Filed Pursuant to Rule 424(b)(3)

Registration Nos. 333-191182

PROSPECTUS

Armstrong Energy, Inc.

OFFER TO EXCHANGE

All Outstanding Unregistered 11.75% Senior Secured Notes Due 2019

($200,000,000 Aggregate Principal Amount) (CUSIP No. 042380 AA3)

For

11.75% Senior Secured Notes Due 2019 ($200,000,000 Aggregate Principal Amount)

that Have Been Registered under the Securities Act of 1933

This exchange offer will expire at 5:00 p.m., New York City time,

on November 13, 2013, unless extended

We are offering to exchange, upon the terms and subject to the conditions set forth in this prospectus and the accompanying letter of transmittal, all of our outstanding unregistered $200,000,000 aggregate principal amount of 11.75% Senior Secured Notes due 2019 (CUSIP No. 042380 AA3) (the “Outstanding Notes”), for an equal amount of 11.75% Senior Secured Notes due 2019 that have been registered (the “Exchange Notes” and collectively with the Outstanding Notes, the “Notes”) under the Securities Act of 1933, as amended (the “Securities Act”). The Exchange Notes will be fully and unconditionally guaranteed on a senior secured basis by substantially all of our existing and future domestic restricted subsidiaries, subject to certain customary release provisions. See “Description of Exchange Notes—Note Guarantees.” The Outstanding Notes have certain transfer restrictions. The Exchange Notes will be freely transferable.

The principal features of the exchange offer, the Exchange Notes and the resales of Exchange Notes are as follows:

The Exchange Offer

| | • | | We will exchange all Outstanding Notes that are validly tendered and not validly withdrawn for an equal principal amount of Exchange Notes. |

| | • | | You may withdraw tenders of Outstanding Notes at any time prior to the expiration of the exchange offer. |

| | • | | The exchange offer expires at 5:00 p.m., New York City time, on November 13, 2013, unless extended. We do not currently intend to extend the exchange offer. |

| | • | | The exchange of Outstanding Notes for Exchange Notes in the exchange offer will not constitute a taxable event for United States federal income tax purposes. |

| | • | | We will not receive any proceeds from the exchange offer. |

The Exchange Notes

| | • | | The Exchange Notes are being offered in order to satisfy certain of our obligations under the registration rights agreement entered into in connection with the placement of the Outstanding Notes. |

| | • | | The terms of the Exchange Notes to be issued in the exchange offer are substantially identical to the Outstanding Notes, except that the Exchange Notes will be freely tradable, except in the limited circumstances described herein. |

Resales of the Exchange Notes

| | • | | The Exchange Notes may be sold in the over-the-counter market, in negotiated transactions or through a combination of such methods. We do not plan to list the Exchange Notes on an exchange or national market. |

All untendered Outstanding Notes will continue to be subject to the restrictions on transfer set forth in the Outstanding Notes and in the indenture. In general, the Outstanding Notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, we do not currently anticipate that we will register the Outstanding Notes under the Securities Act.

Each broker-dealer that receives Exchange Notes for its own account pursuant to the exchange offer, where such Outstanding Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities, must acknowledge that it will deliver a prospectus in connection with any resale of such Exchange Notes. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of Exchange Notes received in exchange for Outstanding Notes where the Outstanding Notes were acquired as a result of market-making activities or other trading activities. We will make this prospectus available to any broker-dealer for use in connection with any such resales until 180 days after the date of the consummation of this exchange offer. The accompanying letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. See “Plan of Distribution.”

We are an “emerging growth company,” as such term is defined in Section 2(a)(19) of the Securities Act.

You should carefully consider theRisk Factors beginning on page 17 of this prospectus before participating in this exchange offer.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this registration statement. Any representation to the contrary is a criminal offense.

The date of this prospectus is October 15, 2013

Each holder of an unregistered Note wishing to accept the exchange offer must deliver the unregistered Note to be exchanged, together with the accompanying letter of transmittal and any other required documentation, to the exchange agent identified herein. Alternatively, you may effect a tender of unregistered Notes by book-entry transfer into the exchange agent’s account at The Depository Trust Company (“DTC”). All deliveries are at the risk of the holder. See “The Exchange Offer.”

You should rely only on the information contained in this prospectus. We have not authorized any person to provide you with any information or represent anything about us or this exchange offer that is different from or not contained in this prospectus. If given or made, any such other information or representation should not be relied upon as having been authorized by us. We are not making an offer to sell securities or soliciting an offer to buy securities in any jurisdiction where an offer or sale is not permitted.

This prospectus incorporates business and financial information about Armstrong Energy, Inc. that is not included or delivered with this prospectus. This information is available without charge to security holders upon written or oral request.You may request business and financial information incorporated but not included in this prospectus by writing to us at Armstrong Energy, Inc., 7733 Forsyth Boulevard, Suite 1625, St. Louis, Missouri 63105, Attention: Senior Vice President, Finance and Administration and Chief Financial Officer, or telephoning us at (314)721-8202. To obtain timely delivery, holders of Outstanding Notes must request the information no later than five business days before November 13, 2013, the date they must make their investment decision.

TABLE OF CONTENTS

No dealer, salesperson or other individual has been authorized to give any information or to make any representation other than those contained in this prospectus in connection with the exchange offer made by this prospectus and, if given or made, such information or representations must not be relied upon as having been authorized by us or the underwriters. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so, or to any person to whom it is unlawful to make such offer or solicitation. Neither the delivery of this prospectus nor any sale made hereunder shall, under any circumstances, create any implication that there has been no change in our affairs or that information contained herein is correct as of any time subsequent to the date hereof.

In this prospectus, unless the context otherwise requires, “Company”, “we”, “us”, and “our” refer to Armstrong Energy, Inc. and its subsidiaries, “Armstrong Resource Partners” refers to Armstrong Resource Partners, L.P. and its subsidiaries taken as a whole, and the term “Yorktown” collectively refers to Yorktown Partners LLC and/or certain investment funds managed by Yorktown Partners LLC.

NON-GAAP FINANCIAL MEASURES

Adjusted EBITDA, as presented in this prospectus, is a supplemental measure of our performance that is not required by, or presented in accordance with, accounting principles generally accepted in the United States (“GAAP”). It is not a measurement of our financial performance under GAAP and should not be considered as an alternative to net income or any other performance measures derived in accordance with GAAP or as an alternative to cash flows from operating activities as measures of our liquidity.

We define “Adjusted EBITDA” as net income (loss) before deducting net interest expense, income taxes, depreciation, depletion and amortization, non-cash production royalty for related party, loss on settlement of interest rate swap, loss on deferment of equity offering, gain on settlement of asset retirement obligations, non-cash stock compensation expense, non-cash charges related to non-recourse notes, gain on deconsolidation, and (gain) loss on extinguishment of debt. We caution investors that amounts presented in accordance with our definition of Adjusted EBITDA may not be comparable to similar measures disclosed by other issuers, because not all issuers and analysts calculate Adjusted EBITDA in the same manner. We present Adjusted EBITDA because we consider it an important supplemental measure of our performance and believe it is useful to an investor in evaluating our company, as more fully discussed under “Prospectus Summary—Summary Historical Consolidated Financial and Operating Data.” Adjusted EBITDA has several limitations that are discussed under “Prospectus Summary—Summary Historical Consolidated Financial and Operating Data,” where we also include a quantitative reconciliation of Adjusted EBITDA to the most directly comparable GAAP financial performance measure, which is net income.

The Securities and Exchange Commission (the “SEC”) has adopted rules to regulate the use in filings with the SEC and public disclosures and press releases of non-GAAP financial measures, such as Adjusted EBITDA, that are derived on the basis of methodologies other than in accordance with GAAP. The non-GAAP financial measures presented in this prospectus may not comply with these rules.

