- Company Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Oxford Immunotec Global DEF 14ADefinitive proxy

Filed: 29 Apr 20, 4:31pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☑ Filed by a Party other than the Registrant ☐

Check the appropriate box: | |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☑ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to § 240.14a-12 |

Oxford Immunotec Global PLC

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☑ | No fee required. | |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

1) | Title of each class of securities to which transaction applies: | |

2) | Aggregate number of securities to which transaction applies: | |

3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

4) | Proposed maximum aggregate value of transaction: | |

5) | Total fee paid: | |

☐ | Fee paid previously with preliminary materials. | |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| ||

1) | Amount Previously Paid: | |

2) | Form, Schedule or Registration Statement No.: | |

3) | Filing Party: | |

4) | Date Filed: | |

Oxford Immunotec Global PLC

94C Innovation Drive, Milton Park

Abingdon, Oxfordshire OX14 4RZ, U.K.

Registered Company No. 08654254

April 29, 2020

Dear Oxford Immunotec Global PLC Shareholder:

On behalf of the Board of Directors of Oxford Immunotec Global PLC (the “Company”), you are cordially invited to attend our 2020 annual general meeting of shareholders (the “Meeting”) on Thursday, June 11, 2020, at 11:00 a.m., London time (6:00 a.m., New York time), at 143 Park Drive, Milton Park, Abingdon, Oxfordshire, OX14 4RZ.

Although the Company is legally obliged to hold the Meeting, the Company’s Board of Directors (the “Board”) is very mindful of the potential public health impacts on the Company's employees, shareholders and broader stakeholders arising from the coronavirus (COVID-19) outbreak and has taken into consideration the compulsory ‘Stay at Home’ measures that have been published by the Government of the United Kingdom. As at the date hereof, these measures provide that public gatherings in the United Kingdom of more than two people are prohibited. Regrettably therefore, shareholders must not attend the Meeting in person and anyone seeking to attend the Meeting in person will be refused entry. The Company's advisers and other guests have also been asked not to attend in person.

The Board, however, understands the importance of the Meeting as an occasion for shareholders to comment on and evaluate the company’s affairs. Accordingly, we will be conducting a hybrid annual general meeting of shareholders and due to impact of the aforementioned ‘Stay at Home’ measures, we are recommending that all shareholders participate in the Meeting online by way of our live webcast as outlined in this proxy. Instructions for accessing the webcast are provided below. If you plan to attend the live webcast of the Meeting, please follow the registration instructions as outlined in this proxy statement.

The resolutions on which you can vote, our reasons for proposing the resolutions and details of the arrangements we have made for the Meeting are set out on the following pages. Other than the resolutions and the presentment of the U.K. statutory annual accounts and reports (see below), we are not aware of any other business to be conducted at the Meeting.

It is important that your shares be represented and voted at the Meeting, particularly in light of the prohibition on attending the Meeting in person. The Meeting will be convened with the minimum necessary quorum of shareholders present in person or by proxy holding one third of the Company’s outstanding ordinary shares. Our Chief Executive Officer, Dr. Peter Wrighton-Smith, will be physically present at the Meeting and will chair it. Since shareholders must not attend the Meeting in person and anyone seeking to attend the Meeting in person will be refused entry, shareholders are therefore strongly encouraged to vote in advance via the Internet, by telephone or by completing and mailing the enclosed proxy card and appointing Dr. Wrighton-Smith proxy with specific voting instructions. If you are a shareholder of record, please vote as soon as possible via the Internet, by telephone or by completing and mailing the enclosed proxy card. If you decide to attend the live webcast of the Meeting, you will be able to vote during the Meeting even if you have previously submitted your proxy. However, the Company strongly recommends shareholders submit proxies in advance of the Meeting to ensure that the Meeting is quorate and that your shares are represented. If you hold shares through a broker, bank or other nominee, please refer to “Questions and Answers About Voting” in the attached Proxy Statement for further information about voting your shares.

Because this is the Company’s first time holding a hybrid annual general meeting of shareholders, and because restrictions on travel mean that the Board cannot be physically present together, in accordance with Company’s Articles of Association, Dr. Wrighton-Smith, the chair of the Meeting, intends to restrict the ability of questions to be asked during the Meeting so as to permit the orderly conduct of its business. Instead, the Company invites shareholders to submit any questions at any time up to 48 hours prior to the Meeting to the Company at www.meetingcenter.io/245697395. The instructions on how to ask questions in advance of the Meeting are described below in this proxy statement. These include any questions that shareholders may have in relation to our U.K. statutory annual accounts and reports for the period January 1, 2019 through December 31, 2019. At the conclusion of the resolutions being put to the Meeting, the Company will endeavour to answer all questions so submitted (subject to Dr. Wrighton-Smith’s view that such questions are in order).

To attend the live webcast of the Meeting, shareholders should visit www.meetingcenter.io/245697395. The password for the Meeting is OXFD2020. Those planning to listen should connect to the live webcast at least 10 minutes prior to the start of the Meeting.

The Meeting webcast will also be archived on the Investor Relations section of our website.

Thank you for your continued support of Oxford Immunotec Global PLC. We appreciate your ongoing interest in our business, and we hope you will be able to attend the live webcast of the Meeting.

Sincerely,

/s/ Patrick J. Balthrop, Sr. Patrick J. Balthrop, Sr. Chairman of the Board of Directors |

Oxford Immunotec Global PLC

94C Innovation Drive, Milton Park

Abingdon, Oxfordshire OX14 4RZ, U.K.

Registered Company No. 08654254

Notice of 2020 Annual General Meeting of Shareholders to be held June 11, 2020

Oxford Immunotec Global PLC, a public limited company incorporated under the laws of England and Wales (the “Company,” “we,” “us” and “our”), will hold its 2020 annual general meeting of shareholders (the “Meeting”) on June 11, 2020, at 11:00 a.m., London time (6:00 a.m., New York time), with a physical location at 143 Park Drive, Milton Park,, Abingdon, Oxfordshire, OX14 4RZ. Simultaneously, the Meeting will be conducted via live webcast at: www.meetingcenter.io/245697395.

Shareholders attending the Meeting via live webcast will be able to listen to the Meeting live, vote, and submit questions in advance. In light of the current ‘Stay at Home’ measures that have been published by the Government of the United Kingdom due to the coronavirus (COVID-19) outbreak, shareholders must not attend the Meeting in person.

The items of business are to consider and vote on the following:

Ordinary resolutions

1. To elect Patrick J. Balthrop, Sr. as a class I director for a term to expire at the 2023 annual general meeting of shareholders.

2. To elect Patricia Randall as a class I director for a term to expire at the 2023 annual general meeting of shareholders.

3. To elect Herm Rosenman as a class I director for a term to expire at the 2023 annual general meeting of shareholders.

4. To ratify the Audit Committee’s appointment of Ernst & Young LLP, the U.S. member firm of Ernst & Young Global Limited, as our U.S. independent registered public accounting firm for the fiscal year ending December 31, 2020.

5. To re-appoint the U.K. member firm of Ernst & Young Global Limited, Ernst & Young LLP, as our U.K. statutory auditors under the U.K. Companies Act 2006, to hold office until the conclusion of the next annual general meeting of shareholders at which the U.K. statutory accounts and reports are presented.

6. To authorize the Audit Committee to determine our U.K. statutory auditors’ remuneration for the fiscal year ending December 31, 2020.

7. To receive the U.K. statutory annual accounts and reports for the fiscal year ended December 31, 2019.

8. To receive and approve our U.K. statutory annual directors’ remuneration report for the year ended December 31, 2019, which is set forth as Part I of Annex A to this Proxy Statement.

9. To approve, on a non-binding, advisory basis, the compensation paid to the named executive officers of the Company as disclosed in the section of this Proxy Statement titled “Executive Compensation”.

10. To approve our Directors’ Remuneration Policy, which, if approved, will take effect upon the conclusion of the Meeting, the full text of which is set forth as Part II of Annex A to this Proxy Statement.

