UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material pursuant to Rule 14a-12 |

SMARTSTOP SELF STORAGE REIT, INC.

(Name of Registrant as Specified in Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

☒ | No fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form of Schedule and the date of its filing. |

| | |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing party: |

| (4) | Date filed: |

SMARTSTOP SELF STORAGE REIT, INC.

10 Terrace Road

Ladera Ranch, California 92694

PROXY STATEMENT AND NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 26, 2020

To the Stockholders of SmartStop Self Storage REIT, Inc. (formerly known as Strategic Storage Trust II, Inc.):

I am pleased to invite you to the annual meeting of stockholders of SmartStop Self Storage REIT, Inc., a Maryland corporation. This year’s annual meeting will be a completely “virtual meeting.” You will be able to attend the annual meeting and vote and submit your questions during the annual meeting via live webcast by visiting http://www.meetingcenter.io/227779788. At the annual meeting, stockholders will be asked to consider and vote upon:

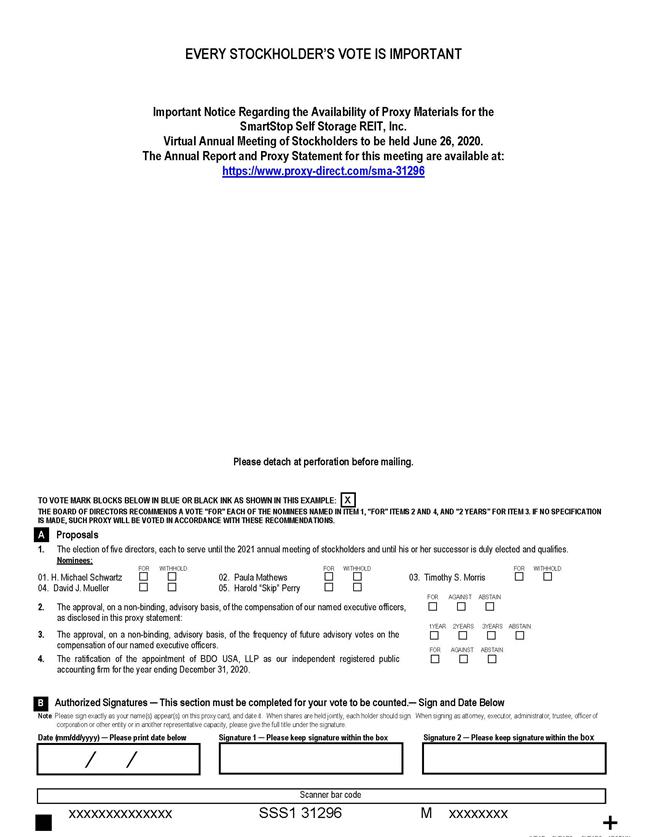

| 1. | the election of five directors, each to serve until the 2021 annual meeting of stockholders and until his or her successor is duly elected and qualifies; |

| 2. | the approval, on a non-binding, advisory basis, of the compensation of our named executive officers, as disclosed in this proxy statement; |

| 3. | the approval, on a non-binding, advisory basis, of the frequency of future advisory votes on the compensation of our named executive officers; |

| 4. | the ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for the year ending December 31, 2020; and |

| 5. | the transaction of such other business as may properly come before the annual meeting or any postponement or adjournment thereof. |

Our board of directors has fixed the close of business on March 31, 2020 as the record date for the determination of stockholders entitled to notice of and to vote at the annual meeting or any postponement or adjournment thereof. Only record holders of common stock, consisting of either Class A shares or Class T shares, at the close of business on the record date are entitled to notice of and to vote at the annual meeting.

For further information regarding the matters to be acted upon at the annual meeting, I urge you to carefully read the accompanying proxy statement. If you have questions about these proposals or would like additional copies of the proxy statement, please contact Nicholas Look, our General Counsel and Secretary, via mail at 10 Terrace Road, Ladera Ranch, California 92694 or via telephone at (877) 327-3485.

Whether you own a few or many shares and whether you plan to attend the live webcast or not, it is important that your shares be voted on matters that come before the annual meeting. None of our stockholders own more than 10% of our outstanding shares, so every stockholder’s vote is important to us. To make voting easier for you, you may authorize a proxy to vote your shares in one of three ways: (1) by marking your votes on the enclosed proxy card, signing and dating it, and mailing it in the envelope provided; (2) by completing a proxy card at www.proxy-direct.com; or (3) by telephone at (800) 337-3503. If you sign and return your proxy card without specifying your choices, it will be understood that you wish to have your shares voted in accordance with the recommendations of our board of directors.

You are cordially invited to attend the annual meeting and are encouraged to attend the live webcast. Whether or not you plan to attend the live webcast, please authorize a proxy to vote your shares using one of the three prescribed methods. Your vote is very important.

| | |

| | By Order of the Board of Directors, |

| | |

| | /s/ Nicholas M. Look |

| | Nicholas M. Look |

| | General Counsel and Secretary |

| | |

Ladera Ranch, California | | |

April 29, 2020 | | |

SMARTSTOP SELF STORAGE REIT, INC.

10 Terrace Road

Ladera Ranch, California 92694

PROXY STATEMENT

Introduction

The accompanying proxy, mailed together with this proxy statement, is solicited by and on behalf of the board of directors of SmartStop Self Storage REIT, Inc. (formerly known as Strategic Storage Trust II, Inc.) (the “Company”) for use at the annual meeting of our stockholders and at any postponement or adjournment thereof. References in this proxy statement to “we,” “us,” “our,” or like terms also refer to the Company. The mailing address of our principal executive offices is 10 Terrace Road, Ladera Ranch, California 92694. We expect to mail this proxy statement and the accompanying proxy to our stockholders on or about April 29, 2020. Our 2019 Annual Report to Stockholders will be mailed on the same date.

QUESTIONS AND ANSWERS

___________________________________________________________________________________

Q:When and where will the annual meeting be held?

A: | Our 2020 annual meeting of stockholders will be held on June 26, 2020 at 8:30 a.m. (PDT). The annual meeting will be held in a virtual meeting format only and can be accessed online at http://www.meetingcenter.io/227779788. There is no physical location for the annual meeting. In order to attend the virtual meeting, you will need your control number and the password for the meeting. The password for this meeting is SSSS2020. Your control number will be supplied to you via your proxy card. At the annual meeting, you will be allowed to vote your shares within the online portal, as well as submit questions. The online portal will open 15 minutes before the beginning of the annual meeting. |

____________________________________________________________________________________

Q: | What is the purpose of the meeting? |

A: | At the meeting, you will be asked to consider and vote upon: |

| • | the election of five directors to serve until the 2021 annual meeting of stockholders and until their respective successors are duly elected and qualify; |

| • | the approval, on a non-binding, advisory basis, of the compensation of our named executive officers, as disclosed in this proxy statement; |

| • | the approval, on a non-binding, advisory basis, of the frequency of future advisory votes on the compensation of our named executive officers; |

| • | the ratification of the appointment of BDO USA, LLP (“BDO”) as our independent registered public accounting firm for the year ending December 31, 2020; and |

| • | the transaction of such other business as may properly come before the annual meeting or any postponement or adjournment thereof. |

Our board of directors is not aware of any matters that may be acted upon at the meeting other than the matters set forth in the first four bullet points listed above.

