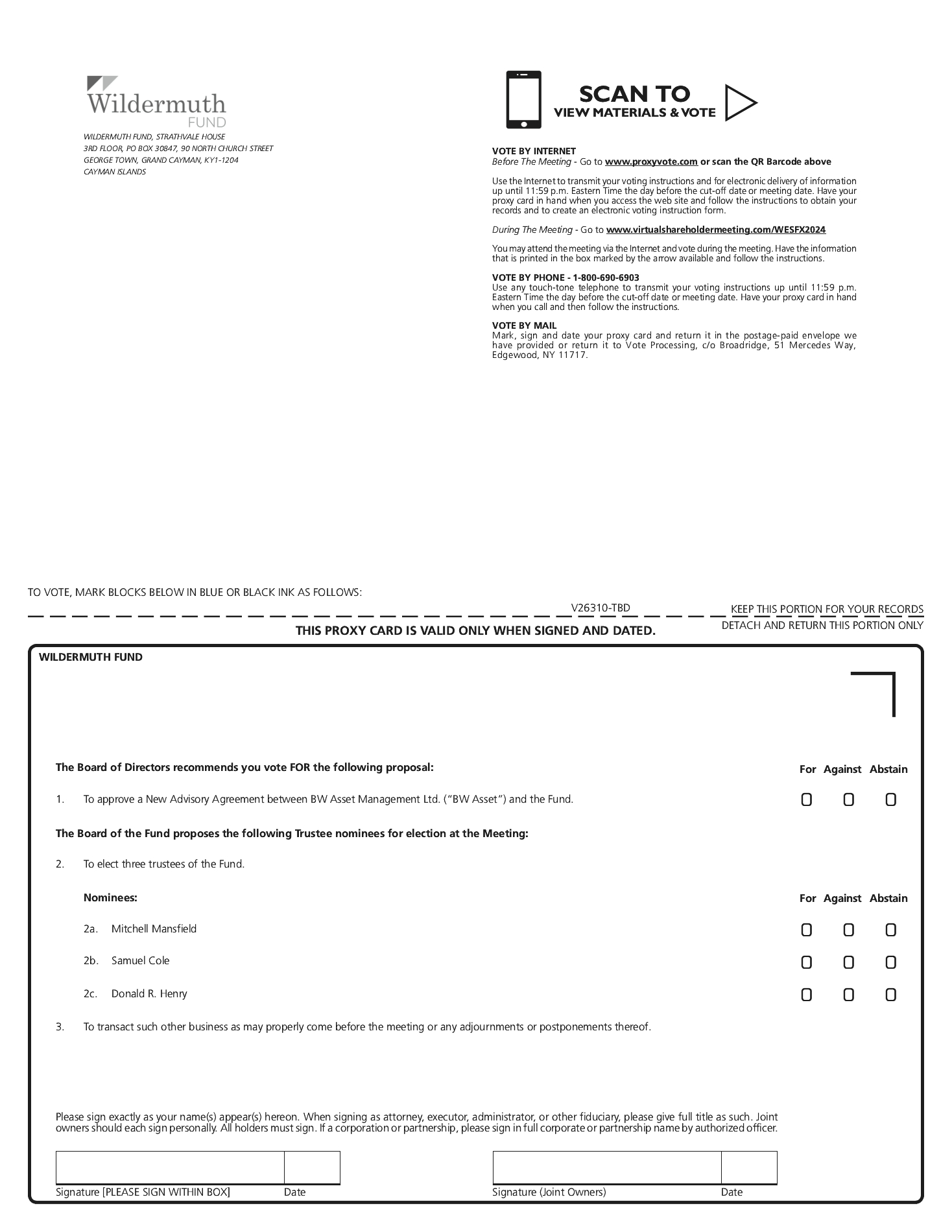

DESCRIPTION OF PROPOSAL 1:

APPROVAL OF NEW ADVISORY AGREEMENT

Background

In general, the Investment Company Act requires all new investment advisory agreements to be approved by both the Board and shareholders of the Fund.