11. That, in substitution for all existing authorities, the Directors be, and are, hereby generally and unconditionally authorised pursuant to section 551 of the U.K. Companies Act 2006 to exercise all the powers of the Company to:

(a) allot shares in the Company and to grant rights to subscribe for or to convert any security into such shares up to an aggregate maximum nominal amount of £57,989, representing 33.3% of the nominal issued share capital of the Company; and

(b) allot further equity securities (within the meaning of section 560(1) of the U.K. Companies Act 2006) up to an aggregate maximum nominal amount of £57,989, representing 33.3% of the nominal issued share capital of the Company, in connection with a right issue in favour of shareholders where such authority to expire at the end of the next annual general meeting of the shareholders following the passing of this resolution or, if earlier, at the close of business on 11 September 2021 (unless previously revoked or varied by the Company in general meeting) but, in each case, prior to its expiry, revocation or variation the Company may make offers, and enter into agreements, which would, or might, require equity securities to be allotted (and treasury shares to be sold) after the authority expires, or is otherwise revoked or varied and the Directors may allot equity securities (and sell treasury shares) under any such offer or agreement as if this authority had not expired or been revoked or varied.

For the purposes of this Resolution 11 “rights issue” means an offer to:

(i) ordinary shareholders in proportion (as nearly as may be practicable) to their existing holdings; and

(ii) holders of other equity securities, as required by the rights of those securities or, subject to such rights, as the Directors otherwise consider necessary, to subscribe for further securities by means of the issue of a renounceable letter (or other negotiable document) which may be traded for a period before payment for the securities is due, including an offer to which the Directors may impose any limits or restrictions or make any other arrangements which they consider necessary or appropriate to deal with treasury shares, fractional entitlements, record dates, legal, regulatory or practical problems in, or under the laws of, any territory or any other matter.

Special resolutions

12. That, subject to the passing of Resolution 11 and in substitution for all existing authorities, the Directors be authorised to allot equity securities (as defined in section 560 of the U.K. Companies Act 2006) for cash under the authority given by Resolution 11 and/ or to sell ordinary shares held by the Company as treasury shares for cash as if section 561 of the U.K. Companies Act 2006 did not apply to any such allotment or sale, such authority to be limited:

(a) to the allotment of equity securities and/or sale of treasury shares for cash in connection with an offer of, or an invitation to apply for, equity securities (but in the case of an allotment pursuant to the authority granted by paragraph (b) of Resolution 11, by way of rights issue only):

(i) in favour of ordinary shareholders where the equity securities are proportionate (as nearly as practicable) to the respective number of ordinary shares held by such holders; and

(ii) to holders of other equity securities, as required by the rights of those securities or, subject to such rights, as the Directors otherwise consider necessary, and so that the Directors may impose any limits or restrictions or make any other arrangements as the Directors may deem necessary or appropriate in relation to treasury shares, fractional entitlements, record dates, or legal or practical problems arising in, or pursuant to, the laws of any territory or the requirements of any regulatory body or stock exchange in any territory, or any other matter; and

(b) to the allotment of equity securities or sale of treasury shares (otherwise than under paragraph (a) above) up to an aggregate maximum nominal amount of £8,698, representing 5% of the nominal issued share capital of the Company, such authority to expire at the end of the next annual general meeting of the shareholders following the passing of this resolution or, if earlier, at the close of business on 11 September 2021 (unless previously revoked or varied by the Company in general meeting) but, in each case, prior to its expiry, revocation or variation the Company may make offers, and enter into agreements, which would, or might, require equity securities to be allotted (and treasury shares to be sold) after the authority expires, or is otherwise revoked or varied and the Directors may allot equity securities (and sell treasury shares) under any such offer or agreement as if this authority had not expired or been revoked or varied.

For the purpose of this Resolution 12, “rights issue” has the same meaning as in Resolution 11 above.

13. That, subject to the passing of Resolution 11 and in substitution for all existing authorities, the Directors be authorised in addition to any authority granted under Resolution 12 to allot equity securities (as defined in section 560 of the U.K. Companies Act 2006) for cash under the authority given by Resolution 11 and/or to sell ordinary shares held by the Company as treasury shares for cash as if section 561 of the U.K. Companies Act 2006 did not apply to any such allotment or sale, such authority to be:

(a) limited to the allotment of equity securities or sale of treasury shares up to an aggregate maximum nominal amount of £8,698 representing 5% of the nominal issued share capital of the Company; and

(b) used only for the purposes of financing (or refinancing, if the authority is to be used within six months after the original transaction) a transaction which the Board of the Company determines to be an acquisition or other capital investment of a kind contemplated by the Statement of Principles on Disapplying Pre-Emption Rights most recently published by the Pre-Emption Group, such authority to expire at the end of the next annual general meeting of the shareholders following the passing of this resolution or, if earlier, at the close of business on 11 September 2021 (unless previously revoked or varied by the Company in general meeting) but, in each case, prior to its expiry, revocation or variation the Company may make offers, and enter into agreements, which would, or might, require equity securities to be allotted (and treasury shares to be sold) after the authority expires, or is otherwise revoked or varied and the Directors may allot equity securities (and sell treasury shares) under any such offer or agreement as if this authority had not expired or been revoked or varied.

We are not aware of any other business to come before the Meeting. Please refer to the attached Proxy Statement for detailed information on each of the proposals identified above.

Proposals 1 through 11 will be proposed as ordinary resolutions, which means that, assuming a quorum is present, each such proposal will be approved if the number of votes cast in favor exceed the number of votes cast against such proposal. Proposals 12 and 13 will be proposed as special resolutions, which means that, assuming a quorum is present, each such resolution will be approved if shareholders holding at least 75% in nominal value of the outstanding shares entitled to vote for or against the resolution present in person or by proxy at the Meeting vote in favor of such resolution.

The result of the shareholder vote on the following ordinary resolutions will not require our Board of Directors to take any action:

● | Proposal 7 regarding receipt of our U.K. statutory annual accounts and reports for the year ended December 31, 2019; | |

● | Proposal 8 regarding receipt and approval of our U.K. statutory directors’ annual report on remuneration for the year ended December 31, 2019; and | |

● | Proposal 9 regarding approval, on a non-binding, advisory basis, of the compensation paid to our named executive officers. |

Our Board of Directors values the opinions of our shareholders as expressed through such votes and will carefully consider the outcome of the votes on proposals 7, 8 and 9.

In accordance with article 79 of our Articles of Association, the chair of the Meeting will demand that every resolution be voted on by way of poll. This is to ensure that we can comply with our Articles of Association in light of shareholders being prohibited from attending the Meeting in person.

Only shareholders of record of our ordinary shares as of the close of business in New York City on April 22, 2020 are entitled to notice of and to vote at the Meeting and at any adjournment or postponement of the Meeting. A list of the shareholders entitled to vote at the Meeting is available at the Company’s registered office. Such list shall also be open to the examination of any shareholder present at the live webcast of the Meeting. In accordance with the provisions in the U.K. Companies Act 2006 and our Articles of Association, a shareholder of record is entitled to appoint another person as his or her proxy to exercise all or any of his or her rights to attend and to speak and vote at the Meeting and to appoint more than one proxy in relation to the Meeting (provided that each proxy is appointed to exercise the rights attached to a different share or shares held by him or her). Such proxy need not be a shareholder of record.

Pursuant to Chapter 5 of Part 16 of the U.K. Companies Act 2006 (sections 527 to 531), if a shareholder or group of shareholders meeting the qualification criteria set out in section 527 request that a matter be raised at the Meeting relating to the audit of the Company’s U.K. statutory annual accounts and reports (including the auditor’s report and the conduct of the audit), we will publish the matter so requested on our website. Such request may either be stated in full or, if made in support of another shareholder’s statement, must clearly identify the statement that is being supported. Further, the request must be authenticated by the shareholder or shareholders making such request and the request must be received by us at least one week before the Meeting.

If we are required to publish such a statement, we will not require the requesting shareholder or shareholders to pay any expenses we incur in complying with the request. We will forward the statement to our U.K. statutory auditors at the same time as or before the statement is made available on our website and we may address the statement at the Meeting.

The results of the polls taken on the resolutions at the Meeting and any other information required by the U.K. Companies Act 2006 will be made available on our website as soon as reasonably practicable following the Meeting and for the required period thereafter.

