Filed Pursuant to Rule 424(b)(3)

Registration No. 333-190983

STRATEGIC STORAGE TRUST II, INC.

SUPPLEMENT NO. 6 DATED SEPTEMBER 11, 2014

TO THE PROSPECTUS DATED JANUARY 10, 2014

This document supplements, and should be read in conjunction with, the prospectus of Strategic Storage Trust II, Inc. dated January 10, 2014, Supplement No. 2 thereto dated April 11, 2014 (which amended and superseded all prior supplements), Supplement No. 3 thereto dated May 23, 2014, Supplement No. 4 thereto dated June 24, 2014, and Supplement No. 5 thereto dated August 19, 2014. Unless otherwise defined in this supplement, capitalized terms used in this supplement shall have the same meanings as set forth in the prospectus.

The purpose of this supplement is to disclose:

| | • | | an update on the status of our public offering; and |

| | • | | an update to the sponsor of our public offering. |

Status of Our Offering

We commenced the initial public offering of shares of our common stock on January 10, 2014. On May 23, 2014, we reached the minimum offering amount of $1.5 million in sales of shares and commenced operations. As of September 8, 2014, we have received gross offering proceeds of approximately $9.7 million from the sale of approximately 1.0 million shares in our initial public offering. As of September 8, 2014, approximately $1.09 billion in shares remained available for sale to the public under our initial public offering, including shares available under our distribution reinvestment plan.

Update to Our Sponsor

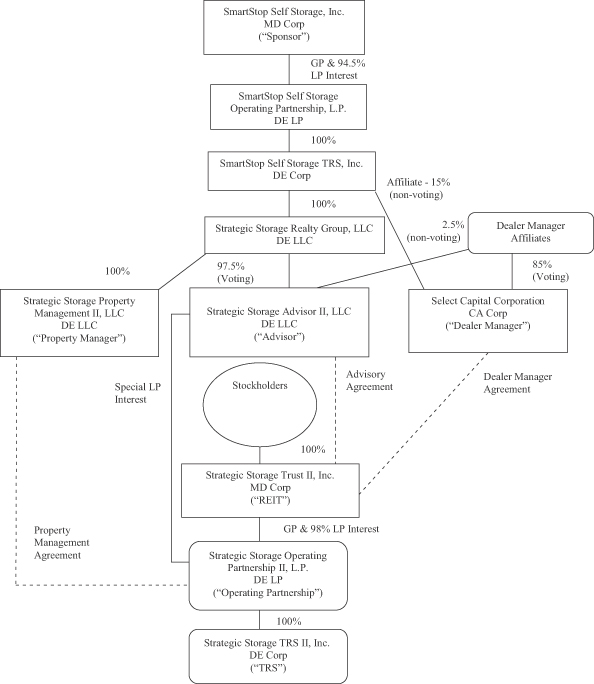

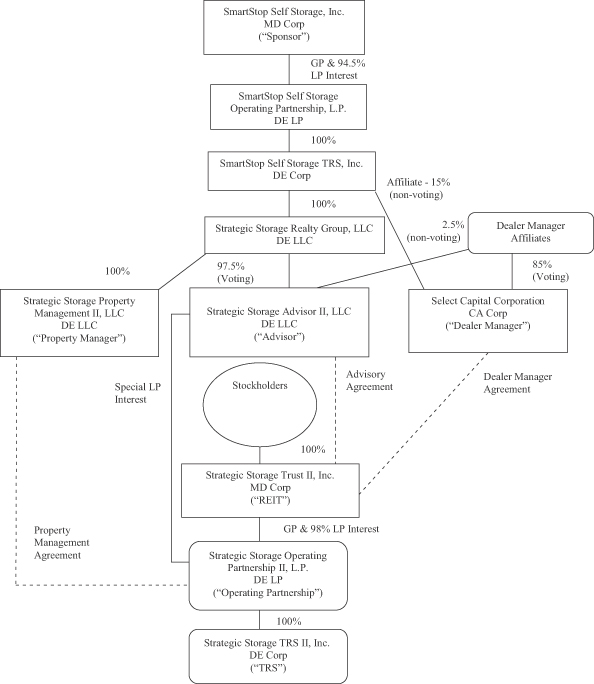

On September 4, 2014, SmartStop Self Storage, Inc. (“SmartStop”), formerly known as Strategic Storage Trust, Inc., and its operating partnership, SmartStop Self Storage Operating Partnership, L.P., entered into a series of transactions, agreements, and amendments to its existing agreements and arrangements (such agreements and amendments hereinafter referred to collectively as the “Self Administration and Investment Management Transaction”), with our prior sponsor, Strategic Storage Holdings, LLC (“SSH”), and its affiliates, pursuant to which, effective as of August 31, 2014, SmartStop acquired the self storage advisory, asset management, property management and investment management businesses of SSH, including SSH’s sole membership interest in Strategic Storage Realty Group, LLC, which owns 97.5% of the economic interests (and 100% of the voting membership interests) of our advisor and owns 100% of our property manager.