1

____________________________________________________________________________________

Q: | Who can vote at the meeting? |

A: | Stockholders of record, consisting of holders of either Class A shares or Class T shares of our common stock, as of the close of business on March 31, 2020, or the record date, are entitled to receive notice of the annual meeting and to vote the shares of common stock that they hold on that date. As of the close of business on the record date, we had approximately 59.5 million shares of common stock issued, outstanding and eligible to vote. |

____________________________________________________________________________________

Q: | How many votes do I have? |

A: | Each outstanding Class A share and Class T share of common stock entitles its holder to cast one vote with respect to each matter to be voted upon at the annual meeting. |

____________________________________________________________________________________

A: | You may vote in person via webcast at the meeting or by proxy. Stockholders have the following three options for submitting their votes by proxy: |

| • | via mail, by completing, signing, dating and returning your proxy card in the enclosed envelope; |

| • | via the Internet at www.proxy-direct.com; or |

| • | via telephone at (800) 337-3503. |

Regardless of whether you plan to attend the annual meeting, we encourage you to authorize a proxy to vote your shares in accordance with one of the methods described above. None of our stockholders own more than 10% of our outstanding shares, so every stockholder’s vote is important to us. If you authorize a proxy to vote your shares, you may still attend the annual meeting and vote in person via webcast. If you do so, any previous votes that you submitted, whether by mail, the Internet or telephone, will be superseded by the vote that you cast at the annual meeting.

____________________________________________________________________________________

Q:How will my proxy be voted?

A: | Shares represented by valid proxies will be voted in accordance with the directions given on the relevant proxy card. If a proxy card is signed and returned without any directions given, the individuals named on the card as proxy holders will vote in accordance with the recommendations of our board of directors as to: (1) the election of directors; (2) the advisory vote on the compensation of our named executive officers; (3) the advisory vote upon the frequency of future advisory votes on executive compensation; and (4) the ratification of the appointment of BDO as our independent registered public accounting firm for the year ending December 31, 2020. |

If other matters requiring the vote of our stockholders come before the meeting, the persons named in the proxy card will vote the proxies held by them in their discretion.

2

____________________________________________________________________________________

Q: | What are the board of directors’ voting recommendations? |

A: | Our board of directors recommends that you vote: |

| (1) | “FOR” each of the nominees to our board of directors; |

| (2) | “FOR” the approval, on a non-binding, advisory basis, of the compensation of our named executive officers, as disclosed in this proxy statement; |

| (3) | “EVERY TWO YEARS” for the approval, on a non-binding, advisory basis, of the frequency of future advisory votes on the compensation of our named executive officers; and |

| (4) | “FOR” the ratification of BDO as our independent registered public accounting firm for the year ending December 31, 2020. |

____________________________________________________________________________________

Q:What vote is required to approve each proposal?

A: | Election of Directors. Each director is elected by the affirmative vote of a plurality of all votes cast at the annual meeting, if a quorum is present. Votes are cast either in person via webcast or by proxy. There is no cumulative voting in the election of our directors. Any shares present but not voted (whether by abstention, broker non-vote, or otherwise) will not count as votes cast on this proposal, and thus will have no effect on the result of the vote on this proposal. |

Advisory Vote on Executive Compensation. The advisory vote on the compensation of our named executive officers is approved by the affirmative vote of a majority of the votes cast on the proposal at the annual meeting, if a quorum is present. Votes are cast either in person via webcast or by proxy. Any shares present but not voted (whether by abstention, broker non-vote, or otherwise) will not count as votes cast on this proposal, and thus will have no effect on the result of the vote on this proposal. As an advisory vote, this proposal is not binding on us, our board of directors, or the Compensation Committee of our board of directors. Our board of directors and the Compensation Committee value the opinions expressed by stockholders in their advisory votes on this proposal and will consider the outcome of the vote when making future compensation decisions regarding our named executive officers.

Advisory Vote on Frequency of Future Advisory Votes on Executive Compensation. The option of one year, two years, or three years that receives a majority of all the votes cast at the annual meeting, if a quorum is present, will be the frequency for the advisory vote on executive compensation that has been recommended by stockholders. If none of the options receive a majority of the votes cast, it is the intention of the board of directors to treat the option that receives the most votes as the option selected by the stockholders. Votes are cast either in person via webcast or by proxy. Any shares present but not voted (whether by abstention, broker non-vote, or otherwise) will not count as votes cast on this proposal, and thus will have no effect on the result of the vote on this proposal. As an advisory vote, this proposal is not binding on us, our board of directors, or the Compensation Committee of our board of directors. However, our board of directors and the Compensation Committee value the opinions expressed by stockholders in their advisory votes on this proposal and will consider the outcome of the vote when making future decisions regarding the frequency of conducting a say-on-pay proposal.

3

Ratification of Appointment of Independent Accounting Firm. The appointment of BDO as our independent registered public accounting firm for the year ending December 31, 2020 is ratified by the affirmative vote of a majority of the votes cast on the proposal at the annual meeting, if a quorum is present. Votes are cast either in person via webcast or by proxy. Any shares present but not voted (whether by abstention, broker non-vote, or otherwise) will not count as votes cast on this proposal, and thus will have no effect on the result of the vote on this proposal. In the event this matter is not ratified by our stockholders, the Audit Committee will take that fact into consideration, together with such other factors it deems relevant, in determining its next selection of our independent registered public accounting firm.

____________________________________________________________________________________

Q:What constitutes a “quorum”?

A: | The presence at the annual meeting, in person via webcast or represented by proxy, of stockholders entitled to cast a majority of all the votes entitled to be cast at the meeting constitutes a quorum. There must be a quorum for a meeting to be held. Abstentions and broker non-votes will be counted as present for the purpose of establishing a quorum; however, abstentions and broker non-votes will not be counted as votes cast. |

____________________________________________________________________________________

Q:How can I change my vote or revoke my proxy?

A: | You have the unconditional right to revoke your proxy at any time prior to the voting thereof by submitting a properly executed, later-dated proxy (via mail, the Internet, or telephone), by attending the annual meeting and voting in person via webcast or by written notice addressed to: SmartStop Self Storage REIT, Inc., Attention: Nicholas Look, Secretary, 10 Terrace Road, Ladera Ranch, California 92694. |

To be effective, a proxy revocation must be received by us at or prior to the annual meeting.

____________________________________________________________________________________

Q:Who will bear the costs of soliciting votes for the meeting?

