Filed Pursuant to Rule 424(b)(3)

Registration No. 333-190983

STRATEGIC STORAGE TRUST II, INC.

SUPPLEMENT NO. 6 DATED OCTOBER 4, 2016

TO THE PROSPECTUS DATED APRIL 11, 2016

This document supplements, and should be read in conjunction with, the prospectus of Strategic Storage Trust II, Inc. dated April 11, 2016, Supplement No. 4 dated July 11, 2016, which amended and superseded all prior supplements to the prospectus, and Supplement No. 5 dated August 22, 2016. Unless otherwise defined in this supplement, capitalized terms used in this supplement shall have the same meanings as set forth in the prospectus.

The purpose of this supplement is to disclose:

| | • | | an update on the status of our public offering; |

| | • | | procedures related to the termination date of our public offering; |

| | • | | updates regarding the acquisitions of two self storage facilities in Las Vegas, Nevada; |

| | • | | updates regarding the potential acquisitions of self storage facilities in Elk Grove Village, Illinois and Aurora, Colorado; and |

| | • | | a revised subscription agreement. |

Status of Our Offering

We commenced the initial public offering of shares of our common stock on January 10, 2014. On May 23, 2014, we reached the minimum offering amount of $1.5 million in sales of shares and commenced operations. Effective September 28, 2015, we reallocated shares in our primary offering to consist of the following: up to $500 million in Class A shares and up to $500 million in Class T shares. As of September 28, 2016, we had received gross offering proceeds of approximately $426 million from the sale of approximately 42.2 million Class A shares and approximately $49.1 million from the sale of approximately 4.9 million Class T shares in our offering. As of September 28, 2016, approximately $620 million in shares remained available for sale to the public under our initial public offering, including shares available under our distribution reinvestment plan.

Procedures Related to Termination Date of our Public Offering

We have determined that our primary offering will close effective January 9, 2017. On January 9, 2017, we will cease offering shares under our primary offering. In connection with the closing of our primary offering, our transfer agent, DST Systems, Inc. (“DST”), must receive all subscription agreements in good order and must receive the funds for all accounts (including qualified accounts) on or before the close of business on January 9, 2017. Any subscriptions received or funded after January 9, 2017 will be promptly returned.

Acquisitions of Two Properties in Las Vegas, Nevada

Las Vegas II Property

On September 23, 2016, we purchased a self storage facility located in Las Vegas, Nevada (the “Las Vegas II Property”). We acquired the Las Vegas II Property from an unaffiliated third party for a purchase price

of approximately $14.2 million, plus closing costs and acquisition fees. Our advisor earned approximately $250,000 in acquisition fees in connection with the acquisition. The Las Vegas II Property has approximately 810 units and approximately 101,400 net rentable square feet. We financed the acquisition of the Las Vegas II Property by using net proceeds from our public offering.

Las Vegas III Property

On September 27, 2016, we purchased a self storage facility located in Las Vegas, Nevada (the “Las Vegas III Property”). We acquired the Las Vegas III Property from an unaffiliated third party for a purchase price of approximately $9.3 million, plus closing costs and acquisition fees. Our advisor earned approximately $160,000 in acquisition fees in connection with the acquisition. The Las Vegas III Property has approximately 640 units and approximately 82,200 net rentable square feet. We financed the acquisition of the Las Vegas III Property by using net proceeds from our public offering.

Property Management of Las Vegas Properties

Strategic Storage Property Management II, LLC, a subsidiary of our sponsor, serves as the property manager of the Las Vegas II Property and the Las Vegas III Property (the “Las Vegas Properties”). Strategic Storage Property Management II, LLC entered into sub-property management agreements with a subsidiary of Extra Space Storage, Inc. who will manage the Las Vegas Properties. Strategic Storage Property Management II, LLC will be paid management fees in an amount equal to the greater of $2,500 per month or 6% of the gross monthly revenues collected from both of the Las Vegas Properties and Strategic Storage Property Management II, LLC will, in turn, pay the sub-property manager an amount equal to the greater of $2,500 per month or 6% of the gross monthly revenues collected from the both of the Las Vegas Properties, except for the months of January and July each year.