Your Vote is Important. Whether or not you plan to attend the live webcast of the Meeting, we strongly urge you to complete, sign, date and return the accompanying proxy card in the enclosed postage-paid envelope. Returning the proxy card does NOT deprive you of your right to attend the live webcast of the Meeting and to vote your shares at the Meeting. The Proxy Statement explains proxy voting and the matters to be voted on in more detail. Please read the Proxy Statement carefully. For specific information regarding the voting of your ordinary shares, please refer to the section of this Proxy Statement titled “Questions and Answers About Voting.”

Sincerely,

/s/ Janet Louise Kidd

Janet Louise Kidd

General Counsel and Company Secretary

OXFORD IMMUNOTEC GLOBAL PLC

94C Innovation Drive, Milton Park

Abingdon, Oxfordshire OX14 4RZ, U.K.

Registered Company No. 08654254

PROXY STATEMENT FOR THE 2020 ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 11, 2020

INFORMATION CONCERNING PROXY SOLICITATION AND VOTING

We have sent you this Proxy Statement and the enclosed proxy card because the Board of Directors of Oxford Immunotec Global PLC (referred to herein as the “Company”, “Group” “we”, “us” or “our”) is soliciting your proxy to vote at our 2020 annual general meeting of shareholders (the “Meeting”) to be held on Thursday, June 11, 2020, at 11:00 a.m., London time (6:00 a.m., New York time), at 143 Park Drive, Milton Park,, Abingdon, Oxfordshire, OX14 4RZ. Simultaneously, the Meeting will be conducted via live webcast at: www.meetingcenter.io/245697395.

Shareholders attending the Meeting via live webcast will be able to listen to the Meeting live, vote, and submit questions in advance. In light of the current ‘Stay at Home’ measures that have been published by the Government of the United Kingdom due to the coronavirus (COVID-19) outbreak, shareholders must not attend the Meeting in person.

● | This Proxy Statement summarizes information about the proposals to be considered at the Meeting and other information you may find useful in determining how to vote. |

● | The proxy card is the means by which you actually authorize another person to vote your shares in accordance with your instructions. |

In addition to solicitations by mail, our directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, e-mail and personal interviews. All costs of solicitation of proxies will be covered by us.

We are mailing the notice of the 2020 annual general meeting, this Proxy Statement and the proxy card to our shareholders of record as of April 22, 2020 (the “Record Date”) for the first time on or about May 5, 2020. In this mailing, we are also including our Annual Report on Form 10-K (“Form 10-K”) for the year ended December 31, 2019, which Form 10-K constitutes our 2019 Annual Report to Shareholders (“2019 Annual Report”). In addition, we have provided brokers, banks and other nominees, at our expense, with additional copies of our proxy materials and the 2019 Annual Report so that our record holders can supply these materials to the beneficial owners of our ordinary shares as of the Record Date.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on June 11, 2020

Our 2019 Annual Report, notice of 2020 annual general meeting, Proxy Statement and proxy card are available in the “Corporate Governance” section of our website at http://investor.oxfordimmunotec.com.

QUESTIONS AND ANSWERS ABOUT VOTING

Why am I receiving these materials?

We have sent you this Proxy Statement and the enclosed proxy card because our Board of Directors is soliciting your proxy to vote at the Meeting, including at any adjournments or postponements of the Meeting. You are invited to attend the live webcast of the Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the live webcast of the Meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below under “How do I vote my shares?” to submit your proxy over the telephone or on the Internet.

We intend to mail this Proxy Statement and accompanying proxy card on or about May 5, 2020 to all shareholders of record entitled to vote at the Meeting.

Who can vote at the Meeting?

Only shareholders of record at the close of business on the Record Date will be entitled to vote at the Meeting. At the close of business on April 22, 2020, there were 25,946,042 ordinary shares issued and outstanding and entitled to vote.

Shareholder of Record: Shares Registered in Your Name

If, on the Record Date, your shares were registered directly in your name with the transfer agent, Computershare Trust Company, N.A., then you are the shareholder of record. As a shareholder of record, you may attend the live webcast of the Meeting and vote at the Meeting or vote by proxy. Whether or not you plan to attend the live webcast of the Meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone or on the Internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Nominee

If, on the Record Date, your shares were held in an account at a broker, bank or other nominee, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the shareholder of record for purposes of voting at the Meeting. As a beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote the shares in your account. You are also invited to attend the live webcast of the Meeting (but are also prohibited from attending in person). However, because you are not the shareholder of record, you may not vote your shares at the Meeting unless you request and obtain a legal proxy from your broker, bank or other nominee.

A complete list of shareholders of record entitled to vote will be open to examination by any shareholder for any purpose relating to the Meeting for a period of 10 days before the Meeting at our offices in Abingdon, Oxfordshire during ordinary business hours. Such list shall also be open to the examination of any shareholder present at the live webcast of the Meeting.

What are the requirements to elect the directors and approve each of the proposals?

You may cast your vote for or against proposals 1 through 13 or abstain from voting your shares on one or more of these proposals.

Proposals 1 through 11 will be proposed as ordinary resolutions, which means that, assuming a quorum is present, each such proposal will be approved if the number of votes cast in favor exceed the number of votes cast against such proposal. For example, a nominee for director will be elected to the Board of Directors if the votes cast “for” such nominee’s election exceed the votes cast “against” such nominee’s election. Abstentions and broker non-votes will not be counted as a vote either for or against these resolutions.

Proposals 12 and 13 will be proposed as special resolutions, which means that, assuming a quorum is present, each such proposal will be approved if shareholders holding at least 75% in nominal value of the outstanding shares entitled to vote for or against the proposal present in person or by proxy at the Meeting vote in favor of such proposal. Abstentions will not be counted as a vote either for or against these resolutions. There will be no broker non-votes submitted for these resolutions.

The result of the shareholder vote on the following ordinary resolutions will not require our Board of Directors to take any action:

● | Proposal 7 regarding receipt of our U.K. statutory annual accounts and reports for the year ended December 31, 2019; |

● | Proposal 8 regarding receipt and approval of our U.K. statutory directors’ annual report on remuneration for the year ended December 31, 2019; and |

● | Proposal 9 regarding approval, on a non-binding, advisory basis, of the compensation paid to our named executive officers. |

Our Board of Directors values the opinions of our shareholders as expressed through such votes and will carefully consider the outcome of the votes on proposals 7, 8 and 9.

What are the voting recommendations of our Board of Directors regarding the election of directors and other proposals?

The following table summarizes the items that will be brought for a vote of our shareholders at the Meeting, along with the Board of Directors’ voting recommendations.

Proposal | Description of Proposal | Board of Directors’ Recommendation |

1 | Election of Patrick J. Balthrop, Sr. as a class I director to serve for a term to expire at the 2023 annual general meeting of shareholders and until his successor has been elected and qualified. | FOR |

2 | Election of Patricia Randall as a class I director to serve for a term to expire at the 2023 annual general meeting of shareholders and until her successor has been elected and qualified. | FOR |

3 | Election of Herm Rosenman as a class I director to serve for a term to expire at the 2023 annual general meeting of shareholders and until his successor has been elected and qualified. | FOR |

4 | Ratification of the Audit Committee’s appointment of Ernst & Young LLP, the U.S. member firm of Ernst & Young Global Limited, as our U.S. independent registered public accounting firm for the fiscal year ending December 31, 2020. | FOR |

5 | Approval of the re-appointment of the U.K. member firm of Ernst & Young Global Limited, Ernst & Young LLP, as our U.K. statutory auditors under the U.K. Companies Act 2006, to hold office until the conclusion of the next general meeting of shareholders at which the U.K. statutory accounts and reports are presented. | FOR |

6 | Authorization for the Audit Committee to determine our U.K. statutory auditors’ remuneration for the fiscal year ending December 31, 2020. | FOR |

7 | To receive the U.K. statutory annual accounts and reports for the fiscal year ended December 31, 2019. | FOR |

8 | Approval of our U.K. statutory directors’ annual report on remuneration, for the year ended December 31, 2019, which is set forth in Part I of Annex A to this Proxy Statement. | FOR |

9 | To approve, on a non-binding, advisory basis, the compensation paid to the named executive officers of the Company as disclosed in the section of this Proxy Statement titled “Executive Compensation”. | FOR |

10 | Approval of our Directors’ Remuneration Policy, which, if approved, will take effect upon the conclusion of the Meeting, the full text of which is set forth as Part II of Annex A to this Proxy Statement. | FOR |

11 | Authorization of our Board of Directors to allot ordinary shares, the full text of which can be found in “Proposal 11” of this Proxy Statement. | FOR |

12 | Approval of the general disapplication of pre-emption rights with respect to the allotment of ordinary shares and rights over ordinary shares referred to in Proposal 11, the full text of which can be found in “Proposal 12” of this Proxy Statement. | FOR |

13 | Approval of the further disapplication of pre-emption rights to be used only in connection with an acquisition or a specified capital investment, with respect to the allotment of ordinary shares and rights over ordinary shares referred to in Proposal 11, the full text of which can be found in “Proposal 13” of this Proxy Statement. | FOR |

What constitutes a quorum?