A: | We will bear the entire cost of the solicitation of proxies from our stockholders. We have retained Computershare to assist us in connection with the solicitation of proxies for the annual meeting. Computershare will be paid fees of approximately $70,000, plus out-of-pocket expenses, for its basic solicitation services, which include review of proxy materials, dissemination of broker search cards, distribution of proxy materials, solicitation of brokers, banks, and institutional holders, and delivery of executed proxies. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person via webcast, by telephone or by electronic communication by our directors and officers who will not receive any additional compensation for such solicitation activities. We also expect to incur approximately $25,000 in expenses related to printing of these proxy materials and our annual report. We will also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy solicitation materials to our stockholders. |

____________________________________________________________________________________

Q: | What if I receive only one set of proxy materials although there are multiple stockholders at my address? |

A: | The SEC has adopted a rule concerning the delivery of documents filed by us with the SEC, including proxy statements and annual reports, which allows us to send a single proxy statement or annual report to any household at which two or more stockholders reside if they share the same last name or we reasonably believe they are members of the same family. This procedure is |

4

| referred to as “householding.” This rule benefits both you and us. It reduces the volume of duplicate information received at your household and helps us reduce expenses. Each stockholder subject to householding will continue to receive a separate proxy card or voting instruction card. |

| We will promptly deliver, upon written or oral request, a separate copy of our annual report or proxy statement, as applicable, to a stockholder at a shared address to which a single copy was previously delivered. If you received a single set of disclosure documents this year, but you would prefer to receive your own copy, you may direct requests for separate copies to SmartStop Self Storage REIT, Inc., Attention: Nicholas Look, Secretary, 10 Terrace Road, Ladera Ranch, California 92694, or call us at (877) 327-3485. Also, if your household currently receives multiple copies of disclosure documents and you would like to receive just one set, please contact us at the same address and phone number. |

_____________________________________________________________________________________

Q: | How do I submit a stockholder proposal for next year’s annual meeting or proxy materials, and what is the deadline for submitting a proposal? |

A: | In order for a stockholder proposal to be properly submitted for presentation at our 2021 annual meeting, we must receive written notice of the proposal at our executive offices during the period beginning on December 30, 2020 and ending January 29, 2021. If you wish to present a proposal for inclusion in the proxy materials for next year’s annual meeting, we must receive written notice of your proposal at our executive offices no later than December 30, 2020. All proposals must contain the information specified in, and otherwise comply with, our bylaws. Proposals should be sent via registered, certified or express mail to: SmartStop Self Storage REIT, Inc., Attention: Nicholas Look, Secretary, 10 Terrace Road, Ladera Ranch, California 92694. For additional information, see the “Stockholder Proposals” section in this proxy statement. |

_____________________________________________________________________________________

Q: | Who do I call if I have questions about the meeting? |

A: | We have retained Computershare to assist with the proxy process. If you have any questions related to the annual meeting (including the new virtual format) or voting your proxy, you can call Computershare and talk to a live proxy representative toll free at (866) 963-6127 with any proxy related questions. |

5

CERTAIN INFORMATION ABOUT MANAGEMENT

Board of Directors

General

We operate under the direction of our board of directors. Our board of directors is responsible for the management and control of our affairs. Our board of directors consists of H. Michael Schwartz, our Founder, Executive Chairman and Chairman of our board of directors, Paula Mathews, and three independent directors, Timothy S. Morris, David J. Mueller and Harold “Skip” Perry, each of whom has been nominated by our board of directors for re-election to serve until our 2021 annual meeting of stockholders and until his or her successor is elected and qualifies. For more detailed information on our directors, see the “Executive Officers and Directors” section below. Our board of directors has formed the following three committees: the Audit Committee, the Nominating and Corporate Governance Committee, and the Compensation Committee.

Leadership Structure

We do not have a policy to separate the roles of principal executive officer and Chairman of the board of directors, as the board of directors believes it is in the best interests of the Company to make that determination based on our current size, the size of our board of directors, the participation of our independent directors in the oversight of our operations and strategy, and the position and direction of the Company. Presently, the board has determined it is in the best interests of the Company for H. Michael Schwartz to serve as our Executive Chairman and Chairman of our board of directors, and Michael S. McClure to serve as our Chief Executive Officer.

Meetings of our Board of Directors

During 2019, our board of directors held 10 meetings. Each of our directors attended at least 75% of the meetings of the board of directors and committees on which he or she served.

Director Independence

While our shares are not listed for trading on any national securities exchange, as required by our charter, a majority of the members of our board of directors and each committee of our board of directors are “independent” as determined by our board of directors by applying the definition of “independent” adopted by the New York Stock Exchange (NYSE) and applicable rules and regulations of the SEC. Our board of directors has determined that Messrs. Morris, Mueller, and Perry each meet the relevant definition of “independent.”

Stockholder Communications with Directors

We have established several means for stockholders to communicate concerns to our board of directors. If the concern relates to our financial statements, accounting practices or internal controls, the concerns should be submitted in writing to the Chairman of the Audit Committee of our board of directors in care of our Secretary at our headquarters address. If the concern relates to our governance practices, business ethics, or corporate conduct, the concern should be submitted in writing to the Chairman of the Nominating and Corporate Governance Committee of our board of directors in care of our Secretary at our headquarters address. If a stockholder is uncertain as to which category his or her concern relates, he or she may communicate it to any one of the independent directors in care of our Secretary. All concerns

6

submitted in care of our Secretary will be delivered to the appropriate independent director based upon our Secretary’s determination.

Though we have no formal policy on the matter, we encourage all of the members of our board of directors to attend our annual meeting of stockholders.

Risk Management Role

As part of its oversight role, our board of directors actively supervises the members of our management that are directly responsible for our day-to-day risk management. The board’s risk management role has no impact on its leadership structure. The Audit Committee of our board of directors, which consists of our three independent directors, annually reviews with management our policies with respect to risk assessment and risk management.

Code of Ethics

Our board of directors adopted an amended Code of Ethics and Business Conduct on September 16, 2019 (the “Code of Ethics”), which contains general guidelines applicable to our executive officers, including our principal executive officer, principal financial officer and principal accounting officer, our directors and our employees. We adopted our Code of Ethics with the purpose of promoting the following: (1) honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; (2) full, fair, accurate, timely and understandable disclosure in reports and documents that we file with or submit to the SEC and in other public communications made by us; (3) compliance with applicable laws and governmental rules and regulations; (4) the prompt internal reporting of violations of the Code of Ethics to our Code of Ethics Compliance Officer; and (5) accountability for adherence to the Code of Ethics. A copy of the Code of Ethics is available on our website at www.strategicreit.com/site/sst2/page/information#gov.

Audit Committee

General

Our board of directors adopted an amended charter for the Audit Committee on September 16, 2019 (the “Audit Committee Charter”). A copy of our Audit Committee Charter is available in the “Information — Governance” section of our website located at http://www.strategicreit.com/site/sst2/page/information#gov. The Audit Committee assists our board of directors by: (1) selecting an independent registered public accounting firm to audit our annual financial statements; (2) reviewing with the independent registered public accounting firm the plans and results of the audit engagement; (3) approving the audit and non-audit services provided by the independent registered public accounting firm; (4) reviewing the independence of the independent registered public accounting firm; and (5) considering the range of audit and non-audit fees and reviewing the adequacy of our internal accounting controls. The Audit Committee fulfills these responsibilities primarily by carrying out the activities enumerated in the Audit Committee Charter and in accordance with current laws, rules and regulations.

The members of the Audit Committee are our three independent directors, Timothy S. Morris, David J. Mueller and Harold “Skip” Perry, with Mr. Mueller currently serving as Chairman of the Audit Committee. Our board of directors has determined that Mr. Mueller satisfies the requirements for an “Audit Committee financial expert” and has designated Mr. Mueller as the audit committee financial expert in accordance with applicable SEC rules. The Audit Committee held six meetings during 2019.

7

Relationship with Principal Auditor

Overview

On the recommendation of the Audit Committee, our board of directors has appointed BDO as our independent registered public accounting firm (“independent auditor”), for the year ending December 31, 2020. Although stockholder ratification of the appointment of our independent auditor is not required by our bylaws or otherwise, we are submitting the selection of BDO to our stockholders for ratification as a matter of good corporate governance practice. Even if the selection is ratified, the Audit Committee reserves the right to select a new independent auditor at any time in the future in its discretion if it deems such decision to be in the best interests of the Company. Any such decision would be disclosed to our stockholders in accordance with applicable securities laws. If our stockholders do not ratify the Audit Committee’s selection, the Audit Committee will take that fact into consideration, together with such other factors it deems relevant, in determining its next selection of our independent registered public accounting firm.