INDUSTRY AND MARKET DATA

We are responsible for the disclosure in this prospectus. However, this prospectus includes industry data that we obtained from periodic industry publications, as well as from research reports prepared for other purposes. Industry publications generally state that the information contained therein has been obtained from sources believed to be reliable. The information in these reports represents the most recently available data from the relevant sources and publications and we believe remains reliable. We engaged Weir International, Inc., an independent mining and geological consultant, to prepare a report regarding estimates of our proven and probable coal reserves at December 31, 2012. In addition, we pay a subscription fee to Wood Mackenzie to obtain access

i

to pre-prepared reports. Except with respect to payment for Weir International, Inc.’s services in this regard and the subscription fee paid to Wood Mackenzie, we did not fund and are not otherwise affiliated with any of the sources cited in this prospectus. Forward-looking information obtained from these sources is subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this prospectus.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

Various statements contained in this prospectus, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. These forward-looking statements may include projections and estimates concerning the timing and success of specific projects and our future production, revenues, income and capital spending. Our forward-looking statements are generally accompanied by words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “plan,” “goal” or other words that convey the uncertainty of future events or outcomes. The forward-looking statements in this prospectus speak only as of the date of this prospectus; we disclaim any obligation to update these statements unless required by law, and we caution you not to rely on them unduly. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These and other important factors, including those discussed under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. These risks, contingencies and uncertainties include, but are not limited to, the following:

| | • | | market demand for coal and electricity; |

| | • | | geologic conditions, weather and other inherent risks of coal mining that are beyond our control; |

| | • | | competition within our industry and with producers of competing energy sources; |

| | • | | excess production and production capacity; |

| | • | | our ability to acquire or develop coal reserves in an economically feasible manner; |

| | • | | inaccuracies in our estimates of our coal reserves; |

| | • | | availability and price of mining and other industrial supplies, including steel-based supplies, diesel fuel, rubber tires and explosives; |

| | • | | the continued weakness in global economic conditions or in any industry in which our customers operate, or sustained uncertainty in financial markets, which may cause conditions we cannot predict; |

| | • | | the disruption of rail, barge and other systems that deliver our coal; |

| | • | | coal users switching to other fuels in order to comply with various environmental standards related to coal combustion; |

| | • | | volatility in the capital and credit markets; |

| | • | | availability of skilled employees and other workforce factors; |

| | • | | disruptions in the quantities of coal produced at our operations as a consequence of weather or equipment or mine failures; |

| | • | | our ability to collect payments from our customers; |

| | • | | defects in title or the loss of a leasehold interest; |

| | • | | railroad, barge, truck and other transportation performance and costs; |

ii

| | • | | our ability to secure new coal supply arrangements or to renew existing coal supply arrangements; |

| | • | | our relationships with, and other conditions affecting, our customers; |

| | • | | the deferral of contracted shipments of coal by our customers; |

| | • | | our ability to service our outstanding indebtedness; |

| | • | | our ability to comply with the restrictions imposed by our Revolving Credit Facility, the indenture governing the Notes and other financing arrangements; |

| | • | | the availability and cost of surety bonds; |

| | • | | terrorist attacks, military action or war; |

| | • | | our ability to obtain and renew various permits, including permits authorizing the disposition of certain mining waste; |

| | • | | existing and future legislation and regulations affecting both our coal mining operations and our customers’ coal usage, governmental policies and taxes, including those aimed at reducing emissions of elements such as mercury, sulfur dioxide, nitrogen oxides, toxic gases, such as hydrogen chloride, particulate matter or greenhouse gases; |

| | • | | the accuracy of our estimates of reclamation and other mine closure obligations; |

| | • | | customers’ ability to meet existing or new regulatory requirements and associated costs, including disposal of coal combustion waste material; |

| | • | | our ability to attract/retain key management personnel; |

| | • | | efforts to organize our workforce for representation under a collective bargaining agreement; and |

| | • | | the other factors affecting our business described below under the caption “Risk Factors.” |

iii

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus, but it does not contain all of the information that you may consider important in making your investment decision. Therefore, you should read the entire prospectus carefully, including, in particular, the “Risk Factors” section beginning on page 17 of this prospectus and the financial statements and related notes thereto included elsewhere in this prospectus.

Company Overview

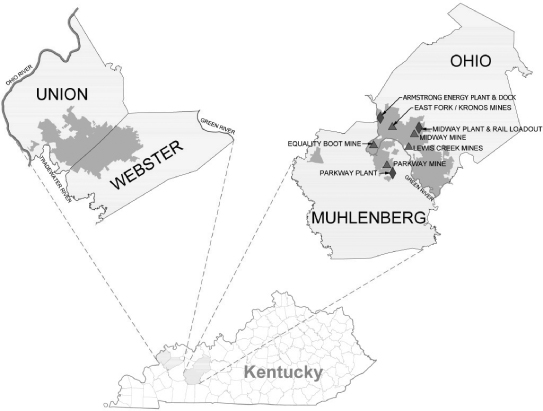

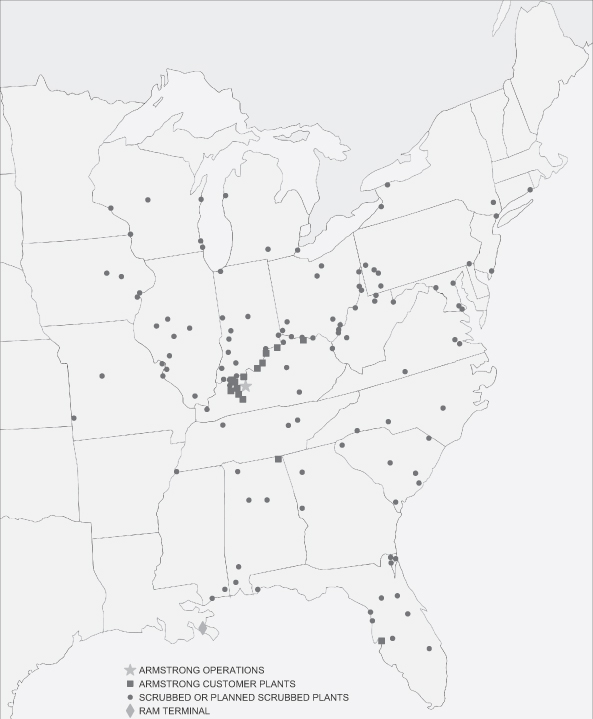

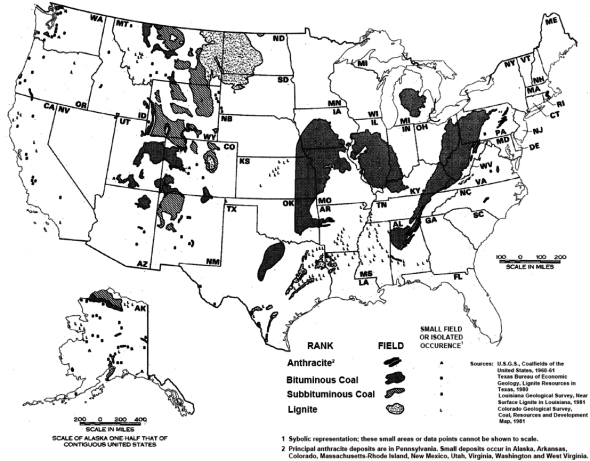

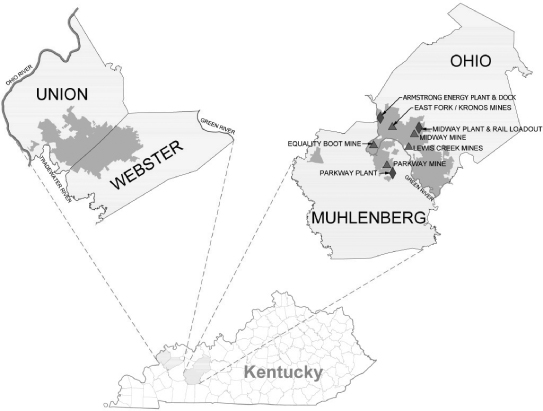

We are a diversified producer of low chlorine, high sulfur thermal coal from the Illinois Basin, with both surface and underground mines. We market our coal primarily to proximate and investment grade electric utility companies as fuel for their steam-powered generators. Based on 2012 production, we are the fifth largest producer in the Illinois Basin and the second largest in Western Kentucky. We were formed in 2006 to acquire and develop a large coal reserve holding. We commenced production in the second quarter of 2008 and currently operate seven mines, including four surface and three underground, and are seeking permits for three additional mines. We control approximately 322 million tons of proven and probable coal reserves. We also own and operate three coal processing plants which support our mining operations. From our reserves, we mine coal from multiple seams that, in combination with our coal processing facilities, enhance our ability to meet customer requirements for blends of coal with different characteristics. The locations of our coal reserves and operations, adjacent to the Green River, together with our river dock coal handling and rail loadout facilities, allow us to optimize our coal blending and handling, and provide our customers with rail, barge and truck transportation options.

Our revenue has increased from zero in 2007 to $382.1 million for the year ended December 31, 2012 and our net loss and Adjusted EBITDA totaled $18.0 million and $50.9 million, respectively, for 2012.

