2021 Second Quarter Update H. Michael Schwartz Chairman & CEO Exhibit 99.1

Disclaimer & Risk Factors 2 Certain of the matters discussed in this investor presentation constitute forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements and any such forward-looking statements are qualified in their entirety by reference to the following cautionary statements. All forward-looking statements speak only as of the date hereof and are based on current expectations and involve a number of assumptions, risks and uncertainties that could cause the actual results to differ materially from such forward-looking statements. Such forward-looking statements include, but are not limited to, statements about the expected effects and benefits of the merger with Strategic Storage Growth Trust, Inc. ("SSGT"), the merger with Strategic Storage Trust IV, Inc. (“SST IV”) and the Series A Preferred equity investment, including anticipated future financial and operating results and synergies, as well as all other statements in this investor presentation, other than historical facts. There are several factors which could cause actual plans and results to differ materially from those expressed or implied in forward-looking statements, including, without limitation, the following: (i) risks related to disruption of management’s attention from SmartStop’s ongoing business operations due to the SSGT merger, the SST IV merger, or other business matters; (ii) significant transaction costs, including financing costs, and unknown liabilities; (iii) failure to realize the expected benefits and synergies of the SSGT merger, the SST IV merger or the self administration transaction in the expected timeframes or at all; (iv) costs or difficulties related to the integration of acquired self storage facilities and operations, including facilities acquired through the SSGT merger, the SST IV merger and operations acquired through the self administration transaction; (v) changes in the political and economic climate, economic conditions and fiscal imbalances in the United States, and other major developments, including wars, natural disasters, epidemics and pandemics, including the outbreak of novel coronavirus (COVID-19), military actions, and terrorist attacks; (vi) changes in tax and other laws and regulations; or (vii) difficulties in SmartStop’s ability to attract and retain qualified personnel and management. Actual results may differ materially from those indicated by such forward-looking statements. In addition, the forward-looking statements represent SmartStop’s views as of the date on which such statements were made. SmartStop anticipates that subsequent events and developments may cause its views to change. These forward-looking statements should not be relied upon as representing SmartStop’s views as of any date subsequent to the date hereof. Additional factors that may affect the business or financial results of SmartStop are described in the risk factors included in SmartStop’s filings with the SEC, including SmartStop’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020 and subsequent Quarterly Reports on Form 10-Q, which factors are incorporated herein by reference, all of which are filed with the SEC and available at www.sec.gov. SmartStop expressly disclaims a duty to provide updates to forward-looking statements, whether as a result of new information, future events or other occurrences. This is neither an offer nor a solicitation to purchase securities. See our Form 10-K and recent Form 10-Q for specific risks associated with an investment in SmartStop Self Storage REIT, Inc. As of June 30, 2021, our accumulated deficit was approximately $159.2 million and it is possible that our operations may not be profitable in 2021. We have paid distributions from sources other than our cash flows from operations, including from the net proceeds of our public offering and our distribution reinvestment plan (DRP offering). We are not prohibited from undertaking such activities by our charter, bylaws or investment policies, and we may use an unlimited amount from any source to pay our distributions. For the twelve months ended December 31, 2020, we funded 54% of our distributions using cash flow from operations, 14% from cash provided by financing activities, and 32% using proceeds from our DRP offering. For the six months ended June 30, 2021, we funded 73% of our distributions using cash flow from operations and 27% using proceeds from our DRP offering. If we continue to pay cash distributions from sources other than cash flows from operations, we will have fewer funds available for acquiring properties, which may reduce our stockholders’ overall returns. Additionally, to the extent distributions exceed cash flows from operations, a stockholder’s basis in our stock may be reduced and, to the extent distributions exceed a stockholder’s basis, the stockholder may recognize a capital gain. No public market currently exists for shares of our common stock and there may never be one. Therefore, it will be difficult for our stockholders to sell their shares. Our charter does not require us to pursue a liquidity transaction at anytime. If you sell your shares, it will likely be at a substantial discount. We may only calculate the value per share for our shares annually and, therefore, you may not be able to determine the net asset value of your shares on an ongoing basis. We cannot assure our stockholders that we will be successful in the marketplace. Revenues and earnings from Strategic Storage Trust VI, Inc. and Strategic Storage Growth Trust II, Inc. (the “Managed REITs”) are uncertain. Because the revenue streams from the advisory agreements with the managed REITs are subject to limitation or cancellation, any such termination could adversely affect our financial condition, cash flow and the amount available for distributions to you. We will face conflicts of interest relating to the purchase of properties, including conflicts with Strategic Storage Trust VI, Inc. and Strategic Storage Growth Trust II, Inc., and such conflicts may not be resolved in our favor, which could adversely affect our investment opportunities. Our trademarks are important to the value of our business, and the ability to protect, and costs associated with protecting, our intellectual property could adversely affect our business and results of operations. We may incur substantial debt, which could hinder our ability to pay distributions to our stockholders or could decrease the value of your investment. Our Series A Preferred Shares rank senior to our common stock, and therefore, any cash we have to pay distributions will be used to pay distributions to the holders of Series A Preferred Shares first, which could have a negative impact on our ability to pay distributions to our common stockholders. We may fail to qualify as a REIT, which could adversely affect our operations and our ability to make distributions. Our board of directors may change any of our investment objectives without your consent.

SmartStop Platform at a Glance 3 11th Largest Self Storage Company in the U.S. 12.1 Million(1) Owned and Managed Rentable Square Feet 157(1) Owned and Managed Self Storage Facilities $1.8 Billion Self Storage Assets Under Management $4.0 Billion Historical Self Storage Transaction Activity(2) 400+ Employees SmartStop Self Storage REIT is the largest public non-traded self storage REIT in the U.S. 96.3% Q2 2021 Quarter End Same-Store Occupancy 28.7% Q2 2021 Same-Store NOI(3) Growth (1) Initially started raising equity capital in 2014 through the broker dealer network Note: Portfolio as of 8/26/2021 and includes all operational properties owned by SmartStop unless otherwise noted As of 8/26/2021 Includes affiliated companies Same-store NOI is a non-GAAP measure. See Appendix for a reconciliation of this measure to the most directly comparable GAAP financial measure.

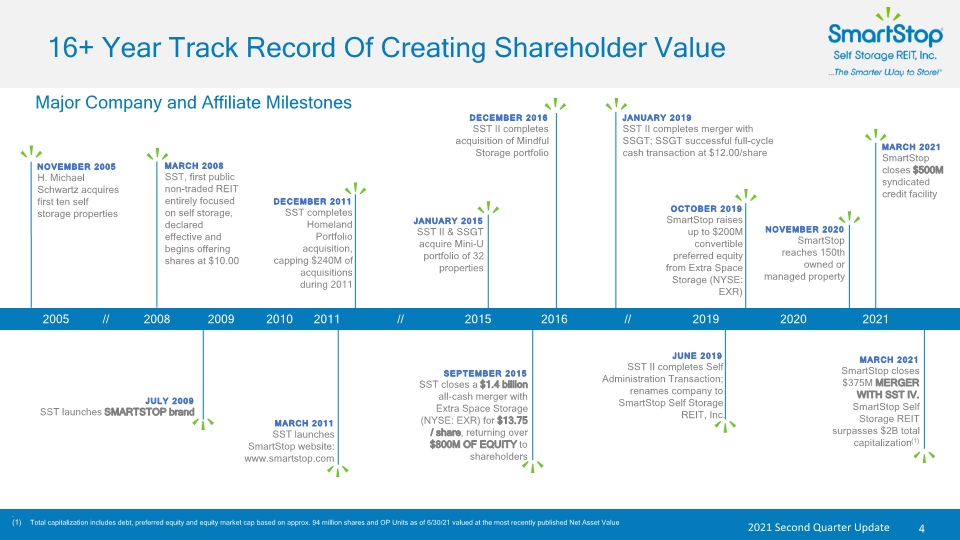

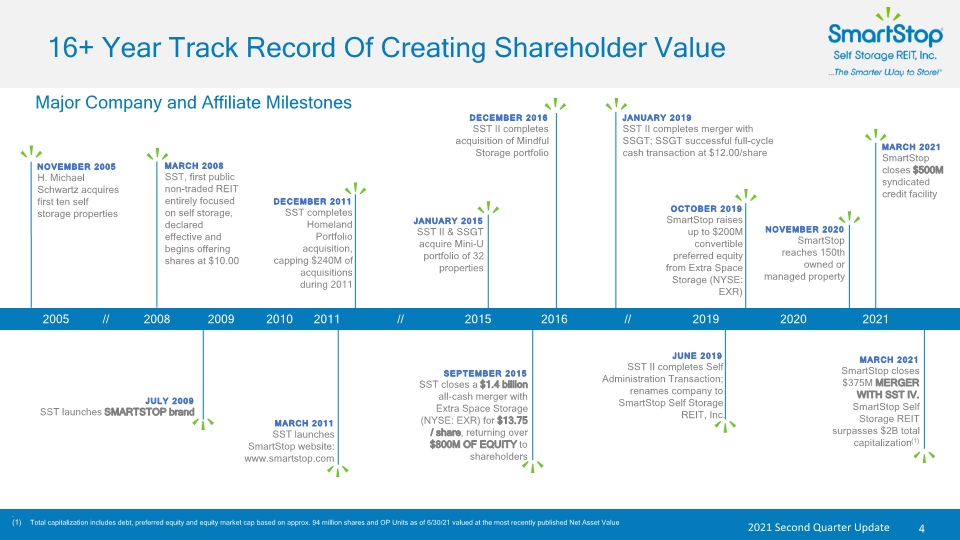

Major Company and Affiliate Milestones 16+ Year Track Record Of Creating Shareholder Value NOVEMBER 2005 H. Michael Schwartz acquires first ten self storage properties MARCH 2008 SST, first public non-traded REIT entirely focused on self storage, declared effective and begins offering shares at $10.00 MARCH 2011 SST launches SmartStop website: www.smartstop.com JULY 2009 SST launches SMARTSTOP brand DECEMBER 2011 SST completes Homeland Portfolio acquisition, capping $240M of acquisitions during 2011 JANUARY 2019 SST II completes merger with SSGT; SSGT successful full-cycle cash transaction at $12.00/share JUNE 2019 SST II completes Self Administration Transaction; renames company to SmartStop Self Storage REIT, Inc. OCTOBER 2019 SmartStop raises up to $200M convertible preferred equity from Extra Space Storage (NYSE: EXR) SEPTEMBER 2015 SST closes a $1.4 billion all-cash merger with Extra Space Storage (NYSE: EXR) for $13.75 / share, returning over $800M OF EQUITY to shareholders MARCH 2021 SmartStop closes $375M MERGER WITH SST IV. SmartStop Self Storage REIT surpasses $2B total capitalization(1) DECEMBER 2016 SST II completes acquisition of Mindful Storage portfolio JANUARY 2015 SST II & SSGT acquire Mini-U portfolio of 32 properties MARCH 2021 SmartStop closes $500M syndicated credit facility 2005 // 2008 2009 2011 2015 2016 2019 2020 2021 2010 // // NOVEMBER 2020 SmartStop reaches 150th owned or managed property . Total capitalization includes debt, preferred equity and equity market cap based on approx. 94 million shares and OP Units as of 6/30/21 valued at the most recently published Net Asset Value 4

Decades of Collective Industry Experience 5 Board of Directors Executive Team Bliss Edwards Executive Vice President - Canada 6 Years Storage Experience Wayne Johnson President & CIO 35 Years Storage Experience

Investment Highlights 6

Institutional Operator And Technology Platform Demonstrated Ability To Grow Externally Conservative And Diversified Capital Structure Experienced Management Team And Board High Quality, Diversified Portfolio In Key Growth Markets Investment Highlights 7 1 2 3 5 6 Naples, Florida High Growth Portfolio of Stabilized and Lease Up Assets 4