Potential Acquisition of a Property in Elk Grove Village, Illinois

On August 23, 2016, one of our subsidiaries executed a purchase and sale agreement with an unaffiliated third party (the “Elk Grove Village Purchase Agreement”) for the acquisition of a self storage facility located in Elk Grove Village, Illinois (the “Elk Grove Village Property”). The Elk Grove Village Property has approximately 770 units and approximately 82,500 net rentable square feet. The purchase price for the Elk Grove Village Property is approximately $10.1 million, plus closing costs and acquisition fees. We expect the acquisition of the Elk Grove Village Property to close in the fourth quarter of 2016. We expect to fund such acquisition with net proceeds from our public offering.

Pursuant to the Elk Grove Village Purchase Agreement, we will be obligated to purchase the Elk Grove Village Property only after satisfactory completion of agreed upon closing conditions. We will decide whether to acquire the Elk Grove Village Property generally based upon:

| | • | | satisfactory completion of due diligence on the Elk Grove Village Property and the seller of the Elk Grove Village Property; |

| | • | | approval by our board of directors to purchase the Elk Grove Village Property; |

| | • | | satisfaction of the conditions to the acquisition in accordance with the Elk Grove Village Purchase Agreement; and |

| | • | | no material adverse changes relating to the Elk Grove Village Property, the seller of the Elk Grove Village Property or certain economic conditions. |

There can be no assurance that we will complete the acquisition of the Elk Grove Village Property. In some circumstances, if we fail to complete the acquisition, we may forfeit up to approximately $400,000 in earnest money on the Elk Grove Village Property.

Other properties may be identified in the future that we may acquire prior to or instead of the Elk Grove Village Property. Due to the considerable conditions to the consummation of the acquisition of the Elk Grove Village Property, we cannot make any assurances that the closing of the Elk Grove Village Property is probable.

Potential Acquisition of a Property in Aurora, Colorado

On September 19, 2016, one of our subsidiaries executed a purchase and sale agreement with an unaffiliated third party (the “Aurora Purchase Agreement”) for the acquisition of a self storage facility located in Aurora, Colorado (the “Aurora Property”). The Aurora Property has approximately 395 units and approximately 53,400 net rentable square feet. The purchase price for the Aurora Property is approximately $10.1 million, plus closing costs and acquisition fees. We expect the acquisition of the Aurora Property to close in the first quarter of 2017. We expect to fund such acquisition with net proceeds from our public offering.

Pursuant to the Aurora Purchase Agreement, we will be obligated to purchase the Aurora Property only after satisfactory completion of agreed upon closing conditions. We will decide whether to acquire the Aurora Property generally based upon:

| | • | | satisfactory completion of due diligence on the Aurora Property and the seller of the Aurora Property; |

| | • | | approval by our board of directors to purchase the Aurora Property; |

| | • | | satisfaction of the conditions to the acquisition in accordance with the Aurora Purchase Agreement; and |

| | • | | no material adverse changes relating to the Aurora Property, the seller of the Aurora Property or certain economic conditions. |

There can be no assurance that we will complete the acquisition of the Aurora Property. In some circumstances, if we fail to complete the acquisition, we may forfeit up to approximately $250,000 in earnest money on the Aurora Property.

Other properties may be identified in the future that we may acquire prior to or instead of the Aurora Property. Due to the considerable conditions to the consummation of the acquisition of the Aurora Property, we cannot make any assurances that the closing of the Aurora Property is probable.

Subscription Agreement

A revised subscription agreement is attached hereto as Appendix A.

Regular Mail: Strategic Storage Trust II, Inc. c/o DST Systems, Inc., P.O. Box 219406, Kansas City, MO 64121-9406

Overnight Mail: Strategic Storage Trust II, Inc. c/o DST Systems, Inc., 430 W. 7th Street, Kansas City, MO 64105

Wire Information: UMB Bank, N.A., 1010 Grand, 4th Floor, Kansas City, MO 64106 ABA# 101000695 Account# 98721879437

Investor Services Toll Free Phone Line: 866.418.5144

A-1

YOUR INITIAL INVESTMENT Make all checks* payable to: “STRATEGIC STORAGE TRUST II, INC.”

