2022 Long-Term Incentive Plan Awards to Independent Directors

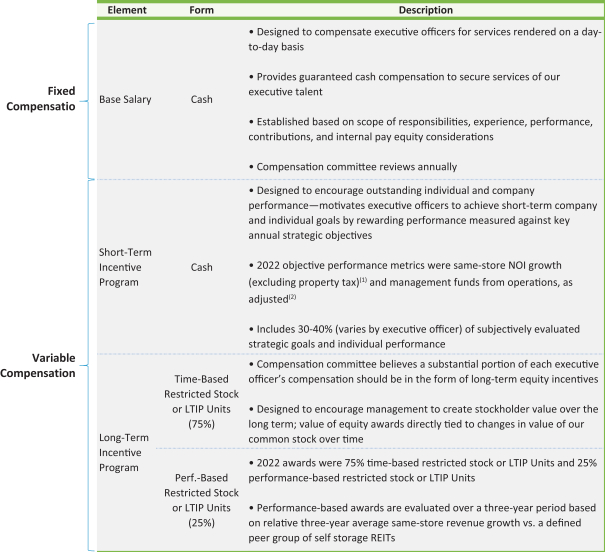

In March 2022, following the recommendation of the Compensation Committee, our board of directors approved the Equity Incentive Plan, which was approved by our stockholders at our 2022 annual meeting of stockholders. The Equity Incentive Plan became effective when it was approved by our stockholders, and it replaced our prior incentive plan, known as the Employee and Director Long-Term Incentive Plan (the “Prior Plan”). From and after the effective date of the Equity Incentive Plan, no further awards have been or will be made under the Prior Plan.

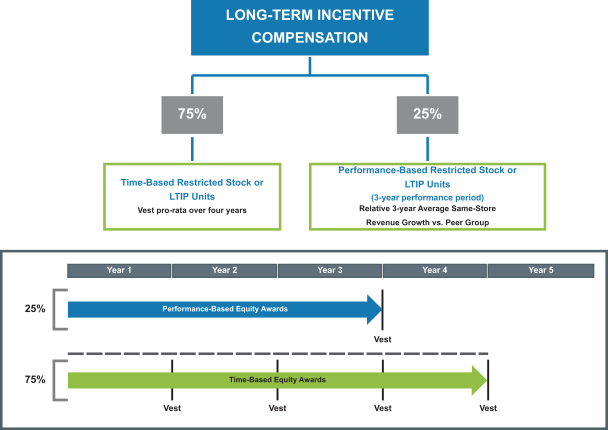

The purpose of the Equity Incentive Plan is to encourage and enable our and our subsidiaries’ eligible employees, directors, consultants, and other key persons, upon whose judgment, initiative, and efforts we largely depend for the successful conduct of our business, to acquire a proprietary interest in us. Pursuant to the Equity Incentive Plan, we may issue stock options, stock appreciation rights, restricted stock unit awards, restricted stock awards, restricted stock unit awards, unrestricted stock awards, dividend equivalent rights, LTIP units, other equity-based awards, and cash-based awards.

The total number of shares of our Class A common stock and our Class T common stock, in the aggregate, authorized and reserved for issuance under the Equity Incentive Plan is equal to 10,000,000 shares. As of December 31, 2022, there were approximately 9.9 million shares available for issuance under the Equity Incentive Plan. The term of the Equity Incentive Plan is 10 years. In the event of a consolidation or merger in which we are not the surviving corporation, or a sale of all or substantially all of our assets, in which outstanding shares of our stock are exchanged for securities, cash, or other property of an unrelated corporation or business entity, or in the event of our liquidation, the board of directors of any corporation assuming our obligations, may, in its discretion, take any one or more of the following actions as to outstanding awards under the Equity Incentive Plan: (i) provide that the awards may be assumed or substituted or (ii) upon written notice to participants, provide that all awards will terminate upon consummation of such a transaction. In the event that awards are not assumed or substituted, except as otherwise provided by the Compensation Committee in the award agreement or other agreement between the holder of an award and us, upon the effective time of such transaction, all awards will become vested and exercisable and vested awards, other than stock options, shall be fully settled in cash or in kind at such appropriate consideration as determined by the Compensation Committee in its sole discretion after taking into account the consideration payable per share pursuant to such transaction, or the “merger price,” and all stock options shall be fully settled in cash or in kind in an amount equal to the difference between the merger price and the exercise price of the options; provided that each participant may be permitted to exercise all outstanding options within a specified period determined by the Compensation Committee prior to such.

In the event the board of directors or the Compensation Committee determines that any distribution, recapitalization, stock split, reorganization, merger, liquidation, dissolution or sale, transfer, exchange or other disposition of all or substantially all of our assets, or other similar corporate transaction or event, affects our stock such that an adjustment is appropriate in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the Equity Incentive Plan or with respect to an award, then our board of directors or Compensation Committee shall, in such manner as it may deem equitable, adjust the number and kind of shares or the exercise price with respect to any award.

As of December 31, 2022, (i) Mr. Mueller has received a total of 34,523 shares of restricted stock or LTIP Units, of which 28,763 shares or LTIP Units have vested, and (ii) Messrs. Morris and Perry have each individually received a total of 32,868 shares of restricted stock of which 27,513 shares have vested and (iii) Ms. Mathews has received a total of 23,523 shares of restricted stock or LTIP Units, of which 17,763 shares or LTIP Units have vested.

39