For the year ended December 31, 2012, we produced 8.8 million tons of coal. As of August 31, 2013, we are contractually committed to sell 9.2 million tons of coal in 2013 and 8.2 million tons of coal in 2014, which represent 98% and 84% of our expected total coal sales in 2013 and 2014, respectively. The following table summarizes our mines, our production and our coal reserves for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Clean Recoverable Coal (Proven

and Probable Reserves)(1) | | | Production | | | Quality

Specifications

(As Received)(2) | |

Mines (Commenced Operations) | | Mining

Method(3) | | | Proven

Reserves | | | Probable

Reserves | | | Total | | | Year Ended

December 31,

2012 | | | Six

Months

Ended

June 30,

2013 | | | Heat

Value

(Btu/

Lb) | | | SO2

Content

(Lbs/

MMBtu) | |

| | | (Tons in thousands) | |

Active mines | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Midway (July 2008) | | | S | | | | 16,440 | | | | 2,122 | | | | 18,562 | (4) | | | 1,518 | | | | 697 | | | | 11,112 | | | | 4.6 | |

Parkway (April 2009) | | | U | | | | 6,933 | | | | 4,747 | | | | 11,680 | | | | 1,558 | | | | 729 | | | | 11,925 | | | | 4.3 | |

East Fork (June 2009)(5) | | | S | | | | 2,604 | | | | 543 | | | | 3,147 | (4) | | | 41 | | | | — | | | | 11,078 | | | | 7.8 | |

Equality Boot (September 2010) | | | S | | | | 19,656 | | | | 826 | | | | 20,482 | (6) | | | 2,868 | | | | 1,327 | | | | 11,401 | | | | 5.6 | |

Lewis Creek (June 2011) | | | S | | | | 5,140 | | | | 97 | | | | 5,237 | (4) | | | 942 | | | | 446 | | | | 11,198 | | | | 4.9 | |

Kronos (September 2011) | | | U | | | | 16,775 | | | | 2,395 | | | | 19,170 | (7) | | | 1,842 | | | | 1,313 | | | | 11,793 | | | | 4.5 | |

Lewis Creek (March 2013) | | | U | | | | 18,676 | | | | 2,666 | | | | 21,342 | (7) | | | — | | | | 165 | | | | 11,793 | | | | 4.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total active mines | | | | | | | 86,224 | | | | 13,396 | | | | 99,620 | | | | 8,769 | (8) | | | 4,677 | (9) | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Additional reserves | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ken | | | S | | | | 17,166 | | | | 3,854 | | | | 21,020 | (4) | | | — | | | | — | | | | 11,809 | | | | 5.0 | |

Union/Webster | | | U | | | | 47,281 | | | | 80,187 | | | | 127,468 | | | | — | | | | — | | | | 12,435 | | | | 4.4 | |

Other | | | S/U | | | | 58,807 | | | | 14,681 | | | | 73,488 | (10) | | | — | | | | — | | | | 11,688 | | | | 5.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total additional reserves | | | | | | | 123,254 | | | | 98,722 | | | | 221,976 | | | | — | | | | — | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | | 209,478 | | | | 112,118 | | | | 321,596 | | | | 8,769 | (8) | | | 4,677 | (9) | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other inferred recoverable resources(11) | | | | | | | | | | | | | | | 104,356 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1

| (1) | As of December 31, 2012. For surface mines, clean recoverable tons are based on a 90% mining recovery, preparation plant yield at 1.55 specific gravity and a 95% preparation plant efficiency. For underground mines other than Union/Webster Counties, clean recoverable tons are based on a 50% mining recovery, preparation plant yield at 1.55 specific gravity and a 95% preparation plant efficiency. For Union/Webster Counties, clean recoverable tons are based on a 50% mining recovery, preparation plant yield at 1.60 specific gravity and a 95% preparation plant efficiency. “Proven and probable reserves” refers to coal that can be economically extracted or produced at the time of the reserve determination. |

| (2) | Quality specifications displayed on an “as received” basis. If derived from multiple seams, data represents an average. |

| (3) | U = Underground; S = Surface. |

| (4) | Of these reserves, 50.81% of the interests controlled by Armstrong Energy were leased from Armstrong Resource Partners as of December 31, 2012. |

| (5) | Warden and Kronos pits. Production at the Kronos pit ceased in August 2011 and the Warden pit was temporarily idled in March 2012. |

| (6) | Of these reserves, 50.81% of the interests controlled by Armstrong Energy were leased from Armstrong Resource Partners as of December 31, 2012. Includes approximately 0.3 million tons related to reserves for which we own or lease a 50% or more partial joint interest and royalties on extractions may be payable to other owners. |

| (7) | Based on internal estimates, recoverable reserves are split among the three mines that will produce coal from the underground properties and coal reserves located in Ohio County, Kentucky that are owned by Armstrong Resource Partners and leased to Armstrong Energy (the “Elk Creek Reserves”). |

| (8) | Of this amount, 76 tons and 31 tons of production from the Kronos and Lewis Creek underground mines, respectively, was capitalized because they were in the developmental phase. |

| (9) | Of this amount, 156 tons and 28 tons of production from the Lewis Creek underground and surface mines, respectively, was capitalized because they were in the developmental phase. |

| (10) | Of these reserves, excluding an estimated 21.3 million tons of Elk Creek Reserves, 50.81% of the interests controlled by Armstrong Energy were leased from Armstrong Resource Partners as of December 31, 2012. Includes approximately 1.9 million tons related to reserves for which we own or lease a 50% or more partial joint interest and royalties on extractions may be payable to other owners. |

| (11) | Other inferred resources includes tonnage for which tonnage, grade and mineral content can be estimated with a low level of confidence. It is inferred from geological evidence and assumed but not verified geological/or grade continuity. Inferred resources are computed by projecting data from available seam measurements to distances beyond those used for the probable classification. These numbers are based on information gathered through appropriate techniques from location such as outcrops, trenches, pits, workings and drill holes which may be of limited or uncertain quality and reliability. |

Our Credit Strengths

We have a demonstrated track record of successfully completing reserve acquisitions, developing new mines, securing required permits and producing coal. Since our formation in 2006, we have successfully completed a series of reserve acquisitions totaling approximately $261 million, with acquisition sizes ranging from $9.0 million to $75.6 million. We have also opened nine separate mines, obtained the necessary regulatory permits for the commencement of mining operations at those mines, and developed significant multi-year contractual relationships with large investment-grade customers in our market area. We believe this resulted from our deep management experience and disciplined approach to the development of our operations as well as our focus on providing competitively priced Illinois Basin coal to customers. We believe this will enable us to continue to maintain our current, and grow our future, customer base, production, revenues and profitability.

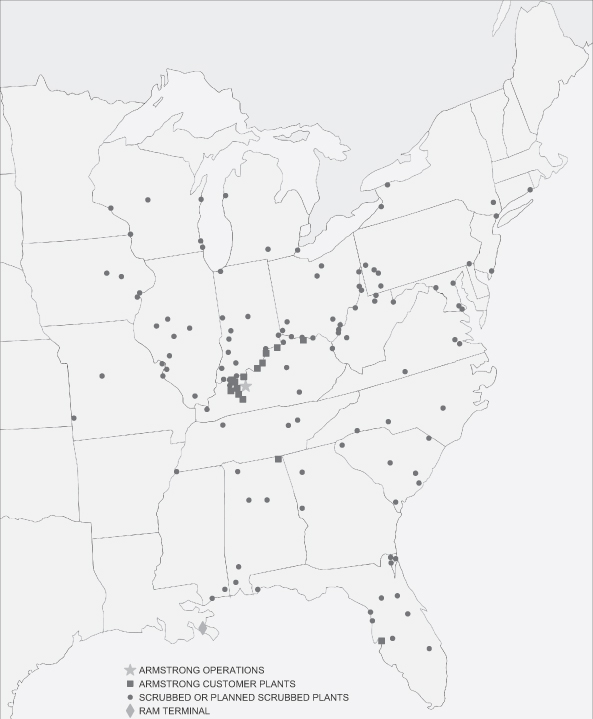

We have multi-year supply agreements with investment grade customers.As of August 31, 2013, we had approximately 9.2 million and 8.2 million tons of coal committed under long-term contracts for calendar years2013 and 2014, respectively. These committed amounts represent 98% and 84% of our expected total coal sales in 2013 and 2014, respectively. We believe that our committed and priced position relative to anticipatedproduction is amongst the highest of any coal producer in the United States, based on publicly available information. We intend to continue to opportunistically grow our production commensurate with long-term sales. Our coal is shipped to 14 different power plants owned and run by primarily investment grade electric utility companies.