*Cash, cashier’s checks/official bank checks under $10,000, foreign checks, money orders, third party checks, temporary/starter checks, or traveler’s checks are not accepted.

The minimum initial investment is $5,000**. Additional investments (minimum $100).

Investment Amount: $_______________________ Existing Account#:

** Unless otherwise described in the prospectus.

Share Class Selection (required)

Class A Share Class T Share

By Mail – Attach a check made payable to Strategic Storage Trust II, Inc.

By Wire – UMB Bank, N.A., 1010 Grand, 4th Floor, Kansas City, MO 64106, ABA# 101000695 Strategic Storage Trust II, Inc. Account# 9871879437. When sending a wire, please request that the wire references the subscriber’s name in order to assure the wire is credited to the proper account.

Asset Transfer – Attach a copy of the asset transfer form. Original to be sent to the transferring institution.

Waiver of Commission - Please check this box if you are eligible for a waiver of commission. Waivers of commissions are available for purchases through an affiliated investment advisor, participating Broker-Dealer or its retirement plan, or for a representative of a participating Broker-Dealer or his or her retirement plan or family member(s).

Registered Investment Advisor (RIA): If this box is checked, commission will be waived. If an RIA has introduced a sale and the RIA is affiliated with a Broker-Dealer, the sale must be conducted through (1) the RIA in his or her capacity as a Registered Representative of a Broker-Dealer, if applicable; or (2) a Registered Representative of a Broker-Dealer, which is affiliated with the RIA, if applicable. If an RIA has introduced a sale and the RIA is not affiliated with a Broker-Dealer, the sale must be made pursuant to a RIA Selling Agreement and include a Certification of Client Suitability. (Section 6 must be filled in)

¨ Volume Discount Purchase: Please check this box if you are eligible for a volume discount on this purchase.

FORM OF OWNERSHIP (Select only one)

Non-Custodial Ownership

Individual Ownership

Joint Tenants with Rights of Survivorship – All parties must sign.

Community Property – All parties must sign.

Tenant In Common – All parties must sign.

Corporate Ownership – Authorized signature required. Include copy of corporate resolution.

S-Corp. C-Corp.

Partnership Ownership – Authorized signature required. Include copy of partnership agreement.

Estate – Authorized representative(s) signature required.

Name of Authorized Representative(s)

Include a copy of the court appointment dated within 90 days.

Trust – Include a copy of the first and last page of the trust.

Name of Trustee(s)

Transfer on Death – Complete Transfer on Death form to effect designation.

Uniform Gift to Minors Act / Uniform Transfers to Minors Act – Custodian signature required in Section 7.

State of Custodian for

Pension Plan and Profit Sharing Plan (Non-Custodian) – Include a copy of the first and last pages of the plan.

Other – Include a copy of any pertinent documents.

Custodial Ownership (Send completed forms to custodian)

Traditional IRA – Custodian signature required in Section 7.

Simple IRA – Custodian signature required in Section 7.

Roth IRA – Custodian signature required in Section 7.

KEOGH Plan – Custodian signature required in Section 7.

Simplified Employee Pension / Trust (SEP)

Pension / Profit-Sharing Plan / 401k – Custodian signature required in Section 7.

Required for custodial ownership accounts

Name of Custodian, Trustee, or Other Administrator

Mailing Address

City, State & Zip Code

Custodian Information – To be completed by Custodian listed above.

Custodian Tax ID#

Custodian Account #

Custodian Telephone #

Special Instructions

[GRAPHIC APPEARS HERE]