Representatives of BDO are expected to be present via webcast at the annual meeting and will have an opportunity to make a statement if they desire. The representatives will also be available to respond to appropriate questions from our stockholders.

Pre-Approval Policies

The Audit Committee Charter requires that the Audit Committee pre-approve all auditing services performed for the Company by our independent auditor, as well as all permitted non-audit services (including the fees and terms thereof) in order to ensure that the provision of such services does not impair the auditor’s independence. In determining whether or not to pre-approve services, the Audit Committee considers whether the service is permissible under applicable SEC rules. The Audit Committee may, in its discretion, delegate one or more of its members the authority to pre-approve any services to be performed by our independent auditor, provided such pre-approval is presented to the full Audit Committee at its next scheduled meeting.

All services rendered by BDO for the years ended December 31, 2019 and 2018 were pre-approved in accordance with the policies set forth above.

Fees to Principal Auditor

The Audit Committee reviewed the audit and non-audit services performed by BDO, as well as the fees charged by BDO for such services. The aggregate fees for professional accounting services provided by BDO, including the audit of our annual financial statements, for the years ended December 31, 2019 and 2018, respectively, are set forth in the table below.

| | BDO USA, LLP for the Year Ended December 31, 2019 | | BDO USA, LLP for the Year Ended December 31, 2018 | | | |

Audit Fees | | $ | 320,133 | | $ | 187,199 | |

Audit-Related Fees | | | — | | | — | |

Tax Fees | | | — | | | — | |

All Other Fees | | | — | | | — | |

Total | | $ | 320,133 | | $ | 187,199 | |

8

For purposes of the preceding table, the professional fees are classified as follows:

| • | Audit Fees – These are fees for professional services performed for the audit of our annual financial statements and the required review of our quarterly financial statements and other procedures performed by the independent auditors to be able to form an opinion on our consolidated financial statements. These fees also cover services that are normally provided by independent auditors in connection with statutory and regulatory filings or engagements, and services that generally only an independent auditor reasonably can provide, such as services associated with filing registration statements, periodic reports and other filings with the SEC. |

| • | Audit-Related Fees – These are fees for assurance and related services that traditionally are performed by an independent auditor, such as due diligence related to acquisitions and dispositions, audits related to acquisitions, attestation services that are not required by statute or regulation, internal control reviews and consultation concerning financial accounting and reporting standards. |

| • | Tax Fees – These are fees for all professional services performed by professional staff in our independent auditor’s tax division, except those services related to the audit of our financial statements. These include fees for tax compliance, tax planning and tax advice, including federal, state and local issues. Such services may also include assistance with tax audits and appeals before the Internal Revenue Service (IRS) and similar state and local agencies, as well as federal, state and local tax issues related to due diligence. |

| • | All Other Fees – These are fees for other permissible work performed that do not meet one of the above-described categories. |

Audit Committee Report

Pursuant to the Audit Committee Charter adopted by the board of directors of the Company, the Audit Committee’s primary function is to assist the board of directors in fulfilling its oversight responsibilities by overseeing the independent auditors, the audit and financial reporting process and the system of internal control over financial reporting that management has established and by reviewing the financial information to be provided to the Company’s stockholders and others. The Audit Committee is composed of three independent directors and met six times during the year ended December 31, 2019. Management of the Company has the primary responsibility for the financial statements and the reporting process, including the system of internal control over financial reporting. Membership on the Audit Committee does not call for the professional training and technical skills generally associated with career professionals in the field of accounting and auditing. In addition, the independent auditors devote more time and have access to more information than does the Audit Committee. Accordingly, the Audit Committee’s role does not provide any special assurances with regard to the financial statements of the Company, nor does it involve a professional evaluation of the quality of the audits performed by the independent auditors.

In this context, in fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed the audited financial statements for the year ended December 31, 2019 included in the Company’s Annual Report on Form 10-K with management, including a discussion of the quality and acceptability of the financial reporting and controls of the Company, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

The Audit Committee discussed with the Company’s independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with U.S. generally

9

accepted accounting principles, their judgments as to the quality and acceptability of the financial reporting and such other matters as are required to be discussed with the Audit Committee under Public Company Accounting Oversight Board (“PCAOB”) Auditing Standard No. 1301, “Communications with Audit Committees.” The Audit Committee also received the written disclosures and the letter from the Company’s independent auditor required by applicable requirements of the PCAOB regarding the independent auditor’s communications with the Audit Committee concerning independence, and has discussed with the independent auditor the independent auditor’s independence.

The Audit Committee discussed with the independent auditors the overall scope and plans for their audit. The Audit Committee meets periodically with the independent auditors, with and without management present, to discuss the results of their examinations and the overall quality of the financial reporting of the Company.

In reliance on these reviews and discussions, the Audit Committee recommended to our board of directors that the audited financial statements of the Company be included in its Annual Report on Form 10-K for the year ended December 31, 2019 for filing with the SEC. Our board of directors subsequently accepted the Audit Committee’s recommendation and approved the Annual Report on Form 10-K for the year ended December 31, 2019 for filing with the SEC.

| | |

| | David J. Mueller (Chairman) |

| | Timothy S. Morris |

| | Harold “Skip” Perry |

| | |

March 23, 2020 | | |

The preceding Audit Committee Report to stockholders is not “soliciting material” and is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

Nominating and Corporate Governance Committee

General

Our board of directors adopted an amended charter for the Nominating and Corporate Governance Committee on September 16, 2019 (the “Nominating and Corporate Governance Committee Charter”). A copy of the Nominating and Corporate Governance Committee Charter is available in the “Information — Governance” section of our website located at http://www.strategicreit.com/site/sst2/page/information#gov. The Nominating and Corporate Governance Committee’s primary focus is to assist our board of directors in fulfilling its responsibilities with respect to director nominations, corporate governance, board of directors and committee evaluations and conflict resolutions. The Nominating and Corporate Governance Committee assists our board of directors in this regard by: (1) identifying individuals qualified to serve on our board of directors, consistent with criteria approved by our board of directors, and recommending that our board of directors select a slate of director nominees for election by our stockholders at the annual meeting of our stockholders; (2) developing and implementing the process necessary to identify prospective members of our board of directors; (3) determining the advisability of retaining any search firm or consultant to assist in the identification and evaluation of candidates for membership on our board of directors; (4) overseeing an annual evaluation of our board of directors, each of the committees of our board of directors and management; (5) developing and recommending to our board of directors a set of corporate governance principles and policies; (6) periodically reviewing our corporate governance principles and policies and suggesting improvements thereto to our board of directors; and (7) considering and acting on any conflicts-related matter required by our Charter or otherwise permitted by Maryland

10

law where the exercise of independent judgment by any of our directors, who is not an independent director, could reasonably be compromised. The Nominating and Corporate Governance Committee fulfills these responsibilities primarily by carrying out the activities enumerated in the Nominating and Corporate Governance Committee Charter and in accordance with current laws, rules, and regulations.