2

Our proven and probable reserves have a long reserve life and attractive characteristics.As of December 31, 2012, we had approximately 322 million tons of clean recoverable (proven and probable) coal reserves and approximately 104 million tons of additional contiguous inferred recoverable resources. Our reserves include both surface and underground mineable coal residing in multiple seams that, in combination with our coal processing facilities, enhance our ability to meet customer requirements for blends of coal with different characteristics. Further, the comparatively low chlorine content of our coal relative to other Illinois Basin coal provides us with an additional competitive advantage in meeting the desired coal fuel profile of our customers.

Our mines are conveniently located in close proximity to our existing and potential customers and have access to multiple transportation options for delivery. Our active mines are located adjacent to the Green River and near our preparation, loading and transportation facilities, providing our customers with rail, barge and truck transportation options and resulting in low delivered cost. We believe this also enables us to sell our coal in both the domestic and export markets. Recently, we purchased an equity interest in, and upon development will have access to, a Mississippi River coal export terminal project in Plaquemines Parish, Louisiana,approximately 10 miles downstream of New Orleans. We intend to oversee the initial design, build-out and operation of this export coal terminal to facilitate the anticipated sale of a portion of our coal to international customers.

Our liquidity position is strong and supports our business strategy.We had $44.7 million in cash and cash equivalents as of June 30, 2013. In addition, under our $50.0 million revolving credit facility (the “Revolving Credit Facility”), we had no borrowings and $19.7 million of undrawn availability as of June 30, 2013. We believe that cash on hand, cash generated from operations and availability under our Revolving Credit Facility will be sufficient to meet working capital requirements, fund anticipated capital expenditures and opportunistic acquisitions, and service outstanding indebtedness.

We have a highly productive, non-union workforce and our business is unencumbered by legacy liabilities.Our highly skilled, non-union workforce uses efficient mining practices that take advantage of economies of scale and reduce operating costs in both surface and underground mining. We believe we are among a small number of operators of large scale dragline surface production in the eastern United States, and our continuous miner underground mining operations are designed to provide operating flexibility to meet production requirements and to fulfill our coal contract specifications. Additionally, our business has minimal exposure to legacy liabilities such as pension benefit obligations and retiree healthcare benefits.

We have a highly experienced management team with a long history of acquiring, building and operating coal businesses.The members of our senior management team have a demonstrated track record of acquiring, building and operating coal businesses profitably and safely. In addition, members of our senior management team have significant experience managing the financial and organizational growth of businesses, including public companies.

Our Business Strategy

Maintain safe mining operations and comply with environmental standards.We consider safety to be our greatest operational priority. We have won numerous awards for our safety record since 2008 recognizing our low injury and incident rates. We intend to maintain programs and policies designed to enable us to remainamong the safest coal operators in the industry. We also intend to continue to implement responsible, effective environmental practices throughout our operations and reclamation activities.

Increase and diversify coal sales to utilities with base load scrubbed power plants in our primary market area and pursue export opportunities. We expect that the demand for Illinois Basin coal will rise as a result of an increase in power plants being retrofitted with flue gas desulfurization (“FGD”) units, or scrubbers. We intend to

3

continue to focus our marketing efforts principally on power plants in the Mid-Atlantic, Southeastern and Midwestern states that we expect will become consumers of Illinois Basin coal and to seek to diversify our customer base through a combination of multi-year coal supply agreements and sales in the spot market. As of August 31, 2013, we are contractually committed to sell 9.2 million tons of coal in 2013 and 8.2 million tons of coal in 2014, which represent 98% and 84% of our expected total coal sales in 2013 and 2014, respectively. In addition, we believe that the relative heat, ash, sulfur content and cost of our coal, combined with the accessibility of our coal mines and coal processing facilities to the Mississippi River and to rail connecting to Louisiana export terminals, will provide opportunities to export our coal to overseas customers.

Continue to grow our production opportunistically.We intend to continue to increase our coal production opportunistically in the coming years as the market environment allows and commensurate with our ability to secure supply agreements in support of this growth. We also intend to continue to make opportunistic contiguous reserve acquisitions in amounts approximately consistent with our acquisition experience. We believe our disciplined growth will be supported by an increasing demand for Illinois Basin coal. We will seek to support production growth by executing mining plans for our existing undeveloped reserves and by opportunistically acquiring additional coal reserves that are located near our current mining operations or otherwise offer the potential for efficient and economical development of low-cost production to serve our primary market area.

Maximize profitability by maintaining low-cost mining operations.We operate our mines in a manner aimed at keeping our product quality high while maintaining low production costs. We seek to maximize our coal production and control our costs by continuing to improve our operating efficiency. Our efficiency is, in part, a function of the overburden ratios (the amount of surface material needed to be removed to extract coal) that exist at our surface coal mines. Our efficiency is also enhanced by our fleet of mobile mining equipment, our use of what we believe to be the only draglines in Kentucky, our utilization of river coal movement, our information technology systems and our coordinated equipment utilization and maintenance management functions. We also believe that our highly experienced operating management and well-trained workforce will continue to help in identifying and implementing cost containment initiatives, such as near-term operating synergies from any potential future reserve acquisitions.

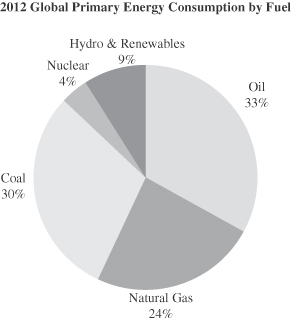

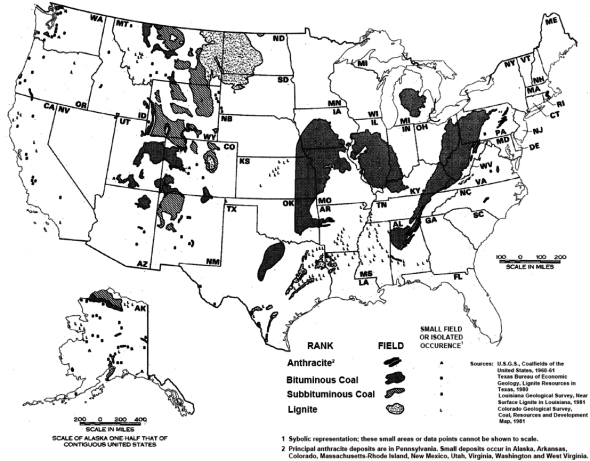

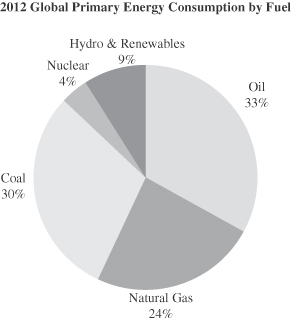

Coal Industry Overview

According to the U.S. Department of Energy’s Energy Information Administration (“EIA”), the U.S. coal industry produced approximately 1.0 billion tons of coal in 2012, a substantial majority of which was sold by U.S. coal producers to operators of electricity generation plants. Coal-fired electricity generation is the largest component of total world electricity generation.

The following market dynamics and trends currently impact thermal coal consumption and production in the United States and are reshaping competitive advantages for coal producers.

| | • | | Increasing demand for coal produced in the Illinois Basin. We believe the increasing demand for coal produced in the Illinois Basin is due to a combination of factors including: |

| | • | | Significant expansion of scrubbed coal-fired electricity generating capacity. The EIA forecasts a 22% increase in FGD installed on the coal-fired generation fleet by 2040 as electricity generation operators invest in retrofit emissions reduction technology to comply with new U.S. Environmental Protection Agency (“EPA”) regulations under the Cross-State Air Pollution Rule and the new mercury and air toxics standards (“MATS”) for power plants. This represents an increase from 192 gigawatts in 2011 to 235 gigawatts, or 86% of all U.S. coal-fired capacity in the electric sector. The EIA estimates that in 2011, approximately 61% of all U.S. coal-fired generation operating or under construction had FGD technology installed. Illinois Basin coal generally has a higher sulfur content per ton than coal produced in other regions. However, we believe that FGD utilization will enable |