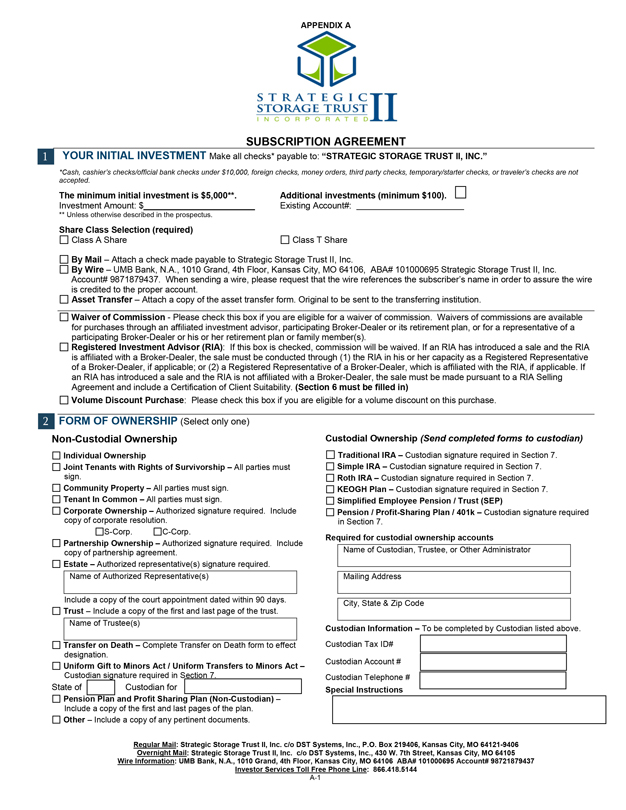

ADDRESS INFORMATION

Subscriber Information (All fields must be completed)

Investor / Trust / Plan Name

Co-Investor / Name of Trustee(s)

Investor Social Security Number / Tax ID Number

Co-Investor Social Security Number / Tax ID Number

Birth Date / Articles of Incorporation (MM/DD/YY)

Co-Investor Birth Date (MM/DD/YY)

Please indicate Citizenship Status¨¨ U.S. Citizen¨¨ Resident Alien – Country of Origin________________________________

¨¨ Non-resident Alien – Country of Origin __________________________________________

Residence Address (No P.O. Box allowed)

Street Address

City

State

Zip Code

Home Telephone

Business Telephone

Email Address

Mailing Address* (if different from above – P.O. Box allowed)

Street Address

City

State

Zip Code

*If the co-investor resides at another address, please attach that address to the subscription agreement

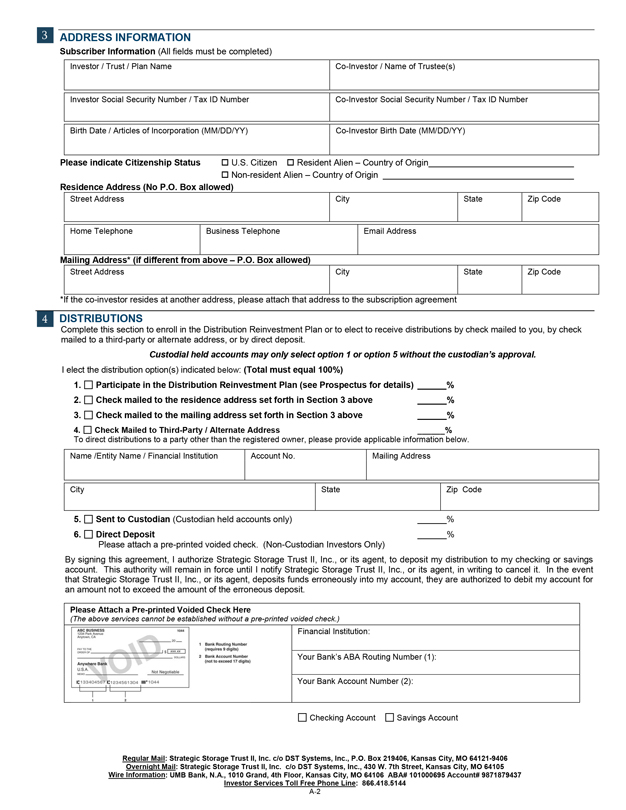

[GRAPHIC APPEARS HERE] DISTRIBUTIONS

Complete this section to enroll in the Distribution Reinvestment Plan or to elect to receive distributions by check mailed to you, by check mailed to a third-party or alternate address, or by direct deposit.

Custodial held accounts may only select option 1 or option 5 without the custodian’s approval.