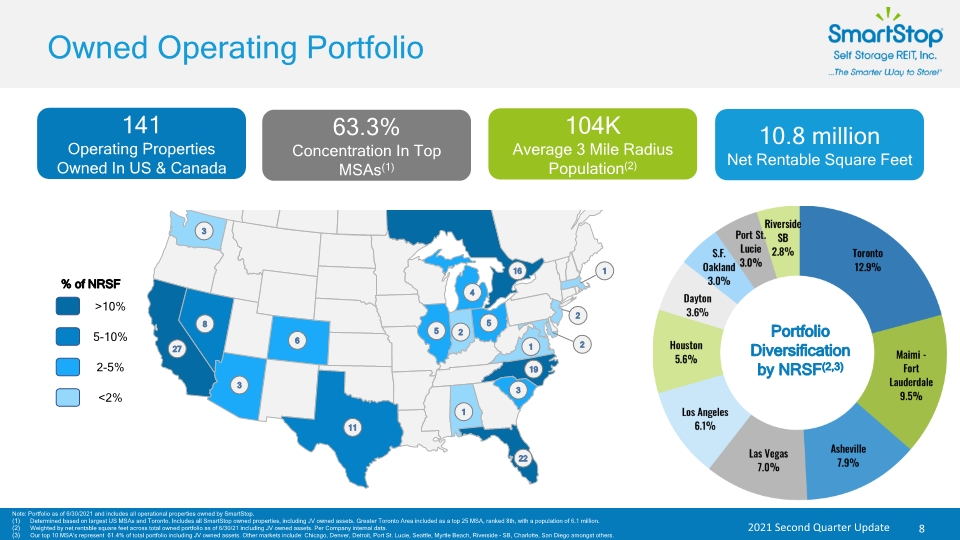

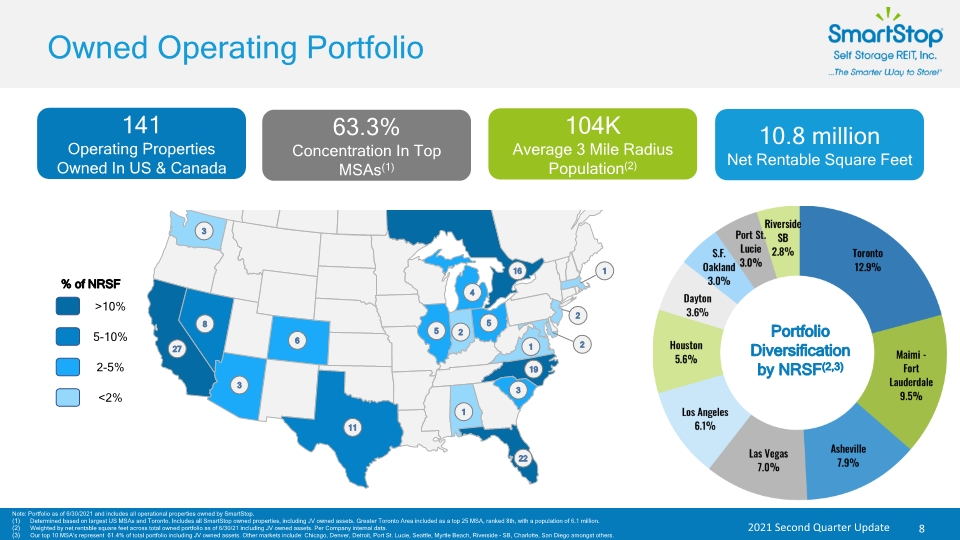

Owned Operating Portfolio 8 Note: Portfolio as of 6/30/2021 and includes all operational properties owned by SmartStop. Determined based on largest US MSAs and Toronto. Includes all SmartStop owned properties, including JV owned assets. Greater Toronto Area included as a top 25 MSA, ranked 8th, with a population of 6.1 million. Weighted by net rentable square feet across total owned portfolio as of 6/30/21 including JV owned assets. Per Company internal data. Our top 10 MSA’s represent 61.4% of total portfolio including JV owned assets. Other markets include: Chicago, Denver, Detroit, Port St. Lucie, Seattle, Myrtle Beach, Riverside – SB, Charlotte, San Diego amongst others. >10% 5-10% 2-5% <2% % of NRSF 1 3 27 6 22 5 2 1 2 2 1 19 3 5 4 16 11 3 8 Portfolio Diversification by NRSF(2,3)

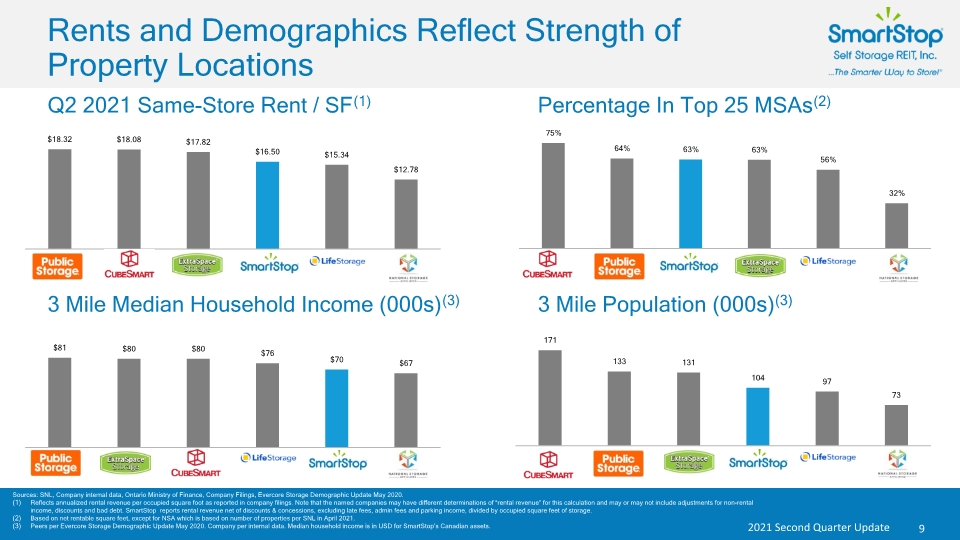

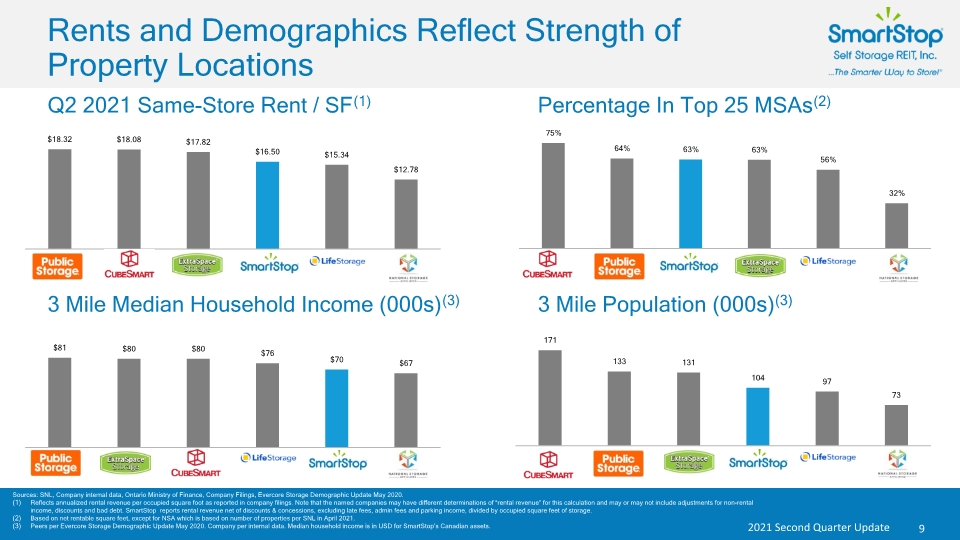

Q2 2021 Same-Store Rent / SF(1) Percentage In Top 25 MSAs(2) 3 Mile Median Household Income (000s)(3) 3 Mile Population (000s)(3) Rents and Demographics Reflect Strength of Property Locations 9 Sources: SNL, Company internal data, Ontario Ministry of Finance, Company Filings, Evercore Storage Demographic Update May 2020. Reflects annualized rental revenue per occupied square foot as reported in company filings. Note that the named companies may have different determinations of “rental revenue” for this calculation and may or may not include adjustments for non-rental income, discounts and bad debt. SmartStop reports rental revenue net of discounts & concessions, excluding late fees, admin fees and parking income, divided by occupied square feet of storage. Based on net rentable square feet, except for NSA which is based on number of properties per SNL in April 2021. Peers per Evercore Storage Demographic Update May 2020. Company per internal data. Median household income is in USD for SmartStop’s Canadian assets.

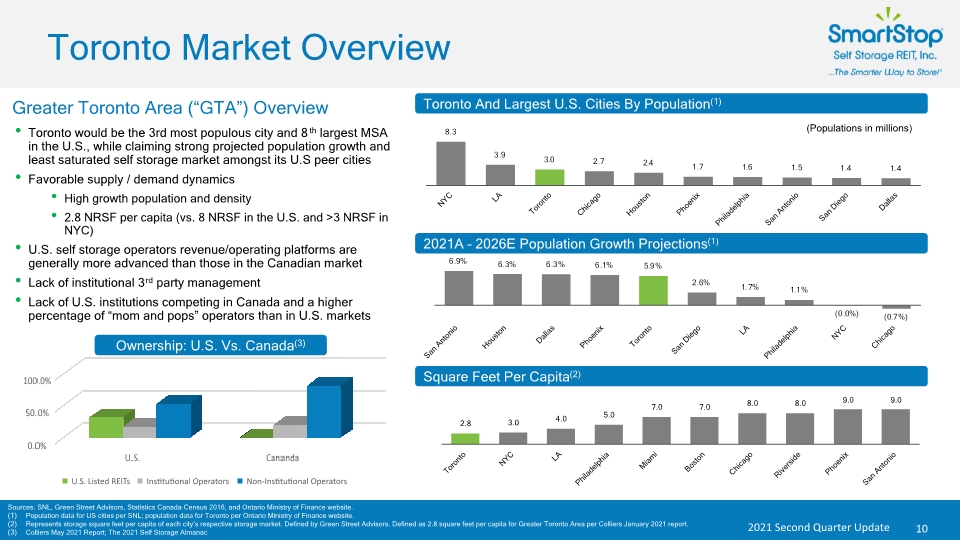

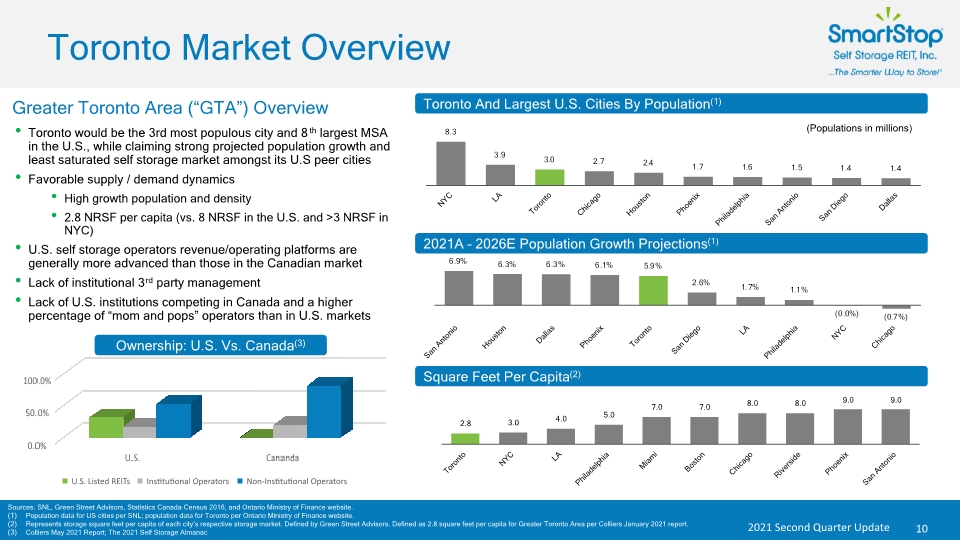

Square Feet Per Capita(2) 2021A – 2026E Population Growth Projections(1) 10 Sources: SNL, Green Street Advisors, Statistics Canada Census 2016, and Ontario Ministry of Finance website. Population data for US cities per SNL; population data for Toronto per Ontario Ministry of Finance website. Represents storage square feet per capita of each city’s respective storage market. Defined by Green Street Advisors. Defined as 2.8 square feet per capita for Greater Toronto Area per Colliers January 2021 report. Colliers May 2021 Report; The 2021 Self Storage Almanac (Populations in millions) Toronto And Largest U.S. Cities By Population(1) Toronto would be the 3rd most populous city and 8th largest MSA in the U.S., while claiming strong projected population growth and least saturated self storage market amongst its U.S peer cities Favorable supply / demand dynamics High growth population and density 2.8 NRSF per capita (vs. 8 NRSF in the U.S. and >3 NRSF in NYC) U.S. self storage operators revenue/operating platforms are generally more advanced than those in the Canadian market Lack of institutional 3rd party management Lack of U.S. institutions competing in Canada and a higher percentage of “mom and pops” operators than in U.S. markets Greater Toronto Area (“GTA”) Overview Toronto Market Overview Ownership: U.S. Vs. Canada(3)