For the purposes of the Meeting, a quorum is present if members holding at least one-third of the outstanding shares of the Company and entitled to vote are present in person, by participation through www.meetingcenter.io/245697395, or by proxy.

How do I vote my shares?

If you are a “shareholder of record,” you may vote using any of the following methods:

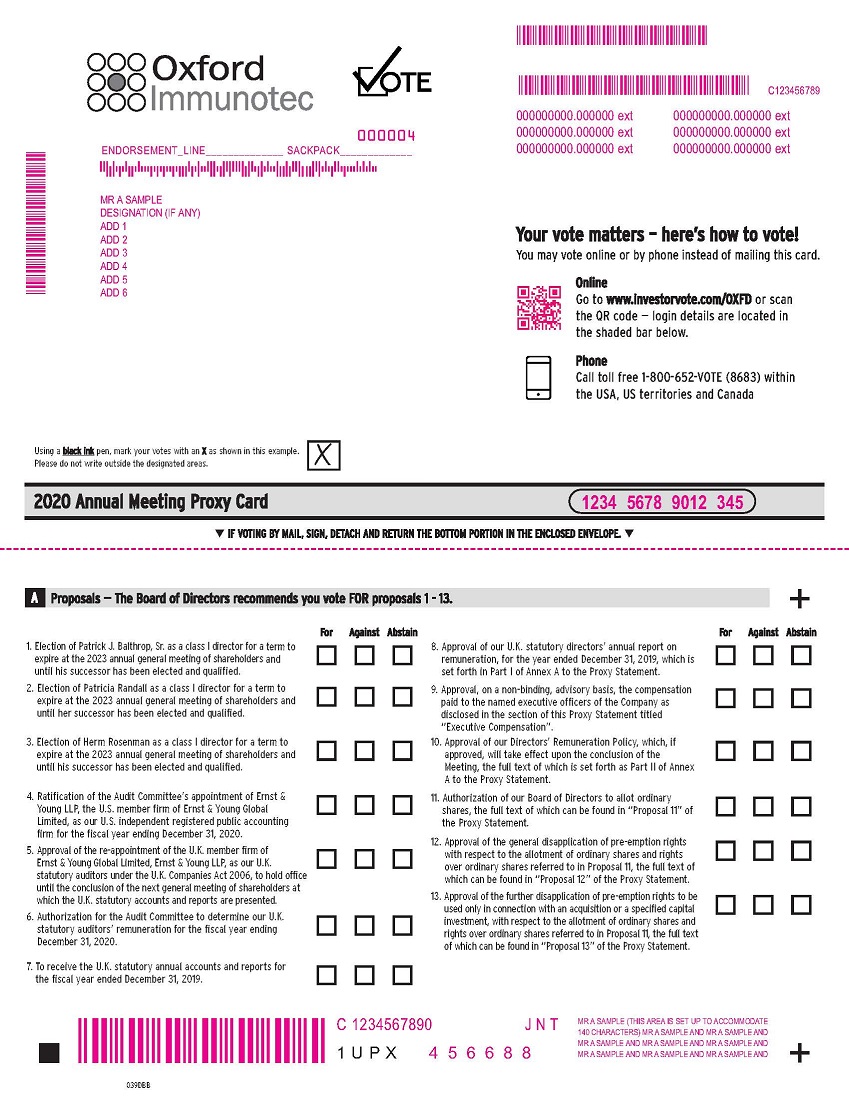

● | By completing and signing the proxy card and returning it in the prepaid envelope provided; | |

● | Via telephone using the toll-free telephone number shown on the proxy card or the Notice of Internet Availability; | |

● | Via the Internet, as instructed on the proxy card or the Notice of Internet Availability; or | |

● | By attending the live webcast of the Meeting and voting in person by participation through www.meetingcenter.io/245697395. |

If you properly give instructions as to your proxy appointment by executing and returning a paper proxy card, and your proxy appointment is not subsequently revoked, your shares will be voted in accordance with your instructions.

If you hold shares in “street name,” you should follow the directions provided by your broker, bank or other nominee. You may submit instructions by telephone or via the Internet to your broker, bank or other nominee, or request and return a paper proxy card to your broker, bank or other nominee. If you hold shares in “street name” and wish to vote at the Meeting, you must obtain a legal proxy from your broker, bank or other nominee to attend and vote at the Meeting via the live webcast.

How do I attend the Meeting via webcast?

If you were a shareholder of record as of April 22, 2020 (i.e., you held your shares in your own name as reflected in the records of our transfer agent, Computershare), you can attend the Meeting by accessing www.meetingcenter.io/245697395 and entering the 15-digit control number on the proxy card you previously received and the Meeting password: OXFD2020.

If you were a beneficial owner of record as of April 22, 2020 (i.e., you held your shares in an account at a brokerage firm, bank or other similar agent), you will need to obtain a legal proxy from your broker, bank or other agent. Once you have received a legal proxy from your broker, bank or other agent, it should be emailed to our transfer agent, Computershare, at legalproxy@computershare.com and should be labeled “Legal Proxy” in the subject line. Please include proof from your broker, bank or other agent of your legal proxy (e.g., a forwarded email from your broker, bank or other agent with your legal proxy attached or an image of your legal proxy attached to your email). Requests for registration must be received by Computershare no later than 5:00 p.m. Eastern Time on Tuesday, June 9, 2020. You will then receive a confirmation of your registration, with a control number, by email from Computershare. At the time of the Meeting, go to www.meetingcenter.io/245697395 and enter your control number and the Meeting password: OXFD2020.

Can I attend the Meeting via webcast as a guest?

If you would like to enter the Meeting as a guest in listen-only mode, click on the “I am a guest” button after entering the meeting center at www.meetingcenter.io/245697395 and enter the information requested on the following screen. Please note you will not have the ability to ask questions or vote if you participate as a guest.

How do I submit a question via webcast?

As a shareholder of record or registered beneficial owner, questions can be submitted by accessing the meeting center at www.meetingcenter.io/245697395, entering your control number and meeting password: OXFD2020, and clicking on the message icon in the upper, right-hand corner of the page. To return to the main page, click the “I” icon at the top of the screen. Questions must be submitted no later than 48 hours prior to the meeting.

How do I vote my shares at the Meeting via webcast?

If you have not already voted your shares in advance, you will be able to vote your shares electronically during the annual meeting by clicking on the “Cast Your Vote” link on the Meeting Center site. Whether or not you plan to attend the Meeting, we urge you to vote and submit your proxy in advance of the Meeting by one of the methods described in the proxy materials.

How will my shares be voted if I do not specify how they should be voted?

If you sign and send your proxy card but do not indicate how you want your shares to be voted, your shares will be voted by the persons appointed as proxies in accordance with the recommendations of our Board of Directors.

Can I change my vote or revoke a proxy?