I elect the distribution option(s) indicated below: (Total must equal 100%)

1.¨¨ Participate in the Distribution Reinvestment Plan (see Prospectus for details) ______%

2.¨¨ Check mailed to the residence address set forth in Section 3 above ______%

3.¨¨ Check mailed to the mailing address set forth in Section 3 above ______%

4.¨¨ Check Mailed to Third-Party / Alternate Address ______% To direct distributions to a party other than the registered owner, please provide applicable information below.

Name /Entity Name / Financial Institution

Account No.

Mailing Address

City

State

Zip Code

5.¨¨ Sent to Custodian (Custodian held accounts only) ______%

6.¨¨ Direct Deposit ______%

Please attach a pre-printed voided check. (Non-Custodian Investors Only)

By signing this agreement, I authorize Strategic Storage Trust II, Inc., or its agent, to deposit my distribution to my checking or savings account. This authority will remain in force until I notify Strategic Storage Trust II, Inc., or its agent, in writing to cancel it. In the event that Strategic Storage Trust II, Inc., or its agent, deposits funds erroneously into my account, they are authorized to debit my account for an amount not to exceed the amount of the erroneous deposit.

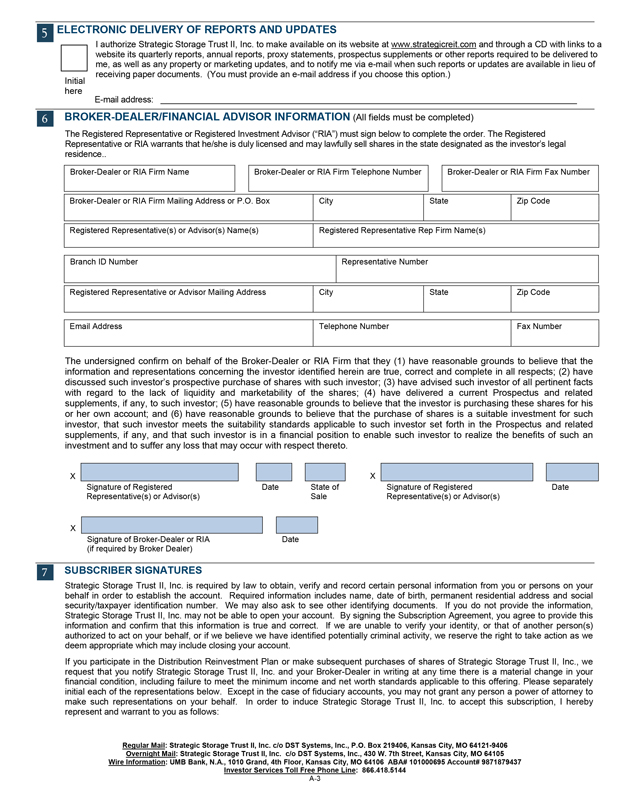

Please Attach a Pre-printed Voided Check Here (The above services cannot be established without a pre-printed voided check.)

[GRAPHIC APPEARS HERE]

Financial Institution:

Your Bank’s ABA Routing Number (1):

Your Bank Account Number (2):

¨¨ Checking Account¨x Savings Account

Regular Mail: Strategic Storage Trust II, Inc. c/o DST Systems, Inc., P.O. Box 219406, Kansas City, MO 64121-9406

Overnight Mail: Strategic Storage Trust II, Inc. c/o DST Systems, Inc., 430 W. 7th Street, Kansas City, MO 64105

Wire Information: UMB Bank, N.A., 1010 Grand, 4th Floor, Kansas City, MO 64106 ABA# 101000695 Account# 9871879437

Investor Services Toll Free Phone Line: 866.418.5144

Regular Mail: Strategic Storage Trust II, Inc. c/o DST Systems, Inc., P.O. Box 219406, Kansas City, MO 64121-9406

Overnight Mail: Strategic Storage Trust II, Inc. c/o DST Systems, Inc., 430 W. 7th Street, Kansas City, MO 64105

Wire Information: UMB Bank, N.A., 1010 Grand, 4th Floor, Kansas City, MO 64106 ABA# 101000695 Account# 9871879437

Investor Services Toll Free Phone Line: 866.418.5144

A-3

ELECTRONIC DELIVERY OF REPORTS AND UPDATES

E-mail address:

BROKER-DEALER/FINANCIAL ADVISOR INFORMATION (All fields must be completed)

The Registered Representative or Registered Investment Advisor (“RIA”) must sign below to complete the order. The Registered

Representative or RIA warrants that he/she is duly licensed and may lawfully sell shares in the state designated as the investor’s legal

residence..