As previously communicated to shareholders, the Fund adopted a plan of liquidation (“Plan of Liquidation” or “Plan”), which was effective as of June 29, 2023. Pursuant to the Plan, all of the Fund’s assets are to be liquidated and the proceeds to be distributed pro rata to Fund shareholders. As a result, the Fund has deviated from its stated investment objective, policies and strategies and is no longer actively pursuing its stated investment objective, policies and strategies. Instead, the Fund is operating solely to liquidate its assets and distribute the assets to shareholders. Pursuant to the Plan of Liquidation, following the liquidation and distribution of the Fund’s final assets, the Fund will then cease operations, de-register under the Investment Company Act, and dissolve.

Wildermuth Advisory, LLC (“Wildermuth”) served as the Fund’s investment adviser pursuant to an investment advisory agreement with the Fund (the “Prior Investment Advisory Agreement”) from the Fund’s inception in 2013 until the Board terminated the Prior Investment Advisory Agreement effective as of November 1, 2023. At the Board’s special meeting on November 1, 2023, the Board determined to terminate Wildermuth as the Fund’s investment adviser after, among other things, Wildermuth had informed the Board on October 30, 2023, that (i) following the adoption of the Plan of Liquidation, all of its employees resigned or will resign from Wildermuth and the lack of staffing will not allow Wildermuth to continue to provide investment advisory services to the Fund; and (ii) as of November 1, 2023, Wildermuth lacked the financial resources to continue to serve as the Fund’s investment adviser.

Additionally, the Board observed that Wildermuth did not have access to potential buyers of the Fund’s assets to sufficiently liquidate the assets in accordance with the Plan and in the best interests of the Fund and its shareholders. As a result, the Board desired to retain a new investment adviser with expertise and experience in fund liquidations and distressed securities to facilitate the liquidation of the Fund’s assets. Accordingly, the Board approved, and recommends that shareholders approve, the Fund entering into a new investment advisory agreement with BW Asset (“New Advisory Agreement”) pursuant to which BW Asset would liquidate the Fund’s assets. The Board did so because, among other things, the Board viewed BW Asset, its affiliates and personnel’s experience in, among other things, replacement investment advisor services, fund liquidations, private equity and distressed securities, as an opportunity to provide the Fund with access to a potentially wider universe of potential buyers of the Fund’s assets than Wildermuth utilized and potentially maximize returns for shareholders in the Fund’s liquidation.

As a result, at a meeting of the Board on November 1, 2023, the Board approved the appointment of BW Asset to serve as the interim investment adviser to the Fund pursuant to an interim advisory agreement (“Interim Advisory Agreement”) between BW Asset and the Fund as permitted by Rule 15a-4 under the Investment Company Act. The interim Advisory Agreement became effective as of November 1, 2023, and will expire on the earlier of either: (1) the date shareholders approve the New Advisory Agreement, and such results are certified; or (2) on April 1, 2024, which is the expiration of the 150-day period following the termination of the Prior Advisory Agreement.

Additionally, at the same meeting the Board, the Board, including a majority of the Independent Trustees, approved and recommended that shareholders approve that the Fund enter into, the New Advisory Agreement with BW Asset.

More information About BW Asset

BW Asset is an investment adviser registered with the Securities and Exchange Commission and is organized as a Cayman Islands corporation, located at 90 N Church Street, George Town, Cayman Islands.

BW Asset is a subsidiary of Kroll, the world’s premier provider of services related to funds and asset management, corporate restructuring, corporate governance, dispute resolution, valuation and risk management. Kroll is headquartered in New York and has nearly 6,500 professionals located in 34 countries and territories around the world. Kroll’s clients include:

| • | 65% of the Fortune 100 companies; |

| • | 51% of the Fortune 500 companies; |