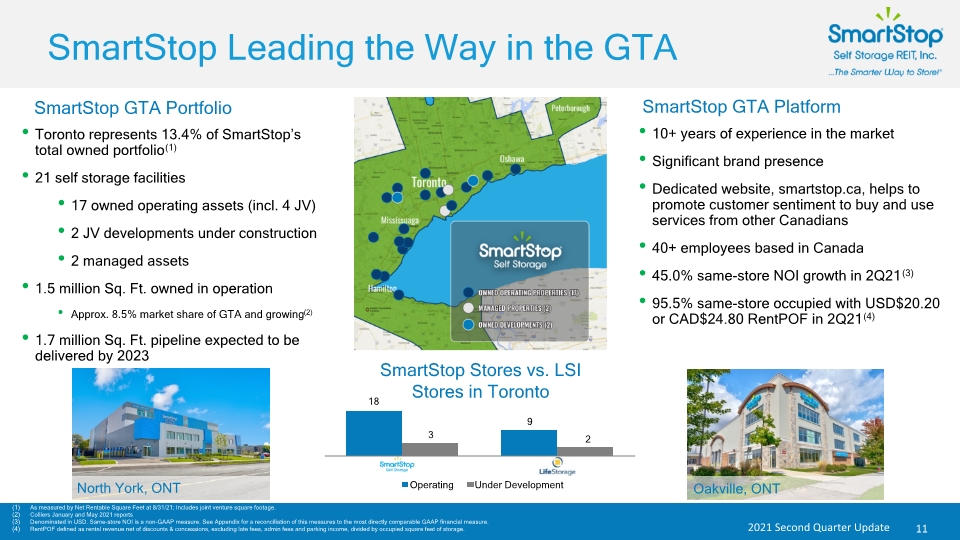

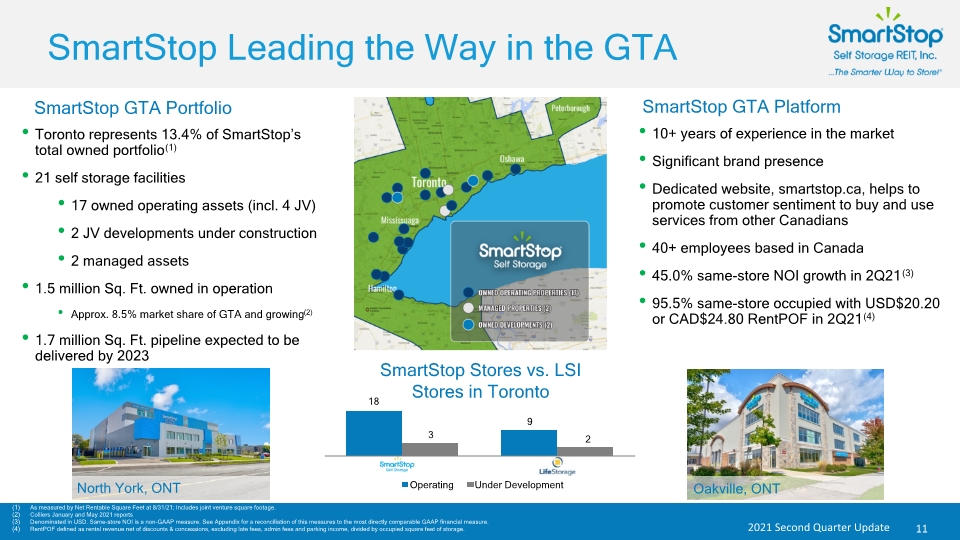

SmartStop Leading the Way in the GTA 11 As measured by Net Rentable Square Feet at 8/31/21; Includes joint venture square footage. Colliers January and May 2021 reports Denominated in USD. Same-store NOI is a non-GAAP measure. See Appendix for a reconciliation of this measures to the most directly comparable GAAP financial measure. RentPOF defined as rental revenue net of discounts & concessions, excluding late fees, admin fees and parking income, divided by occupied square feet of storage. SmartStop GTA Portfolio SmartStop Stores vs. LSI Stores in Toronto SmartStop GTA Platform 10+ years of experience in the market Significant brand presence Dedicated website, smartstop.ca, helps to promote customer sentiment to buy and use services from other Canadians 40+ employees based in Canada 45.0% same-store NOI growth in 2Q21(3) 95.5% same-store occupied with USD$20.20 or CAD$24.80 RentPOF in 2Q21(4) Toronto represents 13.4% of SmartStop’s total owned portfolio(1) 21 self storage facilities 17 owned operating assets (incl. 4 JV) 2 JV developments under construction 2 managed assets 1.5 million Sq. Ft. owned in operation Approx. 8.5% market share of GTA and growing(2) 1.7 million Sq. Ft. pipeline expected to be delivered by 2023 North York, ONT Oakville, ONT 18 3 9 2 Under Development Operating

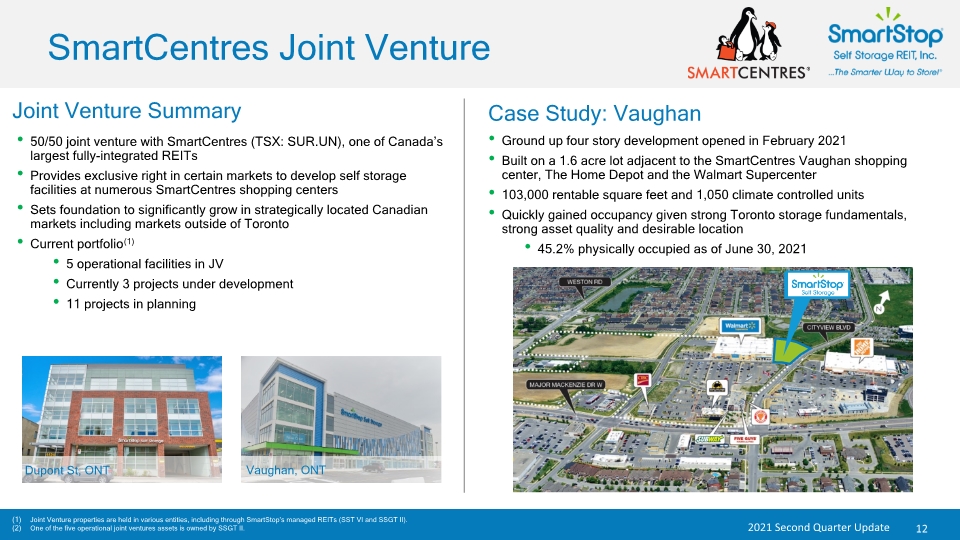

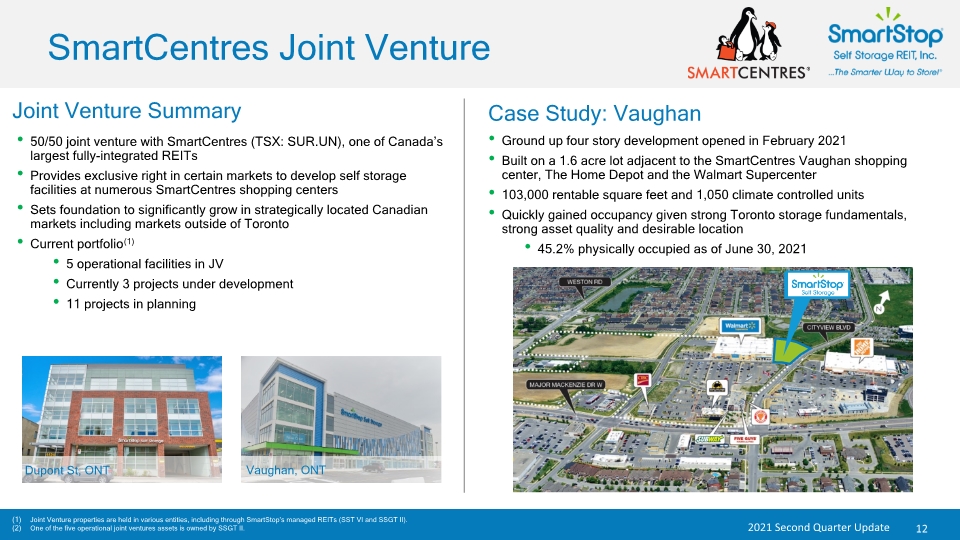

SmartCentres Joint Venture 12 Case Study: Vaughan Joint Venture properties are held in various entities, including through SmartStop’s managed REITs (SST VI and SSGT II). One of the five operational joint ventures assets is owned by SSGT II. Joint Venture Summary 50/50 joint venture with SmartCentres (TSX: SUR.UN), one of Canada’s largest fully-integrated REITs Provides exclusive right in certain markets to develop self storage facilities at numerous SmartCentres shopping centers Sets foundation to significantly grow in strategically located Canadian markets including markets outside of Toronto Current portfolio(1) 5 operational facilities in JV Currently 3 projects under development 11 projects in planning Ground up four story development opened in February 2021 Built on a 1.6 acre lot adjacent to the SmartCentres Vaughan shopping center, The Home Depot and the Walmart Supercenter 103,000 rentable square feet and 1,050 climate controlled units Quickly gained occupancy given strong Toronto storage fundamentals, strong asset quality and desirable location 45.2% physically occupied as of June 30, 2021 Toronto, ONT Dupont St, ONT Vaughan, ONT 50 Cityview Blvd, Vaughan, ONT

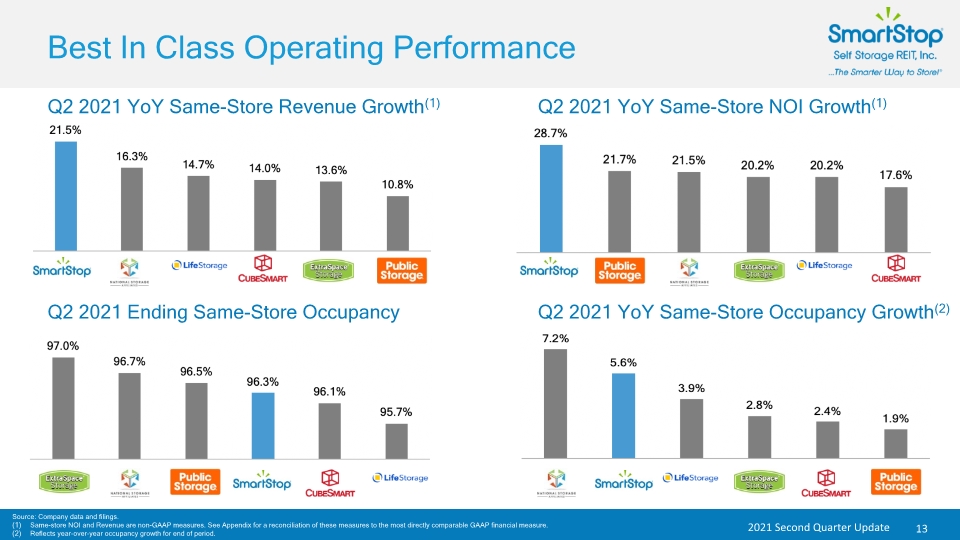

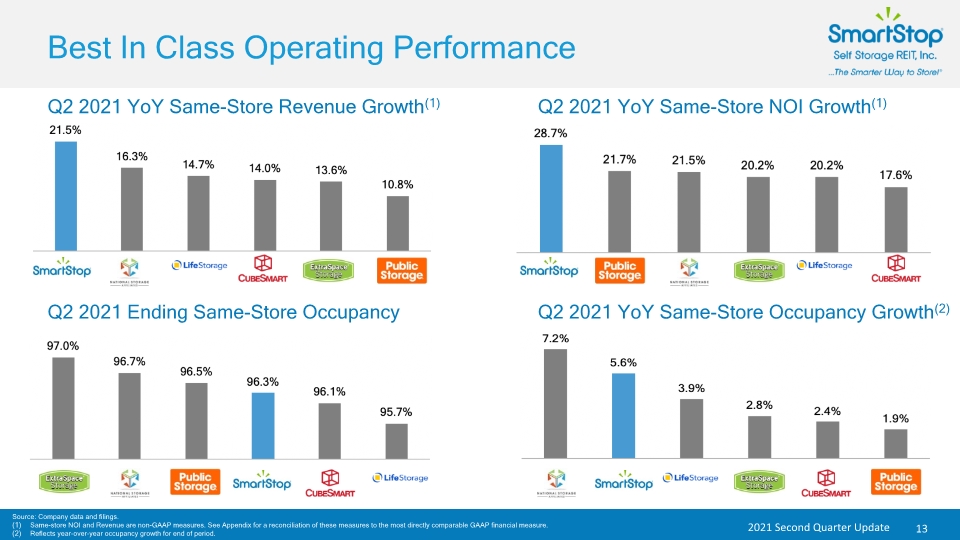

Best In Class Operating Performance 13 Q2 2021 YoY Same-Store Revenue Growth(1) Q2 2021 YoY Same-Store NOI Growth(1) Q2 2021 YoY Same-Store Occupancy Growth(2) Q2 2021 Ending Same-Store Occupancy Source: Company data and filings. Same-store NOI and Revenue are non-GAAP measures. See Appendix for a reconciliation of these measures to the most directly comparable GAAP financial measure. Reflects year-over-year occupancy growth for end of period.