4

| | operators to use the most competitively priced coal (on a delivered cents per million Btu basis) irrespective of sulfur content, and thus lead to a strong increase in demand for Illinois Basin coal. |

| | • | | Declines in Central Appalachian thermal coal production. Wood Mackenzie forecasts that production of Central Appalachian thermal coal will continue to decline, falling from 84 million tons in 2013 to 49 million tons in 2015, due to reserve depletion, regulatory-driven decreases in surface production and more difficult geological conditions. These factors are expected to result in significantly higher mining costs and prices for Central Appalachian thermal coal. We believe this will lead to an increase in demand for thermal coal from the Illinois Basin due to its comparatively lower delivered cost to the major Eastern U.S. utilities who are currently the principal users of thermal coal from Central Appalachia. |

| | • | | Growing demand for seaborne thermal coal. Global thermal coal exports are projected to rise from 890 million tons in 2012 to 1.1 billion tons by 2018. We believe that limitations on existing global export coal supply, infrastructure constraints, relative exchange rates, coal quality and cost structure could create significant thermal coal export opportunities for U.S. coal producers, including Illinois Basin coal producers, particularly those similar to us with transportation access to both the Mississippi River and to rail connecting to Louisiana export terminals. In addition, we believe that certain domestic users of U.S. thermal coal will need to seek alternative sources of domestic supply as an increasing amount of domestic coal is sold in global export markets. |

| | • | | Stable long-term outlook for U.S. thermal coal market. According to the EIA, coal-fired electricity generation accounted for approximately 37% of all electricity generation in the United States in 2012. On a long-term basis, coal continues to be the lowest cost fossil fuel source of energy for electric power generation. Despite recent increases in generation from natural gas, as well as federal and state subsidies for the construction and operation of renewable energy, the EIA projects that coal-fired generation will continue to remain the largest single source of electricity generation in 2040, at 35% of total generation. |

Recent Developments

In July 2013, our Lewis Creek underground mine came out of development and was placed in active production. Lewis Creek is a two unit mine that extracts coal from the West Kentucky #9 coal seam.

On June 28, 2013, Thoroughbred Resources, LLC (“Thoroughbred”), an entity wholly owned by Yorktown, acquired approximately 65 million tons of fee-owned underground coal reserves and 40 million tons of leased underground coal reserves from Peabody Energy, Inc. and certain of its affiliates (“Peabody”). The acquired coal reserves are located in Muhlenberg and McLean Counties of Kentucky, contiguous to Armstrong Energy’s reserves. It is intended that these reserves will be leased to us in exchange for a production royalty.

In connection with Thoroughbred’s acquisition of these reserves, we loaned Thoroughbred $17.5 million, which was repaid in July 2013. The proceeds of the loan, which was evidenced by a promissory note, were used to make a portion of the down payment to Peabody for the reserves.

Corporate Information

Our principal executive offices are located at 7733 Forsyth Boulevard, Suite 1625, St. Louis, Missouri 63105 and our telephone number is (314) 721-8202. Our corporate website address iswww.armstrongenergyinc.com.Information on, or accessible through, our website is not part of, or incorporated by reference in, this prospectus. We are incorporated under the laws of the State of Delaware.

5

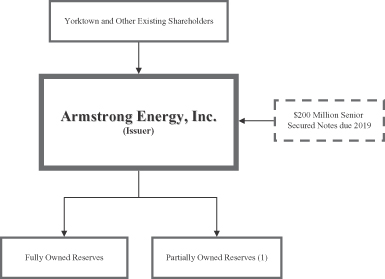

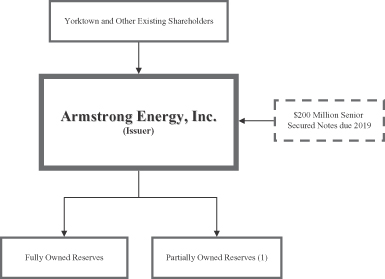

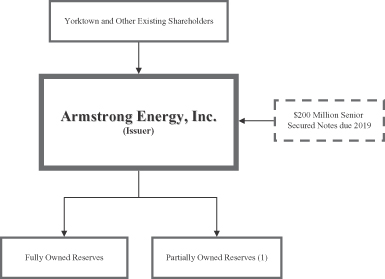

Corporate Structure

The following chart shows a summary of the corporate structure of Armstrong Energy, Inc. and certain of its relationships.

| (1) | A portion of our reserves are controlled jointly by our affiliate, Armstrong Resource Partners (with a 53.4% undivided interest as of June 30, 2013), and Armstrong Energy (with a 46.6% undivided interest as of June 30, 2013) and certain of our remaining reserves are owned solely by Armstrong Resource Partners, with whom we have a long-term leasehold interest. See “Business—About Armstrong Resource Partners” and “Certain Relationships and Related Party Transactions—Lease Agreements.” These reserves include the Kronos and Lewis Creek underground mines. |

Emerging Growth Company Status

We are an “emerging growth company,” as defined in Section 2(a)(19) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We have not made a decision whether to take advantage of any or all of these exemptions.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards, and delay compliance with new or revised accounting standards until those standards are applicable to private companies. However, we intend to opt out of any extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act

6

provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

We could be an emerging growth company until the last day of the first fiscal year following the fifth anniversary of our first common equity offering, although circumstances could cause us to lose that status earlier if our annual revenues exceed $1.0 billion, if we issue more than $1.0 billion in non-convertible debt in any three-year period or if we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Yorktown Partners LLC

We are majority-owned by Yorktown. Yorktown was formed in 1991 and has approximately $3.0 billion in assets under management. Yorktown invests exclusively in the energy industry with an emphasis on North American oil and gas production, coal mining and midstream businesses. Yorktown’s investors include university endowments, foundations, families, insurance companies and other institutional investors.

After giving effect to this exchange offer, we will continue to be majority-owned by Yorktown. In addition, Yorktown is represented on our board by Bryan H. Lawrence, founder and principal of Yorktown Partners LLC. As a result, Yorktown has, and can be expected to have, a significant influence in our operations, in the outcome of stockholder voting concerning the election of directors, the adoption or amendment of provisions in our charter and bylaws, the approval of mergers, and other significant corporate transactions.

7

The Exchange Offer

On December 21, 2012, we completed a private offering of the Outstanding Notes. Concurrently with the private offering, we entered into a registration rights agreement with the initial purchasers. Pursuant to the registration rights agreement, we agreed, among other things, to file the registration statement of which this prospectus is a part. The following is a summary of the exchange offer. Certain of the terms and conditions described below are subject to important limitations and exceptions. “The Exchange Offer,” beginning on page 17 of this prospectus, contains a more detailed description of the terms and conditions of the exchange offer. In this section, the “Company” refers to Armstrong Energy, Inc. only and not any of its subsidiaries.

General | The form and terms of the Exchange Notes are substantially the same as the form and terms of the Outstanding Notes except that: |

| | • | | The issuance and sale of the Exchange Notes have been registered pursuant to a registration statement under the Securities Act; and |

| | • | | The holders of the Exchange Notes will not be entitled to registration rights or the liquidated damages provision of the registration rights agreement, which permits an increase in the interest rate on the Outstanding Notes in some circumstances relating to the timing of the exchange offer. See “The Exchange Offer.” |

The Exchange Offer | We are offering to exchange $200,000,000 aggregate principal amount of 11.75% Senior Secured Notes due 2019 that have been registered under the Securities Act for all of our outstanding unregistered 11.75% Senior Secured Notes due 2019. |

| | The exchange offer will remain in effect for a limited time. We will accept any and all Outstanding Notes validly tendered and not validly withdrawn prior to 5:00 p.m., New York City time, on November 13, 2013. Holders may tender some or all of their Outstanding Notes pursuant to the exchange offer. Outstanding Notes, however, may be tendered only in a denomination equal to $2,000 and integral multiples of $1,000 in excess thereof. |

Resale | Based upon interpretations by the staff of the SEC set forth in no-action letters issued to unrelated third-parties, we believe that the Exchange Notes may be offered for resale, resold or otherwise transferred by you without compliance with the registration and prospectus delivery requirements of the Securities Act, unless you: |

| | • | | are an “affiliate” of ours within the meaning of Rule 405 under the Securities Act; |

| | • | | are a broker-dealer that purchased the Outstanding Notes directly from us for resale under Rule 144A, Regulation S or any other available exemption under the Securities Act; |

| | • | | acquired the Exchange Notes other than in the ordinary course of your business; |

8

| | • | | have an arrangement with any person to engage in the distribution of the Exchange Notes; or |

| | • | | are prohibited by law or policy of the SEC from participating in the exchange offer. |

| | However, we have not obtained a no-action letter, and there can be no assurance that the SEC will make a similar determination with respect to the exchange offer. Furthermore, in order to participate in the exchange offer, you must make the representations set forth in the letter of transmittal that we are sending you with this prospectus. |

Expiration Date | The exchange offer will expire at 5:00 p.m., New York City time, on November 13, 2013. |

Conditions to the Exchange Offer | The exchange offer is subject to certain customary conditions, some of which may be waived by us. See “The Exchange Offer—Conditions to the Exchange Offer.” |

