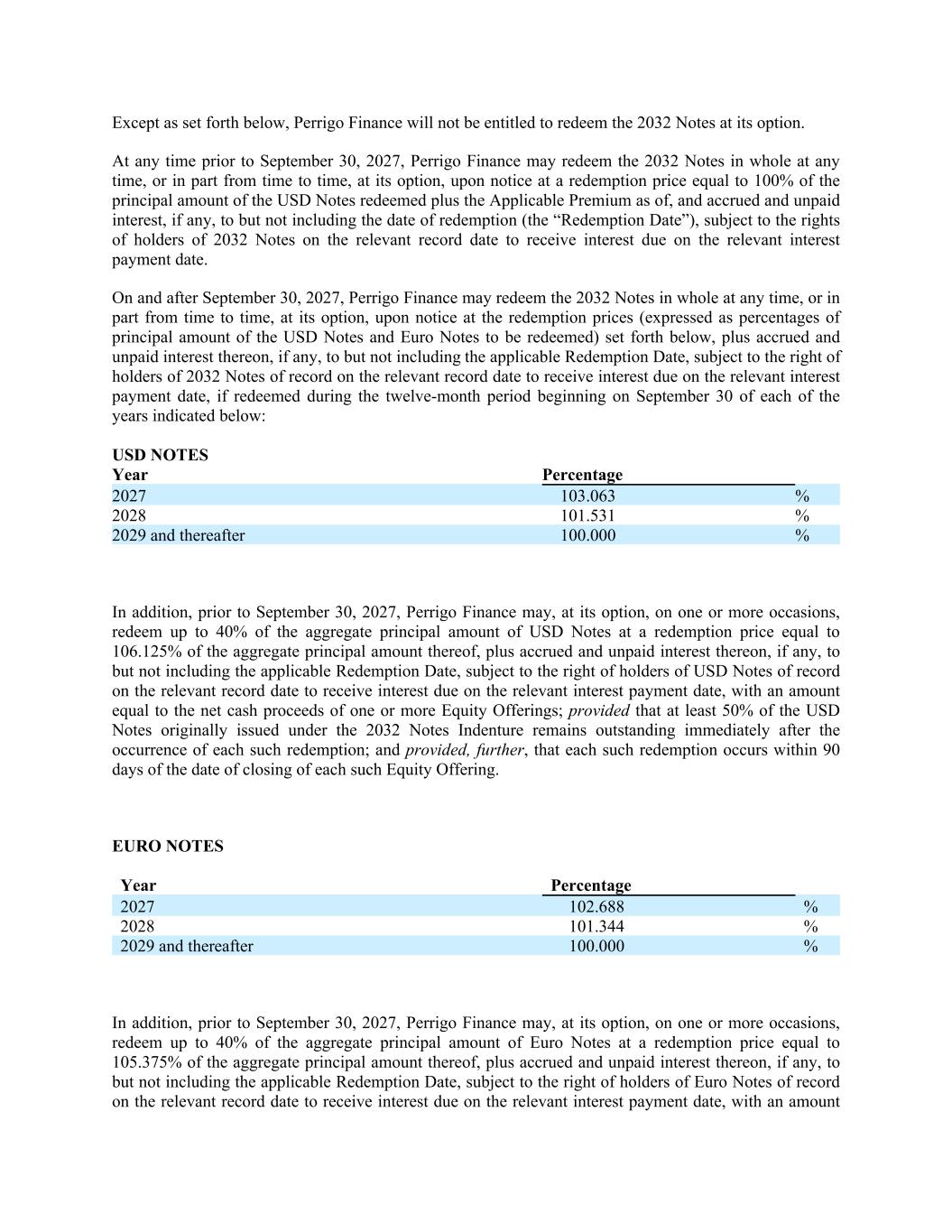

(iii) such holding company provides a full and unconditional guarantee of the notes (whereupon such holding company shall be substituted as the “Perrigo” for the purposes of the notes and 2020 Indenture, without the release of the guarantee of the entity formerly considered to be the “Perrigo”), and (iv) the direct or indirect holders of the voting stock of such holding company immediately following that transaction are substantially the same as the holders of Perrigo’s voting stock immediately prior to that transaction. The definition of change of control includes a phrase relating to the direct or indirect sale, transfer, conveyance or other disposition, in one or a series of related transactions, of “all or substantially all” of the assets of Perrigo and the assets of the subsidiaries of Perrigo , taken as a whole. Although there is a limited body of case law interpreting the phrase “substantially all,” there is no precise established definition of such phrase under applicable law. Accordingly, the ability of a holder of the notes to require us to repurchase that holder’s notes as a result of the sale, transfer, conveyance or other disposition of less than all of the assets of Perrigo and the assets of the subsidiaries of Perrigo, taken as a whole, to one or more persons may be uncertain. Limitations on Liens Perrigo will not permit any Restricted Subsidiary to create, incur, issue, assume or guarantee any Debt secured by a Lien upon or with respect to any Principal Property of Perrigo or any Restricted Subsidiary, or on the capital stock of any Restricted Subsidiary held by Perrigo or any other Restricted Subsidiary unless: the notes are secured by such Lien equally and ratably with (or prior to) such other secured Debt; or the aggregate principal amount of: all of such secured Debt then outstanding, together with all Attributable Debt of Perrigo and its Restricted Subsidiaries in respect of Sale and Lease-Back Transactions existing at such time, with the exception of transactions which are not subject to the limitation described in “Limitations on sale and lease-back transactions,” does not exceed an amount equal to 15% of Perrigo’s Consolidated Net Tangible Assets. This limitation will not apply to any Debt secured by: any Lien existing on the Issue Date; any Lien in Perrigo’s favor or in favor of any Restricted Subsidiary; any Lien on any asset of any entity at the time such entity becomes a Restricted Subsidiary or at the time such entity is merged or consolidated with or into Perrigo Finance, Perrigo or a Restricted Subsidiary, as long as such Lien does not attach to any of the other assets of Perrigo or any Restricted Subsidiary; any Lien on any property or assets or shares of stock or Debt which exists at the time of the acquisition thereof; Liens on any property or assets or shares of stock or Debt securing the payment of all or any part of the purchase price or construction cost thereof (including improvements thereon) or securing any Debt incurred or assumed for the purpose of financing all or any part of the purchase price or construction cost thereof if such Lien attaches concurrently with or within 180 days after the acquisition of such property or assets or shares of stock or Debt or the completion of any such construction, whichever is later, provided the principal amount of the Debt secured by any such Lien, together with all other Debt secured by a Lien on such property or assets or shares of stock