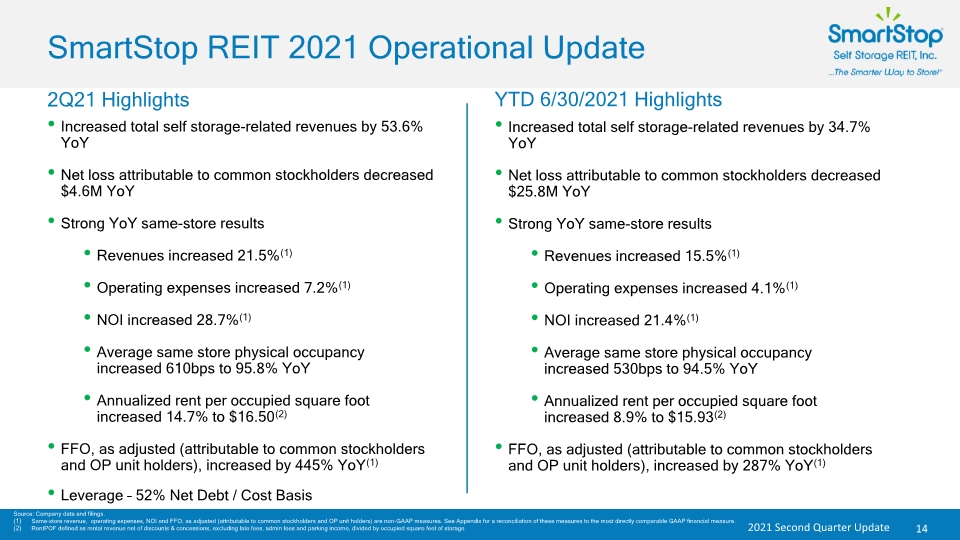

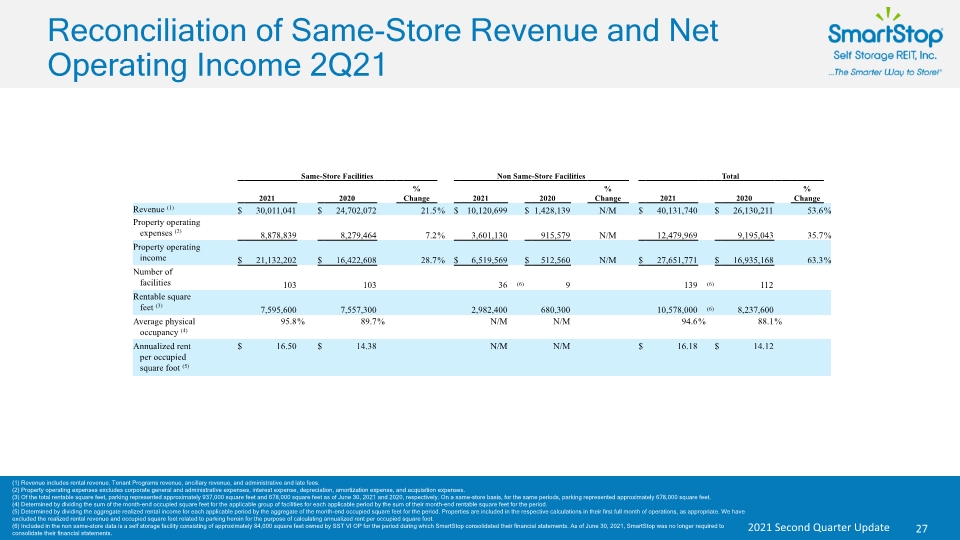

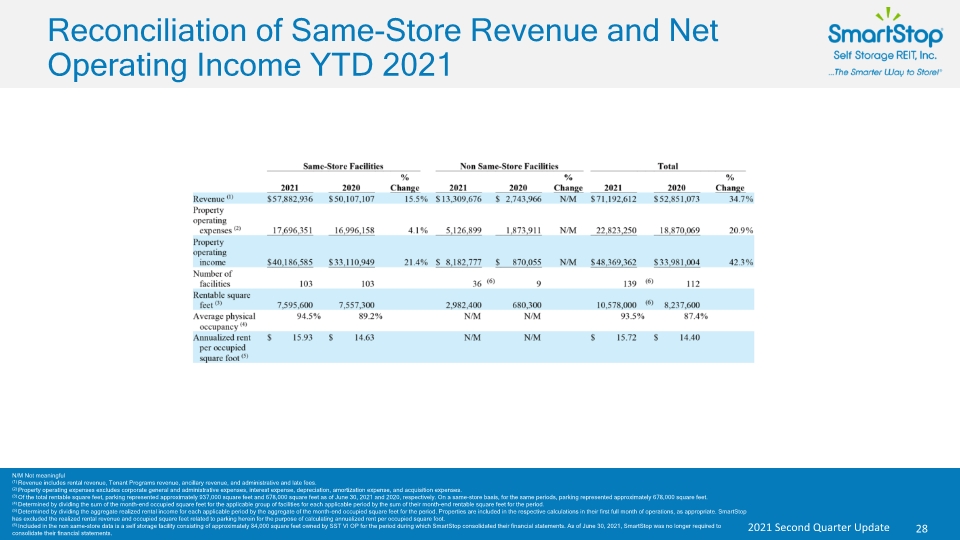

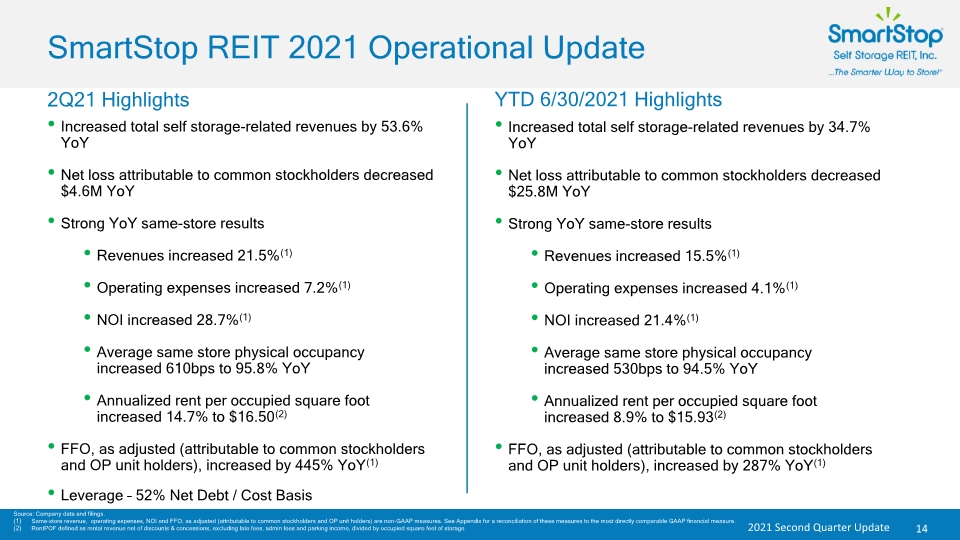

SmartStop REIT 2021 Operational Update 14 Source: Company data and filings. Same-store revenue, operating expenses, NOI and FFO, as adjusted (attributable to common stockholders and OP unit holders) are non-GAAP measures. See Appendix for a reconciliation of these measures to the most directly comparable GAAP financial measure. RentPOF defined as rental revenue net of discounts & concessions, excluding late fees, admin fees and parking income, divided by occupied square feet of storage. 2Q21 Highlights Increased total self storage-related revenues by 53.6% YoY Net loss attributable to common stockholders decreased $4.6M YoY Strong YoY same-store results Revenues increased 21.5%(1) Operating expenses increased 7.2%(1) NOI increased 28.7%(1) Average same store physical occupancy increased 610bps to 95.8% YoY Annualized rent per occupied square foot increased 14.7% to $16.50(2) FFO, as adjusted (attributable to common stockholders and OP unit holders), increased by 445% YoY(1) Leverage – 52% Net Debt / Cost Basis YTD 6/30/2021 Highlights Increased total self storage-related revenues by 34.7% YoY Net loss attributable to common stockholders decreased $25.8M YoY Strong YoY same-store results Revenues increased 15.5%(1) Operating expenses increased 4.1%(1) NOI increased 21.4%(1) Average same store physical occupancy increased 530bps to 94.5% YoY Annualized rent per occupied square foot increased 8.9% to $15.93(2) FFO, as adjusted (attributable to common stockholders and OP unit holders), increased by 287% YoY(1)

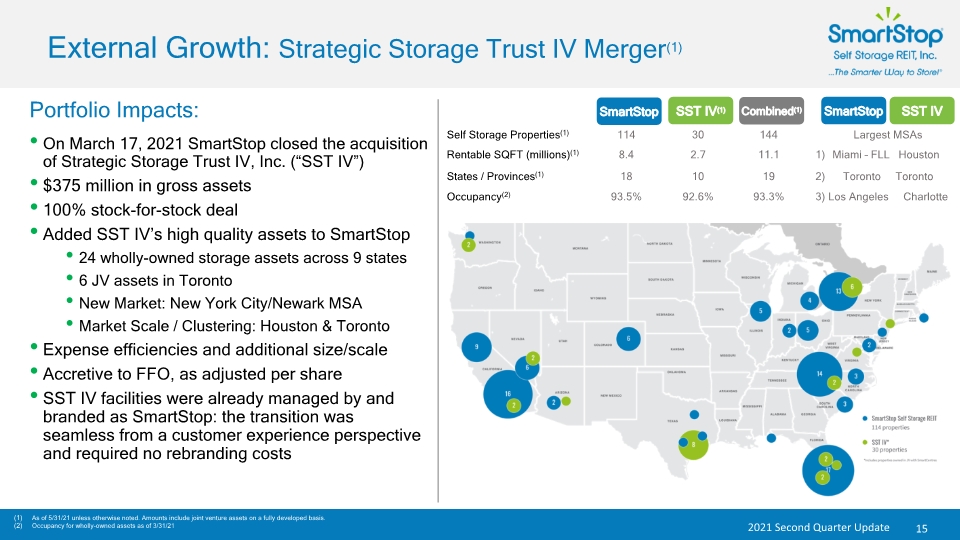

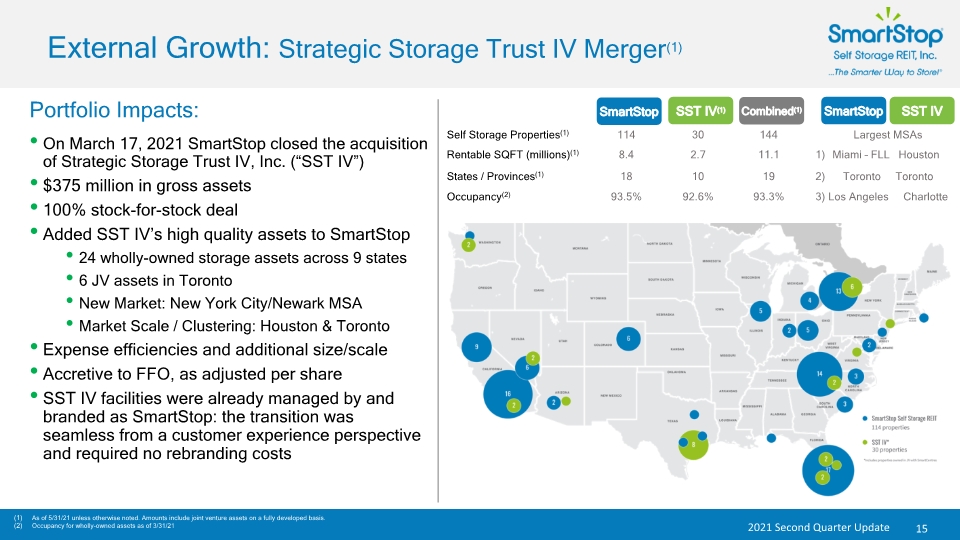

External Growth: Strategic Storage Trust IV Merger(1) 15 Portfolio Impacts: (5) As of 5/31/21 unless otherwise noted. Amounts include joint venture assets on a fully developed basis. Occupancy for wholly-owned assets as of 3/31/21 On March 17, 2021 SmartStop closed the acquisition of Strategic Storage Trust IV, Inc. (“SST IV”) $375 million in gross assets 100% stock-for-stock deal Added SST IV’s high quality assets to SmartStop 24 wholly-owned storage assets across 9 states 6 JV assets in Toronto New Market: New York City/Newark MSA Market Scale / Clustering: Houston & Toronto Expense efficiencies and additional size/scale Accretive to FFO, as adjusted per share SST IV facilities were already managed by and branded as SmartStop: the transition was seamless from a customer experience perspective and required no rebranding costs SmartStop SST IV(1) Combined(1) SmartStop SST IV Self Storage Properties(1) Occupancy(2) Rentable SQFT (millions)(1) States / Provinces(1) 114 93.5% 8.4 18 30 92.6% 2.7 10 144 93.3% 11.1 19 Largest MSAs Los Angeles Charlotte Miami – FLL Houston Toronto Toronto 3) 1) 2)

SST IV Merger: High Quality Properties in Key Growth Markets 16 Toronto, ONT Houston, TX Naples, FL Orlando, FL San Diego, CA Charlotte, NC