Procedures for Tendering Outstanding Notes | To participate in the exchange offer, you must properly complete and duly execute a letter of transmittal, which accompanies this prospectus, and transmit it, along with all other documents required by such letter of transmittal, to the exchange agent on or before the expiration date at the address provided on the cover page of the letter of transmittal. |

| | In the alternative, you can tender your Outstanding Notes by following the automated tender offer program (“ATOP”) procedures established by DTC for tendering Notes held in book-entry form, as described in this prospectus, whereby you will agree to be bound by the letter of transmittal and we may enforce the letter of transmittal against you. |

| | If a holder of Outstanding Notes desires to tender such Notes and the holder’s Outstanding Notes are not immediately available, or time will not permit the holder’s Outstanding Notes or other required documents to reach the exchange agent before the expiration date, or the procedure for book-entry transfer cannot be completed on a timely basis, a tender may be effected pursuant to the guaranteed delivery procedures described in this prospectus. For more details, please read “The Exchange Offer—Procedures for Tendering,” “The Exchange Offer—Book-Entry Delivery Procedures” and “The Exchange Offer—Guaranteed Delivery Procedures.” |

Special Procedures for Beneficial Owners | If you are a beneficial owner of Outstanding Notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender those Outstanding Notes in the exchange offer, you should contact the registered holder promptly and instruct the registered holder to tender those Outstanding Notes on |

9

| | your behalf. If you wish to tender on your own behalf, you must, prior to completing and executing the letter of transmittal and delivering your Outstanding Notes, either make appropriate arrangements to register ownership of the Outstanding Notes in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time and may not be able to be completed prior to the expiration date. |

Withdrawal Rights | You may withdraw your tender of Outstanding Notes at any time prior to 5:00 p.m., New York City time, on the expiration date of the exchange offer. Please read “The Exchange Offer—Withdrawal of Tenders.” |

Acceptance of Outstanding Notes and Delivery of Exchange Notes | Subject to customary conditions, we will accept Outstanding Notes that are properly tendered in the exchange offer and not validly withdrawn prior to 5:00 p.m., New York City time, on the expiration date. The Exchange Notes will be delivered promptly following the expiration date. We will return any Outstanding Notes that we do not accept for exchange promptly after expiration or termination of the exchange offer. |

Consequences of Failure to Exchange Outstanding Notes | If you do not exchange your Outstanding Notes in the exchange offer, you will no longer be able to require us to register the Outstanding Notes under the Securities Act, except in the limited circumstances provided under the registration rights agreement, and will not be entitled to the liquidated damages provision of the registration rights agreement. In addition, you will not be able to resell, offer to resell or otherwise transfer the Outstanding Notes unless we have registered the Outstanding Notes under the Securities Act, or unless you resell, offer to resell or otherwise transfer them under an exemption from the registration requirements of, or in a transaction not subject to, the Securities Act. |

Interest on the Exchange Notes and the Outstanding Notes | The Exchange Notes will bear interest from the most recent interest payment date on which interest has been paid on the Outstanding Notes. Holders whose Outstanding Notes are accepted for exchange will be deemed to have waived the right to receive interest accrued on the Outstanding Notes. |

Broker-Dealers | Each broker-dealer that receives Exchange Notes for its own account pursuant to the exchange offer, where such Outstanding Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities, must acknowledge that it will deliver a prospectus in connection with any resale of such Exchange Notes. See “Plan of Distribution.” |

Risk Factors | You should consider carefully all of the information set forth in this prospectus and, in particular, you should evaluate the specific factors |

10

| | under the section entitled “Risk Factors” in this prospectus before deciding to invest in the Exchange Notes. |

Certain Federal Income Tax Considerations | Neither the registration of the Outstanding Notes pursuant to our obligations under the registration rights agreement nor the holder’s receipt of Exchange Notes in exchange for Outstanding Notes will constitute a taxable event for U.S. federal income tax purposes. Please read “Certain U.S. Federal Income Tax Considerations.” |

Exchange Agent | Wells Fargo Bank, National Association, the trustee and collateral agent under the indenture governing the Notes, is serving as exchange agent in connection with the exchange offer. |

Use of Proceeds | The issuance of the Exchange Notes will not provide us with any new proceeds. We are making the exchange offer solely to satisfy certain of our obligations under the registration rights agreement. |

Fees and Expenses | We will bear all expenses related to the exchange offer. Please read “The Exchange Offer—Fees and Expenses.” |

11

THE EXCHANGE NOTES

The following is a brief summary of some of the principal terms of the Exchange Notes and is not intended to be complete. You should carefully review the “Description of Exchange Notes” section of this prospectus, which contains a detailed description of the terms and conditions of the Exchange Notes.

Issuer | Armstrong Energy, Inc. |

Exchange Notes Offered | $200,000,000 aggregate principal amount of 11.75% senior secured notes due 2019 which are registered under the Securities Act. |

Maturity Date | December 15, 2019. |

Original Issue Discount | Because the principal amount of the Exchange Notes exceeds their issue price by an amount that is equal to or greater than a statutoryde minimis amount, the Exchange Notes will be treated as issued with original issue discount (“OID”) for U.S. federal income tax purposes in an amount equal to such difference. U.S. holders of such Exchange Notes generally must include the OID in gross income over the term of the Exchange Notes on a constant-yield basis in advance of the receipt of cash attributable to such income. |

Interest | Interest on the Exchange Notes will accrue at a rate of 11.75% per annum and be payable semi-annually in cash in arrears on June 15 and December 15 of each year, commencing December 15, 2013. |

Guarantees | The Exchange Notes will be fully and unconditionally guaranteed, jointly and severally, on a senior secured basis, by the Company and substantially all of its future domestic restricted subsidiaries, subject to certain customary release provisions. See “Description of Exchange Notes—Note Guarantees.” The Exchange Notes and the guarantees will be effectively subordinated to indebtedness under our Revolving Credit Facility to the extent of the value of the collateral securing our Revolving Credit Facility on a first-priority basis. |

Security Interest | The Exchange Notes and the guarantees will be secured, subject to certain exceptions and permitted liens, on a first-priority basis by our and the guarantors’ existing and after-acquired owned and leased real property, coal mines, reserves, stock of subsidiaries and substantially all of our and the guarantors other assets that do not secure our Revolving Credit Facility on a first-priority basis (the “Exchange Notes Priority Collateral”). Subject to certain exceptions and permitted liens, the Exchange Notes and the guarantees will also be secured on a second-priority basis by a lien on the assets securing our obligations under our Revolving Credit Facility on a first-priority basis, including present and future receivables, inventory and certain other assets and the proceeds thereof (the “Revolver Collateral” and, together with the Exchange Notes Priority Collateral, the “Collateral”). See “Description of Exchange Notes—Security.” |

12

Ranking | The Exchange Notes will be our and the guarantors’ senior secured obligations and will: |

| | • | | rank equal in right of payment with our and the guarantors’ existing and future senior indebtedness; |

| | • | | rank senior in right of payment to all of our and the guarantors’ existing and future subordinated indebtedness; |

| | • | | be effectively junior to our and the guarantors’ indebtedness and obligations under our Revolving Credit Facility to the extent of the value of the Revolver Collateral; |

| | • | | be effectively senior to our and the guarantors’ indebtedness and obligations under our Revolving Credit Facility to the extent of the value of the Exchange Notes Collateral; |

| | • | | be effectively senior to all existing and future senior unsecured debt to the extent of the value of the Collateral; and |

| | • | | be structurally subordinated to all indebtedness and other liabilities of each of our future non-guarantor subsidiaries. |

| | As of June 30, 2013, excluding $104.9 million of certain long-term obligations to Armstrong Resource Partners that are characterized as financing transactions, we had $211.0 million of indebtedness outstanding, consisting of the Notes, capital leases and other long-term debt. |

Intercreditor Agreement | The trustee and the administrative agent under the Revolving Credit Facility are parties to an intercreditor agreement as to the relative priorities of their respective security interests in the assets securing the Exchange Notes and the guarantees and borrowings under the Revolving Credit Facility and certain other matters relating to the administration of security interests. See “Description of Exchange Notes—Intercreditor Agreement.” |

Optional Redemption | On or after December 15, 2016, we may redeem some or all of the Notes at any time at the redemption prices described in the section “Description of Exchange Notes—Optional Redemption.” Prior to such date, we may redeem some or all of the Exchange Notes at a redemption price of 100% of the principal amount plus accrued and unpaid interest, if any, to the redemption date, plus a “make-whole” premium. |

| | In addition, we may redeem up to 35% of the aggregate principal amount of the Exchange Notes before December 15, 2015 with the proceeds of certain equity offerings at a redemption price of 111.75% plus accrued and unpaid interest, if any, to the redemption date. |