A “shareholder of record” can change or revoke his or her proxy before the time of voting at the Meeting in several ways by:

(1) | mailing a revised proxy card dated later than the prior proxy card; |

(2) | voting at the Meeting via the live webcast; or |

(3) | notifying our Company Secretary in writing that you are revoking your proxy. Your revocation must be received before the Meeting to be effective. |

If you hold shares in “street name,” you may change or revoke your voting instructions by contacting the broker, bank or other nominee holding the shares or by obtaining a legal proxy from such institution and voting in person at the Meeting as described above under “How do I vote my shares?” See also “What if I plan to attend the Meeting?”

Who counts the votes?

Computershare Trust Company, N.A. (“Computershare”) has been engaged as our independent agent to tabulate shareholder votes. If you are a shareholder of record, your executed proxy card is returned directly to Computershare for tabulation. If you hold your shares through a broker, your broker will return one proxy card to Computershare on behalf of all of its clients.

How are votes counted?

Votes will be counted by Computershare, who will separately count “for” and “against” votes, abstentions and broker non-votes. If your shares are held in “street name,” you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “routine” items, but not with respect to “non-routine” items. See below for more information regarding: “What are ‘broker non-votes?’” and “Which proposals are considered ‘routine’ and ‘non-routine’?”

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker, bank or other nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in “street name,” the beneficial owner of the shares is entitled to give voting instructions to the broker, bank or other nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker, bank or other nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. In the event that a broker, bank or other nominee or other record holder of ordinary shares indicates on a proxy form that it does not have discretionary authority to vote certain shares on a particular proposal, then those shares will be treated as broker non-votes with respect to that proposal. Accordingly, if you own shares through a nominee, such as a broker or bank, you must instruct your nominee how to vote to ensure that your vote is counted on each of the proposals.

Which proposals are considered “routine” or “non-routine?”

The following proposal are considered discretionary or “routine” under applicable rules:

● | Proposal 4 - the ratification of the appointment of Ernst & Young LLP, the U.S. member firm of Ernst & Young Global Limited, as our U.S. independent registered public accounting firm for the fiscal year ending December 31, 2020; | |

● | Proposal 5 - the approval of the re-appointment of the U.K. member firm of Ernst & Young Global Limited, Ernst & Young LLP as our U.K. statutory auditors; | |

● | Proposal 6 - the authorization for the Audit Committee to determine our U.K. statutory auditors’ remuneration for the fiscal year ending December 31, 2020; | |

● | Proposal 7 - to receive the U.K. statutory annual accounts and reports for the fiscal year ended December 31, 2019; | |

● | Proposals 11, 12 and 13 - the authorization of allotment of shares and disapplication of pre-emption rights. |

Therefore, broker non-votes are not expected to be submitted in connection with these proposals. Proposals 1, 2, 3, 8, 9 and 10 are non-routine and broker non-votes may be submitted with respect to them.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of the ordinary shares you own as of the Record Date.

What if I plan to attend the Meeting?

You must not attend the Meeting in person. As at the date hereof, the ‘Stay at Home’ measures that have been published by the Government of the United Kingdom prohibit public gatherings in the United Kingdom of more than two people. As a result, you will be refused entry if you attempt to attend the Meeting in person.

Instructions on how to attend the live webcast of the Meeting, including how to demonstrate proof of stock ownership, are posted at the Meeting center website at www.meetingcenter.io/245697395. See also “How do I attend the Meeting via webcast?” and “Can I attend the Meeting via webcast as a guest?”

Why is the Company having a hybrid Meeting?

At the date of the mailing of this Proxy Statement, the coronavirus (COVID-19) outbreak continues to spread around the world. We are facing an unpredictable and volatile situation with respect to the progress of COVID-19, which has been classified as a global pandemic. The health and safety of our shareholders and employees are of paramount concern to your Board of Directors and management. Therefore, to minimize the risk to shareholders and employees and to comply with the law of the United Kingdom, we are prohibiting shareholders from attending the Meeting in person and instead strongly encouraging all shareholders to access the Meeting via the live webcast. Instructions for accessing the webcast are provided throughout this Proxy Statement.

What if during the Meeting I have technical difficulties or trouble accessing the live webcast of the Meeting?

If you encounter any difficulties once you have logged into the live webcast of the Meeting, Computershare will have online technical assistance available. Please follow the instructions that will be posted on the Meeting center website at www.meetingcenter.io/245697395 in case you experience any technical difficulties during the Meeting.

How do you solicit proxies?

We will solicit proxies and will bear the entire cost of this solicitation. The initial solicitation of proxies may be supplemented by additional mail communications and by telephone, e-mail, Internet and personal solicitation by our directors, officers or other employees. No additional compensation for soliciting proxies will be paid to our directors, officers or other employees for their proxy solicitation efforts. We also reimburse brokers, banks and other nominees for their expenses in sending these materials to shareholders who hold shares in street name.

What do I do if I receive more than one notice or proxy card?

If you hold your shares in more than one account, you will receive a notice or proxy card for each account. To ensure that all of your shares are voted, please sign, date and return all proxy cards or use each proxy card or notice to vote by telephone or via the Internet. Please be sure to vote all of your shares.

Will there be any other business conducted at the Meeting?

No. In accordance with our Articles of Association, no matters other than proposals 1 through 13 may be presented at this Meeting. We have not been notified of, and our Board of Directors is not aware of, any other matters to be presented for action at the Meeting.

Who is the transfer agent?

As noted above, our transfer agent is Computershare. All communications concerning shareholder of record accounts, including address changes, name changes, share transfer requirements and similar issues can be handled by contacting our transfer agent at +1-855-895-7224 (within the U.S., U.S. Territories and Canada), +1-732-491-0756 (outside the U.S., U.S. Territories and Canada), or in writing by regular mail to Computershare, P.O. Box 505005, Louisville, KY 40233-5005 USA or by overnight mail to Computershare, 462 South 4th Street, Suite 1600, Louisville KY 40202, USA.

How can I find out the results of the voting at the Meeting?

Voting results will be announced by the filing of a current report on Form 8-K within four business days after the Meeting. If final voting results are unavailable at that time, we will file an amended current report on Form 8-K within four business days of the day the final results are available.

Our Board of Directors currently consists of nine seated directors, divided into the following three classes:

● | Class I directors: Patrick J. Balthrop, Sr., Patricia Randall and Herm Rosenman whose current terms will expire at the Meeting; | |

● | Class II directors: Ronald A. Andrews, Jr., Mark Klausner and James R. Tobin whose current terms will expire at the 2021 annual general meeting of shareholders; | |

● | Class III directors: A. Scott Walton, Richard A. Sandberg and Dr. Peter Wrighton-Smith whose current terms will expire at the 2022 annual general meeting of shareholders. |

Each class has a three-year term. At each annual general meeting of shareholders, directors whose terms will then expire (or their successors, if such directors are not nominated for re-election) will be elected to serve for a three year term.

Upon the recommendation of the Nominating, Corporate Governance and Compliance Committee, our Board of directors has nominated Patrick J. Balthrop, Sr., Patricia Randall and Herm Rosenman for re-election as class I directors to hold office from the date of his or her election until the 2023 annual general meeting of shareholders and until his or her successor is elected and has been qualified, or until his or her earlier death, resignation or removal. No other nominees for class I directors have been presented. Therefore, it is anticipated that following the Meeting, the Board of Directors will be comprised of nine members, with three members representing each class of directors.

In connection with proposals 1 through 3, we set forth the biographical information for each of the nominees to our Board of Directors. For biographical information for the class II and class III directors not subject to re-election at the Meeting, see the section of this Proxy Statement titled “Board of Directors and Corporate Governance.”

PROPOSAL 1 – ELECTION OF PATRICK J. BALTHROP, SR. TO THE BOARD OF DIRECTORS AS A CLASS I DIRECTOR

Patrick J. Balthrop, Sr. is currently a member of our Board of Directors and has been nominated for re-election as a class I director. If elected, he will hold office from the date of his election until the 2023 annual general meeting of shareholders and until his successor is elected and has been qualified, or until his earlier death, resignation or removal. Mr. Balthrop has agreed to serve if elected, and we have no reason to believe that he will be unable to serve.