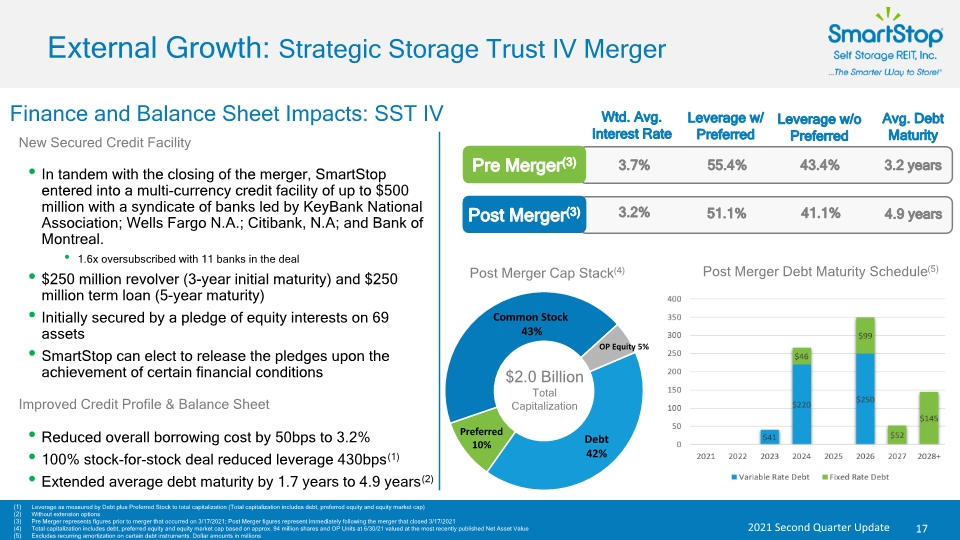

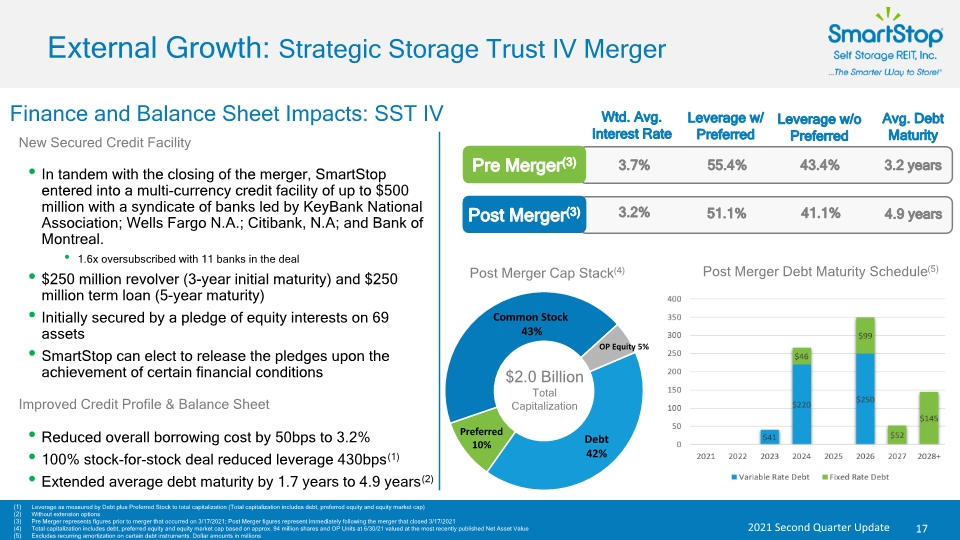

External Growth: Strategic Storage Trust IV Merger 17 Finance and Balance Sheet Impacts: SST IV In tandem with the closing of the merger, SmartStop entered into a multi-currency credit facility of up to $500 million with a syndicate of banks led by KeyBank National Association; Wells Fargo N.A.; Citibank, N.A; and Bank of Montreal. 1.6x oversubscribed with 11 banks in the deal $250 million revolver (3-year initial maturity) and $250 million term loan (5-year maturity) Initially secured by a pledge of equity interests on 69 assets SmartStop can elect to release the pledges upon the achievement of certain financial conditions New Secured Credit Facility Leverage as measured by Debt plus Preferred Stock to total capitalization (Total capitalization includes debt, preferred equity and equity market cap) Without extension options Pre Merger represents figures prior to merger that occurred on 3/17/2021; Post Merger figures represent immediately following the merger that closed 3/17/2021 Total capitalization includes debt, preferred equity and equity market cap based on approx. 94 million shares and OP Units at 6/30/21 valued at the most recently published Net Asset Value Excludes recurring amortization on certain debt instruments. Dollar amounts in millions Pre Merger(3) Improved Credit Profile & Balance Sheet Reduced overall borrowing cost by 50bps to 3.2% 100% stock-for-stock deal reduced leverage 430bps(1) Extended average debt maturity by 1.7 years to 4.9 years(2) $2.0 Billion Total Capitalization Post Merger(3) Post Merger Debt Maturity Schedule(5) Post Merger Cap Stack(4) 55.4% 3.2% Wtd. Avg. Interest Rate Leverage w/ Preferred Avg. Debt Maturity 3.7% 51.1% 3.2 years 4.9 years Leverage w/o Preferred 43.4% 41.1%

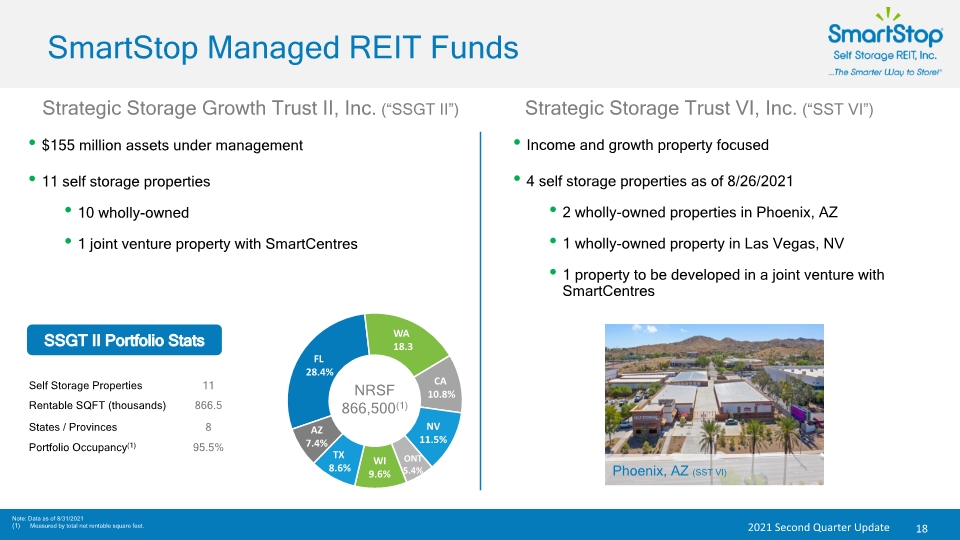

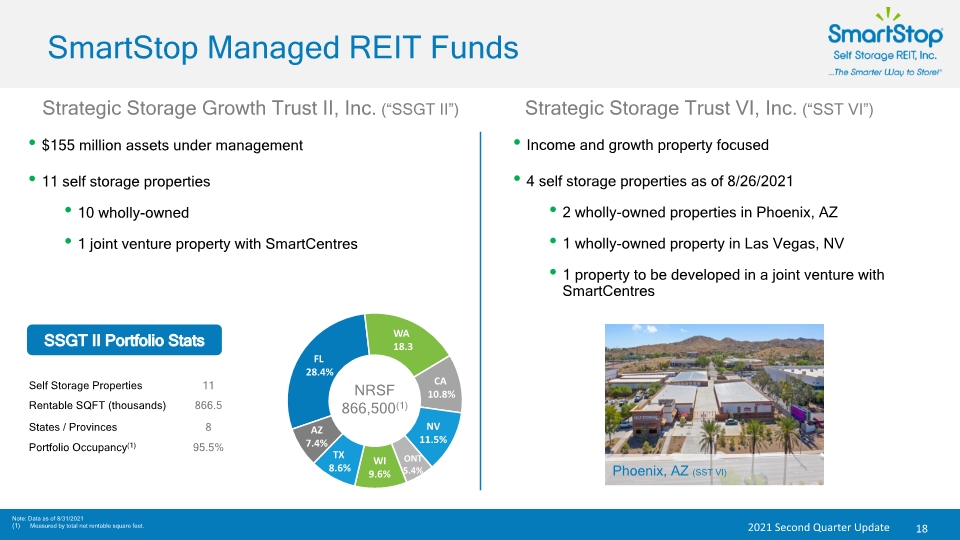

SmartStop Managed REIT Funds 18 (5) Strategic Storage Growth Trust II, Inc. (“SSGT II”) Strategic Storage Trust VI, Inc. (“SST VI”) $155 million assets under management 11 self storage properties 10 wholly-owned 1 joint venture property with SmartCentres SSGT II Portfolio Stats Income and growth property focused 4 self storage properties as of 8/26/2021 2 wholly-owned properties in Phoenix, AZ 1 wholly-owned property in Las Vegas, NV 1 property to be developed in a joint venture with SmartCentres Phoenix, AZ (SST VI) NRSF 866,500(1) Note: Data as of 8/31/2021 Measured by total net rentable square feet. Self Storage Properties Portfolio Occupancy(1) Rentable SQFT (thousands) States / Provinces 11 95.5% 866.5 8 WA 18.3

Store Branding Brand Awareness Strong and Valuable Brand Identity 19 Well-Known Brand Name Brand Protection Recognizable Signage and Colors SmartStop® Brand Appearances Registered trademarks in U.S. / Canada 250 U.S. / Canadian domain names Continued investment in brand and marketing translates to customer awareness Moving Supplies Website Special Events / Sponsorships Employee Uniforms Processes in place to act upon brand infringement 157 Stores operating under the SmartStop® brand Digital Marketing

Ability to search for and reserve units at one of SmartStop’s 140+ locations Integrated into revenue management system to update pricing and occupancy real time Online Reservations Industry Leader In Customer Experience 20 Technology-driven platform gives SmartStop the ability to meet customers’ unique service needs Dedicated call center employees streamline the customer experience Agents able to use web-based or SMS text features to complete leasing process to meet customer needs Dedicated In-House Call Center Convenient online access allowing customers to seamlessly browse available units and rent units on the web SmartStop’s state-of-the-art website is optimized to reduce barriers in the shopping experience and fast loading times Online Rentals Highly-trained SmartStop employees on facility premises to accommodate walk-ins Staff trained to utilize SmartStop’s management technology and tools to provide high-quality in-person sales experience Walk-Ins Winner - Best Customer Service 2021 Award for Storage Companies

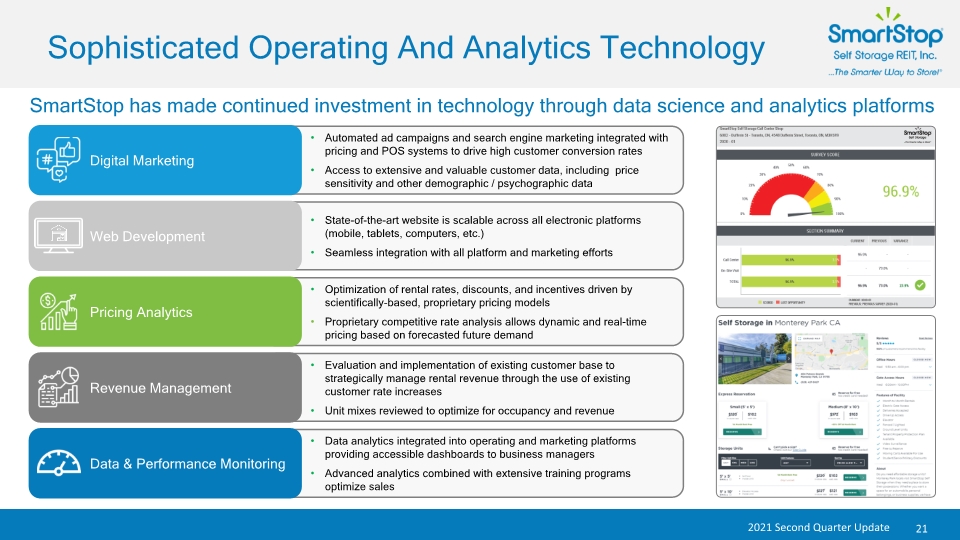

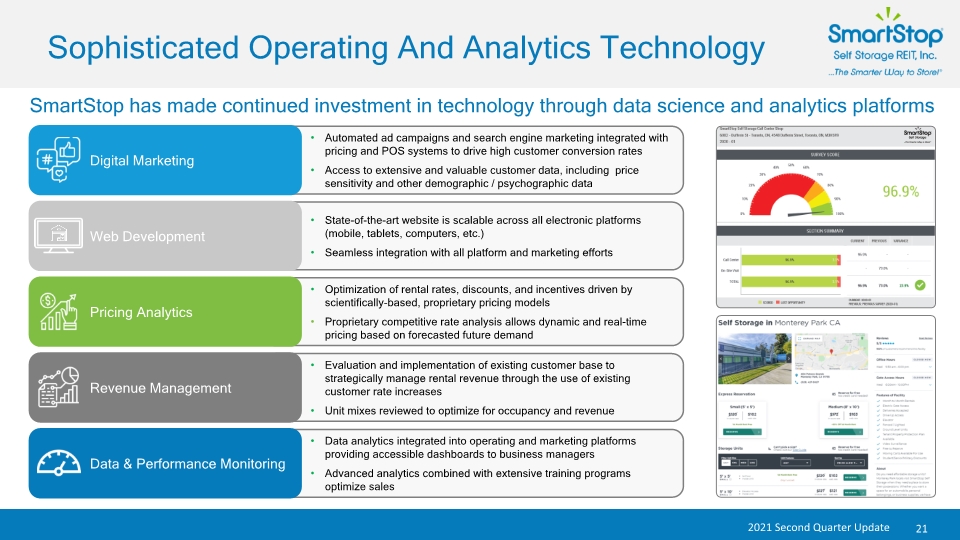

Sophisticated Operating And Analytics Technology 21 Optimization of rental rates, discounts, and incentives driven by scientifically-based, proprietary pricing models Proprietary competitive rate analysis allows dynamic and real-time pricing based on forecasted future demand Evaluation and implementation of existing customer base to strategically manage rental revenue through the use of existing customer rate increases Unit mixes reviewed to optimize for occupancy and revenue Data analytics integrated into operating and marketing platforms providing accessible dashboards to business managers Advanced analytics combined with extensive training programs optimize sales State-of-the-art website is scalable across all electronic platforms (mobile, tablets, computers, etc.) Seamless integration with all platform and marketing efforts Automated ad campaigns and search engine marketing integrated with pricing and POS systems to drive high customer conversion rates Access to extensive and valuable customer data, including price sensitivity and other demographic / psychographic data Pricing Analytics Revenue Management Data & Performance Monitoring Web Development Digital Marketing SmartStop has made continued investment in technology through data science and analytics platforms