Broker-Dealer or RIA Firm Name Broker-Dealer or RIA Firm Telephone Number Broker-Dealer or RIA Firm Fax Number

Broker-Dealer or RIA Firm Mailing Address or P.O. Box City State Zip Code

Registered Representative(s) or Advisor(s) Name(s) Registered Representative Rep Firm Name(s)

Branch ID Number Representative Number

Registered Representative or Advisor Mailing Address City State Zip Code

Email Address Telephone Number Fax Number

The undersigned confirm on behalf of the Broker-Dealer or RIA Firm that they (1) have reasonable grounds to believe that the

information and representations concerning the investor identified herein are true, correct and complete in all respects; (2) have

discussed such investor’s prospective purchase of shares with such investor; (3) have advised such investor of all pertinent facts

with regard to the lack of liquidity and marketability of the shares; (4) have delivered a current Prospectus and related

supplements, if any, to such investor; (5) have reasonable grounds to believe that the investor is purchasing these shares for his

or her own account; and (6) have reasonable grounds to believe that the purchase of shares is a suitable investment for such

investor, that such investor meets the suitability standards applicable to such investor set forth in the Prospectus and related

supplements, if any, and that such investor is in a financial position to enable such investor to realize the benefits of such an

investment and to suffer any loss that may occur with respect thereto.

X

X

Signature of Registered

Representative(s) or Advisor(s)

Date State of

Sale

Signature of Registered

Representative(s) or Advisor(s)

Date

X

Signature of Broker-Dealer or RIA

(if required by Broker Dealer)

Date

SUBSCRIBER SIGNATURES

Strategic Storage Trust II, Inc. is required by law to obtain, verify and record certain personal information from you or persons on your

behalf in order to establish the account. Required information includes name, date of birth, permanent residential address and social

security/taxpayer identification number. We may also ask to see other identifying documents. If you do not provide the information,

Strategic Storage Trust II, Inc. may not be able to open your account. By signing the Subscription Agreement, you agree to provide this

information and confirm that this information is true and correct. If we are unable to verify your identity, or that of another person(s)

authorized to act on your behalf, or if we believe we have identified potentially criminal activity, we reserve the right to take action as we

deem appropriate which may include closing your account.

If you participate in the Distribution Reinvestment Plan or make subsequent purchases of shares of Strategic Storage Trust II, Inc., we

request that you notify Strategic Storage Trust II, Inc. and your Broker-Dealer in writing at any time there is a material change in your

financial condition, including failure to meet the minimum income and net worth standards applicable to this offering. Please separately

initial each of the representations below. Except in the case of fiduciary accounts, you may not grant any person a power of attorney to

make such representations on your behalf. In order to induce Strategic Storage Trust II, Inc. to accept this subscription, I hereby

represent and warrant to you as follows:

I authorize Strategic Storage Trust II, Inc. to make available on its website at www.strategicreit.com and through a CD with links to a

website its quarterly reports, annual reports, proxy statements, prospectus supplements or other reports required to be delivered to

me, as well as any property or marketing updates, and to notify me via e-mail when such reports or updates are available in lieu of

receiving paper documents. (You must provide an e-mail address if you choose this option.)