Mr. Balthrop, 63, is the Chairman of our Board of Directors, having been appointed in 2019. He has served as a Director since 2016. He is the founding principal of Apalachee Ventures LLC, a venture and investment company focusing on emerging life science companies. Mr. Balthrop served as president, chief executive officer and director of Luminex Corporation (“Luminex”), a life science tools and molecular diagnostics company from 2004 to 2014, during which time the company’s revenues grew eightfold. While at Luminex, he implemented innovative research and development programs which led to the development and subsequent successful commercialization of many new products and oversaw multiple significant acquisitions. Prior to joining Luminex, Mr. Balthrop served as president of Fisher Healthcare, now a division of Thermo Fisher Scientific, Inc. from 2002 to 2004. Prior to that, he held multiple positions in diagnostics and vascular devices during his more than twenty years at Abbott Laboratories. Mr. Balthrop currently serves as chairman of the board of directors of Agendia, Inc., a personalized medicine and molecular cancer diagnostics company, and as chairman of the board of directors of Discovery Life Sciences (formerly Folio Conversant), a premier provider of research services and biospecimen solutions to the life sciences industry. He is also a member of the board of directors of Personalis, Inc., a provider of advanced genomic sequencing and analytics for immuno-oncology. He serves as a director of Klaris Dx, a company using neural networks and single cell biometric analysis to enable fast and accurate diagnosis of antibiotic resistant infectious agents. Mr. Balthrop earned his bachelor’s degree in Biology from Spring Hill College and his Master of Business Administration from the Kellogg School of Management Northwestern University.

Based on his extensive experience as a senior executive and member of the board of directors of companies in the healthcare sector, the Nominating, Corporate Governance and Compliance Committee of our Board of Directors concluded that Mr. Balthrop is qualified to serve on our Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR THE ELECTION OF PATRICK J. BALTHROP, SR. TO THE BOARD OF DIRECTORS AS A CLASS I DIRECTOR.

PROPOSAL 2 – ELECTION OF PATRICIA RANDALL TO THE BOARD OF DIRECTORS AS A CLASS I DIRECTOR

Patricia Randall is currently a member of our Board of Directors and has been nominated for re-election as a class I director. If elected, she will hold office from the date of her election until the 2023 annual general meeting of shareholders and until her successor is elected and has been qualified, or until her earlier death, resignation or removal. Ms. Randall has agreed to serve if elected, and we have no reason to believe that she will be unable to serve.

Ms. Randall, 69, is a Director, having been elected in 2014. Most recently, she served as our senior vice president and general counsel. Ms. Randall joined Oxford Immunotec in 2008 as general counsel and was responsible for all legal affairs of the Company through her retirement and election to the board of directors. Before joining Oxford Immunotec, from 2003 to 2008, she served as vice president, general counsel and secretary of Matritech, Inc., a biotechnology company specializing in proteomic diagnostic products for the early detection of a variety of cancers. She previously served as a member of senior management and general counsel of two other publicly-traded companies. Ms. Randall has practiced law for over 35 years for both public and private companies and in private practice. Until December 2017, she served as a member of the board of directors of Belmont Instrument Corporation, a private medical device company that develops, manufactures and markets critical care devices. She continues to serve as a member of the board of directors of BIC Holding Corp. following the sale of a majority interest in Belmont Instrument Corporation to a private equity firm. Ms. Randall earned her bachelor’s degree in Philosophy from American University and her juris doctor from Northeastern University School of Law.

Based on her extensive experience as a senior executive and an officer of several publicly-traded companies, the Nominating, Corporate Governance and Compliance Committee of our Board of Directors concluded that Ms. Randall is qualified to serve on our Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR THE ELECTION OF PATRICIA RANDALL TO THE BOARD OF DIRECTORS AS A CLASS I DIRECTOR.

PROPOSAL 3 – ELECTION OF HERM ROSENMAN TO THE BOARD OF DIRECTORS AS A CLASS I DIRECTOR

Herm Rosenman is currently a member of our Board of Directors and has been nominated for re-election as a class I director. If elected, he will hold office from the date of his election until the 2023 annual general meeting of shareholders and until his successor is elected and has been qualified, or until his earlier death, resignation or removal. Mr. Rosenman has agreed to serve if elected, and we have no reason to believe that he will be unable to serve.

Mr. Rosenman, 72, is a Director, having been elected in 2013. He was the chief financial officer of Natera, Inc., a publicly-traded company focused on non-invasive genetic testing and the analysis of circulating cell-free DNA, from January 2014 to January 2017. Prior to that, Mr. Rosenman served as senior vice president, finance and chief financial officer of Gen-Probe Incorporated, a publicly-traded molecular diagnostics company, from 2001 until the sale of that company to Hologic, Inc. in October 2012. From 1997 to 2000, he was president and chief executive officer of Ultra Acquisition Corp., a manufacturer and parts retailer and from 1994 to 1997, he was president and chief executive officer of RadNet Management, Inc., a healthcare provider. Mr. Rosenman also previously served as chief financial officer of Rexene Corp. and was an audit partner at Coopers & Lybrand (now PricewaterhouseCoopers LLP). He is currently a member of the board of directors and audit committee chairman at Natera, Inc., a publicly-traded company, a member of the board of directors and audit committee chairman at Vivus, Inc., a publicly traded biopharmaceutical company, a member of the board of directors at DermTech, Inc., a publicly-traded global leader in non-invasive molecular dermatology, since its business combination completion in August 2019 and on DermTech Operations’ board of directors and audit committee chairman between February 2017 and August 2019 and an advisory board member of the Scripps Clinic and Scripps Green Hospital, a large healthcare provider in San Diego, California. Previously, Mr. Rosenman served on numerous other public and private company boards of directors, frequently as a member of audit committee, including BioFire Diagnostics, Inc., Medistem, Inc., ARYx Therapeutics, Infinity Pharmaceuticals, Inc., Emphasys Medical, Inc. and Discovery Partners International, Inc. He is a certified public accountant who received his bachelor’s degree in Finance and Accounting from Pace University and his Master of Business Administration from the Wharton School of the University of Pennsylvania.

Based on his extensive experience as a senior executive and member of the board of directors of numerous public companies in the diagnostics and healthcare sectors, as well as his substantial background as a public company chief financial officer and as an auditor and certified public accountant, the Nominating, Corporate Governance and Compliance Committee of our Board of Directors concluded that Mr. Rosenman is qualified to serve on our Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR THE ELECTION OF HERM ROSENMAN TO THE BOARD OF DIRECTORS AS A CLASS I DIRECTOR.

PROPOSAL 4 – RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP, THE U.S. MEMBER FIRM OF ERNST & YOUNG GLOBAL LIMITED AS OUR U.S. INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2020

PROPOSAL 5 – APPROVAL OF THE RE-APPOINTMENT OF THE U.K. MEMBER FIRM OF ERNST & YOUNG GLOBAL LIMITED, ERNST & YOUNG LLP, AS OUR U.K. STATUTORY AUDITORS UNDER THE U.K. COMPANIES ACT 2006, TO HOLD OFFICE UNTIL THE CONCLUSION OF THE NEXT GENERAL MEETING AT WHICH THE U.K. STATUTORY ACCOUNTS ARE PRESENTED

PROPOSAL 6 – AUTHORIZATION FOR THE AUDIT COMMITTEE TO DETERMINE THE U.K. STATUTORY AUDITORS’ REMUNERATION FOR THE FISCAL YEAR ENDING DECEMBER 31, 2020

The Audit Committee is responsible for the selection, appointment and negotiation of the remuneration of our U.S. independent registered public accounting firm and our U.K. statutory auditors. The Audit Committee has approved the appointment of Ernst & Young Global Limited’s U.S. member firm, Ernst & Young LLP (“E&Y (U.S.) LLP”) as our principal auditors and U.S. independent registered public accounting firm and the appointment of Ernst & Young Global Limited’s U.K. member firm, Ernst & Young LLP (“E&Y (U.K.) LLP”) as our U.K. statutory auditor for our fiscal year ending December 31, 2020. E&Y (U.K.) LLP has served as our U.K. statutory auditors under the U.K. Companies Act 2006 since our registration as a public limited company on August 16, 2013. Although current laws, rules and regulations, as well as the charter of the Audit Committee, require our independent auditors to be selected and supervised by the Audit Committee, the Board of Directors considers the selection of the independent auditors to be an important matter of shareholder concern and is submitting the selection of E&Y (U.S.) LLP and E&Y (U.K.) LLP for ratification by shareholders as a matter of good corporate practice. If the shareholders do not ratify the selection of E&Y (U.S.) LLP as our U.S. independent registered public accounting firm and the selection of E&Y (U.K.) LLP as our U.K. statutory auditor, the Audit Committee will consider this vote in determining whether or not to continue the engagement of Ernst & Young Global Limited’s U.S. and U.K. member firms. If the shareholders do ratify the selection of E&Y (U.S.) LLP as our U.S. independent registered public accounting firm and the selection of E&Y (U.K.) LLP, the Audit Committee may nonetheless select a different auditing firm at any time during the year if it determines that such a change would be in our best interests.