Questions? 22

Appendix 23

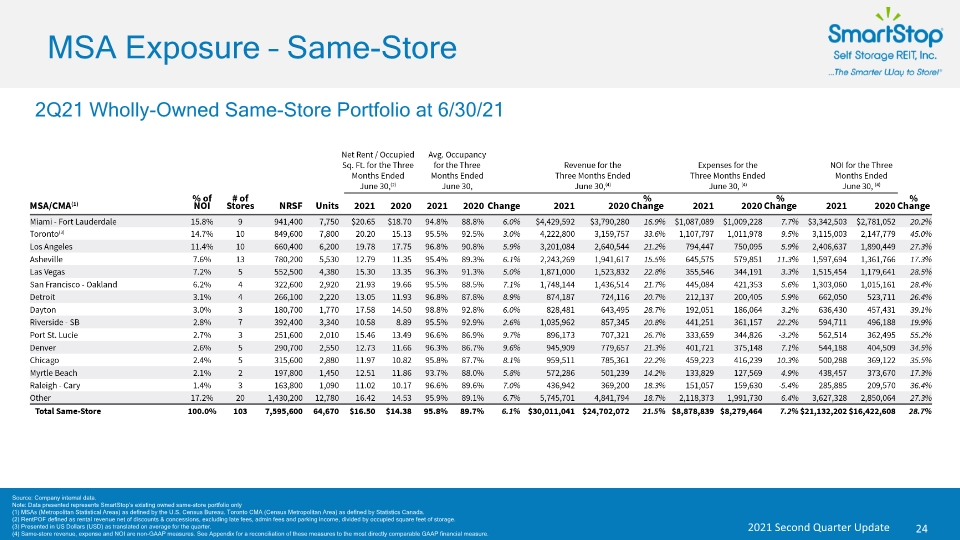

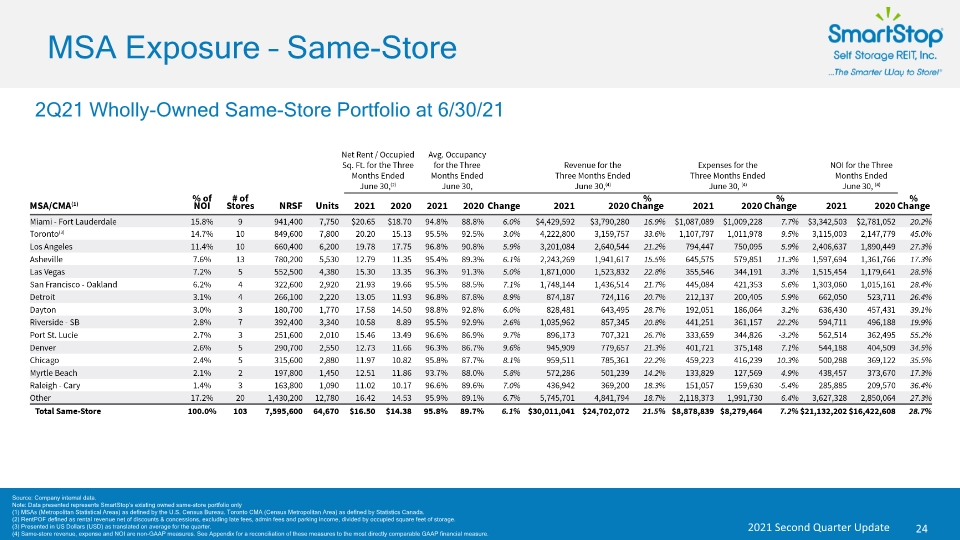

MSA Exposure – Same-Store 24 Source: Company internal data. Note: Data presented represents SmartStop’s existing owned same store portfolio only MSAs (Metropolitan Statistical Areas) as defined by the U.S. Census Bureau. 2Q21 Wholly-Owned Same-Store Portfolio at 6/30/21 Source: Company internal data. Note: Data presented represents SmartStop’s existing owned same-store portfolio only (1) MSAs (Metropolitan Statistical Areas) as defined by the U.S. Census Bureau. Toronto CMA (Census Metropolitan Area) as defined by Statistics Canada. (2) RentPOF defined as rental revenue net of discounts & concessions, excluding late fees, admin fees and parking income, divided by occupied square feet of storage. (3) Presented in US Dollars (USD) as translated on average for the quarter. (4) Same-store revenue, expense and NOI are non-GAAP measures. See Appendix for a reconciliation of these measures to the most directly comparable GAAP financial measure.

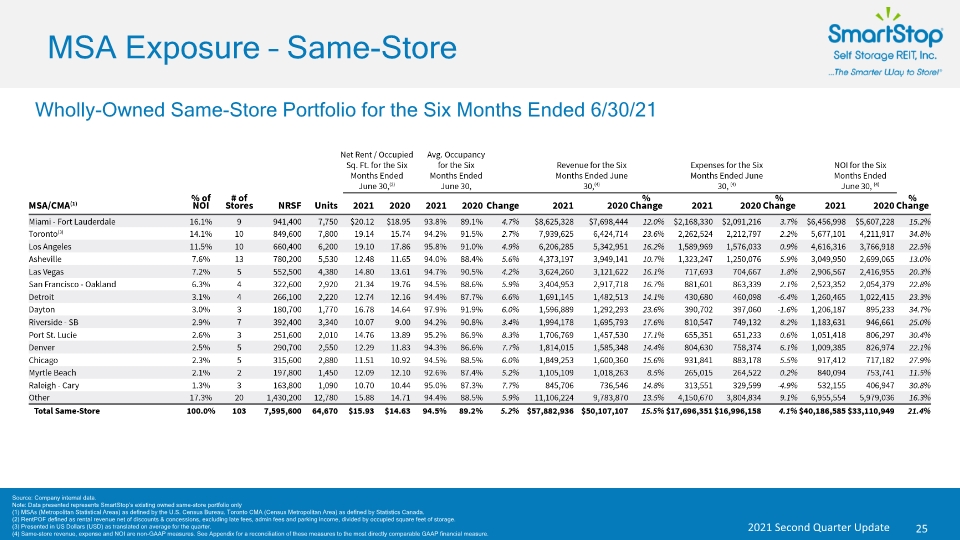

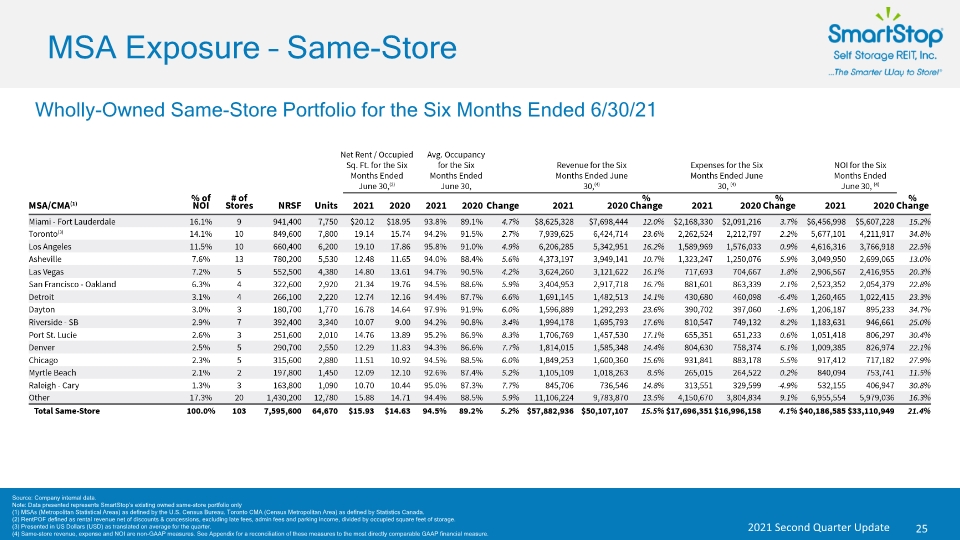

MSA Exposure – Same-Store 25 Source: Company internal data. Note: Data presented represents SmartStop’s existing owned same store portfolio only MSAs (Metropolitan Statistical Areas) as defined by the U.S. Census Bureau. Wholly-Owned Same-Store Portfolio for the Six Months Ended 6/30/21 Source: Company internal data. Note: Data presented represents SmartStop’s existing owned same-store portfolio only (1) MSAs (Metropolitan Statistical Areas) as defined by the U.S. Census Bureau. Toronto CMA (Census Metropolitan Area) as defined by Statistics Canada. (2) RentPOF defined as rental revenue net of discounts & concessions, excluding late fees, admin fees and parking income, divided by occupied square feet of storage. (3) Presented in US Dollars (USD) as translated on average for the quarter. (4) Same-store revenue, expense and NOI are non-GAAP measures. See Appendix for a reconciliation of these measures to the most directly comparable GAAP financial measure.

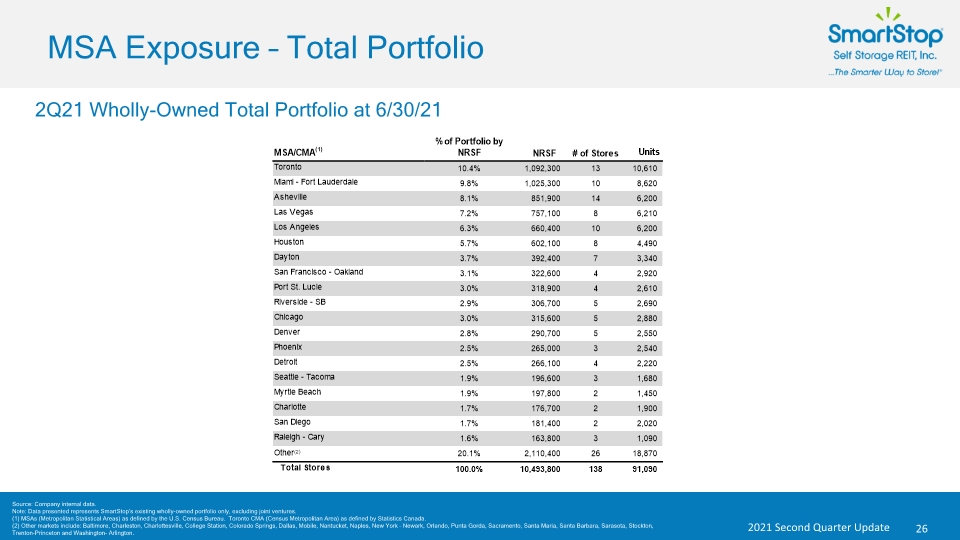

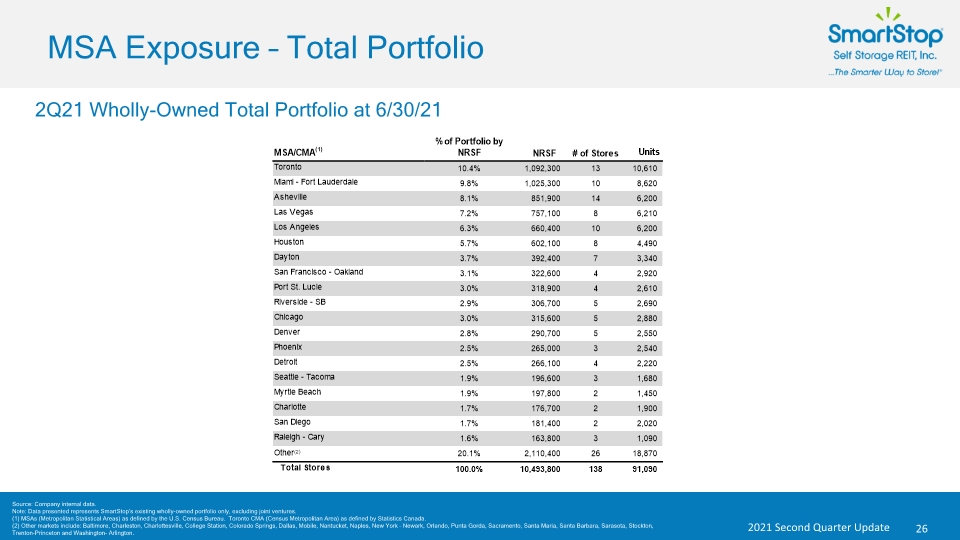

MSA Exposure – Total Portfolio 26 2Q21 Wholly-Owned Total Portfolio at 6/30/21 Source: Company internal data. Note: Data presented represents SmartStop’s existing wholly-owned portfolio only, excluding joint ventures. (1) MSAs (Metropolitan Statistical Areas) as defined by the U.S. Census Bureau. Toronto CMA (Census Metropolitan Area) as defined by Statistics Canada. (2) Other markets include: Baltimore, Charleston, Charlottesville, College Station, Colorado Springs, Dallas, Mobile, Nantucket, Naples, New York – Newark, Orlando, Punta Gorda, Sacramento, Santa Maria, Santa Barbara, Sarasota, Stockton, Trenton-Princeton and Washington- Arlington.