Initial

here

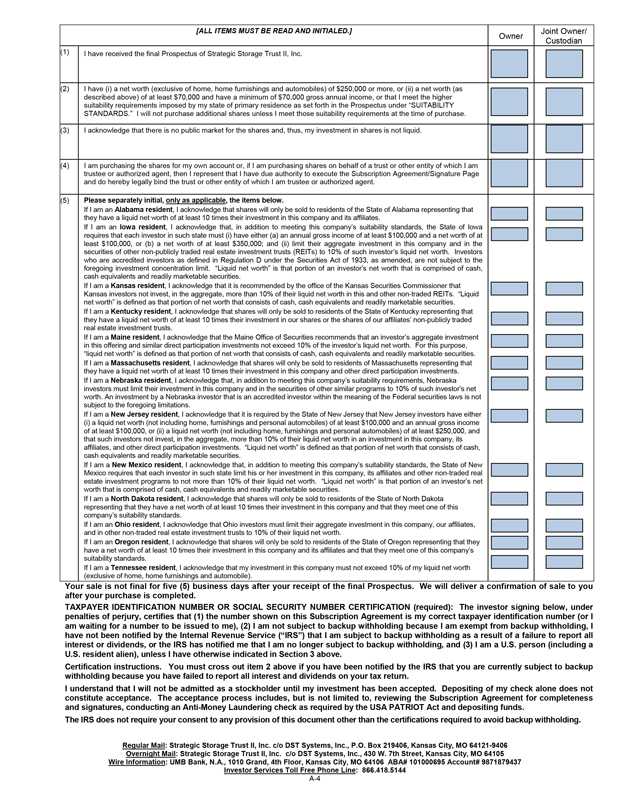

[ALL ITEMS MUST BE READ AND INITIALED.]

Owner

Joint Owner/

Custodian

(1) I have received the final Prospectus of Strategic Storage Trust II, Inc.

(2) I have (i) a net worth (exclusive of home, home furnishings and automobiles) of $250,000 or more, or (ii) a net worth (as described above) of at least $70,000 and have a minimum of $70,000 gross annual income, or that I meet the higher suitability requirements imposed by my state of primary residence as set forth in the Prospectus under “SUITABILITY STANDARDS.” I will not purchase additional shares unless I meet those suitability requirements at the time of purchase.

(3) I acknowledge that there is no public market for the shares and, thus, my investment in shares is not liquid.

(4) I am purchasing the shares for my own account or, if I am purchasing shares on behalf of a trust or other entity of which I am trustee or authorized agent, then I represent that I have due authority to execute the Subscription Agreement/Signature Page and do hereby legally bind the trust or other entity of which I am trustee or authorized agent.

(5) Please separately initial, only as applicable, the items below.

If I am an Alabama resident, I acknowledge that shares will only be sold to residents of the State of Alabama representing that they have a liquid net worth of at least 10 times their investment in this company and its affiliates.

If I am an Iowa resident, I acknowledge that, in addition to meeting this company’s suitability standards, the State of Iowa requires that each investor in such state must (i) have either (a) an annual gross income of at least $100,000 and a net worth of at least $100,000, or (b) a net worth of at least $350,000; and (ii) limit their aggregate investment in this company and in the securities of other non-publicly traded real estate investment trusts (REITs) to 10% of such investor‘s liquid net worth. Investors who are accredited investors as defined in Regulation D under the Securities Act of 1933, as amended, are not subject to the foregoing investment concentration limit. “Liquid net worth” is that portion of an investor’s net worth that is comprised of cash, cash equivalents and readily marketable securities.

If I am a Kansas resident, I acknowledge that it is recommended by the office of the Kansas Securities Commissioner that Kansas investors not invest, in the aggregate, more than 10% of their liquid net worth in this and other non-traded REITs. “Liquid net worth” is defined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities.

If I am a Kentucky resident, I acknowledge that shares will only be sold to residents of the State of Kentucky representing that they have a liquid net worth of at least 10 times their investment in our shares or the shares of our affiliates’ non-publicly traded real estate investment trusts.

If I am a Maine resident, I acknowledge that the Maine Office of Securities recommends that an investor’s aggregate investment in this offering and similar direct participation investments not exceed 10% of the investor’s liquid net worth. For this purpose, “liquid net worth” is defined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities.

If I am a Massachusetts resident, I acknowledge that shares will only be sold to residents of Massachusetts representing that they have a liquid net worth of at least 10 times their investment in this company and other direct participation investments.

If I am a Nebraska resident, I acknowledge that, in addition to meeting this company’s suitability requirements, Nebraska investors must limit their investment in this company and in the securities of other similar programs to 10% of such investor’s net worth. An investment by a Nebraska investor that is an accredited investor within the meaning of the Federal securities laws is not subject to the foregoing limitations.