Change of Control Offer | If a Change of Control occurs, each holder of Exchange Notes may require us to repurchase all or a portion of its Exchange Notes at a purchase price equal to 101% of the principal amount of the |

13

| | Exchange Notes, plus accrued interest. See “Description of Exchange Notes—Repurchase of Notes upon a Change of Control.” |

Certain Covenants | The indenture governing the Exchange Notes contains covenants limiting the ability of the Company and its restricted subsidiaries to: |

| | • | | incur additional indebtedness and issue preferred equity; |

| | • | | pay dividends or distributions on or purchase our stock or our restricted subsidiaries’ stock; |

| | • | | make certain investments; |

| | • | | use assets as security in other transactions; |

| | • | | create guarantees of indebtedness by restricted subsidiaries; |

| | • | | enter into agreements that restrict dividends, distributions, or other payments by restricted subsidiaries; |

| | • | | sell certain assets or merge with or into other companies; and |

| | • | | enter into transactions with affiliates. |

| | These covenants are subject to a number of important limitations and exceptions. See “Description of Exchange Notes.” |

Absence of an Established Market for the Notes | The Exchange Notes will be a new class of securities for which there is currently no market. Accordingly, we cannot assure you that a liquid market for the Exchange Notes will develop or be maintained. We do not intend to apply for listing of the Exchange Notes on any securities exchange or for the inclusion of the Exchange Notes in any automated quotation system. |

Risk Factors | See “Risk Factors” and the other information in this prospectus for a discussion of factors you should carefully consider before deciding to exchange your Outstanding Notes. |

14

Summary Historical Consolidated Financial and Operating Data

The following table presents our summary historical consolidated financial and operating data for the periods indicated for Armstrong Energy, Inc. and its subsidiaries and Armstrong Energy, Inc.’s predecessor, Armstrong Land Company, LLC, and its subsidiaries (our “Predecessor”). The summary historical financial data for the years ended December 31, 2010, 2011 and 2012 and the balance sheet data as of December 31, 2010, 2011 and 2012 are derived from the audited financial statements of Armstrong Energy and our Predecessor. The summary historical financial data for the six months ended June 30, 2012 and 2013 and the balance sheet data as of June 30, 2012 and 2013 are derived from the unaudited financial statements included herein.

As of October 1, 2011, we no longer consolidate the results of operations of Armstrong Resource Partners in our consolidated financial statements and we account for our ownership in Armstrong Resource Partners under the equity method of accounting. As a result, our financial results for the year ended December 31, 2010 are not directly comparable to our financial results for the years ended December 31, 2011 or 2012. For more information, please see Note 3, “Deconsolidation of Armstrong Resource Partners,” to our audited financial statements included in this prospectus.

Historical consolidated financial and operating information is included for illustrative and informational purposes only and is not necessarily indicative of results we expect in future periods. You should read the following summary financial data in conjunction with “Selected Historical Consolidated Financial and Operating Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes appearing elsewhere in this prospectus.

| | | | | | | | | | | | | | | | | | | | |

| | | Predecessor | | | | | | | | | | |

| | | Year Ended December 31, | | | Six Months Ended

June 30, | |

| | | 2010 | | | 2011 | | | 2012 | | | 2012 | | | 2013 | |

| | | | | | | | | | | | (Unaudited) | |

Results of Operations Data | | | | | | | | | | | | | | | | | | | | |

Total revenues | | $ | 220,625 | | | $ | 299,270 | | | $ | 382,109 | | | $ | 193,173 | | | $ | 202,466 | |

Costs and expenses: | | | | | | | | | | | | | | | | | | | | |

Operating costs and expenses, exclusive of items shown separately below | | | 151,838 | | | | 221,597 | | | | 282,569 | | | | 137,794 | | | | 146,606 | |

Production royalty to related party | | | — | | | | 578 | | | | 5,695 | | | | 2,363 | | | | 4,017 | |

Depreciation, depletion, and amortization | | | 18,892 | | | | 27,661 | | | | 33,066 | | | | 16,119 | | | | 17,765 | |

Asset retirement obligation expenses | | | 3,087 | | | | 4,005 | | | | 3,977 | | | | 2,140 | | | | 1,165 | |

Selling, general, and administrative expenses | | | 27,656 | | | | 37,494 | | | | 50,154 | | | | 25,324 | | | | 26,975 | |

| | | | | | | | | | | | | | | | | | | | |

Operating income | | | 19,152 | | | | 7,935 | | | | 6,648 | | | | 9,433 | | | | 5,938 | |

Interest expense | | | (11,070 | ) | | | (10,839 | ) | | | (19,268 | ) | | | (9,050 | ) | | | (17,242 | ) |

Other income (expense), net | | | 87 | | | | 278 | | | | (1,466 | ) | | | 393 | | | | 275 | |

(Loss) gain on extinguishment of debt | | | — | | | | 6,954 | | | | (3,953 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | 8,169 | | | | 4,328 | | | | (18,039 | ) | | | 776 | | | | (11,029 | ) |

Income tax provision | | | — | | | | (856 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 8,169 | | | $ | 3,472 | | | $ | (18,039 | ) | | $ | 776 | | | $ | (11,029 | ) |

| | | | | | | | | | | | | | | | | | | | |

Balance Sheet Data (at period end) | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 478,038 | | | $ | 507,908 | | | $ | 560,309 | | | $ | 504,502 | | | $ | 571,122 | |

Working capital | | | 2,905 | | | | (30,629 | ) | | | 48,873 | | | | (33,181 | ) | | | 39,120 | |

Total long-term debt(1) | | | 123,996 | | | | 159,709 | | | | 203,896 | | | | 125,761 | | | | 203,366 | |

Total stockholders’ equity | | | 296,681 | | | | 168,138 | | | | 182,662 | | | | 199,475 | | | | 171,069 | |

15

| | | | | | | | | | | | | | | | | | | | |

| | | Predecessor | | | | | | | | | | |

| | | Year Ended December 31, | | | Six Months Ended

June 30, | |

| | | 2010 | | | 2011 | | | 2012 | | | 2012 | | | 2013 | |

| | | | | | | | | | | | (Unaudited) | |

Other Data | | | | | | | | | | | | | | | | | | | | |

Tons sold (unaudited) | | | 5,387 | | | | 7,030 | | | | 8,521 | | | | 4,263 | | | | 4,454 | |

Tons produced (unaudited) | | | 5,645 | | | | 6,642 | | | | 8,769 | | | | 4,454 | | | | 4,677 | |

Sales price per ton (unaudited) | | $ | 40.96 | | | $ | 42.57 | | | $ | 44.84 | | | $ | 45.32 | | | $ | 45.45 | |

Operating cost per ton (unaudited) | | $ | 28.19 | | | $ | 31.52 | | | $ | 33.16 | | | $ | 32.33 | | | $ | 32.91 | |

Adjusted EBITDA per ton (unaudited) | | $ | 7.63 | | | $ | 5.92 | | | $ | 5.97 | | | $ | 7.22 | | | $ | 6.59 | |

Investments in property, plant, equipment and mine development | | | 41,755 | | | | 73,627 | | | | 46,464 | | | | 29,778 | | | | 23,372 | |

Adjusted EBITDA (unaudited)(2) | | | 41,099 | | | | 41,601 | | | | 50,854 | | | | 30,764 | | | | 29,330 | |

| (1) | Does not include certain long-term obligations to Armstrong Resource Partners of $71.0 million and $98.4 million as of December 31, 2011 and 2012, respectively, and $96.8 million and $104.9 million as of June 30, 2012 and 2013, respectively, that are characterized as financing transactions due to our continuing involvement in the lease of the related land and mineral reserves. |

| (2) | Adjusted EBITDA is a non-GAAP financial measure, and when analyzing our operating performance, investors should use Adjusted EBITDA in addition to, and not as an alternative for, operating income and net income (loss) (each as determined in accordance with GAAP). Adjusted EBITDA is defined as net income (loss) before deducting net interest expense, income taxes, depreciation, depletion and amortization, non-cash production royalty to related party, loss on settlement of interest rate swap, loss on deferment of equity offering, gain on settlement of asset retirement obligations, non-cash stock compensation expense, non-cash charges related to non-recourse notes, gain on deconsolidation, and (gain) loss on extinguishment of debt. The following is a reconciliation of Adjusted EBITDA to net income (loss) the most directly comparable GAAP measure: |

| | | | | | | | | | | | | | | | | | | | |

| | | Predecessor | | | | | | | | | | | | | |

| | | Year Ended December 31, | | | Six Months Ended

June 30, | |

| | | 2010 | | | 2011 | | | 2012 | | | 2012 | | | 2013 | |

Net income (loss) | | $ | 8,169 | | | $ | 3,472 | | | $ | (18,039 | ) | | $ | 776 | | | $ | (11,029 | ) |