Proposal 4 seeks your ratification of the appointment of E&Y (U.S.) LLP as our U.S. independent registered public accounting firm for the fiscal year ending December 31, 2020.

Proposal 5 seeks your approval of the re-appointment of E&Y (U.K.) LLP to serve as our U.K. statutory auditor, to hold office until the conclusion of the next general meeting at which the U.K. statutory accounts are presented to shareholders. In the event this proposal does not receive the affirmative vote of the holders of a majority of the shares entitled to vote and present in person or represented by proxy at the Meeting, the Board of Directors may appoint an auditor to fill the vacancy.

Proposal 6 authorizes the Audit Committee to determine our U.K. statutory auditors’ remuneration for the fiscal year ending December 31, 2020.

THE BOARD OF DIRECTORS AND AUDIT COMMITTEE RECOMMEND A VOTE

FOR:

● | Proposal 4 to ratify the appointment of ERNST & YOUNG LLP, THE U.S. MEMBER FIRM OF ERNST & YOUNG GLOBAL LIMITED, as our U.S. independent registered public accounting firm for the year endING December 31, 2020; | |

● | Proposal 5 to approve the re-appointment of THE U.K. MEMBER OF Ernst & Young GLOBAL LIMITED, ERNST & YOUNG LLP, as our U.K. statutory auditors under the U.K. Companies Act 2006, to hold office until the conclusion of the next general meeting at which our Statutory accounts are presented; and | |

● | Proposal 6 to authorize our Audit Committee to determine our U.K. statutory auditors’ remuneration FOR THE FISCAL YEAR ENDING DECEMBER 31, 2020. |

PROPOSAL 7 – RESOLUTION TO RECEIVE THE COMPANY’S U.K. STATUTORY ANNUAL ACCOUNTS AND REPORTS

At the Meeting, our Board of Directors will present our U.K. statutory annual accounts and reports for the period January 1, 2019 through December 31, 2019, which includes the audited portion of the directors’ annual report on remuneration. We will provide our shareholders with an opportunity to receive the U.K. statutory annual accounts and reports to raise questions in relation to them.

THE BOARD OF DIRECTORS AND AUDIT COMMITTEE RECOMMEND A VOTE

FOR THE RESOLUTION TO RECEIVE THE COMPANY’S U.K. STATUTORY ANNUAL ACCOUNTS AND REPORTS.

PROPOSAL 8 – APPROVAL OF OUR U.K. STATUTORY DIRECTORS’ ANNUAL REPORT ON REMUNERATION

Our U.K. statutory directors’ remuneration report is set forth as Part I of Annex A to this Proxy Statement. The directors’ remuneration report includes the annual report on remuneration. This document describes in detail our remuneration policies and procedures and explains how these policies and procedures help to achieve our compensation objectives with regard to attracting and retaining high-quality directors. Our Board of Directors and the Remuneration Committee believe that the policies and procedures as articulated in the directors’ remuneration report are effective and that as a result of these policies and procedures we have and will continue to have high-quality directors. Our Board of Directors has approved and signed the report in accordance with English law.

At the Meeting, the shareholders will vote on the annual report on remuneration. This vote is advisory and non-binding. Although non-binding, our Board of Directors and Remuneration Committee will review and consider the voting results when making future decisions regarding our director remuneration program. Following the Meeting, and as required under English law, the directors’ annual report on remuneration will be delivered to the U.K. Registrar of Companies.

THE BOARD OF DIRECTORS RECOMMENDS YOU VOTE

FOR APPROVAL OF OUR U.K. STATUTORY DIRECTORS’ ANNUAL REPORT ON REMUNERATION, AS SET FORTH IN PART I OF ANNEX A TO THIS PROXY STATEMENT.

PROPOSAL 9 – APPROVAL, ON A NON-BINDING, ADVISORY BASIS, THE COMPENSATION PAID TO OUR NAMED EXECUTIVE OFFICERS

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) enables our shareholders to vote to approve, on a non-binding, advisory basis, the compensation paid to our named executive officers (“Named Executive Officers”) as disclosed in this Proxy Statement in accordance with the Securities and Exchange Commission’s (the “SEC”) rules. This proposal, commonly known as a “say-on-pay” proposal, gives our shareholders the opportunity to express their views on the compensation paid to our Named Executive Officers.

As described in more detail in the section of this Proxy Statement titled “Executive Compensation,” the primary goal of our executive compensation program is to ensure that we attract, hire and retain talented and experienced executive officers who are motivated to achieve or exceed our corporate goals. We seek to have an executive compensation program that fosters synergy among our management team, incentivizes our executive officers to achieve our short-term and long-term goals, and fairly rewards our executive officers for corporate and individual performance.

In determining the form and amount of compensation payable to our executive officers, we are guided by the following objectives and principles:

● Compensation should relate to performance. We believe that executive compensation should be directly linked to corporate, as well as individual performance.

● Equity awards help executive officers think like shareholders. We believe that our executive officers' total compensation should have a significant equity component because share-based awards help reinforce the executive officers' long-term interest in our overall performance and align the interests of our executive officers with the interests of our shareholders.

● Total compensation opportunities should be competitive. We believe that our total compensation programs should be competitive so that we can attract, retain and motivate talented executive officers who will help us to outperform our competitors.

Our Board of Directors believes that our current executive compensation program has been effective at linking executive compensation to our performance and aligning the interests of our executive officers with those of our shareholders.

We are asking our shareholders to indicate their support for the compensation paid to our Named Executive Officers as described in this Proxy Statement. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our Named Executive Officers and the philosophy, policies and practices described in this Proxy Statement. Accordingly, we will ask our shareholders to vote “FOR” the following resolution at the Meeting:

“RESOLVED, that the Company’s shareholders approve, on a non-binding, advisory basis, the compensation paid to our named executive officers, as disclosed in the Company’s Proxy Statement for the 2020 Annual General Meeting of Shareholders.”

Although this “say-on-pay” vote is advisory and non-binding, our Board of Directors and Remuneration Committee will review and consider the voting results when making future decisions regarding our executive compensation program. Accordingly, to the extent there is a significant vote against the compensation of our Named Executive Officers, we will consider shareholders’ concerns, and the remuneration committee will evaluate what actions may be necessary or appropriate to address those concerns. Currently, we expect to hold an advisory vote on the compensation paid to our Named Executive Officers each year and expect that the next such vote will occur at our 2021 annual general meeting of shareholders.

THE BOARD OF DIRECTORS RECOMMENDS YOU VOTE

FOR APPROVAL, ON A NON-BINDING, ADVISORY BASIS, THE COMPENSATION PAID TO OUR NAMED EXECUTIVE OFFICERS, AS DESCRIBED IN THIS PROXY STATEMENT.