If I am a New Jersey resident, I acknowledge that it is required by the State of New Jersey that New Jersey investors have either (i) a liquid net worth (not including home, furnishings and personal automobiles) of at least $100,000 and an annual gross income of at least $100,000, or (ii) a liquid net worth (not including home, furnishings and personal automobiles) of at least $250,000, and that such investors not invest, in the aggregate, more than 10% of their liquid net worth in an investment in this company, its affiliates, and other direct participation investments. “Liquid net worth” is defined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities.

If I am a New Mexico resident, I acknowledge that, in addition to meeting this company’s suitability standards, the State of New Mexico requires that each investor in such state limit his or her investment in this company, its affiliates and other non-traded real estate investment programs to not more than 10% of their liquid net worth. “Liquid net worth” is that portion of an investor’s net worth that is comprised of cash, cash equivalents and readily marketable securities.

If I am a North Dakota resident, I acknowledge that shares will only be sold to residents of the State of North Dakota representing that they have a net worth of at least 10 times their investment in this company and that they meet one of this company’s suitability standards.

If I am an Ohio resident, I acknowledge that Ohio investors must limit their aggregate investment in this company, our affiliates, and in other non-traded real estate investment trusts to 10% of their liquid net worth.

If I am an Oregon resident, I acknowledge that shares will only be sold to residents of the State of Oregon representing that they have a net worth of at least 10 times their investment in this company and its affiliates and that they meet one of this company’s suitability standards.

If I am a Tennessee resident, I acknowledge that my investment in this company must not exceed 10% of my liquid net worth (exclusive of home, home furnishings and automobile).

Your sale is not final for five (5) business days after your receipt of the final Prospectus. We will deliver a confirmation of sale to you after your purchase is completed.

TAXPAYER IDENTIFICATION NUMBER OR SOCIAL SECURITY NUMBER CERTIFICATION (required): The investor signing below, under penalties of perjury, certifies that (1) the number shown on this Subscription Agreement is my correct taxpayer identification number (or I am waiting for a number to be issued to me), (2) I am not subject to backup withholding because I am exempt from backup withholding, I have not been notified by the Internal Revenue Service (“IRS”) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or the IRS has notified me that I am no longer subject to backup withholding, and (3) I am a U.S. person (including a U.S. resident alien), unless I have otherwise indicated in Section 3 above.

Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return.

I understand that I will not be admitted as a stockholder until my investment has been accepted. Depositing of my check alone does not constitute acceptance. The acceptance process includes, but is not limited to, reviewing the Subscription Agreement for completeness and signatures, conducting an Anti-Money Laundering check as required by the USA PATRIOT Act and depositing funds.

The IRS does not require your consent to any provision of this document other than the certifications required to avoid backup withholding.

Regular Mail: Strategic Storage Trust II, Inc. c/o DST Systems, Inc., P.O. Box 219406, Kansas City, MO 64121-9406

Overnight Mail: Strategic Storage Trust II, Inc. c/o DST Systems, Inc., 430 W. 7th Street, Kansas City, MO 64105

Wire Information: UMB Bank, N.A., 1010 Grand, 4th Floor, Kansas City, MO 64106 ABA# 101000695 Account# 9871879437

X Signature of Owner

Date

X Signature of Custodian

Date

X Signature of Joint Owner or Beneficial Owner (if Applicable)

Date

(MUST BE SIGNED BY CUSTODIAN OR TRUSTEE IF IRA OR QUALIFIED PLAN IS ADMINISTERED BY A THIRD PARTY)

All items on the Subscription Agreement must be completed in order for your subscription to be processed. Subscribers are encouraged to read the Prospectus in its entirety for a complete explanation of an investment in Strategic Storage Trust II, Inc.

Regular Mail: Strategic Storage Trust II, Inc. c/o DST Systems, Inc., P.O. Box 219406, Kansas City, MO 64121-9406

Overnight Mail: Strategic Storage Trust II, Inc. c/o DST Systems, Inc., 430 W. 7th Street, Kansas City, MO 64105 Wire Information: UMB Bank, N.A., 1010 Grand, 4th Floor, Kansas City, MO 64106 ABA# 101000695 Account# 9871879437 Investor Services Toll Free Phone Line: 866.418.5144