The members of the Nominating and Corporate Governance Committee are our three independent directors, Timothy S. Morris, David J. Mueller and Harold “Skip” Perry, with Mr. Perry serving as Chairman of the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee held 21 meetings during 2019, including 16 meetings of the Nominating and Corporate Governance Committee members as special committees for the purpose of evaluating strategic transactions.

Board of Directors Membership Criteria and Director Selection

The Nominating and Corporate Governance Committee annually reviews with our board of directors the appropriate experience, skills and characteristics required of our directors in the context of the current membership of our board of directors. This assessment includes, in the context of the perceived needs of our board of directors at the time, issues of knowledge, experience, judgment and skills such as an understanding of the real estate industry or brokerage industry or accounting or financial management expertise. Other considerations include the candidate’s independence from conflict with the Company and the ability of the candidate to attend board of directors meetings regularly and to devote an appropriate amount of effort in preparation for those meetings. It also is expected that independent directors nominated by our board of directors shall be individuals who possess a reputation and hold or have held positions or affiliations befitting a director of a publicly held company and are or have been actively engaged in their occupations or professions or are otherwise regularly involved in the business, professional, or academic community.

Though we do not have a formal policy regarding diversity with respect to identifying nominees and overall board composition, our Nominating and Corporate Governance Committee considers the impact of diverse backgrounds and experiences of potential nominees on the effectiveness and quality of our board of directors. As part of its annual review process discussed below, the Nominating and Corporate Governance Committee reviews its own effectiveness in recommending director nominees with diverse backgrounds and experiences relative to any perceived needs in the composition of our board of directors.

While our full board of directors remains responsible for selecting its own nominees and recommending them for election by our stockholders, our board of directors has delegated the screening process necessary to identify qualified candidates to the Nominating and Corporate Governance Committee. Pursuant to our bylaws, however, vacancies in the board may be filled only by a majority of the remaining directors.

The Nominating and Corporate Governance Committee annually reviews director suitability and the continuing composition of our board of directors; it then recommends director nominees who are voted on by our full board of directors. In recommending director nominees to our board of directors, the Nominating and Corporate Governance Committee solicits candidate recommendations from its own members, other directors, and management of the Company. The Committee will also consider suggestions made by stockholders and other interested persons for director nominees who meet the established director criteria. In order for a stockholder to make a nomination, the stockholder must satisfy the procedural requirements for such nomination as provided in the Company’s bylaws, which include, among other things, providing the nominee’s name, age, address, and ownership of the Company’s stock. Such nominations must also be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

11

In evaluating the persons nominated as potential directors, the Nominating and Corporate Governance Committee will consider each candidate without regard to the source of the recommendation and take into account those factors that the Nominating and Corporate Governance Committee determines are relevant.

With respect to the current nominees to our board of directors, whose backgrounds and experience are described in greater detail on pages 20–24, our Nominating and Corporate Governance Committee considered all of the factors set forth above in its determination to recommend them for nomination. In particular, our Nominating and Corporate Governance Committee considered (1) H. Michael Schwartz’s active participation in the management of our operations and his experience in the self storage industry, (2) Paula Mathews’ extensive real estate management experience, and particularly self storage experience, across multiple organizations, including our Company and SmartStop Asset Management, our former sponsor (“SAM”), (3) Timothy S. Morris’ extensive financial and management experience across multiple organizations over more than 30 years, (4) David J. Mueller’s more than 25 years of financial management experience, and (5) Harold “Skip” Perry’s more than 40 years of financial accounting, management and consulting experience in the real estate industry. In addition, the Nominating and Corporate Governance Committee considered these particular aspects of the backgrounds of Messrs. Morris, Mueller and Perry relative to the needs of the committees of our board of directors in determining to recommend them for nomination.

Corporate Governance

Pursuant to the Nominating and Corporate Governance Committee Charter, the Nominating and Corporate Governance Committee developed and recommended a set of formal, written guidelines for corporate governance, which were adopted by our full board of directors on September 16, 2019.

The Nominating and Corporate Governance Committee also, from time to time, reviews the governance structures and procedures of the Company and suggests improvements thereto to our full board of directors. Such improvements, if adopted by the full board of directors, will be incorporated into the written guidelines.

Periodic Evaluations

The Nominating and Corporate Governance Committee conducts an annual evaluation of its own performance and oversees the annual evaluations of our directors, each of the other committees of our board of directors, and management.

Conflicts of Interest

The Nominating and Corporate Governance Committee considers and acts upon any conflicts of interest-related matter to the extent permitted by Maryland law. The Nominating and Corporate Governance Committee will evaluate such transactions based upon standards set forth in our Code of Ethics, as well as applicable laws, rules and regulations.

12

Compensation Committee

General

Our board of directors adopted a charter for the Compensation Committee on September 16, 2019 (the “Compensation Committee Charter”). A copy of the Compensation Committee Charter is available in the “Information — Governance” section of our website located at http://www.strategicreit.com/site/sst2/page/information#gov. The Compensation Committee’s primary focus is to assist our board of directors in fulfilling its responsibilities with respect to officer and director compensation. The Compensation Committee assists our board of directors in this regard when necessary by: (1) reviewing and approving our corporate goals with respect to compensation of officers and directors; (2) recommending to our board of directors compensation for all non-employee directors, including board of directors and committee retainers, meeting fees and equity-based compensation; (3) administering and granting equity-based compensation to our employees; and (4) setting the terms and conditions of such equity-based compensation in accordance with our Employee and Director Long-Term Incentive Plan (the “Plan”). The Compensation Committee fulfills these responsibilities in accordance with current laws, rules and regulations.

The members of our Compensation Committee are Messrs. Morris, Mueller, and Perry, with Mr. Morris serving as Chairman of the Compensation Committee. The Compensation Committee held 10 meetings during 2019.

Compensation Committee Interlocks and Insider Participation

For the year ended December 31, 2019, decisions regarding director compensation were made by our Compensation Committee.

No member of the Compensation Committee served as an officer or employee of us or any of our affiliates during 2019, and none had any relationship requiring disclosure by us under Item 404 of Regulation S-K under the Exchange Act. None of our executive officers has served on the board of directors or compensation committee of any other entity that has or has had one or more executive officers who served as a member of our board of directors or our Compensation Committee during the fiscal year ended December 31, 2019.

Executive Compensation

Background

Prior to June 28, 2019, we did not directly compensate our executive officers, including our named executive officers, for services rendered to us, and only our directors who were not employed by us or our affiliates, or by Strategic Storage Advisor II, LLC, our external advisor prior to June 28, 2019 (our “Former External Advisor”) or its affiliates, received compensation for their services to us. A majority of our executive officers were also officers of our Former External Advisor and its affiliates, and were compensated by such entities for their services to us. We paid these entities fees and reimbursed expenses pursuant to an advisory agreement. However, as a result of the closing of our initial public offering (the “Offering”) on January 9, 2017, none of our named executive officers’ time was spent on matters connected to our Offering during the 2019 fiscal year, and accordingly, there were no such fees or reimbursements to our Former External Advisor during the year for the named executive officers. In addition, we reimbursed SAM $328, which is the allocable amount of premiums paid on a life insurance policy SAM purchased for the benefit of H. Michael Schwartz’s beneficiaries. See “— Director Compensation for the Year Ended December 31, 2019 — Director Life Insurance Policies,” below.