The following information should be read in conjunction with the paragraph under the “Our Sponsor” subsection of the “Prospectus Summary” section on page 7 of our prospectus, the “Affiliated Companies” subsection of the “Management” section on page 74 of our prospectus, the first paragraph of the “Interests in Other Real Estate Programs and Other Concurrent Offerings” subsection of the “Conflicts of Interest” section on page 83 of our prospectus, the “General” subsection of the “Plan of Distribution” section on page 147 of our prospectus and all similar discussions appearing throughout the prospectus:

Our Sponsor

Below is some information about our new sponsor immediately following the Self Administration and Investment Management Transaction:

| | • | | SmartStop is now the seventh largest fully integrated, self-administered and self-managed self storage company, owning 126 self storage properties in 17 states and Toronto, Canada; |

| | • | | SmartStop and its subsidiaries will now serve as our sponsor, advisor, and property manager, and the sponsor, advisor, and property manager of Strategic Storage Growth Trust, Inc. (“SSGT”), a private REIT focused on opportunistic self storage assets; |

| | • | | SmartStop is a diversified real estate company focused on the acquisition, advisory, asset management and property management of self storage properties; |

| | • | | SmartStop employs approximately 300 self storage, investment and management professionals focused on increasing revenue, occupancy, net operating income and customer satisfaction; |

| | • | | SmartStop now owns the “SmartStop®” brand, “Strategic Storage” brand, related trademarks and over 200 domain names including www.SmartStop.com; |

| | • | | The executive officers of SmartStop are substantially the same executive officers of our prior sponsor; and |

| | • | | SmartStop also indirectly owns a 15% non-voting equity interest in our dealer manager, Select Capital Corporation. |

In all places in our prospectus where our sponsor is mentioned, our sponsor shall mean SmartStop Self Storage, Inc. In all places in our prospectus where Strategic Storage Trust, Inc. is mentioned, the name shall be changed to SmartStop Self Storage, Inc.

The following information should be read in conjunction with the paragraph under the “Concurrent Offerings” subsection of the “Prospectus Summary” section on page 8 of our prospectus and the second paragraph under the “Interests in Other Real Estate Programs and Other Concurrent Offerings” subsection of the “Conflicts of Interest” section on page 83 of our Prospectus:

Concurrent Offerings

SmartStop is our new sponsor and also sponsors SSGT. SmartStop and SSGT are, as of the date of this prospectus, raising capital pursuant to offerings of shares of their common stock. SmartStop has closed its primary offering to new investors; however, it expects to continue selling shares of its common stock pursuant to its distribution reinvestment plan. As of August 31, 2014, SmartStop had raised approximately $561 million of gross offering proceeds in its initial and follow-on public offerings and its ongoing distribution reinvestment plan offering. As of the date of this prospectus, SSGT is raising capital pursuant to a private placement memorandum to sell up to $109.5 million in shares of its common stock to “accredited investors” as defined under the Securities Act of 1933. As of September 8, 2014, SSGT had raised approximately $4.9 million of gross offering proceeds in its private placement offering.

The chart and notes under the “Our Structure” subsection of the “Prospectus Summary” section on page 9 of our prospectus and the “Certain Conflict Resolution Procedures” subsection of the “Conflicts of Interest” section on page 89 of our prospectus is hereby amended and replaced with the following chart, as of August 31, 2014:

| * | The address of all of these entities, except for Select Capital Corporation, is 111 Corporate Drive, Suite 120, Ladera Ranch, California 92694. The address for Select Capital Corporation is 31351 Rancho Viejo Road, Suite 205, San Juan Capistrano, California 92675. |

The risk factor on page 24 of our prospectus is hereby amended and restated as follows:

Because our dealer manager is affiliated with our sponsor, you may not have the benefit of an independent review of the prospectus or our company as is customarily performed in underwritten offerings.

SmartStop indirectly owns a 15% non-voting equity interest in our dealer manager, Select Capital Corporation. In addition, an affiliate of our dealer manager owns a 2.5% non-voting membership interest in our advisor. Accordingly, our dealer manager may not be deemed to have made an independent review of our company or the offering. See “Management — Affiliated Companies” for more information on our dealer manager. You will have to rely on your own broker-dealer to make an independent review of the terms of this offering. If your broker-dealer does not conduct such a review, you will not have the benefit of an independent review of the terms of this offering. Further, the due diligence investigation of our company by our dealer manager should not be considered to be an independent review and, therefore, may not be as meaningful as a review conducted by an unaffiliated broker-dealer or investment banker.