PROPOSAL 10 – APPROVAL OF OUR DIRECTORS’ REMUNERATION POLICY

Our U.K. statutory directors’ remuneration policy is set forth as Part II of Annex A to this proxy statement. Our directors’ remuneration policy has as its objective the engagement and retention of high-quality directors. The original remuneration policy was approved by the shareholders at our 2014 annual general meeting and approved again at our 2017 annual general meeting. As set forth in Part II of Annex A, we submit our new proposed remuneration policy, which our Board of Directors has determined is competitive and consistent with current market practices. The policy, as proposed, amends the fixed compensation for service as a member or chair of a committee of our Board of Directors and instead requires the Board of Directors to set compensation for committee service at rates that are consistent with market practice. Similarly, the proposed remuneration policy retains the equity components of compensation but allows the Board greater discretion in fixing the size of the awards consistent with market practice. By making these changes, our Board of Directors will be required to maintain compensation practices consistent with our market peer group while having the flexibility to form committees as required to achieve Board objectives and to recruit qualified directors.

Our Board of Directors has approved the directors’ remuneration policy and believe it effective to achieve its objectives. The directors’ remuneration policy, if approved, will take effect immediately upon conclusion of the Meeting. For further information about the policy, see the section of this Proxy Statement titled “Director Remuneration and Attendance.”

THE BOARD RECOMMENDS YOU VOTE

FOR APPROVAL OF OUR DIRECTORS’ REMUNERATION POLICY INCLUDED IN PART II OF ANNEX A TO THIS PROXY STATEMENT.

PROPOSALS 11, 12 and 13 – AUTHORIZATION OF ALLOTMENT OF SHARES AND DISAPPLICATION OF PRE-EMPTION RIGHTS

As a U.K. Company which is governed by the Companies Act 2006, our Board of Directors may only allot ordinary shares or grant rights over ordinary shares if authorized to do so by our shareholders. If so authorized, English law requires us to offer them in the first instance to our existing shareholders in proportion to their holdings, unless the shareholders have waived their statutory rights of pre-emption in respect of such allotment or grant of rights.

Our Board of Directors anticipates that there may occasions when they need flexibility to finance business opportunities, or otherwise act in the best interests of the Company, by the issuance of ordinary shares or rights over ordinary shares without a pre-emptive offer to existing shareholders. To ensure our continued ability to respond to market conditions and address business needs, our Board of Directors considers it appropriate that they be granted additional authority in Proposal 11 to allot ordinary shares or grant rights over ordinary shares up to an aggregate nominal amount equal to £57,989 which represents approximately 33.3% of our issued share capital of the Company as of April 22, 2020, the latest practicable date prior to publication of this Proxy Statement; provided however, that if we make offers or agreements prior to the expiration of the granted authority that will require allotment of ordinary shares after such expiration, our Board of Directors may allot ordinary shares or grant rights to subscribe for, or convert any security into, ordinary shares pursuant to such offer or agreement notwithstanding the expiration of authority conferred by this resolution. If the shareholders approve this grant of authority, their approval would be effective until the conclusion of the next annual general meeting of shareholders. In line with the Investment Association guidelines, the authority will also permit the Board of Directors to allot an additional one-third of the Company’s issued share capital provided such shares are reserved for a fully pre-emptive rights issue.

If the Board of Directors wish to use the authority conferred in Proposal 11 to allot shares for cash, section 561(a) of the Companies Act requires that the new shares must be offered first to the existing equity shareholders in proportion to their holdings, unless a special resolution (i.e., at least 75% of votes cast) has been passed in a general meeting of shareholders dis-applying such pre-emption. To ensure the Company has flexibility to use its share capital to pursue strategic transactions or finance growth, our Board of Directors proposes that they be empowered to allot equity securities without having to offer them first to existing shareholders. To enable this to be done, shareholders must first waive these pre-emption rights.

Proposal 12 seeks the dis-application of pre-emption rights and reflects the recommendations set out in the Pre-Emption Group’s (“PEG”) Statement of Principles. It seeks to modify the pre-emption rights of existing shareholders as follows:

● | sub-paragraph (a) of Proposal 12 seeks authority for the Board of Directors to allot new shares for cash by way of a pre-emptive offer or rights issue and to make any arrangements which may be necessary to deal with any legal or practical problems arising from a rights issue or the pre-emptive offer; |

● | sub-paragraph (b) of Proposal 12 seeks authority to issue new shares up to a maximum aggregate nominal value of £8,698, being approximately 5% of the issued ordinary share capital of the Company as of April 22, 2020, being the latest practicable date prior to publication of this proxy statement; and |

● | Proposal 13 seeks authority to issue new shares up to a further maximum aggregate nominal value of £8,698, being approximately 5% of the issued ordinary share capital of the Company as of April 22, 2020, being the latest practicable date prior to publication of this proxy statement, provided that such issue is made in connection with an acquisition or specified capital investment. |

If given, the authorities sought by our Board of Directors under Proposals 11, 12 and 13 will expire at the close of the 2021 annual general meeting of shareholders or, if earlier, fifteen months from the date of the passing of the resolutions (unless varied or revoked before then).

Our Board of Directors does not have any present intention to exercise the authorities proposed under Proposals 11, 12 and 13. We do not currently hold any of our shares in treasury.

THE BOARD OF DIRECTORS RECOMMENDS YOU VOTE

FOR APPROVAL OF THE AUTHORIZATION OF ALLOTMENT OF SHARES AND DISAPPLICATION OF PRE-EMPTION RIGHTS.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Board of Directors

As stated above, our Board of Directors currently consists of nine directors, divided into three classes. Following the Meeting, if proposals 1 through 3 are approved, our Board of Directors will have nine directors, with three members in each class of directors. The biographical information for Patrick J. Balthrop, Patricia Randall and Herm Rosenman, the three nominees to our Board of Directors as class I directors is provided in the foregoing proposals. Below is biographical information for the class II and class III directors who will remain seated following the Meeting.

Class II Directors — Continuing in Office until the 2021 Annual General Meeting of Shareholders

Ronald A. Andrews, Jr., 60, is a Director, having been elected in 2015. Mr. Andrews is currently the president and chief executive officer of Oncocyte, a molecular oncology company. Prior to stepping into the role of chief executive officer in July of 2019, Mr. Andrews was the co-founder and senior partner of the Bethesda Group, a consulting firm that advises companies in the molecular diagnostics and genomics fields. Prior to founding the Bethesda Group in 2015, Mr. Andrews served as president of the Genetic Sciences Division of Thermo Fisher Scientific from September 2013 to December 2014, and as president of the Medical Sciences Venture for Life Technologies from February 2012 to September 2013 when Life Technologies was acquired by Thermo Fisher Scientific. From 2004 to December 2010, Mr. Andrews was the chief executive officer and vice chairman of the board of Clarient, Inc., a cancer diagnostics company, and from December 2010 to February 2012 he served as chief executive officer of GE Molecular Diagnostics after Clarient, Inc. was acquired by GE Healthcare. Mr. Andrews also held management positions with companies in diagnostics and related medical fields, including Roche Molecular Diagnostics, Immucor, Inc. and Abbott Labs. Mr. Andrews is a member of the board of governors of CancerLinQ LLC, a wholly-owned non-profit subsidiary of the American Society of Clinical Oncology. Mr. Andrews earned his bachelor’s degree in Biology and Chemistry from Wofford College. Based on his extensive experience as a senior executive and member of the board of directors of companies in the healthcare sector, the Nominating, Corporate Governance and Compliance Committee of our Board of Directors concluded that Mr. Andrews is qualified to serve on our Board of Directors.

Mark Klausner, 54, is a Director, having been elected in March 2018. He is the co-founder and managing partner of Westwicke, an ICR Company, a capital markets advisory and investor relations firm focused on the healthcare industry. Prior to co-founding Westwicke in 2006, Mr. Klausner was a managing director in the equity capital markets group at Wachovia Corporation (now Wells Fargo Corporation) from 2004 to 2006. Prior to this, from 1991 to 2004, he worked in investment banking, equity capital markets and commercial banking positions at firms including Deutsche Bank (and predecessor firms Bankers Trust and Alex. Brown & Sons), Merrill Lynch (now Bank of America Merrill Lynch) and Citibank. Mr. Klausner earned his bachelor’s degree in Economics and Computer Science from Colgate University and his Master of Business Administration from the University of Virginia Darden School of Business. Based on his extensive experience in the capital markets and knowledge of the healthcare industry, the Nominating, Corporate Governance and Compliance Committee of our Board of Directors concluded that Mr. Klausner is qualified to serve on our Board of Directors.