13

On June 28, 2019, we acquired the self storage advisory, asset management, property management and certain joint venture interests of SAM, which included the self storage management team and self storage employees (the “Self Administration Transaction”). In connection with the Self Administration Transaction, the Compensation Committee retained FPL Associates, LP (“FPL Associates”) to assist us in various compensation-related matters. Accordingly, we (i) entered into severance agreements with our seven executive officers at such time and (ii) began to directly compensate such executive officers, which compensation was approved by the Compensation Committee and board of directors. For more information regarding the various agreements relating to the Self Administration Transaction, please see “Certain Relationships and Related Transactions.”

Overview

The following discussion describes our executive compensation paid to the following named executive officers:

| • | H. Michael Schwartz, our Executive Chairman, |

| • | Michael S. McClure, our Chief Executive Officer, |

| • | Wayne Johnson, our President and Chief Investment Officer, and |

| • | Michael O. Terjung, our Chief Accounting Officer. |

The following discussion should be read in conjunction with the compensation tables and related disclosure set for the below.

Summary Compensation Table

The following table summarizes the compensation that we paid to each of our named executive officers during the years ended December 31, 2019 and 2018.

| | | | | | | | | | | | | | | | Non-Equity | | | | | | | | | | |

| | | | | | | | | | | | Stock | | | Incentive Plan | | | All Other | | | | | | |

Name and Principal Position | | Year | | Salary(1) | | | Bonus(1) | | | Awards(2) | | | Compensation | | | Compensation(3) | | | | Total | |

H. Michael Schwartz, Executive Chairman and Former Chief Executive Officer | | 2019 | | $ | 323,438 | | | $ | 320,205 | | | $ | 1,111,632 | | | $ | - | | | $ | 328 | | (4) | | $ | 1,755,275 | |

| 2018 | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | | $ | - | |

Michael S. McClure, Chief Executive Officer | | 2019 | | $ | 233,542 | | | $ | 270,445 | | | $ | 578,049 | | | $ | - | | | $ | - | | | | $ | 1,082,036 | |

| 2018 | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | | $ | - | |

Wayne Johnson, President and Chief Investment Officer | | 2019 | | $ | 129,375 | | | $ | 160,143 | | | $ | 222,326 | | | $ | - | | | $ | 11,035 | | (5) | | $ | 522,879 | |

| 2018 | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | | $ | - | |

Michael O. Terjung, Chief Accounting Officer | | 2019 | | $ | 117,021 | | | $ | 107,685 | | | $ | 88,931 | | | $ | - | | | $ | - | | | | $ | 313,637 | |

| 2018 | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | | $ | - | |

(1) | During the fiscal year ended December 31, 2018 and prior to June 28, 2019, we had no employees and did not directly compensate any officers, including named executive officers. Amounts shown in the “Salary” column reflect our direct compensation expenses subsequent to June 28, 2019. Amounts shown in the “Bonus” column reflect bonuses earned for a full year of service by each individual, including time such individuals were employed by our Former External Advisor. |

(2) | Represents the aggregate grant date fair value computed in accordance with FASB ASC Topic 718. |

(3) | Except as otherwise disclosed herein, the aggregate incremental cost associated with each perquisite provided to our named executive officers was less than $10,000 for each named executive officer. |

14

(4) | Represents payment of life insurance premiums in connection with Mr. Schwartz’s service on our board of directors, as discussed in “Director Compensation for the Year Ended December 31, 2019 — Director Life Insurance Policies” below. |

(5) | Represents payment of health insurance premiums equal to $6,165 and 401(k) contributions equal to $4,870. |

Narrative Explanation of Certain Aspects of Summary Compensation Table

Amounts shown in the “Stock Awards” column above consist of awards of time-based restricted stock (“RSAs”). The shares of restricted stock vest ratably over a period of four years from grant date. Recipients of RSAs are entitled to dividends or distributions paid or made on the underlying shares of restricted stock but only as and when the restricted shares to which the dividends or other distributions are attributable become vested. Dividends or distributions made prior to such date will be held by the Company and transferred to the recipient on the date that the restricted shares become vested.

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth information regarding outstanding restricted stock awards held by each of our named executive officers as of December 31, 2019. The applicable vesting provisions are described in the footnote following the table. For a description of the acceleration of vesting provisions applicable to the restricted stock held by our named executive officers, please see the subsection titled “Severance and Change in Control Benefits” below.

| | | | | | | | | | | | | | |

| | | | Stock Awards |

Name | | Grant Date | | Number of Shares or Units of Stock that Have Not Vested(1) | | | Market Value of Shares or Units of Stock that Have Not Vested(2) | | Number of Unearned Shares, Units or Other Rights that Have Not Vested | | | Market or Payout Value of Unearned Shares, Units or Other Rights that Have Not Vested |

H. Michael Schwartz | | 6/28/2019 | | 117,260.79 | | $ | 1,250,000 | | - | | $ | - |

Michael S. McClure | | 6/28/2019 | | 60,975.61 | | $ | 650,000 | | - | | $ | - |

Wayne Johnson | | 6/28/2019 | | 23,452.16 | | $ | 250,000 | | - | | $ | - |

Michael O. Terjung | | 6/28/2019 | | 9,380.86 | | $ | 100,000 | | - | | $ | - |

(1) | All restricted stock awards vest ratably over a period of four years from grant date. |

(2) | There is no public market for our shares. Amount is calculated as the net asset value of a share of our common stock at the end of the last completed fiscal year, multiplied by the number of units of stock. |

Severance and Change in Control Benefits

On June 28, 2019, the Compensation Committee adopted and approved the SmartStop Self Storage REIT, Inc. Executive Severance and Change of Control Plan (the “Severance Plan”) and designated certain of our executives, including our named executive officers, as participants (each, a “Participant” and together, the “Participants”) of the Severance Plan. The following are the terms of the Severance Plan, which benefits are in addition to standard accrued obligations:

Termination Without Cause or For Good Reason Not Related to a Change of Control: In the event a Participant’s employment with the Company is terminated by the Company without “cause” (other than by reason of death or disability) or by the Participant for “good reason” and such termination does not occur during a limited period following a “change of control” (each, as defined in the Severance Plan),

15

the Participant will be entitled to receive (1) a Severance Payment (as defined below); (2) payment or reimbursement by the Company of the cost of premiums for healthcare continuation coverage over a number of years based on the Severance Payment period; (3) any unvested time-based equity awards that would have otherwise vested over the 12 month period following the date of termination (the “Termination Date”) will immediately vest; and (4) any unvested performance-based equity awards that remain outstanding on the Termination Date shall remain outstanding and eligible to be earned following the completion of the performance period based on achievement of performance goals, vesting pro rata if such award becomes earned based on days employed during the performance period. A “Severance Payment” is an amount equal to: (a) 2.0 if the Participant is the Executive Chairman or Chief Executive Officer of the Company, 1.5 if the Participant is the Chief Investment Officer or Chief Accounting Officer, or 1.0 if the Participant is another officer of the Company or its affiliates; multiplied by (b) the sum of: (i) such Participant’s highest base salary during the prior 2 years; plus (ii) such Participant’s Average Cash Bonus (generally measured over the prior 3 years, as set forth in the Severance Plan), payable in installments.

Change of Control: In the event of a “change of control” (as defined in the Severance Plan), any unvested time-based equity awards will immediately become vested and any unvested performance-based equity awards that are not continued, converted, assumed or replaced with a substantially similar award by the Company or a successor or related entity in connection with the change of control will vest in full immediately prior to the date of the change of control, based on actual achievement of performance goals through the change of control, as determined by the Compensation Committee.