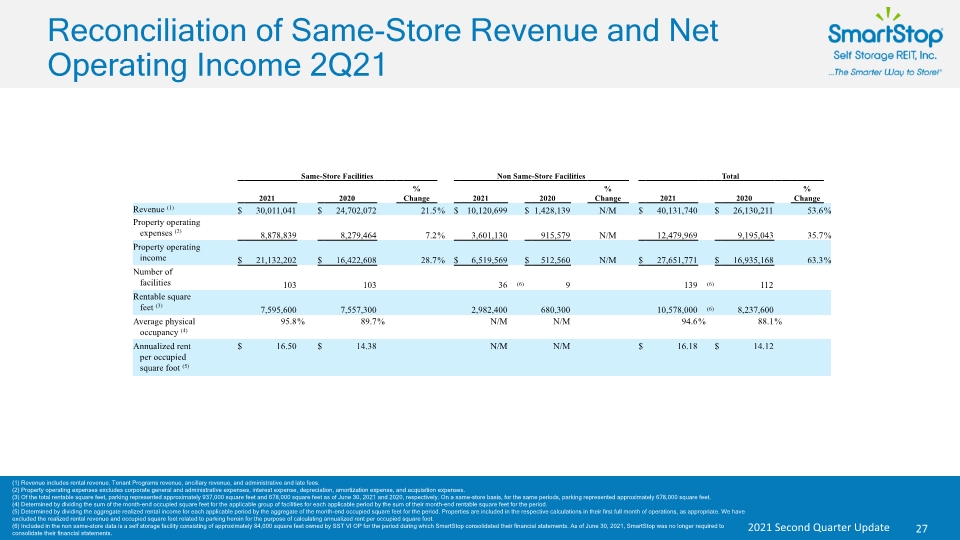

Reconciliation of Same-Store Revenue and Net Operating Income 2Q21 27 (1) Revenue includes rental revenue, Tenant Programs revenue, ancillary revenue, and administrative and late fees. (2) Property operating expenses excludes corporate general and administrative expenses, interest expense, depreciation, amortization expense, and acquisition expenses. (3) Of the total rentable square feet, parking represented approximately 937,000 square feet and 678,000 square feet as of June 30, 2021 and 2020, respectively. On a same-store basis, for the same periods, parking represented approximately 678,000 square feet. (4) Determined by dividing the sum of the month-end occupied square feet for the applicable group of facilities for each applicable period by the sum of their month-end rentable square feet for the period. (5) Determined by dividing the aggregate realized rental income for each applicable period by the aggregate of the month-end occupied square feet for the period. Properties are included in the respective calculations in their first full month of operations, as appropriate. We have excluded the realized rental revenue and occupied square feet related to parking herein for the purpose of calculating annualized rent per occupied square foot. (6) Included in the non same-store data is a self storage facility consisting of approximately 84,000 square feet owned by SST VI OP for the period during which SmartStop consolidated their financial statements. As of June 30, 2021, SmartStop was no longer required to consolidate their financial statements.

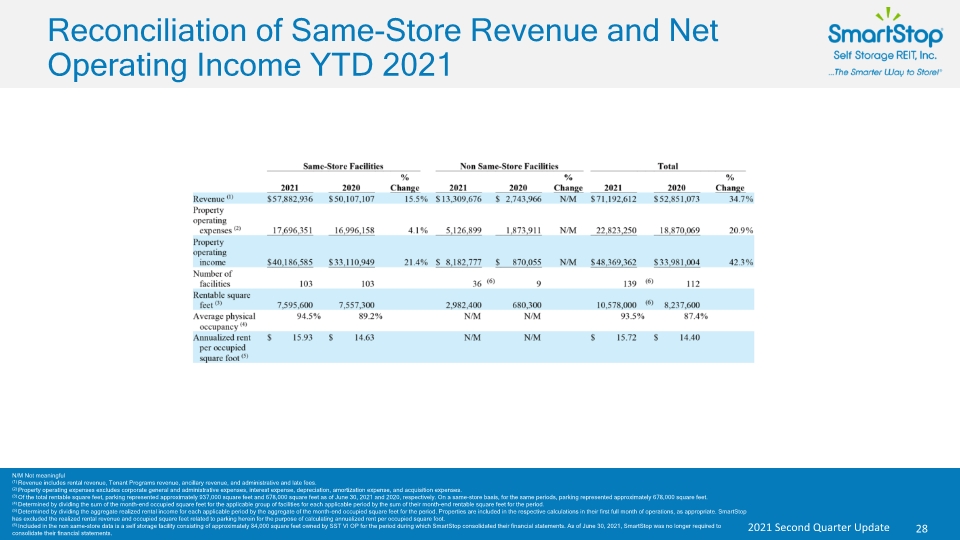

Reconciliation of Same-Store Revenue and Net Operating Income YTD 2021 28 N/M Not meaningful (1) Revenue includes rental revenue, Tenant Programs revenue, ancillary revenue, and administrative and late fees. (2) Property operating expenses excludes corporate general and administrative expenses, interest expense, depreciation, amortization expense, and acquisition expenses. (3) Of the total rentable square feet, parking represented approximately 937,000 square feet and 678,000 square feet as of June 30, 2021 and 2020, respectively. On a same-store basis, for the same periods, parking represented approximately 678,000 square feet. (4) Determined by dividing the sum of the month-end occupied square feet for the applicable group of facilities for each applicable period by the sum of their month-end rentable square feet for the period. (5) Determined by dividing the aggregate realized rental income for each applicable period by the aggregate of the month-end occupied square feet for the period. Properties are included in the respective calculations in their first full month of operations, as appropriate. SmartStop has excluded the realized rental revenue and occupied square feet related to parking herein for the purpose of calculating annualized rent per occupied square foot. (6) Included in the non same-store data is a self storage facility consisting of approximately 84,000 square feet owned by SST VI OP for the period during which SmartStop consolidated their financial statements. As of June 30, 2021, SmartStop was no longer required to consolidate their financial statements.