Income tax provision | | | — | | | | 856 | | | | — | | | | — | | | | — | |

Depreciation, depletion and amortization | | | 21,979 | | | | 31,666 | | | | 37,043 | | | | 18,259 | | | | 18,930 | |

Non-cash production royalty to related party | | | — | | | | 578 | | | | 5,695 | | | | 2,363 | | | | 4,017 | |

Interest expense, net | | | 10,872 | | | | 10,694 | | | | 19,200 | | | | 9,016 | | | | 17,212 | |

Non-cash stock compensation expense | | | 79 | | | | 1,383 | | | | 697 | | | | 350 | | | | 290 | |

Loss on settlement of interest rate swap | | | — | | | | — | | | | 1,409 | | | | — | | | | — | |

Loss on deferment of equity offering | | | — | | | | — | | | | 1,130 | | | | — | | | | — | |

Gain on settlement of asset retirement obligations | | | — | | | | — | | | | (234 | ) | | | — | | | | (90 | ) |

(Gain) loss on extinguishment of debt | | | — | | | | (6,954 | ) | | | 3,953 | | | | — | | | | — | |

Non-cash charge related to non-recourse notes | | | — | | | | 217 | | | | — | | | | — | | | | — | |

Gain on deconsolidation | | | — | | | | (311 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| | $ | 41,099 | | | $ | 41,601 | | | $ | 50,854 | | | $ | 30,764 | | | $ | 29,330 | |

| | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA, as used and defined by us, may not be comparable to similarly titled measures employed by other companies and is not a measure of performance calculated in accordance with GAAP. There are significant limitations to using Adjusted EBITDA as a measure of performance, including the inability to analyze the effect of certain recurring and non-recurring items that materially affect our net income or loss, the lack of comparability of results of operations of different companies and the different methods of calculating Adjusted EBITDA reported by different companies, and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP.

16

RISK FACTORS

An investment in the Exchange Notes involves significant risks. In addition to matters described elsewhere in this prospectus, you should carefully consider the following risks involved with an investment in the Exchange Notes. You are urged to consult your own legal, tax or financial counsel for advice before making a decision to participate in the exchange offer. The occurrence of any one or more of the following could materially adversely affect an investment in the Exchange Notes or our business and operating results. If that occurs, you could lose some or all of your investment in, or fail to achieve the expected return on, the Exchange Notes.

Risks Related to Our Business

Coal prices are subject to change and a substantial or extended decline in prices could materially and adversely affect our profitability and the value of our coal reserves.

Our profitability and the value of our coal reserves depend upon the prices we receive for our coal. The contract prices we may receive in the future for coal depend upon factors beyond our control, including the following:

| | • | | the domestic and foreign supply and demand for coal; |

| | • | | the demand for electricity; |

| | • | | the relative cost, quantity and quality of coal available from competitors; |

| | • | | competition for production of electricity from non-coal sources, which are a function of the price and availability of alternative fuels, such as natural gas, fuel oil, nuclear, hydroelectric, wind, biomass and solar power, and the location, availability, quality and price of those alternative fuel sources; |

| | • | | legislative, regulatory and judicial developments, environmental regulatory changes or changes in energy policy and energy conservation measures that would adversely affect the coal industry, such as legislation limiting carbon emissions or providing for increased funding and incentives for alternative energy sources; |

| | • | | domestic air emission standards for coal-fired power plants and the ability of coal-fired power plants to meet these standards by installing scrubbers and other pollution control technologies or by other means; |

| | • | | adverse weather, climatic or other natural conditions, including natural disasters; |

| | • | | domestic and foreign economic conditions, including economic slowdowns; |

| | • | | the proximity to, capacity of and cost of, transportation, port and unloading facilities; and |

| | • | | market price fluctuations for sulfur dioxide emission allowances. |

A substantial or extended decline in the prices we receive for our future coal sales contracts or on the spot market could materially and adversely affect us by decreasing our profitability and the value of operating our coal reserves.

Our business requires substantial capital expenditures and we may not have access to the capital required to reach full productive capacity at our mines.

Maintaining and expanding mines and infrastructure is capital intensive. Specifically, the exploration, permitting and development of coal reserves, mining costs, the maintenance of machinery and equipment and compliance with applicable laws and regulations require substantial capital expenditures. While a significant amount of the capital expenditures required to build-out our mines has been spent, we must continue to invest capital to maintain our production. Decisions to increase our production could also affect our capital needs. We

17

cannot assure you that we will be able to maintain our production levels or generate sufficient cash flow, or that we will have access to sufficient financing to continue our production, exploration, permitting and development activities at or above our present levels and on our current or projected timelines and we may be required to defer all or a portion of our capital expenditures. Our results of operations, business and financial condition, as well as our ability to satisfy our obligations under the Notes, may be materially adversely affected if we cannot make such capital expenditures.

Our coal mining operations are subject to operating risks that are beyond our control, which could result in materially increased operating expenses and decreased production levels and could materially and adversely affect our profitability.

We mine coal both at underground and at surface mining operations. Certain factors beyond our control, including those listed below, could disrupt our coal mining operations, adversely affect production and shipments and increase our operating costs:

| | • | | poor mining conditions resulting from geological, hydrologic or other conditions that may cause instability of mining portals, highwalls or spoil piles or cause damage to mining equipment, nearby infrastructure or mine personnel; |

| | • | | delays or challenges to and difficulties in obtaining or renewing permits necessary to produce coal or operate mining or related processing and loading facilities; |

| | • | | adverse weather and natural disasters, such as heavy rains or snow, flooding and other natural events affecting operations, transportation or customers; |

| | • | | a major incident at the mine site that causes all or part of the operations of the mine to cease for some period of time; |

| | • | | mining, processing and plant equipment failures and unexpected maintenance problems; |

| | • | | unexpected or accidental surface subsidence from underground mining; |

| | • | | accidental mine water discharges, fires, explosions or similar mining accidents; and |

| | • | | competition and/or conflicts with other natural resource extraction activities and production within our operating areas, such as coalbed methane extraction or oil and gas development. |

If any of these conditions or events occurs, we could experience a delay or halt of production or shipments or our operating costs could increase significantly.

Competition within the coal industry could put downward pressure on coal prices and, as a result, materially and adversely affect our revenues and profitability.

We compete with numerous other coal producers in the Illinois Basin and in other coal producing regions of the United States, primarily Central Appalachia and the Powder River Basin. The most important factors on which we compete are:

| | • | | delivered price (i.e., the cost of coal delivered to the customer on a cents per million Btu basis, including transportation costs, which are generally paid by our customers either directly or indirectly); |

| | • | | coal quality characteristics (primarily heat, sulfur, ash and moisture content); and |

Our competitors may have, among other things, greater liquidity, greater access to credit and other financial resources, newer or more efficient equipment, lower cost structures, partnerships with transportation companies or more effective risk management policies and procedures. Our failure to compete successfully could have a material adverse effect on our business, financial condition or results of operations.

18

International demand for U.S. coal also affects competition within our industry. The demand for U.S. coal exports depends upon a number of factors outside our control, including the overall demand for electricity in foreign markets, currency exchange rates, ocean freight rates, port and shipping capacity, the demand for foreign-priced steel, both in foreign markets and in the U.S. market, general economic conditions in foreign countries, technological developments and environmental and other governmental regulations in both U.S. and foreign markets. Foreign demand for U.S. coal has increased in recent periods. If foreign demand for U.S. coal were to decline, this decline could cause competition among coal producers for the sale of coal in the United States to intensify, potentially resulting in significant downward pressure on domestic coal prices.

Decreases in demand for electricity and changes in coal consumption patterns of U.S. electric power generators could adversely affect coal prices and materially and adversely affect our results of operations.

Our coal is used primarily as fuel for electricity generation. Overall economic activity and the associated demand for power by industrial users can have significant effects on overall electricity demand. An economic slowdown can significantly slow the growth of electrical demand and could result in contraction of demand for coal. Declines in international prices for coal generally will impact U.S. prices for coal. During the past several years, international demand for coal has been driven, in significant part, by increases in demand due to economic growth in emerging markets, including China and India. Significant declines in the rates of economic growth in these regions could materially affect international demand for U.S. coal, which may have an adverse effect on U.S. coal prices.