Termination Without Cause or For Good Reason following a Change of Control: In the event that, within 12 months following a change of control, a Participant’s employment with the Company is terminated by the Company without “cause” (other than by reason of death or disability, as defined in the Severance Plan) or by the Participant for good reason, the Participant will be entitled to the following: (1) a Change of Control Severance Payment (as defined below), (2) payment or reimbursement by the Company of the cost of premiums for healthcare continuation coverage over a number of years based on the Change of Control Severance Payment period, and (3) any unvested performance-based equity awards that were continued, converted, assumed, or replaced by the Company or a successor following the change of control shall (a) to the extent only subject to time-based vesting as of the Termination Date, immediately vest, or (b) to the extent subject to performance-based vesting as of the Termination Date, remain outstanding and eligible to be earned following completion of the performance period based on achievement of performance goals, and to the extent earned (if at all) shall vest on a pro rata basis based on days employed during the performance period. A “Change of Control Severance Payment” is an amount equal to (a) 3.0 if the Participant is the Executive Chairman or Chief Executive Officer of the Company, or 2.0 if the Participant is another officer of the Company or any of its subsidiaries; multiplied by (b) the sum of: (i) the Participant’s highest base salary during the prior 2 years; plus (ii) the Participant’s Average Cash Bonus, paid in a single lump sum.

Termination Other than Without Cause or For Good Reason: In the event a Participant’s employment with the Company is terminated due to the Participant’s death or disability, the Participant will be entitled to receive: (1) a pro rata portion of the Participant’s annual cash performance bonus, as determined by the Compensation Committee based on actual performance; (2) immediate vesting of all unvested time-based equity awards; and (3) any unvested performance awards that remain outstanding on the Termination Date shall remain outstanding and eligible to be earned following the completion of the performance period based on achievement of performance goals, vesting pro rata if such award becomes earned based on days employed during the performance period. In the event a Participant’s employment with the Company is terminated for any reason other than those specified above, the Participant shall not be entitled to any annual cash bonus and the unvested portion of any award shall be forfeited as of the date of such termination.

16

In connection with the adoption of the Severance Plan, the Company entered into a letter agreement with each of the Participants with respect to their participation in the Severance Plan. Each letter agreement entered into with the Participants contains (i) a confidentiality covenant that extends indefinitely, (ii) a non-compete provision while the Participant is employed by the Company, (iii) certain employee, investor and customer nonsolicitation covenants that extend during the Participant’s employment and for a period of time after separation (with such time period varying based upon the officer’s position), and (iv) a non-disparagement provision.

Compensation Committee Report

The Compensation Committee has reviewed and discussed the foregoing “Executive Compensation” discussion with management and, based on such review and discussions, the Compensation Committee recommended to the board of directors that the “Executive Compensation” discussion set forth above be included in this proxy statement. The Company is not subject to the requirements of Item 402(b) of Regulation S-K, and accordingly, no “Compensation Discussion and Analysis” has been included herein.

| | |

| | Timothy S. Morris (Chairman) |

| | David J. Mueller |

| | Harold “Skip” Perry |

| | |

March 23, 2020 | | |

The preceding Compensation Committee Report to stockholders is not “soliciting material” and is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

Director Compensation for the Year Ended December 31, 2019

Summary

The following table provides a summary of the compensation earned by or paid to our directors for the year ended December 31, 2019:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Fees Earned or Paid in Cash | | | | Stock Awards(1) | | | Option Awards | | | Non-Equity Incentive Plan Compensation | | | Change in Pension Value and Nonqualified Deferred Compensation | | | All Other Compensation(2) | | | Total | |

H. Michael Schwartz | | $ | - | | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | 328 | | | $ | 328 | |

Paula M. Mathews | | $ | 59,000 | | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | 638 | | | $ | 59,638 | (3) |

Timothy S. Morris | | $ | 121,250 | | (4) | | $ | 53,358 | | | $ | - | | | $ | - | | | $ | - | | | $ | 982 | | | $ | 175,590 | |

David J. Mueller | | $ | 123,000 | | (5) | | $ | 53,358 | | | $ | - | | | $ | - | | | $ | - | | | $ | 638 | | | $ | 176,996 | |

Harold “Skip” Perry | | $ | 129,750 | | (6) | | $ | 53,358 | | | $ | - | | | $ | - | | | $ | - | | | $ | 393 | | | $ | 183,501 | |

(1) | This column represents the full grant date fair value in accordance with FASB ASC Topic 718. |

(2) | Represents payment of life insurance premiums, as discussed below. |

(3) | Ms. Mathews was awarded restricted stock in February 2020 in connection with her September 2019 reelection to the board of directors. Such shares of restricted stock vest one year from the date of her reelection. |

17

(4) | Amount includes total fees earned or paid during the year ended December 31, 2019, of which $7,500 was earned during the year ended December 31, 2018, and $7,500 was paid during 2020. |

(5) | Amount includes total fees earned or paid during the year ended December 31, 2019, of which $8,000 was earned during the year ended December 31, 2018, and $7,500 was paid during 2020. |

(6) | Amount includes total fees earned or paid during the year ended December 31, 2019, of which $9,000 was earned during the year ended December 31, 2018, and $7,500 was paid during 2020. |

As noted above, the Compensation Committee assists our board of directors in fulfilling its responsibilities with respect to employee, officer, and director compensation. All of our directors received compensation in the form of premiums paid on life insurance policies. See “— Director Life Insurance Policies,” below. Other than the foregoing, only our non-employee directors received any compensation from us for services on our board of directors and its committees, as provided below.

Terms of Director Compensation Prior to June 28, 2019

Prior to June 28, 2019, the only non-employee directors we compensated were our independent directors. Each of our independent directors was entitled to a retainer of $45,000 per year plus $1,500 for each board or board committee meeting the director attended in person or by telephone ($1,750 for attendance at each meeting of any committee of the board for which they are a chairperson). In the event there were multiple meetings of the board and one or more committees in a single day, the fees were limited to $3,000 per day ($3,500 for the chairperson of the Audit Committee if there was a meeting of such committee). In addition, during fiscal year 2019, members of the Nominating and Corporate Governance Committee were also members of special committees formed for the purpose of evaluating strategic transactions. The Nominating and Corporate Governance Committee established the compensation for such committees, with each member thereof receiving a retainer equal to an aggregate of $70,000 (paid in 2018, when such committee was formed), plus $1,500 for each meeting of the special committee ($2,000 for the chairperson). In addition, upon the initial appointment of each independent director, we issued 2,500 shares of restricted stock to each independent director, which vest ratably over a period of four years from the date such initial award was awarded to the independent directors. We also issued additional awards of restricted stock to each independent director upon each of their re-elections to our board of directors, which vest ratably over a period of four years from the date of re-election.

All directors received reimbursement of reasonable out-of-pocket expenses incurred in connection with attendance at meetings of our board of directors.

Terms of Director Compensation Subsequent to June 28, 2019

On June 28, 2019, the Compensation Committee approved changes to the compensation of certain of our directors to make such compensation more comparable to self-managed publicly-traded REITs, as recommended by FPL Associates. Each of our non-employee directors is now entitled to a cash retainer of $50,000 per year and an award of restricted stock with a market value of $60,000, which vests one year from the date of the director’s re-election, for membership on the board of directors. In addition, the chairpersons of the Audit Committee, Nominating and Corporate Governance Committee, and Compensation Committee will receive an annual retainer of $15,000 for such chairperson position, and the other members of each such committee will receive an annual retainer of $7,500 for membership on each committee. Membership on our committees is comprised solely of independent directors. In the event that the board of directors or any committee thereof meets more than six times in a given year, additional compensation of $1,500 per meeting will be paid to each non-employee director or committee member, as applicable.