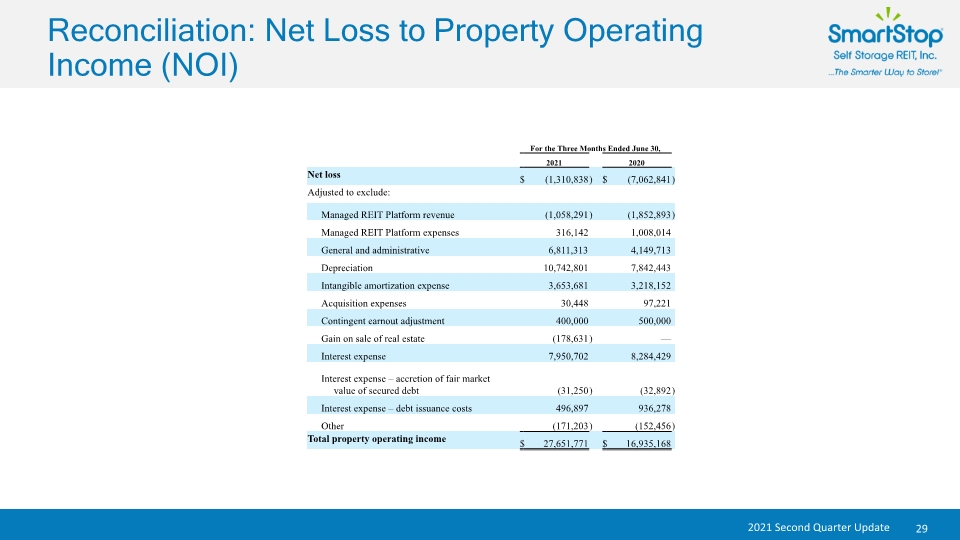

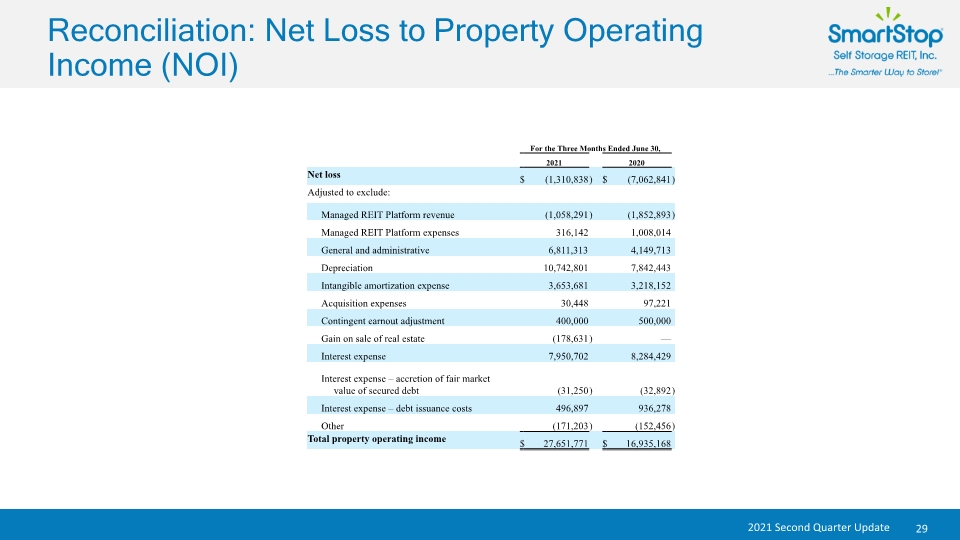

Reconciliation: Net Loss to Property Operating Income (NOI) 29

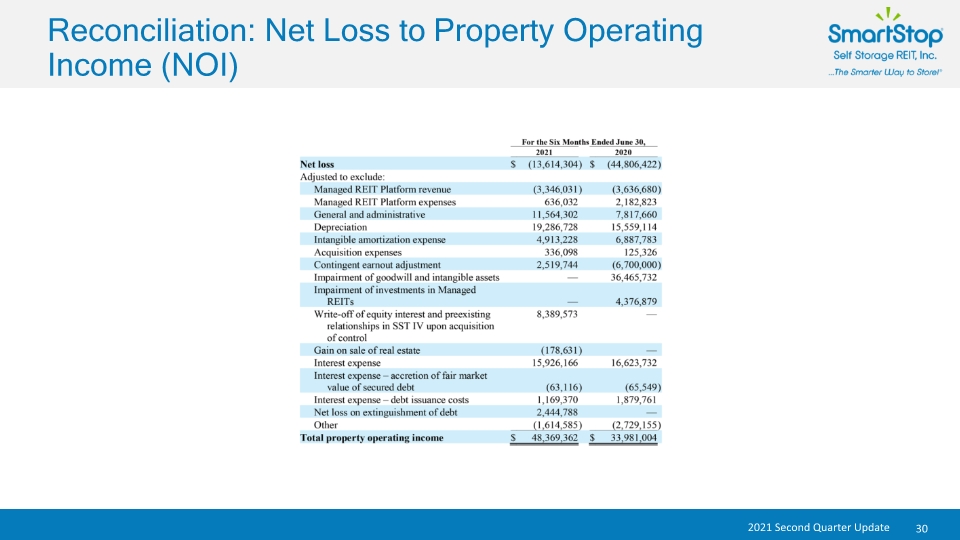

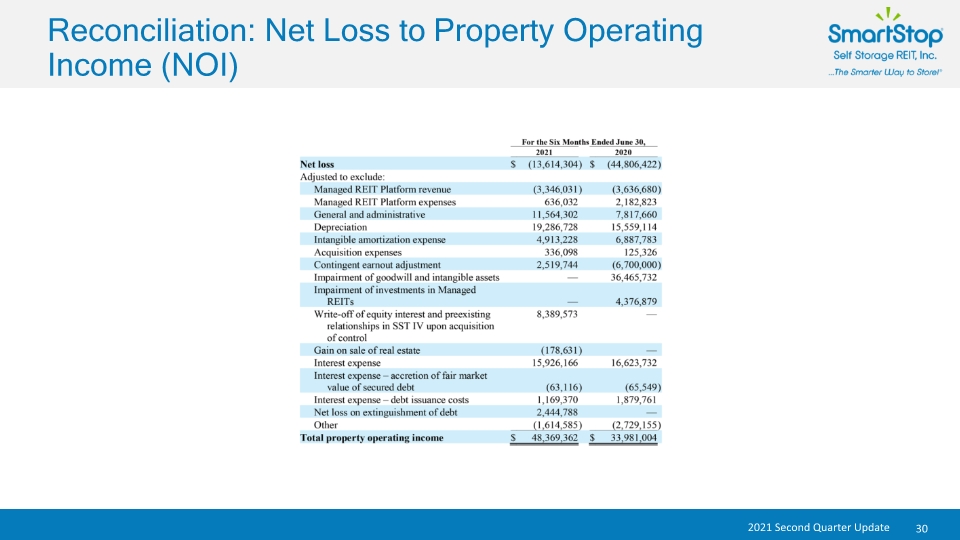

Reconciliation: Net Loss to Property Operating Income (NOI) 30

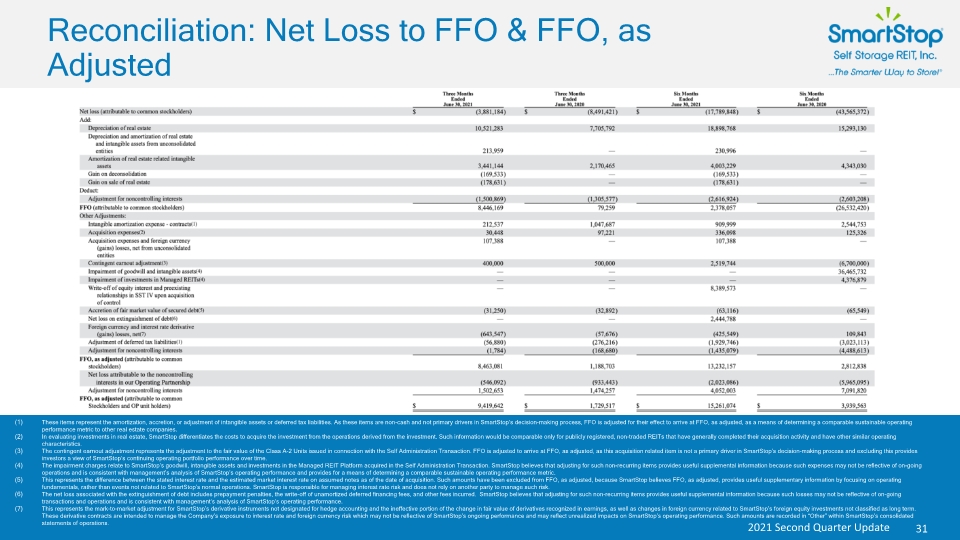

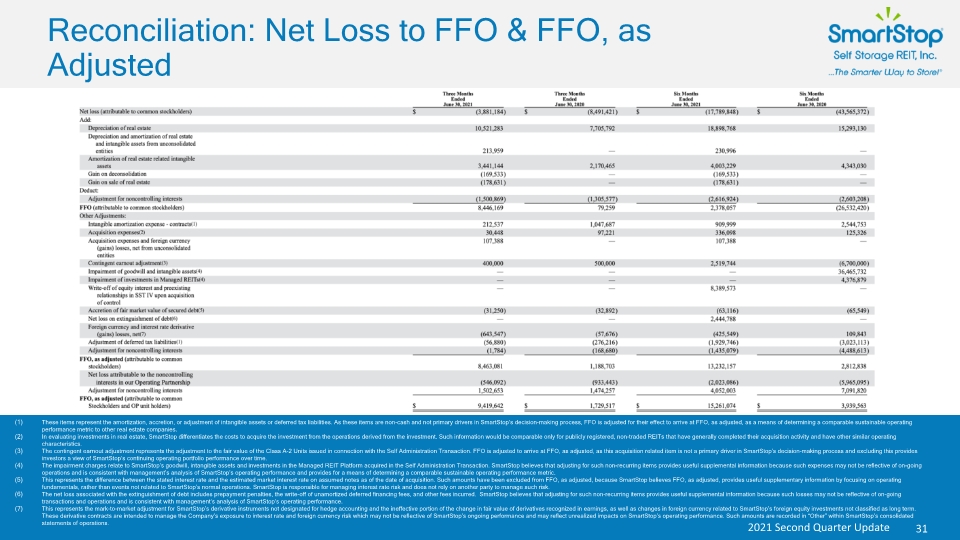

Reconciliation: Net Loss to FFO & FFO, as Adjusted 31 These items represent the amortization, accretion, or adjustment of intangible assets or deferred tax liabilities. As these items are non-cash and not primary drivers in SmartStop’s decision-making process, FFO is adjusted for their effect to arrive at FFO, as adjusted, as a means of determining a comparable sustainable operating performance metric to other real estate companies. In evaluating investments in real estate, SmartStop differentiates the costs to acquire the investment from the operations derived from the investment. Such information would be comparable only for publicly registered, non-traded REITs that have generally completed their acquisition activity and have other similar operating characteristics. The contingent earnout adjustment represents the adjustment to the fair value of the Class A-2 Units issued in connection with the Self Administration Transaction. FFO is adjusted to arrive at FFO, as adjusted, as this acquisition related item is not a primary driver in SmartStop’s decision-making process and excluding this provides investors a view of SmartStop’s continuing operating portfolio performance over time. The impairment charges relate to SmartStop’s goodwill, intangible assets and investments in the Managed REIT Platform acquired in the Self Administration Transaction. SmartStop believes that adjusting for such non-recurring items provides useful supplemental information because such expenses may not be reflective of on-going operations and is consistent with management’s analysis of SmartStop’s operating performance and provides for a means of determining a comparable sustainable operating performance metric. This represents the difference between the stated interest rate and the estimated market interest rate on assumed notes as of the date of acquisition. Such amounts have been excluded from FFO, as adjusted, because SmartStop believes FFO, as adjusted, provides useful supplementary information by focusing on operating fundamentals, rather than events not related to SmartStop’s normal operations. SmartStop is responsible for managing interest rate risk and does not rely on another party to manage such risk. The net loss associated with the extinguishment of debt includes prepayment penalties, the write-off of unamortized deferred financing fees, and other fees incurred. SmartStop believes that adjusting for such non-recurring items provides useful supplemental information because such losses may not be reflective of on-going transactions and operations and is consistent with management’s analysis of SmartStop’s operating performance. This represents the mark-to-market adjustment for SmartStop’s derivative instruments not designated for hedge accounting and the ineffective portion of the change in fair value of derivatives recognized in earnings, as well as changes in foreign currency related to SmartStop’s foreign equity investments not classified as long term. These derivative contracts are intended to manage the Company’s exposure to interest rate and foreign currency risk which may not be reflective of SmartStop’s ongoing performance and may reflect unrealized impacts on SmartStop’s operating performance. Such amounts are recorded in “Other” within SmartStop’s consolidated statements of operations.

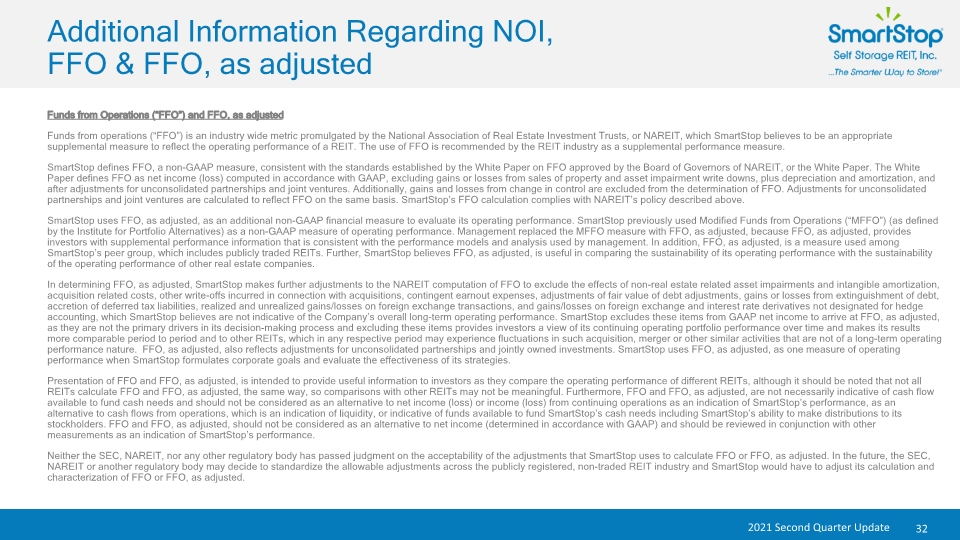

Additional Information Regarding NOI, FFO & FFO, as adjusted 32 Funds from Operations (“FFO”) and FFO, as adjusted Funds from operations (“FFO”) is an industry wide metric promulgated by the National Association of Real Estate Investment Trusts, or NAREIT, which SmartStop believes to be an appropriate supplemental measure to reflect the operating performance of a REIT. The use of FFO is recommended by the REIT industry as a supplemental performance measure. SmartStop defines FFO, a non-GAAP measure, consistent with the standards established by the White Paper on FFO approved by the Board of Governors of NAREIT, or the White Paper. The White Paper defines FFO as net income (loss) computed in accordance with GAAP, excluding gains or losses from sales of property and asset impairment write downs, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Additionally, gains and losses from change in control are excluded from the determination of FFO. Adjustments for unconsolidated partnerships and joint ventures are calculated to reflect FFO on the same basis. SmartStop’s FFO calculation complies with NAREIT’s policy described above. SmartStop uses FFO, as adjusted, as an additional non-GAAP financial measure to evaluate its operating performance. SmartStop previously used Modified Funds from Operations (“MFFO”) (as defined by the Institute for Portfolio Alternatives) as a non-GAAP measure of operating performance. Management replaced the MFFO measure with FFO, as adjusted, because FFO, as adjusted, provides investors with supplemental performance information that is consistent with the performance models and analysis used by management. In addition, FFO, as adjusted, is a measure used among SmartStop’s peer group, which includes publicly traded REITs. Further, SmartStop believes FFO, as adjusted, is useful in comparing the sustainability of its operating performance with the sustainability of the operating performance of other real estate companies. In determining FFO, as adjusted, SmartStop makes further adjustments to the NAREIT computation of FFO to exclude the effects of non-real estate related asset impairments and intangible amortization, acquisition related costs, other write-offs incurred in connection with acquisitions, contingent earnout expenses, adjustments of fair value of debt adjustments, gains or losses from extinguishment of debt, accretion of deferred tax liabilities, realized and unrealized gains/losses on foreign exchange transactions, and gains/losses on foreign exchange and interest rate derivatives not designated for hedge accounting, which SmartStop believes are not indicative of the Company’s overall long-term operating performance. SmartStop excludes these items from GAAP net income to arrive at FFO, as adjusted, as they are not the primary drivers in its decision-making process and excluding these items provides investors a view of its continuing operating portfolio performance over time and makes its results more comparable period to period and to other REITs, which in any respective period may experience fluctuations in such acquisition, merger or other similar activities that are not of a long-term operating performance nature. FFO, as adjusted, also reflects adjustments for unconsolidated partnerships and jointly owned investments. SmartStop uses FFO, as adjusted, as one measure of operating performance when SmartStop formulates corporate goals and evaluate the effectiveness of its strategies. Presentation of FFO and FFO, as adjusted, is intended to provide useful information to investors as they compare the operating performance of different REITs, although it should be noted that not all REITs calculate FFO and FFO, as adjusted, the same way, so comparisons with other REITs may not be meaningful. Furthermore, FFO and FFO, as adjusted, are not necessarily indicative of cash flow available to fund cash needs and should not be considered as an alternative to net income (loss) or income (loss) from continuing operations as an indication of SmartStop’s performance, as an alternative to cash flows from operations, which is an indication of liquidity, or indicative of funds available to fund SmartStop’s cash needs including SmartStop’s ability to make distributions to its stockholders. FFO and FFO, as adjusted, should not be considered as an alternative to net income (determined in accordance with GAAP) and should be reviewed in conjunction with other measurements as an indication of SmartStop’s performance. Neither the SEC, NAREIT, nor any other regulatory body has passed judgment on the acceptability of the adjustments that SmartStop uses to calculate FFO or FFO, as adjusted. In the future, the SEC, NAREIT or another regulatory body may decide to standardize the allowable adjustments across the publicly registered, non-traded REIT industry and SmartStop would have to adjust its calculation and characterization of FFO or FFO, as adjusted.

Additional Information Regarding NOI, FFO & FFO, as adjusted 33 Net Operating Income or (“NOI”) NOI is a non-GAAP measure that SmartStop defines as net income (loss), computed in accordance with GAAP, generated from properties before corporate general and administrative expenses, asset management fees, interest expense, depreciation, amortization, acquisition expenses and other non-property related expenses. SmartStop believes that NOI is useful for investors as it provides a measure of the operating performance of its operating assets because NOI excludes certain items that are not associated with the ongoing operation of the properties. Additionally, SmartStop believes that NOI (also referred to as property operating income) is a widely accepted measure of comparative operating performance in the real estate community. However, SmartStop’s use of the term NOI may not be comparable to that of other real estate companies as they may have different methodologies for computing this amount.