For the year ended December 31, 2019, the directors earned an aggregate of $433,000.

18

Employee and Director Long-Term Incentive Plan Awards to Independent Directors

The Employee and Director Long-Term Incentive Plan (the “Plan”) was approved and adopted prior to the commencement of our public offering (the “Offering”). The purpose of the Plan is to (1) provide incentives to individuals who are granted awards because of their ability to improve our operations and/or increase our profits; (2) encourage selected persons to accept or continue employment or other service relationship with us or with our affiliates, determined in accordance with the Plan; and (3) increase the interest of our directors in our success through their participation in the growth in value of our stock. Pursuant to the Plan, we may issue options, stock appreciation rights, distribution equivalent rights and other equity-based awards, including, but not limited to, restricted stock.

The total number of shares of our Class A common stock authorized and reserved for issuance under the plan is equal to 10% of our outstanding shares of Class A and Class T common stock at any time, net of any shares already issued under the plan, but not to exceed 10,000,000 shares in the aggregate. As of December 31, 2019, there were approximately 5.6 million shares available for issuance under the Plan. The term of the Plan is 10 years. Upon our earlier dissolution or liquidation, reorganization, merger or consolidation with one or more corporations as a result of which we are not the surviving corporation, or sale of all or substantially all of our properties, the Plan will terminate, and provisions will be made for the assumption by the successor corporation of the awards granted under the Plan or the replacement of such awards with similar awards with respect to the stock of the successor corporation, with appropriate adjustments as to the number and kind of shares and exercise prices. Alternatively, rather than providing for the assumption of such awards, the board of directors may either (1) shorten the period during which awards are exercisable, or (2) cancel an award upon payment to the participant of an amount in cash that the Compensation Committee determines is equivalent to the fair market value of the consideration that the participant would have received if the participant exercised the award immediately prior to the effective time of the transaction.

In the event our board of directors or the Compensation Committee determines that any distribution, recapitalization, stock split, reorganization, merger, liquidation, dissolution or sale, transfer, exchange or other disposition of all or substantially all of our assets, or other similar corporate transaction or event, affects our stock such that an adjustment is appropriate in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the Plan or with respect to an award, then the board of directors or Compensation Committee shall, in such manner as it may deem equitable, adjust the number and kind of shares or the exercise price with respect to any award.

As of December 31, 2019, (i) Mr. Mueller has received a total of 16,629 shares of restricted stock, of which 6,813 shares have vested, and (ii) Messrs. Morris and Perry have each individually received a total of 15,379 shares of restricted stock of which 4,938 shares have vested.

Director Life Insurance Policies

SAM purchased life insurance policies covering each of the members of our board of directors for the benefit of such director’s beneficiaries. For the year ended December 31, 2019, we reimbursed SAM for the total premiums paid on such life insurance policies, which was $2,979. Of this amount, $328 was attributed to the policy covering H. Michael Schwartz, $638 was attributed to the policy covering Paula M. Mathews, $982 was attributed to the policy covering Timothy S. Morris, $638 was attributed to the policy covering David J. Mueller, and $393 was attributed to the policy covering Harold “Skip” Perry.

19

Executive Officers and Directors

Included below is certain information regarding our current executive officers and directors. All of our directors, including our three independent directors, have been nominated for re-election at the 2020 annual meeting of stockholders. All of our executive officers serve at the pleasure of our board of directors.

| | | | |

Name | | Age | | Position(s) |

H. Michael Schwartz | | 53 | | Executive Chairman |

Michael S. McClure | | 57 | | Chief Executive Officer |

Wayne Johnson | | 62 | | President and Chief Investment Officer |

Joe Robinson | | 46 | | Chief Operations Officer |

James Barry | | 31 | | Chief Financial Officer and Treasurer |

Michael O. Terjung | | 43 | | Chief Accounting Officer |

Nicholas M. Look | | 37 | | General Counsel and Secretary |

Gerald Valle | | 51 | | Senior Vice President – Self Storage Operations |

Paula Mathews | | 68 | | Director |

David J. Mueller | | 67 | | Independent Director |

Timothy S. Morris | | 59 | | Independent Director |

Harold “Skip” Perry | | 73 | | Independent Director |

H. Michael Schwartz. Mr. Schwartz is our Executive Chairman. Mr. Schwartz has been an officer and director since our initial formation in January 2013, and served as our Chief Executive Officer from January 2013 to June 2019. Mr. Schwartz was appointed Chief Executive Officer of our Former External Advisor in January 2013. Mr. Schwartz served as our President and the President of our Former External Advisor from January 2013 through January 2017. Mr. Schwartz is also the Chief Executive Officer of SAM. He served as President of SAM from August 2007 through January 2017. He also serves as Chief Executive Officer and Chairman of each of Strategic Storage Trust IV, Inc. (“SST IV”), Strategic Storage Growth Trust II, Inc. (“SSGT II”), and Strategic Student & Senior Housing Trust, Inc. (“SSSHT”), a public non-traded student and senior housing REIT sponsored by SAM. He served as Chief Executive Officer and Chairman of Strategic Storage Growth Trust, Inc. (“SSGT”), a public non-traded self storage REIT sponsored by SAM, until the merger of SSGT with us on January 24, 2019. Mr. Schwartz also served as Chief Executive Officer, President, and Chairman of SmartStop Self Storage, Inc. (“SmartStop Self Storage”), our former sponsor, from August 2007 until the merger of SmartStop Self Storage with Extra Space Storage, Inc. (“Extra Space”) on October 1, 2015. Since February 2008, Mr. Schwartz has also served as Chief Executive Officer and President of Strategic Storage Holdings, LLC (“SSH”). He was appointed President of Strategic Capital Holdings, LLC in July 2004. Previously, he held the positions of Vice Chairman or Co-President of U.S. Advisor from July 2004 until April 2007. He has more than 26 years of real estate, securities and corporate financial management experience. His real estate experience includes international investment opportunities, including self storage acquisitions in Canada. From 2002 to 2004, Mr. Schwartz was the Managing Director of Private Structured Offerings for Triple Net Properties, LLC (now an indirect subsidiary of Grubb & Ellis Company). In addition, he served on the board of their affiliated broker-dealer, NNN Capital Corp. (subsequently known as Grubb & Ellis Securities, Inc.). From 2000 to 2001, Mr. Schwartz was Chief Financial Officer for Futurist Entertainment, a diversified entertainment company. From 1995 to 2000, he was President and Chief Financial Officer of Spider Securities, Inc. (now Merriman Curhan Ford & Co.), a registered broker-dealer that developed one of the first online distribution outlets for fixed and variable annuity products. From 1990 to 1995, Mr. Schwartz served as the Vice President and Chief Financial Officer of Western Capital Financial (an affiliate of Spider Securities), and from 1994 to 1998 Mr. Schwartz was also President of Palladian Advisors, Inc. (an affiliate of Spider Securities). Mr. Schwartz holds a B.S. in Business Administration with an emphasis in Finance from the University of Southern California.

20